What Kind of Market Is Conducive to the Development of High-Tech Industry? Configuration Analysis Based on Market Field Theory

Abstract

:1. Introduction

2. Literature Review and Model

2.1. Three Main Perspectives of the Market in Sociology of Markets

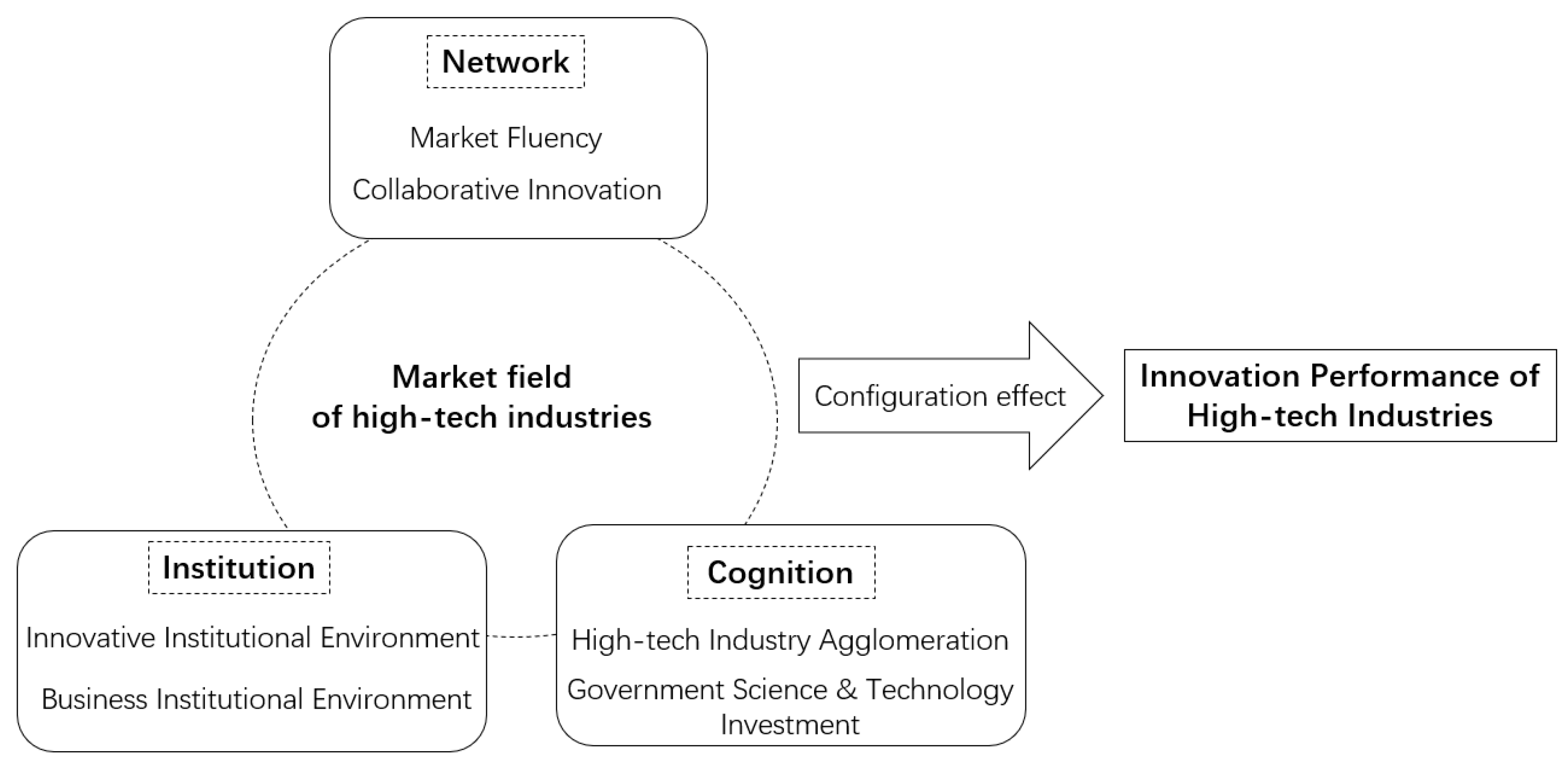

2.2. Perspective Synthesis and Framework building Based on Field Theory

- (i)

- According to the literature [32], market fluency mainly refers to the speed of technological information transmission and diffusion. Improving market fluency can reduce information asymmetry, accelerate technology trading speed and efficiency, and promote the diffusion of technology resources [10]. If there is a fast speed of technological information transmission and diffusion within a market field, it indicates that the field has good social connectivity. Therefore, market fluency can measure the technology trading network situation in the high-tech long industry market field.

- (ii)

- Ansoff first proposed the concept of “collaboration”, believing that collaboration reflects the overall performance of collaboration between enterprises [33]. Collaborative innovation reflects the willingness of enterprises to cooperate, the level of knowledge sharing, and the richness of innovation resources in the technology market. A higher level of collaborative innovation helps improve the efficiency of innovation resource allocation [11]. Thus, if the degree of collaborative innovation in a specific market field is high, it indicates that there is a good innovation collaboration network established among enterprises in this field, which can achieve an efficient allocation of innovation resources.

- (i)

- The innovation institution environment and the business institution environment are the two most important institution environments that affect the formation and development of the high-tech industry market [14]. On the one hand, innovation is an important factor affecting the development of high-tech industries, and the innovation willingness and activities of industrial organizations are influenced by institutions [35]. Therefore, a market conducive to developing high-tech industries is more likely to be embedded in an institutional environment conducive to innovation. On the other hand, a good business institutional environment can reduce institutional transaction costs for enterprises [36], improve their commercial credit financing capabilities [37], eliminate the impact of rent seeking [38], and so on. Therefore, the high-tech industry market embedded in a good business environment will be more conducive to developing high-tech industries.

- (ii)

- The boundaries of a field are not determined by geography, but by culture, politics, society, etc. [23,31]. While restricting the development of high-tech industries [39], China’s regional market segmentation actually establishes and develops different high-tech industry markets with the administrative division as the boundary and the innovation institution environment and business institution environment within their respective boundaries as the institutional basis. Therefore, this study adopts the innovative institutional environment and the business institutional environment to measure the social institutional environment embedded in the high-tech industry market in different regions of China.

- (i)

- In the market field, the government and enterprises are the most important actors, and these two actors often influence the market via technology investment and industrial agglomeration. In recent studies, high-tech industry agglomeration and government technology investment are generally regarded as the two main variables driving technological innovation or affecting regional innovation performance [40,41].

- (ii)

- These two variables also reflect the local cognition of the government and enterprises towards the high-tech industry market. On the one hand, there are obvious local leading industries and enterprises in high-tech industrial clusters. These enterprises gather within administrative divisions with specific boundaries rooted in local social and cultural factors, constrained by the institutional constraints of the region, and also build interactive networks within the region. On the other hand, government innovation policies play an important role in the agglomeration of high-tech industries, which is often reflected in government science and technology investment [41]. Under the administrative system of China, due to factors such as resources, economy, and historical culture, there are distinct regional differences in government innovation policies. Therefore, in the process of jointly constructing a high-tech industry market, local governments and enterprises will produce their local cognition defined by local culture [23].

3. Method and Data

3.1. Fuzzy-Set Qualitative Comparative Analysis Approach

3.2. Data Source

3.3. Calibration

4. Results

4.1. Necessity and Sufficiency Analysis

” indicates the absence of the edge condition, and “blank” indicates either presence or absence of the condition.

” indicates the absence of the edge condition, and “blank” indicates either presence or absence of the condition.4.2. Configuration Analysis

4.2.1. Configurations of IPHI

4.2.2. Configurations of ~IPHI

5. Discussion

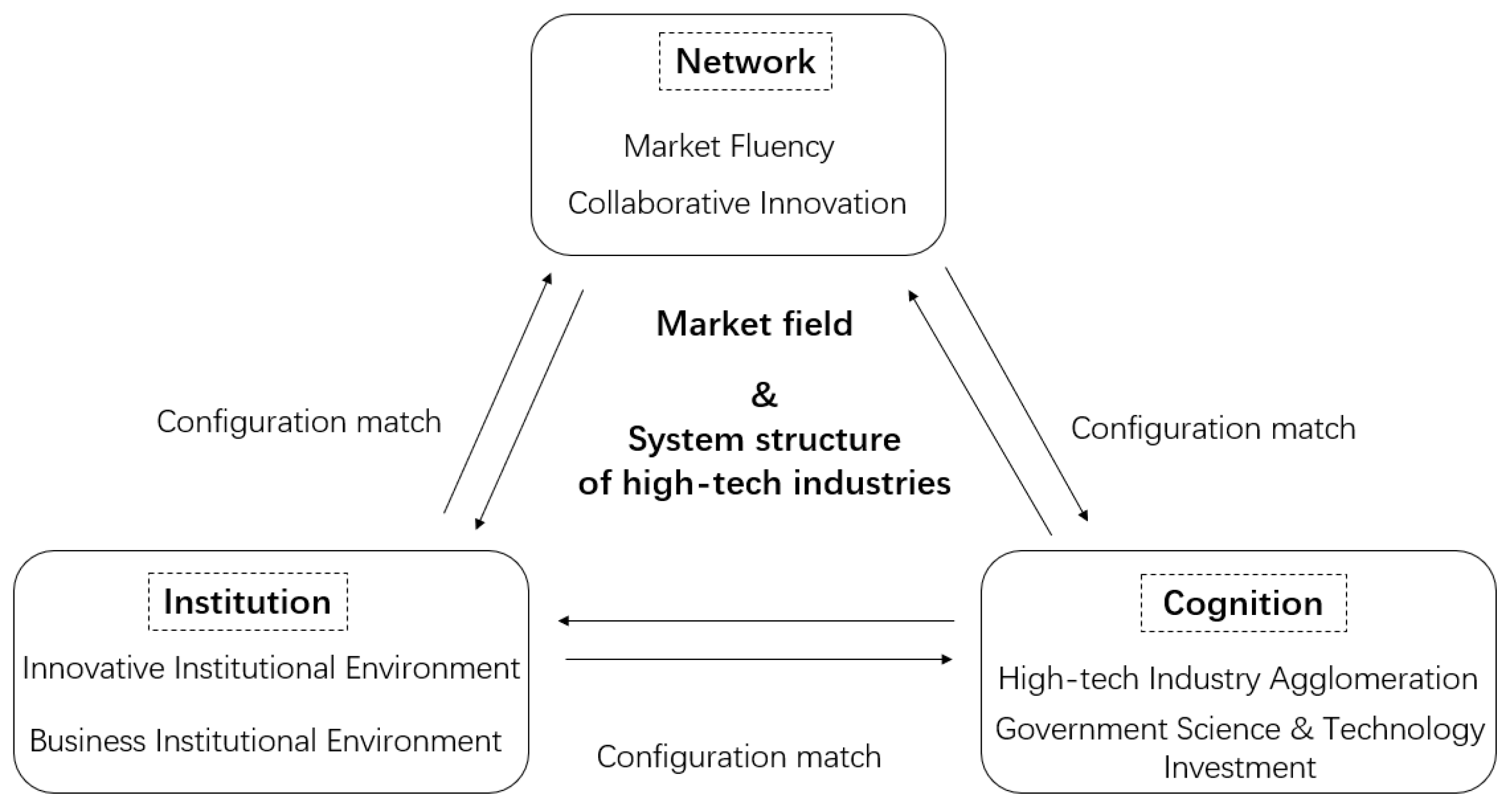

5.1. System Structure of High-Tech Industry Market Field

5.2. Equivalent Configuration and Substitution Effect

5.3. Causal Asymmetry

5.4. Typical Cases of the Configurations

6. Conclusions

- (1)

- The three structural variables of network, institution, and cognition cannot individually constitute the necessary conditions for explaining the high or low innovation performance of high-tech industries.

- (2)

- Three high-tech industry market field configurations can lead to high innovation performance, and the condition combination among the different configurations has a substitution effect.

- (3)

- Four high-tech industry market field configurations can lead to low innovation performance, and the lack of multiple conditions in networks, institutions, and cognition is the main reason for the failure of the high-tech industry market.

- (1)

- Taking a specific high-tech industry market as the research object, this study adopts the field theory to integrate the structural variables that affect the market construction, such as network, system, and cognition, and proposes six secondary conditions to further refine the structural variables, providing a foundation for qualitative comparative analysis of high-tech industry market fields.

- (2)

- Based on the configuration analysis provided in the fsQCA approach and the observation conditions provided in the market segmentation scenario in China, this study empirically analyzes the substitution effect and causal asymmetry of multiple conditions, such as network, institution, and cognition, in the framework of the field theory in shaping the high-tech industry market and expanding the application of field theory in explaining the mechanism of market construction.

- (1)

- Policymakers should pay attention to the role of cognition in market construction. It is pointed out that only when actors effectively consider the market as a method to improve the innovation performance of high-tech industries is it possible to endow the relevant networks and institutions of high-tech industries with market significance and reform obstructive institutional rules and network structures.

- (2)

- With the construction of a unified market in China, policymakers should pay attention to the configuration characteristics of the effective high-tech industry market field and focus on the synergistic effects of multiple conditions, such as network, system, and cognition, in the process of shaping the high-tech industry market.

- (1)

- Considering the sample size and the characteristics of the QCA approach, the configuration model constructed in this study mainly analyzed six conditions in the three structural variables of institution, network, and cognition. Our future research will explore including more conditions to enrich the understanding of the high-tech industry market field.

- (2)

- This study mainly conducted a static analysis of the configuration of the high-tech industry market field. Future research will try to apply the dynamic QCA approach to deeply explore the evolutionary mechanism of how multiple conditions combine to shape the high-tech industry market field.

- (3)

- Using the fsQCA approach, this study has identified the market configurations that are conducive to the innovative development of high-tech industries. However, instead of directly providing in-depth vertical explanations for typical cases, the fsQCA approach only provides possibilities for in-depth case analysis. Therefore, future research needs to use approaches such as in-depth interviews to explain the dynamic mechanisms of the construction and evolution of the high-tech industry market.

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Province | IPHI | MF | CI | IIE | BIE | HIA | GSTI |

|---|---|---|---|---|---|---|---|

| Beijing | 10,163.939 | 0.025 | 0.0046 | 84.830 | 78.230 | 0.418 | 0.057 |

| Tianjin | 5274.161 | 0.026 | 0.0024 | 80.750 | 51.760 | 0.942 | 0.034 |

| Hebei | 820.701 | 0.027 | 0.0036 | 48.780 | 53.930 | 0.469 | 0.010 |

| Shanxi | 742.795 | 0.010 | 0.0009 | 51.280 | 46.740 | 0.472 | 0.014 |

| Inner Mongolia | 142.501 | 0.024 | 0.0006 | 46.760 | 44.970 | 0.176 | 0.005 |

| Liaoning | 764.732 | 0.023 | 0.0031 | 60.550 | 47.430 | 0.410 | 0.014 |

| Jilin | 548.848 | 0.015 | 0.0043 | 54.590 | 51.210 | 0.359 | 0.011 |

| Heilongjiang | 489.175 | 0.014 | 0.0026 | 56.050 | 47.980 | 0.180 | 0.008 |

| Shanghai | 6611.139 | 0.017 | 0.0028 | 85.630 | 79.650 | 0.996 | 0.051 |

| Jiangsu | 10,884.400 | 0.019 | 0.0010 | 77.130 | 63.200 | 1.974 | 0.044 |

| Zhejiang | 7916.176 | 0.036 | 0.0040 | 74.260 | 60.680 | 1.000 | 0.044 |

| Anhui | 2989.560 | 0.025 | 0.0017 | 63.460 | 59.270 | 0.720 | 0.045 |

| Fujian | 5492.937 | 0.029 | 0.0011 | 61.380 | 54.360 | 0.801 | 0.024 |

| Jiangxi | 3847.704 | 0.014 | 0.0012 | 51.280 | 54.540 | 1.372 | 0.026 |

| Shandong | 1973.534 | 0.032 | 0.0041 | 65.710 | 59.260 | 0.713 | 0.023 |

| Henan | 2495.477 | 0.012 | 0.0004 | 50.700 | 57.170 | 0.844 | 0.017 |

| Hubei | 3105.104 | 0.034 | 0.0037 | 67.440 | 53.170 | 0.718 | 0.037 |

| Hunan | 1665.001 | 0.025 | 0.0017 | 57.340 | 44.950 | 0.890 | 0.017 |

| Guangdong | 19,099.977 | 0.024 | 0.0047 | 79.470 | 68.690 | 2.556 | 0.066 |

| Guangxi | 366.148 | 0.004 | 0.0006 | 44.840 | 37.920 | 0.430 | 0.012 |

| Hainan | 86.349 | 0.019 | 0.0127 | 43.760 | 55.270 | 0.259 | 0.009 |

| Chongqing | 4258.644 | 0.011 | 0.0005 | 66.630 | 60.950 | 1.061 | 0.015 |

| Sichuan | 1880.438 | 0.020 | 0.0015 | 62.470 | 67.530 | 0.866 | 0.015 |

| Guizhou | 526.248 | 0.017 | 0.0012 | 41.240 | 58.110 | 0.540 | 0.020 |

| Yunnan | 229.769 | 0.013 | 0.0014 | 43.010 | 54.130 | 0.187 | 0.009 |

| Shaanxi | 1625.576 | 0.029 | 0.0016 | 66.580 | 46.270 | 0.684 | 0.016 |

| Gansu | 274.084 | 0.040 | 0.0015 | 51.380 | 41.220 | 0.153 | 0.007 |

| Qinghai | 516.939 | 0.023 | 0.0072 | 43.950 | 43.050 | 0.248 | 0.008 |

| Ningxia | 1624.000 | 0.032 | 0.0010 | 46.680 | 51.730 | 0.316 | 0.024 |

| Xinjiang | 61.765 | 0.016 | 0.0011 | 40.590 | 43.190 | 0.072 | 0.008 |

Appendix B

| Province | IPHI | MF | CI | IIE | BIE | HIA | GSTI |

|---|---|---|---|---|---|---|---|

| Beijing | 1 | 0.79 | 0.98 | 1 | 1 | 0.11 | 1 |

| Tianjin | 0.98 | 0.87 | 0.73 | 1 | 0.28 | 0.97 | 0.94 |

| Hebei | 0.1 | 0.92 | 0.92 | 0.08 | 0.48 | 0.16 | 0.05 |

| Shanxi | 0.08 | 0.01 | 0.03 | 0.16 | 0.05 | 0.16 | 0.23 |

| Inner Mongolia | 0.02 | 0.69 | 0.01 | 0.05 | 0.03 | 0.02 | 0.01 |

| Liaoning | 0.09 | 0.56 | 0.87 | 0.76 | 0.06 | 0.1 | 0.23 |

| Jilin | 0.05 | 0.05 | 0.97 | 0.35 | 0.24 | 0.07 | 0.07 |

| Heilongjiang | 0.05 | 0.03 | 0.78 | 0.45 | 0.08 | 0.02 | 0.02 |

| Shanghai | 0.99 | 0.1 | 0.82 | 1 | 1 | 0.99 | 1 |

| Jiangsu | 1 | 0.19 | 0.05 | 1 | 0.99 | 1 | 0.99 |

| Zhejiang | 1 | 1 | 0.95 | 0.99 | 0.97 | 0.99 | 0.99 |

| Anhui | 0.8 | 0.79 | 0.53 | 0.88 | 0.94 | 0.62 | 0.99 |

| Fujian | 0.98 | 0.97 | 0.08 | 0.8 | 0.53 | 0.83 | 0.77 |

| Jiangxi | 0.91 | 0.03 | 0.12 | 0.16 | 0.56 | 1 | 0.82 |

| Shandong | 0.59 | 0.99 | 0.96 | 0.94 | 0.94 | 0.6 | 0.74 |

| Henan | 0.71 | 0.02 | 0 | 0.14 | 0.84 | 0.9 | 0.51 |

| Hubei | 0.82 | 1 | 0.93 | 0.96 | 0.41 | 0.61 | 0.97 |

| Hunan | 0.51 | 0.79 | 0.53 | 0.55 | 0.02 | 0.94 | 0.51 |

| Guangdong | 1 | 0.69 | 0.98 | 1 | 1 | 1 | 1 |

| Guangxi | 0.03 | 0 | 0.01 | 0.03 | 0 | 0.12 | 0.11 |

| Hainan | 0.02 | 0.19 | 1 | 0.02 | 0.65 | 0.03 | 0.03 |

| Chongqing | 0.94 | 0.01 | 0 | 0.95 | 0.98 | 0.99 | 0.32 |

| Sichuan | 0.56 | 0.26 | 0.38 | 0.85 | 1 | 0.92 | 0.32 |

| Guizhou | 0.05 | 0.1 | 0.12 | 0.01 | 0.9 | 0.24 | 0.63 |

| Yunnan | 0.02 | 0.02 | 0.27 | 0.02 | 0.499 | 0.02 | 0.03 |

| Shaanxi | 0.49 | 0.97 | 0.501 | 0.95 | 0.04 | 0.501 | 0.42 |

| Gansu | 0.03 | 1 | 0.38 | 0.17 | 0.01 | 0.02 | 0.01 |

| Qinghai | 0.05 | 0.56 | 1 | 0.02 | 0.01 | 0.03 | 0.02 |

| Ningxia | 0.49 | 0.99 | 0.05 | 0.05 | 0.28 | 0.05 | 0.77 |

| Xinjiang | 0.02 | 0.07 | 0.08 | 0.01 | 0.01 | 0.01 | 0.02 |

Appendix C

| Configurations | Raw Coverage | Unique Coverage | Consistency | |

|---|---|---|---|---|

| IPHI | ||||

| Complex Solution | IIE*BIE*HIA*GSTI | 0.547 | 0.236 | 0.996 |

| MF*CI*IIE*BIE*GSTI | 0.358 | 0.047 | 0.972 | |

| MF*CI*IIE*HIA*GSTI | 0.419 | 0.108 | 0.997 | |

| solution coverage: 0.702 solution consistency: 0.982 | ||||

| Parsimonious Solution | IIE*GSTI | 0.781 | 0.781 | 0.948 |

| solution coverage: 0.781 solution consistency: 0.948 | ||||

| Intermediate Solution | IIE*BIE*HIA*GSTI | 0.547 | 0.236 | 0.996 |

| MF*CI*IIE*BIE*GSTI | 0.358 | 0.047 | 0.972 | |

| MF*CI*IIE*HIA*GSTI | 0.419 | 0.108 | 0.997 | |

| solution coverage: 0.702 solution consistency: 0.982 | ||||

| ~IPHI | ||||

| Complex Solution | ~MF*~IIE*~BIE*~HIA*~GSTI | 0.387 | 0.190 | 0.998 |

| CI*~IIE*~BIE*~HIA*~GSTI | 0.283 | 0.094 | 0.980 | |

| ~MF*CI*~IIE*~HIA*~GSTI | 0.225 | 0.029 | 0.997 | |

| ~MF*~CI*~IIE*BIE*~HIA*GSTI | 0.083 | 0.040 | 0.992 | |

| solution coverage: 0.557 solution consistency: 0.990 | ||||

| Parsimonious Solution | ~MF*~HIA | 0.570 | 0.338 | 0.972 |

| CI*~IIE | 0.397 | 0.165 | 0.976 | |

| solution coverage: 0.735 solution consistency: 0.966 | ||||

| Intermediate Solution | ~MF*~IIE*~BIE*~HIA*~GSTI | 0.387 | 0.190 | 0.998 |

| CI*~IIE*~BIE*~HIA*~GSTI | 0.283 | 0.094 | 0.980 | |

| ~MF*CI*~IIE*~HIA*~GSTI | 0.225 | 0.029 | 0.997 | |

| ~MF*~CI*~IIE*BIE*~HIA*GSTI | 0.083 | 0.040 | 0.992 | |

| solution coverage: 0.557 solution consistency: 0.990 | ||||

References

- Liu, Z. Study on the major trends changes of China’s industrial development environment during the 14th five-year plan period. Econ. Rev. J. 2020, 8, 76–86. [Google Scholar]

- Song, Y.S.; Yu, C.; Hao, L.; Chen, X. Path for China’s high-tech industry to participate in the reconstruction of global value chains. Technol. Soc. 2021, 65, 101486. [Google Scholar] [CrossRef]

- Yu, F.; Dong, F. Influence of cross-level environment on the choice of transformation path for Chinese manufacturing enterprises: Based on the method of fsQCA. RD Manag. 2020, 32, 37–47. [Google Scholar]

- Li, H.; Wang, M. A Research on the impetus function of high-tech industry to the economic growth of urban agglomeration. Stud. Sci. Sci. 2019, 37, 1006–1012. [Google Scholar]

- Chen, X.; Liu, X.; Zhu, Q. Comparative analysis of total factor productivity in China’s high-tech industries. Technol. Forecast. Soc. Chang. 2022, 175, 121332. [Google Scholar] [CrossRef]

- Ni, J.; Li, H. Market segmentation and high-tech industries’ development: From the perspective of institutional logics. Stud. Sci. Sci. 2021, 39, 1584–1592. [Google Scholar]

- Yu, L.; Zhong, C.; Zhang, H. Market segmentation, trade protection and high-tech industry innovation: Driven development under the background of dual circulation. Inq. Into Econ. Issues 2022, 6, 40–53. [Google Scholar]

- Han, B. FDI and the efficiency of high-tech industries: The mediating effect of technological innovation and market competition. Soc. Sci. 2020, 36, 172–188. [Google Scholar]

- Wan, C.; Yuan, L.; Tan, Z. The influence of the sci-tech talents agglomeration, market competition and interaction on innovation performance of high-tech industry. Soft Sci. 2021, 35, 7–12. [Google Scholar]

- Yu, L.; Wan, X. Technology market thickness, fluency and innovation speed. Stat. Decis. 2022, 38, 158–162. [Google Scholar]

- Yu, L.; Wang, B. Research on the influence of technology market on collaborative innovation under the theory of market design: Take high-tech enterprises as an example. Sci. Res. Manag. 2021, 43, 144–153. [Google Scholar]

- Zhao, Q.; Liu, Z.; Cui, H. Internet development, technology market and technological innovation efficiency of high-tech industry of China: Empirical analysis based on SBM-Entropy-Tobit model. J. Technol. Econ. 2022, 41, 1–10. [Google Scholar]

- Liu, W.; Liu, H. Impact of factor market distortions and institutional quality on R&D investment: Empirical analysis based on China’s high-tech industry. Res. Financ. Econ. Issues 2020, 32, 32–39. [Google Scholar]

- Fang, D.; Gu, X. Research on multiple modes for improving technological innovation efficiency of high-tech industry: Based on the perspective of innovation environment. Sci. Technol. Prog. Policy 2020, 37, 52–59. [Google Scholar]

- Sun, J.; Yu, M.; Wei, Z. Institutional environment and technical efficiency of Chinese high-tech industries. Forum Sci. Technol. China 2020, 1, 80–87. [Google Scholar]

- Granovetter, M. Economic action and social structure: The problem of embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Beckert, J. How do fields change? The interrelations of institutions, networks, and cognition in the dynamics of markets. Organ. Stud. 2010, 5, 605–627. [Google Scholar] [CrossRef]

- Jafari, A.; Aly, M.; Doherty, A.M. An analytical review of market system dynamics in consumer culture theory research: Insights from the sociology of markets. J. Bus. Res. 2022, 139, 1261–1274. [Google Scholar] [CrossRef]

- Du, Y.; Jia, L. Configuration perspective and qualitative comparative analysis: A new way of management research. Manag. World 2017, 6, 155–167. [Google Scholar]

- Zhang, M.; Du, Y. Qualitative comparative analysis in management and organization research: Position, tactics and directions. Chin. J. Manag. 2019, 9, 1312–1323. [Google Scholar]

- Chen, L. The market as a social structure: The application of market fields and its methodology Issues. Acad. Forum 2013, 36, 66–72. [Google Scholar]

- Swedberg, R. Market as a social structure. Chin. J. Sociol. 2003, 2, 42–49. [Google Scholar]

- Fligstein, N. The Architecture of Markets. An Economic Sociology of Twenty-First-Century Capitalist Societies; Shanghai People Press: Shanghai, China, 2008. [Google Scholar]

- Fu, P. Toward an integrative paradigm of market sociology: A review of N. Fligstein’s The Architecture of Markets and discussion on revising his paradigm. Sociol. Stud. 2010, 25, 211–225. [Google Scholar]

- Polanyi, K. The Great Transformation: The Political and Economic Origins of Our Time; Farrar Rinehart: New York, NY, USA, 1944. [Google Scholar]

- Fligstein, N.; Dauter, L. The sociology of markets. Annu. Rev. Sociol. 2007, 33, 105–128. [Google Scholar] [CrossRef]

- Uzzi, B. How Social Relations and Networks Benefit. Am. Sociol. Rev. 1999, 64, 481–505. [Google Scholar] [CrossRef]

- Fligstein, N.; Mara-Drita, I. How to make a market: Reflections on the attempt to create a single market in the European Union. Am. J. Sociol. 1996, 22, 1–33. [Google Scholar] [CrossRef]

- Fu, P. The logic starting point and research approaches of the sociology of market. Zhejiang Soc. Sci. 2013, 8, 97–105. [Google Scholar]

- McDermott, G.A. Politics and the evolution of inter-firm networks: A post-communist lesson. Organ. Stud. 2007, 6, 885–908. [Google Scholar] [CrossRef]

- Dequech, D. Cognition and valuation: Some similarities and contrasts between institutional economics and the economics of convention. J. Econ. Issues 2005, 39, 465–473. [Google Scholar] [CrossRef]

- Yu, L.; Wan, X.; Zhong, C.; Duan, Y.; Tang, X. Technology market thickness, market fluency and high technology industry innovation. China Soft Sci. 2021, 1, 21–31. [Google Scholar]

- Ansoff, H. Corporate Strategy; McGraw HillBook Company: New York, NY, USA, 1987. [Google Scholar]

- Li, J.; Du, B. How can the intellectual capital of incubators leverage regional innovation? Based on the moderating role of institutional environment. Product. Res. 2023, 1, 40–43. [Google Scholar]

- Baumol, W.J. Entrepreneurship: Productive, unproductive, and destructive. J. Political Econ. 1990, 95, 893–921. [Google Scholar] [CrossRef]

- Wang, X.L.; Fan, G.; Hu, L.P. Marketization Index of China’s Provinces: NERI Report 2018; Social Sciences Academic Press: Beijing, China, 2019. [Google Scholar]

- Zhang, M.S.; Xu, H.; Feng, T. Business environment, relationship lending and the technological innovation in small and medium-sized enterprises. J. Shanxi Univ. Financ. Econ. 2019, 41, 35–49. [Google Scholar]

- Xia, H.; Tang, Q.; Bai, J. Business environment, enterprise rent-seeking and market innovation: Evidence from the China enterprise survey. Econ. Res. J. 2019, 54, 84–98. [Google Scholar]

- Han, Q.; Yang, C. The impact of regional market segmentation on the innovation efficiency of high-tech industries: From the perspective of different market segmentation types. Mod. Econ. Res. 2018, 5, 78–85. [Google Scholar]

- Xu, D.; Yu, B. The influence of high-tech industries agglomeration on regional innovation ability: Based on the empirical investigation of city cluster of the Yangtze Delta. Soft Sci. 2021, 35, 1–8. [Google Scholar]

- Gao, H.; Zhang, Y. Exploring the path of improving the innovation ability of high-tech industrial development zones. Econ. Probl. 2020, 5, 105–112. [Google Scholar]

- Duan, J. Research on financing situation and adjustment path of large high tech enterprises in hubei province after the COVID-19. Manag. Technol. SME 2023, 6, 185–187. [Google Scholar]

- Luan, S. Impact of COVID-19 on China’s macro-economy and suggestions. China Mark. 2023, 2, 8–10. [Google Scholar]

- China Academy of Science and Technology Development. China Regional Science and Technology Innovation Evaluation Report 2018; Scientific and Technical Documentation Press: Beijing, China, 2018. [Google Scholar]

- Zhang, S.; Kang, B.; Zhang, Z. Evaluation of doing business in Chinese provinces: Indicator system and quantitative analysis. Bus. Manag. J. 2020, 42, 5–19. [Google Scholar]

- Hu, A.; Guo, A.; Zhong, F.; Wang, X. Can the high-tech industrial agglomeration improve the green economic efficiency of the region? China Popul. Resour. Environ. 2018, 28, 93–101. [Google Scholar]

- Zhao, Z.; Zhang, L.; Chen, Z. Urbanization, technological innovation and urban-rural income gap: An empirical study based on panel data of Chinese prefecture-level cities. Forum Sci. Technol. China 2018, 10, 138–145. [Google Scholar]

- Fiss, P.C. Building better causal theories: A fuzzy set approach to typologies in organization research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef]

- Crilly, D.; Zollo, M.; Hansen, M.T. Faking It or Muddling Through? Understanding Decoupling in Response to Stakeholder Pressures. Acad. Manag. J. 2012, 9, 1429–1448. [Google Scholar] [CrossRef]

- Ragin, C.C.; Fiss, P.C. Net Effects Analysis versus Configurational Analysis: An Empirical Demonstration. In Redesining Social Inquiry: Fuzzy Set and Beyond; Ragin, C.C., Ed.; University of Chicago Press: Chicago, IL, USA, 2008; pp. 190–212. [Google Scholar]

- Wan, Q.; Ye, J.; Zheng, L.; Tan, Z.; Tang, S. The impact of government support and market competition on China’s high-tech industry innovation efficiency as an emerging market. Technol. Forecast. Soc. Chang. 2023, 192, 122585. [Google Scholar] [CrossRef]

- Nguyen, B.; Yu, X.; Melewar, T.C.; Gupta, S. Critical brand innovation factors (CBIF): Understanding innovation and market performance in the Chinese high-tech service industry. J. Bus. Res. 2016, 69, 2471–2479. [Google Scholar] [CrossRef]

- Wang, K.; Lestari, Y. Firm competencies on market entry success: Evidence from a high-tech industry in an emerging market. J. Bus. Res. 2013, 66, 2444–2450. [Google Scholar] [CrossRef]

- Gu, Y.; Wang, Z.; Guo, T.; Chen, H. The configuration effect of sci-tech financial investment on innovation performance of high-tech industry: A fuzzy-set QCA approach. Sci. Technol. Prog. Policy 2023, 40, 60–68. [Google Scholar]

- Fiss, P.C. A Set-Theoretic Approach to Organizational Configurations. Acad. Manag. Rev. 2007, 32, 1180–1198. [Google Scholar] [CrossRef]

- Armenia, S.; Barnabe, F.; Franco, E.; Iandolo, F.; Pompei, A.; Tsaples, G. Identifying policy options and responses to water management issues through system dynamics and fsQCA. Technol. Forecast. Soc. Chang. 2023, 194, 122737. [Google Scholar] [CrossRef]

- Gao, Q.; Li, Z.; Sun, M. Study on the influence path of public participation in marine ecotourism under the perspective of conspicuous consumption—Analysis of fsQCA based on VBN theory. Mar. Pollut. Bull. 2023, 194, 115279. [Google Scholar] [CrossRef] [PubMed]

- Huang, Y.; Li, K.; Li, P. Innovation ecosystems and national talent competitiveness: A country-based comparison using fsQCA. Technol. Forecast. Soc. Chang. 2023, 194, 122733. [Google Scholar] [CrossRef]

| Variable Type | Indicators, Year | Abbreviation | Measuring Method |

|---|---|---|---|

| Outcome | Innovation Performance of High-tech Industry, 2019 | IPHI | sales revenue of new products in high-tech industries/10,000 people |

| Conditions | Market Fluency, 2018 | MF | R&D internal expenditure/revenue |

| Collaborative Innovation, 2018 | CI | R&D external expenditure/revenue | |

| Innovation Institution Environment, 2018 | IIE | comprehensive science and technology innovation index of each province in China | |

| Business Institution Environment, 2018 | BIE | evaluation of the business environment of each province in China | |

| High-tech Industry Agglomeration, 2018 | HIA | location entropy | |

| Government Science and Technology Investment, 2018 | GSTI | science and technology expenditure/local general public budgeting expenditure |

| Outcome and Conditions | Complete Membership | Crossover | Complete Non-Membership |

|---|---|---|---|

| IPHI | 4512.523 | 1645.289 | 509.998 |

| MF | 0.028 | 0.023 | 0.015 |

| CI | 0.004 | 0.002 | 0.001 |

| IIE | 66.833 | 56.695 | 46.740 |

| BIE | 59.623 | 54.130 | 46.623 |

| HIA | 0.903 | 0.684 | 0.302 |

| GSTI | 0.035 | 0.017 | 0.010 |

| Conditions | IPHI | ~IPHI |

|---|---|---|

| Consistency | Consistency | |

| MF | 0.634 | 0.437 |

| ~MF | 0.455 | 0.645 |

| CI | 0.599 | 0.556 |

| ~CI | 0.558 | 0.589 |

| IIE | 0.857 | 0.304 |

| ~IIE | 0.263 | 0.807 |

| BIE | 0.773 | 0.325 |

| ~BIE | 0.324 | 0.764 |

| HIA | 0.864 | 0.241 |

| ~HIA | 0.287 | 0.898 |

| GSTI | 0.887 | 0.287 |

| ~GSTI | 0.302 | 0.887 |

| Conditions | IPHI | ~IPHI | |||||

|---|---|---|---|---|---|---|---|

| H1 | H2 | H3 | L1 | L2 | L3 | L4 | |

| MF | • | • | ⊗ | ⊗ | ⊗ | ||

| CI | • | • | ● | ● |  | ||

| IIE | ● | ● | ● | ⊗ | ⊗ | ⊗ | ⊗ |

| BIE | • | • |  |  | • | ||

| HIA | • | • | ⊗ | ⊗ | ⊗ | ⊗ | |

| GSTI | ● | ● | ● |  |  | ⊗ | • |

| raw coverage | 0.547 | 0.358 | 0.419 | 0.387 | 0.283 | 0.225 | 0.083 |

| unique coverage | 0.236 | 0.047 | 0.108 | 0.190 | 0.094 | 0.029 | 0.040 |

| consistency | 0.996 | 0.972 | 0.997 | 0.998 | 0.980 | 0.997 | 0.992 |

| solution coverage | 0.702 | 0.557 | |||||

| solution consistency | 0.982 | 0.990 | |||||

| IPHI | ~IPHI | |||||

|---|---|---|---|---|---|---|

| H1 | H2 | H3 | L1 | L2 | L3 | L4 |

| Guangdong | Beijing | Zhejiang | Xinjiang | Qinghai | Hainan | Guizhou |

| Shanghai | Zhejiang | Tianjing | Guangxi | Jilin | Jilin | |

| Jiangsu | Shandong | Guangdong | Shanxi | Heilongjiang | Heilongjiang | |

| Zhejiang | Guangdong | Hubei | Jilin | Hebei | ||

| Anhui | Anhui | Shandong | Heilongjiang | |||

| Shandong | Anhui | Yunnan | ||||

| Fujian | Hunan | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, Z. What Kind of Market Is Conducive to the Development of High-Tech Industry? Configuration Analysis Based on Market Field Theory. Systems 2023, 11, 444. https://doi.org/10.3390/systems11090444

Huang Z. What Kind of Market Is Conducive to the Development of High-Tech Industry? Configuration Analysis Based on Market Field Theory. Systems. 2023; 11(9):444. https://doi.org/10.3390/systems11090444

Chicago/Turabian StyleHuang, Zhenyu. 2023. "What Kind of Market Is Conducive to the Development of High-Tech Industry? Configuration Analysis Based on Market Field Theory" Systems 11, no. 9: 444. https://doi.org/10.3390/systems11090444

APA StyleHuang, Z. (2023). What Kind of Market Is Conducive to the Development of High-Tech Industry? Configuration Analysis Based on Market Field Theory. Systems, 11(9), 444. https://doi.org/10.3390/systems11090444