1. Introduction

Multi-attribute decision making (MADM) is a process of investigating an alternative ranking under multiple attributes [

1,

2,

3,

4,

5,

6]. Identifying weights is an important challenge for MADM [

7].To integrate the evaluation values of an alternative under multiple attributes, aggregation operators are often used by researchers [

8,

9]. In the development of human decision making, objective conditions such as technology [

10,

11,

12,

13,

14,

15] and decision-making information collection [

16,

17,

18,

19,

20,

21,

22,

23] no longer have the merit of dominating decision-making results. On the contrary, researchers have attached great importance to subjective conditions such as the motivation, decision consciousness, and knowledge level of decision makers. In other words, decision makers are strategic. Decision makers may express their opinion dishonestly to satisfy their interests [

24], which will cause the decision results to develop in the direction they expect [

25,

26]. Therefore, it is meaningful to study strategic decision making.

In the real world, in order to realize their goal, decision makers will give a higher weight to specific attributes of an alternative, helping to achieve the expected ranking. This behavior is often referred to as strategic weight manipulation (SWM) [

27]. Strategic decision making has been widely investigated by scholars. Dong et al. [

28] investigated the strategic weight manipulation of multi-attribute decision making, and they reported that decision makers could strategically set attribute weights to achieve their desired alternative ranking. Liu et al. [

29] indicated that attribute weights played a key role in alternative classification because different weights would lead to different alternative classification results. Dutta et al. [

30] studied the TOPSIS multi-attribute decision-making approach for the case where the decision makers did not offer any weight information and provided partial weight preference information. Liu et al. [

31] introduced strategic weight manipulation in interval attribute group decision making; they specified that the modification of the initial attribute weights needed to pay the cost, and they developed a linear programming model to optimize the cost. In the process of MADM, the allocation of attribute weights has a great influence on the scheme ranking [

32,

33]. Different weighting algorithms will obtain different sorting results when the criterion is weighted. For instance, the methods for calculating weights using AHP (analytic hierarchy process), BWM (Best Worst Method), and EWM (entropy weight method)—as well as the importance of the weight results—are all distinct. Although the pairwise comparison technique will yield inconsistent weight results, it is advantageous for risk preference decision makers. The weighting method of direct rating and distance estimation will provide consistent weights. Therefore, we acknowledge the varying importance of the weights in the different MADM approaches [

34,

35,

36,

37,

38,

39] that employ criteria weighting [

40]. In different MADM methods, weights play different roles [

41,

42]. For example, expert weights can be dynamically generated from the MADM matrix. The attribute weight of entropy weight TOPSIS is improved by adjusting the weight coefficient, which improves the relative importance of attributes and reduces the impact of criteria with a large weight. In addition, different MADM methods consider different types of subjective or objective information. Because the objective weighting method ignores the decision makers’ experience, and the subjective weighting method ignores the performance ratings of alternatives across various criteria, objective and subjective weights must be combined in MADM.

In actual decision making, it is difficult to modify the weight, which needs to pay the corresponding cost. In SWM, the manipulator may use some resources (e.g., material, financial) to compensate the manager to achieve a specific ranking of the alternative, which is called the compensation cost. In strategic weight manipulation, each attribute weight modification has its corresponding unit compensation cost, which is often disturbed in the interval under an uncertain environment. In this paper, we abstractly represent the unit compensation cost corresponding to each attribute weight in vector form in order to quantitatively characterize the compensation cost. For more information, please refer to Example 1. The manipulator wants to spend as little of the cost as possible to achieve manipulation. However, decision makers are often in a complex and uncertain decision-making environment, where they do not have enough information and historical experience to determine how much compensation cost should be provided. Accordingly, the compensation cost of decision makers will be in a range rather than a fixed value.

In this paper, robust optimization is utilized to characterize the uncertainty of the compensation cost. Robust optimization is a powerful tool to tackle uncertain problems [

43,

44,

45]. Different from stochastic programming [

46,

47] and fuzzy programming [

48], robust optimization does not need to assume the probability distribution and fuzzy membership function of uncertain parameters but puts the uncertain parameters in an interval. The goal is to satisfy all implementations of the worst-case constraints [

49,

50]. In recent years, the robust optimization approach has been widely used in consensus-reaching processes [

51], portfolios [

52], location allocation [

53], and other fields. However, few scholars have applied robust optimization to strategic weight manipulation. For example, Jin et al. [

54] found that an uncertain unit adjustment cost would lead to a higher weight allocation cost, and they illustrated the effectiveness of their proposed model through an actual anti-epidemic case. We note that the method proposed in this paper is different from theirs, which only investigated the uncertain unit compensation cost. Ji et al. [

55] discussed the expected ranking of alternatives under uncertain attribute values, and they pointed out that attribute weights were easier to manipulate when attribute values obeyed a linear uncertain distribution.

Uncertain circumstances in decision making are often accompanied by risks [

56], which cannot be completely eliminated. To describe the risks faced by the manipulator in an uncertain environment, we introduce the concept of the risk-sensitive cost. The risk cost refers to the expenses that people must pay due to the existence of risk. Decision risk is present in SWM under uncertain settings. The quality of the model and the outcomes of the solutions will suffer if the decision risk is not taken into account. As a result, MVT is utilized to describe the risk of the compensation cost. In other words, the cost vector’s mean or covariance matrix contains the estimation error, which poses a risk. Hence, this paper reflects the risk cost by discussing the disturbance of the mean or covariance. For more information, please refer to Example 2. The optimal decision scheme of the manipulator is to minimize the compensation cost and reduce the impact of the risk-sensitive cost [

57,

58]. To measure the risk-sensitive cost, we need to use risk measurement tools in decision making. Risk measurement methods mainly include mean-variance theory [

59], conditional value at risk [

60,

61,

62], and the Von Neumann–Morgenstern utility measure [

63]. MVT has a straightforward solution technique that can yield realistic and practical solutions. Consequently, this paper describes the risk compensation cost of the manipulator through mean-variance theory.

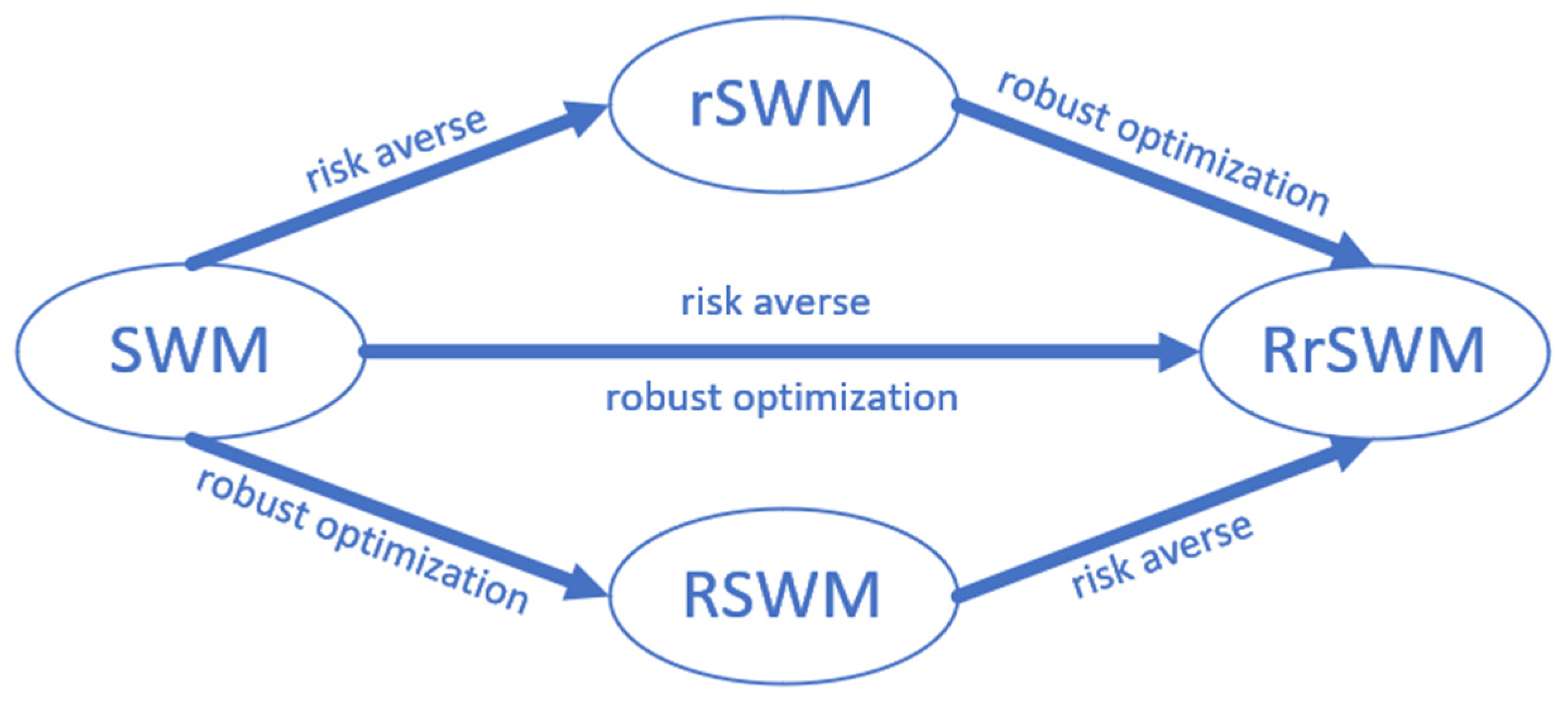

The literature review mentioned above reveals that the current SWM issue has a lot of flaws. For instance, there will be risks associated with the SWM problem in an uncertain environment that cannot be entirely eradicated. The best decision-making strategy should aim to cut costs and lessen risky outcomes. In order to achieve the least risk-sensitive cost, this paper first proposes a risk strategic weight manipulation (rSWM) based on MVT. Because minimax rSWM (Robust rSWM) is more suited to uncertain decision environments, it is the model we recommend. The proposed robust rSWM offers a solution to address the ambiguity and estimation error of the mean and covariance, two parameters connected to the uncertain unit adjustment cost. A set is used to describe the mean and covariance uncertainty.

The contributions of this paper are summarized as follows: (1) Compared with the deterministic compensation cost, the uncertain cost is characterized by the robust optimization method in this paper. (2) In this paper, some errors in calculating the mean and variance of the unit compensation cost are considered, and the risk aversion behavior of the manipulator is described using MVT. A risk-averse robust strategic weight manipulation model (RrSWM) is built, which is equivalently transformed into a tractable robust counterpart model through duality theory. Meanwhile, the proposed model is an extension of the robust strategic weight manipulation model (RSWM). To establish a connection with the extant strategic weight manipulation models, the specific transformation conditions between them are given. (3) Through a practical application of emergency facility location, the applicability of the proposed model is covered. The approach in this paper is more effective than prevenient methods, which is shown through comparative analysis and sensitivity analysis. Our work can provide some reference for the government or enterprises to carry out risk management.

The remainder of this paper is organized as follows:

Section 2 presents some basic knowledge utilized in this paper;

Section 3 proposes a robust risk strategic weight manipulation model;

Section 4 specifies a case study and presents the comparative analysis and sensitivity analysis;

Section 5 concludes this paper and puts forward future research work.

2. Preliminaries

In order to assist the readers in understanding the proposed approach, some preliminaries are introduced in this section. Several approaches, theories, and models of strategic weight manipulation and robust optimization are presented.

2.1. Strategic Weight Manipulation

We define as a set of alternatives. is a set of multiple attributes. is the weight set corresponding to the attribute, where and . We assume and are number sets. Therefore, the decision matrix is , where indicates the attributes value of an alternative with respect to .

Generally speaking, multi-attribute decision making is divided into three sections: normalization of the decision matrix, aggregation of the standardized decision matrix, and ranking of alternatives.

(1) Normalization of decision matrix

For benefit indicators, the standardized process is shown in Equation (1):

For cost indicators, the standardized process is shown in Equation (2):

(2) Aggregation of the standardized decision matrix

Assume

is the comprehensive evaluation score of the alternative

under various attributes, which can be calculated by introducing the aggregation function. The weighted average (WA) and ordered weighted average (OWA) operators are the most often used aggregation operators. In this work, we utilize the WA operator to compute the comprehensive evaluation score of alternatives, as shown in Equation (3):

(3) Ranking of alternatives

The ranking order is determined by comparing the score of alternative , which ranks first with the higher value. When comparing the ranking of alternatives and , in order to calculate the ranking of alternative , we only need to find out the number of alternatives that meet the cardinality set . Suppose represents the ranking of alternative ; therefore, we have .

In multi-attribute decision making, the attribute weights will be manipulated strategically by decision makers to realize their interests. Assuming that the manipulator wants to change the ranking of alternative , we define the expected ranking of the manipulator as ; it is obvious that . Suppose the attribute weight vector before manipulation is , the weight vector after manipulation is , and the attribute weight deviation in the manipulation process is . Assuming that the unit compensation cost is , the total cost paid by the decision makers to manipulate the attribute weight is . We introduce an infinite constant and a binary variable .

In order to comprehensively treat the compensation cost, we propose an example to illustrate it.

Example 1. Suppose the vector of the compensation cost is , and the unit compensation cost corresponding to each attribute is 3, 2, 4, 5, and 2.5, respectively. The weight adjustment deviation is ; therefore, we can obtain the total cost that the decision maker should pay.

The manipulator wants to make the compensation cost as low as possible. Hence, the minimum cost strategic weight manipulation model built in this paper is as follows:

The objective function is to minimize the total cost to be compensated by the manipulator to change the attribute weight. The specific constraints are as follows. The first constraint and the second constraint represent the comprehensive evaluation score comparison between alternatives and . We introduce an infinite constant and a binary variable in model (4). When , we have . On the contrary, when , we have . The third constraint represents the expected ranking of alternative . The fourth constraint indicates that the attribute weight deviation in the manipulation process is less than or equal to . The fifth constraint indicates that the sum of attribute weights is 1. The sixth constraint is the binary variable. The seventh constraint indicates that the weight of attribute is greater than 0 but not greater than 1.

2.2. Robust Optimization

Uncertainty exists extensively in MADM. For example, the compensation cost of SWM in real life is often uncertain, because the manipulator cannot know the probability distribution information of the compensation cost in advance. Therefore, this paper utilizes robust optimization to deal with the uncertainty of the parameters. The key to robust optimization is to select an appropriate uncertainty set to characterize the random parameters and meet the realization of all constraints in the worst case.

We first introduce a general linear programming problem:

where the variable

is the given data,

is the decision variable vector,

is the coefficient matrix of the uncertain parameters, and

is the right-hand-side vector. When the uncertain parameters fluctuate in the uncertainty set

, the robust optimization model can be expressed as

The perturbation vector

changes in the form of an affine transformation in a given perturbation set

, which is expressed as follows:

where

denotes the

row of matrix

, and

denotes the

element of vector

.

Assume

is the

constraint in

. We let

and

, where

and

are the nominal values of the uncertain parameters,

and

are basic shifts. In order to control the range of uncertainty, the new variable

is introduced. Hence, the inequality can also be written as

Then, the robust counterpart of model (6) can be expressed as

The feasible solution and optimal value of model (6) are equivalent to the feasible solution and optimal value of model (9). Because model (9) is a semi-infinite programming problem, it is difficult to solve it in polynomial time. In this paper, we equivalently transform model (9) into convex optimization problems under different scenarios.

3. The Proposed Model

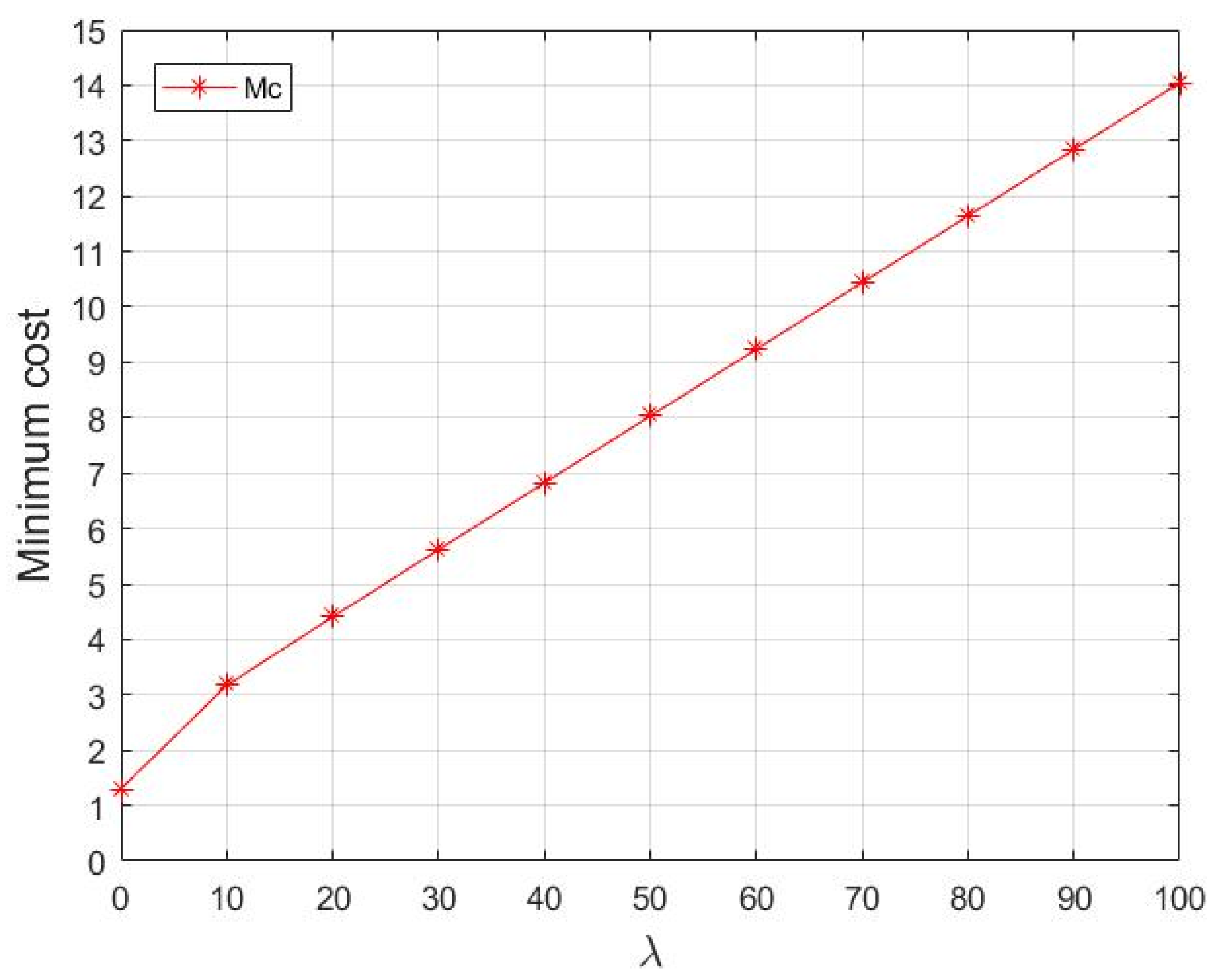

Previous studies investigated the uncertainty of the compensation cost in SWM. However, the risk preference of decision makers was not taken into account. The uncertainty of decision making is often accompanied by risk. The lowest cost and the lowest risk are expected by decision makers. Accordingly, we introduce the risk function to describe the risk associated with decision making. It is assumed that the compensation cost is a random parameter with a mean value and variance . The risk aversion cost of the manipulator is , where represents the expected cost that the manipulator needs to compensate for adjusting the attribute weight of the alternative, and stands for the variance of the cost. indicates the risk aversion coefficient of the manipulator. Generally speaking, with the increase in the value of , the risk aversion degree of the manipulator gradually increases.

In order to comprehensively treat the risk-sensitive cost, an example is proposed.

Example 2. Suppose the evaluation value of the compensation cost is a matrix . We can obtain the mean value and covariance matrix using the MATLAB tool. The weight adjustment deviation is ; therefore, we can obtain the total risk cost that the decision maker should pay. is the risk aversion coefficient.

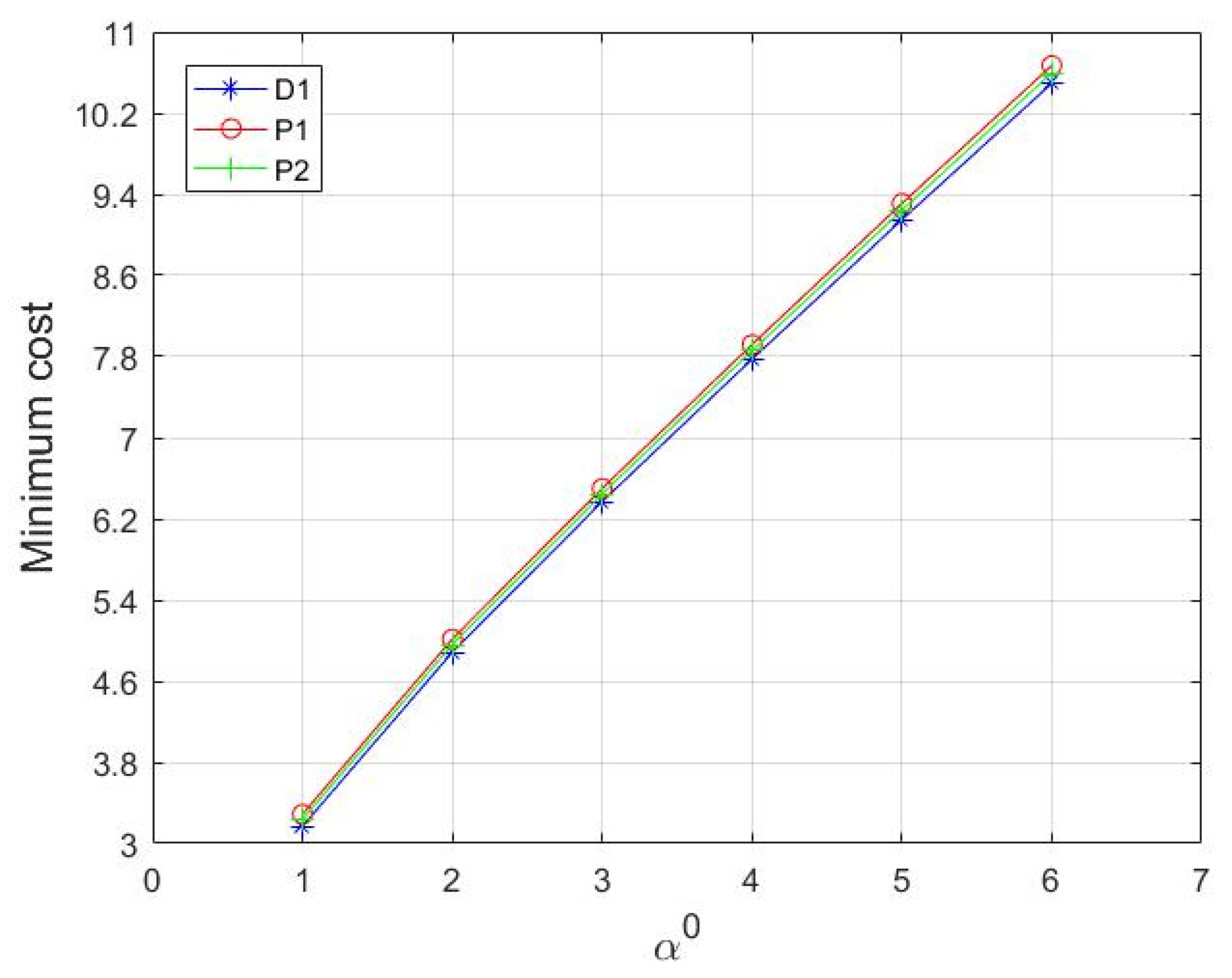

Therefore, the model with risk aversion (rSWM) constructed in this paper is as follows. We define model (10) as model D1:

The objective function includes the risk aversion behavior of the manipulator, including the mean value and covariance of the compensation cost. The objective is to minimize the sum of the mean value and covariance evaluation errors. The details of the constraints are as follows. The first constraint and the second constraint represent the comprehensive evaluation score comparison between alternatives and . An infinite constant and a binary variable are introduced here. When , we have . On the contrary, when , we have . The third constraint represents the expected ranking of alternative for the manipulator. The fourth constraint indicates that the attribute weight deviation is less than or equal to . The fifth constraint indicates that the sum of attribute weights is 1. The sixth constraint is the binary variable. The seventh constraint indicates that the weight of attribute is greater than 0 but not greater than 1.

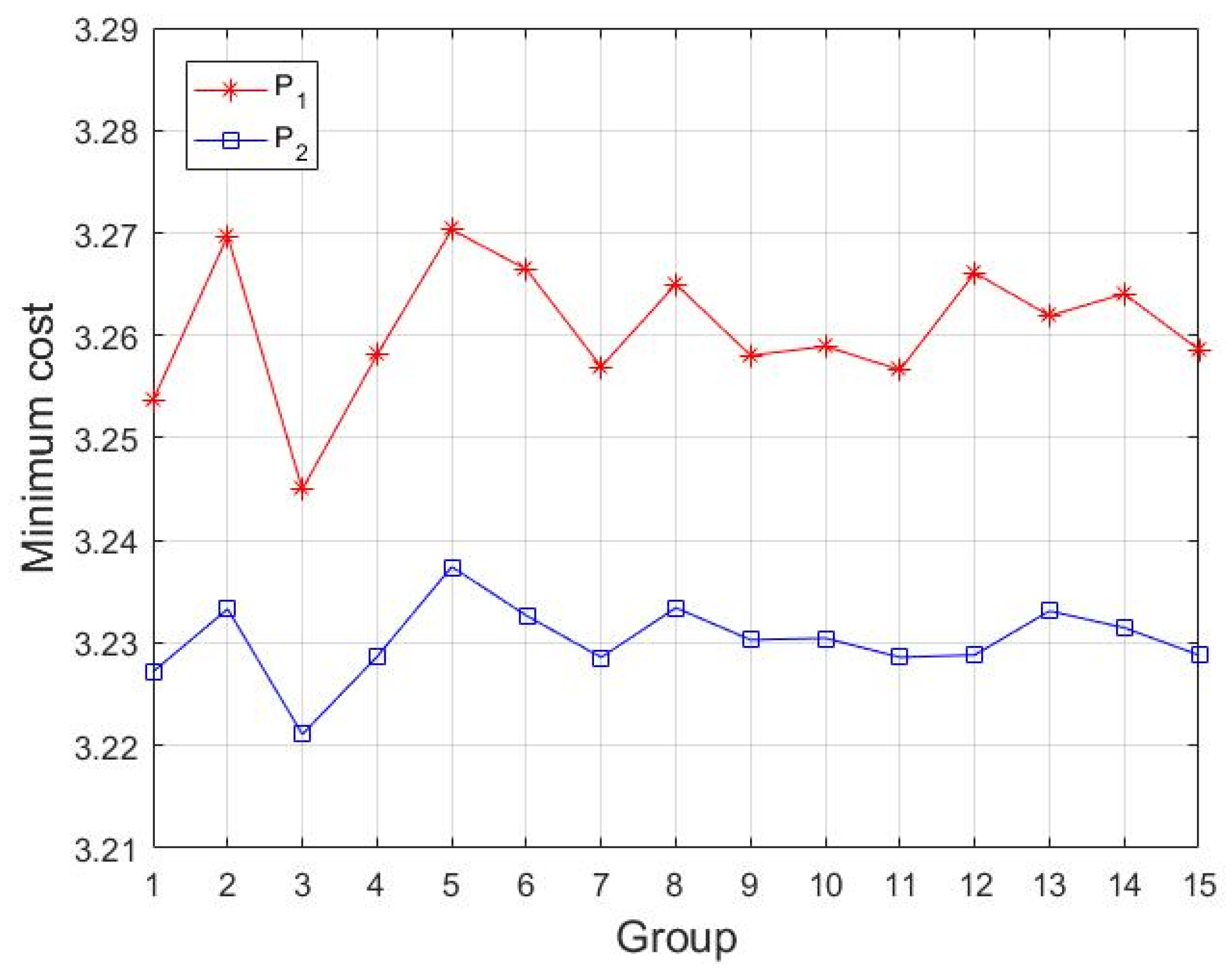

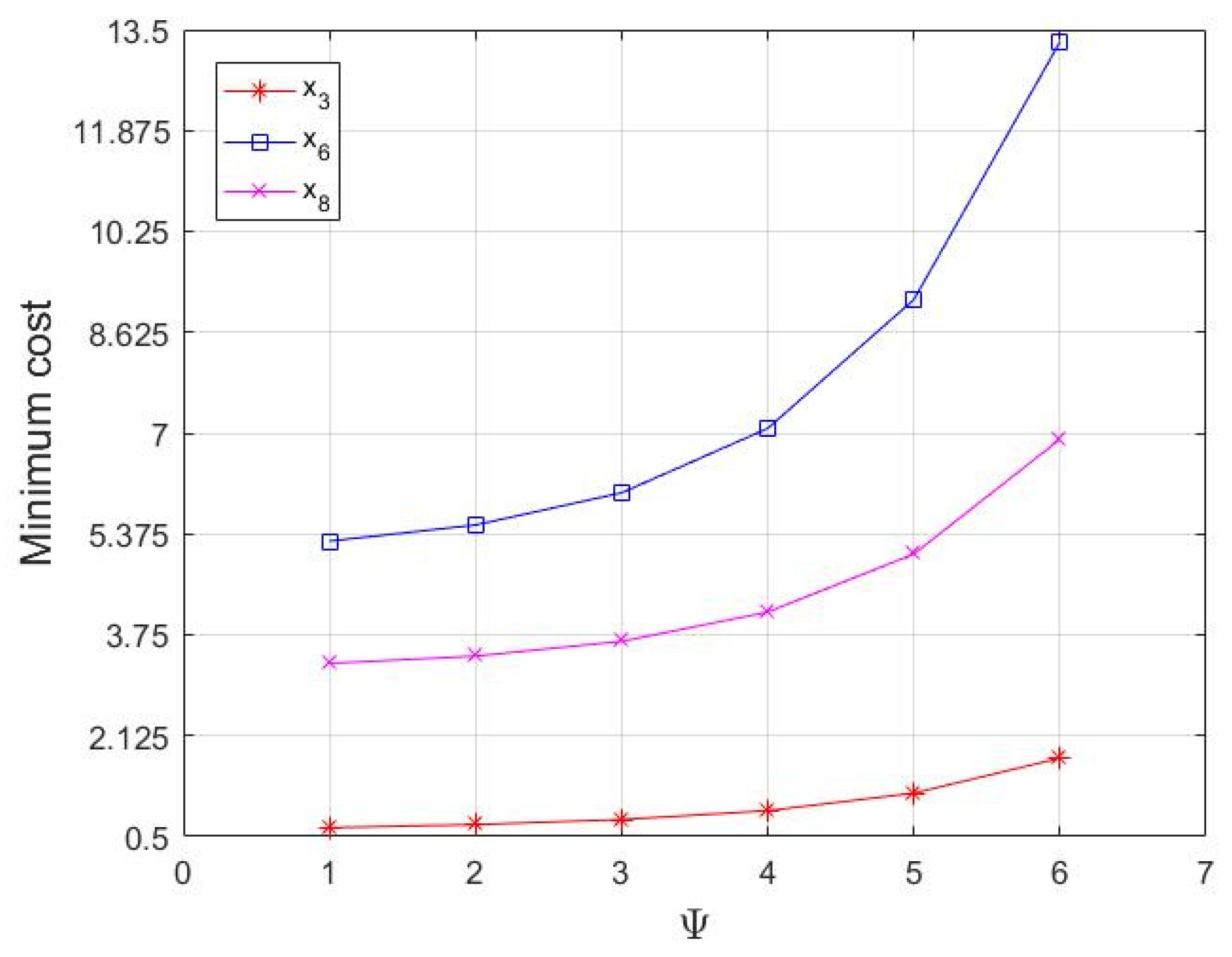

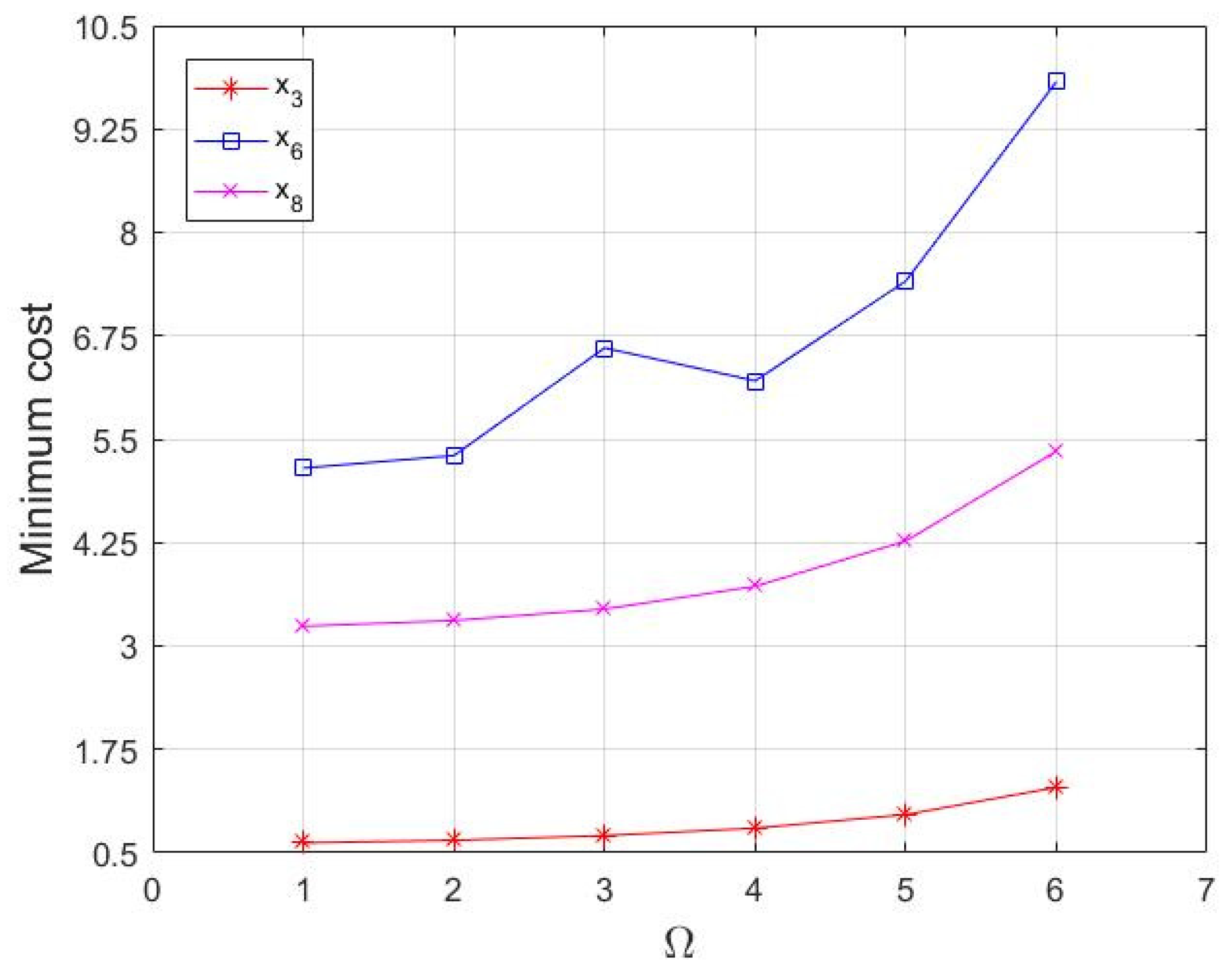

However, the cost change caused by the evaluation error of the cost mean and variance cannot be sufficiently measured with the above model. The robustness of model D1 is poor. Therefore, we characterize the perturbation of the cost mean and variance through robust optimization. We discuss the minimum cost incurred by the manipulator in three cases: in the first case, we research the uncertain risk of the cost mean when the cost variance is known; in the second case, we investigate the uncertain risk of the cost variance when the cost mean is known; in the third case, we discuss the uncertain risk when the evaluation errors of cost mean and covariance are both present.

3.1. The Mean Value of the Compensation Cost Is Uncertain

When the covariance of the unit compensation cost is known, we may compute the minimum risk-sensitive cost under the given uncertainty set . The model we constructed is as follows:

Because the goal function involves an operator , model (11) cannot be solved directly. When the mean value of the unit compensation cost is uncertain, we characterize the perturbation of the cost using two commonly used uncertainty sets in robust optimization, namely, a box set and an ellipsoid set.

3.1.1. Box Uncertainty Set

Theorem 1. If the mean value of the uncertain cost is defined as a box uncertainty set, that is, , where is the level of parameter uncertainty, the robust counterpart of model (11) can be constructed as model (12). We define model (12) as P1.

Proof of Theorem 1. [

64] According to the definition of the box set, the uncertain cost to be compensated by the risk manipulator can be written as

In the worst case, we have

Because the maximum value on the left side of the inequality is

, the explicit constraint form can be obtained:

As a result, the box uncertainty set model is proven. □

3.1.2. Ellipsoid Uncertainty Set

Theorem 2. If the mean value of the uncertain cost is defined as an ellipsoid uncertainty set, that is, , where is the level of parameter uncertainty, the robust counterpart of model (11) can be built as model (13). We define model (13) as P2.

Proof of Theorem 2. [

65] According to the definition of the ellipsoid set, the uncertain cost to be compensated by the risk manipulator can be written as

In the worst case, we have

Consequently, the explicit form of the above formula can be obtained:

Therefore, the model based on the ellipsoid uncertainty set is proved. □

3.2. The Compensation Cost Covariance Matrix Is Uncertain

When the mean value of the unit compensation cost is known, we can compute the minimum risk-sensitive cost under the provided uncertainty set regarding the covariance of the unit compensation cost. The model we constructed is as follows:

where

is an uncertainty set provided in advance.

The simplest way to describe the uncertainty set is to add a set of interval positivity constraints: , where and are the lower and upper limits of , which are positive semidefinite matrices.

Theorem 3. When the evaluation error of the cost variance change in the set of uncertainty intervals , model (14) is equivalently transformed into model (15). We define model (15) as P3.

Proof of Theorem 3. [

59] The internal maximization problem of model (14) is

when

is not considered, for all

, we have

. When all

take the upper bound value—that is,

—the relaxation problem

of model (16) reaches the maximum value. Because

is assumed to be a positive semidefinite matrix, it must be optimum for the non-relaxation model (16). The proof is finished. □

3.3. Both the Mean Value and Compensation Cost Covariance Matrix Are Uncertain

In this section, we introduce the interval uncertainty sets

and

to characterize the perturbations of the mean value and covariance matrix of the unit compensation cost.

,

,

, and

represent the lower and upper bounds of

and

, respectively.

and

are positive semidefinite matrices. A new model is constructed as follows:

where

and

are the given uncertainty sets.

Theorem 4. When the mean value and covariance of the unit compensation cost change in the uncertainty intervals and , model (17) is equivalently transformed into model (18). We define model (18) as P4.

Proof of Theorem 4. [

59] Because the internal maximizing issue of model (17) is divisible, it may be separated into two maximization problems:

and

. For the first maximization problem:

Because , when each vector element takes its upper bound—that is, —the maximum value is obtained by the objective function in model (19). The proof of the procedure for the second maximizing issue is identical to that of Theorem 3. □