How Transformative Business Model Renewal Leads to Sustained Exploratory Business Model Innovation in Incumbents: Insights from a System Dynamics Analysis of Case Studies

Abstract

:1. Introduction

- Investigate incumbent companies that have developed systematic BMI processes through an integrated approach.

- Analyze the evolution of the investigated incumbents’ BMI process.

2. Theoretical Background

2.1. Business Model Innovation in Incumbents

2.2. Sytems Thinking and Business Model Innovation

3. Method

3.1. Research Methodology

3.2. Case Selection

The Selected Cases

3.3. Data Collection

3.4. Data Analysis

4. Results of the Case Studies

4.1. Presentation of the Cases

4.1.1. Alpha

4.1.2. Beta

4.1.3. Gama

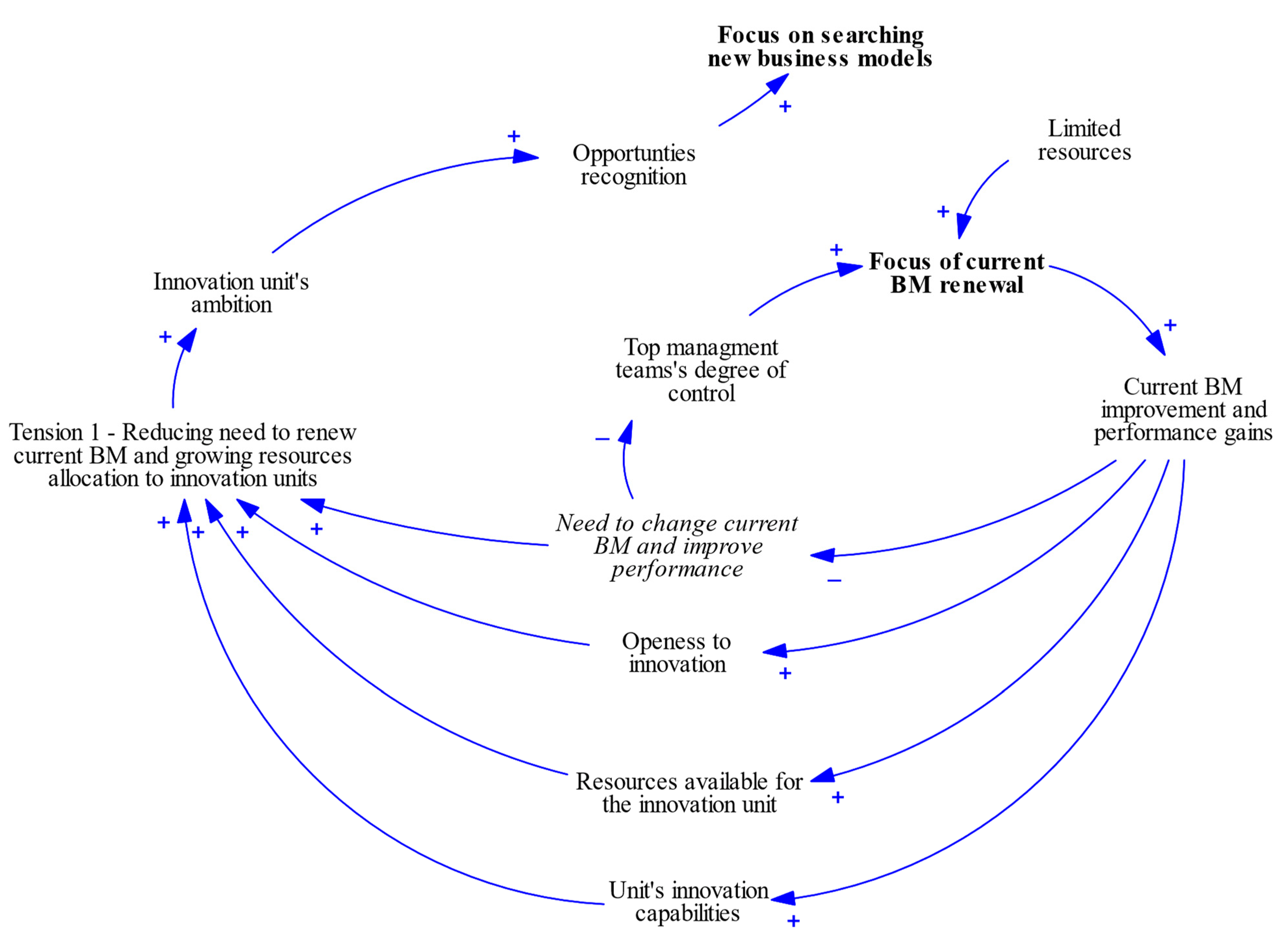

4.2. From Business Model Renewal to Business Model Exploration

“We are an organization that we had a medical and technical board, and I was also part of it, where there is an R&D with all the doctors conducting innovation in tests and innovation in services. The doctor with the R&D team sets up this test. Now we have a new arm in business innovation. […] And there is the whole IT part that has the traditional, infrastructure and systems and there is the all-digital part that looks after squads, whether in the traditional or in the new businesses.”(Alpha’s CEO)

“In 2012, when digitalization actions began, the goal was the digitalization of the business, and not of internal specific departments. Hence, the challenge was to digitalize our representatives’ network in the society.”(Beta’s innovation manager)

“We had limited resources, and the department was comprised only by me. So, I had to create engagement and gather volunteers, which worked outside their hours.”(Gama’s innovation director)

4.2.1. Openness to Innovation

“But new capabilities as professionals who think about User Experience, digital, platform solutions, we didn’t have. We bought [a] primary care startup. We set up a digital team, a team with young people with these other capabilities. We were making a mix, because in our view these people with new capabilities cannot be left alone in the organization”(Alpha’s innovation director)

“The CEO and the chairman were the biggest sponsors’ of the projects. As we had successful small wins, we earned top management’s interest and that allowed us to reach the current stage. […]. So, we spent 2 years piloting a digital Business Model in which the digital was placed at the center. The first was in Campinas and ended up being rejected due to the view that the Value Proposition for consultants was still insufficient. The second pilot was in São José dos Campos, with adjustments to this value proposition, and already a slightly more open vision. This led to changes even in the organization’s way of approving projects. In the past, to make a small change to the company’s logo had to be approved by the Vice Presidents. In 2014, when the Business model was created, Natura started to provide a platform for the consultant, with all the necessary functionalities”(Beta’s CIO)

“We transmitted a message for the employees that innovation was of utmost importance. We designed our open innovation funnel and how innovation would contribute for our core business, hired an experienced, yet forward thinking, innovation director.”(Gama’s CEO)

4.2.2. Resource Availability

“(Today) 50, my team practically does the leadership, who does it in practice is consulting (partnerships). In our squads, the Product Owners, Tech leads, scrum master and User Experience are all [Beta] employees. The remainder of the development and quality force is outsourced. There are more than 50 [outsourced] consulting partners.”(Beta’s CIO)

4.2.3. Innovation Capabilities

“In the first rounds of our open innovation event, we had many potential opportunities brought by our employees, but we noticed that they still lacked quality, and we could only create basic ideas that, despite serving our core BM well, had no potential to become new business models. After a few iterations we noticed an important improvement, and were able to create our first ideas that had true potential to become new BMs”(Gama’s innovation director)

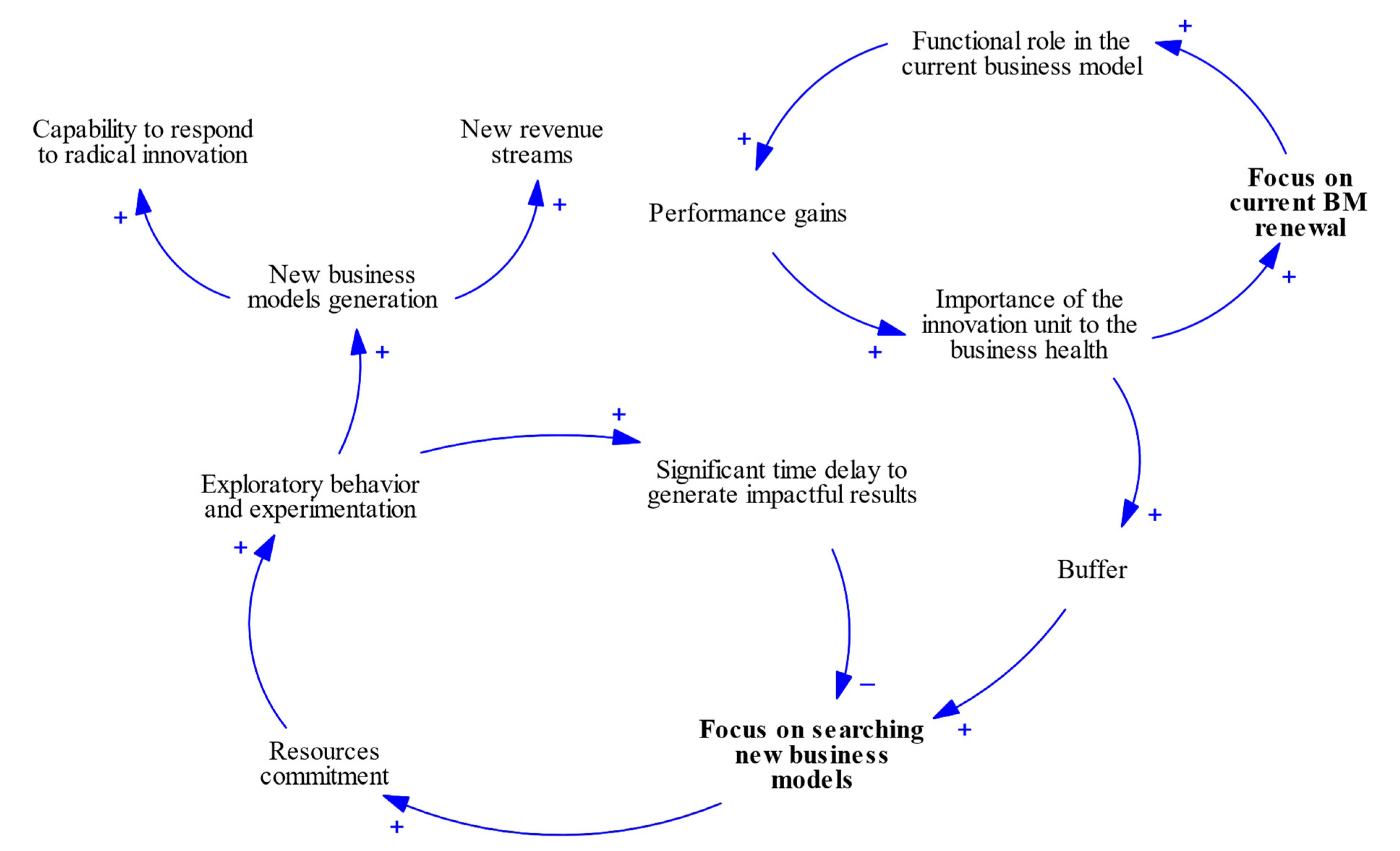

4.3. Sustaining Business Model Exploration through the Creation of a “Buffer”

4.3.1. Alpha’s Healthcare Platform Business Model as the Driver for Exploring New Business Models

“In fact, the potential of using genomic information, behavioral and biological data from exams, has enormous potential. You can make a more predictive medicine. So how can we reduce patient health risk, do better follow-up to make an individualized and personalized health journey. Predictive medicine, such as using genomic, behavioral, and environmental data. So, the potential is very large and goes into analytics”(Alpha CEO interview)

4.3.2. Beta’s Incremental Business Model Exploration to Improve Its Core Business Model

“What we have is an innovation machine that is not yet fully tuned. An incremental H1 type innovation is super easy. Now a more disruptive innovation is much more complex. We identify a cool startup that can speed up a process, the squads go there and promise that it will impact a certain indicator within a period of 4 months. The new business team does this pre-sale a lot, to raise funds. Everything that talks about innovation that is not connected with the core of the current business model is more complex”(Beta’s CIO)

4.3.3. Gama’s Competency “Encapsulation” and the Search for Pioneering Digital Technology Business Models

“We are a competencies seller. To have a competitive advantage in this market, we need to prove our skill to the clients, which is challenging because competencies are not tangible. What we do is anticipate our customers’ needs by deeply studying what they will do in the future, build our experiments, transform into MVPs and PoCs and then enchant our customer. This is what differentiates us from our competitors in the market”(Gama’s CEO)

“My dream for the future of our innovation department is, that we will be creating our future clients.”(Gama’s innovation director)

5. Discussion and Conclusions

5.1. Theorethical Contributions

5.2. Managerial Implications

5.3. Limitations

5.4. Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Teece, D.J.; Linden, G. Business models, value capture, and the digital enterprise. J. Organ. Des. 2017, 6, 8. [Google Scholar] [CrossRef] [Green Version]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable business model innovation: A review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Franco, M.; Minatogawa, V.; Duran, O.; Batocchio, A.; Quadros, R. Opening the Dynamic Capability Black Box: An Approach to Business Model Innovation Management in the Digital Era. IEEE Access 2021, 9, 69189–69209. [Google Scholar] [CrossRef]

- Minatogawa, V.; Franco, M.; Rampasso, I.S.; Anholon, R.; Quadros, R.; Durán, O.; Batocchio, A. Operationalizing Business Model Innovation through Big Data Analytics for Sustainable Organizations. Sustainability 2019, 12, 277. [Google Scholar] [CrossRef] [Green Version]

- Laudien, S.M.; Daxböck, B. Understanding the lifecycle of service firm business models: A qualitative-empirical analysis. R&D Manag. 2017, 47, 473–483. [Google Scholar] [CrossRef]

- Schoemaker, P.J.H.; Heaton, S.; Teece, D. Innovation, dynamic capabilities, and leadership. Calif. Manag. Rev. 2018, 61, 15–42. [Google Scholar] [CrossRef] [Green Version]

- Hacklin, F.; Björkdahl, J.; Wallin, M.W. Strategies for business model innovation: How firms reel in migrating value. Long Range Plan. 2018, 51, 82–110. [Google Scholar] [CrossRef]

- Schaffer, N.; Hermes, S.; Weking, J.; Hein, A.; Krcmar, H. Continuous Business Model Innovation and Dynamic Capabilities: The Case of Cewe. Int. J. Innov. Manag. 2022, 26, 2250038. [Google Scholar] [CrossRef]

- Kim, S.K.; Min, S. Business Model Innovation Performance: When does Adding a New Business Model Benefit an Incumbent? Strateg. Entrep. J. 2015, 9, 34–57. [Google Scholar] [CrossRef]

- Osiyevskyy, O.; Dewald, J. Explorative Versus Exploitative Business Model Change: The Cognitive Antecedents of Firm-Level Responses to Disruptive Innovation. Strateg. Entrep. J. 2015, 9, 58–78. [Google Scholar] [CrossRef]

- Sund, K.J.; Bogers, M.L.A.M.; Sahramaa, M. Managing business model exploration in incumbent firms: A case study of innovation labs in European banks. J. Bus. Res. 2021, 128, 11–19. [Google Scholar] [CrossRef]

- Chesbrough, H.; Rosenbloom, R.S. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’ s technology spin-off companies. Ind. Corp. Chang. 2002, 11, 529–555. [Google Scholar] [CrossRef] [Green Version]

- Tongur, S.; Engwall, M. The business model dilemma of technology shifts. Technovation 2014, 34, 525–535. [Google Scholar] [CrossRef]

- Kaulio, M.; Thorén, K.; Rohrbeck, R. Double ambidexterity: How a Telco incumbent used business-model and technology innovations to successfully respond to three major disruptions. Creat. Innov. Manag. 2017, 26, 339–352. [Google Scholar] [CrossRef] [Green Version]

- Kuhlmann, M.; Bening, C.R.; Hoffmann, V.H. How incumbents realize disruptive circular innovation—Overcoming the innovator’s dilemma for a circular economy. Bus. Strateg. Environ. 2022, 1–16. [Google Scholar] [CrossRef]

- Habtay, S.R.; Holmén, M. Incumbents responses to disruptive business model innovation: The moderating role of technology vs. market-driven innovation. Int. J. Entrep. Innov. Manag. 2014, 18, 289–309. [Google Scholar] [CrossRef]

- Egfjord, K.F.H.; Sund, K.J. Do you see what I see? How differing perceptions of the environment can hinder radical business model innovation. Technol. Forecast. Soc. Chang. 2020, 150, 119787. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Res. Policy 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Teece, D.J. Business models and dynamic capabilities. Long Range Plan. 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Li, F. The digital transformation of business models in the creative industries: A holistic framework and emerging trends. Technovation 2018, 92–93, 102012. [Google Scholar] [CrossRef]

- Bosbach, K.E.; Brillinger, A.S.; Schäfer, B. More can be better: Operating multiple business models in a corporate portfolio. J. Bus. Strategy 2020, 41, 47–54. [Google Scholar] [CrossRef]

- Benson-Rea, M.; Brodie, R.J.; Sima, H. The plurality of co-existing business models: Investigating the complexity of value drivers. Ind. Mark. Manag. 2013, 42, 717–729. [Google Scholar] [CrossRef]

- Velu, C.; Stiles, P. Managing Decision-Making and Cannibalization for Parallel Business Models. Long Range Plan. 2013, 46, 443–458. [Google Scholar] [CrossRef]

- Markides, C.C. Business Model Innovation: What can the ambidexterity literature teach us? Acad. Manag. Perspect. 2014, 27, 313–323. [Google Scholar] [CrossRef]

- Khanagha, S.; Volberda, H.; Oshri, I. Business model renewal and ambidexterity: Structural alteration and strategy formation process during transition to a Cloud business model. R&D Manag. 2014, 44, 322–340. [Google Scholar] [CrossRef]

- Rennings, G.; Wustmans, M.; Kupp, M. Dedicated business model innovation units: Do they work? A case study from Germany. J. Bus. Strategy 2022, 43, 168–174. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Demil, B.; Lecocq, X. Business model evolution: In search of dynamic consistency. Long Range Plan. 2010, 43, 227–246. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Business models and business model innovation: Between wicked and paradigmatic problems. Long Range Plan. 2018, 51, 9–21. [Google Scholar] [CrossRef]

- von Bertalanffy, L. General System Theory: Foundations, Development, Applications; George Braziller, Inc.: New York, NY, USA, 1968; ISBN 978-0807600153. [Google Scholar]

- Casadesus-Masanell, R.; Ricart, J.E. From strategy to business models and onto tactics. Long Range Plan. 2010, 43, 195–215. [Google Scholar] [CrossRef]

- Baden-fuller, C.; Morgan, M.S. Business Models as Models. Long Range Plan. 2010, 43, 156–171. [Google Scholar] [CrossRef]

- Silva, D.S.; Ghezzi, A.; de Aguiar, R.B.; Cortimiglia, M.N.; ten Caten, C.S. Lean Startup, Agile Methodologies and Customer Development for business model innovation: A systematic review and research agenda. Int. J. Entrep. Behav. Res. 2019, 26, 595–628. [Google Scholar] [CrossRef]

- Ries, E. The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses; Crown Books: New York, NY, USA, 2011; ISBN 0307887898. [Google Scholar]

- Girotra, K.; Netessine, S. OM Forum—Business Model Innovation for Sustainability. Manuf. Serv. Oper. Manag. 2013, 15, 537–544. [Google Scholar] [CrossRef]

- Doz, Y.L.; Kosonen, M. Embedding Strategic Agility A Leadership Agenda for Accelerating Business Model Renewal. Long Range Plan. 2010, 43, 370–382. [Google Scholar] [CrossRef]

- Christensen, C.M.; Bartman, T.; van Bever, D. The Hard Truth about Business Model Innovation. Sloan Manag. Rev. 2016, 58, 31–40. [Google Scholar]

- Christensen, C.M. The Innovator’s Dilemma, 2nd ed.; Harper Business: New York, NY, USA, 2000; ISBN 0-06-662069-4. [Google Scholar]

- Koen, P.A.; Bertels, H.M.J.; Elsum, I.R. The three faces of Business model innovation: Challenges for established firms. Res. Technol. Manag. 2011, 54, 52–59. [Google Scholar] [CrossRef]

- Lucas, H.C.; Goh, J.M. Disruptive technology: How Kodak missed the digital photography revolution. J. Strateg. Inf. Syst. 2009, 18, 46–55. [Google Scholar] [CrossRef]

- Ahuja, G.; Novelli, E. Incumbent Responses to an Entrant with a New Business Model: Resource Co-Deployment and Resource Re-Deployment Strategies; Emerald Group Publishing Limited: Bingley, UK, 2016; Volume 35, ISBN 3322201600. [Google Scholar]

- Casadesus-Masanell, R.; Zhu, F. Business model innovation and competitive imitation: The case of sponsor-based business models. Strateg. Manag. J. 2013, 34, 464–482. [Google Scholar] [CrossRef] [Green Version]

- Foss, N.J.; Saebi, T. Fifteen Years of Research on Business Model Innovation: How Far Have We Come, and Where Should We Go? J. Manag. 2016, 43, 200–227. [Google Scholar] [CrossRef] [Green Version]

- Volberda, H.W.; Khanagha, S.; Baden-fuller, C.; Mihalache, O.R.; Birkinshaw, J. Strategizing in a digital world: Overcoming cognitive barriers, reconfiguring routines and introducing new organizational forms. Long Range Plan. 2021, 54, 102110. [Google Scholar] [CrossRef]

- Futterer, F.; Schmidt, J.; Heidenreich, S. Effectuation or causation as the key to corporate venture success? Investigating effects of entrepreneurial behaviors on business model innovation and venture performance. Long Range Plan. 2018, 51, 64–81. [Google Scholar] [CrossRef]

- Chesbrough, H.W. The era of open innovation. MIT Sloan Manag. Rev. 2003, 44, 35–41. [Google Scholar]

- Schreyögg, G.; Sydow, J. Organizational path dependence: A process view. Organ. Stud. 2011, 32, 321–335. [Google Scholar] [CrossRef] [Green Version]

- Chesbrough, H. Business Model Innovation: Opportunities and Barriers. Long Range Plan. 2010, 43, 354–363. [Google Scholar] [CrossRef]

- Jovanovic, M.; Engwall, M.; Jerbrant, A. Matching service offerings and product operations: A key to servitization success. Res. Technol. Manag. 2016, 59, 29–36. [Google Scholar] [CrossRef]

- Huang, H.C.; Lai, M.C.; Lin, L.H.; Chen, C.T. Overcoming organizational inertia to strengthen business model innovation: An open innovation perspective. J. Organ. Chang. Manag. 2013, 26, 977–1002. [Google Scholar] [CrossRef]

- Bashir, M.; Verma, R. Internal factors & consequences of business model innovation. Manag. Decis. 2019, 57, 262–290. [Google Scholar] [CrossRef]

- Bohnsack, R.; Pinkse, J.; Kolk, A. Business models for sustainable technologies: Exploring business model evolution in the case of electric vehicles. Res. Policy 2014, 43, 284–300. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Gärtner, C.; Schön, O. Modularizing business models: Between strategic flexibility and path dependence. J. Strateg. Manag. 2016, 9, 39–57. [Google Scholar] [CrossRef]

- de Reuver, M.; Bouwman, H.; Haaker, T. Business Model Roadmapping: A Practical Approach To Come From an Existing To a Desired Business Model. Int. J. Innov. Manag. 2013, 17, 1340006. [Google Scholar] [CrossRef]

- Tushman, M.L.; O’Reilly, C.A. Ambidextrous Organizations: Managing Evolutionary and Revolutionary Change. Calif. Manag. Rev. 1996, 38, 8–29. [Google Scholar] [CrossRef] [Green Version]

- Karimi, J.; Walter, Z. Corporate Entrepreneurship, Disruptive Business Model Innovation Adoption, and Its Performance: The Case of the Newspaper Industry. Long Range Plan. 2016, 49, 342–360. [Google Scholar] [CrossRef]

- Urbano, D.; Turro, A.; Wright, M.; Zahra, S. Corporate entrepreneurship: A systematic literature review and future research agenda. Small Bus. Econ. 2022, 59, 1541–1565. [Google Scholar] [CrossRef]

- Zahra, S.A. Environment, corporate entrepreneurship, and financial performance: A taxonomic approach. J. Bus. Ventur. 1993, 8, 319–340. [Google Scholar] [CrossRef]

- Ford, S.; Garnsey, E.; Probert, D. Evolving corporate entrepreneurship strategy: Technology incubation at Philips. R D Manag. 2010, 40, 81–90. [Google Scholar] [CrossRef]

- Urbaniec, M.; Żur, A. Business model innovation in corporate entrepreneurship: Exploratory insights from corporate accelerators. Int. Entrep. Manag. J. 2021, 17, 865–888. [Google Scholar] [CrossRef] [Green Version]

- Covin, J.G.; Morgan, P. Miles Strategic use of Corporate Venturing. Entrep. Theory Pract. 2007, 31, 183–207. [Google Scholar] [CrossRef]

- Sosna, M.; Trevinyo-Rodríguez, R.N.; Velamuri, S.R. Business model innovation through trial-and-error learning: The naturhouse case. Long Range Plan. 2010, 43, 383–407. [Google Scholar] [CrossRef]

- Vivarelli, M. Are all the potential entrepreneurs so good? Small Bus. Econ. 2004, 23, 41–49. [Google Scholar] [CrossRef]

- Brenk, S.; Lüttgens, D.; Diener, K.; Piller, F. Learning from Failures in Business Model Innovation: Solving Decision-Making Logic Conflicts through Intrapreneurial Effectuation; Springer: Berlin/Heidelberg, Germany, 2019; Volume 89, ISBN 0123456789. [Google Scholar]

- Johnson, M.W. Seizing the White Space: Business Model Innovation for Growth and Renewal; Harvard Business Press: Boston, MA, USA, 2010; ISBN 1422124819. [Google Scholar]

- Behl, D.V.; Ferreira, S. Systems thinking: An analysis of key factors and relationships. Procedia Comput. Sci. 2014, 36, 104–109. [Google Scholar] [CrossRef] [Green Version]

- Senge, P.M. The Fifth Discipline: The Art and Practice of the Learning Organization; Broadway Business: New York, NY, USA, 2006. [Google Scholar]

- Leveson, N.G. Applying systems thinking to analyze and learn from events. Saf. Sci. 2011, 49, 55–64. [Google Scholar] [CrossRef]

- Martínez León, H.C.; Calvo-Amodio, J. Towards lean for sustainability: Understanding the interrelationships between lean and sustainability from a systems thinking perspective. J. Clean. Prod. 2017, 142, 4384–4402. [Google Scholar] [CrossRef]

- Buchanan, R. Systems Thinking and Design Thinking: The Search for Principles in the World We Are Making. She Ji J. Des. Econ. Innov. 2019, 5, 85–104. [Google Scholar] [CrossRef]

- Leischow, S.J.; Best, A.; Trochim, W.M.; Clark, P.I.; Gallagher, R.S.; Marcus, S.E.; Matthews, E. Systems Thinking to Improve the Public’s Health. Am. J. Prev. Med. 2008, 35, S196–S203. [Google Scholar] [CrossRef] [Green Version]

- Linnéusson, G.; Andersson, T.; Kjellsdotter, A.; Holmén, M. Using systems thinking to increase understanding of the innovation system of healthcare organisations. J. Health Organ. Manag. 2022, 36, 179–195. [Google Scholar] [CrossRef]

- Schiuma, G.; Carlucci, D.; Sole, F. Applying a systems thinking framework to assess knowledge assets dynamics for business performance improvement. Expert Syst. Appl. 2012, 39, 8044–8050. [Google Scholar] [CrossRef]

- Cady, P. Applied systems thinking: The impact of system optimization strategies on financial and quality performance in a team-based simulation. Healthc. Manag. Forum 2021, 34, 29–33. [Google Scholar] [CrossRef]

- Blokland, P.; Reniers, G. Achieving organisational alignment, safety and sustainable performance in organisations. Sustain. 2021, 13, 10400. [Google Scholar] [CrossRef]

- Galanakis, K. Innovation process. Make sense using systems thinking. Technovation 2006, 26, 1222–1232. [Google Scholar] [CrossRef]

- Dodgson, M.; Hughes, A.; Foster, J.; Metcalfe, S. Systems thinking, market failure, and the development of innovation policy: The case of Australia. Res. Policy 2011, 40, 1145–1156. [Google Scholar] [CrossRef] [Green Version]

- Kapsali, M. Systems thinking in innovation project management: A match that works. JPMA 2011, 29, 396–407. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business model design: An activity system perspective. Long Range Plan. 2010, 43, 216–226. [Google Scholar] [CrossRef]

- Wirtz, B.W.; Pistoia, A.; Ullrich, S.; Göttel, V. Business Models: Origin, Development and Future Research Perspectives. Long Range Plan. 2016, 49, 36–54. [Google Scholar] [CrossRef]

- Massa, L.; Tucci, C.L.; Afuah, A. A critical assessment of Business Model research. Acad. Manag. Ann. 2017, 11, 73–104. [Google Scholar] [CrossRef]

- Clauss, T.; Abebe, M.; Tangpong, C.; Hock, M. Strategic Agility, Business Model Innovation, and Firm Performance: An Empirical Investigation. IEEE Trans. Eng. Manag. 2021, 68, 767–784. [Google Scholar] [CrossRef]

- Halecker, B.; Hartmann, M. Contribution of systems thinking to business model research and business model innovation. Int. J. Technol. Intell. Plan. 2013, 9, 251–270. [Google Scholar] [CrossRef]

- Kurti, E.; Salavati, S.; Mirijamdotter, A. Using systems thinking to illustrate digital business model innovation. Systems 2021, 9, 86. [Google Scholar] [CrossRef]

- Ammirato, S.; Linzalone, R.; Felicetti, A.M. The value of system dynamics’ diagrams for business model innovation. Manag. Decis. 2022, 60, 1056–1075. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications: Design and Methods, 6th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2018; Volume 53, ISBN 9781433813757. [Google Scholar]

- Eisenhardt, K.M.; Gräbner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef] [Green Version]

- Eisenhardt, K.M. What is the Eisenhardt Method, really? Strateg. Organ. 2021, 19, 147–160. [Google Scholar] [CrossRef]

- Flyvbjerg, B. Five Misunderstandings About Case-Study Research. Qual. Inq. 2006, 12, 219–245. [Google Scholar] [CrossRef] [Green Version]

- Ruddin, L.P. You Can Generalize Stupid! Social Scientists, Bent Flyvbjerg, and Case Study Methodology. Qual. Inq. 2006, 12, 797–812. [Google Scholar] [CrossRef]

- Annosi, M.C.; Martini, A.; Brunetta, F.; Marchegiani, L. Learning in an agile setting: A multilevel research study on the evolution of organizational routines. J. Bus. Res. 2020, 110, 554–566. [Google Scholar] [CrossRef]

- Gibbert, M.; Ruigrok, W.; Wicki, B. What passes as a rigorous case study? Strateg. Manag. J. 2008, 29, 1465–1474. [Google Scholar] [CrossRef]

- Strauss, A.L.; Corbin, J.M. Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory; SAGE Publications Inc: Thousand Oaks, CA, USA, 1998. [Google Scholar]

- Nemeth, C.; Brown, K.; Rogers, J. Devil’s advocate versus authentic dissent: Stimulating quantity and quality. Eur. J. Soc. Psychol. 2001, 31, 707–720. [Google Scholar] [CrossRef]

- Holloway, I. Basic Concepts for Qualitative Research; Blackwell: Malden, MA, USA, 1997. [Google Scholar]

- Miles, M.B.; Huberman, A.M. Qualitative Data Analysis, 2nd ed.; SAGE Publications Inc.: Thousand Oaks, CA, USA, 1994. [Google Scholar]

- Dorst, K. The core of ‘design thinking’ and its application. Des. Stud. 2011, 32, 521–532. [Google Scholar] [CrossRef]

- Bocken, N.; Snihur, Y. Lean Startup and the business model: Experimenting for novelty and impact. Long Range Plan. 2020, 53, 101953. [Google Scholar] [CrossRef]

- Johnson, M.W.; Christensen, C.M.; Kagermann, H. Reinventing your business model. Harv. Bus. Rev. 2008, 86, 57–68. [Google Scholar]

| Case | Age (Years in 2021) | BMI Journey Beginning | Industry | Employee Count | Revenues (USD) |

|---|---|---|---|---|---|

| Alpha | 96 | 2014 | Health services | ~13.000 | >1 billion |

| Beta | 53 | 2012 | Personal care and cosmetics manufacturing | ~17.500 | >22 billion |

| Gama | 21 | 2017 | Software | ~700 | >100 million |

| Case | Key Informants | Number of Interviews (Average Duration) | Managerial Reports Analyzed | Additional Sources |

|---|---|---|---|---|

| Alpha | CTO and innovation manager | 3 (60 min) | 7, from 2015 to 2021 (~200 pages) | Public data from social media, website, and informative documents. |

| Beta | Executive business director and CEO | 2 (63 min) | 7, from 2015 to 2021 (~750 pages) | Public data from website, social media, news, and mergers and acquisitions. |

| Gama | CEO, innovation director, HR director, R&D personnel | 9 (15–75 min) | Not available | Internal strategic documents (strategic map evolution, strategic communication); public data from website, social media, and news. |

| Alpha | Beta | Gama | ||||

|---|---|---|---|---|---|---|

| Year | Revenue Growth (% Compared to Previous Year) | Head Count | Revenue Growth (% Compared to Previous Year) | Head Count | Revenue Growth (% Compared to Previous Year) | Head Count |

| 2015 | 11.60% | 8600 | 8.60% | 6591 | 7.20% | 291 |

| 2016 | 9.70% | 8400 | 1.73% | 6397 | −5.91% | 229 |

| 2017 | 12.40% | 8700 | 25.09% | 6311 | −29.11% | 181 |

| 2018 | 11.30% | 9400 | 34.99% | 6635 | 32.80% | 188 |

| 2019 | 9.10% | 10,000 | 6.17% | 6820 | 36.53% | 227 |

| 2020 | 2.10% | 11,200 | 39.97% | 6920 | 40.86% | 399 |

| 2021 | 30.10% | 13,000 | 7.64% | 17,672 | 116.59% | 600 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Franco, M.; Minatogawa, V.; Quadros, R. How Transformative Business Model Renewal Leads to Sustained Exploratory Business Model Innovation in Incumbents: Insights from a System Dynamics Analysis of Case Studies. Systems 2023, 11, 60. https://doi.org/10.3390/systems11020060

Franco M, Minatogawa V, Quadros R. How Transformative Business Model Renewal Leads to Sustained Exploratory Business Model Innovation in Incumbents: Insights from a System Dynamics Analysis of Case Studies. Systems. 2023; 11(2):60. https://doi.org/10.3390/systems11020060

Chicago/Turabian StyleFranco, Matheus, Vinicius Minatogawa, and Ruy Quadros. 2023. "How Transformative Business Model Renewal Leads to Sustained Exploratory Business Model Innovation in Incumbents: Insights from a System Dynamics Analysis of Case Studies" Systems 11, no. 2: 60. https://doi.org/10.3390/systems11020060