Abstract

The digital era and mounting sustainability pressures have reinforced incumbents’ need to respond to radical innovation through business model innovation. Despite advancements in the literature on incumbent business model innovation, there are still open debates regarding strategies for achieving systematic innovation and poor integration between the literature on managing multiple business models and the strategic management of business model innovation. To address these gaps, we investigated three Brazilian incumbents that developed systematic business model innovation processes and analyzed their evolution. We followed a multiple case study methodology, deploying system dynamics as an analytical lens. Our findings showed that the evolution of innovation departments from business model renewal to exploration is based on a systemic tension between solving the core problems of the business and creating openness to innovation, innovation capabilities, and resources. By assigning the innovation departments a vital role in the renewed business model and exploring synergies to manage multiple business models, the companies create a “buffer” to sustain exploratory business model innovation. We suggest that the strategy for conducting business model renewal matters, especially when the renewal is transformative, aiming to shape the future. We contribute to incumbent business model innovation theory by showing the system dynamics behind the evolution from business model renewal to exploration and by connecting the management of parallel business models to the strategic management of business model innovation.

1. Introduction

The need for incumbents to respond to radical innovation through business model innovation (BMI) acquired momentum in the last 20 years. This was mainly because of digital technologies (e.g., the internet, big data analytics, cloud computing, mobile phones, the internet of things, and artificial intelligence) and mounting sustainability pressures (e.g., circular economy, grand challenges, sustainable development goals, and societal and regulatory demands), which created multiple possibilities for designing and proposing new BMs [1,2,3] as well as instability in competitive environments, thus reducing BMs’ lifecycles [4,5,6]. Under such a context, the literature concluded that incumbents need BM renewal and BM exploration capabilities to build long-term resilience [7,8], highlighting the relevance of balancing exploitative and exploratory BMI [9,10,11].

The literature on achieving such a balance is still rather controversial, with ongoing debates on how to structure the configuration of “BMI engines”. Chesbrough and Rosenbloom’s [12] study of Xerox’s spin-offs provided evidence that incumbents’ dominant logic operates against exploratory behavior, though structural separation helps to avoid such pitfalls. This study had its roots in the interaction between radical technological innovation and BMI (e.g., Tongur and Engwall [13]; Kaulio et al. [14]), showing that technological incompatibilities favor structural separation. Similarly, Kuhlmann et al. [15] found that separation is fruitful with paradigmatic changes, such as moving towards circular BMs. Habtay and Holmén’s [16] study provided empirical evidence that in cases of a combination of radical technological innovation and BMI, a separation seems superior, while under other conditions, an integrative strategy should be applied.

Despite research partially supporting the separation strategy, it does not come without challenges. Egfjord and Sund [17], for instance, investigated how separation generates a misalignment of perceptions among those responsible for the current BM and those responsible for the exploration of new BMs. Likewise, Sund et al. [11] investigated the barriers to exploring BMI. Their study showed that BMI engines have limited resources and capabilities, experiencing control pressures from the dominant BM to obtain results. Thus, integration mechanisms and balancing incremental and radical innovation might be needed. Another relevant barrier is the notion that adding a new BM is not always beneficial [9]. Besides the possible creation of unwanted complexity by adding new BMs, Hacklin et al. [7] showed that when the core BM is under threat, searching for new BMs draws attention away from saving the former, leading to catastrophic results. Thus, exploratory BMI is a sound strategy under stable environments, not only because it creates new revenue streams, but also because the proactive search for new BMs plays a major role in the ability to respond when the time of obsolescence arrives. Thus, the exploration of new BMs benefits incumbents’ ability to respond to radical innovation [7,8,18,19].

These contributions, therefore, advocate against a separation strategy, reinforcing the significance of managing BM renewal and exploration in parallel and creating a portfolio of multiple BMs [20,21], whereby incumbents benefit from deliberately exploiting complementarities between parallel BMs [22], even under the existence of partial cannibalizations [23]. Markides’ [24] seminal account provided a theoretical basis for understanding the exploration of such complementarities through degrees of integration between co-existing BMs while managing specific conflicts through partial separation. In line with this view, Khanaga et al. [25] showed that exploring touch points and integration between the obsolete BM and the substitute BM is beneficial for accelerating change while reducing organizational inertia.

Thus, the notion of incumbents benefitting from multiple BMs is rather contradictory to the idea of structurally separating the BMI engines to provide isolation from the influence of the core BM. The barriers to radical BMI also provide conflicting evidence, considering that the key barriers primarily stem from such a separation. Therefore, the literature focusses on understanding separated approaches and informing the need for integration mechanisms [11,15,16,17,26]. There are, however, fewer studies exploring in-depth cases aiming at understanding how the creation of integrated innovation departments can work to overcome existing barriers [11]. Moreover, despite the contradictory findings between both research streams, the literature on incumbent BMI has, to the best of the authors’ knowledge, neglected the bidirectional impacts of managing parallel BMs on the degree of exploratory BMI by incumbents.

To contribute to filling these gaps, our study’s objectives were to:

- Investigate incumbent companies that have developed systematic BMI processes through an integrated approach.

- Analyze the evolution of the investigated incumbents’ BMI process.

As a methodological approach, we conducted a multiple-case study involving three large Brazilian incumbents and adopted a system dynamics analytical lens to develop our theories. Our findings showed that a structured approach to achieving BM renewal with positive outcomes leads incumbents to pursue exploratory BMI. This structured search, besides achieving BM renewal, generates, as relevant outcomes, an increase in the openness to innovation, the buildup of innovation capabilities, and the greater availability of resources. The systemic consequence is a tension that pushes companies towards exploratory behavior to harness the favorable conditions. We also found that this evolution from BM renewal to exploration is insufficient because of the significant time delays between deciding to explore new BMs and achieving significant returns. Hence, the systemic forces push in the other direction: the lack of (short-term) results reduces the openness to change and increases control. To prevent this, our findings encourage the creation of a “buffer” that consists of: (1) the assignment of a vital role in the renewed BM to the innovation departments; and (2) the exploration of synergies between the core BM and new BMs. Our cases suggested that the type of BM renewal matters for the creation of the “buffer”. In particular, transformative BM renewal leads to the creation of white spaces inside novel paradigms, which the company can explore through new BMs, and tends to connect the innovation departments to the renewed BM’s value proposition.

This study’s contributions to the BMI literature are threefold. First, we contribute to the ongoing debate on the degrees of separation between BMI engines and the existing BM by providing evidence to suggest that integrated BMI engines that evolve from a transformative BM renewal strategy have positive impacts on solving potential barriers to exploratory BMI in incumbents. Second, we take the first steps in understanding how the management of multiple BMs through the deliberate pursuit of complementary new BMs as part of the renewed BM core logic plays a significant role as a “buffer” to support the longevity and the health of exploratory BMI. Third, we contribute to incumbent BMI theory by implementing the system dynamics lens to explain the key forces behind balancing BM renewal and exploration. Finally, our study contributes to practice by describing a process that can be followed by incumbent managers when creating their BMI engines.

The next section describes the theoretical background, including the business model and business model innovation concepts, the challenges and opportunities for incumbent BMI, and the bases for our analytical lens of systems thinking. Section 3 explains the methodological approach as well as the strategies for case selection, data collection, and analysis. In Section 4, we present our core findings from the case studies. Finally, we discuss this study’s key contributions to the literature and implications for practice and suggest some future research avenues in Section 5.

2. Theoretical Background

2.1. Business Model Innovation in Incumbents

A business model is a dynamic concept encompassing a combination of internal components, often referred to as the value proposition, value capture, and value delivery [27], and their evolution to adapt to and anticipate external environmental changes [28]. As such, the BM, as a non-static concept, is a complex system in constant evolution. Its architecture builds internal consistency between components [29], which must be aligned to the external environment under continuous change.

As a complex system, the power of the BM concept lies in the interactions between its components [29], as the whole is greater (or smaller) than the sum of its parts [30]. Casadesus-Masanell and Ricart [31] referred to the components as choices directed by the strategy, leading to several consequences that should create complementarities and sensemaking, ultimately generating competitive advantages. The evaluation of the Ryanair case showed that every BM part was aligned with the value proposition of offering low-fare flights. Similarly, by explaining the concept of business models as models, Baden-Fuller and Morgan’s [32] seminal account improved the understanding that BMs can be scale models, scientific models, and recipes. Condensing a complex system into a scale model, such as “the Ryanair model”, “Rolls Royce’s power-by-the-hour model”, and “the McDonald’s model”, represents it as a (well-understood) coherent system, which can be, of course, broken down into more detailed parts for analysis as a scientific model and then represented as a recipe of ingredients (components) and preparation modes (their interrelations).

This notion is particularly relevant, as BMI is a result of not only deliberate design practices [27,33,34] but also organic evolution, often with less-extensive design processes, in the pursuit of competitive advantages [29,35,36,37]. In connection with this, it is worth differentiating the development of a startup, i.e., a new BM from scratch, and the innovation of existing BMs, as in the case of incumbents. For the former, there is no previous system, as the BM does not yet exist, and it is, therefore, often an outcome of design [33]. For the latter, the BM evolves and creates complementarities that strengthen its market position over time. Such conditions generate not only structural but also cognitive forces around a system that already works that tend to create rigidity and inertia to change [36,37,38,39,40,41]. Understanding the nuances inside the umbrella term BMI is crucial because, as Casadesus-Masanell and Zhu [42] argued, BMI is a “slippery construct to study.” Thus, the particularities of each type of BMI lead to not only very different outcomes but also different managerial processes, capabilities, and challenges.

In a recent literature review, Foss and Saebi [43] created a typology for BMI by separating changes in the components (modular) and changes in the complex system (architectural), which could be new to the firm or the industry. However, it is still hard to grasp the differences between types of incumbent BMI based on such definitions. Volberda et al. [44] proposed a detailed typology considering the type of change, either transformative or evolutionary, and the strategic orientation in the ecosystem, either responding or shaping. As such, they provided a more fine-grained analysis of the possibilities of BMI by incumbents. For evolutionary changes, the BM renewal proceeds with no fundamental change in the BM logic. In cases of innovations (or societal changes) that dislocate the tight coupling between an incumbent’s BM and the environmental conditions (e.g., customer behavior, technology, changing society, and customer needs), transformative changes in the BM are called for, demanding different approaches [7,8,25]. Responding and shaping refer, respectively, to the strategic positioning of adaptations to changes as they come and the attempt to induce the changes themselves, pioneering and creating the future.

Additionally, incumbents can explore new BMs, creating new ventures [7,11,12,26,36,45,46]. Finally, incumbents can also explore both paths, targeting ambidextrous behavior conducive to BM renewal and exploration [7,8,22,24]. Thus, for incumbents, the concept of BMI can represent different things, ranging from incremental changes to transformative changes, coupled with the possibility of creating new BMs from scratch. Bearing this in mind, we differentiate the various types of incumbent BMI as incremental BM renewal, transformative BM renewal, and BM exploration:

• Incremental business model renewal

This type of BMI may be an outcome of both diagnosis and design activities and evolutionary, less deliberate changes that occur during a company’s search for increasing performance. In terms of the degree of change, it can be modular and/or architectural, but the core notion is that there is no radical change in the underlying BM logic, i.e., the changes tend to rely on additional value creation and delivery as means to increase the value flow and potentialize the value proposition already in place. As such, the core idea is to strengthen the position in the market, which is often represented by a greater willingness to change in order to obtain short-term results and is broadly supported by top management teams, considered the path-dependent solution [25,47]. A good example is the optimization of an existing BM by making it digital, i.e., through an online channel, to increase its reach and automate the value creation activities and its underlying business processes. In terms of challenges, naturally, any changes display inertia, but as the resulting changes fit the dominant logic [48], the barriers are lower and there is a reduced need for structured approaches to conduct [25].

• Transformative business model renewal

This type of BMI involves in-depth changes to the BMI logic, broadening or altering the customer bases, supply network position, and overall value proposition alongside value creation, delivery, and capture, i.e., a deep change in the organization’s capabilities. As such, the value proposition is reconceived, which calls for the rethinking of the creation, delivery, and capture. Illustrations of transformative BMI are Rolls Royce’s power-by-the-hour model [49] and the Encyclopaedia Britannica adaptation. The literature stresses that inertia [13,50,51], path dependency [52,53,54,55], and the potential cannibalization [23,25] of the business works against transformative BMI. Accordingly, the recommendation is for a separated, focused structure [37,56]. This type of BMI is often linked to a survival threat whereby the organization faces a situation in which the BM change is inevitable. However, the literature highlights the importance of proactivity and the realistic prognosis of the relevance of conducting transformative BMI as an opportunity to shape the future and improve an incumbent’s capacity to respond to radical innovation [7,44].

• Business model exploration: corporate entrepreneurship

This type of BMI refers to entrepreneurial activities undertaken by incumbents to create and explore new BMs, such as startups, either to open new markets and create new revenue sources or to accelerate current BM performance [45,57]. This involves exploring new knowledge, resources, and partnerships to develop innovative value propositions and seize new business opportunities. It requires entrepreneurial vision from a company’s board and top management, as its development is realized through corporate entrepreneurship or corporate venturing initiatives [58,59]. A good example is the undergoing strategic transformation of Bosch from a B2B manufacturing leader based on outstanding product innovation to a B2B leading provider of technological solutions based on internet of things and artificial intelligence [26]. As illustrated in the Bosch case, companies that pursue venturing BMI are primarily exploring the frontier of opportunities opened up by the digital economy and digital transformation. Moreover, as much as innovation itself has moved from the closed paradigm based primarily on internal R&D to open innovation based on interorganizational collaboration and access to external knowledge, venturing BMI has been characterized by strong external partnerships, particularly through corporate engagement with startups, i.e., incubation [60], acceleration [61], venture building, and corporate venture capital [62]. However, this BMI type presents barriers to incumbents, and many initiatives tend to collapse with time [11]. The first barrier is that experimentation and trial and error [48,63] are the underlying processes for BM exploration. This results in a resource-intensive process that takes a long time to achieve returns, depending on strong commitment. Startup founders, for example, depend on their entrepreneurial activities’ success, and the literature shows that commitment is crucial [64]. This is not true for incumbents, as they already have a successful BM that they can easily turn to if the endeavors fail. Thus, issues such as goal incompatibility [48,65], managerial complexity [7], and a loss of focus [17] play a role in shaping the tendency to return to incrementalism.

Therefore, in the literature and in practice, attempts are being made to uncover ways of overcoming such barriers and determine the most suitable organizational structure for pursuing lasting BM exploration that allows companies to seize “white spaces” [66] for business opportunities. Moreover, the relationship between BM renewal and exploration needs further clarification, especially considering the literature’s emphasis on both being vital for incumbents. This relationship can be either positive or negative. An excessive focus on BM renewal with an incremental goal, i.e., extrapolating from the current BM perspective, can hinder the ability to respond to discontinuities and constrain exploration [25,36]. The random exploration of new BMs can bring complexity, i.e., too many technological bases, high rates of cannibalization, and conflicts, leading to suboptimal BM management and consuming managerial attention [7]. Moreover, the challenges of generating relevant returns through new BMs [11] and the cognitive barriers relating a departure from the dominant logic [12,17,26] can induce barriers to exploratory BM, thus limiting future exploratory efforts. On the other hand, BM exploration is regarded as relevant to fostering experiments that can improve future envisioning, reduce dominant logic, and enhance BM renewal activity [3,7,8,36,63]. In this regard, the dynamics behind incumbent BMI and the relationship between BM renewal and BM exploration needs to be further studied. In particular, the balancing of renewal and exploration and the impacts of the various BMI types on each other remain understudied. To tackle these issues, we deployed systems thinking lens to better understand the dynamics behind incumbent BMI.

2.2. Sytems Thinking and Business Model Innovation

Systems thinking is a manner of understanding complex systems as a whole instead of looking at their parts individually [67]. The underlying notion is that the different parts of a system (e.g., businesses, ecosystems, or groups of people) are connected and that it is vital to understand how these parts affect one another. As such, it can be understood as a framework for analyzing and evaluating the interrelation between a system’s parts rather than listing its parts, i.e., it helps uncover patterns of change rather than taking static snapshots. Senge [68] highlights how, for example, short-term solutions to business problems represent a remedy that can, although improving performance, worsen the root problem that caused the issue in the first place. One of the reasons for this is that alleviating the problem’s symptoms works against setting up means to effectively solve the problem [68,69]. Furthermore, small changes in one part of a system can greatly affect the whole system [68].

In this regard, the literature provides a plethora of studies that have investigated the impacts of systems thinking on performance under different settings, such as sustainability [70], design thinking [71], public health and healthcare [72,73], and business performance [74]. The search for efficiency can begin by analyzing each member of an organization, with the goal of improving their individual performance. However, it is necessary to understand the mechanisms in place to determine how individual improvement affects performance—for example, the organizational processes, culture, and teamwork norms. For example, Cady’s [75] study showed that interventions at the system level can significantly improve teams’ performance when aligned with systems thinking concepts, i.e., the invisible (sometimes visible) mechanisms in which the individuals are embedded affect their mental models, thus shaping their interaction dynamics [76], highlighting the power of systems thinking for businesses.

Considering its relevance, the field of research on innovation management has explored the concept of systems thinking to, for example, explain decision making within the innovation process [77], understand and inform policy making to improve national innovation systems [78], and enhance the management and success rate of innovation projects [79]. BMs are broadly defined as complex systems [43,80,81,82], and there is wide recognition that innovations or changes in specific parts of a BM require systemic alignment in others [3,29,83]. However, despite the theoretical recognition, few studies have deliberately deployed a systems thinking analytical lens to understand BMI [84,85]. Nevertheless, the emerging literature has made advancements by proposing tools to help uncover the dynamics behind BMI, suggesting the application of causal loop diagrams, time delays, and stocks and flows [86].

3. Method

3.1. Research Methodology

As a research methodology, we conducted a multiple-case study, as this is considered a suitable research approach when the subject involves complex systems and organizational phenomena about which there is little knowledge [87,88]. In line with this study’s objectives, multiple-case studies allow an in-depth and longitudinal analysis of cases, which could help us uncover and establish theories by assessing the similarities and differences between various companies, ensuring the reliability, validity, and relevance of the research [89,90]. Additionally, case studies provide a richness of data that is supportive of exploratory studies aiming at the creation of new theories, as was the case with this study [88].

3.2. Case Selection

Following Eisenhardt and Gräbner’s [89] guidelines, we sought to build a theoretical sample. Moreover, we followed recommendations for critical [91,92] and longitudinal cases [88]. We delineated the following criteria: (1) we selected cases at least in the stage of pursuing the creation of new BMs through a BMI engine; (2) the selected companies displayed resilience and longevity in their BMI engines; (3) we selected large incumbents that were leading companies in their market segments; (4) the sample comprised at least one company in the manufacturing industry, one company in the ICT industry, and one company in the services industry; (5) the cases were not born digital and had existed for at least 20 years. The focus on large companies was based on the notion that larger and older companies tend to display a higher degree of systemic complementarity in their BMs [37,43], which leads to greater rigidity. This criterion rounded up our focus on critical cases, as the BMI literature highlights the challenge of changing existing BMs and moving from traditional business-as-usual to agile and exploratory organizations (for more details on agile organizations, see [93]).

The Selected Cases

Alpha is a 96-year-old leading incumbent in the Brazilian health diagnosis industry, offering a broad range of services. In 2014, the company started its renewal, in particular by reshaping and intensifying innovation activities, moving from traditional reactive medicine with diagnostic services to precision medicine. In the last three years, the company has created its first new BM and has been pursuing the creation of new startups to fill in the predictive and precision medicine value chain.

Beta is a global player and a leading incumbent in the personal care and cosmetics industry, with a long and successful history. The company was born with innovation at its core, as it is one of the only players in the world to leverage Brazil’s extensive flora and fauna. The uniqueness of the products has placed R&D at the core of the company since its founding. Since 2012, the company has been rethinking its BM, especially due to digital transformation. In the last three years, it has been attempting to create new startups with a strong merger and acquisition strategy.

Gama is one of the ten largest incumbents in the field of R&D outsourcing in the Brazilian ICT industry, and recently it has become an international player with projects in North America and other countries in South America. Despite the company’s core activity of operationalizing third-party R&D projects, it has displayed poor innovation performance since its founding. Considering its basis in information technology, the company had no specific technological focus, executing almost any kind of project. To tackle this issue, the company began its BMI journey in 2017 by narrowing its technological focuses to the most promising future technologies according to a foresight study (including 3D printing, data science, cognitive computing, industry 4.0, cybersecurity, and blockchain) and creating new BMs based on these technologies. In 2020, the company launched its first new startup, and it launched two more in 2021. Table 1 summarizes the cases in terms of their size, revenue, and employee count.

Table 1.

A brief description of the cases, including the country of origin, age, industry, size, employee count, and revenue.

3.3. Data Collection

For the data collection, we followed the literature’s directives for multiple-case studies [87,88,90]. We developed a case-study protocol, considering data from semi-structured interviews with key informants and a longitudinal analysis of annual reports and public documents as secondary data. To ensure reliability and validity, we deployed triangulation techniques to cope with possible informant biases, especially stemming from the characteristics and judgments of our interviewees that may have led to a distortion of reality [94]. Considering the different realities of our case companies, we followed different triangulation and data-collection strategies. For Alpha and Beta, which are public companies, we took advantage of the availability of a large amount of documentary data, extensively using reports and documents to triangulate with the interviews. Thus, we first conducted an in-depth documentary analysis and then proceeded to the interviews. This allowed us to confront interviewees from Alpha and Beta with documentary data when contradicting information arose. For Gama, which is not public and thus did not provide such a richness of documentary data, we broadened the demographics of our interviewees by including persons from different backgrounds and managerial layers and conducted an internal document analysis.

We conducted 14 semi-structured interviews, with an average duration of 60 min, ranging from 15 to 75 min. We created transcripts of the interviews immediately following their completion. Considering the goal of understanding the systemic complementarities between the BMI engine and the current BM, focusing on the structural and strategic levels, we chose our key informants from the top management team of the companies, preferably at the CXO level and directly connected to the BMI engines. In the case of Gama, we included interviewees from other departments and levels, such as R&D and human resources, to make up for the lower amount of available data and facilitate a deeper analysis. Table 2 depicts the demographic data of the key informants in each case, the supplementary material used to triangulate, the number of interviews per case, and the duration of the interviews.

Table 2.

Key informants, number of interviews, average duration, annual and managerial reports, and additional documents.

3.4. Data Analysis

For the data analysis, we filed and documented the data into tables and revisited the interview transcriptions multiple times to analyze the gathered data. Then, we followed Strauss and Corbin’s [95] recommendations. First, we conducted open coding, focusing on first analyzing each case separately. After understanding each case, we moved to axial coding, looking for similarities and differences between the cases and considering how they contributed to answering our research question. Finally, we conducted selective coding to derive relevant constructs and concepts from the cases [87]. We also employed one of the researchers as a devil’s advocate to help reduce potential biases in the analysis [96]. Finally, the authors conducted data ideation and representation processes, contrasting the available data sources as the underlying triangulation method [97,98].

4. Results of the Case Studies

In this section, we present our study’s core findings. First, we briefly present the BM of each of the studied cases, highlighting how it co-evolved with their BMI engines from the beginning of our analysis. Then, we investigate the system dynamics through which their structured approach to pursuing BM renewal led them to begin exploring more radical BMI. We then show how our case studies created integration mechanisms between their BMI engines and the core business model to sustain their exploratory efforts. Hence, through a system dynamics analytical lens, we present the inducted theory of how incumbents can create BMI capabilities to prepare themselves to respond to radical BMI.

4.1. Presentation of the Cases

4.1.1. Alpha

Alpha’s initial BM was that of a health diagnostics service, operating via intermediates, in the B2B2C model or directly via the B2C model. The core value proposition was centered on high-quality tests and sample collection. Its value creation architecture was based on deploying a technical-oriented staff responsible for conducting R&D to create new tests or improve the existing ones. Alpha’s position in the market was to attend all patient classes, with different layers of tests and exams and through different channels, focusing on service excellence to acquire and retain customers. Thus, innovation until 2015 was mostly directed toward technological advancements in medical techniques and analysis.

The BMI efforts in the company began in 2017 with the “genomic project”, an initiative that aimed to leverage the power of digital technologies, particularly artificial intelligence, to pioneer predictive and precision medicine in the future (Alpha’s annual reports, 2017, 2018, 2019, 2020; CEO interview). Alpha’s modular BMI process was based on reframing its value proposition to focus on predictive and precision medicine, i.e., patient well-being. This materialized as modular differentiation from the reactive medicine practiced so far via the exams and tests offered by the company, based in discrete product innovations inside the BM (Alpha’s new business director).

The evolution of such a practice led Alpha to a transformative change in its BM, rethinking its business model from a diagnostic services provider to a healthcare platform (Alpha’s annual reports, 2020 and 2021). The value creation element of the new BM changed to incorporate the exploration of new businesses that could play a role in the predictive medicine ecosystem. In 2019, Alpha launched its first spin-off, a B2C BM platform that performed the functions of telemedicine marketing, genetic and lifestyle conditions monitoring, treatment and exam scheduling, and so on (Alpha’s annual report, 2019 and 2020).

4.1.2. Beta

Beta’s initial BM followed the traditional personal care and cosmetics manufacturing model. The company delivered value by deploying a large force of sales representatives that increased its sales and created value through R&D to provide product and process innovations that sustained the value proposition of well-being through differentiation. The company differentiated itself within the market by positioning itself as a sustainability-oriented company, exploiting the country’s vast plant diversity without depleting it and creating value for neglected populations living in underexplored areas. In a manner, the company’s demand was driven by its network of representatives, which sold the products through personal contacts to end customers. Thus, it could be understood as a B2B2C model.

Naturally, this network of representatives played a major role by shaping Beta’s product mix, obtaining customer feedback that could inform R&D, and creating bonds with end customers to transmit the company’s core values to society. This was, however, a largely analogical process that relied on suboptimal information flow and emphasized mouth-to-mouth mechanisms. Thus, Beta depended on its representatives’ knowledge creation and sharing, whose effectiveness was perceived as low due to information loss (interviews with Beta’s CIO and innovation manager). As such, Beta’s BMI journey began by focusing on how to digitalize this highly analogical process, therefore improving its effectiveness. It is safe to say that this represented modular and incremental BM renewal.

The evolution of Beta’s BMI journey followed the digitalization of its entire BM, with the precise goal of becoming a digital company (interview with Beta’s CIO). For Beta, this meant implementing an agile culture to reduce lead times from innovation processes, and therefore the company moved forward to renew its value creation mechanisms through digitalizing the R&D process. Finally, Beta decided to explore the addition of new BMs, especially a service BM, to reinforce its value proposition through a BM exploration strategy. The company mainly adopted an acquisitions strategy to purchase fast-growing startups with BMs that were seen as complementary to the company’s vision in order to create a well-being platform around its core BM.

4.1.3. Gama

As described by its CEO, Gama’s initial BM was that of a “passive outsourcing of Information technology R&D” (interview with Gama’s CEO). In this regard, Gama’s value propositions were information technology competency and knowledge, with its value creation process being the application of knowledge to solve customers’ problems. Under the initial model, the value delivery was achieved through the company’s commercial department. Large IT companies found Gama due to its market reputation and asked for potential solutions to well-defined projects, which the companies were unwilling to conduct internally. Although offering R&D outsourcing solutions, Gama did not have its own R&D department and hired people ad hoc to solve demands as they arose (interviews with Gama’s operations manager and CEO).

Gama’s BMI journey began in 2017, when macroeconomic problems in Brazil led major IT companies to cut their R&D budgets, which had drastic consequences for Gama (interview with Gama’s innovation director, internal strategic documents). The company needed new revenue sources to complement its main BM, as it was too dependent upon the external economic conditions. Gama first changed its value proposition by proactively searching for market problems and creating potential solutions in the form of minimum viable products (MVPs) or proofs of concepts (PoCs), which were implemented to improve the company’s reputation in the market and gain a competitive advantage.

Following this, Gama created an R&D department responsible for anticipating the problems faced by large IT companies and building MVPs and PoCs encapsulating the resources needed to solve such problems. In doing so, the company transformed its BM from a passive R&D outsourcing BM to an active R&D outsourcing BM. The accumulation of such MVPs and PoCs, considered assets by the company, led it to explore novel BMs, launching its first startup in 2020 and three more in 2021. Gama’s startups are still in the market creation stage.

4.2. From Business Model Renewal to Business Model Exploration

The BMI efforts of our studied cases arose due to the perceived threats stemming from digitalization, which created a feeling of needing to act among the companies’ management. Alpha’s journey began by repositioning its services toward high-end customer segments, with the focus of the improvements being on the value proposition (Alpha’s annual report, 2015 and 2016). Then, it coupled this action with the genomic project, which combined the company’s medical capabilities with novel bioinformatic and digital capabilities, targeting the creation of new business strands through novel service offerings complementary to the existing BM (annual reports, 2018 and 2019; CEO interview). Beta focused on its sales representatives network, which was highly personal and analogical, targeting its value delivery architecture to improve performance while creating means to extract value from customer data (CTO interview, Beta’s annual report). Gama’s target was the creation of new assets, such as prototypes, that could support its reputation and image in the market, thus reshaping its value proposition and value delivery by better segmenting its customers and sharpening its offerings (interviews with the CEO and innovation director).

The first step to achieving the outlined goals was to deploy a structured approach, changing the organization’s design by: (1) either creating an innovation department at the top management level (Beta and Gama) or reframing a top-management-level department’s role to focus on innovation (Alpha) and (2) assigning a champion to the innovation departments at an executive position. Alpha’s choice was to reframe its new business department to embed digitalization at the core of the business (Alpha’s annual report) through the deployment of IT personnel in the leadership:

“We are an organization that we had a medical and technical board, and I was also part of it, where there is an R&D with all the doctors conducting innovation in tests and innovation in services. The doctor with the R&D team sets up this test. Now we have a new arm in business innovation. […] And there is the whole IT part that has the traditional, infrastructure and systems and there is the all-digital part that looks after squads, whether in the traditional or in the new businesses.”(Alpha’s CEO)

Relevant to the evolution dynamics of the BMI efforts by the studied cases was the provision of limited resources coupled with a high degree of control and a need for results. Alpha had the most significant resources for its innovation department, as it reassigned part of the new business department, providing a dedicated innovation personnel and budget. However, the company understood the need to keep the department lean by building the innovation team transversal to the company, with employees from different departments participating in the innovation squads (CEO interview). Beta assigned to its newly created vice presidency of the business platform (Beta’s annual report) a team of five members (interview with Beta’s CIO). These groups were also deployed transversal to the organization through a matrixial structure, in which the projects were managed through squads (interviews with Beta’s CIO and innovation manager).

“In 2012, when digitalization actions began, the goal was the digitalization of the business, and not of internal specific departments. Hence, the challenge was to digitalize our representatives’ network in the society.”(Beta’s innovation manager)

Similarly, Gama’s approach was to entrust its innovation direction to its innovation director, with other team members being volunteers taking part in the innovation projects (interviews with CEO, innovation director, and R&D manager).

“We had limited resources, and the department was comprised only by me. So, I had to create engagement and gather volunteers, which worked outside their hours.”(Gama’s innovation director)

Due to the combination of limited resources, a high degree of control, and the need to change, the innovation department focused on renewing the current BM, targeting solutions that consumed fewer resources and delivered more significant results. The innovation departments’ actions grew from small modular changes in specific parts of the BM, i.e., digitalization, to architectural changes across the whole BM. In doing so, the companies experienced an increase in the performance of their current BMs. Alpha’s revenue grew from around USD 500 million in 2015 to USD 1 billion in 2021 (Alpha’s financial reports). Beta grew 175% from 2016 to 2021, along with an increase in net profits, in comparison to its growth of 43% in the period from 2011 to 2015, during which Beta shrunk its margins and net profits (Beta’s financial reports). Gama’s income grew 250% in the period between 2017 and 2021, and it swelled from around 250 employees in 2017 to more than 600 in 2021, again in high contrast to the period between 2014 to 2017, when the company reduced its size from around 300 to less than 200 employees and struggled to maintain its revenue size (Gama’s internal documents). Table 3 provides more details on the companies’ performance.

Table 3.

Performance of Alpha, Beta, and Gama by year.

Interestingly, whereas Alpha and Gama’s growth was steady during the considered periods, Beta displayed an “accordion effect”, whereby it recorded high growth in one year, followed by a stagnant period the next year. This phenomenon, which can be interpreted as a consequence of the company’s acquisitions strategy, will be explored further below. Although limited, these performance indicators help partially translate the BM renewal in terms of the company’s growth rate and employee count.

Despite the main result being a reduction in the need to change the current BMs, this growing evolutionary approach led to a set of relevant additional outcomes that we will explore in the next subsections: (1) increased openness to innovation among both the top management and the wider employee bases of the companies; (2) enhanced resource mobilization (human, budgetary, relational) and availability for innovation departments; and (3) an increase in BMI capabilities, with the teams focusing their learning efforts in this direction, enjoying greater freedom and growing resources.

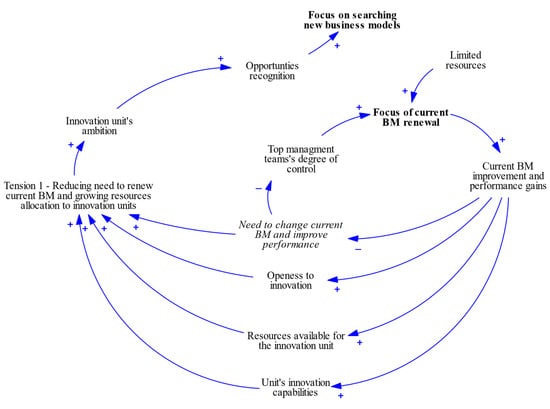

This subsection examined how the conditions surrounding the emergence of BMI efforts in the incumbents played a vital role in the evolutionary dynamics of their BMI capabilities. This was because such conditions led the companies to deploy creative methods for gathering resources, coupled with an incremental and more chirurgical focus on Pareto solutions that consumed the least resources but led to higher returns. The achievement of performance gains through the renewal of the current BMs reduced the need to change the current BMs while creating a latent stock of BMI capabilities. We observed a growing set of resources for innovation departments and cultural changes related to increased openness to innovation. This created a tension (i.e., between growing BMI capabilities, openness to innovation, and available resources and a diminishing need to change the current BM) that led to a shift in focus from BM renewal to the exploration of new BMs. Figure 1 summarizes the system dynamics surmised from the multiple case studies, which we will explore further in the next subsections.

Figure 1.

The system dynamics behind the evolution from BM renewal to BM exploration.

4.2.1. Openness to Innovation

We found that openness to innovation had its roots in three different mechanisms. The first was the integration mechanism of creating transversal agile teams, in which members from different departments took part. To unfreeze and change the organizational culture towards innovation, the companies chose the strategy of introducing BMI techniques and creating an innovation-friendly atmosphere to motivate and capacitate their personnel. Alpha and Beta introduced Spotify squads (Alpha’s innovation manager; Beta’s CIO) led by IT experts, with the particular aim of helping disseminate agile techniques. This action was conducive to engaging interested employees to take part in Hackathons, design thinking [99], and lean startup [100] events (Alpha CEO interview, Beta innovation manager interview, Gama CEO interview). One essential element cited in the interviews was the acceptance of failure, which was accompanied by events and a secure space to think outside the box.

“But new capabilities as professionals who think about User Experience, digital, platform solutions, we didn’t have. We bought [a] primary care startup. We set up a digital team, a team with young people with these other capabilities. We were making a mix, because in our view these people with new capabilities cannot be left alone in the organization”(Alpha’s innovation director)

The second mechanism was the top management team’s degree of control, the consequent autonomy of the innovation department, and the influential actions of the innovation department’s leadership. The need to generate results with limited resources naturally pushed the leadership to act as a seller of ideas in pursuit of buy-in from the top management. The incremental growth from small wins to larger changes in the current BM increased the top management team’s confidence in the department’s ability to deliver results and make autonomous decisions for larger jumps. As Beta’s CIO put it:

“The CEO and the chairman were the biggest sponsors’ of the projects. As we had successful small wins, we earned top management’s interest and that allowed us to reach the current stage. […]. So, we spent 2 years piloting a digital Business Model in which the digital was placed at the center. The first was in Campinas and ended up being rejected due to the view that the Value Proposition for consultants was still insufficient. The second pilot was in São José dos Campos, with adjustments to this value proposition, and already a slightly more open vision. This led to changes even in the organization’s way of approving projects. In the past, to make a small change to the company’s logo had to be approved by the Vice Presidents. In 2014, when the Business model was created, Natura started to provide a platform for the consultant, with all the necessary functionalities”(Beta’s CIO)

The third mechanism stemmed from the managerial point of view. The structural change induced by the top management teams through creating specialized innovation departments transmitted an important message across the organization regarding the company deemed relevant. This induced a shift in cognition, with personnel believing that to fit into the organization it was essential to embrace innovation, triggering an evolution in the culture to one more open to innovation:

“We transmitted a message for the employees that innovation was of utmost importance. We designed our open innovation funnel and how innovation would contribute for our core business, hired an experienced, yet forward thinking, innovation director.”(Gama’s CEO)

4.2.2. Resource Availability

We noticed a solid and constant growth in the number of employees involved in the innovation departments. Gama started with only the innovation director in 2017. In 2020, the company had more than 30 employees dedicated to the department, which increased to around 50 employees in 2022, accompanied by the creation of a formal R&D department (Gama’s internal documents). Beta’s vice presidency of business platforms started with five employees, i.e., the CIO, one product owner, one tech lead, one scrum master, and one user experience professional (Beta CIO interview). Subsequently, it grew and separated into two core subdivisions, the innovation lab and the business innovation department, and added a CTO to share the leadership with the CIO (interview with Beta’s innovation manager). This represented an increase in resources and freedom to balance incremental and radical innovation. When asked about the size of the fixed team, the CIO answered as follows:

“(Today) 50, my team practically does the leadership, who does it in practice is consulting (partnerships). In our squads, the Product Owners, Tech leads, scrum master and User Experience are all [Beta] employees. The remainder of the development and quality force is outsourced. There are more than 50 [outsourced] consulting partners.”(Beta’s CIO)

4.2.3. Innovation Capabilities

The accumulation of innovation capabilities stemmed from the combination of learning activities conducted by the innovation departments and the strategic and structural approach followed by the studied cases. The guiding thread that allowed the associated activities to create BMI capabilities was the attention devoted to searching for opportunities, designing changes to gather necessary resources, and the cultural and transformational actions necessary for change. The efforts to create an innovative culture and improve the quality of solutions led to a learning curve regarding BMI in the studied cases. Alpha’s attempts to combine digital competencies and innovation capabilities with their core competence in medicine through the squads led to knowledge sharing regarding BMI and the spread of knowledge about its tools, practices, and processes (Alpha CEO interview). In measurable terms, Alpha increased from 66 implemented product and process innovations in 2015 to 430 in 2021 (Alpha’s annual reports, 2015 and 2021). Gama’s approach was to encourage its employees to use their working hours to study innovation and engage in events, including their own BMI-oriented event, which combined theoretical and practical knowledge as the basis for their BMI capability evolution.

“In the first rounds of our open innovation event, we had many potential opportunities brought by our employees, but we noticed that they still lacked quality, and we could only create basic ideas that, despite serving our core BM well, had no potential to become new business models. After a few iterations we noticed an important improvement, and were able to create our first ideas that had true potential to become new BMs”(Gama’s innovation director)

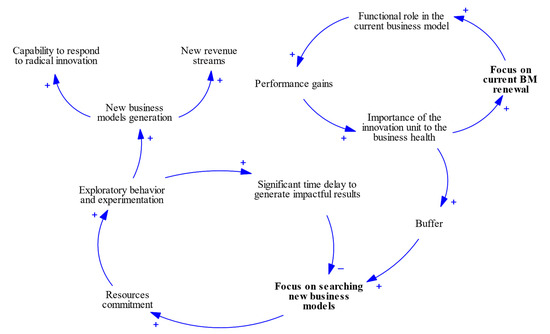

4.3. Sustaining Business Model Exploration through the Creation of a “Buffer”

Exploring new BMs is an uncertain and time-consuming activity, from initiation until the new BMs provide relevant returns to the incumbents. The exploration of new BMs is also a resource-intensive activity. This is further exacerbated for incumbents, which need to sustain growth to satisfy their shareholders’ and stakeholders’ interests. In systemic terms, this means that the resources committed lead to a momentaneous increase in exploratory behavior and experimentation to create novel BMs. Given the time and learning curves, such activity might lead to the generation of new business models. However, on the other hand, the time delay associated with this activity in terms of years tends to suppress the activities by unbalancing the resource allocation towards incremental BM renewal, suppressing radical BM exploration.

In our cases, Beta had the most significant barriers to the pursuit of exploratory BMI. Alpha and Gama followed a more organic and evolutionary path. One probable reason was that Beta, after achieving BM renewal and securing greater resources, attempted to separate its new business creation engine from the core business (interviews with Beta’s CIO and innovation manager). Moreover, Beta’s BM renewal was mostly incremental, with most innovation manifesting as a transformation from analogical to digital, but without changing the BM logic (Beta’s reports, 2015–2021). On the other hand, Alpha and Gama pursued transformative BM renewal; Alpha rethought its business from a value proposition of diagnostic services towards fully predictive medicine (Alpha’s reports, 2018–2021, and Alpha CEO interview), and Gama moved from responsively operating outsourced R&D activity to anticipating its customers’ needs, offering projects with cutting-edge technology, coupled with the creation of innovative BMs based on digital technologies (interviews with Gama’s innovation director, CEO, and R&D manager).

Such a situation emphasizes the need to create integration mechanisms between the exploratory BMI endeavors and the current BMs. Alpha and Gama took advantage of the evolutionary dynamics of their BMI engines to establish touchpoints between both. Hence, to avoid the suppression of exploratory behavior, it makes sense to create a “buffer” that sustains the long-term perspective. One possible path, followed by Alpha and Gama, was to assign to their BMI engine a significant role in the existing BM and to explore the creation of complementary parallel BMs. Figure 2 depicts the systemic model of the buffer as a bridge mechanism between the renewal of the current BM and the creation of a new business model in incumbents, allowing incumbents to develop the ability to respond to radical innovation. The next subsections explore the cases’ “buffers”.

Figure 2.

The “buffer” as a mechanism for sustaining exploratory BMI and bridging the dual goals of focusing on the core BM while exploring new BMs.

4.3.1. Alpha’s Healthcare Platform Business Model as the Driver for Exploring New Business Models

Alpha had two core integration mechanisms. The first was the genomic project, in which the innovation department provided an inflow of high-value-added services for predictive and precision medicine to its customers, underpinning the company’s differentiation strategy within the healthcare platform BM (annual report, 2021; CEO interview). This project formed the basis of mixing medical knowledge with data science and bioinformatics, comprising the core value proposition of the company’s healthcare platform BM. The company defined this core as precision and predictive medicine based on patients’ genomic, proteomic, and habit-related information, aimed at predicting future diseases and anticipating treatments.

“In fact, the potential of using genomic information, behavioral and biological data from exams, has enormous potential. You can make a more predictive medicine. So how can we reduce patient health risk, do better follow-up to make an individualized and personalized health journey. Predictive medicine, such as using genomic, behavioral, and environmental data. So, the potential is very large and goes into analytics”(Alpha CEO interview)

Alpha promoted, through both mergers and acquisitions and internal startup development programs, the creation of new businesses that could orbit this central value proposition (Alpha’s annual reports, 2019, 2020, 2021; CEO interview). Consequently, Alpha sought to fill multiple gaps in the predictive healthcare supply chain, delivering prediction services, treatment solutions, surgeries, habit and nutrition counseling, and services for digitalizing hospitals and nurseries. Therefore, although new businesses may take time to yield returns, Alpha’s mixture of acquisitions and the creation of new BMs created a “constellation” of mutually reinforcing BMs. For example, its newly created BM, a B2C market platform, uses patients’ data to promote their health and well-being. The platform has connections to the genomic project, as it provides predictive and preventive care for users, but it is also part of the marketplace for diagnosis, treatments, and so on, alongside Alpha’s service and competitors. Additionally, Alpha took advantage of its access to data and large customer base to accelerate the growth of this new BM. The result is that this BM represents 5.2% of Alpha’s revenue due to such linkages (Alpha’s annual reports, 2020 and 2021).

4.3.2. Beta’s Incremental Business Model Exploration to Improve Its Core Business Model

Beta rooted its BM exploration strategy in deploying startup challenges to (1) accelerate the resolution of current process bottlenecks and (2) solve large sustainability problems and, by exploring startups that offered services aligned with its core BM value proposition, strengthen its market position (interview with Beta’s innovation manager). The idea was to create a BM constellation, to which the innovation department added, through acquisitions, fast-growing startups offering services that could potentialize their core business’ product sales (CIO interview). Beta’s innovation department, however, faced challenges when attempting to create its own new BMs:

“What we have is an innovation machine that is not yet fully tuned. An incremental H1 type innovation is super easy. Now a more disruptive innovation is much more complex. We identify a cool startup that can speed up a process, the squads go there and promise that it will impact a certain indicator within a period of 4 months. The new business team does this pre-sale a lot, to raise funds. Everything that talks about innovation that is not connected with the core of the current business model is more complex”(Beta’s CIO)

One explanation for Beta’s struggle to sustain its BM exploration strategy lay in the fact that the company skipped radical (or transformative) BM renewal, moving directly to BM exploration. Despite the accumulation of favorable conditions, this did not create an effective buffer through renewing the company’s value proposition, which remained the same after Beta’s BM renewal. In this regard, Beta’s deployment of acquisitions to accelerate the transformation and create new startups was conducted in order to gain buy-in from the top management and the company (Beta’s CIO), leading to the observed accordion effect.

4.3.3. Gama’s Competency “Encapsulation” and the Search for Pioneering Digital Technology Business Models

Gama’s innovation department was at the root of their active R&D outsourcing BMs, whereby the R&D activity was focused on anticipating widespread customer trends and needs and creating highly customized and high-value-added offerings (interviews with Gama’s CEO, innovation director, and R&D manager and Gama’s strategic map). Similar to Alpha’s approach, Gama’s innovation department underlays the value creation at the core of its renewed BM’s value proposition. To create the value of actively anticipating the widespread needs of IT customers, the company deployed its R&D team to explore well-defined technological platforms. This allowed them to play with novel solutions and create MVPs and PoCs (considered by the company as assets) that represented the cutting edge and tacit technological competencies in tangible terms (R&D manager interview).

“We are a competencies seller. To have a competitive advantage in this market, we need to prove our skill to the clients, which is challenging because competencies are not tangible. What we do is anticipate our customers’ needs by deeply studying what they will do in the future, build our experiments, transform into MVPs and PoCs and then enchant our customer. This is what differentiates us from our competitors in the market”(Gama’s CEO)

As stressed by different members of the company (CEO, innovation director, R&D manager, new business manager) one of the greatest challenges for Gama when persuading customers to engage in R&D projects is to prove its competency. This is a task that the company is addressing through its innovation department in order to differentiate itself from other players in the market. The effective execution of plans and the achievement of meaningful results, such as growing from less than 200 employees in 2017 to more than 600 in 2021, were attributed by the company’s management and employees to the innovation department (interviews with Gama’s innovation director, CEO, R&D manager, and operations manager).

As a side-effect, Gama began accumulating such assets on its “shelf”, which led the company to attempt to explore the natural creation of new BMs. Consequently, it was possible to observe a crescent-shaped growth in Gama’s attempts to create new BMs. In 2019, Gama accumulated a set of 18 assets in the form of MVPs and PoCs, with no attempt to create a new BM. In 2020, Gama launched its first four startups in the market, and in 2021, two more were launched (Gama’s internal documents).

In addition to the competency “encapsulation” integration mechanism, Gama has also followed the approach of linking the exploration of new BMs to a core strategic vision. Through this connection, the new BMs should follow the company’s long-term goals regarding technological bases and market areas (Gama’s internal documents). As such, the company can explore links between the core BM and newly created BMs by accelerating technological development and exploring its connections to facilitate market penetration (interviews with Gama’s innovation director and new business manager). The impetus behind the technological alignment is not only the possibility for Gama to accelerate its nascent BMs’ technological development and market penetration, but also the opportunity to create future clients who would also leverage Gama’s R&D outsourcing BM.

“My dream for the future of our innovation department is, that we will be creating our future clients.”(Gama’s innovation director)

5. Discussion and Conclusions

5.1. Theorethical Contributions

The innovator’s dilemma [38] has provided a basis for understanding that well-managed and innovative incumbents tend to crumble in the face of radical innovation. This theory highlights the fact that incumbent BMs are structured not to promote innovation and the creation of novel BMs, but to be further improved [36,37]. However, incompatible with the current realities of businesses, digitalization, the increasing pace of technological development, and the growing pressures to achieve sustainable development goals have emphasized the need to solve this dilemma. The literature has reached a consensus that the ability to conduct core BM renewal and new BM exploration is vital [3,6,11,18,26]. Furthermore, creating parallel BMs is a potential path to building resilience and anticipating future disruptions [7,8]. The development of such resilience is, however, a significant challenge considering path-dependency issues [52,53,54,55], the cognitive and cultural barriers stemming from dominant logic and goal incompatibility [12,48,65], the possible adverse effects of adding new BMs to a portfolio [7,9], the time delays and challenges presented by new BMs before they can generate relevant results for the company, and the high resource mobilization required [11]. Thus, despite the wide recognition of the relevance of conducting both exploitative and exploratory BMI, the attempts to achieve the latter still suffer from high failure rates and poor results [7,11,17]. Our findings mirror exactly such phenomena, with the movement from BM renewal to BM exploration occurring in a semi-automatic fashion. The major problems arise when sustaining BM exploration efforts. We found that these are dependent upon a series of factors.

Bearing this in mind, by analyzing through a system dynamics lens the evolution over time of incumbents that developed systematic BMI processes though an integrated approach, we provided a series of contributions to understanding how incumbents can sustain their BM exploration efforts. More precisely, we depicted the existence of an evolutionary approach comprising a movement from BM renewal to the creation of favorable conditions for exploratory BMI. In line with the barriers identified by the literature (e.g., [8]), our findings also provide evidence that the discrepancy between the need to grow and the results obtained by BM exploration creates resistance from the top management and a tendency to move backwards to incrementalism. This vicious cycle has its roots in the fact that searching for new BMs is an activity that demands high resource allocation. Nevertheless, it presents long delays before providing noteworthy results, i.e., it is challenging and time-consuming to create a BM that generates results comparable to those achieved by incremental and short-term efforts. Thus, there is a paradoxical tension: exploring new BMs needs strategic alignment and a balance between incremental and radical innovations, which tends to favor incremental solutions over radical and exploratory ones. Our study, therefore, provides an initial contribution by showing that such a paradox is also a problem for integrated approaches. Beta’s case precisely illustrates this paradox.

In contrast, our findings also provide evidence to support the idea that the integrated approach may have advantages in overcoming these barriers, especially through the creation of a buffer. Alpha and Gama’s approach was to strategically assign to the BMI engines a vital role in contributing to the renewed BMs’ value proposition and creation architecture. The companies thus relied on their BMI engines to create value and returns that satisfied the top management’s requirements while creating integration mechanisms such as the transversal participation of the organizations’ members in innovative activities. This pertains to the continuous pursuit of innovations within the core BM. An additional mechanism identified was the exploration of new BMs that are somehow complementary to the core BM, in line with the ambidexterity theory [21,22,24,25]. In this regard, our results provide evidence that both agrees with and contradicts the literature. In Beta’s case, the strategic alignment between the core and the exploratory endeavors favored path-dependent behavior, while we found contradictory results for Alpha and Gama, whose buffers worked to foster radical innovation.

One explanation for this contradiction is that the problem did not seem to lie in the attempt to align the strategy of the innovation departments and the core BM, which, as the literature has highlighted, tends to unbalance attempts in favor of incremental innovation [11,12,48]. We suggest that when BM renewal is carried out with a long-term perspective in anticipation of disruptive BMs in a particular industry, this problem becomes a potential solution. Alpha’s BM renewal began with the understanding that their present BM, focused on reactive medicine, would become obsolete when predictive and precision medicine became the new paradigm. Such a strategic vision led the company to carry out its BM renewal within this new paradigm, changing its BMs to those of a healthcare platform. Considering the possibility of pioneering this new paradigm and the existence of many “white spaces” [66,101], the exploration of new BMs turned out to be aligned with the company’s strategic orientation and complementary to its vision. Likewise, Gama envisioned the future of R&D-outsourcing BMs as more collaborative, working with customers to anticipate the future, i.e., generating the demand from customers, rather than the customers outsourcing whatever R&D projects they are unwilling to conduct internally. With this approach, the company also changed its core BM into a pool from which many new BMs could be derived, creating mutual complementarities.

On the other hand, Beta stuck to its current BM’s core logic, focusing on the digitalization of its analogical processes and targeting performance gains. In this case, the alignment did not lead directly to creating opportunity spaces for developing new BMs. Likewise, many of the abovementioned barriers stemmed from a scenario whereby the innovation departments were seen as a panacea, with the exploratory BMI able to diversify the company’s revenue streams and save the company. One explanation for this is that in cases where no future envisioning takes place during the BM renewal, the dominant logic, with strong roots in the present state of the BMs, tends to win out over the exploratory behavior.

This theory also helps explain why the issue of managing parallel BMs does not arise in some cases of radical BMI by incumbents. For example, the exploration is seen to be segregated from the incumbent’s core BM [11]; attempts are made to fit it into the present state of the core BM, as in the case of the Xerox spin-off [12]; or the exploration is carried out in random directions, which negatively affects the incumbent by increasing its managerial complexity [7]. It is reasonable to assume that diversifying the revenue stream through new BMs may be seen as unproductive in the short term by the top management, as the exploration takes time to produce results that represent significant returns. We argue that if this is the case, the tendency is for companies to attempt to gain buy-in by acquiring larger startups that can bring additional customers to the core BM, which can be understood as “incremental BM exploration”.

Beta’s example is particularly revealing. In the face of the top management team’s reluctance to accept exploratory projects, the innovation department’s managers began to map and purchase more mature startups to show the top management the power of adding novel BMs. The startups were aligned to the company’s core BM, as they offered services that could encourage users to purchase Beta’s products, thus improving the current BM and targeting lock-in effects. In sharp contrast, we observed that Alpha’s spin-off encouraged patients to use not only Alpha’s solution but also its competitors’ solutions. Such a scenario highlights the fact that Alpha’s buffer and BM constellation core were not aimed at further improving the initial BM but rather at contributing to the overarching future vision of predictive medicine benefiting patients’ quality of life. Hence, with this case study, we provide the first evidence to complement the view presented in the literature that incumbents can sustain their exploratory BMI by following a transformative BM renewal strategy, attempting to anticipate possible disruptive paradigms for their respective BMs.

Finally, it is also noteworthy that of our three studied cases, the manufacturing company struggled the most to pursue transformative BM renewal. Although the focus of the study was not on conducting such a comparison, it should be mentioned. This difference may have been due to influences of higher sunk costs and a product-oriented mentality, which might have rendered the manufacturing company more rigid when it came to transformative BM renewal. Many cases presented in the literature, such as Kodak, Nokia, and Blockbuster, as well as those introduced by the innovator’s dilemma, represent poor responses to radical innovation from manufacturing companies. Further investigation in this regard may be fruitful to broaden our understanding of the subject.

5.2. Managerial Implications

This study revealed relevant managerial implications. We sought to understand the process of BMI in incumbents, presenting a fine-grained consideration of different types of BM. Our results were in line with the literature’s suggestion that incumbents should not abandon their focus on the core BM to explore new BMs randomly, and that a combination of both approaches can be fruitful for creating resilience when responding to radical innovation. In this regard, our system dynamics analysis of the evolution of BMI engines showed significant differences between the impacts of incremental and transformative BM renewal regarding the effectiveness of BM exploration, especially in relation to the creation of a strong “buffer”. Thus, our study can assist the managerial audience in implementing BM renewal strategies that are future-oriented and transformative, targeting the anticipation of future disruptions. Although we recognize the challenges surrounding this process, innovation departments could assist in developing the necessary innovation capabilities to help overcome such issues. To this end, our studied cases followed the path of beginning with incremental changes, building capabilities, and advancing to a transformative BM renewal process. Then, leveraging conditions favorable to exploratory BMI, they moved forward to begin exploring new BMs in order to fill the gaps that existed inside the transformed value proposition.

5.3. Limitations

This study provided valuable insights into the system dynamics of BMI and the role of innovation departments in driving and managing this process. It is important to note that as qualitative research, this study’s focus was not on validating or confirming a hypothesis. Instead, this paper offered important contributions to theory construction in the field of BMI. However, certain limitations of the present study should be pointed out. This research was based on multiple case studies, i.e., three Brazilian incumbents, which may not be representative of other companies or industries. We would have liked to address a wider range of technology and company types and, consequently, investigate different types of BMI. Comparing companies from different sectors could highlight the potential for cross-industry learning and the transferability of best practices. Nevertheless, comparing the BMI processes of similar companies, in terms of size and technology, could also lead us to new insights.

5.4. Future Research

Considering the abovementioned limitations and the results of this study, future studies could explore different areas. First, conducting a multiple-case study with a more representative organizational sample would be interesting. This would help to expand our knowledge regarding BMI and BM renewal processes. Second, a comparative analysis between similar companies, as mentioned previously, could also help to enhance our theoretical and practical understanding of this matter.

Furthermore, quantitative studies are essential to the development of this field, especially as they allow researchers to test hypotheses and evaluate the strength of relationships between identified variables. For instance, a future study could explore structural equation modeling (SEM) to examine the relationships between different variables that impact the success of business model innovation processes in incumbents. SEM would help identify the drivers of business model innovation and renewal and the mechanisms through which they operate in incumbents. Such a study could test hypotheses regarding the factors influencing the ability of companies to implement BMI effectively. Furthermore, studies could be conducted to provide empirical evidence regarding the relationship between transformative BM renewal and the performance of BM exploration endeavors in incumbents. Likewise, the effects and characteristics of top management teams could also be assessed to further elucidate the conditions that facilitate the pursuit of BM exploration.

Our findings highlighted an interesting connection between transformative BM renewal, from a future-based perspective of shaping the market and building avenues for planned opportunism, and BM exploration, which seeks to fill the consequent “white spaces” that emerge from such behavior. Thus, there is an opportunity to combine future studies on topics such as corporate foresight and BMI in incumbents. Such studies could provide better evidence regarding how companies can benefit from foresight activities and investigate whether certain forecasting practices negatively affect transformative BMI, shedding light on its barriers and opportunities. An analysis of top management teams could also be revealing in this regard. Finally, future studies could also investigate the long-term results of BMI processes, considering the impact on organizational sustainability. A combination of qualitative and quantitative approaches could help with this task.

Author Contributions

Conceptualization, M.F., V.M. and R.Q.; methodology, M.F.; investigation, M.F. and R.Q.; resources, M.F., V.M. and R.Q.; data curation, M.F.; writing—original draft preparation, M.F.; writing—review and editing, M.F., V.M. and R.Q.; supervision, R.Q.; project administration, M.F.; funding acquisition, V.M. and R.Q. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Brazilian Agency CAPES (Coordenação de Aperfeiçoamento de Pessoal de Nível Superior), grant number 33003017, and by the Proyecto VRIEA-PUCV 039.348/2022. The authors also acknowledge the funding provided by DI Interdisciplinaria Pontificia Universidad Católica de Valparaíso (PUCV), 039.414/2021. The APC was funded by PUCV.

Data Availability Statement

The raw data of the presented findings are available from the corresponding author Matheus Franco on request.

Conflicts of Interest

The authors declare no conflict of interest.

References