Abstract

Non-fungible tokens (NFTs) are unique digital assets powered by blockchain technology, enabling secure and decentralized ownership and monetization across diverse industries. However, their energy consumption is primarily linked to energy-intensive consensus mechanisms and has raised significant environmental concerns. This survey provides a comprehensive analysis of the evolution and use of token standards and blockchain workflows in developing green NFT technologies, emphasizing the transition to energy-efficient consensus mechanisms. By seamlessly blending technological acumen with a discerning gaze, the current analysis suggests that, apart from the blockchain consensus mechanisms, the environmental impact of NFTs should also be investigated and linked to certain blockchain factors such as interoperability, scalability, sustainability, and Layer-2 scaling solutions. As such, the current endeavor offers a perspective on the symbiotic relationship between blockchain and NFTs by identifying pathways to balance innovation with environmental stewardship. Finally, this paper offers valuable insights into the role of green NFTs in fostering sustainable digital economies by exploring under-represented applications in various economic and industrial domains.

1. Introduction

Non-fungible tokens (NFTs) represent unique, non-interchangeable digital assets stored on a blockchain, designed to guarantee authenticity and ownership through decentralized verification processes [1,2]. Each NFT is linked to specific digital content, e.g., artworks, music, videos, etc., enabling creators to monetize their work while giving collectors ownership of rare digital items. The concept of scarcity combined with digital ownership has sparked a significant expansion of NFTs across various sectors, including, but not limited to, digital art, decentralized finance, gaming, collectibles, and supply chain [3,4,5,6,7,8]. This has positioned NFTs as a central innovation element within the wider blockchain ecosystem.

The upsurge in popularity has also sparked concerns regarding the environmental ramifications of blockchain technology, primarily stemming from the energy-intensive consensus mechanisms typically used in validating NFT transactions [9,10]. As a representative, the Proof of Work (PoW) consensus mechanism relies on robust computers to unravel intricate mathematical problems, thereby consuming substantial electricity. For example, the process of the creation (i.e., minting) of a single NFT the corresponding transaction through to its sale consumes approximately 230 kWh of energy, an equivalent of 135 kg CO2, equal to the electricity supply needed to run an average household for two days [11]. This elevated energy usage transcends carbon emissions as it is also related to electronic device waste and natural resource depletion, raising environmental concerns [12,13,14].

As a result, embracing green NFT strategies has become crucial for reducing the effects of the above-mentioned impacts while still harnessing their potential as innovative technologies [12,14,15].

To advocate for green NFT practices, multiple policy actions can be enforced, which involve incentivizing the formulation and acceptance of more environmentally friendly consensus mechanisms within blockchain networks [9,16]. One such action with huge ramifications was the Ethereum merge, which took place in September 2022 and shifted the Ethereum consensus approach from the PoW to the Proof of Stake (PoS). That action managed to reduce the estimated average energy consumption for Ethereum, rendering the whole approach much less wasteful by reducing consumption from 83.52 TWh/year (in terms of PoW) to 4.83 TWh/year (in terms of PoS) [17]. The PoS mechanism is based on swapping miners with validators who possess large cryptocurrency amounts, making their impact superior regarding the validation of transactions. As a result, the chosen validators attempt to authenticate secure transaction validations in exchange for pursuing rewards [18]. There exist several blockchain platforms that incorporate consensus protocols with low energy demands, which are striving towards formulating and executing sustainable solutions using PoS or hybrid consensus mechanisms that merge different energy-efficient algorithms.

Alongside incentivizing eco-friendly consensus mechanisms and advocating for renewable energy utilization, other policy strategies involve establishing transparent criteria and certifications for green NFTs and the respective underlying blockchain networks [19,20]. Furthermore, eco-friendly consensus mechanisms support the design of specialized financial tools to satisfy certain needs of sustainable projects. For example, tokenization, which is a basic instrument in NFT technologies, enables users to buy small green bond shares and utilize relative financial tools without large commissions, making green bond management efficient and favoring low-cost green solutions. On the other hand, the staking model used in the energy-efficient consensus mechanism assumes that validators are self-interested economic actors [21]. In that sense, the consensus protocols involved can assist the effective process coordination without relying on significant trust assumptions. Hence, by providing environmentally friendly products, providers can get some financial incentives [22]. For example, during the last few years, the applications of blockchains have enabled the trading of electricity coming from renewable energy sources. Other applications focus on using the tokenization of recycled plastics, with the ultimate purpose of monitoring and controlling waste management. In that direction, tokenized carbon credits can be easily traded, establishing an effective marketplace for carbon offsets [23]. This can provide financial incentives to individuals and companies, based on their motivation to reduce their carbon footprint.

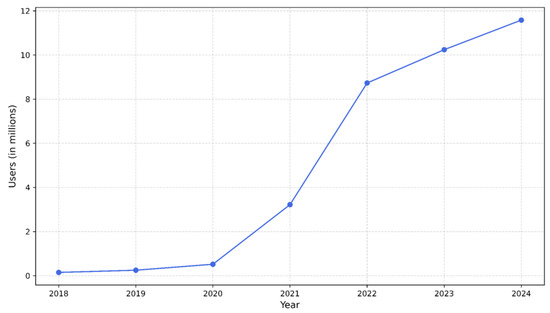

So far, NFT technologies are gaining popularity because they enable free and easy trade due to the development of effective decentralized applications (DApps) [24]. A very brief estimation of the marketplace indicates the substantial use of NFT technologies in the coming years [25]. Currently, worldwide, there are 11.58 million users, and that number is expected to reach 11.64 million users by 2025, while for the years 2022 and 2023, there were 8.73 and 10.24 million users, respectively [26]. It is estimated that more than 10,000 active wallets interact per day, while at least 12,000 NFT sales take place every day [27].

Although the NFT market exhibited a meteoric surge in 2021, which was supported by high-profile sales and substantial interest from tech users, there was a crash in 2022 that was primarily initiated by market saturation and scams [28]. Signs of recovery appeared in 2023 and 2024, mainly due to the emergence of eco-friendly blockchain technologies [28,29]. Despite market downturns, it is expected that the market size of NFTs will significantly increase by 2030 due to the development of new blockchain technologies, providing the potential for more effective NFT applications in many different areas [5,18,30,31].

This paper investigates the technological directions that support the development of green NFTs. The main contributions of the paper are enumerated as follows:

- (a)

- Considerations about the status of green NFTs.

- (b)

- An analysis of the essential blockchain processes and protocols supporting green NFT processes, such as processes related to the creation and transfer of NFTs.

- (c)

- The identification and categorization of certain blockchain factors (e.g., interoperability, scalability, etc.) that appear to have direct impacts on green NFT technologies, thus providing a different point of view regarding the symbiotic relationship between blockchain platforms and NFTs.

- (d)

- The identification of critical gaps in various industrial areas (e.g., supply chain, digital art, etc.), highlighting further innovation areas.

The rest of this paper is synthesized as follows. Section 2 presents the related studies. Section 3 describes a typical NFT model and how it integrates with the blockchain platform. The blockchain technologies used in developing energy-efficient NFTs are presented in Section 4, while Section 5 investigates the effect of certain blockchain factors on green NFTs. The environmental impact of NFTs is discussed in Section 6. Section 7 discusses several industrial use cases that enable the integration of green NFTs into their operational infrastructure. Section 8 presents selected topics related to future opportunities and challenges. Finally, the paper concludes in Section 9.

2. Related Studies

There are only a handful of publications on green NFTs concerning their development and future directions. The current literature on the environmental effects of NFTs is associated mainly with environmental impacts derived from the corresponding blockchain consensus mechanisms and transactions [9,19,20,24].

Alongside PoS, the development of green NFTs has gained momentum as far as the promotion of environmentally and socially responsible practices are concerned. For example, Razi et al. [24] and Valeonti et al. [32] have discussed various efforts to create and support green NFTs, which are designed to minimize environmental impacts and align with broader sustainability goals.

In [12], Truby et al. analyzed the climate concerns and future of NFTs, proposing technological solutions to mitigate the environmental impact. They emphasized the critical gap in understanding the potential of renewable energy sources to satisfy NFT demands by investigating the efficacy of technological solutions, such as the utilization of renewable energy and energy-efficient consensus mechanisms [18]. These findings suggest that a multifaceted approach, including technological innovations and policy interventions, is necessary to address the environmental challenges posed by NFTs. In addition, the authors address several solutions to the challenges associated with NFTs, such as the adoption of zero-knowledge proofs (ZKPs) to improve privacy and security [3,33,34,35], the use of non-browser wallets to safeguard crypto assets from cyber threats, and the transition of blockchain development to more sustainable platforms, like SolarCoin and BitGreen, to mitigate environmental impacts.

Further research highlights the importance of exploring innovative technological solutions, as well as the need for policy interventions, to address the environmental impact of NFTs and unlock their sustainable potential. For instance, Kräussl and Tugnetti [31] studied the decentralized energy marketplace via NFTs and investigated the use of alternative consensus protocols and the integration of renewable energy sources to create an eco-friendlier NFT ecosystem. Similarly, Ko et al. [36] investigated the climate concerns and the future of non-fungible tokens by studying frameworks for leveraging the environmental benefits of the Ethereum network through technological enhancements. These studies investigate holistic approaches that combine advancements in blockchain design, renewable energy integration, and supportive regulatory frameworks and are crucial to mitigating the ecological footprint of the NFT market while fostering its continued growth and innovation.

The development of appropriate policy interventions to maintain eco-friendly NFT technologies has also been explored regarding various application frameworks, such as arts, heritage, and health [24,37,38,39,40,41,42,43,44]. Policies to enhance the carbon neutrality of NFT solutions can be considered from the perspective of lazy minting and Layer-2 analyses, which can significantly reduce the energy consumption during transactions [45].

Other studies point out the need to develop initiatives aimed at promoting environmentally and socially responsible practices within the NFT ecosystem. As a result, many studies discuss various efforts to create and support eco-friendly NFTs under the framework of green blockchain networks, which are designed to minimize environmental impact and align with broader sustainability goals [8,18,46]. In that sense, green NFTs can effectively be minted using blockchain platforms that employ sustainable consensus mechanisms, thus reducing their energy consumption and carbon footprint [13,47].

Although blockchain networks can perform immutable, transparent, and secure transactions [48,49], they are associated with high energy consumption processes, mainly due to the computational demands needed to apply the corresponding complex algorithms. As a straightforward result, the green NFT policies and practices are strongly linked to green blockchain technological solutions. In that direction, various papers have studied the roadmap toward green blockchain solutions regarding the many different implementation levels of blockchain networks. In [50], several blockchain networks (e.g., Cardano, Solana [51], Polkadot, and Nano [52]) were analyzed, considering the consensus mechanisms, types of transactions (e.g., on-chain transactions, off-chain transactions, etc.), and smart contract validation efforts. The investigation reported in [53] concentrates on the environmental impacts of different blockchain networks, considering the existing law frameworks in various countries and the thematic maps for energy consumption regarding certain cryptocurrencies. Wendl et al. [54] performed a comparative review between PoW and PoS that concerned environmental issues, which were projected at the level of resource aspects, electronic waste, energy consumption, carbon footprint, environmental-related social aspects, and environmental-related economic aspects. Their results were based on obtaining a categorization of the methods for specific identified environmental-related tasks, highlighting in this way some inter-relationships between the above-mentioned consensus mechanisms. Finally, Alzoubi et al. [55] studied several green blockchain technologies, along with various organizations that support and use green blockchain technologies, regarding their energy-efficient use and carbon neutrality. Numerous solutions were also reported by the authors that mainly focused on sustainable cryptocurrency enhancement, the usage increase of renewable energies, the appropriate modification of the relative standards and regulations, and ways for maintaining effective collaboration between stakeholders and international organizations.

3. A Technical Description of a Typical NFT Model

The very hypostasis of NTFs is realized under the umbrella of blockchain technology, which is used for both creating and selling NFTs in terms of blockchain transactions. A blockchain transaction defines the asset exchanges between users following specific mechanisms [56]. A convenient operation provided by blockchain is the analysis of transaction history, enabling the tracking of the fund flow and revealing any disparate activities linked to a specific address. In the Ethereum network, smart contracts automate contract execution by converting detailed agreements into a code that runs based on predetermined conditions [36]. As such, they reflect a synergistic mixing process between the distributed records and the computer code [47].

Transactions are validated and verified through the consensus mechanism, which is the backbone of the blockchain operation. Its main functionality consists of several processes related mainly to the corresponding transactions, such as promoting the agreement between nodes for imminent transactions, validating transactions, maintaining the integrity of the network, etc. [48,57].

The essential nature of each NFT is witnessed by an associated unique identifier [58]. Thus, all the transactions associated with the creation/sale of an NFT are recorded on the blockchain in a permanent and immutable way, synthesizing the resulting transaction history.

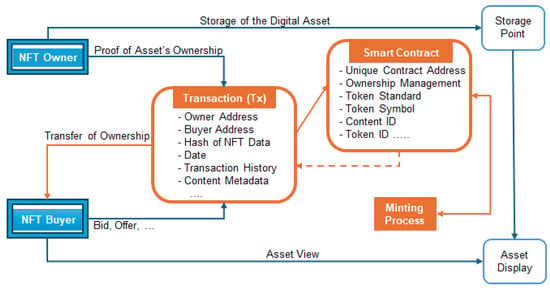

Figure 1 depicts a typical model structure, which is a combination of the models presented in [47,58,59]. The procedure encompasses two distinct user roles, namely, the owner/creator and the buyer. Both are identified by the corresponding public addresses. The owner creates/digitizes the asset and then stores it either on the blockchain (i.e., on-chain) or in an external database/hosting service (i.e., off-chain). The latter is preferable because the former is more costly due to the need for gas fee payments. The same holds for the metadata related to the NFT.

Figure 1.

The information flow within a typical NFT structure, where the blue color indicates the processes taking place outside of the blockchain, whereas the orange color corresponds to processes within the blockchain (the flowsheet has been created as a combination of the models taken from [47,58,59]).

After viewing the asset at a listed price, the buyer makes an offer. If that offer is accepted, the owner signs a transaction that includes all the appropriate information [60]. Then, the transaction is sent to the corresponding smart contract. In that sense, an NFT belongs to a smart contract, which is assigned to a unique contract address, and it is specified by a token symbol defined in the smart contract [59]. The token symbol is combined with the above-mentioned unique smart contract address to ensure the NFT’s distinguishability from others. Moreover, the NFT is determined by a unique token identity (ID) generated by the minting process.

The creation of NFTs is conducted by the minting process, which is triggered and controlled by specialized token standards that establish communication between the associated smart contract and the blockchain, with the ultimate purpose of performing vital operations, such as NFT tracing, tracking, and transferring [60]. Popular token standards are the ERC-721 and its successors (e.g., ERC-1155), which are all designed to operate under the framework of the Ethereum network.

Upon the confirmation of the transaction, the minting process is finished, and the asset’s ownership is transferred to the buyer, who is in the position, if needed, to modify and/or recreate the asset.

4. Blockchain Technologies for Green NFTs

4.1. Consensus Mechanisms Used in Creating Energy-Efficient NFTs

First, our attention focuses on analyzing several consensus mechanisms that appear to be efficient regarding energy consumption, rendering them good candidates to create and sell green NFTs. Most of them are based on the PoS procedure. All these directly reduce energy consumption by leveraging more users who require significantly less computational power, which is crucial, especially in the case of NFTs.

Table 1 and Table 2 depict their names and basic characteristics, such as the method of validator selection, the relation between decentralization and efficiency in energy consumption, use cases, and the property of key differentiators.

Table 1.

Validator selection, level of decentralization, and level of energy efficiency of various consensus mechanisms used in green NFT technologies.

Table 2.

The use cases and properties of the key differentiators of various consensus mechanisms used in green NFT technologies.

The decentralization ranking is determined by the method of validator selection, as indicated in the third column of Table 1. Mechanisms like PoS and its variants are categorized as high decentralization because they allow a large number of validators to participate in the network, making it more distributed. Furthermore, Proof of Authority (PoA) is ranked low to moderate due to its reliance on a smaller, trusted set of validators, reducing the level of decentralization.

For energy efficiency, most consensus mechanisms are ranked high, reflecting the shift away from the energy-intensive PoW. All the consensus mechanisms discussed are energy-efficient because they do not require significant computational resources for block validation. However, Proof of Authority and the Directed Acyclic Graph are ranked as having very high energy efficiency due to their minimal resource requirements for transaction validation and faster consensus mechanisms.

4.2. Token Standards and Their Role in Green NFTs

Token standards outline rules that ensure NFTs are unique, their ownership is verifiable, and the assets can be securely transferred. By adhering to these guidelines, token standards have established a foundation for green NFT innovation and adoption across diverse sectors, such as digital art, gaming, supply chains, etc. [79,80].

Table 3 provides some of the properties possessed by the token protocols, along with descriptive estimations of the level of their environmental impact. Each protocol brings unique features and capabilities to ensure scalability, functionality, and reduced environmental impact across diverse industries.

Table 3.

Properties of the most used energy-efficient token protocols.

The ERC-721 standard pioneered the concept of NFTs. Unlike ERC-20 tokens, which are fungible and interchangeable, ERC-721 tokens are unique and distinct. This non-fungible characteristic has allowed ERC-721 to gain traction as a standard for digital art and collectibles [81]. However, its lack of batch processing leads to high gas fees and energy consumption, particularly during periods of high demand. Each NFT transaction, whether minting, transferring, or burning, requires separate processes that significantly scale up the environmental impact when compared to standards that support batch operations. These inefficiencies underscore the need for more advanced standards capable of addressing such challenges.

In that direction, ERC-1155 introduces a multi-token standard that can create and manage both fungible and non-fungible tokens within a single smart contract [82]. This design facilitates batch processing, enabling multiple transactions to be combined into one, thereby reducing gas fees and energy consumption. ERC-1155 is particularly suitable for applications demanding efficiency and scalability, such as gaming and digital collectibles [81,82]. Further advances triggered the development of ERC-2309, which supports the batch minting approaches of multiple NFTs within the framework of single transactions.

The above-mentioned strategy appeared to significantly enhance cost efficiency while reducing the carbon footprint of large-scale NFT projects [36]. Similarly, ERC-2981 focuses on automated royalty payments to creators after secondary sales. This feature ensures continuous revenue streams for creators and minimizes additional transaction overheads, aligning with sustainable and green NFT practices [101].

A higher level of functionality is provided by ERC-998, which generates composable NFTs that support user-defined hierarchies of non-fungible assets [102]. This approach is particularly important for complex asset structures related to gaming characters with the associated items, where multiple assets can be transferred as a single transaction [103]. Although this standard offers remarkable composability, its architectural complexity and reliance on Ethereum-virtual-machine (EVM) compatible self-executing smart contracts introduce certain tradeoffs in terms of computational effectiveness [103].

Beyond Ethereum, other blockchain platforms have developed specialized token standards, expanding the possibilities for green NFTs while addressing specific use cases. For instance, Algorand’s ASA standard provides a carbon-neutral framework ideal for decentralized finance (DeFi) and payment systems [85,86]. Avalanche’s AVIP-001 emphasizes cross-chain compatibility, fostering interoperability across the NFT ecosystem. Cosmos blockchain uses its CW-721 standard for NFT-focused interoperability, leveraging the inter-blockchain communication (IBC) protocol [93]. Binance Smart Chain’s BEP-721 and BEP-1155 standards offer energy-efficient alternatives to Ethereum, albeit with some tradeoffs in decentralization [89]. Cardano’s Native Token architecture projects flexible and efficient NFT implementation [90,91], while Celo’s CIP-20 standard integrates NFTs into a mobile-first ecosystem [92]. Similarly, Hedera Hashgraph’s HIP-412 and HIP-17 [95] focus on enterprise-grade NFTs with a low environmental impact, while IOTA’s zero-fee NFT token standard capitalizes on its DAG architecture to eliminate transaction costs [96]. Other platforms, such as Polkadot, Polygon, and Solana, have also introduced innovative solutions to fulfill specific needs. Polkadot employs Substrate Tokens for cross-chain compatibility, while Polygon supports ERC standards with a Layer-2 scaling approach, enhancing the resulting efficiency for gaming and DeFi applications [97]. Finally, Solana’s SPL tokens provide fast and low-cost transactions for high-frequency NFT applications [98].

4.3. Blockchain Layered Architecture

To improve efficiency, scalability, and usability, blockchain technology is divided into different, more specialized layers, and these layers serve as the groundwork for various applications, such as green NFTs, while ensuring resource optimization [104,105,106].

Layer-0 (L0) focuses on providing a secure infrastructure that allows a variety of blockchains to enhance their ability to communicate with one another and perform data sharing [106]. Layer-0 mitigates the need for energy-intensive operations, such as asset minting or duplicate data processing, enabling the NFT transfer through various blockchains without needing to be newly minted, thus reducing carbon emission.

Layer-1 (L1) is responsible for transaction validation, consensus mechanisms, and network security [107]. It acts as support for decentralized applications. These developments directly impact NFT minting and trading by performing transactions in an efficient manner, without having to sacrifice speed and security [108,109].

Layer-2 (L2) builds upon L1 technology, addressing the challenges of a low transaction throughput and network congestion by offloading some of the transaction processing to secondary chains. This offloading of processing significantly enhances scalability, making the network faster and more efficient compared to L1 [97,98,99,100,101,102,103,104,105,106]. L2 solutions are particularly crucial for NFT platforms and DeFi applications, which handle high transaction volumes. By moving transaction processing to Layer-2, these solutions drastically reduce gas fees and, more importantly, decrease the energy consumption per transaction. This happens because L2 transactions are processed off-chain or in a more efficient manner before being settled back to L1, leading to lower computational costs for each operation. For example, rollups, one of the most common L2 solutions, bundle multiple transactions off-chain and then store a single summary of these transactions on-chain [110,111,112]. This method significantly reduces the amount of data stored on the main blockchain, leading to a substantial decrease in energy consumption compared to processing transactions directly on L1.

Sidechains are independent blockchains connected to the main chain via a two-way bridge. By offloading transaction processing to sidechains, the overall energy consumption per transaction is reduced compared to the main chain, as sidechains can handle a higher volume of transactions with less computational power [97,110,111]. In that direction, Plasma constitutes an L2 solution that executes transactions off-chain and only periodically commits important procedures, like asset ownership, to the main chain. This reduces the need for constant interaction with the L1 chain, saving significant computational resources and, thus, reducing energy consumption.

Rollups are another prominent L2 solution. There are two main types of rollups: zero-knowledge (ZK) rollups and Optimistic rollups [113,114]. ZK rollups bundle multiple transactions off-chain and generate a cryptographic proof (SNARK) to validate these transactions before storing a single proof on L1. This method significantly reduces energy consumption because only minimal data are written to the main chain, making it far more efficient than executing every single transaction on L1 [97,110]. Optimistic rollups, on the other hand, assume that transactions are valid by default and only perform computational checks when a fraud claim arises. This reduces the need for redundant computational efforts and minimizes energy usage.

Transactions executed on rollups require two to three orders of magnitude less gas compared to their L1 counterparts. This directly correlates with a reduction in the energy consumption for transactions processed through rollups. Moreover, ZK rollups such as Immutable X, a platform for NFTs, have shown a significant decrease in gas costs and, thus, a lower carbon footprint for the platform’s users. By reducing the energy necessary for each transaction, L2 solutions not only enhance blockchain scalability but also promote greener NFT applications. These solutions make blockchain technologies more sustainable by enabling the use of lower-layer solutions, which is critical as blockchain adoption grows globally. Interestingly, L1 or L0 systems (such as Avalanche’s C-Chain) can also function as an L2 solution in some contexts, further showcasing the flexibility of these architectures in supporting energy-efficient transactions. By combining the blockchain functionality between these layers and some platforms able to demonstrate multi-layer compatibility, the system becomes more efficient and sustainable [108,109,110]. This multi-layered approach also solves technical issues of scalability and interoperability, while maintaining the requirement for deploying flexibility, allowing blockchains to foster green innovations.

5. Blockchain Factors Involved in Developing Green NFTs Solutions

As more blockchain networks integrate and cover larger application fields, the ability to exchange information between different networks (interoperability), handle large numbers/high levels of transactions (scalability), and exhibit sustainable behavior (sustainability) encircles topics related to environmental, operational, and user-centric issues. A critical point that enhanced the growing contribution of the above factors in designing energy-efficient blockchains was the Ethereum merge [115]. For example, regarding scalability, the PoW model can handle a small number of transactions per second (TPS), while the PoS framework supports thousands of TPS, due to the employment of Layer-2 solutions [115,116]. Therefore, smart contracts can function faster, achieving lower transaction costs, and significantly enhance the performance of DApps that rely on the network [82]. As such, PoS is the underlying technology of popular NFT marketplaces such as OpenSea, Rarible, etc. [117].

5.1. Interoperability

Interoperability refers to the ability of blockchain networks to exchange assets or data and is critical in developing an interconnected system. In its absence, blockchain technologies are fragmented and their properties are underutilized [106]. By facilitating communication, interoperability takes unlinked systems and integrates them into a single network, creating avenues in DeFi, gaming, and digital asset trading.

Interoperability is not without challenges, and these are related to reaching a consensus on cross-chain finality transactions, developing smart contracts, and guaranteeing interaction security. Technologies such as sidechains, relay chains, and cross-chain bridges have been developed to solve the above challenges. Sidechains improve the cross-chain transfer of assets by lowering the respective costs and working in parallel to the main chain. Relay chains facilitate the decentralization of various independent blockchains without sacrificing security, as illustrated by Polkadot, and foster communication by integrating light-client verification. Cross-chain bridges allow asset or data transfers between different chains and eliminate the need for a central body, which opens the decentralized exchange of an asset [118].

Table 4 presents how various blockchains implement consensus mechanisms to achieve interoperability to become more sustainable. Unlike traditional blockchains, cross-chain systems are designed around multi-network connectivity, often leveraging protocols and consensus mechanisms.

Table 4.

Consensus mechanisms and interoperability of various energy-efficient blockchains.

The classifications of decentralization and energy efficiency in Table 1 and of interoperability in Table 4 are based on a qualitative assessment of relevant blockchain features, including validator participation, computational resource requirements, and cross-chain capabilities. While these rankings do not rely on strict numerical thresholds, they provide a comparative framework to highlight differences among blockchain networks. For example, the Cosmos and Polkadot blockchains are rated as high due to their robust cross-chain capabilities, using technologies like IBC and XCMP, which allow efficient communication across different blockchain networks. Medium interoperability is assigned to blockchains like Solana and Polygon, as they support multi-chain functionality, enabling interaction with other chains (i.e., Ethereum), but they do not offer the same degree of interoperability across a wider range of networks. Low interoperability is given to blockchains that do not provide native cross-chain communication or have limited capabilities for interacting with other blockchains.

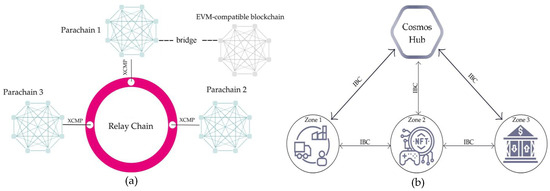

Interoperable blockchain networks, by bridging isolated systems, can gain greater utility and create space for real-world applications like DeFi, gaming, and NFT trading. Technologies like Cosmos’s inter-blockchain communication (IBC) protocol and Polkadot’s relay chain demonstrate this strategy [119,120,121,122]. Figure 2 depicts the architecture of these two blockchains. The relay chain of Polkadot (Figure 2a) connects specialized parachains that serve different functions. The use of XCMP (Cross-Chain Message Passing) enables communication between these parachains, which increases the efficiency of the network without requiring every single chain to perform an energy-consuming consensus process. This design enhances scalability by supporting a larger number of transactions with a smaller environmental impact. This is beneficial to platforms supporting NFTs, where faster, efficient, and lower-cost processing is needed. On the other hand, Cosmos uses IBC (inter-blockchain communication) technology (Figure 2b), which enables communication between zones in both directions. This type of communication is effective in permitting data and asset transfers between non-contiguous zones, such as industrial and financial sectors, utilizing low energy demands to perform the inter-zone or cross-chain operations. These architectures shift the burden of operations away from a single blockchain, significantly enhancing interoperability.

Figure 2.

(a) Polkadot’s cross-chain system and (b) Cosmo’s IBC protocol.

Building on this concept, the Avalanche blockchain has developed a multi-chain approach that relies on three individual chains: the X-chain for asset transfer, the P-chain for staking and validators, and the EVM-compatible C-chain [87]. That architectural design allows for cross-chain functions, such as asset swapping, within the same ecosystem, making it possible for businesses to create dApps that are interoperable [87]. For instance, a DeFi platform called Trader Joe operates on the Avalanche platform and highlights the ability to integrate financial services across chains with minimal friction [88].

Similarly, Cardano brings forth cross-chain functionality with its Ouroboros Proof of Stake (OPoS) mechanism but on a scientific note. The platform supports side chains to integrate with other blockchains and experimental Protochains, designed to facilitate protocol updates without disruptive hard forks [115,123]. These functionalities provide the ability for Cardano to support cross-chain dApps, e.g., OccamFi offers DeFi tools targeted to users on different blockchain platforms [124].

In that direction, the Solana blockchain uses cross-chain bridges to expand its interoperability with other networks, making it a key player in enabling the collaboration between networks and supporting a diverse range of DeFi and NFT applications [51].

On the other hand, the EOS network, which employs the DPoS consensus mechanism, supports seamless cross-chain communication, and instant high-volume transactions at affordable fees [125]. Finally, the XRP blockchain utilizes the Ripple Protocol Consensus Algorithm to provide lower cost and energy-efficient international payments that set up financial institutions, such as Santander and SBI Holdings, to handle payments internationally with convenience [77,126].

5.2. Scalability

Scalability has emerged as an imperative paradigm of blockchain technology because it concerns issues that revolve around traditional networks where transaction volume is high and difficult to facilitate. Consequently, blockchain systems with multiple chains prioritize workload balancing, ensuring that each chain is broken down into tasks.

For example, Polygon considers scalability issues within its architecture in terms of the Layer-2 structure implemented on Ethereum protocols and the use of side chains capable of offloading transaction execution before settling them on Ethereum’s main chain. This approach lowers the transaction fees and energy consumption, rendering Polygon an ideal solution for reducing energy consumption in NFT applications [127]. As such, OpenSea, the largest marketplace, is one of the projects that uses Polygon to counterbalance the costs resulting from NFT trading, while at the same time considering practices to reduce the corresponding environmental impact.

To consider scalability issues, the Avalanche blockchain distributes its workload across the three above-mentioned chains; this enables efficient transaction processing and low latency [87]. This separation of duties has attracted certain platforms, (e.g., Pangolin), to perform a decentralized service exchange that earns benefits from Avalanche’s high throughput and scalability levels [112].

On the other hand, the Binance Smart Chain (BSC) employs a dual-chain architecture that integrates interactions with high-speed asset transfers, regarding smart contract execution [128]. With this configuration, scaling becomes easier, and existing DeFi and NFT ecosystems such as PancakeSwap can be easily integrated, enabling faster transfers while maintaining low fees [129].

Another network that considers scalability as one of its main synthetic properties is the Solana blockchain, the operation of which is based on a hybrid consensus mechanism combining both the Proof of History (PoH) and the PoS [51]. As a result, Solana can handle 65,000 transactions per second [130]. This capability assists platforms, such as Magic Eden, with achieving a high NFT minting frequency driven by a fast processing time, as well as a low cost [131].

Finally, an interesting blockchain structure that appears to have effective performance regarding scalability is the TRON network, which is efficient and cost-effective because it is equipped with Just NFT, which supports the creation and trading of digital collectibles with minimal energy costs [99,132].

5.3. Sustainability

Sustainability in blockchain technology encompasses three primary dimensions: environmental, social, and economic. The environmental dimension refers to the energy efficiency and carbon footprint of blockchain networks, particularly in relation to consensus mechanisms. The social dimension defines and includes aspects such as equitable access, governance models, and ethical considerations in blockchain adoption. Finally, the economic dimension concerns the long-term viability, cost-effectiveness, and scalability of blockchain-based solutions, ensuring that they remain functional and beneficial over time. Although these three directions are relevant and related to climate change, this paper primarily focuses on environmental sustainability, given its critical role in the discussion of energy consumption and efficiency in blockchain networks, particularly within the NFT ecosystem. The platforms that employ energy-efficient consensus methods and careful environmental awareness are expected to shape the future of much-wanted eco-friendly blockchain solutions. A key feature of this paper is to analyze the environmental impact of blockchain networks, particularly focusing on NFTs. Instead of determining which blockchain is the “greenest”, a complex and multi-dimensional task, this paper examines various factors that contribute to the sustainability of NFTs, including the consensus mechanism, the blockchain protocol, and the impact of scaling solutions, such as Layer-2 protocols.

Table 5 provides a comparative view of several blockchain networks in terms of electricity consumption, environmental impact, network transactions and market share, an essential metric as it reflects the relative size of each blockchain in the ecosystem, thus providing a clearer picture of their environmental impact relative to their usage. The data were extracted from the CCRI [133], Chainspect [134], and Glassnode Studio [135] data bases.

Table 5.

Annual electricity, CO2 emissions, average Tx/s, max theoretical Tx/s, and market share of various blockchain networks.

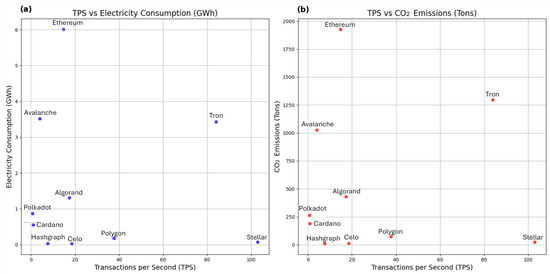

Figure 3 visualizes the relationship between the transactions per second and electricity consumption (Figure 3a) and CO2 emissions (Figure 3b) for various blockchain networks. In these scatter plots, each dot represents a blockchain, with the TPS on the x-axis and the respective electricity consumption (in GWh) or CO2 emissions (in tons) on the y-axis. The size and position of each dot highlight the tradeoff between transaction efficiency and the environmental impact, providing insights into the sustainability of each blockchain.

Figure 3.

A scatter plot of TPS and electricity consumption (a) and CO2 emissions (b) of various blockchain networks (the data to create the figure were taken from CCRI [133], Chainspect [134], and Glassnode Studio [135] and refer to the period 1 November 2023–31 October 2024).

In this regard, the Algorand blockchain maintains high eco-friendly behavior due to PPoS. That mechanism requires less energy to complete transactions, and the platform has partnered with ClimateTrade to offset its already low carbon footprint, achieving a carbon-negative status [136]. Similarly, Celo combines accessibility with sustainability, targeting unbanked populations while maintaining a low environmental impact. Tezos implements LPoS, which improves the self-amending protocol and decreases the necessity for hard forks [70]. This principle has enabled several organizations that utilize Tezos NFT platforms to reinforce the hypothesis of greening the creation of digital assets [137].

The Tangle architecture, utilized by the IOTA network, eliminates the need for miners, significantly reducing energy consumption [74,75]. By enabling machine-to-machine transactions with a minimal environmental impact, IOTA aligns perfectly with the principles of sustainability [75].

Notable platforms that operate with sustainability strategies are the Stellar blockchain, with its low-energy Stellar Consensus Protocol (SCP) [78], and Hedera Hashgraph, which achieves high throughput with minimal energy use [73]. Finally, VeChain, with its PoA consensus methodology, provides an innovative solution for enterprise applications with a focus on supply chain transparency and sustainability [100]. As the PoA model depends on a system of validators approved in advance, this platform promotes decentralization and credibility [138].

The analysis reveals that a high TPS rate correlates with higher energy consumption and CO2 emissions, especially for blockchains like Ethereum and Solana. However, Layer-2 solutions, like Polygon, demonstrate a path toward energy efficiency by maintaining high TPS without significantly increasing energy usage. The market share plays an important role, as larger networks, like Ethereum, tend to have a more significant environmental impact due to their higher transaction volume, while smaller blockchains with efficient protocols, like Polygon, exhibit lower emissions and energy consumption despite lower market shares.

6. Environmental Impact of NFTs

Although NFTs have revolutionized the life cycle of digital assets, many questions have been raised concerning their environmental impact, considering the resources they utilize. Figure 4 shows that there has been a surge in growth over the past few years as the number of users roughly became much larger within the period between 2018 and 2024. This proliferation accounts for the fact that people have started to be interested in NFTs. However, it also raises questions related to the increasing environmental cost due to the growing use of blockchain ecosystems [139].

Figure 4.

Growth of NFT users between 2018 and 2024 (the diagram was created by using data taken from NFT Club [66]).

6.1. Energy Consumption in PoW Systems

The environmental questions surrounding NFTs are strongly linked to the consensus mechanism adopted by the various blockchain networks. In PoW, the act of creating, bidding, purchasing, or simply transferring one NFT is estimated to emit 268 kg CO2, which is equivalent to driving an internal combustion engine car for one thousand kilometers. It is estimated that the CryptoKitties collection alone has generated 239,833,200 kg of CO2 emissions, requiring 3,997,220 trees to offset its carbon emissions over 100 years [139]. Considering the millions of NFTs transacted each year across collections, the level of total emissions has been very high under PoW.

6.2. Ethereum’s Transition to PoS

The movement towards blockchain technological advancements using other alternatives to NFT energy, such as Ethereum, shifted towards the incorporation of Ethereum 2.0 PoS. With this advancement, it was predicted that the Ethereum network could cut its energy consumption by more than 99% [140]. After the Ethereum merge, it was estimated from CCRI’s consumption model that the Ethereum blockchain requires 0.0026 kWh for each transaction, which corresponds to energy consumption approximately equal to 4.83 TWh [133]. Compared to Ethereum’s PoW counterpart, the new model does guarantee substantially lower carbon emissions per transaction, enhancing Ethereum’s ambitions in assisting the community in reaching a worldwide goal focused on sustainability.

Lal et al. [9] revealed that the energy consumption for NFTs during the PoW phase reached a peak of 4.36 TWh, with a rapid increase in the number of NFTs minted and traded. After Ethereum’s successful shift to PoS in 2022, energy consumption per transaction dropped substantially. However, with an exponential increase in NFT transactions, energy consumption is projected to rebound to 0.8 TWh by 2030. This accounts for 18% of the peak values observed under PoW.

Carbon emissions from NFTs are also a critical concern. Without the use of cleaner energy sources, the annual emissions due to NFTs are estimated to reach 0.37 Mt CO2-eq by 2030, which is roughly equivalent to the carbon footprint of 1 million one-way flights from New York to London. This highlights the significant environmental impact of NFTs, even with PoS, due to the scaling effect driven by increasing transaction volumes.

6.3. Challenges in the Post-Merge Era

Despite the promising developments, the shift from PoW to PoS is related to certain challenges that might result in increasing energy consumption and imposing environmental concerns for the NFT ecosystem.

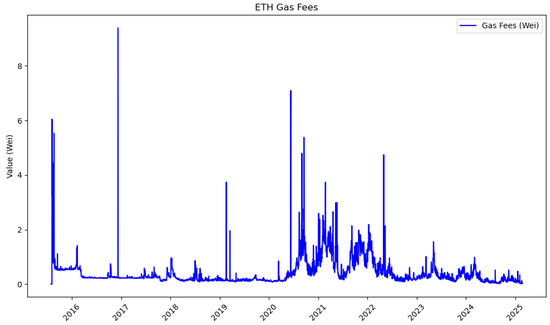

The first challenge refers to the number of users. As Figure 4 shows, this number has substantially increased over the last six years, and it is expected to show further growth in the years to come [141]. This tendency might lead to long-term environmental costs due to the network’s growth. In addition, there could be a rise in transaction costs. This is particularly true when the demand for NFTs peaks, as shown in Figure 5, which presents a significant increase in transaction fees during high-demand periods, e.g., around 2017 and 2020–2021. The spikes illustrated in Figure 5 correspond to NFT market booms and increased activity on the Ethereum network.

Figure 5.

Fluctuations in Ethereum gas fees from 2015–2025 (the diagram was created by using data taken from etherscan.io (https://etherscan.io/)).

The second challenge concerns the number of Ethereum validators. Up to 2023, that number reached new heights exceeding 800,000 validators, doubling the amount before the Ethereum merge [141]. Compared to the era before the merge, the advantage of using less-complex computer structures provides an easy way for one user to become a validator, boosting the total number of validators. As a result, the energy expenses have also shifted.

The third challenge focuses on the creation of new directions of profitability, such as the maximum extractable value (MEV) [142]. The MEV consists of algorithms concerned with finding the optimal ordering of transactions, and thus new actors, termed “searchers” have emerged, who facilitate these impressive computations and, hence, the usage of a lot of energy.

The fourth challenge concerns the centralization risks arising from large staking pools, which are an important consideration for PoS networks. Specifically, PoS could inadvertently lead to a concentration of power within a few large pools, undermining the network’s decentralization, a vital blockchain property. As highlighted in Table 1, the centralization level of certain networks remains moderate or low due to the influence of large staking entities. Notably, platforms like Binance, Kraken, Coinbase, KuCoin, and MEXC Global control substantial portions of the staking pools across various blockchains, including the Binance Smart Chain (BSC), Cardano, and Polkadot. This concentration not only poses a risk to decentralization but could also affect the network’s resilience and governance, impacting the integrity of green NFTs. We will incorporate data from these major platforms to demonstrate how staking is becoming increasingly centralized and the impact this has on the overall security, fairness, and governance of the blockchain ecosystem.

Finally, energy-efficient consensus mechanisms do not eliminate concerns about the carbon footprint of the broader blockchain infrastructure. For example, the production, maintenance, operation, and disposal of hardware used in NFT transactions, such as validator nodes, mining rigs repurposed for staking, and data centers, contribute to embodied emissions that are often overlooked in sustainability discussions. Moreover, blockchain carbon offsetting initiatives, while an encouraging step, pose questions about their long-term effectiveness and market stability. The effectiveness of these mechanisms depends on robust verification frameworks, transparent governance, and the avoidance of greenwashing, as some offsetting projects have been criticized for failing to deliver tangible environmental benefits. The reliance on voluntary carbon markets introduces risks associated with price volatility, inconsistent regulatory oversight, and the potential for double counting emissions reductions.

Although the above challenges raise concerns regarding the direct energy implications of the post-merge Ethereum ecosystem, they also highlight the necessity of analyzing broader ecosystem dynamics. For example, apart from consensus mechanisms, additional components, such as Layer-2 solutions and scaling innovations, could play a critical role in balancing the efficiency, sustainability, and performance of a blockchain/NFT environment.

In summary, the simplification of PoS as an environmentally friendly alternative to PoW might overlook risks of validator centralization, economic disparity in staking, and the possible long-term environmental cost of network growth. Therefore, these issues must be considered during the development of new blockchain and NFT technologies.

6.4. Broader Ecosystem Considerations

Beyond consensus mechanisms, other layers within Ethereum allow various blockchain platforms to do scaling and, therefore, obtain high efficiency levels within the blockchain. These solutions help to diminish the environmental impact stemming from overloading the Ethereum network, as high transaction activity is dispersed from the main chain. On the flip side, the popularity of NFTs has led to a drastic surge in user activity, which has increased total emissions, although the emissions per transaction have been improved.

Moreover, the increase in centralization poses another critical challenge. The staking power on Ethereum is highly distributed among a handful of participants, including large, centralized exchanges and staking pools. This level of concentration impairs one of the key tenets of the blockchain decentralization principle and maintains high governance risks that are likely to undermine the viability of the network in long-term perspectives.

Concerning the green outlook, Ethereum’s PoS transition is indeed a major step forward. However, achieving true sustainability is a more complex process that would need to consider the validator dynamics, MEV practices, and decentralization. Adopting green blockchain principles, such as carbon offsets and renewable energy sources, will also affect the NFT world, with the ultimate target being the reduction of the corresponding environmental impact.

7. Industrial Use Cases of Green NFTs

7.1. Supply Chain

The usage of NFTs in supply chain management is continuously transforming the digital records that allow for the real-time tracking of products, ensuring authenticity and safety. This innovation aligns economic goals with sustainability efforts to fulfill consumer demands for traceability while promoting responsible practices and minimizing environmental impacts throughout the supply chain.

7.1.1. Engaging Supply Chain Stakeholders with NFTs

Tracking products using NFTs involves creating a digital record that details the path of each type of item throughout the supply chain. This approach involves many key players, including manufacturers, distributors, retailers, consumers, and regulators. Therefore, understanding the responsibilities of each participant is essential.

Manufacturers must provide key product data (e.g., product name, batch number, expiration date, certificate of authenticity, etc.) to create the respective metadata, which are then embedded into the corresponding NFT smart contracts [143]. Following manufacturing, distributors attempt to transport products to retail locations. The main goal during this operation is to ensure that the products reach the store intact, without compromise [56].

The integration of NFTs in the above process takes place in certain ways, mainly facilitating the information flow related to the products [56]. More specifically, distributors sign a custody agreement under an NFT smart contract to provide details for the products they own and the corresponding quantities. These data, along with real-time mapping and inventory updates, are continuously updated in the relevant metadata [144]. Stores then receive the products that have traveled from production to sale. Upon arrival at the retail location, authenticity and storage conditions are verified through the NFT metadata. Additionally, any changes in the custody agreement will be reflected in the updated product distribution records. Consumers and administrators are the end users of products [145]. Their responsibility is to scan the QR code on the product, which directs them to the corresponding metadata. A consumer who opens a product package can also claim the associated NFT, thus providing a final update to indicate that the product is no longer in stock. Regulators are also important stakeholders in the supply chain process. They are charged with ensuring that products are safe, effective, and comply with legal standards. Regulators can request access to NFTs to confirm the authenticity of items and verify that they have been produced and transported appropriately. In addition, NFTs can be used by regulators to track adverse events and monitor product safety over time.

7.1.2. Sustainable Supply Chains and the Emergence of Green NFTs

In the evolving landscape of inventory management, particularly concerning perishable products, traditional models are being redefined to incorporate considerations for inspection errors and carbon emissions [145]. Emerging inventory management models focus on maximizing profit within carbon-regulated environments, emphasizing the necessity of green investments to reduce emissions while enhancing profitability across supply chains [146,147]. Green supply chain management is characterized by intricate and multifaceted approaches emphasizing the convergence of economic goals with environmental stewardship [148].

So far, blockchain technologies have significantly contributed to developing sustainable innovative solutions, such as a third-party certification method for plant-based products that utilize smart contracts to provide a transparent and tamper-proof record of various production processes [146,147,148]. In this regard, the advantages of integrating blockchain technology with NFTs could be effectively incorporated into the supply chain environment, especially in the food sector, where the properties of transparency, quality, and environmental impact are paramount.

Green NFT technologies continuously impose changes in the supply chain sector, where traditional methods are inadequate and vulnerable to misrepresentation. Green NFTs, with their immutable and decentralized nature, can facilitate the comprehensive tracking of product journeys from origin to end consumer, thereby fostering transparency and accountability throughout the supply chain [149]. By employing such strategies, innovative solutions are being developed to monitor agricultural products, address critical issues related to food safety, and significantly reduce fraud risks [146].

Additionally, green NFTs introduce various applications in supply chain management, including, but not limited to, provenance tracking, real-time inventory management, and quality control [147]. By creating digital records of goods and their attributes, NFTs facilitate enhanced inventory oversight and quality assurance, which are vital for preventing counterfeiting and improving overall efficiency. The ability of NFTs to prevent fraud extends from ticketing events and secure transactions in secondary markets to reduced ticket scalping incidents [150].

Another perspective of applying green NFTs in supply chain management lies in their effective coupling with Internet of Things (IoT) technologies. That development has enhanced supply chain efficiency, especially in real-time data collection on product conditions, such as temperature and humidity. It has been proven that this integration minimizes spoilage and waste, thereby promoting sustainability throughout the product lifecycle [144,145,146,147,148,149,150,151]. IoT technologies contribute to better resource management and efficient farming practices, while improving transparency regarding environmental impacts. As such, it is expected that the synergy between green NFTs and the IoT will become standard practice, paving the way for more efficient, sustainable, and transparent supply chain ecosystems that respond to growing consumer demands for authenticity and traceability [144]. The synergy between NFTs and the IoT is expected to offer significant opportunities for improving supply chain operations through real-time monitoring and data-driven decision-making [29,152].

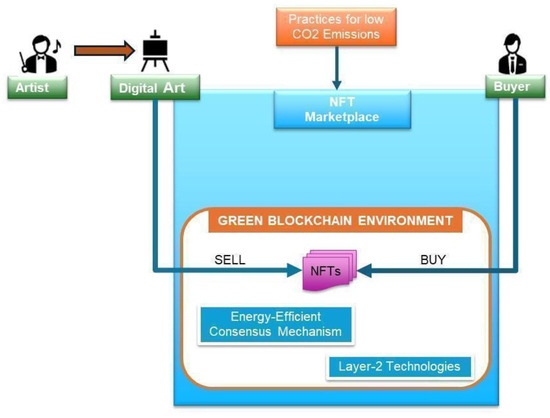

7.2. Digital Art

NFTs have revolutionized the art world by allowing artists to earn directly from their work, bypassing traditional marketplaces. However, challenges remain, including market volatility and ethical implications. With the advent of PoS blockchains, artists now have the opportunity to adopt eco-friendly alternatives. Notable blockchain solutions like Tezos and Algorand have emerged as key players in the green NFT space, helping to mitigate the environmental costs associated with NFTs’ creation and trading [153,154,155]. The life cycle of green NFTs in digital art is depicted in Figure 6.

Figure 6.

Transaction life cycle of Green NFTs in digital art.

This streamlined life cycle begins with the minting process, wherein eco-conscious blockchains (e.g., Tezos, Algorand, etc.) ensure minimal energy consumption [156]. Subsequent stages, including listing, bidding, and the transfer of ownership, are designed to maintain low carbon footprints through the enhanced energy efficient blockchain mechanisms that were discussed in the previous sections (e.g., energy-efficient consensus, Layer-2 solutions, etc.). Further practices to alleviate the energy consumption include several actions that can be made in that direction, such as selecting marketplaces with reduced carbon footprints and that are committed to environmental responsibility, optimizing the digital artwork in order to require less computational efforts during the NFT processes (e.g., reducing the size of files can provide faster and easier NFT processes yielding lees energy), using green materials to create art, etc. The role of art history is crucial in this context, particularly for Generation Z artists who are navigating the digital landscape. By integrating historical contexts into their artistic designs, students and creators can forge a deeper connection between traditional art forms and contemporary digital expression. This structured educational approach—encompassing the exploration of cultural concepts, collaborative discussions, and hands-on design processes—can significantly enhance engagement levels, fostering a new appreciation among younger audiences for both the historical and innovative dimensions of art [157]. Moreover, the integration of blockchain technology and NFTs raises critical ethical considerations, especially regarding potential financial bubbles and the environmental impacts associated with artificial intelligence in art creation [158,159]. The rapid growth of the digital art market introduces challenges, such as concerns about “art hyperinflation”, where the value of art is inflated beyond sustainable levels, and the necessity for curated experiences to stabilize this evolving landscape. Such ethical dilemmas are paramount to ensuring the sustainability of this innovative art form as the market continues to evolve [160,161].

To this end, the incorporation of two well-known blockchains, i.e., Tezos and Algoran, in green NFT implementation in the art market is briefly discussed. These blockchain platforms have demonstrated that NFTs can be both commercially viable and environmentally sustainable, providing concrete examples of how green NFTs function in practice. Tezos has been widely adopted in the digital art sector, with artists leveraging its eco-friendly infrastructure to create and trade NFTs without the high carbon footprint associated with traditional Ethereum-based minting. Algorand, on the other hand, has seen growing adoption in industries such as gaming and digital identity verification, where its low-energy blockchain facilitates large-scale NFT transactions efficiently. These case studies illustrate how green NFTs operate beyond theoretical sustainability claims, providing practical insights into their adoption, scalability, and long-term viability [160,161].

7.3. Gaming Sector

In gaming, the environmental impact of blockchain-based assets has prompted developers to explore eco-friendly NFT solutions. NFTs have found a prominent place in the gaming industry, where they enable players to own, trade, and earn revenue from in-game assets through play-to-earn models. These gaming ecosystems reward players with NFTs for their achievements, creating opportunities for players to monetize their in-game actions. Green gaming platforms have emerged, leveraging PoS consensus mechanisms and other energy-efficient technologies to reduce the carbon footprint of gaming NFTs. Platforms, like Immutable X [162], which use Layer-2 scaling solutions, have gained prominence by offering a more sustainable approach to gaming while maintaining scalability and security. These platforms reduce transaction costs and energy consumption, enabling games to operate in a more environmentally friendly manner without sacrificing performance.

Additionally, major gaming companies have begun exploring green NFTs within their ecosystems, demonstrating the growing need within the gaming industry to address environmental concerns. This shift reflects a broader commitment across the gaming sector to adopt more sustainable practices and mitigate the environmental impact of blockchain-based gaming platforms [163].

In conclusion, the rise of green NFTs and sustainable gaming platforms represents a significant step towards addressing the environmental challenges associated with digital art and gaming. While challenges such as market volatility and the ethical implications of AI in art remain, progress is being made towards creating more sustainable digital ecosystems. Through continued technological innovation, supportive regulatory frameworks, and heightened consumer awareness, both the art and gaming industries have the potential to evolve in a way that promotes artistic innovation while ensuring environmental sustainability.

8. Challenges and Future Directions

8.1. Usability Challenges

Despite their potential, green NFTs will face usability challenges that could impede their widespread adoption. The high transaction costs associated with minting and trading NFTs, particularly on the Ethereum blockchain during peak congestion, present a barrier to many potential users (e.g., not-well-known digital art creators) wishing to join the ecosystem [3,18]. Addressing these high gas fees through innovative blockchain solutions, such as Layer-2 scaling mechanisms, will be crucial for expanding the NFT user base and ensuring equitable participation. Additionally, the slow transaction speeds associated with PoS limit the number of simultaneous transactions and often lead to delays that frustrate users and diminish their overall experience [19,36]. Therefore, advancements in blockchain scalability are essential to provide a seamless user experience, which is vital for maintaining engagement within the NFT ecosystem.

8.2. Privacy Challenges

The usability property is associated, to a certain degree, with privacy considerations. In this regard, while eco-friendly blockchain technologies offer transparency, they also pose risks to user privacy by exposing activities recorded on public ledgers [18,19]. Notable instances of hacks and fraud, including high-profile thefts from marketplaces and vulnerabilities in smart contracts, have led to substantial financial losses for users [1,3]. To cultivate trust within the community, developers and platforms need to prioritize security and implement best practices. Addressing these privacy concerns while maintaining the benefits of the public blockchain history will be critical for enabling the wider acceptance of NFTs.

8.3. Security Threats and Centralization Risks in Energy-Efficient Consensus Models

While energy-efficient consensus models have gained traction, there are concerns about certain security threats and centralization risks, especially in the case of the context of staking pools.

One of the primary problems associated with staking pools is the risk of centralization itself. In many PoS-based networks, a small number of participants hold a disproportionately large amount of the total stake, potentially allowing them to exert a significant influence over the network’s consensus decision-making process. This control contradicts the decentralized ethos of blockchain technology and can lead to collusion among large stakeholders, further entrenching their position and increasing their ability to manipulate transactions for personal gain [18]. For instance, if several large holders band together, they could easily outvote smaller validators and undermine the integrity of the system.

Furthermore, staking pools can introduce security vulnerabilities that do not exist in more decentralized systems. For example, “nothing at stake” problems arise when validators can vote on multiple competing blockchain histories without suffering losses, making malicious actions costly [54]. This situation poses a risk of chain splits and reduces the overall security of the blockchain because it encourages dishonest validation behavior. At the same time, reliance on third-party staking services can create additional attack vectors. Users may be lured into staking with seemingly trustworthy platforms that may not employ adequate security measures. Scenarios involving hacks, the loss of funds, and phishing attacks can arise due to improper management or inadequate security protocols in these ecosystems [161]. As users delegate the control of their stakes to these third parties, they may inadvertently open themselves up to risks that compromise their investments.

To mitigate these risks, it is essential to develop a regulatory framework that encourages diversity in validators and limits the proportion of the total stake held by any single entity. Furthermore, enhancing security protocols within staking services, such as incorporating multi-signature wallets and robust security audits, can help protect users and maintain trust in these systems.

8.4. Interoperability Challenges

The current green NFT environment constitutes a granular ecosystem, where various platforms operate either independently or communicate with others. In the first case, interoperability is lower, preventing the users from transferring assets between different platforms. This above-mentioned fragmentation limits the utility and potential of NFTs [18,47]. Interoperability challenges can be addressed by establishing more advanced standardized protocols and metadata formats that will be able to significantly address the above-mentioned challenges, making NFTs more attractive and functional for a wide spectrum of users.

8.5. Fostering the Metaverse

Energy-efficient NFTs can play a pivotal role in the framework of the Metaverse, where physical and virtual realities converge. Since they enable users to buy, sell, and trade virtual assets, they can substantially facilitate economic interactions in immersive online environments. Several projects exemplify how NFTs support user-generated content and virtual real estate, thus creating new business models and fostering innovation in immersive experiences [3]. As the Metaverse continues to develop, the role of energy-efficient NFTs will likely become essential, further solidifying their relevance in the future virtual ecosystem.

8.6. Legal and Regulatory Considerations

The NFT ecosystem is currently facing unclear legal frameworks, making it difficult for creators and investors to understand their rights and obligations. The ambiguous status surrounding intellectual property rights poses significant risks and uncertainties [3,18]. As governments and regulatory bodies work to address these challenges, establishing clear guidelines will be crucial for creating a secure and transparent environment for NFT technologies. This challenge is further compounded by the complexities of blockchain-based gambling regulations, which vary significantly across jurisdictions. The decentralized nature of blockchain platforms makes it difficult to enforce compliance with Know Your Customer (KYC) and Anti-Money-Laundering (AML) requirements, raising concerns about the potential for illicit financial activities. Without standardized regulatory frameworks, blockchain-based gambling operations may struggle to gain legitimacy, limiting their mainstream adoption.

In addition to regulatory uncertainty in digital asset markets, ensuring that physical supply chain transactions are accurately represented on-chain presents another significant challenge. While blockchain technology enhances transparency and immutability, its effectiveness in tracking real-world goods depends on the reliability of off-chain mechanisms such as IoT-enabled tracking, trusted oracles, and third-party verification services. The absence of standardized protocols for verifying the authenticity of physical assets before they are recorded on-chain can lead to discrepancies, undermining the trustworthiness of blockchain-based supply chain solutions. Addressing these concerns requires integrating regulatory oversight with technological advancements, including smart contracts that automate compliance enforcement and data validation from real-world sources.

The regulatory landscape will also play a crucial role in the future of NFTs. A clearer regulatory framework will be essential for fostering trust and security in the marketplace. Collaborations between the NFT community and legislative bodies are vital for generating comprehensive guidelines regarding intellectual property, taxation, and consumer protection [1,3]. By creating a well-defined regulatory environment that encompasses both digital assets and their real-world applications, concerns for creators, investors, and businesses can be alleviated, contributing to a more robust and trustworthy marketplace.

8.7. Policy Interventions and the Future of Green NFTs

Policy interventions will play a vital role in shaping the future of NFTs across various sectors, such as digital art, gaming, and supply chains. Policymakers can aid the transition to more-sustainable blockchain technologies by implementing incentives like tax benefits or research and development grants that foster energy-efficient innovations. Alongside these efforts, education and consumer awareness will be crucial in driving demand for green NFTs. By increasing the understanding of blockchain’s environmental impact, policymakers can motivate consumers to select sustainable platforms and encourage developers to prioritize energy efficiency. One potential approach could be the creation of certification systems for green NFTs, paired with guidelines for developers to minimize the carbon footprint of blockchain transactions.

The future landscape of NFTs is set to undergo significant transformation, driven by rapid technological advancements and evolving societal needs. While they offer substantial opportunities for innovation and digital ownership, numerous challenges must be addressed to facilitate their growth and broader adoption. Central to their future is the ongoing evolution of blockchain technology, particularly through Layer-2 solutions that enhance transaction speed and reduce costs.

Another direction is related to the systematic integration of NFTs with emerging technologies, such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI). Innovations in these areas can enhance user engagement and create immersive experiences. For instance, AR-enabled NFT galleries may allow users to visualize digital art in their own environments, while AI could facilitate the generation of unique, dynamic artworks. This fusion of technologies will not only redefine how users interact with digital assets but also introduce new opportunities in the NFT space.

9. Conclusions

The rise of green NFTs presents a significant opportunity to reduce the environmental impact of several industrial sectors. However, achieving sustainability requires the overcoming of several critical challenges. While the adoption of PoS consensus mechanisms and carbon offsetting initiatives show promise, it is important to maintain sustainable NFT operations by further reducing greenhouse gas emissions.

The current endeavor focused on studying the available energy-efficient technologies involved in the development of eco-friendly NFTs and encompassed three basic steps. The first step investigated certain considerations concerning the current environmental impact of NFTs and their symbiotic relationship with blockchain components. The second step demonstrated that the effectiveness and sustainability of the above relationship depends on several blockchain operational properties, such as interoperability and scalability. It was shown that both interoperability and scalability are strongly related to certain blockchain technologies, such as energy-efficient consensus mechanisms, layer structures, and token protocols. In addition, the relationship between NFTs’ sustainability and accessibility was highlighted. The third step concentrated on analyzing several industrial applications of NFTs, indicating certain directions of further innovation.

Finally, the study delineated certain challenges related to the field, which concerned the development of usable, interoperable, and privacy-preserving applications of energy-efficient NTFs.

Author Contributions

Conceptualization, G.E.T. and Z.S.; methodology, Z.S. and C.C.; formal analysis, Z.S. and E.M.; investigation, C.C., Z.S. and E.M.; resources, C.C. and Z.S.; writing—original draft preparation, C.C., Z.S. and E.M.; writing—review and editing, G.E.T., Z.S. and E.M.; supervision, G.E.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

The authors would like to thank the anonymous reviewers for their effort to provide very helpful comments that improved the paper.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Lohar, P.; Rathi, K. Evaluation of non-fungible token (NFT). arXiv 2023, arXiv:2308.14389. [Google Scholar]

- Parham, A.; Breitinger, C. Non-fungible tokens: Promise or peril? arXiv 2022, arXiv:2202.06354. [Google Scholar]

- Rehman, W.; Zainab, H.; Imran, J.; Bawany, N.Z. NFTs: Applications and challenges. In Proceedings of the 22nd International Arab Conference on Information Technology (ACIT), Muscat, Oman, 21–23 December 2021. [Google Scholar] [CrossRef]

- Xia, Y.; Li, J.; Fu, Y. Are non-fungible tokens (NFTs) different asset classes? Evidence from quantile connectedness approach. Financ. Res. Lett. 2022, 49, 103156. [Google Scholar] [CrossRef]

- Taherdoost, H. Non-fungible tokens (NFT): A systematic review. Information 2023, 14, 26. [Google Scholar] [CrossRef]