1. Introduction

Water and energy are the two essential interdependent resources. All energy sources, including electricity, require water for their generation. Additionally, making the water available for human use, through methods such as irrigation, pumping, transportation, and desalination, necessitates energy. However, these resources are facing decline and scarcity due to factors such as population growth, overuse, wastage, contamination, and global warming. Both resources, water and electricity, are used in various domains such as industrial, domestic, and agricultural purposes [

1], where 70% of the water withdrawals are dedicated to farming with electricity support. The study carried out by the World Wide Fund shows that only 10% of the water withdrawals are used efficiently, and, out of that, 2500 trillion liters are used annually in agriculture, with an estimated 1500 trillion liters of water being wasted on the farming grounds [

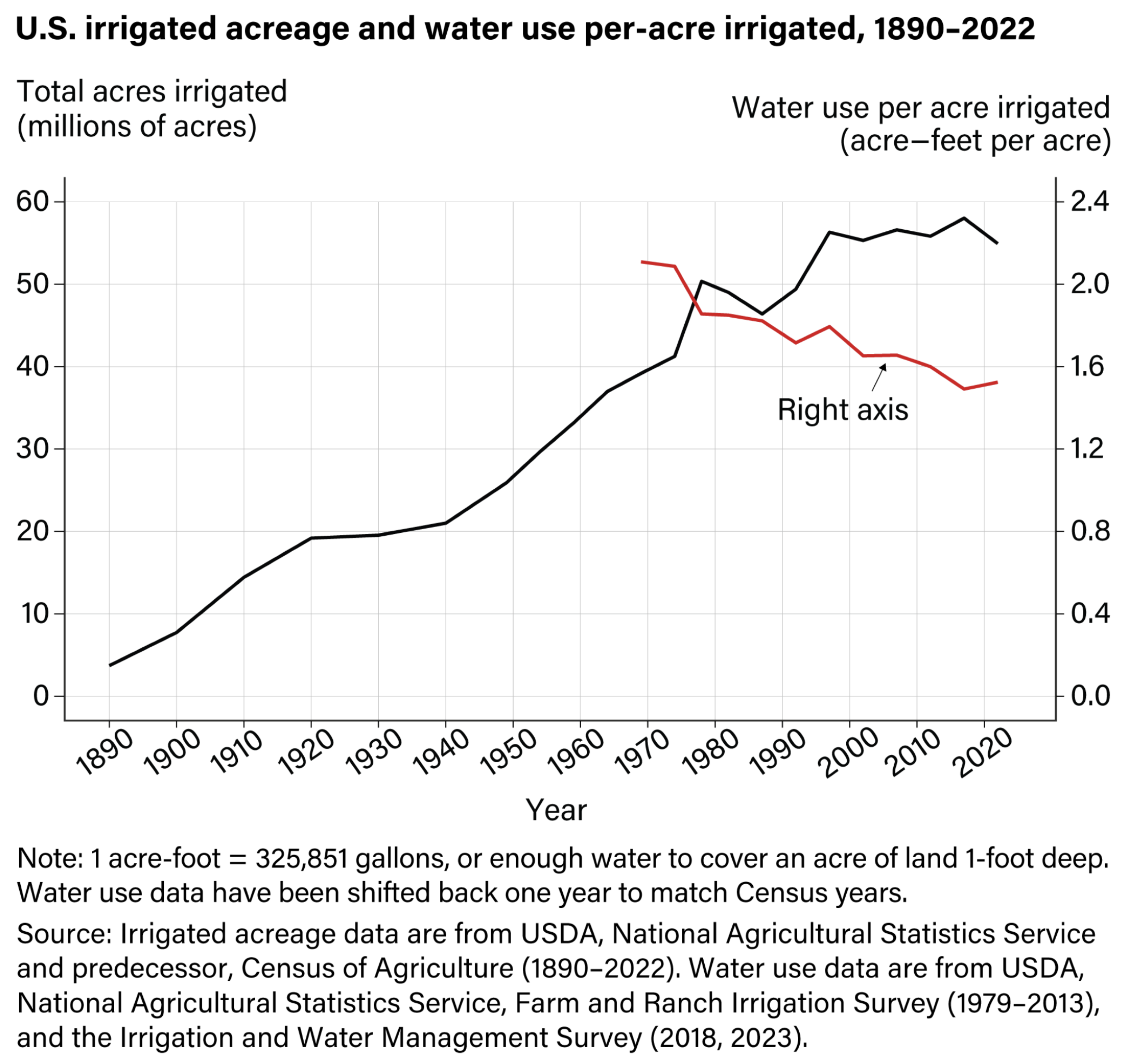

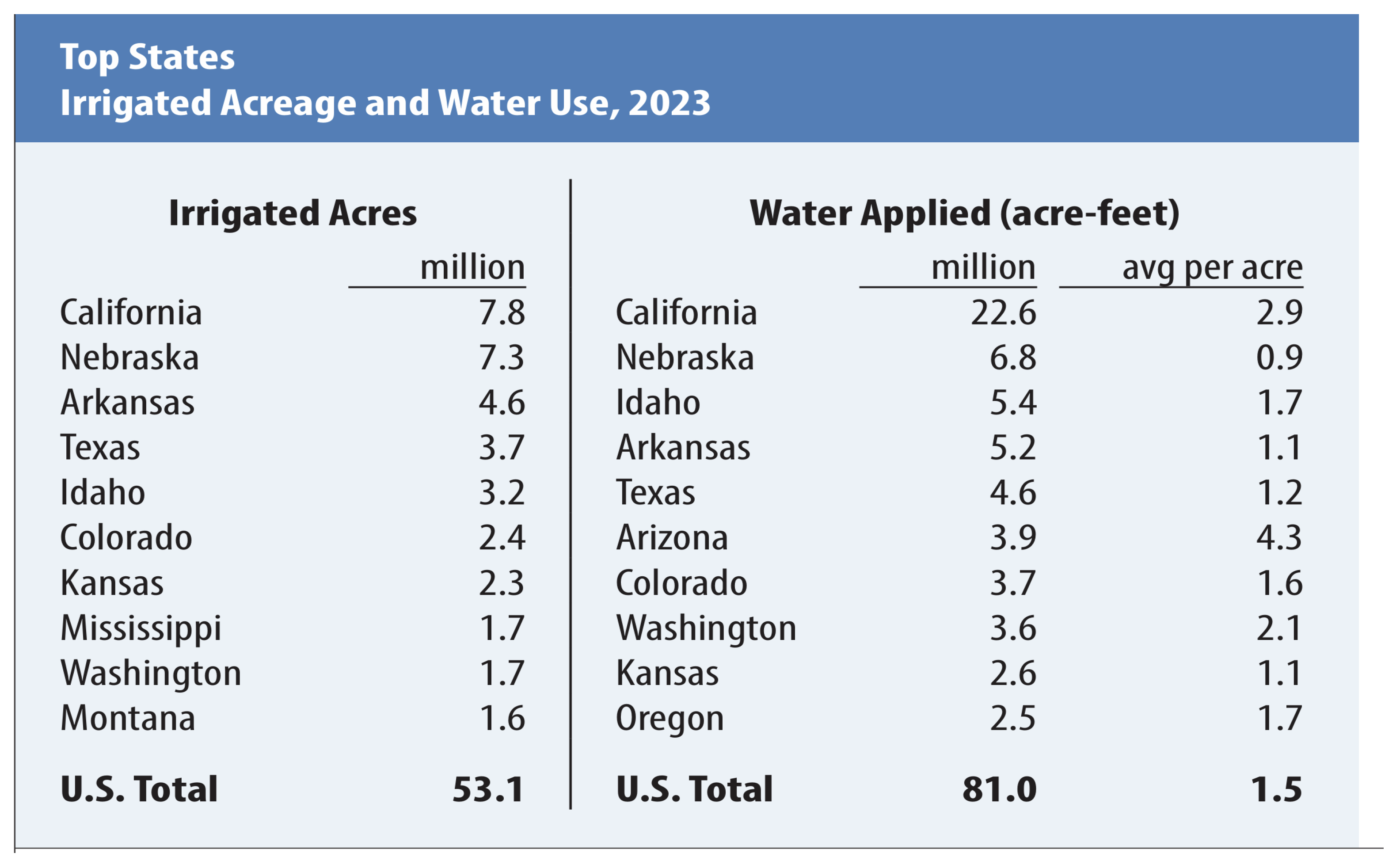

2]. In the USA alone, according to a U.S. Geological Survey report, agriculture is a major user of ground and surface water in the United States, and irrigation accounted for 47 percent of the nation’s total freshwater withdrawals between 2010 and 2020 [

3].

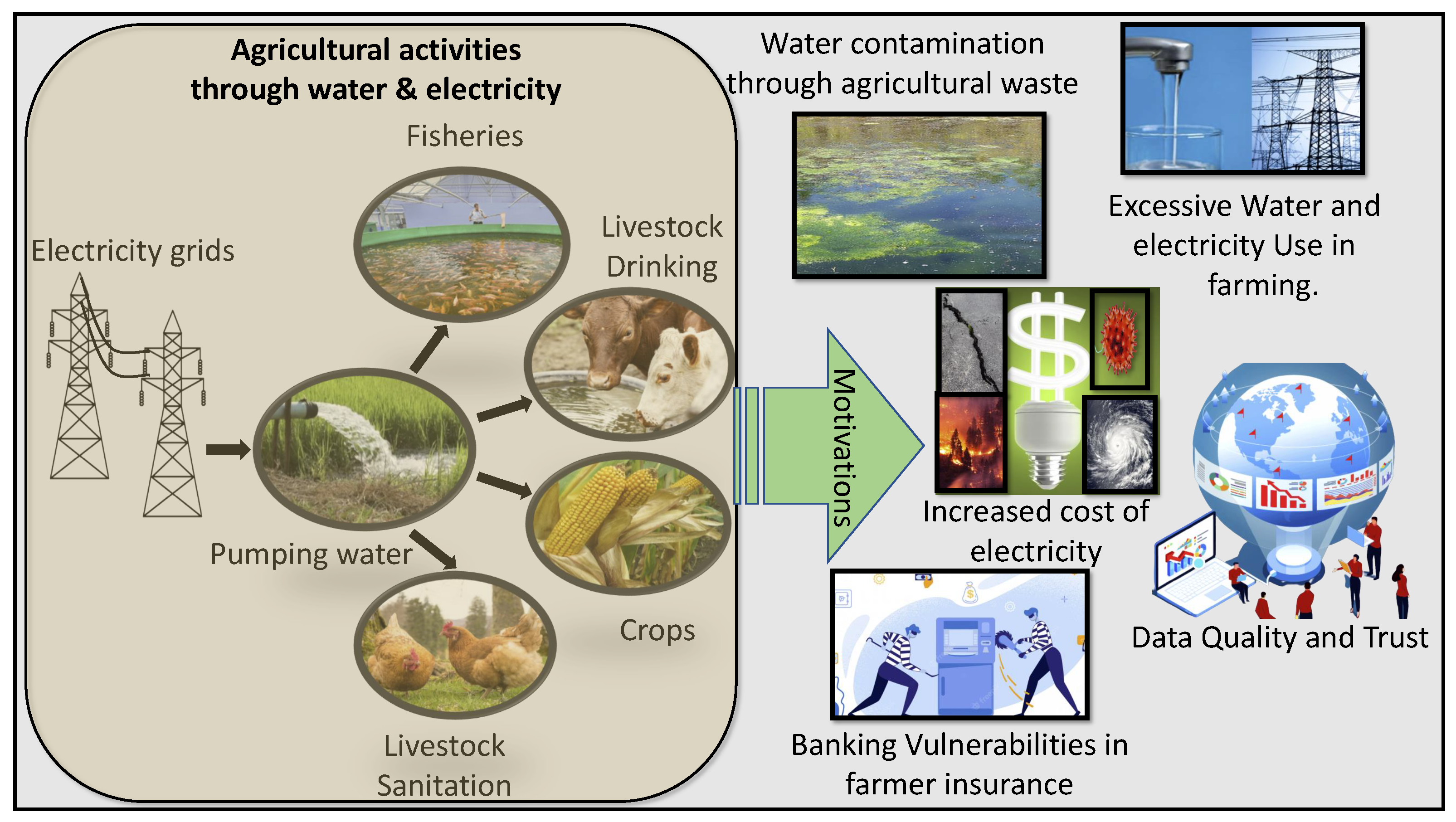

Along with the above-discussed issues regarding water and energy resources, the cost of electricity has also increased recently due to the COVID-19 pandemic, providing an additional reason to use it efficiently and effectively. Observing that farmers must allocate budgets for power sources and may need to collaborate with third-party providers highlights the need for efficient, data-driven decision-making [

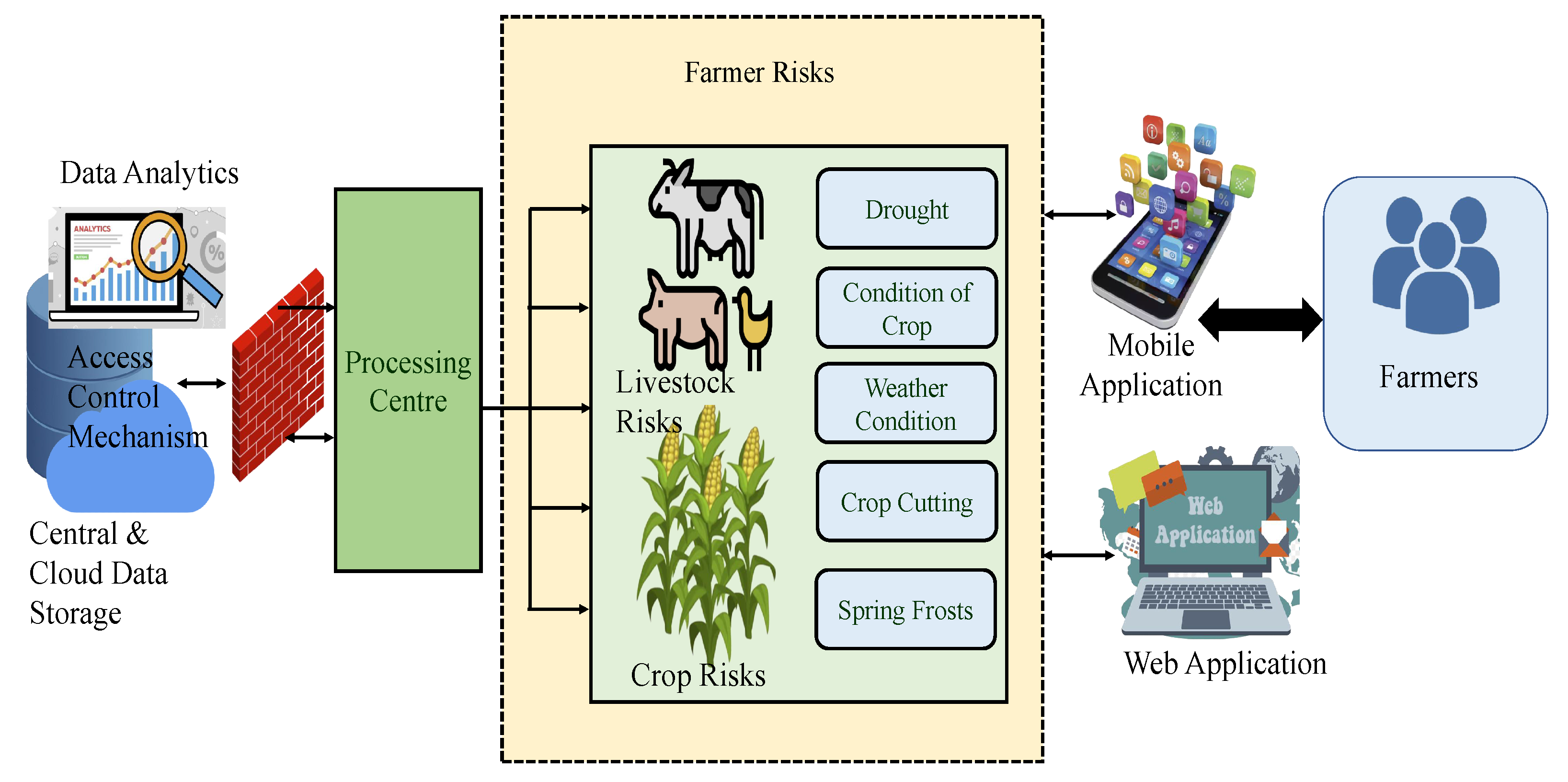

4]. These real-world constraints form the basis of our IncentiveChain framework, which aims to optimize resource allocation, reduce costs, and provide actionable insights for farmers. Some of the motives for our current paper are discussed in

Figure 1.

Farming can include various jobs, such as crop growing, raising livestock and fish/shellfish, supplying dairy, and caring for nurseries [

5]. The quality of the product increases along with its marketing price by making timely and correct decisions during farming, watering, fertilizing, maintaining health and hygiene, and removing weeds. All of these tasks in agriculture require water and energy throughout every phase and necessitate expertise and specialized skills from the farmer, which becomes crucial. An individual farmer is mainly responsible for all the activities taking place in their fields. If farmers could limit their resource usage on agricultural fields and benefit from the reduced carbon footprint, it would help reduce the global environmental impact.

Each farming field has a utility service connection for farming activities, which helps with generating monthly bills for the electricity used in farming. A threshold limitation is embedded into the current IncentiveChain application for water and energy usage on fields, so when farmers reach these units, they receive rewards. Agriculture departments can set the threshold limit of water and energy units in farming as they are responsible for developing and executing federal laws related to agriculture, forestry, and food. The current application, IncentiveChain, can be made practical and usable when a robust design for incentives, an accountable involvement from farmers, and strong efforts from national and local entities are integrated. A novel architecture design and cyber-physical systems are discussed more extensively in

Section 4.

A blockchain works as a distributed ledger that is shared among a group of network nodes. Each chain operates based on distributed ledger technology (DLT), where each piece of data is recorded as a transaction on the digital ledger. Each transaction is stored electronically in groups called blocks, and all are signed through cryptographic hashes to generate secure data transactions.

The increase in blockchain applications has allowed the platform to permeate into a wide range of industries. Some of the use cases of blockchains in the real world today include cryptocurrencies, banking and finance, smart contracts, healthcare, supply chains, and voting systems. Traditional banking systems take more processing time during money transactions and are more vulnerable to attacks. Blockchain platforms in banking are benefiting financial systems by reducing processing times and increasing security and trust among relevant nodes [

6]. A more elaborate discussion on banking systems shifting to more secure transactions through distributed ledger systems is given in

Section 4.

The following is the order of the remaining parts of the paper: We explain the challenges and problems and discuss a state-of-the-art solution method in

Section 2. We demonstrate how blockchain is applied in various use cases of smart agriculture and in previous studies on the efficient use of resources in farming under

Section 3. A novel architecture for the current system and a cyber-physical system through the Interplanetary File System (IPFS) and blockchain is given in

Section 4 for the current IncentiveChain from a broader perspective, followed by algorithms proposed in

Section 5.

Section 6 explains the implementation and results to validate the current system. At the end, we discuss the conclusions of the current paper and future improvements in

Section 7.

Author Contributions

Conceptualization, S.L.T.V. and S.P.M.; methodology, S.L.T.V., S.P.M. and E.K.; writing—original draft, S.L.T.V.; writing—review and editing, S.P.M. and E.K.; supervision, S.P.M.; S.L.T.V. and S.P.M. contributed equally to this work. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All the data generated or analyzed during this study are included in the published article. Any data related to this study can be provided with reasonable request.

Acknowledgments

This work incorporates material from the author’s doctoral dissertation: Lakshmi Sukrutha Tirumala Vangipuram, AGROSTRING: Exploring Distributed Ledger for Effective Data Management in Smart Agriculture, Ph.D. Thesis, University of North Texas, Denton, TX, USA, July 2024. The corresponding authors of this manuscript are Sukrutha L. T. Vangipuram and Saraju P. Mohanty.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Nations, U. World Population Projected to Reach 9.8 Billion in 2050, and 11.2 Billion in 2100. Department of Economic and Social Affairs. 2017. Available online: https://www.un.org/development/desa/en/news/population/world-population-prospects-2017.html (accessed on 9 July 2024).

- Farm, C. How Much Water Is Used for Farming? 19 November 2024. Available online: https://coolfarm.org/how-much-water-is-used-for-farming/ (accessed on 19 December 2024).

- Potter, N. Irrigation and Water Use. USDA:Economic Research Survey. 2024. Available online: https://www.ers.usda.gov/topics/farm-practices-management/irrigation-water-use (accessed on 14 October 2024).

- Reardon, T.; Awokuse, T.; Belton, B.; Liverpool-Tasie, L.S.O.; Minten, B.; Nguyen, G.; Qanti, S.; Swinnen, J.; Vos, R.; Zilberman, D. Emerging outsource agricultural services enable farmer adaptation in agrifood value chains: A product cycle perspective. Food Policy 2024, 127, 102711. [Google Scholar] [CrossRef]

- Greenwood, B. Duties and Responsibilities of Farmers. CHRON Newsletters. 2018. Available online: https://work.chron.com/duties-responsibilities-farmers-19369.html (accessed on 14 May 2024).

- Puthal, D.; Malik, N.; Mohanty, S.P.; Kougianos, E.; Das, G. Everything You Wanted to Know About the Blockchain: Its Promise, Components, Processes, and Problems. IEEE Consum. Electron. Mag. 2018, 7, 6–14. [Google Scholar] [CrossRef]

- Office of Energy and Environmental Policy. Census of Agriculture. 2024. Available online: https://www.nass.usda.gov/Publications/AgCensus/2022/Online_Resources/Farm_and_Ranch_Irrigation_Survey/iwms.pdf (accessed on 29 August 2024).

- The U.S. Environmental Protection Agency. Inventory of U.S. Greenhouse Gas Emissions and Sinks. EPA. 2023. Available online: https://nepis.epa.gov/Exe/ZyPDF.cgi/P101EZHC.PDF?Dockey=P101EZHC.PDF (accessed on 14 September 2025).

- Office, Congressional Budget Emissions of Greenhouse Gases in the Agriculture Sector. 2025. Available online: https://www.cbo.gov/publication/61690#_idTextAnchor035 (accessed on 20 September 2025).

- USDA National Agriculture Statistics Services (NASS). Irrigation and Water Management. Census of Agriculture. 2024. Available online: https://www.nass.usda.gov/Publications/Highlights/2024/Census22_HL_Irrigation_4.pdf (accessed on 14 December 2024).

- Rinkesh. Causes, Effects and Solutions of Agricultural Pollution on Our Environment. 2022. Available online: https://www.conserve-energy-future.com/causes-and-effects-of-agricultural-pollution.php (accessed on 9 July 2024).

- Alon, S. Putting Core Insurance Systems in the Cloud. 2018. Available online: https://insuranceblog.accenture.com/putting-core-insurance-systems-in-the-cloud (accessed on 9 July 2024).

- Pandey, S. Pros and Cons of Cloud Adoption in Insurance and Financial Services Industry. 2020. Available online: https://insurance.apacciooutlook.com/cxoinsights/pros-and-cons-of-cloud-adoption-in-insurance-and-financial-services-industry-nwid-1501.html (accessed on 9 July 2024).

- Gupta, N. Impact on Real-Time Cross-Border Payments. 2018. Available online: https://www.yesbank.in/digital-banking/tech-for-change/financial-services/impact-on-realtime-cross-border-payments (accessed on 9 July 2024).

- Georgievich, K.V. Choosing an Agricultural Insurance Strategy. In Proceedings of the 2021 14th International Conference Management of Large-Scale System Development (MLSD), Moscow, Russia, 27–29 September 2021; pp. 1–4. [Google Scholar] [CrossRef]

- Wang, H.; Liu, H.; Wang, D. Agricultural Insurance, Climate Change, and Food Security: Evidence from Chinese Farmers. Sustainability 2022, 14, 9493. [Google Scholar] [CrossRef]

- Choudhury, I.; Bhattacharya, B.K. Satellite Based Composite Weather Insurance Product for assessing mid-term adversary. Remote. Sens. Appl. Soc. Environ. 2024, 36, 101373. [Google Scholar] [CrossRef]

- Tappi, M.; Santeramo, F.G. (Extreme) Weather index-based insurances: Data, models, and other aspects we need to think about. In Proceedings of the 2022 IEEE Workshop on Metrology for Agriculture and Forestry (MetroAgriFor), Perugia, Italy, 3–5 November 2022; pp. 313–317. [Google Scholar] [CrossRef]

- Facility, G.I.I. Blockchain Application in Agriculture Insurance. 2021. Available online: https://www.indexinsuranceforum.org/blog/blockchain-application-agriculture-insurance (accessed on 19 October 2024).

- Kshetri, N. Blockchain-Based Smart Contracts to Provide Crop Insurance for Smallholder Farmers in Developing Countries. IT Prof. 2021, 23, 58–61. [Google Scholar] [CrossRef]

- Nguyen, T.; Das, A.; Tran, L. NEO Smart Contract for Drought-Based Insurance. In Proceedings of the 2019 IEEE Canadian Conference of Electrical and Computer Engineering (CCECE), Edmonton, AB, Canada, 5–8 May 2019; pp. 1–4. [Google Scholar] [CrossRef]

- Bai, P.; Kumar, S.; Kumar, K. Use of Blockchain Enabled IoT in Insurance: A Case Study of Calamity Based Crop Insurance. In Proceedings of the 2022 Third International Conference on Intelligent Computing Instrumentation and Control Technologies (ICICICT), Kannur, India, 11–12 August 2022; pp. 1135–1141. [Google Scholar] [CrossRef]

- Vangipuram, S.L.T.; Mohanty, S.P.; Kougianos, E.; Ray, C. G-DaM: A Distributed Data Storage with Blockchain Framework for Management of Groundwater Quality Data. Sensors 2022, 22, 8725. [Google Scholar] [CrossRef] [PubMed]

- Vangipuram, S.L.T.; Mohanty, S.P.; Kougianos, E.; Ray, C. agroString: Visibility and Provenance through a Private Blockchain Platform for Agricultural Dispense towards Consumers. Sensors 2022, 22, 8227. [Google Scholar] [CrossRef] [PubMed]

- Yang, X.; Li, M.; Yu, H.; Wang, M.; Xu, D.; Sun, C. A Trusted Blockchain-Based Traceability System for Fruit and Vegetable Agricultural Products. IEEE Access 2021, 9, 36282–36293. [Google Scholar] [CrossRef]

- Soni, P.; Sinha, R.; Perret, S.R. Energy use and efficiency in selected rice-based cropping systems of the Middle-Indo Gangetic Plains in India. Energy Rep. 2018, 4, 554–564. [Google Scholar] [CrossRef]

- Xu, H.; Yang, R.; Song, J. Agricultural Water Use Efficiency and Rebound Effect: A Study for China. Int. J. Environ. Res. Public Health 2021, 18, 7151. [Google Scholar] [CrossRef] [PubMed]

- Ullah, R.; Abbas, A.W.; Ullah, M.; Khan, R.U.; Khan, I.U.; Aslam, N.; Aljameel, S.S. EEWMP: An IoT-Based Energy-Efficient Water Management Platform for Smart Irrigation. Sci. Program. 2021, 2021, 9. [Google Scholar] [CrossRef]

- Nhamo, L.; Magidi, J.; Nyamugama, A.; Clulow, A.D.; Sibanda, M.; Chimonyo, V.G.P.; Mabhaudhi, T. Prospects of Improving Agricultural and Water Productivity through Unmanned Aerial Vehicles. Agriculture 2020, 10, 256. [Google Scholar] [CrossRef]

- Lin, X.; Sun, X.; Manogaran, G.; Rawal, B.S. Advanced energy consumption system for smart farm based on reactive energy utilization technologies. Environ. Impact Assess. Rev. 2021, 86, 106496. [Google Scholar] [CrossRef]

- Palihapitiya, T. Blockchain in Banking Industry. 2020. Available online: https://www.researchgate.net/publication/344954493_Blockchain_in_Banking_Industry (accessed on 29 August 2024).

- CoinLaw. XRP vs. SWIFT Statistics 2025: Transaction Speed, Fees and Adoption. 2025. Available online: https://coinlaw.io/xrp-vs-swift-statistics/ (accessed on 10 September 2025).

- Finextra. 3 Major Roadblocks to Blockchain Adoption in Banking. 2019. Available online: https://www.finextra.com/blogposting/18197/3-major-roadblocks-to-blockchain-adoption-in-banking (accessed on 29 August 2024).

Figure 1.

IncentiveChain motivations.

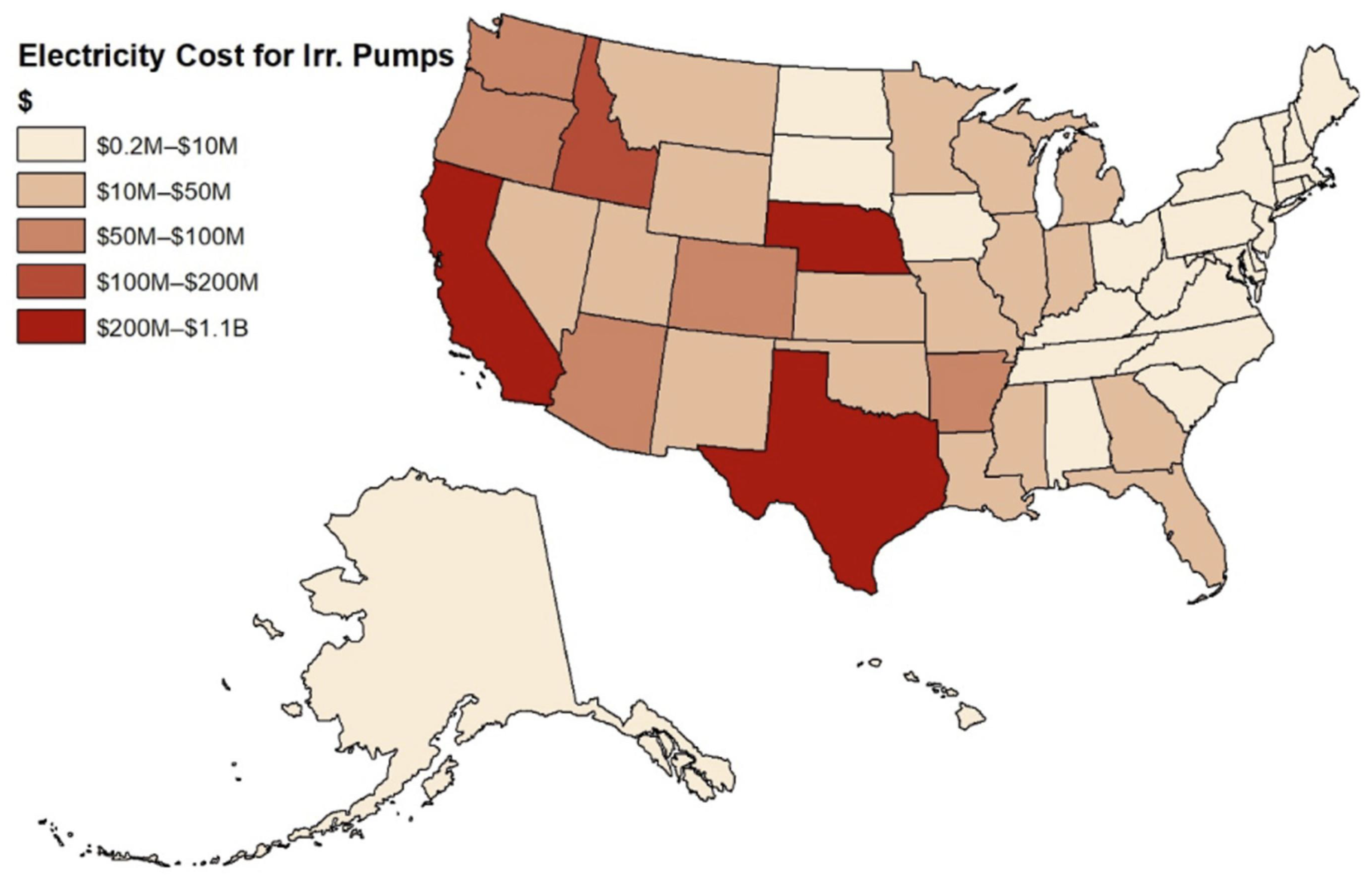

Figure 2.

Electricity use and costs for on-farm irrigation pumps.

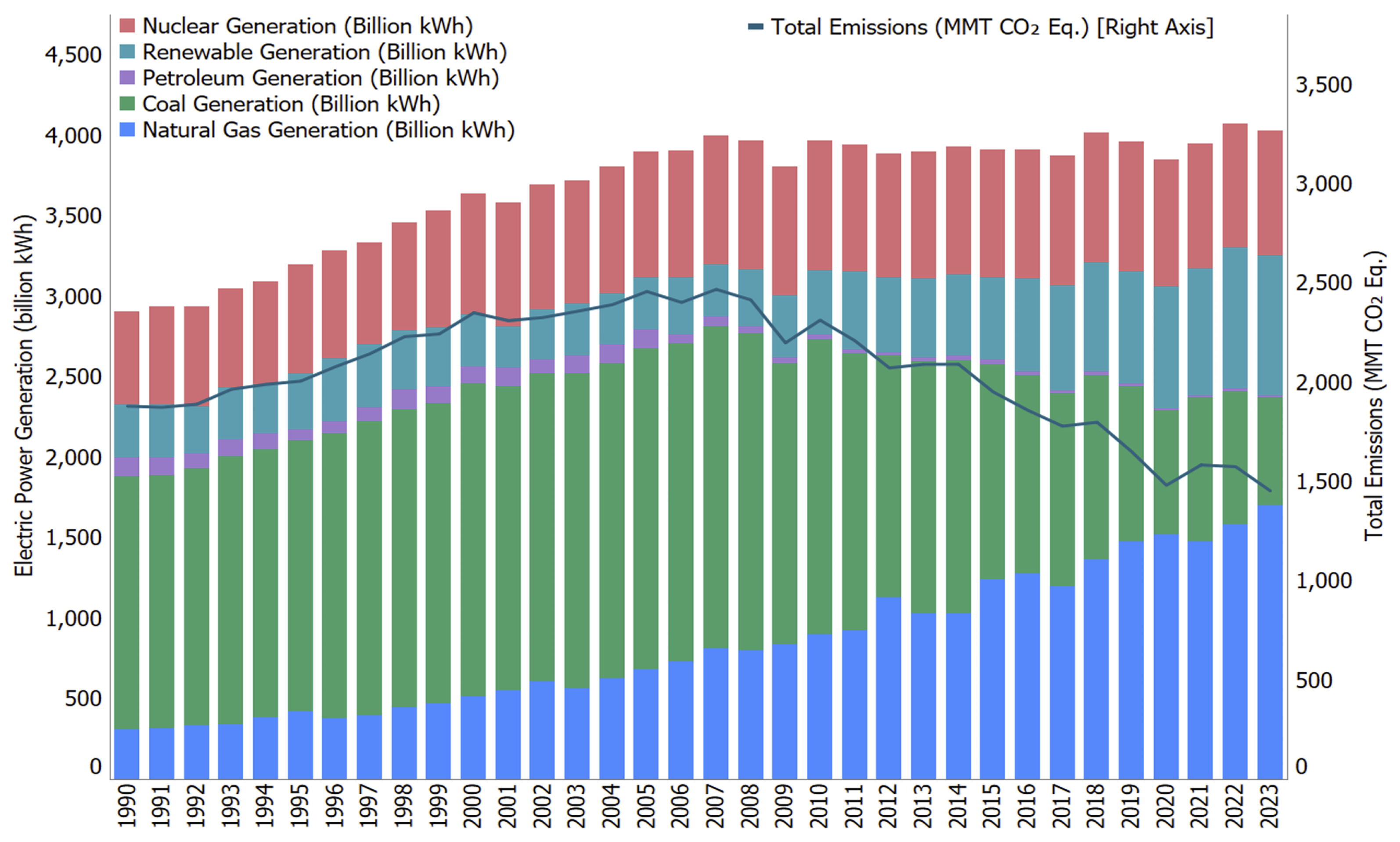

Figure 3.

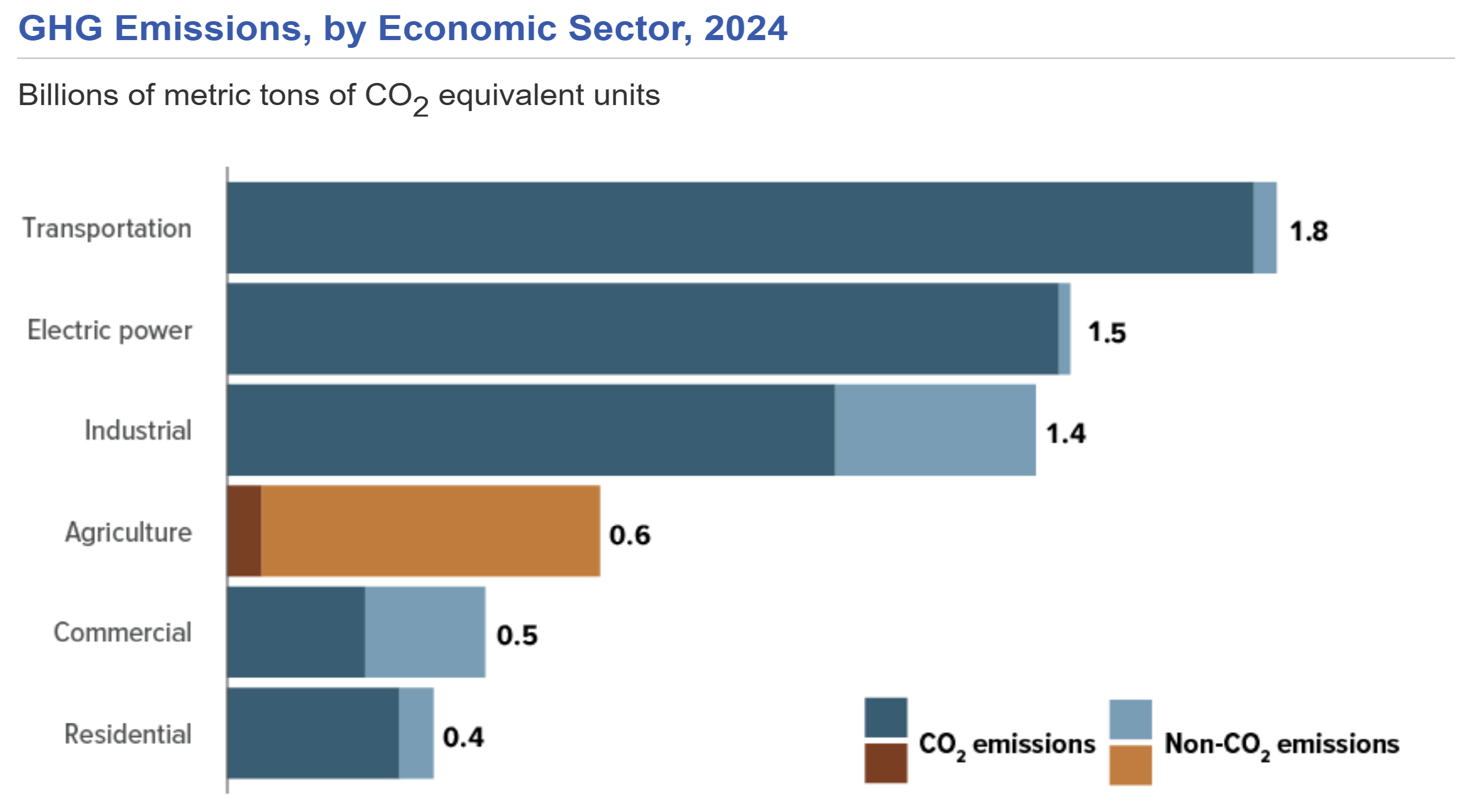

Greenhouse gas emissions from electricity usage.

Figure 4.

Greenhouse gas emissions of CO2 in agriculture.

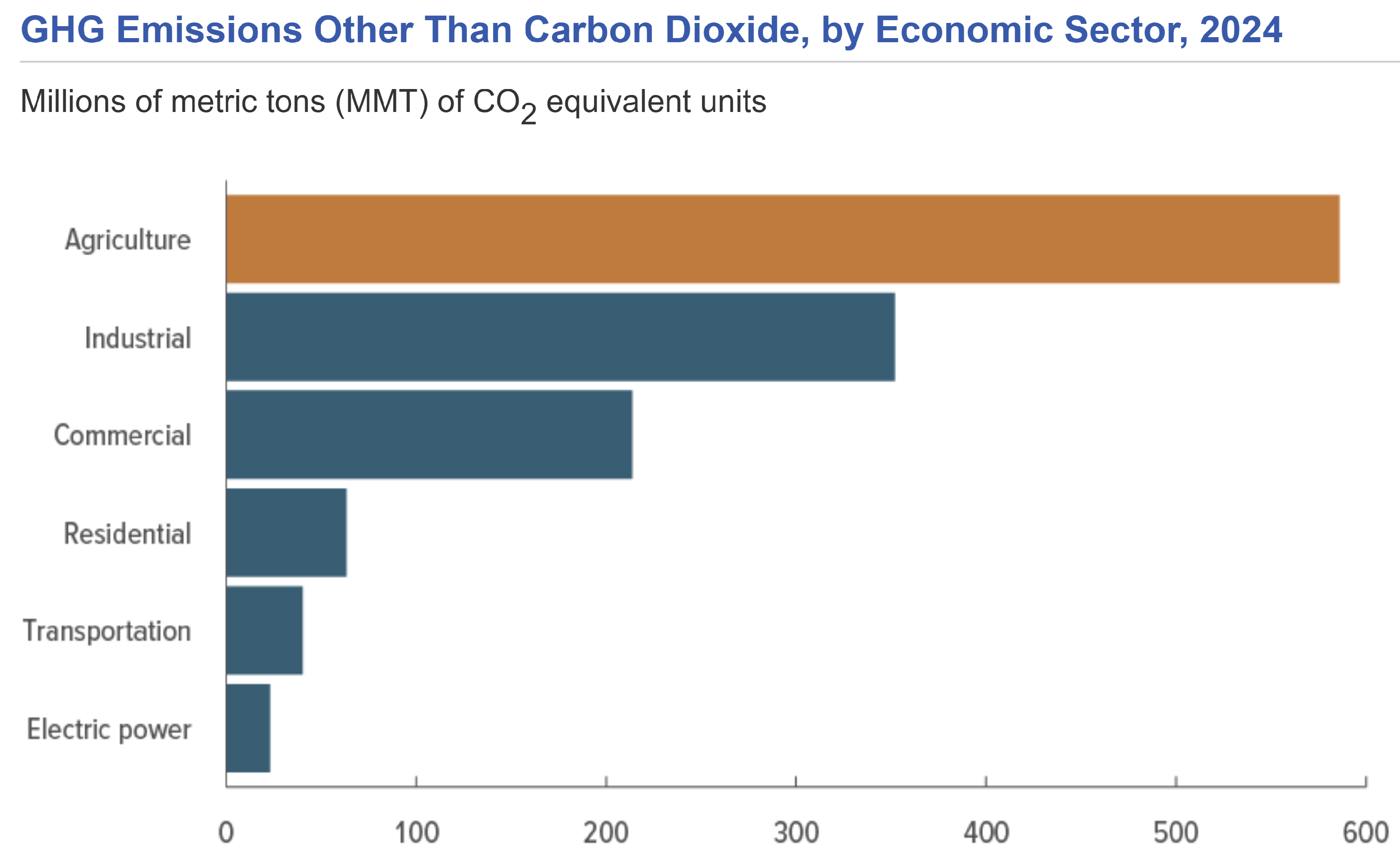

Figure 5.

Greenhouse gas emissions other than CO2 in agriculture.

Figure 6.

Water usage in agriculture.

Figure 7.

Distribution of irrigated farmland and associated water use across key U.S. states.

Figure 8.

Traditional agricultural insurance system platform.

Figure 9.

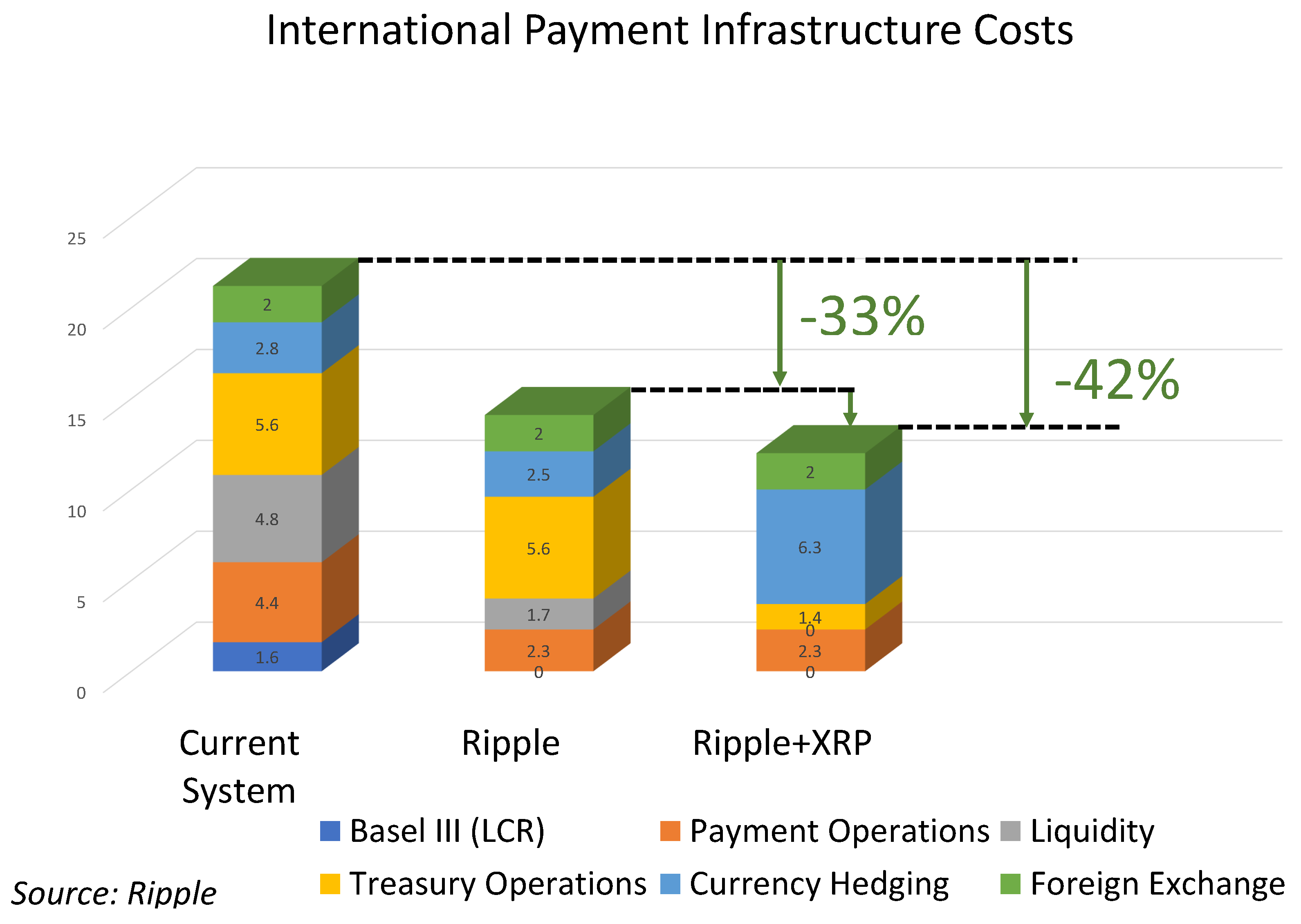

A study demonstrating comparisons with Ripple financial systems.

Figure 10.

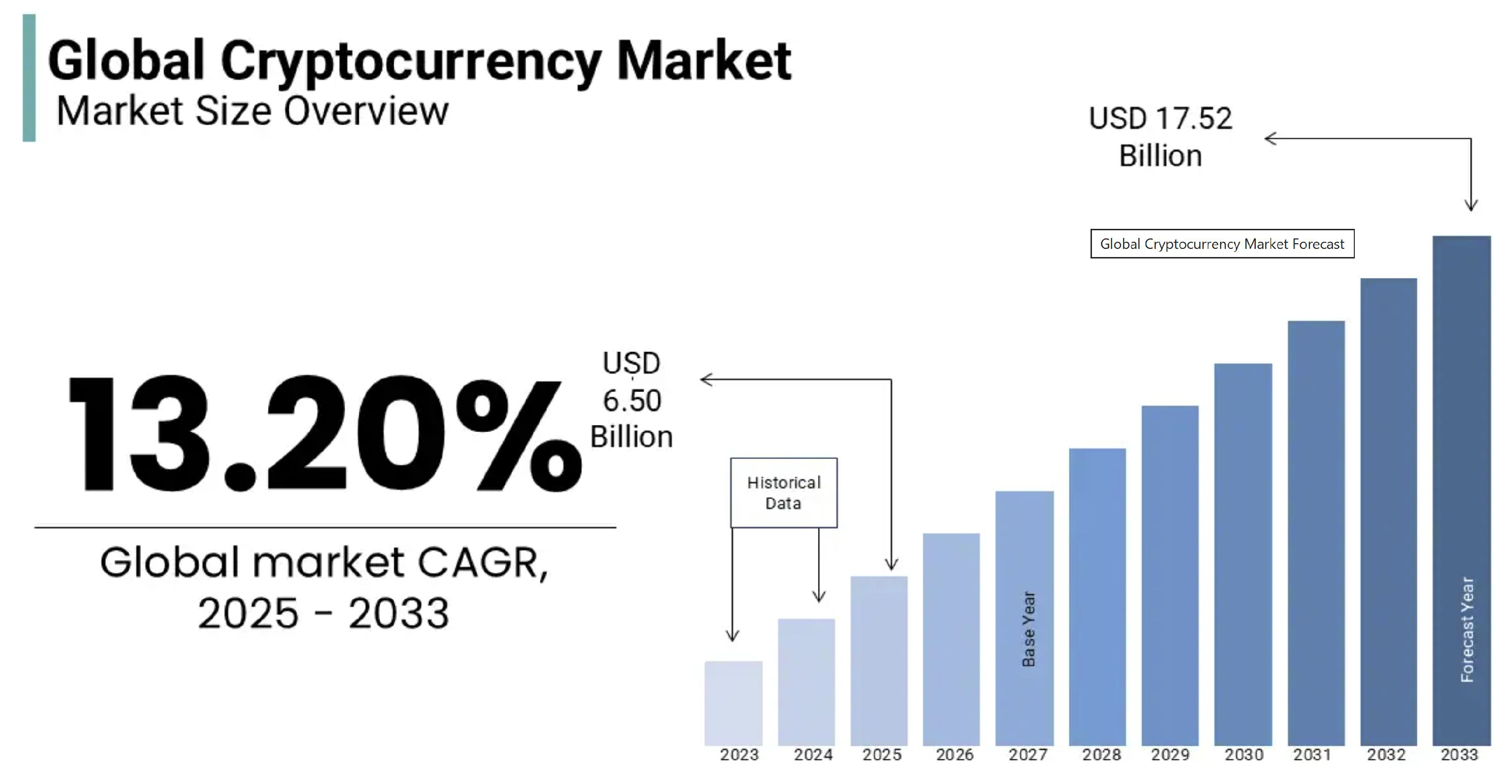

Global cryptocurrency market.

Figure 11.

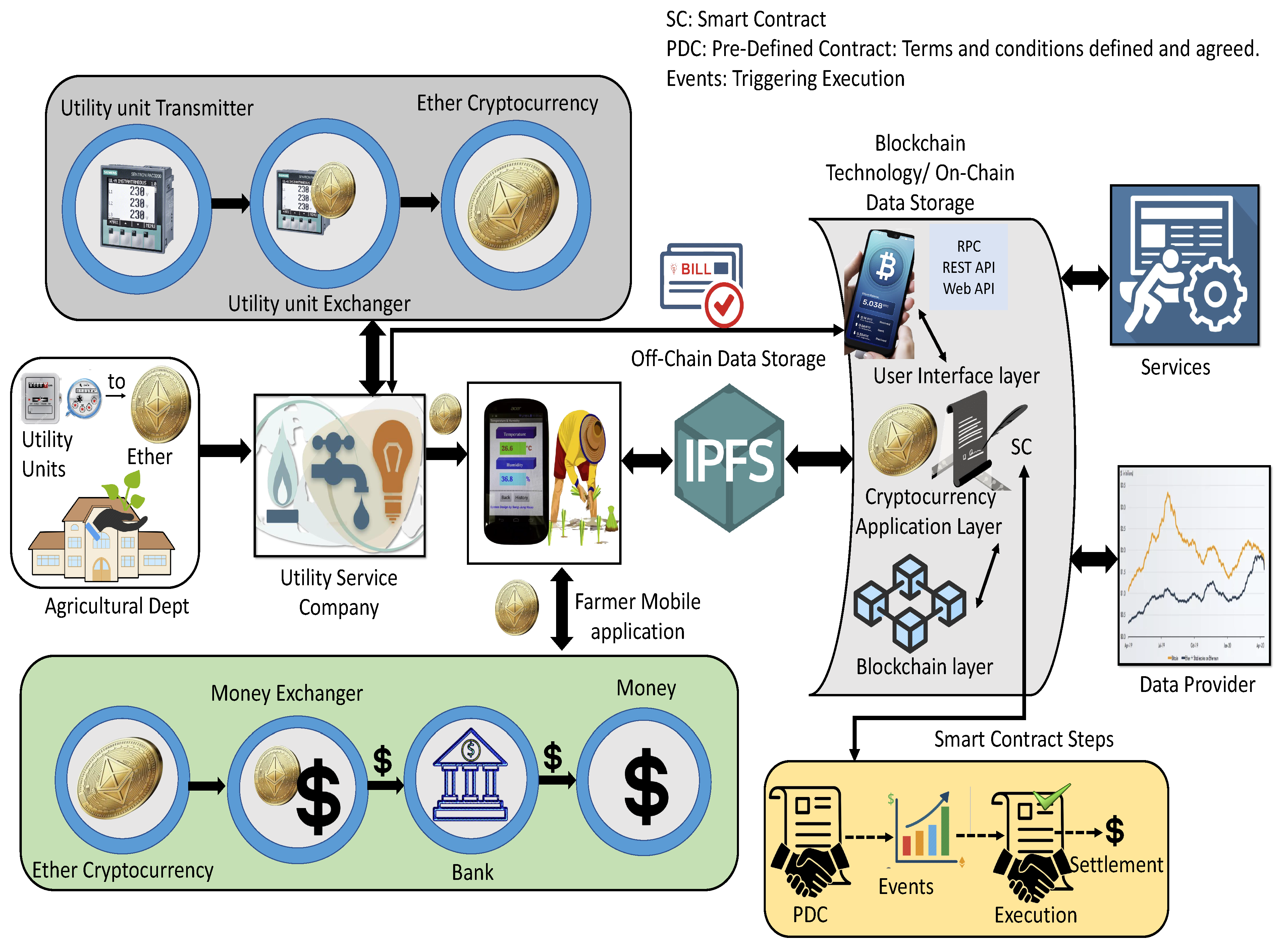

State-of-the-art IncentiveChain architecture.

Figure 12.

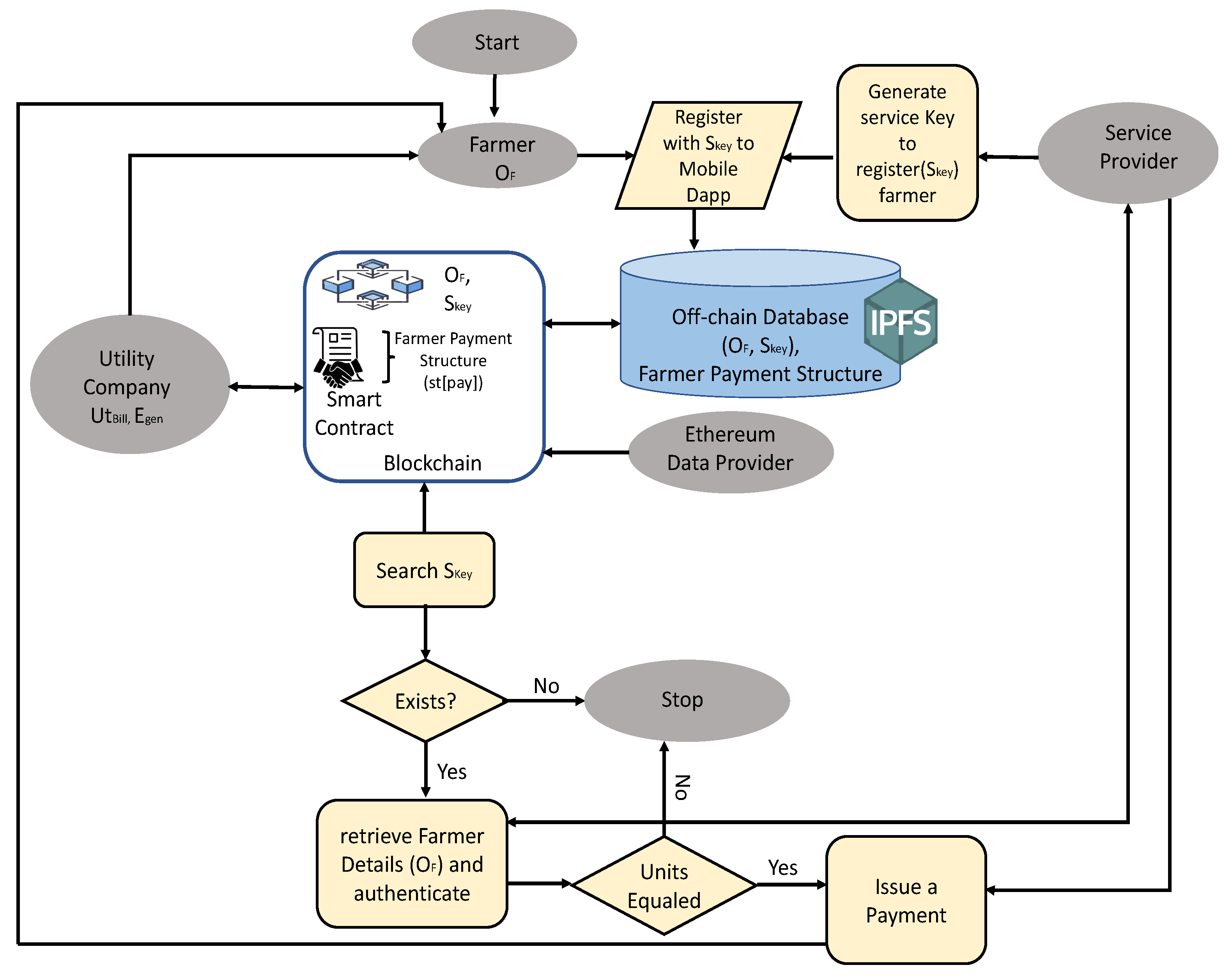

Flow chart of IncentiveChain.

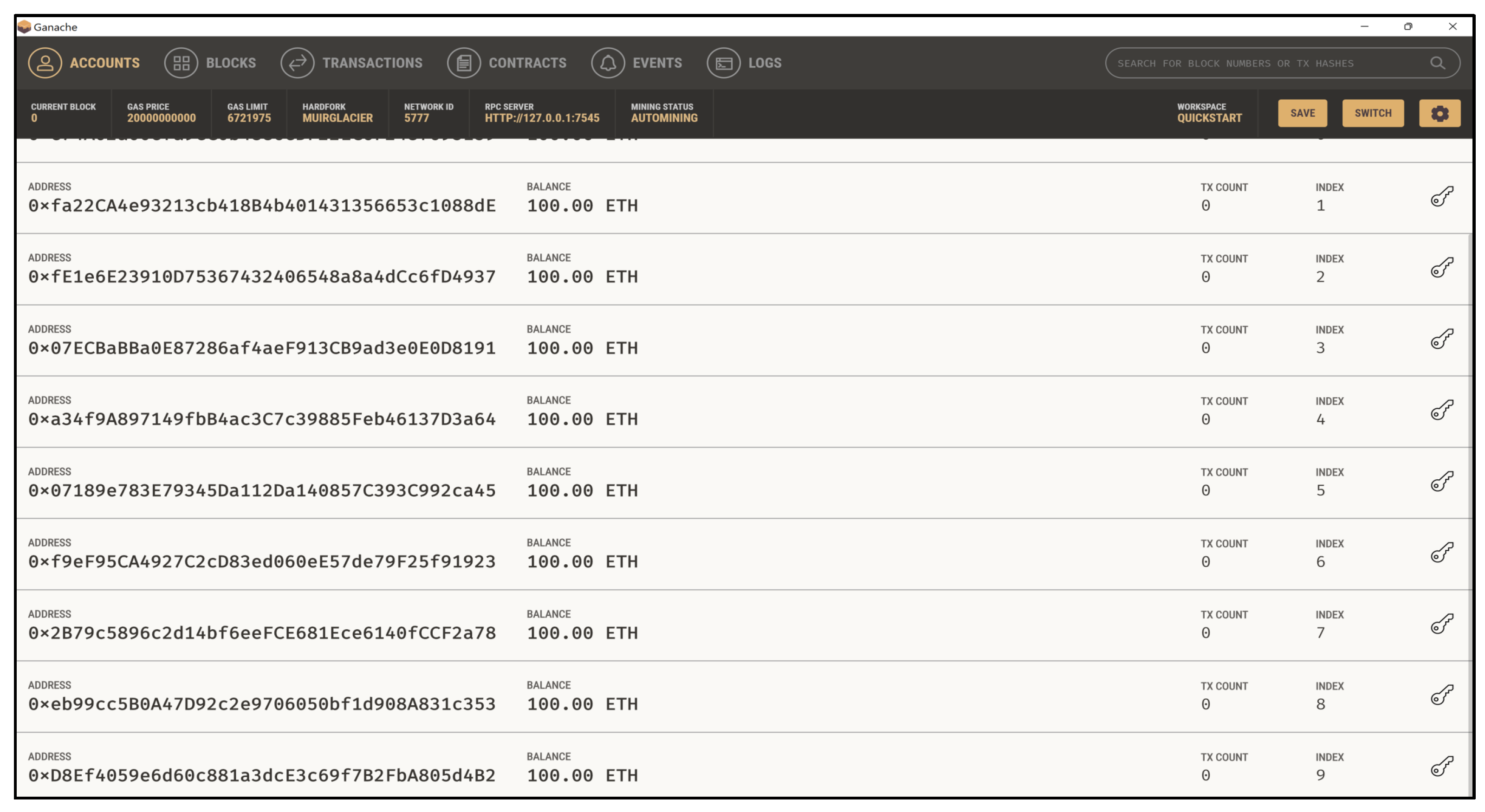

Figure 13.

Ten free Ganache accounts.

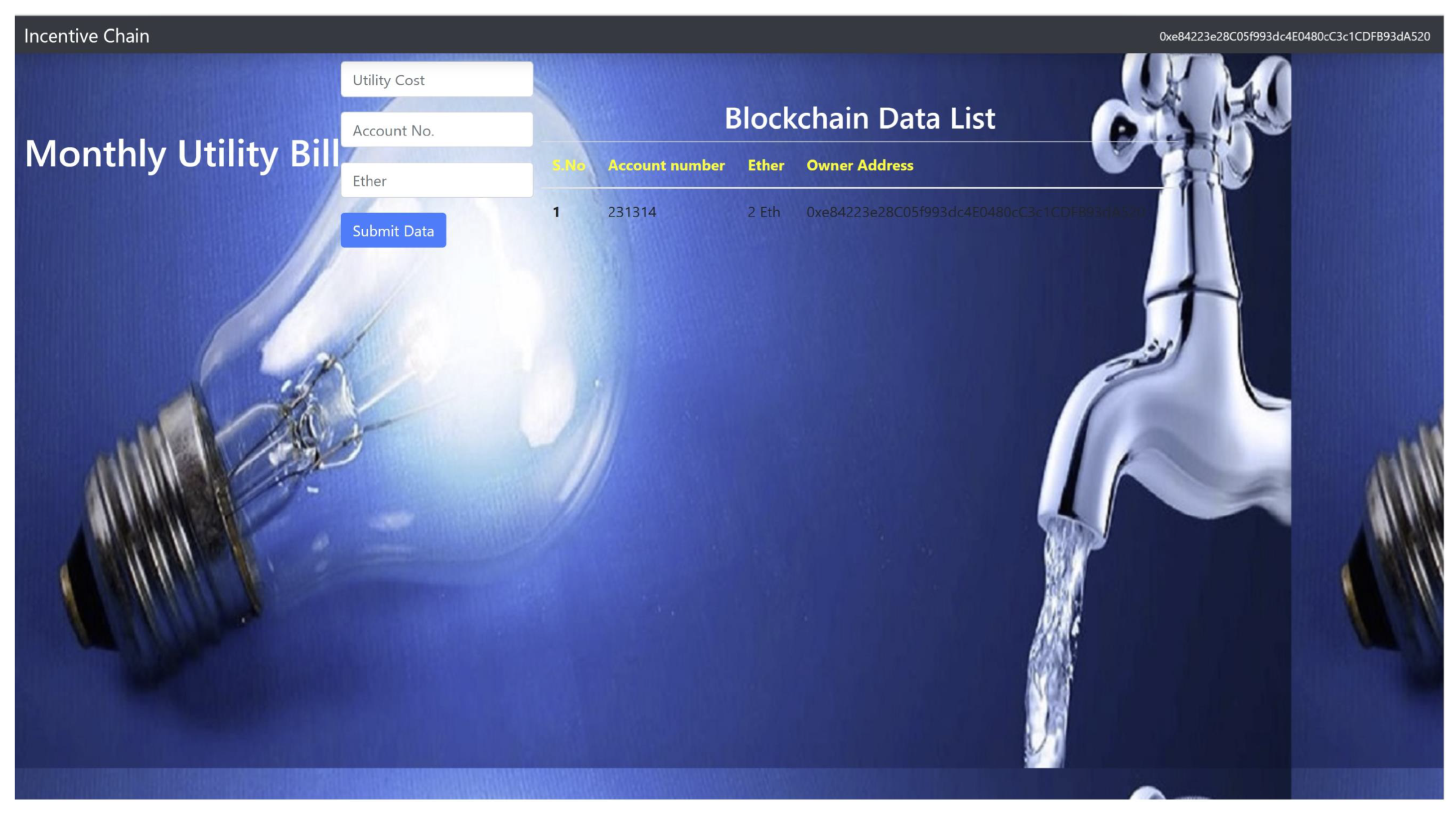

Figure 14.

User interface for IncentiveChain.

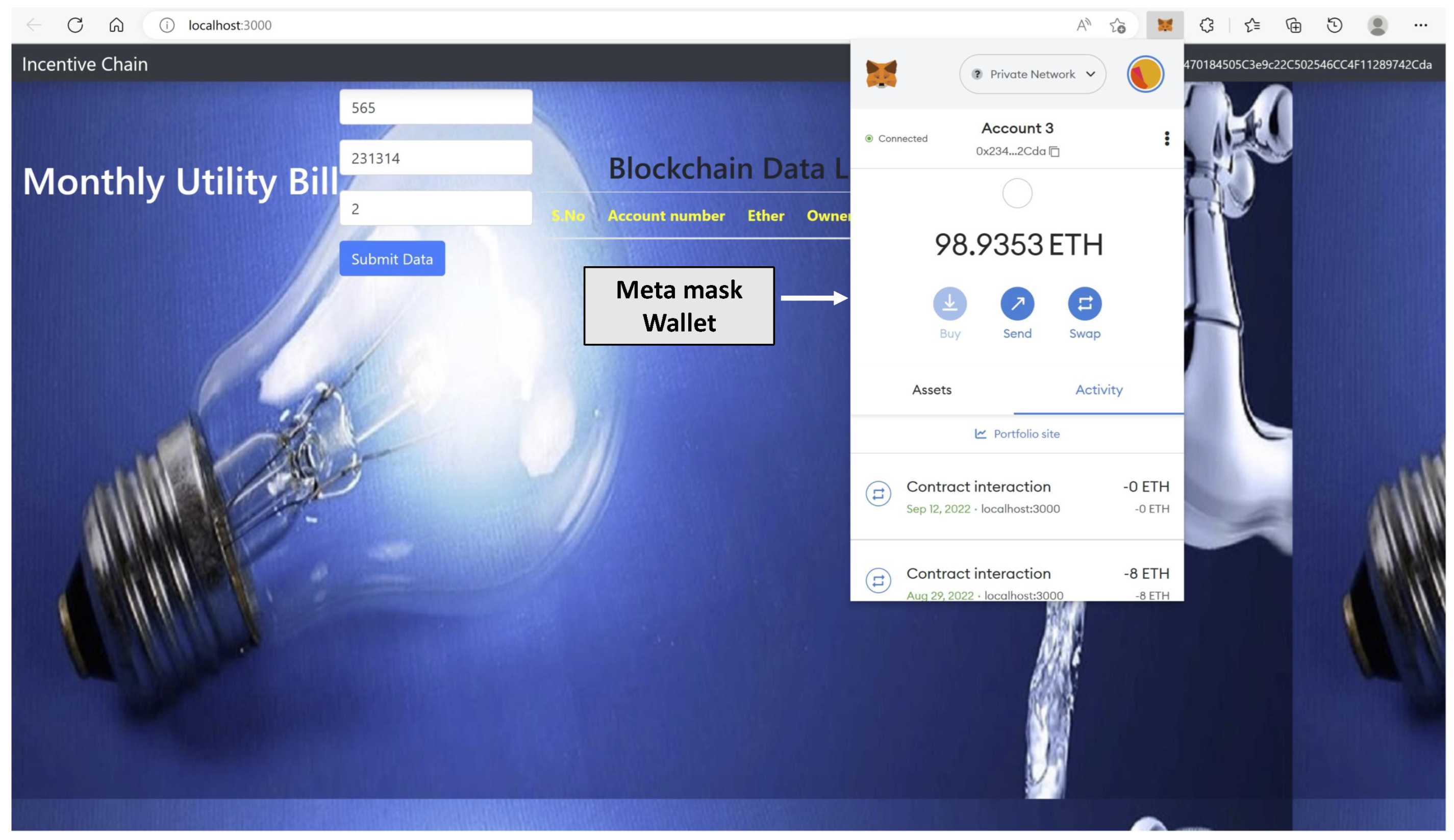

Figure 15.

Metamask wallet to communicate and perform transaction fees.

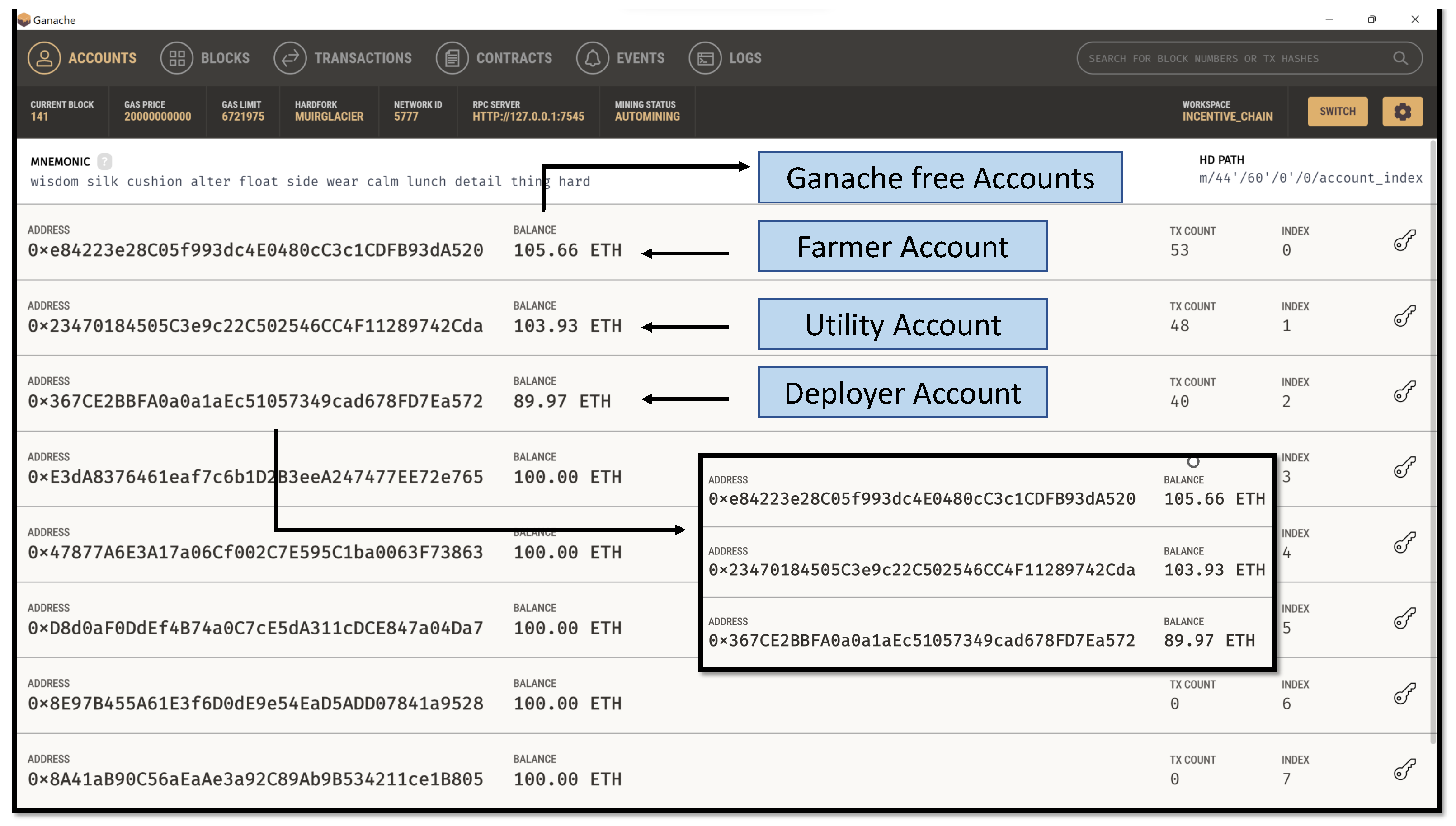

Figure 16.

Ganache results.

Table 1.

Existing traditional agricultural insurance systems.

| Application | Technology | Incentives to Farmers | Domain |

|---|

| Georgievich. [15] | Central/Cloud System | No Rewards | Crop, Poultry, Dairy Insurance |

| Wang et al. [16] | Central/Cloud System | No Rewards | Climate Risk and Food Security |

| Choudhury and Bhattacharya. [17] | Central System | No Rewards | Optimal Insurance Decisions |

| Tappi and Santeramo. [18] | Central System | No Rewards | Yield-Weather Analysis |

| Incentive Chain [Current-Paper] | Distributed Ledger | Designed to give Incentives | Efficient use of water and Electricity |

Table 2.

Existing blockchain agricultural insurance systems.

| Application | Technology | Incentives to Farmers | Domain |

|---|

| Kshetri [20] | Smart Contracts | No | Crop Insurance |

| Nguyen et al. [21] | NEO Smart Contract | No | Insurance for drought weather |

| Bai et al. [22] | IoT with Blockchain | No | Calamity-based |

| Incentive Chain [Current-Paper] | Distributed Ledger | Yes | Efficient use of water and Electricity |

Table 3.

Existing blockchain agricultural insurance systems.

| Application | Technology | Incentives to Farmers | Domain |

|---|

| Soni et al. [26] | Central System | No Rewards | Energy Management |

| Xu et al. [27] | Central System | No Rewards | Water Management |

| Ullah et al. [28] | Central System | No Rewards | Water Management |

| Nhamo et al. [29] | Central System | No Rewards | Water Management |

| Lin et al. [30] | Central System | No Rewards | Calamity-based |

| Incentive chain [current paper] | Distributed ledger | Designed to give incentives | Efficient use of water and electricity |

Table 4.

Results.

| Account Holder | Account Address | Starting Balance | Balance After Transaction |

|---|

| Farmer | 0xe84223e28C0 5f993dc4E0480c C3c1CDFB93dA520 | 103.66 Eth | 105.66 Eth |

| Utility Company | 0x23470184505C 3e9c22C502546CC 4F11289742Cda | 105.93 Eth | 103.33 Eth |

| Deployer | 0x367CE2BBFA 0a0a1aEc5105734 9cad678FD7Ea572 | 100 Eth | 89.97 Eth |

Table 5.

Feature comparison of prior works and IncentiveChain.

| System | Technology | IoT | Smart Contracts | Rewards | On/Off Chain | Primary Contribution |

|---|

| Georgievich [15] | Central | No | No | No | Central | Insurance models under risk |

| Wang [16] | Central | No | No | No | Central | Climate impact/

policy study |

| Sung [17] | Central Platform | No | No | No | Central | Behavioral insurance model |

| Tappi [18] | Central Platform | No | No | No | Central | Weather index insurance |

| Kshetri [20] | Blockchain | Limited | Yes | No | On-chain | Smart contract crop insurance |

| Nguyen [21] | NEO Blockchain | No | Yes | No | On-chain | Drought Oracle prototype |

| Bai [22] | Blockchain + IoT | Yes | Yes | No | Hybrid | IoT-triggered claims |

| Vangipuram [23] | Blockchain + Storage | Yes | Yes | No | Hybrid | Groundwater integrity |

| Vangipuram [24] | Private Blockchain | Yes | Yes | No | Private +Off | Supply chain provenance |

| Soni [26] | Central Platform | No | No | No | Central | Energy efficiency in crops |

| Ullah [28] | IoT Platform | Yes | No | No | Cent/Edge | IoT irrigation EEWMP |

| Lin [30] | Central and Reactive | Limited | No | No | Central | Renewable energy use |

| Incentive Chain | Distributed Ledger Hybrid | Yes | Yes | Yes | Hybrid | Rewards, edge validation, privacy hashes, auto payouts |

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).