1. Introduction

The European Union (EU) has embarked on an ambitious goal toward sustainable development and climate change mitigation with initiatives such as the European Green Deal [

1,

2] and the 2030 Agenda for Sustainable Development [

3,

4,

5,

6]. In this transformative era, digital technologies are reshaping the economic landscape at a rapid pace, influencing all sectors and levels of society. As a result, digital transformation is emerging as a crucial enabler for EU countries to unlock sustainable value while promoting environmental, social, and governance (ESG) efficiency [

7,

8,

9,

10].

Digital transformation holds immense potential for driving sustainable development [

11,

12]. By harnessing innovative technologies and data-driven solutions, countries can optimize resource utilization [

13], reduce carbon emissions [

14], and enhance operational efficiency across various sectors [

15,

16,

17]. For instance, the adoption of smart grids, IoT-enabled energy management systems, and advanced analytics revolutionize the energy sector, facilitating the integration of renewable energy sources and improving energy efficiency [

18,

19]. Furthermore, digitalization facilitates better the monitoring, reporting, and management of environmental impacts [

19,

20,

21,

22]. The use of digital platforms and real-time data collection allow measuring and tracking of the country’s environmental performance [

23], enabling them to identify areas for improvement and implement targeted sustainability measures [

23]. This enhanced transparency and accountability contribute to the achievement of ESG goals. The potential of digital transformation extends beyond environmental sustainability [

23,

24]. It also supports social and governance objectives within the EU. Digital technologies facilitate inclusive and accessible services, ensuring that vulnerable populations are not left behind in the digital era. Additionally, digital platforms enable better stakeholder engagement, allowing citizens, businesses, and governments to collaborate and address societal challenges collectively [

25,

26,

27,

28,

29,

30]. ESG performance has gained significant importance as investors and consumers increasingly prioritize sustainable practices and ethical considerations. By integrating ESG factors into their decision-making processes, countries strengthen their reputation, attract investment, and tap into new market opportunities. Digital transformation plays a vital role in facilitating ESG measurement, reporting, and analysis, providing stakeholders with accurate and timely information about countries’ sustainable development [

31,

32].

At the same time, Miśkiewicz et al. [

33] confirm that the rapid expansion of digital infrastructure, data centers, and high-tech devices can lead to a significant increase in energy consumption. This may result in higher carbon emissions and a strain on limited natural resources. Furthermore, the constant upgrading of digital devices and the disposal of obsolete electronics contribute to the growing problem of electronic waste [

34,

35]. The improper disposal and recycling of e-waste can lead to environmental pollution and health hazards. The automation and digitization of various processes can result in job losses and workforce displacement. Workers who are not equipped with the necessary digital skills [

36,

37,

38,

39,

40,

41,

42,

43,

44] may find it challenging to transition into new roles, leading to social and economic challenges.

In this case, it is topical to identify the effect of digitalization on ESG performance for countries to develop the appropriate policy for intensifying the positive effect of digitalization on promoting sustainable values. This paper aims to test the spatial spillover effect of digitalization on ESG performance for EU countries in the period of 2008–2020. The study fills the theoretical gaps in promoting sustainable values by developing an approach for assessing the digitalization effect on ESG performance based on applying the spatial Durbin model, which highlights the interconnected nature of digitalization and its influence on ESG outcomes, emphasizing the importance of considering regional dynamics and the diffusion of digital initiatives when evaluating and enhancing ESG performance.

The paper has the following structure: the Literature Review analyses the theoretical landscape of links between digitalization and the ESG performance of the country; Materials and Methods describes the applied instruments and methods to test the research hypotheses and explain the selected variables and sources; Results describes the results of the analysis of the links between digitalization and ESG performance of the country; Discussion and Conclusion outlines the core results of the research, policy implications, limitations, and further directions for research.

2. Literature Review

The linkage between the sustainable development goals (SDGs) and digital inclusion is centered on the idea that access to digital technologies and the internet play a vital role in achieving sustainable development [

45,

46,

47]. Digital inclusion refers to ensuring that everyone has equal access to and can effectively utilize digital technologies, such as computers, the internet, and mobile devices [

47]. ICT has a direct impact on economic growth by driving productivity [

48], innovation, and efficiency across various sectors. It enables the creation of new industries [

49,

50], improves business processes [

51], and enhances competitiveness [

48,

49,

50]. The adoption and use of ICT tools, such as digital infrastructure, telecommunications, and e-commerce, lead to increased productivity and GDP growth.

Digital inclusion can enhance the access to educational resources, online learning platforms, and digital skills training, thereby improving educational opportunities and outcomes for individuals, especially in underserved communities (which is coherent with SDG4 and the social effect within ESG performance). Kuzior [

52] and Zaloznova et al. [

53] confirm that digitalization promotes economic empowerment by providing access to online job opportunities, entrepreneurial resources, and digital tools for small businesses, contributing to job creation and economic growth (which is coherent with SDG8: Decent Work and Economic Growth and the social and economic effects within ESG performance). Prior studies [

54] outline that digitalization provides equal access to modern infrastructure, technology, and innovation, fostering inclusive and sustainable industrialization. It is relevant to SDG 9: Industry, Innovation, and Infrastructure and allows for attaining the economic and ecological effects within ESG performance. Mahmood et al. [

55] emphasize that increasing ESG performance requires relevant digital solutions. Based on the petroleum industry, scholars [

55] show that digital technologies allow a decline in carbon dioxide emissions by 43% and improve the well-being of workers. Applying confirmatory factor analysis and structural equation modeling, scholars [

56] confirm the close relationships between ESG performance and Industry 4.0. An earlier study [

57] shows that the beneficial impact of disclosing ESG information to stakeholders promotes corporate governance and facilitates the organization’s technological and environmentally friendly digital transformation in China. Macchiavello and Siri [

58] outline the close relationship between green FinTech and attaining sustainable development goals. In addition, scholars [

59] highlight that green FinTech could catalyze the extension and implementation of green innovations.

Clark et al. [

60] found that digitalization promotes transparent and accountable governance, citizen engagement, and access to justice through digital platforms, enhancing democratic processes and institutions. It is coherent with SDG 16: Peace, Justice, and Strong Institutions and the social and economic effects within ESG performance. Scholars [

61] have explored the development of e-government in European countries, focusing on its socioeconomic and environmental aspects. Applying the TOPSIS method and based on the empirical results, they confirm the significant statistical connections between the e-government and comprehensive indicators encompassing environmental, social, and economic aspects. These findings highlight the clear and favorable influence of digitized administrative procedures on sustainable development. Moreover, scholars [

61,

62,

63,

64,

65] provide evidence that investments in digital infrastructure and government e-services yield numerous long-term advantages and directly contribute to all three domains crucial for ensuring the sustainability of contemporary progress. Past studies [

66,

67,

68] prove that enterprises with e-commerce and web sales are expected to adhere to ethical business practices and promote transparency. They can ensure fair trade, responsible sourcing, and respect for labor rights throughout their supply chains [

67]. By providing clear and accurate information about products, services, and their environmental and social impacts, these enterprises contribute to transparency and accountability. Scholars [

66,

67,

68] prove that digital technologies reduce inequalities by providing marginalized groups, including women, rural communities, and persons with disabilities, with equal access to information, services, and opportunities (SDG10: Reduced Inequalities and social effects within ESG performance). Erturk and Purdon [

68] outline that by promoting digital inclusion, countries harness the power of technology to bridge gaps, empower individuals and communities, and ensure that no one is left behind on the way toward sustainable development. It requires addressing barriers such as infrastructure limitations, affordability, digital literacy [

69,

70,

71], and gender disparities to create an inclusive digital society that benefits all. Earlier studies [

72,

73,

74,

75] show that digitalization boosts international collaboration [

72], knowledge sharing [

73,

74,

75], and capacity building [

76,

77], enabling partnerships and innovation [

78] to accelerate progress toward ESG performance.

Scholars empirically confirm that ICT plays a pivotal role in driving economic growth [

79], promoting sustainable development, and improving ESG performance. Leveraging ICT tools and technologies effectively and inclusively contributes to achieving the SDGs and enhancing environmental, social, and governance outcomes. Furthermore, considering Ghouse et al. [

80], digital inclusion contributes to sustainable development by enabling a more efficient resource management, reducing environmental impacts, and supporting the transition to a carbon-free economy [

81]. Scholars [

82,

83,

84] have confirmed that smart grids, energy management systems, and IoT-based solutions optimize energy consumption, reduce greenhouse gas emissions, and enhance sustainability performance, aligning with SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action) and ecological effects within ESG performance. In addition, the studies prove that companies with e-commerce and web sales catalyze the reduction in environmental impact and support climate action. By enabling digital transactions and reducing the need for physical infrastructure [

83,

84], transportation, and paper-based documentation, these companies are conducive to declining carbon emissions and conserving resources. The results of the analysis of the existing theoretical landscape show that most studies have focused on investigating the direct link between digitalization and ESG performance in attaining sustainable development. Therefore, this paper aims to analyze digitalization’s spillover effect on the ESG performance of a country. Several empirical studies [

85,

86,

87,

88,

89,

90,

91] have investigated the spatial spillover effects of digitalization on ESG performance. For instance, researchers [

85,

86,

87,

88] have shown that countries with higher levels of digitalization tend to exhibit positive spillover effects on neighboring countries, particularly in terms of environmental performance. The diffusion of digital technologies and knowledge transfer can lead to increased environmental awareness, resource efficiency, and sustainable practices across borders [

89,

90]. Similarly, digitalization has been found to have positive social and governance spillover effects, fostering social connectivity, inclusive governance, and participatory decision-making processes [

91]. Considering the above, the following hypothesis is proposed:

Hypothesis 1. Digitalization has a spatial spillover effect on the ESG performance of a country.

4. Results

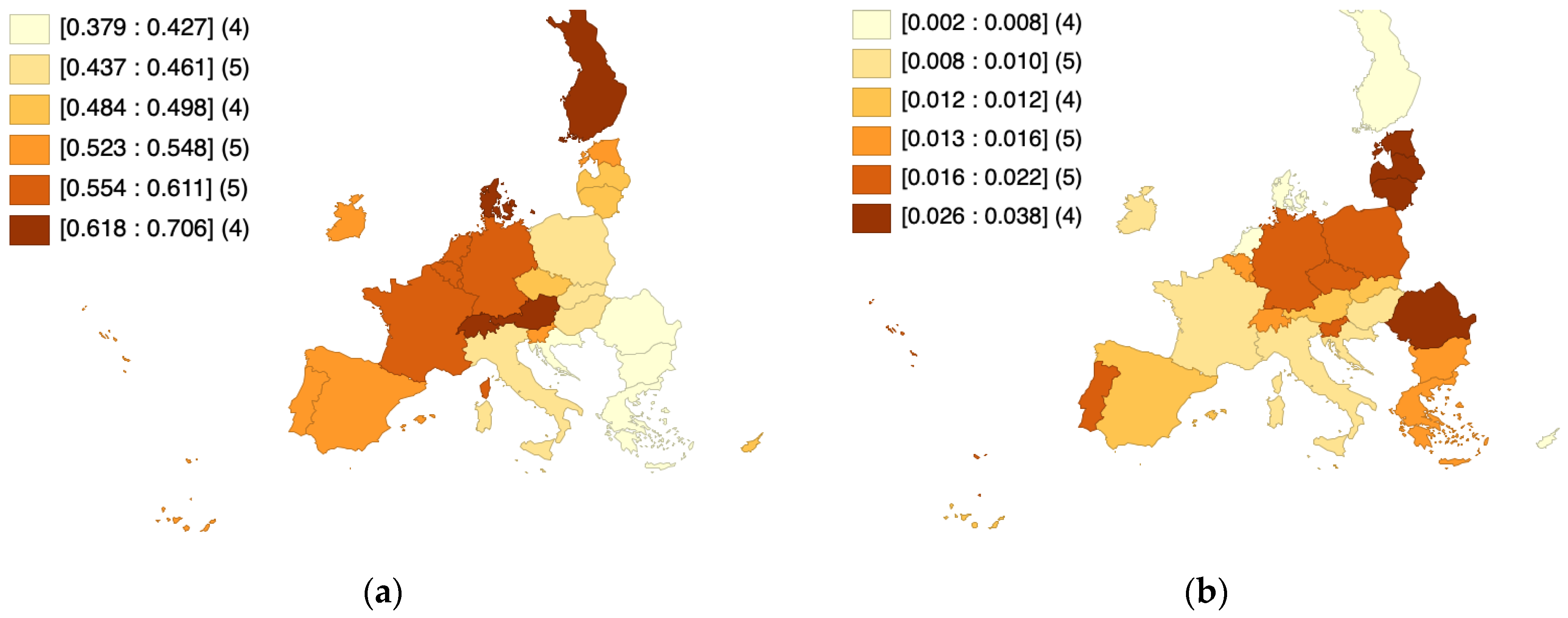

In the first stage, this study checks the spatial connection distributions of the mean and standard deviation of ESG performance within EU countries (

Figure 1).

The results (

Figure 1a) show that the highest average value of ESG in the interval of 0.2–0.71 for 2011–2020 is observed in the following countries: Austria, Sweden, Finland, and Denmark. These countries could serve as examples for others in terms of their successful practices and policies in promoting environmental sustainability, social responsibility, and good governance. At the same time, Romania, Bulgaria, Greece, and Croatia have the lowest ESG values (0.38–0.43). This highlights the need for targeted interventions and policies in these countries to improve their ESG performance and align with sustainable development goals. However, the fluctuation of ESG has a different pattern compared to the mean value (

Figure 1b). Thus, the value of ESG has lower volatility in Greece, Finland, and Denmark. This suggests that these countries have been able to maintain more stable and consistent ESG performance over the analyzed period. Examining the policies, practices, and initiatives implemented in these countries can provide valuable insights for others looking to enhance their ESG stability and reduce fluctuations. The following EU countries have huge fluctuations in ESG values: Latvia, Lithuania, Romania, and Estonia. These countries may benefit from focused efforts to identify the underlying factors contributing to these fluctuations and to implement measures to enhance stability and improve their overall ESG performance.

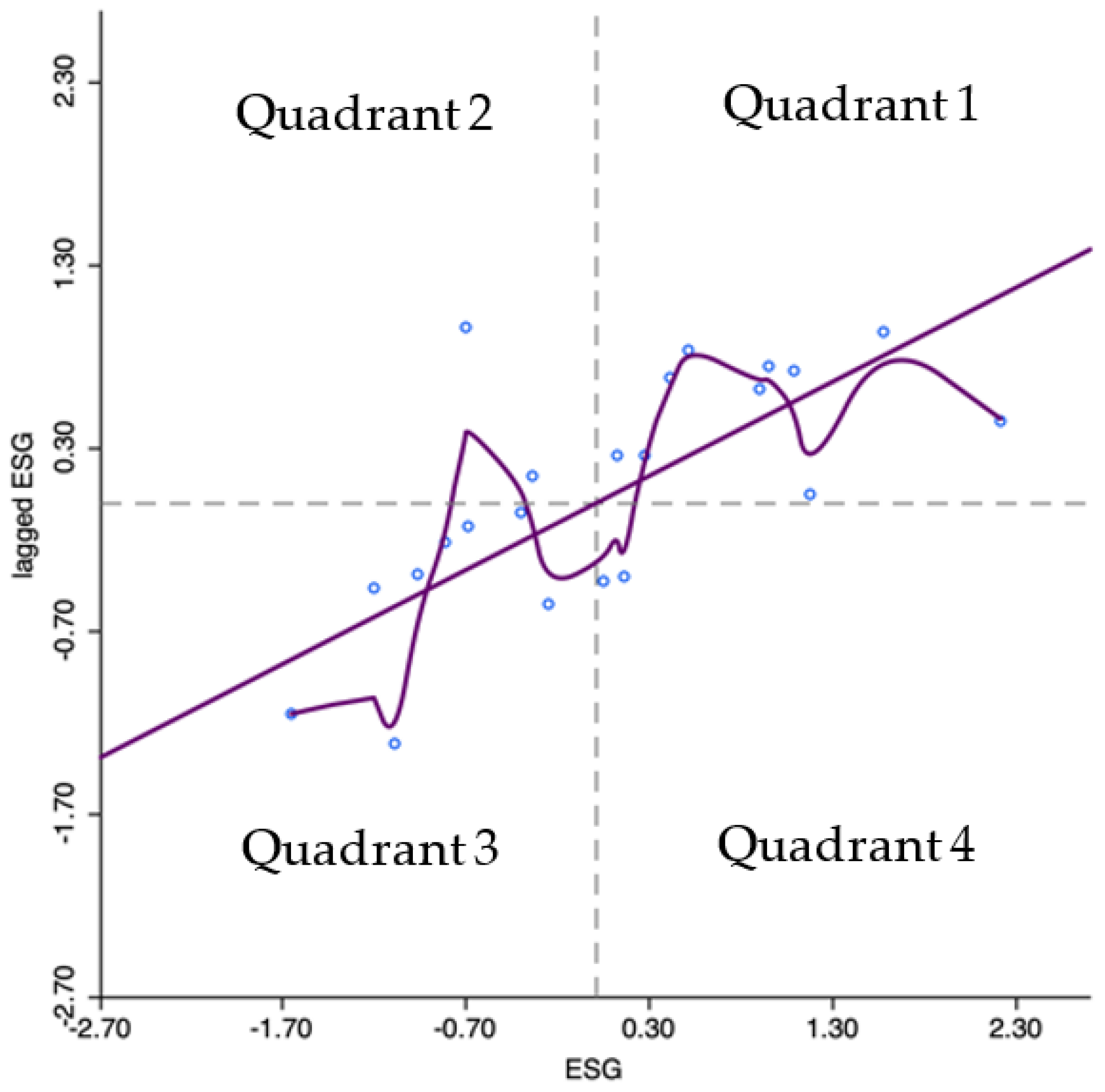

The Moran scatterplot allows the relationship between a value and the average value of its neighbors for the same variable to be checked. The findings (

Figure 2) of Moran’s I show that most countries are in the 1st and 3rd quadrants. Thus, the 1st quadrant means that countries with high ESG values are surrounded by countries with high ESG values: France, Austria, Belgium, Sweden, Germany, Denmark, Spain, Portugal, Luxembourg, and the Netherlands.

The 3rd quadrant contains countries with lower ESG values and is surrounded by countries with lower ESG values. The 3rd quadrant includes the following countries: Croatia, Hungary, Bulgaria, Greece, Romania, Slovakia, Lithuania, Latvia, and Poland. This confirms the positive spatial autocorrelation. The 4th quadrant (low value is surrounded by high value) contains Estonia and Slovenia. The second cluster (high value is surrounded by lower value) contains Czechia and Italy. The results allow for outlining the cluster effects, which means that countries with similar ESG values are likely to be located in closed areas.

To evaluate the presence of spatial relationships, a nonspatial panel model was employed as a point of comparison with the spatial panel model. The outcomes presented in

Table 3 reveal that augmenting digital inclusion, fortifying key enablers, expanding digital public services for businesses, and offering digital public services for citizens have statistically significant positive effects on ESG. These findings suggest that the adoption of digitalization initiatives and the leveraging of digital technologies and services can contribute to enhanced ESG performance. The growth of

increases ESG performance by 0.390 in the model with digital inclusion, by 0.089 in the model with eGovke, by 0.137 in the model with eGovbuss, and by 0.165 in the model with eGovcit. All results are statistically significant with a probability of 0.000.

To examine the persistence of the observed effects in geographic space, a spatial model was employed for verification and assessment. The first two rows of

Table 4 compare the spatial autoregressive (SAR) model with the spatial Durbin model (SDM) and the spatial error model (SEM) with the SDM. For each digitalization variable (DI, eGovke, eGovbuss, eGovcit), the chi-square test statistic (

) and its corresponding p value (all equal to 0.000) indicate that there is strong enough evidence to reject the null hypothesis, suggesting that the SDM is a more suitable model than both the SAR and SEM for analyzing the relationship between ESG and

. The results of the Hausman test, reported in the third row of

Table 4, reveal significant chi-square test statistics (

) and corresponding p values (0.001, 0.031, 0.045, and 0.000). These findings strongly reject the null hypothesis, suggesting that the fixed-effects spatial Durbin model (SDM) is the appropriate model to detect the impact of digitalization on ESG.

The results of the SDM models (

Table 5) suggest that digitalization has a positive impact on ESG, with varying degrees of significance depending on the specific independent variables (DI, eGovke, eGovbuss, eGovcit) included in each model. The coefficient for the main effect of DI is 0.048 (significant at 0.002), indicating a positive impact of digitalization on ESG. It suggests that policies and initiatives aimed at promoting digital inclusion contribute to improving ESG performance. The EU should focus on enhancing digital accessibility, bridging the digital divide, and ensuring equal opportunities for individuals and businesses to access and utilize digital technologies. This can include measures such as improving internet infrastructure, providing affordable access to digital services, and promoting digital literacy and skills development.

However, the coefficients for TO and GFDI are not statistically significant, suggesting that trade openness and green field investment do not have a significant impact on ESG in this model. It is important to note that trade openness could still have indirect effects on ESG performance. Policymakers should consider integrating sustainability criteria into trade agreements and promoting sustainable practices within international trade. This can include measures to encourage environmentally friendly production processes, the responsible sourcing of raw materials, and the adoption of sustainable supply chain management practices. In addition, the EU should create an enabling environment for green investment by offering incentives for sustainable investments, promoting green technologies and innovation, and ensuring transparent and accountable governance frameworks to monitor and regulate environmental impacts.

On the other hand, eGovke has a positive and significant impact on ESG with a coefficient of 0.011 (significant at 0.010) and a significant positive effect on GFDI. This suggests that the EU should focus on developing and implementing digital platforms and services that facilitate business operations, promote sustainability practices, and enhance collaboration between businesses and government entities.

Furthermore, both eGovbuss and eGovcit exhibit a positive impact on ESG, with both TO and GFDI showing significant positive associations. This suggests that investing in digital public services for citizens contributes to improving the overall ESG performance. The EU should prioritize the development of user-friendly digital platforms and services that enable citizens to access essential public services, participate in decision-making processes, and engage in sustainable behaviors. It could include enhancing online platforms for e-government services, digital channels for citizen engagement, and initiatives promoting digital inclusion among marginalized and vulnerable groups.

In all models (

Table 5), the coefficients for the main effect of Digital in the Wx term are significant and positive, indicating a positive spatial spillover effect. This suggests that higher levels of digitalization in neighboring regions positively affect the ESG performance of the targeted region. The spatial rho values in all models are positive and statistically significant, suggesting the presence of spatial autocorrelation in the data. This implies that there is a spatial pattern or clustering in the relationship between digitalization, trade openness, green field investment, and ESG performance. The variance of sigma2_e represents the error variance in the model, capturing the unexplained variation in the dependent variable (ESG) not accounted for by the independent variables. In all models, the sigma2_e variance values are small and statistically significant at 0.000. This indicates a low level of unexplained variation, suggesting that the models effectively capture the relationships between the independent variables and ESG performance.

The regression results presented in

Table 6 demonstrate a significant and positive effect of the lagged value of ESG on the current value of ESG, underscoring the persistence of ESG performance over time. This finding emphasizes the need for sustained efforts and long-term strategies in fostering and maintaining a positive ESG performance. By recognizing the lasting influence of historical ESG practices, stakeholders can better understand the importance of continuous commitment to sustainable practices and policies. The variable DI (Digital Inclusion) exhibits a statistically significant yet relatively modest positive effect on ESG. This suggests that initiatives aimed at improving digital inclusion can contribute favorably to ESG outcomes. More precisely, the dynamic SDM model estimates that a 1% increase in DI results in a minimal 0.001% increase in the ESG index. These findings align with prior studies [

102,

103], providing further validation of the significance of digital inclusion in advancing ESG objectives. The statistically significant positive effects observed in the variables eGovke (Key Enablers), eGovbuss (Digital Public Services for Businesses), and eGovcit (Digital Public Services for Citizens) highlight the contribution of digitalization to improving ESG performance. These findings suggest that the digitalization of key enablers and the provision of digital public services for businesses and citizens play a crucial role in fostering positive ESG outcomes. One plausible explanation for these positive impacts is that digitalization enhances the efficiency, transparency, and accessibility of ESG-related processes and information. By leveraging digital platforms and services, organizations can streamline the reporting and monitoring of environmental practices, facilitate stakeholder engagement, and empower individuals and businesses to make more sustainable choices. The EU has been actively promoting digitalization across various ESG domains [

104]. However, to fully realize the potential positive impacts on ESG, further improvements in digitalization strategies and infrastructure are necessary. Government interventions aimed at enhancing ESG performance should prioritize refining digitalization strategies and infrastructure to effectively leverage digital technologies and services. It allows us to boost progress in ESG areas and contribute to a more sustainable and inclusive future.

Additionally, the coefficients of greenfield investment (GFDI) in all dynamic SDM models are found to be significantly positive at the 1% level, indicating a positive association between GFDI and ESG outcomes. Specifically, according to the dynamic SDM model, a 1% increase in GFDI corresponds to a 0.002–0.004% increase in ESG. One possible explanation for these positive impacts is that the allocation of resources toward greenfield investments can promote sustainable practices and technologies, thereby positively influencing ESG performance. Across all models of dynamic SDM, the coefficients associated with the main effect of Digital in the Wx term consistently display statistical significance and a positive direction. These findings provide evidence of a positive spatial spillover effect, indicating that increased levels of digitalization in neighboring regions have a beneficial impact on the ESG performance of the focal region. The results highlight the interconnected nature of digitalization and its influence on ESG outcomes, emphasizing the importance of considering regional dynamics and the diffusion of digital initiatives when evaluating and enhancing ESG performance.

Table 7 presents the direct, indirect, and total effects of digitalization on ESG. The coefficients for both the direct and indirect effects of DI (Digital Inclusion), eGovke (Key Enablers), eGovbuss (Digital Public Services for Businesses), and eGovcit (Digital Public Services for Citizens) on ESG are positive, indicating a beneficial influence. These results support the hypothesis that digitalization has a spatial effect on ESG performance. Notably, the indirect effect coefficients of DI, eGovke, eGovbuss, and eGovcit on ESG are all significant with p values of 0.000, indicating a strong statistical relationship. This finding is in line with prior research [

24,

64] and suggests that digitalization initiatives focusing on these areas have a significant impact on promoting positive ESG outcomes.

Considering the other variables, TO (trade openness) and GFDI (greenfield investment), their coefficients and probabilities indicate mixed results. In general, the coefficients for TO show relatively weak and statistically insignificant effects on ESG. However, the coefficients for GFDI suggest a statistically significant positive impact on ESG, with probabilities ranging from 0.027 to 0.051, indicating the potential importance of greenfield investments in promoting ESG outcomes.