A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption

Abstract

1. Introduction

2. Literature Review and Theoretical Background of M-Banking Apps’ Adoption

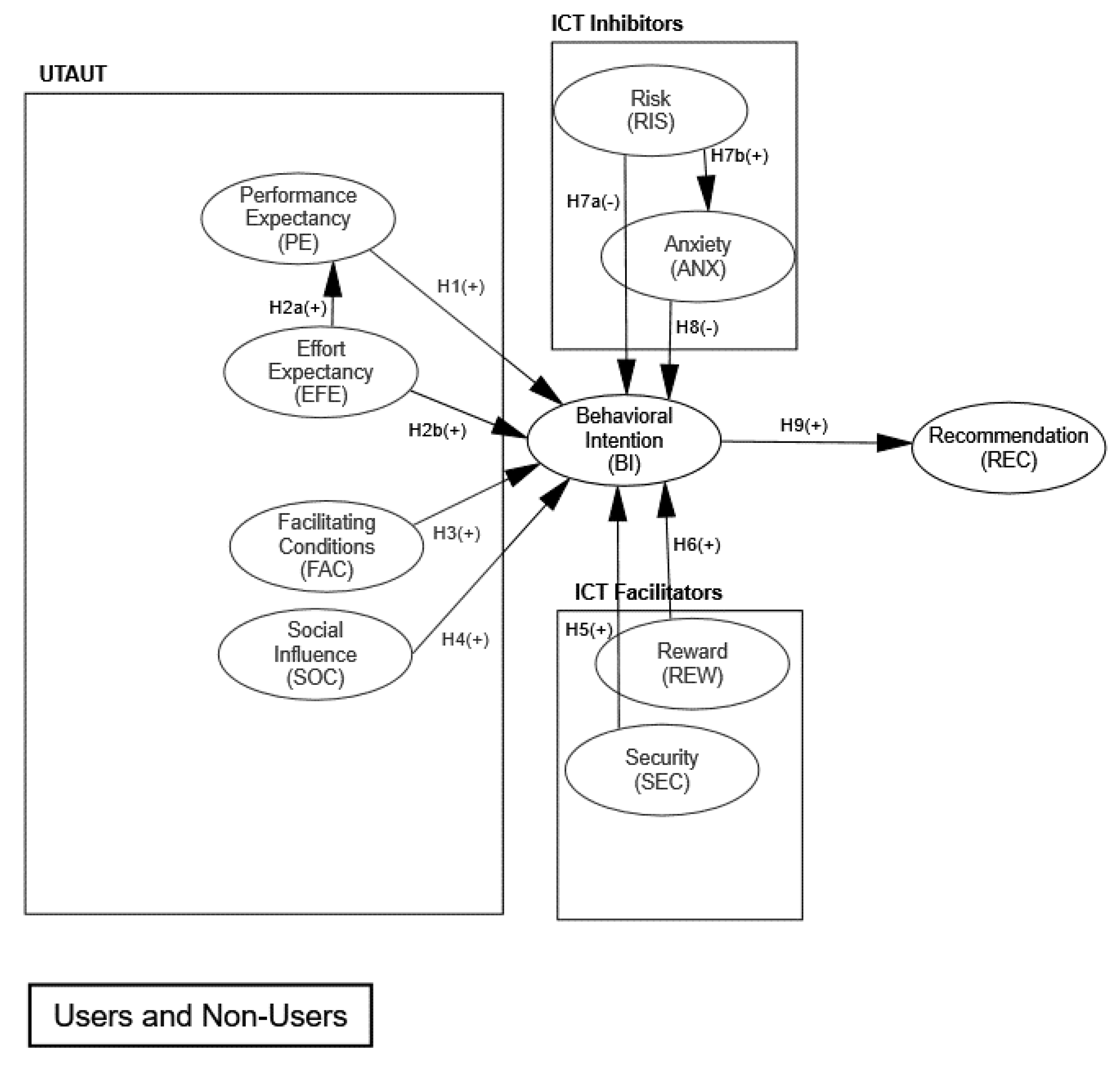

3. Proposed Conceptual Model

3.1. UTAUT Variables

3.1.1. Behavioral Intention

3.1.2. Performance Expectancy

3.1.3. Effort Expectancy

3.1.4. Social Influence

3.1.5. Facilitating Conditions

3.2. ICT Facilitators

3.2.1. Security

3.2.2. Reward

3.3. ICT Inhibitors

3.3.1. Risk

3.3.2. Anxiety

3.4. Recommendation

4. Research Methodology

4.1. Measurement Instrument

4.2. Data Collection and Sample Characteristics

5. Data Analysis and Results

5.1. Measurement Model

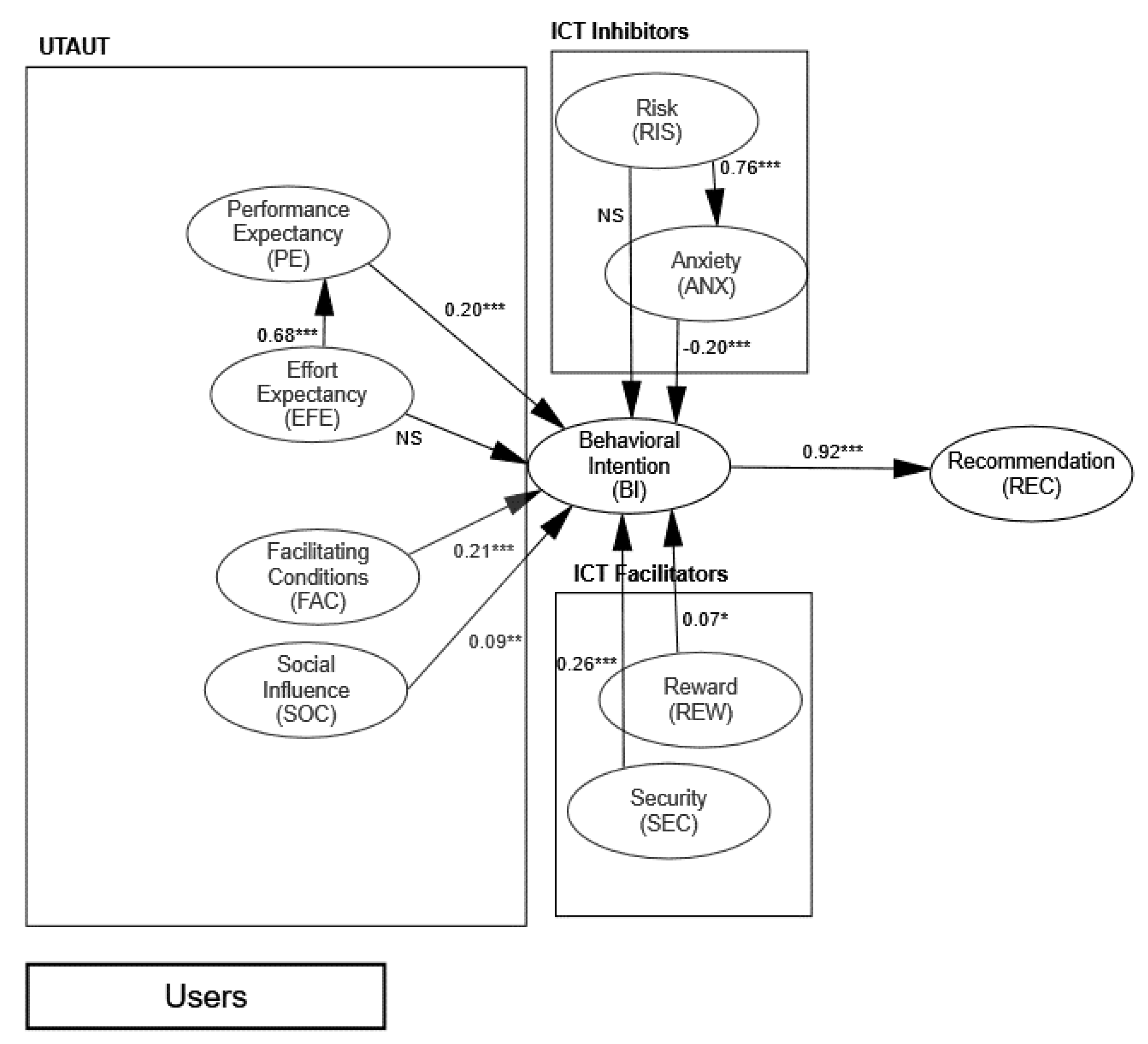

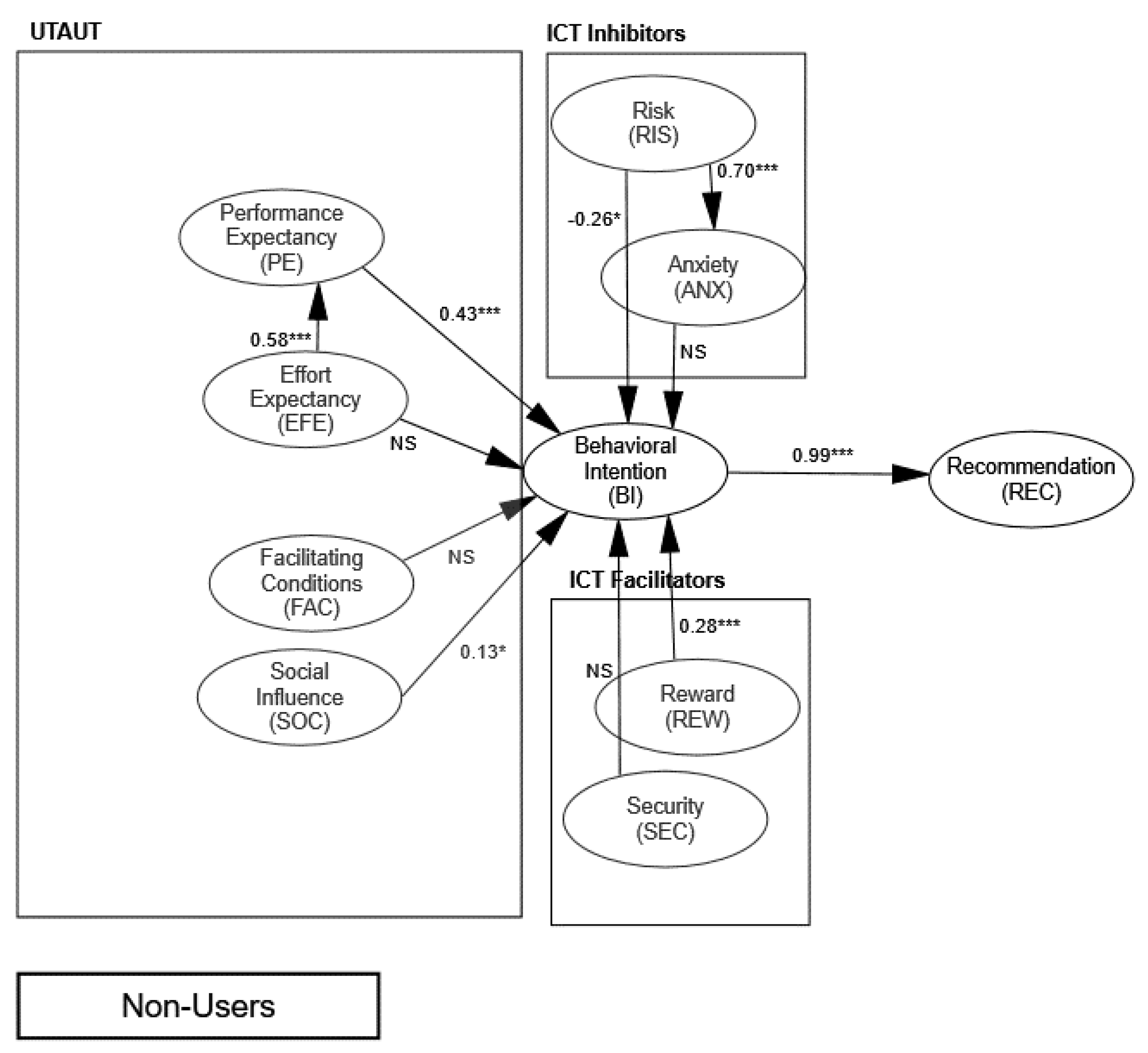

5.2. Structural Models

6. Discussion

6.1. Theoretical and Practical Implications

6.2. Limitations and Further Research

7. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alavi, S.; Ahuja, V. An Empirical Segmentation of Users of Mobile Banking Apps. J. Internet Commer. 2016, 15, 390–407. [Google Scholar] [CrossRef]

- Bons, R.W.H.; Alt, R.; Lee, H.G.; Weber, B. Banking in the Internet and mobile era. Electron. Mark. 2012, 22, 197–202. [Google Scholar] [CrossRef]

- Souiden, N.; Ladhari, R.; Chaouali, W. Mobile banking adoption: A systematic review. Int. J. Bank Mark. 2020, 39, 214–241. [Google Scholar] [CrossRef]

- Zhang, T.; Lu, C.; Kizildag, M. Banking “on-the-go”: Examining consumers’ adoption of mobile banking ser-vices. Int. J. Qual. Serv. Sci. 2018, 10, 279–295. [Google Scholar]

- Laukkanen, T. Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the Internet and mobile banking. J. Bus. Res. 2016, 69, 2432–2439. [Google Scholar] [CrossRef]

- Martins, C.; Oliveira, T.; Popovič, A. Understanding the Internet banking adoption: A unified theory of ac-ceptance and use of technology and perceived risk application. Int. J. Inf. Manag. 2014, 34, 1–13. [Google Scholar] [CrossRef]

- Shankar, A.; Jebarajakirthy, C.; Ashaduzzaman, M. How do electronic word of mouth practices contribute to mobile banking adoption? J. Retail. Consum. Serv. 2020, 52, 101920. [Google Scholar] [CrossRef]

- Shankar, A.; Datta, B.; Jebarajakirthy, C.; Mukherjee, S. Exploring Mobile Banking Service Quality: A Qualitative Approach. Serv. Mark. Q. 2020, 41, 182–204. [Google Scholar] [CrossRef]

- Bhatiasevi, V. An extended UTAUT model to explain the adoption of mobile banking. Inf. Dev. 2016, 32, 799–814. [Google Scholar] [CrossRef]

- Ha, K.-H.; Canedoli, A.; Baur, A.W.; Bick, M. Mobile banking—Insights on its increasing relevance and most common drivers of adoption. Electron. Mark. 2012, 22, 217–227. [Google Scholar] [CrossRef]

- Lee, K.C.; Chung, N. Understanding factors affecting trust in and satisfaction with mobile banking in Korea: A modified DeLone and McLean’s model perspective. Interact. Comput. 2009, 21, 385–392. [Google Scholar] [CrossRef]

- Oliveira, T.; Faria, M.; Thomas, M.A.; Popovič, A. Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. Int. J. Inf. Manag. 2014, 34, 689–703. [Google Scholar] [CrossRef]

- Sharma, S.K. Integrating cognitive antecedents into TAM to explain mobile banking behavioral intention: A SEM-neural network modeling. Inf. Syst. Front. 2017, 21, 815–827. [Google Scholar] [CrossRef]

- Komulainen, H.; Saraniemi, S. Customer centricity in mobile banking: A customer experience perspec-tive. Int. J. Bank Mark. 2019, 37, 1082–1102. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Karjaluoto, H. Mobile banking adoption: A literature review. Telemat. Inform. 2015, 32, 129–142. [Google Scholar] [CrossRef]

- Poromatikul, C.; De Maeyer, P.; Leelapanyalert, K.; Zaby, S. Drivers of continuance intention with mobile banking apps. Int. J. Bank Mark. 2019, 38, 242–262. [Google Scholar] [CrossRef]

- Baabdullah, A.M.; Alalwan, A.A.; Rana, N.P.; Kizgin, H.; Patil, P. Consumer use of mobile banking (M-Banking) in Saudi Arabia: Towards an integrated model. Int. J. Inf. Manag. 2018, 44, 38–52. [Google Scholar] [CrossRef]

- Giovanis, A.; Athanasopoulou, P.; Assimakopoulos, C.; Sarmaniotis, C. Adoption of mobile banking services: A comparative analysis of four competing theoretical models. Int. J. Bank Mark. 2019, 37, 1165–1189. [Google Scholar] [CrossRef]

- Luarn, P.; Lin, H.-H. Toward an understanding of the behavioral intention to use mobile banking. Comput. Hum. Behav. 2005, 21, 873–891. [Google Scholar] [CrossRef]

- Thusi, P.; Maduku, D.K. South African millennials’ acceptance and use of retail mobile banking apps: An inte-grated perspective. Comput. Hum. Behav. 2020, 111, 106405. [Google Scholar] [CrossRef]

- Gu, J.-C.; Lee, S.-C.; Suh, Y.-H. Determinants of behavioral intention to mobile banking. Expert Syst. Appl. 2009, 36, 11605–11616. [Google Scholar] [CrossRef]

- Hanif, Y.; Lallie, H.S. Security factors on the intention to use mobile banking applications in the UK older gen-eration (55+). A mixed-method study using modified UTAUT and MTAM-with perceived cyber security, risk, and trust. Technol. Soc. 2021, 67, 101693. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Shaikh, A.A.; Saarijärvi, H.; Saraniemi, S. How perceived value drives the use of mobile finan-cial services apps. Int. J. Inf. Manag. 2019, 47, 252–261. [Google Scholar] [CrossRef]

- Laukkanen, T. Internet vs mobile banking: Comparing customer value perceptions. Bus. Process. Manag. J. 2007, 13, 788–797. [Google Scholar] [CrossRef]

- Farah, M.; Hasni, M.J.S.; Abbas, A.K. Mobile-banking adoption: Empirical evidence from the banking sector in Pakistan. Int. J. Bank Mark. 2018, 36, 1386–1413. [Google Scholar] [CrossRef]

- Sampaio, C.H.; Ladeira, W.J.; Santini, F.D.O. Apps for mobile banking and customer satisfaction: A cross-cultural study. Int. J. Bank Mark. 2017, 35, 1133–1153. [Google Scholar] [CrossRef]

- Hogan, J.E.; Lemon, K.N.; Libai, B. Quantifying the ripple: Word-of-mouth and advertising effective-ness. J. Advert. Res. 2004, 44, 271–280. [Google Scholar] [CrossRef]

- Goyette, I.; Ricard, L.; Bergeron, J.; Marticotte, F. e-WOM Scale: Word-of-mouth measurement scale for e-services context. Can. J. Adm. Sci./Rev. Can. Des Sci. L’administration 2010, 27, 5–23. [Google Scholar] [CrossRef]

- Kim, K.K.; Prabhakar, B. Initial trust and the adoption of B2C e-commerce: The case of internet banking. ACM Sigmis Database Database Adv. Inf. Syst. 2004, 35, 50–64. [Google Scholar] [CrossRef]

- Yousafzai, S.Y. A literature review of theoretical models of Internet banking adoption at the individual lev-el. J. Financ. Serv. Mark. 2012, 17, 215–226. [Google Scholar] [CrossRef]

- Zhou, T. Examining mobile banking user adoption from the perspectives of trust and flow experience. Inf. Technol. Manag. 2011, 13, 27–37. [Google Scholar] [CrossRef]

- Freier, A. Mobile Banking Customers Drive Better Retention and Higher Revenue for Institutions. 2016. Available online: www.businessofapps.com/mobile-banking-customers-drive-better-retention-andhigher-revenue-for-institutions/ (accessed on 14 August 2018).

- Aboelmaged, M.; Gebba, T.R. Mobile Banking Adoption: An Examination of Technology Acceptance Model and Theory of Planned Behavior. Int. J. Bus. Res. Dev. 2013, 2. [Google Scholar] [CrossRef]

- Malaquias, R.F.; Hwang, Y. An empirical study on trust in mobile banking: A developing country perspec-tive. Comput. Hum. Behav. 2016, 54, 453–461. [Google Scholar] [CrossRef]

- Mohammadi, H. A study of mobile banking usage in Iran. Int. J. Bank Mark. 2015, 33, 733–759. [Google Scholar] [CrossRef]

- Salimon, M.G.; Bin Yusoff, R.Z.; Mokhtar, S.S.M. The mediating role of hedonic motivation on the relationship between adoption of e-banking and its determinants. Int. J. Bank Mark. 2017, 35, 558–582. [Google Scholar] [CrossRef]

- Singh, S. Customer perception of mobile banking: An empirical study in National Capital Region Delhi. J. Internet Bank. Commer. 2014, 19, 1–22. [Google Scholar]

- Tam, C.; Oliveira, T. Literature review of mobile banking and individual performance. Int. J. Bank Mark. 2017, 35, 1044–1067. [Google Scholar] [CrossRef]

- Tran, H.T.T.; Corner, J. The impact of communication channels on mobile banking adoption. Int. J. Bank Mark. 2016, 34, 78–109. [Google Scholar] [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P.; Williams, M.D. Consumer adoption of mobile banking in Jordan: Examining the role of usefulness, ease of use, perceived risk and self-efficacy. J. Enterp. Inf. Manag. 2016, 29, 118–139. [Google Scholar] [CrossRef]

- Giovanis, A.; Assimakopoulos, C.; Sarmaniotis, C. Adoption of mobile self-service retail banking technologies: The role of technology, social, channel and personal factors. Int. J. Retail Distrib. Manag. 2019, 47, 894–914. [Google Scholar] [CrossRef]

- Koksal, M.H. The intentions of Lebanese consumers to adopt mobile banking. Int. J. Bank Mark. 2016, 34, 327–346. [Google Scholar] [CrossRef]

- Kwateng, K.O.; Atiemo, K.A.O.; Appiah, C. Acceptance and use of mobile banking: An application of UTAUT2. J. Enterp. Inf. Manag. 2019, 32, 118–151. [Google Scholar] [CrossRef]

- Majumdar, S.; Pujari, V. Exploring usage of mobile banking apps in the UAE: A categorical regression analysis. J. Financ. Serv. Mark. 2021, 1–13. [Google Scholar] [CrossRef]

- Fenu, G.; Pau, P.L. An Analysis of Features and Tendencies in Mobile Banking Apps. Procedia Comput. Sci. 2015, 56, 26–33. [Google Scholar] [CrossRef][Green Version]

- Shankar, A.; Jebarajakirthy, C. The influence of e-banking service quality on customer loyalty: A moderated mediation approach. Int. J. Bank Mark. 2019, 37, 1119–1142. [Google Scholar] [CrossRef]

- Siyal, A.W.; Ding, D.; Siyal, S. M-banking barriers in Pakistan: A customer perspective of adoption and conti-nuity intention. Data Technol. Appl. 2019, 53, 58–84. [Google Scholar] [CrossRef]

- BBC. Mobile Banking Is Saving Us ‘Billions’ in Charges. 2017. Available online: http://www.bbc.co.uk/news/business-39290041 (accessed on 8 October 2017).

- Ho, J.C.; Wu, C.G.; Lee, C.S.; Pham, T.T.T. Factors affecting the behavioral intention to adopt mobile bank-ing: An international comparison. Technol. Soc. 2020, 63, 101360. [Google Scholar] [CrossRef]

- Shankar, A.; Rishi, B. Convenience matter in mobile banking adoption intention? Australas. Mark. J. 2020, 28, 273–285. [Google Scholar] [CrossRef]

- Cheah, C.M.; Teo, A.C.; Sim, J.J.; Oon, K.H.; Tan, B.I. Factors affecting Malaysian mobile banking adoption: An empirical analysis. Int. J. Netw. Mobile Technol. 2011, 2, 149–160. [Google Scholar]

- Jadil, Y.; Rana, N.P.; Dwivedi, Y.K. A meta-analysis of the UTAUT model in the mobile banking literature: The moderating role of sample size and culture. J. Bus. Res. 2021, 132, 354–372. [Google Scholar] [CrossRef]

- Tan, E.; Lau, J.L. Behavioural intention to adopt mobile banking among the millennial generation. Young Consum. 2016, 17, 18–31. [Google Scholar] [CrossRef]

- Pages. The Growth of Digital Banking Report. 2021. Available online: https://pages.caci.co.uk/rs/752-EBZ-498/images/caci-future-growth-digital-banking-report-2019.pdf (accessed on 17 September 2021).

- Applause. 61% of People Access Mobile Banking on a Regular Basis. 2017. Available online: https://www.applause.com/blog/mobile-banking-adoption-rates/ (accessed on 2 January 2018).

- Deloitte. The Value of Online Banking Channels in a Mobile-Centric World. 2019. Available online: https://www2.deloitte.com/us/en/insights/industry/financial-services/online-banking-usage-in-mobilecentric-world.html (accessed on 3 March 2020).

- Farzin, M.; Sadeghi, M.; Kharkeshi, F.Y.; Ruholahpur, H.; Fattahi, M. Extending UTAUT2 in M-banking adop-tion and actual use behavior: Does WOM communication matter? Asian J. Econ. Bank. 2021, 5, 136–157. [Google Scholar] [CrossRef]

- Geebren, A.; Jabbar, A.; Luo, M. Examining the role of consumer satisfaction within mobile eco-systems: Evi-dence from mobile banking services. Comput. Hum. Behav. 2021, 114, 106584. [Google Scholar] [CrossRef]

- DESI. Greece in the Digital Economy and Society Index. 2021. Available online: https://digital-strategy.ec.europa.eu/en/policies/desi-greece (accessed on 2 January 2022).

- Veríssimo, J.M.C. Enablers and restrictors of mobile banking app use: A fuzzy set qualitative comparative analy-sis (fsQCA). J. Bus. Res. 2016, 69, 5456–5460. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Hew, J.J.; Lee, V.H.; Ooi, K.B.; Wei, J. What catalyses mobile apps usage intention: An empirical analy-sis. Ind. Manag. Data Syst. 2015, 115, 1269–1291. [Google Scholar] [CrossRef]

- Munoz-Leiva, F.; Climent-Climent, S.; Liébana-Cabanillas, F. Determinants of intention to use the mobile bank-ing apps: An extension of the classic TAM model. Span. J. Mark.-ESIC 2017, 21, 25–38. [Google Scholar]

- Kamdjoug, J.R.K.; Wamba-Taguimdje, S.-L.; Wamba, S.F.; Kake, I.B. Determining factors and impacts of the intention to adopt mobile banking app in Cameroon: Case of SARA by afriland First Bank. J. Retail. Consum. Serv. 2021, 61, 102509. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.; Xu, X. Consumer acceptance and use of information technology: Extending the uni-fied theory of acceptance and use of technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research; Addison-Wesley: Reading, MA, USA, 1975. [Google Scholar]

- Wu, J.-H.; Wang, S.-C. What drives mobile commerce?: An empirical evaluation of the revised technology acceptance model. Inf. Manag. 2005, 42, 719–729. [Google Scholar] [CrossRef]

- Bhatti, T. Exploring factors influencing the adoption of mobile commerce. J. Internet Bank. Commer. 2007, 12, 1–13. [Google Scholar]

- Chung, N.; Han, H.; Joun, Y. Tourists’ intention to visit a destination: The role of augmented reality (AR) ap-plication for a heritage site. Comput. Hum. Behav. 2015, 50, 588–599. [Google Scholar] [CrossRef]

- Compeau, D.R.; Higgins, C.A.; Huff, S. Social cognitive theory and individual reactions to computing technolo-gy: A longitudinal study. MIS Q. 1999, 23, 145–158. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G.; Katarachia, A. Determinants of the Intention to Adopt Mobile Augmented Reality Apps in Shopping Malls among University Students. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 491–512. [Google Scholar] [CrossRef]

- Abed, S. An empirical investigation of Instagram as an s-commerce channel. J. Adv. Manag. Res. 2018, 15, 146–160. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G. Modeling users’ acceptance of mobile social commerce: The case of ‘Instagram checkout’. Electron. Commer. Res. 2021. [Google Scholar] [CrossRef]

- Bawack, R.E.; Kamdjoug, J.R.K. Adequacy of utaut in clinician adoption of health information systems in de-veloping countries: The case of Cameroon. Int. J. Med. Inform. 2018, 109, 15–22. [Google Scholar] [CrossRef]

- Cao, Q.; Niu, X. Integrating context-awareness and UTAUT to explain Alipay user adoption. Int. J. Ind. Ergon. 2018, 69, 9–13. [Google Scholar] [CrossRef]

- Cimperman, M.; Brencic, M.M.; Trkman, P. Analyzing older users’ home telehealth services acceptance behav-ior-applying an extended utaut model. Int. J. Med. Inform. 2016, 90, 22–31. [Google Scholar] [CrossRef] [PubMed]

- Khalilzadeh, J.; Ozturk, A.B.; Bilgihan, A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 2017, 70, 460–474. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G. Factors That Determine the Adoption Intention of Direct Mobile Purchases through Social Media Apps. Information 2021, 12, 449. [Google Scholar] [CrossRef]

- Salisbury, W.; Pearson, R.; Pearson, A.; Miller, D. Identifying barriers that keep shoppers off the world wide web: Developing a scale of perceived web security. Ind. Manag. Data Syst. 2001, 101, 165–176. [Google Scholar] [CrossRef]

- Rahi, S.; Ghani, M.A.; Ngah, A.H. A structural equation model for evaluating user’s intention to adopt internet banking and intention to recommend technology. Accounting 2018, 4, 139–152. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile payment: Understanding the determinants of cus-tomer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Saprikis, V. Examining behavioral intention towards social commerce: An empirical investigation in university students. In Proceedings of the 32nd IBIMA Conference, Seville, Spain, 15–16 November 2018; pp. 15–16. [Google Scholar]

- Morgan, R.M. Relationship Marketing and Marketing Strategy: The Evolution of Relationship Marketing within the Organization. In Handbook of Relationship Marketing; Sheth, J., Parvatiyar, A., Eds.; Sage: Thousand Oaks, CA, USA, 2000; pp. 481–505. [Google Scholar]

- Androulidakis, N.; Androulidakis, I. Perspectives of mobile advertising in Greek market. In Proceedings of the International Conference on Mobile Business (ICMB’05), Sydney, Australia, 11–13 July 2005; pp. 441–444. [Google Scholar]

- Zarmpou, T.; Saprikis, V.; Markos, A.; Vlachopoulou, M. Modeling users’ acceptance of mobile ser-vices. Electron. Commer. Res. 2012, 12, 225–248. [Google Scholar] [CrossRef]

- Forsythe, S.M.; Shi, B. Consumer patronage and risk perceptions in Internet shopping. J. Bus. Res. 2003, 56, 867–875. [Google Scholar] [CrossRef]

- Hew, J.-J.; Leong, L.-Y.; Tan, G.W.-H.; Ooi, K.-B.; Lee, V.-H. The age of mobile social commerce: An Artificial Neural Network analysis on its resistances. Technol. Forecast. Soc. Chang. 2017, 144, 311–324. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. The moderating effect of experience in the adoption of mobile payment tools in Virtual Social Networks: The m-Payment Acceptance Model in Virtual Social Net-works (MPAM-VSN). Int. J. Inf. Manag. 2014, 34, 151–166. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Villarejo Ramos, Á.F.; Sánchez Franco, M.J. Mobile social commerce acceptance model: Factors and influences on intention to use s-commerce. In Proceedings of the XXVI Congreso Nacional de Marketing, Elche, Alicante, Spain, 17–19 September 2014. [Google Scholar]

- Corbitt, B.J.; Thanasankit, T.; Yi, H. Trust and e-commerce: A study of consumer perceptions. Electron. Commer. Res. Appl. 2003, 2, 203–215. [Google Scholar] [CrossRef]

- Igbaria, M.; Iivari, J. The effects of self-efficacy on computer usage. Omega 1995, 23, 587–605. [Google Scholar] [CrossRef]

- Lu, H.; Su, P.Y. Factors affecting purchase intention on mobile shopping web sites. Internet Res. 2009, 19, 442–458. [Google Scholar] [CrossRef]

- Bahli, B.; Benslimane, Y. An exploration of wireless computing risks: Development of a risk taxono-my. Inf. Manag. Comput. Secur. 2004, 12, 245–254. [Google Scholar] [CrossRef]

- Yang, K.; Forney, J.C. The moderating role of consumer technology anxiety in mobile shopping adoption: Dif-ferential effects of facilitating conditions and social influences. J. Electron. Commer. Res. 2013, 14, 334–347. [Google Scholar]

- Leong, L.-Y.; Hew, T.-S.; Tan, G.W.-H.; Ooi, K.-B. Predicting the determinants of the NFC-enabled mobile credit card acceptance: A neural networks approach. Expert Syst. Appl. 2013, 40, 5604–5620. [Google Scholar] [CrossRef]

- Jarvenpaa, S.L.; Tractinsky, N.; Vitale, M. Consumer trust in an Internet store. Inf. Technol. Man-Agement 2000, 1, 45–71. [Google Scholar]

- Thatcher, J.; Perrewe, P.L. An Empirical Examination of Individual Traits as Antecedents to Computer Anxiety and Computer Self-Efficacy. MIS Q. 2002, 26, 381. [Google Scholar] [CrossRef]

- Venkatesh, V.; Bala, H. Technology Acceptance Model 3 and a Research Agenda on Interventions. Decis. Sci. 2008, 39, 273–315. [Google Scholar] [CrossRef]

- Wakefield, R.L.; Whitten, D. Examining User Perceptions of Third-Party Organizations Credibility and Trust in an E-Retailer. J. Organ. End User Comput. 2006, 18, 1–19. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory, 2nd ed.; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Hair, J.; Black, W.; Babin, B.; Anderson, R. Multivariate Data Analysis, 3rd ed.; Pearson/Prentice Hall: Upper Saddle River, NJ, USA, 2014. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Al-gebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Bentler, M. Comparative it indexes in structural models. Psychol. Bull. 1990, 107, 238–246. [Google Scholar] [CrossRef] [PubMed]

- Hu, L.-T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Muthén, L.K.; Muthén, B.O. Mplus for Windows 7.31. Available online: http://www.statmodel.com/verhistory.shtml (accessed on 10 December 2021).

- Hu, P.J.; Chau, P.Y.; Sheng, O.R.L.; Tam, K.Y. Examining the Technology Acceptance Model Using Physician Acceptance of Telemedicine Technology. J. Manag. Inf. Syst. 1999, 16, 91–112. [Google Scholar] [CrossRef]

- Singh, S.; Srivastava, R. Predicting the intention to use mobile banking in India. Int. J. Bank Mark. 2018, 36, 357–378. [Google Scholar] [CrossRef]

| Research Variables | Measurement Items | Sources |

|---|---|---|

| Performance Expectancy (PE) | PE1: I think that using an m-banking app through my smartphone would help me accomplish my transactions more quickly | [61] |

| PE2: I think that using an m-banking app through my smartphone would increase my chances of completing transactions that are important to me | ||

| Effort Expectancy (EFE) | EFE1: I think it would be easy for me to learn how to use an m-banking app through my smartphone | |

| EFE2: I think that it would be easy for me to use an m-banking app through my smartphone | ||

| EFE3: I think that my interactions via an m-banking app through my smartphone would be clear and understandable | ||

| Social Influence (SOC) | SOC1: People who influence my behavior think that I should use an m-banking app through my smartphone | |

| SOC2: People who are important to me think that I should use an m-banking app through my smartphone | ||

| SOC3: People whose opinion count think that I should use an m-banking app through my smartphone | ||

| Facilitating Conditions (FAC) | FAC1: I think that I have the proper smartphone to use an m-banking app | |

| FAC2: I think that I could use an m-banking app with my current smartphone | ||

| Behavioral Intention (BI) | BI1: I intend to use an m-banking app through my smartphone in the near future | |

| BI2: I predict I would use an m-banking app through my smartphone in the near future | ||

| BI3: If I have the chance I would use an m-banking app through my smartphone | ||

| Reward (REW) | REW1: I would use an m-banking app through my smartphone if it provides motives | [82,85] |

| REW2: I would use an m-banking app through my smartphone if it provides information on special offers | ||

| Security (SEC) | SEC1: I think using an m-banking app through my smartphone is secure to send and receive data/ information | [79] |

| SEC2: I feel secure to use an m-banking app through my smartphone | ||

| SEC3: I would feel safe to provide sensitive information about myself via an m-banking app through my smartphone | ||

| RISK (RIS) | RIS1: I think that there would be a high potential for financial fraud if I use an m-banking app through my smartphone | [96,99] |

| RIS2: I think that other people could know information about my transactions if I use an m-banking app through my smartphone | ||

| RIS3: I think that using an m-banking app through my smartphone would be risky | ||

| Anxiety (ANX) | ANX1: I would feel apprehensive about using an m-banking app through my smartphone | [70,97,98] |

| ANX2: Using an m-banking app through my smartphone would make me feel nervous | ||

| ANX3: Using an m-banking app through my smartphone would make me feel uncomfortable | ||

| Recommendation (REC) | REC1: If I have a good experience with an m-banking app through my smartphone, I will recommend it to friends and relatives | [81] |

| REC2: I intend to recommend to friends and relatives to use an m-banking app through their smartphone | ||

| REC3: I think that I would recommend to friends and relatives to use an m-banking app through their smartphone |

| Demographics | Respondents (Ν) | % |

|---|---|---|

| Sex: | ||

| Male | 375 | 44.8 |

| Female | 462 | 55.2 |

| Age: | ||

| 18–24 | 124 | 14.8 |

| 25–34 | 302 | 36.1 |

| 35–44 | 231 | 27.6 |

| 45–54 | 177 | 21.1 |

| >54 | 3 | 0.4 |

| Occupation: | ||

| Public servant | 166 | 19.8 |

| Private employee | 323 | 38.6 |

| Freelancer | 158 | 18.9 |

| Unemployed | 105 | 12.5 |

| other | 85 | 10.2 |

| Education: | ||

| Elementary School | 3 | 0.4 |

| High school | 204 | 24.4 |

| University/College | 434 | 51.8 |

| Master/Phd | 196 | 23.4 |

| Monthly salary: | ||

| <600 € | 179 | 21.4 |

| 601–900 € | 171 | 20.4 |

| 901–1200 € | 163 | 19.5 |

| 1201–1500 € | 90 | 10.8 |

| 1501–1800 € | 40 | 4.8 |

| 1801–2500 € | 22 | 2.6 |

| >2500 € | 24 | 2.9 |

| Νot answer | 148 | 17.7 |

| Construct | Item | Loading | CR | AVE | Cronbach’s α |

|---|---|---|---|---|---|

| Performance Expectancy (PE) | PE1 | 0.740 | 0.735 | 0.581 | 0.845 |

| PE2 | 0.784 | ||||

| Effort Expectancy (EFE) | EFE1 | 0.814 | 0.852 | 0.658 | 0.893 |

| EFE2 | 0.803 | ||||

| EFE3 | 0.816 | ||||

| Facilitating Conditions (FAC) | FAC1 | 0.866 | 0.838 | 0.722 | 0.904 |

| FAC2 | 0.833 | ||||

| Social Influence (SOC) | SOC1 | 0.876 | 0.924 | 0.801 | 0.903 |

| SOC2 | 0.920 | ||||

| SOC3 | 0.889 | ||||

| Security (SEC) | SEC1 | 0.769 | 0.798 | 0.570 | 0.920 |

| SEC2 | 0.749 | ||||

| SEC3 | 0.745 | ||||

| Reward (REW) | REW1 | 0.919 | 0.916 | 0.845 | 0.962 |

| REW2 | 0.920 | ||||

| Anxiety (ANX) | ANX1 | 0.832 | 0.871 | 0.692 | 0.916 |

| ANX2 | 0.838 | ||||

| ANX3 | 0.826 | ||||

| Risk (RIS) | RIS1 | 0.795 | 0.800 | 0.571 | 0.896 |

| RIS2 | 0.783 | ||||

| RIS3 | 0.685 | ||||

| Behavioral Intention (BI) | BI1 | 0.824 | 0.843 | 0.642 | 0.948 |

| BI2 | 0.811 | ||||

| BI3 | 0.768 | ||||

| Recommendation (REC) | REC1 | 0.782 | 0.848 | 0.650 | 0.937 |

| REC2 | 0.818 | ||||

| REC3 | 0.818 | ||||

| Total Variance Explained = 87.550 | |||||

| PE | EFE | SOC | FAC | SEC | REW | ANX | RIS | BI | REC | |

|---|---|---|---|---|---|---|---|---|---|---|

| PE | 0.76 | |||||||||

| EFE | 0.67 | 0.81 | ||||||||

| SOC | 0.18 | 0.10 | 0.85 | |||||||

| FAC | 0.55 | 0.67 | 0.13 | 0.89 | ||||||

| SEC | 0.45 | 0.41 | 0.19 | 0.42 | 0.75 | |||||

| REW | 0.22 | 0.14 | 0.28 | 0.25 | 0.29 | 0.92 | ||||

| ANX | −0.36 | −0.49 | 0.08 | −0.46 | −0.42 | −0.10 | 0.83 | |||

| RIS | −0.34 | −0.42 | 0.01 | −0.38 | −0.66 | −0.11 | 0.72 | 0.75 | ||

| BI | 0.48 | 0.47 | 0.14 | 0.53 | 0.47 | 0.23 | −0.41 | −0.37 | 0.80 | |

| REC | 0.43 | 0.36 | 0.28 | 0.39 | 0.48 | 0.29 | −0.31 | −0.39 | 0.50 | 0.81 |

| Measures | Recommended Value | Measurement Model |

|---|---|---|

| χ2/df | 5.00 | 1.709 |

| Goodness of fit index (GFI) | 0.90 | 0.949 |

| Adjusted goodness of fit index (AGFI) | 0.90 | 0.930 |

| Comparative fit index (CFI) | 0.90 | 0.985 |

| Normed fit index (NFI) | 0.90 | 0.965 |

| Incremental fit index (IFI) | 0.90 | 0.985 |

| Tucker-Lewis index (ΤLI) | 0.90 | 0.981 |

| Root mean square Error of Approximation (RMSEA) [90%CI] | 0.05 | 0.034 [0.028–0.039] |

| Measures | Recommended Value | Structural Model |

|---|---|---|

| χ2/df | 5.00 | 1.793 |

| Goodness of fit index (GFI) | 0.90 | 0.944 |

| Adjusted goodness of fit index (AGFI) | 0.90 | 0.926 |

| Comparative fit index (CFI) | 0.90 | 0.982 |

| Normed fit index (NFI) | 0.90 | 0.961 |

| Incremental fit index (IFI) | 0.90 | 0.982 |

| Tucker-Lewis index (ΤLI) | 0.90 | 0.978 |

| Root mean square Error of Approximation (RMSEA) [90%CI] | 0.05 | 0.036 [0.031–0.040] |

| Hypotheses | Paths | Coefficients |

|---|---|---|

| H1 | PE→BI | 0.20 *** |

| H2 | (a) EFE→PE (b) EFE→BI | (a) 0.68 *** (b) Non-Significant |

| H3 | FAC→BI | 0.21 *** |

| H4 | SOC→BI | 0.09 ** |

| H5 | SEC→BI | 0.26 *** |

| H6 | REW→BI | 0.07 * |

| H7 | (a) RIS→BI (b) RIS→ANX | (a) Non-Significant (b) 0.76 *** |

| H8 | ANX→BI | −0.20 *** |

| H9 | BI→REC | 0.92 *** |

| Measures | Recommended Value | Structural Model |

|---|---|---|

| χ2/df | 5.00 | 1.488 |

| Goodness of fit index (GFI) | 0.90 | 0.869 |

| Adjusted goodness of fit index (AGFI) | 0.90 | 0.834 |

| Comparative fit index (CFI) | 0.90 | 0.972 |

| Normed fit index (NFI) | 0.90 | 0.920 |

| Incremental fit index (IFI) | 0.90 | 0.972 |

| Tucker-Lewis index (ΤLI) | 0.90 | 0.967 |

| Root mean square Error of Approximation (RMSEA) [90%CI] | 0.05 | 0.048 [0.039–0.058] |

| Hypotheses | Paths | Coefficients |

|---|---|---|

| H1 | PE→BI | 0.43 *** |

| H2 | (a) EFE→PE (b) EFE→BI | (a) 0.58 *** (b) Non-Significant |

| H3 | FAC→EFE | Non-Significant |

| H4 | SOC→BI | 0.13 * |

| H5 | SEC→BI | Non-Significant |

| H6 | REW→BI | 0.28 *** |

| H7 | (a) RIS→B1 (b) RIS→ANX | (a) −0.26 * (b) 0.70 *** |

| H8 | ANX→BI | Non-Significant |

| H9 | BI→ REC | 0.99 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saprikis, V.; Avlogiaris, G.; Katarachia, A. A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information 2022, 13, 30. https://doi.org/10.3390/info13010030

Saprikis V, Avlogiaris G, Katarachia A. A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information. 2022; 13(1):30. https://doi.org/10.3390/info13010030

Chicago/Turabian StyleSaprikis, Vaggelis, Giorgos Avlogiaris, and Androniki Katarachia. 2022. "A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption" Information 13, no. 1: 30. https://doi.org/10.3390/info13010030

APA StyleSaprikis, V., Avlogiaris, G., & Katarachia, A. (2022). A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information, 13(1), 30. https://doi.org/10.3390/info13010030