1. Introduction

Bitcoin, a decentralized open-source digital ledger, enables global peer-to-peer financial transactions [

1]. Its Proof-of-Work (PoW) consensus mechanism rewards the ‘miner’ who solves a cryptographic challenge with the right to create the next transaction block. Once validated by decentralized node operators, the miner receives bitcoin (lower-case bitcoin denotes the currency; upper-case Bitcoin denotes the protocol) as a reward, plus transaction fees collected for that block. The PoW consensus mechanism safeguards the ledger’s integrity, creating a secure and immutable record of transactions. Attempts to falsify it are not only mathematically formidable but also extremely energy- and capital-intensive. Bitcoin miners are central to network security.

For newcomers to Bitcoin, several essential points are worth noting. Firstly, miners, ranging from individuals with a single computer to large-scale entities with thousands, provide computing power and security to the Bitcoin network. Secondly, tens of thousands of independent Bitcoin network node operators validate mining transactions, providing a balance of power between the compute and validation functions. Each node operator stores a copy of the globally distributed ledger, securing the network’s integrity. Lastly, Bitcoin, distinctively decentralized, has no central authority or foundation and derives its power and security from its inherently decentralized design.

As of November 2023, the Bitcoin network reached a computation capacity of >500 exahash per second (

https://data.hashrateindex.com/network-data/btc (accessed on 20 November 2023)), accounting for nearly 0.65% of global electricity consumption (

https://ccaf.io/cbnsi/cbeci/comparisons (accessed on 20 November 2023). Despite its numerous and innovative benefits [

2], Bitcoin’s energy-intensive production has become a point of criticism [

3,

4,

5,

6,

7]. Some policymakers [

8] and parts of the public [

9,

10] equate Bitcoin’s global energy demand and contributions to climate change, even though these two factors are not necessarily correlated should mining prove to support the transition to renewable energy.

The foundation for informed Bitcoin policy decisions is currently limited, partly due to its nascent nature and partly due to conclusions drawn by researchers unfamiliar with Bitcoin’s intricacies [

11,

12]. This underscores the urgent need for a comprehensive Bitcoin research program that spans environmental, applied, and social sciences [

13]. The research should contextualize Bitcoin mining within the broader framework of energy production and socio-economic dynamics, catering to policymakers by providing high-level studies on Bitcoin mining’s influence on energy systems and, as needed, in-depth case studies and modeling efforts. Much of the current knowledge resides with industry experts and experienced practitioners, so engaging them is crucial.

In this study, we explore research areas to enhance the understanding of bitcoin mining and its multifaceted impact on climate, energy systems, the environment, and society. Utilizing a twofold approach inspired by the horizon scanning field [

14,

15], our first step involved assessing a broad spectrum of publicly accessible broadcasts within Bitcoin’s dynamic social media landscape. This discourse laid the foundation for AI-assisted identification and articulation of pivotal Bitcoin information needs and candidate research questions. Secondly, we collaborated with industry stakeholders to scrutinize the AI-generated research questions, add additional questions when necessary, and enrich the knowledge-building process. This paper aims to significantly contribute to an emerging Bitcoin research agenda that can help policymakers and other decision-makers make informed decisions and prioritize research needs.

3. Industry Perspectives on High-Priority Issues and Research Needs

We discussed the AI-generated research questions at an open Bitcoin industry workshop (Mining Disrupt, 26 July 2023, Miami, FL, USA). After the workshop, industry representatives reviewed the questions and contributed to the manuscript. Once the manuscript draft was complete, it was circulated among a wider group of industry participants for review. Contributors who provided substantive input during the preparation of the draft manuscript were included in this paper as ‘review and editing’ co-authors.

In the material that follows, research questions identified by the AI are shown in tables, while the accompanying commentary for each section was developed by the co-authors. There was no obligation for co-authors to mention every AI-generated question nor to restrict themselves to questions in the tables. This level of freedom is similar to the freedom that breakout group participants have at in-person meetings. Participants in the key questions exercises are always free to accept or reject candidate questions or develop their own questions [

14,

21,

22].

Our focus was on Bitcoin mining in this paper. We recognize that there are a variety of Bitcoin’s impacts that are also important (e.g., the impacts on issues like financial inclusion and adoption, cybersecurity and crime, and macroeconomic and political implications), but those are beyond the scope of the current mining paper.

3.1. General Energy Use

This section explores questions pertaining to the complex interplay between Bitcoin mining and sustainable energy (

Table 5). This kind of targeted research may help Bitcoin miners and policymakers make informed decisions on the optimal settings, locations, and terms for conducting business.

Bitcoin mining now holds significant influence in the energy landscape in some regions and is increasingly being used to monetize underused energy resources. As the Bitcoin network continues to grow, the industry will need to increasingly rely on lower-cost power to remain economically viable, particularly during bear markets when miners may face significant cash flow challenges.

From a mining supply and demand perspective, low-cost electricity, the most important input in bitcoin production, enables producers to increase production levels and reduce average costs (i.e., the supply curve shifts outward). Thus, the exploration of innovative strategies to access under-utilized energy sources and integrate Bitcoin mining may both enhance financial viability and valorize previously wasted energy resources [

23]. Utilizing waste methane from abandoned oil wells, gas from operational oil wells that are venting methane, landfills, wastewater plants, and agricultural and forestry wastes to power mining operations may also help rapidly reduce greenhouse gas emissions, an important consideration given methane’s potent greenhouse gas impact [

24] and the urgent need to reduce CO2e emissions [

25,

26,

27].

Understanding the challenges and solutions related to employing renewable and carbon-free energy sources in large-scale mining operations is also important [

28]. Integrating Bitcoin mining with intermittent solar and wind energy systems and electricity transmission grids [

29] may expedite the expansion of renewable energy infrastructure and the initial and sustained investments needed for their grid interconnection [

30].

Nuclear generation is also a well-suited generation partner for Bitcoin mining, given that nuclear power is baseload generation but still has a shutdown cycle of several weeks for refueling, though this shutdown cycle is manageable for Bitcoin mining. Nevertheless, it is also crucial to consider other factors like the predictability of ‘excess’ energy generation, generating capacity factors, and policy-driven financial incentives for energy production.

The accurate measurement of the emissions intensity of energy used by the Bitcoin network has historically been a critical point of contention. Thus, precise quantification of Bitcoin mining’s carbon footprint is fundamental for the industry’s credibility and accountability [

31]. This not only enhances transparency but also provides miners and policymakers with the essential knowledge to make informed decisions regarding energy consumption and emissions reduction. Furthermore, improving measurement and contextualization within inherently variable energy grids is vital.

3.2. Energy Grids

Table 6 introduces research questions concerning Bitcoin mining and its impact on energy grids. The current energy paradigm, characterized by decentralized energy grids and distributed energy resources, significantly steers the evolution of energy infrastructure. Industrial-scale Bitcoin mining, because of its unique qualities as a large flexible load, may be poised to contribute to transformative shifts in the energy sector, potentially solidifying Bitcoin mining’s role as a foundational support for power grids [

28] and catalyzing further transitions toward renewable sources and innovations [

32]. Effectively identifying and navigating these types of grid management challenges requires research that can inform complex decisions about grid design and efficiency.

Bitcoin mining’s distinct flexibility has underscored its capability as an adaptable load with substantial implications for grid behavior [

28]. In instances of high energy output or low market demand, Bitcoin mining operations can function as an energy load balancer, assimilating excess energy generated by renewable sources such as solar and wind. Rather than permitting this surplus to remain unused, being unprofitably curtailed by the generator, or relying on less efficient and more expensive storage methods, it can be channeled toward Bitcoin mining. This positions Bitcoin mining as a fully adjustable load [

28], proficiently managing fluctuations in surplus energy while concurrently enhancing the economics of renewables by mitigating negative pricing, an increasingly prevalent issue in regions with abundant renewable energy resources [

33,

34].

Flexible Bitcoin mining operations that leverage advanced software control systems for quickly adjusting their load consumption can provide grid operators with a flexible resource that can be used for real-time energy load balancing or providing ancillary services such as frequency response (sudden drops in system frequency) and contingency reserves (back-up power in case a power plant trips offline). Bitcoin miners running on renewable energy have a faster response time to shut down compared to powering up fossil fuel ‘peaker plants’, therefore positioning Bitcoin mining as a better grid stability partner that does not require increased burning of fossil fuels during periods of extreme market demand. Bitcoin mining may also offer advantages is situations requiring power system flexibility [

35,

36] by rapidly offsetting any sudden fluctuations in system frequency, ensuring the grid’s continuous operation. ASICs can be over- or under-clocked, though it is important to recognize that they were engineered to have a constant 24/7 inflow of electrons and run without fault.

The integration of Bitcoin mining into both regulated and deregulated power systems poses not only a technological challenge but also a strategic one, with impacts on the sustainability and efficiency of the wider energy system. Ensuring affordability and reliability in supplying electricity, a commodity that needs to be used immediately upon production, is pivotal. Electricity pricing schedules [

37,

38] and innovative power purchasing agreements are needed, ensuring equitable energy pricing for electricity users and producers, including Bitcoin miners, while incentivizing the uptake of clean energy. Efficiency is so important for power grid managers that, according to some internal reports, some curtailment service providers now offer Bitcoin miners financial incentives to upgrade computers running the current most energy-efficient ASICs, which helps reduce overall grid energy consumption.

The modernization of energy grids and the expansion of transmission capacity to meet Bitcoin miners’ needs present challenges, extending from regulatory nuances [

39] to the logistics of infrastructure development [

40,

41,

42]. Transmission requirements are a key development issue for renewables, and Bitcoin might allow renewable facilities to generate value without grid buildout. This alone is a key attribute of Bitcoin mining that might enable it to be a true partner for renewables that are located in remote locations, allowing them to produce energy and generate revenue prior to grid transmission connections becoming operational [

30].

It is important to acknowledge that highly flexible loads (i.e., 75% uptime) are quite distinctive compared to firm loads. Whereas a firm load perpetually draws energy from the grid without reciprocity, flexible loads offer grid operators a substantial degree of flexibility, aiding in the reliable flow of electricity to the market and the potential for integration of higher levels of renewables.

3.3. Bitcoin Mining Operations

Bitcoin mining companies must balance energy efficiency, profitability, network security, decentralization, and energy independence amidst fluctuating mining difficulties and hashrate (

Table 7). This requires a context-specific understanding of energy consumption. Mining needs to be considered within the context of distinct regional energy grids, ensuring a precise representation of its energy utilization and environmental impact. Given the direct influence of electricity cost fluctuations on the profitability and economic viability of Bitcoin mining operations, research must explore how miners can adeptly mitigate these impacts and address the economic challenges posed by such variations.

Strategies and collaborative models that forge robust partnerships between Bitcoin mining companies and local energy providers (local distribution companies, retail electric providers, utilities, load-serving entities, and qualified scheduling entities who schedule the electricity into the grid) constitute another important research avenue. Such partnerships, vital for securing a sustainable and cost-effective energy supply, also dictate the resilience and strategic direction of Bitcoin mining operations. An in-depth exploration of partnership models across a spectrum of energy providers, from co-ops to major independent power producers, may illuminate how effective, sustainable partnerships across varied operational contexts can be created and sustained. In some cases, miners might vertically integrate (e.g., investing in energy production) to accrue greater control over their energy supply chain, enhance energy security, and mitigate costs.

The promotion of responsible mining practices, consonant with the principles of a circular economy and aimed at preventing resource waste and minimizing electronic waste [

43], is both an ethical imperative and a strategic necessity for the industry’s sustained viability. Research is needed to identify pathways through which the industry can navigate the intricacies of energy use, environmental impact, and sustainability while ensuring operations retain their profitability.

Incorporating variable pricing strategies, miners might leverage low electricity prices during off-peak hours and employ predictive analytics to ascertain optimal mining times. Moreover, diversifying energy sources through a blend of renewable and non-renewable energy could attenuate exposure to price fluctuations while concurrently addressing local environmental concerns, such as water usage and habitat disruption.

Given that Bitcoin is a network technology with each computer having its own media access control (MAC) ID as well as its own IP address, understanding IT systems management is important. Often, companies will choose to design systems to stringent Service Oriented Company (SOC) compliance frameworks such as SOC 1 for monetary and payment transfer systems and SOC 2 for network and IT systems. Maintaining systems integrity is critical to maintaining the flow of hashrate to a mining pool.

To augment transparency and accountability, miners might consider collecting and sharing data on their operations, inclusive of real-time energy consumption, energy source mix, and environmental impact metrics. Joining industry associations or engaging in working groups focused on sustainable mining practices can facilitate access to best practices, knowledge sharing, and collective problem-solving for environmental and operational challenges.

3.4. Geographic Distribution of Bitcoin Mining

The exploration of Bitcoin mining’s geographic distribution highlights vital considerations for energy use, environmental sustainability, and interactions with various sectors, providing valuable insights for miners and policymakers (

Table 8). Bitcoin mining is likely to concentrate in areas with very reliable and abundant energy, which may not coincide with areas of high energy demand.

Astute management significantly determines the beneficial and detrimental repercussions of Bitcoin mining. The intersections between Bitcoin mining and other energy-intensive industries raise questions regarding competition and compatibility, providing distinct challenges and opportunities that require research. Additionally, factors such as varying energy costs, electricity tariffs, climatic variations, and water availability exert a notable influence on mining site choices and profitability [

44,

45,

46].

A crucial aspect deserving exploration is the role of geographic distribution in maintaining network security. The possible impact of geographic centralization on risk and security is pivotal. For example, while Texas has become a mining hub due to its favorable conditions, does this concentration effectively consolidate these miners into a single entity? Alternatively, do the distinct characteristics of each firm provide enough differentiation to collectively enhance network resilience?

Geopolitical nuances, political stability, and regional regulations substantially guide Bitcoin mining location choices, molding the industry’s global footprint and influencing miners’ decisions [

47]. Bitcoin’s openness and mining present intriguing questions related to geopolitics and network credibility, especially considering nations under stringent sanctions, such as North Korea, Russia, and Iran, can enter the market and reap returns. Does this situation merely showcase Bitcoin’s intrinsic equity as an open protocol? Or does it indicate a potential risk of ideological decay, possibly hindering its adoption by entities adhering to the US-centric world order?

3.5. Local and Regional Impacts of Bitcoin Mining

Examining the local and regional effects of Bitcoin mining requires context-dependent analysis. The research questions laid out in

Table 9 may help unpack Bitcoin’s impact on local energy markets, the environment, and communities, including the issue of revenue diversification and resilience in rural regions.

The infrastructure demands of large-scale Bitcoin mining operations are significant. Bitcoin miners provide a very large-scale, point-specific load that can consume as much as 50 MW of power within five acres. This highly energy-dense footprint allows for a minimally intrusive physical presence. At the same time, the large power density allows for the possibility of miners becoming new anchor tenants, helping to revitalize existing industrial facilities into Bitcoin data centers that use existing on-site infrastructure. For example, an old paper mill in the Pacific Northwest, a carpet mill in the USA Southeast, or a steel mill in the USA Midwest might be re-purposed, and the high voltage substation and grid connectivity used instead of building new substation and power lines that could be disruptive to the local landscape. Industrial properties can sit undeveloped for years, if not decades, causing potential community decline through the ‘broken windows syndrome’ process of neglect-led decline.

Having an economically viable local industrial base also offers the potential for indigenous communities to increase the degree of sovereignty they hold over economic development, social impacts, and their own financial independence.

Accurate forecasting of the influence of Bitcoin mining on electricity prices is often the focus of local and state-level politicians. Policymakers need to develop strategies that ease the burden on local energy supplies and market prices and create smart power use and pricing strategies for both wholesale and retail electricity customers [

37].

By encouraging economic diversification, job creation, and entrepreneurial efforts, Bitcoin mining might enhance regional development [

48]. While mining activities can drive economic growth, create jobs, and diversify economies, they may also demand more from infrastructure and impact local communities across social, economic, and environmental dimensions [

29,

49]. Noise generated by Bitcoin mining operations is an important, yet sometimes overlooked, factor that may become a local issue.

Regional economic impact models are sometimes used to assess spillover effects of new industrial investments, but they have their limitations, especially when arbitrary multipliers are used in input–output models [

50]. Refined multi-account assessment methodologies can provide valuable insights beyond financial and employment impacts [

51]. In areas like Texas, where Bitcoin mining is a major industry, it might also be possible to use computable general equilibrium models [

52] to assess mining’s regional and national economic impacts. Life cycle analysis, which is commonly used in energy research [

53,

54], has also been applied in studies on Bitcoin mining in China [

43,

55] and the United States [

56], but rigorous research in multiple locations would be valuable.

The future of Bitcoin mining likely involves finding ways to monetize waste heat, especially as the industry becomes highly competitive. Bitcoin mining has shown that waste heat from data centers can be reused for other firms within a local circular economy. Options include district heating [

2,

57] and alternative uses such as heating greenhouses and lumber drying. Projects in Sweden and Norway, where waste heat from hydropower-based Bitcoin mining is used for district heating, avoid the need to burn wood chips or fossil fuels while also increasing economic returns for the hydropower-generating facilities.

The geographical spread of Bitcoin mining activities can significantly shape regional economic landscapes, suggesting a need to explore both opportunities for revitalization as well as the strength of enduring impacts of Bitcoin mining once miners leave a region. This ‘boomtown’ phenomenon has been studied in the Bitcoin mining context [

49], and there are likely many places where understanding Bitcoin’s impact on rural development dynamics would be extremely useful for policymakers. Research may involve comparing the environmental and economic impacts relative to the departure of other industrial-scale operations, the impacts of Bitcoin mining on local human capital, and the role of expanded grid infrastructure for future high-technology industries.

Exploring the opportunity cost of electricity is needed in the Bitcoin mining context. The global market for low-cost, stranded power will likely have multiple actors, including hydrogen producers, AI data centers, and other industries. Evaluating whether allocating electricity to mining is the most valuable option requires considering factors such as economic returns, environmental impact, and societal priorities. In some cases, the opportunity cost may suggest that diverting electricity to alternative uses with broader benefits is more advantageous. Such analyses would require comprehensive economic cost-benefit analyses in support of regulatory actions and infrastructure investments [e.g., [

58]].

3.6. Security and Risk Management

Navigating security issues spanning physical and cyber domains is key for Bitcoin miners. The research questions outlined in

Table 10 probe into various facets of security, from the indispensability of decentralization to confronting potential threats. The essence of decentralization is woven into the very fabric of Bitcoin’s design [

1,

59]. Excessive consolidation of core network attributes such as hashrate or the geographic distribution of mining could jeopardize the network’s security and utility. The network’s security grows with energy use, yet the optimum energy consumption for bitcoin’s security is still undetermined [

60]. Furthermore, mining pools play a central role in fostering decentralization and fortifying network security, particularly given their influence on consensus-building within the network. Understanding the implications of consolidation is vital to safeguard the resilience and stability of the Bitcoin network [

61].

Addressing risks such as mining centralization, potential 51% attacks, cartel formations, limited ASIC manufacturers, hard forks, and coordinated efforts by major entities to launch attacks (e.g., the theorized ‘Satoshi’s heel’ type attack) is crucial. Even theoretical attacks that may seek to destabilize the network regardless of associated costs merit scrutiny [

62].

Ensuring the safety of facilities, hardware, and data from physical and cyber threats is vital for maintaining the continuity of mining endeavors. Moreover, adroitly navigating through the intricate challenges posed by balancing financial privacy concerns with legal and regulatory obligations demands scrutiny. Significant bottlenecks in supply chains could restrict the availability of essential infrastructure components. Conducting research into the robustness, vulnerabilities, and alternative strategies within the supply chain could help build understanding and mitigate potential mining hurdles.

Moreover, the interdependent relationship between Bitcoin mining and energy grids is crucial to the discourse on security. Bitcoin mining could potentially fortify the security of energy supply through in-depth integration with energy grids and infrastructure enhancements. Deciphering how Bitcoin intertwines with tangible energy infrastructure to amplify security is crucial for miners, grid operators, and regulatory entities, ensuring a coordinated, secure, and resilient operational landscape.

3.7. Innovation

Ongoing technological innovation within Bitcoin mining highlights diverse research needs crucial for both miners and policymakers (

Table 11). The Bitcoin mining industry revolves around the optimization of energy consumption and reducing the energy intensity inherent in manufacturing specialized mining hardware [

63,

64]. ASICs can be managed at the chip level, potentially opening up possibilities for increasing energy efficiency at the data center scale by 5% or more. Collaborative efforts among researchers, mining operators, and hardware and software manufacturers are vital, serving as catalysts to spur innovation within the Bitcoin mining ecosystem. Such collaborations might pave ways to identify and implement technological advancements, thereby enhancing energy efficiency while concurrently fostering industry-wide growth and sustainability.

Exploration and refinement of energy storage technologies is one area of need for renewable energy production [

65] and Bitcoin mining [

66]. Battery storage works to reduce emissions by charging when energy is cheaper and discharging, or using, that stored energy when it is more expensive, which often happens when less efficient thermal power plants set the price. From a grid operator’s short-run supply and demand perspective, energy storage is a measure that pushes out the renewable energy supply curve (more energy becomes available due to the flexibility that energy storage provides), while Bitcoin mining affects the demand curve, shifting it rapidly inwards as mining operations shut down in response to market price signals or the negotiated terms in pre-defined power purchase agreements (i.e., they receive mandatory shut-down notices that they abide by in order to secure long-term favorable electricity pricing). The combination of increasing energy supply via energy storage (pushing supply up and prices down) and Bitcoin mining (reducing demand and prices) can work in tandem to control price spikes in electricity markets. Together, they may also prevent the need for deploying fossil fuel peaker plants during times of extreme weather events. There is a need to explore how the dynamics of energy storage and mining interact and their potential for reducing reliance on fossil fuels during peak loads.

Investigating new partnerships with energy producers and those who manage power grids is worth exploring, particularly when it comes to creating innovative agreements and working arrangements in a unique field like Bitcoin mining. The ability to effectively respond to energy demands and create optimal power grids or patterns of energy use through these partnerships is a largely unexplored area but one that could have a wide-reaching impact.

Finding new ways to cool mining computers could lead to improvements in how efficiently and sustainably they run. Mining outputs include both desired Bitcoin and unwanted waste heat, so finding and using innovative cooling strategies is crucial. Understanding how these cooling technologies work in different climate conditions is also important. Bitcoin-driven advances in computer cooling technology provide positive spillover impacts in other industries that need advanced cooling technologies.

Innovation-focused research highlights the key role of technological advances in shaping the Bitcoin mining sector. The critical points here include the need for efficiency, sustainability, collaboration, and the use of the latest manufacturing, computing, and grid management technologies to navigate the various challenges and opportunities in the Bitcoin mining landscape. Exploring these aspects is crucial for managing miners, as well as for policymakers responsible for balancing trade-offs between human well-being, economic development, and sustainability in the face of rapid technological innovation [

67].

3.8. Corporate Operations and Strategy

Navigating through the strategic corporate decisions in Bitcoin mining entails balancing profitability, sustainability, and ethical considerations. Research questions outlined in

Table 12 delve into the nuances of how corporate decisions shape enduring success. Focal areas such as custodial management, investment strategies, and fiscal approaches are central for miners aiming to safeguard assets and create value. Encouraging accountability and transparency among mining firms can help build needed trust among a wide array of stakeholders, from investors to local communities.

Human resources and personnel operations also need significant research. Training workers in mining regions and transforming untrained individuals into proficient data center technicians, for instance, is vital for sustaining successful mining operations. Further, mergers and acquisitions (M&A), foreseen to play a pivotal role amidst industry consolidation, warrant an in-depth exploration.

Bitcoin miners, characterized by their pronounced price sensitivity regarding electricity pricing and their active management of energy risks, find innovations like Bitcoin and hashrate derivatives markets attractive. Derivatives markets, which enable Bitcoin miners and energy suppliers to hedge their transactions, reflect practices employed by firms in traditional commodities markets.

The sustainability of Bitcoin mining operations is intrinsically intertwined with various factors: the persistent stability of the network, the fiat valuation of Bitcoin, and the efficacy of their mining hardware. Exploring alternative hedging strategies, such as diversifying into mining other cryptocurrencies or utilizing their computing facilities for alternative high-performance computing tasks, suggests additional research needs. This exploration might address questions related to the trade-offs between enhanced operational resilience provided by diversification strategies and the profitability of the foundational Bitcoin mining business.

Finding the right balance between management systems and the different interests of various stakeholders is a key challenge. Miners have to manage the needs and expectations of different groups; research could help address various challenges in the Bitcoin mining industry, ranging from managing risks and financial strategies to considering ethical aspects and sustainable practices.

3.9. Financial Sector

Understanding the relationship between Bitcoin mining and the financial sector requires a detailed look at its economic, environmental, and strategic aspects, providing important insights for both miners and policymakers. Addressing research questions relating to the interaction between the traditional finance sector and Bitcoin mining (

Table 13) could shed light on the economic, environmental, and regulatory facets of the industry, aiding miners in decision-making and assisting policymakers in crafting multifaceted policies and regulations.

Developing precise methodologies and metrics is vital to accurately compare Bitcoin mining’s energy consumption with traditional financial systems. For instance, discerning what proportion of global electricity demand from Bitcoin miners provides demand response, compared to the traditional financial system—a ‘firm load’ that solely consumes electricity—would be useful. Such evaluations could be indispensable for miners documenting their environmental impact.

The entrance of mainstream financial institutions into the Bitcoin arena influences market liquidity, price stability, and the overarching trajectory of the mining sector. Market liquidity in the Bitcoin sphere is critical, affecting price consistency, trading volume, and susceptibility to market manipulation. Market volatility can significantly impact miners’ revenues, underscoring the necessity for astute risk-mitigation strategies and operational finesse. Furthermore, financial institutions and utility companies must adeptly assess the economic viability of Bitcoin mining firms, especially as mainstream entities increasingly invest in the mining sector. The addition of secondary markets (e.g., ETFs, futures trading, etc.) also adds complexity that Bitcoin mining, investment, and insurance firms all need to understand and account for in their business planning.

Considering accounting standards for Bitcoin, notable efforts towards standardization and their current unfavorable terms is also critical. The present accounting context, as highlighted by proponents like Michael Saylor, dissuades firms from incorporating bitcoin into their balance sheets. Progress is being made (

https://www.cpajournal.com/2023/09/25/fasb-takes-on-crypto/, accessed on 20 November 2023), but financial services research focusing on accounting is warranted. Research is also needed on the impacts of banks increasingly restricting access to commercial banking services for mining companies. Such moves in the financial sector also suggest that research exploring mining company mobility jurisdictional arbitrage warrants attention.

3.10. Bitcoin Policy and Regulation

Navigating through the multifaceted impacts of Bitcoin mining requires policy- and governance-oriented research (

Table 14). Policymakers are tasked with crafting policies and regulations that ensure responsible energy sourcing and sustainable growth in the sector. Bitcoin miners, on the other hand, face the significant challenge of maneuvering through complex, multi-layered regulatory frameworks, amplifying the need for regulatory clarity. Nonetheless, due to the challenges of keeping up with the swift pace of technological advancements and bureaucratic competition, policy coherence—the alignment of policies and regulations across diverse departments and agencies [

68]—in the digital asset arena is low.

One governance theme revolves around incorporating renewable energy into Bitcoin mining [

28,

31,

34]. Given the widespread concern about Bitcoin mining’s environmental impact [

8], identifying effective strategies and incentives to expedite the transition to renewable energy sources becomes paramount. Carbon offsetting is progressively emerging as a pivotal topic within sustainable Bitcoin mining discussions [

69]. Institutional involvement in Bitcoin, from entities like BlackRock and Fidelity Investments, is growing despite the environmental risks posed by Bitcoin mining, which have been a barrier due to ESG mandates. While these institutions are seeking approval for Bitcoin ETFs in the US, indicating a rising interest in Bitcoin as an asset class, concerns about its environmental impact persist. A possible solution involves developing policies or market mechanisms that encourage miners to use verified clean energy sources. The success of Energy Attribute Certificate markets in supporting renewable energy financing and validating clean energy use claims might offer a model to incentivize sustainable practices in Bitcoin mining, enhancing its appeal to institutional investors without sacrificing Bitcoin’s intrinsic qualities.

An additional dimension needing exploration pertains to the ongoing debate concerning Bitcoin’s classification as a commodity versus a security. Regulatory frameworks and policies significantly pivot upon this classification, influencing various aspects of Bitcoin mining, from operational prerequisites to financial reporting and compliance mandates. Thus, exploring the implications of these classifications becomes crucial for both miners and policymakers.

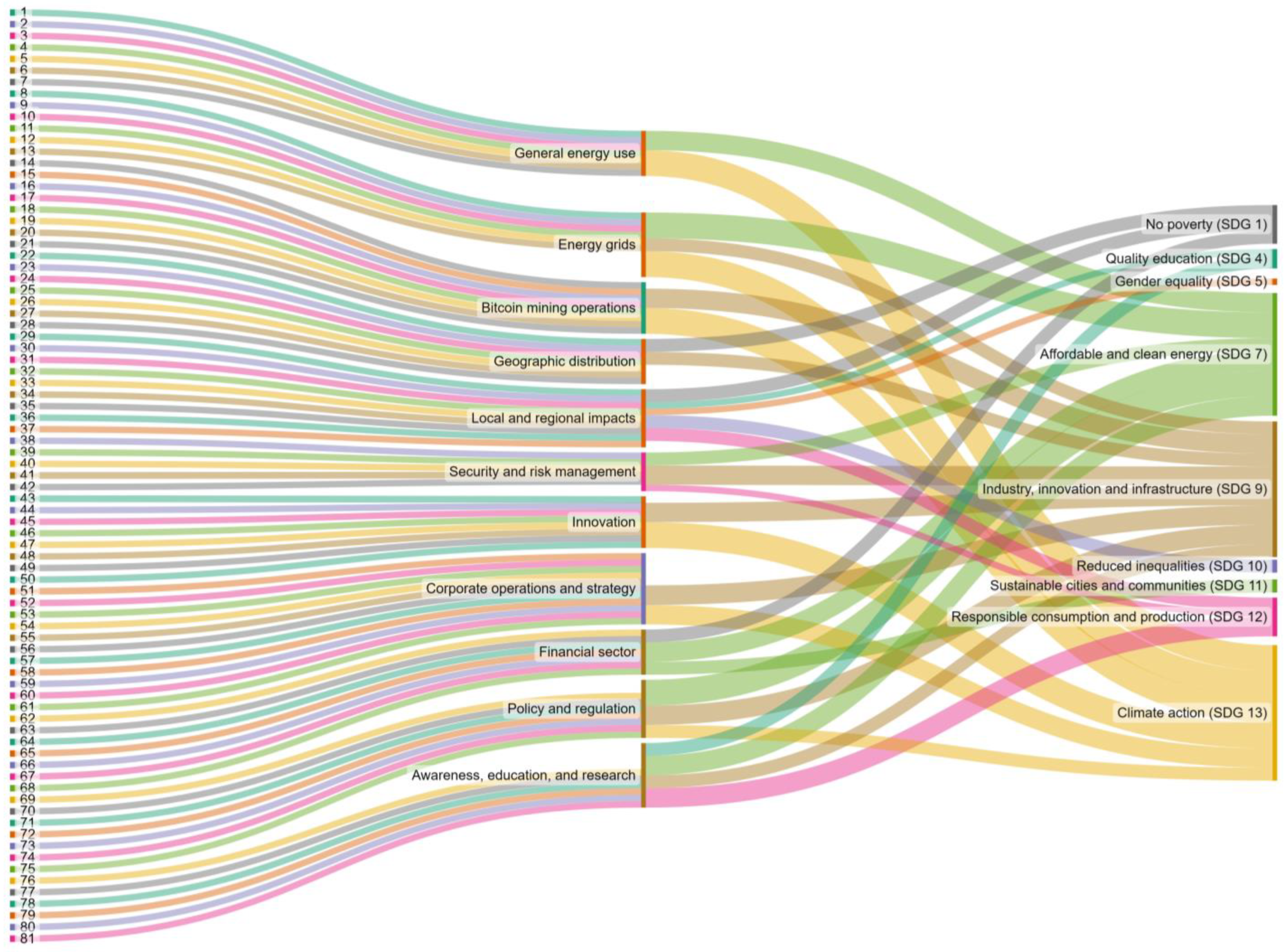

Examining broader implications, such as aligning Bitcoin mining with Sustainable Development Goals (SDGs) [

70], also demands attention. Gaining an understanding of the potential economic, social, and environmental repercussions of intertwining Bitcoin with SDGs is vital to augmenting Bitcoin mining’s visibility and traction among key policy agencies and organizations that influence the international energy and environmental research agenda.

3.11. Bitcoin Awareness, Education, and Research

Understanding the Bitcoin mining industry demands a focus on collaboration, innovation, and responsibility, all of which are highlighted by the research questions in

Table 15. Research on the educational sector itself may help to develop impactful formal training programs for high schools, technical colleges, and undergraduate and graduate university programs. Research on the dynamics of knowledge mobilization across the science-policy interface [

71,

72] will be needed if Bitcoin is to provide policymakers with the kind of information they need. Such research may need to consider factors such as policy windows, advocacy coalitions, and other methodologies that assess knowledge mobilization pathways in academic and policy networks [

73,

74,

75,

76].

Undertaking research on the perceptions of members of the public [

77] and government agencies regarding Bitcoin mining’s energy use is needed. It is possible to prioritize research needs among industry, academic, and government stakeholders [

78]. This would not only inform policymakers about the likely support or opposition to particular mining developments or regulatory initiatives but may help pro-actively build awareness about how best to foster responsible Bitcoin mining practices.

In the context of education, there is a need for training at both technical and university levels. Bitcoin mining requires network engineers, electrical technicians, data center construction specialists, and infrastructure systems professionals. A unique dynamic of Bitcoin mining is its ability to create technical and mechanical jobs for those without advanced degrees. This strongly distinguishes Bitcoin’s PoW mechanism from Proof-of-Stake cryptocurrencies, which rely on staking rewards that largely accrue to token holders. Initiatives, such as Bitcoin mining engineering fellowships for high school graduates in some urban areas, offer technical training and access to jobs for those typically without access to higher education. Research on the design and effectiveness of such programs could help document and optimize impacts on disadvantaged communities.

Within higher education, new initiatives are being developed to educate students about Bitcoin mining and adoption, but these are currently isolated, and there is a clear need for more advancements in Bitcoin-oriented educational opportunities for both students and faculty. In situations where there is insufficient demand for Bitcoin courses within individual institutions, online programs that could be used for specialty teaching may be possible. For example, the Saylor Academy offers a variety of undergraduate courses with strong Bitcoin relevance, as well as professional development courses explicitly focused on Bitcoin. Other options for university training support might include independent study options facilitated by industry groups, thus allowing MSc-level students to gain direct experience through independent Bitcoin study and research projects.

Cross-cutting research is vital for building understanding about Bitcoin mining impacts: the industry’s complexity requires cooperation that transcends traditional academic boundaries [

13]. There is a clear need for transdisciplinary research [

79,

80] that is problem-focused and involves sustained interaction and mutual learning among researchers, miners, and policymakers. Such transdisciplinary collaboration takes time and funding, allowing participants from disparate backgrounds and epistemic communities to learn the language of other sectors and disciplines prior to being able to fully participate in synthesizing concepts and methodologies [

81,

82]. Direct researcher and industry engagement with policymakers may also increase the likelihood that relevant research is later recognized and utilized in policy and regulatory decisions.

3.12. Outside-the-Box Research Questions

Beyond the 81 candidate questions, we used the AI to generate 212 speculative questions about Bitcoin mining and energy grid transitions in a zero-emission global economy. Recall that for research needs presented above, we focused GPT-4 on identifying only threats and opportunities identified within transcriptions. It is also possible to widen the focus of the AI-assisted question-generation process. We additionally asked GPT-4 to, in two steps, draw on its general knowledge and anticipate other Bitcoin mining questions that may not have made our current list but that might become important over the next several years and to speculate about emerging Bitcoin-oriented possibilities that, “if successful, could have a massive impact on Bitcoin and the transition to a zero carbon emissions global economy?”.

Table 16 presents nine notable questions that our AI identified. These explore both existing and emerging technologies, speculating on their importance in the next decade. While some of these questions build upon existing technologies, others concentrate on newly emerging trends, with the AI speculating about their growing significance over the coming decade.