Abstract

While blockchain and distributed ledger technology offer immense potential for applications in transparency, security, efficiency, censorship resistance, and more, they have been criticized due to the energy-intensive nature of the proof of work consensus algorithm, particularly in the context of Bitcoin mining. We systematically explore the state-of-the-art regarding the relationship between Bitcoin mining and grid decarbonization. We specifically focus on the role of flexible load response through proof of work mining as a potential contributor to renewable energy penetration and net decarbonization of the energy grid. The existing literature has not comprehensively examined this area, leading to conflicting views. We address the gap, analyzing the capabilities and limitations of Bitcoin mining in providing flexible load response services. Our findings show that renewable-based mining could potentially drive a net-decarbonizing effect on energy grids, although key adaptations in mining practices are needed to fully realize this potential. Overall, the paper suggests a re-evaluation of the environmental impact of Bitcoin mining, highlighting its potential role as a facilitator for renewable energy expansion, and decarbonization more broadly.

1. Introduction

The energy consumption of the Bitcoin blockchain has raised concerns about its greenhouse gas (GHG) emissions and “social license to operate” [1,2,3,4,5]. In turn, this has sparked debate. While advocates argue that a higher energy consumption is associated with enhanced protocol security [3], critics express concern over the significant carbon footprint, and a fear that it may grow further with additional Bitcoin adoption.

Nevertheless, Bitcoin (BTC) proponents make a series of claims in defense of the protocol, arguing that not only is its carbon footprint overestimated, but furthermore that the cryptocurrency could provide an environmental service through flexible load response capabilities and methane onsite neutralization [6,7]. This could support renewable energy (RE) profitability and penetration, as well as decrease Bitcoin’s carbon footprint, and could theoretically result in net decarbonizing additions of load.

Previous studies estimating Bitcoin’s carbon footprint have been limited and debated, often lacking scientific rigor, while few have explored its potential synergy with flexible load response or methane reduction [6,7]. This paper aims to fill this gap by systematically reviewing the characteristics of Bitcoin mining and the renewable energy sector, potential complementarities, and limitations.

Our contribution consists of a comprehensive literature review leading to an assessment of the state of the art in the field. Relevant databases (Google Scholar, IEEE Xplore, ScienceDirect, and JSTOR) were searched using related keywords from 2009 to June 2023. Due to the emergent nature of the field and the novelty of this particular area of study, as well as due to the fact that this article largely deals with industry nuances, a large amount of grey literature was also consulted, including industry reports and online divulgation articles (this is acknowledged in the Supplementary Material).

For both scientific and grey literature, our research unfolded in four stages. We initiated a keyword-driven literature search, then cross-referenced our bibliography with cited articles until nearing theoretical saturation, resulting in a large database of works. Next, we extracted and classified data from the screened studies based on relevance. Finally, we analyzed and thematically categorized the articles, critically assessing their respective contributions to the themes at issue.

We provide an overview of Bitcoin’s environmental impact, discuss challenges in the renewable energy market, identify unique characteristics of Bitcoin mining relevant to decarbonization, and explore potential applications within the renewable energy sector. Additionally, we evaluate the positive effects of green Bitcoin mining, consider its limitations and challenges, and compare Bitcoin mining to alternative ancillary service providers. To do this, we begin by providing necessary background and context to the topic. We then engage with various literary works to build a comprehensive view of this impact. The paper also delves into the complex relationship between variable renewable energy (VRE) and Bitcoin mining, focusing on the business models that enable this partnership.

One of the main angles we explore is the potential positive effects that green Bitcoin mining might have in the push for decarbonization. Despite these potential benefits, we recognize and critically assess the limitations and challenges posed by this approach, especially when it comes to competition with other flexible load resources.

To support our findings and arguments, we survey the landscape of empirical evidence currently available in this field. A discussion of our findings follows, laying the foundation for our conclusion. The conclusion not only provides a summary of our research but also suggests possible directions for future work in this domain.

This approach is designed to bridge a gap in the articulation and communication of credible evidence pertaining to Bitcoin’s energy use and environmental impact. In a context of growing criticism, but also adoption, of a technology with potential that is transformational for issues such as political repression safeguarding and poverty reduction, filling this gap is crucial [8]. In addition, divergent perspectives on the matter further strengthen the need for evidence that is not only reliable but also balanced and systematically examined, encapsulating the myriad nuances in the landscape of this field. Rudd [8] outlines a hundred significant questions in this landscape. This paper endeavors to tackle several of these, including elucidating the larger perspective on Bitcoin’s energy usage, and Bitcoin’s potential applications for methane mitigation and electricity grid transition, aiming to contribute to a comprehensive research agenda’s fulfillment.

2. Background and Context

In the context of international advocacy for limiting global temperature increases to 1.5 °C [9], the primary environmental concern surrounding Bitcoin is its high energy consumption, even raised to Satoshi Nakamoto in 2010 (https://bitcointalk.org/index.php?topic=721.msg8114#msg8114, accessed on 2 May 2023). This issue has contributed to slower Bitcoin market penetration and even increased price volatility, becoming a central focus in academic research [7].

Bitcoin’s energy-intensive “mining” process is a key contributor to its energy consumption. In this process, some network nodes, known as “miners”, compete to add a block of transactions to the shared ledger. They do this by finding a specific number or “nonce” that, when hashed with the block data and the hash of the previous block, meets network-defined conditions. This requires millions of hash attempts per second, which is energy-intensive (costly) by design, and it is this difficulty in generating a valid output that constitutes a “proof of work” and contributes to the security of the network. In compensation, the successful miner is rewarded with transaction fees and a newly created block subsidy. This results in a framework of incentives that bolsters network security, as miners are encouraged to afford energy costs that make fraudulent blockchain alterations prohibitively difficult.

Bitcoin mining occurs globally, with miners seeking cost-effective locations offering the cheapest energy sources [2,10,11,12,13,14]. However, some of these sources are carbon-intensive, raising environmental concerns. Mining practices in countries such as Iran, Kazakhstan, parts of China, Venezuela, and the retrofitting of natural gas power plants for mining in the US and Canada exemplify this issue [2,3,6,13,15]. When green energy sources are employed, the criticism often centers on the argument that mining diminishes green energy availability for other uses.

However, while some mining relies on carbon-intensive energy sources, the extent of this reliance is debated. China’s and Kazakhstan’s cryptocurrency bans have furthermore shifted the landscape, consolidating the pre-existing trend to mine Bitcoin in the United States (US) and potentially influencing the industry’s carbon footprint [2,3,12].

3. Bitcoin’s Environmental Impact

Bitcoin’s energy consumption and Scope 2 carbon intensity are undeniably high compared to other systems, e.g., proof of stake (PoS) [4,5,16,17,18,19]. However, there is disagreement regarding the most suitable data sources, metrics, and projections to account for this.

Estimates of the magnitude of Bitcoin’s energy consumption and carbon footprint vary widely. The White House Office of Science and Technology Policy [16] suggests that the former ranges between 72 and 185 billion kWh per year. This is because the exact hardware used and the carbon intensity of its energy sources are hard to ascertain. On the first front, one may resort to a “top-down” approach, estimating the share of miners’ revenue spent on electricity, or a “bottom-up” approach, which estimates energy consumption based on the hash rate. The latter method is usually preferred [20,21]. On the second front, one may calculate carbon intensity based on the grid mix corresponding to mining pools’ IP addresses, or based on first-hand data from the miners. The first method overlooks behind-the-meter (BTM), RE-based mining, and the second is vulnerable to the limitations due to self-reporting and inconsistency of accounting methods.

Bitcoin’s environmental impact has been portrayed in comparison to countries (Netherlands, Ireland, Argentina) [16] and to industries (steel, aluminum, gold, banking, Christmas lights, aviation, tumble dryers, and even the global monetary system) [2,3,14]. The former is usually preferred by critics, as it gives a sense of the scale of Bitcoin energy consumption. In contrast, the latter is usually preferred by advocates, who highlight that many industries surpass individual countries in energy consumption and this is not usually seen as a problem.

In addition, different denominators are used to depict Bitcoin’s share of a global magnitude. Against a share of global electricity consumption [2], some argue for a metric of global energy consumption, to avoid obscuring conversion efficiencies between different energy sources in a context where Bitcoin uses an energy mix different from the grid average [2,3,12]. For the same reason, denominators of global CO2 and GHG emissions are proposed [12,16], also considering that climate change is a function of the latter, not the former.

Various denominators are used to contrast carbon emissions and energy consumption with the return on value. This has led to the introduction of measuring energy consumption “per transaction”, known as “transaction accounting”. However, as Table 1 illustrates, alternatives to transaction accounting have also been developed.

For carbon accounting in particular, alternatives to transaction accounting include origin accounting (a genealogical analysis of the historically necessary carbon emissions to produce each block), maintenance accounting (attributing carbon footprint to the holding of a coin, as demand for the coin incentivizes mining), and hybrid accounting (a combination of transaction accounting, applied to emissions from the pursuit of transaction fees, and maintenance accounting, applied to emissions from the pursuit of block rewards) [22,23,24].

There is also a divide between marginal accounting and attributional accounting, with the usage of each often implicitly entailing the usage of different theories of causality to Bitcoin’s impact on the energy grid and the environment [22,25]. Marginal accounting matches before-and-after energy consumption with before-and-after carbon emissions, respectively. It succeeds at assigning additional energy consumption of the latest consumer to the additional carbon emissions subsequent to the addition of the new demand source, but may illegitimately prioritize older energy consumers over younger ones, leading to problematic conclusions in the long term, as well as failing to preserve compositionality [22]. Attributional accounting, in turn, takes the totality of a grid’s (or group’s) emissions and attributes it to all its members based on some criterion—average emissions, purchase of Energy Attribute Certificates or others—thus preserving compositionality but failing to provide a before-and-after perspective.

Table 1.

Various alternatives for denominators to illustrate the magnitude of Bitcoin’s energy consumption or carbon emissions, with corresponding criticisms.

Table 1.

Various alternatives for denominators to illustrate the magnitude of Bitcoin’s energy consumption or carbon emissions, with corresponding criticisms.

| Approach | Description | Limitations |

|---|---|---|

| Per-transaction basis | “Taking all the emissions (or electricity consumption) in a given time frame and dividing them by the number of transactions in the period, to arrive at a carbon (or electricity consumption) per transaction metric” [22]. A variant of this considers the entire history of past transactions as secured with every new mining event, and not just the coinage of the latest coin. | Usually overlooks L2 transactions, overlooks that Bitcoin demand for transactions is a minor contributor to mining incentives, and thus is incorrectly used to imply that Bitcoin’s throughput can only grow at the cost of more energy consumption [5,16,22,26]. |

| Per-dollar or per-coin settled basis | Considering that L2 solutions allow scaling without increasing energy usage, it focuses on value delivered per kWh [5]. | May incorrectly suggest that additional trading leads to a lower environmental impact. |

| Per-dollar or per-coin mined basis | A novel short-run perspective assuming an “origin accounting” methodology [10]. | Neglects Bitcoin’s decreasing emission rate and presents impractical long-term implications, such as assuming that when the last Bitcoin is mined, Bitcoin’s emissions will be infinite, as well as that approximately 90% of Bitcoin’s climate damages have already occurred and the rest will be spread over an increasingly carbon-neutral energy grid. |

Whichever theory of causality is preferred, it is crucial to apply it consistently. Claims that the introduction of miners in a grid leads to high marginal emissions are inconsistent with worldwide figures of the carbon footprint of the Bitcoin network based on attributional accounting. Similarly, if it is not legitimate for a miner to claim the average grid mix if there is a market for Energy Attribute Certificates and none have been purchased (a frequent scenario when the grid mix is highly renewable), it is not legitimate for journal articles, press, and activists to take mining pools’ IP addresses and assign to them the average emissions of the corresponding area.

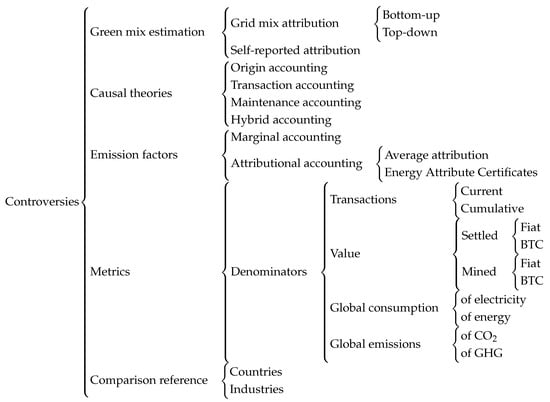

The multiplicity of ways of looking at Bitcoin’s environmental impact (see Figure 1) should always be considered, as the choice of any given methodology might significantly impact the reader’s conclusions. The upcoming introduction of carbon accounting requirements [27] may provide additional insight into these debates.

Figure 1.

Different approaches to ascertaining the environmental impact of Bitcoin mining.

In addition, Bitcoin critics express concern about the potentially increasing energy requirements as Bitcoin becomes more mainstream. In short, if the demand for Bitcoin (for hoarding or for transaction settlement) increases, its price rises together with the incentive to mine. On the other hand, advocates argue that Bitcoin leads to a higher standard of living, which in turn may result in lower emissions through the environmental Kuznets curve [3,16]. They also highlight the effect of halvings in their projections [2,3,12], which will reduce the incentive to mine. This, together with the bans in carbon-intensive countries and the expectation of efficiency gains in mining hardware is used to argue that mining emissions will peak at 1% of global emissions at worst [3]. However, one should note that Bitcoin’s peak as a share of global emissions may proceed Bitcoin’s peak in terms of absolute energy consumption, especially if the latter peaks before the global electrification rates.

The reader should note that debates on Bitcoin’s environmental impact are not confined to GHG emissions but also encompass issues such as e-waste [28,29,30,31] and noise pollution [16]. Moreover, much of the discussion hinges on the broader controversy regarding whether Bitcoin possesses intrinsic value [1]. This article does not exhaust these other environmental matters fully. Moreover, the reader should note that a host of wider issues, potentially of even greater significance than energy consumption, challenge the adoption and integration of Bitcoin. These include regulatory hurdles and the inherent market volatility associated with Bitcoin, both of which further complicate the discourse. While these matters are acknowledged, they remain outside the scope of this article.

4. Bitcoin Mining and RE

4.1. Limitations of RE

The adoption of RE sources on a wide scale is faced with two major challenges: profitability and intermittency. Historically, generating RE has not been cost-effective for mass adoption by producers. Despite the cost efficiency of RE generation improving over time, profitability remains a challenge that often necessitates governmental subsidies [3,32,33].

Inherent intermittency and an inability to follow load on-demand present significant challenges for VRE generation [2,3]. The duck curve is a notable manifestation of these issues, where daylight VRE production does not align with peak energy demand in the evening [2]. These problems are exacerbated by factors such as transmission constraints and extreme weather events, leading to imbalances (in a broad sense, as obviously grid operators seek to prevent imbalances in a narrow sense, but socializing the costs of this [34]), negative pricing, or curtailment at high levels of VRE penetration [7,12,15,33,34,35,36]. As electricity is a unique good that must be consumed almost immediately after production [30], discrepancies between fluctuating VRE sources and variable demand pose threats to grid resiliency, often necessitating the limitation of VRE contributions and reliance on non-renewable sources for peak load [30], and posing significant obstacles to decarbonization efforts. Some partial solutions to these issues are discussed in Table 2.

Table 2.

An overview of some of the main strategies to counter problems of imbalance spurred by VRE.

Curtailment and negative prices threaten the financial sustainability of RE projects. This is exacerbated by other issues such as solar value deflation, delays in the construction of RE generation facilities, transmission investment costs and transmission losses due to their remote locations [3,30,46], technical and regulatory connection queues [46], and spot price volatility in energy markets [46].

4.2. Distinctive Characteristics of Proof of Work (PoW) Mining

In this context, PoW mining emerges as an alternative that can provide additional income and ancillary services (auxiliary services designed to provide stability to the energy grid), including reactive power and voltage control, frequency control, scheduling and dispatch of contingency energy supply reserves, flexibility energy supply reserves for outages, and flexible energy demand load [30,47]: “power-to-Bitcoin”. This is due to a series of unique characteristics that set Bitcoin miners apart as energy buyers, which are discussed in Table 3 and Table 4.

Table 3.

Unique characteristics of Bitcoin mining.

Table 4.

Salient characteristics of Bitcoin mining identified.

4.3. Applications

Due to the unique characteristics discussed in Section 4.2, Bitcoin mining can offer various services to the energy sector, including ancillary services, consumption of stranded resources, prevention of gas flaring, and provision of additional funding.

For VRE such as wind and solar energy, flexible load response, Bitcoin mining can act as a flexible load response providing shock-absorbing ancillary services, increasing profitability by offering an alternative to selling energy at extremely low prices during periods of excess supply [2,50]. This is typically performed on-grid but BTM (next to generation), which does not require additional transport infrastructure. There is literature showing that VRE-mining cogeneration systems significantly increase profitability [13,42].

In addition, Bitcoin mining can provide services in the form of waste gas recovery. Landfill gas and stranded natural gas are two significant sources of methane emissions (and of other volatile organic compounds) to the atmosphere, either through venting or flaring (which produces mainly methane due to inefficient combustion and strong winds) [1,2,3,12,17,54,55,56,57]. Containerized mining and generator solutions transform these GHGs into carbon dioxide, which, considering methane’s higher global warming potential (GWP) than CO2 [58], not only provides an additional income stream for energy companies (and helps avoid flaring penalties), but also reduces the carbon footprint through a load addition that does not take from the overall energy supply [1,2,3,6,12,16,17,30,33,54,55,56,57,59]. While, theoretically, an additional source of income may prevent a drilling site from shutting down or stimulates additional hydrocarbon exploration, empirically a significant reduction in GHG emissions has been observed, which has led to endorsement of this business model by the US Office of Science and Technology Policy, and even claims that from flare mining are already negative [2,16,57]. Often conducted off-grid, this mining method is noted for its high uptime but shorter time horizon. One should note that the amount of natural gas that is flared at present exceeds the requirements of the entire Bitcoin network [2,57].

Nuclear energy shares more similarities with oil and gas than with renewable energy in terms of supply patterns, yet adjustments to match demand are technically and economically challenging, due to reactor cooling costs and reactor efficiency affecting the variable cost of selling nuclear energy [60]. Hence, negative prices may also emerge, and flexible load response, can potentially offer a path to sustainability [61,62].

Other applications of Bitcoin mining in the renewable energy sector are also significant. BTM hydroelectric mining, for example, is a primary renewable energy source for miners and is particularly effective with curtailed hydroelectric power in areas with excess hydro capacity [1,3,63]. It usually follows a high uptime model with modern ASIC sets. Biogas and geothermal sources are also employed, offering environmental benefits and solving energy transportation problems respectively, albeit with their own challenges [64,65].

The intense competition within the Bitcoin mining sector fosters rapid innovation [12,15]. This competition boosts the development of energy-efficient chips, potentially surpassing Koomey’s Law, and facilitates global energy price arbitrage [15].

4.4. Business Models

Bitcoin mining offers potential growth opportunities at the intersection of the energy and cryptocurrency industries. Figure 2 and Table 5 explore various business models that utilize these synergies between the two sectors.

Figure 2.

A typology of low-carbon mining models per defining factor.

Table 5.

Business models for low-carbon mining models.

5. Potential Impact of Mining

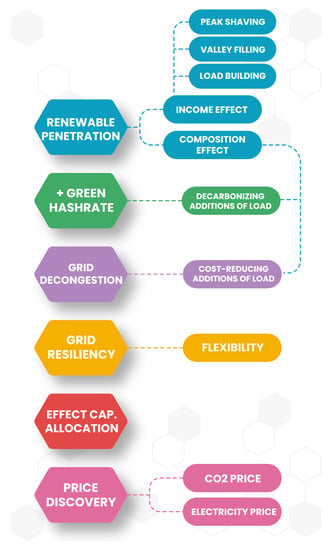

The influence of mining on RE generation and energy grid management is visible [3,12,30,56,57,59] but not yet large enough to significantly affect the global RE sector. However, should the adoption of PoW mining intensify, this scale could change (see Figure 3).

Figure 3.

Possible upsides of Bitcoin mining for decarbonization goals.

An increase in PoW mining could potentially favor renewable sources in grid mixes, thereby driving decarbonization. This effect could be attributed to the income effect, where Bitcoin mining incentivizes renewable capacity expansion by buying excess energy and offering an additional income source of first and last resort for VRE [35]. Through peak-shaving, valley-filling, and load-building [67], mining may be beneficial to demand-side energy grid management.

In addition, mining could introduce a composition effect, whereby low-carbon energy sources are made relatively more profitable than high-carbon ones, displacing them on the margin. This could potentially lead to the holy grail of net-decarbonizing additions of load. These additions might even be cost-reducing if upward pressure on prices due to increased demand is more than counterbalanced by increased renewable supply resulting from a surge in profitability.

On the issue of grid congestion, which introduces significant management costs at present [34], the portability and scalability of mining means that miners can be strategically located behind congested transmission nodes. This may help in de-risking renewable buildout and consequently contribute to the reduction of carbon emissions.

Transmission decongestion also contributes to improved grid resiliency and reliability, i.e., the ability (of vital geopolitical importance) to adapt to rapid fluctuations or disruptions in supply, demand or transition capacity. A larger set of controllable load resources allows for improved reaction to black swan events. Indeed, co-locating mining facilities with inflexible plants that produce stable loads effectively increases plant flexibility without altering generation practices [33,35,38,50]. This is particularly valuable as grid resiliency is lower when renewable penetration is high [34].

One should note that a decarbonizing effect may happen not only when existing miners switch from from grid-connected sources to curtailed energy, but also if new green miners enter the market using RE. This is because new miners increase the global hashrate, which decreases the profitability of all other miners, penalizing them and pushing them out on the margin. This effect is due to the unique global zero-sum nature of the Bitcoin mining game.

Finally, mining holds potential to mitigate entrepreneurial and government errors that typically arise from RE government promotion schemes such as subsidies and quotas. These issues include interference with market signals, “picking winners and losers”, capital misallocation, and the hindering of “creative destruction” [68]. As a market-based mechanism that can subsidize RE, mining can alleviate these issues while preserving price signals and enabling economic calculation. An example of this would be miners capitalizing on overbuilt hydroelectric capacity, contributing to the discovery of a global market price for carbon. As Bitcoin acts as a predator of energy, it may drive the discovery of the real value of electricity and potentially contribute to finding a global market price for carbon, a long-sought environmental objective.

6. Challenging Trends

Achieving decarbonization through PoW mining is a complex process faced with multiple interconnected challenges. For starters, Bitcoin miners grapple with the volatility of Bitcoin prices in the short-term [30,59] and long-term [36], as well as in the production volume [30]. Emerging hedging instruments such as difficulty derivatives and hash-rate tokens offer potential solutions to these volatilities, but the constantly low profit margins owing to suppressed Bitcoin prices and unexpected hashrate increases remain a significant issue [30].

Additionally complicating matters, the mining process itself is not insulated from broader industry and market trends. Supply chain disruptions and the concentrated ASIC production market, exacerbated by semiconductor shortages, are challenges that extend beyond mining but have direct, tangible impacts on it [2]. These circumstances constrain new mining capacity and hinder large-scale demand-response initiatives [30].

This broader view of the industry also brings into focus the need for further research into the relationship between high-uptime waste (landfill, stranded, flare) gas mining and low-uptime VRE mining. Both industry niches may resort to “outdated” ASICs that new market entries displace, meaning that they could be competitors of one another and an increase in the profitability of one could harm the other. This interaction has not been thoroughly researched to date.

Beyond the immediate challenges tied to market forces and technological capabilities, PoW mining also contends with external factors such as regulatory and social acceptance. The scale of PoW mining could face significant reduction if it loses its “social license to operate” due to regulatory intervention or public backlash [3,16,30]. The regulatory environment is unpredictable, with harsh interventions being considered or applied in some jurisdictions, adding another layer of risk to an already challenging situation [6,30]. In this context, it is important to consider fossil energy subsidies as part of the regulatory environment, as these subsidies can artificially undercut the ability of RE sources to sustain mining activity.

The interplay between mining and the broader energy ecosystem adds another dimension to these challenges. While mining can theoretically drive renewable energy development, it also demands additional conventional energy, which can theoretically lead to an increase in GHG emissions instead of a decrease [16,17]. Individual instances of power plants operating on natural gas being maintained or re-ignited for Bitcoin mining purposes highlight this contradiction [1,6]. Similarly, there are criticisms of front-of-the-meter mining using existing renewable capacity, potentially displacing other consumers towards fossil energy.

Finally, one should consider that with the growth of electrification and the maturation of the global quest for decarbonization, the RE landscape could shift. Interconnection queues may eventually clear, meaning that miners would need to seek other energy sources. In a similar fashion, a more electrified world may mean that Bitcoin as a whole is too small to have a serious impact on climate change in one way or another, e.g., if Bitcoin’s electricity consumption peaks at only 1% of global electricity, it may neither significantly impede global decarbonization nor notably exacerbate climate change. This point reflects the complexity and interdependence of the challenges presented and emphasizes the need for a multi-faceted approach to decarbonizing PoW mining.

7. Challenger Technologies: Alternative Load Resources

Velicky argues that “short-term electricity overproduction can be partly mitigated by conversion to potential energy (hydropumped storage), chemical energy (batteries, hydrogen generation), or heat (aluminum smelters)” [14]. Indeed, Bitcoin is not the only technology that can deal with excess energy. Various technologies can act as flexible, interruptible, portable, and potentially nonrival sources of energy load, supplementing grid decarbonization alongside it. Each of these technologies comes with unique characteristics, strengths, and limitations. In Table 6, we present a summary of these alternative load resources along with their potential for decarbonization and inherent limitations.

Table 6.

Alternative load resources and their potential for decarbonization and limitations.

The array of technologies examined are not mere competitors of mining, but each possesses potential to supplement Bitcoin mining in the process of grid decarbonization. Distinct attributes such as portability, cost, risk, and flexibility create a spectrum of advantages and disadvantages across these technologies. These differences suggest potential for complementarity under diverse circumstances. Notably, the economic viability of electrolysis hinges predominantly on the market price of hydrogen, whereas the profitability of mining relies on an array of factors including Bitcoin price, difficulty of mining, hashrate, and capital expenditure [15]. This positions each technology to be optimally suited for distinct operational scenarios. Mellerud, for instance, argues that green hydrogen is particularly appropriate for providing “seasonal demand flexibility”, whereas Bitcoin mining is proficient at “balancing unpredictable fast changes” [30] (p. 9).

Similarly, the energy consumption profiles of batteries differ from those of Bitcoin miners. Batteries necessitate energy input for shorter durations, while Bitcoin miners may require more extended operational periods. Conversely, batteries have the capability to provide power for limited time spans, while Bitcoin miners can, in theory, remain inactive indefinitely. This differentiation suggests that batteries might be more appropriate for specific applications (e.g., on-site backup power), while Bitcoin mining could be more suitable for alternative uses (e.g., managing sustained excess RE over multiple days).

8. Empirical Support for Synergies between Bitcoin and RE

In the rapidly evolving landscape of RE and cryptocurrency mining, the exploration of their mutual interdependencies is still nascent. However, an emergent body of literature suggests the plausibility of a decarbonizing effect driven by these synergies [3,38,70,71,72], caused by increased profitability of VRE in the presence of Bitcoin mining [70,73,74,75,76].

Supporting this, simulations conducted by Lancium and IdeaSmiths posit that the introduction of highly flexible data centers, such as those used for Bitcoin mining, can reduce CO2 emissions in grids oversaturated with wind power. This is achieved by decreasing reliance on natural gas for energy intermittency [47]. Rather than bolstering natural gas generation during periods of stress, market dynamics may instead reduce the load, facilitating a net reduction in carbon emissions through near-zero carbon energy.

Adding weight to this hypothesis, Nikzad and Mehregan have estimated a significant 77.7% reduction in atmospheric GHG emissions via the development of cogeneration projects that pair solar plants with cryptocurrency mining facilities [13]. Moreover, additional research indicates a causal association between clean energy and emission allowances with Bitcoin, both in terms of volume and price, with a negative correlation observed with carbon emissions and energy prices [7,38,77].

In practice, there have been instances where hashrate has been significantly reduced to maintain grid resilience during periods of heightened demand such as winter storms [12,71,78]. Individual cases of miners facilitating the operation of gas desulfurization equipment for the remediation of ash landfills from previous coal mining activities also exist [1,6]. This remediation activity, although context-specific, further illustrates the possible beneficial interaction between these two seemingly unrelated sectors.

This apparent trend towards symbiosis is further demonstrated by the actions of some miners who purchase renewable energy certificates. Despite inherent limitations, the purchase of renewable energy certificates provides tangible benefits to the RE sector.

Complementarily, Eid et al. found that although batteries offer a lower ROI compared to Bitcoin mining, the combined operation of both activities yields a superior alternative in terms of profitability and battery “state of charge” optimization [42]. This aligns with Frumkin’s assertion that batteries, similarly to non-intermittent secondary energy sources, facilitate increased uptime which can offset mining capital expenditure. This capability becomes especially valuable in an increasingly electrified world, where surplus energy acquires additional usefulness [2,36].

Consequently, Öysti posits that in the absence of Bitcoin mining, renewables could fulfill only 40 percent of grid demand. However, a concerted use of Bitcoin mining, batteries, and solar energy could potentially cater to 99 percent of the grid’s needs [2] (p. 40). This perspective aligns with the International Energy Agency’s projection that batteries and demand response will become primary sources of flexibility, meeting four times the amount of hour-to-hour flexibility needs [79] (p. 177).

9. Discussion and Critical Analysis

9.1. Intermittency, Profitability and Increasing Fierceness of Competition

While acknowledging the energy-intensive nature of Bitcoin, naively using metrics that compare industries to countries, and framing Bitcoin’s energy consumption as solely wasteful, might overlook potential benefits, especially in terms of stimulating RE buildout. We have identified evidence suggesting that Bitcoin mining is attracted to inexpensive, often renewable, energy sources, providing an additional revenue source which could help drive VRE expansion and support a transition to a greener grid [2,3,25], in addition to increasingly greener grids leading to a lower-carbon Bitcoin network on their own [3,12].

This is not without challenges. The intermittent nature of VRE entails financial difficulties, as reduced uptime implies a longer period to recover CAPEX, even with occasional negative energy prices [36]. In fact, in scenarios of low energy prices, selling electricity to miners might not significantly improve a VRE project’s profitability. Under risk aversion, these concerns are potentially exacerbated by the volatility of Bitcoin’s price, which can amplify perceived risk, and surges in new mining rig efficiency, which may make the flexible mining model unprofitable.

However, there are reasons to suggest these are not unsurmountable obstacles. First, vertical integration may lead to maximum internalization of the benefits of cheap energy prices. Second, miners can rely on secondary, more expensive energy sources for underclocking when VRE is not available to reach a blended cost, resulting in a competitive levelized cost of electricity [36,41]. Third, older, less efficient, and cheaper ASICs have profitability profiles that ASICs depend on OPEX, being better suited for intermittent patterns. Fourth, there are non-intermittent mining methods that can contribute to decarbonization, such as flare mining (despite scalability barriers and higher CAPEX) and hydro mining (which addresses capital misallocation issues in an environmentally friendly manner, even though it faces growth limitations in the long term; [80]).

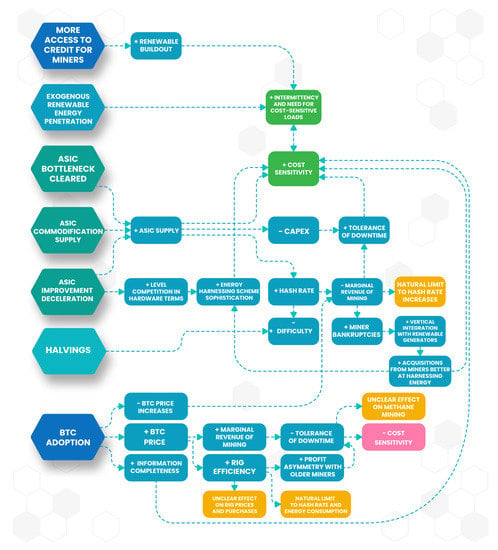

In addition, the characteristics of the Bitcoin mining market suggest a trend towards perfect competition in the years to come, which would imply a growing sensitivity to marginal cost, that may encourage VRE adoption for mining [2,3,12,36,41]. Influencing factors include rising mining difficulty [36], halvings [3], the end of a bottleneck in the ASIC supply chain that had coincided with a bull market, a bear market [41], mining equipment commodification driving CAPEX further down, with prices following production costs rather than Bitcoin prices, [2,12], slowing increases in rig efficiency as quantum limits are approached [2,12,41], increasing access to credit (see Aspen Creek Digital, https://acdigitalcorp.com/, accessed on 2 May 2023), limitations on Bitcoin’s price ability to continue increasing exponentially [30] (p. 61) and limitations on the ability to halve the cost of IT repeatedly. The convergence of these trends indicates an impending scenario where Bitcoin miners’ marginal cost aligns with their marginal income, incentivizing the use of economically viable RE sources [41] as only or mostly near-free, free, or negatively-priced energy sources may lead to economic profits (see Figure 4).

Figure 4.

Factors influencing Bitcoin mining’s cost-sensitivity, with additional cost-sensitivity entailing more suitability for an ancillary services provider role.

This should be considered in the context of an already highly competitive market for Bitcoin mining, characterized by entirely homogeneous output secured through strong property rights [3], that can be traded at near-zero transaction costs (e.g., through the Lightning Network), with an increasingly large number of buyers and sellers, non-increasing returns to scale (in fact, scale may have decreasing returns if fear of a 51% attack is triggered), few barriers to entry or exit, and near-perfect factor mobility [3,12,28]. Empirically, the Bitcoin network also seems to follow the Pareto Principle or 80/20 rule, in another indication that it approximates a perfect competition state [2,12]. Generally, the main differentiator between miners is the cost of energy. Increasingly, this includes the sophistication of PPAs and by mining-VRE co-location arrangements [41].

Note also that in a worst-case scenario where the profit gap between flexible, low-efficiency mining and continuous, high-efficiency mining becomes too wide due to an unexpected surge in the efficiency of new mining rigs, the flexible mining model might become unprofitable. However, such a surge in efficiency would also lead to a reduction in the overall energy consumption of the Bitcoin network, thereby mitigating associated environmental concerns.

9.2. Bitcoin’s Potential: A Balanced Perspective

Our exploration of the role of Bitcoin mining in grid decarbonization suggests a nuanced reality. Bitcoin mining has been the subject of intense scrutiny due to its high energy consumption, yet a growing body of evidence highlights potential benefits for decarbonization. Bitcoin mining has shown an increasing trend towards utilizing VRE sources, particularly driven by the allure of low and sometimes even negative energy prices [12]. Moreover, it holds potential as a flexible load in the energy system, with an ability to offer demand-response services, an essential feature for grid resilience as RE penetration increases.

However, a key requirement for this decarbonization scenario is that Bitcoin mining must evolve to operate without exacerbating peak demand, a characteristic not entirely realized today in all geographies [41]. The timeframe over which we assess Bitcoin’s impact significantly influences our interpretation, moreover. In the short term, Bitcoin’s energy consumption can appear daunting relative to current RE generation. Yet, projecting into the future, this picture might shift, and one may envision a Bitcoin network running mostly only on BTM intermittent RE sources. It is certainly reasonable to anticipate a more substantial proportion of RE in the energy mix and a plateauing of Bitcoin’s energy consumption [3,30].

However, uncertainties remain. It is challenging to offer hard assurances regarding decarbonization timelines or guarantee that all load additions will be carbon-neutral. These uncertainties, though, should be contextualized. Other industries are not subjected to such stringent standards and yet continue to contribute significantly to global carbon emissions. Furthermore, we should question the fairness of holding new load additions, similarly to Bitcoin mining, to higher standards than incumbent loads. The notion that new additions must be carbon-neutral is predicated on an incumbency-based theory of causality, implying older electricity consumers have a more legitimate claim to green electricity—a claim requiring further justification [22]. This is hard to sustain and, especially, hard to apply to all data centers consistently (let alone all industries).

It is also essential to acknowledge that, by increasing energy demand, mining provides additional revenue for RE producers. This is a windfall profit that is often overlooked in critical analyses. In conclusion, to ensure a balanced and fair discussion on Bitcoin’s “social license to operate”, Bitcoin mining’s requirements should be reasonably defined. A location-agnostic buyer of last resort that protects downside cases in financial models and purchases otherwise-curtailed energy should not be held to exclusively purchase VRE energy, provided it does not operate under peak demand and price conditions, thereby avoiding the risk of incentivizing fossil fuel capacity expansion.

There are reasons to view Bitcoin for decarbonization in a positive light: not only does it need minimal policy support to deploy, but also the advantages of Bitcoin mining (interruptibility, flexibility, portability, etc.) are intrinsic technical strengths, whereas challenges are mostly the result of economic factors and contingent technical circumstances [59]. On the other hand, Bitcoin may have particularities but it is not entirely special: there is a well-established roadmap for data centers operators seeking to contribute to a zero-carbon grid [81], and miners’ willingness to learn from this experience will necessarily be a part of their willingness to be flexible.

10. Limitations and Future Work

This paper has not considered in depth other environmental impacts that go beyond GHG emissions, notably the impact of Bitcoin mining in acidification, particulate emissions and smog formation, which have already been identified as areas for future research by others [6], but also e-waste and noise pollution.

This paper is furthermore not exhaustive of all the issues framing this discussion. For instance, an understanding of the explanation of Bitcoin mining, Bitcoin’s value and Bitcoin’s value proposition are assumed and outside of the scope of this paper. Similarly, the 1.5 degree goal is taken as a standard reference framing the climate change debate and not necessarily advocated for [82]. This article also makes some elementary assumptions that are plausible but nonetheless contingent, such as that in the short run PoW-based cryptocurrencies will not entirely cease to exist.

Finally, there are some obvious limitations that should also be taken into account. Most notably, research on (the environmental impact of) Bitcoin and especially on its impact on RE is both still embryonic and fast-paced, meaning that significant findings may emerge after the release of this paper.

Our research indicates that Bitcoin and other PoW blockchains might support RE adoption. However, the question of whether intermittent VRE-based operations can remain profitable in a competitive mining market remains [36,41]. This under-researched field presents various opportunities for future studies, including exploration of renewable-based mining business models, empirical profitability case studies, scalability analyses, identification of optimal geographic and regulatory contexts for mining, quantification of Bitcoin’s externalities and impact of mining intermittency and thermal cycling in silicon chip quality degradation.

In terms of policy implications, it is recommendable to undertake thorough carbon accounting projects in renewable-based Bitcoin mining and to investigate the impact of PoW-based cryptocurrencies on the renewable and non-renewable energy balance [7]. Regulatory interventions should be designed with caution to avoid driving miners to jurisdictions with fossil fuel subsidies, which could increase emissions. Future research should aim to inform these regulations to maximize the decarbonization potential of Bitcoin mining.

11. Conclusions

This research underscores the possible role of Bitcoin mining in promoting grid decarbonization. Despite its high energy consumption, the unique energy buying behavior of Bitcoin miners may contribute to net decarbonization as a flexible load resource. We acknowledge valid concerns about Bitcoin’s energy consumption and challenges to a future role for Bitcoin as a facilitator of RE expansion. However, considering Bitcoin’s technical characteristics, emerging trends towards RE penetration and more intense competition in the mining market, there is a plausible argument that these challenges may be overcome.

For Bitcoin mining to significantly support RE deployment, a willingness of Bitcoin loads to be flexible is needed. This is plausible but not necessarily guaranteed, indicating future development potential in the sector. An eventual transition towards a decarbonized Bitcoin network might not follow a linear path. We encourage continued and nuanced research, as well as carefully formulated regulatory measures, to maximally utilize the strengths of Bitcoin mining while mitigating associated challenges, in line with the International Energy Agency’s goals for decarbonization, renewable energy penetration, grid resilience, and electrification [79].

Within the broader field of Bitcoin research, this study positions the energy consumption and decarbonization potential of Bitcoin mining as a significant and consequential area of investigation. Given the unique attributes and possible impacts of Bitcoin mining on energy grids and climate change, it is our conviction that this issue represents one of the most important future research directions in the realm of Bitcoin studies. The convergence of Bitcoin mining and RE usage demands consistent and evolving research efforts.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/challe14030035/s1, due to the nascent state of the field and the industry specificity of the topics analyzed, this study utilizes a blend of academic and grey literature to provide a comprehensive analysis. Although some very select industry reports and pre-prints have been included among the main references of this article, a detailed review of these grey literature sources, which have informed key aspects of our methodology and findings, is available in the supplementary information file for further consultation.

Author Contributions

Conceptualization, J.I.I. and A.F.; Methodology, J.I.I. and A.F.; Software, J.I.I. and A.F.; Validation, J.I.I. and A.F.; Formal analysis, J.I.I. and A.F.; Investigation, J.I.I. and A.F.; Resources, J.I.I. and A.F.; Data curation, J.I.I. and A.F.; Writing—original draft, J.I.I. and A.F.; Writing—review & editing, J.I.I. and A.F.; Visualization, J.I.I. and A.F.; Supervision, J.I.I. and A.F.; Project administration, J.I.I. and A.F.; Funding acquisition, J.I.I. and A.F. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported through a research grant from the University College London Centre for Blockchain Technologies.

Acknowledgments

We thank Laura Angélica Casola, Troy Cross, Jens Strueker, Philipp Laemmel, Marcos Miranda, Paolo Tasca, Shaun Connell, Margot Paez, Florian Schemmerer, Jean-Philippe Vergne, Christian Ziegler and Elliot David for comments that greatly improved the manuscript. J.I.I. and A.F. were supported by the University College London Centre for Blockchain Technologies. The authors are thankful to Energiequelle GmbH and Fraunhofer-FOKUS for their valuable comments and cooperation, as well as to the article’s editor and two anonymous referees. Following a recommendation from the editor of this article, the authors utilized artificial intelligence (GPT-4) assistance to improve organization and succinctness in part. The authors retained full control of the writing process and remain completely responsible for the article’s originality, validity, and integrity.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Rennie, E. Climate change and the legitimacy of Bitcoin. SSRN Electron. J. 2021. [Google Scholar] [CrossRef]

- Öysti, L. Bitcoin and Energy Consumption. Ph.D. Thesis, Aalto University, Espoo, Finland, 2021. [Google Scholar]

- Carter, N.; Stevens, R. Bitcoin Net Zero; Technical Report; NYDIG: New York, NY, USA, 2021. [Google Scholar]

- Platt, M.; Sedlmeir, J.; Platt, D.; Xu, J.; Tasca, P.; Vadgama, N.; Ibanez, J.I. The Energy Footprint of Blockchain Consensus Mechanisms Beyond Proof-of-Work. In Proceedings of the 2021 21st International Conference on Software Quality, Reliability and Security Companion, QRS-C, Hainan, China, 6–10 December 2021; pp. 1135–1144. [Google Scholar] [CrossRef]

- Ibañez, J.I.; Rua, F. The energy consumption of Proof-of-Stake systems: Replication and expansion. arXiv 2023, arXiv:2302.00627. [Google Scholar] [CrossRef]

- Roeck, M.; Drennen, T. Life cycle assessment of behind-the-meter Bitcoin mining at US power plant. Int. J. Life Cycle Assess. 2022, 27, 355–365. [Google Scholar] [CrossRef]

- Dogan, E.; Majeed, M.T.; Luni, T. Are clean energy and carbon emission allowances caused by bitcoin? A novel time-varying method. J. Clean. Prod. 2022, 347, 131089. [Google Scholar] [CrossRef]

- Rudd, M.A. 100 Important Questions about Bitcoin’s Energy Use and ESG Impacts. Challenges 2022, 14, 1. [Google Scholar] [CrossRef]

- IPCC. Global Warming of 1.5 °C; Technical Report; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2018. [Google Scholar]

- Jones, B.A.; Goodkind, A.L.; Berrens, R.P. Economic estimation of Bitcoin mining’s climate damages demonstrates closer resemblance to digital crude than digital gold. Nature 2022, 12, 14512. [Google Scholar] [CrossRef] [PubMed]

- Köhler, S.; Pizzol, M. Life Cycle Assessment of Bitcoin Mining. Environ. Sci. Technol. 2019, 53, 13598–13606. [Google Scholar] [CrossRef] [PubMed]

- McCook, H. Drivers of Bitcoin Energy Use and Emissions. In Proceedings of the 3rd Workshop on Coordination of Decentralized Finance (CoDecFin) 2022, St. George’s, Grenada, 6 May 2022. [Google Scholar]

- Nikzad, A.; Mehregan, M. Techno-economic, and environmental evaluations of a novel cogeneration system based on solar energy and cryptocurrency mining. Sol. Energy 2022, 232, 409–420. [Google Scholar] [CrossRef]

- Velický, M. Renewable Energy Transition Facilitated by Bitcoin. ACS Sustain. Chem. Eng. 2023, 11, 3160–3169. [Google Scholar] [CrossRef]

- Ghaebi Panah, P.; Bornapour, M.; Cui, X.; Guerrero, J.M. Investment opportunities: Hydrogen production or BTC mining? Int. J. Hydrogen Energy 2022, 47, 5733–5744. [Google Scholar] [CrossRef]

- OSTP. Climate and Energy Implications of Crypto-Assets in the United States; Technical Report; White House Office of Science and Technology Policy: Washington, DC, USA, 2022.

- Read, C.L. (Ed.) Greenwashing in the Bitcoin Industry. In The Bitcoin Dilemma; Palgrave Macmillan: Cham, Switzerland, 2022; pp. 219–229. [Google Scholar] [CrossRef]

- GDF. Re: OSTP, Request for Information on the Climate Implications of Digital Assets; Technical Report; Global Digital Finance: London, UK, 2022. [Google Scholar]

- Gallersdörfer, U.; Klaaßen, L.; Stoll, C. Energy Efficiency and Carbon Footprint of Proof of Stake Blockchain Protocols; Technical Report; Crypto Carbon Ratings Institute: Dingolfing, Germany, 2022. [Google Scholar]

- CCRI. The Merge: Implications on the Electricity Consumption and Carbon Footprint of the Ethereum Network; Technical Report; Crypto Carbon Ratings Institute: Dingolfing, Germany, 2022. [Google Scholar]

- CCRI. Energy Efficiency and Carbon Footprint of the Polygon Blockchain; Technical Report; Crypto Carbon Ratings Institute: Dingolfing, Germany, 2022. [Google Scholar]

- Ibañez, J.I.; Freier, A. Don’t Trust, Verify: Towards a Framework for the Greening of Bitcoin. Soc. Sci. Res. Netw. (SSRN) 2023. [Google Scholar] [CrossRef]

- Gallersdörfer, U.; Klaaßen, L.; Stoll, C. Accounting for carbon emissions caused by cryptocurrency and token systems. arXiv 2021, arXiv:2111.06477. [Google Scholar] [CrossRef]

- South Pole; CCRI. Accounting for Cryptocurrency Climate Impacts; Technical Report; South Pole and Crypto Carbon Ratings Institute: Dingolfing, Germany, 2022. [Google Scholar]

- Stoll, C.; Klaaßen, L.; Gallersdörfer, U. The Carbon Footprint of Bitcoin. Joule 2019, 3, 1647–1661. [Google Scholar] [CrossRef]

- CCRI. Determining the Electricity Consumption and Carbon Footprint of Proof-of-Stake Networks; Technical Report; Crypto Carbon Ratings Institute: Dingolfing, Germany, 2022. [Google Scholar]

- SEC. The Enhancement and Standardization of Climate-Related Disclosures for Investors. SEC Proposed Rule; 2022. Available online: https://www.sec.gov/rules/proposed/2022/33-11042.pdf (accessed on 9 May 2023).

- Mankala, S.; Bansal, U.; Baker, Z. An Innovative Criterion in Evaluating Bitcoin’s Environmental Impact. Soc. Sci. Res. Netw. (SSRN) 2022. [Google Scholar] [CrossRef]

- de Vries, A.; Gallersdörfer, U.; Klaaßen, L.; Stoll, C. The true costs of digital currencies: Exploring impact beyond energy use. One Earth 2021, 4, 786–789. [Google Scholar] [CrossRef]

- Mellerud, J. Bitcoin Mining as a Demand Response in an Electric Power System: A Case Study of the ERCOT-System in Texas. Ph.D. Thesis, NORD University, Bodø, Norway, 2021. [Google Scholar]

- Yazıcı, A.F.; Olcay, A.B.; Arkalı Olcay, G. A framework for maintaining sustainable energy use in Bitcoin mining through switching efficient mining hardware. Technol. Forecast. Soc. Chang. 2023, 190, 122406. [Google Scholar] [CrossRef]

- Guo, X.; Ma, X.; Qian, T.; Mao, W. Optimization allocation method for flexible load as peaking resource. In Proceedings of the China International Conference on Electricity Distribution, CICED, Tianjin, China, 17–19 September 2018; pp. 2800–2804. [Google Scholar] [CrossRef]

- Brook, B.W.; Alonso, A.; Meneley, D.A.; Misak, J.; Blees, T.; van Erp, J.B. Why nuclear energy is sustainable and has to be part of the energy mix. Sustain. Mater. Technol. 2014, 1–2, 8–16. [Google Scholar] [CrossRef]

- Joos, M.; Staffell, I. Short-term integration costs of variable renewable energy: Wind curtailment and balancing in Britain and Germany. Renew. Sustain. Energy Rev. 2018, 86, 45–65. [Google Scholar] [CrossRef]

- Shan, R.; Sun, Y. Bitcoin Mining to Reduce the Renewable Curtailment: A Case Study of Caiso. Soc. Sci. Res. Netw. (SSRN) 2019. [Google Scholar] [CrossRef]

- Frumkin, D. Economics of Bitcoin Mining with Solar Energy. 2021. Available online: https://braiins.com/blog/economics-bitcoin-mining-solar-energy (accessed on 9 May 2023).

- Jenkins, J.D.; Farbes, J.; Jones, R.; Patankar, N.; Schivley, G. Electricity Transmission Is Key to Unlock the Full Potential of the Inflation Reduction Act; REPEAT Project: Princeton, NJ, USA, 2022. [Google Scholar] [CrossRef]

- Menati, A.; Lee, K.; Xie, L. Modeling and Analysis of Utilizing Cryptocurrency Mining for Demand Flexibility in Electric Energy Systems: A Synthetic Texas Grid Case Study. Trans. Energy Mark. Policy Regul. 2023, 1, 1–10. [Google Scholar] [CrossRef]

- Frew, B.; Sergi, B.; Denholm, P.; Cole, W.; Gates, N.; Levie, D.; Margolis, R. The curtailment paradox in the transition to high solar power systems. Joule 2021, 5, 1143–1167. [Google Scholar] [CrossRef]

- Bird, L.; Cochran, J.; Wang, X. Wind and Solar Energy Curtailment: Experience and Practices in the United States; National Renewable Energy Labratory (NREL): Golden, CO, USA, 2014. [CrossRef]

- Braiins. Optimizations for Bitcoin Mining with Intermittent Energy Sources. 2021. Available online: https://braiins.com/blog/optimizations-bitcoin-mining-intermittent-energy (accessed on 9 May 2023).

- Eid, B.; Islam, M.R.; Shah, R.; Nahid, A.A.; Kouzani, A.Z.; Mahmud, M.A. Enhanced profitability of photovoltaic plants by utilizing cryptocurrency-based mining load. IEEE Trans. Appl. Supercond. 2021, 31, 0602105. [Google Scholar] [CrossRef]

- Ramsebner, J.; Haas, R.; Ajanovic, A.; Wietschel, M. The sector coupling concept: A critical review. Wiley Interdiscip. Rev. Energy Environ. 2021, 10, e396. [Google Scholar] [CrossRef]

- Sternberg, A.; Bardow, A. Power-to-What?—Environmental assessment of energy storage systems. Energy Environ. Sci. 2015, 8, 389–400. [Google Scholar] [CrossRef]

- Lund, P.D.; Lindgren, J.; Mikkola, J.; Salpakari, J. Review of energy system flexibility measures to enable high levels of variable renewable electricity. Renew. Sustain. Energy Rev. 2015, 45, 785–807. [Google Scholar] [CrossRef]

- Bastian-Pinto, C.L.; Araujo, F.V.S.; Brandão, L.E.; Gomes, L.L. Hedging renewable energy investments with Bitcoin mining. Renew. Sustain. Energy Rev. 2021, 138, 110520. [Google Scholar] [CrossRef]

- Rhodes, J.D.; Deetjen, T.; Smith, C. Impacts of Large, Flexible Data Center Operations on the Future of ERCOT; Idea Smiths LLC.: Austin, TX, USA, 2021. [Google Scholar]

- Bonaparte, Y. Time horizon and cryptocurrency ownership: Is crypto not speculative? J. Int. Financ. Mark. Inst. Money 2022, 79, 101609. [Google Scholar] [CrossRef]

- Ammous, S.; D’Andrea, F.A.M.C. Hard Money and Time Preference. MISES Interdiscip. J. Philos. Law Econ. 2022, 10. [Google Scholar] [CrossRef]

- Hajipour, E.; Khavari, F.; Hajiaghapour-Moghimi, M.; Azimi Hosseini, K.; Vakilian, M. An economic evaluation framework for cryptocurrency mining operation in microgrids. Int. J. Electr. Power Energy Syst. 2022, 142, 108329. [Google Scholar] [CrossRef]

- Ströhle, P.; Flath, C.M. Local matching of flexible load in smart grids. Eur. J. Oper. Res. 2016, 253, 811–824. [Google Scholar] [CrossRef]

- Wang, L.; Dong, Y.; Liu, N.; Liang, X.; Yu, J.; Dou, X. A Novel Modeling Method for Multi-Regional Flexible Load Aggregation based on Monte Carlo Method. In Proceedings of the 2021 IEEE 11th Annual International Conference on CYBER Technology in Automation, Control, and Intelligent Systems, CYBER, Jiaxing, China, 27–31 July 2021; pp. 632–637. [Google Scholar] [CrossRef]

- Sarquella, M.B. Bitcoin Mining, the Clean Energy Accelerator. Ph.D. Thesis, Universitat Politécnica de Catalunya, Barcelona, Spain, 2022. [Google Scholar]

- Decker, L.A. Bitcoin Mining and Innovations in the Oil Field. Nat. Resour. Environ. 2021, 36, 50–52. [Google Scholar]

- US EPA. Basic Information about Landfill Gas; US Environmental Protection Agency: Washington, DC, USA, 2022.

- Jacobs, T. Innovators Seek To Transform Flaring Into Money and Power. J. Pet. Technol. 2020, 72, 24–29. [Google Scholar] [CrossRef]

- Snytnikov, P.; Potemkin, D. Flare gas monetization and greener hydrogen production via combination with cryptocurrency mining and carbon dioxide capture. iScience 2022, 25, 103769. [Google Scholar] [CrossRef] [PubMed]

- Allen, M.R.; Shine, K.P.; Fuglestvedt, J.S.; Millar, R.J.; Cain, M.; Frame, D.J.; Macey, A.H. A solution to the misrepresentations of CO2-equivalent emissions of short-lived climate pollutants under ambitious mitigation. NPJ Clim. Atmos. Sci. 2018, 1, 1–8. [Google Scholar] [CrossRef]

- Vazquez, J.; Crumbley, D.L. Flared Gas Can Reduce Some Risks in Crypto Mining as Well as Oil and Gas Operations. Risks 2022, 10, 127. [Google Scholar] [CrossRef]

- Denholm, P.; King, J.C.; Kutcher, C.F.; Wilson, P.P. Decarbonizing the electric sector: Combining renewable and nuclear energy using thermal storage. Energy Policy 2012, 44, 301–311. [Google Scholar] [CrossRef]

- Yüksel, S.; Dinçer, H.; Çağlayan, Ç.; Uluer, G.S.; Lisin, A. Bitcoin Mining with Nuclear Energy. In Multidimensional Strategic Outlook on Global Competitive Energy Economics and Finance; Emerald Publishing Ltd.: Bingley, UK, 2022; pp. 165–177. [Google Scholar] [CrossRef]

- Gonzalez, E.S. Investment in Alternative Applications for Next-Generation Nuclear Reactors in the United States. In IAEA Net Zero Challenge. Policy Recommendations for a Transition to Net Zero with Nuclear Power; International Atomic Energy Agency (IAEA): Vienna, Austria, 2021. [Google Scholar]

- Liu, B.; Liao, S.; Cheng, C.; Chen, F.; Li, W. Hydropower curtailment in Yunnan Province, southwestern China: Constraint analysis and suggestions. Renew. Energy 2018, 121, 700–711. [Google Scholar] [CrossRef]

- Malfuzi, A.; Mehr, A.S.; Rosen, M.A.; Alharthi, M.; Kurilova, A.A. Economic viability of bitcoin mining using a renewable-based SOFC power system to supply the electrical power demand. Energy 2020, 203, 117843. [Google Scholar] [CrossRef]

- Kumar, S. Review of geothermal energy as an alternate energy source for Bitcoin mining. J. Econ. Econ. Educ. Res. 2022, 23, 1–12. [Google Scholar]

- Corbet, S.; Lucey, B.; Yarovaya, L. Bitcoin-energy markets interrelationships—New evidence. Resour. Policy 2021, 70, 101916. [Google Scholar] [CrossRef]

- Attia, H.A. Mathematical Formulation of the Demand Side Management (DSM) Problem and its Optimal Solution. In Proceedings of the 14th International Middle East Power Systems Conference (MEPCON’10), Giza, Egypt, 19–21 December 2010; pp. 19–21. [Google Scholar]

- Caballero, R.J.; Hammour, M.L. On the Timing and Efficiency of Creative Destruction. Q. J. Econ. 1996, 111, 805–852. [Google Scholar] [CrossRef]

- Atia, A.A.; Fthenakis, V. Active-salinity-control reverse osmosis desalination as a flexible load resource. Desalination 2019, 468, 114062. [Google Scholar] [CrossRef]

- Liang, Y.; Saner, C.B.; Kwang Lim, B.M.; Hong, K.T.; Chong Lim, J.W.; Hwee Ho, K.J.; Lim, L.Z.; Loh, Y.Y. Sustainable Energy-based Cryptocurrency Mining. In Proceedings of the 11th International Conference on Innovative Smart Grid Technologies-Asia, ISGT-Asia 2022, Singapore, 1–5 November 2022; pp. 789–793. [Google Scholar] [CrossRef]

- Bruno, A.; Weber, P.; Yates, A.J. Can Bitcoin mining increase renewable electricity capacity? Resour. Energy Econ. 2023, 74, 101376. [Google Scholar] [CrossRef]

- Hallinan, K.P.; Hao, L.; Mulford, R.; Bower, L.; Russell, K.; Mitchell, A.; Schroeder, A. Review and Demonstration of the Potential of Bitcoin Mining as a Productive Use of Energy (PUE) to Aid Equitable Investment in Solar Micro- and Mini-Grids Worldwide. Energies 2023, 16, 1200. [Google Scholar] [CrossRef]

- Vega-Marcos, R.; Colmenar-Santos, A.; Mur-Pérez, F.; Pérez-Molina, C.; Rosales-Asensio, E. Study on the economics of wind energy through cryptocurrency. Energy Rep. 2022, 8, 970–979. [Google Scholar] [CrossRef]

- Halaburda, H.; Yermack, D. Bitcoin Mining Meets Wall Street: A Study of Publicly Traded Crypto Mining Companies. Soc. Sci. Res. Netw. (SSRN) 2023. [Google Scholar] [CrossRef]

- Fridgen, G.; Körner, M.F.; Walters, S.; Weibelzahl, M. Not All Doom and Gloom: How Energy-Intensive and Temporally Flexible Data Center Applications May Actually Promote Renewable Energy Sources. Bus. Inf. Syst. Eng. 2021, 63, 243–256. [Google Scholar] [CrossRef]

- Mcdonald, M.T.; Hayibo, K.S.; Hafting, F.; Pearce, J.M. Economics of Open-Source Solar Photovoltaic Powered Cryptocurrency Mining. Ledger 2023, 8. [Google Scholar] [CrossRef]

- Di Febo, E.; Ortolano, A.; Foglia, M.; Leone, M.; Angelini, E. From Bitcoin to carbon allowances: An asymmetric extreme risk spillover. J. Environ. Manag. 2021, 298, 113384. [Google Scholar] [CrossRef]

- Menati, A.; Zheng, X.; Lee, K.; Shi, R.; Du, P.; Singh, C.; Xie, L. High resolution modeling and analysis of cryptocurrency mining’s impact on power grids: Carbon footprint, reliability, and electricity price. Adv. Appl. Energy 2023, 10, 100136. [Google Scholar] [CrossRef]

- IEA. Net Zero by 2050—A Roadmap for the Global Energy Sector; Technical Report; International Energy Agency: Paris, France, 2021. [Google Scholar]

- IEA. Renewables 2022: Analysis and Forecast to 2027; Technical Report; International Energy Agency: Paris, France, 2023. [Google Scholar]

- Google. Moving toward 24 × 7 Carbon-Free Energy at Google Data Centers: Progress and Insights; Technical Report; Google: Mountainview, CA, USA, 2018. [Google Scholar]

- Tol, R.S. Targets for global climate policy: An overview. J. Econ. Dyn. Control 2013, 37, 911–928. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).