Innovation and Collaboration: Opportunities for the European Seaweed Sector in Global Value Chains

Abstract

:1. Introduction

- What concepts can be used to describe the organisation of global value chains?

- How can the different value chains for seaweed be characterized?

- What are the consequences for the future of the European seaweed industry?

2. Materials and Methods

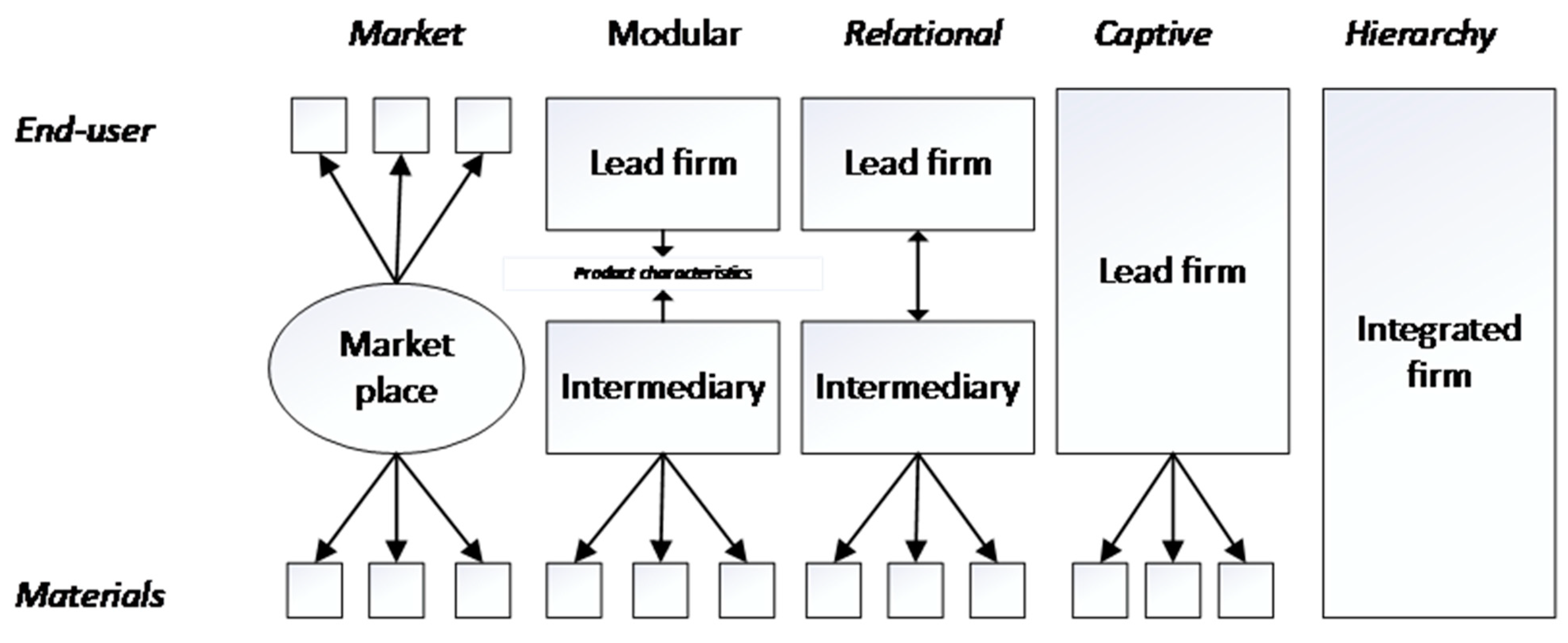

2.1. Conceptual Framework

2.2. Operationalisation

2.3. Data Collection

3. Results

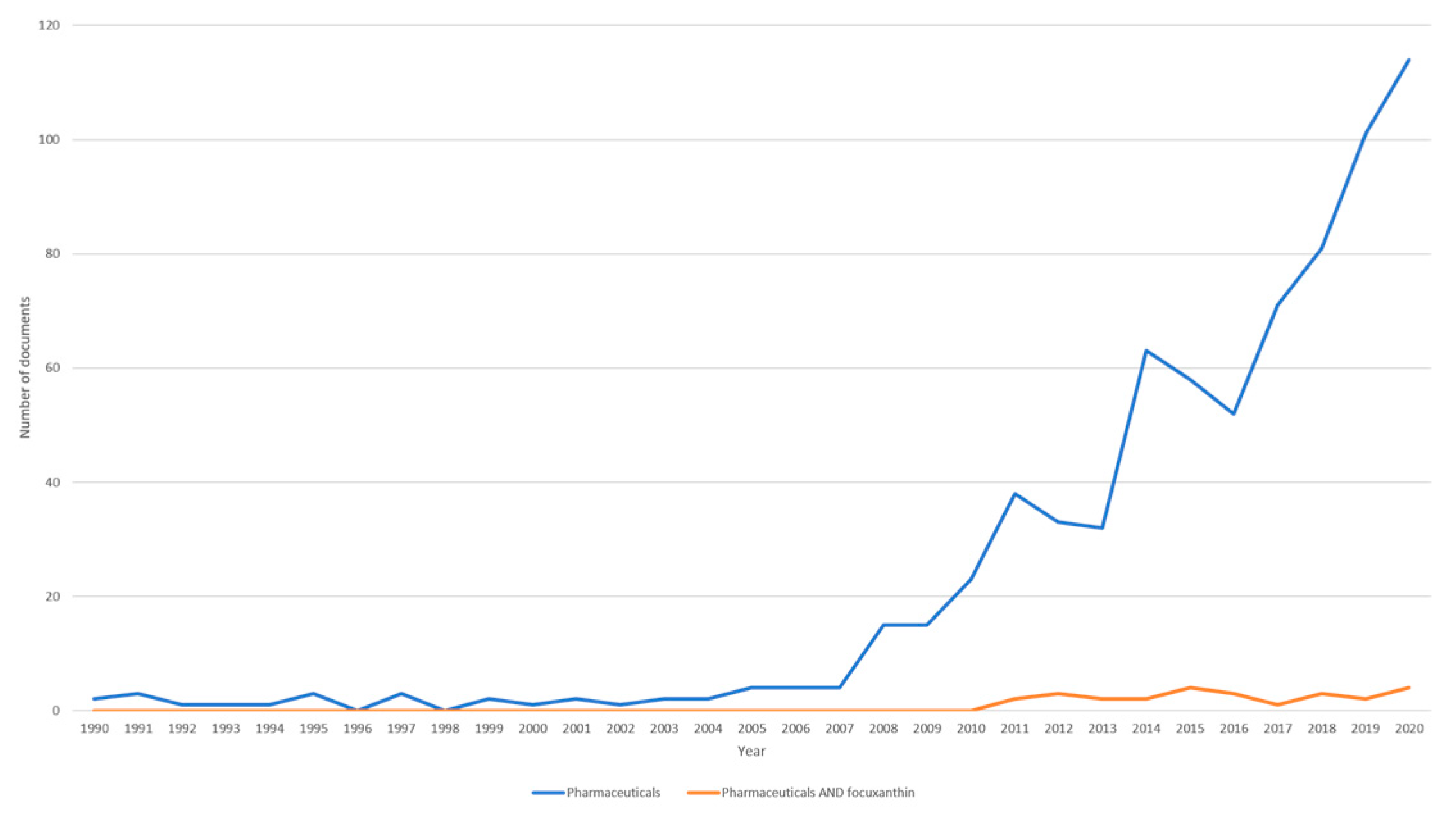

3.1. Pharmaceuticals

3.1.1. Innovation

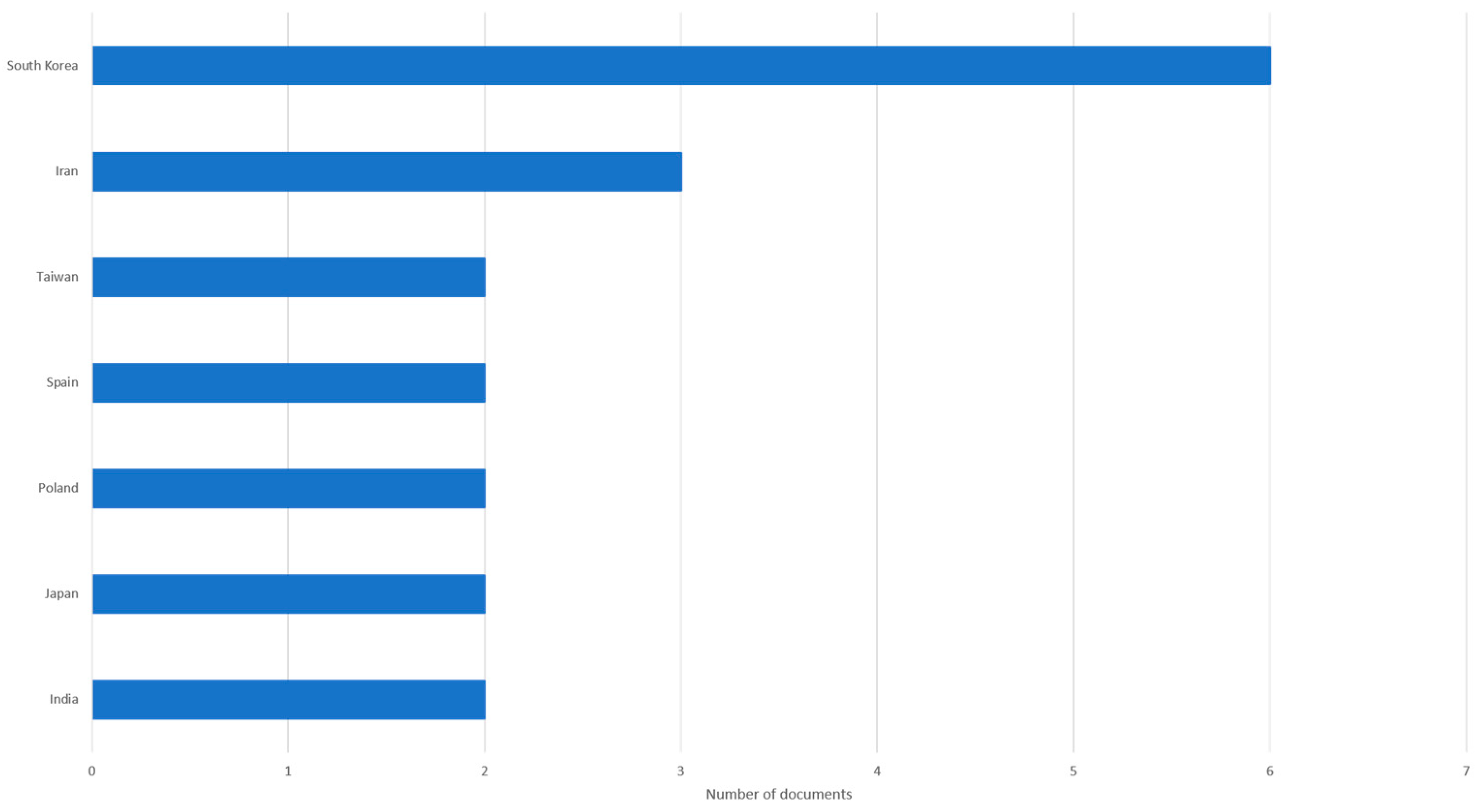

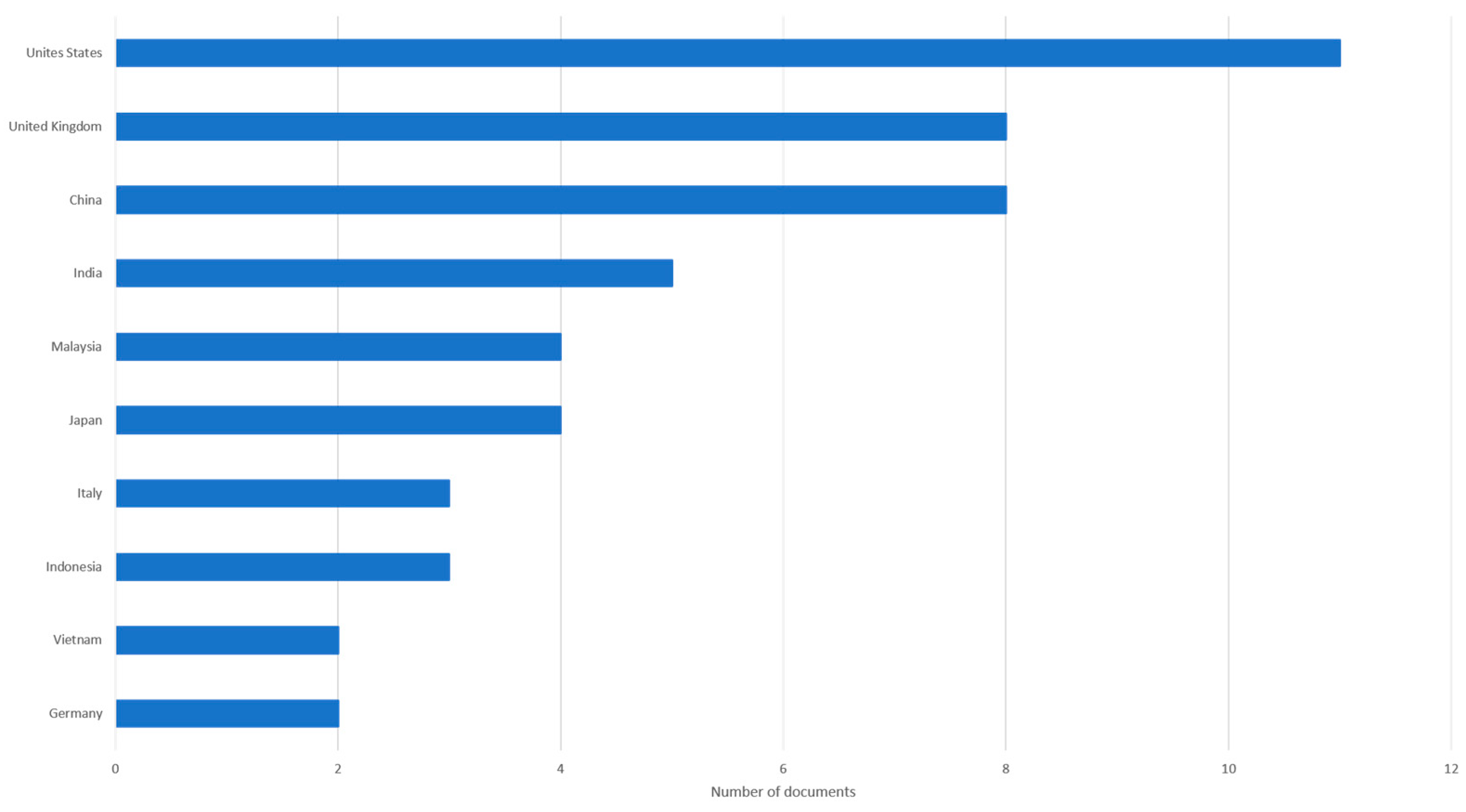

3.1.2. Geographic Coverage

3.1.3. Governance

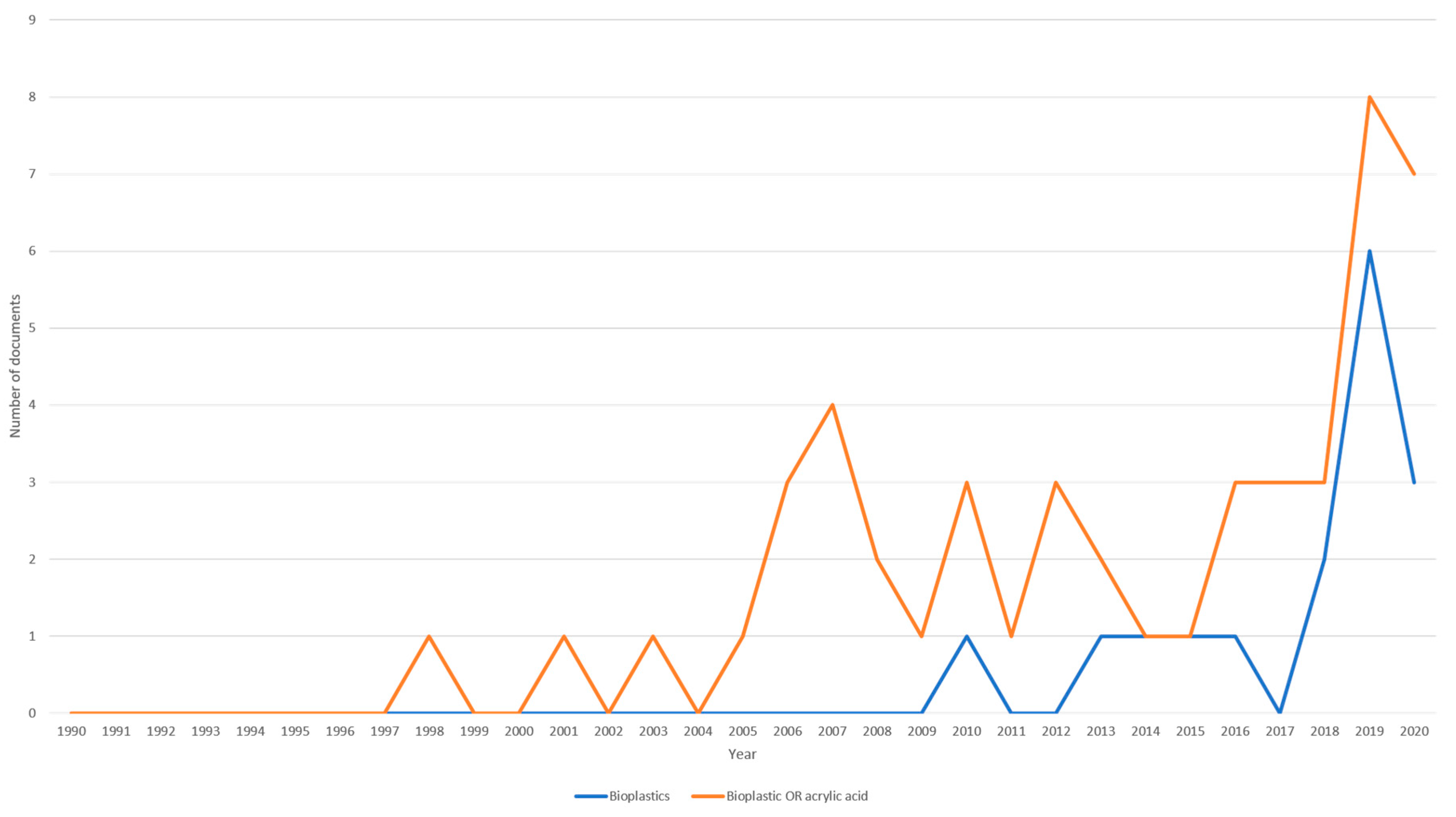

3.2. Bioplastics

3.2.1. Innovation

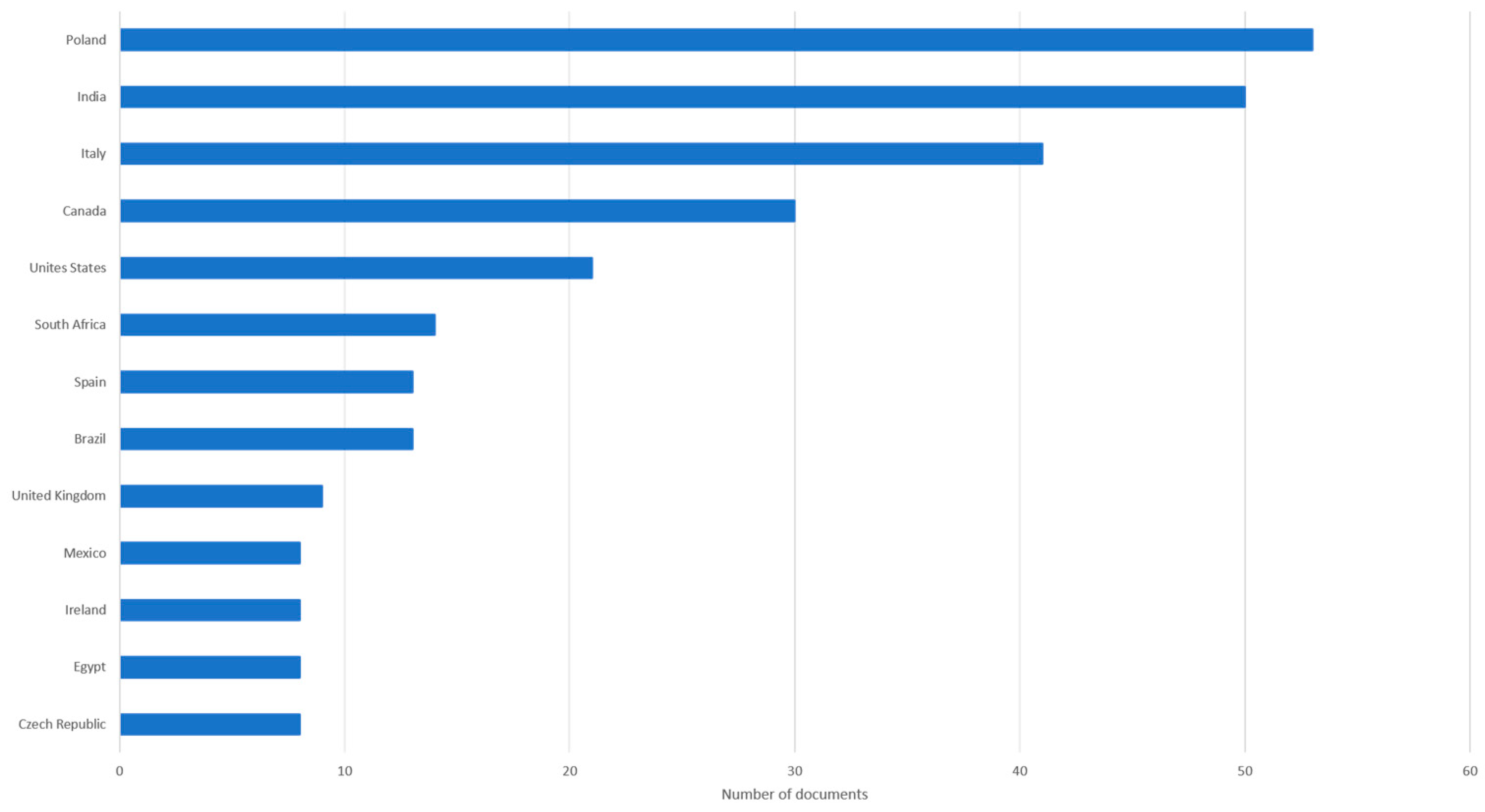

3.2.2. Geographic Scope

3.2.3. Governance

3.3. Biostimulants

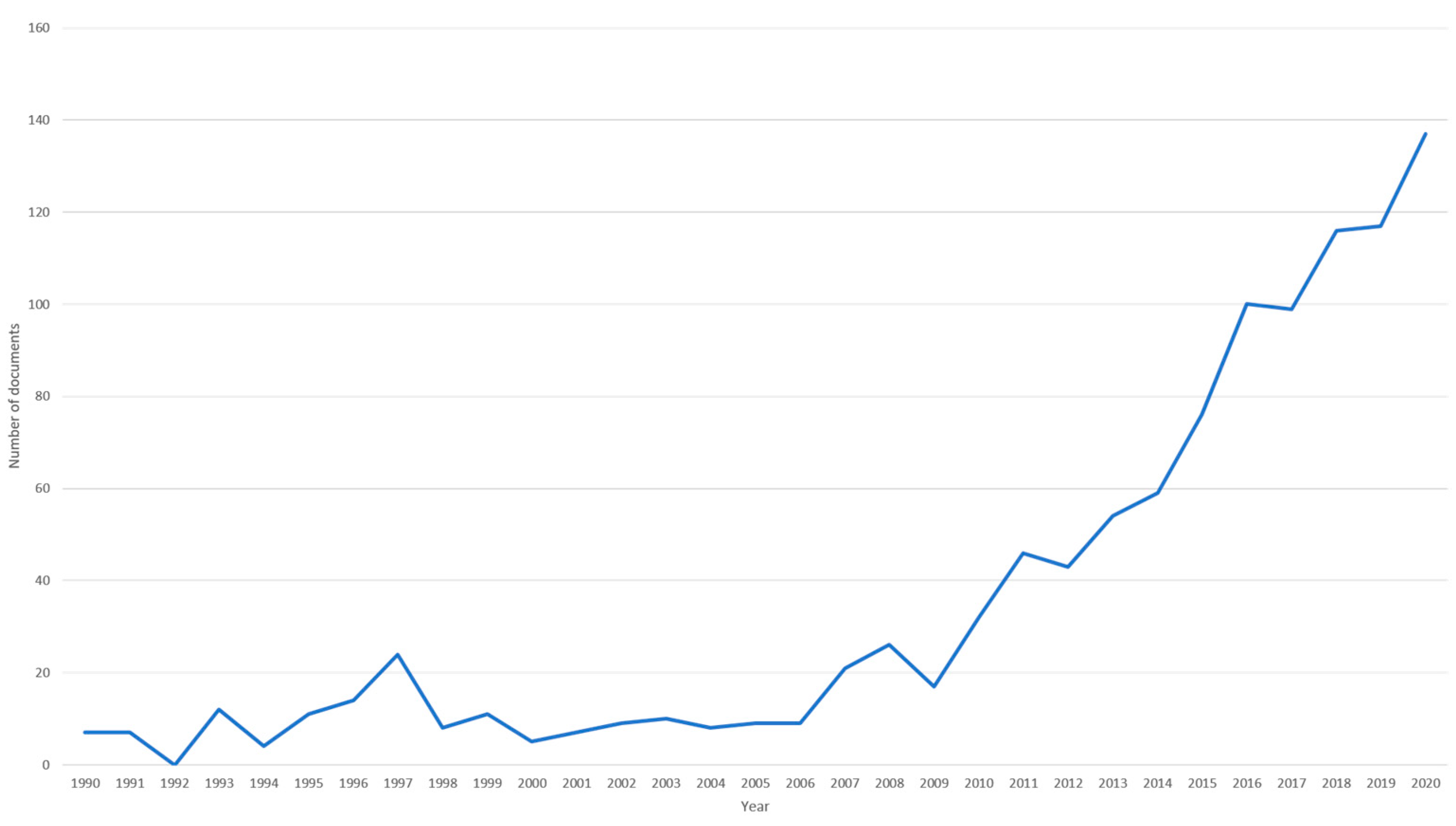

3.3.1. Innovation

3.3.2. Geographic Scope

3.3.3. Governance

3.4. Alginate

3.4.1. Innovation

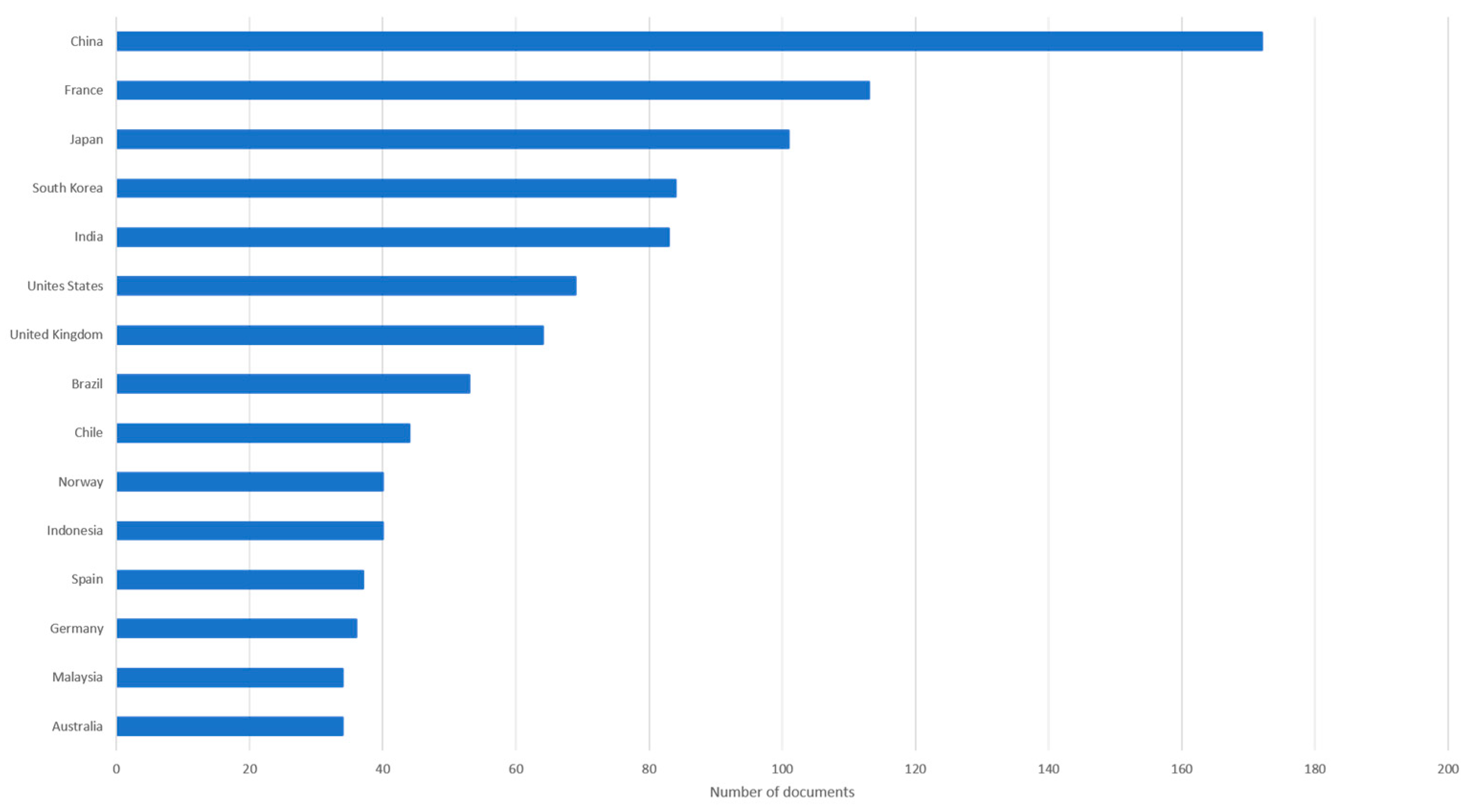

3.4.2. Geographical Scope

3.4.3. Governance

3.5. Cosmetics

3.5.1. Innovation

3.5.2. Geographic Scope

3.5.3. Governance

4. Discussion

4.1. Comparing the Five Value-Chains

4.2. Implications for European Seaweed Sector

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Number of Search Results Supplementary

| Seaweed OR Macro-Algae OR Macroalgae OR Brown Macro-Algae OR Green Macro-Algae OR Brown Macroalgae OR Green Macroalgae OR Saccharina Latissima OR Ulva | |

|---|---|

| Pharmaceuticals | 732 |

| Pharmaceuticals and Fucoxanthin | 26 |

| Bioplastic OR bio-plastic | 16 |

| Bioplastic OR bio-plastic OR acrylic acid | 49 |

| Biostimulant OR bio-stimulant | 286 |

| Alginate OR ulvan | 1098 |

| Cosmetics | 406 |

| Cosmetics AND antioxidant OR anti-oxidant | 136 |

Appendix B. Search Terms Used in Scholar

References

- Barbier, M.; Charrier, B.; Araujo, R.; Holdt, S.L.; Jacquemin, B.; Rebours, C. PEGASUS-PHYCOMORPH European guidelines for a sustainable aquaculture of seaweeds. In COST Action FA1406; Barbier, M., Charrier, B., Eds.; Roscoff, France, 2019; Available online: http://www.phycomorph.org/pegasus-phycomorph-european-guidelines-for-a-sustainable-aquaculture-of-seaweeds (accessed on 23 June 2021). [CrossRef]

- Araújo, R.; Vázquez Calderón, F.; Sánchez López, J.; Costa Azevedo, I.; Bruhn, A.; Fluch, S.; Garcia Tasende, M.; Ghaderiardakani, F.; Ilmjärv, T.; Laurans, M.; et al. Current status of the algae production industry in Europe: An emerging sector of the Blue Bioeconomy. Front. Mar. Sci. 2021, 7, 626389. [Google Scholar] [CrossRef]

- Naylor, R.L.; Hardy, R.W.; Buschmann, A.H.; Bush, S.R.; Cao, L.; Klinger, D.H.; Little, D.C.; Lubchenco, J.; Shumway, S.E.; Troell, M. A 20-year retrospective review of global aquaculture. Nature 2021, 591, 551–563. [Google Scholar] [CrossRef] [PubMed]

- Bak, U.G.; Mols-Mortensen, A.; Gregersen, O. Production Method and Cost of Commercial-Scale Offshore Cultivation of Kelp in the Faroe Islands Using Multiple Partial Harvesting. Algal Res. 2018, 33, 36–47. [Google Scholar] [CrossRef]

- van den Burg, S.W.K.; van Duijn, A.P.; Bartelings, H.; van Krimpen, M.M.; Poelman, M. The Economic Feasibility of Seaweed Production in the North Sea. Aquac. Econ. Manag. 2016, 20, 235–252. [Google Scholar] [CrossRef] [Green Version]

- Tallman, S.; Luo, Y.; Buckley, P.J. Business Models in Global Competition. Glob. Strategy J. 2018, 8, 517–535. [Google Scholar] [CrossRef]

- Gereffi, G.; Fernandez-Stark, K. Global Value Chain Analysis: A Primer, 2nd ed.; Center on Globalization, Governance & Competitiveness, Duke University: Durham, NC, USA, 2011. [Google Scholar]

- Milberg, W.; Houston, E. The High Road and the Low Road to International Competitiveness: Extending the Neo-Schumpeterian Trade Model beyond Technology. Int. Rev. Appl. Econ. 2005, 19, 137–162. [Google Scholar] [CrossRef]

- Martins, M.; Fernandes, A.P.; Torres-Acosta, M.A.; Collén, P.N.; Abreu, M.H.; Ventura, S.P. Extraction of chlorophyll from wild and farmed Ulva spp. Using aqueous solutions of ionic liquids. Sep. Purif. Technol. 2021, 254, 117589. [Google Scholar] [CrossRef]

- de Backer, K.; Miroudot, S. Mapping Global Value Chains. In Global Value Chains and World Trade. Prospects and Challenges for Latin America; Hernández, R.A., Martínez-Piva, J.M., Mulder, N., Eds.; Economic Commission for Latin America and the Carribean: Santiago, Chile, 2013; pp. 43–78. [Google Scholar] [CrossRef] [Green Version]

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The Governance of Global Value Chains. Rev. Int. Polit. Econ. 2006, 12, 78–104. [Google Scholar] [CrossRef]

- Gereffi, G. The Organisation of Buyer-Driven Global Commodity Chains: How US Retailers Shape Overseas Production Networks. In Commodity Chains and Global Capitalism; Gereffi, G., Korzeniewicz, M., Eds.; Praeger: Westport, CT, USA, 1994; pp. 95–122. [Google Scholar]

- Frederick, S.; Gereffi, G. Review and Analysis of Protectionist Actions in the Textile and Apparel Industries. Paper Prepared for the World Bank and the Centre for Economic and Policy Research. 2009. Available online: https://www.researchgate.net/publication/266094771_Review_and_Analysis_of_Protectionist_Actions_in_the_Textile_Apparel_Industries (accessed on 23 June 2021).

- Pranckuté, R. Web of Science (WoS) and Scopus: The Titans of Bibliographic Information in Today’s Academic World. Publications 2021, 9, 12. [Google Scholar] [CrossRef]

- Zhu, J.; Liu, W. A tale of two databases: The use of Web of Science and Scopus in academic papers. Scientometrics 2020, 123, 331–335. [Google Scholar] [CrossRef] [Green Version]

- Karkhane Yousefi, M.; Seyed Hashtroudi, M.; Mashinchain Moradi, A.; Ghasempour, A.R. In vitro investigating of anticancer activity of focuxanthin from marine brown seaweed spieces. Glob. J. Environ. Sci. Manag. 2018, 4, 81–90. [Google Scholar] [CrossRef]

- Komba, S.; Kotake-Nara, E.; Tsuzuki, W. Degradation of fucoxanthin to elucidate the relationship between the fucoxanthin molecular structure and its antiproliferative effect on caco-2 cells. Mar. Drugs 2018, 16, 275. [Google Scholar] [CrossRef] [Green Version]

- Phull, A.R.; Kim, S.J. Undaria pinnatifida a Rich Marine Reservoir of Nutritional and Pharmacological Potential: Insights into Growth Signaling and Apoptosis Mechanisms in Cancer. Nutr. Cancer 2018, 70, 956–970. [Google Scholar] [CrossRef]

- Qurrota’Ayun, N.; Zakaria, A.D.; Bahtiar, A. Preliminary of Pharmacokinetics Study of Brown Seaweed (Turbinaria decurrens Bory) Extract in Colon Cancer Model Mice Induced by AOM (Azoxymethane) and DSS (Dextran Sodium Sulphate). Pharmacogn. J. 2018, 10, 567–570. [Google Scholar] [CrossRef] [Green Version]

- Ferreira, J.; Ramos, A.A.; Almeida, T.; Azqueta, A.; Rocha, E. Drug resistance in glioblastoma and cytotoxicity of seaweed compounds, alone and in combination with anticancer drugs: A mini review. Phytomedicine 2018, 48, 84–93. [Google Scholar] [CrossRef] [PubMed]

- Wang, Z.; Li, H.; Dong, M.; Zhu, P.; Cai, Y. The Anticancer Effects and Mechanisms of Fucoxanthin Combined with Other Drugs. J. Cancer Res. Clin. Oncol. 2019, 145, 293–301. [Google Scholar] [CrossRef]

- Lu, X.; Sun, H.; Zhao, W.; Cheng, K.W.; Chen, F.; Liu, B. A Hetero-Photoautotrophic Two-Stage Cultivation Process for Production of Fucoxanthin by the Marine Diatom Nitzschia Laevis. Mar. Drugs 2018, 16, 219. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- van den Burg, S.W.K.; Dagevos, H.; Helmes, R.J.K. Towards Sustainable European Seaweed Value Chains: A Triple P Perspective. ICES J. Mar.Sci. 2019, 78, 443–450. [Google Scholar] [CrossRef] [Green Version]

- Haakonsson, S.J. The Changing Governance Structures of the Global Pharmaceutical Value Chain. Compet. Change 2009, 13, 75–95. [Google Scholar] [CrossRef]

- Buncher, C.R.; Tsay, J.-Y. Introduction to the Evolution of Pharmaceutical Products. In Statistics in the Pharmaceutical Industry, 3rd ed.; Buncher, C.R., Tsay, J.-Y., Eds.; Chapman & Hall/CRC: Boca Raton, FL, USA, 2006; pp. 1–17. [Google Scholar]

- Aitken, M.; Machin, C.; Troein, P. Understanding the Pharmaceutical Value Chain. Pharm. Policy Law 2016, 18, 55–66. [Google Scholar] [CrossRef] [Green Version]

- Buciuni, G.; Pisano, G. Variety of Innovation in Global Value Chains. J. World Bus. 2021, 56, 101167. [Google Scholar] [CrossRef]

- Karan, H.; Funk, C.; Grabert, M.; Oey, M.; Hankamer, B. Green Bioplastics as Part of a Circular Bioeconomy. Trends Plant Sci. 2019, 24, 237–249. [Google Scholar] [CrossRef] [PubMed]

- du Jardin, P. Plant Biostimulants: Definition, Concept, Main Categories and Regulation. Sci. Hortic. 2015, 196, 3–14. [Google Scholar] [CrossRef] [Green Version]

- North Sea Farm Foundation. Identification of the Seaweed Biostimulant Market (Phase 1); Bio4safe WP1 Market Analyses. 2018. Available online: https://www.noordzeeboerderij.nl/public/documents/Bio4safe_WP1_D111_Seaweed-Biostimulants-Market-Study_2018.pdf (accessed on 23 June 2021).

- MarketsAndMarkets. Biostimulant Market—Global Forecast to 2022. 2017. Available online: https://www.marketsandmarkets.com/Market-Reports/biostimulant-market-1081.html?gclid=CjwKCAjwt8uGBhBAEiwAayu_9VZRwPcQcgfMRGMj_yJrYLwNQ92iiMFi1-ifeQNPeNUJHikihIoTQhoC6ZsQAvD_BwE (accessed on 23 June 2021).

- Khan, W.; Rayirath, U.P.; Subramanian, S.; Jithesh, M.N.; Rayorath, P.; Hodges, D.M.; Critchley, A.T.; Craigie, J.S.; Norrie, J.; Prithiviraj, B. Seaweed Extracts as Biostimulants of Plant Growth and Development. J. Plant Growth Regul. 2009, 28, 386–399. [Google Scholar] [CrossRef]

- Battacharyya, D.; Babgohari, M.Z.; Rathor, P.; Prithiviraj, B. Seaweed Extracts as Biostimulants in Horticulture. Sci. Hortic. 2015, 196, 39–48. [Google Scholar] [CrossRef]

- Hurtado, A.Q.; Critchley, A.T. Chapter 4-Time for Applications of Biostimulants in Phyconomy: Seaweed Extracts for Enhanced Cultivation of Seaweeds (SEECS). In Sustainable Seaweed Technologies: Cultivation, Biorefinery, and Applications; Torres, M.D., Kraan, S., Dominguez, H., Eds.; Elsevier BV: Amsterdam, The Netherlands, 2020; pp. 103–127. [Google Scholar] [CrossRef]

- Umanzor, S.; Shin, S.; Yarish, C.; Augyte, S.; Kim, J.K. Exploratory Evaluation of the Effects of Kelpak® Seaweed Extract on Cultivated Kelp Saccharina Spp. Exposed to Sublethal and Lethal Temperatures. J. World Aquac. Soc. 2020, 51, 960–969. [Google Scholar] [CrossRef]

- Bixler, H.J.; Porse, H. A Decade of Change in the Seaweed Hydrocolloids Industry. J. Appl. Phycol. 2011, 23, 321–335. [Google Scholar] [CrossRef]

- Tønnesen, H.H.; Karlsen, J. Alginate in Drug Delivery Systems. Drug Dev. Ind. Pharm. 2002, 28, 621–630. [Google Scholar] [CrossRef] [PubMed]

- Cui, C.-L.; Gan, L.; Lan, X.-Y.; Li, J.; Zhang, C.F.; Li, F.; Wang, C.-Z.; Yuan, C.-S. Development of Sustainable Carrier in Thermosensitive Hydrogel Based on Chitosan/Alginate Nanoparticles for in Situ Delivery System. Polym. Compos. 2018, 40, 2187–2196. [Google Scholar] [CrossRef]

- Song, J.; Chen, H. Preparation of Aroma Microcapsules with Sodium Alginate and Tetradecylallyldimethylammonium Bromide (TADAB) and Its Potential Applications in Cosmetics. Flavour Fragr. J. 2018, 33, 160–165. [Google Scholar] [CrossRef]

- Martins, E.; Poncelet, D.; Rodrigues, R.C.; Renard, D. Oil Encapsulation Techniques Using Alginate as Encapsulating Agent: Applications and Drawbacks. J. Microencapsul. 2017, 34, 754–771. [Google Scholar] [CrossRef]

- Porse, H.; Rudolph, B. The Seaweed Hydrocolloid Industry. J. Appl. Phycol. 2017, 29, 2187–2200. [Google Scholar] [CrossRef]

- Couteau, C.; Coiffard, L. Seaweed Application in Cosmetics. In Seaweed in Health and Disease Prevention; Fleurence, J., Levine, I., Eds.; Academic Press: Salt Lake City, UT, USA, 2016; pp. 423–441. [Google Scholar] [CrossRef]

- Amberg, N.; Fogarassy, C. Green Consumer Behavior in the Cosmetics Market. Resources 2019, 8, 137. [Google Scholar] [CrossRef] [Green Version]

- Jesumani, V.; Du, H.; Aslam, M.; Pei, P.; Huang, N. Potential Use of Seaweed Bioactive Compounds in Skincare—A Review. Mar. Drugs 2019, 17, 688. [Google Scholar] [CrossRef] [Green Version]

- Ariede, M.B.; Candido, T.M.; Jacome, A.L.M.; Velasco, M.V.R.; de Carvalho, J.C.M.; Baby, A.R. Cosmetic Attributes of Algae—A Review. Algal Res. 2017, 25, 483–487. [Google Scholar] [CrossRef]

- Kumar, S.; Massie, C.; Dumonceaux, M.D. Comparative Innovative Business Strategies of Major Players in Cosmetic Industry. Ind. Manag. Data Syst. 2006, 106, 285–306. [Google Scholar] [CrossRef]

- Cosmetics Europe. Socio-Economic Contribution of the European Cosmetics Industry June 2019. Available online: https://www.cosmeticseurope.eu/files/4715/6023/8405/Socio-Economic_Contribution_of_the_European_Cosmetics_Industry_Report_2019.pdf (accessed on 23 June 2021).

- Bom, S.; Jorge, J.; Ribeiro, H.M.; Marto, J. A Step Forward on Sustainability in the Cosmetics Industry: A Review. J. Clean. Prod. 2019, 225, 270–290. [Google Scholar] [CrossRef]

- Global Insights Inc. A Study of the European Cosmetics Industry. 2007. Available online: https://ec.europa.eu/growth/content/study-european-cosmetics-industry-2007-0_en (accessed on 23 June 2021).

- van den Burg, S.; Selnes, T.; Alves, L.; Giesbers, E.; Daniel, A. Prospects for upgrading by the European kelp sector. J. Appl. Phycol. 2020, 33, 557–566. [Google Scholar] [CrossRef]

| Dimensions | Operationalisation |

|---|---|

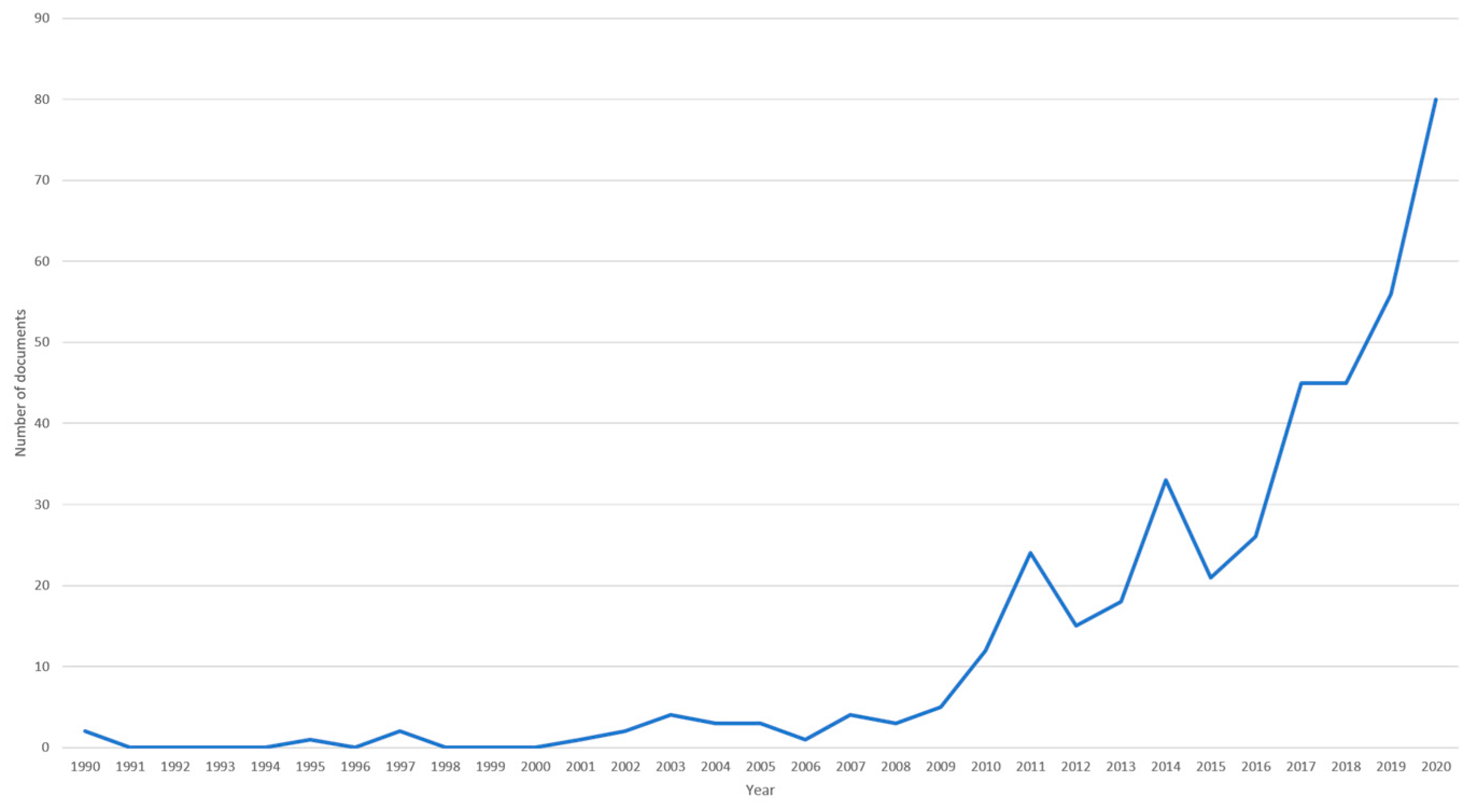

| Innovation | Quantitative analysis of trends in number of scientific literature |

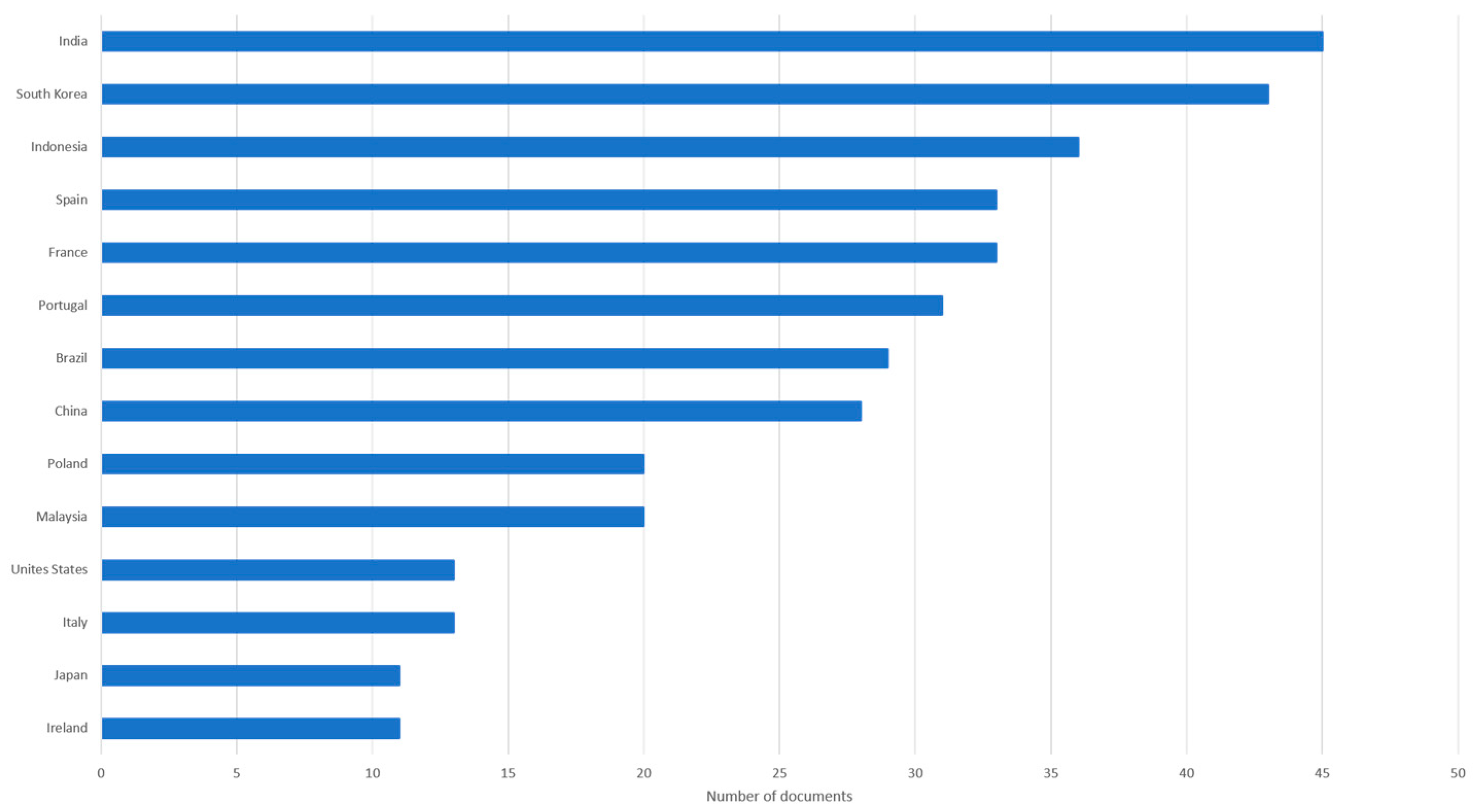

| Geographic scope | Identifying the spread in location of publications for the five value chains |

| Governance | Trends in (the authority) relations, in relation to Gereffi’s fivefold distinction (see Figure 1 below) |

| Innovation | Geographic Scope | Governance | ||

|---|---|---|---|---|

| Description | Type | |||

| Pharmaceutical | Growth number of publicationsFocus on fucoxanthin is recent | Many Western companies but for research mixed (more Asian) | Many large companies; tight control, strict regulation EU. | Captive |

| Bioplastics | Few publications | Asia dominates | A few big companies. No clear role for regulators, but policies are underway. | Captive |

| Biostimulant | Growth number of publications. Most cited publications on plant biostimulants | Globally distributed | Mix of large and small companies. Some government regulation. | Market |

| Alginate | Growth no. of publications. Mixed topics, extraction and use | Concentrated in Asia with some (large) European and US companies | Importance of standards from targeted markets. Large companies dominate production. | Modular, with central role for alginate producers |

| Cosmetics | Growing number of publicationsFocus on characteristics of seaweed | Most companies in Europe and USA, Asian market is booming | Dominance of few large companies. Many small SMEs. Regulation mainly on ingredients and information provision to consumers. | Modular |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Selnes, T.; Giesbers, E.; van den Burg, S.W.K. Innovation and Collaboration: Opportunities for the European Seaweed Sector in Global Value Chains. J. Mar. Sci. Eng. 2021, 9, 693. https://doi.org/10.3390/jmse9070693

Selnes T, Giesbers E, van den Burg SWK. Innovation and Collaboration: Opportunities for the European Seaweed Sector in Global Value Chains. Journal of Marine Science and Engineering. 2021; 9(7):693. https://doi.org/10.3390/jmse9070693

Chicago/Turabian StyleSelnes, Trond, Else Giesbers, and Sander W. K. van den Burg. 2021. "Innovation and Collaboration: Opportunities for the European Seaweed Sector in Global Value Chains" Journal of Marine Science and Engineering 9, no. 7: 693. https://doi.org/10.3390/jmse9070693

APA StyleSelnes, T., Giesbers, E., & van den Burg, S. W. K. (2021). Innovation and Collaboration: Opportunities for the European Seaweed Sector in Global Value Chains. Journal of Marine Science and Engineering, 9(7), 693. https://doi.org/10.3390/jmse9070693