Game of Chains: Unravelling Uncertainty and Trading Behaviour in Horticultural Supply Chains

Abstract

1. Introduction

2. Literature Review

2.1. Uncertainty

2.2. Trading Behaviour

2.3. Transaction Cost Theory

2.4. Syntheses of Uncertainty, Trading Behaviour and Trading Strategies

3. Materials and Methods

3.1. Data Collection

3.2. Participants

- Market organisation and trading routines (how transactions are structured and governed);

- Information flows and uncertainty (sources of and ways of managing incomplete or asymmetric information);

- Strategic behaviour and opportunism (e.g., withholding, signalling, or timing strategies);

- Coordination and governance mechanisms (e.g., the use of contracts, cooperatives, auctions, or informal agreements).

3.3. Data Analysis

4. Results

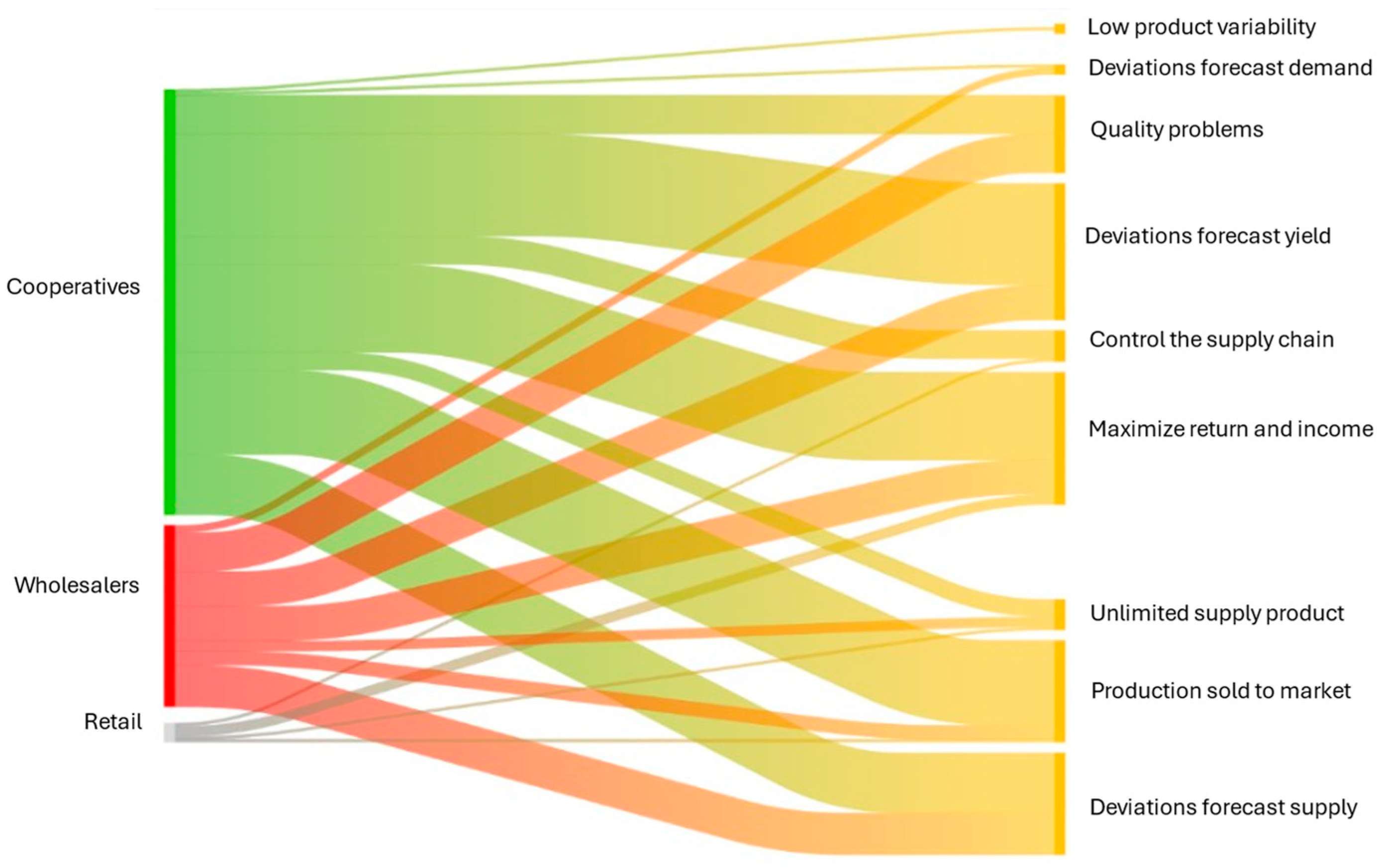

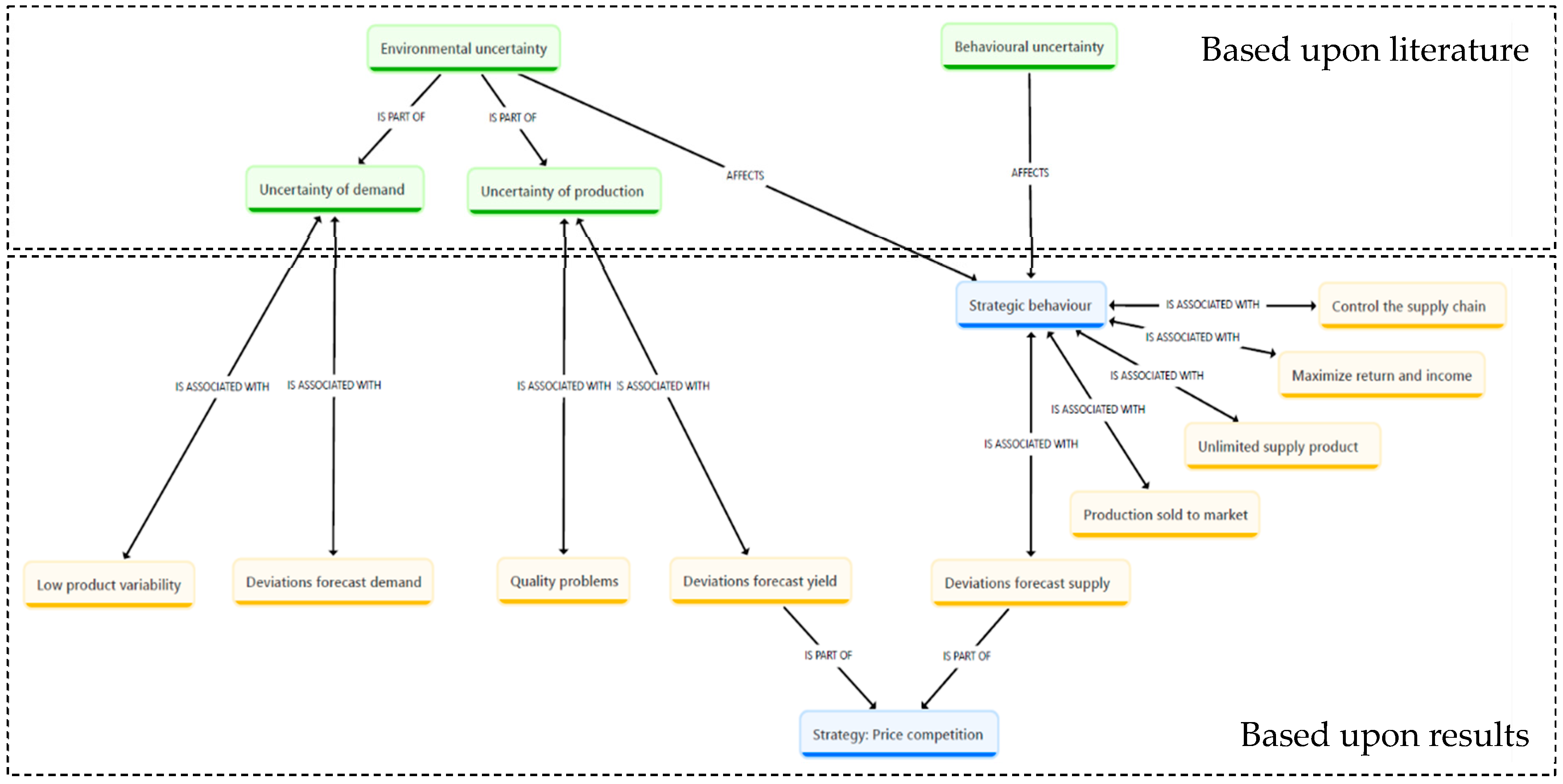

4.1. Uncertainty as Motivation

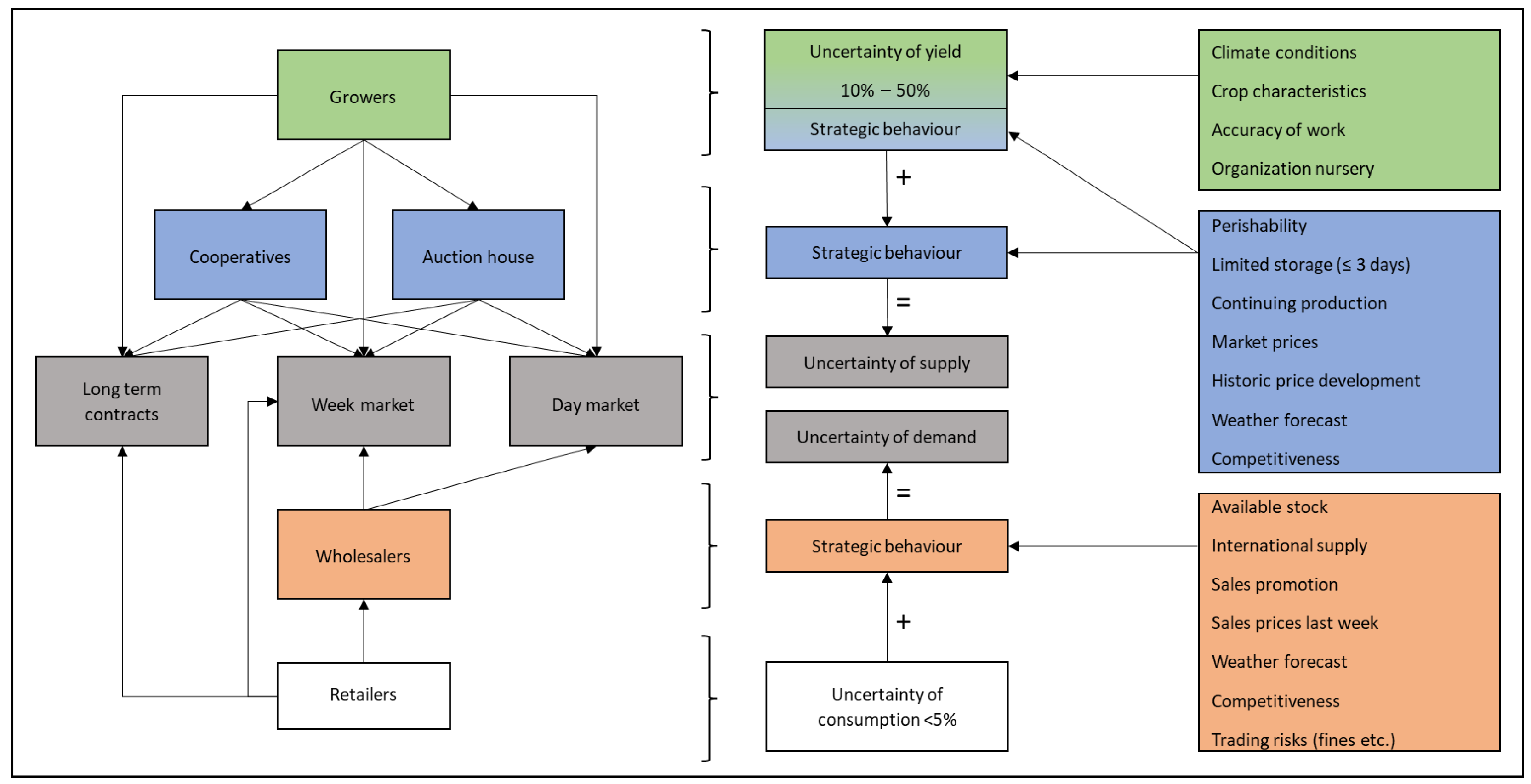

4.2. Supply-Chain Structure

4.3. Strategic Trading Behaviour

4.4. Trading Strategies

5. Discussion

5.1. Uncertainty and Associated Factors

5.2. Competition in Trading Behaviour

5.3. Balancing Competition, Information and Risk

5.4. Limitations and Implications for Research and Practice

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Bijman, W.J.; Hendrikse, G.W.J. Co-operatives in chains: Institutional restructuring in the Dutch fruit and vegetables industry. J. Chain. Netw. Sci. 2003, 3, 95–107. [Google Scholar] [CrossRef]

- Bijman, W.J.; van der Sangen, G.; Doorneweert, R. Support for Farmers’ Cooperatives: Country Report the Netherlands; Wageningen UR: Wageningen, The Netherlands, 2012. [Google Scholar]

- Sexton, R.J. Market power, misconceptions, and modern agricultural markets. Am. J. Agric. Econ. 2013, 95, 209–219. [Google Scholar] [CrossRef]

- Buurma, J.S. Dutch agricultural development and its importance to China. In Case Study: The Evolution of Dutch Greenhouse Horticulture; LEI: Den Haag, The Netherlands, 2001. [Google Scholar]

- Astuti, R.; Marimin, M.; Machfud, M.; Arkeman, Y. Risks and risks mitigations in the supply chain of mangosteen: A case study. Oper. Supply Chain. Manag. Int. J. 2014, 6, 11–25. [Google Scholar] [CrossRef]

- Van der Vorst, J.G.A.J. Performance Measurement in Agrifood Supply Chain Networks: An Overview, in Quantifying the Agri-Food Supply Chain; Ondersteijn, C.J.M., Wijnands, J.H.M., Huirne, R.B.M., van Kooten, O., Eds.; Springer: Dordrecht, The Netherlands, 2006; pp. 13–24. [Google Scholar]

- Diederen, P. Co-Ordinaton Mechanisms in Chains and Networks, in The Emerging World of Chains and Networks, Bridging Theory and Practice; Camps, T., Diederen, P., Vos, G.C.J.M., Eds.; Reed Business Information: Amsterdam, The Netherlands, 2004; pp. 33–47. [Google Scholar]

- van der Vorst, J.G.; Beulens, A.J. Identifying sources of uncertainty to generate supply chain redesign strategies. Int. J. Phys. Distrib. Logist. Manag. 2002, 32, 409–430. [Google Scholar]

- Hart, V.; Kavallari, A.; Schmitz, P.M.; Wronka, T.C. Supply Chain Analysis of Fresh Fruit and Vegetables in Germany; Discussion Paper; Econstor: Kiel, Germany, 2007. [Google Scholar]

- Dobson, P.W. Buyer power in food retailing: The European experience. In Proceedings of the OECD Conference on Changing Dimensions of the Food Economy: Exploring the Policy Issues, Hague, The Netherlands, 23–24 June 2003. [Google Scholar]

- Breukers, A.; Hietbrink, O.; Ruijs, M.N.A. The Power of Dutch Greenhouse Vegetable Horticulture: An Analysis of the Private Sector and Its Institutional Framework; LEI Wageningen UR: Den Haag, The Netherlands, 2008. [Google Scholar]

- Linn, T.; Maenhout, B. The impact of environmental uncertainty on the performance of the rice supply chain in the Ayeyarwaddy Region, Myanmar. Agric. Food Econ. 2019, 7, 11. [Google Scholar] [CrossRef]

- Gebhardt, A.C. The Making of Dutch Flower Culture: Auctions, Networks, and Aesthetics; Universiteit van Amsterdam: Amsterdam, The Netherlands, 2014. [Google Scholar]

- Pannekoek, L.; van Kooten, O.; Kemp, R.; Omta, S. Entrepreneurial innovation in chains and networks in Dutch greenhouse horticulture. J. Chain. Netw. Sci. 2005, 5, 39–50. [Google Scholar] [CrossRef]

- Wilson, D.T. An integrated model of buyer-seller relationships. J. Acad. Mark. Sci. 1995, 23, 335–345. [Google Scholar] [CrossRef]

- Matanda, M.; Schroder, B. Environmental factors, supply chain capabilities and business performance in horticultural marketing channels. J. Chain. Netw. Sci. 2002, 2, 47–60. [Google Scholar] [CrossRef]

- Ford, M.W.; Greer, B.M. Institutional uncertainty and supply chain quality management: A conceptual framework. Qual. Manag. J. 2020, 27, 134–146. [Google Scholar] [CrossRef]

- Gupta, M.; Gupta, S. Influence of national cultures on operations management and supply chain management practices—A research agenda. Prod. Oper. Manag. 2019, 28, 2681–2698. [Google Scholar] [CrossRef]

- Kull, T.J.; Oke, A.; Dooley, K.J. Supplier selection behavior under uncertainty: Contextual and cognitive effects on risk perception and choice. Decis. Sci. 2014, 45, 467–505. [Google Scholar] [CrossRef]

- Carter, C.R.; Kaufmann, L.; Michel, A. Behavioral supply management: A taxonomy of judgment and decision-making biases. Int. J. Phys. Distrib. Logist. Manag. 2007, 37, 631–669. [Google Scholar] [CrossRef]

- Kim, Y.; Chen, Y.-S.; Linderman, K. Supply network disruption and resilience: A network structural perspective. J. Oper. Manag. 2015, 33, 43–59. [Google Scholar] [CrossRef]

- Yang, Y.; Lin, J.; Liu, G.; Zhou, L. The behavioural causes of bullwhip effect in supply chains: A systematic literature review. Int. J. Prod. Econ. 2021, 236, 108120. [Google Scholar] [CrossRef]

- Heydari, J.; Kazemzadeh, R.B.; Chaharsooghi, S.K. A study of lead time variation impact on supply chain performance. Int. J. Adv. Manuf. Technol. 2009, 40, 1206–1215. [Google Scholar] [CrossRef]

- Yanes-Estévez, V.; Oreja-Rodríguez, J.R.; García-Pérez, A.M. Perceived environmental uncertainty in the agrifood supply chain. Br. Food J. 2010, 112, 688–709. [Google Scholar] [CrossRef]

- Snyder, L.V.; Shen, Z.-J.M. Supply and Demand Uncertainty in Multi-Echelon Supply Chains; Lehigh University: Berkeley, CA, USA, 2006; Volume 15. [Google Scholar]

- Wikner, J.; Naim, M.; Towill, D. The system simplification approach in understanding the dynamic behaviour of a manufacturing supply chain. J. Syst. Eng. 1992, 2, 164–178. [Google Scholar]

- Svensson, G. The bullwhip effect in intra-organisational echelons. Int. J. Phys. Distrib. Logist. Manag. 2003, 33, 103–131. [Google Scholar] [CrossRef]

- Cachon, G.P.; Randall, T.; Schmidt, G.M. In search of the bullwhip effect. Manuf. Serv. Oper. Manag. 2007, 9, 457–479. [Google Scholar] [CrossRef]

- Brito, G.D.; Pinto, P.D.; De Barros, A.D.M. Reverse bullwhip effect: Duality of a dynamic model of Supply Chain. Indep. J. Manag. Prod. 2020, 11, 2043–2063. [Google Scholar] [CrossRef]

- Rong, Y.; Shen, Z.-J.M.; Snyder, L.V. Pricing During Disruptions: A Cause of the Reverse Bullwhip Effect; SSRN: Rochester, NY, USA, 2009; SSRN:1374184. [Google Scholar]

- Liu, Z.; Wu, Y. Study on Countermeasures that Reduce Reverse Bullwhip Effect in County Retail Supply Chain. In Proceedings of the 2013 Conference on Education Technology and Management Science (ICETMS 2013), Nanjing, China, 8–9 June 2013; Atlantis Press: Dordrecht, The Netherlands, 2013. [Google Scholar][Green Version]

- Rong, Y.; Snyder, L.V.; Shen, Z.J.M. Bullwhip and reverse bullwhip effects under the rationing game. Nav. Res. Logist. (NRL) 2017, 64, 203–216. [Google Scholar] [CrossRef]

- Croson, R.; Donohue, K. Behavioral causes of the bullwhip effect and the observed value of inventory information. Manag. Sci. 2006, 52, 323–336. [Google Scholar] [CrossRef]

- Liu, M.; Cao, E.; Salifou, C.K. Pricing strategies of a dual-channel supply chain with risk aversion. Transp. Res. Part E Logist. Transp. Rev. 2016, 90, 108–120. [Google Scholar] [CrossRef]

- Bessler, W.; Kurmann, P. Bank risk factors and changing risk exposures: Capital market evidence before and during the financial crisis. J. Financ. Stab. 2014, 13, 151–166. [Google Scholar] [CrossRef]

- Cannella, S.; Di Mauro, C.; Dominguez, R.; Ancarani, A.; Schupp, F. An exploratory study of risk aversion in supply chain dynamics via human experiment and agent-based simulation. Int. J. Prod. Res. 2019, 57, 985–999. [Google Scholar] [CrossRef]

- Tang, O.; Musa, S.N. Identifying risk issues and research advancements in supply chain risk management. Int. J. Prod. Econ. 2011, 133, 25–34. [Google Scholar] [CrossRef]

- Choi, T.Y.; Krause, D.R. The supply base and its complexity: Implications for transaction costs, risks, responsiveness, and innovation. J. Oper. Manag. 2006, 24, 637–652. [Google Scholar] [CrossRef]

- Tian, X.; Song, Y.; Luo, C.; Zhou, X.; Lev, B. Herding behavior in supplier innovation crowdfunding: Evidence from Kickstarter. Int. J. Prod. Econ. 2021, 239, 108184. [Google Scholar] [CrossRef]

- Banerjee, A.V. A simple model of herd behavior. Q. J. Econ. 1992, 107, 797–817. [Google Scholar] [CrossRef]

- Bikhchandani, S.; Hirshleifer, D.; Welch, I. A theory of fads, fashion, custom, and cultural change as informational cascades. J. Political Econ. 1992, 100, 992–1026. [Google Scholar] [CrossRef]

- Layton, L. Irrational exuberance: Neoliberal subjectivity and the perversion of truth. Subjectivity 2010, 3, 303–322. [Google Scholar] [CrossRef]

- French, J. Asset pricing with investor sentiment: On the use of investor group behavior to forecast ASEAN markets. Res. Int. Bus. Financ. 2017, 42, 124–148. [Google Scholar] [CrossRef]

- Daniel, K.; Hirshleifer, D.; Subrahmanyam, A. Investor psychology and security market under-and overreactions. J. Financ. 1998, 53, 1839–1885. [Google Scholar] [CrossRef]

- Hao, Y.; Chu, H.-H.; Ho, K.-Y.; Ko, K.-C. The 52-week high and momentum in the Taiwan stock market: Anchoring or recency biases? Int. Rev. Econ. Financ. 2016, 43, 121–138. [Google Scholar] [CrossRef]

- Rieger, M.O.; Wang, M.; Huang, P.-K.; Hsu, Y.-L. Survey evidence on core factors of behavioral biases. J. Behav. Exp. Econ. 2022, 100, 101912. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A.; Sokolov, B.; Ivanova, M. Literature review on disruption recovery in the supply chain. Int. J. Prod. Res. 2017, 55, 6158–6174. [Google Scholar] [CrossRef]

- Tsay, A.A. The quantity flexibility contract and supplier-customer incentives. Manag. Sci. 1999, 45, 1339–1358. [Google Scholar] [CrossRef]

- Simatupang, T.M.; Sridharan, R. The collaborative supply chain. Int. J. Logist. Manag. 2002, 13, 15–30. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism. Firms, Markets, Relational Contracting; The Free Press Macmillan Inc.: New York, NY, USA, 1985. [Google Scholar]

- Fildes, R.; Goodwin, P.; Lawrence, M.; Nikolopoulos, K. Effective forecasting and judgmental adjustments: An empirical evaluation and strategies for improvement in supply-chain planning. Int. J. Forecast. 2009, 25, 3–23. [Google Scholar] [CrossRef]

- Coase, R.H. The nature of the firm. In Essential Readings in Economics; Estrin, S., Marin, A., Eds.; Palgrave: London, UK, 1995; pp. 37–54. [Google Scholar]

- Peterson, H.C.; Wysocki, A.; Harsh, S.B. Strategic choice along the vertical coordination continuum. Int. Food Agribus. Manag. Rev. 2001, 4, 149–166. [Google Scholar] [CrossRef]

- Williamson, O.E. Outsourcing: Transaction cost economics and supply chain management. J. Supply Chain. Manag. 2008, 44, 5–16. [Google Scholar] [CrossRef]

- Robertson, T.S.; Gatignon, H. Technology development mode: A transaction cost conceptualization. Strateg. Manag. J. 1998, 19, 515–531. [Google Scholar] [CrossRef]

- Koopmans, T.C. Three Essays on the State of Economic Science; McGraw—Hill Book Company Inc.: New York, NY, USA, 1957; p. 231. [Google Scholar]

- Abebe, G.K.; Bijman, J.; Kemp, R.; Omta, O.; Tsegaye, A. Contract farming configuration: Smallholders’ preferences for contract design attributes. Food Policy 2013, 40, 14–24. [Google Scholar] [CrossRef]

- Denzin, N.K. The Research Act: A Theoretical Introduction to Sociological Method; Transaction Publishers: Piscataway, NJ, USA, 2017. [Google Scholar]

- ELAN, version 6.1; Max Planck Institute for Psycholinguistics, The Language Archive: Nijmegen, The Netherlands, 2021. Available online: https://archive.mpi.nl/tla/elan (accessed on 15 December 2023).

- ATLAS.ti Scientific Software Development GmbH, ATLAS.ti Windows, version 23.2.1. Qualitative Data Analysis Software. ATLAS.ti: Berlin, Germany, 2023. Available online: https://atlasti.com (accessed on 9 April 2025).

- IBM Corp. IBM SPSS Statistics for Windows, version 26.0; IBM Corp.: Armonk, NY, USA, 2019. [Google Scholar]

- Kallio, H.; Pietilä, A.-M.; Johnson, M.; Kangasniemi, M. Systematic methodological review: Developing a framework for a qualitative semi-structured interview guide. J. Adv. Nurs. 2016, 72, 2954–2965. [Google Scholar] [CrossRef] [PubMed]

- Della Porta, D. In-depth interviews. In Methodological Practices in Social Movement Research; Oxford University Press: Oxford, UK, 2014; pp. 228–261. [Google Scholar]

- Guest, G.; Namey, E.; Chen, M. A simple method to assess and report thematic saturation in qualitative research. PLoS ONE 2020, 15, e0232076. [Google Scholar]

- Harrison, G.W.; List, J.A. Field experiments. J. Econ. Lit. 2004, 42, 1009–1055. [Google Scholar] [CrossRef]

- Westera, W.; Nadolski, R.; Hummel, H. Serious gaming analytics: What students log files tell us about gaming and learning. Int. J. Serious Games 2014, 1, 35–50. [Google Scholar] [CrossRef]

- Van Haaften, M.; Lefter, I.; Lukosch, H.; van Kooten, O.; Brazier, F. Do Gaming Simulations Substantiate That We Know More Than We Can Tell? Simul. Gaming 2021, 52, 478–500. [Google Scholar] [CrossRef]

- van Haaften, M.; Lefter, I.; van Kooten, O.; Brazier, F. The validity of simplifying gaming simulations. Comput. Hum. Behav. Rep. 2024, 14, 100384. [Google Scholar] [CrossRef]

- McMahon, S.A.; Winch, P.J. Systematic debriefing after qualitative encounters: An essential analysis step in applied qualitative research. BMJ Glob. Health 2018, 3, e000837. [Google Scholar] [CrossRef]

- Torrente, J.; Borro-Escribano, B.; Freire, M.; del Blanco, A.; Marchiori, E.J.; Martinez-Ortiz, I.; Moreno-Ger, P.; Fernandez-Manjon, B. Development of game-like simulations for procedural knowledge in healthcare education. IEEE Trans. Learn. Technol. 2013, 7, 69–82. [Google Scholar] [CrossRef]

- Kriz, W.C. A systemic-constructivist approach to the facilitation and debriefing of simulations and games. Simul. Gaming 2010, 41, 663–680. [Google Scholar] [CrossRef]

- Saunders, B.; Sim, J.; Kingstone, T.; Baker, S.; Waterfield, J.; Bartlam, B.; Burroughs, H.; Jinks, C. Saturation in qualitative research: Exploring its conceptualization and operationalization. Qual. Quant. 2018, 52, 1893–1907. [Google Scholar] [CrossRef] [PubMed]

- Nowell, L.S.; Norris, J.M.; White, D.E.; Moules, N.J. Thematic analysis: Striving to meet the trustworthiness criteria. Int. J. Qual. Methods 2017, 16, 1–13. [Google Scholar] [CrossRef]

- Strauss, A.; Corbin, J. Basics of Qualitative Research Techniques, 2nd ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 1998. [Google Scholar]

- Heiman, A.; Zilberman, D.; Baylis, K. The role of agricultural promotions in reducing uncertainties of exported fruits and vegetables. J. Int. Food Agribus. Mark. 2001, 12, 1–26. [Google Scholar] [CrossRef]

- Guido, Z.; Lopus, S.; Waldman, K.; Hannah, C.; Zimmer, A.; Krell, N.; Knudson, C.; Estes, L.; Caylor, K.; Evans, T. Perceived links between climate change and weather forecast accuracy: New barriers to tools for agricultural decision-making. Clim. Change 2021, 168, 9. [Google Scholar] [CrossRef]

- Gommes, R. Non-parametric crop yield forecasting, a didactic case study for Zimbabwe. In Proceedings of the EU/JRC Meeting on Remote Sensing Support to Crop Yield Forecast and Area Estimates, Stresa, Italy, 30 November–1 December 2006; p. 79. [Google Scholar]

- Munsaka, E. The Use of Information Sharing Systems to Address Opportunistic Behaviour Between Tomato Farmers and Brokers in Zambia. Master’s Thesis, University of Pretoria, Pretoria, South Africa, 2018. [Google Scholar]

- Mwiinga, M.; Tschirley, D. Comparative Analysis of Price Behavior in Fresh Tomato Markets with Special Reference to Zambia. In Proceedings of the Socio-Economic Research in Vegetable Production and Marketing in Africa, Nairobi, Kenya, 5–6 March 2009. [Google Scholar]

- Arah, I.K.; Amaglo, H.; Kumah, E.K.; Ofori, H. Preharvest and postharvest factors affecting the quality and shelf life of harvested tomatoes: A mini review. Int. J. Agron. 2015, 2015, 478041. [Google Scholar] [CrossRef]

- Boccaletti, S.; Moro, D.; Sckokai, P. Vertical integration and institutional contracts in the Italian food system. In Proceedings of the 2nd International Conference on Chain Management in Agri-and Food Business; Wageningen Academic Publishers: Leiden, The Netherlands, 1996; Available online: https://onlinelibrary.wiley.com/doi/10.1155/2015/478041 (accessed on 12 October 2025).

- Masten, S.E. Transaction-cost economics and the organization of agricultural transactions. In Industrial Organization; Baye, M.R., Ed.; Emerald Group Publishing Limited: Bingley, UK, 2009; pp. 173–195. [Google Scholar]

- Baltussen, W.; van Galen, M.; Logatcheva, K.; Reinders, M.; Schebesta, H.; Splinter, G.; Doornewaard, G.; van Horne, P.; Hoste, R.; Janssens, B.; et al. Positie Primaire Producent in de Keten: Samenwerking en Prijsvorming; Wageningen Economic Research: Wageningen, The Netherlands, 2018. [Google Scholar]

- Huitzing, H. The Netherlands Visualised. A Different View on Issues Impacting the Living Environment; Nederland Verbeeld. Een Andere Blik op Vraagstukken Rond de Leefomgeving; Planbureau voor de Leefomgeving PBL: Den Haag, The Netherlands, 2012; 41p. [Google Scholar]

- Los, E.; Gardebroek, C.; Huirne, R. Explaining Recent Firm Growth in Dutch Horticulture. EuroChoices 2019, 18, 38–43. [Google Scholar] [CrossRef]

- Van Heck, H.; Ribbers, P. Electronic Markets in Value-added Chains: An Analysis of Four Cases in the Dutch Flower and Transport Industries. In Proceedings of the 2nd International Conference on Chain Management in Agri-and Food Business; Wageningen Agricultural University: Wageningen, The Netherlands, 1996. [Google Scholar]

- Meijer, S.; Hofstede, G.J.; Beers, G.; Omta, S.W.F. Trust and Tracing game: Learning about transactions and embeddedness in a trade network. Prod. Plan. Control. 2006, 17, 569–583. [Google Scholar] [CrossRef]

- Riezebos, R.; Zimmermann, K. Brands in the Horticultural Sector: Positioning Paper on Horticulture; The Hague: Rotterdam, The Netherlands, 2005; Available online: https://edepot.wur.nl/26023 (accessed on 2 July 2025).

- Van der Velden, N. Local-for-Local Productie Kastomaten: Mogelijkheden voor Nederlandse Productiebedrijven in Noord-Europa. LEI Wageningen UR: Wageningen, The Netherlands, 2016. [Google Scholar]

- Camps, T. Chains and Networks: Theory and Practice, in The Emerging World of Chains and Networks, Bridging Theory and Practice; Camps, T., Diederen, P., Vos, G.C.J.M., Eds.; Reed Business Information: Amsterdam, The Netherlands, 2004; pp. 13–33. [Google Scholar]

- Abou Jaoude, G.; Sanz, V.M. Between Promise and Performance: Technology, Land, Energy, and Labor in the Agro-Industrial Greenhouse Cluster of Westland, The Netherlands. J. Urban Technol. 2025, 2498870. [Google Scholar] [CrossRef]

- Sano, Y.; Verstegen, J.A.; Ishihara, H. What affects institutional and organizational transitions of sales cooperatives in the Dutch horticultural sector? J. Rural. Stud. 2024, 106, 103225. [Google Scholar] [CrossRef]

- Salvini, G.; Hofstede, G.J.; Verdouw, C.N.; Rijswijk, K.; Klerkx, L. Enhancing digital transformation towards virtual supply chains: A simulation game for Dutch floriculture. Prod. Plan. Control. 2022, 33, 1252–1269. [Google Scholar] [CrossRef]

- Nguyen, Q.C.; Nguyen, H.T.; Jung, C. Application of artificial intelligence in Vietnam’s agriculture supply chain. Int. J. Internet Broadcast. Commun. 2024, 16, 379–387. [Google Scholar]

- Farjana, S.; Ali, M.; Jeon, Y.; Nam, D.H.; Chung, S.O. Artificial intelligence in floriculture and its industrial applications. Int. J. Adv. Smart Converg. 2024, 13, 487–503. [Google Scholar]

- Berkhout, P.; van der Meulen, H.; Ramaekers, P. State of Agriculture, Nature and Food; Report 2023-124; Wageningen Economic Research: Wageningen, The Netherlands, 2023. [Google Scholar]

- van Wassenaer, L.; Jellema, A.; Jukema, G.; Oosterkamp, E.; Peeters, S.; Pessers, R.; van Asseldonk, M.; van Ruiten, C.; van Wonderen, D.; Walker, A.N. Future Directions for Dutch Agriculture and Trade in an International Context: Scenarios and Strategic Perspectives; Rapport 2025-007; Wageningen Social & Economic Research: Wageningen, The Netherlands, 2025. [Google Scholar]

- van Rijswick, C.; Gomersbach, R. Robots and AI in Greenhouse Horticulture; Rabobank Sector Reports; Rabobank: Utrecht, The Netherlands, 2022. [Google Scholar]

- de Beer, C.; van Vliet, M.; van der Sar, P.; Maijers, W. The Role of Digitisation in ‘Feeding and Greening Megacities’: A Vision on Digitalisation for Greenhouse Horticulture. Greenport West-Holland. June 2021. Available online: https://issuu.com/innovationquarter/docs/a4_digitaliseringsvisie_glastuinbouw_engels_02 (accessed on 24 October 2025).

- van Dalen, T.; van Heijningen, J. The Optimal Sales Model for Every Grower; AGF Primeur: Tholen, The Netherlands, 2020; Volume 3, pp. 6–7. [Google Scholar]

- Royal FloraHolland. Management Column: “With Floriday We Make the Supply Chain More Efficient”. 25 September 2024. Available online: https://www.royalfloraholland.com/nieuws-2024/week-39/met-floriday-maken-we-de-hele-keten-efficienter (accessed on 24 October 2025).

- Royal FloraHolland. 2023 Annual Report. 2023. Available online: https://np-royalfloraholland-production.s3-eu-west-1.amazonaws.com/3-Financieel/Jaarverslag-2023/2023-Annual-repot-Royal-FloraHolland.pdf (accessed on 23 October 2025).

- Royal FloraHolland. Floriday: Platform for the Floriculture Industry. 2023. Available online: https://www.royalfloraholland.com/en/about-us/business-strategy/floriday (accessed on 22 October 2025).

- Topsector Tuinbouw & Uitgangsmaterialen. The Power of Technological Value Chains in Dutch Horticulture. 2023. Available online: https://topsectortu.nl/wp-content/uploads/2023/11/A5-flyer-The-power-of-technological-value-chains-in-Dutch-horticulture_-paginas-onder-elkaar-EN.pdf (accessed on 22 October 2025).

- Van Wassenaer, L.; van der Meij, K.; Kempenaar, C. Blockchain for Agrifood: Between Dream and Reality; An Exploration of the Opportunity and Challenges; Rapport 2020-114; Wageningen University & Research: Wageningen, The Netherlands, 2020; 52p. [Google Scholar]

- Van Wassenaer, L. Blockchain as a Catalyst for the Digital Transformation of Agrifood; Wageningen University & Research: Wageningen, The Netherlands, 2021; Available online: https://www.wur.nl/nl/onderzoek-resultaten/onderzoeksinstituten/social-economic-research/show-ser/blockchain-as-a-catalyst-for-the-digital-transformation-of-agrifood.htm (accessed on 24 October 2025).

- Rabobank. Use of Robots and Artificial Intelligence in Greenhouse Horticulture. 2022. Available online: https://www.rabobank.com/knowledge/q011329445-use-of-robots-and-artificial-intelligence-in-greenhouse-horticulture (accessed on 22 October 2025).

- Statistics Netherlands. Higher Incomes in the Agriculture Sector in 2024 (Netherlands). 2024. Available online: https://www.cbs.nl/en-gb/news/2024/51/higher-incomes-in-the-agriculture-sector-in-2024 (accessed on 24 October 2025).

- Statistics Netherlands. Vegetable Cultivation; Harvest and Cultivation Area per Vegetable Type. 28 March 2025. Available online: https://www.cbs.nl/nl-nl/cijfers/detail/37738 (accessed on 22 October 2025).

- HortDaily. More Kilos of Greenhouse Vegetables from a Smaller Area. 2 April 2025. Available online: https://www.hortidaily.com (accessed on 22 October 2025).

| Data Collection Method | In-Depth Interviews | Simulation Sessions | Debriefings |

|---|---|---|---|

| Function | Topic list | Participation in gaming simulation | Reflecting on behaviour |

| Data collection (Section 3.1) | In-depth interviews with professionals in the field | Participation of professionals in simulation | Reflection and discussion of participants |

| Subjects (Section 3.2) | Interviewees: Growers (self-trading) (n = 3) Traders cooperatives (n = 4, all male) Traders wholesalers (n = 3, all male) | Participants: Traders cooperatives (n = 10, all male) Traders wholesalers (n = 8, 7 male, 1 female) | Participants: Traders cooperatives (n = 10, all male) Traders wholesalers (n = 8, 7 male, 1 female) |

| Data analysis (Section 3.3) | Transcription of recordings in Elan [59] Coded text (open and axial coding, categorization) in Atlas.ti [60] Statistical analysis of co-occurrences in SPSS 26.0 [61] | ||

| Occupation Cooperative | Occupation Wholesaler | Adjusted Residuals | χ2-Test | Strength Association | |||||

|---|---|---|---|---|---|---|---|---|---|

| Role | C a | W b | C a | W b | Sign. | Phi (ϕ) | Sign. | ||

| Motivations to act | |||||||||

| E | Low product variability | 1 | 1 | 0 | 0 | - | - | - | - |

| E | Deviations forecast demand | 1 | 0 | 1 | 10 | 2.335 | χ2 = 5.455 (0.020) | 0.674 | 0.020 |

| E | Quality problems | 11 | 3 | 0 | 9 | 3.682 | χ2 = 13.554 (0.001) | 0.768 | 0.000 |

| E | Deviations forecast yield | 33 | 1 | 0 | 2 | 4.826 | χ2 = 23.294 (0.000) | 0.804 | 0.000 |

| B | Control the supply chain | 8 | 0 | 1 | 0 | - | - | - | - |

| B | Maximise return and income | 27 | 7 | 0 | 4 | 3.313 | χ2 = 10.973 (0.001) | 0.537 | 0.001 |

| B | Unlimited supply product | 5 | 1 | 0 | 2 | 2.108 | χ2 = 4.444 (0.035) | 0.745 | 0.035 |

| B | Production sold to market | 26 | 1 | 1 | 3 | 3.970 | χ2 = 15.758 (0.000) | 0.713 | 0.000 |

| B | Deviations forecast supply | 19 | 3 | 4 | 14 | 4.083 | χ2 = 16.667 (0.000) | 0.646 | 0.000 |

| Occupied as Cooperative | Occupied as Wholesaler | Fisher’s Exact Test | Strength Association | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Supply-chain member | C | W | R | C | W | R | Sign. | Phi (ϕ) | Sign. |

| Strategies | |||||||||

| Information asymmetry | 37 | 9 | 3 | 3 | 13 | 1 | 0.000 | 0.547 | 0.000 |

| Customer supplier satisfaction | 40 | 11 | 3 | 1 | 29 | 5 | 0.000 | 0.700 | 0.000 |

| Differentiation | 42 | 0 | 2 | 1 | 0 | 0 | 1.000 | −0.033 | 0.827 |

| Economies of scale | 49 | 13 | 6 | 0 | 11 | 1 | 0.000 | 0.576 | 0.000 |

| Laissez-faire | 12 | 8 | 3 | 0 | 1 | 0 | 0.500 | 0.269 | 0.419 |

| Price competition | 175 | 91 | 27 | 63 | 181 | 28 | 0.000 | 0.381 | 0.000 |

| Supply-chain shortening | 50 | 3 | 1 | 1 | 4 | 1 | 0.000 | 0.639 | 0.000 |

| Homogeneity Between Roles | Homogeneity Between Occupations | |||||||

|---|---|---|---|---|---|---|---|---|

| χ2 | Sign. | χ2 | Sign. | |||||

| Strategies | ||||||||

| Information asymmetry | 40 | 22 | 5.226 | 0.022 | 46 | 16 | 14.516 | 0.000 |

| Customer/supplier satisfaction | 41 | 40 | 0.012 | 0.912 | 51 | 30 | 5.444 | 0.020 |

| Differentiation | 42 | 1 | 39.093 | 0.000 | 42 | 1 | 39.093 | 0.000 |

| Economies of scale | 49 | 24 | 8.562 | 0.003 | 62 | 11 | 35.630 | 0.000 |

| Laissez-faire | 12 | 9 | 0.429 | 0.513 | 20 | 1 | 17.190 | 0.000 |

| Price competition | 238 | 272 | 2.267 | 0.132 | 266 | 244 | 0.949 | 0.330 |

| Supply-chain shortening | 51 | 7 | 33.379 | 0.000 | 53 | 5 | 39.724 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

van Haaften, M.; Lefter, I.; Kemmers, J.L.; van Kooten, O.; Brazier, F. Game of Chains: Unravelling Uncertainty and Trading Behaviour in Horticultural Supply Chains. Agriculture 2025, 15, 2327. https://doi.org/10.3390/agriculture15222327

van Haaften M, Lefter I, Kemmers JL, van Kooten O, Brazier F. Game of Chains: Unravelling Uncertainty and Trading Behaviour in Horticultural Supply Chains. Agriculture. 2025; 15(22):2327. https://doi.org/10.3390/agriculture15222327

Chicago/Turabian Stylevan Haaften, Marinus, Iulia Lefter, Jessy Lee Kemmers, Olaf van Kooten, and Frances Brazier. 2025. "Game of Chains: Unravelling Uncertainty and Trading Behaviour in Horticultural Supply Chains" Agriculture 15, no. 22: 2327. https://doi.org/10.3390/agriculture15222327

APA Stylevan Haaften, M., Lefter, I., Kemmers, J. L., van Kooten, O., & Brazier, F. (2025). Game of Chains: Unravelling Uncertainty and Trading Behaviour in Horticultural Supply Chains. Agriculture, 15(22), 2327. https://doi.org/10.3390/agriculture15222327