The Relationship of Agricultural and Non-Agricultural Income and Its Variability in Regard to Farms in the European Union Countries

Abstract

1. Introduction

2. Literature Review

3. Material and Methods

- X1it—the value of subsidies for public goods (understood as the sum of payments on account of setting fields aside and agri-environmental payments, support for less favored areas and other subsidies within the framework of rural area support programs per FWU).

- X2it—the value of subsidies for crop and livestock production (the sum of other subsidies for crop and livestock production, balances of subsidies and fines for milk producers, subsidies for other cattle, and subsidies for sheep and goats per FWU).

- X3it—the value of decoupled payments per FWU.

- X4it—the value of other subsidies per FWU.

4. Results and Discussion

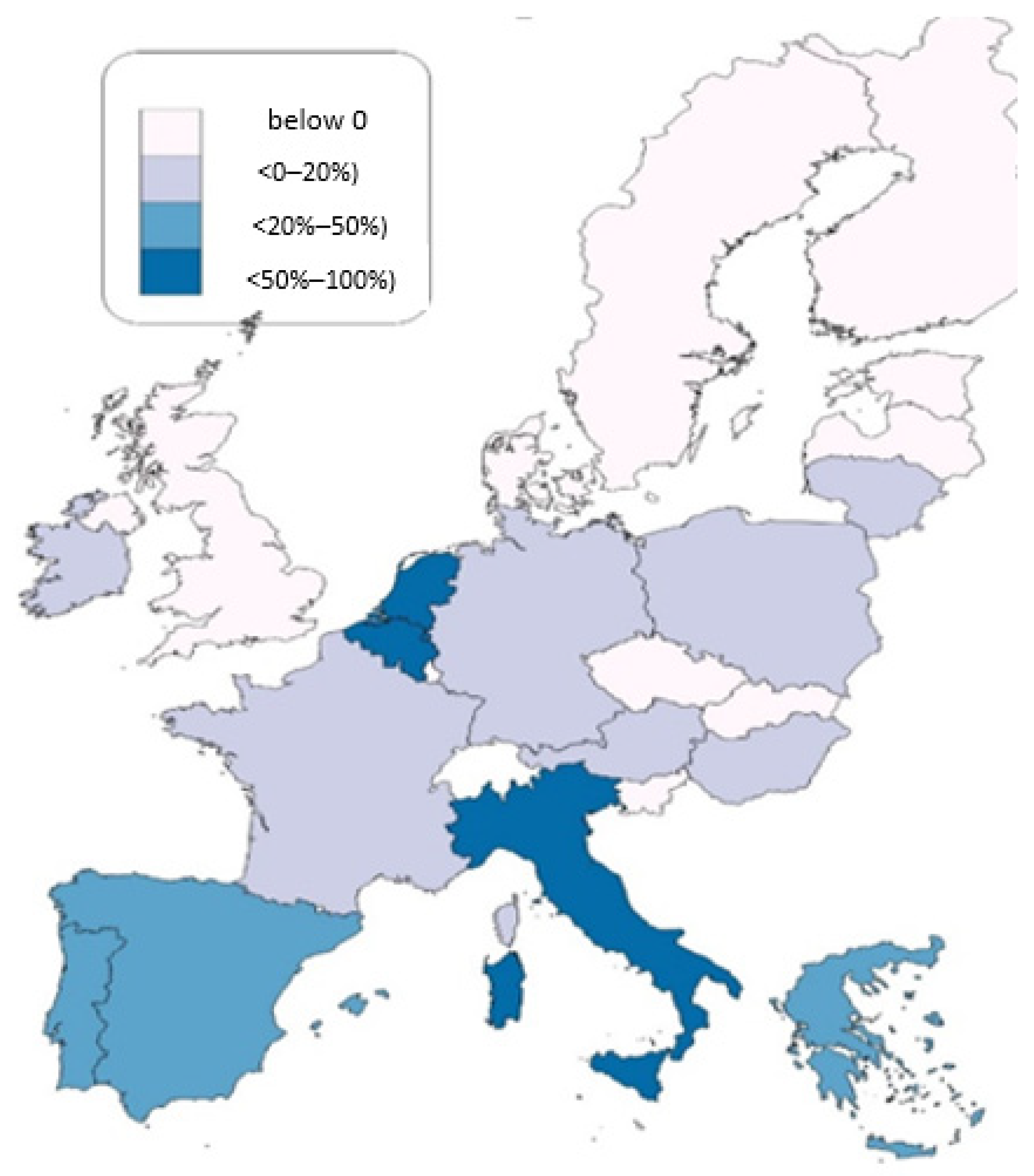

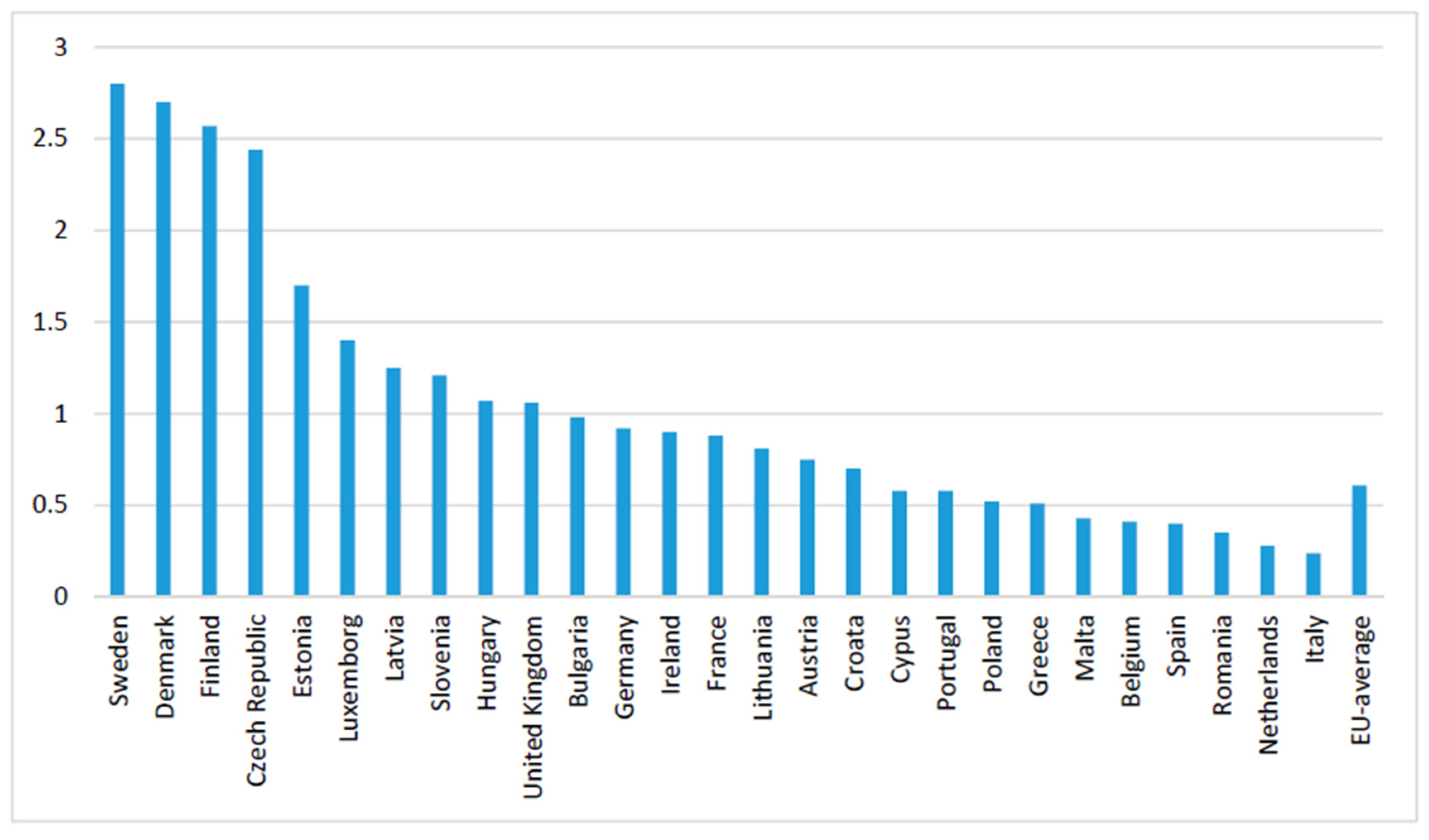

4.1. Income of Family Farms in Relation to Non-Agricultural Incomes in the European Union Countries

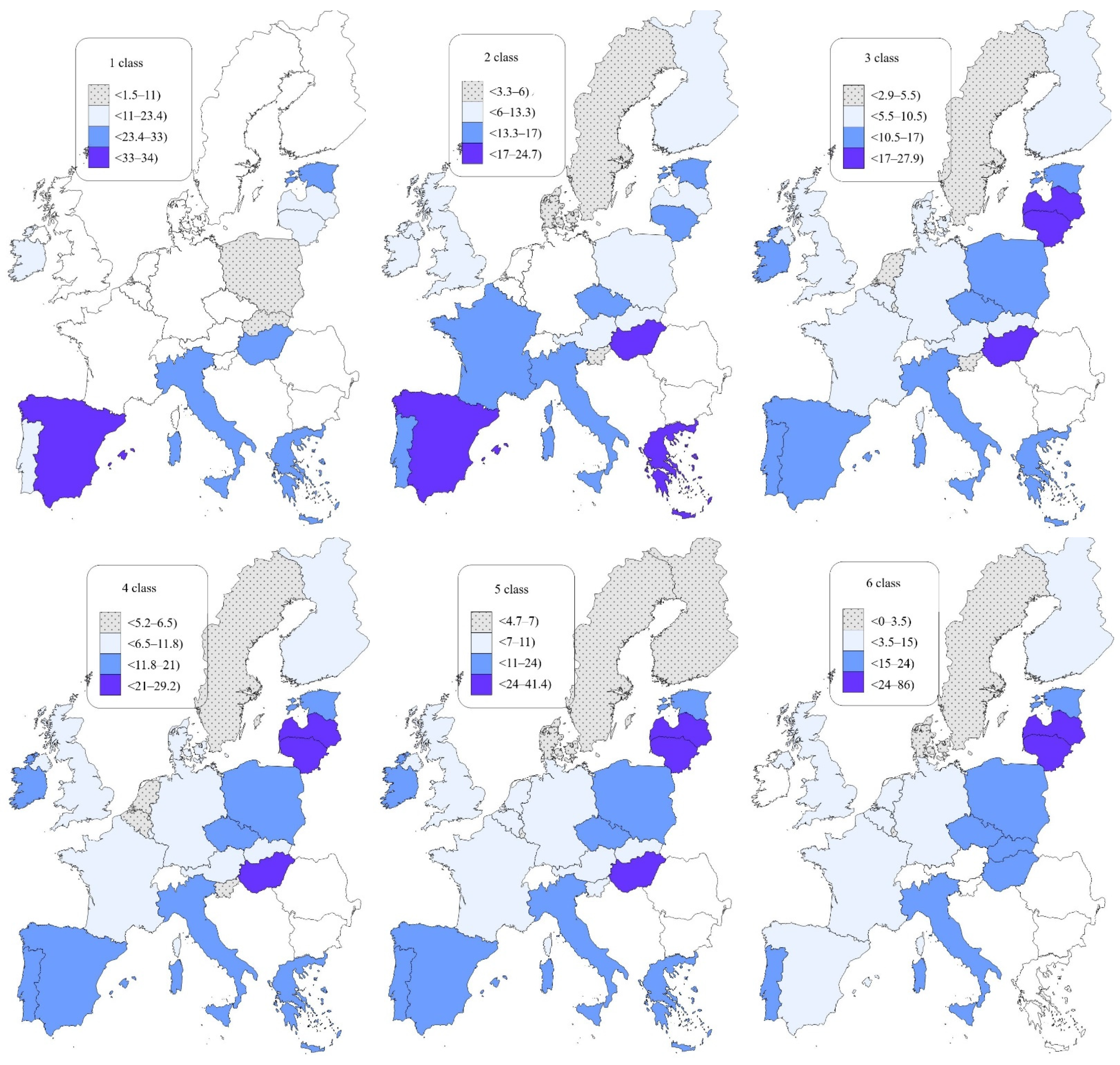

4.2. Income of Family Farms with Different Value of Agricultural Production in Relation to Non-Agricultural Incomes in the European Union Countries

4.3. Impact of CAP-Subsidies on the Income of Family Farms with Different Value of Agricultural Production in the European Union

5. Conclusions

6. Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Country/Year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Average |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Slovenia | 0.13 | 0.11 | 0.07 | 0.17 | 0.15 | 0.18 | 0.15 | 0.19 | 0.14 | 0.15 | 0.14 | 0.12 | 0.12 | 0.17 | 0.14 |

| Poland | 0.23 | 0.22 | 0.28 | 0.40 | 0.34 | 0.26 | 0.37 | 0.41 | 0.38 | 0.36 | 0.32 | 0.24 | 0.23 | 0.28 | 0.31 |

| Denmark | 0.18 | 0.44 | 0.58 | 0.08 | - * | - | 0.28 | 1.03 | 1.84 | 1.86 | 0.77 | 0.30 | 0.22 | 1.17 | 0.40 |

| Sweden | 0.15 | 0.33 | 0.23 | 0.74 | 0.83 | 0.18 | 0.50 | 0.53 | 0.46 | 0.46 | 0.29 | 0.47 | 0.55 | 0.60 | 0.45 |

| Austria | 0.42 | 0.42 | 0.46 | 0.59 | 0.64 | 0.45 | 0.47 | 0.64 | 0.56 | 0.51 | 0.40 | 0.31 | 0.35 | 0.44 | 0.48 |

| Portugal | 0.30 | 0.29 | 0.35 | 0.39 | 0.47 | 0.44 | 0.48 | 0.51 | 0.54 | 0.57 | 0.61 | 0.61 | 0.56 | 0.62 | 0.48 |

| Latvia | 0.43 | 0.42 | 0.53 | 0.59 | 0.52 | 0.37 | 0.51 | 0.66 | 0.60 | 0.44 | 0.43 | 0.45 | 0.46 | 0.49 | 0.49 |

| Lithuania | 0.34 | 0.32 | 0.32 | 0.62 | 0.64 | 0.65 | 0.73 | 0.76 | 0.70 | 0.57 | 0.41 | 0.43 | 0.34 | 0.43 | 0.52 |

| Greece | 0.41 | 0.47 | 0.48 | 0.56 | 0.54 | 0.48 | 0.54 | 0.59 | 0.55 | 0.59 | 0.62 | 0.48 | 0.53 | 0.60 | 0.53 |

| Finland | 0.50 | 0.48 | 0.44 | 0.72 | 0.60 | 0.46 | 0.70 | 0.67 | 0.65 | 0.54 | 0.62 | 0.44 | 0.33 | 0.51 | 0.55 |

| Irleand | 0.50 | 0.51 | 0.50 | 0.63 | 0.57 | 0.44 | 0.45 | 0.65 | 0.53 | 0.55 | 0.68 | 0.57 | 0.52 | 0.70 | 0.56 |

| Luxembourg | 0.56 | 0.58 | 0.60 | 0.81 | 0.73 | 0.41 | 0.40 | 0.79 | 0.58 | 0.69 | 0.70 | 0.67 | 0.45 | 0.73 | 0.62 |

| EU-average | 0.47 | 0.49 | 0.51 | 0.73 | 0.58 | 0.41 | 0.65 | 0.82 | 0.81 | 0.76 | 0.71 | 0.59 | 0.59 | 0.74 | 0.63 |

| Estonia | 0.57 | 0.56 | 0.43 | 0.76 | 0.83 | 0.61 | 0.79 | 1.01 | 1.06 | 0.85 | 0.47 | 0.44 | 0.21 | 0.65 | 0.66 |

| Slovakia | 0.64 | 0.51 | 0.01 | 1.30 | 0.56 | 0.09 | 0.29 | 1.27 | 0.91 | 0.32 | 1.19 | 1.06 | 1.23 | 1.04 | 0.74 |

| France | 0.64 | 0.63 | 0.72 | 1.01 | 0.87 | 0.41 | 0.93 | 1.07 | 1.01 | 0.69 | 0.73 | 0.63 | 0.46 | 0.66 | 0.75 |

| Germany | 0.57 | 0.58 | 0.64 | 0.90 | 0.65 | 0.59 | 0.79 | 0.88 | 0.96 | 1.02 | 0.78 | 0.56 | 0.72 | 0.83 | 0.75 |

| Spain | 0.80 | 0.64 | 0.76 | 0.93 | 0.88 | 0.62 | 0.71 | 0.72 | 0.66 | 0.72 | 0.66 | 0.78 | 0.89 | 0.94 | 0.76 |

| Czech Republic | 0.61 | 0.57 | 0.70 | 1.02 | 0.93 | 0.70 | 0.73 | 1.18 | 1.01 | 1.10 | 1.10 | 0.76 | 0.69 | 0.68 | 0.84 |

| Italy | 0.63 | 0.66 | 0.67 | 0.86 | 0.83 | 0.88 | 0.81 | 0.84 | 0.86 | 0.84 | 1.18 | 0.94 | 0.97 | 0.94 | 0.85 |

| Belgium | 0.72 | 0.75 | 0.86 | 1.01 | 0.80 | 0.72 | 1.03 | 0.87 | 1.01 | 0.94 | 0.84 | 0.64 | 0.80 | 0.88 | 0.85 |

| The Netherlands | 0.50 | 0.67 | 0.81 | 0.84 | 0.59 | 0.40 | 1.00 | 0.72 | 1.12 | 1.19 | 0.93 | 0.91 | 1.00 | 1.31 | 0.86 |

| United Kingdom | 0.61 | 0.72 | 0.75 | 1.17 | 1.16 | 0.97 | 1.21 | 1.54 | 1.13 | 1.08 | 0.87 | 0.54 | 0.64 | 0.89 | 0.95 |

| Hungary | 0.41 | 0.37 | 0.46 | 0.78 | 0.82 | 0.59 | 0.98 | 1.43 | 1.41 | 1.45 | 1.50 | 1.27 | 1.38 | 1.34 | 1.01 |

Appendix B

| Country/Year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Average |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Slovakia | - | - | - | - | - | - | - | - | - | - | 5.68 | 5.11 | 1.87 | 20.77 | - |

| Sweden | 5.45 | 2.56 | 3.88 | 1.39 | 1.31 | 6.24 | 2.20 | 2.34 | 2.42 | 2.44 | 3.85 | 1.94 | 1.66 | 1.51 | 2.80 |

| Denmark | 3.95 | 1.67 | 1.41 | 12.30 | - | - | 3.33 | 1.04 | 0.56 | 0.56 | 1.24 | 2.57 | 3.46 | 0.69 | 2.70 |

| Finland | 2.02 | 2.20 | 2.32 | 1.79 | 2.43 | 3.18 | 2.14 | 2.31 | 2.40 | 3.00 | 2.59 | 3.00 | 3.85 | 2.69 | 2.57 |

| Czech Republic | 1.33 | 2.42 | 2.45 | 1.65 | 2.66 | 6.70 | 3.39 | 1.72 | 1.70 | 1.76 | 1.50 | 2.21 | 2.41 | 2.25 | 2.44 |

| Estonia | 0.84 | 0.85 | 1.10 | 0.74 | 1.52 | 2.39 | 1.43 | 1.24 | 1.13 | 1.81 | 3.48 | 3.63 | - | 1.49 | 1,70 |

| Luxembourg | 1.08 | 1.16 | 1.21 | 1.03 | 1.19 | 2.10 | 1.96 | 1.26 | 1.54 | 1.32 | 1.26 | 1.43 | 1.75 | 1.25 | 1.40 |

| Latvia | 0.91 | 0.89 | 1.06 | 0.96 | 1.40 | 2.10 | 1.44 | 1.32 | 0.95 | 1.35 | 1.52 | 1.20 | 1.33 | 1.07 | 1.25 |

| Slovenia | 1.04 | 1.00 | 1.13 | 0.77 | 1.27 | 1.16 | 1.26 | 1.01 | 1.45 | 1.59 | 1.43 | 1.41 | 1.32 | 1.15 | 1.21 |

| Hungary | 1.33 | 1.79 | 1.29 | 1.00 | 0.88 | 1.93 | 1.09 | 0.79 | 0.79 | 0.93 | 0.84 | 0.90 | 0.76 | 0.72 | 1.07 |

| United Kingdom | 1.44 | 1.31 | 1.28 | 0.91 | 0.92 | 1.11 | 0.83 | 0.68 | 0.86 | 0.94 | 1.10 | 1.36 | 1.23 | 0.90 | 1.06 |

| Bulgaria | x | x | x | 0.37 | 0.63 | 1.31 | 0.77 | 0.70 | 0.76 | 1.24 | 1.22 | 1.26 | 1.47 | 1.08 | 0.98 |

| Germany | 0.93 | 0.93 | 0.95 | 0.72 | 1.12 | 1.49 | 0.97 | 0.91 | 0.70 | 0.68 | 0.85 | 1.07 | 0.84 | 0.72 | 0.92 |

| Ireland | 0.93 | 0.97 | 1.02 | 0.91 | 1.09 | 1.39 | 1.08 | 0.75 | 0.89 | 0.86 | 0.72 | 0.65 | 0.75 | 0.59 | 0.90 |

| France | 0.92 | 0.95 | 0.89 | 0.68 | 0.86 | 1.63 | 0.70 | 0.65 | 0.63 | 0.92 | 0.85 | 0.78 | 1.08 | 0.77 | 0.88 |

| Lithuania | 0.54 | 0.70 | 0.86 | 0.50 | 0.64 | 1.03 | 0.82 | 0.72 | 0.61 | 0.81 | 1.07 | 0.88 | 1.29 | 0.93 | 0.81 |

| Austria | 0.83 | 0.86 | 0.82 | 0.63 | 0.65 | 0.97 | 0.84 | 0.66 | 0.67 | 0.75 | 0.76 | 0.74 | 0.71 | 0.67 | 0.75 |

| Croatia | x | x | x | x | x | x | x | x | x | 0.69 | 0.73 | 0.69 | 0.71 | 0.69 | 0.70 |

| EU average | 0.58 | 0.62 | 0.62 | 0.51 | 0.61 | 0.82 | 0.61 | 0.58 | 0.56 | 0.61 | 0.62 | 0.63 | 0.63 | 0.55 | 0.61 |

| Cyprus | 0.83 | 0.73 | 0.61 | 0.48 | 0.68 | 0.72 | 0.39 | 0.35 | 0.64 | 0.51 | 0.67 | 0.60 | 0.52 | 0.37 | 0.58 |

| Portugal | 0.68 | 0.70 | 0.60 | 0.55 | 0.51 | 0.59 | 0.55 | 0.57 | 0.60 | 0.58 | 0.54 | 0.59 | 0.52 | 0.50 | 0.58 |

| Poland | 0.28 | 0.31 | 0.43 | 0.35 | 0.59 | 0.75 | 0.55 | 0.52 | 0.49 | 0.57 | 0.63 | 0.62 | 0.69 | 0.58 | 0.52 |

| Greece | 0.40 | 0.38 | 0.49 | 0.45 | 0.53 | 0.54 | 0.51 | 0.54 | 0.54 | 0.58 | 0.52 | 0.55 | 0.57 | 0.50 | 0.51 |

| Malta | 0.42 | 0.50 | 0.50 | 0.51 | 0.62 | 0.46 | 0.57 | 0.57 | 0.39 | 0.31 | 0.32 | 0.33 | 0.25 | 0.25 | 0.43 |

| Belgium | 0.32 | 0.32 | 0.35 | 0.36 | 0.50 | 0.53 | 0.39 | 0.46 | 0.39 | 0.41 | 0.46 | 0.47 | 0.41 | 0.35 | 0.41 |

| Spain | 0.28 | 0.36 | 0.31 | 0.25 | 0.36 | 0.47 | 0.49 | 0.49 | 0.49 | 0.47 | 0.53 | 0.40 | 0.35 | 0.37 | 0.40 |

| Romania | x | x | x | 0.65 | 0.24 | 0.44 | 0.28 | 0.27 | 0.31 | 0.32 | 0.28 | 0.31 | 0.42 | 0.35 | 0.35 |

| Netherlands | 0.18 | 0.22 | 0.25 | 0.27 | 0.43 | 0.65 | 0.26 | 0.41 | 0.26 | 0.21 | 0.18 | 0.25 | 0.22 | 0.14 | 0.28 |

| Italy | 0.28 | 0.29 | 0.30 | 0.23 | 0.22 | 0.23 | 0.24 | 0.24 | 0.23 | 0.25 | 0.21 | 0.23 | 0.22 | 0.23 | 0.24 |

References

- Clutterbuck, C. Bittersweet Brexit. In The Future of Food, Farming, Land and Labour; Pluto Press: London, UK, 2017. [Google Scholar] [CrossRef]

- Demidov, P.V.; Ulezko, A.V. The effectiveness of the use of productive land in agriculture of the Voronezh region. Vestn. Voronežskogo Gos. Univ. Inženernyh Tehnol. 2018, 80, 398–406. [Google Scholar] [CrossRef][Green Version]

- Czyżewski, B.; Czyżewski, A.; Kryszak, Ł. The Market Treadmill Against Sustainable Income of European Farmers: How the CAP Has Struggled with Cochrane’s Curse. Sustainability 2019, 11, 791. [Google Scholar] [CrossRef]

- Argilés, J.M. Accounting information and the prediction of farm non-viability. Eur. Account. Rev. 2001, 10, 73–105. [Google Scholar] [CrossRef]

- Hennessy, T.; Shresthra, S.; Farrell, M. Quantifying the viability of farming in Ireland: Can decoupling address the regional imbalances. Ir. Geogr. 2008, 41, 29–47. [Google Scholar] [CrossRef]

- Vrolijk, H.C.J.; De Bont, C.J.; Blokland, P.W.; Soboh, R.A. Farm Viability in the European Union: As-sessment of the Impact of Changes in Farm Payments. In Report 2010-011; LEI: Wageningen, The Netherlands, 2010. [Google Scholar]

- Prus, P. Sustainable development of individual farms based on chosen groups of farmers. Electron. J. Pol. Agric. Univ. 2008, 11. Available online: http://www.ejpau.media.pl/volume11/issue3/art-06.html (accessed on 10 December 2020).

- Sakketa, T.G. Relative Deprivation in Income, Assets, and Social Capital: Motivational and Deterrent Impacts on the Well-Being of Rural Youth. In Proceedings of the International Association of Agricultural Economists 2018 Conference, Vancouver, BC, Canada, 28 July–2 August 2018; Available online: https://ideas.repec.org/p/ags/iaae18/277116.html (accessed on 14 December 2020).

- You, J.; Wang, S.; Roope, L. Intertemporal deprivation in rural china: Income and nutrition. J. Econ. Inequal. 2018, 6, 61–101. Available online: https://ideas.repec.org/a/kap/jecinq/v16y2018i1d10.1007_s10888-017-9352-z.html (accessed on 14 December 2020). [CrossRef]

- GUS. Sustainable Development Indicators in Poland; GUS: Warszawa, Poland, 2011.

- EUROSTAT. Sustainable Development Indicators; EUROSTAT: Brussels, Belgium, 2017. Available online: http://ec.europa.eu/eurostat/web/sdi/indicators/socioeconomic-development.15.03.20170 (accessed on 15 February 2018).

- Aznar-Sánchez, J.A.; Piquer-Rodríguez, M.; Velasco-Muñoz, J.F.; Manzano-Agugliaro, F. Worldwide research trends on sustainable land use in agriculture. Land Use Policy 2019, 87, 104069. [Google Scholar] [CrossRef]

- Roman, M.; Roman, M.; Roman, K. The forecast of economic processes of selected agricultural products in the development of bioenergy and agritourism activity in Poland. Proc. Int. Sci. Conf. Hradec Econ. Days 2018, 8, 246–247. [Google Scholar]

- Guth, M.; Smędzik-Ambroży, K.; Czyżewski, B.; Stępień, S. The Economic Sustainability of Farms under Common Agricultural Policy in the European Union Countries. Agriculture 2020, 10, 34. [Google Scholar] [CrossRef]

- Smędzik-Ambroży, K.; Guth, M.; Stępień, S.; Brelik, A. The Influence of the European Union’s Common Agricultural Policy on the Socio-Economic Sustainability of Farms (the Case of Poland). Sustainability 2019, 11, 7173. [Google Scholar] [CrossRef]

- Stępień, S.; Czyżewski, A. Quo vadis Common Agricultural Policy of the European Union? Management 2019, 23, 295–309. [Google Scholar] [CrossRef]

- Smędzik-Ambroży, K.; Sapa, A. The European Union’s agricultural policy and income disparities. Soc. Inequalities Econ. Growth 2021, (under review; accepted; in press). [Google Scholar]

- Hill, B.; Bradley, D. Comparison of Farmers’ Incomes in the EU Member States. In Study for the European Parliament’s Committee on Agriculture and Rural Development; European Parliament: Brussels, Belgium, 2015. [Google Scholar]

- Zawalińska, K.; Majewski, E.; Was, A. Long-term changes in the incomes of the Polish agriculture compared to the European Union countries. Ann. Pol. Assoc. Agric. Agribus. Econ 2016, 17, 346–354. [Google Scholar]

- Czyżewski, B.; Poczta-Wajda, A. Effects of Policy and Market on Relative Income Deprivation of Agricultural Labour. In Proceedings of the 160th EAAE Seminar “Rural Jobs and the CAP”, Warsaw, Poland, 1–2 December 2016; Available online: http://ageconsearch.umn.edu/bitstream/249759/2/Czyzewski_Poczta-Wajda.pdf (accessed on 10 December 2017).

- Peacock, W.G.; Hoover, G.A.; Kilian, C.D. Divergence and Convergence in International Development: A Decomposition Analysis of Inequality in the World System. Am. Sociol. Rev. 1988, 6, 843. [Google Scholar] [CrossRef]

- Starka, O.; Micevska, M.; Mycielskic, J. Relative poverty as a determinant of migration: Evidence from Poland. Econ. Lett. 2009, 103, 119–122. [Google Scholar] [CrossRef]

- Daly, H.E.; Cobb, J.B., Jr. For the Common Good. Redirecting the Economy toward Community, the Environment and a Sustainable Future; Beacon Press: Boston, MA, USA, 1989. [Google Scholar]

- Graczyk, A. Sustainable development in economic theory and practice (Zrównoważony rozwój w teorii ekonomii i w praktyce). Sci. Pap. Univ. Econ. Wrocław 2007, 1190, 377. [Google Scholar]

- Boarini, R.; d’Ercole, M.M. Measures of material deprivation in OECD countries. OECD Soc. Employ. Migr. Work. Pap. 2006, 37, 1–70. [Google Scholar] [CrossRef]

- Martino, S.; Muenzel, D. The economic value of high nature value farming and the importance of the Common Agricultural Policy in sustaining income: The case study of the Natura 2000 Zarandul de Est (Romania). J. Rural Stud. 2018, 60, 176–187. [Google Scholar] [CrossRef]

- European Parliament. Comparison of Farmers’ Incomes in the UE Member States. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2015/540374/IPOL_STU(2015)540374_EN.pdf (accessed on 14 December 2020).

- Swinnen, J. The Political Economy of the 2014-2020 Common Agricultural Policy. An Imperfect Storm 2015; Centre for European Policy Studies–Brussels: Rowman and Littlefield International: London, UK, 2015. [Google Scholar]

- Poczta-Wajda, A. The Policy of Supporting Agriculture and the Problem of Income Deprivation of Farmers in Countries with Different Levels of Development (Polityka Wspierania Rolnictwa a Problem Deprywacji Dochodowej Rolników W Krajacho Różnym Poziomie Rozwoju); PWN: Warsaw, Poland, 2017. [Google Scholar]

- Stępień, S.; Maican, S. Small Farms in the Paradigm of Sustainable Development: Case Studies of Collected Central and Eastern European Countries; Adam Marszałek Publishing House: Toruń, Poland, 2020. [Google Scholar]

- Czyżewski, B.; Matuszczak, A.; Czyżewski, A.; Brelik, A. Public goods in rural areas as endogenous drivers of income: Developing a framework for country landscape valuation. Land Use Policy 2020, 1, 104646. [Google Scholar] [CrossRef]

- Czyżewski, B.; Matuszczak, A.; Miśkiewicz, R. Public goods versus the farm price-cost squeeze: Shaping the sustainability of the EU’s common agricultural policy. Technol. Econ. Dev. Econ. 2019, 25, 82–102. [Google Scholar] [CrossRef]

- Vanni, F. Agriculture and Public Goods; Springer: Agriculture and Public Goods, 2014. [Google Scholar]

- Uddin, M.T.; Dhar, A.R. Conservation Agriculture Practice in Bangladesh: Farmers’ Socioeconomic Status And Soil Environment Perspective. Int. J. Econ. Manag. Eng. 2017, 11, 1251–1259. [Google Scholar]

- Czyżewski, B.; Smędzik-Ambroży, K. The regional structure of the CAP subsidies and the factor productivity in agriculture in the EU 28. Agric. Econ. 2017, 63, 149–163. [Google Scholar] [CrossRef]

- Kufel, T. Econometrics. Solving Problems Using the GRETL Program (Ekonometria. Rozwiązywanie Problemów Z Wykorzystaniem Programu GRETL); PWN: Warsaw, Poland, 2011. [Google Scholar]

- Roszkowska-Mądra, B. The Concept and Importance of High Nature Value Farmland (Koncepcja i znaczenie obszarów rolniczych o wysokich walorach przyrodniczych). Probl. Glob. Agric. 2018, 18, 417–425. [Google Scholar] [CrossRef]

- Beaufoy, G. HNV–Farming–Explaining the Concept and Interpreting EU and National Policy Comments. Available online: http://www.efncp.org/download/EFNCP-HNV-farming-concept.pdf (accessed on 15 December 2020).

- Committee of Agricultural Organisations in the European Union. General Committee for Agricultural Cooperation in the European Union, The European Model of Agriculture. Available online: https://trade.ec.europa.eu/doclib/docs/2005/april/tradoc_122241.pdf (accessed on 18 December 2020).

- Olper, A. Determinants of Agricultural Protection: The Role of Democracy and Institutional Setting. J. Agric. Econ. 2001, 52, 463–487. [Google Scholar] [CrossRef]

- Swinnen, J.; Banerjee, A.; Rauser, G.; de Gorter, H. The Political Economy of Public Research Investment and Commodity Policies in Agriculture. An Empirical Study. Agric. Econ. 2000, 22, 111–122. [Google Scholar] [CrossRef]

- Czyżewski, B. Kierat Rynkowy W Europejskim Rolnictwie; PWN: Warszawa, Poland, 2017. [Google Scholar]

- OECD. Average wages (indicator). OCED ilibrary. 2019. [Google Scholar] [CrossRef]

- Galbraith, J.K.; Black, J.D. The Maintenance of Agricultural Production During the Depression: The Explanations Reviewed. J. Political Econ. 1938, 46, 305–323. [Google Scholar] [CrossRef]

- Cochrane, W.W. Farm Prices Myth and Reality; University of Minnesota Press: Minneapolis, MN, USA, 1958. [Google Scholar]

- Gardner, B.L. Changing Economic Perspectives on the Farm Problem. J. Econ. Lit. 1992, 30, 62–101. [Google Scholar]

- US Small Business Administration. 1999–2000 Together with the Office of Advocacy’s Annual Report on Small Business and Competition 2001. Available online: https://www.sba.gov/sites/default/files/files/stateofsb99_00.pdf (accessed on 10 November 2020).

- Erickson, K.W.; Mishra, A.K.; Moss, C.B. Rates of return in the farm and non-farm sectors: A Time Series Comparison. Communication Presented at the Western Agricultural Economics Association 2001. Available online: https://ageconsearch.umn.edu/bitstream/36148/1/sp01er01.pdf (accessed on 10 November 2020).

- Hopkins, J.W.; Morehart, M.J. Distributional Analysis of U.S. Farm Household Income. In Proceedings of the Annual Meeting, Vancouver, BC, Canada, 29 June–1 July 2000. [Google Scholar] [CrossRef]

- Martin, L. Return on Assets on Farms in Canada In Advancing a Policy Dialogue. Series I: Understanding the Structure of Canadian Farm Income; George Morris Centre: Ontario, ON, Canada, 2011. [Google Scholar]

- Drygas, M. The Impact of Direct Payments under Common Agricultural Policy 2004-2006 and 2007-2013 on the Changes of Rural Areas in Pomorskie Voivodship (Wpływ dopłat Bezpośrednichwramach Wspólnej Polityki Rolnej 2004–2006 i 2007–2013 Na Przekształcenia obszarów Wiejskich W Województwie Pomorskim); IRWiR—PAN: Warsaw, Poland, 2011. [Google Scholar]

- Baer-Nawrocka, A. Impact of the Common Agricultural Policy on income efects in agriculture of new member countries (Wpływ Wspólnej Polityki rolnej na efekty dochodowe w rolnictwie nowych krajów członkowskich). Wars. Univ. Life Sci. SGGW Wars. Eur. Policies Financ. Mark 2013, 9, 11. [Google Scholar]

- Stępień, S.; Guth, M.; Smędzik-Ambroży, K. The Role of the Common Agricultural Policy in Creating Agricultural Incomes in the European Union in the Context of Socio-Economic Sustainability (Rola wspólnej polityki rolnej w kreowaniu dochodów gospodarstw rolnych w Unii Europejskiej w kontekście zrównoważenia ekonomiczno-społecznego). Probl. Glob. Agric. 2018, 18, 295–305. [Google Scholar] [CrossRef]

- Kisielińska, J. Income from the Farm and Remuneration in EU Countries (Dochody z gospodarstwa rolnego a wynagrodzenia z pracy najemnej w krajach UE). Probl. Glob. Agric. 2018, 18, 13–139. [Google Scholar] [CrossRef]

- Kata, R. Intra-sectoral inequalities of farm income in Poland in 2004–2017 (Wewnątrzsektorowe nierówności dochodów gospodarstw rolniczych w Polsce w latach 2004–2017). Soc. Inequalities Econ. Growth 2020, 61, 26–42. [Google Scholar] [CrossRef]

- DG Agriculture and Rural Development. Agricultural and Farm Income. Available online: https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/farming/documents/agricultural-farm-income_en.pdf (accessed on 8 January 2021).

- Smędzik-Ambroży, K. Resources and Sustainable Development of Agriculture in Poland after Accession to the European Union (Zasoby A Zrównoważony Rozwój Rolnictwa W Polsce Po Akcesji Do Unii Europejskiej); PWN: Warsaw, Poland, 2018. [Google Scholar]

- World Bank Group; Thinking CAP. Supporting Agricultural Jobs and Incomes in the EU. Available online: http://pubdocs.worldbank.org/en/369851513586667729/Thinking-CAP-World-Bank-Report-on-the-EU.pdf. (accessed on 8 January 2021).

| Country/Class of Farms by Production Value in EUR | 2–8 k EUR | 8–25 k EUR | 25–50 k EUR | 50–100 k EUR | 100–500 k EUR | Above 500 k EUR | Average for the Country |

|---|---|---|---|---|---|---|---|

| Austria | x * | 9.72 | 9.27 | 8.66 | 7.17 | x | 8.71 |

| Belgium | x | x | 9.08 | 6..38 | 7.66 | 6.04 | 7.29 |

| Czech Republic | x | 14.65 | 13.94 | 12.59 | 14.44 | 15.83 | 14.29 |

| Denmark | x | 5.55 | 8.70 | 8.86 | 4.75 | 0.48 | 5.67 |

| Estonia | 27.32 | 13.34 | 15.22 | 20.05 | 23.56 | 20.46 | 20.00 |

| Finland | x | 6.00 | 8.63 | 8.05 | 6.95 | 4.34 | 6.79 |

| France | x | 14.35 | 7.74 | 7.60 | 7.49 | 6.35 | 8.71 |

| Greece | 30.56 | 19.29 | 16.73 | 15.74 | 12.64 | x | 33.64 |

| Spain | 33.82 | 19.24 | 15.96 | 14.59 | 12.51 | 13.11 | 18.21 |

| Netherlands | x | x | 4.35 | 5.24 | 7.30 | 5.38 | 5.57 |

| Ireland | 18.49 | 10.32 | 10.84 | 11.87 | 11.94 | x | 12.69 |

| Lithuania | 18.55 | 16.19 | 24.03 | 28.83 | 41.34 | 85.80 | 35.79 |

| Luxembourg | x | x | 2.95 | 6.70 | 6.29 | 3.31 | 4.81 |

| Latvia | 21.32 | 13.02 | 17.30 | 21.69 | 31.37 | 37.22 | 23.65 |

| Germany | x | x | 5.85 | 6.97 | 7.69 | 6.25 | 6.69 |

| Poland | 10.99 | 8.13 | 10.57 | 12.41 | 15.40 | 20.01 | 12.92 |

| Portugal | 22.61 | 13.42 | 13.04 | 13.22 | 12.32 | 20.63 | 15.87 |

| Slovakia | 1.50 | 12.64 | 9.60 | 8.16 | 10.86 | 21.04 | 10.63 |

| Slovenia | x | 4.13 | 5.44 | 5.96 | 7.39 | x | 5.73 |

| Sweden | x | 3.39 | 3.62 | 6.36 | 6.07 | 2.29 | 4.35 |

| Hungary | 30.09 | 24.60 | 27.85 | 29.19 | 30.52 | 23.11 | 27.56 |

| United Kingdom | x | 10.69 | 8.21 | 8.14 | 9.69 | 11.42 | 16.42 |

| Italy | 23.45 | 14.48 | 13.53 | 13.67 | 15.92 | 22.21 | 17.21 |

| Average for the EU | 34.45 | 12.27 | 11.41 | 12.21 | 13.53 | 25.04 | 14.05 |

| Variable | Below 8 k EUR | 8–25 k EUR | 25–50 k EUR | 50–100 k EUR | 100–500 k EUR | Above 500 k EUR |

|---|---|---|---|---|---|---|

| Public goods (X1) | 1.571 *** | 0.829 *** | 0.596 | 0.084 | 0.206 | 1.127 * |

| (0.354) | (0.224) | (0.404) | (0.277) | (0.237) | (0.605) | |

| Plant and animal production (X2) | 1.179 * | 0.769 ** | 0.175 | 0.063 | 0.646 ** | 0.220 |

| (0.602) | (0.340) | (0.412) | (0.461) | (0.262) | (0.163) | |

| Decoupled payments (X3) | 0.863 | 0.671 ** | 0.064 | 0.246 | 0.781 ** | 0.461 |

| (0.509) | (0.285) | (0.303) | (0.440) | (0.357) | (0.264) | |

| Other payments (X4) | 0.435 *** | 0.797 *** | 0.865 *** | 0.968 *** | 0.619 *** | 0.347 * |

| (0.111) | (0.164) | (0.093) | (0.126) | (0.213) | (0.169) | |

| Constant | 235.757 | 1945.105 | 9725.3 *** | 20,361 *** | 27,563.294 *** | 84,754 *** |

| (962.976) | (1801.598) | (2735.457) | (6344.631) | (9210.754) | (12,040.31) | |

| Number of observations | 117 | 254 | 334 | 345 | 340 | 202 |

| Number of countries | 9 | 20 | 25 | 25 | 25 | 16 |

| R2 | 0.484 | 0.202 | 0.094 | 0.114 | 0.138 | 0.131 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Smędzik-Ambroży, K.; Matuszczak, A.; Kata, R.; Kułyk, P. The Relationship of Agricultural and Non-Agricultural Income and Its Variability in Regard to Farms in the European Union Countries. Agriculture 2021, 11, 196. https://doi.org/10.3390/agriculture11030196

Smędzik-Ambroży K, Matuszczak A, Kata R, Kułyk P. The Relationship of Agricultural and Non-Agricultural Income and Its Variability in Regard to Farms in the European Union Countries. Agriculture. 2021; 11(3):196. https://doi.org/10.3390/agriculture11030196

Chicago/Turabian StyleSmędzik-Ambroży, Katarzyna, Anna Matuszczak, Ryszard Kata, and Piotr Kułyk. 2021. "The Relationship of Agricultural and Non-Agricultural Income and Its Variability in Regard to Farms in the European Union Countries" Agriculture 11, no. 3: 196. https://doi.org/10.3390/agriculture11030196

APA StyleSmędzik-Ambroży, K., Matuszczak, A., Kata, R., & Kułyk, P. (2021). The Relationship of Agricultural and Non-Agricultural Income and Its Variability in Regard to Farms in the European Union Countries. Agriculture, 11(3), 196. https://doi.org/10.3390/agriculture11030196