Today, farmers have to cope with many challenges, which due to their social, environmental and economic context, often contradict each other. In the economic and social dimension, the basic goal of a farm’s operation is to maintain business continuity, further development and ensure a decent income for its owners [

1]. In the environmental context, it is taking actions aimed at achieving sustainable agricultural development, which is associated with the implementation of resilient agricultural practices that support synergy between increasing productivity and maintaining ecosystems capable of providing specific services [

2]. As agricultural producers face the inherent threats of climate change, they employ various risk management strategies to reduce uncertainty, including crop insurance [

3].

Crop insurance has long been considered one of the main drivers of structural change in agriculture. Crop insurance contributes to the improvement and stabilization of the production results of farms [

4], leads to an increase in productivity [

5,

6], inter alia, by undertaking risky agricultural practices [

7]. Despite this, crop insurance can also have serious economic, social and environmental consequences [

8]. It should be noted that global agricultural production is currently unsustainable [

9]. Global land-use change, mainly due to the expansion and intensification of agriculture, has resulted in widespread biodiversity decline, 74% of the earth’s surface degradation [

10], land deforestation, water degradation [

11] and significant greenhouse gas emissions [

12]. As a consequence of these activities, serious climate changes occur, which will increase the demand for insurance and/or increase the amount of compensations paid. They will also influence “what” can be produced, “when” it can be produced and “how much” can be produced [

13]. Climate change has a direct and indirect impact on agricultural production. With increased variability of weather conditions and more frequent episodic weather events temperature changes and water availability will have a direct impact on yields [

14] and thus on productivity [

15]. Rising temperatures increase ozone formation in the troposphere, and increased ozone levels cause oxidative stress in plants, limiting photosynthesis and plant growth [

16]. Climate change affects the decline in the population of plant pollinators, which may have multiple effects on agricultural production [

17,

18]. Climate change also increases crop losses and damage caused by pests, pathogens and weeds [

19].

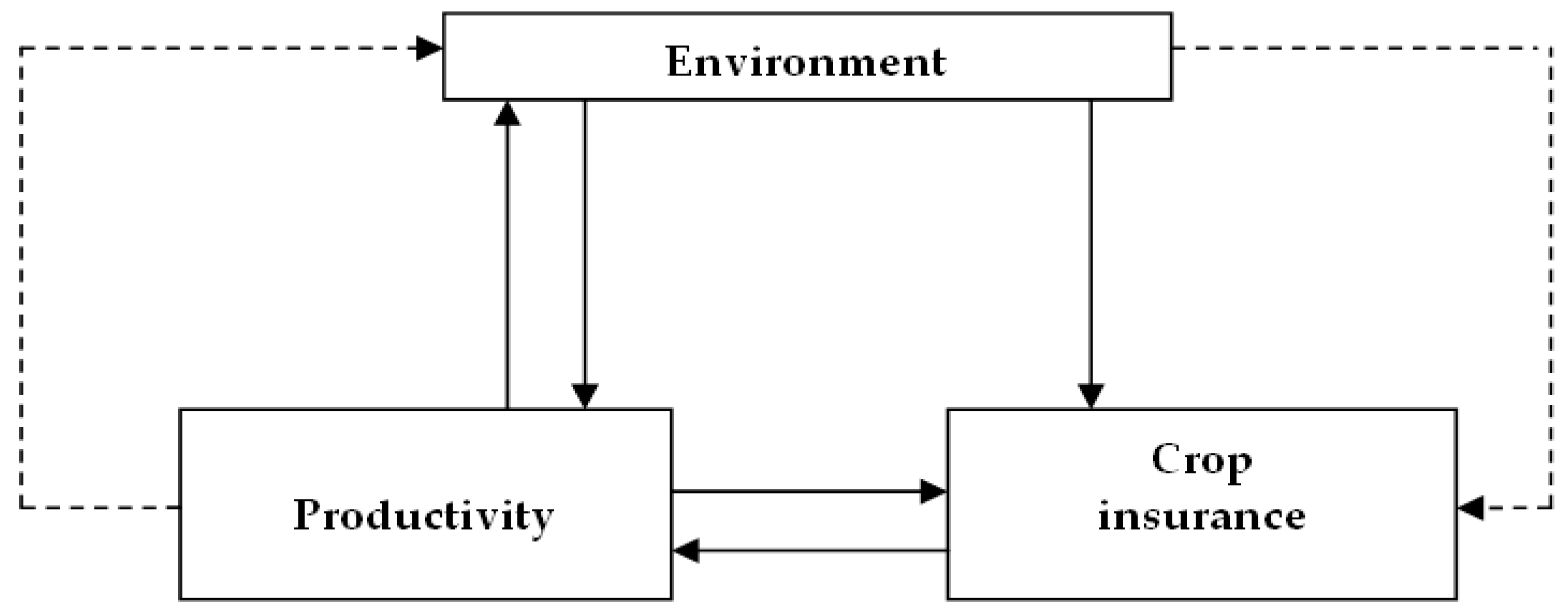

Research to date on determining the relationship between crop insurance, land productivity and the environment has yet to use its potential to systematize our understanding of these processes. In this context, the aim of our research is to identify and assess the relationship between crop insurance and land productivity in the context of environmental impacts. In particular, we want to find out if there is a relationship between crop insurance and land productivity, which is determined, inter alia, by the use of specific agricultural practices that may have a negative impact on the environment. We assume that the farmer can choose to accept certain practices or not because he is insured; likewise, he may or may not take out insurance because he uses certain practices that affect the state of the environment. The relationships between crop insurance, productivity and the environment are summarized in

Figure 1. The figure below shows a schematic illustration of the cause and effect relationship of crop, productivity and environmental insurance. On the one hand, crop insurance determines higher productivity; on the other hand, higher productivity is a factor determining the use of insurance in farms. In turn, the environment, and more specifically environmental changes, results from the application of specific practices that increase productivity. Environmental changes are not without significance for achieving higher productivity in the future and the need for greater protection of production.

Literature Review

Productivity in agriculture is a measure of resource efficiency in the production process. It allows one to assess the final effect of activities undertaken on the farm based on the resources available [

22]. Farm resource productivity is important in view of the global challenges facing agriculture today, including food security and poverty, climate change adaptation and mitigation, natural resource degradation and depletion and increased farm incomes. As pointed out by Ozkan et al. the work of [

23] relates to productivity, which refers to the best possible allocation of resources included in the production system, in other words, it is the sum of technical efficiency and resource allocation efficiency. Productivity gains reflect an increase in the efficiency of production processes and is an important mechanism for generating higher farm income, leading to increased social welfare. Land productivity is assigned an important role in sustainable development, but higher productivity is also accompanied by “side effects” causing environmental damage, mainly as a result of intensive land use, biodiversity depletion, high specialization, high doses of plant protection products and fertilizers. Productivity is an issue of great interest to researchers from many countries. Productivity is assessed in various contexts: in relation to various production factors, in a time system or in a comparative system [

24]. Productivity, however, is not only determined by inputs. The efficiency of processing inputs into production is influenced by external conditions, and in agriculture, these conditions can be divided into natural conditions, such as weather and climate, social conditions, such as relationships, behaviors and attitudes, [

25] and economic conditions, including, inter alia, access to capital, agricultural insurance systems, agricultural subsidies, structure and the level of prices.

The development of the agricultural insurance market has a positive impact on the increase in productivity [

26]. At the same time, the resources of farms (land, labor, capital) determine whether they have insurance. This is suggested by previous studies which proved that agricultural production, farm income, level of profitability, return on equity, cash flow, land structure, yields or the value of fixed assets have an impact on farmers’ decisions to purchase insurance (see: [

27]).

Tahamipour et al. [

6], by examining the factors determining productivity in the Iranian agricultural sector, showed that crop insurance has a positive effect on the productivity of agricultural factors of production. By paying risk management premiums, farmers increase the degree of productivity by allocating resources more appropriately and investing in more risky and productive activities. Pawłowska-Tyszko and Soliwoda [

28] analyzed the impact of agricultural insurance on the economic and financial sustainability of farms in Poland and proved that the productivity of land in farms insuring crops was higher than in farms without insurance. This may indicate that insurance may contribute to the improvement of land productivity, and thus—an increase in the level of income. Gross value added that is related to labor inputs informing about labor productivity and the ability to generate income in farms was also higher in farms with insurance. This may mean that farms that insure their crops use their labor resources much more effectively, which may be associated with greater possibilities for limiting costs for restoration of agricultural production in the perspective of the possessed security in the form of insurance. The value of the return on equity ratio and the value of the debt ratio suggest that farms with insurance are able to effectively use their capital, and they are also willing to take on more risky activities in terms of shaping the capital structure. Sihem [

26], by assessing the relationship between agricultural insurance and productivity in 23 American and European countries, proves that the penetration of the agricultural insurance market may be conducive to an increase in land productivity by considering crop risk management. Kurdyś-Kujawska and Sompolska-Rzechuła [

29], analyzed the impact of insurance on the development of farms in the central Pomeranian region of Poland, and they showed that insured farms were characterized by a higher average share of own land in the structure of agricultural land, compared to uninsured farms. On these farms, land lease was also of great importance, thanks to which farmers could increase the production potential of the farm and adapt production to the effective demand on the market. In addition, farms with insurance had better access to financial services, meaning they could engage in more risky activities (e.g., increasing investments, changing the way production is organized, etc.). Compared to other units, the insured farms increased the area of agricultural land, which was associated with an increase in agricultural income, economic efficiency and productivity and labor efficiency. This is because insurance stabilizes your income by paying compensation for insured losses. A stable income is often a prerequisite for receiving a financial loan and investing. By having insurance, farm managers are able to adjust their production strategies and thus improve economic performance [

4]. Hazell [

30] argues that farmers can allocate resources to the maximum extent if they are confident that they will be compensated for significantly lower income for reasons beyond their control. In addition, they can develop more profitable crops, even if they are risky, and use better but uncertain technology when they are compensated in the event of a loss.

Insurance, similar to productivity, is assigned an important role in the sustainable development of agriculture. The condition for achieving sustainable development is the stability and financial security of economic entities that enable uninterrupted operation. Insurance has a positive impact on individual elements of sustainable development, i.e., social, economic, environmental and institutional and political order [

31]. Particular importance is attached to insurance in achieving farm stabilization by reducing the uncertainty of operation, maintaining the financial liquidity of the farm, ensuring profitability and stabilization of income. Insurance may also have a negative impact on the environment, as shown by previous research. For example Claassen et al. [

32] indicated that crop insurance affects land use change and crop choices. As evidenced by Ren et al. [

33] and Wang et al. [

34] the productivity, efficiency and profitability of agriculture are closely related to the size of the farm. The consequences of increasing UAA in farms can be observed in many negative environmental effects, such as air and water pollution [

35]. In addition, as the farm size grows, specialization increases mainly in the cultivation of cereals and livestock grazing and a shift away from permanent crops, grain-eating animals or mixed agriculture [

36]. Greater land specialization and polarization will actually increase yields and input use efficiency, but at the same time drives many small and medium-sized farms out of the market and results in land abandonment and production decline in many different areas [

37]. The increase in the degree of farm specialization, irrespective of the economic benefits resulting from a larger scale of production, its quality and higher prices, has negative effects on agriculture, such as increased market and production risk, uneven use of labor and incomplete use of land. It also leads to a reduction in biodiversity and an infringement of the ecological balance. Increasing the degree of specialization of farms is most often associated with an increase in the level of production intensity, which in turn leads to a harmful burden on the natural environment [

38].

Walters et al. [

39] suggested that crop insurance affects the allocation of acreage. Changes in land use and crop structure under insurance can lead to unforeseen side effects on environmental quality. Converting grassland to crop production could mean an increased use of fertilizers, pesticides and other chemicals in sensitive areas, potentially leading to additional runoff and water pollution. Shifts in crop mix towards more erosive and chemically intensive crops can also lead to increased runoff, leaching and water pollution [

40]. Weber et al. [

41] indicated that crop insurance can lead farmers to take more risks, grow crops in erodible soils or specialize in fewer crops, thereby increasing the environmental spill-over effects of agriculture. Goodwin et al. [

42] indicated that crop insurance results in the conversion of a significant amount of land into arable land. These practices can increase the damage to surface water, loss of nutrients and carbon dioxide in the soil. Cai et al. [

43] suggested that crop insurance leads to riskier farming practices with potential food security implications. A similar opinion is expressed by Summer and Zulauf [

44], who, analyzed the environmental consequences of subsidized crop insurance and found that insurance subsidies affect the environment through several channels. These included an incentive to expand into more environmentally sensitive areas, and to use more inputs such as average return, changes to crops that may have more negative environmental consequences and fewer risk-reducing practices. Chakir and Hardelin [

45] showed that crop insurance changes the amount of chemicals used by farmers. Farmers also achieve higher land productivity thanks to the use of fertilizers and plant protection products. Fertilizers are the main inputs used to achieve high and quick rates of return from agriculture [

46]. Increasing the input of mineral fertilizers increases production per hectare, and thus it intensifies agricultural production, as it increases production per unit of land and possibly also per unit of work [

47]. A study by Lin et al. [

48] showed that intensive production is associated with a transition from a state of high diversity (in terms of crop species and genetic varieties) over time and space to monoculture. In addition, as production intensifies, there is a shift from locally adapted varieties to high-yielding, high-input varieties, where the nutrient and water requirements of the new variety are often higher than that available in the wild. Thus, the intensive use of synthetic fertilizers and pesticides leads to soil degradation and environmental pollution in several agroecosystems, which has an adverse effect on humans, animals and aquatic ecosystems [

49]. Production intensification is one of the key drivers of the loss of biodiversity and ecosystem services [

50], as well as climate change [

51].

Möhring et al. [

52], based on the analysis of the relationship between crop insurance and pesticide use in French and Swiss agriculture, proved a statistically and economically significant relationship between crop insurance and the use of pesticides. In both countries, crop insurance was associated with the selection of more intensive crops with a higher pesticide consumption. In the case of France, it was found that crop insurance was also associated with a higher pesticide intensity per hectare. Insurance coverage may also lead to the cultivation of crops on land where the cultivation was previously too risky, for example due to poor growing conditions, natural hazards or high pest pressure. Growing crops on such land leads to a greater use of inputs and the use of pesticides. In turn, Deryugina and Konar [

53] showed that crop insurance might induce farmers to use more water per unit area, reducing their water-use efficiency. It is also possible that the terms of the insurance contract could lead to an increase in water abstraction for a certain type of crop and a fixed area.