Milk Market Integration between Poland and the EU Countries

Abstract

1. Introduction

- What is the long-run dependence between the milk prices in Poland and in different EU countries?

- In what EU countries do the milk prices have a dominant effect on the milk price variation in Poland?

- Do the Polish milk prices have an impact on the prices in other EU countries?

- What changes have occurred in the level of price integration on the milk market between Poland and the EU countries?

2. Materials and Methods

3. Results and Discussion

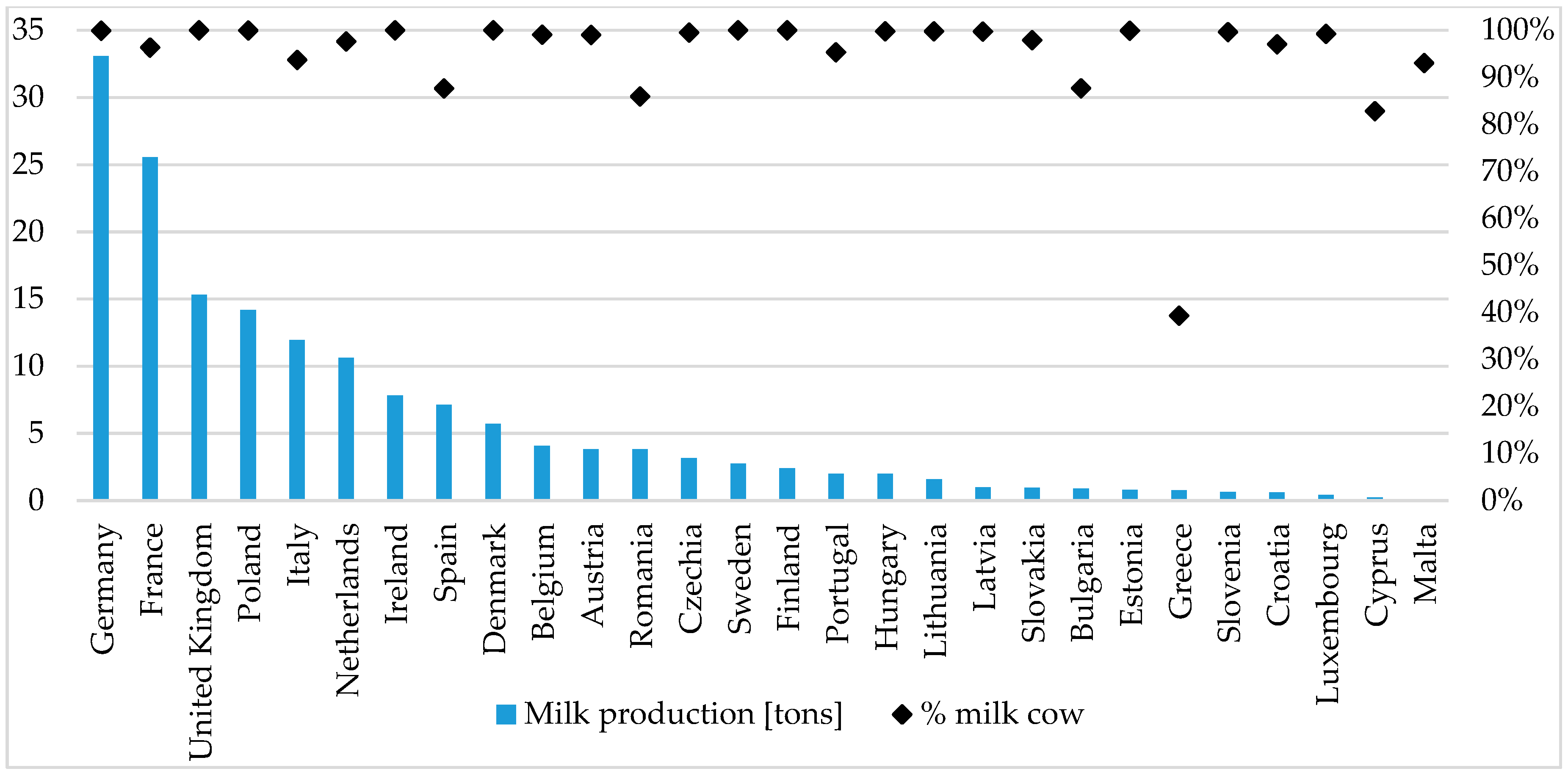

3.1. Trade Exchange as an Expression of the Integration of Markets

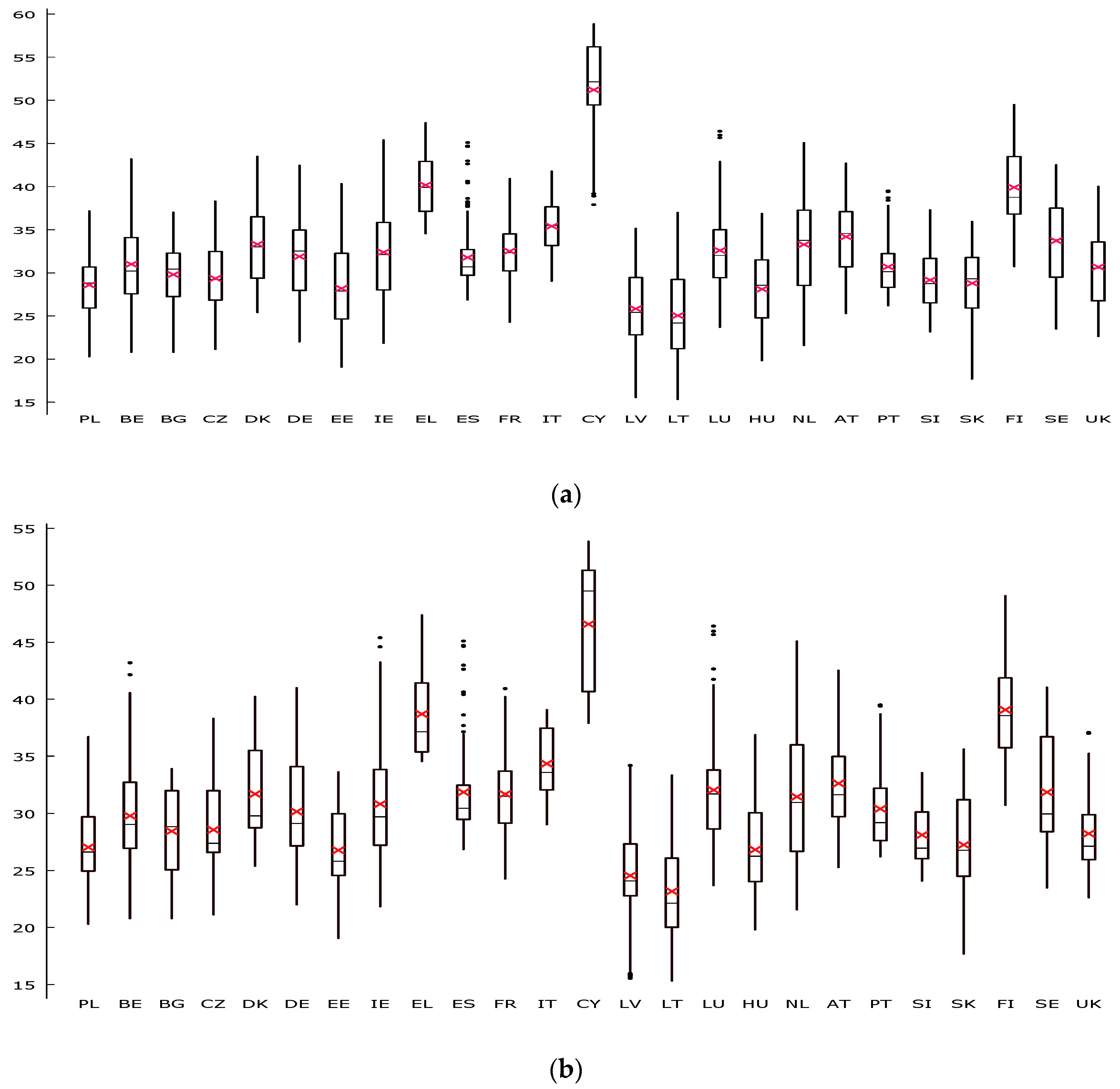

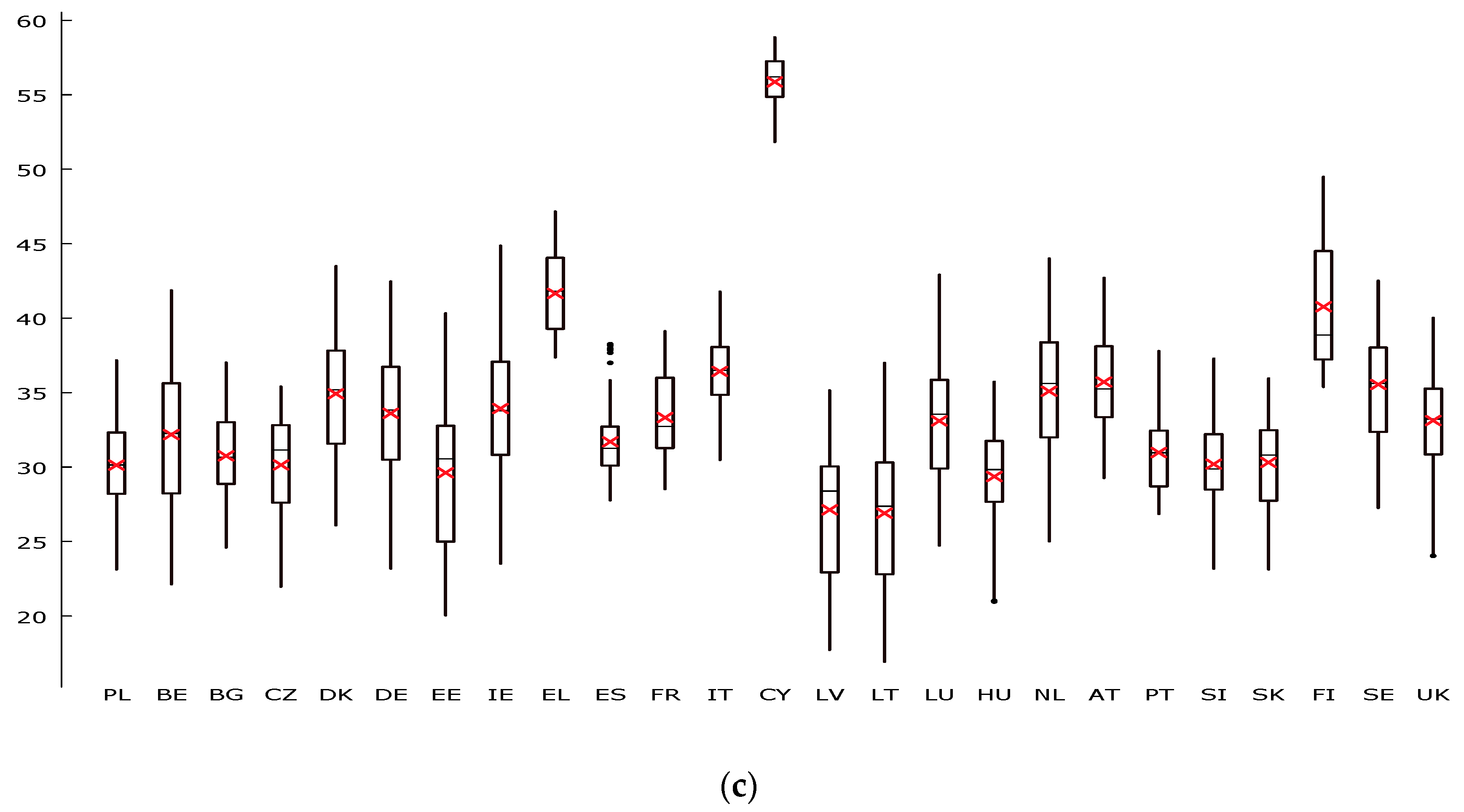

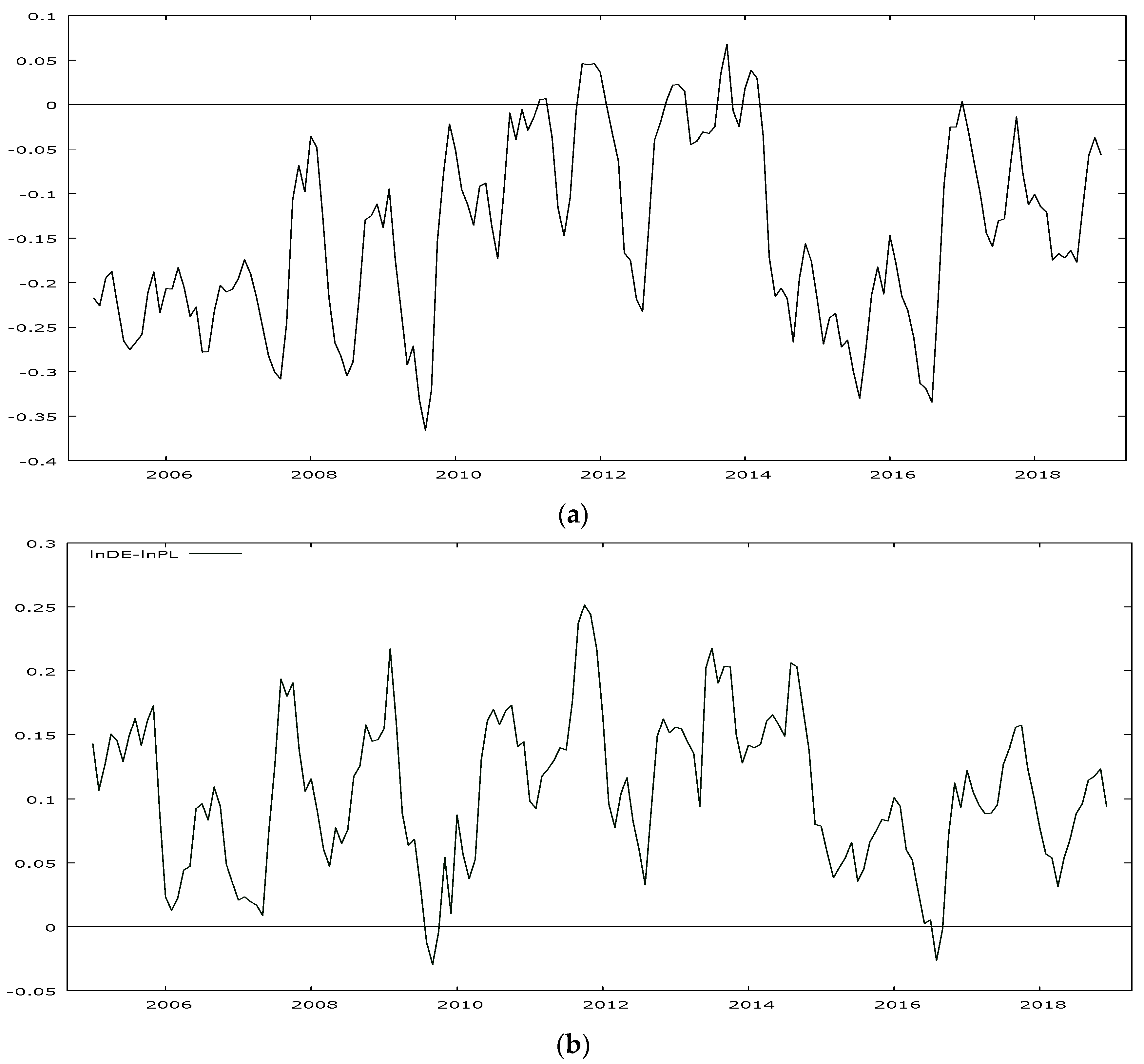

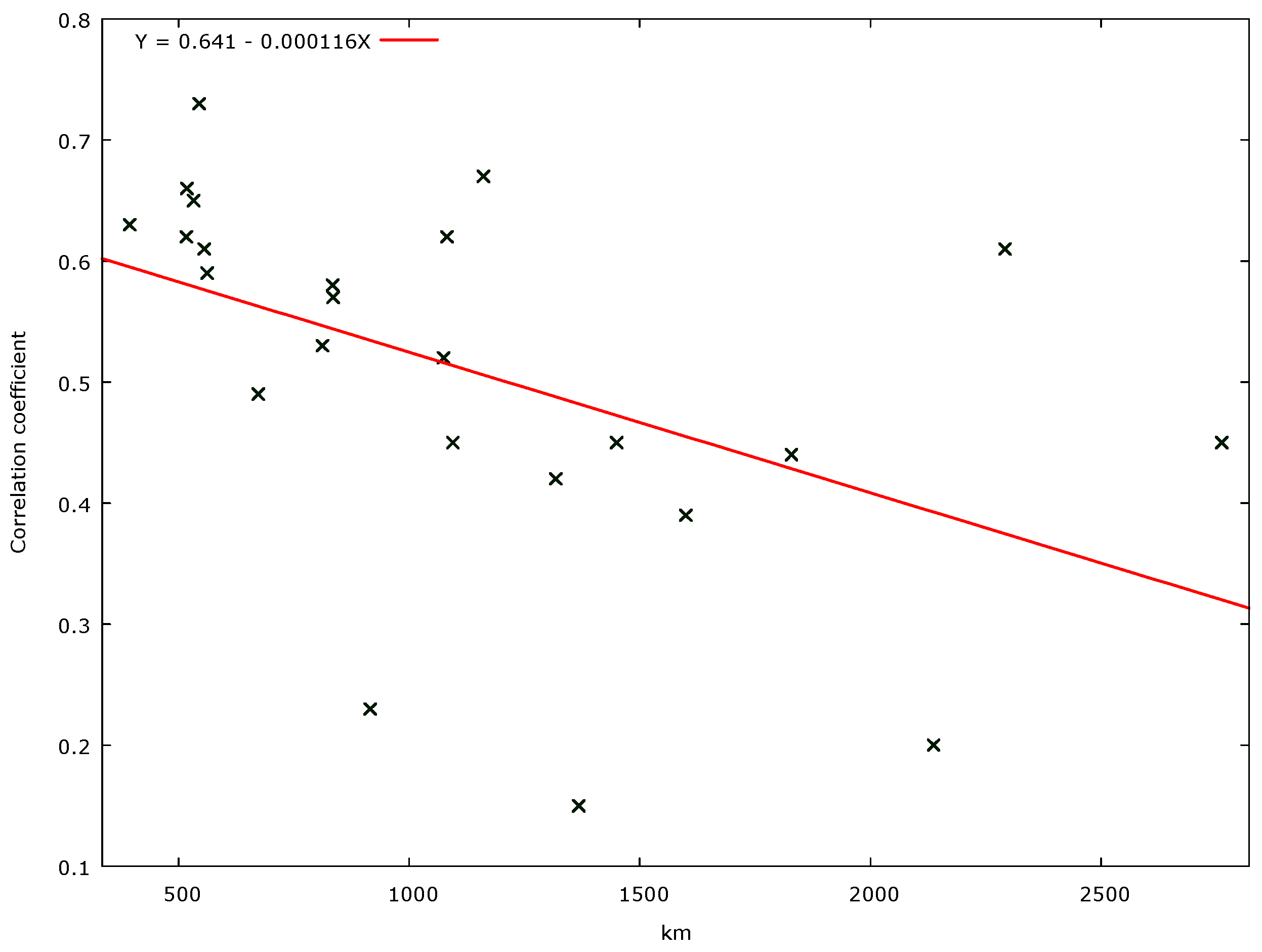

3.2. Price Differences as an Expression of The Integration of Markets

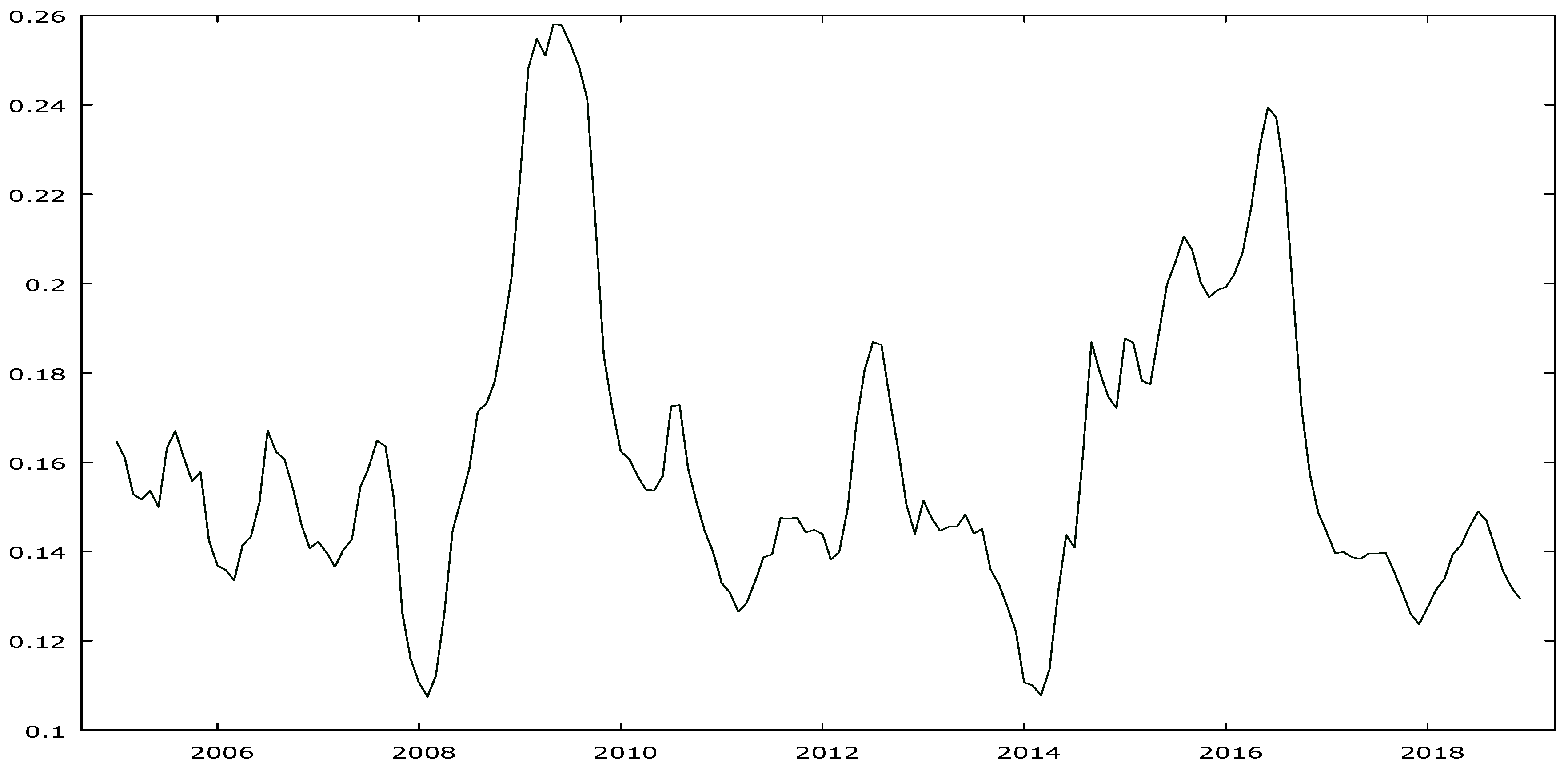

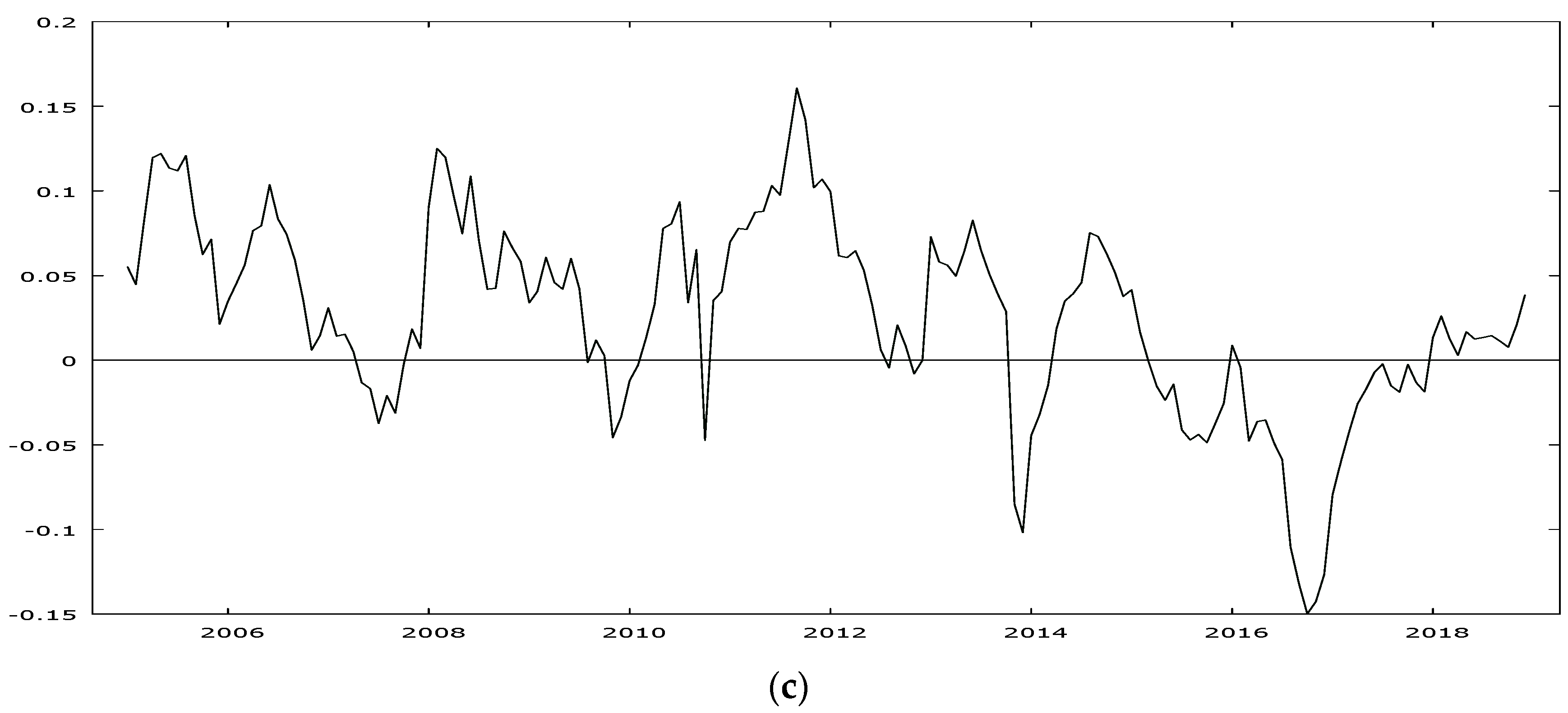

3.3. Correlation between the Prices and the Direction of the Dependence

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Coef. | Coef. | Coef. | Coef. | ||||

|---|---|---|---|---|---|---|---|

| PL | PL | PL | PL | ||||

| Constant | 0.252 *** | Constant | 0.239 *** | Constant | 0.185 *** | Constant | 0.189 *** |

| PL (−1) | 1.161 *** | PL (−1) | 1.426 *** | PL (−1) | 1.373 *** | PL (−1) | 1.393 *** |

| PL (−2) | −0.377 *** | PL (−2) | −0.465 *** | PL (−2) | −0.426 *** | PL (−2) | −0.439 *** |

| BE (−1) | 0.293 ** | BG (−1) | 0.181 ** | CZ (−1) | 0.222 ** | DK (−1) | 0.207 *** |

| BE (−2) | −0.159 *** | BG (−2) | −0.214 *** | CZ (−2) | −0.223 ** | DK (−2) | −0.218 *** |

| R2 | 0.964 | R2 | 0.960 | R2 | 0.959 | R2 | 0.960 |

| PL | PL | PL | PL | ||||

| Constant | 0.181 *** | Constant | 0.178 *** | Constant | 0.165 *** | Constant | 0.145 |

| PL (−1) | 1.235 *** | PL (−1) | 1.448 *** | PL (−1) | 1.306 *** | PL (−1) | 1.488 *** |

| PL (−2) | −0.350 *** | PL (−2) | −0.526 *** | PL (−2) | −0.415 *** | PL (−2) | −0.544 *** |

| DE (−1) | 0.361 *** | EE (−1) | 0.11 | IE (−1) | 0.266 *** | FR (−1) | 0.129 *** |

| DE (−2) | −0.302 *** | EE (−2) | −0.086 | IE (−2) | −0.209 *** | FR (−2) | −0.117 ** |

| R2 | 0.964 | R2 | 0.958 | R2 | 0.966 | R2 | 0.960 |

| PL | PL | PL | PL | ||||

| Constant | 0.192 ** | Constant | 0.194 *** | Constant | 0.198 *** | Constant | 0.19 *** |

| PL (−1) | 1.443 *** | PL (−1) | 1.443 *** | PL (−1) | 1.333 *** | PL (−1) | 1.287 *** |

| PL (−2) | −0.499 *** | PL (−2) | −0.534 *** | PL (−2) | −0.359 *** | PL (−2) | −0.311 *** |

| IT (−1) | 0.294 *** | LV (−1) | 0.096 | LT (−1) | 0.223 *** | HU (−1) | 0.273 *** |

| IT (−2) | −0.296 *** | LV (−2) | −0.063 | LT (−2) | −0.256 *** | HU (−2) | −0.307 *** |

| R2 | 0.960 | R2 | 0.959 | R2 | 0.961 | R2 | 0.961 |

| PL | PL | PL | PL | ||||

| Constant | 0.166 *** | Constant | 0.218 *** | Constant | 0.261 *** | Constant | 0.269 *** |

| PL (−1) | 1.437 *** | PL (−1) | 1.358 *** | PL (−1) | 1.434 *** | PL (−1) | 1.354 *** |

| PL (−2) | −0.516 *** | PL (−2) | −0.389 *** | PL (−2) | −0.463 *** | PL (−2) | −0.389 *** |

| NL (−1) | 0.106 *** | AT (−1) | 0.251 *** | PT (−1) | 0.144 | SI (−1) | 0.300 *** |

| NL (−2) | −0.076 *** | AT (−2) | −0.284 *** | PT (−2) | −0.192 ** | SI (−2) | −0.346 *** |

| R2 | 0.960 | R2 | 0.961 | R2 | 0.960 | R2 | 0.961 |

| PL | PL | PL | PL | ||||

| Constant | 0.210 *** | Constant | 0.167 ** | Constant | 0.168 *** | Constant | 0.167 *** |

| PL (−1) | 1.351 *** | PL (−1) | 1.492 *** | PL (−1) | 1.416 *** | PL (−1) | 1.389 *** |

| PL (−2) | −0.459 *** | PL (−2) | −0.539 *** | PL (−2) | −0.472 *** | PL (−2) | −0.446 *** |

| SK (−1) | 0.297 *** | FI (−1) | 0.139 ** | SE (−1) | 0.156 ** | UK (−1) | 0.248 *** |

| SK (−2) | −0.252 *** | FI (−2) | −0.142 *** | SE (−2) | −0.151 ** | UK (−2) | −0.241 *** |

| R2 | 0.960 | R2 | 0.959 | R2 | 0.959 | R2 | 0.962 |

| BE | BG | CZ | DK | ||||

| Constant | 0.167 *** | Constant | 0.138 | Constant | 0.053 | Constant | 0.134 ** |

| PL (−1) | 0.116 | PL (−1) | 0.322 *** | PL (−1) | 0.438 *** | PL (−1) | 0.314 *** |

| PL (−2) | −0.064 | PL (−2) | −0.256 *** | PL (−2) | −0.339 *** | PL (−2) | −0.181 ** |

| BE (−1) | 1.605 *** | BG (−1) | 1.157 *** | CZ (−1) | 1.096 *** | DK (−1) | 1.284 *** |

| BE (−2) | −0.704 *** | BG (−2) | −0.263 *** | CZ (−2) | −0.209 ** | DK (−2) | −0.450 *** |

| R2 | 0.960 | R2 | 0.943 | R2 | 0.965 | R2 | 0.956 |

| DE | EE | IE | FR | ||||

| Constant | 0.091 | Constant | 0.069 | Constant | 0.095 | Constant | 0.572 *** |

| PL (−1) | 0.171 | PL (−1) | 0.444 *** | PL (−1) | 0.487 *** | PL (−1) | 0.116 |

| PL (−2) | −0.047 | PL (−2) | −0.395 *** | PL (−2) | −0.263 ** | PL (−2) | 0.073 |

| DE (−1) | 1.478 *** | EE (−1) | 1.349 *** | IE (−1) | 1.320 *** | FR (−1) | 1.066 *** |

| DE (−2) | −0.625 *** | EE (−2) | −0.418 *** | IE (−2) | −0.563 *** | FR (−2) | −0.413 *** |

| R2 | 0.965 | R2 | 0.973 | R2 | 0.940 | R2 | 0.825 |

| IT | LV | LT | HU | ||||

| Constant | 0.225 *** | Constant | 0.056 | Constant | −0.046 | Constant | 0.031 |

| PL (−1) | 0.164 *** | PL (−1) | 0.439 *** | PL (−1) | 0.577 *** | PL (−1) | 0.428 *** |

| PL (−2) | −0.072 | PL (−2) | −0.345 *** | PL (−2) | −0.384 *** | PL (−2) | −0.295 *** |

| IT (−1) | 1.032 *** | LV (−1) | 1.481 *** | LT (−1) | 1.412 *** | HU (−1) | 1.207 *** |

| IT (−2) | −0.181 ** | LV (−2) | −0.596 *** | LT (−2) | −0.598 *** | HU (−2) | −0.349 *** |

| R2 | 0.946 | R2 | 0.977 | R2 | 0.962 | R2 | 0.968 |

| NL | AT | PT | SI | ||||

| Constant | 0.087 | Constant | 0.169 *** | Constant | 0.119 | Constant | 0.118 *** |

| PL (−1) | 0.611 *** | PL (−1) | 0.209 *** | PL (−1) | 0.310 *** | PL (−1) | 0.098 |

| PL (−2) | −0.358 ** | PL (−2) | −0.081 | PL (−2) | −0.245 *** | PL (−2) | −0.035 |

| NL (−1) | 0.987 *** | AT (−1) | 1.363 *** | PT (−1) | 0.993 *** | SI (−1) | 1.468 *** |

| NL (−2) | −0.255 *** | AT (−2) | −0.532 *** | PT (−2) | −0.092 *** | SI (−2) | −0.567 *** |

| R2 | 0.885 | R2 | 0.967 | R2 | 0.924 | R2 | 0.975 |

| SK | FI | SE | UK | ||||

| Constant | 0.035 | Constant | 0.283 *** | Constant | 0.121 | Constant | 0.131 |

| PL (−1) | 0.296 *** | PL (−1) | 0.111 | PL (−1) | 0.614 *** | PL (−1) | 0.143 |

| PL (−2) | −0.177 *** | PL (−2) | −0.088 | PL (−2) | −0.534 *** | PL (−2) | −0.073 |

| SK (−1) | 1.467 *** | FI (−1) | 1.148 *** | SE(−1) | 1.004 *** | UK (−1) | 1.246 *** |

| SK (−2) | −0.594 *** | FI (−2) | −0.246 *** | SE (−2) | −0.115 | UK (−2) | −0.353 *** |

| R2 | 0.986 | R2 | 0.882 | R2 | 0.945 | R2 | 0.938 |

References

- Bakus, Z.; Falkowski, J.; Fertő, I. Milk Market Integration between Hungary and Poland. In Proceedings of the 84th Annual Conference, Edinburgh, Scotland, 29–31 March 2010; Available online: http://ageconsearch.umn.edu/record/91809/files/74Bakucs_falkowski_ferto.pdf (accessed on 15 November 2019).

- Lence, S.H.; Moschini, G.C.; Santeramo, F.G. Threshold cointegration and spatial price transmission when expectations matter. Agric. Econ. 2018, 49, 25–39. [Google Scholar] [CrossRef]

- Roman, M. Spatial integration of the milk market in Poland. Sustainability 2020, 12, 1471. [Google Scholar] [CrossRef]

- Sexton, R.J.; Kling, C.L.; Carman, H.F. Market Integration, Efficiency of Arbitrage and Imperfect Competition: Methodology and Application to US Celery. Am. J. Agric. Econ. 1991, 73, 568–580. [Google Scholar] [CrossRef]

- Asche, F.; Bremnes, H.; Wessels, C. Product aggregation, market integration, and relationships between prices. Am. J. Agric. Econ. 1999, 81, 568–581. [Google Scholar] [CrossRef]

- Serra, T.; Gil, J.; Goodwin, B. Local polynomial fitting and spatial price relationship: Price transmission in EU pork markets. Eur. Rev. Agric. Econ. 2006, 33, 415–436. [Google Scholar] [CrossRef]

- Pietrzak, M.; Roman, M. The Problem of Geographical Delimitation of Agri-Food Markets: Evidence from the Butter Market in European Union. Acta Sci. Pol. Oecon. 2018, 17, 85–95. [Google Scholar] [CrossRef]

- Jena, P.K. Commodity market integration and price transmission: Empirical evidence from India. Theor. Appl. Econ. 2016, 3, 283–306. [Google Scholar]

- Fousekis, P. Price interrelationships in the EU cow milk markets: Evidence from rank-based cointegration tests. Outlook Agric. 2018, 47, 101–107. [Google Scholar] [CrossRef]

- Milk Market. Milk Market Observatory. European Commission. Available online: https://ec.europa.eu/info/food-farming-fisheries/farming/facts-and-figures/markets/overviews/market-observatories/milk_en (accessed on 10 July 2020).

- Emmanouilides, C.J.; Fousekis, P. Testing for the LOP under nonlinearity: An application to four major EU pork markets. Agric. Econ. 2012, 43, 715–723. [Google Scholar] [CrossRef]

- Gil, J.M.; Angulo, A.M.; Zapata, H.O. Further Empirical Evidence of Wheat and Barley Market Integration in the EU. J. Int. Food Agribus. Mark. 2000, 11, 45–61. [Google Scholar] [CrossRef]

- Zanias, G.P. Testing for Integration in European Community Agricultural Product Markets. J. Agric. Econ. 1993, 44, 418–427. [Google Scholar] [CrossRef]

- Santeramo, F.G.; Di Gioia, L. On the Analysis of Price Dynamics in Agricultural Markets. In Progress in Economics Research; Tavidze, A., Ed.; Nova Science Publishers, Inc.: New York, NY, USA, 2017; pp. 63–90. [Google Scholar]

- Katrakilidis, C. Testing for market integration and the law of one price: An application to selected European milk markets. Int. J. Econ. Res. 2008, 5, 93–104. [Google Scholar]

- Fałkowski, J. Price transmission and market power in a transition context: Evidence from the Polish fluid milk sector. Post-Communist Econ. 2010, 22, 513–529. [Google Scholar] [CrossRef]

- Reziti, I. Price transmission analysis in the Greek milk market. SPOUDAI J. Econ. Bus. 2014, 64, 75–86. [Google Scholar]

- Bor, Ö.; Ismihan, M.; Bayaner, A. Asymmetry in farm-retail price transmission in the Turkish fluid milk market. N. Medit. 2014, 2, 2–8. [Google Scholar]

- Rezitis, A.N. Investigating price transmission in the Finnish dairy sector: An asymmetric NARDL approach. Empir. Econ. 2019, 57, 861–900. [Google Scholar] [CrossRef]

- Serra, T.; Goodwin, B.K. Price transmission and asymmetric adjustment in the Spanish dairy sector. Applied Economics 2003, 35, 1889–1899. [Google Scholar] [CrossRef]

- Bakus, Z.; Fertő, I. Empirical tests of sale theories: Hungarian milk prices. Agric. Econ-Czech 2015, 61, 511–521. [Google Scholar] [CrossRef]

- Fernandez-Amador, O.; Baumgartner, J.; Crespo-Cuaresma, J. Milking the prices: The Role of Asymmetries in the Price Transmission Mechanism for Milk Products in Austria; Working Paper 378; Austrian Institute of Economic Research (WIFO): Vienna, Austria, 2010. [Google Scholar]

- Waldesenbet, T. Asymmetric price transmission in the Slovak liquid milk market. Agric. Econ. Czech 2013, 59, 512–524. [Google Scholar] [CrossRef]

- Acosta, A.; Valdes, A. Vertical Price Transmission of Milk Prices: Are Small Dairy Producers Efficiently Integrated into Markets? Agribusiness 2013, 30, 56–63. [Google Scholar] [CrossRef]

- Kharin, S. Price Transmission Analysis: The Case of Milk Products in Russia. AGRIS On-line Pap. Econ. Inform. 2018, 10, 15–23. [Google Scholar] [CrossRef]

- Acosta, A.; Ihle, R.; Robles, M. Spatial Price Transmission of Soaring Milk Prices from Global to Domestic Markets. Agribusiness 2014, 30, 64–73. [Google Scholar] [CrossRef]

- Benedek, Z.; Bakucks, Z.; Falkowki, J.; Fertő, I. Intra-EU trade of dairy products: Insights from network analysis. Stud. Agric. Econ. 2017, 119, 91–97. [Google Scholar] [CrossRef]

- Zhang, J.; Brown, C.; Dong, X.; Waldron, S. Price transmission in whole milk powder markets: Implications for the Oceania dairy sector of changing market developments. N. Z. J. Agric. Res. 2017, 60, 140–153. [Google Scholar] [CrossRef]

- Hillen, J.; von Cramon-Taubadel, S. Protecting the Swiss milk market from foreign price shocks: Public border protection vs. quality differentiation. Agribusiness 2019, 35, 516–536. [Google Scholar] [CrossRef]

- Bakcus, Z.; Benedek, Z.; Ferto, I. Spatial Price Transmission and Trade in the European Dairy Sector. AGRIS On-Line Pap. Econ. Inform. 2019, 11, 13–20. [Google Scholar] [CrossRef]

- European Dairy Association—EDA. Economic Report 2017/18. Available online: http://eda.euromilk.org/fileadmin/user_upload/Public_Documents/Facts_and_Figures/EDA_Economic_Report_2017.pdf (accessed on 7 January 2020).

- Wysokiński, M.; Baran, J.; Florkowski, J. Concentration of milk production in Poland. In Proceedings of the 2015 International Conference “Economic Science for Rural Development”, Jelgava, Latvia, 23–24 April 2015; pp. 93–104. [Google Scholar]

- Eurostat. Milk and Milk Products—30 Years of Quotas. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Archive:Milk_and_milk_products_-30_years_of_quotas (accessed on 3 September 2019).

- FAO. Data. Production. Livestock Primary. Available online: http://www.fao.org/faostat/en/#data/QL (accessed on 10 July 2020).

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Rapsomanikis, G.; Hallam, D.; Conforti, P. Market integration and price transmission in selected food and cash crop markets of developing countries: Review and applications. In FAO, Commodity Market Review; FAO Commodities and Trade Division: Rome, Italy, 2004; Volume 7, pp. 1–21. [Google Scholar]

- Sims, C.A. Macroeconomics and Reality. Econometrica 1980, 49, 1–48. [Google Scholar] [CrossRef]

- Mills, T.C. The Econometric Modeling of Financial Time Series; Cambridge University Press: Cambridge, UK, 2002. [Google Scholar]

- Kusideł, E. Modelowanie Wektorowo-Autoregresyjne VAR. Metodologia I Zastosowanie W Badaniach Ekonomicznych; Absolwent Press: Lodz, Poland, 2000. (In Polish) [Google Scholar]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Hamulczuk, M. Spatial integration of agricultural commodity markets—Methodological problems. Probl. Agric. Econ. 2020, 263, 32–52. [Google Scholar] [CrossRef]

- Roman, M. Problems with the Logistics of Supplying Dairy Plants with Milk. Ann. Pol. Assoc. Agric. Agribus. Econ. 2018, 20, 162–167. [Google Scholar] [CrossRef]

- Laborde, D.; Martin, W.; Swinnen, J.; Vos, R. COVID-19 risks to global food security. Science 2020, 369, 500–502. [Google Scholar] [CrossRef] [PubMed]

| Country | Stat. | p-Value | Decision |

|---|---|---|---|

| PL | −2.9849 | 0.0363 | I(0) |

| BE | −4.0946 | 0.0014 | I(0) |

| BG | −3.2482 | 0.0174 | I(0) |

| CZ | −3.3339 | 0.0135 | I(0) |

| DK | −3.4842 | 0.0084 | I(0) |

| DE | −3.6346 | 0.0061 | I(0) |

| EE | −3.3970 | 0.0126 | I(0) |

| IE | −3.4508 | 0.0108 | I(0) |

| EL | −2.4057 | 0.1417 | I(1) |

| ES | −2.2651 | 0.1844 | I(1) |

| FR | −3.6545 | 0.0058 | I(0) |

| IT | −2.9601 | 0.0413 | I(0) |

| CY | −1.8627 | 0.3491 | I(1) |

| LV | −3.2118 | 0.0213 | I(0) |

| LT | −3.0500 | 0.0329 | I(0) |

| LU | −2.9512 | 0.0422 | I(0) |

| HU | −3.3071 | 0.0163 | I(0) |

| NL | −3.5322 | 0.0084 | I(0) |

| AT | −2.9608 | 0.0412 | I(0) |

| PT | −3.0672 | 0.0314 | I(0) |

| SI | −3.4869 | 0.0097 | I(0) |

| SK | −3.5828 | 0.0072 | I(0) |

| FI | −3.3735 | 0.0135 | I(0) |

| SE | −3.3862 | 0.0130 | I(0) |

| UK | −2.9638 | 0.0409 | I(0) |

| Country | 2005 | 2012 | 2018 | |||

|---|---|---|---|---|---|---|

| Export | % | Export | % | Export | % | |

| Germany | 46.091 | 93.26 | 99.267 | 76.56 | 173.253 | 71.91 |

| United Kingdom | 3 | 0.01 | 4197 | 3.24 | 16.307 | 6.77 |

| Lithuania | 1.148 | 2.32 | 3.599 | 2.78 | 15.589 | 6.47 |

| Bulgaria | 4 | 0.01 | 749 | 0.58 | 6.200 | 2.57 |

| Latvia | 10 | 0.02 | 94 | 0.07 | 5.633 | 2.34 |

| Romania | 0 | 0.00 | 2 620 | 2.02 | 4.884 | 2.03 |

| Greece | 0 | 0.00 | 925 | 0.71 | 3.848 | 1.60 |

| Italy | 61 | 0.12 | 6 206 | 4.79 | 3.074 | 1.28 |

| Hungary | 322 | 0.65 | 5 643 | 4.35 | 2.578 | 1.07 |

| Others | 1.782 | 3.61 | 6 365 | 4.91 | 9.552 | 3.96 |

| Country | 2005 | 2012 | 2018 | |||

|---|---|---|---|---|---|---|

| Import | % | Import | % | Import | % | |

| Lithuania | 0 | 0.00 | 35218 | 63.26 | 26260 | 44.19 |

| Germany | 101 | 23.49 | 10267 | 18.44 | 14916 | 25.10 |

| Czechia | 148 | 34.42 | 8223 | 14.77 | 11651 | 19.61 |

| Austria | 0 | 0.00 | 461 | 0.83 | 2895 | 4.87 |

| Belgium | 0 | 0.00 | 721 | 1.30 | 1064 | 1.79 |

| Netherlands | 0 | 0.00 | 322 | 0.58 | 906 | 1.52 |

| France | 181 | 42.09 | 324 | 0.58 | 752 | 1.27 |

| Hungary | 0 | 0.00 | 28 | 0.05 | 620 | 1.04 |

| Slovakia | 0 | 0.00 | 48 | 0.09 | 313 | 0.53 |

| Others | 0 | 0.00 | 62 | 0.11 | 44 | 0.07 |

| Country | 2005–2018 | 2005–2011 | 2012–2018 | 2005–2018 | 2005–2011 | 2012–2018 |

|---|---|---|---|---|---|---|

| PL Level | PL First Differences | |||||

| BE | 0.88 | 0.90 | 0.86 | 0.67 | 0.62 | 0.72 |

| BG | 0.67 | 0.60 | 0.68 | 0.52 | 0.42 | 0.60 |

| CZ | 0.90 | 0.90 | 0.90 | 0.66 | 0.63 | 0.69 |

| DK | 0.86 | 0.79 | 0.83 | 0.49 | 0.50 | 0.48 |

| DE | 0.91 | 0.87 | 0.90 | 0.62 | 0.51 | 0.70 |

| EE | 0.85 | 0.85 | 0.85 | 0.57 | 0.51 | 0.63 |

| IE | 0.87 | 0.84 | 0.85 | 0.44 | 0.41 | 0.47 |

| EL | 0.61 | 0.62 | 0.11 a | 0.39 | 0.36 | 0.44 |

| ES | 0.72 | 0.68 | 0.71 | 0.61 | 0.57 | 0.64 |

| FR | 0.75 | 0.60 | 0.81 | 0.15 | 0.14 a | 0.16 a |

| IT | 0.79 | 0.75 | 0.72 | 0.42 | 0.26 | 0.55 |

| CY | 0.50 | 0.26 | 0.28 | 0.20 | 0.14 a | 0.31 |

| LV | 0.87 | 0.91 | 0.86 | 0.59 | 0.49 | 0.69 |

| LT | 0.88 | 0.87 | 0.85 | 0.63 | 0.55 | 0.72 |

| LU | 0.80 | 0.76 | 0.87 | 0.62 | 0.53 | 0.71 |

| HU | 0.90 | 0.92 | 0.79 | 0.73 | 0.70 | 0.75 |

| NL | 0.85 | 0.75 | 0.89 | 0.45 | 0.32 | 0.62 |

| AT | 0.89 | 0.82 | 0.89 | 0.61 | 0.53 | 0.70 |

| PT | 0.70 | 0.67 | 0.63 | 0.45 | 0.42 | 0.46 |

| SI | 0.80 | 0.74 | 0.77 | 0.58 | 0.50 | 0.67 |

| SK | 0.92 | 0.94 | 0.87 | 0.65 | 0.62 | 0.70 |

| FI | 0.42 | 0.47 | 0.32 | 0.23 | 0.20 a | 0.26 |

| SE | 0.84 | 0.82 | 0.78 | 0.53 | 0.51 | 0.55 |

| UK | 0.77 | 0.77 | 0.52 | 0.45 | 0.31 | 0.57 |

| 2005–2018 | 2005–2011 | 2012–2018 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| H0: PL ≠> Country UE | H0: Country UE ≠> PL | Direction | H0: PL ≠> Country UE | H0: Country UE ≠> PL | Direction | H0: PL ≠> Country UE | H0: Country UE ≠> PL | Direction | |

| BE | 0.063 | 17.205 *** | → | 0.063 | 16.218 *** | ← | 0.008 | 5.984 ** | ← |

| BG | 3.924 *** | 2.196 ** | ↔ | 3.853 ** | 0.845 | → | 5.648 ** | 6.094 ** | ↔ |

| CZ | 6.055 *** | 3.581 ** | ↔ | 5.487 *** | 2.037 | → | 7.833 *** | 1.579 | → |

| DK | 12.181 *** | 6.219 *** | ↔ | 6.439 *** | 5.139 *** | ↔ | 2.299 | 2.917 | - |

| DE | 3.613 ** | 14.59 *** | ↔ | 12.53 *** | 0.273 | → | 1.481 | 12.535 *** | ← |

| EE | 14.079 *** | 2.054 | ← | 6.089 *** | 1.629 | → | 21.944 *** | 0.207 | → |

| IE | 4.692 *** | 5.874 *** | ↔ | 3.242 | 9.192 *** | ← | 3.771 *** | 13.216 *** | ↔ |

| FR | 6.332 *** | 2.774 *** | ↔ | 3.116 ** | 2.787 ** | ↔ | 0.035 | 12.061 *** | ← |

| IT | 13.073 *** | 4.975 *** | ↔ | 3.596 | 2.522 | - | 7.224 *** | 2.6 | → |

| LV | 5.797 *** | 1.241 | → | 5.103 *** | 0.695 | → | 9.935 *** | 0.803 | → |

| LT | 6.739 *** | 3.759 | ↔ | 6.941 *** | 4.561 *** | ↔ | 4.793 *** | 2.475 ** | ↔ |

| LU | 4.254 *** | 2.565 ** | ↔ | 2.371 | 5.336 *** | ← | 6.385 ** | 0.519 | → |

| HU | 9.051 *** | 5.6489 *** | ↔ | 14.542 *** | 2.808 | → | 2.234 | 4.743 ** | ← |

| NL | 9.887 *** | 3.273 ** | ↔ | 2.671 ** | 2.418 ** | ↔ | 5.151 ** | 0.921 | → |

| AT | 6.975 *** | 3.859 *** | ↔ | 2.217 | 3.950 *** | ← | 6.956 *** | 0.941 | → |

| PT | 11.656 *** | 4.008 *** | ↔ | 6.279 ** | 5.295 ** | ↔ | 19.216 *** | 0.118 | → |

| SI | 4.029 *** | 3.122 ** | ↔ | 4.563 *** | 3.975 *** | ↔ | 1.468 | 4.131 *** | ← |

| SK | 10.439 *** | 2.713 ** | ↔ | 16.261 *** | 1.461 | → | 1.786 | 8.735 *** | ← |

| FI | 2.730 *** | 1.267 | → | 3.316 *** | 2.108 | → | 3.383 ** | 2.246 | → |

| SE | 20.939 *** | 3.123 ** | ↔ | 33.233 *** | 3.448 | → | 5.055 ** | 1.175 | → |

| UK | 2.982 *** | 4.471 *** | ↔ | 0.294 | 7.912 *** | ← | 2.116 | 7.139 *** | ← |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roman, M.; Roman, M. Milk Market Integration between Poland and the EU Countries. Agriculture 2020, 10, 561. https://doi.org/10.3390/agriculture10110561

Roman M, Roman M. Milk Market Integration between Poland and the EU Countries. Agriculture. 2020; 10(11):561. https://doi.org/10.3390/agriculture10110561

Chicago/Turabian StyleRoman, Monika, and Michał Roman. 2020. "Milk Market Integration between Poland and the EU Countries" Agriculture 10, no. 11: 561. https://doi.org/10.3390/agriculture10110561

APA StyleRoman, M., & Roman, M. (2020). Milk Market Integration between Poland and the EU Countries. Agriculture, 10(11), 561. https://doi.org/10.3390/agriculture10110561