Modeling the Future of Liquefied Natural Gas Transportation: Regression Analysis of Historical Data and Fleet Development Scenarios

Abstract

1. Introduction

2. Research Methodology

3. Analysis of the Previous Prediction

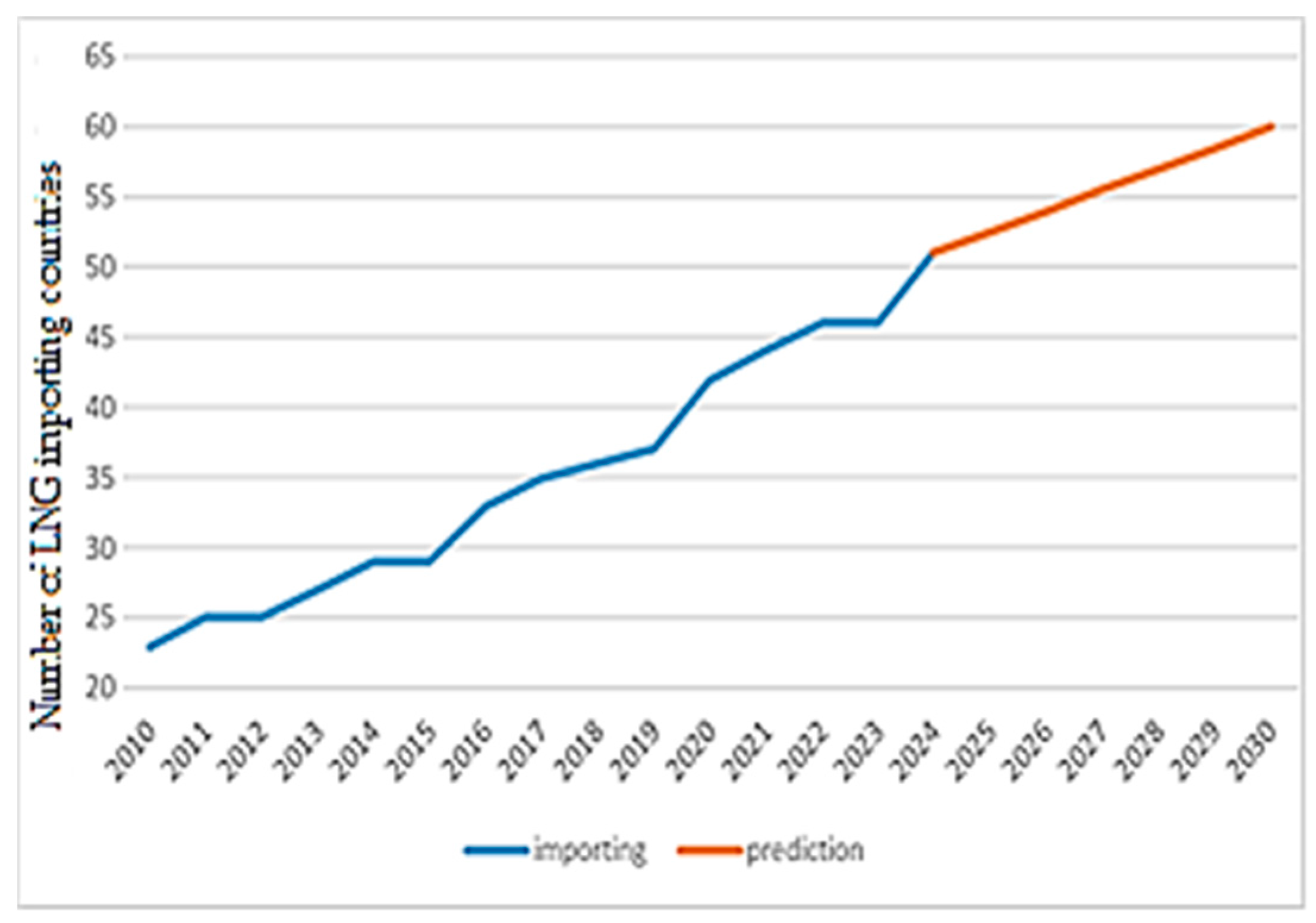

3.1. LNG-Importing Countries Comparison

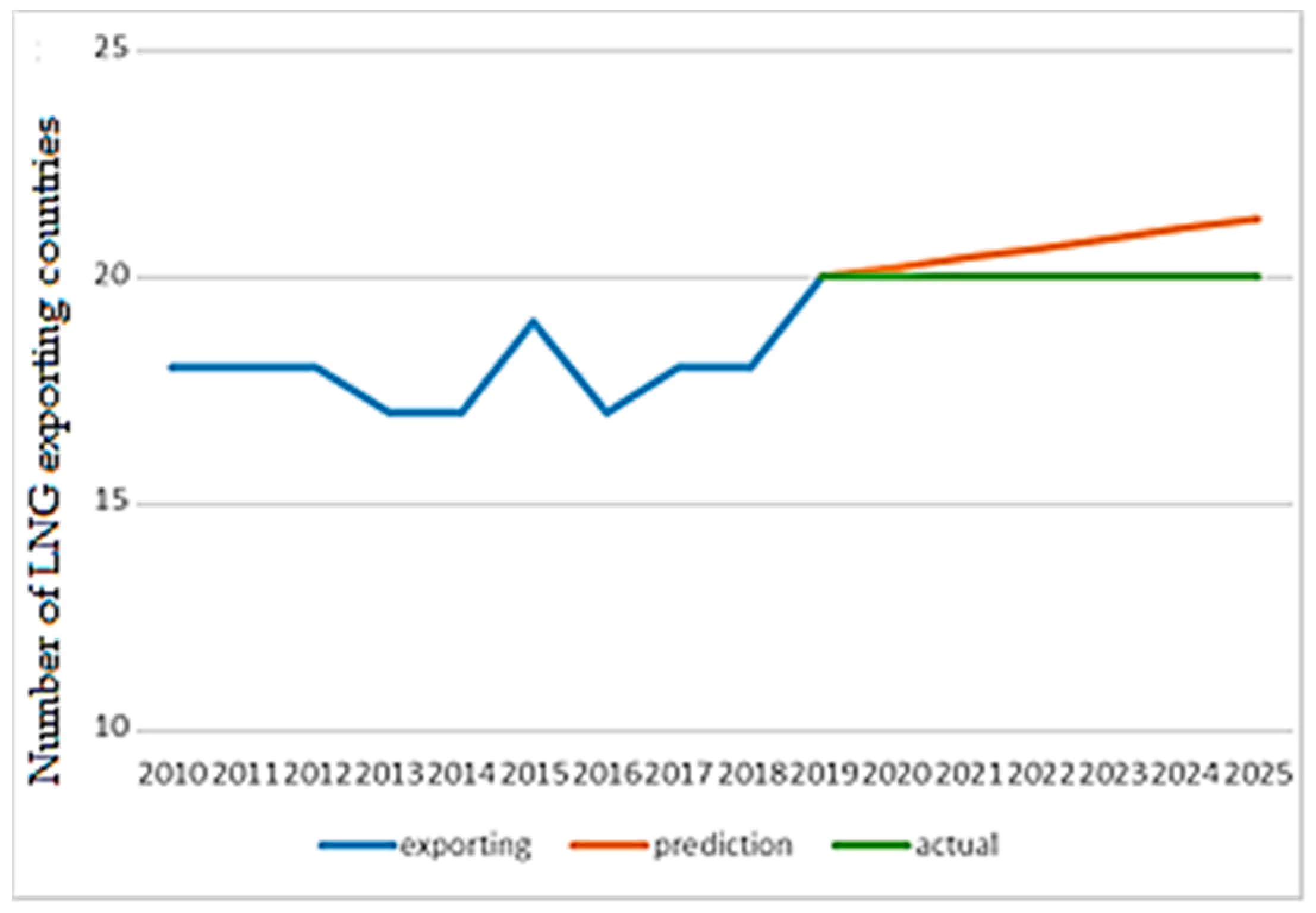

3.2. LNG-Exporting Countries Comparison

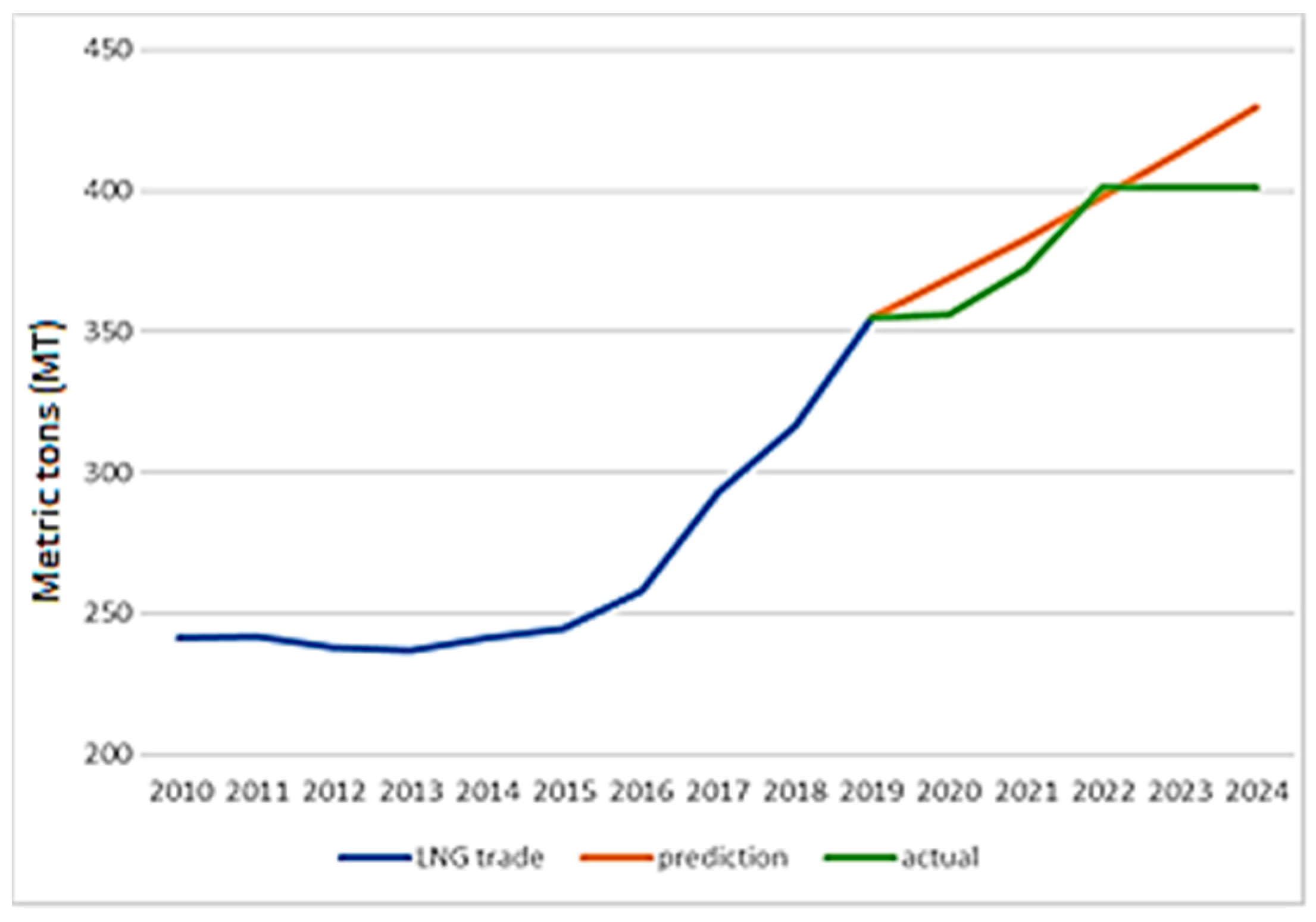

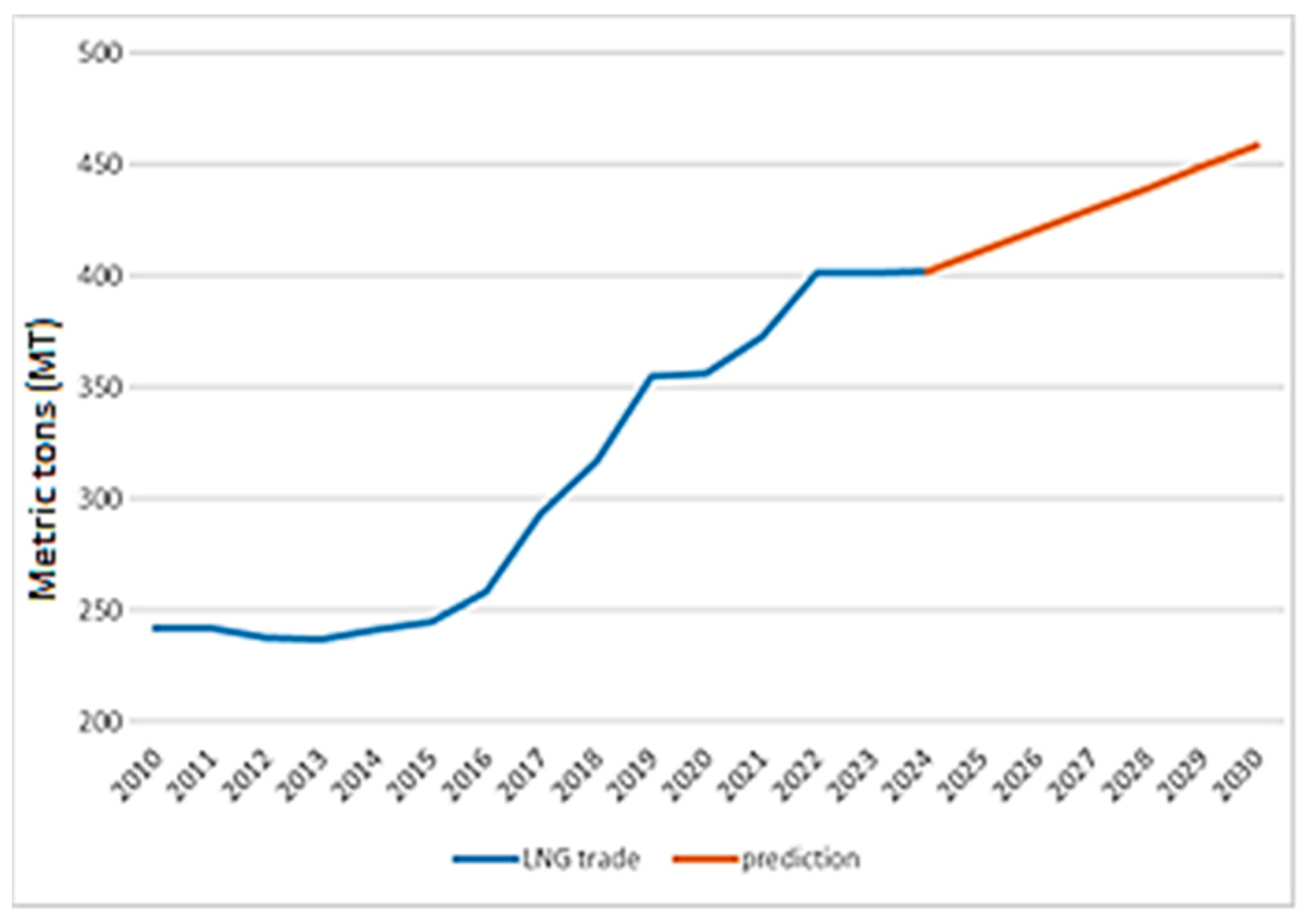

3.3. LNG Trade Volume Comparison

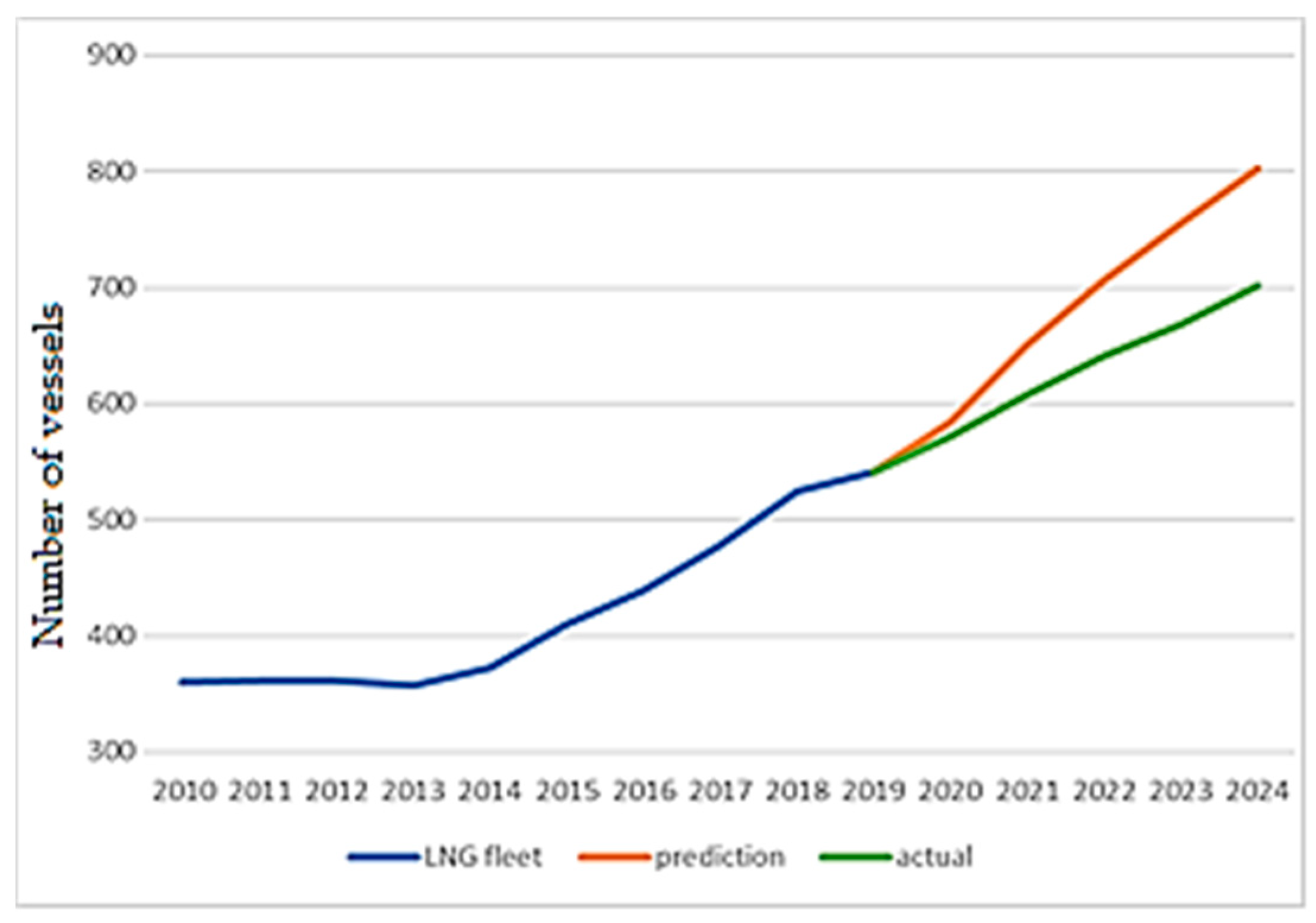

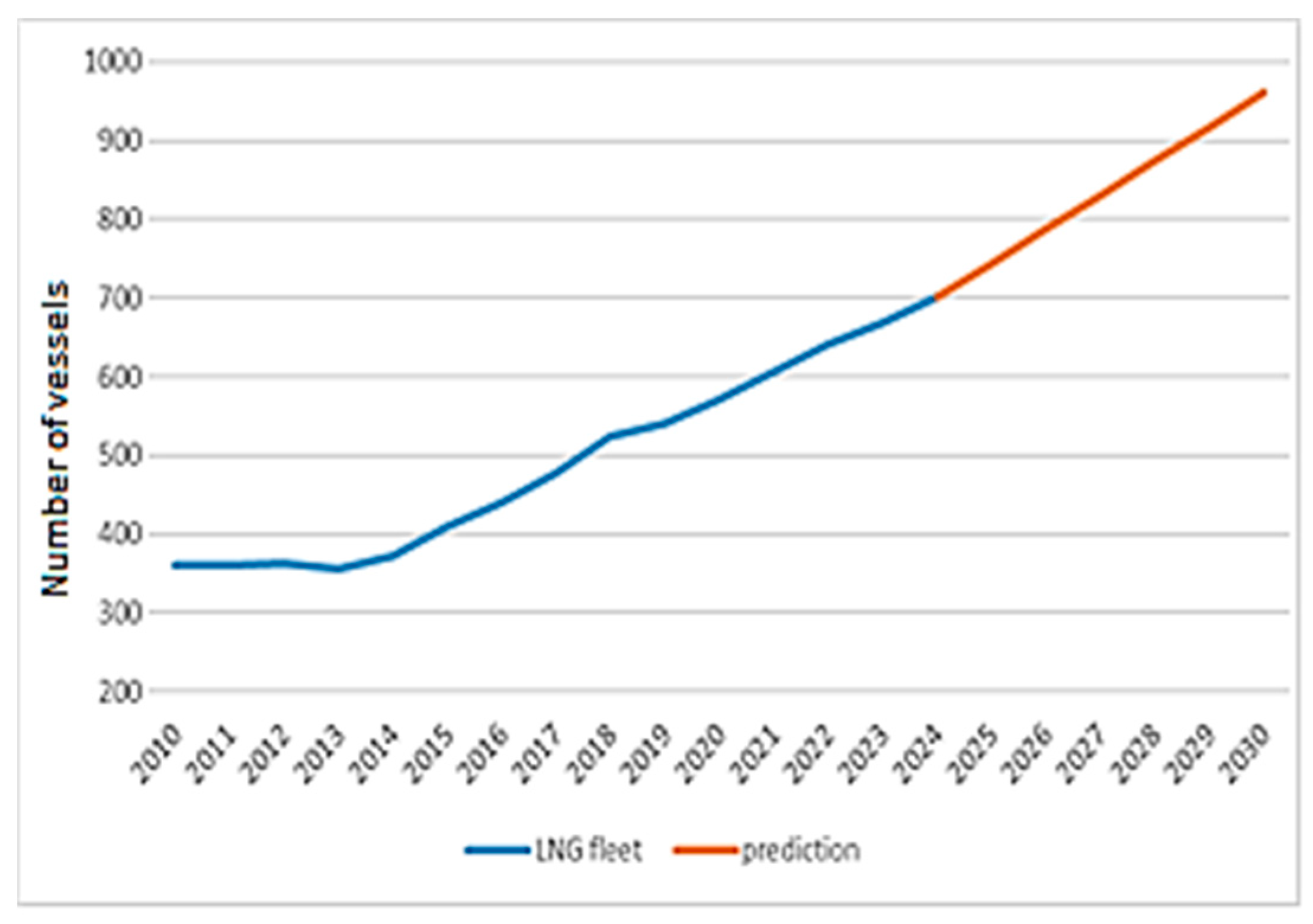

3.4. LNG Fleet Comparison

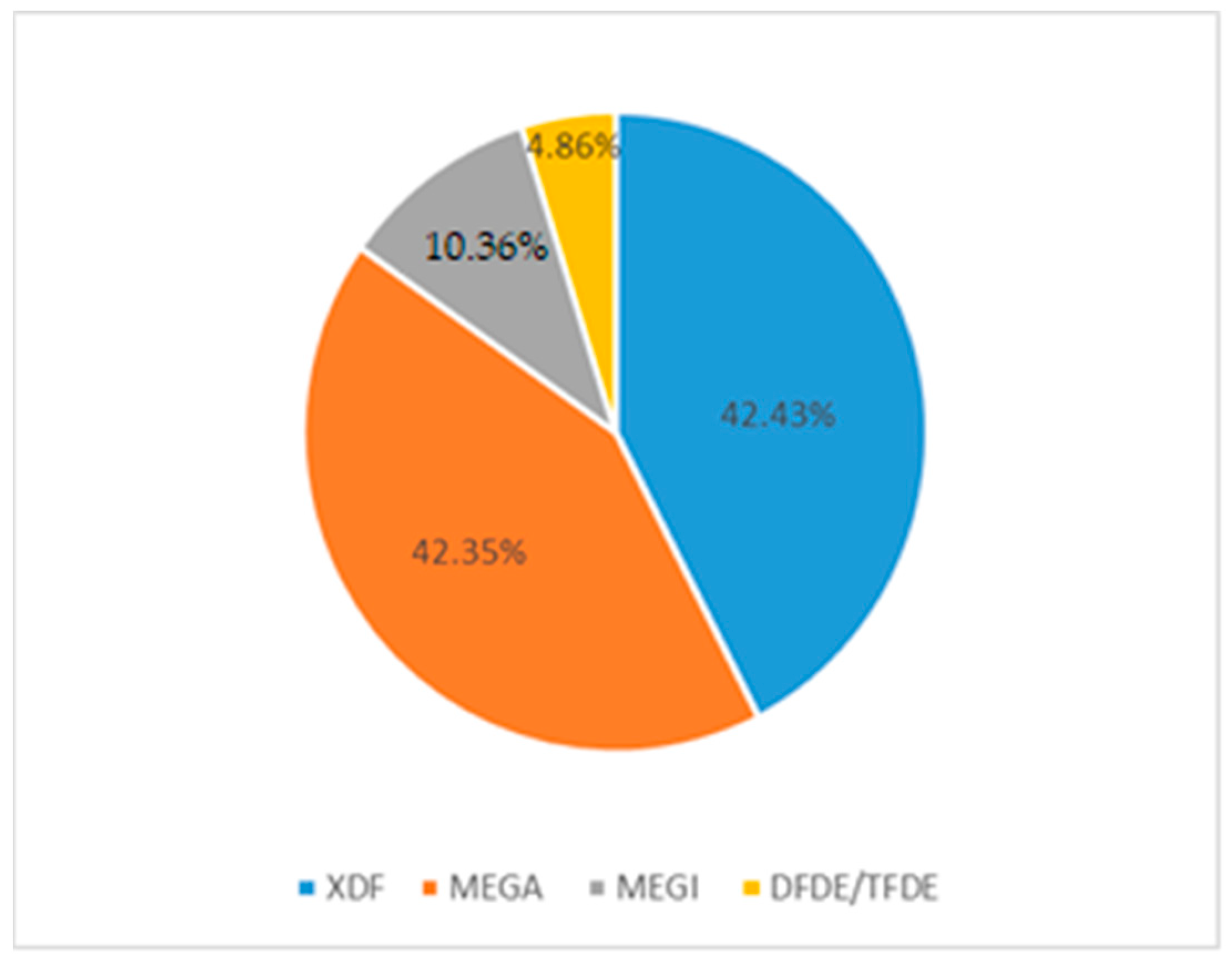

3.5. Propulsion Solutions on LNG Ships Comparison

3.6. Analysis of Deviation from Actual Results

4. Forecast for the Future Period

4.1. New Prediction for LNG Import

4.2. New Prediction for LNG Export

4.3. New Prediction for Volume of LNG Trade

4.4. New Prediction for World LNG Fleet

4.5. New Prediction for Propulsion Solutions for LNG Ships

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- International Energy Agency. World Energy Outlook Report; IEA/OECD: Paris, France, 2018. [Google Scholar]

- Makarichev, Y.A.; Anufriev, A.S.; Zubkov, Y.V.; Didenko, N.I. Energy efficiency of the wind power generator. In Proceedings of the 2019 IEEE Conference of Russian Young Researchers in Electrical and Electronic Engineering (ELConRus), Saint Petersburg and Moscow, Russia, 28–31 January 2019; pp. 1011–1015. [Google Scholar]

- Liu, Y.; Shi, X.; Laurenceson, J. Dynamics of Australia’s LNG export performance: A modified constant market shares analysis. Energy Econ. 2020, 89, 104808. [Google Scholar] [CrossRef]

- Hashimoto, S. A New Idea for LNG Trade: Enhancing Market Competition through a Tanker-Based Trading System. J. Asian Energy Stud. 2020, 4, 9–19. [Google Scholar] [CrossRef]

- Dyatlov, S.A.; Didenko, N.I.; Ivanova, E.A.; Soshneva, E.B.; Kulik, S.V. Prospects for Alternative Energy Sources in Global Energy Sector. IOP Conf. Ser. Earth Environ. Sci. 2020, 434, 012014. [Google Scholar] [CrossRef]

- Merkulov, V.I.; Skripnuk, D.F.; Kulik, S.V. Analysis of world LNG production capacity. IOP Conf. Ser. Earth Environ. Sci. 2020, 539, 012057. [Google Scholar] [CrossRef]

- IGU (International Gas Union). World LNG Report (2011–2024); IGU: London, UK.

- Flower, A. LNG in the Global Context; Springer Books: Berlin/Heidelberg, Germany, 2021; pp. 235–285. [Google Scholar]

- Kiebzak, P.W.; Czerniawski, F.K. LNG Market-Passing Trend or Effective Solution During Energy Transition-Global Market Forecast for 2020–2030; SPE Europec; OnePetro: Richardson, TX, USA, 2020. [Google Scholar]

- Gałczyński, M.; Ruszel, M.; Turowski, P.; Zajdler, R.; Zawisza, A. Global LNG Market; Ignacy Lukasiewicz Energy Policy Institute: Rzeszów, Poland, 2017. [Google Scholar]

- Danilov, R.; Arabyan, M.; Usov, D. Influence of technologies on LNG market development. IOP Conf. Ser. Mater. Sci. Eng. 2019, 537, 042030. [Google Scholar] [CrossRef]

- Nikhalat-Jahromi, H.; Fontes, D.B.; Cochrane, R.A. Future liquefied natural gas business structure: A review and comparison of oil and liquefied natural gas sectors. WIREs Energy Environ. 2016, 6, e240. [Google Scholar] [CrossRef]

- Razmanova, S.; Steblyanskaya, A. Arctic LNG cluster: New opportunities or new treats? IOP Conf. Ser. Earth Environ. Sci. 2020, 539, 012165. [Google Scholar] [CrossRef]

- Pavlenko, N.; Comer, B.; Zhou, Y.; Clark, N.; Rutherford, D. The Climate Implications of Using LNG as a Marine Fuel; International Council on Clean Transportation: Berlin, Germany, 2020. [Google Scholar]

- Herdzik, J. LNG as a marine fuel-possibilities and problem. J. KONES 2011, 18, 169–176. [Google Scholar]

- Stefana, E.; Marciano, F.; Alberti, M. Qualitative risk assessment of a Dual Fuel (LNG-Diesel) system for heavy-duty trucks. J. Loss Prev. Process. Ind. 2016, 39, 39–58. [Google Scholar] [CrossRef]

- IMO 2020—Cutting Sulphur Oxide Emissions. Available online: https://www.imo.org/en/MediaCentre/HotTopics/Pages/Sulphur-2020.aspx (accessed on 27 April 2025).

- Iannaccone, T.; Landucci, G.; Tugnoli, A.; Salzano, E.; Cozzani, V. Sustainability of cruise ship fuel systems: Comparison among LNG and diesel technologies. J. Clean. Prod. 2020, 260, 121069. [Google Scholar] [CrossRef]

- Unseki, T. Environmentally superior LNG-Fueled vessels. Mitsubishi Heavy Ind. Tech. Rev. 2013, 50, 37–43. [Google Scholar]

- Zhang, Y.; Jiang, H.; Li, J.; Shao, S.; Hou, H.; Qi, Y.; Zhang, S. Life cycle assessment and optimization analysis of different LNG usage scenarios. Int. J. Life Cycle Assess. 2017, 23, 1218–1227. [Google Scholar] [CrossRef]

- Langton, T. LNG prospects in the Asia–Pacific region. Resour. Policy 1994, 20, 257–264. [Google Scholar] [CrossRef]

- Jing, D.; Dai, L.; Hu, H.; Ding, W.; Wang, Y.; Zhou, X. CO2 emission projection for Arctic shipping: A system dynamics approach. Ocean Coast. Manag. 2021, 205, 105531. [Google Scholar] [CrossRef]

- Katebah, M.A.; Hussein, M.M.; Shazed, A.; Bouabidi, Z.; Al-Musleh, E.I. Rigorous simulation, energy and environmental analysis of an actual baseload LNG supply chain. Comput. Chem. Eng. 2020, 141, 106993. [Google Scholar] [CrossRef]

- Righi, M.; Hendricks, J.; Sausen, R. The global impact of the transport sectors on atmospheric aerosol in 2030—Part 1: Land transport and shipping. Atmos. Meas. Tech. 2015, 15, 633–651. [Google Scholar] [CrossRef]

- Ytreberg, E.; Åström, S.; Fridell, E. Valuating environmental impacts from ship emissions—The marine perspective. J. Environ. Manag. 2021, 282, 111958. [Google Scholar] [CrossRef]

- Stanivuk, T.; Mahić, J.; Stazić, L.; Perdić-Lukačević, H. LNG market and fleet analysis. Transp. Probl. 2021, 16, 173–183. [Google Scholar] [CrossRef]

- Khadka, B. Data Analysis Theory and Practice: Case: Python and Excel Tools. 2019. Available online: https://www.academia.edu/65189499/Data_analysis_theory_and_practice_Case_Python_and_Excel_Tools (accessed on 25 April 2025).

- BP Statistical Review of World Energy (2011–2024). Available online: https://www.bp.com/en/global/corporate/energy-economics/webcast-and-on-demand.html (accessed on 26 April 2025).

- Environmental Impact Statement (EIS)—Appendixes: Parts, I.; II; III. Available online: https://pnglng.com/Environment/Environmental-Impact-Statement (accessed on 12 April 2025).

- Meyer, D.Z.; Avery, L.M. Excel as a Qualitative Data Analysis Tool. Field Methods 2008, 21, 91–112. [Google Scholar] [CrossRef]

- Palocsay, S.W.; Markham, I.S.; Markham, S.E. Utilizing and teaching data tools in Excel for exploratory analysis. J. Bus. Res. 2010, 63, 191–206. [Google Scholar] [CrossRef]

- Nikhalat, H.; Zavitsas, K.; Mireille, E.H.; Bell, M.G. A Comparison of Oil and LNG Industries Performance Indicators: LNG Market Future Prediction. Available online: https://www.researchgate.net/publication/282119705_Predicting_the_future_of_LNG_market_A_review_and_comparison_of_oil_and_LNG_industries_performance_indicators_and_risk_factors (accessed on 26 April 2025).

- Medica-Viola, V.; Mrzljak, V.; Anđelić, N.; Jelić, M. Analysis of Low-Power Steam Turbine With One Extraction for Marine Applications. Nase More 2020, 67, 87–95. [Google Scholar] [CrossRef]

- Poljak, I.; Orović, J.; Knežević, V.; Mrzljak, V. LNG carrier main steam turbine reliability in the exploitation period of time. TransNav Int. J. Mar. Navig. Saf. Sea Transp. 2020, 14, 39–42. [Google Scholar]

- Huan, T.; Hongjun, F.; Wei, L.; Guoqiang, Z. Options and Evaluations on Propulsion Systems of LNG Carriers. In Propulsion Systems; IntechOpen: London, UK, 2019. [Google Scholar] [CrossRef]

- Svensson, B. Making The Most of BOG; Diesel & Gas Turbine Worldwide, vol. 4/2017; KHL Group: Southfields, UK, 2017; Available online: https://www.researchgate.net/publication/380978526_DFDE_and_Steam_Turbine_Propulsion_System_Energy_Efficiency_Operational_Index_comparison_on_board_LNG_Carrier (accessed on 28 April 2025).

- Yeo, D.; Ahn, B.; Kim, J.; Kim, I. Propulsion alternatives for modern LNG carriers. In Gas Technology Institute—15th International Conference and Exhibition on Liquefied Natural Gas, Barcelona, Spain, 24–27 April 2007; pp. 620–635. Available online: https://www.man-es.com/company/press-releases/press-details/2021/03/18/world-first-me-ga-engine-demonstration#:~:text=MAN%20Energy%20Solutions%20has%20has,its%20Copenhagen%20Research%20Centre%20today (accessed on 26 April 2025).

- MAN Energy Solutions. Available online: https://www.man-es.com/company/press-releases/press-details/2023/07/17/me-ga-opti-optimises-combustion-onboard-lng-carrier-newbuilding (accessed on 13 April 2025).

- United States Environmental Protection Agency (EPA)—Importance of Methane. Available online: https://www.epa.gov/gmi/importance-methane (accessed on 14 April 2025).

- European Commision—Decarbonising Maritime Transport—FuelEU Maritime. Available online: https://transport.ec.europa.eu/transport-modes/maritime/decarbonising-maritime-transport-fueleu-maritime_en (accessed on 14 April 2025).

- Diesel, M.A.N. Turbo, Propulsion Trends in LNG Carriers. 2013. Available online: https://www.yumpu.com/en/document/read/31495070/propulsion-trends-in-lng-carriers-man-diesel-turbo#google_vignette (accessed on 26 April 2025).

- DNV IMO MEPC 83: GHG Requirements Approved, Taking Effect from 2028. Available online: https://www.dnv.com/news/imo-mepc-83-ghg-requirements-approved-taking-effect-from-2028/ (accessed on 15 April 2025).

- Wood, D.A. The evolution of global liquefied natural gas supply chains: A review. In Sustainable Liquefied Natural Gas; Elsevier: Amsterdam, The Netherlands, 2024; pp. 23–55. [Google Scholar] [CrossRef]

- Ke, R.; Wang, X.; Peng, P. Analysis of the Impact of the Russia–Ukraine Conflict on Global Liquefied Natural Gas Shipping Network. J. Mar. Sci. Eng. 2024, 13, 53. Available online: https://www.mdpi.com/2077-1312/13/1/53#:~:text=Ports%20in%20LNG%20import%20countries,has%20a%20very%20limited%20change (accessed on 17 April 2025). [CrossRef]

- Riviera. MAN ES Cuts ME-GA from Its Two-Stroke Engine Programme. Available online: https://www.rivieramm.com/news-content-hub/news-content-hub/man-es-cuts-me-ga-from-its-two-stroke-engine-programme-82833 (accessed on 16 April 2025).

- Rystad Energy. Gas & LNG Markets; Rystad Energy: Oslo, Norway, 2021. [Google Scholar]

| Year | Predicted | Realized | Difference (%) |

|---|---|---|---|

| 2020 | 39 | 39 | 0 |

| 2021 | 41 | 42 | +2.38 |

| 2022 | 43 | 44 | +2.27 |

| 2023 | 46 | 46 | 0 |

| 2024 | 48 | 51 | +6.25 |

| Year | Predicted | Realized | Difference (%) |

|---|---|---|---|

| 2020 | 20 | 20 | 0 |

| 2021 | 20 | 20 | 0 |

| 2022 | 21 | 20 | −4.76 |

| 2023 | 21 | 20 | −4.76 |

| 2024 | 21 | 20 | −4.76 |

| Year | Predicted | Realized | Difference (%) |

|---|---|---|---|

| 2020 | 368.6 | 356.1 | −3.39 |

| 2021 | 383.0 | 372.3 | −2.79 |

| 2022 | 398.1 | 401.2 | +0.77 |

| 2023 | 413.7 | 401.4 | −2.97 |

| 2024 | 429.9 | 401.42 | −6.62 |

| Year | Predicted | Realized | Difference (%) |

|---|---|---|---|

| 2020 | 584.0 | 572 | −2.05 |

| 2021 | 650.0 | 607 | −6.61 |

| 2022 | 706.0 | 641 | −9.20 |

| 2023 | 755.0 | 668 | −11.52 |

| 2024 | 803.0 | 701 | −12.70 |

| Propulsion Type | Fuel Consumption (tons/Day) |

|---|---|

| Steam | 175 |

| DFDE/TFDE | 130 |

| MEGI | 110 |

| ME-GA | 109 |

| XDF | 108 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stanivuk, T.; Korljan, D.; Stazić, L. Modeling the Future of Liquefied Natural Gas Transportation: Regression Analysis of Historical Data and Fleet Development Scenarios. Appl. Sci. 2025, 15, 5973. https://doi.org/10.3390/app15115973

Stanivuk T, Korljan D, Stazić L. Modeling the Future of Liquefied Natural Gas Transportation: Regression Analysis of Historical Data and Fleet Development Scenarios. Applied Sciences. 2025; 15(11):5973. https://doi.org/10.3390/app15115973

Chicago/Turabian StyleStanivuk, Tatjana, Dario Korljan, and Ladislav Stazić. 2025. "Modeling the Future of Liquefied Natural Gas Transportation: Regression Analysis of Historical Data and Fleet Development Scenarios" Applied Sciences 15, no. 11: 5973. https://doi.org/10.3390/app15115973

APA StyleStanivuk, T., Korljan, D., & Stazić, L. (2025). Modeling the Future of Liquefied Natural Gas Transportation: Regression Analysis of Historical Data and Fleet Development Scenarios. Applied Sciences, 15(11), 5973. https://doi.org/10.3390/app15115973