Abstract

Cryptocurrency has emerged as a well-known significant component with both economic and financial potential in recent years. Unfortunately, Bitcoin acquisition is not simple, due to uneven business and significant rate fluctuations. Traditional approaches to price forecasting have proven incapable of proving adequate data and solutions because prices can now be forecast in real time. We recommended a machine learning-based alternative for a mortgage lender based on highlighted problems in forecasting the price of Bitcoin. The proposed system included a reinforcement learning algorithm for price estimation and forecasting, as well as a blockchain framework for an efficient and secure environment. The proposed prediction, compared to other state-of-the-art strategies in this sector, demonstrated better performance. In this system, the proposed prediction reached improved consistency, in comparison to other systems, with respect to Monero (XMR), Litecoin (LTC), Oryen (ORY), and Bitcoin (BTC).

1. Introduction

Bitcoin has gained notoriety in the global financial picture since its unveiling in 2008, concomitant with the international economic meltdown and the resulting loss of integrity in the monetary sector. It attracted many regulated entities, governmental organizations, domestic and global stockholders, and academic researchers, as well as the broader population. Although Nakomoto is recognized as having launched the most well-known cryptocurrency, Bitcoin (Nakamoto, 2008), the notion of a reliable community blockchain-based digital currency was not new at the time. David Chaum, a cryptographer, initially conceived the idea in a 1983 dissertation with the ambition of improving credit card transaction privacy using a virtual environment (Chaum, 1983). Chaum also developed DigiCash, the first cryptocurrency, which flopped in subsequent years.

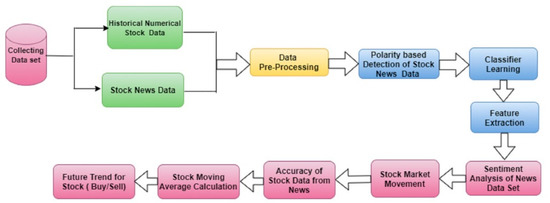

In a normal economic system, payment is carried out through a number of techniques by a third-party institution in order to meet financial conditions. These serve as middlemen between parties exchanging funds and also maintain thorough transaction logs. For small amounts of money this strategy works well, but it lacks transparency, usability, security, and confidence. To address these issues, the elimination of intermediary parties from closing transactions became necessary. For instance, allowing direct financial transactions between parties could lead to changes in the way the economy functions. Cryptocurrency makes it possible for people or organizations to swap money in a solitary business transaction [1]. Peer-to-peer-based connections, dealings, transactions, conversations, and exchanges are protected by highly secure encryption and decryption methods. Blockchain infrastructure and cryptocurrencies are intricately bound. In developing the blockchain’s redistribution and accountability features in the conventional cryptocurrency system, however, it is challenging to handle central authority. This procedure validates the blockchain’s consensus mechanism, eliminating the issue of network stakeholder trust. The price of cryptocurrencies has become a contentious issue among academics around the world. A variety of factors influence price swings, including transaction fees, processing hurdles, competitive landscape, liquidity, and alternative currencies [2]. The aforementioned factors result in unexpected price fluctuations for cryptocurrencies over time, as well as making prediction very challenging. Figure 1 describes an overview of prognostication approaches to cryptocurrency. Cryptocurrency market information was organized into different categories in this strategy; we used sources of data such as Litecoin, Bitcoin, Tether, Ripple, Monero, and IOTA. In the machine learning phase, we analyzed the information and integrated it into a preprocessing technique to make it compatible with the Ethereum blockchain framework. For the retrieval of properties, the blockchain structure integrated transaction hash records, identity, timestamps, and numerous transactions. The functional module supported insights into Bitcoin, electronic wallet, formal verification, and decentralized applications.

Figure 1.

Prognostication approaches of cryptocurrency: an overview.

The primary objective of virtual currency exchanges is to conduct transactions. In recent decades, Bitcoin trading has emerged as a frequent topic [3]. This is a popular misunderstanding about skilled financial markets, which require a particular talent for entrepreneurship, relying on the turbulence of public attitudes. Furthermore, the price forecast efficacy of several cryptocurrencies provided the fitness of maximum energy computation of the blockchain [4]. Numerous factors impact cryptocurrency significance, notably the previous trend of pricing, community sentiments, economic growth, and policy. Inspired by current structure, we built a version to forecast Bitcoin price discrepancies using a reinforcement learning framework [1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22].

This framework also resolved the unpredictable volatility issue in Bitcoin prices. The most significant impacts of the process can be categorized as follows:

- The employment of reinforcement learning (RL) to anticipate the values of coins such as Litecoin and Monero;

- The monitoring of the effectiveness of strategies used for assessment indices, such as Root Mean Square Error (RMSE), mean absolute error (MAE), Mean Absolute Percentage Error (MAPE), and Mean Squared Error (MSE);

- The creation of a healthy and accessible framework for forecasting stock using digital currency.

The features of the method especially highlighted Bitcoin qualities, such as international connectivity, convenience of use for intermediate exchanges, and preservation of assets. Nevertheless, the values of numerous cryptocurrencies are completely influenced by individual perceptions and fluctuating tendencies, with a very weak association with the preponderance of treasury securities. This guaranteed an integrated processes view for business process modeling. Contracts and integrated services are two additional perspectives that integration aspects cover [23,24,25,26,27,28,29,30,31,32,33,34,35].

In Chapter Two, we summarized the most massive price recognition investigations. In Chapter Three we described the design methodology, as well as issues to be addressed and articulation in Bitcoin forecasting stock. The forecasting pipeline and review were outlined in Chapter Four, and the practice was concluded in Chapter Five.

2. Materials and Methods

A significant portion of this consensus-based approach to forecasting and inflation targeting of cryptocurrency spanned generations. This research was conducted in two core areas: (1) machine learning and (2) Ethereum in blockchain on forecasting stock. The literature was explored in order to discuss and illustrate the most contemporary knowledge. Distributed ledger technology implementations extended the mentoring credit system. This provided credibility, security, and integrity to the dispersed record of transactions systems, permitting IoT technology ideas to be used for framework offsite replication [5]. One notable aspect of this technique was that it was randomized and absolutely protected the community and environment, enabling new structures to connect.

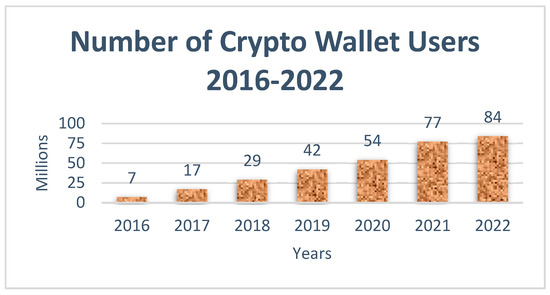

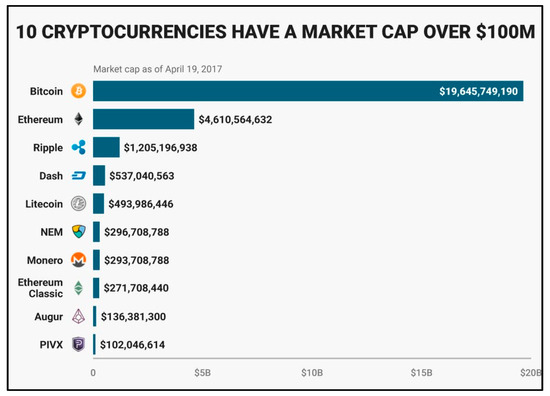

Implementations for cryptocurrency have influenced numerous blockchain and digital currencies. Since they afford computers the opportunity to take action and use energy for blockchain authentication, cryptocurrencies are coupled to the blockchain. A comparatively recent form of virtual currency, cryptocurrency leverages ledgers to further confidentiality, unlikability, and openness [6]. Decentralization and the usage of crypto assets are both expanding. This permits the estimation of the innate value of the link, depending on multiple factors. This novel kind of finance preserves values and attempts to comprehend market movements. The price modifications of cryptocurrency exchange rates over time are included in Figure 2, depending on the principles. The increased enterprise value levels were significant and exceeded 19 billion annually. Additionally, 90% of the enterprise value was comprised of seven currencies, as was 97% of the market. The share price statistics, based on year and global currency of united states, are represented in Figure 3.

Figure 2.

Increase in the number of crypto-wallet users.

Figure 3.

Market capitalization of cryptocurrency.

Some existing comparisons were made, forecasting Bitcoin based on the approach adopted by Marcel et al.; using Bitcoin transactions to approach floatation in forecasting using single layer neural networks using a dataset from CoinDesk.com [10]. Wirawan et al. used an Auto Regressive Integrated Moving Average (ARIMA) model to predict Bitcoin [11]. Lahmiri et al. used the LSTM approach to predict Bitcoin using the Largest Lyapunav Exponent and Detrended fluctuation analysis approaches [12]. Laura et al. applied LSTM, along with an integrated model of RNN and XG boost for a sample regression tree, to forecast Bitcoin movement. The method was employed with 1681 cryptocurrencies, using the coinmarketcap.com dataset [13]. Chen et al. used LDA, Logistic Regression, SVM, and LSTM approaches, using four classes for feature engineering, to enable cryptocurrency prediction [14]. Smuts et al. proposed predicting trends using the LSTM approach for Ethereum and Bitcoin; the dataset used was a Telegram, Google trends, and market data aggregator [15]. Mittal et al. used approaches such as regression, LSTM and RNN to meet their goals and tweet sentiment trends forecasting Bitcoin market values, strengthening the forecast based on Facebook and Wikipedia predictions. In this approach, the CoinDesk, Google trends, and Twitter API datasets were used [16]. Jang et al. proposed a methodology leveraging Bayesian neural networks to incorporate nonlinear features from Ethereum using MLP; the datasets used were from blockchainmart.com and blockchain.info [17]. Sin et al. used techniques such as MLP and the ensemble of neural networks to make next-day predictions based on a genetic algorithm, using datasets from Bitcoinity.org and blockchain.info [18]. Saad et al. used multivariate regression to summarize and analyze the cryptocurrency market, using correlation analysis with a dataset from etherscan.io and blockchain.info [19].

A potent machine-learning algorithm called deep learning addressed tough regression equations to take advantage of vast factual data and make excellent forecasts. Price forecasts with realistic consequences remained a significant challenge, since quantities varied considerably; however, deep learning analysis took that into consideration and addressed those problems. An analysis was provided by Ji et al. on deep neural networks with long short-term memory (LSTM)-(DNNs) and, merging their findings with Bitcoin cost forecasting, the findings of their procedure were revealed. LSTM exhibited adequate reliability, in comparison to other method frameworks for regression. With this process they aimed to examine the regression analysis using deep learning models, which were insufficient for use with only cryptocurrency exchanges. Thus, development was undertaken for an artificial neural network which was trained and tested on the time series trends of two well-known crypto-currencies, Bitcoin and Ethereum [24].

For Ethereum blockchain forecasting stock, Peng et al. [9] developed the Simplified Dynamically Conditional Heteroscedasticity problem using Support Vector Machine (SVM). The analysis was based on minimum and maximum recurrence, and the forecast was assessed using the Dielbold–Matiano criterion and Hansen’s Model’s confidence criterion. The suggested forecasting model used numerous cryptocurrency data as inputs and handled them individually in order to extract useful information from each cryptocurrency separately. In some fields, distributed ledger systems take on the role of conventional computational techniques [25]. When the predictor tried to trade on the advice of these systems, numerous investors saw their capital decline. Therefore, more thorough study will be required for the stock market in order to increase investor success assurance. The method attempted to use a machine learning algorithm to handle this problem [26]. If all the assets are compared to one another, it may be possible to achieve higher investment diversification on cryptocurrency markets because they comprise hundreds of assets. Self-attention networks are suited for handling the issue, since attention mechanisms can process lengthy data sequences and concentrate on the inputs’ most crucial components. The formulation of the research problem took transaction fees into account, as well. Systems that execute trades at high frequencies cannot ignore this problem because, over the course of many deals, modest fees can build up to substantial costs [27]. Thus, a system must set effective trading (buying and selling) points using machine learning techniques and repeat these actions using an algorithm in order to generate efficient profits [28]. We employed social media texts as the source of public opinion data, rather than news websites. To create the sentiment indexes, data were processed using linguistic statistical methodology. In the meantime, the model chose the technical indicators as input as well, since it was a financial market forecasting model [29]. These models are crucial because they could have a big impact on the economy, assisting traders and investors in determining when to buy and sell cryptocurrencies [30]. Using data from the three cryptocurrencies with the largest market capitalization over the span of three consecutive years, a thorough empirical investigation was carried out [31].

When a huge quantity of data is used, conventional systems do not work adequately; data sets grow noisy, performance suffers, the data filtering procedure takes too long, systems suffer from low redundancy, and there is no transactional proof for this methodologies. These shortcomings could be overcome by the proposed approach.

3. System Design and Proposed Techniques

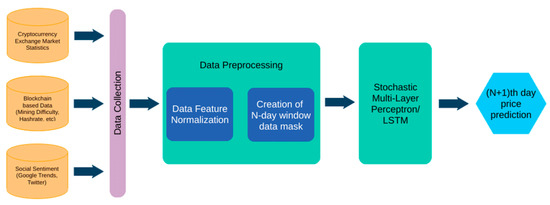

In the proposed system’s Bitcoin price forecasting, three significant knowledge sources were considered. The very first was a statistic: the market value. The next was Ethereum connectivity data, encompassing process quantity and charge, hash rate, etc. The last category source involved search engine and tweet intensity. The preponderance of scientific studies to date have used the types of information indicated above to integrate into their techniques—frequently, regression coefficients. The information loader obtained information from the distinct sources. In the following step, the data characteristics were harmonized and the knowledge pyramids were built. To forecast the N-day price, the source data were analyzed with supervised learning. The time series forecasting process is presented in further context in Figure 4.

Figure 4.

Recommended blockchain and RL model for forecasting Bitcoin prices.

Monero and Litecoin were applied as information sources for Bitcoin forecasting processes in this strategy. The Litecoin learning algorithm encompassed statistics from 2018 to 2022, with 1276 sample points. The trained model was intended to forecast the value for the subsequent day. Monero’s validation dataset encompassed the years 2017 to 2022. The total number of information entries was 1276. The predictive model guessed future price records. For gathering and analyzing Litecoin and Monero, the training process was 80 percentage points and the validation set was 20 percentage points. The dataset was not extremely useful because of project restrictions.

In terms of days, the volume of transactions was determined. Since there was no schedule for launching and quitting, the equities market was not really a component of the securities exchange. Among the peculiarities encountered was the quantity of transferred currencies (a milestone for a calendar day). The trading volume was specified for the current occasion, and financial equivalents were anticipated. The volume of coinage was indicative of total net worth. The processing complexity was essential for mining single-structure Bitcoins. Transaction acknowledgement demanded the use of specific devices in order to achieve a higher hash toward generating a frame. Considering power requirements and hash rate, there was an exchange. This cluster method had the advantage of resource extraction rate and challenge. The miners’ beneficial revenue was in juxtaposition to the consumption of emission and time-consuming resources. The compensation for miners diminished geometrically as the quantity of miners rose.

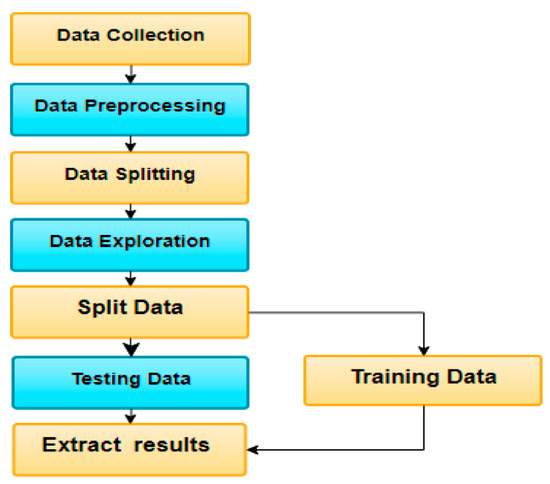

The estimated duration and reporting to the block table were essential for authentication and integrity between counterparties. The process reporting required approximately ten minutes to authenticate the process, which was contingent on the authorized clients and their venue for table block notification. The daily Bitcoin maximum was computed in dollars. People’s interactions expanded as the volume of tweets climbed. This methodology required an addition to the association as well as the vicious circle. Tweet frequency did not mark the extent of the association, as people may have preferred to search for trending, current, and relevant issues [20]. Search engine surge has also been connected to the price of Bitcoins, which may be a trivial presumption. One of the essential supervised learning paradigms for assessing the compensation generated from such behavior was reinforcement learning (RL). RL focused on a framework and prototype architecture that offered the platform a continual-learning framework. The learning model could be developed to enhance the specified system structure and system performance with high accuracy, as shown in Figure 5. The original objective of RL was to formulate a guideline for behaviors to undertake in numerous steps in order to optimize potential benefits. Under certain scenarios, the RL system computed this in the context of learning from compensation to perform a particular action and defining a policy for meaningful occupations. Pre-processing, algorithm development, conversion, and extraction of features were the four main phases for the original required data. To train and test the price information, we partitioned the sample information and fed it into the RL method. There were 13 derived properties, with interpretations and measurements in aggregate.

Figure 5.

Forecasting approaches of market value based on RL.

The skilled forecasting model was compared using several outcome measures, comprising Absolute Error, Mean_Absolute_Percentage_Error, Mean_Absolute_Error, Mean Square_Error and Root_Mean_Square_Error [22]. The prescription was categorized as follows:

Here, Δx is absolute error, X is the actual value of a quantity and X0 is the measured value of the quantity,

where:

MAE = Mean Absolute Error;

Σ: Total;

Yi: Value observed for the ith process;

: forecasted value for the ith process;

a: overall collected number of findings.

where:

MAPE = Mean Absolute Percentage Error;

Σ: Total;

Zi: Value observed for the ith process;

: forecasted value for the ith process;

n: overall collected number of findings.

where:

Yi is the value observed for the ith process;

: is the forecasted value for the ith process.

4. Implementation and Results

Herein, we described in great detail, the forecasting system’s operational procedure and research domain. The machine learning atmosphere’s operating system used basic and advanced browsers. Python and IDE were the programming languages used to simulate and validate the built models. The blockchain platform was designed with the Ubuntu Linux 22.10 LTS operating system.

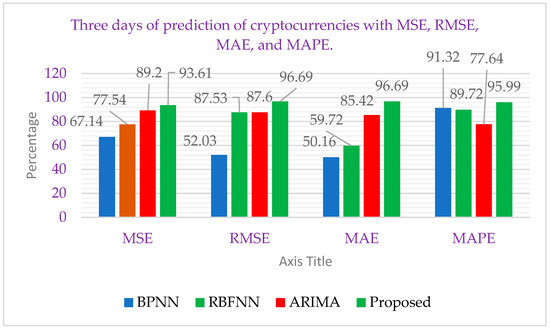

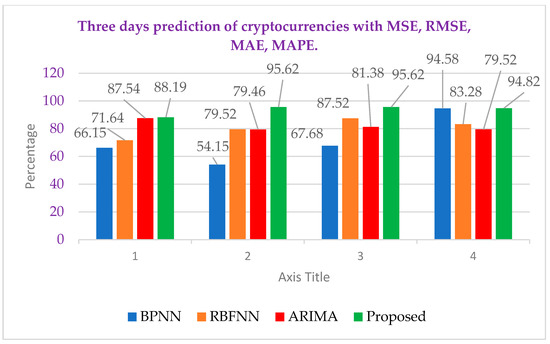

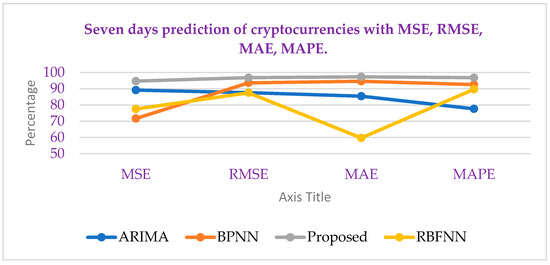

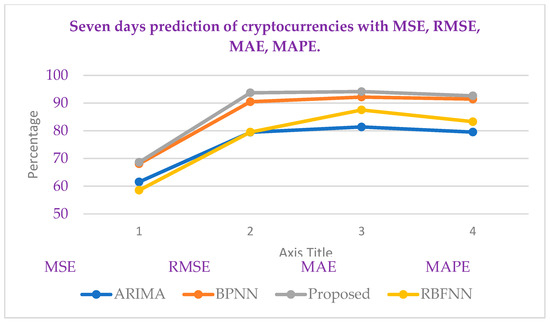

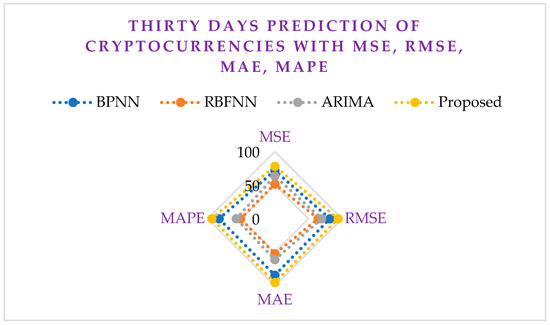

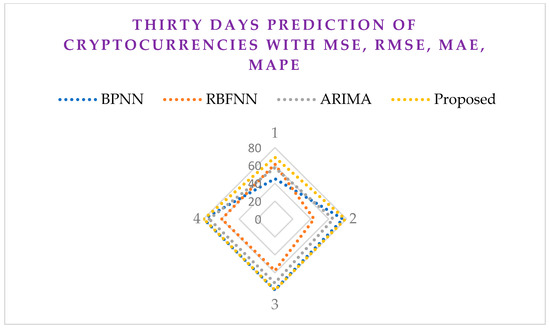

Figure 6 and Figure 7 provide a daily study of Litecoin and Monero. The model was trained for Litecoin and Monero, encompassing the years 2017–2021 and 1276 pieces of information. The trained report sought to forecast the three-day price from 14 December 2022 to 17 December 2022, as per Table 1. Figure 8 and Figure 9 provide a weekly study of Litecoin and Monero, while Figure 10 and Figure 11 provide a monthly study of the same. Table 2 shows seven-day predictions of cryptocurrencies with MSE and RMSE. Similarly, Table 3 shows thirty-day cryptocurrency predictions with MSE and RMSE. The rates are in dollars.

Figure 6.

Three days of Litecoin cryptocurrency predictions with MSE, RMSE, MAE, and MAPE.

Figure 7.

Three days of Moreno cryptocurrency predictions with MSE, RMSE, MAE, and MAPE.

Table 1.

Three days of prediction of cryptocurrencies with MSE, RMSE, MAE, and MAPE.

Figure 8.

Seven days of predictions of Litecoin with MSE, RMSE, MAE, and MAPE.

Figure 9.

Seven days of predictions of Monero with MSE, RMSE, MAE, and MAPE.

Figure 10.

Thirty days of predictions of Litecoin with MSE, RMSE, MAE, and MAPE.

Figure 11.

Thirty days of predictions of Monero with MSE, RMSE, MAE, MAPE.

Table 2.

Seven days of cryptocurrency predictions with MSE, RMSE, MAE, and MAPE.

Table 3.

Thirty days of predictions of cryptocurrencies with MSE, RMSE, MAE, and MAPE.

We compared the outcome of our suggested strategy to the outcomes of other prior systems. In the illustrations, yellow represents previous work [21] associated with this technique. Orange represents planned system outcomes, while the real market value results are indicated with red in this technique, over a time period of three days. The projection was based on daily, weekly, and monthly Bitcoin price information. The time required to execute the large volume of data took a minimum of 1 min and a maximum of 50 min. The number of iterations and forecasting frame were employed to make the projection.

5. Conclusions and Future Work

Regarding the subjective outside aspects that influence forecasting, such as SARIMA and ARIMA, which are frequently considered for monetary strategy analyses and academic purposes, forecasting cryptocurrency prices is a challenging task. There have been several hypotheses associated with this; these have had varying constraints and are mostly employed for time series. Using neural networks to determine prices has previously shown satisfactory results in recent findings concerned with a range of techniques. For the purpose of predicting the prices of Litecoin and Monero, we defined the reinforcement learning development of a framework integrated with a blockchain framework. When compared to other state-of-the-art strategies in this sector, the suggested scheme demonstrated better performance. In this system, we reached improved consistency, in comparison to other systems, with respect to Litecoin and Monero, which we mentioned in the previous relevant literature. The intention of this study was to achieve superior results in cryptocurrency prognosis with a lower degree of inaccuracy. Even though accurate predictions were made, some of the limitations—such as a lack of data, public trust, human engineering, hardware, and processing power—also influenced the prediction rate.

People from all around the world have been attempting to enter the cryptocurrency network over the last ten years, as it has evolved to become a recognized corporate culture. Forecasting the daily, weekly, and monthly value of these digital currencies, however, has remained somewhat difficult. To address this issue, we applied reinforcement learning to the forecast of two digital currencies: Litecoin and Monero. The objective of the projected research in the future will be to investigate and strengthen the putative therapeutics. Comparable efforts would include assessing other digital coins, comparing the results of the current structure to those of other cryptocurrencies, and determining the results obtained under various circumstances.

Author Contributions

Conceptualization, L.T.M. and O.G.; Methodology, L.T.M., J.A.P., V.D.K., O.G., I.C. and C.N.; Validation, L.T.M. and J.A.P.; Formal analysis, I.C.; Investigation, V.D.K.; Resources, J.A.P. and I.C.; Data curation, J.A.P. and C.N.; Writing—original draft, L.T.M. and V.D.K.; Writing—review & editing, all authors.; Visualization, L.T.M.; Supervision, V.D.K. and O.G.; Project administration, all authors.; Funding acquisition, all authors. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Gupta, R.; Tanwar, S.; Al-Turjman, F.; Italiya, P.; Nauman, A.; Kim, S.W. Smart contract privacy protection using AI in cyber-physical systems: Tools, techniques and challenges. IEEE Access 2020, 8, 24746–24772. [Google Scholar] [CrossRef]

- Sovbetov, Y. Factors influencing cryptocurrency prices: Evidence from bitcoin, ethereum, dash, litcoin, and Monero. J. Econ. Financ. Anal. 2018, 2, 1–27. [Google Scholar]

- Liew, J.K.-S.; Li, R.; Budavari, T. Crypto-currency investing examined. SSRN Electron. J. 2019, 4, 8720. [Google Scholar] [CrossRef]

- Li, G.; Zhao, Q.; Song, M.; Du, D.; Yuan, J.; Chen, X.; Liang, H. Predicting Global Computing Power of Blockchain Using Cryptocurrency Prices. In Proceedings of the 2019 International Conference on Machine Learning and Cybernetics (ICMLC), Kobe, Japan, 7–10 July 2019; pp. 1–6. [Google Scholar]

- Miraz, M.H.; Ali, M. Applications of Blockchain Technology beyond Cryptocurrency. arXiv 2018, arXiv:1801.03528. [Google Scholar] [CrossRef]

- Navamani, T.M. A Review on Cryptocurrencies Security. J. Appl. Secur. Res. 2021. [Google Scholar] [CrossRef]

- Ji, S.; Kim, J.; Im, H. A Comparative Study of Bitcoin Price Prediction Using Deep Learning. Mathematics 2019, 7, 898. [Google Scholar] [CrossRef]

- Shintate, T.; Pichl, L. Trend Prediction Classification for High Frequency Bitcoin Time Series with Deep Learning. J. Risk Financ. Manag. 2019, 12, 17. [Google Scholar] [CrossRef]

- Peng, Y.; Albuquerque, P.H.M.; de Sá, J.M.C.; Padula, A.J.A.; Montenegro, M.R. The best of two worlds: Forecasting high frequency volatility for cryptocurrencies and traditional currencies with Support Vector Regression. Expert Syst. Appl. 2018, 97, 177–192. [Google Scholar] [CrossRef]

- Kurbucz, M.T. Predicting the price of Bitcoin by the most frequent edges of its transaction network. Econ. Lett. 2019, 184, 108655. [Google Scholar] [CrossRef]

- Wirawan, I.M.; Widiyaningtyas, T.; Hasan, M.M. Short Term Prediction on Bitcoin Price Using ARIMA Method. In Proceedings of the 2019 International Seminar on Application for Technology of Information and Communication (iSemantic), Semarang, Indonesia, 21–22 September 2019; pp. 260–265. [Google Scholar]

- Lahmiri, S.; Bekiros, S. Cryptocurrency forecasting with deep learning chaotic neural networks. Chaos Solitons Fractals 2019, 118, 35–40. [Google Scholar] [CrossRef]

- Alessandretti, L.; Elbahrawy, A.; Aiello, L.M.; Baronchelli, A. Anticipating Cryptocurrency Prices Using Machine Learning. Complexity 2018, 2018, 1–16. [Google Scholar] [CrossRef]

- Chen, Z.; Li, C.; Sun, W. Bitcoin price prediction using machine learning: An approach to sample dimension engineering. J. Comput. Appl. Math. 2020, 365, 112395. [Google Scholar] [CrossRef]

- Smuts, N. What drives cryptocurrency prices? An investigation of Google trends and telegram sentiment. ACM SIGMETRICS Perform. Eval. Rev. 2019, 46, 131–134. [Google Scholar] [CrossRef]

- Mittal, A.; Dhiman, V.; Singh, A.; Prakash, C. Short-Term Bitcoin Price Fluctuation Prediction Using Social Media and Web Search Data. In Proceedings of the 2019 Twelfth International Conference on Contemporary Computing (IC3), Noida, India, 8–10 August 2019; pp. 1–6. [Google Scholar]

- Jang, H.; Lee, J. An Empirical Study on Modeling and Prediction of Bitcoin Prices with Bayesian Neural Networks Based on Blockchain Information. IEEE Access 2017, 6, 5427–5437. [Google Scholar] [CrossRef]

- Sin, E.; Wang, L. Bitcoin price prediction using ensembles of neural networks. In Proceedings of the 2017 13th International Conference on Natural Computation, Fuzzy Systems and Knowledge Discovery (ICNC-FSKD), Guilin, China, 29–31 July 2017; pp. 666–671. [Google Scholar]

- Saad, M.; Choi, J.; Nyang, D.; Kim, J.; Mohaisen, A. Toward Characterizing Blockchain-Based Cryptocurrencies for Highly Accurate Predictions. IEEE Syst. J. 2019, 14, 321–332. [Google Scholar] [CrossRef]

- Rahman, S.; Hemel, J.N.; Anta, S.J.A.; Al Muhee, H.; Uddin, J. Sentiment Analysis Using R: An Approach to Correlate Cryptocurrency Price Fluctuations with Change in User Sentiment Using Machine Learning. In Proceedings of the 2018 Joint 7th International Conference on Informatics, Electronics & Vision (ICIEV) and 2018 2nd International Conference on Imaging, Vision & Pattern Recognition (icIVPR), Kitakyushu, Japan, 25–29 June 2018; pp. 492–497. [Google Scholar]

- Kang, C.Y.; Lee, C.P.; Lim, K.M. Cryptocurrency Price Prediction with Convolutional Neural Network and Stacked Gated Recurrent Unit. Data 2022, 7, 149. [Google Scholar] [CrossRef]

- Shahbazi, Z.; Byun, Y.-C. Improving the Cryptocurrency Price Prediction Performance Based on Reinforcement Learning. IEEE Access 2021, 9, 162651–162659. [Google Scholar] [CrossRef]

- Górski, T. The 1 + 5 Architectural Views Model in Designing Blockchain and IT System Integration Solutions. Symmetry 2021, 13, 2000. [Google Scholar] [CrossRef]

- Ranaldi, L.; Gerardi, M.; Fallucchi, F. CryptoNet: Using Auto-Regressive Multi-Layer Artificial Neural Networks to Predict Financial Time Series. Information 2022, 13, 524. [Google Scholar] [CrossRef]

- Soltani, R.; Zaman, M.; Joshi, R.; Sampalli, S. Distributed Ledger Technologies and Their Applications: A Review. Appl. Sci. 2022, 12, 7898. [Google Scholar] [CrossRef]

- Sattarov, O.; Muminov, A.; Lee, C.W.; Kang, H.K.; Oh, R.; Ahn, J.; Oh, H.J.; Jeon, H.S. Recommending Cryptocurrency Trading Points with Deep Reinforcement Learning Approach. Appl. Sci. 2020, 10, 1506. [Google Scholar] [CrossRef]

- Betancourt, C.; Chen, W.-H. Reinforcement Learning with Self-Attention Networks for Cryptocurrency Trading. Appl. Sci. 2021, 11, 7377. [Google Scholar] [CrossRef]

- Kim, Y.; Byun, Y.-C. Ultra-Short-Term Continuous Time Series Prediction of Blockchain-Based Cryptocurrency Using LSTM in the Big Data Era. Appl. Sci. 2022, 12, 11080. [Google Scholar] [CrossRef]

- Ye, Z.; Wu, Y.; Chen, H.; Pan, Y.; Jiang, Q. A Stacking Ensemble Deep Learning Model for Bitcoin Price Prediction Using Twitter Comments on Bitcoin. Mathematics 2022, 10, 1307. [Google Scholar] [CrossRef]

- Hamayel, M.J.; Owda, A.Y. A Novel Cryptocurrency Price Prediction Model Using GRU, LSTM and bi-LSTM Machine Learning Algorithms. AI 2021, 2, 477–496. [Google Scholar] [CrossRef]

- Livieris, I.; Kiriakidou, N.; Stavroyiannis, S.; Pintelas, P. An Advanced CNN-LSTM Model for Cryptocurrency Forecasting. Electronics 2021, 10, 287. [Google Scholar] [CrossRef]

- Brezulianu, A.; Popa, I.; Geman, O.; Chiuchisan, I.; Nastase, C. GreenChain: A Solana Blockchain-based Management Platform for Academic/Commercial Areas. In Proceedings of the 2022 E-Health and Bioengineering Conference (EHB), Iasi, Romania, 17–18 November 2022; pp. 1–5. [Google Scholar] [CrossRef]

- Turcu, C.; Turcu, C.; Chiuchisan, I. Blockchain and its Potential in Education. In Proceedings of the International Conference on Virtual learning ICVL, Online; 2018; pp. 361–367. [Google Scholar]

- Vicoveanu, D.I.; Geman, O.; Balcos, C.; Prelipceanu, M. Medical Devices Management System Based on Blockchain Technology. Bull. Polytech. Inst. Iasi 2021. [Google Scholar] [CrossRef]

- Elahi, H.; Castiglione, A.; Wang, G.; Geman, O. A human-centered artificial intelligence approach for privacy protection of elderly App users in smart cities. Neurocomputing 2021, 444, 189–202. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).