Abstract

The non-fungible tokens trading of digital content works, as an emerging business model, has rapidly developed while also posing challenges to current copyright protection. The NFT infringement incidents in recent years have exposed many issues, such as lack of government regulation, imperfect copyright protection mechanisms, and illegal profits from service platforms. Considering the collusive behavior during the NFT minting process, this study uses evolutionary game theory to model a game composed of three populations: digital content creators; NFT service platforms; and government regulatory agencies. We derived and analyzed the replication dynamics of the game to determine the evolutionary stability strategy. In addition, combined with numerical simulations, we also analyzed the impact of individual factors on the stability of system evolution. This study identifies that the incentives and fines set by the government must be above a certain threshold in order for game results to develop toward an ideal equilibrium state, and the government can try to improve the efficiency of obtaining and updating market information and set dynamic punishment and reward mechanisms based on this. This study also found that excessive rewards are not conducive to the government fulfilling its own regulatory responsibilities. In this regard, the government can use information technology to reduce the cost of regulation, thereby partially offsetting the costs brought about by incentive mechanisms. In addition, the government can also enhance the governance participation of platforms and creators to improve the robustness of digital copyright protection by strengthening media construction and cultivating public copyright awareness. This study helps to understand the complex relationship between NFT service platforms, digital content creators, and government regulatory authorities and proves the practical meaning of countermeasures and suggestions for improving government digital copyright regulations.

1. Introduction

In the era of the digital economy, with the continuous development of blockchain, non-fungible tokens (NFT), as a new form of digital assets, have attracted widespread attention in the fields of digital publishing and cultural exchanges. NFT is a trustworthy digital equity certificate with non-homogeneous characteristics in the blockchain network. It is a data object created, maintained, and executed by smart contracts that can record and process multi-dimensional and complex attributes on the blockchain [1]. The application of NFT in the digital publishing industry has promoted the interoperable commercialization of digital or physical goods [2], improved copyright registration efficiency, and increased transparency and liquidity [3]. According to a report released by Nonfungible, an NFT data company, the NFT market volume exceeded $17 billion for the full year 2021, an increase of 21,000% compared to $82 million in 2020; more than 2.5 million crypto wallets held or traded NFTs in 2021, and this number was only 0.089 million in the previous year; the number of buyers has also increased from 0.075 million in 2020 to 2.3 million. In addition, in 2021, investors earned about $5.4 billion in profits from NFT sales, with about 470 wallets earning more than $1 million in profits [4]. These data not only reflect the commercial value of NFT digital publishing, but also confirm that NFT digital publishing is ushering in a new era globally.

With the application of NFT, its inherent limitations are gradually becoming apparent. In recent years, NFT infringement cases have been constantly emerging. In February 2023, the case of the famous French luxury brand Hermès against the artist Mason Rothschild came to an end [5]. The jury ruled that the “MetaBirkins” NFTs series designed by Mason had the potential to confuse consumers and was suspected of trademark infringement, trademark dilution, and domain name squatting. Industry pioneer Dapper Labs (the development company of CryptoKitties, Vancouver, BC, Canada) has also been involved in infringement incidents. In 2017, a virtual cat in CryptoKitties caused a copyright dispute by taking images from copyrighted artwork without the permission of the original copyright holder [6]. OpenSea, the world’s largest NFT service platform, claims that more than 80% of the assets created by their simplified “lazy casting” process are plagiarized works, fake collections, and spam [7]. NFT has not yet truly fulfilled its promise to protect digital rights.

On the one hand, there are still shortcomings in the application of NFT technology in digital publishing. The original intention of NFT’s application in the digital publishing industry was to use its unique digital ownership certificate to assist in the authentication of digital works [8]. However, the practical application of NFT seems to have not fully achieved the originally envisioned effect. In every NFT transaction activity, there is a tokenization process of the original work, which will transfer the copyright from the owner to the buyer to be included in a smart contract, which means that in every NFT transaction, there will be a simultaneous transfer of rights from the same creation or ownership license [9]. Although the blockchain can provide a unique token identity for digital content and record transaction details, it cannot prove the identity of the author nor the authenticity and originality of the digital content [10]. At the same time, the easy availability of digital content, NFT casting tools, and casting tutorials on the Internet has intensified digital copyright infringement [11]. In addition, after the infringement is discovered, the blockchain platform is unable to technically and logically decompose the infringing NFT into black hole addresses [12,13], and the remedies available to the platform are extremely limited.

On the other hand, collusion between NFT service platforms and digital content creators is motivated and achievable. NFT has gradually entered the public eye since 2021, and not many users currently know and use NFT. Consumers without mature cognition rely more on similarity detection tools developed by service platforms to determine the originality of NFTs. However, in the field of similarity detection, the detection agency’s judgment on whether a sample is plagiarized depends on artificially set thresholds [14]. The adjustability of this threshold determines the likelihood of collusion. In addition, in the field of detection, it is common to detect collusion between the executing party and the executed party [15]. Especially in the NFT market, where the value assessment mechanism is not yet complete, facing huge profit temptations, counterfeit entities, and NFT service platforms may collude in plagiarism in order to make huge profits.

Evolutionary Game Theory (EGT) originates from the idea of biological evolution, which describes the process of bounded rational entities continuously responding to external shocks through imitation, learning, trial, and error under information asymmetry conditions [16]. Evolutionary Stability Strategy (ESS) and replicator dynamics are two core concepts in evolutionary game theory. ESS is a strategy that dominates a population for a long time and remains stable even in the face of small changes or mutations in other strategies. Replicator dynamics is a mathematical model that describes how the proportions of different strategies in a population change over time, where the rate of growth of a strategy is proportional to its advantage relative to the mean fitness. The replicator dynamic equation refers to a simple imitation of the dominant strategy by bounded rational group players, expressed by a dynamic differential equation or a system of differential equations. Therefore, the use of evolutionary games can accurately describe the development and changes in strategy selection, which is suitable for studying the behavior of copyright protection subjects in the NFT market.

The situation of NFT infringement is theoretically feasible and has been confirmed in practice. Studying the regulatory strategies for digital copyright protection in response to the collusion phenomenon in the NFT casting process has important practical significance in stimulating the production of original high-quality content, strengthening cultural digitization construction, and promoting the healthy development of the digital publishing industry chain. Therefore, this study constructed a three-party game evolution model including digital content creators, NFT service platforms, and government regulatory authorities. The focus is on discussing the following three issues: ① How to establish an evolutionary game model for digital copyright protection considering collusion behavior in NFT infringement scenarios? ② How do collusion costs and other factors affect each player’s strategic choices? ③ How to take effective measures to avoid collusion and ensure the originality of NFT?

Our contributions include:

- Model the digital copyright protection issue in the NFT market as a non-cooperative game between three groups: digital content creators; NFT service platforms; and government regulatory authorities;

- Use evolutionary game theory to derive the replication dynamics of these three groups, analyze the Nash equilibrium solution of the proposed evolutionary game model, and determine the conditions for the asymptotic stability of the equilibrium solution;

- Validate our theoretical results using three-dimensional phase diagrams with state combinations and draw evolution diagrams to confirm the presence of ESS in the proposed game;

- Through digital simulation, analyze and discuss the impact of sales revenue, penalties and rewards, speculation costs, collusion costs, administrative penalties, and other factors on ESS.

The remainder of this article is arranged as follows. Section 2 is related to the literature. Section 3 provides model assumptions and construction. Section 4 solves and analyzes the evolutionary stability strategies of each population and system. Section 5 uses Matlab R2018a software to conduct numerical simulations in three-dimensional space. Section 6 provides research conclusions, limitations, and future research plans.

2. The Related Literature

2.1. NFTs and Traditional Tokens

The origin of NFT can be traced back to “colorful coins”, a method of representing real-world assets on the Bitcoin blockchain [17], including digital and physical assets. However, due to the limitations of the Bitcoin scripting language, the functionality of colored coins is limited [18]. Therefore, a more scalable blockchain has been proposed and continuously developed—the Etherchain. According to Vitalik Buterin, the founder of Ethereum, his main motivation for developing Ethereum was that “the concept of blockchain can be used for more than just money” [19]. Ethereum represents a blockchain with a built-in Turing complete programming language. It provides an abstract layer that allows anyone to write smart contracts and decentralized applications, where they can create their own arbitrary rules, including ownership rules, transaction formats, and state transition functions [20]. Of course, beyond the Ethereum blockchain, emerging blockchains such as Flow, Tezos, and Algorand have also been increasing their support for NFT.

The introduction and adoption of smart contract interface standards have aided the development process of decentralized applications. This has facilitated a consistent application interaction, as well as creating, managing, and transferring tokens in a universal and uniform way [21]. ERC20 [22] and ERC721 [23] are the two most popular standards. ERC-20 is the standard interface for Ethereum-issued tokens, providing interoperability and fungibility to tokens. ERC721 standard was introduced by Dieter Shirley, a contributor to the Ethereum source code library and founder of the digital collectibles game CryptoKitties. It established the concept and status of NFTs, known as the “gold standard” [24]. On the basis of ERC-20, ERC-721 has added interfaces such as tokenId and ownerOF, which endowed each token with unique and indivisible characteristics and left the initial impression of NFT on the public. In addition to these two standards, other standards such as ERC-998 (composite NFTs) [25], ERC-1155 (semi fungible Token) [26], and ERC-725 (attachable data key/value store) [27] are also constantly innovating and reshaping the creative space of NFTs.

Tokens are a type of digital asset issued on blockchain technology, which can represent a certain equity, value, or physical object. According to actual functions, tokens are divided into three categories: payment tokens, utility tokens, and asset tokens [28,29]. Table 1 provides a comparative analysis of them. Payment tokens, also known as cryptocurrencies or fungible tokens, are mainly used to pay for goods or services. Utility tokens are designed to provide digital access to an application or service. Asset tokens refer to broad tradable assets with investment or collection attributes, including security tokens and NFTs. Compared to payment tokens, NFTs have uniqueness, cannot be replaced with each other, cannot be divided, and do not have payment functionality. Compared with securities tokens with investment attributes, NFTs have a more prominent collection attribute and are not security vouchers with a certain future cash flow, and they cannot be considered financial products.

Table 1.

Classification and characteristics/essence of Tokens.

Similar to traditional tokens, research on NFT is mainly distributed in the three fields of economics and finance, computer science, and law [30], focusing on the market, technology, and legal risks they face. Under the theme of market risk, scholars use economic and financial methods to explore the value of NFT. Research shows that in the early market, the price of NFT showed inefficiency, and the value steadily increased [31]. In addition, factors such as the situation of the cryptocurrency market [32], macroeconomic conditions, and public attitudes [33] are related to the value of NFT. Under the theme of technological risk, scholars are committed to developing and improving computer science technology. In order to address the security vulnerabilities inherent in NFT-based key technology smart contracts, many tools for verifying smart contracts have been developed and released as open sources [34]. In response to the problems of privacy leakage and high-value NFT fraud caused by the owner’s address being stored in plaintext. A new transaction scheme was proposed by [35] to hide the address of the NFT owner during the transaction process. Under the theme of legal risk, scholars focus on the risk and supervision of NFT financialization transactions, such as speculation [36], market bubbles [37], etc. In addition, due to its association with data assets in the physical world, NFT also poses a legal risk that has never existed in traditional tokens, namely, the risk of infringement, such as plagiarism and counterfeiting. In this field, scholars have conducted extensive research on copyright protection. Digital copyright protection in the NFT field is the core of this study, so the existing, more detailed research status will be introduced in the next section.

2.2. Infringement of NFTs

The infringement risk of NFT is a problem that has never occurred in the development of cryptocurrencies. The NFT smart contract contains metadata that describes the basic attributes of the NFT, including name, description, creator, copyright information, image links, audio links, etc. Although blockchain can ensure that these metadata are not tampered with and are traceable, it cannot guarantee the correspondence between metadata and copyright holders. Ensuring that NFT digital works do not infringe on the rights of others is an inevitable requirement for achieving innovative development of the digital economy. The academic community has demonstrated how to prevent NFT infringement from both legal and technical perspectives.

In terms of legal means, relevant research mainly discusses the types of infringement and the identification of infringement liability. In the mining process, the types of infringement include personal rights of authorship and all copyrights. In the trading process, the types of infringement include personal rights of authorship, copyrights, and transmission rights [38]. From the manifestation of infringement behavior, NFT infringement can be divided into three situations: unauthorized; beyond the scope of authorization; and plagiarism of others’ works [39]. The research on the identification of infringement liability focuses on the NFT service platform. Whether the gas fees charged by the platform are technical expenses or platform profits directly affects the platform’s regulatory obligations [12]. The service platform’s repeated collection of transaction commissions in the secondary market is also a reason for its liability [13]. In the NFT infringement cases that have occurred, the court’s determination of infringement liability mostly tends to increase the obligation of operating the platform [40], requiring the platform to undertake necessary technical support while also assisting in undertaking obligations such as work review, risk notification, notification deletion, etc. It should be mentioned that blockchain platforms are technically and logically unable to decompose infringing NFTs into black hole addresses. In addition, an increasing number of platforms support the transfer of NFTs through electronic wallets in overseas market transactions, making infringement even more difficult to control [12,13].

The technical research on preventing NFT infringement mainly involves the development and application of digital watermarking technology and similarity detection technology. Digital watermarking technology is a technology that uses prior information detection for copyright protection and anti-counterfeiting protection [41]. For audio data, [42] proposes a framework for detecting pseudo audio NFTs using audio watermarking technology by combining Discrete Wavelet Transform (DWT) and Statistical Mean Manipulation. For video data, [43] embedded encrypted watermarks into selected subbands and designed a color watermarking algorithm with high imperceptibility. In response to the JPEG compression attacks faced by image data, [44] developed a method to detect key information regions in images and encrypt multiple watermarks. The above digital watermarking techniques can, to some extent, protect digital copyrights from infringement, but there are also certain limitations. On the one hand, digital watermarking technology is difficult to accept in environments with high-quality requirements. On the other hand, most of the existing digital content has not been pre-embedded with the imprinting information of digital water technology, resulting in this method not being widely applied. Therefore, some scholars focus on the development and application of similarity detection technology. Moreover, [45] proposed an NFT image plagiarism detection method based on deep learning and trained and verified on the publicly available NFT-Classifier dataset from Kaggle. The approximate pattern-matching method for plagiarism detection proposed by [46] shows high performance in blockchain-driven, NFT-enabled platforms and ecosystems.

2.3. Application of EGT in Copyright Protection

Evolutionary games reflect the continuous learning and improvement process of game participants, which can effectively demonstrate the evolution of their learning mechanisms and strategies and are widely applied in computer science, engineering, physics, and business economics [47]. In recent years, scholars in the fields of copyright protection and infringement management have gradually used evolutionary game theory to conduct more analysis and research. Based on the theory of opportunity and motivation, [48] constructed an evolutionary game model for data abuse governance between digital service platforms and users, achieving a win–win result. Based on evolutionary game theory, [49] analyzed the government–industry–university–research intellectual property cooperation behavior and its influencing factors from two aspects: market and administrative supervision mechanisms. Using evolutionary games, [50] analyzed the impact of litigation costs, platform response attitudes, rights holders’ attitudes toward infringement, and other factors on social co-governance of intellectual property protection. In addition, [51], based on the evolutionary game, explored the strategic interaction between different subjects and the influence of various factors and explored the copyright governance mechanism of China’s UGC. The above research further confirms the feasibility of the evolutionary game theory in copyright protection research to prevent NFT infringement.

3. Model Assumptions and Construction

3.1. Model Assumptions

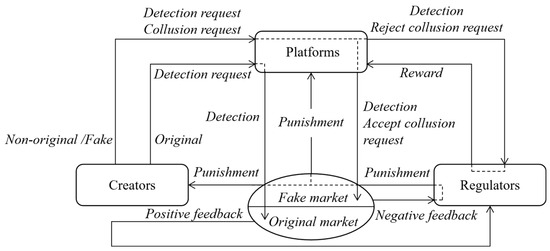

There are three populations in the copyright protection system: digital content creators; NFT service platforms; and government regulatory authorities. Figure 1 illustrates our system. First, the digital content creators produce works and submit them to the NFT publishing platform for similarity detection. Then, the platform controls the process of minting (Tokenizing) based on the detection results. Finally, the regulator rewards or punishes creators and platforms through feedback from the market. Evolutionary game theory is an effective method for studying the dynamic changes in bounded rational agent strategies in long-term repeated games under information asymmetry conditions [16]. In the game process, each subject integrates various interests, learns, and evolves in the repeated game, and finally makes the optimal decision. Based on the above logic, we propose the following assumptions:

Figure 1.

The logic relationship of the game model.

- (1)

- The NFT digital work copyright protection system involves three populations: digital content creators; NFT service platforms; and government regulatory authorities. All players involved exhibit bounded rationality, and their strategic choices tend to converge to stable strategies over time;

- (2)

- The strategy space available for digital content creators is α = (α1, α2) = (original, non-original/fake). In the population of creators, the proportion of entities who adopt the α1 strategy is x, and the proportion of entities who adopt the α2 strategy is (1 − x); x ∈ [0, 1]. The strategy space of NFT digital publishing platforms is β = (β1, β2) = (fair detection, collusive detection). In the population of platforms, the proportion of entities who adopt the β1 strategy is y, and the proportion of entities who adopt the β2 strategy is (1 − y); y ∈ [0, 1]. The strategy selection space of regulators is γ = (γ1, γ2) = (strict supervision, loose supervision). In the population of regulators, the proportion of entities who adopt the γ1 strategy is z, and the proportion of entities who adopt the γ2 strategy is (1 − z); z ∈ [0, 1];

- (3)

- The sales revenue of NFT is Rc. The cost of designing and producing original digital works is Cco. The cost of producing non-original digital works is Ccf, Cco > Ccf. Original digital content can definitely pass similarity detection. The non-original digital content can only pass similarity detection when the NFT service platform conducts collusion detection, and the cost of collusion is Ccfr, Ccfr < (Cco − Ccf). Meanwhile, the speculative act of producing non-original works will incur speculative costs Ccfs, mainly including expenses on information search, false advertising, and others. The production activities of creators are aimed at economic benefits and require initial parameters to meet Rc > Cco > Ccf + Ccfr + Ccfs;

- (4)

- Digital content works can only be sold on the blockchain after successfully passing similarity detection, and the detection revenue is RP. When digital content is non-original, if the service platform conducts fair detection, it is not qualified. If the platform conducts collusion detection, it reaches collusion with the infringer and helps the infringing work obtain the online license. The speculative cost of conducting collusion detection for the platform is Cp, including expenses on modifying detection reports, strengthening information security management, and others. The activities of platforms are driven by economic benefits and require initial parameters to meet Ccfr > Cp;

- (5)

- When regulators enforce strict supervision, creators of non-original works will be fined with Fc; platforms conducting collusion detection will be fined with Fp; platforms conducting fair detection will receive a reward MP, and the cost of strict supervision is Cg. When the regulators enforce loose supervision, they do not impose rewards and punishments on market entities;

- (6)

- The benefits brought by the production of original digital content to society are Rg, including providing innovative development momentum for society, promoting the development of the digital economy, and strengthening the protection of intellectual property rights. When collusion is achieved between creators and platforms, the infringing works will flow into the market. In order to maintain market stability and crack down on piracy, the regulators spend cost Dg. When regulators adopt the loose supervision, they will receive an administrative penalty of Tg from the superior government; Tg > Cg.

The parameters used to describe the game are shown in Table 2.

Table 2.

List of parameters used in the proposed evolutionary game mode.

3.2. Model Construction

The evolutionary game model payoff matrix among the regulators, platforms, and creators is obtained, as shown in Table 3.

Table 3.

Payoff matrix among the regulators, platforms, and creators.

4. Model Stability Analysis

4.1. Analysis of Creators

The expected return for creators who choose strategy α1 is Uc1. The expected return for creators who choose strategy α1 is Uc2. According to the income matrix, it can be concluded that

Uc1 = yz(Rc − Cco) + y(1 − z)(Rc − Cco) + (1 − y)z(Rc − Cco) + (1 − y)(1 − z)(Rc − Cco)

= Rc − Cco

= Rc − Cco

Uc2 = yz(−Ccf − Ccfs − Fc) + y(1 − z)(−Ccf − Ccfs) + (1 − y)z(Rc − Ccf − Ccfs − Ccfr − Fc) + (1 − y)(1 − z)(Rc − Ccf − Ccfs − Ccfr)

= y(Ccfr − Rc) − zFc − Ccf − Ccfr − Ccfs + Rc

= y(Ccfr − Rc) − zFc − Ccf − Ccfr − Ccfs + Rc

The replication dynamic equation of digital content creators and its first derivative with respect to x are as follows:

F(x) = x(1 − x)(Uc1 − Uc2) = x(1 − x)(−Cco + Rc − (y(Ccfr − Rc) − zFc − Ccf − Ccfr − Ccfs + Rc))

= x(1 − x)((Rc − Ccfr)y + zFc + Ccf + Ccfr + Ccfs − Cco)

= x(1 − x)((Rc − Ccfr)y + zFc + Ccf + Ccfr + Ccfs − Cco)

F′(x) = (1 − 2x)((Rc − Ccfr)y + zFc + Ccf + Ccfr + Ccfs − Cco)

Set G(y) = (Rc − Ccfr)y + zFc + Ccf + Ccfr + Ccfs − Cco

According to the stability theorem for replicating dynamic equations, the corresponding strategy is ESS only when x satisfies F(x) = 0 and F′(x) < 0 [52].

- (1)

- When y = (−zFc − Ccf − Ccfr − Ccfs + Cco)/(Rc − Ccfr) = y*, there are G(y) = 0, and F(x) ≡ 0; the digital content creator’s choice of any proportion of original strategy is stable strategy, meaning that their strategic choice will not change with the passage of time;

- (2)

- Due to G(y) being a monotonically increasing function, when y < y*, there are G(y) < 0, F′(1) > 0, and F′(0) < 0; therefore, x = 0 is the ESS of the digital content creator. When y > y*, there are G(y) > 0, F′(1) < 0, and F′(0) > 0; therefore, x = 1 is ESS of the digital content creator.

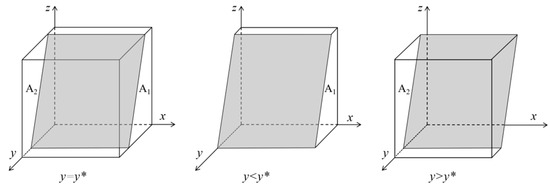

The evolutionary trend of digital content creators’ strategy is shown in Figure 2. The probability that the creator steadily chooses the non-original strategy is VA1, that is, the volume of A1, and the probability that steadily chooses the original strategy is VA2, that is, the volume of A2. The expression is as follows:

Figure 2.

The evolutionary trend of digital content creators’ strategy.

Lemma 1.

The probability of digital content creators choosing the original strategy is positively correlated with the fines, sales revenue, collusive costs, and speculative costs they bear while negatively correlating with the production costs saved by choosing a fake strategy.

Proof 1.

According to the expression for VA2 (probability that creators choose the original strategy), solving for the first-order partial derivatives of each parameter, and obtaining ∂VA2/∂Rc > 0, ∂VA2/∂Ccfr > 0, ∂VA2/∂Ccfs > 0, ∂VA2/∂Fc > 0, ∂VA2/∂(Cco − Ccf) < 0. □

Lemma 1 indicates that ensuring the sales revenue of digital content creators can prevent them from engaging in copyright infringement. The regulators can curb the production of non-original digital content by increasing penalties while also increasing the speculative cost by improving the level of information security management and expanding media influence, thereby promoting the production of original works.

Lemma 2.

The probability of digital content creation choosing the original strategy increases with the increasing probability of NFT service platforms choosing to refuse collusion and regulators choosing strict supervision.

Proof 2.

According to F(x) and F′(x), when z < (Cco − Ccf − Ccfr − Ccfs − (Rc − Ccfr)y)/Fc, y < y*, there are F′(1) > 0 and F′(0) < 0, and x = 0 is ESS. Conversely, x = 1 is ESS. Therefore, with the gradual increase in y and z, the probability of digital content creators choosing the original strategy increases from x = 0 (non-original strategy) to x = 1 (original strategy). □

Lemma 2 indicates that the implementation of fair detection on the NFT service platform is conducive to digital content creators choosing the production of original works as a stable strategy. The government regulatory authorities can not only ensure the non-infringement of NFT by increasing the probability of strict government regulation but also fully leverage the regulatory effectiveness of social forces by developing the fairness of the platform, such as enhancing the platform’s reputation value and social responsibility.

4.2. Analysis of Platforms

The expected return for platforms that choose strategy β1 is Up1. The expected return for platforms that choose strategy β2 is Up2. According to the income matrix, it can be concluded that

Up1 = xz(RP + Mp) + x(1 − z)(RP) + (1 − x)z(RP + Mp) + (1 − x)(1 − z)(RP)

= zMp + RP

= zMp + RP

Up2 = xz(RP − Cp − Fp) + x(1 − z)(RP − Cp) + (1 − x)z(RP − Cp + Ccfr − Fp) + (1 − x)(1 − z)(RP − Cp + Ccfr)

= − xCcfr − zFp + Ccfr − Cp + RP

= − xCcfr − zFp + Ccfr − Cp + RP

The replication dynamic equation of the NFT publishing platform and its first derivative with respect to y are as follows:

F(y) = y(1 − y)(Up1 − Up2) = y(1 − y)(zMp + RP − (−xCcfr − zFp + Ccfr − Cp + RP))

= y(1 − y)(xCcfr + z(Fp + Mp) − Ccfr + Cp)

= y(1 − y)(xCcfr + z(Fp + Mp) − Ccfr + Cp)

F′(y) = (1 − 2y)(xCcfr + z(Fp + Mp) − Ccfr + Cp)

Set. H(z) = xCcfr + z(Fp + Mp) − Ccfr + Cp

- (1)

- When z = ((1 − x)Ccfr − Cp)/(Fp + Mp) = z*, there are H(z) = 0, and F(y) ≡ 0; the NFT publishing platform’s choice of any proportion of fair detection strategy is stable strategy;

- (2)

- Due to H(z) being a monotonically increasing function, when z < z*, there are H(z) < 0, F′(1) > 0, and F′(0) < 0; therefore, y = 0 is the ESS of the NFT publishing platform. When z > z*, there are H(z) > 0, F′(1) < 0, and F′(0) > 0; therefore, y = 1 is the ESS of the NFT publishing platform.

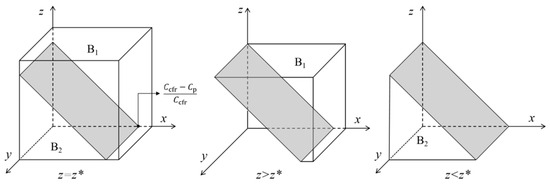

The evolutionary trend of the NFT service platforms’ strategy is shown in Figure 3. The tangent crosses the point ((Ccfr − Cp)/Ccfr, 0, 0), and 0 < (Ccfr − Cp)/Ccfr < 1. The probability that the NFT publishing platform steadily chooses the fair detection strategy is VB1, which is the volume of B1, and the probability that steadily chooses the collusion detection strategy is VB2, which is the Volume of B2. The expression is as follows:

Figure 3.

The evolutionary trend of the NFT digital publishing platforms’ strategy.

Lemma 3.

The probability of the NFT digital publishing platform choosing fair detection is negatively correlated with the collusive costs and positively correlated with the fines faced, rewards received, and speculative costs paid.

Proof 3.

According to the expression for VB1 (probability that the platform chooses the fair detection strategy), solving for the first-order partial derivatives of each parameter, obtain ∂VB1/∂Ccfr < 0, ∂VB1/∂Mp > 0, ∂VB1/∂Fp > 0, ∂VB1/∂Cp > 0. □

Lemma 3 indicates that when the collusion revenue is significant, regulators should choose a strict supervision strategy and increase the intensity of rewards and fines. At the same time, regulators can also increase the speculative costs of complicity by enhancing the professionalism of testers and expanding media disclosure to promote fair testing.

Lemma 4.

The probability of NFT service platforms choosing a fair detection strategy increases with the increasing probability of regulators choosing strict supervision and digital content creators choosing the original strategy.

Proof 4.

According to F(y) and F′(y), when z < z* and x < (Ccfr − Cp − z(Fp + Mp))/Ccfr, there are F′(1) > 0, and F′(0) < 0; therefore, y = 0 is ESS. Conversely, y = 1 is ESS. Therefore, with the gradual increase in x and z, the probability of NFT service platforms choosing fair detection increases from y = 0 (collusion detection) to y = 1 (fair detection). □

Lemma 4 indicates that the strategic choices of digital content creators and regulators will affect the stable strategic choices of NFT service platforms. The strengthening of strict supervision and the production of original works can urge the NFT publishing platform to choose fair detection as a stable strategy. Therefore, to protect digital copyrights from infringement and ensure the fairness of NFT publishing platform detection, it is necessary for regulators to implement strict regulatory initiatives, incentivize digital content creators to standardize their creations, and cultivate creators’ sense of originality.

4.3. Analysis of Regulators

The expected return for regulators who choose strategy γ1 is Ug1. The expected return for regulators who choose strategy γ2 is Ug2. According to the income matrix, it can be concluded that

Ug1 = xy(−Cg − Mp + Rg) + x(1 − y)(−Cg + Fp + Rg) + (1 − x)y(−Cg + Fc − Mp) + (1 − x)(1y)(−Cg + Fp + Fc − Dg)

= x(Dg − Fc + Rg) + y(Dg − Fp − Mp) − xyDg − Cg − Dg + Fc + Fp

= x(Dg − Fc + Rg) + y(Dg − Fp − Mp) − xyDg − Cg − Dg + Fc + Fp

Ug2 = xy(Rg) + x(1 − y)(Rg) + (1 − x)y(0) + (1 − x)(1 − y)(−Dg − Tg)

= x(Dg + Rg + Tg) + y(Dg + Tg) + xy(−Dg − Tg) − Dg − Tg

= x(Dg + Rg + Tg) + y(Dg + Tg) + xy(−Dg − Tg) − Dg − Tg

The replication dynamic equation of regulators and its first derivative with respect to z are as follows:

F(z) = z(1 − z)(Ug1 − Ug2) = z(1 − z)(x(Dg − Fc + Rg) + y(Dg − Fp − Mp) − xyDg − Cg − Dg + Fc + Fp − (x(Dg + Rg + Tg) + y(Dg + Tg) + xy(−Dg − Tg) − Dg − Tg))

= z(1 − z)(x(−Fc − Tg) + y(−Fp − Mp − Tg) + xyTg − Cg + Fc + Fp + Tg)

= z(1 − z)(x(−Fc − Tg) + y(−Fp − Mp − Tg) + xyTg − Cg + Fc + Fp + Tg)

F′(z) = (1 − 2z)(x(−Fc − Tg) + y(−Fp − Mp − Tg) + xyTg − Cg + Fc + Fp + Tg)

Set. J(y) = x(−Fc − Tg) + y(−Fp − Mp − Tg) + xyTg − Cg + Fc + Fp + Tg

- (1)

- When y = (−Cg + Fc + Fp + Tg − x(Fc + Tg))/(Fp + Mp + Tg − xTg) = y**, there are J(y) = 0, and F(z) ≡ 0, the regulator’s choice of any proportion of strict strategy is stable strategy;

- (2)

- Due to J(y) being a monotonically decreasing function, when y < y**, there are J(y) > 0, F′(1) < 0, and F′(0) > 0; therefore, z = 1 is the ESS. When y > y**, there are J(y) < 0, F′(1) > 0, and F′(0) < 0; therefore, z = 0 is the ESS of the NFT publishing platform.

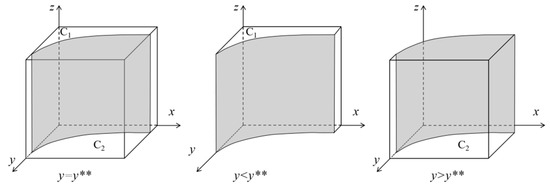

The evolutionary trend of the regulators’ strategy is shown in Figure 4. The probability that regulators steadily choose a strict supervision strategy is VC1, that is, the volume of C1, and the probability that steadily chooses the loss supervision strategy is VC2, that is, the volume of C2. The expression is as follows:

Figure 4.

The evolutionary trend of regulators’ strategy.

Lemma 5.

The probability of strict supervision by regulators is positively related to the fines borne by creators and the penalties suffered by regulatory authorities for loose supervision, negatively related to the rewards received by NFT service platforms, and the relationship with the fines borne by NFT service platforms is influenced by multiple factors.

Proof 5.

According to the expression for VC1 (probability that regulators chooses strict supervision), obtain ∂VC1/∂Fc > 0, ∂VC1/∂Tg > 0, ∂VC1/∂Mp < 0, ∂VC1/∂Fp > 0(s.t.Cg + Mp > Fc). □

Lemma 5 indicates that higher fines promote the enforcement of strict supervision by the regulator, and higher rewards reduce the probability of strict supervision by the regulator. The administrative penalties that the regulators face can prompt strict compliance with regulatory responsibilities. In addition, the higher the rate of strict supervision, the greater the probability of platforms refusing collusion, which helps prevent pirated and infringing digital works from entering the market.

Lemma 6.

The probability of regulators choosing a strict supervision strategy increases with the increasing probability of NFT service platforms choosing fair detection and digital content creators choosing original strategies.

Proof 6.

According to F(z) and F′(z), when y < y** and x < (−Cg + Fc + Fp + Tg − y(Fp + Mp + Tg))/(Fc + (1 − y)Tg), there are F′(1) < 0, and F′(0) > 0; therefore, z = 1 is ESS. Conversely, z = 0 is ESS. Therefore, with the gradual increase in x and y, the probability of regulators choosing the strict supervision strategy decreases from z = 1 (strict supervision) to z = 0 (loose supervision). □

Lemma 6 indicates that the probability of strict supervision is affected by the choice of digital content creator and NFT publishing platform strategies. When digital content creators produce original digital works and NFT service platforms adopt fair detection, the probability of strict supervision will decrease.

4.4. Analysis of System

In the evolutionary game of multiple groups, the strict Nash equilibrium is the stable solution of the evolutionary game [53]. In the asymmetric evolutionary game constructed in this article, the strict Nash equilibrium is a pure strategy. According to F(x) = 0, F(y) = 0, F(z) = 0, the system equilibrium points are E1(0, 0, 0), E2(1, 0, 0), E3(0, 1, 0), E4(0, 0, 1), E5(1, 1, 0), E6(1, 0, 1), E7(0, 1, 1), E8(1, 1, 1), E9(0, (Fc + Fp + Tg − Cg)/(Mp + Fp + Tg), (Ccfr − Cp)/(Fp + Mp)), E10((Fc + Fp + Tg − Cg)/(Fc + Tg), 0, (Cco − Ccf − Ccfs − Ccfr)/Fc), E11((Fc − Mp − Cg)/Fc, 1, (Cco − Ccf − Ccfs − Rc)/Fc), E12((Ccfr − Cp)/Ccfr, (Cco − Ccf − Ccfs − Ccfr)/(Rc − Ccfr), 0), and E13((Ccfr − Mp − Fp − Cp)/Ccfr, (Cco − Ccf − Ccfs − Ccfr − Fc)/(Rc − Ccfr), 1). Because (Cco − Ccf − Ccfs − Rc) < 0, E11 is meaningless. According to the replication dynamic equation of the system, the Jacobian matrix and determinant are constructed as follows:

Bring the above strategy equilibrium points into matrix J and obtain the corresponding eigenvalues of each point, as shown in Table 4.

Table 4.

Stability analysis of equilibrium points.

According to Lyapunov Stability theory, the eigenvalues of the Jacobian matrix and determinant can determine the asymptotic stability of the equilibrium point [54]. The equilibrium is evolutionarily stable when the eigenvalues of the matrix are all negative and unstable when at least one of the matrix eigenvalues is positive. According to Table 4, there are λ3 > 0 for E1, λ2 > 0 for E2, λ1 > 0 for E3, λ2 > 0 for E6, λ1 > 0 for E7, and λ3 > 0 for E8, so that E1, E2, E3, E6, E7, and E8 are the unstable points.

Lemma 7.

When the initial parameters satisfy −Cco + Ccf + Ccfr + Ccfs + Fc < 0 and Fp + Mp − Ccfr + Cp < 0, there are two stable points, E4 and E5, in the replicated dynamic system.

Proof 7.

When the initial parameters satisfy −Cco + Ccf + Ccfr + Ccfs + Fc < 0 and Fp + Mp − Ccfr + Cp < 0, according to Table 3, conditions ② and ③ are not satisfied, so the equilibrium points E9 and E10 are meaningless. Conditions ④ and ⑤ are met, so equilibrium points E12 and E13 are unstable points. Condition ① is satisfied, so only E4 and E5 are asymptotic stable points. □

Lemma 7 indicates that when the rewards and punishments set by government regulatory authorities are relatively small, or when the speculative returns and collusion costs of creators producing non-original digital content are high, the evolution of the strategy combination is stable at two points: (non-original, collusion detection, strict supervision) and (original, fair detection, loose supervision) based on the different initial points selected by the tripartite strategy. At this point, government regulation lacks effectiveness and cannot effectively regulate the actions of creators and NFT service platforms, resulting in infringing NFTs flowing into the market. To avoid the emergence of stable strategy combinations (non-original, collusive detection, strict supervision), regulatory authorities must set sufficient fines or rewards to leverage the effectiveness of reward and punishment mechanisms.

Lemma 8.

When Fc > Cco − Ccf − Ccfr − Ccfs and Fp + Mp > Ccfr − Cp, the system has at least one stable point E5. When additional conditions Fc − Mp > Cg and Fp > Cg are added, the system has only one stable point, E5.

Proof 8.

When Fc > Cco − Ccf − Ccfr − Ccfs and Fp + Mp > Ccfr − Cp, according to Table 3, conditions ① and ⑤ are not satisfied, which means that E4 is an unstable point, and E13 is meaningless. Condition ④ is satisfied, which means that E12 is an unstable point. Conditions ② and ③ need to be judged by additional conditions, which means that the stability of E9 and E10 cannot be determined. When the additional conditions Fc − Mp > Cg and Fp > Cg are added, conditions ② and ③ are not satisfied, which means that E9 and E10 are meaningless, and there is only one stable point, E5, in the replicated dynamic system. □

Lemma 8 indicates that the sum of fines and rewards levied by government regulatory authorities on creators and platforms should be at least higher than their respective speculative returns in order to effectively prevent the emergence of a stable strategy combination (non-original, collusion detection, strict supervision) in the three-party gaming system. Moreover, changes in NFT sales revenue, the cost of strict government supervision, and the number of administrative penalties for weak government supervision do not change the evolutionary stability results. In addition, the government can avoid the emergence of a mixed strategy equilibrium point by setting a reasonable reward and punishment mechanism. For example, the difference between the fines for creators and the rewards for platforms is greater than the cost of strict supervision, and the fines for platforms are greater than strictly monitored costs. It can be seen that a reasonable reward and punishment mechanism designed by the government can ensure the originality of NFT digital works and promote the healthy and orderly development of the digital economy.

5. Model Simulation Analysis

5.1. Evolution Path Simulation

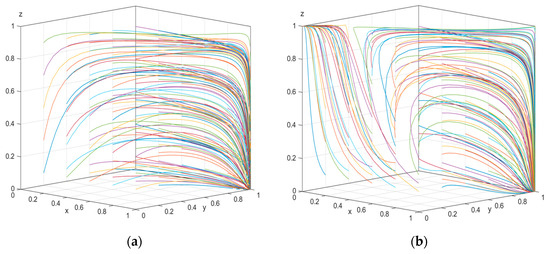

Conducting simulation experiments allows for a more intuitive analysis of the strategy choices of the three subjects in a certain initial state. This study set two initial parameters corresponding to stable evolution conditions that only satisfy E5 and simultaneously satisfy E4 and E5. Respectively, array 1 is as follows: Rc = 150; Cco = 70; Ccf = 30; Ccfs = 20; Ccfr = 30; Fc = 20; Cp = 20; Fp = 25; Mp = 15; Cg = 15; Tg = 40, and array 2 is as follows: Rc = 150; Cco = 120; Ccf = 20; Ccfs = 10; Ccfr = 50; Fc = 20; Cp = 10; Fp = 20; Mp = 10; Cg = 15; Tg = 40. Substitute the arrays into the game model and use MATLAB R2018a software to obtain the evolution path, as shown in Figure 5.

Figure 5.

The evolution result of the replicator dynamic system. (a) Array 1 evolves 50 times; (b) Arravy 2 evolves 50 times.

The simulation results show that (1) is consistent with lemma 7; E5 (1, 1, 0) is the only deterministic evolutionary strategy, and E4 (0, 0, 1) is a potential ESS; (2) The evolution of the system is affected by multiple variables, such as the revenue, speculative costs, collusive costs, rewards, fines, penalties, and others. When the initial values of these variables change, the evolution results of the tripartite game will also change.

The simulation analysis of the above different initial parameters verifies the effectiveness of qualitative analysis and further demonstrates that the numerical relationship between variables affects the evolutionary stability strategy. In order to avoid collusion detection of digital works and the influx of pirated NFT digital works into the market and infringement of others’ rights, regulators should strengthen information technology construction, conduct in-depth inspections of the interests of digital content creators and NFT digital publishing platforms, and ensure that the sum of fines and rewards for all parties exceeds the sum of speculative profits for all parties.

5.2. Parameter Simulation

In order to further determine the impact of various parameters on the strategic choices of the three entities, the article conducts sensitivity measurements on key factors such as on-chain sales revenue, collusive costs, fines, rewards, and penalties based on Array 1.

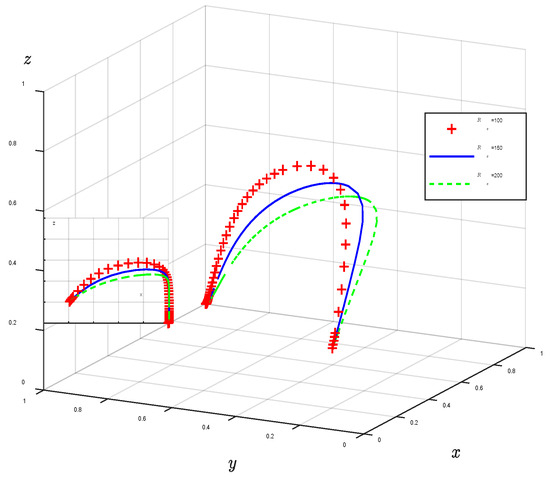

- (1)

- Sales Revenue. Setting Rc = 100, Rc = 150, and Rc = 200, the system evolution simulation results are shown in Figure 6. The growth of NFT sales revenue can accelerate the evolution of digital content creators toward original strategy. With the increase in Rc, the probability of digital content creation choosing the original strategy increases, and the probability of the regulators choosing strict supervision decreases. Therefore, while the regulators strictly control the price of NFT to avoid a bubble economy, they also must strengthen the quality supervision of NFT and appropriately relax price controls on some high-quality works;

Figure 6. The impact of sales revenue.

Figure 6. The impact of sales revenue.

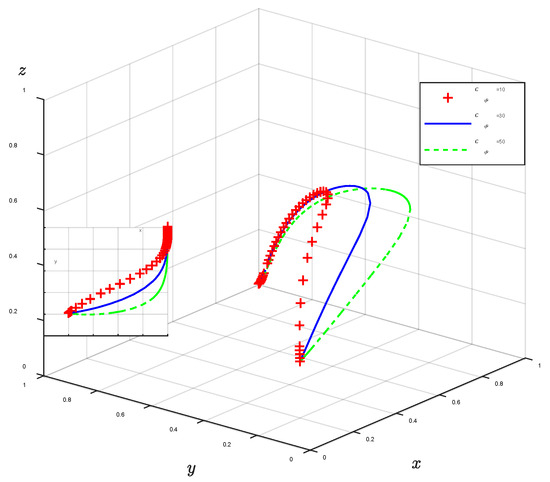

- (2)

- Collusive Costs. Setting Ccfr = 10, Ccfr = 30, and Ccfr = 50, the system evolution simulation results are shown in Figure 7. Figure 7 indicates that as the collusive costs of Ccfr increase, the probability of creators choosing the original strategy increases, and the probability of NFT service platforms choosing fair detection decreases. At this point, regulators can increase collusive costs by increasing media disclosure and cultivating copyright awareness of creators and consumers to increase the probability of producing original digital content;

Figure 7. The impact of collusive costs.

Figure 7. The impact of collusive costs.

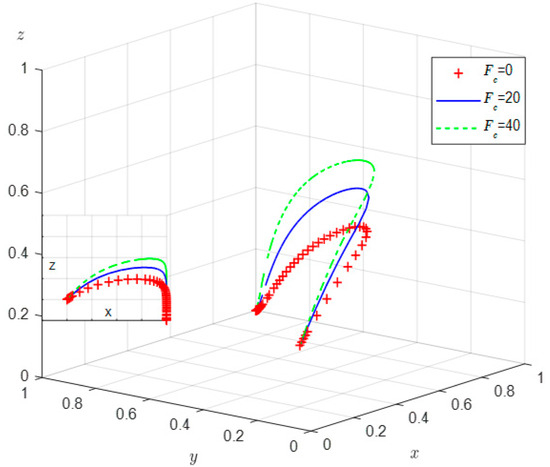

- (3)

- Fines Borne By Creators. Setting Fc = 0, Fc = 20, and Fc = 40, the system evolution simulation results are shown in Figure 8. Figure 8 shows that the probability of creators choosing the original strategy increases with the increase in the fines Fc. Before the probability of digital content, creators choosing original strategies evolve to 1, and the probability of strict supervision increases with the increase in Fc. After the probability of digital content producers choosing original strategies evolves to 1, the probability of strict supervision gradually decreases and eventually stabilizes at 0;

Figure 8. The impact of fines borne by creators.

Figure 8. The impact of fines borne by creators.

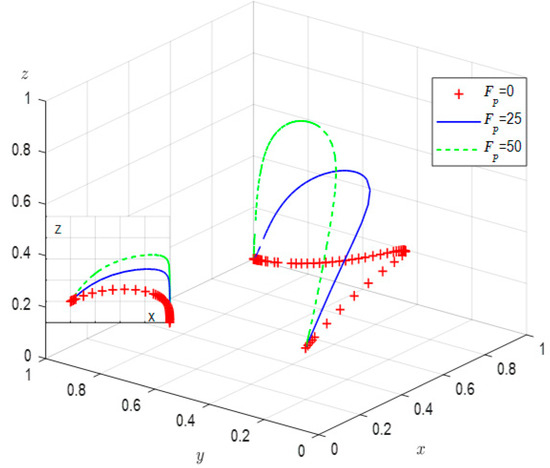

- (4)

- Fines Borne By Platforms. Setting Fp = 0, Fp = 25, and Fp = 50, the system evolution simulation results are shown in Figure 9. Similar to Figure 8, the probability of NFT service platforms conducting fair detection increases with the increase in fines Fp. Before the probability of digital content creators choosing original strategies evolves to 1, the probability of strict supervision increases with the increase in Fp. After the probability of digital content producers choosing original strategies evolves to 1, the probability of strict supervision gradually decreases and eventually stabilizes at 0;

Figure 9. The impact of fines borne by platforms.

Figure 9. The impact of fines borne by platforms.

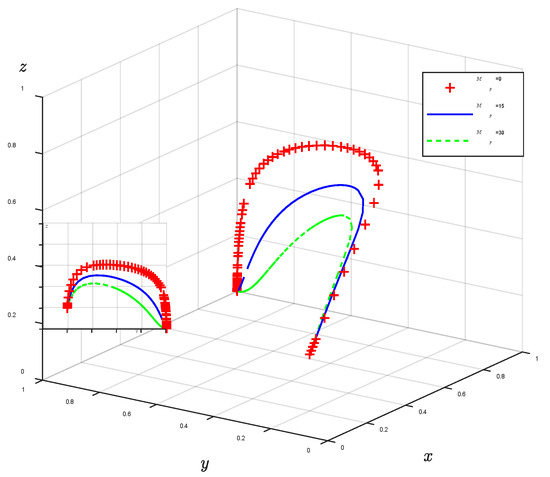

- (5)

- Rewards Received By Platforms. Setting Mp = 0, Mp = 15, and Mp = 30, the system evolution simulation results are shown in Figure 10. Figure 10 shows that an increase in Mp will reduce the probability of strict supervision and increase the probability of fair detection. Therefore, the regulators should reasonably establish a reward and punishment mechanism to reward NFT service platforms in the form of bonuses so that NFT service platforms can share the responsibility of ensuring the healthy development of the cultural digital economy with the regulators;

Figure 10. The impact of rewards received by platforms.

Figure 10. The impact of rewards received by platforms.

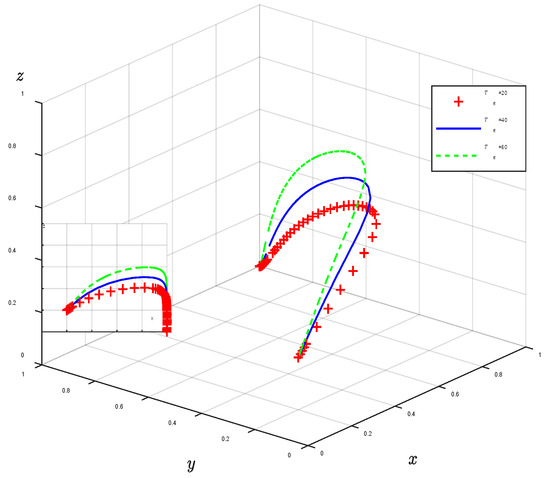

- (6)

- Penalties Borne By Regulators. Setting Tg = 20, Tg = 40, and Tg = 60; the system evolution simulation results are shown in Figure 11. Figure 11 shows that before the probability of digital content creators choosing original strategies evolves to 1, the probability of strict supervision increases with the increase in Tg. After the probability of digital content producers choosing original strategies evolves to 1, the probability of strict supervision gradually decreases and eventually stabilizes at 0.

Figure 11. The impact of penalties borne by regulators.

Figure 11. The impact of penalties borne by regulators.

6. Conclusions and Suggestions

With the development of blockchain technology and the digital economy, NFT has entered the digital publishing industry and promoted public participation in cultural creation. The legitimacy of creative content copyright has always been a problem that has been plagued by copyright theory and judicial practice. The reason behind the NFT infringement issue lies in the fierce game between government regulatory authorities, NFT service platforms, and digital content creators. We are seeking a copyright governance mechanism that can balance the interests of the three parties and achieve the expected progress in digital copyright protection and NFT platform industry development. Based on the assumption of bounded rationality and an incomplete information environment, we constructed an evolutionary game model of “Government Regulatory Department NFT Service Platform Digital Content Creator”. By solving the replication dynamic equation, we derived the evolutionary stability strategy and evolutionary path of the game subject and conducted numerical simulation using MATLAB software to analyze and discuss the impact of various factors on system stability. The main conclusions are as follows:

- (1)

- The digital rights governance mechanism in the NFT market requires the coordinated participation of multiple entities at different levels, and the government plays a leading role in the governance process. Strengthening the government’s incentives and punishments can help promote the production of original works by digital content creators and the implementation of fair similarity testing on NFT service platforms. However, it is worth mentioning that there is a non-linear relationship between rewards and strategic choices. Excessive rewards can make the government face a trade-off between costs and benefits, leading to regulatory difficulties. In this regard, the government can establish clear legal norms before the actors implement their actions, providing reasonable standards and a theoretical basis for the scale of punishment and rewards. The government can also try to establish a credit database that includes integrity and dishonesty records of creators and service platforms and use intelligent digital statistical analysis technology to reduce the cost of strict regulation, thereby partially offsetting the costs brought about by reward mechanisms;

- (2)

- The digital rights governance mechanism in the NFT market is spirally evolving, and its evolution process is influenced by the respective interest parameters of multiple governance entities. Specifically, only when the sum of penalties and rewards set by the government on the platform and creators is greater than the profits brought to the platform and creators by collusive behavior the difference between penalties and rewards for creators is greater than the cost of strict supervision, and the penalties for platforms are greater than the cost of strict supervision too, the evolutionary game system of digital rights protection in the NFT market can avoid the emergence of mixed strategy equilibrium points and ensure that the game only evolves toward the only ideal equilibrium state of the original, fair detection and loose supervision. In this regard, the government can strengthen market research, establish and complete information collection channels, timely and accurately grasp market information such as speculative costs, collusive costs, and sales returns, and dynamically adjust the punishment and reward intensity based on this information to ensure the rationality and effectiveness of regulatory mechanisms;

- (3)

- The benefits brought to both parties by the collusive behavior of users and platforms are key factors that hinder the platform from choosing fair detection and creators to produce original digital content. The greater accountability faced by regulatory authorities can help improve the robustness of the original NFT market. On the one hand, the government can strengthen the construction of new government media, increase media disclosure capabilities, and enhance the professional literacy of testing personnel. This can increase the speculative cost of NFT service platforms performing collusive testing and compress the profit space of their illegal operations. On the other hand, the government can also cultivate consumers’ copyright awareness and actively handle and protect the complaints and legitimate rights and interests of rights holders. This can increase the speculative cost of creators’ plagiarism and may also create psychological pressure on infringers to give up plagiarism, thereby eliminating the phenomenon of NFT infringement from the source. In addition, the above two methods, to some extent, increased the participation of service platforms and creators in the governance process, which has a significant impact on improving the robustness of governance.

This study aims to construct a framework for analyzing digital copyright protection in the NFT market and an evolutionary game analysis model involving three main participants. We analyzed the key factors that affect the effectiveness of digital copyright protection in the NFT market from a theoretical perspective. However, this study has certain limitations. Firstly, in terms of model construction, we overlooked the influence of right holders and game order. Therefore, we will further investigate the cooperative and adversarial relationships between right holders, infringers, NFT service platforms, and governments under incomplete information and dynamic game models, as well as the impact of multiple royalties, right holder attitudes, and other factors on digital copyright protection strategies in the NFT market. Secondly, in terms of model effectiveness, although we use sensitivity analysis to simulate the development and actual situation of the model, we cannot judge its effectiveness. In addition, the variables involved in the model, such as speculative costs and social benefits, are difficult to quantify. Therefore, future research can consider using methods such as crawling and field investigations for data collection and using system dynamics methods to simulate this problem to validate and expand the conclusions of this study.

Author Contributions

Conceptualization, Y.G. and X.X.; methodology, Y.G.; software, Y.G.; validation, Y.G., X.X. and Y.N.; formal analysis, Y.G.; writing—original draft preparation, Y.G.; writing—review and editing, Y.G., X.X. and Y.N.; visualization, Y.G.; supervision, X.X.; project administration, Y.N.; funding acquisition, Y.N. All authors have read and agreed to the published version of the manuscript.

Funding

This work is funded by the National Key R&D Program of China (2021YFF0900200).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wang, Q.; Li, R.; Wang, Q.; Chen, S. Non-Fungible Token (NFT): Overview, Evaluation, Opportunities and Challenges. arXiv 2021, arXiv:2105.07447. [Google Scholar]

- Idelberger, F.; Mezei, P. Non-Fungible Tokens. Internet Policy Rev. 2022, 11. [Google Scholar] [CrossRef]

- Bamakan, S.M.H.; Nezhadsistani, N.; Bodaghi, O.; Qu, Q. Patents and Intellectual Property Assets as Non-Fungible Tokens; Key Technologies and Challenges. Sci. Rep. 2022, 12, 2178. [Google Scholar] [CrossRef] [PubMed]

- Nonfungible Corporation. NFT Market Report 2021. Available online: https://nonfungible.com/reports/2021/en/yearly-nft-market-report (accessed on 5 July 2023).

- Watson, R. MetaBirkins Lost to Hermès. But Be They Art or Merchandise, NFTs are Being Taken Seriously. Available online: https://www.theblock.co/post/210317/metabirkins-lost-to-hermes-but-be-they-art-or-merchandise-nfts-are-being-taken-seriously (accessed on 5 July 2023).

- Handono, M.; Widiyanti, I.D.; Andini, P.P. Dispute Resolution for Non-Fungible Token (NFT) Businesses in Indonesia. Int. J. Soc. Sci. Educ. Res. Stud. 2023, 3, 1519–1526. [Google Scholar] [CrossRef]

- Manoylov, M. OpenSea Reveals That Over 80% of Its Free NFT Mints Were Plagiarized, Spam or Fake. Available online: https://www.theblock.co/linked/132511/opensea-reveals-that-over-80-ofits-free-nft-mints-were-plagiarized-spam-or-fake (accessed on 5 July 2023).

- Zhao, L.; Zhang, J.; Jing, H. Blockchain-Enabled Digital Rights Management for Museum-Digital Property Rights. Intell. Autom. Soft Comput. 2022, 34, 1785–1801. [Google Scholar] [CrossRef]

- Mochram, R.A.A.; Makawowor, C.T.; Tanujaya, K.M.; Moniaga, J.V.; Jabar, B.A. Systematic Literature Review: Blockchain Security in NFT Ownership. In Proceedings of the 2022 International Conference on Electrical and Information Technology (IEIT), Malang, Indonesia, 15–16 September 2022; pp. 302–306. [Google Scholar]

- Park, K.S. A study on copyright issues as regards NFT art under the Korean copyright system: Focusing on Works of Art. Q. Copyr. 2021, 34, 5–43. [Google Scholar] [CrossRef]

- Park, K.S. The Study on NFT Art and the Allowable Scope of Use of Trademark. J. Korea. Inf. Law 2022, 26, 1–45. [Google Scholar]

- Dong, Y.; Wang, C. Copyright Protection on NFT Digital Works in the Metaverse. Secur. Saf. 2023, 2, 2023013. [Google Scholar] [CrossRef]

- Dong, Y.; Wu, H. Copyright of NFT Works in China: Infringement, Liability, and Remedies. SSRN Electron. J. 2023. [Google Scholar] [CrossRef]

- Xiao, C.; Wang, W.; Lin, X.; Yu, J.X.; Wang, G. Efficient Similarity Joins for Near-Duplicate Detection. ACM Trans. Database Syst. 2011, 36, 1–41. [Google Scholar] [CrossRef]

- Porter, R.H. Detecting collusion. Rev. Ind. Organ. 2005, 26, 147–167. [Google Scholar] [CrossRef]

- Alexander, J.M. Evolutionary Game Theory. In The Stanford Encyclopedia of Philosophy; Zalta, E.N., Ed.; Metaphysics Research Lab, Stanford University: Stanford, CA, USA, 2021. [Google Scholar]

- Rosenfeld, M. Overview of Colored Coins. Available online: https://bitcoil.co.il/BitcoinX.pdf (accessed on 16 September 2023).

- Steinwold, A. The History of Non-Fungible Tokens (NFTs). Available online: http://108.166.64.190/omeka222/files/original/453bc3985fdc186319dcaa6c0fcc9f8a.pdf (accessed on 16 September 2023).

- Buterin, V. A Next-Generation Smart Contract and Decentralized Application Platform. Available online: https://finpedia.vn/wp-content/uploads/2022/02/Ethereum_white_paper-a_next_generation_smart_contract_and_decentralized_application_platform-vitalik-buterin.pdf (accessed on 16 September 2023).

- Vujičić, D.; Jagodic, D.; Ranđić, S. Blockchain Technology, Bitcoin, and Ethereum: A Brief Overview. In Proceedings of the 2018 17th International Symposium on INFOTEH-JAHORINA, East Sarajevo, Bosnia and Herzegovina, 21–23 March 2018; pp. 1–6. [Google Scholar]

- Chirtoaca, D.; Ellul, J.; Azzopardi, G. A framework for creating deployable smart contracts for non-fungible tokens on the Ethereum blockchain. In Proceedings of the 2020 IEEE International Conference on Decentralized Applications and Infrastructures (DAPPS), Oxford, UK, 3–6 August 2020; pp. 100–105. [Google Scholar]

- Vogelsteller, F.; Buterin, V. ERC-20: Token Standard. Available online: https://eips.ethereum.org/EIPS/eip-20 (accessed on 10 October 2023).

- Entriken, W.; Shirley, D.; Evans, J.; Sachs, N. ERC-721: Non-Fungible Token Standard. Available online: https://eips.ethereum.org/EIPS/eip-721 (accessed on 10 October 2023).

- Beanie Beanie on Twitter: “ERC-721 Is a Non Fungible Token by Default and Is, and Always Will Be the Gold Standard of a Valuable Collectible NFT. ERC-1155 Is a Dual Purpose Fungible and Non Fungible Token. It Was Developed by Enjin, to Tokenize Things Like Common Gaming Skins and Other Commoditized Items”. Available online: https://mobile.twitter.com/beaniemaxi/status/1397280788597641217 (accessed on 17 September 2023).

- Lockyer, M.; Mudge, N.; Schalm, J.; Echeverry, S.; Zhou, Z. ERC-998: Composable Non-Fungible Token. Available online: https://eips.ethereum.org/EIPS/eip-998 (accessed on 10 October 2023).

- Radomski, W.; Cooke, A.; Castonguay, P.; Therien, J.; Binet, E.; Sandford, R. ERC-1155: Multi Token Standard. Available online: https://eips.ethereum.org/EIPS/eip-1155 (accessed on 10 October 2023).

- Vogelsteller, F.; Yasaka, T. ERC-725: General Data Key/Value Store and Execution. Available online: https://eips.ethereum.org/EIPS/eip-725 (accessed on 10 October 2023).

- Fokri, W.N.I.W.M.; Alib, E.M.T.E.; Nordinc, N.; Chikd, W.M.Y.W.; Azize, S.A.; Jusoh, A.J.M. Classification of Cryptocurrency: A Review of the Literature. Turk. J. Comput. Math. Educ. TURCOMAT 2021, 12, 1353–1360. [Google Scholar]

- FINMA. Guidelines for Enquiries Regarding the Regulatory Framework for Initial Coin Offerings (ICOs); FINMA: Bern, Switzerland, 2018. [Google Scholar]

- Bao, H.; Rouband, D. Non-Fungible Token: A Systematic Review and Research Agenda. J. Risk Financ. Manag. 2022, 15, 215. [Google Scholar] [CrossRef]

- Dowling, M. Fertile LAND: Pricing Non-Fungible Tokens. Financ. Res. Lett. 2022, 44, 102096. [Google Scholar] [CrossRef]

- Dowling, M. Is Non-Fungible Token Pricing Driven by Cryptocurrencies? Financ. Res. Lett. 2022, 44, 102097. [Google Scholar] [CrossRef]

- Kong, D.-R.; Lin, T.-C. Alternative Investments in the Fintech Era: The Risk and Return of Non-Fungible Token (NFT). SSRN Electron. J. 2021. [Google Scholar] [CrossRef]

- Kushwaha, S.S.; Joshi, S.; Singh, D.; Kaur, M.; Lee, H.N. Ethereum Smart Contract Analysis Tools: A Systematic Review. IEEE Access 2022, 10, 57037–57062. [Google Scholar] [CrossRef]

- Chen, Z.; Omote, K. Toward Achieving Anonymous NFT Trading. IEEE Access 2022, 10, 130166–130176. [Google Scholar] [CrossRef]

- White, J.T.; Wilkoff, S.; Yildiz, S. The Role of the Media in Speculative Markets: Evidence from Non-Fungible Tokens (NFTs). SSRN Electron. J. 2022. [Google Scholar] [CrossRef]

- Maouchi, Y.; Charfeddine, L.; El Montasser, G. Understanding Digital Bubbles amidst the COVID-19 Pandemic: Evidence from DeFi and NFTs. Financ. Res. Lett. 2022, 47, 102584. [Google Scholar] [CrossRef]

- Kim, C.G. A Study On Technology To Counter Copyright Infringement According To Nft Transaction Types. J. Semicond. Disp. Technol. 2021, 20, 187–191. [Google Scholar]

- Chen, J.; Friedmann, D. Jumping from Mother Monkey to Bored Ape: The Value of NFTs from an Artist’s and Intellectual Property Perspective. Asia Pac. Law Rev. 2023, 31, 100–122. [Google Scholar] [CrossRef]

- Baiyang, X. Chinese court rules on NFT transactions and responsibility of trading platforms. J. Intellect. Prop. Law 2022, 17, 604–606. [Google Scholar] [CrossRef]

- Evsutin, O.; Dzhanashia, K. Watermarking Schemes for Digital Images: Robustness Overview. Signal Process. Image Commun. 2022, 100, 116523. [Google Scholar] [CrossRef]

- Ansori, M.R.R.; Alief, R.N.; Igboanusi, I.S.; Lee, J.M.; Kim, D.-S. Watermarking-Based Fake Audio NFT Detection in NFT Marketplace. Available online: https://journal-home.s3.ap-northeast-2.amazonaws.com/site/2023w/abs/0716-XEAFX.pdf (accessed on 3 October 2023).

- Cao, Z.; Wang, L. A secure video watermarking technique based on hyperchaotic Lorentz system. Multimed. Tools Appl. 2019, 78, 26089–26109. [Google Scholar] [CrossRef]

- Lin, C.; Xu, X. An Electronic Bill Encryption Algorithm Based on Multiple Watermark Encryption. Trait. Signal 2021, 38, 127–133. [Google Scholar] [CrossRef]

- Prihatno, A.T.; Suryanto, N.; Oh, S.; Le, T.-T.-H.; Kim, H. NFT Image Plagiarism Check Using EfficientNet-Based Deep Neural Network with Triplet Semi-Hard Loss. Appl. Sci. 2023, 13, 3072. [Google Scholar] [CrossRef]

- Pungila, C.; Galis, D.; Negru, V. A New High-Performance Approach to Approximate Pattern-Matching for Plagiarism Detection in Blockchain-Based Non-Fungible Tokens (NFTs). arXiv 2022. [Google Scholar] [CrossRef]

- Traulsen, A.; Glynatsi, N.E. The future of theoretical evolutionary game theory. Philos. Trans. R. Soc. B 2023, 378, 20210508. [Google Scholar] [CrossRef]

- Wang, Z.; Yuan, C.; Li, X. Evolutionary Analysis of the Regulation of Data Abuse in Digital Platforms. Systems 2023, 11, 188. [Google Scholar] [CrossRef]

- Yang, Z.L.; Shi, Y.Y.; Li, Y.C. Analysis of intellectual property cooperation behavior and its simulation under two types of scenarios using evolutionary game theory. Comput. Ind. Eng. 2018, 125, 739–750. [Google Scholar] [CrossRef]

- Wang, X.; Xie, J.; Fan, Z.P. B2C cross-border E-commerce logistics mode selection considering product returns. Int. J. Prod. Res. 2021, 59, 3841–3860. [Google Scholar] [CrossRef]

- Yang, S. Evolutionary Game Analysis of UGC Copyright Infringement Governance. Available online: https://assets.researchsquare.com/files/rs-2645420/v1_covered_f5e1ba86-5750-4db7-a2de-6d653da37a65.pdf?c=1695056859 (accessed on 3 October 2023).

- Friedman, D. Evolutionary Games in Economics. Econometrica 1991, 59, 637–666. [Google Scholar] [CrossRef]

- Eshel, I. Evolutionary and Continuous Stability. J. Theor. Biol. 1983, 103, 99–111. [Google Scholar] [CrossRef]

- Newton, J. Evolutionary Game Theory: A Renaissance. Games 2018, 9, 31. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).