Volatile Freight Rates in Maritime Container Industry in Times of Crises

Abstract

:1. Introduction

2. Literature Review on the Maritime Container Industry in the Times of the Pandemic and the Russian Invasion on Ukraine

2.1. Methodology

2.2. Overview of the Literature on the Maritime Container Industry during the Pandemic

2.3. Overview of the Literature on the Maritime Container Market during the Russian Invasion

- Recognize the rights belonging to Ukraine in its territorial waters, i.e., the zone within 12 nautical miles off the Russian coast.

- Establish the balance of forces in coastal waters closer to the Ukrainian coast, which Ukraine can legally claim regardless of the status of Crimea.

- Strive to maintain strong presence in those waters claimed by Russia after the Crimea annexation.

- Changed the course (the destination port) with no port charges or with minimum costs of relocation;

- Completely erased the charges for cancelling the reservations in Ukrainian ports;

- Defined special conditions for demurrage fees and storing the unloaded containers in alternative ports;

- Special conditions for storing the unloaded containers.

3. Maritime Container Market and the Freight Rates in Times of Crises

- Pre-existing unfavorable conditions. The scope of trade has been growing at considerably lower rates than in the period before the crisis of 2008.

- This crisis is global and has been affecting almost every world economy. Earlier crises were more regional.

- The worst effects of the crisis that had begun in the middle of 2008, followed months after it had started, while the crisis of 2020 immediately shook the global market.

- The effects of the pandemic caused by the coronavirus represent the greatest drop in international trade since World War II.

3.1. Impact of the Crises on the Maritime Container Market

- Overcapacity of the cargo area;

- Drop of freight rates;

- Freight rated grow;

- Job loss;

- Debt, financial losses, bankruptcy or complete shut-down.

- Capacity consolidation (for example, by reducing the navigation speed).

- Optimization and operating expenses reduction—OPEX. Main operating expenses that should be reduced are fuel and lubricants, crew, maintenance, spare parts and consumable supplies.

- Economies of scale. This is nothing new on the maritime container market, but it is very difficult to realize due to high financial investments necessary for achieving economies of scale.

- Integration. Earlier, liner conferences were responsible for controlling the tariffs for specific routes. However, over the last decade, there are more and more strategic trading alliances that share information, resources and control to expand their businesses.

- Increase the number of the vaccinated employees for their own protection;

- Implement a horizontal cooperation and provide coordination and facilitation of the change of the vessels crew members;

- Increase investments in crewless vessels;

- Energy sources diversification;

- Increase the use of automatization and digitalization.

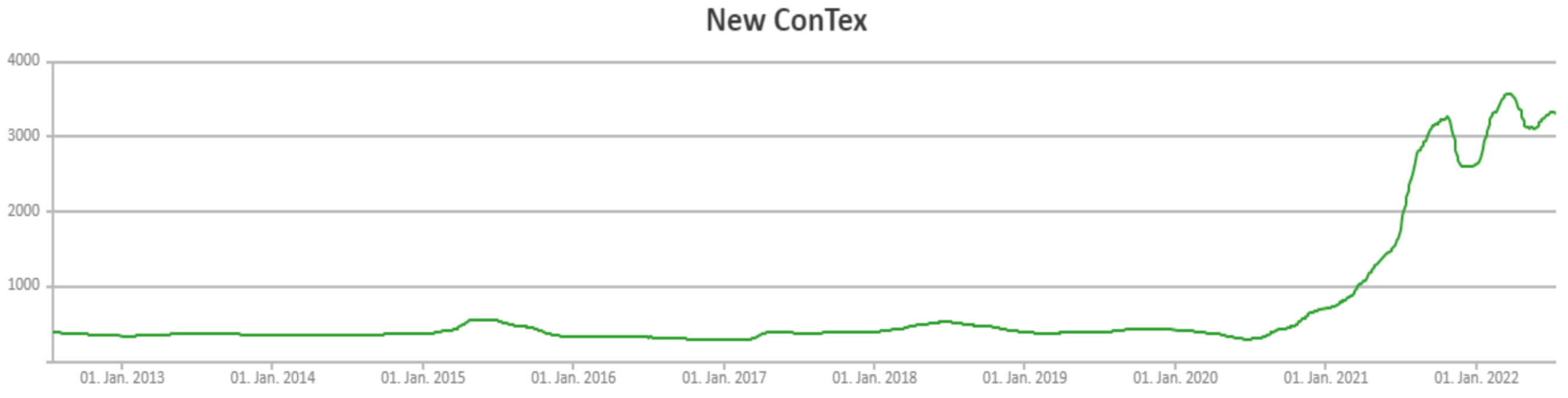

3.2. Freight Rates on the Maritime Container Market in Times of Crises

- Due to restrictions in mobility that were in force in most countries, many shipping companies had no choice but to send their ships to navigate their routes, but with much unused loading capacity due to cancellations or reductions.

- China was faced with more volume of goods for export to main world ports. Many world ports were facing long waits for unloading, which led to slower container ship rotation and, consequently, to higher prices of the contracts for container shipping.

- At the beginning of 2020, freight rates were going up because of the provisions laid by the International Maritime Organization concerning the change of fuel. In line with the provisions, since 1 January 2020, shipping companies are under obligation to use VLSFO (very low sulfur fuel oil). The level of sulfur in the fuel the ships use during navigation must not be over 0.5% m/m [52].

- Causes increase in import and consumer prices.

- Price fluctuations affect entire economies and various goods and are not occurring only in underdeveloped or developing countries.

- Affects global production and costs.

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Shah, P.V.; Prajapati, B.J.; Panchal, J.J.; Thakker, S. Disruptions in Indian Supply Chain Due to COVID-19. Recent Advances in Manufacturing Modelling and Optimization; Springer: Singapore, 2022; pp. 799–811. [Google Scholar]

- Santacreu, A.M.; LaBelle, J. Global Supply Chain Disruptions and Inflation During the COVID-19 Pandemic. Review 2022, 104, 78–91. [Google Scholar] [CrossRef]

- Allianz Global Corporate & Specialty. Safety and Shipping Review. 2022. Available online: https://www.agcs.allianz.com/content/dam/onemarketing/agcs/agcs/reports/AGCS-Safety-Shipping-Review-2022.pdf (accessed on 16 May 2022).

- Nguyen, T.-T.; Tran, D.T.M.; Duc, T.T.H.; Thai, V.V. Managing disruptions in the maritime industry—A systematic literature review. Marit. Bus. Rev. 2022; ahead of print. [Google Scholar] [CrossRef]

- Sanchez, R.J.; Hoffmann, J.; Micco, A.; Pizzolitto, G.V.; Sgut, M.; Wilmsmeier, G. Port Efficiency and International Trade: Port Efficiency as a Determinant of Maritime Transport Costs. Marit. Econ. Logist. 2003, 5, 199–218. [Google Scholar] [CrossRef]

- Vilke, S.; Mance, D.; Debelić, B.; Maslarić, M. Correlation Between Freight Transport Industry and Economic Growth—Panel Analysis of CEE Countries. Promet 2021, 33, 517–526. [Google Scholar] [CrossRef]

- Limão, N. Infrastructure, Geographical Disadvantage, Transport Costs, and Trade. World Bank Econ. Rev. 2001, 15, 451–479. [Google Scholar] [CrossRef]

- Hummels, D. Towards a Geography of Trade Costs; Mimeo: Chicago, IL, USA; University of Chicago: Chicago, IL, USA, 1999; Available online: https://dx.doi.org/10.2139/ssrn.160533 (accessed on 4 July 2022).

- International Chamber of Shipping (N/A). Shipping and World Trade: Driving Prosperity. Available online: https://www.ics-shipping.org/shipping-fact/shipping-and-world-trade-driving-prosperity/ (accessed on 12 June 2021).

- Eryarsoy, E.; Shahmanzari, M.; Tanrisever, F. Models for government intervention during a pandemic. Eur. J. Oper. Res. 2022; in press. [Google Scholar] [CrossRef]

- Stevens, P. The Ship that Blocked the Suez Canal May be Free, but Experts Warn the Supply Chain Impact Could Last Months, CNBC. Available online: https://www.cnbc.com/2021/03/29/suez-canal-is-moving-but-the-supply-chain-impact-could-last-months.html (accessed on 18 June 2021).

- Orhan, E. The Effects of the Russia-Ukraine War on Global Trade. J. Int. Trade Logist. Law 2022, 8, 141–146. [Google Scholar]

- United Nations. Review of Maritime Transport; United Nations Publications: New York, NY, USA, 2021; Available online: https://unctad.org/system/files/official-document/rmt2021_en_0.pdf (accessed on 2 September 2021).

- UNCTAD Communications and Information Unit. High Freight Rates Cast a Shadow over Economic Recovery, PR. 2021/040. 2021. Available online: https://unctad.org/press-material/high-freight-rates-cast-shadow-over-economic-recovery (accessed on 19 November 2021).

- Crossley, G.; Xu, M. Congestion at South China Ports Worsens on Anti-COVID-19 Measures, Reuters. 2021. Available online: https://www.reuters.com/world/china/congestion-south-china-ports-worsens-anti-covid-19-measures-2021-06-11/ (accessed on 3 July 2022).

- Grzelakowski, A. Global Container Shipping Market Development and Its Impact on Mega Logistics System. TransNav Int. J. Mar. Navig. Saf. Sea Transp. 2019, 13, 529–535. [Google Scholar] [CrossRef]

- Adam, A.F.; Moldovan, I.G.; Nita, S.; Hrebenciuc, A. The Importance of Maritime Transport for Economic Growth in the European Union: A Panel Data Analysis. Sustainability 2021, 13, 7961. [Google Scholar] [CrossRef]

- Cullinane, K.; Haralambides, H. Global trends in maritime and port economics: The COVID-19 pandemic and beyond. Marit. Econ. Logist. 2021, 23, 369–380. [Google Scholar] [CrossRef]

- Choi, Y.; Kim, H.-J.; Lee, Y. Economic Consequences of the COVID-19 Pandemic: Will It Be a Barrier to Achieving Sustainability? Sustainability 2022, 14, 1629. [Google Scholar] [CrossRef]

- Berger, N.; Schulze-Schwering, S.; Long, E.; Spinler, S. Risk management of supply chain disruptions: An epidemic modeling approach. Eur. J. Oper. Res. 2022; in press. [Google Scholar] [CrossRef]

- McMaster, M.; Nettleton, C.; Tom, C.; Xu, B.; Cao, C.; Qiao, P. Risk Management: Rethinking Fashion Supply Chain Management for Multinational Corporations in Light of the COVID-19 Outbreak. J. Risk Financ. Manag. 2020, 13, 173. [Google Scholar] [CrossRef]

- Barleta, E.P.; Sánchez, R.J. Port Report: The impact of the Coronavirus Disease (COVID-19) Pandemic on the Shipping Trade, Trans-Shipment and Throughput of Container Ports in Latin America and the Caribbean, Bulletins, no. 2. 2021. Available online: https://repositorio.cepal.org/bitstream/handle/11362/47017/1/S2100301_en.pdf (accessed on 22 August 2021).

- World Health Organization. WHO Director-General’s Opening Remarks at the Media Briefing on COVID-19. 2020. Available online: https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19---11-march-2020 (accessed on 23 June 2020).

- Notteboom, T.; Pallis, T.; Rodrigue, J.-P. Disruptions and resilience in global container shipping and ports: The COVID-19 pandemic versus the 2008–2009 financial crisis. Marit. Econ. Logist. 2021, 23, 179–210. [Google Scholar] [CrossRef]

- TEC CONTAINER. 3 Reasons for the Rise in the Price of Maritime Transport. 2021. Available online: https://www.teccontainer.com/blog/rise-in-the-price-of-maritime-transport/ (accessed on 27 August 2021).

- Cariou, P.; Notteboom, T. Implications of COVID-19 on the US container port distribution system: Import cargo routing by Walmart and Nike. Int. J. Logist. Res. Appl. 2022, 1–20. [Google Scholar] [CrossRef]

- Nwokedi, T.C.; Okoroji, L.I.; Nwoloziri, C.N.; Efanga, H.O.; Okafor, C.O. COVID-19: Disruption of Container Freight Transportation on Last Mile Corridors between Regional Hub Ports and Hinterland Markets in Nigeria, Himalayan. J. Econ. Bus. Manag. 2021, 2, 1–13. [Google Scholar] [CrossRef]

- Rodrigue, J.-P. The Vulnerability and Resilience of the Global Container Shipping Industry. Curr. Hist. 2022, 121, 17–23. [Google Scholar] [CrossRef]

- United Nations. Review of Maritime Transport 2020; United Nations Publications: New York, NY, USA, 2020; Available online: https://unctad.org/system/files/official-document/rmt2020_en.pdf (accessed on 25 September 2020).

- UNCTAD. Review of Maritime Transport 2020 (Executive Summary), UNCTAD/RMT/2020 (Executive Summary), New York and Geneva. 2020. Available online: https://unctad.org/system/files/official-document/rmt2020summary_en.pdf (accessed on 13 February 2021).

- Zhao, Y.; Ye, J.; Zhou, J. Container fleet renewal considering multiple sulfur reduction technologies and uncertain markets amidst COVID-19. J. Clean. Prod. 2021, 317, 128361. [Google Scholar] [CrossRef]

- Mańkowska, M.; Pluciński, M.; Kotowska, I.; Filina-Dawidowicz, L. Seaports during the COVID-19 Pandemic: The Terminal Operators’ Tactical Responses to Disruptions in Maritime Supply Chains. Energies 2021, 14, 4339. [Google Scholar] [CrossRef]

- Russell, D.; Ruamsook, K.; Roso, V. Managing supply chain uncertainty by building flexibility in container port capacity: A logistics triad perspective and the COVID-19 case. Marit. Econ. Logist. 2020, 24, 92–113. [Google Scholar] [CrossRef]

- Sudan, T.; Taggar, R. Recovering Supply Chain Disruptions in Post-COVID-19 Pandemic Through Transport Intelligence and Logistics Systems: India’s Experiences and Policy Options. Front. Future Transp. 2021, 2, 660116. [Google Scholar] [CrossRef]

- Kormych, B.; Averochkina, T. Ukrainian Maritime Industry under Fire: Consequences of Russian Invasion. Lex Portus 2022, 8, 7–32. [Google Scholar] [CrossRef]

- Green, J.A.; Henderson, C.; Ruys, T. Russia’s attack on Ukraine and the jus ad bellum. J. Use Force Int. Law 2022, 9, 4–30. [Google Scholar] [CrossRef]

- Malyarenko, T. Strengthening Ukraine’s Black Sea Navy to be a Bulkhead against Russia. 2021. Available online: https://www.ponarseurasia.org/strengthening-ukraines-black-sea-navy-to-be-a-bulkhead-against-russia/ (accessed on 19 November 2021).

- Weizhen, T. How the Russia-Ukraine War Is Worsening Shipping Snarls and Pushing Up Freight Rates, CNBC. 2022. Available online: https://www.cnbc.com/2022/03/11/russia-ukraine-war-impact-on-shipping-ports-air-freight.html (accessed on 23 May 2022).

- Gorovaya, K.; Gorachek, O. Sea Line Carriers: Operation in Ukraine from 24.02.2022; Interlegal: Odesa, Ukraine, 2022. [Google Scholar]

- ECLAC. The Effects of the Coronavirus Disease (COVID-19) Pandemic on International Trade and Logistics, Bulletins, br. 6. 2020. Available online: https://repositorio.cepal.org/bitstream/handle/11362/45878/1/S2000496_en.pdf (accessed on 23 June 2021).

- UNCTAD. Global Trade Hits Record $7.7 Trillion in First Quarter of 2022. 2022. Available online: https://unctad.org/news/global-trade-hits-record-77-trillion-first-quarter-2022 (accessed on 23 July 2022).

- OECDiLibrary. Containerships—The Engines of Globalization and Trade. Available online: https://www.oecd-ilibrary.org/sites/508bfb5b-en/index.html?itemId=/content/component/508bfb5b-en (accessed on 23 July 2022).

- Jerebić, V.; Pavlin, S. Global Economy Crisis and its Impact on Operational Container Carrier’s Strategy. Promet 2018, 30, 187–194. [Google Scholar] [CrossRef] [Green Version]

- Agbaba, R. Maritime Challenges in Crisis Times. J. Marit. Transp. Sci. 2020, 59, 51–60. [Google Scholar] [CrossRef]

- Min, D.; Wang, F.; Zhan, S. Impact analysis of the global financial crisis on global container fleet. In Proceedings of the 2009 6th International Conference on Service Systems and Service Management, Xiamen, China, 8–10 June 2009; pp. 161–166. [Google Scholar] [CrossRef]

- Keuper, M. The Implications of the Russian Invasion of Ukraine on the Future of Sino-European Overland Con-nectivity, AIES, No. 6. 2022. Available online: https://euagenda.eu/upload/publications/aies-fokus-2022-06.pdf (accessed on 8 July 2022).

- Tucker, H. Coronavirus Bankruptcy Tracker: These Major Companies Are Failing Amid the Shutdown, Forbes. 2020. Available online: https://www.forbes.com/sites/hanktucker/2020/05/03/coronavirus-bankruptcy-tracker-thesemajor-companies-are-failing-amid-the-shutdown/ (accessed on 18 July 2021).

- Chua, J.Y.; Foo, R.; Tan, K.H.; Yuen, K.F. Maritime resilience during the COVID-19 pandemic: Impacts and solutions. Contin. Resil. Rev. 2022, 4, 124–143. [Google Scholar] [CrossRef]

- Nikolopoulos, K.; Punia, S.; Schäfers, A.; Tsinopoulos, C.; Vasilakis, C. Forecasting and planning during a pandemic: COVID-19 growth rates, supply chain disruptions, and governmental decisions. Eur. J. Oper. Res. 2020, 290, 99–115. [Google Scholar] [CrossRef]

- Prevljak, H. EU Maritime Transport to Increase in Coming Years. So Will GHG Emissions. 2021. Available online: https://www.offshore-energy.biz/eu-maritime-transport-to-increase-in-coming-years-so-will-ghg-emissions/ (accessed on 23 July 2022).

- UNCTAD. Container Shipping in Times of COVID-19: Why Freight Rates have Surged, and Implications for Policymakers, UNCTAD Policy Briefs, No. 84. 2021. Available online: https://unctad.org/system/files/official-document/presspb2021d2_en.pdf (accessed on 23 June 2022).

- International Maritime Organization. Tehnical Circular, No. 087/2018. 2018. Available online: https://www.irclass.org/media/3880/technical-circular-no87.pdf (accessed on 19 June 2021).

- Cheng, E. Surging Shipping Costs Will Drive Up Prices for Some Consumer Products by 10%, New UN Report Finds, CNBC. 2021. Available online: https://www.cnbc.com/2021/11/19/surging-shipping-costs-to-drive-consumer-price-inflation-unctad-says.html (accessed on 23 November 2021).

- VCFI. Valencia Containerised Indeks. Balance of the Year 2021. Available online: https://biblio.ugent.be/publication/8751576/file/8751577 (accessed on 3 July 2022).

- Verband Hamburger und Bremer Schiffsmakler e.V. New ConTex-ll Rates in USD($). Available online: https://www.vhbs.de/index.php?id=5&L=1 (accessed on 12 July 2022).

- Kay, G. Russia’s War on Ukraine Could Triple Ocean Shipping Rates to $30,000 per Container, Expert Says. 2022. Available online: https://www.businessinsider.com/russia-war-ukraine-could-triple-ocean-shipping-rates-experts-2022-3 (accessed on 9 July 2022).

- International Maritime Organization. Initial IMO Strategy on Reduction of GHG Emissions from Ships. Resolution MEPC.304(72), adopted on 13 April 2018, MEPC 72/17/Add.1 Annex 11, London. 2018. Available online: https://wwwcdn.imo.org/localresources/en/KnowledgeCentre/IndexofIMOResolutions/MEPCDocuments/MEPC.304(72).pdf (accessed on 13 May 2022).

- International Maritime Organization. Fourth IMO GHG Study; International Maritime Organization: London, UK, 2020; Available online: https://greenvoyage2050.imo.org/wp-content/uploads/2021/07/Fourth-IMO-GHG-Study-2020-Full-report-and-annexes_compressed.pdf (accessed on 15 July 2022).

- International Maritime Organization. Comprehensive Impact Assessment of the Short-Term Measure Approved by MEPC 75. Note by the Secretariat, MEPC 76/7/13. 2021. Available online: https://data.consilium.europa.eu/doc/document/ST-8277-2021-INIT/en/pdf (accessed on 2 June 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rožić, T.; Naletina, D.; Zając, M. Volatile Freight Rates in Maritime Container Industry in Times of Crises. Appl. Sci. 2022, 12, 8452. https://doi.org/10.3390/app12178452

Rožić T, Naletina D, Zając M. Volatile Freight Rates in Maritime Container Industry in Times of Crises. Applied Sciences. 2022; 12(17):8452. https://doi.org/10.3390/app12178452

Chicago/Turabian StyleRožić, Tomislav, Dora Naletina, and Mateusz Zając. 2022. "Volatile Freight Rates in Maritime Container Industry in Times of Crises" Applied Sciences 12, no. 17: 8452. https://doi.org/10.3390/app12178452

APA StyleRožić, T., Naletina, D., & Zając, M. (2022). Volatile Freight Rates in Maritime Container Industry in Times of Crises. Applied Sciences, 12(17), 8452. https://doi.org/10.3390/app12178452