The Blockchain Oracle Problem in Decentralized Finance—A Multivocal Approach

Abstract

:1. Introduction

- What is the role of oracles in decentralized finance according to the existing literature?

- What are the current risks connected with the implementation of oracles in DeFi, and how are they being addressed?

2. Literature Background

2.1. The Oracle Problem

2.2. Narrowing the Oracle Problem in Decentralized Finance

2.3. Related Works

3. Methodology

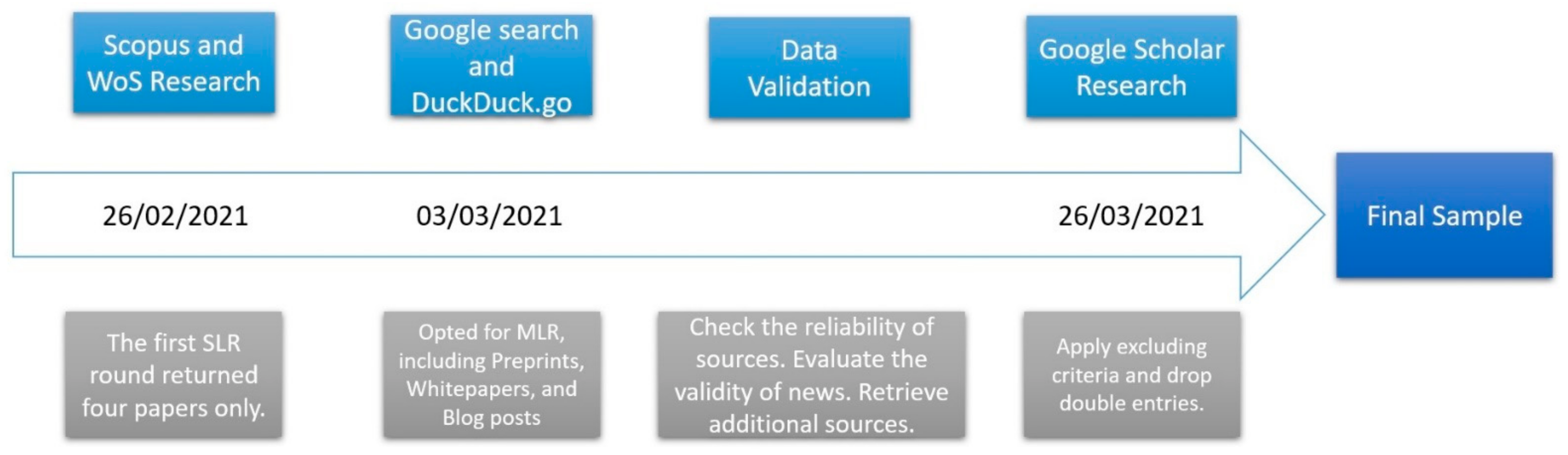

3.1. Data Acquisition

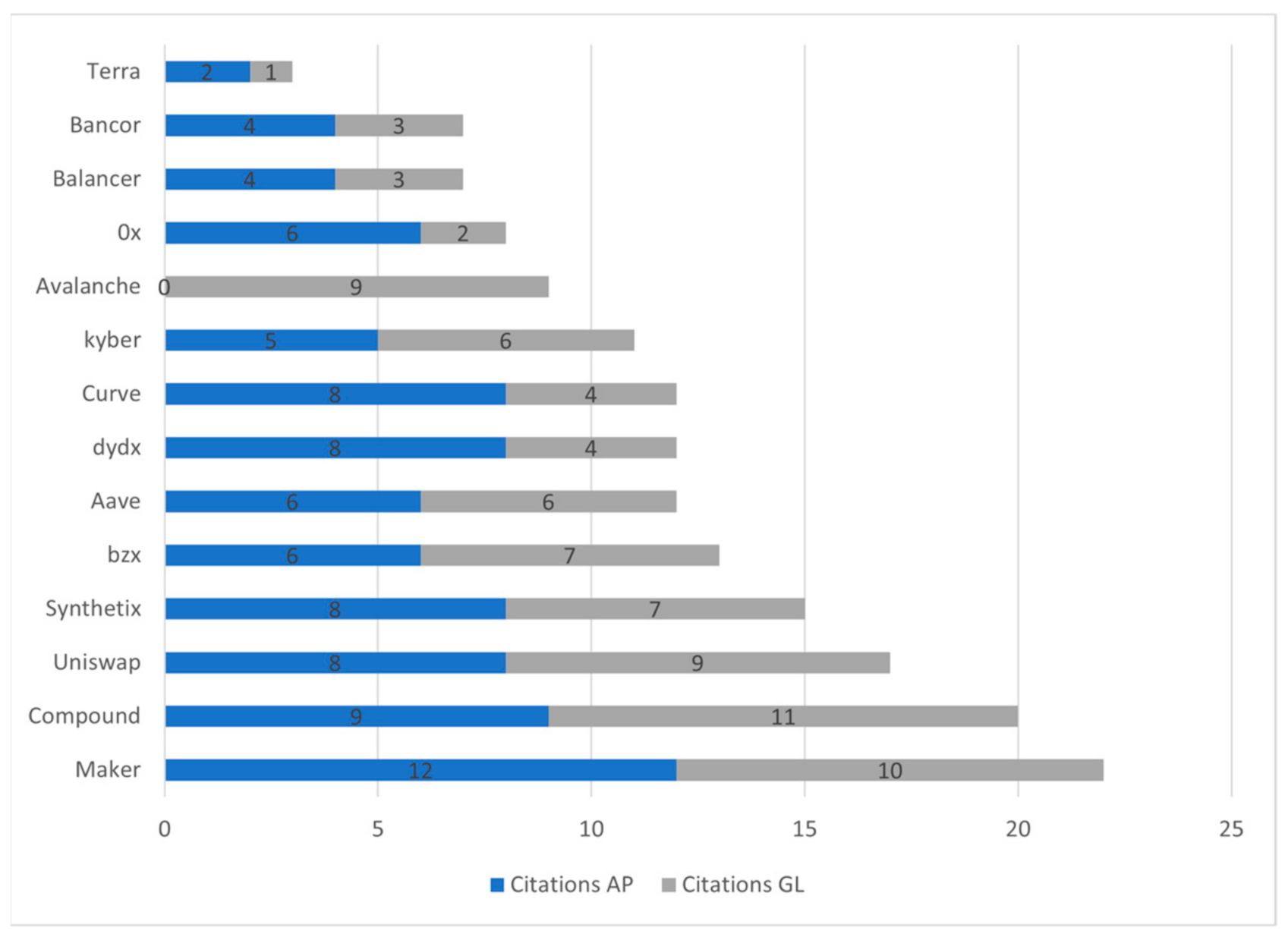

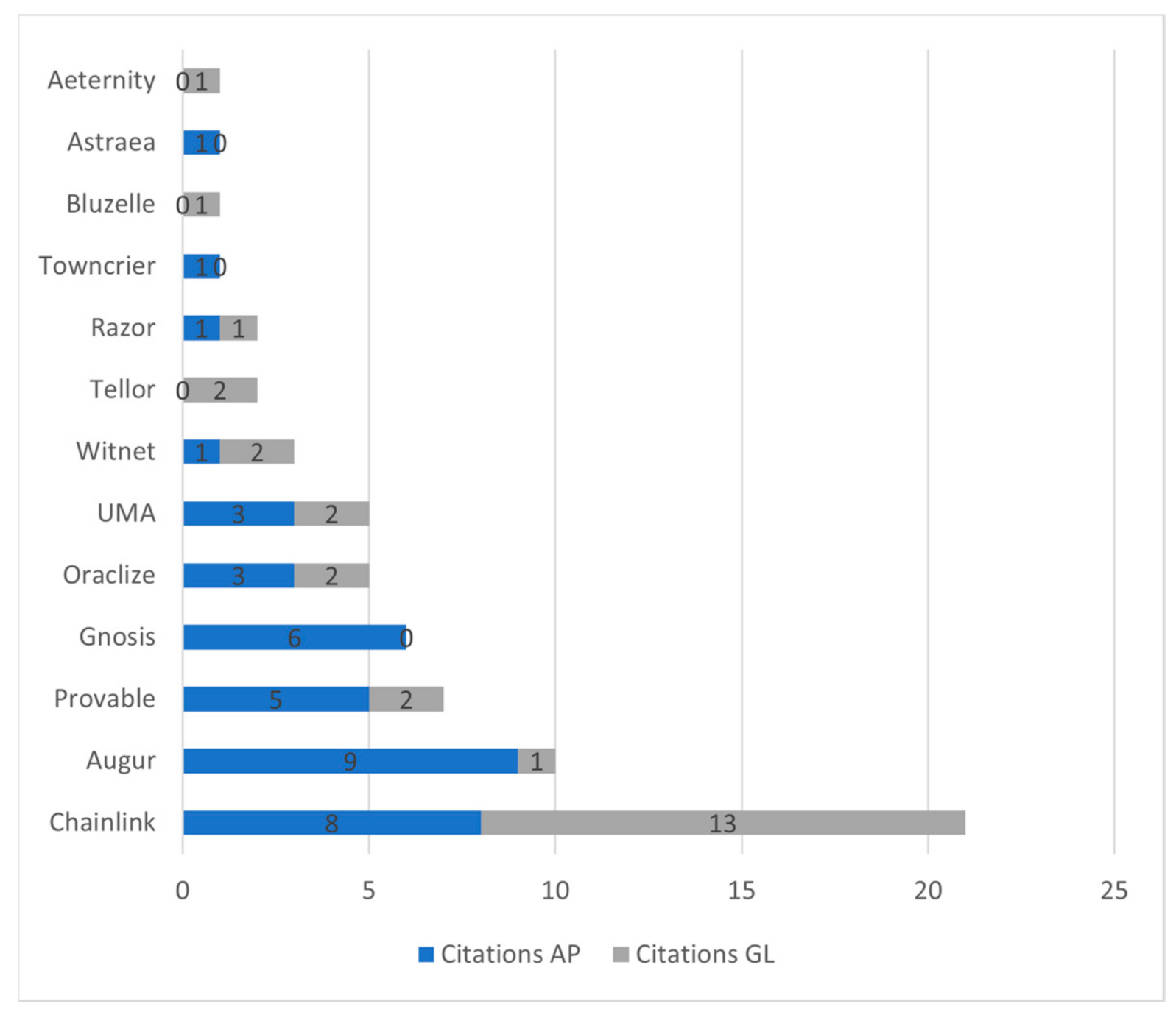

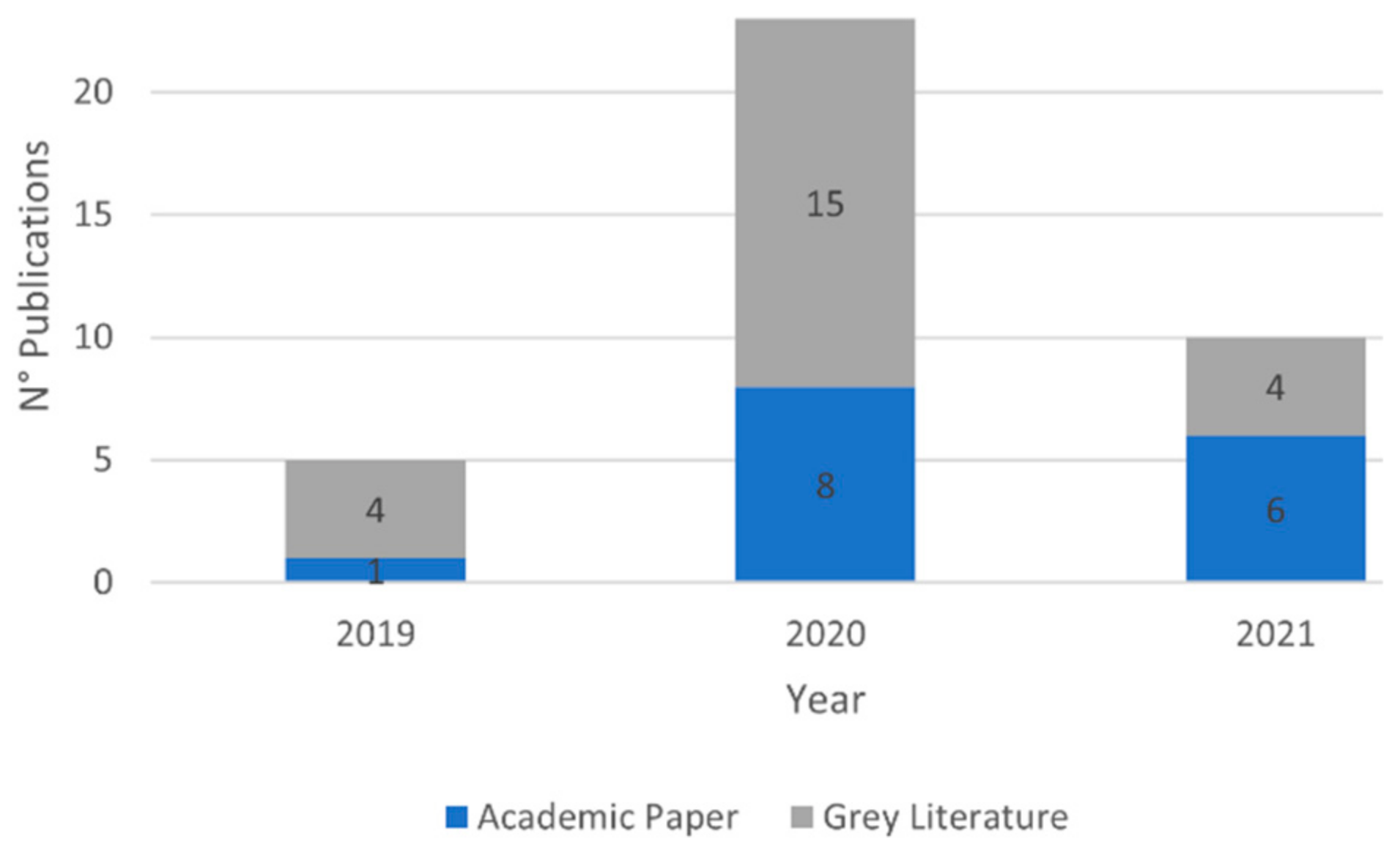

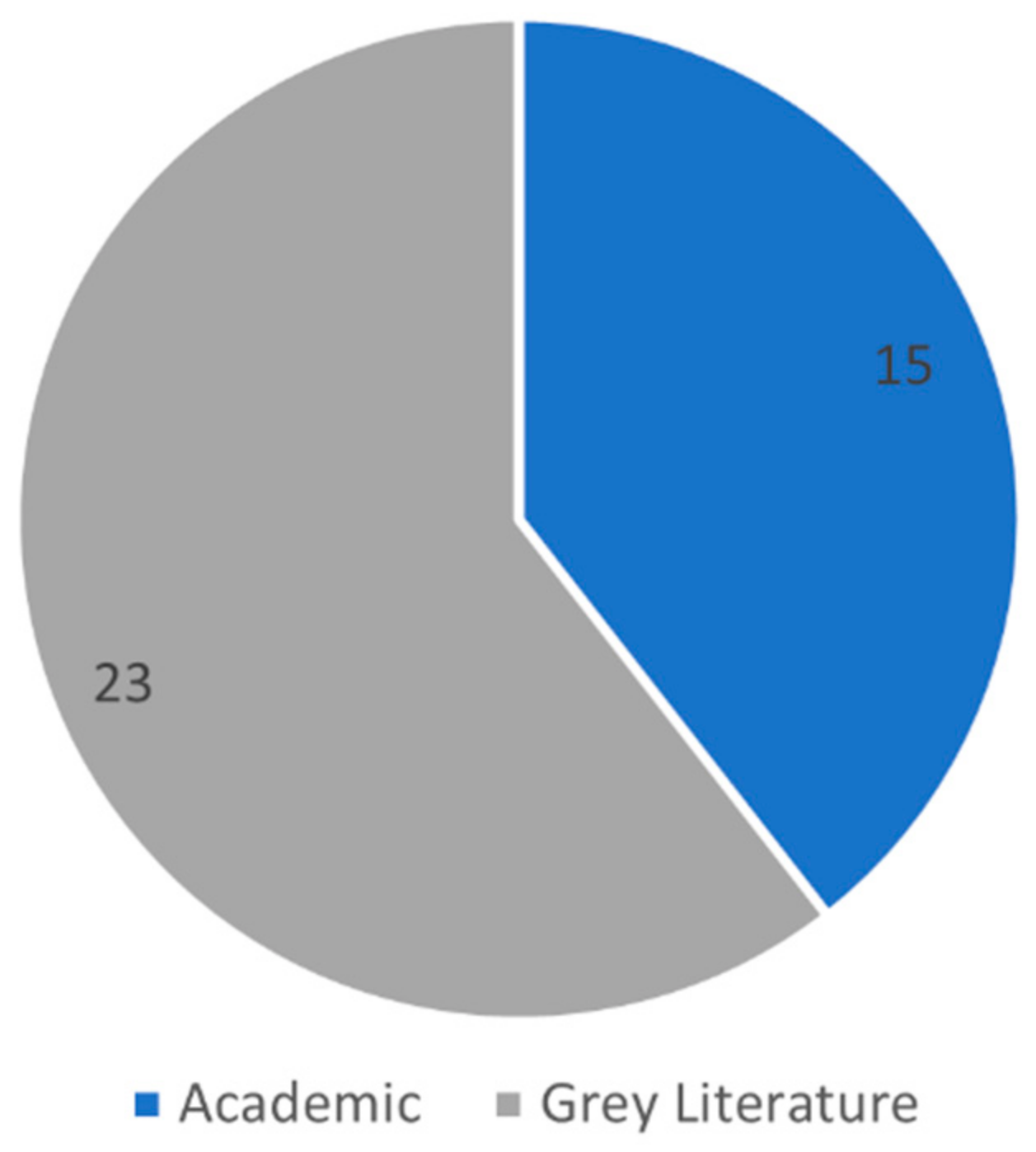

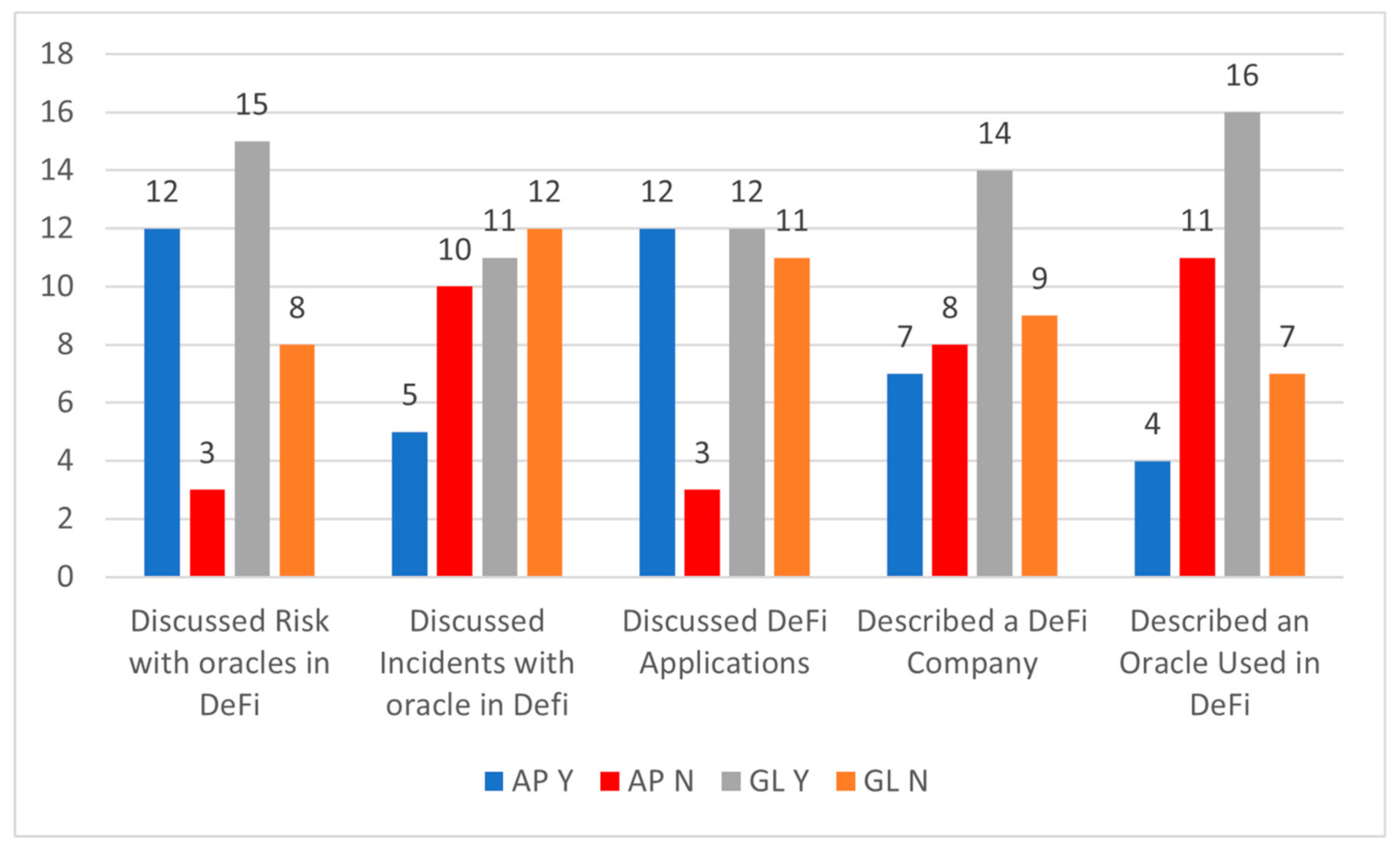

3.2. Results

4. Oracles in Decentralized Finance

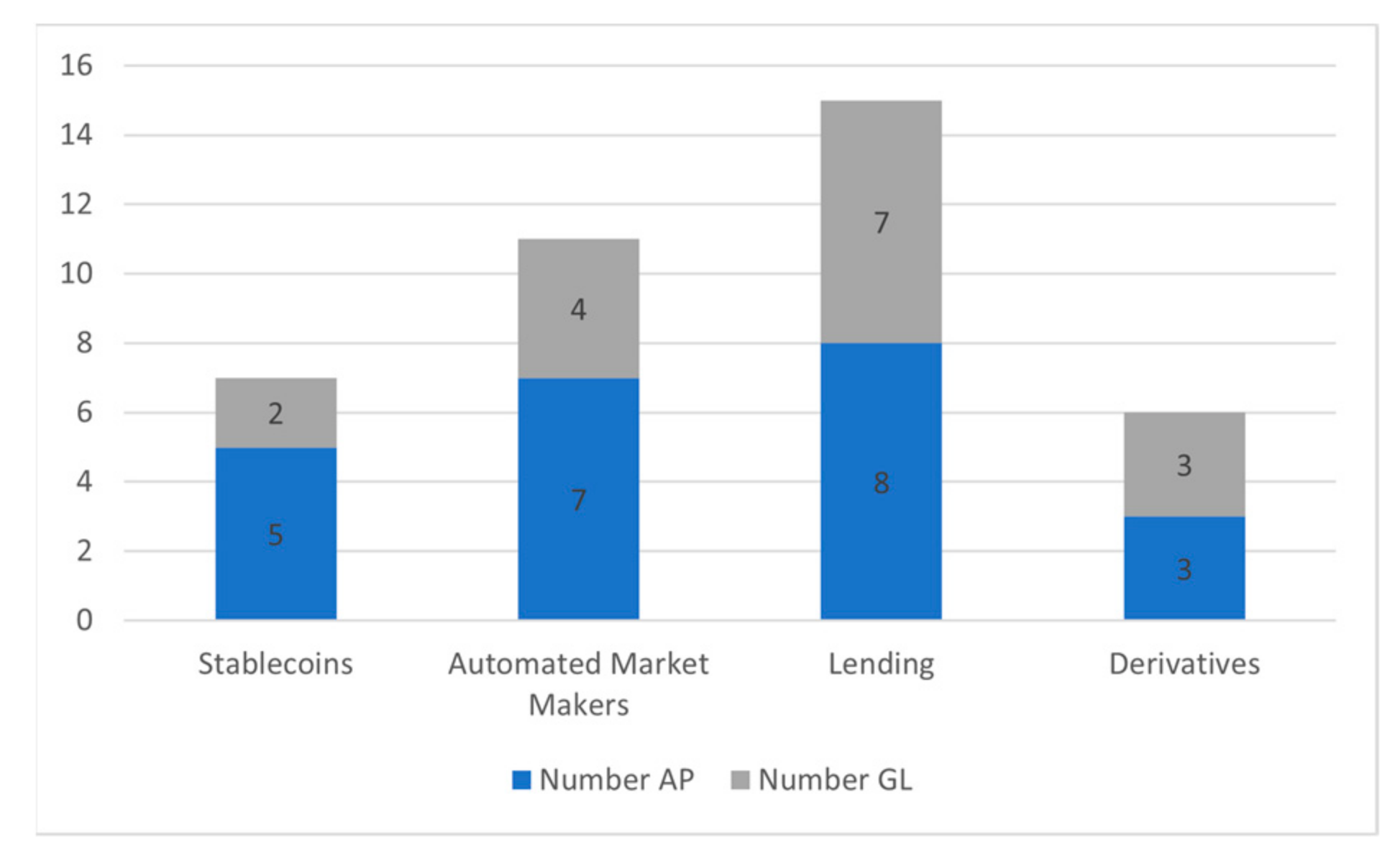

4.1. Lending Pools

4.2. Automated Market Makers (AMM)

4.3. Stablecoins

4.4. Derivatives

5. Risks and Attack Vectors

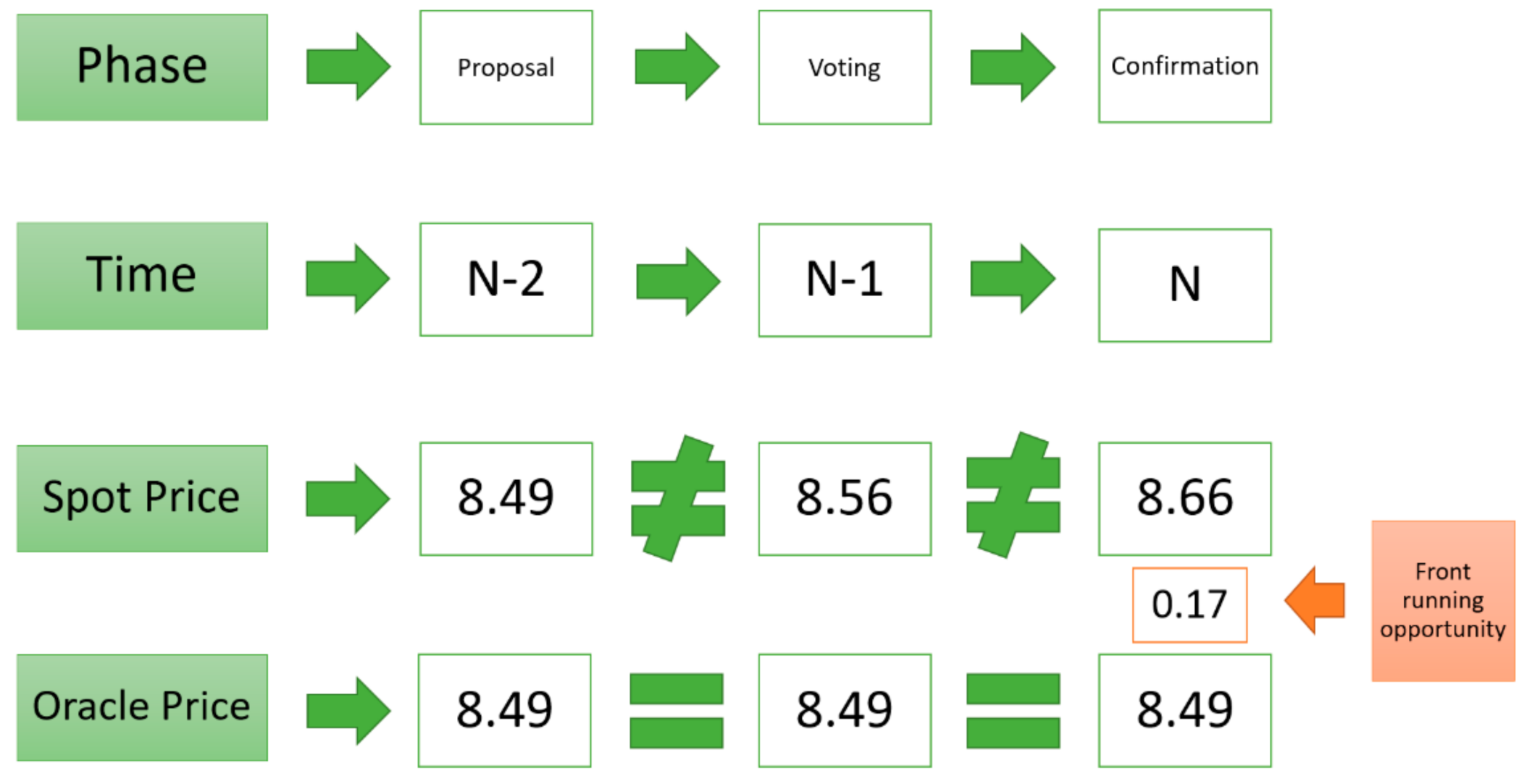

5.1. Front Running (S)

5.2. Sybil Attacks (S)

5.3. Selection Bias (S)

5.4. Data Manipulation (T)

5.5. Malfunctions (T)

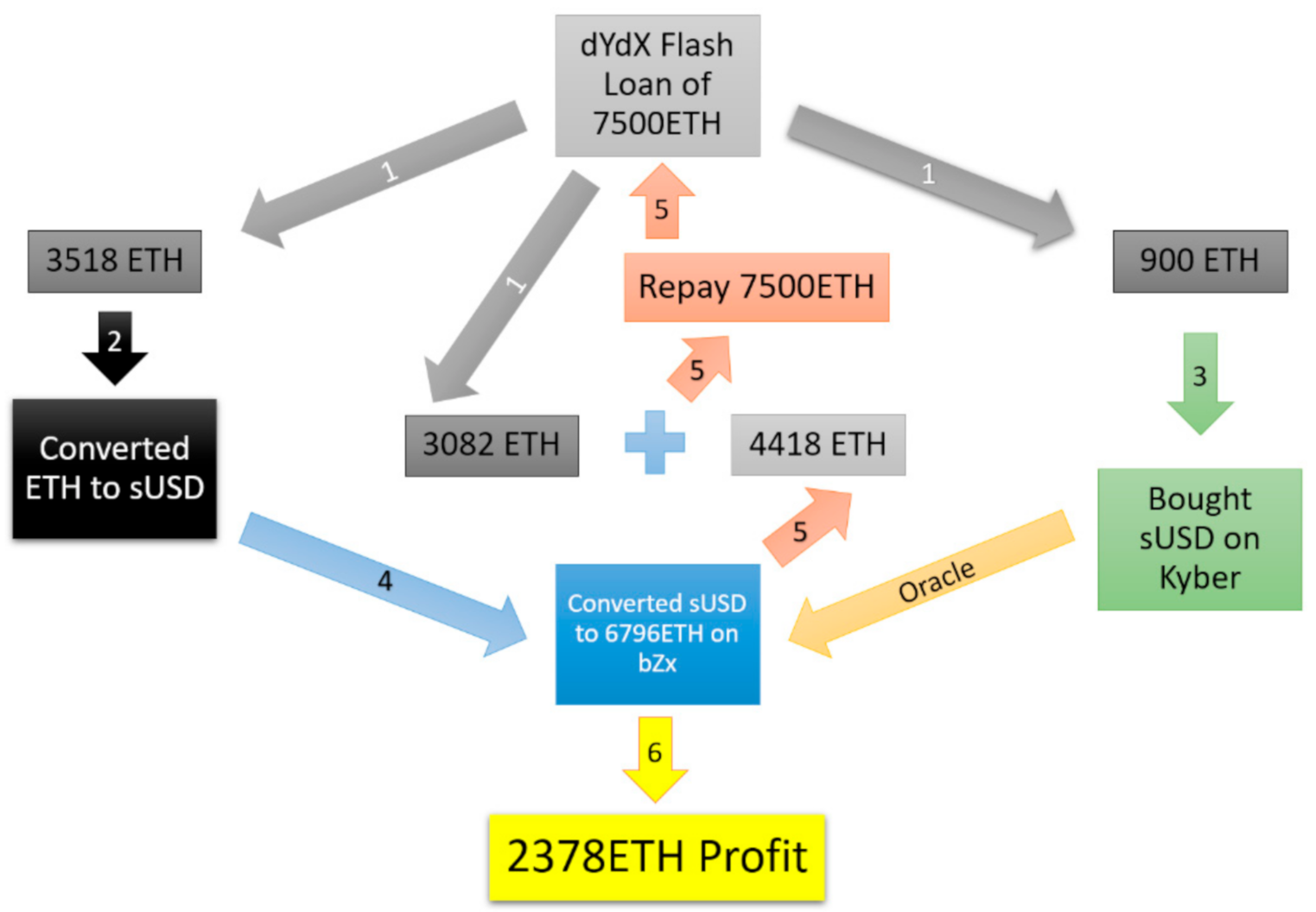

5.6. Flash-Loan Attacks

6. Discussion

7. Conclusions

- What is the oracle problem, and how does it impact DeFi applications?

- How do price oracles work?

- How do different DeFi applications rely on oracles?

- What are the risks associated with oracles in DeFi?

- What was the impact of past oracle failures in DeFi?

- What are possible improvements to oracle weaknesses?

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

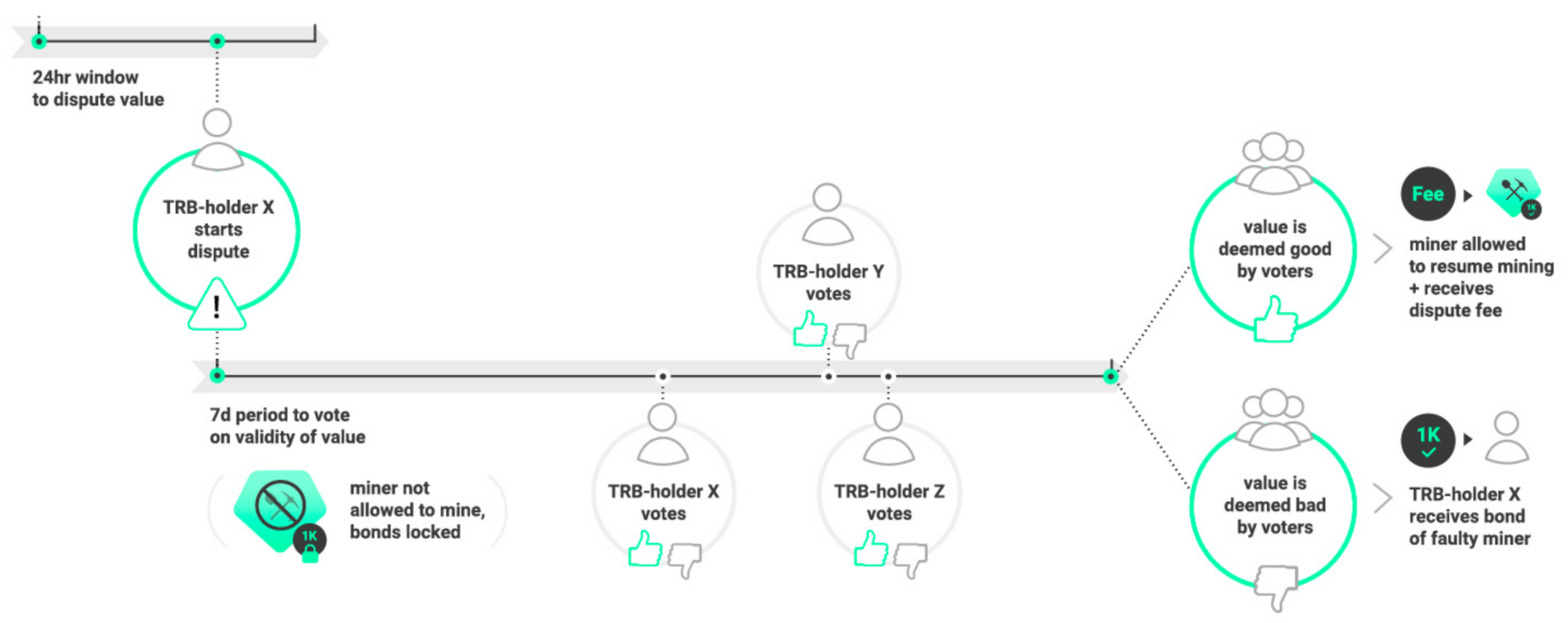

Appendix A.1. Tellor Oracle

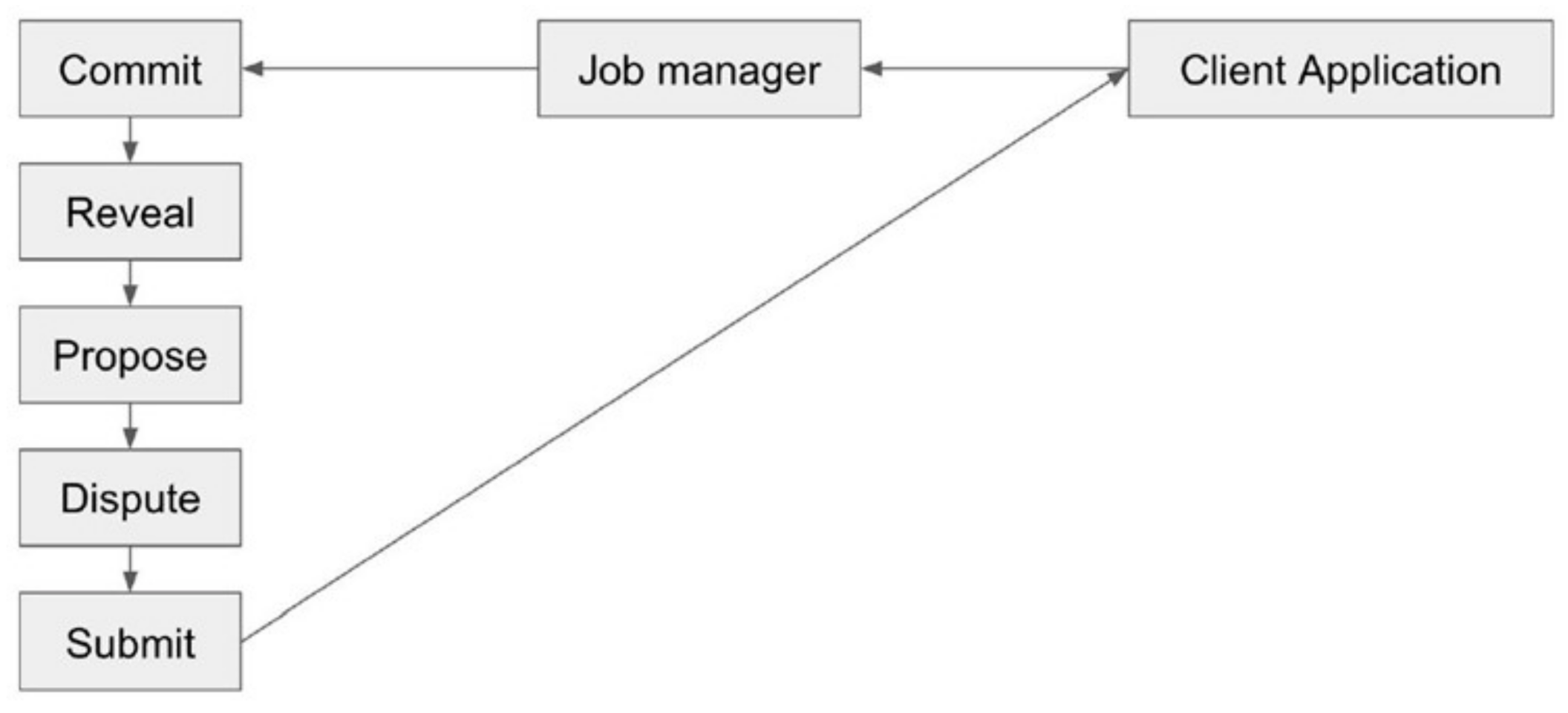

Appendix A.2. Razor Network

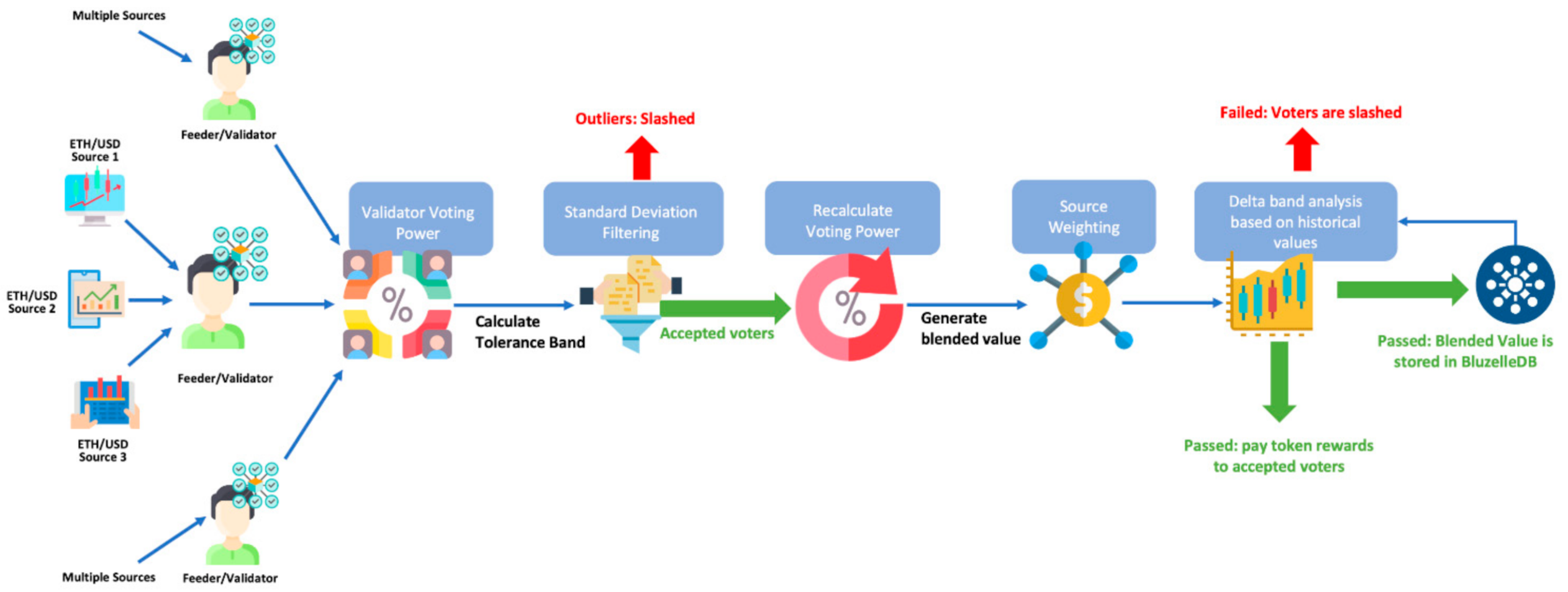

Appendix A.3. Bluzelle DeFi Oracle

Appendix B

| Title | Author | Year | Source | DR | DI | DA | DC | DO |

|---|---|---|---|---|---|---|---|---|

| “SoK: Decentralized Finance (DeFi)” | Werner et al. [49] | 2021 | AP | Y | N | Y | N | N |

| “DeFi and the Future of Finance” | Campbell et al. [51] | 2021 | AP | N | N | Y | Y | N |

| “A First Look into DeFi Oracles” | Liu et al. [17] | 2020 | GL | Y | Y | Y | Y | Y |

| “So you want to use a price oracle” | SamCzun [8] | 2020 | GL | Y | Y | Y | N | Y |

| “Biggest DeFi Hacks in 2020” | Peasteron W.M. [7] | 2021 | GL | Y | Y | N | N | N |

| “Automated Market Makers for Decentralized Finance (DeFi)” | Wang Y. [77] | 2020 | GL | Y | N | Y | N | N |

| “Decentralized Finance: On Blockchain- and Smart-Contract-based Financial Markets” | Schär F. [50] | 2021 | AP | N | N | Y | Y | N |

| “Decentralising Finance using Decentralised Blockchain Oracles” | Manoj Kumar et al. [20] | 2020 | AP | Y | N | N | N | N |

| “Improved Price Oracles: Constant Function Market Makers” | Angeris G. and Chitra T [52] | 2020 | AP | Y | N | Y | N | N |

| “Stablecoins 2.0: Economic Foundations and Risk-based Models” | Klages-Mundt et al. [85] | 2020 | AP | Y | N | Y | Y | Y |

| “Flash Loans: Why Flash Attacks will be the New Normal” | Qureshi H. [71] | 2020 | GL | Y | Y | N | N | N |

| “When is Uniswap a good oracle?” | Angeris G. [79] | 2020 | GL | Y | N | Y | Y | Y |

| “Analysis of 8/5, 8/12 Front-Running Attack” | EJ [104] | 2019 | GL | Y | Y | N | Y | Y |

| “Bluzelle Reveals Decentralized Oracle to Enhance DeFi Project Security and Price Reliability” | Edelstein D. [135] | 2020 | GL | Y | N | N | N | Y |

| “Razor Network: A decentralized oracle platform” | Huilgokar H. [34] | 2021 | GL | Y | N | Y | N | Y |

Appendix C. Retrieved DeFi/Oracle Projects

References

- Huilgolkar, H. Designing the Most Secure Oracle for the Decentralized Finance. Available online: https://medium.com/coinmonks/designing-the-most-secure-oracle-for-the-decentralized-finance-9853237f0c37 (accessed on 11 January 2021).

- DefiPulse DexGuru-Real-Time Data. Analytics and Trading for AMMs in One Place. Available online: https://defipulse.com/blog/dexguru/ (accessed on 19 April 2021).

- Leybold, M. Decentralized Finance (DeFi) in 2020 and Its Future Trajectory. Available online: https://www.linkedin.com/pulse/decentralized-finance-defi-2020-its-future-trajectory-matthew-leybold/ (accessed on 12 March 2021).

- Thompson, P. The DeFi Hacks of 2020. Available online: https://coingeek.com/the-defi-hacks-of-2020/ (accessed on 20 March 2021).

- Thomson, C. The DAO of ETHEREUM: Analyzing the DAO hack, the Blockchain, Smart contracts, and the Law. Available online: https://medium.com/blockchain-review/the-dao-of-ethereum-e228b93afc79 (accessed on 3 April 2020).

- Ellis, S.; Juels, A.; Nazarov, S. ChainLink: A Decentralized Oracle Network. Retrieved March 2017, 11, 2018. [Google Scholar]

- Peaster, W.M. Biggest DeFi Hacks in 2020. Available online: https://defiprime.com/hacks2020 (accessed on 12 March 2021).

- Sun, S. So You Want to Use a Price Oracle. Available online: https://samczsun.com/so-you-want-to-use-a-price-oracle/ (accessed on 24 March 2021).

- Staff, F.M. DeFi Startup Acala to Restructure Oracle Network—For the Better. Available online: https://www.financemagnates.com/thought-leadership/defi-startup-acala-to-restructure-oracle-network-for-the-better/ (accessed on 3 February 2021).

- Sharma, T.K. Centralized Oracles vs. Decentralized Oracles. Available online: https://www.blockchain-council.org/blockchain/centralized-oracles-vs-decentralized-oracles/ (accessed on 11 February 2021).

- Zheng, S. Compound Launches an Open Oracle System for Decentralized Pricing Data. Available online: https://www.theblockcrypto.com/post/36460/compound-launches-an-open-oracle-system-for-decentralized-pricing-data (accessed on 19 April 2020).

- Anadiotis, G. Off-Chain Reporting: Toward a New General Purpose Secure Compute Framework by Chainlink. Available online: https://www.zdnet.com/article/off-chain-reporting-towards-a-new-general-purpose-secure-compute-framework-by-chainlink/ (accessed on 19 March 2021).

- Egberts, A. The Oracle Problem—An Analysis of how Blockchain Oracles Undermine the Advantages of Decentralized Ledger Systems. SSRN Electron. J. 2017. [Google Scholar] [CrossRef]

- Caldarelli, G. Blockchain Oracles and the Oracle Problem, 1st ed.; Amazon Publishing: Seattle, WA, USA, 2021; ISBN 979-1220083386. [Google Scholar]

- Caldarelli, G. Real-World blockchain applications under the lens of the oracle problem. A systematic literature review. In Proceedings of the 2020 IEEE International Conference on Technology Management, Marrakech, Morocco, 25–27 November 2020. [Google Scholar]

- Caldarelli, G. Understanding the Blockchain Oracle Problem: A Call for Action. Information 2020, 11, 509. [Google Scholar] [CrossRef]

- Liu, B.; Szalachowski, P.; Zhou, J. A First Look into DeFi Oracles. arXiv 2020, arXiv:2005.04377. [Google Scholar]

- Morselli, G. Oracles as Decentralized Data Sources for the Blockchain. Available online: https://en.cryptonomist.ch/2020/01/12/oracles-decentralized-data-blockchain/ (accessed on 6 January 2021).

- Al-Breiki, H.; Rehman, M.H.U.; Salah, K.; Svetinovic, D. Trustworthy Blockchain Oracles: Review, Comparison and Open Research Challenges. IEEE Access 2020, 8, 85675–85685. [Google Scholar] [CrossRef]

- Kumar, M.; Nikhil, N.; Singh, R. Decentralising finance using decentralised blockchain oracles. In Proceedings of the 2020 International Conference for Emerging Technology, Belgaum, India, 21–23 December 2020; pp. 1–4. [Google Scholar]

- Amler, H.; Eckey, L.; Faust, S.; Kaiser, M.; Sandner, P.; Schlosser, B. DeFi-ning DeFi: Challenges & Pathway. arXiv 2021, arXiv:2101.05589. [Google Scholar]

- Ellul, J.; Pace, G.J. Towards External Calls for Blockchain and Distributed Ledger Technology towards External Calls for Blockchain and Distributed Ledger Technology. arXiv 2021, arXiv:2105.10399. [Google Scholar]

- Curran, B. What are Oracles? Smart Contracts, Chainlink & “The Oracle Problem”. Available online: https://blockonomi.com/oracles-guide (accessed on 12 April 2019).

- Damjan, M. The interface between blockchain and the real world. Ragion Prat. 2018, 2018, 379–406. [Google Scholar] [CrossRef]

- Beniiche, A. A study of blockchain oracles. arXiv 2020, arXiv:2004.07140. [Google Scholar]

- Park, J.; Kim, H.; Kim, G.; Ryou, J. Smart contract data feed framework for privacy-preserving oracle system on blockchain. Computers 2021, 10, 7. [Google Scholar] [CrossRef]

- Caldarelli, G.; Rossignoli, C.; Zardini, A. Overcoming the blockchain oracle problem in the traceability of non-fungible products. Sustainability 2020, 12, 2391. [Google Scholar] [CrossRef] [Green Version]

- Wang, S.; Lu, H.; Sun, X.; Yuan, Y.; Wang, F.Y. A Novel Blockchain Oracle Implementation Scheme Based on Application Specific Knowledge Engines. In Proceedings of the 2019 IEEE International Conference on Service Operations and Logistics, and Informatics (SOLI), Zhengzhou, China, 11–13 October 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 258–262. [Google Scholar] [CrossRef]

- Dale, O. What Is Chainlink? Guide to the Decentralized Oracle Network. Available online: https://blockonomi.com/chainlink-guide/ (accessed on 12 March 2020).

- Nattapatsri, P. Guide to Building DeFi Using Band Protocol Oracle and Cosmos IBC. Available online: https://blog.cosmos.network/guide-to-building-defi-using-band-protocol-oracle-and-cosmos-ibc-fa5348832f84 (accessed on 19 January 2021).

- Delphi Delphi Systems Whitepaper. Available online: https://delphi.systems/whitepaper.pdf (accessed on 12 July 2020).

- Gu, W.C.; Raghuvanshi, A.; Boneh, D. Empirical measurements on pricing oracles and decentralized governance for stablecoins. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Peterson, J.; Krug, J.; Zoltu, M.; Williams, A.K.; Alexander, S. Augur: A decentralized oracle and prediction market platform. arXiv 2015, arXiv:1501.01042. [Google Scholar]

- Huilgolkar, H. Razor Network: A Decentralized Oracle Platform. 2021. Available online: https://razor.network/whitepaper.pdf (accessed on 18 February 2021).

- Murimi, R.M.; Wang, G.G. On elastic incentives for blockchain oracles. J. Database Manag. 2021, 32, 1–26. [Google Scholar] [CrossRef]

- Yutaka, K.; Fujihara, A. Ken-System: Experimental performance evaluation on avoidance of blockchain oracle problem using collective intelligence. In Proceedings of the IEICE Technical Report; No. 414; IN2020-74; The Institute of Electronics, Information and Communication Engineers: Tokyo, Japan, 2021; Volume 120, pp. 120–125. [Google Scholar]

- Wöhler, S. Blockchain Oracles I of II. Available online: https://www.anyblockanalytics.com/blog/blockchain-oracles-part-1/ (accessed on 5 March 2021).

- Frankenreiter, J. The Limits of Smart Contracts. J. Inst. Theor. Econ. JITE 2019, 175, 149–162. [Google Scholar] [CrossRef]

- Low, K.F.K.; Mik, E. Pause the blockchain legal revolution. Int. Comp. Law Q. 2020, 69, 135–175. [Google Scholar] [CrossRef]

- Song, J. The Truth about Smart Contracts. Available online: https://medium.com/@jimmysong/the-truth-about-smart-contracts-ae825271811f (accessed on 2 March 2020).

- Sztorc, P. The Oracle Problem. Available online: https://www.infoq.com/presentations/blockchain-oracle-problems (accessed on 3 March 2020).

- Antonopoulos, A.M.; Woods, G. Mastering Ethereum—Building Smart Contracts and DAPPS; O’Reilly Media, Inc.: Newton, MA, USA, 2018. [Google Scholar]

- Kumar, A.; Liu, R.; Shan, Z. Is Blockchain a Silver Bullet for Supply Chain Management? Technical Challenges and Research Opportunities. Decis. Sci. 2020, 51, 8–37. [Google Scholar] [CrossRef]

- Caldarelli, G.; Ellul, J. Trusted academic transcripts on the blockchain: A systematic literature review. Appl. Sci. 2021, 11, 1842. [Google Scholar] [CrossRef]

- Finck, M.; Moscon, V. Copyright Law on Blockchains: Between New Forms of Rights Administration and Digital Rights Management 2.0. IIC Int. Rev. Intellect. Prop. Compet. Law 2019, 50, 77–108. [Google Scholar] [CrossRef] [Green Version]

- Zetzsche, D.A.; Arner, D.W.; Buckley, R.P. Decentralized Finance (DeFi). IIEL Issue Brief 2020. [Google Scholar] [CrossRef]

- Arndt, T. Towards an Implementation of Blockchain-Based Transcripts with Nosql Databases. In Proceedings of the 17th International Conference on E-Society 2019, Utrecht, The Netherlands, 11–13 April 2019; IADIS Press: Lisbon, Portugal, 2019; pp. 309–312. [Google Scholar]

- Mühlberger, R.; Bachhofner, S.; Castelló Ferrer, E.; Di Ciccio, C.; Weber, I.; Wöhrer, M.; Zdun, U. Foundational Oracle Patterns: Connecting Blockchain to the Off-Chain World. In Proceedings of the International Conference on Business Process Management; Springer: Cham, Switzerland, 2020; pp. 35–51. [Google Scholar]

- Werner, S.M.; Perez, D.; Gudgeon, L.; Klages-Mundt, A.; Harz, D.; Knottenbelt, W.J. SoK: Decentralized Finance (DeFi). arXiv 2021, arXiv:2101.08778. [Google Scholar]

- Schär, F. Decentralized Finance: On Blockchain- and Smart Contract-based Financial Markets. FRB St. Louis Rev. 2020. [Google Scholar] [CrossRef]

- Harvey, C.R.; Ramachandran, A.; Santoro, J. DeFi and the Future of Finance; John Wiley & Sons: New York, NY, USA, 2021. [Google Scholar] [CrossRef]

- Angeris, G.; Chitra, T. Improved Price Oracles: Constant Function Market Makers. In Proceedings of the 2nd ACM Conference on Advances in Financial Technologies; Association for Computing Machinery: New York, NY, USA, 2020; pp. 80–91. [Google Scholar] [CrossRef]

- Kaleem, M.; Shi, W. Demystifying Pythia: A Survey of ChainLink Oracles Usage on Ethereum. arXiv 2021, arXiv:2101.06781. [Google Scholar]

- Robert, R. What Do You Look for in a Classic Literature Review? Available online: https://classic-literature.yoexpert.com/classic-literature-general/what-do-you-look-for-in-a-classic-literature-revie-30604.html (accessed on 12 January 2021).

- Sutherland, S.E. An introduction to systematic reviews. J. Evid. Based. Dent. Pract. 2004, 4, 47–51. [Google Scholar] [CrossRef]

- Alammary, A.; Alhazmi, S.; Almasri, M.; Gillani, S. Blockchain-Based Applications in Education: A Systematic Review. Appl. Sci. 2019, 9, 2400. [Google Scholar] [CrossRef] [Green Version]

- Ahmed, U. The Importance of Cross-Border Regulatory Cooperation in an Era of Digital Trade. World Trade Rev. 2019, 18, S99–S120. [Google Scholar] [CrossRef]

- Kursawe, K. Wendy, the Good Little Fairness Widget: Achieving Order Fairness for Blockchains. In Proceedings of the 2nd ACM Conference on Advances in Financial Technologies; Association for Computing Machinery: New York, NY, USA, 2020; pp. 25–36. [Google Scholar] [CrossRef]

- Elghaish, F.; Abrishami, S.; Hosseini, M.R. Integrated project delivery with blockchain: An automated financial system. Autom. Constr. 2020, 114, 103182. [Google Scholar] [CrossRef]

- Fedorova, E.P.; Skobleva, E.I. Application of blockchain technology in higher education. Eur. J. Contemp. Educ. 2020, 9, 552–571. [Google Scholar] [CrossRef]

- Ogawa, R.T.; Malen, B. Towards Rigor in Reviews of Multivocal Literatures: Applying the Exploratory Case Study Method. Rev. Ed. Red. 2016, 61, 265–286. [Google Scholar] [CrossRef]

- Schöpfel, J.; Farace, D.J. Grey Literature. Encycl. Libr. Inf. Sci. 2010, 3, 2029–2039. [Google Scholar]

- Eskandari, S.; Salehi, M.; Gu, W.C.; Clark, J. SoK: Oracles from the Ground Truth to Market Manipulation; Association for Computing Machinery: New York, NY, USA, 2021; Volume 1. [Google Scholar]

- Kitchenham, B.; Charters, S. Guidelines for Performing Systematic Literature Reviews in Software Engineering. 2007, Volume 1. Available online: https://www.elsevier.com/__data/promis_misc/525444systematicreviewsguide.pdf (accessed on 2 April 2021).

- Wang, H.; Wang, Y.; Cao, Z.; Li, Z.; Xiong, G. An overview of blockchain security analysis. Commun. Comput. Inf. Sci. 2019, 970, 55–72. [Google Scholar] [CrossRef] [Green Version]

- Bartoletti, M.; Chiang, J.H.; Lluch-Lafuente, A. SoK: Lending Pools in Decentralized Finance. arXiv 2020, arXiv:2012.13230. [Google Scholar]

- Harwick, C.; Caton, J. What’s holding back blockchain finance? On the possibility of decentralized autonomous finance. Q. Rev. Econ. Financ. 2020. [Google Scholar] [CrossRef]

- Boado, E. AAVE Protocol Whitepaper. Available online: https://github.com/aave/protocol-v2/blob/master/aave-v2-whitepaper.pdf (accessed on 2 April 2021).

- Leshner, R.; Hayes, G. Compound: The Money Market Protocol. White Paper. 2018. Available online: https://www.digitalcoindata.com/whitepapers/compound-whitepaper.pdf (accessed on 2 April 2021).

- Juliano, A. dYdX: A Standard for Decentralized Margin Trading and Derivatives. 2018. Available online: https://whitepaper.dydx.exchange (accessed on 2 April 2021).

- Qureshi, H. Flash Loans: Why Flash Attacks Will Be the New Normal. Available online: https://medium.com/dragonfly-research/flash-loans-why-flash-attacks-will-be-the-new-normal-5144e23ac75a (accessed on 19 August 2020).

- Wolff, M. Introducing Marble: A Smart Contract Bank. Available online: https://medium.com/marbleorg/introducing-marble-a-smart-contract-bankc9c438a12890 (accessed on 12 March 2021).

- Chainlink The Aave Oracle Network Powered by Chainlink Is Now Live! Available online: https://chainlinkecosystem.com/ecosystem/aave/ (accessed on 2 April 2021).

- DYdX dYdX Chooses Chainlink as its Oracle Provider for New Market. Available online: https://integral.dydx.exchange/dydx-chooses-chainlink-as-its-oracle-provider-for-new-market/ (accessed on 2 April 2021).

- Tiwari, A. DeFi Protocol Compound (COMP) Releases Decentralized Price Oracle. Available online: https://btcmanager.com/defi-protocol-compound-comp-decentralized-price-oracle/ (accessed on 5 April 2021).

- Omelchenko, D. Compound Launches Decentralized Price Oracle. Available online: https://ihodl.com/topnews/2020-08-09/compound-launches-decentralized-price-oracle/ (accessed on 2 January 2021).

- Wang, Y. Automated market makers for decentralized finance (DeFi). arXiv 2020, arXiv:2009.01676. [Google Scholar]

- Coin Market Cap Coin Market Cap-Defi. Available online: https://coinmarketcap.com/view/defi/ (accessed on 5 April 2021).

- Angeris, G. When Is Uniswap a Good Oracle? Available online: https://medium.com/gauntlet-networks/why-is-uniswap-a-good-oracle-22d84e5b0b6c (accessed on 2 April 2021).

- Enclave Projects Utilizing Uniswap Oracle. Available online: https://enclaveresearch.com/projects-utilizing-uniswap-oracle/ (accessed on 5 April 2021).

- Waas, M. Using the New Uniswap v2 as Oracle in Your Contracts. Available online: https://soliditydeveloper.com/uniswap-oracle (accessed on 2 April 2021).

- Angeris, G.; Kao, H.T.; Chiang, R.; Noyes, C.; Chitra, T. An analysis of Uniswap markets. arXiv 2019, arXiv:1911.03380. [Google Scholar]

- Lielacher, A. What Is Impermanent Loss? Available online: https://trustwallet.com/blog/what-is-impermanent-loss (accessed on 3 April 2021).

- Jakub What Is Impermanent Loss? DEFI Explained. Available online: https://finematics.com/impermanent-loss-explained/ (accessed on 13 April 2021).

- Klages-Mundt, A.; Harz, D.; Gudgeon, L.; Liu, J.Y.; Minca, A. Stablecoins 2.0: Economic Foundations and Risk-based Models. In Proceedings of the 2nd ACM Conference on Advances in Financial Technologies; Association for Computing Machinery: New York, NY, USA, 2020; pp. 59–79. [Google Scholar] [CrossRef]

- Tether. Tether: Fiat Currencies on the Bitcoin Blockchain. Available online: https://assets.ctfassets.net/sdlntm3tthp6/SevuOTDbYiCcoaeKEoQAO/828cba8e4e76f9c3075594a98ba807df/TetherWhitePaper.pdf (accessed on 3 April 2021).

- Centre USDC Centre whitepaper. Self-Published White Paper.; 2018.

- Coinbase DAI Stablecoin. Available online: https://www.coinbase.com/it/earn/dai (accessed on 9 April 2020).

- Maker Team the Dai Stablecoin System. Whitepaper. 2017. 21p. Available online: https://makerdao.com/whitepaper/DaiDec17WP.pdf (accessed on 9 April 2020).

- Maker Introducing Oracles V2 and DeFi Feeds. Available online: https://blog.makerdao.com/introducing-oracles-v2-and-defi-feeds/ (accessed on 14 February 2020).

- Maker MakerDAO Oracle Module. Available online: https://docs.makerdao.com/smart-contract-modules/core-module (accessed on 7 April 2021).

- Al-Naji, N. Basis. Available online: https://www.basis.io/ (accessed on 5 April 2021).

- Kuo, E.; Iles, B.; Cruz, M.R. Ampleforth: A New Synthetic Commodity. Ampleforth White Paper. 2019. Available online: https://www.ampleforth.org/papers/ (accessed on 7 April 2021).

- Slawson, A. CELO Holders: Make Your Voice Heard through On-Chain Governance. Available online: https://medium.com/celoorg/celo-gold-holders-make-your-voice-heard-through-on-chain-governance-96cb5a1e8b90 (accessed on 7 April 2021).

- Croessmann, R. Zooming in on the Celo Expansion & Contraction Mechanism. Available online: https://medium.com/celoorg/zooming-in-on-the-celo-expansion-contraction-mechanism-446ca7abe4f (accessed on 3 April 2020).

- Celo-org Celo-Oracle. Available online: https://github.com/celo-org/celo-oracle (accessed on 7 April 2021).

- Hull, J.C. Options, Futures and Other Derivatives, 1st ed.; Pearson Education India: New York, NY, USA, 2017; ISBN 9781292212890. [Google Scholar]

- Larsen, A. A Primer on Blockchain Interoperability. Available online: https://medium.com/blockchain-capital-blog/a-primer-on-blockchain-interoperability-e132bab805b (accessed on 9 December 2019).

- Brooks, S.; Jurisevic, A.; Spain, M.; Warwick, K. Synthetix: A decentralised payment network and stablecoin v0.8. 2018.

- UMA. UMA: A Decentralized Financial Contract Platform; UMA: New York, NY, USA, 2018. [Google Scholar]

- UMA. How UMA Solves the Oracle Problem. Available online: https://docs.umaproject.org/oracle/econ-architecture (accessed on 3 April 2021).

- Mitchell, C. Front-Running. Available online: https://www.investopedia.com/terms/f/frontrunning.asp (accessed on 9 April 2021).

- Kereiakes, E.; Kwon, D.; Di Maggio, M.; Platias, N. Terra Money: Stability and Adoption. 2019. Available online: https://res.tuoluocaijing.cn/20190705164535-yagq.pdf (accessed on 19 March 2021).

- EJ Analysis of 8/5, 8/12 Front-Running Attack (Korean). Available online: https://medium.com/terra-money/analysis-of-8-5-8-12-front-running-attack-프론트-러닝-공격-보고서-4f150ae0bf26 (accessed on 6 April 2021).

- Foxley, W. Bad Sandwich: DeFi Trader “Poisons” Front-Running Miners for $250K Profit. Available online: https://www.coindesk.com/bad-sandwich-defi-trader-poison-front-running-ethermine-miners (accessed on 9 April 2021).

- Douceur, J.R. The Sybil Attack. In Peer-To-Peer Systems; MIT Faculty Club: Cambridge, MA, USA, 2002; pp. 251–260. [Google Scholar] [CrossRef]

- Gudgeon, L.; Perez, D.; Harz, D.; Livshits, B.; Gervais, A. The Decentralized Financial Crisis. In 2020 Crypto Valley Conference on Blockchain Technology (CVCBT); IEEE: Piscataway, NJ, USA, 2020; pp. 1–15. [Google Scholar] [CrossRef]

- Zoltu, M. How to Turn $20M into $340M in 15 s. Available online: https://medium.com/coinmonks/how-to-turn-20m-into-340m-in-15-s-48d161a42311 (accessed on 1 July 2020).

- Kelso, E. $340,000,000 Worth of ETH Locked in Maker DAO Can Be Stolen in Seconds, Right Now, Analyst Claims. Available online: https://coinspice.io/news/340000000-worth-of-eth-locked-in-maker-dao-can-be-stolen-in-seconds-right-now-analyst-claims/ (accessed on 9 November 2020).

- LongForWisdom Flash Loans and Securing the Maker Protocol. Available online: https://forum.makerdao.com/t/updates-flash-loans-and-securing-the-maker-protocol/4923 (accessed on 12 June 2021).

- Lu, K. Why DeFi Needs Real Oracles. Available online: https://medium.com/bandprotocol/why-defi-needs-real-oracles-beyond-dex-9c80cf192883 (accessed on 19 December 2020).

- Stevens, R. After DeFi Lost $100 Million to Flash Loan Attacks, Curve Pushes Chainlink. Available online: https://decrypt.co/49758/after-100-million-lost-to-flash-loan-attacks-curve-pushes-chainlink (accessed on 12 February 2021).

- Mlinaric, N. DeFi Hacks-Million Lost in 2020. Available online: https://nodefactory.io/blog/defi-hacks-millions-lost-in-2020/ (accessed on 9 April 2021).

- WIlliams, C. Compound User Liquidated for $49 Million, Price Oracle Blamed. Available online: https://cryptobriefing.com/compound-user-liquidated-49-million-price-oracle-blamed/ (accessed on 11 March 2021).

- Chipolina, S. Oracle Exploit Sees $89 Million Liquidated on Compound. Available online: https://decrypt.co/49657/oracle-exploit-sees-100-million-liquidated-on-compound (accessed on 9 April 2021).

- Jared Compound: Open Price Feed Live.

- Carl, T. Synthetix Users Returns 1$ Billion After an Oracle Issue with Their Exchange Platform. Available online: https://bitcoinexchangeguide.com/synthetix-users-returns-1-billion-after-an-oracle-issue-with-their-exchange-platform/ (accessed on 18 April 2021).

- Redman, J. ETH Price Strains Defi Collateral Loans as “Black Swan” Event Strikes Makerdao. Available online: https://news.bitcoin.com/eth-price-dai-collateral-loans-makerdao/ (accessed on 3 March 2021).

- Campbell, L. MakerDAO Systems Struggles Amid Volatility-$4M in Dai Left. Available online: https://defirate.com/makerdao-shutdown-concerns/ (accessed on 19 January 2021).

- HacKen Biggest DeFi Hacks of 2020 Report. Available online: https://hacken.io/researches-and-investigations/biggest-defi-hacks-of-2020-report/ (accessed on 2 March 2021).

- De’Shazer, M. Flash Loan, Re-Entrancy Attack and DEX Oracle Manipulation Exploit on Ethereum (Trojan Coin Bricks Project Instructions). Available online: https://medium.com/@mikedeshazer/flash-loan-reentry-attack-and-dex-oracle-manipulation-exploit-on-ethereum-trojan-coin-bricks-7969820589d7 (accessed on 14 February 2021).

- Tarasov, A. Millions Lost: The Top 19 DeFi Cryptocurrency Hack of 2020. Available online: https://cryptobriefing.com/50-million-lost-the-top-19-defi-cryptocurrency-hacks-2020/ (accessed on 9 March 2021).

- Cao, Y.; Zou, C.; Cheng, X. Flashot: A Snapshot of Flash Loan Attack on DeFi Ecosystem. arXiv 2021, arXiv:2102.00626. [Google Scholar]

- Kain, W. Synthetix Response to Oracle Incident. Available online: https://blog.synthetix.io/response-to-oracle-incident/ (accessed on 21 March 2021).

- Davies, A. How to Audit a Smart Contract? A Guide. Available online: https://www.devteam.space/blog/how-to-audit-a-smart-contract-a-guide/ (accessed on 9 January 2021).

- Osato, A.-N. MakerDAO Takes New Measures to Prevent Another “Black Swan” Collapse. Available online: https://cointelegraph.com/news/makerdao-takes-new-measures-to-prevent-another-black-swan-collapse (accessed on 9 February 2021).

- Dramaliev, V. The 7 Biggest Threats to Decentralized Finance. Available online: https://www.trendingtopics.eu/the-7-biggest-threats-to-decentralized-finance-part-2/ (accessed on 3 January 2021).

- Swami, G. Managing MakerDAO Vault Liquidations with Notifications. Available online: https://www.covalenthq.com/blog/makerdao-liquidation-notifications/ (accessed on 12 February 2021).

- Breidenbach, L.; Cachin, C.; Coventry, A.; Ellis, S.; Juels, A.; Miller, A.; Magauran, B.; Nazarov, S.; Topliceanu, A.; Chan, B.; et al. Chainlink 2.0: Next Steps in the Evolution of Decentralized Oracle Networks. 2021, pp. 1–136. Available online: https://research.chain.link/whitepaper-v2.pdf (accessed on 7 April 2021).

- MINA Snarks and Snarky. Available online: https://docs.minaprotocol.com/en/snarks (accessed on 7 April 2021).

- Shapiro, E. HTTPS and Snapps: Bridging Cryptocurrency and the Real World. Available online: https://medium.com/minaprotocol/https-and-snapps-bridging-cryptocurrency-and-the-real-world-962beb21cf2b (accessed on 21 April 2021).

- Tellor Tellor: A Decentralized Oracle Network. Available online: https://docs.tellor.io/tellor/whitepaper/introduction (accessed on 29 March 2021).

- Curmi, A.; Inguanez, F. Blockchain Based Certificate Verification Platform; Springer International Publishing: Cham, Switzerland, 2019; Volume 339, ISBN 9783030048488. [Google Scholar]

- Bains, P.; Murarka, N. Bluzelle: A Decentralized Database for the Future; 2017; pp. 1–42. [Google Scholar]

- Edelstein, D. Bluzelle Reveals Decentralized Oracle to Enhance DeFi Project Security and Price Reliability. Available online: https://finance.yahoo.com/news/bluzelle-reveals-decentralized-oracle-enhance-132000129.html (accessed on 9 November 2020).

- Bluzelle Introducing Bluzelle Oracles. Available online: https://blog.bluzelle.com/introducing-bluzelle-oracles-6b06c547d830 (accessed on 12 November 2020).

- Bluzelle Bluzelle Oracles Update-Ryu Release. Available online: https://blog.bluzelle.com/bluzelle-oracles-update-ryu-release-41b0116796d1 (accessed on 4 July 2021).

| Database | Research String |

|---|---|

| Scopus | (TITLE-ABS-KEY (decentralized AND finance) AND ALL (oracle)) |

| Web of Science | (TS = (decentralized finance)) AND ALL = (oracle) |

| Title | Author | Year | Source |

|---|---|---|---|

| “Decentralizing finance using Decentralized Blockchain Oracles” | Kumar M., Nikhil, Singh R. | 2020 | International Conference for Emerging Technologies, 2020 |

| “Stablecoins 2.0: Economic Foundations and Risk-Based Models” | Klages-Mundt A., Harz D., Gudgeon L. | 2020 | Conference on Advances in Financial Technologies 2020 |

| “LoC—A new financial loan management system based on smart contracts” | Wang H., Guo C., Cheng S. | 2020 | Future Generation Computer Systems |

| “Improved Price Oracles: Constant Function Market Makers” | Angeris G., Chitra T. | 2020 | Conference on Advances in Financial Technologies 2020 |

| Database | Scopus | WoS | Google Scholar | Web Search |

|---|---|---|---|---|

| Initial Sample | 14 | 1 | 26 | 47 |

| Misplaced keywords | 3 | 0 | 6 | 19 |

| Off-topic | 5 | 1 | 7 | 5 |

| Non-English | 2 | 0 | 0 | 0 |

| Duplicates | 0 | 0 | 2 | 0 |

| Final Sample | 4 | 0 | 11 | 23 |

| Data Item | Description |

|---|---|

| Title | Title of the paper |

| Year | Time of Publication |

| Source Type | Academic Article or Grey Literature |

| Source Name | The name of the Site, Journal, or Proceedings |

| DeFi Applications | Discussed DeFi Applications |

| Applications type | Which application was described |

| DeFi Companies | Presented DeFi Projects |

| Risks and Attack vectors | Discussed risks connected with the use of oracles in DeFi |

| Issues with oracles | Discussed real incidents in DeFi connected with the use of oracles. |

| Oracle Providers | Described Oracle providers who operate in the DeFi Domain |

| Dimension | Name | Description | Mitigation | Challenges | Source |

|---|---|---|---|---|---|

| Technical | Malfunction | An unpredictable condition in which oracles provide biased data, although the source is reliable and trustworthy | Enable a consensus mechanism to include more oracles to spot faulty ones. | Bear the costs of multiple oracles and maintenance services. | Curran [23], Sun [8], Campbell [119], Harvey et al. [51] |

| Biased data | Despite the genuineness of the oracle design and its reliability, data are biased at their origin. | Query different data sources and monitor their reliability in time. | Find multiple but equally trusted data sources at an affordable price that remains provably honest. | Mlinaric [113], Jared [116], Omelchenko [76] | |

| Timeliness | The oracle provides trustworthy data but at an unwanted time. | Adapt the timeliness of the oracle to the specific application. Apply a dynamic fees model. | Lack of standards to understand the exact delay required for an oracle to be perceived as a good oracle. | Liu et al. [17], Kain [124], Lu [111], Eskandari et al. [63] | |

| Social | Sybil Schemes | Act of one or multiple entities to modify the governance of oracles for selfish purposes. | Decentralize the governance by ensuring a fairer distribution of voting power. Provide economic incentives. | Irrational behavior. Deliberate destruction of the platform. | Gudgeon et al. [107], Kelso [109], Zoltu [108] |

| Front Running | Exploit of the transparency of data fetched by oracles for selfish purposes. | Apply a Commit/Reveal scheme so that data are disclosed at the last time. Apply fees to counterbalance small deviations. | Reduce the transparency of oracles. Increase in the cost of service for customers. | Lu [111], Morselli [18] | |

| Selection Bias | Selection of an oracle whose scope is different from the one required by the application. | Select data feeds specifically created for the attended purposes. | Risk of centralization of power by the early players in the oracle industry. | Stevens [112], Kaleem and Shi [53], Gu et al. [32] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Caldarelli, G.; Ellul, J. The Blockchain Oracle Problem in Decentralized Finance—A Multivocal Approach. Appl. Sci. 2021, 11, 7572. https://doi.org/10.3390/app11167572

Caldarelli G, Ellul J. The Blockchain Oracle Problem in Decentralized Finance—A Multivocal Approach. Applied Sciences. 2021; 11(16):7572. https://doi.org/10.3390/app11167572

Chicago/Turabian StyleCaldarelli, Giulio, and Joshua Ellul. 2021. "The Blockchain Oracle Problem in Decentralized Finance—A Multivocal Approach" Applied Sciences 11, no. 16: 7572. https://doi.org/10.3390/app11167572

APA StyleCaldarelli, G., & Ellul, J. (2021). The Blockchain Oracle Problem in Decentralized Finance—A Multivocal Approach. Applied Sciences, 11(16), 7572. https://doi.org/10.3390/app11167572