Multiplicative Structural Decomposition Analysis of Spatial Differences in Energy Intensity among G20 Countries

Abstract

1. Introduction

2. Model and Data Description

2.1. Energy Intensity in I–O Frameworks

2.2. Multiplicative Decomposition of Aggregate Embodied Intensity

2.3. Data

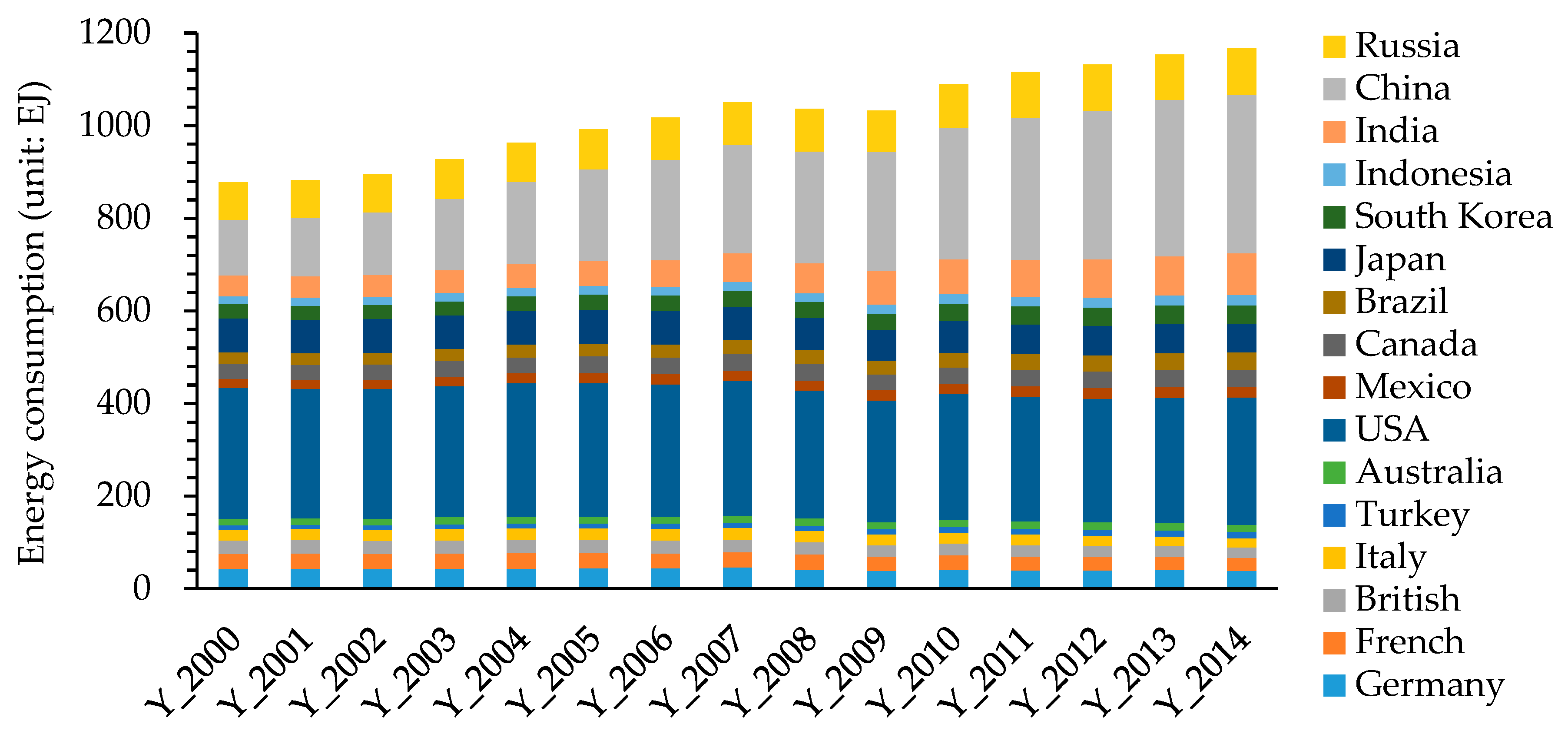

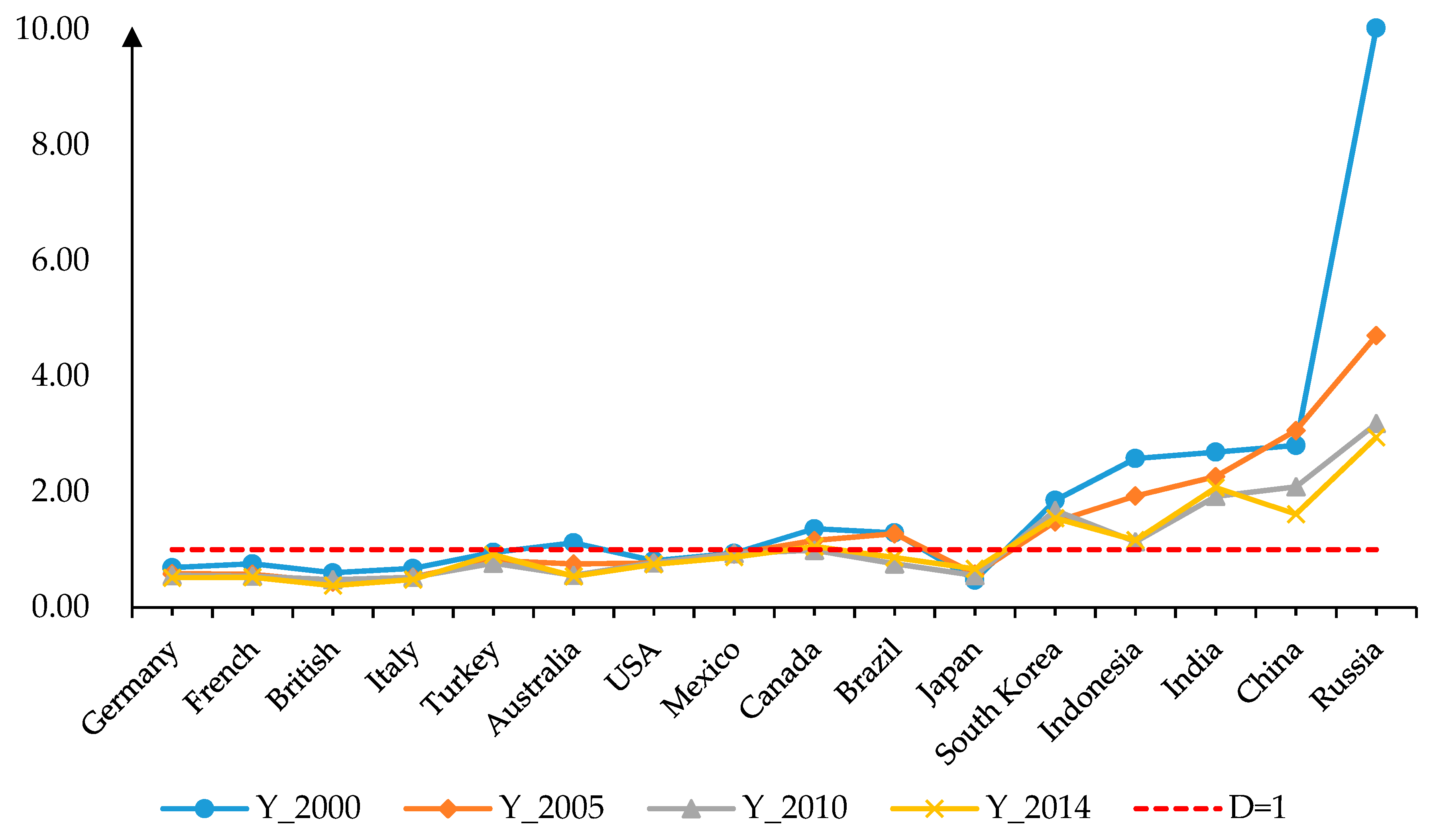

3. Differences in Energy Intensity and Sector Structure among the G20 Countries

4. Driving Factors of Spatial Differences in EEI

4.1. National Level

4.2. Theoretical Optimization of EEI

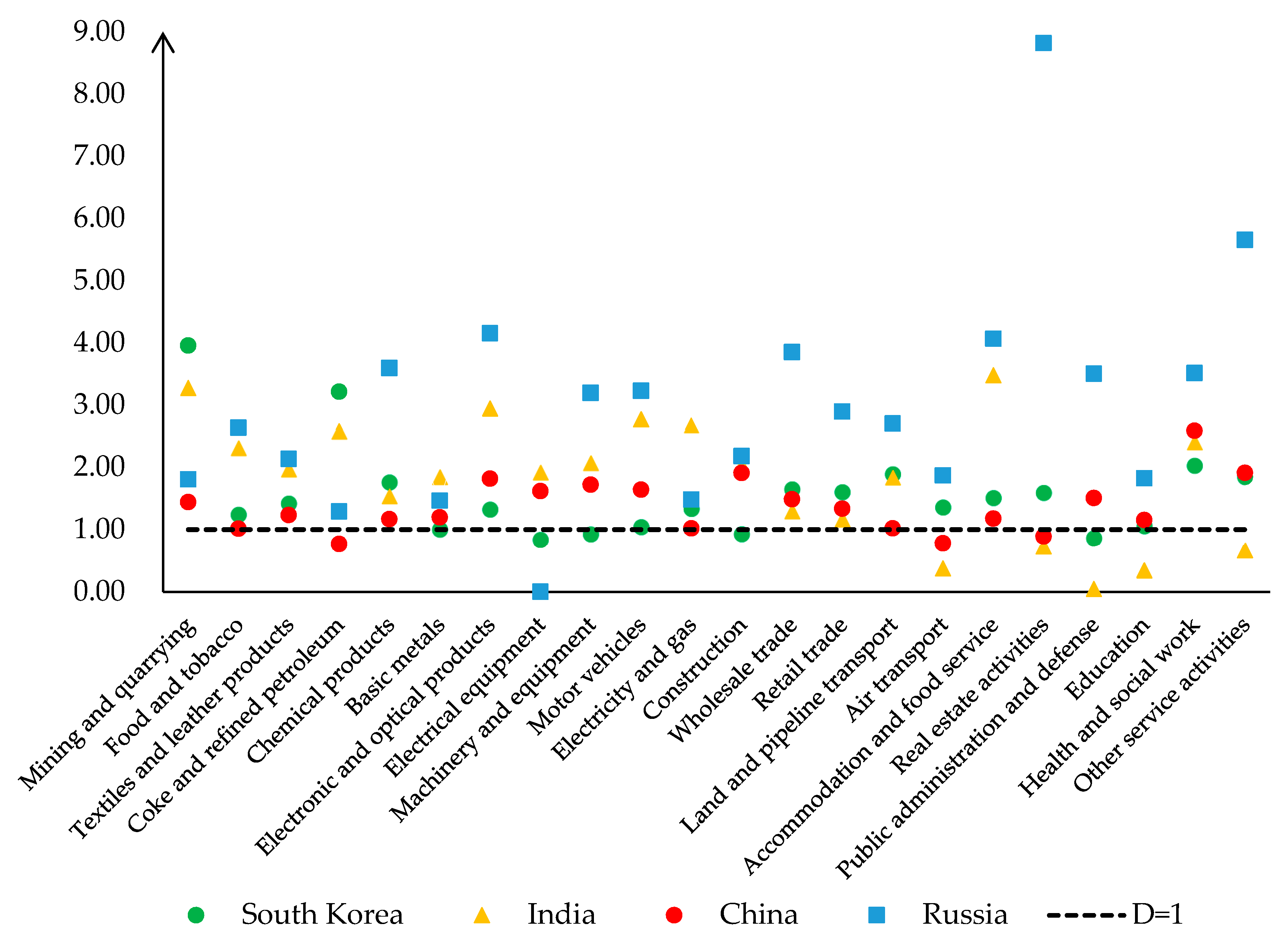

4.3. Sectoral Level

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Sector ID | Sector Name |

|---|---|

| A01 | Crop and animal production, hunting and related service activities |

| A02 | Forestry and logging |

| A03 | Fishing and aquaculture |

| B | Mining and quarrying |

| C10-C12 | Manufacture of food products, beverages and tobacco products |

| C13-C15 | Manufacture of textiles, wearing apparel and leather products |

| C16 | Manufacture of wood and of products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials |

| C17 | Manufacture of paper and paper products |

| C18 | Printing and reproduction of recorded media |

| C19 | Manufacture of coke and refined petroleum products |

| C20 | Manufacture of chemicals and chemical products |

| C21 | Manufacture of basic pharmaceutical products and pharmaceutical preparations |

| C22 | Manufacture of rubber and plastic products |

| C23 | Manufacture of other non-metallic mineral products |

| C24 | Manufacture of basic metals |

| C25 | Manufacture of fabricated metal products, except machinery and equipment |

| C26 | Manufacture of computer, electronic and optical products |

| C27 | Manufacture of electrical equipment |

| C28 | Manufacture of machinery and equipment n.e.c. |

| C29 | Manufacture of motor vehicles, trailers and semi-trailers |

| C30 | Manufacture of other transport equipment |

| C31-C32 | Manufacture of furniture; other manufacturing |

| C33 | Repair and installation of machinery and equipment |

| D35 | Electricity, gas, steam and air conditioning supply |

| E36 | Water collection, treatment and supply |

| E37-E39 | Sewerage; waste collection, treatment and disposal activities; materials recovery; remediation activities and other waste management services |

| F | Construction |

| G45 | Wholesale and retail trade and repair of motor vehicles and motorcycles |

| G46 | Wholesale trade, except of motor vehicles and motorcycles |

| G47 | Retail trade, except of motor vehicles and motorcycles |

| H49 | Land transport and transport via pipelines |

| H50 | Water transport |

| H51 | Air transport |

| H52 | Warehousing and support activities for transportation |

| H53 | Postal and courier activities |

| I | Accommodation and food service activities |

| J58 | Publishing activities |

| J59-J60 | Motion picture, video and television program production, sound recording and music publishing activities; programming and broadcasting activities |

| J61 | Telecommunications |

| J62-J63 | Computer programming, consultancy and related activities; information service activities |

| K64 | Financial service activities, except insurance and pension funding |

| K65 | Insurance, reinsurance and pension funding, except compulsory social security |

| K66 | Activities auxiliary to financial services and insurance activities |

| L68 | Real estate activities |

| M69-M70 | Legal and accounting activities; activities of head offices; management consultancy activities |

| M71 | Architectural and engineering activities; technical testing and analysis |

| M72 | Scientific research and development |

| M73 | Advertising and market research |

| M74-M75 | Other professional, scientific and technical activities; veterinary activities |

| N | Administrative and support service activities |

| O84 | Public administration and defense; compulsory social security |

| P85 | Education |

| Q | Human health and social work activities |

| R-S | Other service activities |

| T | Activities of households as employers; undifferentiated goods- and services-producing activities of households for own use |

| U | Activities of extraterritorial organizations and bodies |

| Number | Code | Number | Code |

|---|---|---|---|

| 1 | COAL_COKE_CRUDE | 7 | ISTE |

| 2 | JETFUEL | 8 | RENEWABLES_NUCLEAR |

| 3 | DIESEL | 9 | NATGAS |

| 4 | GASOLINE | 10 | OTHGAS |

| 5 | FUEL_OIL | 11 | ELECTR_HEATPROD |

| 6 | OTHPETRO | 12 | LIQUID_GASEOUS_BIOFUELS |

| Sector ID | Short Description | Detail Description |

|---|---|---|

| B | Mining and quarrying | Mining and quarrying |

| C10-C12 | Food and tobacco | Manufacture of food products, beverages and tobacco products |

| C13-C15 | Textiles and leather products | Manufacture of textiles, wearing apparel and leather products |

| C19 | Coke and refined petroleum | Manufacture of coke and refined petroleum products |

| C20 | Chemical products | Manufacture of chemicals and chemical products |

| C24 | Basic metals | Manufacture of basic metals |

| C26 | Electronic and optical products | Manufacture of computer, electronic and optical products |

| C27 | Electrical equipment | Manufacture of electrical equipment |

| C28 | Machinery and equipment | Manufacture of machinery and equipment n.e.c. |

| C29 | Motor vehicles | Manufacture of motor vehicles, trailers and semi-trailers |

| D35 | Electricity and gas | Electricity, gas, steam and air conditioning supply |

| F | Construction | Construction |

| G46 | Wholesale trade | Wholesale trade, except of motor vehicles and motorcycles |

| G47 | Retail trade | Retail trade, except of motor vehicles and motorcycles |

| H49 | Land and pipeline transport | Land transport and transport via pipelines |

| H51 | Air transport | Air transport |

| I | Accommodation and food service | Accommodation and food service activities |

| L68 | Real estate activities | Real estate activities |

| O84 | Public administration and defense | Public administration and defense; compulsory social security |

| P85 | Education | Education |

| Q | Health and social work | Human health and social work activities |

| R-S | Other service activities | Other service activities |

| Country | Sector ID |

|---|---|

| Australia | C33, M71, M72, M73, M74-M75, U |

| Brazil | C33, E37-E39, H53, K65, K66, M73, M74-M75, U |

| Canada | C33, E36, K66, T, U |

| China | C33, G45, J58, J59-J60, K66, M71, M73, T, U |

| Germany | U |

| French | U |

| British | U |

| Indonesia | C33, E37-E39, K66, M71, M72, M73, M74-M75, T, U |

| India | C33, E37-E39, H53, J58, J59-J60, K66, M72, M73, M74-M75, T, U |

| Italy | U |

| Japan | C33, K66, M69-M70, M71, U |

| South Korea | C33, T, U |

| Mexico | L68, M73 |

| Russia | A02, A03, C18, C21, C25, C27, C30, C33, E36, E37-E39, H53, J58, J59-J60, J62-J63, K65, K66, M69-M70, M71, M72, M73, M74-M75, T, U |

| Turkey | C21, C33, H53, J58, J59-J60, M69-M70, M71, M73, U |

| USA | U |

References

- Kanamura, T. Supply-side perspective for carbon pricing. Quant. Financ. Econ. 2019, 3, 109–123. [Google Scholar] [CrossRef]

- IEA. Energy Indicators for Sustainable Development: Guidelines and Methodologies; International Atomic Energy Agency: Vienna, Austria, 2005. [Google Scholar]

- World Bank. GDP at Current US Dollors. Available online: https://data.worldbank.org (accessed on 25 December 2018).

- Petroleum, B. BP Statistical Review of World Energy Report; BP: London, UK, 2019. [Google Scholar]

- Ang, B.W.; Mu, A.; Zhou, P. Accounting frameworks for tracking energy efficiency trends. Energy Econ. 2010, 32, 1209–1219. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W. Structural decomposition analysis applied to energy and emissions: Some methodological developments. Energy Econ. 2012, 34, 177–188. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W. Multiplicative decomposition of aggregate carbon intensity change using input–output analysis. Appl. Energy 2015, 154, 13–20. [Google Scholar] [CrossRef]

- Ma, C.; Stern, D.I. China’s changing energy intensity trend: A decomposition analysis. Energy Econ. 2008, 30, 1037–1053. [Google Scholar] [CrossRef]

- Zhao, X.; Ma, C.; Hong, D. Why did China’s energy intensity increase during 1998–2006: Decomposition and policy analysis. Energy Policy 2010, 38, 1379–1388. [Google Scholar] [CrossRef]

- Choi, K.H.; Ang, B. Attribution of changes in Divisia real energy intensity index—An extension to index decomposition analysis. Energy Econ. 2012, 34, 171–176. [Google Scholar] [CrossRef]

- González, P.F.; Landajo, M.; Presno, M. The Divisia real energy intensity indices: Evolution and attribution of percent changes in 20 European countries from 1995 to 2010. Energy 2013, 58, 340–349. [Google Scholar] [CrossRef]

- González, P.F.; Landajo, M.; Presno, M. Multilevel LMDI decomposition of changes in aggregate energy consumption. A cross country analysis in the EU-27. Energy Policy 2014, 68, 576–584. [Google Scholar] [CrossRef]

- Voigt, S.; De Cian, E.; Schymura, M.; Verdolini, E. Energy intensity developments in 40 major economies: Structural change or technology improvement? Energy Econ. 2014, 41, 47–62. [Google Scholar] [CrossRef]

- Ang, B.W. LMDI decomposition approach: A guide for implementation. Energy Policy 2015, 86, 233–238. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W. Multiplicative structural decomposition analysis of aggregate embodied energy and emission intensities. Energy Econ. 2017, 65, 137–147. [Google Scholar] [CrossRef]

- Dietzenbacher, E.; Hoen, A.R.; Los, B. Labor productivity in Western Europe 1975–1985: An intercountry, interindustry analysis. J. Reg. Sci. 2000, 40, 425–452. [Google Scholar] [CrossRef]

- Lin, B.; Du, K. Decomposing energy intensity change: A combination of index decomposition analysis and production-theoretical decomposition analysis. Appl. Energy 2014, 129, 158–165. [Google Scholar] [CrossRef]

- Wang, J.; Hu, M.; Rodrigues, J.F. The evolution and driving forces of industrial aggregate energy intensity in China: An extended decomposition analysis. Appl. Energy 2018, 228, 2195–2206. [Google Scholar] [CrossRef]

- Hoekstra, R.; Van den Bergh, J.C. Comparing structural decomposition analysis and index. Energy Econ. 2003, 25, 39–64. [Google Scholar] [CrossRef]

- Wang, H.; Ang, B.; Su, B. Multiplicative structural decomposition analysis of energy and emission intensities: Some methodological issues. Energy 2017, 123, 47–63. [Google Scholar] [CrossRef]

- Zeng, L.; Xu, M.; Liang, S.; Zeng, S.; Zhang, T. Revisiting drivers of energy intensity in China during 1997–2007: A structural decomposition analysis. Energy Policy 2014, 67, 640–647. [Google Scholar] [CrossRef]

- Ang, B.W.; Liu, F.; Chung, H.S. A generalized Fisher index approach to energy decomposition analysis. Energy Econ. 2004, 26, 757–763. [Google Scholar] [CrossRef]

- Su, B.; Ang, B. Attribution of changes in the generalized Fisher index with application to embodied emission studies. Energy 2014, 69, 778–786. [Google Scholar] [CrossRef]

- Su, B.; Ang, B. Multi-region comparisons of emission performance: The structural decomposition analysis approach. Ecol. Indic. 2016, 67, 78–87. [Google Scholar] [CrossRef]

- Zhou, X.; Zhou, D.; Wang, Q. How does information and communication technology affect China’s energy intensity? A three-tier structural decomposition analysis. Energy 2018, 151, 748–759. [Google Scholar] [CrossRef]

- Wiedmann, T.; Lenzen, M.; Turner, K.; Barrett, J. Examining the global environmental impact of regional consumption activities—Part 2: Review of input–output models for the assessment of environmental impacts embodied in trade. Ecol. Econ. 2007, 61, 15–26. [Google Scholar] [CrossRef]

- Sato, M. Embodied carbon in trade: A survey of the empirical literature. J. Econ. Surv. 2014, 28, 831–861. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhao, Y.; Su, B.; Zhang, Y.; Wang, S.; Liu, Y.; Li, H. Embodied carbon in China’s foreign trade: An online SCI-E and SSCI based literature review. Renew. Sustain. Energy Rev. 2017, 68, 492–510. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W. Input–output analysis of CO2 emissions embodied in trade: Competitive versus non-competitive imports. Energy Policy 2013, 56, 83–87. [Google Scholar] [CrossRef]

- Timmer, M.P.; Dietzenbacher, E.; Los, B.; Stehrer, R.; De Vries, G.J. An illustrated user guide to the world input–output database: The case of global automotive production. Rev. Int. Econ. 2015, 23, 575–605. [Google Scholar] [CrossRef]

- Ang, B.W.; Choi, K.H. Decomposition of aggregate energy and gas emission intensities for industry: A refined Divisia index method. Energy J. 1997, 18, 59–73. [Google Scholar] [CrossRef]

- Ang, B.W.; Zhang, F.Q.; Choi, K.H. Factorizing changes in energy and environmental indicators through decomposition. Energy 1998, 23, 489–495. [Google Scholar] [CrossRef]

| Country | ||||

|---|---|---|---|---|

| Germany | 0.51 | 0.87 | 0.51 | 1.17 |

| French | 0.52 | 1.39 | 0.40 | 0.95 |

| British | 0.38 | 0.79 | 0.56 | 0.85 |

| Italy | 0.48 | 1.49 | 0.33 | 0.98 |

| Turkey | 0.92 | 0.99 | 0.84 | 1.11 |

| Australia | 0.55 | 0.81 | 0.77 | 0.88 |

| USA | 0.75 | 0.85 | 1.00 | 0.87 |

| Mexico | 0.88 | 0.92 | 0.90 | 1.07 |

| Canada | 1.06 | 1.16 | 0.87 | 1.04 |

| Brazil | 0.87 | 1.00 | 0.84 | 1.03 |

| Japan | 0.67 | 0.79 | 0.91 | 0.93 |

| South Korea | 1.61 | 1.5 | 0.80 | 1.34 |

| Indonesia | 1.17 | 0.81 | 1.14 | 1.27 |

| India | 2.08 | 2.13 | 0.79 | 1.24 |

| China | 1.62 | 1.16 | 1.26 | 1.11 |

| Russia | 2.99 | 1.55 | 1.63 | 1.19 |

| Country | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| Canada | 0.81 | 2.38 | −2.58 | 0.66 |

| South Korea | 7.67 | 6.76 | −5.07 | 5.15 |

| Indonesia | 1.47 | −2.34 | 1.23 | 2.12 |

| India | 21.24 | 21.64 | −10.84 | 7.90 |

| China | 62.75 | 22.56 | 33.75 | 16.21 |

| Russia | 31.94 | 16.98 | 18.50 | 7.64 |

| Short Description | Russia | |||

|---|---|---|---|---|

| Real estate activities | 8.81 | 2.19 | 4.02 | 3.89 |

| Wholesale trade | 3.85 | 1.51 | 2.54 | 9.5 |

| Health and social work | 3.51 | 1.7 | 2.07 | 5.94 |

| Public administration and defense | 3.5 | 1.5 | 2.33 | 7.66 |

| Retail trade | 2.9 | 1.53 | 1.89 | 4.04 |

| Land and pipeline transport | 2.71 | 1.61 | 1.68 | 4.56 |

| Food and tobacco | 2.64 | 1.67 | 1.58 | 5.38 |

| Construction | 2.18 | 1.49 | 1.46 | 11.64 |

| Education | 1.82 | 1.17 | 1.55 | 3.93 |

| Mining and quarrying | 1.81 | 1.49 | 1.21 | 10.02 |

| Coke and refined petroleum | 1.29 | 0.9 | 1.43 | 3 |

| Other service activities | 5.65 | 1.92 | 2.95 | 1.6 |

| Electronic and optical products | 4.15 | 1.83 | 2.27 | 0.73 |

| Accommodation and food service | 4.06 | 1.73 | 2.34 | 1.08 |

| Chemical products | 3.6 | 3.02 | 1.19 | 1.72 |

| Motor vehicles | 3.23 | 1.85 | 1.75 | 2.14 |

| Machinery and equipment | 3.2 | 1.74 | 1.83 | 1.75 |

| Textiles and leather products | 2.13 | 1.78 | 1.2 | 0.56 |

| Air transport | 1.87 | 1.27 | 1.48 | 0.49 |

| Electricity and gas | 1.48 | 1.85 | 0.8 | 1.06 |

| Basic metals | 1.46 | 1.3 | 1.12 | 2.35 |

| Electrical equipment | 0 | 0 | 0 | 0 |

| The percentage of of key industries in total industry | 83.06 | |||

| Short Description | China | |||

|---|---|---|---|---|

| Health and social work | 2.59 | 1.46 | 1.77 | 4.41 |

| Construction | 1.91 | 1.18 | 1.61 | 23.7 |

| Electronic and optical products | 1.82 | 1.21 | 1.5 | 5.49 |

| Machinery and equipment | 1.72 | 1.22 | 1.41 | 4.66 |

| Motor vehicles | 1.64 | 1.21 | 1.36 | 4.57 |

| Electrical equipment | 1.62 | 1.23 | 1.32 | 3.3 |

| Public administration and defense | 1.51 | 1.19 | 1.26 | 6.09 |

| Wholesale trade | 1.49 | 1.19 | 1.25 | 3.84 |

| Textiles and leather products | 1.23 | 1.14 | 1.09 | 4.08 |

| Education | 1.15 | 0.9 | 1.28 | 4.55 |

| Other service activities | 1.91 | 1.35 | 1.41 | 2 |

| Mining and quarrying | 1.44 | 1.09 | 1.32 | 0.23 |

| Retail trade | 1.34 | 1.12 | 1.2 | 0.79 |

| Basic metals | 1.2 | 1.24 | 0.96 | 0.86 |

| Accommodation and food service | 1.18 | 1.05 | 1.12 | 2.03 |

| Chemical products | 1.17 | 1.16 | 1.01 | 1.06 |

| Electricity and gas | 1.02 | 1.37 | 0.74 | 0.56 |

| Land and pipeline transport | 1.02 | 0.95 | 1.07 | 1.06 |

| Food and tobacco | 1.01 | 1.01 | 1 | 6.12 |

| Real estate activities | 0.89 | 1.2 | 0.74 | 4.03 |

| Air transport | 0.78 | 0.72 | 1.09 | 0.23 |

| Coke and refined petroleum | 0.77 | 1 | 0.77 | 0.57 |

| The percentage of of key industries in total industry | 84.25 | |||

| Short Description | India | |||

|---|---|---|---|---|

| Motor vehicles | 2.77 | 2.3 | 1.21 | 3.1 |

| Coke and refined petroleum | 2.58 | 2.09 | 1.24 | 3.63 |

| Food and tobacco | 2.31 | 2.89 | 0.8 | 6.23 |

| Construction | 2.03 | 2.37 | 0.86 | 12.68 |

| Textiles and leather products | 1.97 | 2.12 | 0.93 | 4.63 |

| Land and pipeline transport | 1.84 | 1.81 | 1.02 | 6.22 |

| Wholesale trade | 1.3 | 1.99 | 0.65 | 3.01 |

| Retail trade | 1.17 | 1.78 | 0.65 | 4.91 |

| Accommodation and food service | 3.47 | 3.79 | 0.92 | 2.15 |

| Mining and quarrying | 3.27 | 3.8 | 0.86 | 0.33 |

| Electronic and optical products | 2.94 | 2.32 | 1.27 | 0.59 |

| Electricity and gas | 2.68 | 2.4 | 1.12 | 0.52 |

| Health and social work | 2.4 | 1.91 | 1.26 | 1.92 |

| Machinery and equipment | 2.07 | 2.23 | 0.93 | 1.69 |

| Electrical equipment | 1.92 | 2.23 | 0.86 | 1.06 |

| Basic metals | 1.85 | 2.25 | 0.82 | 2.26 |

| Chemical products | 1.54 | 1.88 | 0.82 | 1.77 |

| Real estate activities | 0.73 | 2.17 | 0.33 | 5.72 |

| Other service activities | 0.67 | 1.5 | 0.44 | 1.89 |

| Air transport | 0.38 | 0.63 | 0.6 | 0.2 |

| Education | 0.34 | 0.74 | 0.47 | 3.75 |

| Public administration and defense | 0.04 | 0.51 | 0.09 | 5.85 |

| The percentage of of key industries in total industry | 74.13 | |||

| Short Description | South Korea | |||

|---|---|---|---|---|

| Coke and refined petroleum | 3.22 | 2.44 | 1.32 | 3.34 |

| Health and social work | 2.03 | 1.49 | 1.36 | 5.36 |

| Chemical products | 1.76 | 1.6 | 1.1 | 3.76 |

| Real estate activities | 1.59 | 1.5 | 1.06 | 5.19 |

| Electronic and optical products | 1.33 | 1.39 | 0.95 | 11.1 |

| Mining and quarrying | 3.96 | 4.34 | 0.91 | −0.03 |

| Land and pipeline transport | 1.89 | 1.96 | 0.96 | 1.26 |

| Other service activities | 1.85 | 1.43 | 1.29 | 2.76 |

| Wholesale trade | 1.65 | 1.57 | 1.05 | 2.07 |

| Retail trade | 1.6 | 1.43 | 1.12 | 2.68 |

| Accommodation and food service | 1.51 | 1.41 | 1.07 | 2.32 |

| Textiles and leather products | 1.42 | 1.29 | 1.1 | 2.16 |

| Air transport | 1.36 | 1.59 | 0.85 | 0.54 |

| Electricity and gas | 1.34 | 1.13 | 1.19 | 1.15 |

| Food and tobacco | 1.24 | 1.34 | 0.93 | 2.64 |

| Education | 1.06 | 0.93 | 1.13 | 5.23 |

| Motor vehicles | 1.04 | 1.27 | 0.82 | 5.46 |

| Basic metals | 1 | 1.01 | 1 | 2.01 |

| Construction | 0.93 | 1.31 | 0.71 | 9.92 |

| Machinery and equipment | 0.92 | 1.17 | 0.79 | 3.53 |

| Public administration and defense | 0.86 | 1.32 | 0.65 | 7.14 |

| Electrical equipment | 0.84 | 1.22 | 0.68 | 1.86 |

| The percentage of of key industries in total industry | 81.46 | |||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Sun, M.; Xie, R.; Chen, X. Multiplicative Structural Decomposition Analysis of Spatial Differences in Energy Intensity among G20 Countries. Appl. Sci. 2020, 10, 2832. https://doi.org/10.3390/app10082832

Wang Y, Sun M, Xie R, Chen X. Multiplicative Structural Decomposition Analysis of Spatial Differences in Energy Intensity among G20 Countries. Applied Sciences. 2020; 10(8):2832. https://doi.org/10.3390/app10082832

Chicago/Turabian StyleWang, Yang, Meng Sun, Rui Xie, and Xiangjie Chen. 2020. "Multiplicative Structural Decomposition Analysis of Spatial Differences in Energy Intensity among G20 Countries" Applied Sciences 10, no. 8: 2832. https://doi.org/10.3390/app10082832

APA StyleWang, Y., Sun, M., Xie, R., & Chen, X. (2020). Multiplicative Structural Decomposition Analysis of Spatial Differences in Energy Intensity among G20 Countries. Applied Sciences, 10(8), 2832. https://doi.org/10.3390/app10082832