1. Introduction

The role of Chief Executive Officers (CEOs) in shaping firm performance remains a central concern in corporate governance and strategic management research. According to Upper Echelons Theory, organisational outcomes are partially predicted by the backgrounds, experiences, and values of top executives (

Hambrick & Mason, 1984;

Hambrick, 2007). As the apex decision-makers, CEOs are instrumental in setting the corporate direction, allocating resources, and influencing strategic choices, all of which directly affect firm performance (

Abatecola & Cristofaro, 2020;

Naseem et al., 2020). As firms face increasing complexity and stakeholder scrutiny, understanding which CEO traits matter most, and under what conditions, has become an academic and practical imperative. Prior research has examined various CEO attributes, including age, gender, tenure, founder status, education, and appointment origin, as potential predictors of financial performance. For example, tenure may reflect accumulated firm-specific knowledge, yet prolonged tenure may also lead to entrenchment and strategic rigidity (

James et al., 2025;

Chikunda et al., 2025). Similarly, gender diversity in top leadership has been linked to improved decision-making and stakeholder engagement (

Cook & Glass, 2014;

Post & Byron, 2015). However, the effects of these traits are context-dependent and often influenced by the institutional, cultural, and regulatory environments in which firms operate (

Kaur & Singh, 2019;

Zhou et al., 2020).

Despite a growing body of literature, two significant gaps persist. First, most existing studies rely on traditional econometric models and fail to assess the relative importance of CEO characteristics in predicting firm outcomes. As a result, it remains unclear as to which attributes are most influential in driving performance. Second, few studies offer a comparative, cross-national perspective, particularly contrasting CEO effects in emerging versus developed economies. This is a critical omission, as institutional voids, governance structures, and investor expectations differ markedly across these contexts (

Khanna & Palepu, 2010;

Matanda et al., 2023). For instance, regulatory environments differ between emerging and developed economies, affecting CEO effectiveness and governance outcomes. Developed markets typically operate under strong legal and regulatory frameworks, well-established investor protection mechanisms, and transparent corporate governance codes (

La Porta et al., 1998;

Natto & Mokoaleli-Mokoteli, 2025). These conditions minimise agency problems and offer CEOs more structured accountability (

La Porta et al., 1998).

In contrast, emerging markets are characterised by weaker institutions, limited enforcement of shareholder rights, concentrated ownership, and greater information asymmetry (

Aguilera & Jackson, 2010;

Refakar & Ravaonorohanta, 2020). These contextual differences shape how CEO traits translate into firm performance. For instance, leadership qualities such as founder status or internal appointment may carry more weight in emerging economies where firms rely more heavily on relational governance and trust-based leadership (

Natto & Mokoaleli-Mokoteli, 2025). Conversely, formal governance structures in developed markets may diminish the relative influence of individual CEO traits. This institutional divergence justifies a comparative analysis, as the same executive characteristics may have divergent performance implications depending on the surrounding governance ecosystem. To address these gaps, this study investigates the influence of CEO characteristics—specifically age, tenure, gender, founder status, and internal appointment—on firm financial performance using a large panel dataset of publicly listed firms from emerging and developed markets.

We employ a hybrid methodology: panel regression models are used for inferential analysis. In contrast, random forest and XGBoost machine learning models are employed to rank CEO traits by predictive importance. In doing so, we contribute to a growing literature that integrates traditional theory-driven approaches with data analytics in governance (

Schneider & Brühl, 2023;

Sun et al., 2024). Our findings reveal that CEO tenure is the most consistent and positive predictor of firm performance, particularly for return on assets and equity. Conversely, CEO age and founder status are negatively associated with performance. While the presence of female CEOs shows limited significance in baseline models, interaction effects indicate a positive valuation effect in emerging markets. Across all models, firm-level attributes such as size and leverage outperform CEO traits in predictive importance, especially in machine learning feature rankings. This study provides practical contributions by providing stakeholders with an evidence-based framework to prioritise executive characteristics in recruitment, succession planning, and governance reform. It provides a detailed cross-country analysis that advances our understanding of the boundary conditions under which CEO characteristics influence firm outcomes.

The rest of this study is structured as follows.

Section 2 reviews the relevant literature on CEO characteristics and firm performance, highlighting theoretical foundations and empirical gaps in the literature.

Section 3 outlines the data sources, variable construction, and methodological approach, including panel regression models and machine learning techniques.

Section 4 presents the empirical results, comparing findings across econometric and ML models, and examines the moderating role of institutional context.

Section 5 discusses the theoretical, practical, and policy implications of the findings. Finally,

Section 6 concludes with a summary of key insights, study limitations, and directions for future research.

2. Literature Review

2.1. Upper Echelons Theory and CEO Performance Influence

This study is grounded in Upper Echelons Theory (UET), which was initially developed by

Hambrick and Mason (

1984). It posits that an organisation’s strategic choices, performance, and firm-level outcomes are partially shaped by its top executives’ observable characteristics and cognitive biases. The central premise is that executives interpret and act upon strategic situations through personal experiences, values, and demographics. As a result, CEO-level traits serve as proxies for decision-making patterns that ultimately affect firm-level outcomes (

Peni, 2014;

Zhou et al., 2020). In this context, characteristics such as age, tenure, gender, founder status, and appointment origin are not merely demographic descriptors; they signal deep-seated preferences, leadership tendencies, and strategic orientations that influence firm performance (

Zhou et al., 2020;

Nguyen et al., 2023). For instance, younger CEOs may favour innovation and strategic risk-taking, whereas longer-tenured CEOs may exercise greater operational control or demonstrate signs of entrenchment.

Similarly, a founder-CEO may prioritise long-term growth over short-term financial gains, while internally promoted CEOs might favour continuity over disruption. This theoretical framework justifies selecting and analysing specific CEO attributes as predictors of firm outcomes. However, while UET explains why CEO traits matter, it does not tell us which traits matter most, or whether their effects vary systematically across institutional contexts. This is where our contribution lies. We move beyond traditional significance testing by integrating UET with machine learning feature importance models (random forest and XGBoost). Instead, we offer a ranked evaluation of CEO traits in shaping firm performance. This addresses the limitations regarding trait comparability and relative influence. Thus, the theoretical foundation of this work motivates our focus on CEO traits and supports our methodological approach, linking the cognitive and demographic framing of leadership to data-driven prioritisation of performance determinants.

2.2. CEO Age and Tenure

CEO age is often a proxy for risk aversion, experience, and cognitive rigidity (

Mukherjee & Sen, 2022). According to the authors, older CEOs may possess deep industry knowledge but could be less responsive to change, particularly in fast-evolving industries where strategic agility is essential. Tenure, meanwhile, reflects the CEO’s embeddedness and familiarity with firm operations. Several studies have shown that longer tenure can enhance firm performance through accumulated firm-specific knowledge and stakeholder trust (

James et al., 2025), while others warn of diminishing returns due to strategic rigidity or managerial entrenchment (

Chikunda et al., 2025). Recent research from emerging markets suggests that these relationships are context-sensitive. For example,

Zhou et al. (

2020) find that tenure nonlinearly affects performance in East Asian markets.

Kaur and Singh (

2019) show a negative association between long-tenured CEOs and performance in Indian firms.

2.3. Gender and Diversity in CEO Roles

Gender diversity in executive leadership has gained increasing attention in recent corporate governance debates. Female CEOs are argued to bring unique perspectives, collaborative leadership styles, and greater ethical sensitivity, all of which can influence firm performance and stakeholder perceptions (

Cook & Glass, 2014;

Post & Byron, 2015). BlackRock’s report in 2023 shows that companies led by women outperform their peers in terms of Return on Assets (ROA), although female CEO representation remains low globally (

Lawson et al., 2023). Regional and cultural contexts may also moderate the effect of gender on performance. For instance,

Amin et al. (

2024) find that female CEOs in Southeast Asia are positively associated with firm internationalisation. Similarly, emerging market firms may experience stronger capital market reactions to gender diversity due to their perceived alignment with global governance standards. Importantly, gender in executive roles may not act independently but in interaction with other institutional or firm-specific variables, such as firm size, ownership structure, and market expectations. Our study addresses this gap by exploring interaction effects in regression analysis and assesses the predictive importance of gender in our ML models. This allows us to clarify whether gender acts as a core performance driver or as a context-sensitive signal.

2.4. Research Gap and Contribution

While existing literature has established that CEO characteristics can influence firm performance, it has yet to provide a clear understanding of which traits matter most. Prior studies rely on traditional regression models that test for statistical significance without offering comparative insights into the relative influence of different CEO attributes. As a result, there remains a key gap in understanding how firms can prioritise specific executive traits when making leadership decisions that align with strategic and financial goals. This study addresses that gap by evaluating CEO performance influence through traditional econometric methods and machine learning-based feature importance models (random forest and XGBoost). This dual-method approach allows us to move beyond binary notions of significance and instead rank CEO attributes based on their predictive power across multiple financial outcomes—specifically, Return on Assets (ROA), Return on Equity (ROE), and market-to-book ratio.

Our main contribution lies in providing a performance-based ranking of CEO characteristics, which equips decision-makers with evidence on which traits are most closely associated with superior firm outcomes. For example, if CEO tenure or founder status emerges as a top predictor, firms operating in volatile or growth-oriented environments may value leadership continuity or entrepreneurial vision more. Conversely, if gender or internal appointment prove less influential, these traits may be assigned a lower weight in performance-based leadership selection. This ranking-based approach opens new avenues for tailoring CEO profiles to strategic objectives, enabling boards and shareholders to align executive appointments with desired financial outcomes. Furthermore, the transparency and replicability of machine learning feature importance techniques can enhance boardroom decision-making, support evidence-based succession planning, and contribute to merit-based executive pipelines. Our contribution prioritises executive traits according to their actual performance impact rather than relying solely on theoretical or significance-based assumptions.

3. Methodology

This study adopts a two-stage methodological approach combining econometric analysis with machine learning (ML) techniques to assess and prioritise the influence of CEO characteristics and firm-specific factors on corporate performance. The objective is to examine whether CEO attributes matter and determine which attributes are most influential across a large panel of firms. In addition to traditional econometric modelling, this study incorporates machine learning (ML) techniques to rank the relative importance of CEO traits in explaining firm performance outcomes. ML models are well-suited for evaluating the relative importance of CEO and firm-level features because they can detect complex, nonlinear relationships without prior functional form assumptions. Furthermore, using feature importance scores allows us to rank CEO characteristics in terms of their contribution to predictive accuracy, providing insights for executive assessment and succession planning.

3.1. Data Sources and Variable Description

The dataset consists of a panel of publicly listed firms from multiple countries between 2012 and 2020, extracted from Bloomberg. It includes variables on CEO characteristics, firm financials, governance indicators, and macroeconomic classifications (emerging vs. developed economies). Firms were included based on the availability of complete information on financial performance metrics and CEO characteristics. Specifically, the inclusion criteria required firms to have non-missing values for at least one of the dependent variables—Return on Assets (ROA), Return on Equity (ROE), and Market-to-Book Ratio (MBR)—as well as for the key CEO attributes under investigation. We use three financial indicators—Return on Assets (ROA), Return on Equity (ROE), and Market-to-Book Tatio (MTB)—to proxy for firm performance. These variables are the dependent variables. ROA reflects a firm’s operational efficiency and ability to generate profit from assets under management. ROE captures the profitability relative to the equity base and is a key indicator of financial performance from the shareholder’s perspective.

The MTB ratio is a market-based performance indicator, reflecting investor expectations and the firm’s future growth prospects. Each of these performance indicators provide a distinct yet complementary perspective on firm outcomes: accounting-based efficiency (ROA), shareholder return (ROE), and market-based valuation (MTB). All three are treated as continuous variables and winsorised at the 1st and 99th percentiles to mitigate the influence of extreme outliers. The independent variables are grouped into CEO characteristics and firm-level controls. CEO Characteristics include the CEO’s age at the end of the fiscal year, measured in years. Tenure measures the number of years the individual has held the CEO position in the firm. Tenure captures accumulated firm-specific leadership experience. Gender is a binary variable coded as 1 if the CEO is female and 0 if male. Founder status is a binary variable coded as 1 if the CEO is also a founder or co-founder of the firm and 0 otherwise. This reflects potential entrepreneurial orientation. And internal appointment is a binary indicator set to 1 if the CEO was promoted from within the firm and 0 if appointed externally. This variable distinguishes between continuity-oriented and change-oriented leadership trajectories.

Four key control variables are included in the models to account for firm-specific heterogeneity and isolate the effects of CEO attributes on performance. Firm size, measured as the natural logarithm of total assets, is a proxy for scale effects and operational capacity. Larger firms may have more diversified operations, greater resource access, and more robust internal governance mechanisms, which can influence financial performance outcomes. Board independence is included to reflect corporate governance quality, measured as the proportion of independent non-executive directors on the board. Financial leverage, calculated as the ratio of total debt to total assets, captures the firm’s capital structure and exposure to financial risk. Firms with higher leverage may face greater pressure to perform or, conversely, encounter financial constraints that limit strategic flexibility. Emerging market status is a moderating variable. A binary indicator distinguishes between firms operating in emerging economies (coded as 1) and those in developed markets (coded as 0). While this study does not directly test institutional theory, this variable enables the examination of whether the importance of CEO characteristics differs systematically across different economic structures.

Table 1 provides a summary of variables description and unit of measurements.

3.2. Descriptive Statistics and Correlation Matrix

Table 2 presents the descriptive statistics for the key variables used in this study. The sample comprises 18,635 firm-year observations. The average CEO age is approximately 56 years, with a mean of 55 years and a standard deviation (SD) of 7.19. The average CEO tenure is approximately 6 years, with an SD of 6.57. Female representation in CEO roles is low (mean = 0.04), aligning with global concerns about gender imbalance in executive leadership (

Post & Byron, 2015). Similarly, only 5% of CEOs in the sample are founders of their firms. Approximately 61% of CEOs are internally appointed, while board independence averages 57%, with some firms having as few as zero and others up to seven independent directors. Firm size (measured as the log of total assets) averages 11.36 with modest dispersion (SD = 2.83), and financial leverage has a mean of 4.64. Regarding firm performance, ROA and ROE average 5.94% and 15.09%, respectively, with standard deviations reflecting considerable variability. The market-to-book ratio has a mean of 9.31 and ranges from −2.86 to 33.63, suggesting the presence of undervalued and highly valued firms in the sample. We employed robust standard errors in the regression models to account for the significant variations in the dataset. The descriptive statistics confirm the presence of substantial cross-sectional heterogeneity in leadership attributes and firm outcomes. These variations justify using panel data methods (to account for unobserved firm effects) and machine learning models (to explore non-linear and interaction effects). They also suggest that characteristics such as gender and founder status are relatively rare, possibly limiting their statistical power in standard models but warranting inclusion for theoretical and contextual significance.

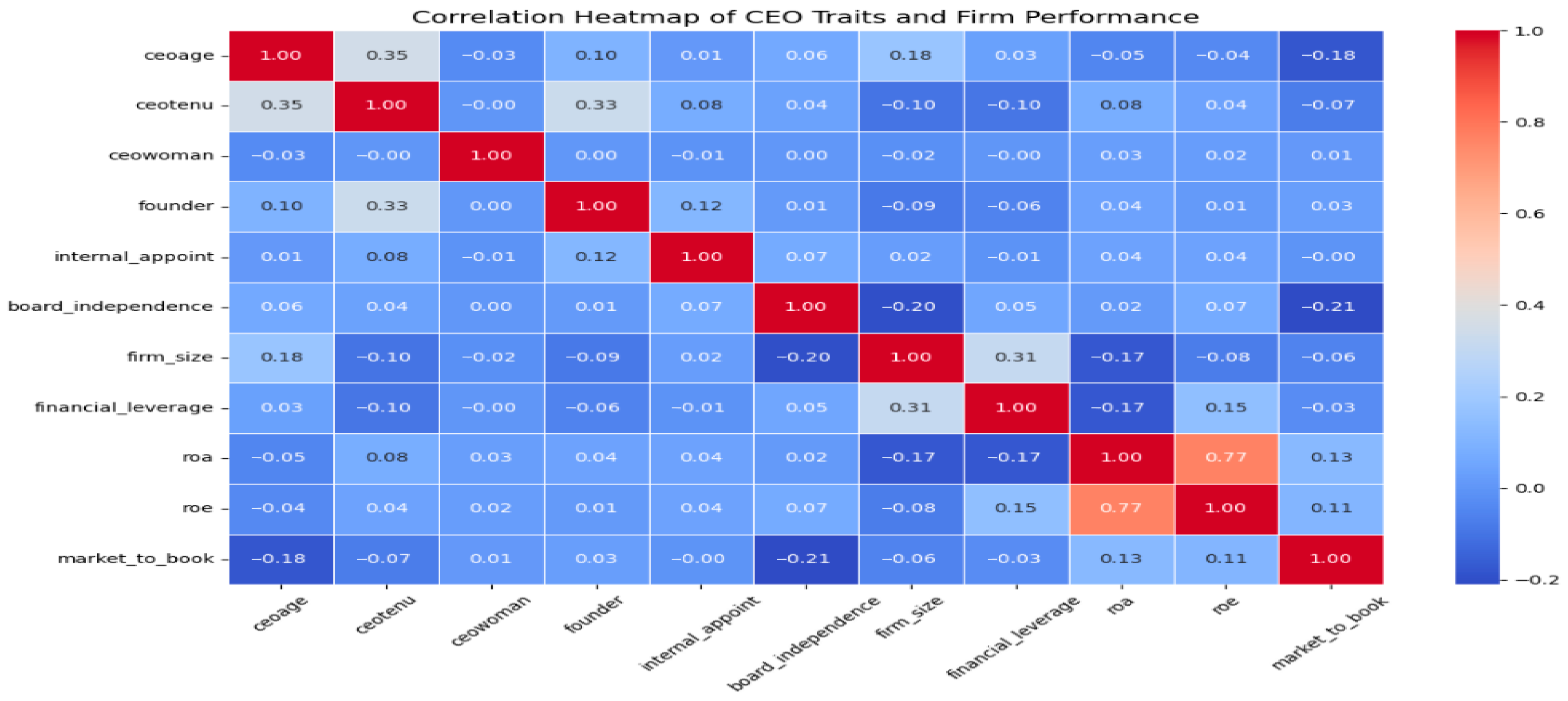

The correlation heatmap in

Figure 1 reveals that multicollinearity is not a significant concern as most correlations are weak. CEO age and tenure are moderately correlated (

r = 0.35), which is theoretically expected. ROA and ROE are highly correlated (

r = 0.77), indicating consistency between accounting-based profitability measures. CEO characteristics exhibit generally low correlations with performance outcomes. For instance, CEO age and market-to-book ratio have a mild negative correlation (

r = −0.18), while board independence and market-to-book ratio also show a weak negative relationship (

r = −0.21). In addition, gender and founder status exhibit near-zero correlations with all performance metrics, implying that any impact of these traits may be nonlinear or contextually moderated. Firm size and financial leverage are moderately correlated, affirming prior research indicating that larger firms can support more debt (

Rajan & Zingales, 1995). These preliminary findings suggest that while individual CEO traits may have limited bivariate influence, their joint effects—and relative importance—require deeper exploration through multivariate econometric and machine learning models.

3.3. Hypothesis Development

Building on Upper Echelons Theory (

Hambrick & Mason, 1984), this study investigates how observable CEO characteristics shape firm performance. Empirical evidence has increasingly supported this theoretical framing, showing that individual CEO traits—such as age, tenure, and gender—can influence strategic direction and financial outcomes (

Zhou et al., 2020;

Mukherjee & Sen, 2022;

Nguyen et al., 2023). CEO age has been associated with experience and risk tolerance, where older CEOs may exhibit conservative decision-making and a preference for stability, which can influence firm performance differently depending on market conditions (

James et al., 2025). Tenure may provide continuity and firm-specific knowledge, although longer-tenured CEOs may also become entrenched or resistant to change (

Chikunda et al., 2025). Gender diversity has received considerable attention in governance literature, with studies suggesting that female CEOs bring distinctive leadership styles and ethical perspectives that may enhance firm value (

Cook & Glass, 2014;

Post & Byron, 2015). Founder status is often associated with visionary leadership and long-term strategic commitment, while internal appointment may enhance smoother succession and stronger organisational fit.

While previous studies have tested these traits individually, fewer have evaluated their relative importance using machine learning techniques. Moreover, most prior studies assume homogeneity across institutional environments, neglecting emerging and developed economies’ structural and regulatory differences. Although this study does not rely on institutional theory per se, it recognises that broader economic contexts may condition the effect of CEO characteristics. For example, leadership traits beneficial in developed markets with stronger governance institutions may function differently in emerging economies, where informal relationships or founder influence could play a greater role. Finally, recognising the limitations of traditional regression models in handling complex nonlinear relationships, this study adopts a machine learning (ML) perspective. By applying ensemble learning models, we aim to test whether CEO traits are significant performance predictors and rank them based on their predictive importance across multiple outcome variables. Accordingly, this study advances the following hypothesis:

H1: CEO characteristics—age, tenure, gender, founder status, and internal appointment—are significantly associated with firm financial performance.

This hypothesis is formally tested using Equation (2), which employs panel regression to examine the linear relationships between CEO traits and performance metrics (ROA, ROE, and market-to-book ratio), controlling for firm-level attributes.

Our second hypothesis examines the moderating role of emerging market status on the relationship between CEO characteristics and firm financial performance, investigating whether this relationship differs between emerging and developed economies.

H2: The relationship between CEO characteristics and firm financial performance is moderated by emerging market status. This hypothesis is operationalised using interaction terms in Equation (3), allowing for the exploration of whether CEO–performance relationships vary systematically between firms in emerging and developed economies.

where

are CEO traits, and

is a binary indicator for country classification. Lastly, we evaluated the predictive power of CEO traits using machine learning models. We aimed to determine if these models can identify and rank CEO traits based on their predictive power for firm financial outcomes.

H3: CEO traits can be effectively ranked by their predictive power for firm financial performance using machine learning models. To examine this hypothesis, we use random forest and XGBoost algorithms (Equation (5)).

Our focus is on the magnitude of feature importance scores across three dependent variables: ROA, ROE, and market-to-book ratio. These hypotheses enable a multidimensional exploration of how leadership characteristics affect financial outcomes and whether these effects are context-specific. They also provide the basis for integrating econometric findings with machine learning-based feature ranking to offer practical guidance for leadership evaluation and succession planning.

3.4. Econometric Modelling Approach

To empirically evaluate the relationship between CEO characteristics and firm financial performance, this study employs panel data econometric techniques that control for both cross-sectional and temporal heterogeneity. Panel models are particularly suited for this analysis as they allow the inclusion of firm-level unobserved heterogeneity, which could otherwise bias the estimation of CEO effects on performance outcomes. The baseline model is expressed as follows:

where

represents the financial performance of firm

at time

(measured using ROA, ROE, and market-to-book ratio),

is a vector of CEO characteristics (age, tenure, gender, founder status, internal appointment),

includes firm-level control variables (firm size, board independence, financial leverage),

captures firm-specific effects, and

is the idiosyncratic error term. To determine the appropriate model specification, i.e., Fixed Effects (FE) or Random Effects (RE), we apply the Hausman test (

Hausman, 2015). The FE estimator controls for all time-invariant heterogeneity by allowing each firm to have its own intercept, thus yielding consistent estimates even when the unobserved effects are correlated with the regressors.

In contrast, the RE estimator assumes that these unobserved firm-specific effects are uncorrelated with the explanatory variables, allowing for greater efficiency and estimating time-invariant regressors. In this study, the Hausman test results support using the Fixed Effects (FE) model for the ROE specification, suggesting that the unobserved firm-specific effects correlate with the CEO-level predictors. As such, the FE model is preferred for estimating the impact of CEO traits on ROE. For the ROA and market-to-book ratio models, the test results do not reject the null hypothesis of no correlation between the firm-specific effects and the regressors, justifying the use of the Random Effects (RE) model in these cases.

To test the first hypothesis, we specify the following linear baseline models for the ROE (FE) and ROA and MBT (RE).

where

is firm-specific fixed effect (unobserved heterogeneity),

denotes the year fixed effects, and

is the idiosyncratic error term. The random effects model is used when the unobserved effects are assumed uncorrelated with the explanatory variables, as supported by the Hausman test for ROA and MTB.

where

is the overall intercept, and

is the random firm-specific effect (uncorrelated with regressors), with other terms as previously defined. To test the second hypothesis—concerning the moderating effect of emerging market status—interaction terms are introduced into the panel model, allowing the slopes of CEO characteristics to vary based on the firm’s market classification. See Equation (10) below.

This approach enables us to assess whether the influence of CEO traits differs systematically between developed and emerging economies. Robust standard errors clustered at the firm level are used in all regressions to correct for serial correlation and heteroscedasticity. Year fixed effects are also included to account for time-specific shocks and macroeconomic trends. One potential limitation of regression-based approaches in CEO research is endogeneity, where CEO traits may be endogenous to firm performance due to unobserved selection mechanisms or reverse causality. For instance, high-performing firms may attract older or more experienced CEOs. While the fixed effects model mitigates time-invariant unobserved heterogeneity, it may not fully address dynamic selection effects or simultaneity bias. Given our study’s emphasis on prioritising trait importance rather than causal identification, we supplement regression models with machine learning techniques that are capable of capturing nonlinear, high-dimensional patterns in the data.

3.5. Machine Learning Modelling Approach

We employed two ML models—random forest and XGBoost—to test hypothesis 3 and generate feature importance. Random forest (

Breiman, 2001) is an ensemble learning technique that builds multiple decision trees and averages their predictions to improve robustness and reduce overfitting. It can handle non-linear relationships and interaction effects without explicit model specification. The random forest prediction for observation

is given by the following:

where

is the number of trees, and

is the prediction from tree

for observation

. Feature importance is computed based on the average reduction in impurity (e.g., variance) from splits involving a given feature. This method was used to rank the CEO and firm-specific attributes based on their predictive power for ROA, ROE, and market-to-book ration. Extreme Gradient Boosting (XGBoost) is a highly optimised implementation of gradient-boosted decision trees (

Nwafor et al., 2024). It builds models sequentially by minimising a regularised objective function:

with

as the loss function,

as the regularisation term, and

represent each regression tree. XGBoost was employed to generate feature importance based on “gain”, which measures the contribution of each feature to improving model accuracy. This method proved particularly effective at uncovering multidimensional interaction effects and outperformed traditional models in identifying context-sensitive CEO traits. We split the data into a train–test split: 80% training and 20% testing in line with previous studies (

Nwafor & Nwafor, 2023;

Nwafor et al., 2024). We used a 5-fold cross-validation (CV) for model tuning. The feature importance ranking is based on a mean decrease in impurity (MDI) and permutation importance. These models provide a non-parametric complement to regression analysis and reveal which CEO characteristics are most influential in predicting firm performance. We do not seek to develop a black-box model for firm performance prediction; our goal is to use machine learning to gain interpretable insights into which CEO attributes are most influential in explaining variations in firm outcomes.

Table 3 provides a summary of the data pre-processing and feature engineering.

4. Discussion of Results

This section presents the empirical findings from the panel dataset analysis. The results are discussed in four parts: (1) baseline panel regression models; (2) extended models incorporating interaction effects between CEO characteristics and emerging versus developed economies; (3) the ML model’s feature importance ranking; and (4) novel features importance holistic ranking.

4.1. Results from the Baseline Model

The baseline panel regression models were estimated using specifications determined by the Hausman test. Specifically, RE estimators were employed for ROA and MTB ratio models, while the FE estimator was used for ROE due to the detected correlation between firm-specific effects and regressors. The results in

Table 4 suggest that firm-level financial characteristics exert a stronger explanatory influence on firm performance than CEO-level attributes—a finding that tempers some of the expectations derived from Upper Echelons Theory (

Hambrick & Mason, 1984).

However, certain CEO traits remain relevant and statistically significant in select models, providing partial support for Hypothesis 1 (H1). Specifically, CEO tenure is negatively associated with ROA, indicating that prolonged time in office may result in declining operational efficiency, possibly due to managerial entrenchment or strategic complacency (

James et al., 2025). This aligns with the literature suggesting that longer-serving CEOs may resist change, particularly in dynamic competitive environments. Other CEO traits, including age, gender, and founder status, are not statistically significant predictors of ROA in the RE model. This suggests operational efficiency may be less sensitive to executive demographics than broader financial fundamentals.

In the ROE model (using fixed effects), CEO tenure displays a positive and significant relationship with shareholder returns, implying that leadership continuity and accumulated firm-specific knowledge may improve capital efficiency and investor confidence. This lends further support to the dual-sided view of tenure found in the literature, where tenure may both enrich and constrain performance, depending on the outcome metric considered. Conversely, CEO age and founder status are negatively associated with ROE, reinforcing findings that older or founder CEOs may exhibit strategic rigidity or overconfidence, potentially hindering shareholder value creation (

Mukherjee & Sen, 2022). Turning to the market-to-book ratio, the results reveal that CEO age and internal appointment are negatively and significantly associated with market valuation. These results suggest that markets may discount firms led by older or internally promoted CEOs, potentially viewing them as less likely to implement bold or transformative strategies. Interestingly, board independence also negatively correlates with MTB, diverging from mainstream governance literature that typically frames board independence as a value-enhancing mechanism (

Post & Byron, 2015). One possible explanation could be that independent boards may be perceived as symbolic or ineffective in emerging markets, thereby failing to reassure investors. Additionally, firm-level control variables such as firm size and financial leverage significantly enhance ROE, consistent with traditional capital structure theory and economies of scale. These results validate the inclusion of financial fundamentals as essential controls when assessing the impact of executive traits.

In summary, the baseline results partially support Hypothesis 1, revealing that while not all CEO traits directly or consistently influence firm performance, CEO tenure and age remain salient predictors, albeit with opposing effects across different performance metrics. These findings also provide an empirical foundation for the feature importance analysis presented later in the machine learning section, where the relative influence of these traits is examined more holistically.

4.2. Moderating Analysis: The Role of Emerging Market Context

To examine Hypothesis 2, interaction terms were introduced between selected CEO attributes and an indicator variable for emerging market status. These interaction models—reported in

Table 5—extend the baseline regression by evaluating whether the impact of CEO traits on firm performance varies between firms in developed and emerging economies. The results reveal context-sensitive patterns that partially confirm Upper Echelons Theory (

Hambrick & Mason, 1984), which suggests that executive characteristics influence strategic choices and outcomes but are often conditioned by environmental and institutional factors.

CEO tenure remains a positive and significant predictor of ROE and ROA across baseline and interaction models. This reinforces the idea that accumulated firm-specific experience and strategic continuity enhance internal performance. However, CEO age maintains a negative effect, consistent with studies suggesting that older executives may exhibit greater risk aversion and diminished adaptability in fast-changing markets (

Mukherjee & Sen, 2022). Of particular interest is the negative interaction effect between founder status and emerging market status, which is statistically significant and theoretically meaningful. This suggests that founder CEOs in emerging economies may underperform, potentially due to weaker corporate governance, limited institutional support, or over-concentration of power—challenges that are more pronounced in emerging markets (

James et al., 2025). Founder-led firms may struggle to professionalise or scale under weaker regulatory oversight, leading to lower returns for shareholders.

Another key finding is the positive and marginally significant interaction between female CEOs and emerging market status in the ROE model (significant at the 10% level). This supports literature suggesting that female executives in emerging markets often face higher barriers to entry, and those who do rise to the top may possess exceptional leadership competencies or strategic acumen (

Post & Byron, 2015). This result is reinforced in the Market-to-Book (MTB) model, where the female CEO–emerging market interaction is strongly positive and significant. It indicates that investors in emerging markets may reward gender diversity, potentially viewing it as a signal of progressive governance or alignment with international standards. These findings reinforce the importance of contextualising CEO effects, supporting Hypothesis 2. CEO traits are not universally effective across institutional environments; broader economic and governance structures shape their performance implications. For example, tenure is consistently beneficial in both contexts, but age and founder status show diminishing or negative returns in emerging markets.

While generally underrepresented and undervalued, female CEOs receive positive market signals in emerging contexts, reflecting an evolving institutional narrative around gender and leadership.

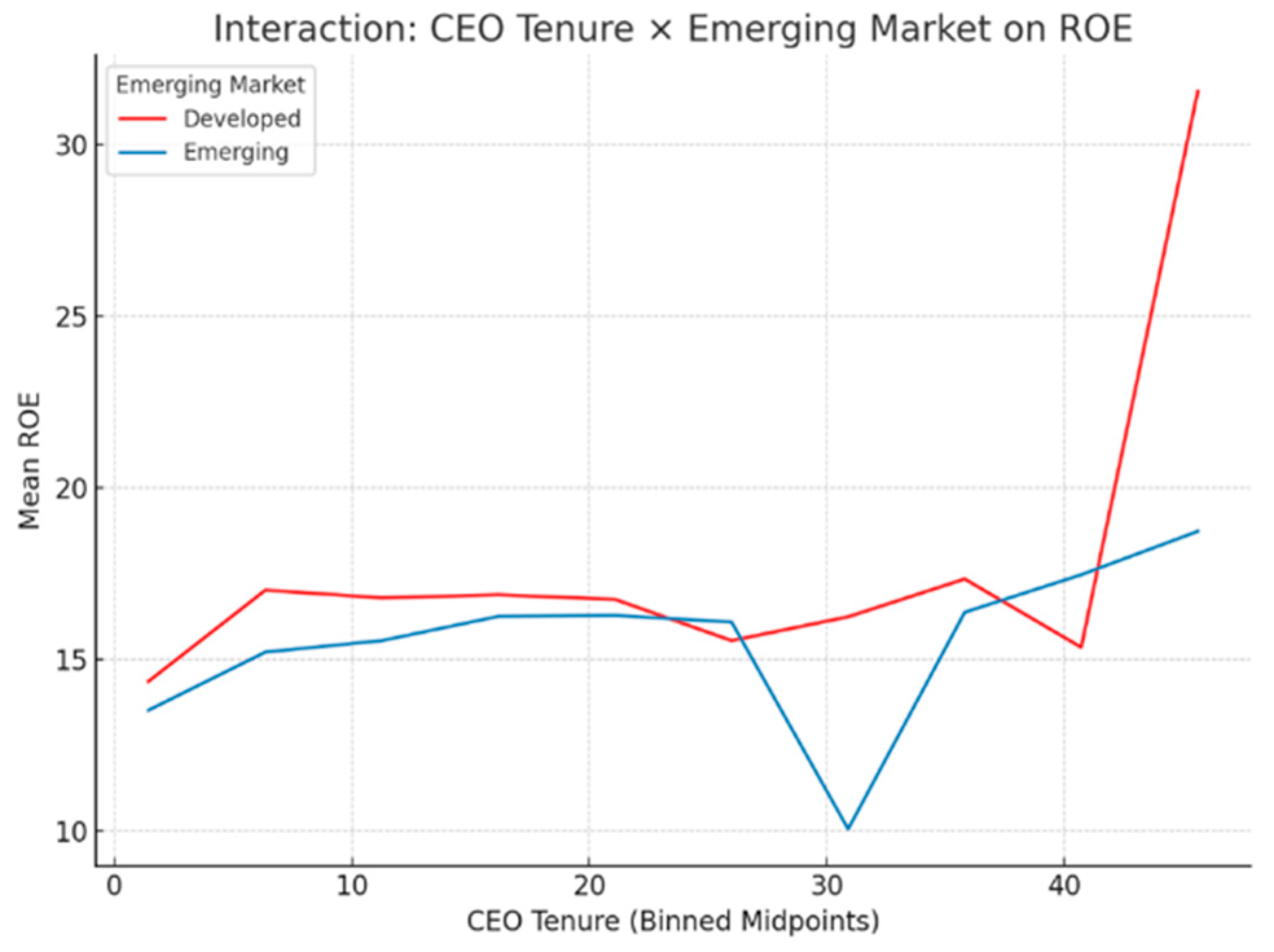

Figure 2 is the interaction plot for CEO tenure and emerging market on ROE. The figure shows that in both emerging and developed markets, moderate tenure is associated with relatively stable ROE. In developed markets, exceptionally long tenures (over 40 years) are associated with a significant spike in ROE, though this may be due to a small sample size. Conversely, in emerging markets, ROE appears to be more sensitive to changes in mid-to-long tenure, suggesting that while experience can lead to performance gains, it may also introduce potential instability.

Figure 3 is a bar plot that illustrates how female CEO status interacts with the emerging market context to impact market valuation. In emerging markets, firms led by female CEOs exhibit a higher average market-to-book ratio than in developed markets. The difference is minimal for male CEOs, but more pronounced for female CEOs. This finding suggests that the effect of gender on firm valuation in this dataset depends on the market context.

The results also support the idea that boards and investors should consider executive traits and institutional settings when evaluating leadership effectiveness. Leadership selection and succession planning should not rely on static criteria but incorporate environmental fit and market perceptions, particularly in globalised or cross-listed firms. In summary, these findings provide empirical support for the context-dependent applicability of Upper Echelons Theory and provide practical implications for firms operating in or expanding into emerging markets.

4.3. Machine Learning Feature Importance Ranking

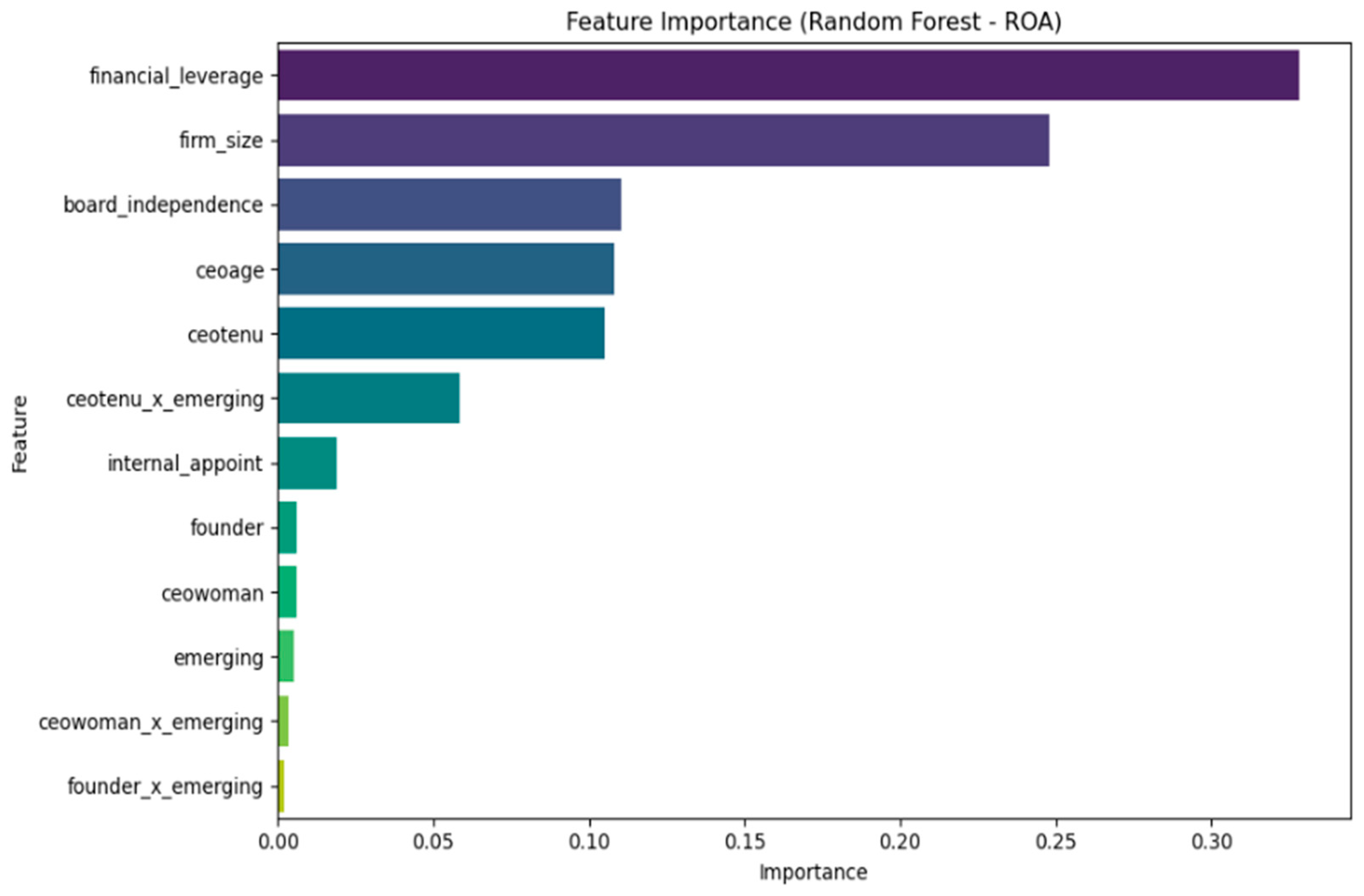

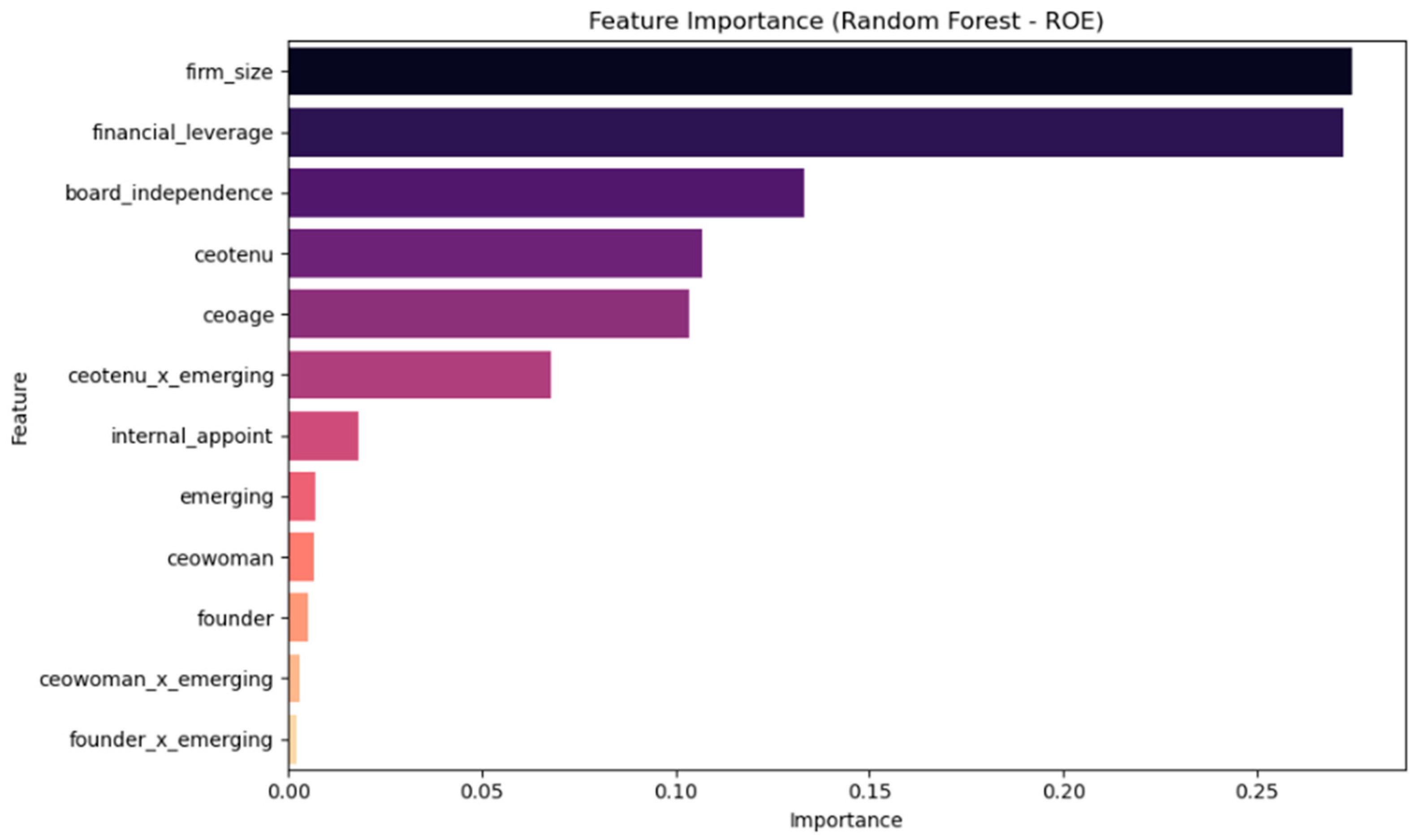

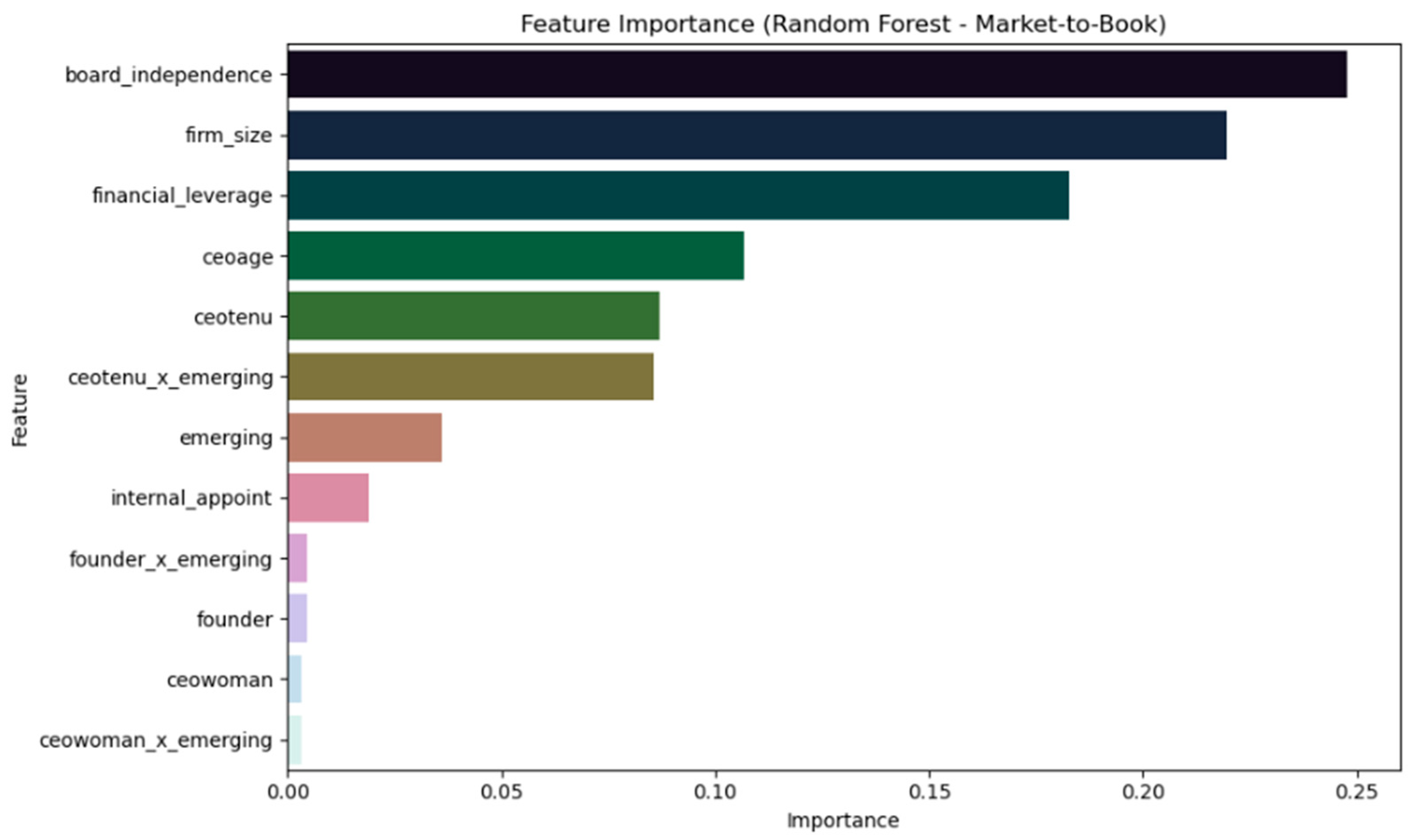

To complement the panel regression analysis and evaluate Hypothesis 3, this study employs two ensemble machine learning models—Random Forest (RF) and XGBoost—to assess the relative predictive importance of CEO traits and firm-specific characteristics in shaping firm financial performance. These models were chosen due to their strengths in handling nonlinear relationships, accounting for high-order interactions, and minimising assumptions about data distributions. These advantages are particularly relevant for leadership performance modelling. A key benefit of these models is their ability to generate feature importance rankings, allowing us to prioritise executive attributes and structural factors based on their contribution to predictive accuracy. The feature importance rankings generated from the Random Forest (RF) models (see

Figure 4,

Figure 5 and

Figure 6) reveals that financial leverage, firm size, and board independence consistently emerge as the top predictors across all three dependent variables. For ROA (

Figure 4), financial leverage demonstrates the highest importance, followed closely by firm size, suggesting that a firm’s capital structure and operational scale are key determinants of its asset efficiency. ROE rankings (

Figure 5) similarly place firm size and financial leverage at the top, although the importance of board independence becomes more pronounced, indicating its relevance to equity returns. In the market-to-book model (

Figure 6) board independence assumes the leading position, highlighting its perceived value by investors in shaping governance quality and long-term valuation.

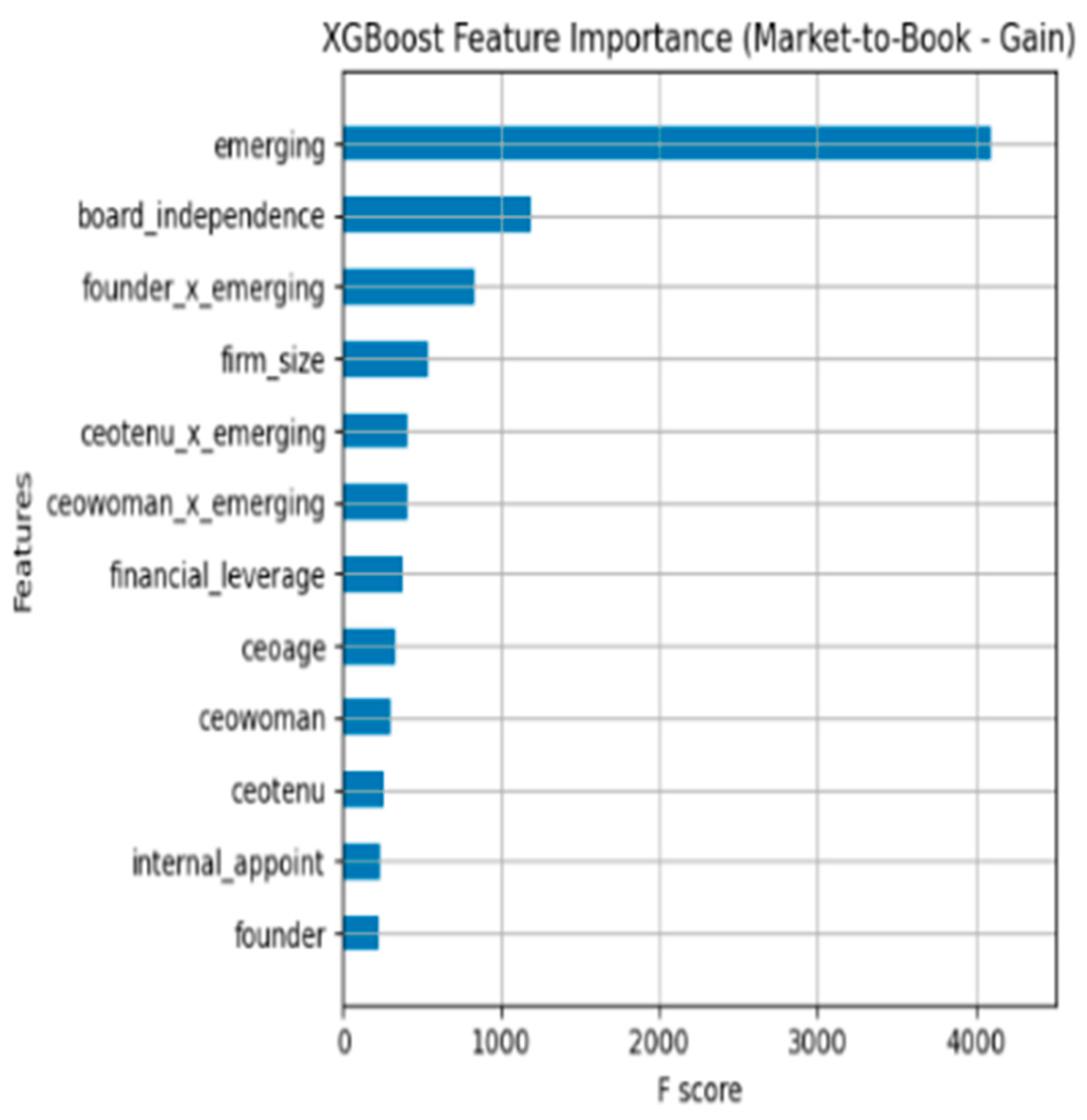

Although CEO-specific variables do not dominate these rankings, they are not absent. Traits such as CEO age and tenure show moderate predictive relevance, with tenure becoming more prominent in the ROE model, consistent with the regression results and the dual nature of tenure in influencing operational and financial outcomes. Interaction terms involving CEO tenure and founder status in emerging markets appear more prominently, especially in the ROE and market-to-book models. This supports the notion that institutional context moderates the value of executive experience and founder influence. Conversely, gender-related variables, including being a female CEO or a female CEO in an emerging market, consistently rank lower in the random forest model. This does not necessarily imply irrelevance but rather a limited standalone predictive power, possibly reflecting the underrepresentation of women in top executive roles and the complexity of gender-performance dynamics. The XGBoost models (

Figure 7,

Figure 8 and

Figure 9) largely reinforce the random forest findings but provide greater granularity in variable ranking due to the algorithm’s optimisation of split gain.

The XGBoost models elevate the importance of interaction terms, particularly

and

, which appear among the top predictors for ROE (

Figure 5) and market-to-book ratio (

Figure 6). This highlights the strength of XGBoost in capturing context-dependent relationships that traditional models may overlook. Moreover, the market-to-book model ranks emerging market status highly, suggesting that institutional environments influence firm valuation beyond CEO traits alone. In comparing the two machine learning approaches, random forest provides greater model interpretability and robustness to overfitting, while XGBoost offers more refined rankings, especially for interaction terms. These findings affirm the usefulness of machine learning for prioritising executive attributes and governance levers in performance forecasting. Moreover, they provide an empirical basis for data-informed leadership profiling, enabling firms and investors to focus on the traits and structural conditions most closely associated with financial success. These findings support Hypothesis 3 and extend this study’s contribution by demonstrating how machine learning can be leveraged to prioritise CEO traits transparently.

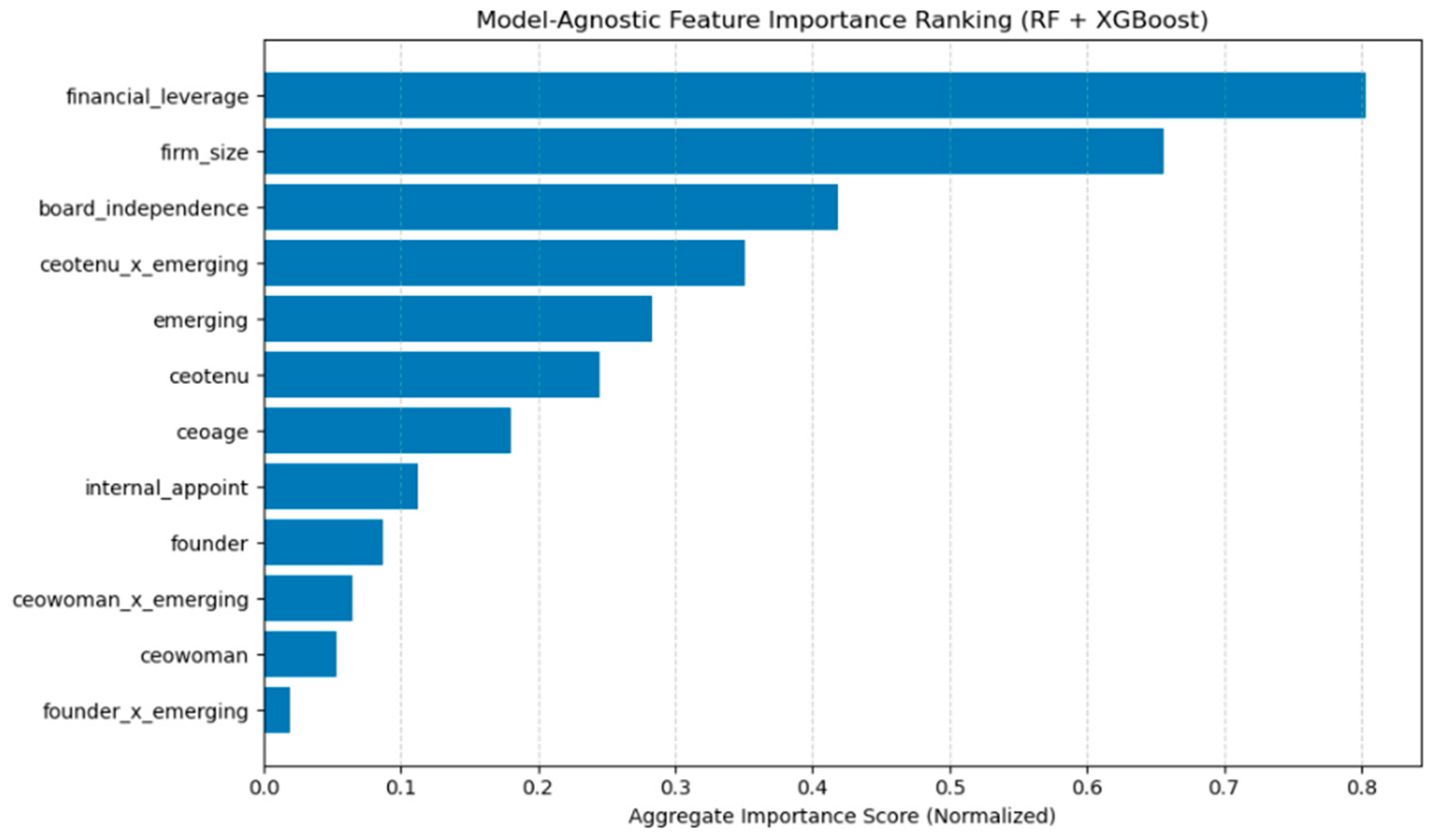

4.4. Model-Agnostic Feature Importance: A Holistic Ranking Framework

To enhance the interpretive strength of the machine learning results, this study developed a novel model-agnostic ranking framework that synthesises insights from the random forest and XGBoost models across all three firm performance metrics: ROA, ROE, and market-to-book ratio. This integrated approach enables a unified, comparative assessment of which CEO traits and firm-specific characteristics consistently exert the strongest predictive power—regardless of model type or performance outcome. The ranking procedure involved two key steps. First, feature importance scores were extracted from the six ML models. In these models, random forest importance scores are based on each feature’s average reduction in variance (impurity) during node splits. In contrast, XGBoost scores are calculated based on gain, which measures each feature’s contribution to reducing prediction error. Given that these importance metrics are on different scales, a min–max normalisation was applied to each model’s feature scores, rescaling them to a standardised 0–1 range (see Equation (13)).

where

is the raw importance of feature

in model

. Second, the normalised scores were averaged across models to yield an aggregate importance score for each feature, see Equation (14) producing a model-agnostic ranking that captures the central tendencies across methods and outcomes.

Figure 10 presents the final model-agnostic ranking, summarising the normalised scores across all models and performance outcomes. The results confirm and reinforce earlier findings that firm-level structural characteristics are the most powerful predictors of financial performance. Financial leverage ranks highest overall, followed closely by firm size, demonstrating consistent importance across all six models. Board independence also emerges as a strong predictor, especially for market-based outcomes, underlining the importance of governance architecture in shaping firm value. Among CEO-related variables, the interaction between CEO tenure and emerging market status ranks as the most influential executive trait, suggesting that leadership experience meaningfully shapes financial outcomes when filtered through institutional context. General CEO tenure, age, and internal appointment follow in importance, each showing moderate but non-trivial predictive relevance. These findings imply that while CEO traits matter, they are generally outweighed by firm-level fundamentals in predictive terms, particularly when using machine learning models optimised for accuracy rather than significance.

By contrast, gender-related traits, such as being a female CEO or a female CEO in an emerging market, consistently rank at the bottom of the importance hierarchy. This mirrors earlier random forest and XGBoost findings and suggests that gender alone may not be a strong standalone predictor of financial performance in this dataset. Likewise, founder status and its interaction with emerging market context exhibit low aggregate importance, though their strategic value may still be meaningful in specific organisational settings. This model-agnostic framework’s contribution lies in its ability to harmonise insights across ML approaches and financial metrics, providing a more robust foundation for strategic decision-making. By aggregating rankings, this study avoids over-reliance on any single model or performance outcome and instead identifies cross-cutting priorities for executive profiling and governance design. These insights have practical implications: Firms—particularly in emerging markets—may benefit from prioritising CEO tenure, institutional experience, and appointment origin in their leadership evaluation processes. However, they must also recognise that broader structural levers, such as capital structure and board composition, exert an even greater influence on performance. Ultimately, this integrated approach demonstrates the potential of machine learning to support more evidence-based, strategic human capital decisions that align executive traits with firm value creation.

5. Theoretical, Practical, and Policy Implications

This study contributes to theory and practice by advancing our understanding of how CEO characteristics and firm-level structures influence financial performance, particularly across institutional contexts. Using traditional panel econometrics and machine learning approaches, this study provides a multi-method evaluation of executive influence and, in doing so, provides new insights for scholars, practitioners, and policymakers.

5.1. Theoretical Implications

This study theoretically extends Upper Echelons Theory (UET) by applying it to a diverse, cross-national dataset and evaluating executive traits not only through significance testing but also via predictive ranking. While UET posits that observable managerial characteristics shape organisational outcomes (

Hambrick & Mason, 1984), this study deepens the framework by asking which traits matter most, and under what conditions. Findings from the panel regression models indicate that CEO tenure and age exert meaningful effects on performance, though the direction and significance vary by financial metric. Including interaction terms with emerging market status adds further theoretical depth by showing how institutional context moderates the effect of CEO traits, a dimension often overlooked in mainstream UET applications. For instance, founder CEOs are less effective in emerging markets, and female CEOs appear to receive stronger market validation in these contexts, suggesting an evolving institutional logic. In addition, integrating machine learning feature importance rankings complements the theory-driven regression analysis. This methodological triangulation enhances the explanatory power of UET by moving beyond significance to prioritisation, providing a ranked view of which traits consistently influence outcomes across models and contexts. In doing so, this study addresses a critical gap in leadership research: the relative weighting of executive characteristics in predicting firm success.

5.2. Practical and Policy Implications

From a practical standpoint, the findings hold implications for executive recruitment, succession planning, and governance reform. The consistent importance of firm size, leverage, and board independence highlights the need for firms to strengthen internal structures and financial strategies to drive performance. However, CEO traits—particularly tenure and appointment origin—should not be overlooked, especially in firms operating in volatile or institutionally weak environments. The model-agnostic feature importance rankings provide a valuable decision-support tool for boards, investors, and HR leaders. They suggest that leadership profiling should be data-informed, prioritising characteristics that yield tangible returns. For example, if CEO tenure in emerging markets ranks highly, firms in such contexts may emphasise experience and institutional familiarity more during selection. Conversely, traits like gender or founder status, while symbolically important, may require complementary strengths or supportive governance mechanisms to translate into performance gains. Furthermore, using machine learning in executive assessment introduces a new paradigm for leadership evaluation.

By highlighting the predictive contributions of CEO and firm-level features, this study promotes a balanced, transparent approach to leadership selection that aligns with evidence-based governance principles and growing stakeholder demands for accountability and inclusiveness. From a policy perspective, the findings highlight the importance of institutional strengthening and leadership transparency in emerging markets. Regulators and corporate governance bodies should promote merit-based executive selection practices incorporating evidence from data-driven performance predictors. Policies encouraging disclosure of CEO characteristics and board structures can enhance market confidence and enable stakeholders to assess leadership effectiveness better. Furthermore, the demonstrated value of governance variables, such as board independence, reinforces the need for more vigorous enforcement of corporate governance codes, particularly in jurisdictions where oversight mechanisms remain weak. Integrating predictive analytics into regulatory frameworks could also support the development of early warning tools for assessing firm resilience and executive accountability.

6. Conclusions, Limitations, and Directions for Future Research

This study examined the relative importance of CEO characteristics and firm-specific factors in predicting financial performance across developed and emerging economies. By integrating panel regression analysis with machine learning models, this study contributes a novel approach to assessing the influence of leadership traits on financial outcomes. The key insights reveal that firm-level structural variables, including financial leverage, firm size, and board independence, consistently outperform CEO traits in predictive power. Nonetheless, CEO tenure, particularly in emerging markets, emerges as a valuable performance determinant. The interaction effects of founder status and gender with institutional context further highlight the complex role that executive characteristics play across different governance environments. Importantly, the model-agnostic ranking framework developed in this study offers a practical tool for firms and investors, enabling more informed and context-sensitive leadership decisions. Moving beyond binary significance testing, this approach enhances a deeper understanding of which executive traits matter and how their influence varies by context and outcome measure.

Despite its contributions, this study is not without limitations. First, the analysis is limited to observable CEO attributes; unobservable traits such as personality, leadership style, and strategic orientation could offer additional explanatory power but were beyond the scope of this dataset. Second, this study does not account for industry-level heterogeneity or macroeconomic shocks that could influence firm performance. Future research should build on these findings by incorporating psychometric data, qualitative CEO assessments, or textual analysis of executive communications to capture deeper cognitive and behavioural dimensions of leadership. Additionally, longitudinal case studies or industry-specific analyses could unpack how CEO influence evolves over time and in response to external disruptions. Our study highlights the growing relevance of combining econometric and machine learning approaches in corporate governance research, providing theoretical insights and practical tools for understanding and enhancing executive impact on firm outcomes.