Abstract

There are calls in the extant literature for further exploration into the factors influencing customer satisfaction in industrial vending solutions (IVS), a distinct vendor-managed inventory method. This study delves into these factors, identifying primary drivers of satisfaction, perceptions of service quality, and indicators of trust and commitment in B2B IVS. It examines how IVS execution impacts perceived service quality through in-depth semi-structured interviews with B2B customers, focusing on efficiency, user-friendliness, and timeliness as key satisfaction drivers. Trust in the customer–supplier relationship positively affects commitment to the supplier. Successful IVS implementation enhances inventory control, customer service, and cost management. Supply chain managers can use these insights to evaluate vending solutions. Future research could explore supplier perceptions of vendor-managed inventory (VMI) success and conduct larger quantitative studies. This study distinguishes itself by focusing on the primary drivers of customer satisfaction and the perception of service quality in B2B IVS environments. It offers a conceptual framework for managing customer satisfaction, product development, and marketing strategies in IVS, addressing a gap in the literature on IVS within VMI contexts.

1. Introduction

Technology has drastically transformed our interactions, lifestyles, work environments, social connections, and business operations. Continuously evolving, it promises new advancements that will reshape our personal and professional lives (Patil et al. 2024). The World Economic Forum reports that technological advancements are driving significant changes various sectors, and this trend is expected to continue (Schwab and Zahidi 2020).

While technology enables seamless communication, information access, travel, idea-sharing, and knowledge creation, there are growing concerns about its potential negative impacts. Notably, artificial intelligence (AI) and automation pose risks such as job displacement and ethical dilemmas (Iaia et al. 2024; Mazurova and Standaert 2024; Shang et al. 2023). A Harvard Business Review study underscores the need for a balanced approach to AI implementation (Wilson and Daugherty 2018).

In the context of industrial vending solutions (IVS), the insights from Kumar et al. (2023), Moliner and Tortosa-Edo (2024), and Tran et al. (2023) offer valuable guidance. Kumar et al. emphasize the importance of collaborative design and identifying satisfaction drivers, such as service quality, ease of use, and reliability, which can be applied to IVS by involving clients in the customization process. Moliner and Tortosa-Edo highlight the need for a seamless, integrated service experience across touchpoints, crucial for IVS in ensuring consistent service delivery. Tran et al. focus on value co-creation through digital platforms, indicating that dedicated apps can enhance perceived service quality and client loyalty in IVS.

Existing research (Albarq 2023) necessitates the need to investigate factors affecting customer satisfaction in industrial vending solutions (IVS), a unique vendor-managed inventory system. This study aims to identify the main drivers of customer satisfaction, service quality perceptions, and trust and commitment indicators in B2B IVS.

Digitalization is now seen as crucial for long-term business success. De Giovanni (2021) integrates digital applications like AI and intelligent systems to enhance vendor-managed inventory, identifying 12 critical success factors. IVS is a business model where “vendor-managed suppliers (vendors) oversee a customer’s (buyer’s) inventory and restock items when supply is low” (Beheshti et al. 2020, p. 836). Effective inventory management impacts production, supply chain activities, and competitiveness (Utama et al. 2022).

Beheshti et al. (2020, p. 850) emphasize that VMI can improve customer service, essential for competitive advantage. Research on VMI began in the 1980s, benefiting both suppliers and customers (Rashid et al. 2024). Intense competition in manufacturing has driven firms to enhance customer value by adding services to traditional products (Beheshti et al. 2020). Rashid et al. (2024) identify planning, resource sharing, and information quality as critical for VMI success. VMI promotes flexible sourcing and quick responses to changing customer needs (Lelo and Israel 2024). IVS systems, consisting of hardware and software, offer point-of-use solutions for storing, vending, and managing consumables, tools, and equipment (Falasca et al. 2016).

1.1. Gaps in the Literature

Lamentably, while the articles by Kumar et al. (2023), Moliner and Tortosa-Edo (2024), and Tran et al. (2023) provide valuable insights into customer satisfaction, digital engagement, and service quality that can be highly relevant to a study focused on industrial vending solutions (IVS)—each of the articles offers valuable insights into interactive marketing and customer satisfaction—there are some common limitations. The specificity of the contexts (e.g., e-grocery, omnichannel retail, branded apps) means that the findings may require significant adaptation to apply to other settings, such as industrial vending solutions (IVS). Moreover, the complexity and resource requirements for implementing the suggested strategies might pose challenges, particularly for smaller enterprises.

Despite the potential to enhance IT application development, operation, and maintenance, IVS providers have not attracted a large client base. Gopalakrishnan and Mohan (2020) studied stakeholder alignment in hospitals and healthcare. The literature (e.g., Pasandideh et al. 2018) suggests limited user satisfaction with such services, and research on IVS satisfaction drivers remains sparse (Stoyanov 2021, 2023; Falasca et al. 2016). Alizadeh et al. (2016) note the complexity of selecting appropriate vendors and propose a framework combining qualitative and quantitative criteria to achieve customer satisfaction. Few studies assess service quality (Kamakoty and Sohani 2015), while Pasch et al. (2016) call for common quality guidelines and understanding customer benefits in B2B settings. Service quality affects trust and commitment to service providers (Beheshti et al. 2020; Gounaris 2005). Examining trust and commitment indicators related to customer satisfaction and perceived quality in IVS solutions can aid firms in improving quality and addressing customer retention challenges (Haverila et al. 2013).

Given this context, more research is needed on customer satisfaction drivers in industrial vending solutions (IVS), a unique form of vendor-managed inventory. This study responds to calls in the existing literature (Manrique and Manrique 2015; Falasca et al. 2016) by identifying key drivers of customer satisfaction and trust and commitment indicators in B2B IVS. The central research question is as follows:

RQ: How is customer-perceived service quality influenced by IVS dimensions, and what customer satisfaction drivers can be derived from this?

1.2. Contributions of This Study

This study fills significant gaps in the literature on customer satisfaction in industrial vending solutions (IVS), a type of vendor-managed inventory system. Previous research has stressed the importance of understanding satisfaction factors in IVS but often lacks detailed exploration in a B2B context. Hence, this study focuses on primary drivers of customer satisfaction and service quality perceptions in B2B IVS environments. It extends prior research (De Giovanni 2021) on the role of technological innovations like AI in enhancing vendor-managed inventory by examining their specific impact on satisfaction and trust in IVS.

While Beheshti et al. (2020) and Rashid et al. (2024) discuss VMI benefits and challenges, such as improved customer service and flexible sourcing strategies, they do not detail satisfaction drivers and trust indicators specific to IVS. This study addresses these gaps by analyzing key aspects like efficiency, user-friendliness, and timeliness, which are critical for understanding customer satisfaction in IVS.

The existing literature (Falasca et al. 2016; Kamakoty and Sohani 2015) touches on the need for quality assessment and aligning service quality with satisfaction but lacks comprehensive research focused on IVS within VMI systems. This study examines how IVS dimensions impact perceived service quality and identifies critical satisfaction drivers.

Additionally, previous studies (Gopalakrishnan and Mohan 2020; Pasandideh et al. 2018) recognize vendor selection complexities and limited user satisfaction with application services but do not extensively explore specific satisfaction factors in IVS. This research provides valuable insights into these factors, contributing to a nuanced understanding of customer–supplier relationships in B2B settings. In a nutshell, therefore, this study significantly contributes to the existing literature by providing a detailed conceptual framework for managing customer satisfaction in IVS. It identifies primary drivers of customer satisfaction and trust in B2B IVS and highlights IVS implementation’s impact on inventory control, customer service, and cost management. It fills a crucial literature gap and lays a foundation for future research and practical applications in vendor-managed inventory.

2. Theoretical Background

Technology has significantly transformed our modes of communication and interaction, revolutionizing the way we connect with one another over the past few decades (Osarenkhoe et al. 2014). However, the COVID-19 pandemic has acted as a catalyst, expediting this transformative process, and necessitating our exclusive reliance on digital tools for socializing, working, and learning. Platforms like social media and video conferencing have emerged in recent years, expanding our options for virtual communication (ibid.). The impact of these changes on our lives cannot be ignored.

2.1. Synthesized Insights on Customer Satisfaction, Digital Engagement, and Service Quality

In addressing customer satisfaction, digital engagement, and service quality, three articles (Kumar et al. 2023; Moliner and Tortosa-Edo 2024; Tran et al. 2023) recommended by one of the reviewers of this paper provide a comprehensive overview. Although co-value creation is not a central theme in the current study, these articles offer valuable insights that are relevant, particularly in the domain of industrial vending solutions (IVS), a vendor-managed inventory method.

Reflections on these articles show that Kumar et al. (2023) emphasize the importance of involving customers in the design process to drive satisfaction in e-grocery retailing. Their study identifies key drivers of customer satisfaction, such as service quality, ease of use, and reliability. These findings can be directly applied to IVS by engaging business clients in the customization and design of vending solutions, ensuring that the service closely aligns with clients’ needs and expectations can significantly enhance satisfaction. Key factors like the accuracy of inventory management, ease of restocking, and the reliability of vending machines are essential elements that should be prioritized in IVS.

Moliner and Tortosa-Edo (2024) explore how an integrated omnichannel consumer journey contributes to e-satisfaction. Their research underscores the importance of a seamless and cohesive service experience across various touchpoints. Translating this to the IVS context involves ensuring a smooth process for ordering, replenishment, and maintenance. By maintaining consistent and high-quality service delivery throughout these stages, overall client satisfaction can be significantly enhanced. Furthermore, improving the online components of the customer journey—such as inventory management, reporting, and communication—can bolster client satisfaction even more.

Tran et al. (2023) investigate the impact of branded apps on perceived quality and brand loyalty through value co-creation. This study highlights the benefits of using dedicated apps or digital platforms for client interaction, feedback, and value co-creation in IVS. The positive influence of branded apps on perceived service quality suggests that digital tools and interfaces in IVS can similarly enhance service perception. Additionally, the connection between positive digital experiences and brand loyalty found in Tran et al.’s research can be translated into client loyalty in IVS. Ensuring a positive experience with vending solutions can foster stronger long-term relationships and client commitment.

Combining insights from these studies (Kumar et al. 2023; Moliner and Tortosa-Edo 2024; Tran et al. 2023), IVS providers can enhance their services by focusing on several critical areas. Engaging clients in the customization and design process ensures that the solutions meet their specific needs, aligning closely with their expectations and driving higher satisfaction. Maintaining a consistent and integrated service experience across all touchpoints, including both digital and physical interactions, is crucial for a seamless customer journey. Leveraging dedicated apps and digital platforms to facilitate interaction, provide feedback, and co-create value enhances the perceived service quality. Prioritizing factors such as accuracy, ease of use, reliability, and maintenance helps in driving satisfaction and fostering long-term client loyalty.

2.2. Customer Expectation and Satisfaction Drivers

Business-to-business (B2B) marketing revolves around value creation and relationship building (Anderson and Narus 1990; Mehta and Durvasula 1998). Customer relationship management (CRM) aligns a company’s marketing, sales, and service processes to establish and maintain long-term relationships (Jayachandran et al. 2005). Allen (2004) notes that CRM integration at both strategic and operational levels enhances customer satisfaction, making satisfaction measures integral to CRM activities.

Customer satisfaction in services stems from comparing expectations with received services (Rust and Oliver 1994). Firms that emphasize customer orientation can gather insights into customer needs and expectations, aiding product development to meet these expectations (Lin et al. 2012). De Giovanni (2021) discusses the evolution from a linear supply chain to a dynamic, interconnected structure due to shifting customer expectations. Anderson et al. (1994) differentiate quality and satisfaction: quality relates to current perceptions, while satisfaction encompasses past, current, and future experiences. Service quality is a key precursor to customer satisfaction (Cronin and Taylor 1992; Fornell et al. 1996), with perceived quality being crucial for overall satisfaction. Customer expectations act as a reference for evaluating actual performance (Zeithaml et al. 1993).

2.3. Customer Interactions and Trust

Trust is essential for lasting relationships between suppliers and customers (Dwyer et al. 1987; Morgan and Hunt 1994; Rashid et al. 2024), often developed through personal interactions (Baumann and Le Meunier-FitzHugh 2014). Trust depends on the supplier’s ability to meet customer requirements. De Ruyter et al. (2001) argue that in high-tech contexts, a higher-quality offer enhances perceived trustworthiness. Trust factors like ability, integrity, benevolence, and similarity promote stronger commitment and loyalty (Morgan and Hunt 1994; Park et al. 2012). Managers should therefore instill these trust-driving characteristics through salespeople, who can build trust by fulfilling customer expectations and quality requirements.

2.4. Dimensions of Industrial Vending Systems

Industrial vending systems (IVS) comprise site-specific vending machines (physical dimension), advanced support infrastructure (service interactions), and sophisticated internal mechanisms (software attributes) (Manrique and Manrique 2015). An IVS involves the supplier managing on-site machines for customer operations, effectively outsourcing the inventory system and replenishment function to the supplier (Falasca et al. 2016). This outsourcing improves supply chain efficiency and cost-effectiveness (Lacity et al. 2010; Mishra et al. 2024; Zammori et al. 2009), with inventory information directly flowing to the supplier, reducing the need for physical checks (Falasca et al. 2016).

2.5. Quality Assessment of Solution Design

The interactive nature of IVS fosters a learning relationship, enabling businesses to understand customer preferences for personalized interactions and loyalty (Peppers and Rogers 1995). High-quality relationships enhance customer outcomes (Hennig-Thurau et al. 2002). The quality assessment of an IVS depends on how well it meets customer requirements throughout its lifecycle (Pasch et al. 2016). Benefits include lower inventory costs, improved service, increased flexibility, operational efficiency, and a focus on core operations (Claassen et al. 2008; Zammori et al. 2009). Pasch et al. (2016) note that reliability, perceived quality, and added value are crucial in quality assessment.

2.6. Software Attributes and Quality Assessment of Software Attributes

Corporations increasingly invest in information systems (ISs) and information technology (IT) (Ho and Wei 2016). Outsourcing ISs through application service provision offers web-based solutions with remote updates and support, benefiting both suppliers and customers (Katzmarzik 2011). Service quality is vital for IS outsourcing success (Grover et al. 1996; Kim et al. 2005; Liang et al. 2016). Variables influencing IS success include service quality, information quality, system quality, user satisfaction, system use, and net benefits (Petter et al. 2013). IS quality depends on system integration, which enhances competitiveness and productivity (Barki and Pinsonneault 2005; Ettlie and Reza 1992). Integration in IVS involves the supplier managing inventory remotely via an integrative IS, demanding high system performance (Falasca et al. 2016). Key success factors include information exchange, information quality, and supplier–customer relationship quality (Falasca et al. 2016).

2.7. Service Interactions

Person-to-person interactions are crucial for customer satisfaction (Crosby et al. 1990; Parasuraman et al. 1985). Successful IVS implementation enhances supplier–customer relationships and transparency (Falasca et al. 2016), allowing for quick adaptation to market changes. Long-term relationships are more common in contexts involving complex products and services (Baumann and Le Meunier-FitzHugh 2014). Shared goals across the supply chain are essential for value creation (Pasch et al. 2016).

2.8. Commitment and Quality Assessment of Service Interactions

IVS represents a customer–supplier collaboration (Aurich et al. 2006). The quality of service received influences trust more than perceived interactions (Deng et al. 2013). Service quality positively correlates with customer commitment, with knowledgeable service staff meeting expectations enhancing perceived quality and satisfaction (Parasuraman et al. 1985; Cronin and Taylor 1992). High satisfaction fosters commitment and bonding, leading to trust and “affective commitment” (Gounaris 2005). Effective relationship management is crucial for performance in B2B relationships (Lövblad et al. 2012). Rashid et al. (2024) emphasize involving all company levels in designing a vendor-managed inventory (VMI) system to build trust and relationships.

2.9. The Customer’s Experience of Service Quality

Service quality provides a competitive edge and boosts satisfaction (Parasuraman et al. 1985). Firms must understand and meet customer expectations to deliver satisfactory service, minimizing organizational shortcomings. The “gap model of service quality” identifies gaps between expected and delivered service (Parasuraman et al. 1985; Kamakoty and Sohani 2015). Functional quality impacts perceived service quality more than technical quality (Grönroos 1988). The supplier’s ability to meet expectations impacts perceived service quality and supplier performance (Parasuraman et al. 1985).

2.10. Organizational Shortcomings in Service Quality

Gaps between service delivery and customer expectations (Gap 4) significantly affect expectations. Discrepancies between promised and received value (Gap 3) negatively influence customer attitudes. Employee performance also impacts perceived service quality (Parasuraman et al. 1985). Gaps between management’s perception of expectations and service specifications (Gap 2) reflect the inability to meet customer needs. Fast service in manufacturing is crucial due to dependency on equipment functionality. Differences in understanding customer expectations (Gap 1) require executives to grasp what constitutes high service quality before delivering services (Parasuraman et al. 1985).

Table 1 synthesizes insights into customer expectations, satisfaction drivers, trust, and dimensions of industrial vending systems (IVS). Key findings include the importance of understanding and meeting expectations to enhance satisfaction and build trust. A multi-dimensional approach involving solution design, software attributes, and service interactions is crucial for IVS. Effective relationship management and high service quality foster trust and commitment, critical for customer satisfaction and loyalty. Addressing organizational shortcomings and aligning promised and actual service delivery are essential for maintaining customer loyalty. Companies should invest in CRM strategies, ensure high service quality, and promote trust through reliable interactions and high-quality offerings to achieve long-term B2B success.

Table 1.

Key themes in customer expectation, satisfaction, and quality in industrial vending systems (IVS).

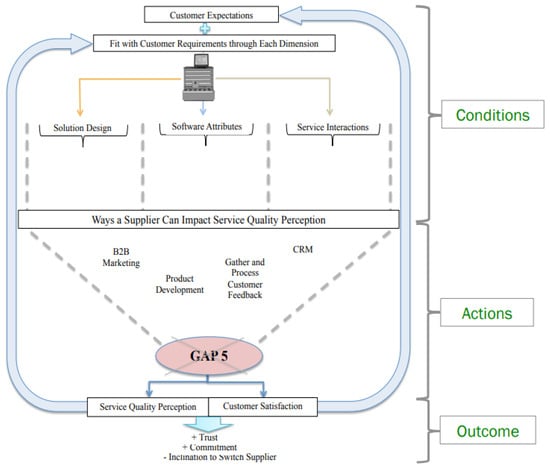

3. Conceptual Framework

The conceptual framework explains how IVS solutions influence customer satisfaction and perceived service quality through their design, software attributes, and customer-supplier interactions. Figure 1’s Level 1 highlights the connections between these elements. The literature indicates that suppliers can enhance perceived service quality and customer satisfaction via CRM activities, B2B marketing, product development, and customer feedback processes. Effective use of these actions can minimize organizational shortcomings, narrowing Gap 5, thus boosting customer satisfaction and positive perceptions of IVS service quality (Level 2 in Figure 1).

Figure 1.

Conceptual framework for service quality perception.

Level 3 in Figure 1 shows that meeting customer expectations and requirements enhances trust and commitment to the supplier, reducing the likelihood of switching. This initiates a cycle where customer expectations and supplier capabilities across IVS dimensions continuously influence perceived service quality and satisfaction levels.

In a nutshell, Figure 1’s conceptual framework, built from the theoretical foundation in Table 1, illustrates how suppliers can impact customer perceptions of service quality. Level 1 connects service design, software, and interactions. Effective actions help narrow Gap 5, enhancing customer satisfaction and service quality perceptions (Level 2). Level 3 shows that fulfilling expectations builds trust, reduces switching, and sets a cycle affecting perceived service quality and satisfaction through the IVS dimensions. Thus, reducing Gap 5 ideally leads to higher customer satisfaction and positive service quality perceptions.

The interdependent customer–supplier relationship is explained by the “gap model of service quality” or “5 gap model” (Parasuraman et al. 1985; Kamakoty and Sohani 2015; Khonglumtana and Srisattayakulb 2023; Albarq 2023). Since technical and functional quality are interconnected, high expectations in one dimension often raise expectations in the other. The customer’s perception of service quality (Gap 5) depends on whether the firm meets or exceeds these expectations, influencing whether the customer views the service quality and supplier performance as high or low (ibid.).

4. Methodology

This study explores how customer-perceived service quality is influenced by IVS dimensions and identifies the drivers of customer satisfaction. It aims to pinpoint the primary drivers of customer satisfaction and service quality perceptions, focusing on trust and commitment indicators in business-to-business (B2B) integrated value solutions (IVS). A qualitative design is utilized to achieve these objectives (Ghauri et al. 2020).

4.1. Data Collection

Primary Data: This study primarily used in-depth, semi-structured interviews with 14 IVS customers from small and medium-sized enterprises that are clients of a multinational enterprise (MNE) vendor. This approach aligns with Eisenhardt and Graebner (2007), who recommend open discussions for obtaining reliable and specific data. These interviews facilitated a deeper understanding of customer attitudes and values toward IVS, with participants given the freedom to discuss their views openly (Barriball and While 1994).

Secondary Data: Secondary data were obtained from academic journals and book chapters sourced from databases like Emerald, Inderscience, Sage, Taylor & Francis, and Wiley. This review was thorough, leveraging keywords to filter and evaluate existing research, and addressing research gaps in IVS. Articles were selected based on citation frequency and relevance, ensuring robust theoretical support for this study’s framework, especially given the limited existing literature on IVS (Saunders et al. 2012).

Interviews: Semi-structured interviews were pivotal for primary data collection. These interviews consisted of nine open-ended questions, encouraging participants to elaborate on their experiences and perceptions. Each interview, averaging 30 min, was conducted via phone during two periods between 2020 and 2022, coinciding with and following the COVID-19 pandemic. This timing provided a contextual backdrop for understanding shifts in customer expectations and perceptions during the pandemic. The interview guide, detailed in Table 2, was designed to uncover customer insights on service quality and satisfaction.

Table 2.

Interview guide, including area, and concepts.

Consequently, the qualitative approach, with a focus on semi-structured interviews and thorough secondary data analysis, provided a comprehensive understanding of how IVS dimensions affect customer-perceived service quality and satisfaction. This methodology ensured that both theoretical insights and practical experiences were integrated, offering a well-rounded perspective on the drivers of customer satisfaction in B2B IVS contexts.

4.2. Interviews

Semi-structured phone interviews, each averaging 30 min, assessed IVS customers’ attitudes and values using nine open-ended questions. This approach allowed for respondents to elaborate, uncovering unforeseen issues. The interview guide is detailed in Table 2 above.

Before each interview, researchers reviewed the company’s core activities, size, market position, and industry trends to better understand the respondent’s context, fostering common ground. Interviews were recorded with consent, ensuring confidentiality for responses, names, and companies. Post-interview, the material was transcribed to identify overlooked factors needing follow-up questions or clarifications, allowing for progressive refinement of the subject matter. Two of the researchers were present during transcription to reduce potential bias (Bryman and Bell 2011). Transcriptions and follow-up questions were sent to respondents for approval, with a specified timeframe for feedback. If no response was received, the material was considered approved.

4.3. Population and Sampling

A convenience sample of 20 contacts was drawn from the IVS supplier’s database. To ensure respondents were familiar with the vending solution and its role within their operations, and the supplier’s service and support function, four criteria were set:

Minimum three years in the industrial manufacturing industry; minimum three years using the vending solution; daily exposure to the vending solution; familiarity with the supplier’s service and support system; initial contact was made via email, followed by a call if no response was received within seven days. Of the 20 contacts, 14 agreed to participate; 5 were unreachable, and 1 declined.

4.4. Operationalization

This study’s conceptual framework has three levels:

Level 1: Explores how customer requirements and expectations influence perceptions of the IVS solution and service quality.

Level 2: Focuses on the supplier’s role but is not covered in the questionnaire.

Level 3: Examines how the supplier’s ability to close Gap 5 enhances trust and commitment, reducing the likelihood of switching suppliers.

The questionnaire had two sections: service quality perception and solution dimensions; and customer satisfaction drivers and commitment/trust indicators. These sections captured respondents’ views on the IVS solution’s operational role and their perceptions of the service and support. Questions were refined through a pilot interview and expert input to enhance clarity (Saunders et al. 2012).

4.5. Data Presentation and Analysis

Post-approval, the transcriptions were compiled and organized by question. Analysis followed Miles and Huberman’s (1994) framework: data reduction, display, and conclusion drawing. Irrelevant responses were excluded, and data were structured for clarity. Inductive coding categorized data by themes and respondent frequency, leading to three main categories: actual service quality perception; suggested solution improvements; and factors affecting the decision to switch solutions. These categories reflected respondents’ perceptions, suggestions, and factors influencing their inclination to switch solutions. Trends across the dataset were analyzed rather than individual responses. Results were interpreted and linked with relevant theories during conclusion drawing (Yin 2009), focusing on understanding and reflecting on the data. Although the steps were intertwined, the analysis aimed to identify emerging trends. While company size was not a primary focus, related trends were noted.

4.6. Ensuring Trustworthiness and Authenticity

Measures to ensure trustworthiness and authenticity (Ghauri et al. 2020) included the following:

Credibility: Developing respondent criteria, interview characteristics, and themes with pre-set rules. Having two interviewers reduced bias, with further validation by respondent transcript approval.

Confirmability and Authenticity: Detailed descriptions of data collection and analysis methods increased transferability and dependability. This transparency allows for other researchers to evaluate this study’s contribution and its applicability within its context. These measures facilitated a credible, dependable, and transferable understanding of the research process and findings.

5. Presentation of Findings

5.1. A Preamble: Scope and Scale of Industrial Vending Solutions (IVS)

This overview addresses the business sizes utilizing industrial vending solutions (IVS), the number of deployed units, and their configurations.

- 1.

- Business Sizes Using IVS

IVS caters to a range of business sizes. Small businesses typically use IVS to manage inventory and reduce waste, deploying a limited number of units. Medium-sized businesses adopt IVS to enhance operational efficiency and cost control across multiple locations. Large enterprises implement IVS on a larger scale, sometimes globally, to manage extensive inventories, ensure compliance, and streamline supply chains. These businesses span various industries including manufacturing, construction, healthcare, automotive, and aerospace.

- 2.

- Number of IVS

The deployment of IVS units varies according to business needs and size. Small businesses generally have 1 to 10 units, while medium-sized businesses deploy between 10 and 50 units. Large enterprises often have extensive networks exceeding 50 units, with some global enterprises deploying hundreds or even thousands. Exact numbers are usually not disclosed but can be estimated through market research.

- 3.

- IVS Topology

The topology of IVS systems includes standalone units, networked systems, and integrated systems. Standalone units are single vending machines placed at strategic locations within a facility, suitable for small to medium-sized operations. Networked systems consist of multiple vending machines connected through a centralized management system, enabling inventory tracking, usage monitoring, and replenishment across various machines and locations. Integrated systems link IVS units with enterprise systems like ERP (enterprise resource planning) and MRP (material requirements planning), automating inventory management and syncing data across business functions.

5.2. Additional Details

IVS encompasses various machine types such as tool vending machines for dispensing tools and equipment, PPE vending machines for personal protective equipment, and MRO vending machines for maintenance and repair supplies. Leading providers include Fastenal, Grainger, and AutoCrib, which offer a range of machine types and configurations to meet different business needs. Key technological features of IVS include RFID technology for tracking inventory and usage, barcode scanning to manage check-in and check-out processes, and real-time data analytics for monitoring inventory levels and usage patterns. For detailed statistics and trends on IVS deployment, consulting market research reports from firms such as Gartner, IDC, or Frost & Sullivan is recommended.

6. Synopsis of the Case Company

The IVS supplier in this study is a global leader in industrial processes, leveraging advanced materials technology. Recently, it partnered with another firm to provide IVS solutions. The focus is on a Swedish multinational enterprise (MNE) in the steel industry with over 150 years of history and 35,000 employees. This B2B manufacturing company specializes in stainless steel, mining, and machine solutions. Its business areas are divided into multiple divisions, each managing customers, R&D, manufacturing, and financials under global branding guidelines. As an industry leader with extensive local and international experience, the company excels in international product customization strategies.

6.1. Positive Perceptions

The industrial vending solution (IVS) is highly regarded for its efficient and well-organized tool storage and inventory tracking capabilities, enabling customers to monitor inventory levels with ease. Respondents appreciated the IVS for its ability to store items from various suppliers within the vending machine, enhancing inventory management by accommodating diverse stock requirements.

Regarding software attributes, most respondents found the IVS convenient and time efficient. They highlighted that the system automatically replenishes stock and allows for presetting preferred levels, thus simplifying operations for operators, and boosting efficiency. This automation not only saves administrative time but also reduces the risk of stockouts. The pre-programmed software’s remote access capabilities and support for multiple users were particularly valued, as was the system’s ability to track tools to specific operators who withdrew them. One respondent noted:

“It simplifies things for the operators, increasing efficiency and saving administration time”.

In terms of service interactions, overall satisfaction with the supplier’s service and support system was notably high. The fast and accurate delivery of spare parts and tools was praised as a crucial attribute effectively managed by the supplier. Knowing delivery schedules in advance was appreciated as it helped reduce downtime, and respondents valued the consistency of having the same contact and support person for technical issues.

6.2. Less Positive Perceptions

Despite the positive aspects, many respondents expressed dissatisfaction with the quality of the IVS hardware. One respondent explicitly stated,

“The hardware breaks easily due to its poor quality, both in terms of the drawers and the electronics. This in turn causes many other problems. For example, the employees have to take the items from the machine and then manually write down what they took, which is not properly handled”.

Such concerns highlight the need for more robust and reliable hardware to minimize operational disruptions. In terms of software attributes, respondents found the user interface problematic. The filter and menu options were described as flawed, making it challenging to search for specific tools. The arbitrary naming of items and non-user-friendly language further complicated the process. Additionally, some respondents noted that the supplier occasionally changed item numbers without informing customers, adding to the confusion. One respondent remarked,

“The one functionality or area that is very poor is the ability to integrate possible upgrades. For example, sometimes they [the supplier] will do an upgrade and then delete a feature, and it seems very difficult to get that feature to be reinstated”.

This lack of innovation and coordination left some users feeling that the supplier did not fulfill its value promise as effectively as some competitors. Service interactions were also a point of concern. Some respondents reported that stock deliveries were often slow, negatively impacting their overall satisfaction with the IVS. Accurate and timely information about delivery schedules was crucial for maintaining trust in the supplier, yet inconsistent communication about deliveries was a recurring issue.

6.3. Suggested Improvements

To address these concerns, several improvements were suggested for the solution design. Respondents called for greater durability in the IVS hardware or, alternatively, easier repairs when breakdowns occur. They recommended that the IVS be better adapted to industrial contexts, with considerations for both hardware and electronics, and expressed a desire for flexible storage options that could accommodate items of various sizes within the same drawer.

Regarding software attributes, respondents expressed a desire for enhancements that would make the IVS more user-friendly. Specifically, they wanted a feature that allows for users to apply filters to display only the cost centers relevant to them, which would streamline the system’s efficiency and reduce the likelihood of errors. One respondent emphasized the need for improvements, stating,

“It should be more user-friendly for the staff. They don’t know all the designations for the items we have in the machine, which makes it a hassle for them”.

There was a commonly expressed need for the IVS to be more innovative, with software improvements aimed at increasing efficiency, lowering costs, and enhancing return on investment. Further suggestions included making item labels less arbitrary and more intuitive for operators, who often struggled to identify items by their given names. For example, one respondent said,

“A lot of engineers know what a tip looks like (a tip is one example of a tool stored in the IVS) but not necessarily what it is called—sub-menus would also be useful to make finding items quicker”.

Another respondent reiterated the need for user-friendliness, stating,

“It should be more user-friendly for the staff. They do not know all the designations for the items we have in the machine, which makes it a hassle for them”.

Additionally, respondents expressed a need for the software to give management better control over what features and tools the operators could access. Those whose IVS lacked automatic software upgrade capabilities desired remote upgrades from the supplier. Greater integration with customer business systems and more transparent communication with the supplier were also desired. Respondents suggested that a better-organized service ticket/support system would improve the efficiency of their operations.

6.4. Service Interactions Dimension

In terms of service interactions, respondents desired a sales team with a deeper understanding of their business operations. They believed that enhanced expertise in this area would enable sales staff to guide them more effectively toward optimal solutions. Faster delivery times were also prioritized, and there was a call for “full customer service”, which would include everything from reloading the machine with new stock to servicing it when issues arose.

7. Summary of Empirical Findings

This case study focuses on an IVS supplier, a global company known for its expertise in industrial processes and materials technology, which has partnered with another entity to provide IVS solutions. The subject of this study is a Swedish multinational enterprise (MNE) in the steel industry, boasting over 150 years of history and more than 35,000 employees, specializing in stainless steel, mining, and machine solutions.

The findings highlight several positive perceptions of the IVS. The solution design is praised for its effective tool storage and inventory tracking capabilities, accommodating items from various suppliers. The software attributes are commended for automating stock replenishment, enabling remote access, supporting numerous users, and tracking tools to specific operators. Service interactions receive high marks for overall satisfaction, with fast and accurate delivery of spare parts and consistent support contacts.

However, this study also identifies several negative perceptions. The solution design is criticized for poor hardware quality, leading to frequent breakdowns and the need for manual tracking. Software attributes are seen as problematic due to difficult-to-use filters and menus, arbitrary item naming, upgrade issues, and a perceived lack of innovation. Service interactions are noted to suffer from slow stock delivery times and inconsistent communication about deliveries. To address these issues, this study suggests several improvements. The solution design should feature more durable hardware, easier repairs, and flexible storage for various item sizes. Software attributes could benefit from a more user-friendly interface, relevant cost center filters, better integration with customer systems, remote upgrades, improved language accessibility, and greater transparency. Service interactions could be enhanced through better sales team understanding of customer operations, faster deliveries, and more comprehensive customer service, including machine reloading and servicing.

8. Discussion of Findings

The analysis and discussion are structured according to the dimensions of solution design, software attributes, and service interaction.

8.1. Solution Design

8.1.1. Flexibility

The desire for flexible vendor-managed solutions, as found by Zammori et al. (2009), leaves customers with more resources and energy to focus on their core operations. Petter et al. (2013) list flexibility as a component of system quality—a desirable characteristic and a success factor. If customer operations can be simplified by adding flexibility, offering this flexibility can increase a supplier’s competitiveness and positively affect the customer’s intentions to maintain the relationship (Pasch et al. 2016). Brax (2005) also supports this, and Pasch et al. (2016) note that industrial customers demand customized, individual solutions, further emphasizing the importance of tailoring solutions to specific needs.

Falasca et al. (2016) argue that efforts to adapt quickly to changing demands can be facilitated through open dialogue with customers. This aligns with Drejer’s (2000) findings that intense competition makes product development and innovation of suitable technological solutions crucial for industrial firms. According to Slack et al. (2004), increasing customer focus can facilitate a symbiotic relationship process between supplier and customer, establishing a high level of trust necessary for stronger commitment and loyalty (Morgan and Hunt 1994; Park et al. 2012). Since product development is a critical and complex competitive tool (Chan and Ip 2011), the ability to turn feedback into enhancements of a company’s offerings and business processes is essential (Allen 2004).

8.1.2. Durability

The need for higher quality in terms of hardware durability parallels Guo and Wang’s (2015) claim that product quality is essential in the manufacturing industry. The need for durability supports Pasch et al.’s (2016) argument that quality assessment for industrial product–service systems is determined by how well a solution meets customer requirements throughout its lifecycle. Thus, the solution’s quality must be enduring. Fragile hardware negatively impacts quality perception as it fails to satisfy customer requirements. Customer-perceived quality has been shown to apply to the entire system provided by the supplier (ibid.).

8.2. Software Attributes

8.2.1. Innovation

Since successful innovation yields profits and efficiency for both the supplier and customer (Drejer 2000), innovations can be a substantial strategic element for service firms in highly competitive contexts (Wikhamn et al. 2013; Guo and Wang 2015). It is also pertinent to mention at this junction that the articles written by Kumar et al. (2023), Moliner and Tortosa-Edo (2024), and Tran et al. (2023) collectively provide a comprehensive view of how interactive marketing strategies can be leveraged to enhance customer satisfaction, ensure continued usage, and build brand loyalty in the digital age. By integrating these insights (ibid), this study on IVS can benefit from established frameworks and methodologies in interactive marketing, adapted to the specific needs and dynamics of B2B industrial vending solutions. This cross-disciplinary approach (ibid) can enrich analysis of customer satisfaction, service quality perceptions, and indicators of trust and commitment in IVS.

Chan and Ip (2011) suggest that product development initiatives can minimize the risk of customers switching to another solution. Respondents in our study perceived the software as lacking innovativeness and expressed dissatisfaction with software attributes, which can be linked to Petter et al.’s (2013) satisfaction determinants for information systems. Dissatisfaction with the software risks negatively impacting perceived quality. Research supports the argument that firms in high-technology markets must maintain advanced features in their offerings (Bhattacharya et al. 1998), provide continuous improvements (Krieg 2004; Su et al. 2006), and offer tailored delivery (Katzmarzik 2011). Failure to do so risks losing customers seeking better-matched technology (Al-Kwifi et al. 2014; Heide and Weiss 1995).

Feedback significance links to Guo and Wang’s (2015) finding that, in a competitive climate, suppliers must remain attentive to customer desires and competitor offerings. The gap between promised and delivered value can be linked to Gap 4 of Parasuraman et al.’s (1985) model, underlining the relevance of aligning product development with customer feedback to increase satisfaction (e.g., Allen 2004). Suppliers can incorporate these measures into business processes to align product development investments with actual customer expectations, increasing satisfaction.

Through information sharing and feedback generated via CRM interactions, suppliers can design and deliver offerings better suited to customer needs (Latusek 2010), gaining competitive advantage and market success (Bose 2002). Improving competitiveness by tailoring offerings and increasing appeal to customers is supported by findings showing a correlation between solution fit with customer requirements and perceived service quality (Pasch et al. 2016; Khonglumtana and Srisattayakulb 2023; Albarq 2023).

8.2.2. User-Friendliness

User-friendliness is achieved by letting user needs influence system design, seen in combinable modules facilitating customization options (Pasch et al. 2016). In our study, customized options would enable quicker, more accurate tool withdrawals from the vending machine. Respondents also noted the need to meet increased efficiency, lower costs, and ROI requirements (Falasca et al. 2016; Petter et al. 2013). The empirical findings indicate customers are somewhat satisfied with the IVS software, with positive factors including remote access to virtual stock levels and remote software updates by the supplier.

A potential area for increased user-friendliness is in allowing for users to see only relevant cost centers. This can be compared to Falasca et al.’s (2016) second enabler for IVS solutions, the quality of gathered information. An intuitive setup enables users to access relevant information easily and use it advantageously. Bajgoric and Moon (2009) argue that adapting hardware or software to simplify management is essential, consistent with Pasch et al. (2016), who argue industrial customers demand integrated, customized solutions comprising both goods and services. Understanding customer views on lacking solution functions can better capture expectations (Allen 2004). If customer expectations are well understood, this information can bridge potential service quality gaps (cf. Parasuraman et al.’s (1985) gap model). Proper monitoring of performance allows for actions that impact customer satisfaction.

8.2.3. Integration

Our study showed substantial inefficiencies associated with lower integration levels between the IVS and business system (i.e., an absence of integration). This aligns with Barki and Pinsonneault’s (2005) organizational model, which argues that perceived IS quality is affected by the system’s integration capability (Chiang et al. 2000). Successful integration increases productivity and competitiveness of a supplier’s offering (Barney 1991; Ettlie and Reza 1992). Thus, enhancing IVS solution integration capability may help increase satisfaction, productivity, and customer retention.

8.2.4. Information Quality

The mismatch between actual inventory levels and the number of manually logged withdrawn items relates to Berente et al.’s (2009) argument that information quality and data transfer between parties are essential for successful systems. This questions the efficiency benefit noted by Manrique and Manrique (2015), that automatic data transfer on stock levels reduces the need for physical inspection.

Efficiency would increase if operational problems from inaccurate stock registration were fixed, eliminating manual inventory checks. We argue, in line with Gounaris (2005), that offering superior information quality increases customer trust and affective commitment. Digital solutions can help generate reports on optimizing stock levels and data on item usage, enhancing cost and space efficiency. As Sanders and Premus (2002) state, increased IS usage offers several benefits, including reduced costs. Thus, these functions are vital and desired by customers. A lack of information features and system capabilities affects customer perception of service quality more negatively than technical shortcomings (Grönroos 1988).

Resources to better comprehend IS benefits in terms of information quality, system use, and net benefits (Petter et al. 2013) would be well spent. Improving IS functionality could enhance the solution’s functional quality and increase trust and commitment towards the supplier (Deng et al. 2013). The importance of these features, alongside an organized support structure, is understandable since IS use increases operational benefits (Sanders and Premus 2002). Better control of features and tool supply (Petter et al. 2013) is another desirable IS characteristic. System flexibility positively correlates with increased IS success and perceived service quality (e.g., Kim et al. 2005; Liang et al. 2016), which in turn increases satisfaction (Cronin and Taylor 1992).

8.2.5. Efficiency

Empirical findings indicate that customers perceive the IVS as an efficient tool storage solution that increases overall operational efficiency by saving administrative costs and time (Goodwin 2011). According to Reddy and Vrat (2007), IVS solutions require communication between the customer site and supplier (Zammori et al. 2009) to pre-set min/max stock levels. Chiang et al. (2000) argue that sharing a mutual platform is key to successful continuous interconnectedness between supplier and customer. This aligns with Brax (2005) and Al-Kwifi et al. (2014), who argue that IS is crucial in organizations. One communication shortcoming noted in our study was the supplier’s failure to inform the customer when an item number changed (Falasca et al. 2016). This aligns with Brax (2005), who found information management crucial for successfully delivering complex service solutions in industrial environments. The competitiveness of the manufacturing industry makes measuring customer satisfaction essential to ensure the solution facilitates the internal processes specific to the customer’s operations (Slack et al. 2004).

8.2.6. Economic Efficiency

Empirical findings show respondents view cost efficiency, ROI, and loyalty as key factors in evaluating suppliers and their satisfaction with a solution. Some respondents explicitly stated that software improvements could increase cost efficiency, supporting Petter et al.’s (2013) claim of the net benefits associated with IS improvements and that cost benefits potential affects supplier choice. Regarding customer retention, Guo and Wang (2015) highlight the importance of a supplier’s ability to meet or exceed competitors’ offerings.

8.3. Service Interactions

8.3.1. Timeliness

Failure to meet customer expectations regarding accurate inventory replenishments and spare part deliveries affects service quality perception. This reflects Parasuraman et al.’s (1985) Gap 2, where timely service and support by suppliers influence customer satisfaction. Claassen et al. (2008) argue that suppliers must maintain customer trust to prevent customers from stockpiling inventory. No such tendencies were noted in the current study, suggesting customer–supplier trust.

8.3.2. Transparency

Respondents highlighted the need for greater transparency in delivery schedules and item number changes, which affects their trust in suppliers. Like Falasca et al. (2016), we found that transparency in customer–supplier communication aids operational planning and efficiency. Zhao and Cavusgil (2006) suggest that good communication and collaboration with customers enhance product innovation, leading to superior value creation, as argued by Kohli and Jaworski (1990) and Narver and Slater (1990). Latusek (2010) also emphasizes transparency, noting that extensive information sharing allows for suppliers to better meet individual customer needs.

8.3.3. Expertise

According to Manrique and Manrique (2015), IVS solutions include advanced service and support infrastructure. Respondents generally found service and support satisfactory, with many praising the supplier’s technical expertise. Brax (2005) notes that continuous support is crucial for complex service solutions in industrial settings, and such support positively impacts customer satisfaction (Allen 2004). Tseng and Wu (2014) argue that customer relationships are a key asset, with service quality perceptions influenced by channels like email, sales, and advertising (Chen and Popovich 2003; Khonglumtana and Srisattayakulb 2023; Albarq 2023).

The supplier’s sales team must understand the customer’s business operations to recommend optimal solutions. In our study, gaps in this understanding illustrated Parasuraman et al.’s (1985) Gap 3, indicating insufficient technical quality (Grönroos 1988). This aligns with Baumann and Le Meunier-FitzHugh (2014), who found value creation succeeds when managers demonstrate trustworthiness and capability through their sales personnel. In B2B contexts, sales personnel’s perceived competence influences customer commitment (Rod and Ashill 2010).

Deng et al. (2013) argue that enhancing personnel’s knowledge of customers’ specific routines improves perceived service quality. Bridging this gap is vital as service quality and personal interactions influence trust-building and retention (Gounaris 2005). Kamakura et al. (2005) suggest analyzing customer interaction information helps develop strategies to prevent customer defection. For the IVS solution, improving these factors is crucial for retaining customers and enhancing service quality perception.

8.3.4. Trustworthiness

Over half of respondents noted that trust in the supplier depends on personal and company-level relationships and accurate deliveries. This can relate to Parasuraman et al.’s (1985) gaps. Managers can address such gaps by training sales teams to bridge Gaps 1 and 3 (Parasuraman et al. 1985). In high-tech environments, delivering on a superior value promise enhances trustworthiness (De Ruyter et al. 2001), but this trust relies on consistent service delivery.

Respondents mentioned a valued contact person from the supplier, linking satisfaction to reliability and knowledge. This implies individual-level trust (Fregidou-Malama and Hyder 2015) and supports credibility in B2B relationships (Rod and Ashill 2010). Higher trust in a supplier increases the likelihood of re-purchase (Komunda and Osarenkhoe 2012), indicating that individual relationships positively impact continuity. Rod and Ashill (2010) and Morrisson and Huppertz (2010) argue that credibility affects relationship commitment. Despite some IVS shortcomings, respondents preferred their current supplier due to existing partnerships, indicating company-level trust. Morgan and Hunt (1994) suggest that such credibility implies the supplier’s competence in fulfilling obligations.

8.3.5. Well-Organized Support

Respondents emphasized the importance of a well-organized support structure for operational efficiency. Effective support is compared to an enabler of IVS success, such as information exchange (Falasca et al. 2016). Efficient communication leads to cost, service, and inventory benefits. Accessible service and support are essential, and mutual understanding of partnership expectations enhances commitment (Falasca et al. 2016).

9. Summary of Discussion of Findings

The discussion of findings is summarized in Table 3, which organizes key aspects of solution design, software attributes, and service interactions. These areas impact customer satisfaction and competitive advantage by relating empirical findings to the existing literature and practical implications for improving industrial customer satisfaction and competitiveness.

Table 3.

Summary of discussion of findings organized into key areas.

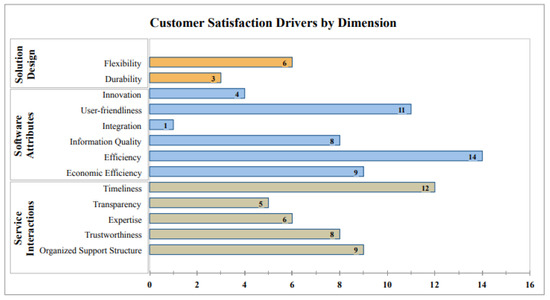

Figure 2 demonstrates an overview of the customer satisfaction drivers by dimension. The analysis is broken down into the three dimensions described in the methods section.

Figure 2.

Identified customer satisfaction drivers by dimension.

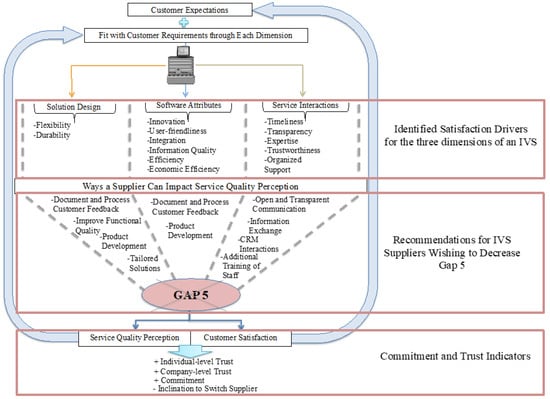

10. A Framework Illuminating Sources of Customer Satisfaction Drivers

The framework presented here is a key contribution of this paper. Figure 3 illustrates how the satisfaction drivers identified for each IVS dimension are distributed. It also contextualizes, in the form of recommended actions, how suppliers can influence service quality perception across these channels. By obtaining customer feedback and integrating it into business processes, gaps in service quality and other potential organizational deficiencies can be addressed and rectified. This process enhances customer satisfaction and positively influences the perception of service quality. Consequently, this leads to increased customer trust, stronger customer commitment, and a greater intention for customers to remain with their current supplier.

Figure 3.

A framework illuminating sources of customer satisfaction drivers.

11. Concluding Remarks and Managerial, Theoretical, and Social Implications

This study identifies key drivers of customer satisfaction, service quality perceptions, and indicators of trust and commitment in business-to-business (B2B) industrial vending systems (IVS). It examines how IVS implementation impacts customer-perceived service quality and satisfaction drivers. Findings show that enhancing satisfaction and building trust are crucial in B2B marketing. In IVS, solution design, software attributes, and service interactions must align with customer expectations to build trust and commitment through high service quality and effective relationship management. Addressing organizational shortcomings and aligning service delivery with expectations are vital for maintaining satisfaction and loyalty, thereby giving companies a competitive edge.

Solution design, software attributes, and service interactions significantly impact customer perception of service quality. Efficiency, user-friendliness, and timeliness were identified as primary satisfaction drivers, influencing operational efficiency and system compatibility with operations. Facilitating rather than restricting IVS use enhances customer satisfaction. Both individual and company-level trust positively impact customer commitment. Perceptions of the supplier failing to fully deliver its value promise negatively affected service quality perceptions, despite the overall adequacy of the supplier’s service and support functions. Personal interactions fostering trust were key indicators of commitment. Service quality that matches the value promise also indirectly indicates commitment, as it results from effective customer interactions. These findings expand on Falasca et al. (2016) by providing empirical evidence of the benefits perceived by IVS users in industrial environments.

Although Kumar et al.’s (2023), Moliner and Tortosa-Edo’s (2024), and Tran et al.’s (2023) articles provide robust frameworks and actionable insights, their applicability might be constrained by the specificity of their contexts and the practical challenges of implementing their recommendations in different industries or smaller-scale operations. For a study on IVS, these insights need to be adapted thoughtfully to account for the unique dynamics and requirements of the B2B environment.

12. Practical Implications

By implementing strategies showcased in Kumar et al. (2023), Moliner and Tortosa-Edo (2024), and Tran et al. (2023), IVS providers can significantly improve customer satisfaction, enhance digital engagement, and deliver superior service quality, ultimately leading to stronger and more loyal client relationships.

Practitioners should deepen their understanding of customer operations to adapt product development, CRM, and marketing strategies to meet individual customer requirements, improving the appeal of the supplier’s offering. Incorporating satisfaction drivers into product differentiation helps managers discern what customers expect and value in IVS solutions.

Practitioners should integrate CRM systems at strategic and operational levels to enhance customer satisfaction by aligning marketing, sales, and service processes to foster long-term relationships. Adopting a customer-oriented approach involves actively seeking feedback and understanding both current and latent customer needs, which is crucial for maintaining high satisfaction levels. Service quality, as an antecedent of satisfaction, necessitates continuous monitoring and improvement to ensure offerings meet or exceed expectations.

Trust is fundamental in B2B relationships; thus, practitioners must ensure their front-line staff embody qualities like ability, integrity, benevolence, and similarity. Meeting customer requirements reliably builds trust and fosters long-term relationships. For IVS solutions, focus on three key dimensions: solution design should meet customer requirements throughout the lifecycle; service interactions should build transparent relationships through effective communication and collaboration; software attributes should support seamless inventory management and integration with customer systems. Regularly assessing customer satisfaction ensures IVS solutions deliver the expected value, evaluating factors like reliability, perceived quality, and added value.

Identifying and bridging gaps between service delivery and customer expectations is essential. Training service staff to be knowledgeable and capable of meeting customer expectations impacts overall satisfaction and perceived service quality. Building strong affective commitment involves creating mutual understanding and motivation to maintain partnerships. High satisfaction and trust strengthen bonds and promote long-term loyalty.

Using the gap model to address discrepancies between expected and delivered services helps practitioners identify areas for improvement. Encouraging open dialogue and a culture of continuous improvement allows for companies to adapt to market changes and evolving customer demands, thereby enhancing customer satisfaction, fostering long-term relationships, and gaining a competitive edge.

13. Theoretical Implications

Overall, integrating insights from Kumar et al. (2023), Moliner and Tortosa-Edo (2024), and Tran et al. (2023), the study on IVS can benefit from the established frameworks and methodologies in interactive marketing. By adapting these strategies to the specific needs and dynamics of B2B industrial vending solutions, research can provide a comprehensive analysis of customer satisfaction, service quality perceptions, and indicators of trust and commitment, enriched by cross-disciplinary approaches from consumer-focused digital engagement studies.

This study underscores integrating CRM with service quality theories, enhancing customer satisfaction by aligning company processes with expectations. Trust emerges as a critical mediator in B2B relationships, reinforcing existing models linking trust with ability, integrity, benevolence, and similarity, impacting satisfaction and loyalty.

This study aligns with the SERVQUAL model, indicating both functional and technical service quality aspects must be optimized to meet customer expectations. Involving customers in IVS solution development highlights the importance of customer input, contributing to the collaborative innovation literature.

Applying the gap model to IVS solutions demonstrates its utility in identifying and addressing service delivery discrepancies, enhancing theoretical insights into service quality management.

14. Social Implications

Focusing on trust and long-term relationships promotes a collaborative, reliable, and mutually beneficial business culture. Customer involvement in development processes fosters more inclusive practices, empowering customers and enhancing satisfaction. Emphasizing service quality and satisfaction improves customer experiences, leading to higher loyalty and advocacy.

Investing in employee training and development ensures a knowledgeable workforce, better job satisfaction, and improved customer service. Ethical business practices, trust, and meeting expectations build stronger relationships, contributing to a more ethical business environment. Efficient IVS solutions enhance operational efficiency, benefiting companies and contributing to overall economic productivity.

15. Limitations and Future Research

This study is limited to the customers of one multinational enterprise (MNE) vending solution in one country. Future research should include a more extensive multi-case study with larger samples to enhance credibility and reliability. A larger dataset for quantitative and qualitative analysis could provide further insights. Expanding the study to different countries and companies would offer a more diverse set of results, filling current research gaps in IVS and customer satisfaction.

Several gaps in the existing literature related to industrial vending solutions (IVS) and customer satisfaction within this context are identified in this study warrant further investigation. The key gaps highlighted can be found below.

Consequently, Table 4 unveils avenues for more comprehensive research on customer satisfaction drivers, service quality assessment, vendor selection processes, and trust and commitment indicators in the context of IVS. Addressing these gaps could significantly enhance the effectiveness and adoption of IVS solutions in various industries.

Table 4.

Gaps in the literature for further studies.

Finally, future study should map information regarding the businesses’ sizes, the number of industrial vending solutions (IVSs), the precise topology of these IVSs, and the fields they cover and economic data.

Epilogue

This study significantly enhances the literature on industrial vending solutions (IVS) by identifying key satisfaction drivers and trust indicators, developing a conceptual framework for managing customer satisfaction, and providing practical implications for supply chain management. It addresses notable gaps in existing research by focusing on the factors influencing customer satisfaction in IVS, particularly within a business-to-business (B2B) context, which has been underexplored. Previous studies have highlighted the importance of technological innovations in vendor-managed inventory (VMI) but have not specifically examined their impact on customer satisfaction and trust in IVS.

Moreover, while prior research has acknowledged the benefits and challenges of VMI, such as improved customer service and flexible sourcing strategies, it has not delved into the specific satisfaction drivers and trust indicators pertinent to IVS. This study bridges this gap by analyzing aspects such as efficiency, user-friendliness, and timeliness, crucial for understanding customer satisfaction in IVS. It also addresses the lack of comprehensive research on IVS within VMI systems by examining how IVS dimensions impact perceived service quality. Thus, this research provides a nuanced understanding of customer–supplier relationships in B2B settings, filling a critical gap in the literature and laying the foundation for future research and practical applications in vendor-managed inventory.

Author Contributions

Conceptualization, A.O., T.G. and A.B.-M.; Methodology, A.O., D.F., T.G. and A.B.-M.; Validation, D.F.; Formal analysis, A.O., D.F. and T.G.; Investigation, T.G. and A.B.-M.; Data curation, A.B.-M.; Writing—original draft, T.G. and A.B.-M.; Writing—review & editing, A.O., D.F. and T.G.; An external proofreader. Supervision, A.O. All authors have read and agreed to the published version of the manuscript.

Funding

Article Processing Charges: Funded by University of Gävle, Sweden. This article is funded by European regional development fund (ERDF) and regional partners (Swedish Agency for Economic and Regional Growth and Gävleborg County Region). The research project is titled: “Strategies for developing sustainable digital transformation capacity in SMEs”. Reference ID: 20359844.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets in this article are not publicly available due to the nature of the research, which involved in-depth, semi-structured interviews with 14 IVS customers from small and medium-sized enterprises, all clients of a multinational enterprise (MNE) vendor. Anonymity was guaranteed to the participants. The IVS supplier, a global leader in industrial processes that leverages advanced materials technology, remains unnamed. The study focuses on a Swedish MNE in the steel industry, with over 150 years of history and 35,000 employees. Given the company’s status as an industry leader with extensive local and international experience, particularly in international product customization strategies, the datasets cannot be disclosed.

Conflicts of Interest

We, the authors of this article, affirm that we have no personal, financial, or professional interests that could have influenced or biased the research, results, or conclusions presented in this article. Thus, there are no external pressures or competing interests that could compromise the integrity or objectivity of this study.

References

- Albadvi, Amir, and Monireh Hosseini. 2011. Mapping B2B value exchange in marketing relationships: A systematic approach. Journal of Business & Industrial Marketing 26: 503–13. [Google Scholar]

- Albarq, Abbas N. 2023. The Impact of CKM and Customer Satisfaction on Customer Loyalty in Saudi Banking Sector: The Mediating Role of Customer Trust. Administrative Sciences 13: 90. [Google Scholar] [CrossRef]

- Alizadeh, Alireza, Mehri Chehrehpak, and Mohsen Jafari Ashlaghi. 2016. A decision support system for vendor selection and quota allocations using dependent and independent criteria. International Journal of Services and Operations Management 23: 201–16. [Google Scholar] [CrossRef]

- Al-Kwifi, Sam, Zafar U. Ahmed, and Dina Yammout. 2014. Brand Switching of High-Technology Capital Products: How Product Features Dictate the Switching Decision. Journal of Product & Brand Management 23: 322–32. [Google Scholar]

- Allen, Derek R. 2004. Customer Satisfaction Research Management: A Comprehensive Guide to Integrating Customer Loyalty and Satisfaction Metrics in the Management of Complex Organizations. Milwaukee: ASQ Quality Press. [Google Scholar]

- Anderson, Eugene W., Claes Fornell, and Donald R. Lehmann. 1994. Customer satisfaction, market share, and profitability: Findings from Sweden. Journal of Marketing 58: 53–66. [Google Scholar] [CrossRef]

- Anderson, James C., and James A. Narus. 1990. A model of distributor firm and manufacturer firm working partnerships. Journal of Marketing 54: 42–58. [Google Scholar] [CrossRef]

- Aurich, Jan C., Christian Fuchs, and Christian Wagenknecht. 2006. Life cycle oriented design of technical product-service systems. Journal of Cleaner Production 14: 1480–94. [Google Scholar] [CrossRef]

- Bajgoric, Nijaz, and Young B. Moon. 2009. Enhancing systems integration by incorporating business continuity drivers. Industrial Management & Data Systems 109: 74–97. [Google Scholar]

- Barki, Henri, and Alain Pinsonneault. 2005. A model of organizational integration, implementation effort, and performance. Organization Science 16: 165–79. [Google Scholar] [CrossRef]

- Barney, Jay. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Barriball, K. Louise, and Alison While. 1994. Collecting data using a semi-structured interview: A discussion paper. Journal of Advanced Nursing 19: 328–35. [Google Scholar] [CrossRef]

- Baumann, Jasmin, and Kenneth Le Meunier-FitzHugh. 2014. Trust as a facilitator of co-creation in customer-salesperson interaction—An imperative for the realization of episodic and relational value? AMS Review 4: 5–20. [Google Scholar] [CrossRef]

- Beheshti, Hooshang M., Iain J. Clelland, and K. Vernard Harrington. 2020. Competitive advantage with vendor managed inventory. Journal of Promotion Management 26: 836–54. [Google Scholar] [CrossRef]

- Berente, Nicholas, Betty Vandenbosch, and Benoit Aubert. 2009. Information flows and business process integration. Business Process Management Journal 15: 119–41. [Google Scholar] [CrossRef]

- Bhattacharya, Shantanu, Viswanathan Krishnan, and Vijay Mahajan. 1998. Managing new product definition in highly dynamic environments. Management Science 44: 50–64. [Google Scholar] [CrossRef]

- Blatherwick, Andrew. 1998. Vendor-Managed Inventory: Fashion Fad or Important Supply Chain Strategy? Supply Chain Management: An International Journal 3: 10–11. [Google Scholar] [CrossRef]

- Bose, Ranjit. 2002. Customer relationship management: Key components for IT success. Industrial Management & Data Systems 102: 89–97. [Google Scholar]

- Brax, Saara. 2005. A manufacturer becoming service provider–challenges and a paradox. Managing Service Quality: An International Journal 15: 142–55. [Google Scholar] [CrossRef]

- Brogowicz, Andrew A., Linda M. Delene, and David M. Lyth. 1990. A Synthesised Service Quality Model with Managerial Implications. International Journal of Service Industry Management 1: 27–45. [Google Scholar] [CrossRef]

- Bryman, Alan, and Emma Bell. 2011. Business Research Methods, 3rd ed. Oxford: Oxford University Press. [Google Scholar]

- Chan, S. L., and W. H. Ip. 2011. A dynamic decision support system to predict the value of customer for new product development. Decision Support Systems 52: 178–88. [Google Scholar] [CrossRef]

- Chen, Injazz J., and Karen Popovich. 2003. Understanding customer relationship management (CRM): People, process and technology. Business Process Management Journal 9: 672–88. [Google Scholar] [CrossRef]

- Chiang, Roger Hsiang-Li, Ee Peng Lim, and Veda C. Storey. 2000. A framework for acquiring domain semantics and knowledge for database integration. Data Base 31: 46–64. [Google Scholar]

- Claassen, Marloes J. T., Arjan J. Van Weele, and Erik M. Van Raaij. 2008. Performance outcomes and success factors of vendor managed inventory (VMI). Supply Chain Management: An International Journal 13: 406–14. [Google Scholar] [CrossRef]

- Cronin, J. Joseph, Jr., and Steven A. Taylor. 1992. Measuring service quality: A re-examination and extension. Journal of Marketing 56: 55–68. [Google Scholar] [CrossRef]

- Crosby, Lawrence A., Kenneth R. Evans, and Deborah Cowles. 1990. Relationship quality in services selling: An interpersonal influence perspective. Journal of Marketing 54: 68–81. [Google Scholar] [CrossRef]

- De Giovanni, Pietro. 2021. Smart Supply Chains with vendor managed inventory, coordination, and environmental performance. European Journal of Operational Research 292: 515–31. [Google Scholar] [CrossRef]

- De Ruyter, Ko, Luci Moorman, and Jos Lemmink. 2001. Antecedents of commitment and trust in customer-supplier relationships in high-technology markets. Industrial Marketing Management 30: 271–86. [Google Scholar] [CrossRef]

- Deng, Chun-Ping, Ji-Ye Mao, and Guo-Shun Wang. 2013. An empirical study on the source of vendors’ relational performance in offshore information systems outsourcing. International Journal of Information Management 33: 10–19. [Google Scholar] [CrossRef]