Artificial Intelligence in Auditing: A Conceptual Framework for Auditing Practices

Abstract

1. Introduction

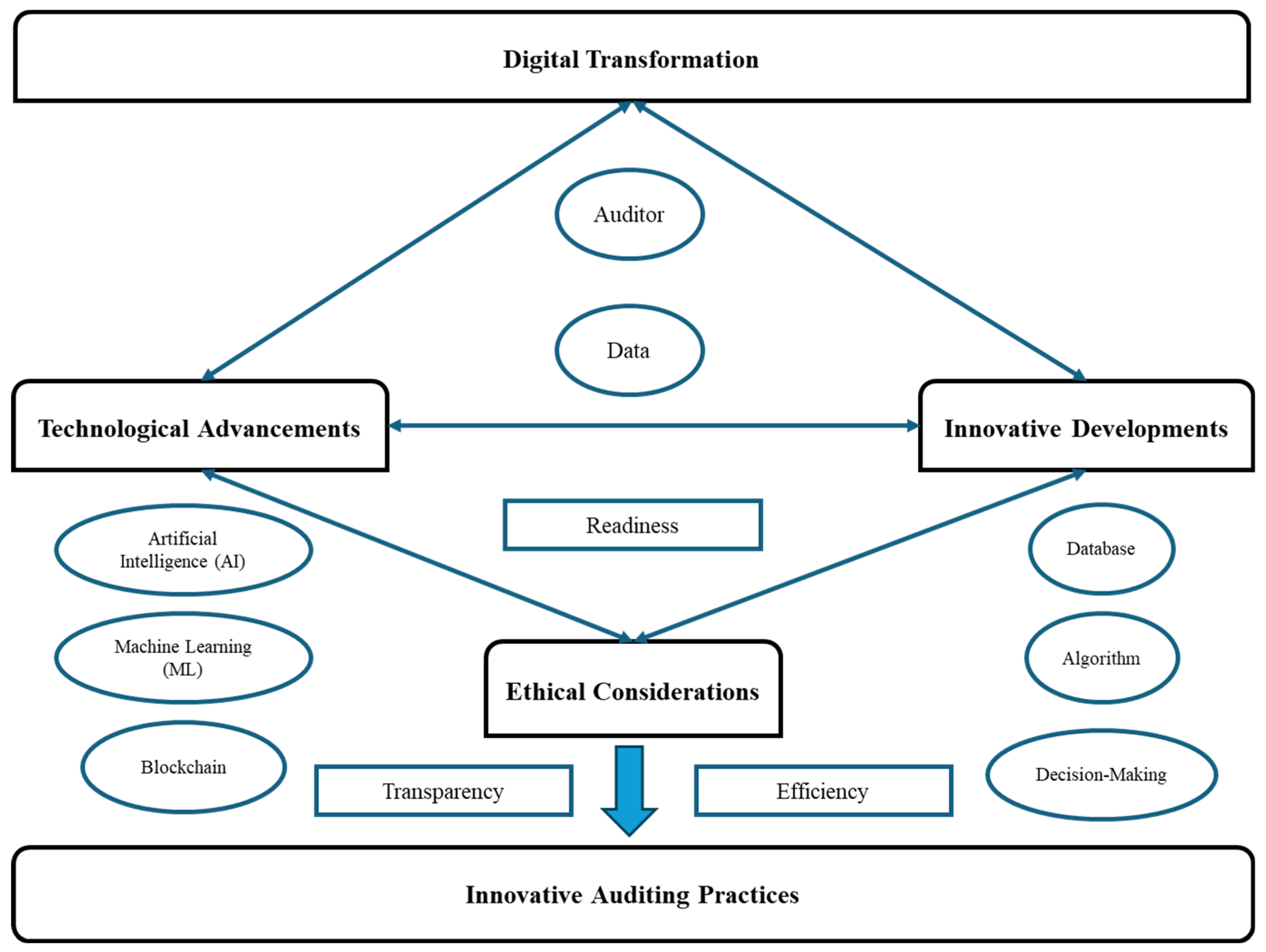

2. Results

2.1. Digital Transformation

2.2. Technological Advancements

2.3. Innovative Developments

2.4. Ethical Considerations

3. Discussion: The Case of MindBridge

4. Materials and Methods

4.1. Search Process

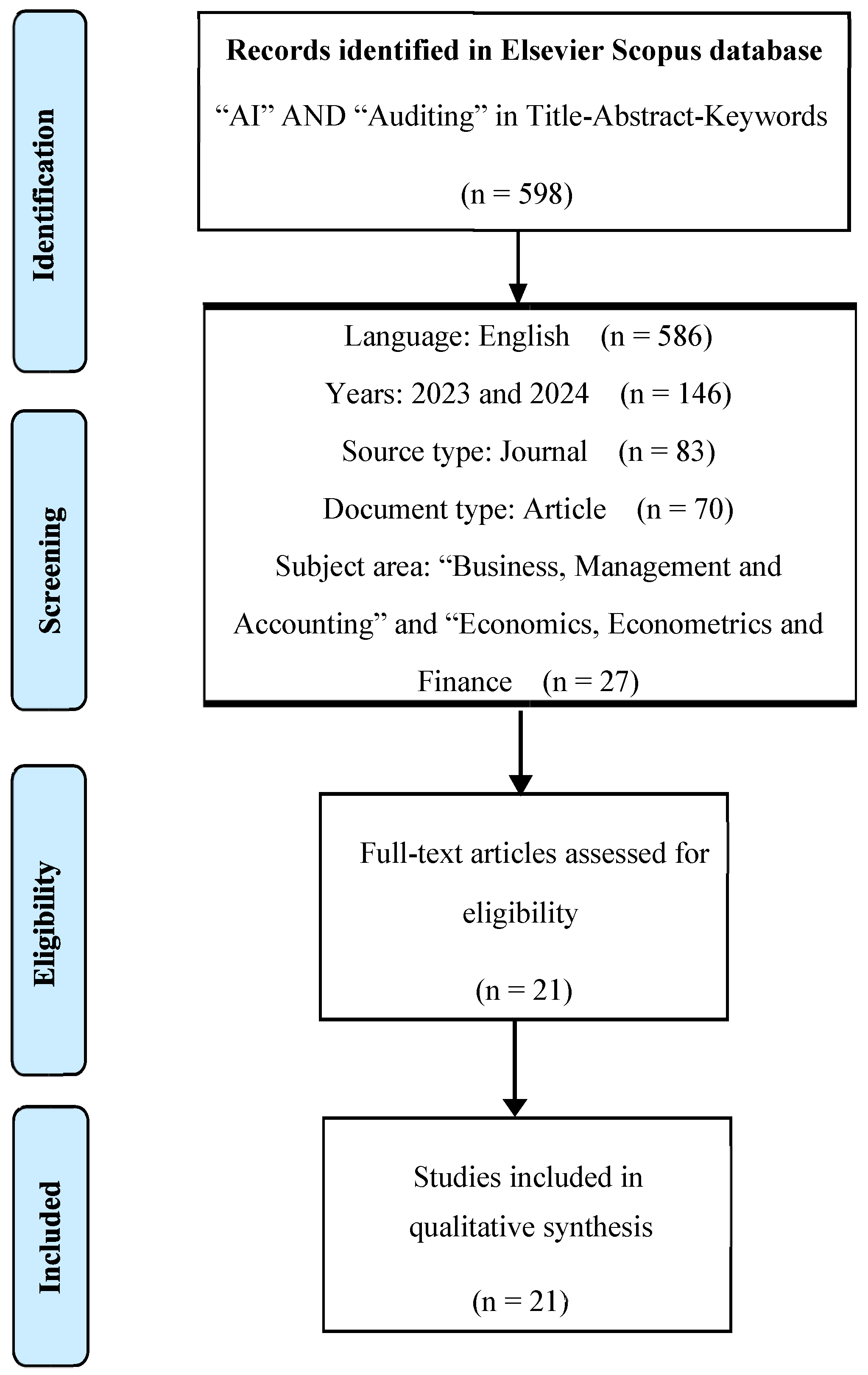

4.2. PRISMA Protocol

4.3. Data Extraction and Synthesis

4.4. Quality Assessment

5. Conclusions

5.1. Theoretical Implications

5.2. Managerial Contributions

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Author(s) (Year) | Purpose | Methodology | Main Findings |

|---|---|---|---|

| Lookadoo and Moore (2024) | Examine coverage of résumés and AI Applicant Tracking Systems (ATSs) in textbooks | Literature Review | The findings indicate a lack of consensus in 18 textbooks, highlighting challenges in providing specific advice on emerging AI technology |

| Semenikhin et al. (2023) | Explore the impact of management accounting on payment risks in online trade during military operations | Exploratory Study | The findings show that effective management accounting, including fast transaction identification and fraud loss estimation, significantly reduces payment risks in online trade during crises |

| Zhao and Wang (2024) | Explore ChatGPT’s applications in accounting | Literature Review | The findings indicate that ChatGPT can automate tasks, enhance reporting, and improve auditing, but ethical considerations are crucial for reliable use |

| Shapovalova et al. (2023) | Develop a modernization concept for national accounting policy within the Accounting 4.0 paradigm, integrating advanced technologies like AI, blockchain, and IoT | Literature Review | The findings indicate that adopting advanced technologies like AI, blockchain, and IoT enhances efficiency, accuracy, and transparency in national accounting policy, improving competitiveness |

| Adeoye et al. (2023) | Explore the effect of AI on audit quality | Exploratory Study | The results showed that AI has a positive impact on audit quality |

| Samiolo et al. (2023) | Examine the impact of technological advancements, particularly AI, on the auditing profession and challenge assumptions about automation’s feasibility | Literature Review | The results indicate that technology in auditing has risks: automating simple tasks may overlook judgment aspects, changing auditor habits and affecting practical knowledge acquisition. |

| Anh et al. (2024) | Investigate the impact of technology readiness (TR) on artificial intelligence (AI) adoption by accountants and auditors in Vietnamese companies | Exploratory Study | The findings reveal a positive relationship between TR and AI adoption, with perceived usefulness and ease-of-use mediating this relationship |

| Khuong et al. (2023) | Explore factors influencing AI demand in Vietnamese accounting and auditing | Experimental Research | The findings, validated by fsQCA, show that finance, tasks, technology, epidemics, readiness, and trust positively impact AI use |

| Seethamraju and Hecimovic (2023) | Explore the impact of AI on auditing, examining factors influencing AI adoption in audit practice | Exploratory Study | The findings display that several factors affect AI adoption in audits. While AI can enhance audit quality, concerns about control and transparency exist, necessitating a reevaluation of audit practices |

| Estep et al. (2023) | Examine managers’ perceptions of AI use in financial reporting and its impact on audit adjustments | Literature Review | The findings indicate that managers are uncertain about the benefits of auditors’ AI use, but it influences larger audit adjustments for companies using AI in complex accounting estimates |

| Castka and Searcy (2023) | Explore the adoption of new technologies in auditing | Literature Review | The study reveals an emerging TIC paradigm, shaped by innovative technology, urging an immediate transition |

| Taherizadeh and Beaudry (2023) | Identify the key dimensions of AI-driven digital transformation (AIDT) and develop a grounded theory that provides an understanding of how the AIDT process unfolds within Canadian SMEs | Literature Review | The study reveals five core dimensions: evaluating transformation context, auditing organizational readiness, piloting the AI integration, scaling the implementation, and leading the transformation |

| Abdullah and Almaqtari (2024) | Investigate the impact of AI, Industry 4.0 readiness, and Technology Acceptance Model (TAM) variables on various aspects of accounting and auditing operations | Experimental Research | The findings indicate that AI, big data analytics, cloud computing, and deep learning can improve accounting and auditing practices |

| Han et al. (2023) | Explore the impact of blockchain on accounting, particularly AI-enabled auditing, focusing on transparency, trust, and decision-making improvement | Literature Review | The findings indicate that blockchain enhances transparency, trust, and efficiency in accounting, along with highlighting challenges and the need for cautious adoption |

| Van Bekkum and Borgesius (2023) | Explore whether the GDPR’s rules on special categories of personal data hinder preventing AI-driven discrimination, focusing on the European context | Literature Review | The findings demonstrate that the GDPR generally prohibits using special category data, posing challenges in preventing AI-driven discrimination. The paper explores arguments for and against exceptions to address this tension |

| Huson et al. (2024) | Examine the literature about information technology, artificial intelligence, and blockchain in auditing | Literature Review | This study provides an overview of the profound impact of technology on the evolution of the auditing profession |

| Rodgers et al. (2023) | Propose a framework to employ think-aloud protocols (TaP) and thematic analysis in qualitative accounting research | Exploratory Study | The results indicate that the lack of an AI framework, IFRS knowledge, and legislation conflict may adversely interact with standard implementation |

| Hu et al. (2023) | Explore the incorporation of AI in internal audit practices, proposing strategies for effective implementation and decision-making within a comprehensive and interconnected framework | Experimental Research | The results indicate that the prioritized improvement order for implementing AI-driven internal audit involves strategies, governance, human factors, and data infrastructure, fostering efficient decision-making in a big data environment |

| Blösser and Weihrauch (2024) | Reveal important insights into the consumer perspective of AI certifications | Literature Review | The findings show that trust in AI certification is complex, and consumers seem to approve more of non-profit entities than for-profit entities, with the government approving the most. |

| Agustí and Orta-Pérez (2023) | Explore the influence of big data and AI in the fields of accounting and auditing | Literature Review | The main findings encompass mapping the evolution of publication activity, highlighting key contributors, and summarizing significant literature within this specific domain |

| Goto (2023) | Explore how PSFs can establish and utilize service R&D to innovate services | Case study | The findings outline the detailed process by which newly created service R&D organizations adopt advanced AI in firms |

| Author(s) | Item 1 | Item 2 | Item 3 | Item 4 | Item 5 | Item 6 | Item 7 | Item 8 | Item 9 | Item 10 | Score | Classification Quality | Scimago |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Lookadoo and Moore | Y | C | C | C | C | Y | Y | C | Y | Y | 15 | Good | Q2 |

| Semenikhin et al. | Y | C | C | N | C | Y | Y | Y | Y | C | 14 | Moderate | Q3 |

| Zhao and Wang | Y | C | C | C | C | Y | Y | C | Y | Y | 15 | Good | Q2 |

| Shapovalova et al. | Y | C | C | C | C | Y | Y | C | Y | Y | 15 | Good | Q1 |

| Adeoye et al. | Y | C | C | N | Y | Y | Y | C | Y | C | 14 | Moderate | Q3 |

| Samiolo et al. | Y | Y | C | C | Y | Y | Y | Y | Y | Y | 18 | Excellent | Q1 |

| Anh et al. | Y | Y | C | N | Y | Y | Y | Y | Y | C | 16 | Good | Q3 |

| Khuong et al. | N | C | C | N | Y | Y | Y | Y | Y | Y | 14 | Moderate | Q3 |

| Seethamraju and Hecimovic | Y | Y | Y | C | Y | Y | Y | Y | Y | Y | 19 | Excellent | Q1 |

| Estep et al. | Y | Y | C | C | Y | Y | Y | Y | Y | Y | 18 | Excellent | Q1 |

| Castka and Searcy | Y | N | C | C | Y | Y | Y | C | Y | Y | 15 | Good | Q1 |

| Taherizadeh and Beaudry | Y | C | C | Y | Y | Y | Y | C | Y | Y | 17 | Good | Q1 |

| Abdullah and Almaqtari | Y | Y | Y | Y | C | Y | Y | C | Y | Y | 18 | Excellent | Q1 |

| Han et al. | Y | Y | Y | C | C | Y | Y | C | Y | Y | 17 | Good | Q1 |

| Van Bekkum and Borgesius | Y | Y | Y | C | C | Y | Y | C | Y | Y | 17 | Good | Q1 |

| Huson et al. | Y | Y | C | Y | Y | Y | Y | C | Y | Y | 18 | Excellent | Q1 |

| Rodgers et al. | Y | Y | C | C | C | Y | Y | Y | Y | Y | 17 | Good | Q1 |

| Hu et al. | Y | Y | C | C | Y | Y | Y | Y | Y | Y | 18 | Excellent | Q1 |

| Blösser and Weihrauch | Y | Y | Y | C | Y | Y | Y | Y | Y | Y | 19 | Excellent | Q1 |

| Agustí and Orta-Pérez | Y | Y | C | C | C | Y | Y | C | Y | Y | 16 | Good | Q3 |

| Goto | Y | Y | Y | Y | C | Y | Y | C | Y | Y | 18 | Excellent | Q1 |

References

- Abdullah, Abdulwahid Hashidand, and Faozi A. Almaqtari. 2024. The impact of artificial intelligence and Industry 4.0 on transforming accounting and auditing practices. Journal of Open Innovation: Technology, Market, and Complexity 10: 1–20. [Google Scholar] [CrossRef]

- Adeoye, Isaiah Oluwasegun, Rufus Ishola Akintoye, Anaekenwa Aguguom Theophilus, and O. A. Olagunju. 2023. Artificial intelligence and audit quality: Implications for practicing accountants. Asian Economic and Financial Review 13: 756–72. [Google Scholar] [CrossRef]

- Afsay, Akram, Arash Tahriri, and Zabihollah Rezaee. 2023. A meta-analysis of factors affecting acceptance of information technology in auditing. International Journal of Accounting Information Systems 49: 1–27. [Google Scholar] [CrossRef]

- Agustí, María A., and Manuel Orta-Pérez. 2023. Big data and artificial intelligence in the fields of accounting and auditing: A bibliometric analysis. Revista Espanola de Financiacion y Contabilidad 52: 412–38. [Google Scholar] [CrossRef]

- Alotaibi, Eid M. 2023. Cloud computing to audit quality-evidence from the Kingdom of Saudi Arabia. International Journal of Applied Economics, Finance and Accounting 17: 18–29. [Google Scholar] [CrossRef]

- Anh, Nguyen Thi Mai, Le Thi Khanh Hoa, Lai Phuong Thao, Duong Anh Nhi, Nguyen Thanh Long, N. T. Truc, and V. Ngoc Xuan. 2024. The Effect of Technology Readiness on Adopting Artificial Intelligence in Accounting and Auditing in Vietnam. Journal of Risk and Financial Management 17: 27. [Google Scholar] [CrossRef]

- Bazeley, Patricia, and Kristi Jackson. 2019. Qualitative Data Analysis with NVivo, 3rd ed. Washington, DC: SAGE Publications. [Google Scholar]

- Bento, Regina F., and Lourdes F. White. 2023. Artificial Intelligence and Ethical Professional Judgments in a Small Audit Firm Context. Business and Professional Ethics Journal 42: 315–57. [Google Scholar] [CrossRef]

- Blösser, Myrthe, and Andrea Weihrauch. 2024. A consumer perspective of AI certification—the current certification landscape, consumer approval and directions for future research. European Journal of Marketing 58: 441–70. [Google Scholar] [CrossRef]

- Braun, Virginia, and Victoria Clarke. 2021. Thematic Analysis: A Practical Guide. Washington, DC: SAGE Publications. [Google Scholar]

- Castka, Pavel, and Cory Searcy. 2023. Audits and COVID-19: A paradigm shift in the making. Business Horizons 66: 5–11. [Google Scholar] [CrossRef]

- Cornacchia, Giandomenico, Vito Anelli, Giovanni Biancofiore, Fedelucio Narducci, Claudio Pomo, Azzurra Ragone, and Eugenio Di Sciascio. 2023. Auditing fairness under unawareness through counterfactual reasoning. Information Processing and Management 60: 1–27. [Google Scholar] [CrossRef]

- Estep, Cassandra, Emily E. Griffith, and Nikki L. MacKenzie. 2023. How do financial executives respond to the use of artificial intelligence in financial reporting and auditing? Review of Accounting Studies 29: 2798–31. [Google Scholar] [CrossRef]

- Fedyk, Anastassia, James Hodson, Natalya Khimich, and Tatiana Fedyk. 2022. Is artificial intelligence improving the audit process? Review of Accounting Studies 27: 938–85. [Google Scholar] [CrossRef]

- Goto, Masashi. 2023. Anticipatory innovation of professional services: The case of auditing and artificial intelligence. Research Policy 52: 104828. [Google Scholar] [CrossRef]

- Guz, A. N., and J. J. Rushchitsky. 2009. Scopus: A system for the evaluation of scientific journals. International Applied Mechanics 45: 351–362. [Google Scholar] [CrossRef]

- Han, Hongdan, Radha K. Shiwakoti, Robin Jarvis, Chima Mordi, and David Botchie. 2023. Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. International Journal of Accounting Information Systems 48: 100598. [Google Scholar] [CrossRef]

- Hu, Kuang-Hua, Fu-Hsiang Chen, Ming-Fu Hsu, and Gwo-Hshiung Tzeng. 2023. Governance of artificial intelligence applications in a business audit via a fusion fuzzy multiple rule-based decision-making model. Financial Innovation 9: 117. [Google Scholar] [CrossRef]

- Huson, Yazan Abu, Laura Sierra-García, and María Antonia Garcia-Benau. 2024. A bibliometric review of information technology, artificial intelligence, and blockchain on auditing. Total Quality Management & Business Excellence 35: 91–113. [Google Scholar] [CrossRef]

- Jagatheesaperumal, Senthil Kumar, Mohamed Rahouti, Kashif Ahmad, Ala Al-Fuqaha, and Mohsen Guizani. 2022. The Duo of Artificial Intelligence and Big Data for Industry 4.0: Applications, Techniques, Challenges, and Future Research Directions. IEEE Internet of Things Journal 9: 12861–85. [Google Scholar] [CrossRef]

- Kaplan, Andreas, and Michael Haenlein. 2019. Siri, Siri, in my hand: Who’s the fairest in the land? On the interpretations, illustrations, and implications of artificial intelligence. Business Horizons 62: 15–25. [Google Scholar] [CrossRef]

- Khuong, Nguyen Vinh, Le Huu Tuan Anh, Le Thi Ngoc Ha, Le Van Cuong, Nguyen Phan Thanh Ngan, Hoang Thi Minh Thu, and Le Kim Minh. 2023. Factors Affecting Decision to Adopt Artificial Intelligence During COVID-19 Pandemic Period: Evidence from PLS-SEM and fsQCA. Vision, 1–15. [Google Scholar] [CrossRef]

- KPMG. 2024. KPMG and MindBridge Announce Alliance to Power KPMG Audits with AI Technology. Available online: https://kpmg.com/xx/en/home/media/press-releases/2023/04/kpmg-and-mindbridge-announce-alliance-to-power-kpmg-audits-with-ai-technology.html (accessed on 25 March 2024).

- Krippendorff, Klaus. 2019. Content Analysis. An Introduction to Its Methodology, 4th ed. Washington, DC: SAGE. [Google Scholar] [CrossRef]

- Laux, Johann, Sandra Wachter, and Brent Mittelstadt. 2024. Trustworthy artificial intelligence and the European Union AI act: On the conflation of trustworthiness and acceptability of risk. Regulation & Governance 18: 3–32. [Google Scholar] [CrossRef]

- Lookadoo, Kathryn, and Sarah Moore. 2024. Is Your Résumé/Textbook Up-To-Date? An Audit of AI ATS Résumé Instruction. Business and Professional Communication Quarterly, 1–24. [Google Scholar] [CrossRef]

- Miller, Barbara, Judith Haber, Jennifer Yost, and Susan Jacobs. 2009. Evidence-Based Practice Challenge: Teaching Critical Appraisal of Systematic Reviews and Clinical Practice Guidelines to Graduate Students. Journal of Nursing Education 48: 186–95. [Google Scholar] [CrossRef] [PubMed]

- MindBridge. 2024. The MindBridge AI Platform General Ledger. Available online: https://www.mindbridge.ai/ (accessed on 22 March 2024).

- Moher, David, Alessandro Liberati, J. Tetzlaff, Douglas G. Altman, and PRISMA Group. 2009. Reprint—Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. Physical Therapy 89: 873–80. [Google Scholar] [CrossRef] [PubMed]

- Munoko, Ivy, Helen L. Brown-Liburd, and Miklos Vasarhelyi. 2020. The Ethical Implications of Using Artificial Intelligence in Auditing. Journal of Business Ethics 167: 209–34. [Google Scholar] [CrossRef]

- Page, Matthew J., Joanne E. McKenzie, P. M. Bossuyt, I. Boutron, Tammy C. Hoffmann, Cynthia D. Mulrow, L. Shamseer, Jennifer M. Tetzlaff, Elie A. Akl, Sue E. Brennan, and et al. 2021. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 372: n71. [Google Scholar] [CrossRef]

- Peng, Chen, and Guixian Tian. 2023. Intelligent auditing techniques for enterprise finance. Journal of Intelligent Systems 32: 20230011. [Google Scholar] [CrossRef]

- Prokofieva, Maria. 2023. Integrating data analytics in teaching audit with machine learning and artificial intelligence. Education and Information Technologies 28: 7317–53. [Google Scholar] [CrossRef]

- Rahman, Md Jahidur, and Ao Ziru. 2023. Clients’ digitalization, audit firms’ digital expertise, and audit quality: Evidence from China. International Journal of Accounting and Information Management 31: 221–46. [Google Scholar] [CrossRef]

- Rodgers, Waymond, Sinan Al-Shaikh, and Mohamed Khalil. 2023. Protocol Analysis Data Collection Technique Implemented for Artificial Intelligence Design. IEEE Transactions on Engineering Management 71: 1–12. [Google Scholar] [CrossRef]

- Rodrigues, Luis, José Pereira, Amélia Ferreira da Silva, and Humberto Ribeiro. 2023. The impact of artificial intelligence on audit profession. Journal of Information Systems Engineering and Management 8: 1–7. [Google Scholar] [CrossRef]

- Saengsith, Nadta, and Phassawan Suntraruk. 2022. Assessing the internal auditors’ readiness for digital transformation. Global Business and Economics Review 28: 1–21. [Google Scholar] [CrossRef]

- Samiolo, Rita, Crawford Spence, and Dorothy Toh. 2023. Auditor judgment in the fourth industrial revolution. Contemporary Accounting Research 41: 1–31. [Google Scholar] [CrossRef]

- Seethamraju, Ravi, and Angela Hecimovic. 2023. Adoption of artificial intelligence in auditing: An exploratory study. Australian Journal of Management 48: 780–800. [Google Scholar] [CrossRef]

- Semenikhin, Maksym, Olena Fomina, Oksana Aksyonova, and Alona Khmeliuk. 2023. Management Accounting of Payment Risks of Online Trade during Military Operations. Theoretical and Practical Research in the Economic Fields 14: 473–83. [Google Scholar] [CrossRef] [PubMed]

- Shapovalova, Alla, Olena Kuzmenko, Oleh Polishchuk, Tetyana Larikova, and Zoriana Myronchuk. 2023. Modernization of the National Accounting and Auditing System Using Digital Transformation Tools. Financial and Credit Activity: Problems of Theory and Practice 4: 33–52. [Google Scholar] [CrossRef]

- Singh, Jatinder. 2013. Critical appraisal skills programme. Journal of Pharmacology and Pharmacotherapeutics 4: 76–77. [Google Scholar] [CrossRef]

- Taherizadeh, Amir, and Catherine Beaudry. 2023. An emergent grounded theory of AI-driven digital transformation: Canadian SMEs’ perspectives. Industry and Innovation 30: 1244–73. [Google Scholar] [CrossRef]

- Tranfield, David, David Denyer, and Palminder Smart. 2003. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. British Journal of Management 14: 207–22. [Google Scholar] [CrossRef]

- Van Bekkum, Marvin, and Frederik Borgesius. 2023. Using sensitive data to prevent discrimination by artificial intelligence: Does the GDPR need a new exception? Computer Law & Security Review 48: 1–12. [Google Scholar] [CrossRef]

- Van Hueveln, Nathaniel. 2017. Ventilator-Associated Pneumonia and the Effectiveness of Endotracheal Tubes Coated with Silver Sulfadiazine. Master’s thesis, Rhode Island College, Providence, RI, USA. [Google Scholar]

- Wassie, Fekadu Agmas, and László Péter Lakatos. 2024. Artificial intelligence and the future of the internal audit function. Humanities and Social Sciences Communications 11: 1–13. [Google Scholar] [CrossRef]

- Zhao, Joanna, and Xinruo Wang. 2024. Unleashing efficiency and insights: Exploring the potential applications and challenges of ChatGPT in accounting. Journal of Corporate Accounting and Finance 35: 269–76. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leocádio, D.; Malheiro, L.; Reis, J. Artificial Intelligence in Auditing: A Conceptual Framework for Auditing Practices. Adm. Sci. 2024, 14, 238. https://doi.org/10.3390/admsci14100238

Leocádio D, Malheiro L, Reis J. Artificial Intelligence in Auditing: A Conceptual Framework for Auditing Practices. Administrative Sciences. 2024; 14(10):238. https://doi.org/10.3390/admsci14100238

Chicago/Turabian StyleLeocádio, Diogo, Luís Malheiro, and João Reis. 2024. "Artificial Intelligence in Auditing: A Conceptual Framework for Auditing Practices" Administrative Sciences 14, no. 10: 238. https://doi.org/10.3390/admsci14100238

APA StyleLeocádio, D., Malheiro, L., & Reis, J. (2024). Artificial Intelligence in Auditing: A Conceptual Framework for Auditing Practices. Administrative Sciences, 14(10), 238. https://doi.org/10.3390/admsci14100238