Abstract

The link between entrepreneur’s network centrality and innovation performance has been broadly studied in knowledge-intensive industries such as biotechnology. However, little research has been focused on the social mechanisms that allow innovators to reach such a central position. We contribute to the existing literature by exploring the factors that may lead or prevent entrepreneurs from reaching a central position in their professional networks of knowledge exchange and social support in French biotech milieu. We use a unique quantitative and qualitative database of 138 and 126 biotech entrepreneurs observed, respectively, in 2008 and 2013. When accounting for entrepreneurs’ position in the social (friendship) and knowledge (advice) domain, we draw on three dimensions through which entrepreneurs build their position: their professional experience, their inter-organizational (or political) engagement, and the financial and geographical situation of their company. Results from a regression analysis showed that the specific individual and organizational aspects of the trajectory of the entrepreneurs explain their position in the observed networks. Factors such as the previous experience in the health industry, the training expertise, the international experience, the political engagement, and the geographical and financial situation of the company help entrepreneurs to build up their centrality. The two observations allow us to describe indirectly the evolution of norms that are considered legitimated to carry out innovation in the biotech field.

1. Introduction

Biotechnology is a knowledge-intensive industry that relies on a fluid and dynamic collaboration network, including firms, universities, research laboratories, suppliers, and customers (Colovic 2019; Hughes and Kitson 2012; Powell et al. 1996). The fundamental role of synergies in creating successful entrepreneurial ecosystems has been discussed extensively (Acs et al. 2017; Focacci and Kirov 2021; Perez 2002). Among the various forms of collaboration, the exchange of ‘tacit knowledge’ is of particular relevance for firms’ performance (Pina Stranger and Lazega 2011). Mainstream research has been usually interested in the factors favouring the spillover of informal knowledge, including through proximity and clustering (Audretsch and Stephan 1996). In this article, we take an alternative approach: based on the idea that the exchange of tacit knowledge is conditioned to the entrepreneur’s epistemic and social status, we propose to explore the sources of these statuses can be explore by looking at the induvial and organizational trajectories.

While maturing as innovators and training in technology development and business, entrepreneurs claim scientific and financial expertise in crucial domains of the biotechnology industry and innovation process. During the initial founding decisions (Tornikoski and Renko 2014) and later on, such expertise is subject to the scrutiny of the community of peers, who judge entrepreneurs’ quality of knowledge as well as trustworthiness for potential collaboration. Thus, the status as an expert or as a reliable stakeholder is a personal intangible asset obtained in a relational way (Kotlar and Sieger 2019). The members of the biotechnology ecosystem evaluate and validate the ‘credentials’ that allow an entrepreneur to be ‘credible’. For this reason, we believe it is necessary to explore what elements in the innovators individual and organizational trajectory allow them to gain epistemic and social status.

The recognition and legitimization of entrepreneurs’ epistemic and social credentials is marked by the socio-historical norms, values, beliefs, and definitions that underly a given milieu in a particular time (Bargues and Valiorgue 2019; Suchman 1995). What is positively appreciated in a specific industry may trigger a negative assessment in another. In the case of engineering-based fields, Roberts (1991) observed that founders with a PhD were not positively regarded by their peers because they were considered to have a temperament, attitude, and orientation usually ‘out of line with those necessary for successful technical entrepreneurship’ (p. 253). Similarly, in the technical industry of the internet, Hsu (2007) found that having a PhD has a significantly negative impact compared to obtaining funding from VCs. In knowledge-intensive fields, biotech entrepreneurs holding an MBA may be considered more highly by their peers, affecting their position in the knowledge and social networks due to larger entrepreneurial intentions (Amofah et al. 2020).

In this article, we aim to identify and explain the attributes or ‘credentials’ that lead biotech entrepreneurs to gain a central status, or ‘prominence position’ in a network (Freeman 1979), either as social or epistemic authorities. Our strategy consists of mapping friendship and advice ties among entrepreneurs belonging to the French biotechnology industry. Both personal ties have been previously studied to explore their influence on performance indicators (Gibbons 2004), including enhanced collaboration and better information exchange among competitors (e.g., Ingram and Roberts 2000; Lazar et al. 2022) or exchange of knowledge (Pina Stranger and Lazega 2010). However, little research has been conducted on the credentials (referred also as social capital o signals) or trajectory events that allow entrepreneurs to be granted with such a central power position in the biotechnology field.

We are interested in understanding the role of social mechanisms in shaping entrepreneurs’ centrality and, therefore, ability to enhance the sector’s coordination capability and economic performance. While previous research has specifically focused on formal networks, we consider informal ties, such as advice exchange and friendship, that are developed through interpersonal channels. Particularly, we are interested in answering the following questions that link the induvial and organizational trajectories of a venture whit the epistemic and social position of entrepreneurs in the peers’ network. Namely, whether industry experience in the health sector affects entrepreneurs’ centrality, whether educational experience plays a role in making the entrepreneur a greater friend or expert, whether political engagement may influence actors’ centrality network positions, to what extent having worked in a public company (IPO) grants entrepreneurs higher levels of expertise and friendship, and finally, whether experience built by working in a capital city affects centrality. While the extant studies have provided evidence for entrepreneurs being innovators, we contribute to the literature by shedding light on the ability of entrepreneurs to also think and behave as social actors in a broad exchange system with their peers.

This article has been organized as follows. First, we describe the theoretical framework (Section 2), which includes research on actors’ attributes (Section 2.1), and centrality through both personal and impersonal ties (Section 2.2) in both advice (Section 2.3) and friendship (Section 2.4) networks. We then describe our methodology (Section 3), and we conclude with a description (Section 4) and discussion (Section 5) of our main results.

2. Theoretical Background

2.1. Researching Attributes

In the domain of innovation studies, individuals’ attributes can be approached from at least two different theoretical perspectives. In the first approach, features such as educational background or business experience are seen as human capital if attributes represent sources of knowledge and as social capital if attributes constitute valuable connections within the network. While human capital shapes individuals’ skills and capabilities (England and Folbre 2023), social capital is a resource linked to the social relations (Häuberer 2011). In this regard, extensive research has accounted for the association between ‘social capital’ and companies’ ‘performance’, including innovativeness (Samad 2020), access to loans and lower interests (Talavera et al. 2012), venture capital activity (Grilli et al. 2018), and stronger supplier relations (Gölgeci and Kuivalainen 2020). Thus, it is possible to establish that social capital directly contributes to obtaining social status or authority (Hsu 2007), while human capital may contribute to the development of epistemic status or authority.

In the second approach, individuals’ attributes are considered ‘signals’ or ‘symbols of legitimacy’ (Feldman and March 1981). When reliable information is lacking, investing organizations base their decisions on ‘observable’ features of information, ‘observable resources’ (Hoenig and Henkel 2015), or ‘meaningful patterns’ that help ‘connecting the dots’ (Baron and Ensley 2006). This explains why, based on entrepreneurs’ scientific background, VC’s could make investment decisions on unexperienced biotech start-ups, or entrepreneurs with appealing backgrounds might be hired as CEOs to strategically attract high investments (Nigam et al. 2020).

2.2. Centrality through Formal Ties

Centrality has been mostly studied with respect to performance indicators, including formal ties such as patents and R&D contractual relations. According to Pina Stranger and Lazega (2011), the exploration of formal ties would be paradoxical given the often-assumed importance of inter-individual relationships through impersonalized ties such as counselling or friendship relationships. Zhou et al. (2021) also used centrality measures (i.e., exchange of information and resources) to explain companies’ product and process development in green-tech ventures. Gilding et al. (2020) used centrality in terms of partner popularity, R&D collaborations, and co-authorships to interpret the number of patent applications, fund raising, and ability to scale-up among biotech firms. In the past, Ahuja (2000) explored the correlation between centrality through inter-firm collaborative linkages with other organizations of the network and the number of successful patent applications in chemical-industry firms.

Other intellectual outputs have been exploited as dependent variables. Rojas et al. (2018) used network centrality through firm-to-firm and government-to-firm collaboration networks to observe possible relations with R&D innovations. Chen et al. (2020) used centrality to estimate the impact of inter-organizational collaboration across research institutes, industries, and universities on scientific performance of research institutes. Financial indicators have also been explained in terms of centrality position. Gloor et al. (2020) exploited centrality measured as engagement of VCs on the board and presence of board members on Twitter to explain total sales and funding received by start-ups since their founding. El-Khatib et al. (2015) researched centrality in terms of CEOs personal connections to illustrate successfully completed acquisitions of a US public target. Chou et al. (2013) used VC’s prestige to analyze companies’ IPO. Co-investment networks were also recently exploited to understand business angel portfolio performance in terms of portfolio returns (Antretter et al. 2020).

While centrality has often been investigated in relation to performance, many studies focus on centrality as a set of values. Huggins et al. (2020) recently looked at universities’ role as open innovators by investigating characteristics such as their involvement in funded research projects with external actors, as well as performance indicators such as status, prestige, reputation, and size. Zhang et al. (2020) considered online B2B companies’ network centrality through features of social interactions between companies and customers and to explain sales performance, while Tsai et al. (2019) considered Chinese companies’ centrality in terms of political connections.

2.3. Centrality through Interpersonal Ties

A limited number of studies have shown the effect of systematic interpersonal ties between organizations and economic activities (Pina Stranger and Lazega 2011). Among interpersonal ties, friendship and advice networks have, for instance, been studied with respect to their roles in maintaining or changing professional values at an organizational level (see the seminal work of Emmanuel Lazega 2001). On this subject, Gibbons (2004) found that advice networks, including advice-seeking and advice-giving, sustain existing professional values as they tend to depend on task structure while friendship tends to facilitate the development of new professional values as it rests on trust and intimacy. In general, it is observed that informal institutions and collaborations support knowledge transfer (Ibidunni et al. 2020) and firm innovation (Saka-Helmhout et al. 2020), in both cases of tech giants such as Apple (Foerderer 2020) and chemistry and biotech starts-ups (Ma et al. 2022; Stanfield et al. 2022).

2.3.1. Advice Ties

Advice has been a relevant exchange system used to explore how epistemic status and collective learning may affect innovation. As highlighted by Galloway et al. (2019), entrepreneurs will be more likely to rely on advice from peers they believe possess valuable knowledge applicable to their business. One key aspect in measuring advice centrality is dyad’s ‘reciprocity’, where asymmetrical relationship among actors may account for prestige or power (Hite 2005). Although advice can be used as a network system to explain a firm’s performance, literature on the topic seems not to be as extensive as that using performance indicators to explain advice centrality. Sparrowe et al. (2001), for instance, examined individual job performance among 190 employees in five different types of organizations to explain centrality in advice networks, concluding that individual performance (measured in terms of performance on required duties and discretionary behaviors beyond the formal job description) was positively related to advice centrality. In other words, epistemic status was associated with knowledge about task-related problems. In another study, Cross et al. (2001) analyzed the behavior of 16 top managers in a human resource department of a large healthcare organization and identified the properties of the (multiplex) advice network, including providing solutions, meta-knowledge, problem reformulation, validation, and legitimation. They found that the five components tend to overlap in social solidarity, meaning that a contact who provides a given benefit is also very likely to provide all the other ones. In connection to this, Erdogan et al. (2015) recently observed that leader–member exchange quality is positively related to centrality for those actors with a high tendency to help coworkers. Recently, Cangialosi et al. (2021) showed that a central position in the advice network is positively associated with innovative work behavior. Broekhuizen and Zhu (2021) also found that employees with a central position in multiplex networks can tap into the complementarity of advice networks’ assets, allowing them to convert market orientation into innovation behaviors more effectively. Similar results were found by Yuan and van Knippenberg in China regarding the role of advice-giving networks on team performance (Yuan and Van Knippenberg 2022) and creativity (Yuan and van Knippenberg 2020). More in general, collaborations where internal or external advice from ‘experts’ is sought positively contribute to innovation performance (Belso-Martínez et al. 2020; Apa et al. 2021).

2.3.2. Friendship Ties

Another interpersonal exchange system that may affect innovation is friendship. A friendship relationship usually satisfies three conditions: interaction, which allows for an exchange of information and resource; affection, or (a)symmetrical liking; and time, intended as continuous interactions over time. With respect to specific attributes of friendship, Muller and Peres (2019) showed how growth, including innovativeness and performance, is especially present in networks where cohesion (i.e., mutual influence), connectedness (i.e., high number of ties), and conciseness are observed. Related to this, Gerges-Yammine and Ter Wal (2023) recently observed how betweenness centrality protects ‘friends’ firms from inter-firm imitation effects. When referring to innovation, Mendoza-Silva (2021) recently showed how friendship relationships are the bedrock of knowledge-sharing and innovation capability. Investigating an R&D center of a global pharmaceutical company, Gómez-Solórzano et al. (2019) found that friendship cliques correlate positively with inventors’ innovative productivity. Similar results were observed by Cao and Zhang (2020) on a sample of 441 managers in China. Looking at the specific case of Italian tourism, Valeri and Baggio (2022) show that stronger ties between travel agencies and tour operators cause the capacity of the system to exchange information and knowledge to increase and its overall efficiency to improve. In the digital field, Sullivan et al. (2020) explored how learning activities and network ties impact performance (e.g., early sales and employee growth) for high tech start-ups in incubators. Radical innovations were also observed for German biotech companies by Shkolnykova and Kudic (2022).

In the next subsection, we present the theoretical framework and develop the hypotheses that will allow us to explain social and epistemic centrality in the French biotechnology industry.

2.4. Towards Social and Epistemic Centrality: Theory and Hypothesis

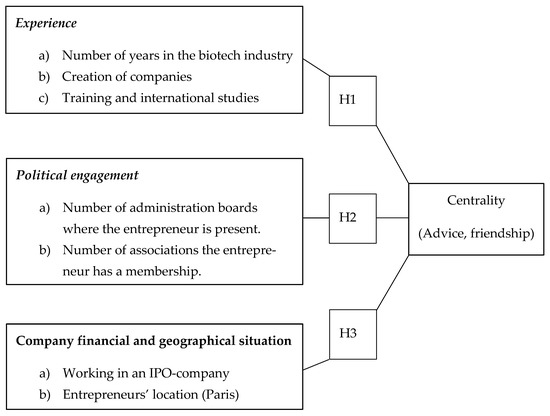

Entrepreneurs can be granted with social and epistemic status based on different credentials or quality signals related to their induvial or organisational trajectory. The justification of this focus lies in the importance of changes in society and the ‘governmentalization’ of entrepreneurs. In other words, the value of entrepreneurs can nowadays not be fully grasped without accounting for the role they play in their surrounding collectives. This includes their engagements in organizations (from professional associations to venture boards) where they can ‘make a change’ thanks to their expertise and networks. It also includes their professional, academic, and entrepreneurial experience and hence accumulation of social and human capital necessary to stand out, as well as the level of centrality reached through the features of their induvial and organizational carriers or trajectories. As explained by Marttila (2013), ‘the entrepreneur has become the role model for the conduct of states, organizations and enterprises. Looking at these aspects is in line with the idea that identified proactive behavior has positive consequences for organizations and the communities and is often found in ‘successful entrepreneurs’ (Bateman and Crant 1999). As illustrated below (Figure 1), in this paper, we argue that success intended as centrality can be influenced by various aspects and that these aspects affect centrality to a different extent.

Figure 1.

Hypothesis explaining centrality in advice and friendship networks.

2.4.1. Experience

Investors often claim that ‘they bet on the jockey, not on the horse’ when choosing which ventures to back, probably because those with prior industry experience or technical skills related to the industry are aware of the industry norms, rules, and dynamics of every changing environment (Delmar and Shane 2006). Higgins and Gulati (2006) found that upper echelons’ ‘origin’ (i.e., work experience), especially from the bio-pharmaceutical sector, affected their ability to receive the endorsement of prestigious investment banks when undertaking an IPO. As ‘valid signals of value’, Cohen and Dean (2005) observed that, unlike education, industrial experience, top management team experience, and age had a significant negative impact on under-pricing in the context of asymmetry between investors and pre-IPO owners. Hiring one manager over 40–45, with prior TMT and industry experience can decrease under-pricing by around USD18 million. In other words, path-dependence, intended as matured experience in the sector, allows granting a higher status to the entrepreneur. This is in line with the idea that successful entrepreneurial ecosystems ‘exhibit distinctive characteristics that are socially, spatially, and relationally intertwined’ (Brown and Mason 2017). As shown, it is precisely entrepreneur’s experience in the sector that strengthens the impact of professional resources and hence the economic performance of businesses (Hernández-Carrión et al. 2017).

Based on this evidence, we contend the following hypothesis about biotech entrepreneurs’ centrality:

Hypothesis 1a.

Industry experience (years in the biotech industry) may influence actors’ centrality network positions.

Entrepreneurial experience has also been considered as a valuable credential in the innovation field. In general, it is possible to distinguish between novice, serial, and portfolio entrepreneurs, which may differ in terms of their decisions, actions, and performance. Defined as ‘individuals who have sold/closed a business in which they had a minority or majority ownership stake, and they currently have a minority or majority ownership stake in a single independent business that is either new, purchased, or inherited’ (Westhead et al. 2005, p. 394), serial entrepreneurs have been studied in terms of start-ups created. Indeed, research on entrepreneurial experience has found that prior start-up founding experience can serve as a powerful human capital signal (Hsu 2007) and can increase the likelihood of obtaining VC funding. According to Zhang (2011), a possible reason is that, compared to novice entrepreneurs, those with prior firm-founding experience are expected to have more skills and social connections, which allows them to raise more venture capital at an early round of financing and complete the early round more quickly. From a cognitive point of view, entrepreneurs with prior experience in creating start-ups are believed to have strong cognitive skills that help them to identify entrepreneurial opportunities (Baron and Ensley 2006). We build on the argument by Chen et al. (1998) that self-efficacy is a distinguishing trait of entrepreneurs. In particular, we opted for founding experience as a proxy for self-efficacy that allows subjects to show, and hence be recognized as such, that they are able to successfully perform ‘the various roles and tasks of entrepreneurship’.

Based on this, we contend the following hypothesis:

Hypothesis 1b.

Entrepreneurial experience in founding companies may influence actors’ centrality network positions.

Frequently considered as a source of ‘power’ (Saidu 2019) or a ‘wealth effect’ trigger (e.g., Colombo and Grilli 2005), entrepreneurs’ education, including the type and level of training, is usually treated as a variable to explain firm’s performance. Interested in the effects of financial education, Lindorff and Jonson (2013) investigated the impact of CEO business education on Australian firms’ performance and found that CEO business training (having an MBA) does not influence firm performance. Contrarily, Colombo and Grilli (2005) found that, while the years of education of founders are not related to growth, the years of undergraduate and graduate education in economic and managerial fields do positively affect growth. With a broader approach to education, Saidu (2019) explored how CEO characteristics, including education, ownership of a firm, and origin (e.g., being promoted as a CEO or coming from outside) influence firm performance and found that postgraduate training improved profitability, possibly due to connections built during education. Specifically concerning PhD degrees, Hsu (2007) observed that, in the context of the emerging (at the time) internet industry, founding teams with a doctoral degree holder were more likely to be funded via a direct VC tie and receive higher valuations. Credentials will also depend on socio-historical norms. In this respect, there are studies that consider education as a social prestigious attribute which helps access to financing (Nigam et al. 2020). We focus on education for the main reason highlighted by Rauch and Hulsink (2015), that education is effective in shaping attitudes and may increase perceived behavioral control. As a result, subjects may grow an interest to become advisers early on and continue developing useful relationships over their career.

Based on this, we contend the following hypothesis:

Hypothesis 1c.

Educational experience may influence actors’ centrality network positions.

2.4.2. Political Engagement

Political engagement has also proven to be a predictor of economic indicators. Do et al. (2017) found that external networks of directors positively and significantly impact firm value and decisions. Close to elections, local firms with directors connected to a narrowly elected governor increase their value by 4.1%, equivalent to $211.7 million and $27.4 million for median firms. The benefits of connections are concentrated on the connected firms and not spread broadly to industry competitors. Guo et al. (2019) also show that a politically engaged board of directors has a positive impact on firm performance in state-owned Chinese enterprises. Related to this, it seems relevant to focus on political engagement as an exogenous source of influencing power. Indeed, as described by Li et al. (2021) for internationalization purposes, engagement in politics can enhance entrepreneurs’ self-perceived status, ‘encouraging them to adopt a higher-commitment entry mode’, and, therefore, making them central to friends and those who seek expert advice.

Based on this, we contend the following hypothesis:

Hypothesis 2.

Political engagement may influence actors’ centrality network positions.

2.4.3. Sociodemographic (IPO or Private)

Company financial and geographical situation are important factors that allows entrepreneurs to be granted with social or epistemic status. According to Kutsuna et al. (2016), non-public SMEs (private firms) benefit indirectly when their supply-chain partners access public equity markets. Among the benefits, IPO firms can transmit liquidity to private firms through their trade credit practices and/or by other means, to suppliers by paying more quickly, and to customers by allowing them to pay more slowly (Kutsuna et al. 2016). We consider IPO a focal point due to the multiple entrepreneurial signals that arise from it and that allow the firm to acquire non-financial resources over time (Pollock and Gulati 2007). This allows entrepreneurs who partake in the IPO process to form other alliances to a larger extent than those who do not, hence granting them a central role in their networks.

Based on this, we contend the following hypothesis:

Hypothesis 3a.

Working in a public company (IPO) may influence actors’ centrality network positions.

Finally, social or epistemic status may be affected by location and particularly being based in a capital city. Indeed, agglomerations, such as London, Berlin, and Paris are often identified as ‘prolific hubs’ that foster the creation of start-ups as they allow entrepreneurs to capitalize on social and material resources. On this subject, there is vast evidence on the relevance of geographic distance for innovation. Regarding investment, Lutz et al. (2013), found that German regions with shorter distances between investor and investee positively impacted the likelihood of an investment, despite the country’s dense infrastructure. Network exchanges within agglomerations would allow entrepreneurs to decrease information asymmetry, promote cooperative behavior (De Clercq and Sapienza 2001), build communities around shared norms and values (Molina-Morales et al. 2014), avoid misunderstanding (Inkpen and Tsang 2005), manage the flux of coded information and tacit information (Gertler 2003), and increase the ability to assess external knowledge within a cluster (Döring and Schnellenbach 2006). The focus on capital cities in granting entrepreneurs higher social and epistemic status is justified by the fact that capital cities naturally generate more entrepreneurship and agglomeration effects (Belitski and Grigore 2022). This then allows entrepreneurs in capital cities to be more connected and, consequently, more sought by friends and those looking for advice, especially in non-capital cities, which do not benefit from such agglomerations.

Based on this, we contend the following hypothesis:

Hypothesis 3b.

Working in the capital city (Paris) may influence actors’ centrality network positions.

3. Materials and Methods

3.1. Population and Data

Our network analysis is based on two waves of observations of friendship and advice exchanges among entrepreneurs in the French biotech industry in 2008 and 2013. The 2008 wave included 138 entrepreneurs from 78 companies, while the 2013 wave included 126 entrepreneurs from 92 firms. In total, 68 entrepreneurs were present in both waves. Approximately half of the companies were in Paris while the rest were located in regional biotech clusters. In addition to data availability, the sample choice was justified by the fact that France has one of the strongest biotech communities in Europe, especially in clinical drug assets. Around 1800 French companies are focused on healthcare aspects, including Sanofi, Servier, Ipsen, and Pierre Fabre. The focus on the biotech sector to investigate network centrality is explained by the fundamental role played by network structure, in addition to knowledge, in determining R&D productivity in the sector (Jain 2023) and, thus, advancement in science and in society more in general, also thanks to dispersion to other innovative sectors (Ma 2023). Networks in this sector work as ‘pipes’ connecting people, allowing for information flows and practical applications of such flows. With respect to the time frame investigated, while the year 2008 registered a large number of corporate crises, the world crisis did not permanently threaten the sector due to the continuous demand for biotech products. The year 2008 is useful as in this period the biotech sector had not fully developed in France, allowing for entrepreneurs to develop their networks, independent of a future guaranteed outcome in biotech. This means that the nature of entrepreneurs sought for advice and friendship was net of predicted personal interests and the focus was rather on the building of ‘norms’ accepted in the more extended community. In 2013, the sector had significantly grown, together with entrepreneurs’ networks and experience. Therefore, epistemic and social statuses in this year were more robust and norms more absorbed in the specifics of the biotech sector. The period was, overall, relevant to observe an evolution of entrepreneurial as well as institutional and social transformation.

Crises can affect management in the biotech industry from multiple viewpoints. Biotech startups, for instance, will find it difficult to access capital via the more standard channels (e.g., IPOs), while they will rely on government measures such as monetary subsidies for economic growth and innovation. At the same time, delays will be registered due to financial obstacles, while some startups will have to inevitably merge with larger companies. The vulnerable situation that the biotech industry can face during years of crisis, including 2008 and 2013, explicitly calls for the presence of managers that are leaders and experts, on the one hand, and that have strong social support of friends in their professional filed. This is why investigating the emergence of centrality in these two years appears crucial to test the hypothesis of whether industrial, educational, political, and international experience, as well as political engagement of entrepreneurs, can help them to reach high levels of epistemic and social status. With regards to investment, for instance, innovative sectors such as biotech heavily rely on external funding. Having a manager who has international connections, as well as reliable experience in raising funds, becomes crucial during financial crises. It is also not a coincidence that financial disruptions usually positively affect corporate social responsibility (Giannarakis and Theotokas 2011), showing the relevance of entrepreneurs as social actors rather than just innovators in efficient crisis response (Huang 2008) and resilience (Xiao et al. 2018). This study is focused on samples collected in 2008 and 2013, thus the results may be affected by the time period considered, encouraging future research for different sectors, countries, and time-frames.

The observed population of entrepreneurs from the 2008 dataset was carefully selected through preliminary ethnographic research. First, lists of biotech companies from biotech specific website were explored. Companies self-defined as biotech but providing service without proprietary technology or providing advice only, were excluded together with firms created as subsidiary companies, or outside of France. Only biotech companies working in ‘human health’ and that had raised more than 500K$ at that time were kept. We identified 94 biotech companies within this profile and a range of 1 to 4 entrepreneurs per company were selected to obtain a population of 220 entrepreneurs, of which 138 were interviewed for 9 months to obtain qualitative information about their potential relationship with other entrepreneurs of the industry. We contribute to the literature by using a mixed-method approach where both qualitative and quantitative data were used. This is justified by the added value of complementarity in management research, the purpose of expansion, triangulation, and the fact that it allows the researcher ‘to simultaneously generate and verify theory in the same study’ (Molina-Azorίn 2011).

In 2013, a second wave of interviews was performed, including the same entrepreneurs of 2008, as well as the new ones. The entrepreneurs interviewed in 2008, who were no longer working in the biotech industry during the collection were removed from our population.

For the interviews, a survey was created to collect data and verify our hypotheses. We asked entrepreneurs to check the boxes next to the name of other entrepreneurs in our population when: (1) they consider the person a friend (i.e., someone you would stay in contact with even after changing your profession); and (2) they asked advice on a complex situation linked to: (a) the management of relationships with an academic research center; (b) the management of relationships with pharmaceutical companies; (c) the management of relationships with investors.

We used (1) and (2) to, respectively, build friendship and advice networks.

All centrality measures used as dependent variables in our model were directly taken from the respective networks. The other attributes on entrepreneurs used as independent variables were either collected in the survey, extracted from their resume, or calculated from the network and existing attributes. We grouped the attributes according to: (1) experience, (2) political engagement, and (3) financial and geographical situation of the company.

3.2. Mode of Analysis

Based on data collected from the survey, four different networks were created: advice 2008, friendship 2008, and advice 2013, friendship 2013. We used the R software to perform our analysis and Python to process existing data and create meaningful variables for our multiple logistic regression models. Social Network Analysis (SNA) was used to get a proxy measure of centrality.

3.2.1. Dependent Variables

We used degree centrality to quantify the status or authority level of individuals in a network. This is in line with the argument that networks allow to increase competitive capabilities when the strength of ties increases (Larrañeta et al. 2020), benefiting the firm and the entrepreneur in question—especially regarding innovation (Bell 2005). More specifically, we used ‘indegree attribute’ to measure the centrality of an entrepreneur in advice and friendship networks. Entrepreneurs who were asked for advice the most are probably considered as ‘epistemic authorities’ in the biotech industry, while those mostly selected as ‘friends’ correspond to the most popular entrepreneurs of the ecosystem and can benefit from their social status and the support provided by this kind of ties.

We used multiple Poisson regression analysis with indegree measures as count data (non-negative integer value) to analyze (1) epistemic authority within the advice network and (2) popularity in the friendship network. Since the Poisson model is known for overdispersion, we used robust standard errors to control for mild violation of the distribution assumption in which the variance equals the mean (Colin Cameron and Trivedi 2009).

3.2.2. Independent Variables

Entrepreneurs’ features were organized around three dimensions: (1) experience, (2) political engagement, and (3) company financial and geographical situation. Each dimension contains one or several characteristics that we used as independent. Justification for usage of such variables is explained in Section 2.4.

The first dimension (1) included three independent variables related to academic and professional experience. The first binary variable, or scientificTraining, was equal to 1 if the entrepreneur has a background in natural science (PhD, Engineer, MSc) and 0 otherwise. The second binary variable, or doubleDegree, was equal to 1 if the entrepreneur had studies in finance (MBA) following a science degree and 0 if not. The third binary variable, or internationalStudies, was 1 if the entrepreneur had studied in more than one country, and 0 if not. Experience was also measured by the continuous variable ExpHealth, representing the number of years that the entrepreneurs had worked in the healthcare industry. For experience, we also accounted for the continuous variable FoundedCompanyinPast namely, the number of companies that the entrepreneur had created in the past excluding the one he funded, and Founder, a binary variable equal to 1 if the entrepreneur was the founder of the company he was working in, and 0 if not.

In the second dimension (2), we observed entrepreneurs’ involvement in other companies’ boards as well as extra-professional activities, such as presence in associations and activism. This dimension included two independent variables. nBoard was an index measuring the number of boards of administration where the entrepreneur was present; the higher the index, the more the entrepreneur was envolved in administration boards. nAssociations was the number of associations in which the entrepreneur had a membership.

In the last dimension (3), we observed the situation of the company of each entrepreneur. This dimension included three variables. The first variable (z normalization) corresponded to privateInvestments, i.e., the private investments received by the company in the 5 years preceding the data collection. The second variable (binary) corresponded to publicCompany, equal to 1 if the company where the entrepreneur was working was public, and 0 otherwise. The third variable represent the geographical position of the company, whether it’s in the capital city, Paris, or not.

As control variables we included age and well-known network effects, due to their spillover effects on innovation (Konno 2016).

We controlled for the age of the entrepreneur at the continuous level, as age is believed to affect entrepreneurial activity (Lévesque and Minniti 2011) and preferences (Kautonen et al. 2014), and the region where the entrepreneur was living (binary), equal to 1 if the person was living in Paris and 0 if not.

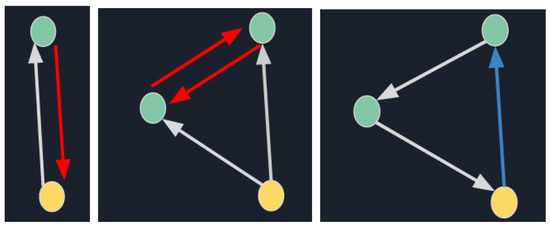

Regarding network effects (Figure 2), we controlled for Reciprocity_X* (closure coefficient), to measure the reciprocity of the links declared by the entrepreneur. The coefficient goes from 0 to 1, where higher values represent higher levels of reciprocity. We also controlled for Transitivity_X*, the local clustering coefficient (0 to 1) calculated for each entrepreneurs’ personal networks. Higher values represent higher transitivity and connections to a cluster of entrepreneurs. Finally, we controlled for Solidarity_X*, a local ‘solidarity’ closure coefficient to measure the hierarchic position of the entrepreneur in the network. We propose that if a hierarchy exists between entrepreneurs, those with higher positions should not have to ask advice to an entrepreneur advised by his advisee. To make up this coefficient, we counted the number of times this relationship did not take place and divided it by the number of situations where it could have happened. The coefficient goes from 0 to 1, where higher values represent higher position in the hierarchy (n + 1). These coefficients were calculated for each network.

Figure 2.

Reciprocity (if you are my friend, then I am also your friend), transitivity (my friends are friends too), and solidarity (the advisor of my advisor should not need my advice).

4. Results

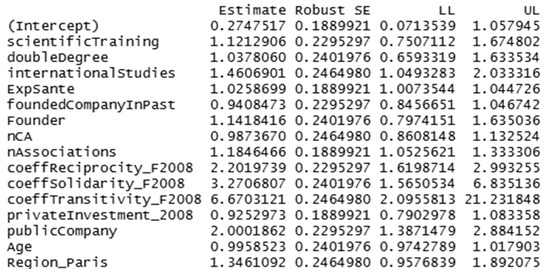

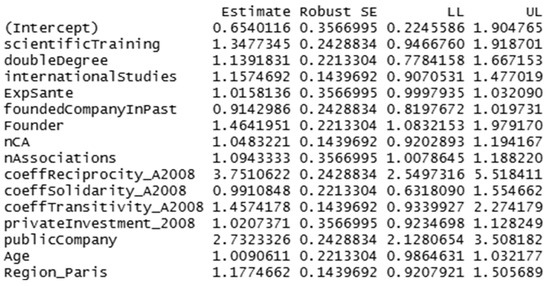

Correlations between the variables of interest and the Poisson multiple regressions results are presented for each year, 2008 in 2013, in Table 1, Table 2, Table 3, Table 4, Table 5 and Table 6. The model can be represented as follows where NetworkT.20XX.IN_DEGREE corresponds to the indegree measure for either friendship or advice in 2008 or 2013:

log(NetworkkT.20XX.IN_DEGREE) = β0 + β1scientificTraining + β2doubleDegree + β3InternationalStudies + β4ExpSante + β5foundedCompanyInPast + β6Founder + β7nBoard + β8nAssociations + β9coeffReciprocityT20XX + β10coeffSolidarityT20XX + β11coeffTransitivityT20XX + β12privateInvestments + β13 publicCompany + β14 Age + β15Region_Paris

Table 1.

Correlation matrix for friendship and advice networks and attributes in 2008.

Table 2.

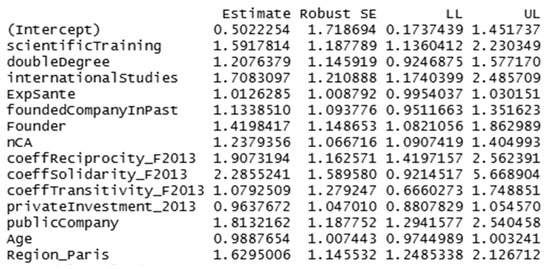

Regression table for friendship in 2008.

Table 3.

Regression table for advice in 2008.

Table 4.

Correlation matrix for friendship and advice networks and attributes in 2013.

Table 5.

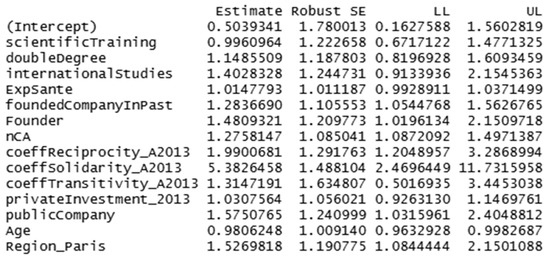

Regression table for friendship in 2013.

Table 6.

Regression table for advice in 2013.

We used 0.05 as the level of significance with robust standard errors to tackle the problem of overdispersion often observed when using Poisson regression. All the models were checked and are globally significant. For each network, we observed outliers that were not caused by an error in our data and, therefore, kept in the models.

All the dimensions were observed separately with six models. In the results section, model in the column (8) is used as the main reference for interpretation as it is the more complete and represents the best data (e.g., the AIC value is lower).

For each year, we present the correlation matrix and, for each network, the Poisson regression estimates that are used to present our results (Table 1, Table 2, Table 3, Table 4, Table 5 and Table 6 below). Incidence rates are provided in the Appendix A.

Hypothesis 1a.

Industry experience (years in the biotech industry) may influence actors’ centrality network positions.

With respect to our Hypothesis 1a, we observed that experience in the biotech industry had a positive and significant effect on indegree measured through friendship in 2008. For entrepreneurs interviewed in 2008, an additional year in the biotech industry corresponds to an increase in advice centrality of 3 percentage points, significant at the 1% level. The fact that insignificant results were observed for 2008 friendship centrality and 2013 advice and friendship centrality leads us to reject this hypothesis. While, in 2008 the biotech industry was starting to develop in the French economy and the central entrepreneurs were those with more healthcare experience, in 2013, when the sector is established, entrepreneurial centrality is transferred to CEO and CFOs with little or non-existent experience in healthcare but with venture capitalists’ support with the scope of making the company reach higher levels. This result may also be explained by the economic world crisis still present in 2008. Networks have been proven to be guarantors of stability in times of economic crisis (Chung et al. 2008), while the quest for social solidarity increases (Sotiropoulos and Bourikos 2014). Thus, expert entrepreneurs may be considered crucial business ‘friends’ in economic contexts where collaborations can determine the survival and success of a company.

Hypothesis 1b.

Entrepreneurial experience in founding companies may influence actors’ centrality network positions.

We observed that being a serial entrepreneur, or someone who has founded several companies, guaranteed epistemic authority only in 2013. For each additional founded company, this feature granted the entrepreneur an increase in advice centrality equal to 25 percentage points, significant at the 5% level. This may be explained by the better positioning of venture capitalist firms in the industry over time, when trust is finally reciprocal (Panda et al. 2020), asymmetrical information diminished (Zhang 2019), and their skills and social connections have been tested (Zhang 2011). While expertise in the biotech industry may help a company to find alternative routes and avoid failure (Hypothesis 1a), in 2008, having multiple companies, especially if some of them was losing momentum, may signal negative or non-existent epistemic authority.

On the other hand, being a founder in a network of entrepreneurs was a good indicator of centrality in both waves. Such feature increased advice centrality by 37 and 39 percentage points, significant at the 5% level, respectively, in 2008 and 2013. In 2013, centrality was impacted at the friendship level. Founders were 35 percentage points more likely to be chosen as friends compared to non-founders. This can be explained in contexts where group cohesiveness is strong, with friendship norms prevailing over business norms in decision-making, due to reciprocity of exchanges (Tognazzo and Mazzurana 2017). Contrarily to established corporations, start-ups have ‘promising ideas, organizational agility, the willingness to take risk, and aspirations of rapid growth’ (Elia et al. 2016). Individuals may find it easy to attribute such characteristics to founding entrepreneurs, contributing to symmetrical liking and friendship. Additionally, being a founder may signal the ability to both create legitimacy to which individuals may want to partake as well as build an activity undertaken by a competitor (Hegeman and Sørheim 2021). This could play a role in identifying a founder as a friend, especially in the biotech industry, where competition is fierce (Yu et al. 2019).

Our analysis showed that founding experience helps entrepreneurs to showcase their self-efficacy, leading to higher levels of trust in expertise advice and friendship on behalf of their peers and, consequently, higher likelihood to perform well in the various tasks assigned. In other words, we enrich extant literature by showing that being a founder in a network of entrepreneurs makes the network stronger, together with the business depending on the network itself.

Hypothesis 1c.

Educational experience may influence actors’ centrality network positions.

Individuals with scientific training were not recognized as epistemic authorities in 2008. In 2013, compared to individuals with no scientific training, they were 46 percentage points more likely, at the 1% significance level, to be chosen as friends by their peers. Knowing that some of the entrepreneurs were interviewed in both 2008 and 2013, this may show the gradual development of trust and mutual liking, which takes time (Derrida 2005). In addition, smart people are often considered attractive (Jackson and Nyström 2015). Thus, a large number of individuals may want to be friends with someone with a good education in the hope for knowledge spillovers (Cunningham et al. 2019). Overall, however, our findings for holders of scientific training and double degrees are not robust enough predictors of epistemic authority as they are not consistently observed for the two waves of observations.

On the other hand, while the direct effect of education may not be significant, our hypothesis is partially confirmed by the indirect effect of it. We found this to be true for entrepreneurs who studied in different countries. We observed a positive and significant effect of 38 and 54 percentage points in, respectively, 2008 and 2013 for friendship centrality. International education was likely to promote social status, shaping the exchange of information and ideas, the distribution of resources, and the normative preferences in the partnership (Menashy and Shields 2017). Studying abroad does not only enhance human capital but social capital as well (Wang and O’Connell 2020). Exposure to cultural diversity and increased social network make individuals used to general and interaction (cross-cultural) adjustment (Shu et al. 2020). As entrepreneurs who had these experiences may find it easy to build friendships, individuals may want to be friends with them for the comfortable social and business environment they are able to create. To that, one may add the marginal benefit that comes from being friends with an entrepreneur with several business connections abroad (Cuypers et al. 2020).

While it is objectively recognized that education helps building relationships, especially abroad, our case study is relevant in that it shows how the direct effect of education becomes void if not supported by the right social norms. By considering two different time periods, we show that when collectives do not recognize science and scientific education as an added value, even in sectors that highly depend on it, then the immediate impact of such education is not absorbed sociologically.

Hypothesis 2.

Political engagement may influence actors’ centrality network positions.

We observed that political engagement, defined in our case by the entrepreneur’s presence in a board of directors, or presence in associations had an influence on centrality. Specifically, in 2013, politically active entrepreneurs were 21 percentage points, significant at the 1% level, more likely than non-politically active entrepreneurs to be considered friends by their peers. They were also 24 percentage points more likely to be sought advice from. Similar effects were found in 2008 for entrepreneurs who were part of associations. The comparative epistemic advantage here is equal to 17 percentage points, significant at the 1% level, for friendship centrality and 9 percentage points for advice centrality. Overall, results suggest that our hypothesis is confirmed. Understandably, individuals interested in the economic success of a sector, in this case biotech, can benefit from forming strong networks with entrepreneurs with high decision-making power. Boards can often influence corporate governance (Li et al. 2020), monitor and enhance innovation, as well as domestic and international venturing (Calabrò et al. 2021) also thanks to knowledge spillover (Del Bosco et al. 2021). The so-called political or policy entrepreneurs can increase their own interests by influencing policy outcomes (Cohen 2016). For biotech companies, having a friend with such power could mean that new horizons of economic possibilities, in or outside their ecosystems of reference, may be more easily reachable. Membership to various external associations also allows ‘political’ entrepreneurs and those who are friends with them to benefit from external connections in terms of interactive learning (Figueiredo et al. 2020). This would help entrepreneurs to overcome knowledge barriers and boost creativity engagement (Cheng and Yang 2019). On this subject, external networks may be of service in a sector where life-changing products also need to be successfully commercialized (Shimasaki 2020).

Through our data, we show that political engagement allows entrepreneurs to be sought by their peers to a larger extent for the consequent signalling of higher commitment proxies as higher knowledge applicable to their business.

Hypothesis 3a.

Working in a public company may influence actors’ centrality network positions.

While the amount of private investments received by a company in the previous 5 years preceding do not attribute epistemic authority or popularity to the entrepreneur, the fact of working in a public company significantly does. The hypothesis was verified in both years of investigation. In 2008 and 2013, an entrepreneur working in a public company was, respectively, 69 and 60 percentage points, significant at the 1% level, more likely than someone who was not to be considered a friend among his peers. A similar pattern was found for in-degree advice centrality. This may be explained by the information (trading) advantages friends can benefit from before the company becomes an IPO (Ozmel et al. 2019), the IPO peer effects that may make the entrepreneur an expert against many competitors in the sector (Aghamolla and Thakor 2022), as well as higher possibilities for R&D investments (Guo et al. 2021), crucial in biotech.

IPOs become an additional source of positive signalling for entrepreneurs due to the possibility that stem from this process in building future additional ‘observable resources’ and potentially keeping them over time. When entrepreneurs partake in the process, they become crucial ‘symbols of legitimacy’ in the eyes of friends interested in increasing innovativeness and productivity, given that IPOs guarantee the emergence of other alliances and, consequently, commercial advantages.

Hypothesis 3b.

Working in the capital city (Paris) may influence actors’ centrality network positions.

Working in a company based in Paris contributed to explaining entrepreneurs’ centrality. Given that we investigated a population of French entrepreneurs, what we observed may be due to a capital effect granted to Parisian entrepreneurs, naturally more exposed to international and national networks as well as more aware of the emergence and development of biotech startups and corporations. In other words, individuals may be attracted to entrepreneurs who, being based in multicultural Paris, are able to exploit and recognize entrepreneurial opportunities more easily (Vandor and Franke 2016). In line with our Hypothesis 3b, we found that, with respect to friendship centrality, Parisian entrepreneurs had a comparative advantage over non-Parisians equal to 30 and 49 percentage points in 2008 and 2013. Entrepreneurs interviewed in 2013 were also 42 percentage points more likely to be considered advisors or experts.

Controls

When looking at our models, we also accounted control variables. With respect to age, we observed that it had a significant effect only for the advice network in 2013.

When accounting for structural variables, we found the reciprocity (a), transitivity (b), and solidarity (c) coefficients to be good predictors of centrality within the network. For instance, in 2008 and 2013, the ‘if you are my friend, I am also your friend’ characteristic (a) increased friendship centrality by, respectively, 79 and 65 percentage points. The effect of ‘my friends are friends too’ (b) was only visible in 2008 for friendship, thus not consistent over time or across types of interpersonal ties. When it came to ‘the advisor of my advisor should not need my advice’ feature (c), we observed that the non-solidarity coefficient was almost always significant confirming hierarchy structures among entrepreneurs. An exception was registered for 2008 (−0.02), when the biotech industry was still emerging, and entrepreneurs could have potentially exchanged advice regularly and independent of their rank.

5. Discussion

Overall, we showed that epistemic authority (advice) and social status (friendship) were significantly affected by the role entrepreneurs play in organizations, whether they are professional associations or venture boards; their educational and professional experience, where both human and social capitals were enhanced; or the financial and geographical situation of their company. It was observed that individual and organizational trajectory aspects (e.g., participation in IPOs, academic background) create collective patterns that cause certain ‘successful’ entrepreneurs to benefit from the ‘governmentalization’ of the milieu. Our results help to understand from where epistemic authority and social status come from, i.e., what are the individual and organizational trajectories linked to the epistemic and social recognition of peers.

Our study is unique in the investigation of outcomes of interest through different channels of ties built in educational, industry, inter-organizational and international experiences. However, the findings align with the empirical findings of other studies. In a study of Peng et al. (2014) on Chinese companies, centrality in social network was shown to have a positive significant impact on individual creativity, especially in departments or teams, where relationships are stronger. Centrality of discussion network has a reliability factor of 0.975 with advice network centrality, while centrality of personal counseling network has a reliability factor of 0.980 with friendship network centrality. In other words, a knowledge spillover is registered to the benefit of the entire team. Al-Laham and Amburgey (2010) used data from German startups and found that centrality was significantly and positively affected by the number of prior international partners and its interaction with prior R&D alliances. In the context of the biotech industry, their findings suggest that building up international diversity in research alliances is crucial for enhancing centrality. A more recent study (Brennecke et al. 2016) for the BiotechNet cluster in Germany observed a density of 7.7 percent with regards to the advice network and of 6.8 percent for the alliance network, suggesting that informal (advice) and formal (alliances) ties between managers co-occur. Salman and Saives (2005) also showed that businesses benefit from indirect linkages: in a biotech cluster of Quebec (Canada), centrality in a network of informal ties positively affects access to useful knowledge and innovation. Similar results were obtained by Wang and Quan (2017) for a biotech cluster in Taiwan, where the interaction between alliance diversity and network centrality increased innovation performance positively. These studies contribute to enhancing the essentiality of centrality for the development of the biotech sector.

6. Conclusions

The link between entrepreneurs’ network centrality and innovation performance has been broadly studied in knowledge-intensive industries such as biotechnology. Extensive research has focused on the role of formal ties such as patents and R&D contractual relations. In this article, we considered the induvial and organizational trajectories that allow entrepreneurs to build a centra position in the peer’s interpersonal networks at the inter-organisational level.

Particularly, we accounted for interpersonal ties such as friendship, representing social status, and advice, representing epistemic status. Advice has been a relevant exchange system used to explore how epistemic credentials may affect innovation. As highlighted by Galloway et al. (2019), entrepreneurs will be more likely to rely on advice from peers they believe possess valuable knowledge applicable to their business. Exchange of information and resource, (a) symmetrical liking, and continuous interactions over time allow entrepreneurs to identify friends within their network. In this regard, Muller and Peres (2019) recently showed how growth, including innovativeness and performance, is especially present in networks where cohesion (i.e., mutual influence), connectedness (i.e., high number of ties), and conciseness are observed.

Based on this, we argue that the exchange of tacit knowledge may be conditioned to the entrepreneur’s epistemic and social status, and that the sources of these status can be explore by looking at the induvial and organizational trajectories. To test our hypotheses, we draw on three dimensions through which entrepreneurs may build their central position; namely, their professional experience, their political inter-organizational engagement, and company financial and geographical situation. We collected qualitative and quantitative data in 2008 and 2013 on 138 and 126 biotech entrepreneurs, respectively, and perform a series of regression analyses.

In line with the idea that upper echelons’ work experience, especially from the bio-pharmaceutical sector, affects their ability to receive generous endorsements (Higgins and Gulati 2006), our results show the elements, on the individual and organizational track of a venture, significantly predicts the likelihood of becoming a central friend and advisor. Being a company’s founder is a strong predictor of social and epistemic status. This connects to the idea that founding a company may create a legitimacy to which individuals may want to partake as well as build an activity undertaken by a competitor (Hegeman and Sørheim 2021). This could play a role in identifying a founder as a friend, especially in the biotech industry, where competition is fierce (Yu et al. 2019). Studying abroad, and in a weaker extent, having a scientific training, is a strong and consistent predictor of social and epistemic status. This result shows that international education helps to promote the position of entrepreneurs in their filed, shaping the exchange of information and ideas, the distribution of resources, and the normative preferences in the partnership (Menashy and Shields 2017). Paris-based entrepreneurs held higher centrality positions in the analysed networks. They are more exposed to international and national networks and, therefore, more aware of entrepreneurial opportunities (Vandor and Franke 2016). They benefit from the higher level of resources in their local ecosystem, thus attracting relationship among their peers. Finally, political engagement also predicts high centrality, together with being part of companies that went public. In one hand, boards can often influence corporate governance (Li et al. 2020), monitor and enhance innovation, as well as domestic and international venturing (Calabrò et al. 2021). In the other, working on a public company, as the signal of financial success, is a credential that strongly consolidate the position of a entrepreneur in its professional network.

Our study showed that as innovators, entrepreneurs in the biotechnology field need to be also social actors. We provide evidence on the role of social mechanisms in shaping entrepreneurs’ centrality and, therefore, ability to enhance the sector’s economic performance. In other words, we found that identifying entrepreneurs as advisors or friends allows for aligning induvial and organizational performative and relational scopes. What is particularly interesting is to note that epistemic authority and social status evolved as norms evolved. In 2008, the biotech sector was still emerging in France, with scientists being sought for advice and financial experts not fully present in the picture. As time went by, the sector grew and looked out for professionals. As a result, in 2013, scientists remained active in biotech companies but as ‘friends’, while entrepreneurs with experience in founding companies, participating in boards, and building on v international networks became the new norm in epistemic terms. Overall, a more homogenous network of scientists and businessmen characterizes the biotechnology sector, strengthening the link between centrality, performance, and institutional or social change.

Our results have several implications. First, they imply that the legitimacy built by the entrepreneur through work, international, political, and founding experience in the biotech industry, significantly and positively predict his opportunity to be acknowledged as a friend and advisor, hence providing him with central power over the business. The fact that the entrepreneur is granted high epistemic status and is considered an expert in the field makes his decision-making more reliable and robust in the eyes of his peers and, therefore, easier to achieve. This also connects to the recognition given to the entrepreneur in terms of well-established knowledge that he is able to share for the benefit of the business. In other words, levels of trust are raised. On this subject, the fact that the manager is recognized as a friend further encourages exchange within the business or the team, whether at the formal or informal level. Due to spillover effects, the expert manager will allow his peers to absorb the values and ideas derived from his knowledge, enhancing research and innovation practices. At the same time, the leadership position achieved by the manager should not favor specific friends but rather encourage improved team performance, cohesion, as well as satisfaction. In other words, centrality through expertise and friendship has a two-fold benefit for businesses. On the one hand, it guarantees higher levels of competitiveness and trust due to efficient and knowledgeable leadership, strategy of communication, and sharing of expertise, potentially changing the way some managers think or act. On the other hand, it guarantees positive team dynamics, team stability, and a developed workplace culture.

While we specifically focused on France, further research may investigate how centrality is shaped in other European regions as well as internationally in the US and Asia, where epistemic authority may be reached differently. On this subject, it would be interesting to investigate alternative interpersonal and informal ties that could affect the identification of an entrepreneur as a friend or advisor. This is especially true for family firms, where social capital plays a fundamental role (Coeurderoy and Lwango 2012). We also focused on a particular sector and a particular timeframe. Results may be significantly different in non-scientific sectors, while contexts such as the pandemic may have overturned the social mechanisms entrepreneurial ecosystems were used to. In general, however, it is evident that the creation of value through centrality should be further explored in line with the idea that hybridization of practice is growing (Cristofini 2021) and so are the mechanisms to develop creativity (Dechamp and Szostak 2016), and ultimately innovation.

Engineers in the future will be the essential means of connection between biology and technology, with the objective of providing scientific solutions to problems of healthcare, the environment, industry, agriculture, and our lifestyles more in general. Biotechnology, in particular, will have to deal with the rapid emergence of automation and robotics, requiring engineers to acquire skills necessary to handle complex automated systems, as well as with the consequent ethical needs between the development of advanced products and their safe application in society. Overall, engineers in the biotech sector will be encouraged to collaborate with other specialists (e.g., biologists, computer, environmental scientists) and exploit interdisciplinary skills in the best possible way. As new techno-economic paradigms come societal changes (Perez 2002), the social role of engineers will become even more crucial to drive progress and increase life quality. As studied by Shah and Nowocin (2015), engineers achieve leadership roles only insofar as they also absorb managerial skills. In an ever-changing future, a successful engineer will manage multi-disciplinary teams, communicate effectively, recognize ethical issues, and acknowledge environmental issues. Similarly, Williamson et al. (2013) showed that the most satisfied engineers are those who are teamwork-oriented, open to new experiences, and resilient. These are all traits that individuals with high centrality develop through their educational, industry, political, and international experience. In a society that demands inclusivity and interpersonal exchanges, becoming an expert and a friend is necessary to develop a technological culture understanding of societal changes. As described by Ravesteijn et al. (2006), ‘the importance of the communicative competence involved in creating a social base for innovation is underpinned’. The entrepreneurs who manage to raise performance and productivity are good innovators but also good social actors, able to understand the social dynamics of technology and the importance of communicating ‘on the level of facts, values, and emotions’.

Author Contributions

A.P.S., G.V., V.G. contributed equally to conceptualization, writing, data analysis, and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

Incidence rations for friendship in 2008.

Figure A1.

Incidence rations for friendship in 2008.

Figure A2.

Incidence rations for advice in 2008.

Figure A2.

Incidence rations for advice in 2008.

Figure A3.

Incidence rations for friendship in 2013.

Figure A3.

Incidence rations for friendship in 2013.

Figure A4.

Incidence rations for advice in 2013.

Figure A4.

Incidence rations for advice in 2013.

In 2008, we observed a 2.6% increase in the mean of friendship’s indegree and a 1.6% increase in the mean of advice indegree for each extra year working in the healthcare industry.

In 2013, we observed a 28% increase in the mean of advice’s indegree for each extra company founded in the past.

In 2008, founders had a higher means of advice indegree of 46% compared to others. In 2013, they had a higher means of advice indegree of 48% compared to others. Moreover, they were also chosen as friends by other entrepreneurs more often. We observed that founders had a higher means of friendship indegree of 41% compared to others.

In 2008, our results showed that an entrepreneur with scientific training had a higher mean of advice indegree of 35% compared to one who had not. In 2013, we observed that entrepreneurs with scientific training had a higher mean friendship indegree of 59% compared to those who had not.

We observed that entrepreneurs who had been studying in different countries developed higher social status as they were recognized as friends by their peers. In, respectively, 2008 and 2013, they had a higher mean in friendship’s indegree of 46% and 70% compared to the ones who had studied in one country.

In 2013, there was a 23% increase in the mean of friendship indegree and a 27% increase in the advice indegree for each extra board the entrepreneur was present in. In 2008, the presence in a board had no visible effect but we observed a 9% increase in the advice indegree and a 18% friendship indegree for each extra association the entrepreneur was involved in.

In 2008, entrepreneurs working in a public company had a higher mean of friendship indegree of 100% and a higher mean of advice indegree of 170%. In 2013, entrepreneurs working in a public company had a higher mean of friendship indegree of 81% and a higher mean of advice indegree of 57%.

References

- Acs, Zoltan J., Erik Stam, David B. Audretsch, and Allan O’Connor Acs. 2017. The lineages of the entrepreneurial ecosystem approach. Small Business Economics 49: 1–10. [Google Scholar] [CrossRef]

- Aghamolla, Cyrus, and Richard T. Thakor. 2022. IPO peer effects. Journal of Financial Economics 144: 206–26. [Google Scholar] [CrossRef]

- Ahuja, Gautam. 2000. Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly 45: 425–55. [Google Scholar] [CrossRef]

- Al-Laham, Andreas, and Terry L. Amburgey. 2010. Who makes you central? Analyzing the influence of international alliance experience on network centrality of start-up firms. Management International Review 50: 297–323. [Google Scholar] [CrossRef]

- Amofah, Kwaku, Ramon Saladrigues, and Ellis Kofi Akwaa-Sekyi. 2020. Entrepreneurial intentions among MBA students. Cogent Business & Management 7: 1832401. [Google Scholar]

- Antretter, Torben, Charlotta Sirén, Dietmar Grichnik, and Joakim Wincent. 2020. Should business angels diversify their investment portfolios to achieve higher performance? The role of knowledge access through co-investment networks. Journal of Business Venturing 35: 106043. [Google Scholar] [CrossRef]

- Apa, Roberta, Valentina De Marchi, Roberto Grandinetti, and Silvia Rita Sedita. 2021. University-SME collaboration and innovation performance: The role of informal relationships and absorptive capacity. The Journal of Technology Transfer 46: 961–88. [Google Scholar] [CrossRef]

- Audretsch, David, and Paula Stephan. 1996. Company-Scientist Locational Links: The Case of Biotechnology. American Economic Association 86: 641–52. [Google Scholar]

- Bargues, Emilie, and Bertrand Valiorgue. 2019. Maintenance and creation of roles during socialization processes in entrepreneurial small firms: An institutional work perspective. Management 22: 30–55. [Google Scholar] [CrossRef]

- Baron, Robert A., and Michael D. Ensley. 2006. Opportunity recognition as the detection of meaningful patterns: Evidence from comparisons of novice and experienced entrepreneurs. Management Science 52: 1331–44. [Google Scholar] [CrossRef]

- Bateman, Thomas S., and J. Michael Crant. 1999. Proactive behavior: Meaning, impact, recommendations. Business Horizons 42: 63–70. [Google Scholar] [CrossRef]

- Belitski, Maksim, and Ana-Maria Grigore. 2022. The economic effects of politically connected entrepreneurs on the quality and rate of regional entrepreneurship. European Planning Studies 30: 1892–918. [Google Scholar] [CrossRef]

- Bell, Geoffrey G. 2005. Clusters, networks, and firm innovativeness. Strategic Management Journal 26: 287–95. [Google Scholar] [CrossRef]

- Belso-Martínez, José Antonio, Francisco Mas-Verdu, and Lorenzo Chinchilla-Mira. 2020. How do interorganizational networks and firm group structures matter for innovation in clusters: Different networks, different results. Journal of Small Business Management 58: 73–105. [Google Scholar] [CrossRef]

- Brennecke, Julia, Irena Schierjott, and Olaf Rank. 2016. Informal managerial networks and formal firm alliances: A multilevel investigation in biotech. Schmalenbach Business Review 17: 103–25. [Google Scholar] [CrossRef]

- Broekhuizen, Thijs L., and Tao Zhu. 2021. Market orientation and innovation behaviour: How do service employees benefit from their uniplex and multiplex intrafirm network centrality? Industry and Innovation 28: 1270–97. [Google Scholar] [CrossRef]

- Brown, Ross, and Colin Mason. 2017. Looking inside the spiky bits: A critical review and conceptualization of entrepreneurial ecosystems. Small Business Economics 49: 11–30. [Google Scholar] [CrossRef]

- Calabrò, Andrea, Mariateresa Torchia, Daniela Gimenez Jimenez, and Sascha Kraus. 2021. The role of human capital on family firm innovativeness: The strategic leadership role of family board members. International Entrepreneurship and Management Journal 17: 261–87. [Google Scholar] [CrossRef]

- Cangialosi, Nicola, Carlo Odoardi, Adalgisa Battistelli, and Antonio Baldaccini. 2021. The social side of innovation: When and why advice network centrality promotes innovative work behaviours. Creativity and Innovation Management 30: 336–47. [Google Scholar] [CrossRef]

- Cao, Feiyuan, and Haomin Zhang. 2020. Workplace Friendship, Psychological Safety, and Innovative Behavior in China: A Moderated-Mediation Model. Chinese Management Studies 14: 661–76. [Google Scholar] [CrossRef]

- Chen, Chao C., Patricia Gene Greene, and Ann Crick. 1998. Does entrepreneurial self-efficacy distinguish entrepreneurs from managers? Journal of Business Venturing 13: 295–316. [Google Scholar] [CrossRef]

- Chen, Kaihua, Yi Zhang, Guilong Zhu, and Rongping Mu. 2020. Do research institutes benefit from their network positions in research collaboration networks with industries or/and universities? Technovation 94: 102002. [Google Scholar] [CrossRef]

- Cheng, Cong, and Monica Yang. 2019. Creative process engagement and new product performance: The role of new product development speed and leadership encouragement of creativity. Journal of Business Research 99: 215–25. [Google Scholar] [CrossRef]

- Chou, Ting-Kai, Jia-Chi Cheng, and Chin-Chen Chien. 2013. How useful is venture capital prestige? Evidence from IPO survivability. Small Business Economics 40: 843–63. [Google Scholar] [CrossRef]

- Chung, Chris Changwha, Jane Lu, and Paul W. Beamish. 2008. Multinational networks during times of economic crisis versus stability. MIR: Management International Review 48: 279–95. [Google Scholar] [CrossRef]

- Coeurderoy, Régis, and Albert Lwango. 2012. Social capital of family firms and organisational efficiency: Theoretical proposals for a transmission model through bureaucratic costs. Management 15: 415–39. [Google Scholar]

- Cohen, Nissim. 2016. Policy Entrepreneurs and Agenda Setting. In Handbook of Public Policy Agenda Setting. Edited by Nikolaos Zahariadis. Cheltenham: Edward Elgar Publishing, pp. 180–99. [Google Scholar]

- Cohen, Boyd D., and Thomas J. Dean. 2005. Information asymmetry and investor valuation of IPOs: Top management team legitimacy as a capital market signal. Strategic Management Journal 26: 683–90. [Google Scholar] [CrossRef]

- Colin Cameron, Adrian, and Pravin K. Trivedi. 2009. Microeconometrics Using Stata. College Station: Stata Press. [Google Scholar]

- Colombo, Massimo G., and Luca Grilli. 2005. Founders’ human capital and the growth of new technology-based firms: A competence-based view. Research Policy 34: 795–816. [Google Scholar] [CrossRef]

- Colovic, Ana. 2019. Cluster connectivity and inter-cluster alliance portfolio configuration in knowledge-intensive industries. Management 22: 619–35. [Google Scholar]

- Cristofini, Olivier. 2021. Toward a Discursive Approach to the Hybridization of Practice: Insights from the Case of Servitization in France. Management 24: 23–47. [Google Scholar] [CrossRef]

- Cross, Rob, Stephen P. Borgatti, and Andrew Parker. 2001. Beyond answers: Dimensions of the advice network. Social Networks 23: 215–35. [Google Scholar] [CrossRef]