Strategy under Ambiguity, and a New Type of Decision Dilemma

Abstract

:1. Introduction

2. Related Literature on SuA Decision Problems

3. Materials and Methods

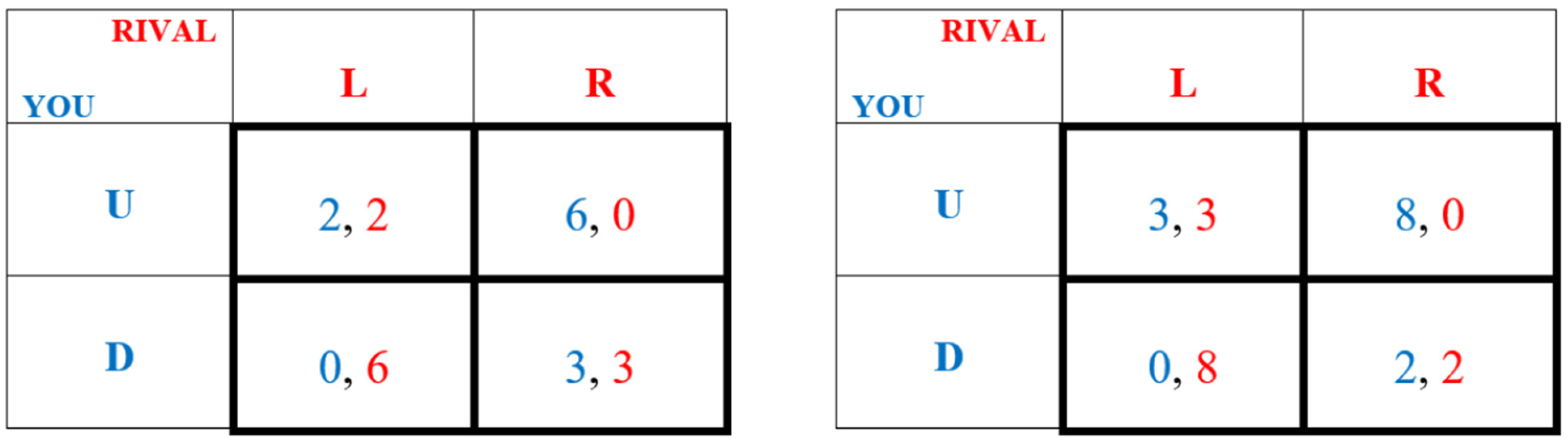

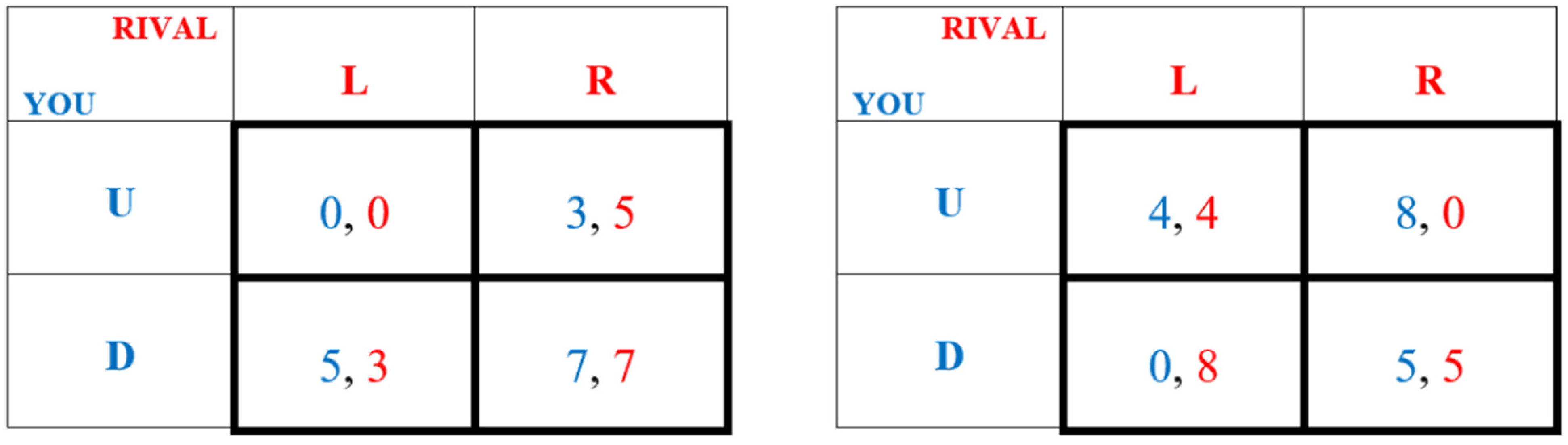

3.1. Specification of the SuA Game Structure

3.2. Expectations of Real Play in SuA Game Problems

3.3. Empirical Methods

3.3.1. Dependent Variables

3.3.2. Independent Variables

4. Results

4.1. Descriptive Statistics

4.2. Empirical Outcomes

5. Discussion

5.1. Discussion of Implications

5.2. Limitations

5.3. Summary and Look Forward

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | We consider Ellsbergian ambiguity to be an important form of Knightian non-risk uncertainty. The uncertainty involves not knowing a specific focal factor’s value—here, the value of the main event’s probability—nor the distribution that provides that value, nor its distribution and so on. In the case of Ellsbergian ambiguity, that value lies within a known range. For example, the number of red pebbles in a bag could lie anywhere between 0 and 100, but whatever mechanism chose the number to place in that bag would be unknowable prior to the decision. |

| 2 | An implied or interior game is determined by calculating the probability-weighted payoffs as p*left-side-game-payoffs + (1 − p)*right-side-game-payoffs for each cell of its payoff matrix. Note that such normal form games are already subject to an informational uncertainty—i.e., that no player knows what her rival is playing prior to their own choice, although Nash provides the calculable rational expectation of it. |

| 3 | Note that a bookend structure-based decision problem can become much more complex when players are asymmetric or more bookends are added. For example, when payoff asymmetry is allowed, a two bookend structure can lead to up to five different possible interior best strategies. To clarify, the reason this is a probabilistic ambiguity problem is that p is unknown and unknowable, while the possible payoffs are known as are the possible options. It is because p is unknown that determining the best option of the known set is usually impossible. |

| 4 | Note that this level of correct choice was consistent with the levels recorded in three standard dominant strategy games that were part of the same survey (but not formally reported here). In other words, the participants displayed rational behavior when best options were easily computable. |

| 5 | This is not to imply that better strategy profiles do not exist for maximizing payoffs when any such profile is played solely against itself; for example, in either game, if D is played against itself, the expected simulated payoffs will exceed those from the average choice profile strategies recorded (at 6.0 and 6.5). |

| 6 | While with the PD, the dilemma is obvious and always exists in that structure, this new dilemma is not obvious (i.e., it needs to be calculated, and does not always exist in that structure) and provides a way to exploit decision-makers who stop calculating with the identification of the strategy choice with the highest-absolute-value over the largest p-range. |

| 7 | That said, there were other rationales consistent with choices available in games two and three. In game two, U was maximax (6.5% of players had that); and, in game three, U was both maximax and maximin (11.5% and 17.5% of players held those positions, respectively). Regardless, the majority of players appeared to under-appreciate the uncertainty that they faced (or found it difficult to admit it, both in their strategy—by not choosing Mix—and in their rationales—by not choosing don’t know). |

| 8 | Recall that the regression analysis indicated a weak correlation of behavior to ambiguity aversion (in game three); however, even if that aversion were measurable, its value is of little use—because knowing that someone is willing to pay something for avoiding ambiguity does not inform one about how they will behave when they cannot avoid it. This insight implies that a new measure would be welcome that does provide such information—a measure of ambiguity awareness for example. |

| 9 | While recent experimental studies (e.g., Aggarwal and Mohanty 2021) have shown that the type and amount of ambiguity do both matter when choosing between a risky and an ambiguous gamble, that differs from what we show here in terms of how quality and quantity of the ambiguity matter in strategic decisions where several options to act exist. |

References

- Aflaki, Sam. 2013. The effect of environmental uncertainty on the tragedy of the commons. Games and Economic Behavior 82: 240–53. [Google Scholar]

- Aggarwal, Divya, and Pitabas Mohanty. 2021. Influence of imprecise information on risk and ambiguity preferences: Experimental evidence. Managerial and Decision Economics. [Google Scholar] [CrossRef]

- Alary, David, Christian Gollier, and Nicolas Treich. 2013. The effect of ambiguity aversion on insurance and self-protection. The Economic Journal 123: 1188–202. [Google Scholar]

- Arend, Richard J. 2020a. Strategic decision-making under ambiguity: A new problem space and a proposed optimization approach. Business Research 13: 1231–51. [Google Scholar]

- Arend, Richard J. 2020b. The expected prisoner’s dilemma—With rationally arising cooperation. PLoS ONE 15: e0239299. [Google Scholar]

- Axelrod, Robert. 1984. The Evolution of Cooperation. New York: Basic Books. [Google Scholar]

- Ben-Haim, Yakov. 2006. Info-Gap Decision Theory: Decisions under Severe Uncertainty. New York: Academic Press. [Google Scholar]

- Budescu, David V., Kristine M. Kuhn, Karen M. Kramer, and Timothy R. Johnson. 2002. Modeling certainty equivalents for imprecise gambles. Organizational Behavior and Human Decision Processes 88: 748–68. [Google Scholar]

- Cerreia-Vioglio, Simone, Fabio Maccheroni, Massimo Marinacci, and Luigi Montrucchio. 2013. Ambiguity and robust statistics. Journal of Economic Theory 148: 974–1049. [Google Scholar]

- Einhorn, Hillel J., and Robin M. Hogarth. 1986. Decision making under ambiguity. The Journal of Business 59: S225–S250. [Google Scholar]

- Ellsberg, Daniel. 1961. Risk, Ambiguity, and the Savage Axioms. Quarterly Journal of Economics 75: 643–69. [Google Scholar]

- Francioni, Barbara, Fabio Musso, and Marco Cioppi. 2015. Decision-maker characteristics and international decisions for SMEs. Management Decision 53: 2226–49. [Google Scholar]

- Gollier, Christian. 2014. Optimal insurance design of ambiguous risks. Economic Theory 57: 555–76. [Google Scholar]

- Hansson, Sven Ove. 1996. Decision making under great uncertainty. Philosophy of the Social Sciences 26: 369–86. [Google Scholar]

- Heath, Chip, and Amos Tversky. 1991. Preference and belief: Ambiguity and competence in choice under uncertainty. Journal of Risk and Uncertainty 4: 5–28. [Google Scholar]

- Hershey, Douglas A., and David A. Walsh. 2000. Knowledge versus experience in financial problem solving performance. Current Psychology 19: 261–91. [Google Scholar]

- Hertwig, Ralph, Timothy J. Pleskac, and Thorsten Pachur. 2019. Taming Uncertainty. Cambridge: MIT Press. [Google Scholar]

- Hodgson, Geoffrey M. 2011. The eclipse of the uncertainty concept in mainstream economics. Journal of Economic Issues 45: 159–76. [Google Scholar]

- Jones, Thomas M. 1991. Ethical decision making by individuals in organizations: An issue-contingent model. Academy of Management Review 16: 366–95. [Google Scholar]

- Kahneman, Daniel, and Amos Tversky. 1979. Prospect theory: An analysis of decision under risk. Econometrica 47: 263–91. [Google Scholar]

- Kelley, Robert, and Janet Caplan. 1993. How Bell Labs create star performers. Harvard Business Review 71: 128–39. [Google Scholar]

- Knight, Frank H. 1921. Risk, Uncertainty, and Profit. Boston: Houghton Mifflin. [Google Scholar]

- Kozyreva, Anastasia, and Ralph Hertwig. 2021. The interpretation of uncertainty in ecological rationality. Synthese 198: 1517–47. [Google Scholar]

- Kuhlthau, Carol C. 1993. A principle of uncertainty for information seeking. Journal of Documentation 49: 339–55. [Google Scholar]

- Lipshitz, Raanan, and Orna Strauss. 1997. Coping with uncertainty: A naturalistic decision-making analysis. Organizational Behavior and Human Decision Processes 69: 149–63. [Google Scholar]

- Machina, Mark J. 2014. Ambiguity Aversion with Three or More Outcomes. American Economic Review 104: 3814–40. [Google Scholar]

- Marchau, Vincent A., Warren E. Walker, Pieter J. Bloemen, and Steven W. Popper, eds. 2019. Decision Making under Deep Uncertainty: From Theory to Practice. Cham: Springer Nature. [Google Scholar]

- Meyer, Robert J., and Darryl Banks. 1997. Behavioral Theory and Naïve Strategic Reasoning. In Wharton on Dynamic Competitive Strategy. Edited by George S. Day, David J. Reibstein and Robert E. Gunther. New York: John Wiley & Sons Inc., pp. 155–76. [Google Scholar]

- Miller, Trudi C. 1993. The duality of human nature. Politics and the Life Sciences 12: 221–41. [Google Scholar]

- Mousavi, Shabnam, and Gerd Gigerenzer. 2014. Risk, uncertainty, and heuristics. Journal of Business Research 67: 1671–78. [Google Scholar]

- Packard, Mark D., Brent B. Clark, and Peter G. Klein. 2017. Uncertainty types and transitions in the entrepreneurial process. Organization Science 28: 840–56. [Google Scholar]

- Petkova, Antoaneta. P., Anu Wadhwa, Xin Yao, and Sanjay Jain. 2014. Reputation and Decision Making Under Ambiguity: A Study of U.S. Venture Capital Firms’ Investments in the Emerging Clean Energy Sector’. Academy of Management Journal 57: 422–48. [Google Scholar]

- Ramoglou, Stratos. 2021. Knowable opportunities in an unknowable future? On the epistemological paradoxes of entrepreneurship theory. Journal of Business Venturing 36: 106090. [Google Scholar]

- Rindova, Violina, and Hugh Courtney. 2020. To Shape Or Adapt: Knowledge Problems, Epistemologies and Strategic Postures Under Knightian Uncertainty. Academy of Management Review 45: 787–807. [Google Scholar]

- Savage, Leonard J. 1954. The Foundations of Statistics. New York: Wiley. [Google Scholar]

- Simon, Herbert A. 1957. Models of Man; Social and Rational. New York: Wiley. [Google Scholar]

- Srivastava, Sameer B. 2015. Intraorganizational Network Dynamics in Times of Ambiguity. Organization Science 26: 1365–80. [Google Scholar]

- Taleb, Nassim N. 2012. Antifragile: How to Live in a World We Don’t Understand. London: Allen Lane, vol. 3. [Google Scholar]

- Turk, Cynthia L., Richard G. Heimberg, Susan M. Orsillo, Craig S. Holt, Andrea Gitow, Linda L. Street, Franklin R. Schneier, and Michael R. Liebowitz. 1998. An investigation of gender differences in social phobia. Journal of Anxiety Disorders 12: 209–23. [Google Scholar]

- Weil, Henry B. 2010. Why markets make mistakes. Kybernetes 39: 1429–51. [Google Scholar]

- Yang, Xiaolan, and Li Zhu. 2016. Ambiguity vs risk: An experimental study of overconfidence, gender and trading activity. Journal of Behavioral and Experimental Finance 9: 125–31. [Google Scholar]

| Variable | Mean | StdDev | Min | Max | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | choice1 = U | 0.880 | 0.326 | 0 | 1 | ||||||||||||||||

| 2 | rationale1 = dom | 0.350 | 0.478 | 0 | 1 | 0.239 | |||||||||||||||

| 3 | choice2 = D | 0.705 | 0.457 | 0 | 1 | 0.166 | 0.084 | ||||||||||||||

| 4 | game2 = D&eV | 0.345 | 0.477 | 0 | 1 | 0.171 | 0.107 | 0.469 | |||||||||||||

| 5 | rationale2 = unk | 0.205 | 0.405 | 0 | 1 | −0.041 | −0.191 | −0.242 | −0.369 | ||||||||||||

| 6 | choice3 = U | 0.670 | 0.471 | 0 | 1 | 0.134 | 0.091 | 0.129 | 0.196 | −0.065 | |||||||||||

| 7 | game3 = U&max | 0.290 | 0.455 | 0 | 1 | 0.033 | 0.085 | −0.022 | 0.000 | 0.030 | 0.449 | ||||||||||

| 8 | rationale3 = unk | 0.150 | 0.358 | 0 | 1 | −0.060 | −0.132 | −0.066 | −0.128 | 0.515 | −0.182 | −0.268 | |||||||||

| 9 | male | 0.645 | 0.480 | 0 | 1 | −0.017 | −0.047 | −0.022 | 0.077 | −0.193 | 0.013 | −0.102 | −0.098 | ||||||||

| 10 | age | 37.805 | 10.404 | 18 | 71 | −0.002 | −0.097 | 0.010 | −0.137 | 0.067 | 0.019 | 0.017 | 0.123 | −0.103 | |||||||

| 11 | US-id | 0.920 | 0.272 | 0 | 1 | 0.061 | −0.015 | 0.133 | 0.020 | 0.013 | −0.089 | −0.096 | 0.021 | −0.103 | 0.037 | ||||||

| 12 | college | 0.765 | 0.425 | 0 | 1 | 0.122 | 0.011 | 0.107 | 0.129 | −0.128 | −0.013 | −0.088 | −0.097 | −0.042 | −0.029 | 0.010 | |||||

| 13 | GT-exposure | 2.245 | 0.848 | 1 | 5 | 0.034 | 0.060 | −0.072 | 0.039 | −0.162 | 0.015 | −0.094 | −0.089 | 0.104 | 0.017 | −0.089 | 0.328 | ||||

| 14 | eV-experience | 2.580 | 0.887 | 1 | 5 | −0.001 | −0.090 | −0.047 | 0.166 | −0.165 | 0.039 | −0.095 | −0.085 | 0.238 | −0.011 | 0.047 | 0.190 | 0.538 | |||

| 15 | options-experience | 2.520 | 0.961 | 1 | 5 | 0.104 | −0.004 | −0.049 | 0.034 | −0.030 | 0.015 | −0.036 | 0.006 | 0.032 | 0.090 | −0.071 | 0.374 | 0.453 | 0.511 | ||

| 16 | ambiguity-aversion | 0.184 | 0.353 | −1 | 1 | −0.014 | 0.040 | 0.049 | 0.055 | 0.047 | 0.099 | 0.179 | −0.129 | −0.072 | 0.053 | −0.039 | −0.137 | −0.184 | −0.113 | −0.109 | |

| 17 | game1score | 1.225 | 0.645 | 0 | 2 | 0.158 | 0.171 | −0.158 | 0.130 | 0.085 | −0.125 | −0.049 | −0.066 | 0.046 | 0.065 | 0.046 | −0.071 | 0.045 | 0.038 |

| DV | choice1 = U | rationale1 = dom | ||||||||||

| IVs | Coeft | Error | z | |z| > Z* | Coeft | Error | z | |z| > Z* | ||||

| constant | 0.440 | 0.749 | 0.59 | 0.557 | 0.095 | 0.580 | 0.16 | 0.870 | ||||

| male | 0.053 | 0.266 | 0.20 | 0.841 | −0.071 | 0.202 | −0.35 | 0.725 | ||||

| age | −0.002 | 0.012 | −0.15 | 0.881 | −0.014 | 0.009 | −1.52 | 0.127 | ||||

| US-id | 0.412 | 0.402 | 1.02 | 0.306 | 0.078 | 0.348 | 0.22 | 0.823 | ||||

| college | 0.289 | 0.290 | 1.00 | 0.319 | −0.037 | 0.244 | −0.15 | 0.879 | ||||

| GT-exposure | 0.006 | 0.179 | 0.03 | 0.974 | 0.261 | 0.141 | 1.86 | 0.064 | ||||

| eV-experience | −0.120 | 0.162 | −0.74 | 0.460 | −0.289 | 0.146 | −1.98 | 0.048 | ||||

| options-experience | 0.200 | 0.158 | 1.27 | 0.206 | 0.056 | 0.122 | 0.46 | 0.645 | ||||

| ambiguity-aversion | −0.028 | 0.335 | −0.08 | 0.932 | 0.212 | 0.269 | 0.79 | 0.432 | ||||

| chi-sq | 5.110 | 0.746 | 8.255 | 0.409 | ||||||||

| pseudo-R2 | 0.035 | 0.032 | ||||||||||

| DV | choice2 = D | game2 = D&eV | rationale2 = unk | |||||||||

| IVs | Coeft | Error | z | |z| > Z* | Coeft | Error | z | |z| > Z* | Coeft | Error | z | |z| > Z* |

| constant | −0.403 | 0.638 | −0.63 | 0.528 | −1.174 | 0.650 | −1.81 | 0.071 | 0.524 | 0.722 | 0.73 | 0.468 |

| male | 0.035 | 0.212 | 0.16 | 0.870 | 0.119 | 0.211 | 0.56 | 0.573 | −0.506 | 0.225 | −2.25 | 0.025 |

| age | 0.005 | 0.010 | 0.50 | 0.620 | −0.015 | 0.010 | −1.57 | 0.117 | 0.003 | 0.010 | 0.33 | 0.739 |

| US-id | 0.506 | 0.343 | 1.48 | 0.140 | −0.049 | 0.364 | −0.13 | 0.893 | −0.003 | 0.393 | −0.01 | 0.993 |

| college | 0.510 | 0.249 | 2.05 | 0.040 | 0.524 | 0.259 | 2.02 | 0.043 | −0.357 | 0.268 | −1.33 | 0.182 |

| GT-exposure | −0.153 | 0.147 | −1.04 | 0.297 | −0.162 | 0.147 | −1.11 | 0.268 | −0.149 | 0.154 | −0.97 | 0.332 |

| eV-experience | 0.043 | 0.146 | 0.30 | 0.766 | 0.404 | 0.149 | 2.71 | 0.007 | −0.232 | 0.158 | −1.47 | 0.142 |

| options-experience | −0.113 | 0.128 | −0.88 | 0.377 | −0.146 | 0.128 | −1.14 | 0.256 | 0.186 | 0.138 | 1.34 | 0.179 |

| ambiguity-aversion | 0.176 | 0.275 | 0.64 | 0.523 | 0.312 | 0.290 | 1.08 | 0.281 | 0.041 | 0.314 | 0.13 | 0.896 |

| game1score | 0.324 | 0.151 | 2.14 | 0.033 | 0.410 | 0.156 | 2.63 | 0.008 | −0.417 | 0.170 | −2.46 | 0.014 |

| chi-sq | 13.440 | 0.144 | 22.967 | 0.006 | 21.795 | 0.010 | ||||||

| pseudo-R2 | 0.055 | 0.089 | 0.107 | |||||||||

| DV | choice3 = U | game3 = U&max | rationale3 = unk | |||||||||

| IVs | Coeft | Error | z | |z| > Z* | Coeft | Error | z | |z| > Z* | Coeft | Error | z | |z| > Z* |

| constant | 0.242 | 0.646 | 0.38 | 0.707 | −0.004 | 0.644 | −0.01 | 0.995 | −0.566 | 0.741 | −0.76 | 0.445 |

| male | 0.007 | 0.203 | 0.03 | 0.974 | −0.256 | 0.209 | −1.22 | 0.222 | −0.267 | 0.243 | −1.10 | 0.272 |

| age | 0.004 | 0.009 | 0.40 | 0.692 | 0.000 | 0.009 | 0.03 | 0.973 | 0.014 | 0.011 | 1.34 | 0.180 |

| US-id | −0.538 | 0.387 | −1.39 | 0.165 | −0.488 | 0.344 | −1.42 | 0.156 | 0.030 | 0.436 | 0.07 | 0.945 |

| college | −0.047 | 0.249 | −0.19 | 0.851 | −0.207 | 0.245 | −0.84 | 0.398 | −0.388 | 0.289 | −1.34 | 0.179 |

| GT-exposure | −0.034 | 0.143 | −0.24 | 0.812 | −0.092 | 0.144 | −0.64 | 0.524 | −0.115 | 0.171 | −0.67 | 0.500 |

| eV-experience | 0.135 | 0.142 | 0.95 | 0.341 | −0.038 | 0.149 | −0.25 | 0.799 | −0.157 | 0.171 | −0.92 | 0.357 |

| options-experience | −0.038 | 0.123 | −0.31 | 0.760 | 0.055 | 0.129 | 0.42 | 0.672 | 0.190 | 0.146 | 1.30 | 0.193 |

| ambiguity-aversion | 0.349 | 0.274 | 1.28 | 0.202 | 0.629 | 0.293 | 2.14 | 0.032 | −0.732 | 0.341 | −2.15 | 0.032 |

| game1score | 0.296 | 0.149 | 1.99 | 0.046 | 0.184 | 0.153 | 1.20 | 0.231 | −0.281 | 0.183 | −1.54 | 0.123 |

| chi-sq | 8.275 | 0.507 | 13.451 | 0.143 | 15.693 | 0.074 | ||||||

| pseudo-R2 | 0.033 | 0.056 | 0.093 | |||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arend, R.J. Strategy under Ambiguity, and a New Type of Decision Dilemma. Adm. Sci. 2022, 12, 44. https://doi.org/10.3390/admsci12020044

Arend RJ. Strategy under Ambiguity, and a New Type of Decision Dilemma. Administrative Sciences. 2022; 12(2):44. https://doi.org/10.3390/admsci12020044

Chicago/Turabian StyleArend, Richard J. 2022. "Strategy under Ambiguity, and a New Type of Decision Dilemma" Administrative Sciences 12, no. 2: 44. https://doi.org/10.3390/admsci12020044

APA StyleArend, R. J. (2022). Strategy under Ambiguity, and a New Type of Decision Dilemma. Administrative Sciences, 12(2), 44. https://doi.org/10.3390/admsci12020044