1. Introduction

In Switzerland, the number of commuters has risen sharply in recent years. In 1990, 2.9 million people used to commute to their place of work. By 2015, the number had already reached 3.9 million. At the same time, the average distances between home and work have grown steadily from 12.9 km in 2000 to 14.6 km in 2013, which is an increase of 13% within 13 years. In this context, 54% of commuters opted for private motorized transport for their daily work travel (

Bundesamt für Statistik 2016,

2017). These growth trends are particularly relevant to economically strong urban centers such as the city of Basel—and reflect trends which are similar in other cities and large agglomerations around the globe (

Aguilera 2005;

Engebretsen et al. 2018). Mobility needs in Switzerland continue to increase with economic development and settlement growth. Rising incomes, an active lifestyle and the increase in population due to migration contribute further to these developments. This trend has consequences for society and the economy: Long or cumbersome commuting can reduce labor productivity and restrict time for other activities such as leisure, recreation or family.

The increasing number of commuters and ever-increasing commuting distances are also pushing existing transport systems to their capacity limits, increasing energy consumption and emissions that are harmful to health and to the environment. As a result, labor mobility is generating negative impacts on social, economic and ecological areas.

Cities with a high proportion of commuters have to adapt their mobility strategies to these changed conditions. Opportunities presented by new technologies can be exploited to improve the sustainability of mobility systems. In particular, the applicability of intermodal planning and booking systems such as “Mobility as a Service (MaaS)” and car-/ridesharing. Other solutions enabled through the rise of Information and Communication Technologies (ICT) are autonomous driving, teleworking or home office. Here, employers are the key in shaping the incentives and structures for their employees to commute to the workplace or to work from home.

Despite the vast literature depicting the positive sustainability effects of the above-mentioned mobility solutions, adoption and implementation stays limited. In order to successfully implement such new mobility offers and measures, a thorough planning with the local stakeholders is inevitable. Their opinion towards new sustainable commuting options is thus of high importance and value for city planners, governments and companies interested in sustainable commuting.

With the help of three stakeholder surveys conducted in Basel (Switzerland), Korneuburg (Austria) and the growth corridor of Finland, insights into the role of stakeholders in sustainable commuting can be drawn. Five semi-structured interviews with experts in Switzerland and two workshops further contribute to the understanding of the roles of stakeholders in the discussion of sustainable commuting and especially company mobility management, which is important in light of the targeted transformation pathway of the current mobility system.

A short literature review about stakeholder involvement in commuting planning is provided in

Section 2. Questionnaire development, sample properties and interview methodology are presented in

Section 3.

Section 4 reveals the stakeholder survey results, while

Section 5 presents and discusses the findings from the expert interviews and workshops. Finally, a conclusion and limitations are provided in

Section 6.

2. Sustainable Commuting Planning—Stakeholder Involvement

As of today, very few numbers of peer-reviewed papers consider the attitude of stakeholders and experts in new sustainable commuting technologies.

Roby (

2010) for example, emphasizes the uptake of organizationally embedded travel plans by companies to support the sustainable commuting of their employees. Yet,

Willamowski et al. (

2014) discovered challenges for the public administrators in supporting such travel plans, as each organization has their own specific resources, needs and motivations. Still, local governments are found to be open towards new ways of promoting sustainable commuting, as well as providing workers a better commuting experience (

Castellani et al. 2014). Nevertheless, decision-makers in companies and transport planners in administrations need valid reasons to implement sustainable commuting strategies. A crucial factor is the return on investments.

Robèrt (

2017) thus underlines the importance of a holistic approach focusing on all employee travel options, together with cost-benefit assessments of these options so to illustrate the potential savings of expenses.

In order to increase consensus building in transportation planning and adopt sustainable commuting strategies,

Cascetta et al. (

2015) propose a decision-making model. Therein, a transparent, cognitive and rational decision making should be combined with stakeholder engagement and a quantitative analysis.

Le Pira et al. (

2016) further stress the importance of public participation in combination with the aforementioned stakeholder engagement in transport planning.

The acceptability of mobility management strategies within a university campus in Catania (Italy), such as parking management, has been investigated using agent-based modeling. They find that preliminary knowledge on stakeholders’ opinions can foster the emergence of consensus (

Le Pira et al. 2016). Similarly,

Giuffrida et al. (

2019) propose a participatory approach in decision making related to transport decisions. By using Public Participatory Geographic Information Systems (PPGIS), a web-based map can provide easy access to information for a wider public, including stakeholders as well as citizens. Within PPGIS, any potential spatial effects of planned mobility projects can be visualized and provide a platform for interaction and decision-making. PPGIS have been found to be a valid aid for transport decision-makers (

Giuffrida et al. 2019).

While these studies address ways on how to improve stakeholder engagement and commuting planning, the actual openness of the diverse stakeholders involved in transport planning regarding sustainable commuting technologies and services has not been addressed so far.

3. Methodology

Stakeholders are individuals, groups, organizations or institutions “that are or perceive themselves as being affected by or interested in the decision-making on a certain issue” (

Van de Kerkhof 2001, p. 4). They might be any group of people, organized or unorganized “who share a common interest or stake in a particular issue or system” (

Grimble and Wellard 1997, p. 175). For the sake of analysis it is necessary to focus on stakeholders whose decisions and actions can contribute to systemic stability or change, and are thus conceived to have a high relevance for the system. For that reason, we focused on interest/action groups, institutions, organizations and persons representing political, social, cultural and economic power.

The survey questions were developed through a brainstorming session with experts from the external advisory board of the “Smart Commuting” project, which consists of practitioners as well as researchers from the field of mobility. In total, 31 questions were derived to yield answers on the following four research questions:

How do stakeholders perceive certain trends/innovations in the context of their activities?

Which are the (positive as well as negative) experiences that stakeholders had encountered when they were involved in different cooperation projects/processes concerning commuting?

What are supporting factors and challenges for the stakeholders concerning the implementation of innovations in commuting?

How do stakeholders perceive the implementation of mobility services and what would they need as a support?

The survey was distributed to all three case study areas of the “Smart Commuting” project in August and September 2017 via email. In Basel, stakeholders that were identified by a network analysis were invited to participate. In Finland, participants of public collaboration processes (such as developing a Sustainable Urban Mobility Plan) were invited to participate. In Austria, existing contacts of the research partners were used, and were asked to distribute the survey further.

Table 1a shows the number of obtained contacts and the completion rate according to each case study area. The questionnaire was implemented as an online survey with the software-package Questback.

3.1. Stakeholder Survey Sample Properties

Participants of the survey were asked to designate their affiliation to one stakeholder category. In the Swiss and Finnish sample, the stakeholder category ‘Administration’ was the most represented one, with shares of around 50%. In the Austrian sample, the most important stakeholder category was ‘Planning & Research’ with a 36% share of the responses. The two categories ‘Associations & NGO’ and ‘Transport company’ were the third and fourth-frequent category, respectively.

Table 1b shows the number of obtained samples per stakeholder category and each case study area.

3.2. Expert Interviews and Workshops

Five expert interviews in Switzerland were organized to yield insights into the extent of how companies can profit from and incorporate new mobility services. All interviewed experts are active within the field of mobility management in companies or similar.

Interview 1: Representative of a public-transport company

Interview 2: Representative of an active-mobility lobby group

Interviews 3 and 4: Representative of a consulting firm for mobility management

Interview 5: Representative of a car-pooling implementation project within a private company

The interviews were semi-structured with a set of already prepared questions and spontaneous follow up questions for clarification and deepening of the discussion. In addition to these interviews, two stakeholder workshops were carried out in Basel and in Winterthur, Switzerland. The aim of the fist workshop was to identify and prioritize the components and aspects of future mobility strategies of administrations, especially with regard to commuting mobility. The target group were representatives of administrations in the Basel region, preferably working in the area of mobility and commuting (

Workshop 1 2018).

The second workshop’s aim was to identify how companies can benefit most effectively from mobility management and which components and aspects must be considered for a forward-looking mobility management in companies, thus having a more narrow view in contrast to the first workshop. Furthermore, the participants were asked what the most important success factors for an efficient and business-friendly implementation are. The target group were representatives of companies interested in mobility management or who were practicing it already (

Workshop 2 2018).

4. Attitudes of Stakeholders towards Trends and Innovations

To what extent do decision-makers play an ‘enabler’-role in the implementation of new technologies? The following chapters will yield answers to this question by analyzing the stakeholder survey on the perspective and openness towards innovations and development in the field of commuter mobility.

4.1. The Relevance of Trends in Mobility form a Stakeholder Perspective

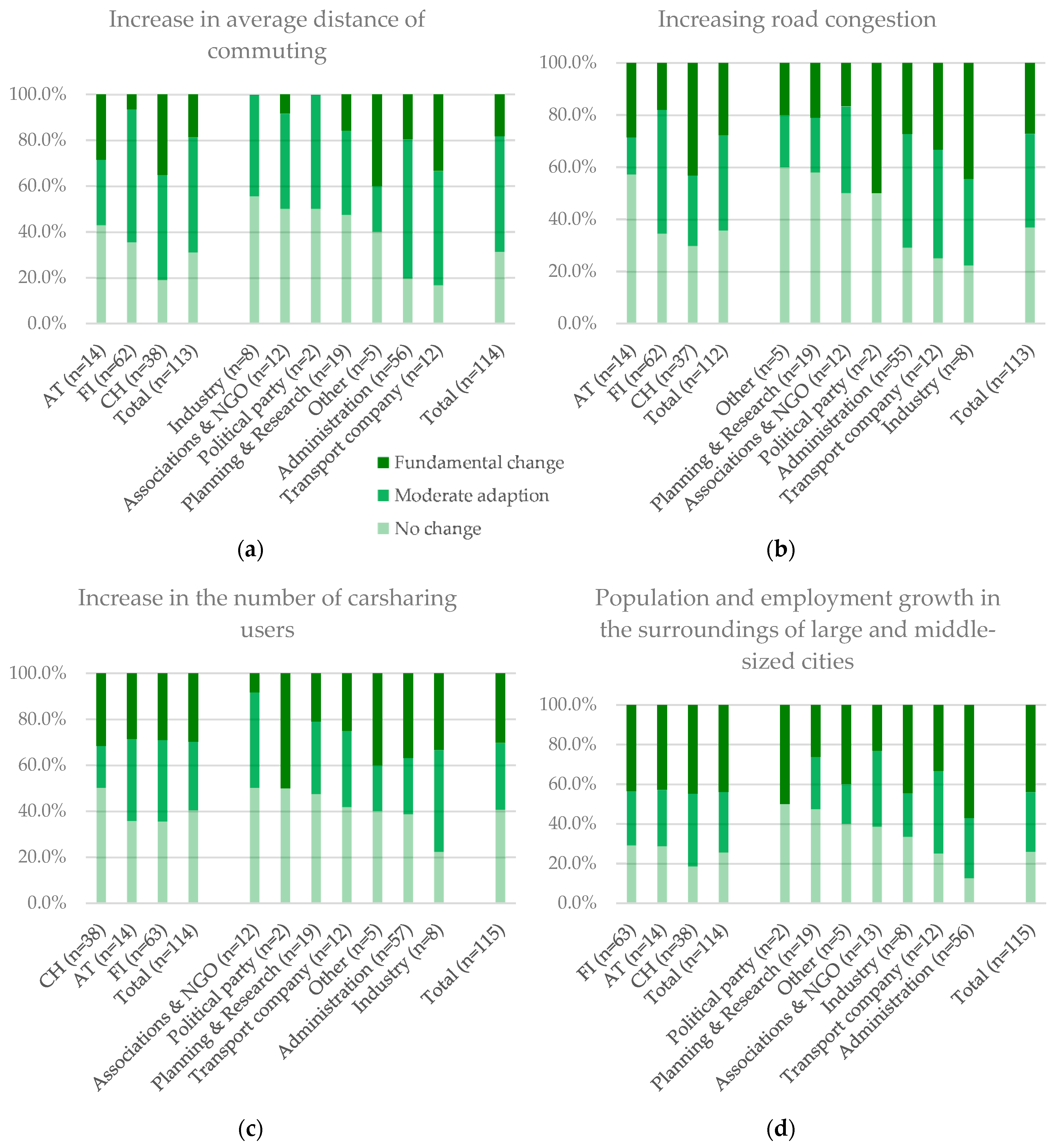

Stakeholders’ views and opinions concerning recent trends in mobility build the basis for their decisions, leading to the design of the transport system in the end. Thus, analyzing the perspective on which these stakeholders base their decisions provides a basis on how to support the stakeholders in order to approach a systemic transformation. Four main trends in mobility and spatial planning were chosen for further investigation regarding stakeholders’ attitudes towards them. The surveyed trends were the increasing average distance of commuting travels, the increasing road congestion, the population and employment growth in the surroundings of large and middle-sized cities and the increase in the number of carsharing users. The stakeholders were asked whether these trends require an adaptation of their strategies and measures in the area of commuting. The results are displayed in

Figure 1.

Generally, stakeholders see all trends as quite influential for their work and strategies. For most surveyed trends, more than 50% of all stakeholders anticipated that these developments would create at least a moderate influence on their strategies. This result indicates a high level of awareness in all of the three case study areas regarding recent trends affecting the area of commuting. Exceptions are the opinions of Austrian stakeholders for the trend ‘Increasing road congestion’. Apparently, stakeholders in Austria, as well as stakeholders of the categories ‘Planning & research’ and ‘Other’ are less concerned by this trend. Similarly, the trend ‘Increase of average distance in commuting’ does not seem to be influential for stakeholders in industry. This may indicate that these stakeholders are less interested in these trends, or have already adapted to these respective developments. It can be pointed out that if a trend has already progressed in a particular country, it might be that stakeholders are expecting the need for an adaptation of their strategies to a lesser degree, as they may already be used to cope with this particular development. For Swiss stakeholders this seems to account for the trend ‘Increasing number of carsharing users’.

In Switzerland, the number of carsharing users has increased more strongly as compared to the countries of the other two case studies (

Loose 2010). If, however, a trend is apparent and comes with challenges (e.g., ‘Increasing of road congestion’ or ‘Population and employment growth in the surroundings of large and middle-sized cities’), the stakeholders tend to be more concerned by these changes. In Switzerland, around 80% of all surveyed stakeholders anticipate a change in their strategies due to the trends ‘Population and employment growth in the surroundings of large and middle-sized cities’ and ‘Increasing average distance of work commuting trips’. This share is around 10 to 20% percent higher as compared to the two other case areas of the survey. Growth of both the economy and the population has been a major issue in the last decades, leading to increasing mobility demand in Switzerland (

BFS and ARE 2017). Stakeholders not only seem to anticipate this trend in the future, but also realize that today’s problems are results from late or inappropriate reactions to the developments of the past. This is reflected in the high relevance they see in trends related to growth, such as commuting distance, road congestion, as well as population and employment growth.

In Austria, the trend ‘Population and employment growth in the surroundings of large and middle-sized cities’ is seen as the most relevant trend for Austrian stakeholders reflecting ongoing sub- and periurbanization. Around 70% of all of the surveyed stakeholders anticipate a change in their strategies due to this development. Some stakeholder categories show a specific sensitivity for particular trends. For example, stakeholders in the category ‘Industry’ show a particular interest in technology trends, and other trends which affect their business directly (e.g., traffic congestion). The trend ‘Longer commuting distances’ however, which affects their employees but not the company itself, received little attention. Trends of growth (population and employment, increasing commuting distance) are considered as important from stakeholders in administration and in transport companies who are responsible for the solutions of related problems.

4.2. Openness of Stakeholders towards New Technologies in Commuting

New technologies and solutions are expected to solve the effects and challenges related to trends in mobility. Optimized organization of the mobility system should lead to a higher efficiency in terms of resource consumption and decreasing negative side effects from transport. Even if these assumptions are not proven yet, the trust in and openness for such solutions would guide stakeholders’ decisions and lead to a certain development of the mobility system in the future. Thus, after having examined stakeholders’ attitudes towards trends in commuting from a strategical viewpoint, in the second part of the survey participants were asked to give their personal opinion on innovations in commuting. Five technological innovations in commuting were chosen for further investigation regarding stakeholders’ attitudes towards them—i.e., whether they support, approve of, or oppose these innovations.

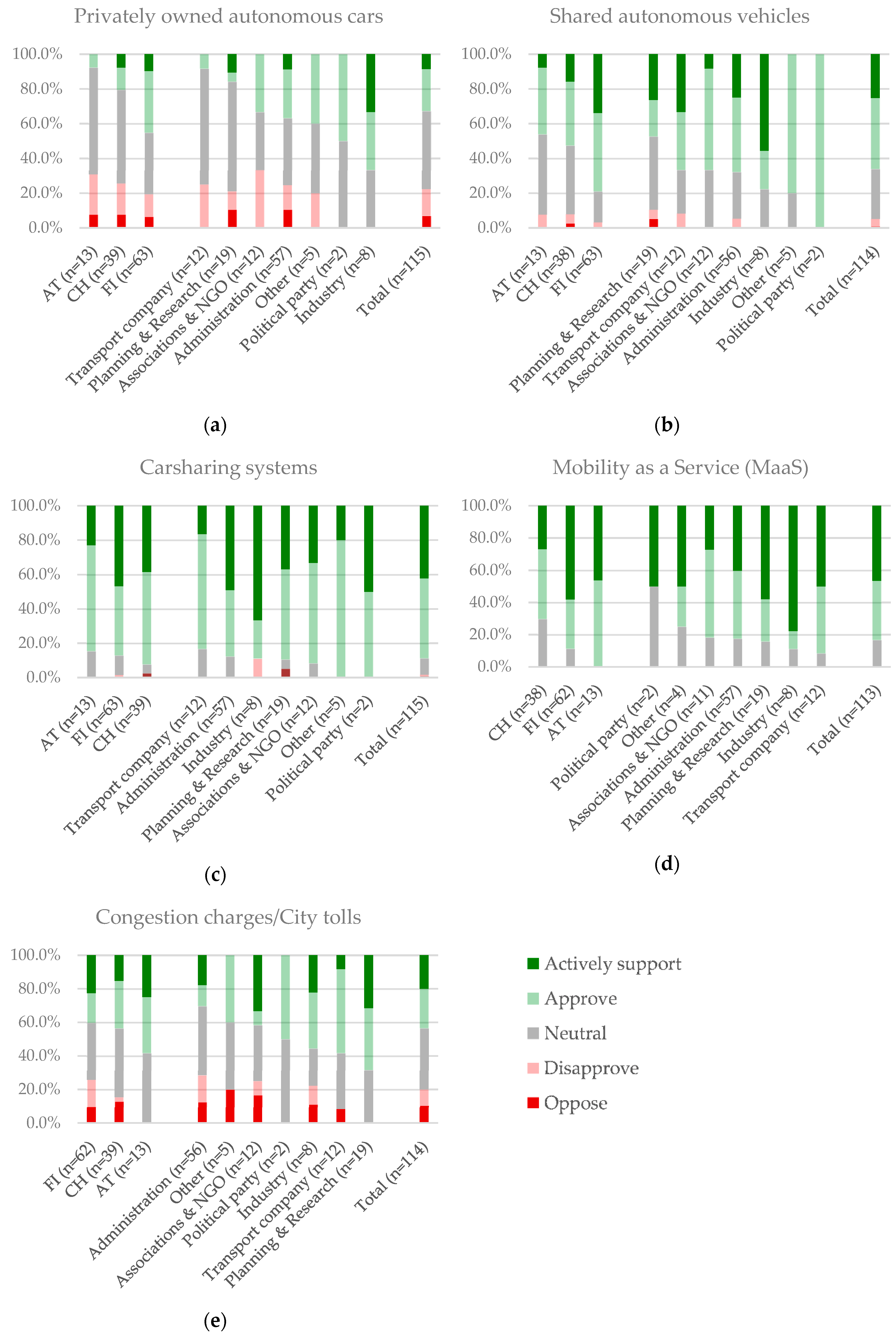

In

Figure 2 results of the survey show that openness it not only related to technologies itself, but depends and differs on the way they might be implemented in the given mobility system.

Stakeholders from all three case areas are rather opposing and skeptical towards the innovation ‘Privately owned autonomous cars’—with the exception of people from industry. The high skepticism especially of stakeholders from transport companies, associations, planning and administrations leads to the assumption that these expect negative consequences for the transport system and an adverse sustainability effect if this innovation thrives. This result is not surprising, taking into account the fact that those autonomous cars could lower the price of individual motorized mobility and increase the number of cars on the street due to optimized traffic flows (

Wadud et al. 2016). Additionally, the possibility for work or entertainment while traveling might lead to higher tolerance of even longer commuting distances as compared to today.

Carsharing systems are approved by all stakeholders and countries, with only little variance.

In general, Finnish stakeholders seem to be quite in favor of innovations in commuting, and as such, see the surveyed innovations more positively than do the Swiss or Austrian stakeholders. However, regarding innovations that restrict or limit accessibility (push-measures) like ‘Congestion charges’, they are more on the opposing side.

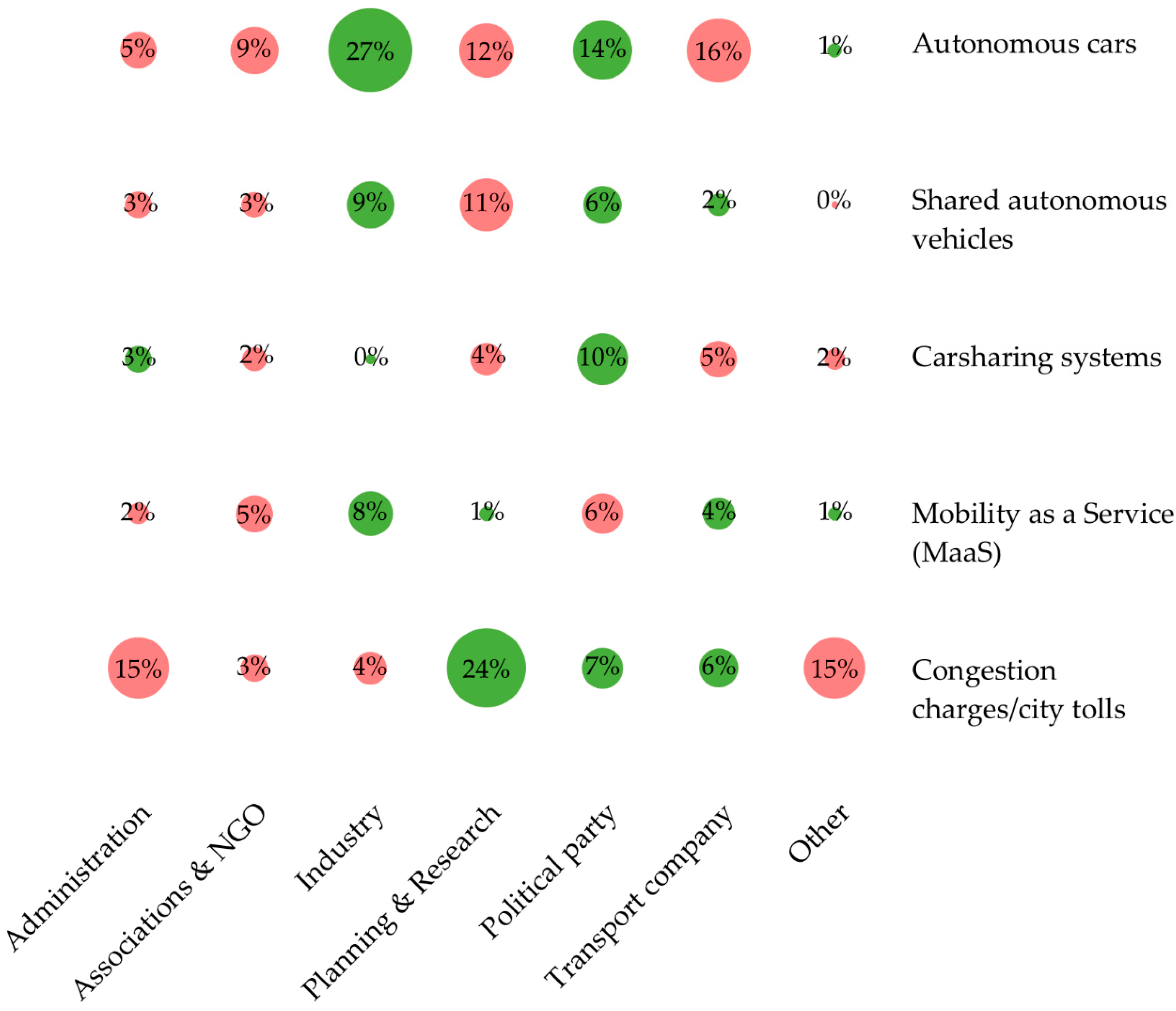

In order to assess the general openness of stakeholders to innovations, the difference in openness to the various innovations, compared to the mean value among all stakeholders, is depicted in

Figure 3. Administrations and associations & NGOs show a below average enthusiasm towards the investigated innovations. As the stakeholder category ‘Administration’ was the most represented one among all of the stakeholders, this aversion to innovations could be a major obstacle for the diffusion of new technologies. Especially concerning city tolls, administrations are strongly below average (15%). While the remaining stakeholders do have a rather average openness towards charges and city tolls, ‘Planning & Research’ is the counterweight with 24% above average openness.

The stakeholder category ‘Industry’ shows an above average enthusiasm towards the surveyed innovations, indicating that these types of stakeholder are likely to cooperate when implementing new mobility solutions. Even concerning the push-measure ‘City toll’, an average openness can be found. Interestingly, the biggest spread of openness between the stakeholders can be found for autonomous vehicles, yet for shared autonomous vehicles the stakeholders seem to have a more common view, and therefore less variance in the openness.

Finally, the openness of the stakeholder category ‘Transport Company’ does not differ strongly from the average, despite for autonomous cars, where they do clearly less support this innovation. Considering that such new mobility offers may disrupt the traditional mobility market, where stakeholders belonging to this category are likely to be currently active, the result reflects the expectations of the authors.

5. Mobility Management in Companies

While the openness to new mobility services of a variety of stakeholders has been investigated in the previous chapter, the following chapter digs deeper into the discussion of how such services could be implemented on the basis of a company mobility management with the help of expert interviews and workshops (see

Section 3.2).

5.1. Motivation

The interviewed experts refer to the trend of increasing intermodality, digitalization and automation. In this respect, companies need to be more dynamic. Rather than providing specific assets (timetable, trains, buses, etc.) they should focus upon organizing the interface to these assets. The term Mobility as a service (MaaS) sums up the development towards this trend. The experts draw up a future where people do not buy specific modes of transport, but where they just order journeys from place A to place B. A service provider then organizes the journey according to the needs of the customer. This fundamental paradigm shift offers the possibility for more sustainable ways of commuting. As an example, the ongoing trend of a sharing economy (ride-/carsharing) can be integrated into MaaS, reducing the need for car ownership.

Baptista et al. (

2015) summarize the reduction of the car ownership potential to be between 4 to 13 cars per introduced carsharing vehicle. Still, this reduction potential depends on a regional context, available alternatives and user profiles. A thorough planning and integration into the existing system of such mobility services is thus essential. Mobility management in companies could help in spreading and enabling the new mobility services by opening up to public private partnerships and by fostering customer experience.

However, according to the interviewees, this requires a paradigm change within the company, including a change in thinking and in acting on a management level.

Public transport providers and traditional actors in the mobility area are more and more under pressure, particularly in financial aspects. New mobility concepts and offers in the area of mobility management could help mobility providers to reach new business areas and industries.

Generally, the pressure of suffering is increasing with mobility becoming a burden for companies. On the one hand, awareness of the hidden costs of mobility (parking, health, satisfaction of employees) has recently increased (

Levy et al. 2010;

Ommeren and Wentink 2012); on the other hand, companies are increasingly confronted with official requirements when moving or expanding their premises (

Jensen et al. 2018). Carpooling for example, could work as a way to minimize costs for employees, which could be implemented through a mobility management (

Ou and Tang 2018).

Similarly to the views of the interviewed experts above, participants from the workshop in Winterthur, Switzerland, were asked due to what reasons they implement mobility management in their companies (

Table 2). The answers were split into five categories, where the category “Parking” seems to be most relevant.

In sum, the interviewed experts and workshop participants see various possibilities where a company mobility management could enhance commuting in respect of sustainability. Most notably, parking management is mentioned as a driver of mobility management, but is also seen as an enabler for sustainability when combined with sharing/pooling services. Furthermore, the role model function of companies, especially in the increasing popularity of sustainability, is seen as a motivation to implement mobility management. Here, companies slowly start to see mobility as a service, and set their focus on the mobility needs of their employees instead of only providing parking spaces.

5.2. Challenges with Company Mobility Management

This chapter is dedicated to the challenges that arise when carrying out mobility management projects. As the evaluation of the interviews and workshops has shown, this issue can be divided into separate categories. The challenges described in this chapter belong, on the one hand, to difficulties in the implementation of mobility management, and on the other hand, to difficulties that concern the entire mobility system, but are also addressed within mobility management projects.

5.2.1. Openness to Sustainable Mobility

The openness and adoption of new and emerging mobility services both depend on many factors. As mentioned by interviewee 1, a major factor is prize: “As long as it is cheaper to use fossil fuels than other forms of energy, an energy carrier’s substitution, which would be needed for a more sustainable mobility system, will not happen” (

Interviewee 1 2017).

Accessibility and spatial context also influence the openness. According to interviewee 2, a general openness regarding sustainable mobility can be observed within the stakeholders of cities. Cantonal stakeholders, which have a more rural view regarding mobility issues, are more car-oriented (

Interviewee 2 2017). If the alternative to the car leads to longer travel time, as is the case for rural areas, the choice is in favor of the car. This statement is in line with the findings of the Swiss Microcensus where, on average, people living outside the influence of core cities use the car 24% more often than do people in the core city (

BFS and ARE 2017).

Hoerler and Hoppe (

2019) investigated the satisfaction with commuting as well as the reasons for mode choice of commuters in Basel, Switzerland. Comfort and enjoyment of travel in commuting are still rated significantly higher for the private car in comparison to public transport. However, what really leads to the choice to commute by car has been found to be flexibility (

Hoerler and Hoppe 2019). In order to increase the openness to use public transport and other alternatives to the private car, it is thus crucial to enhance the flexibility of such offers—which is a main selling point of MaaS.

“The canton said: ‘This is a main access road’. We said: ’That’s a future boulevard, a city space for people, which need to be planned appropriately’”.

5.2.2. Missing Parking Management

Another issue, especially concerning medium- and large-sized companies, according to several interviewees, is a missing or insufficient parking management. Parking spaces are expensive to maintain, especially when land prices are increasing. Despite these costs, many companies still see free parking spaces for their employees as an important factor in order to be a competitive employer. Here it is often forgotten that car drivers get an extra “bonus”, and that people who do not drive with the car often feel disadvantaged. Therefore, a missing awareness regarding the effects of providing free parking spaces can be observed within companies.

Furthermore, many communities do not use the scope of action that would be available to them. For example, there are still a lot of regulations for minimum parking spaces in many municipalities. This means that building owners (both private and public) must offer a minimum number of parking spaces if they are constructing new buildings, and therefore decelerate the transformation process. Still some positive developments can be observed. Winterthur, for example, has greatly lowered the minimum parking space requirements for new buildings, and forces existing underground parking spaces to be used: People who live in a house with an underground garage cannot purchase a permanent parking card for aboveground parking spaces (

Interviewee 2 2017).

5.2.3. Focus on Certain Modes and Parts of the Mobility Chain

Interviewee 2, a member of a lobby organization, criticizes the fact that many actors within the area of mobility have wrong focal points. Often, there is a lack of focus on active traffic within mobility policy and measures. Most people would walk to a public transport stop and only a few use Park&Ride or Bike&Ride offers without the need of walking. Even public transport operators seem to neglect this topic. Interviewee 2 explains this by people often seeking salvation in new technologies, also when performing mobility management. Instead, the basic importance of active mobility, like walking or biking, is neglected. Many organizations are not thinking door-to-door, but still station-to-station. This would ignore the current needs of mobility users (

Interviewee 2 2017).

“In the past, pedestrian walking was important, today it is important and it will be important in the future.”.

5.2.4. Attitudes of Companies

Another challenge elaborated by interviewee 3 is the idea of the long established and old school working cultures in companies. In such cases, employers often want to maintain control over their employees. They are afraid that they will not work properly at home and will not fulfil their obligations. This is a common reason why home offices are not allowed in companies where the actual working tasks would allow it.

According to interviewee 3, in the future, when new people are to be recruited, this can be very unattractive from the employer’s side. Thus employers have to deal with the fact that not only the mobility market is changing, but also the expectations of the employees. In the past, people used to come and ask: “May I have a free parking space?” Today it is more. Home office and flexible working hours are increasingly becoming important (

Interviewee 3 2018).

In contrast, free parking spaces are considered the “downfall of everything” (

Interviewee 3 2018). Planned countermeasures often do not go far enough. Small levies in the double-digit range a year are considered. According to Interviewee 3, this is clearly too little to start a paradigm shift. In addition, the financial losses due to the congestion (stress and time loss) of companies are not taken into account (

Interviewee 3 2018).

A similar view has interviewee 4. According to him, employers do generally not care how long their employees are stuck in traffic jams in the morning, as long as they are in the office on time. To realize that it would be economically beneficial to take these externalities into account would require “thinking beyond the tip of one’s nose”. In addition, according to interviewee 4, the focus of many small and middle-sized companies is still on cars and parking spaces. When defining measures, companies often expect an estimation of a return of investment. For consultants this is very difficult, as little practical implementation cases exist, and every company represents its own case (

Interviewee 4 2018).

“I often hear that employers don’t want their employees to do home office because they want to see them. This is a very traditional way of looking at things without understanding that some trips are no longer necessary with home office.”.

5.2.5. Lack of Courage

Another problem mentioned by Interviewee 5 is the lack of courage to take measures that are more drastic. This can even be observed in progressive companies that actively try to put mobility management measures into practice. Interviewee 5 gave an example from his case study in which an internal carpooling project was implemented. After defining a set of very restrictive measures, such as free parking for carpooling commuters, these measures were avoided by the chief executive (

Interviewee 5 2018). According to interviewee 5, openness regarding restrictive measures is strongly related to the pressure of suffering. The more a region suffers from traffic, the sooner it is ready to apply restrictive measures. In Ticino, where the pressure of suffering is higher, carpooling is much more successful than in the German-speaking part of Switzerland, where the pressure is lower. In addition, measures can cannibalize each other. The concept of extremely flexible working conditions—such as the possibility of working 100% from home—raises hurdles for carpooling, as people feel that they would lose flexibility.

“Regarding carpooling, people thought that they won’t come home when they want to. People feel restricted.”.

5.2.6. The Convenience of the Private Car

One other issue in order to change the mobility behavior of commuters are stalled views and perceptions. Interviewee 3 gave examples of commuters that consider their hour in the car in the morning as a recovery time. Also, the views regarding traffic jams are often unfathomable—commuters begin to blank out the traffic jams therein completely (

Interviewee 3 2018). The pressure of suffering caused by traffic jams alone does not seem to be high enough to persuade people to change their mode of commuting.

According to interviewee 4 another issue considered to be a barrier in order to change the current mobility system are “personal attitudes, missing values and awareness that mobility with more roads and more infrastructure is not the solution” (

Interviewee 4 2018). This includes other reasons like status symbol or the “feeling of freedom” when owning and driving a car (

Interviewee 4 2018). Even when stuck in traffic, car users have their private living space. In addition, that living space becomes more and more attractive with further developments of equipped electronics and comfort devices.

“Even if a journey to work is only 3 or 4 kilometers, using the bicycle isn’t even considered.”.

5.2.7. Childcare and Combination of Trips

A strong reason for people to be on the move at peak times is due to childcare. People with children often have to get up at 6 a.m. and need to pick up the child from school at 5 p.m. According to interviewee 3, only very few childcare centers are designed to receive children at off-peak times. This behavior continues due to habit reasons after the children are out of school age (

Interviewee 3 2018). Therefore, interviewee 4 sees more flexible childcare as an important lever in order to reduce commuting at peak times. Generally, it is important to prevent as many additional car trips as possible. Here, also the combination of commuting with other activities such as shopping and leisure activities need to be considered. However, missing transport alternatives or bad public transport connections of shopping/sports areas can motivate people to use the car instead of public transport (

Interviewee 4 2018).

5.3. Best Practice and Recommendations

In this chapter, the best practice examples to incorporate mobility management given by the mobility experts are presented. These are based on the issues shown in the previous chapter and provide solutions to these problems.

“If somebody buys an electric car, try at least to also make them a public transport user.”.

5.3.1. Overcome Habits and Reluctance with Public/Private Networks

Emphasis should be given to remaining persistent when persuading decision makers or public administrations on doing mobility management. As an example, the organization of one of the experts is doing “low level” recommendations for municipalities. Every year a conference or meeting is organized trying to change approval procedures for construction projects. The aim is to always include pedestrians in the planning processes. For example, during the public authorization phase of a construction project, it needs to be clear that a pedestrian interest group has given its “ok” to the project. With extensive lobbying and the “low-level” events, the organization aims to “widen the scope of the participants” (

Interviewee 2 2017).

This already lead to some successful developments as, according to interviewee 2, pedestrian traffic was almost inexistent within traffic planning fifteen years ago. Today, this has changed and the expert expects that more people in municipalities, cities and cantons are entrusted with walkability and pedestrian issues. However, these developments do not work without increasing know-how and creating visions. Many municipalities wait until a construction proposition is made, and if it adheres to the law, it is built. “Municipalities need to have a clear picture on what they want to have built on their area, and actively communicate these restrictions. This includes an interaction between public and private spaces.” (

Interviewee 2 2017).

5.3.2. Highlight the “Return of Investment”

When it comes to convincing upper management on fostering sustainable mobility, identifying, quantifying and demonstrating the return of invested (RoI) is crucial. Interviewee 4 mentions that they are often asked about the expected RoI by consulted companies (

Interviewee 4 2018). This is indeed difficult, especially for measures that foster slow mobility. Still some studies investigated any financial benefits of investments in pedestrian and cycling traffic (

Davis 2010;

Deenihan and Caulfield 2014;

Pérez et al. 2017). The general finding is that the RoI is actually very big. Pedestrian traffic almost has no external costs, 11 cents per walked kilometer is the economic benefit for Switzerland, according to interviewee 4. According to the interviewee, such figures help fundamentally in order to argue in favor of active mobility measures in companies, but also towards municipalities.

According to interviewee 2, it is absurd that parking spaces in underground parking are empty (as they are expensive to rent, around CHF 150/month) and above ground, the public spaces are crammed with cars due to much cheaper prices (CHF 25/month). There, a political decision is necessary, e.g., people living in houses with underground parking should not be allowed to use long term public parking.

The city of Winterthur, Switzerland, has implemented such a rule, for example. Real estate companies are (often) obliged to build parking spaces, but their tenants are still allowed to park their car on long-term public parking. According to the interviewee 1, it needs to be made clear that parking in public spaces is expensive. A proper mobility management should not only be sustainable, but also cheaper. Yet for such argumentations, more rigorous research is needed according to interviewee 1, especially when highlighting sustainability effects (

Interviewee 1 2017).

Interviewee 3 also mentions such costs: “Absurdly, when it comes to costs, I can state that there is not the correct realization where ‘mobility costs’ happen. For example, parking spaces did not fall from space. They cost when they were built, and they cost to maintain and exploit them. These costs are often just hidden by the ones responsible. When we do mobility management, these costs are often seen as dramatic. But when the real mobility costs of maintaining parking spaces are considered, the mobility management costs are not so high anymore.” (

Interviewee 3 2018).

Interviewee 4 is convinced that mobility management can be cost-neutral and even financially profitable for a company, if applied and calculated correctly. Finally, interviewee 3 adds that an attractive and progressive mobility situation is important for many employees. The interviewee can well imagine that in the future, when new people are to be recruited, an unsustainable and old-fashioned mobility situation within a company can be very unattractive from the employer’s point of view. As such, it would also have a financial impact on the employer (

Interviewee 3 2018).

Furthermore, a full costing should be increasingly carried out by commuters. According to the experts: “No commuter makes a full costing. We often hear from car commuters that public transport is too expensive. That is the problem; there is no display in the car that shows how expensive its usage is.” (

Interviewee 4 2018). The current literature shows that, indeed, the full cost of owning a car is underestimated by its users (

Allcott 2013). Awareness rising, such as information campaigns, could therefore help to reduce the attractiveness of cars.

5.3.3. Use a Specific “Burden of Suffering”

Another aspect, which is often a driver in order to motivate companies to perform mobility management according to the interviewed experts, is a specific “burden of suffering”. For companies, the suffering is often related to a parking problem. This is the case when production expansion, company expansion or relocation is imminent and the demand for parking spaces exceeds the limited supply, for example due to lack of space or official requirements. According to interviewee 3, this is the main driver as to why companies are performing mobility management, and has also been identified to be the main reasons by the workshop participants (see

Table 2). This case may also arise when a company is rebuilding or planning new buildings. It then often receives constraints within the building permit, and therefore needs to deal with mobility management. According to interviewee 3, using mobility management in this way has very little to do with voluntariness or with sustainability in commuting, per se. “If there is no pressure from somewhere, no culture change will happen.” (

Interviewee 3 2018).

The other experts share similar points of view. Interviewee 4 mentioned the example of the canton of Ticino. The whole canton has a major mobility problem, since a large proportion of border commuters drive to work by car, pushing the transport infrastructure to its limits, especially close to the border with Italy. The canton provides a program that financially supports companies in order to undertake mobility measures and further decreed push-measures: Organizations with more than 50 parking spaces need to pay a parking-tax to the canton. This money is then used to support measures to shift commuting traffic away from the car, e.g., carpooling projects, shuttle buses, ferry trails etc. (

Interviewee 4 2018). Ticino has been considered to be the most successful region in Switzerland regarding these projects, according to interviewee 5.

5.3.4. Internal Caretaker

According to several interviewees, one of the major issues while performing mobility management is the missing courage and attitude to implement far-reaching measures. Often this is also due to the lack of a person that has the capabilities and willingness to accompany the implementation of such measures. According to interviewee 4, from five to ten input consultations, only one to two concrete projects are agreed to be analyzed in detail. Interviewee 4 mentioned an example of a consultancy case of his company where they developed a comprehensive catalog of measures together with the client. However, the feedback and responses from their contact person within the company became more and more scarce. In the end, it turned out that the person entrusted with this task in the company had neither sufficient resources nor the competence to implement such measures accordingly. The project was terminated without any implementation (

Interviewee 4 2018). According to the interviewees, a person is needed that has the resources and the competences to implement such measures (referred to as a “caretaker”). The relevance of such a caretaker is often underestimated. Yet it needs careful planning, and the responsible person should be internal, as well as supported by an executive board (

Interviewee 3 2018;

Interviewee 4 2018).

5.3.5. Target the Right User Groups

When defining and implementing mobility measures within a company, it is key, according to the mobility experts, to define and target the right user groups. For some experts it is utopian to make carsharing an attractive alternative for a broad section of the population. Certain commuter groups will simply not be motivated to switch their mode of transport. It would therefore be important to spend the (usually very limited) resources on those who would be open to such a change to another mode of transport. Also, according to interviewee 3, it should not be forgotten that there are still many people who still cannot (or do not) use a smartphone (

Interviewee 3 2018;

Interviewee 4 2018).

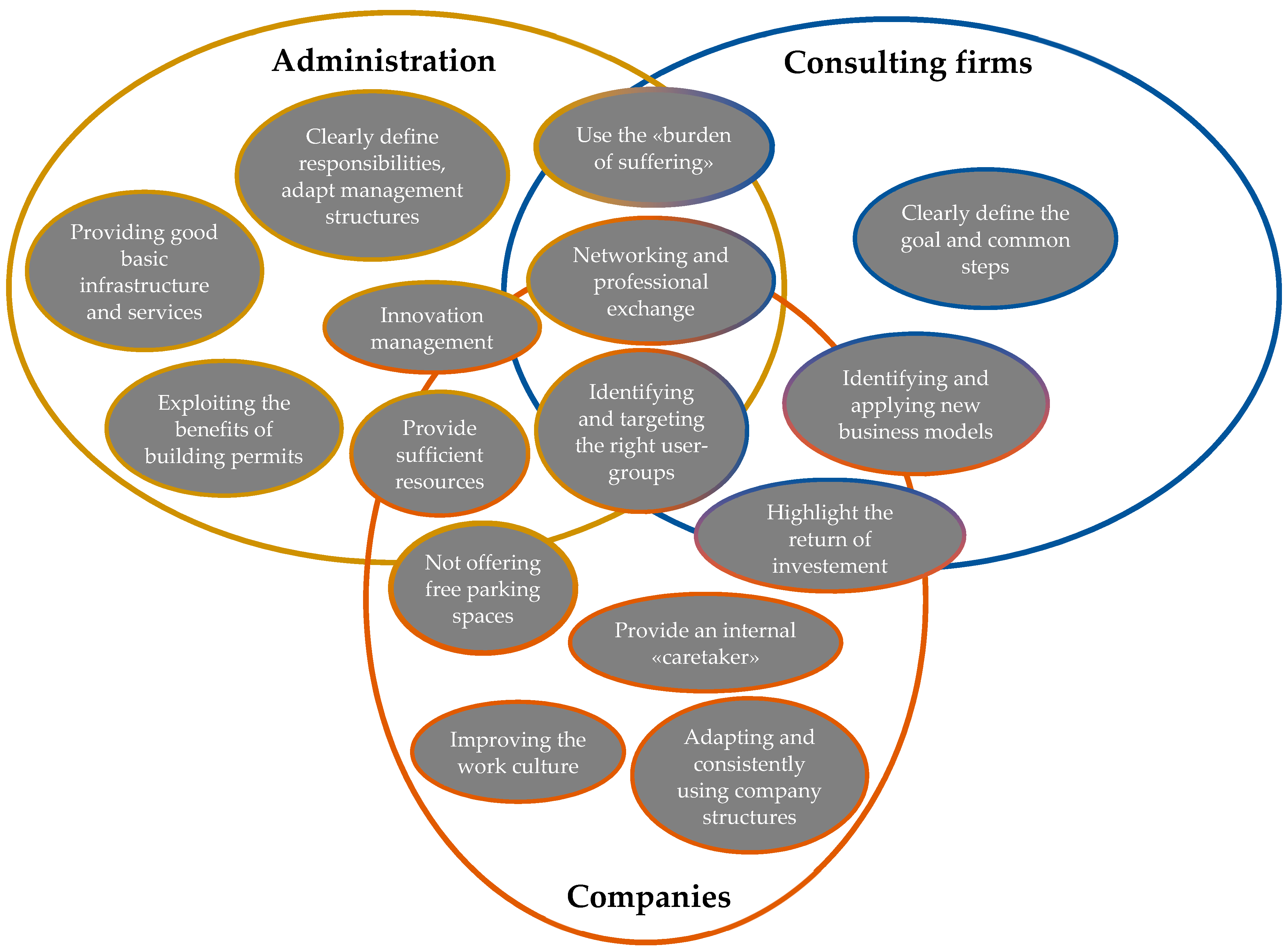

Figure 4 gives a holistic overview of the many best practice examples and recommendations that were mentioned by the interviewed experts as well as workshop participants. It is important to focus on a combined effort of both the administrations and companies in order to yield satisfactory outcomes of a mobility management. Administrations can set the right requirements, infrastructure and resources, while companies need to provide an internal caretaker, good working culture and parking management. Public private partnerships are necessary to build a suitable mobility service that is an integral part of the mobility management. Consulting firms could accelerate such processes by highlighting the return of investments, good networking and user guides (goal and common steps).

6. Conclusions and Limitations

Trends in society, economy, technology and politics, as well as new and emerging technological innovations influence the development of supply and demand in mobility, as well as their framework conditions. It is therefore important for strategies of sustainable commuting to take these into account. The paper investigated the role of European stakeholders in this changing environment as well as the motivation and barriers to mobility management from Swiss experts.

From the four major trends that were investigated, road congestion and population growth have been identified to be the most relevant trends for Swiss as well as Finnish stakeholders. Similarly, population growth is the most important trend for Austrian stakeholders, yet the increasing commuter distance is also seen to be quite influential. In general, only a small difference between these three countries exists when it comes to the perceived influence of trends, yet concerning openness to technological innovations, more distinct preferences can be elaborated. Here, Finnish stakeholders are significantly more open towards innovations like autonomous cars and carsharing, yet—for non-technological innovation such as city tolls—they show the most opposition among surveyed countries. However, for such innovations to flourish and foster the transformation to a sustainable mobility system, collaboration with different stakeholders is necessary.

Administrations and the industry have been found to play a key role in this transformation process. While administrations show a below average enthusiasm towards innovations, the stakeholders from the industry are more open towards the technological innovations. Accordingly, it is important to cooperate in a targeted manner to overcome the reluctance of administrations in innovative mobility technologies.

One possibility is the prototyping of pilot projects, in which new approaches can be tested, both by the administration and the companies, and at the same time tried out by users. Instead of long-term planning in an attempt to take all of the eventualities into account in advance, this offers the opportunity to make solutions directly tangible in the literal sense, and to establish networks and cooperations aimed at common goals. Such networks create opportunities for exchange and learning from the experience of others. In this way, the necessary alliances can emerge, not only for sustainable commuting, but for sustainable mobility in general.

Mobility management in companies was identified as a possible way to make commuter mobility more sustainable. The qualitative interviews with experts on their experiences resulted in a number of starting points that can be helpful beyond the actual mobility management at the measure level:

Developing infrastructure and services: Services must be developed in such a way that they offer alternatives to the car for commuting, so that work and everyday life are compatible.

Use building permits: Administrative instruments can generally provide a great lever in the service of overarching strategies for sustainable commuting.

Creating resources and competencies: Investment in personnel, know-how and the continuous continuation of measures is needed, beyond temporary projects.

Abolish free parking: In addition to establishing alternatives to cars, incentives for their use must be abolished—in particular, the space can be used differently and better.

User group focus: A focus on certain groups with high potential for the use of alternative offers is at least initially more promising than one-fits-all approaches.

Changes in the economy and society, as well as new technologies, would enable a greater flexibility of work in terms of time and place and a higher quality of life through time savings—by replacing physical mobility with digital mobility. In order to solve problems associated with mobility and commuting, a more flexible working environment would be needed. In the area of mobility and transport systems themselves, the development of innovative, attractive and individualizable public transport services is one way in particular, and this must be accompanied by framework conditions—so that alternatives to the car are a better choice for the user. Cooperation between the transport sector, politics and planning, as well as the economy, is indispensable for this—best guided by sufficiency strategies that bring, not only ecological, but also economic and social benefits for Switzerland as a whole.

The findings from this study are rooted in an international stakeholder survey as well as Swiss expert consultation both through interviews and workshops. While the same questionnaire has been distributed to all three case studies in Basel (Switzerland), Korneuburg (Austria) and the growth corridor of Finland, the targeted sample was not random. Furthermore, the case studies differed from a spatial perspective (Basel being a city, Korneuburg a district and the case study in Finland being a growth corridor). For better comparability and assessment of the openness to adopt sustainable commuting alternatives on a European level, a random or quota sample in spatially similar cities or regions is suggested. The insights from the expert interviews and workshops represent the Swiss market, regulations and culture. The applicability of these results on other regions needs to be critically reflected. Still, the study provides starting points for sustainable commuting management, which could be addressed in more detail. The feasibility of the various proposed measures could be further investigated through accompanying studies of mobility management in companies and administrations.