Abstract

The authors conducted a survey of 502 Turkish and Australian undergraduate and graduate business and economic students to determine their views regarding the ethics of tax evasion. These two groups were selected on the premise that their views represented the perceptions of two very different cultures, which has not been investigated in previous studies. The survey instrument required students to indicate their level of agreeableness to 18 general statements representing various scenarios in the socio-economic environment. The statements in the survey reflected the three main viewpoints regarding the ethics of tax evasion which have emerged from the literature to date. The results of the study show that although Turkish scores are significantly different from the Australian scores, both Turkish and Australian respondents believe that tax evasion can be ethically justifiable in certain situations, although some arguments are stronger than others.

1. Introduction

An examination of the tax evasion literature reveals that culture plays an important role in determining the views and opinions of taxpayers. There have been a number of studies that have focused on tax evasion in a particular country but few that have encompassed comparative studies) [1,2,3]. In some of the previous studies ethics are sometimes discussed but, more often than not, the focus of the discussion is on government corruption and the reasons why the citizenry does not feel any moral duty to pay taxes to the government. Most studies on tax evasion tend to look at issues from a public finance or economics perspective, although ethical issues may be mentioned briefly, in passing. It is also evident that some previous studies have compared the ethical views of citizens from different countries without taking into account genuine differences in culture, religion and legal systems [4].

This study aims to overcome this research gap by presenting the preliminary results of an empirical investigation into the views and opinions of both Australian and Turkish tax/accounting students, regarding the ethics of tax evasion. In comparing Australia and Turkey, the Australian legal system is based on common law while Turkey is a civil law jurisdiction. Likewise Australian society is of predominately Christian belief while Turkey is predominately of Muslim belief. Australian culture generally derives from an Anglo-Saxon origin although arguments could be mounted for a more multi-cultural society nowadays while Turkey has strong European and Middle Eastern ties. Thus, there is a need for further research, which the present study is intended to partially address. Collaboration between Monash University in Australia and Inonu University in Turkey was established to conduct the research. This paper reports on the ethics of tax evasion based on the opinions of Turkish and Australian tax/accounting students and compares their views to determine whether cultural differences may explain the differing perceptions of tax evasion. For the purposes of this study tax evasion is defined as intentional illegal behavior, or as behavior involving a direct violation of tax law to escape the payment of tax [5].

Following the introduction in part one of the paper part two briefly reviews the literature on the ethics of tax evasion, based on the three main viewpoints which have emerged over the past few centuries. The results of similar empirical student studies untaken worldwide are also considered with a focus on the religious approaches to tax evasion. Legal, political and philosophical approaches to tax evasion are outside the scope of this study and are not directly examined. Part three proceeds to outline the methodology which was employed in this study. Part four presents the statistical results including a reliability analysis, demographics and overall assessment. Part four also provides a comparative analysis of the two groups of respondents and summarizes the main research findings. Finally, part five, notes the study’s conclusions, limitations and offers some suggestions for further research.

2. Literature Review

Tax evasion has been in existence since ancient times when taxes first started to be collected as evidenced in Biblical references of both the Old and New Testaments [6,7]. Other authors, Jewish [8,9], Christian [10,11], Muslim [12,13,14] and Baha’i have also conducted research on tax evasion [15]. Some scholars have taken a secular perspective [16,17,18]. Despite the plethora of reasons given over time to justify tax evasion, some reasons have been more persuasive than others [19].

There is a vast history of individuals who have avoided or evaded taxes. According to some scholars, the historical records go back 5000 years or more [6,7]. Most of the early literature on tax evasion is from a religious source. Both the Old and New Testament of the Christian Bible address the issue. The general view proposes that there is a moral or religious duty to pay taxes, but that duty is not absolute. In the New Testament, when Jesus was asked what duty exists to pay taxes to Rome, he replied that one should render unto Caesar what is Caesar’s and to God what is God’s (Matthew 22: 21). This response prevented Jesus from getting into trouble with the Roman officials, but begged the question, “Exactly what is Caesar/the government entitled to?”

Historically, there have been three main views on the morality of tax evasion [19,20,21,22,23]. At one extreme is the first main view that evading taxes is immoral and that one has an absolute duty to pay whatever taxes the government demands. A multitude of justifications have been put forward for this position. One justification proposes that whoever is the king/leader is there with God’s permission and consequently the failure to support any leader amounts to disobeying God [20,22]. This view has had little support in recent times, as fewer people believe that political leaders are only there as a result of God’s approval.

A further reason supporting the individuals’ absolute duty to pay whatever taxes the government imposes is that people have voted for government leaders who have endorsed this. It is an individuals’ democratic right to vote or leave and go to another jurisdiction if they disagree with the government which legally imposes tax on its citizens.

These related arguments can be refuted on several grounds. For instance, if a 51 percent majority passes a certain law, the other 49 percent does not have to automatically obey. If this was the case it would mean that one’s rights would disappear whenever one is in the minority. A quip attributed to Benjamin Franklin sums up this view. “Democracy is two wolves and one sheep voting on what’s for lunch. Freedom is a well-armed sheep contesting the vote” [24].

The “if you don’t like it, leave” argument also suffers from some philosophical deficiencies. Taxpayers should not be compelled to leave their homes and country just so that they can avoid an unjust or excessive tax. In some cases, leaving is not an option either because their government prevents them from leaving (e.g., Cuba, North Korea and the former Soviet Union), or because they lack the resources or approval of the country of refuge. Where there is no choice, acting morally is impossible [22].

The view which supports a rigid moral duty to pay whatever taxes the government demands lacks creditability when one considers the question, “Was there a moral duty for the Jews living in Nazi Germany to pay taxes to Hitler?” However, despite this extreme case, some individuals—Orthodox Jews—believe that there is at least some duty to pay taxes to Hitler. In a survey of Orthodox Jews (employing a similar survey instrument to the one used in the present study), the sample population was asked whether tax evasion would be ethical if the taxpayer were a Jew living in Nazi Germany [25]. Although there was heavy support for tax evasion in this case, the support for evasion was not absolute.

Three reasons were cited in the Jewish literature supporting the Jews obligation to pay taxes even to Hitler [8,9]. One view held the belief that “the law is the law”, which means one must obey all laws always. Today, this view is questioned on moral grounds, but a few thousand years ago many people held this view.

The second justification given in the Jewish literature was that one must never do anything to disparage another Jew [8,9]. If one Jew evades taxes, it makes all Jews look bad. Such a view is collectivist at its core, in that it requires individuals to make moral choices based on the consequences to others, rather than doing the right thing regardless of the consequences. If no Jews paid taxes to Hitler, it would have made it more difficult for Hitler to fund his reign of terror against the Jews, which would have benefitted the Jewish community.

The third reason some Jews gave for being morally obligated to pay taxes even to Hitler was because of the view that failure to pay taxes could result in going to prison, which would make it impossible to perform mitzvahs (good works). Since one has a moral duty to do good works, according to the Jewish literature, the logical conclusion is that it is immoral to evade taxes [8,9].

This view may also be criticized, on logical grounds. For example, if one goes to prison, it may actually provide more opportunities for performing good works than if one remained on the outside. It also seems outrageous to require a Jew to pay taxes to Hitler merely to avoid going to prison, when the probable outcome would be to go to a death camp. Going to a prison as opposed to a death camp was a valid reason to evade taxes [22].

At the other extreme is the second main view that evading taxes is never immoral. Those who espouse this view often believe that all governments are illegitimate and need not be obeyed or supported financially [19,22,26]. A more limited espousal of this view was made by Robert Nozick [27], the late Harvard philosophy professor, who equated taxes on income as the moral equivalent of slavery [24]. For example, taxing away 40 percent of one’s income is the equivalent of enslaving the person for two days a week. If one accepts his premise, then the logical conclusion would be that there is nothing immoral about evading the income tax, since slaves owe no duty to their master. One counterargument would be that slaves owe at least some duty to their master because the master provides food, clothing and shelter to slaves (or that citizens owe some duty to the government because the government provides services to them). Some slaves (and taxpayers) would disagree with this argument.

The third main view is that tax evasion may be justified on moral grounds sometimes. This view is the prevalent view in the theological [19,22], philosophical [20] and empirical [17,28,29,30,31] literature.

The most comprehensive study of the theological and philosophical literature on the ethics of tax evasion conducted in the twentieth century was done by Martin Crowe a Catholic priest. Crowe researched 500 years of philosophical and theological literature, mostly Catholic, some of which was in the Latin Language. Crowe’s examination of the literature found that most (not all) theologians and philosophers held the belief that there is some justification for tax evasion in some cases [19]. The strongest arguments justifying tax evasion over the centuries have been mainly based on fairness. Tax evasion might be justified if the king is a tyrant, if the government is corrupt, if the tax system is perceived as being unfair or if the taxpayer does not have the ability to pay.

Other religious literature has generally supported this view, although there have been some exceptions. An examination of the Mormon (Church of Jesus Christ of Latter-day Saints) religious literature could not find any justification for evading taxes [32]. The Baha’i literature was almost as absolute, justifying tax evasion only in cases where the government persecuted members of the Baha’i faith [15]. The Jewish literature holds that tax evasion is usually unethical, although exceptions can be made in certain cases, such as where the government is corrupt [8,9].

Most of the twentieth-century Christian literature holds that tax evasion is justifiable in some cases. The most common justifications are in cases where the system is perceived as being unfair, where the government is corrupt, or where the taxpayer has an inability to pay [16,20]. Some of both the Christian and secular literature take the position that some evasion is justified if the tax funds are used to finance an unjust war [11,22].

A few scholars have examined the Muslim literature on this issue. The findings are mixed. Two scholars took the position that there is no moral duty to pay taxes on income, and that there is no duty to pay a tax that increases prices, such as a sales or use tax, value added tax, or a tariff [12,14]. Another Muslim scholar disputed their position, arguing that there is an absolute duty to pay all taxes the government imposes. However, this absolute duty exists only if the government in question has adopted Sharia law. Evading taxes in such cases would be to disobey Allah [13].

Further empirical studies surveyed various groups to determine their views on the ethics of tax evasion [30,33]. In particular, the following selection of international empirical studies employed an 18 statement survey instrument similar to the one used in the present study. The findings of an Australian study indicated that females were slightly more opposed to tax evasion in most cases, while business and economics students were least opposed to tax evasion, and that seminary students were most opposed. In addition Muslims were found to be least opposed to tax evasion as were Asians, while Catholics were most opposed and Anglo Saxsons were most strongly opposed [34].

A further study of students from the Peoples Republic of China (PRC) found strong opposition to tax evasion in general, although some arguments were stronger than others. Women were significantly more opposed to tax evasion than were men. The business and economics students were least opposed, while the law and philosophy students were found to be equally opposed [30]. Another study of social science, business and economics students in Southern China and Macau that omitted the three human rights issues found moderate to strong opposition to tax evasion in general, although some justifications for evasion were stronger than others. Students from Macau and China were equally opposed to tax evasion, as evidenced by the insignificant differences in mean scores. Men and women were also found to be equally opposed to tax evasion [35].

A survey of Estonian business students, faculty and practitioners found strong opposition to tax evasion. Women were significantly more opposed to tax evasion. Overall, undergraduate students were least opposed to tax evasion; faculty and practitioners were most opposed. Older people were significantly more opposed to tax evasion than were younger people. However, the differences in mean scores between accounting students and other business students were not significant [36].

An Indian study of business students found moderate to strong opposition to tax evasion. Men were slightly more opposed to tax evasion, but the difference in mean scores was significant in only 1 of 18 cases. Faculty representatives were significantly more opposed to tax evasion than were graduate students. However, Accounting students were slightly more opposed to tax evasion than other business majors [37].

A further study of Spanish student opinion in South Texas found moderate to strong opposition to tax evasion. There were no significant gender differences, between those in the under 25 and over 25 age groups. Similar to the Indian study, Accounting majors were significantly more opposed to tax evasion than were other business majors [38]. Likewise a study of Puerto Rican accounting and law students found moderate to strong opposition to tax evasion. Women were more opposed to tax evasion in 16 of the 18 cases, but their opposition was significantly higher in only three cases [39].

Therefore when examining cultural differences predominately resulting from differences in religious beliefs some broad conclusions can be drawn. In considering the views of the various religious groups it is evident that Jew’s and Baha’s are strongly opposed to tax evasion, whereas other Christians including Catholics and also Muslims take a more flexible approach. Likewise due to the lack of theoretical and empirical studies with regards to tax evasion under Buddhism and Hinduism the impact is largely unknown [40].

Overall the above studies found that, although tax evasion was generally considered to be unethical, there were exceptions. Some arguments justifying tax evasion were stronger than others. The strongest arguments to justify tax evasion were in cases where the government engaged in human rights abuses. The second strongest set of arguments justifying tax evasion were in cases where the tax system was perceived as being unfair, where the government was corrupt, where the tax funds were wasted, where tax rates were too high, or where the taxpayer was not able to pay. The weakest arguments to justify tax evasion were in cases where the taxpayer received benefits from the government or where the tax funds were spent on worthy projects and the taxpayers got good value in return for their taxes paid.

3. Methodology

3.1. Measured Variables

The present study builds on prior research and uses a survey instrument that is similar to that used in some other empirical studies to facilitate comparison [29,33]. A survey was distributed to groups of university students in Turkey (N = 291) and Australia (N = 211) in order to ascertain their views on the ethics of tax evasion. The two groups of respondents were selected because their views would represent the perceptions of two different cultures. To determine their perceptions on the issue of tax evasion, students were requested to state their level of agreeableness (on a 7-point Likert scale, 1 = strongly agree, 7 = strongly disagree) to 18 general statements that provided differing scenarios in the socio-economic environment (see Table 1). The statements in the survey reflected the three main viewpoints on the ethics of tax evasion, (a. tax evasion is always or almost always ethical; b. tax evasion is sometimes ethical; c. tax evasion is never or almost never ethical) that have emerged over the past centuries [19].

Table 1.

Eighteen statements in the survey.

3.2. Descriptive Analysis

A reliability analysis employing Cronbach’s Alpha is presented below. In Table 2, the scale scores (Turkey = 0.862, Australia = 0.954), exceeds the minimum acceptable level of 0.70 as recommended by Carmines and Zeller [41]. In addition, it was observed that none of the variables has a negative relationship with the total correlation. Consequently, this finding indicates that internal consistency of the data is considerably high.

Table 2.

Reliability analysis.

The main demographic variables, comprising; education level, academic major, age and gender are presented in Table 3. Although 100% of the Turkish students were undergraduates nearly half of the Australian respondents were graduates with 16.5% over the age of 30 years. Consequently, although they are students, many would have work experience and have paid taxes. Also the 100% of Turkish students have a business and economics major while 85% of Australian students were completing an accounting major. This indicates that most would have been familiar with the role and application of taxes in society and would have had some knowledge base from which to answer the survey questions.

Table 3.

Demographics.

4. Results

4.1. Overall Assessment

The survey incorporated 18 statements reflecting the socio-economic environment which produced the following means and standard deviations for the Turkish and Australian samples depicted in Table 4. The overall means were 4.83 for the Turkish sample and 4.26 for the Australian sample, which indicates that overall, the Turkish respondents were more opposed to tax evasion than were the Australian respondents. The results of the study indicate that although Turkish scores are significantly different from the Australian scores (see Table 5 below: The tests on mean difference indicated that the overall mean for Turkey was 4.83 and Australia 4.26), both the Turkish and Australian respondents believe that tax evasion can be ethically justifiable in certain situations, although it has to be emphasized that some arguments are stronger than others. However, the fact that the scale was from 1 to 7 indicates that there was generally wide support for tax evasion.

Table 4.

Responses from Turkey and Australia.

Table 5.

Mann-Whitney U test results of Turkey and Australia.

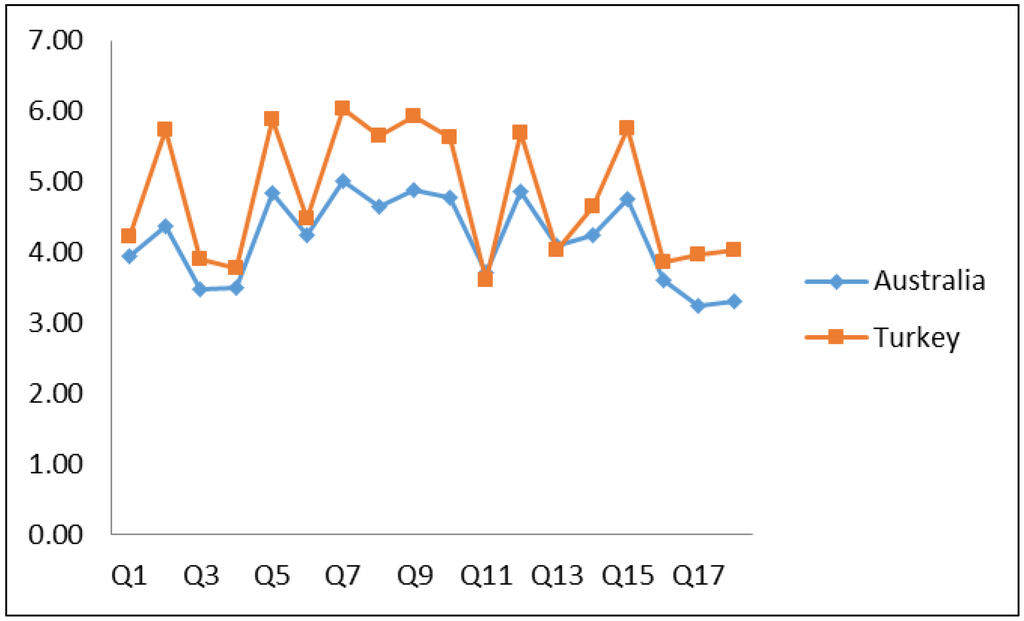

The ranges of scores for the Australian and Turkish sample are illustrated in Figure 1. In most cases, the Turks were more opposed to tax evasion than were the Australians. In particular, in Q10 the Turks strongly disagreed that “tax evasion was ethical if everyone was doing it” with a mean of 5.63 and high of 6.63. Whereas the Australian students felt that wider acceptability of evasion made it more ethical, producing a mean of 4.77. Additionally in Q2, with respect to the collection of government revenues justifying tax evasion, the Turks (mean = 5.73) were more opposed than the Australians (mean = 4.37). The other main issues where the Turks and Australians differed, were with respect to government spending regardless of whether they were spent on worthy projects or whether they benefited the citizen or not. The Australians were more comfortable with tax evasion in these cases. (See Q7 Turk mean 6.04 Aust. mean 5.01, Q8 Turk mean = 5.66 Aust. mean = 4.64 and Q9 Turk mean 5.93 Aust. 4.88). The other discrepancy of note between the two nationalities was the selfish attitude of paying less tax even if others have to pay more. (See Q15 Turk mean = 5.76 and Aust. mean = 4.75).

Figure 1.

Range of scores Turkey and Australia.

4.2. Test on Mean Difference and Analysis

The difference on opinions of the respondents on tax evasion is tested through non-parametric Mann Whitney U Test. Interesting results of both the z-stats and p-values for each country against all 18 statements appear in Table 5. In 11 cases the difference in mean score was significant at the one percent level (p-value **). Significant differences between Australian and Turkish opinion revolved around issues such as, tax collection, tax fairness, tax spending (exchange equity), the acceptability of tax evasion, the probability of detection, the duty to pay (vertical/horizontal equity) racial and political discrimination. In one other case the difference was significant at the five percent level (p-value *) where the issue was with regards to the ability to pay. The overall mean for Turkey was 4.83 and Australia 4.26 which illustrates the difference of opinion within the (neither agree nor disagree) band. The Mann Whitney U Test were chosen to conform to the methodological approach used in previous studies.

4.3. Ranking of the Statements Relative to the Views Regarding the Ethics of Tax Evasion

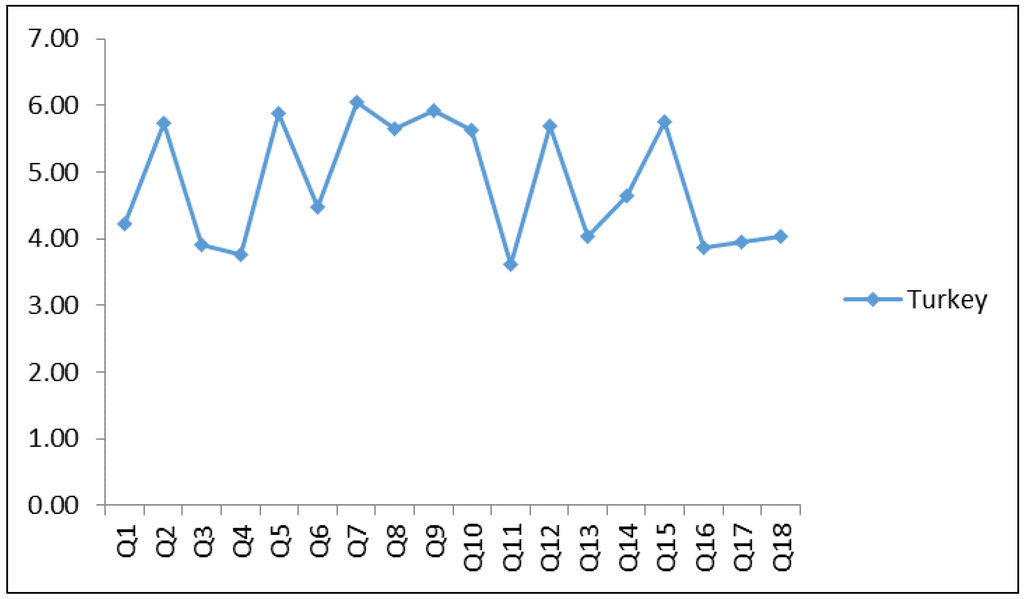

The scores from the first to the last question are from the Turkish sample are ranked and presented in Figure 2. The strongest arguments to justify tax evasion were in cases where the government is corrupt, wasteful, or oppressive, where the tax system is perceived as unfair, where the government discriminates or is engaged in an unjust war. The weakest arguments were in cases where the government spends money on worthy projects or where the taxpayer benefits by the government’s programs.

Figure 2.

Range of scores for Turkish sample.

As indicated in Figure 2, not surprisingly, the major arguments justifying tax evasion for the Turks are the more serious issues of government corruption lowest ranked (mean = 3.61), followed by wasteful expenditure (mean = 3.77) and oppressive regimes (mean = 3.86). The issue of government corruption and crime is similar to the situation where the government collecting taxes is evil. In this regard, citizens develop a moral duty to evade tax and have a duty to resist. This is consistent with the war theory where there is no moral duty to support governments in times of oppression [40].

The issue of wasteful expenditure is also consistent with the recent view of [22]. The Turks may have seen a moral duty to evade taxes based on a utilitarian view that tax evasion was the most efficient option to utilize resources. By not transferring resources to the government by way of taxes it was better for the country and the individual’s productivity. This view may be further supported when considering the Turks view of their politicians and government authority.

Although it would be inappropriate to suggest that Turkey operates under an oppressive regime, its citizens would be most familiar with neighboring counties in the Middle East where oppressive regimes still operate today. This knowledge and familiarization with oppressive government authorities where people are persecuted for their political opinions and where war and civil unrest are common may justify the ethical response to tax evasion.

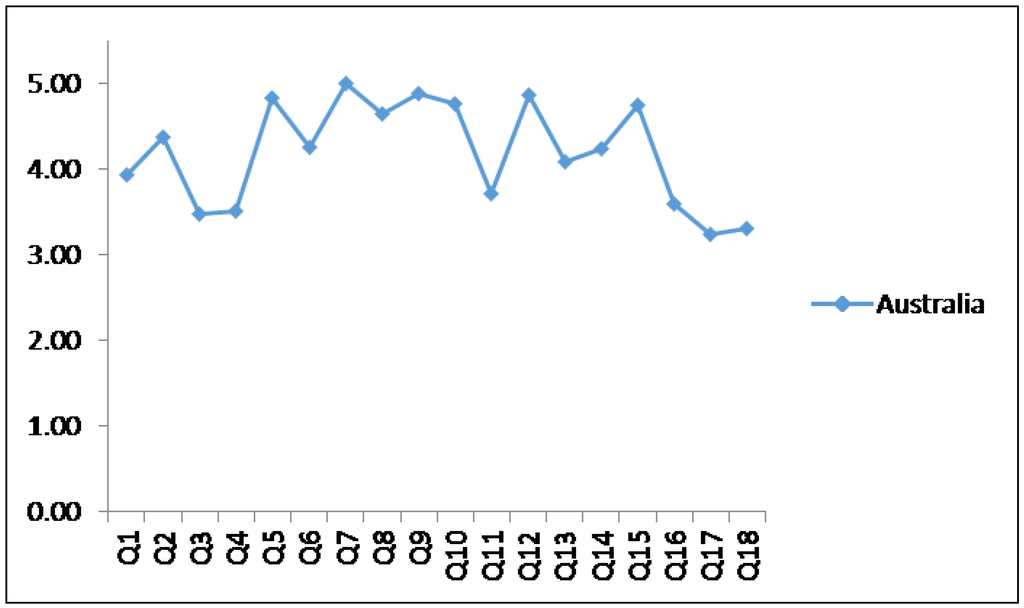

Figure 3 lists the scores from the first to the last question regarding the arguments justifying tax evasion from the Australian perspective. The strongest arguments were in cases where the government discriminates or imprisons people, where the tax system is perceived as being unfair, where the government engages in wasteful spending or is oppressive. The weakest arguments were in cases where evasion causes others to pay more, or where the government spends on worthy projects that benefit the taxpayer.

Figure 3.

Range of scores for the Australian sample.

The major arguments justifying tax evasion for the Australian sample are government discrimination based on religion, race or ethnic considerations (mean = 3.24), followed by imprisonment for political opinions (mean = 3.30) and unfairness of the tax system (mean = 3.47) as depicted in Figure 3. These results are not surprising for citizens who live in a democratic country such as Australia. In particular freedom of speech and racial vilification are important issues and when these basic rights are violated it is understandable that Australians would rebel against the government. One of the ways rebellion could be demonstrated is through the non-payment of taxes.

Likewise, it is no surprise that tax fairness also rates very highly on this scale. It is noted that as Australian’s generally pay a high rate of personal tax by world standards, this is compromised when the citizen feels that they are not getting value for their tax dollar (i.e., exchange equity). Tax evasion can occur when taxpayers feel they are not getting their fair share of goods and services from the government in return. The Australian government recently responded to this belief by issuing taxpayers a notice of government spending areas accompanying their notice of assessment [42]. This was an attempt to increase compliance by showing people how public monies were spent and ultimately show how taxes have been fair. Similarly issues around vertical and horizontal equity are also raised if citizens perceive that they are paying more tax than their fellow Australians such that there is also justification for evasion.

4.4. Comparative Analysis of the Respondent Groups and Summary of the Main Findings

Initial comparisons of the Australian and Turkish samples indicates that cultural differences were not predominant in determining tax evasion attitudes when a tax system is both unfair, (Turkey mean = 3.94) and (Australian mean = 3.47) and when a large portion of the money collected is wasted (Turkey mean = 3.77) and (Australian mean = 3.51). Both these criteria were ranked highly in the top 4 of the 18 statements in the survey for both samples. These findings are consistent with studies by Crowe [19] and McGee [22]. Clearly, to have a fair tax system where money is spent wisely is paramount to improving compliance and curbing potential evasion. However, this is difficult to achieve and needs to be juggled with competing priorities such as, tax efficiency and tax simplicity, a discussion of which is outside the scope of this paper.

It is also notable that oppression (mean = 3.86) and corruption (mean = 3.61) also rank highly with the Turkish sample but to a slightly lesser degree with the Australian sample, oppression (mean = 3.60) and corruption (mean = 3.71). Thus, despite cultural differences, these criteria indicate that tax evasion is sometimes justified on moral grounds, which is consistent with the prevalent view in the theological [19,22], philosophical [20] and empirical [17,28,29,30,31] literature.

Statements that ranked in the middle for both the Turkish and Australian samples revolved around personal justification for evasion. That is, tax evasion was found to be ethical where citizens couldn’t afford to pay, Australian (mean = 4.24) and Turkish (mean = 4.65). Also in cases where citizens felt that money was spent on projects that did not directly benefit them, Australian (mean = 4.64) and Turkish (mean = 5.66). This finding suggests that elements of human selfishness and greed exist regardless of race or culture.

Interestingly, the lowest ranked criteria for evading tax for respondents from both Turkey and Australia was where a large amount of the money collected was spent on worthy projects clearly benefiting citizens directly, Australia (mean = 5.01) and Turkey (mean = 6.04). So there was a natural tendency not to evade tax where the tax system was perceived to be fair and exchange equity was evident. This was also consistent with the findings of previous studies regarding the weakest arguments justifying tax evasion [29,33].

5. Conclusions

An examination of the mean scores indicates that both samples believe that tax evasion can be morally justified in some cases, and that some arguments to justify tax evasion are stronger than others. Therefore, the samples included in the present study hold views that are similar to those of most other empirical studies, in that they believe tax evasion can be ethically justifiable.

However, the mean scores in the present study are lower than those found in the other studies [17,28,29,30,31] that used this survey instrument, which indicates that the Australian and Turkish samples were generally less opposed to tax evasion than were the samples in the other studies. It was evident that the cultural differences found in the different religions of predominately Muslim in Turkey and Christian in Australia, had some impact upon tax evasion beliefs. This is consistent with previous studies [40]. It is possible that as this study encompassed the views of students as opposed to real taxpayers there was less opposition to tax evasion. Students lack the real imposition of taxation in their daily lives and are somewhat oblivious to its impact. To a lesser degree the other cultural differences between Australia and Turkey by way of legal systems may have also impacted the results. Consequently, the study contributes to the literature by providing an insight into the role that culture plays in determining the ethical attitudes towards tax evasion.

The obvious limitation of this study is in the sampling technique adopted. As the samples consist of students some demographic areas maybe unrepresented and consequently the results may not be generalized to the wider populations. Other limitations include the possible misunderstanding of questions and terminology used in the survey by some participants, issues of honesty and also the number of variables examined. Nevertheless, sample sizes were adequate to perform the level of analysis adopted and the results achieved were robust.

The possibilities for further research include, drawing samples from other countries which demonstrate further cultural differences. Alternatively, other sample populations within Australia and Turkey could be solicited for their views. Perhaps business people would hold different views and opinions on the ethics of tax evasion compared to students. For instance those who own their own business may hold different views from those who merely work in someone else’s business.

The reasons for the views held could also be further examined. The present survey instrument asked participants to indicate the extent of their agreement or disagreement with each statement, but did not ask for their reasoning process. Consequently, future qualitative studies could investigate the reasons behind the views held by the students. It is envisaged that as further data is gathered and analyzed meaningful determinants of the ethics of tax evasion will be revealed.

Author Contributions

Robert W. McGee, and Serkan Benk designed the study and conducted statistical analysis. Ken Devos, Robert W. McGee and Serkan Benk contributed to the analysis and writing. The final manuscript was approved by all authors.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Neil Brooks, and Anthony N. Doob. “Tax Evasion: Searching for a Theory of Compliant Behaviour.” In Securing Compliance: Seven Case Studies. Edited by Martin L. Friedland. Toronto: University of Toronto Press, 1990. [Google Scholar]

- Hughlene A. Burton, Stewart S. Karlinsky, and Cynthia Blanthorne. “Perception of White-Collar Crime: Tax Evasion.” Journal of Legal Tax Research 3 (2005): 35–48. [Google Scholar] [CrossRef]

- Gerrit Antonides, and Henry S. J. Robben. “True Positives and False Alarms in the Detection of Tax Evasion.” Journal of Public Psychology 16 (1995): 617–40. [Google Scholar] [CrossRef]

- Ranjana Gupta, and Robert McGee. “Study on Tax Evasion Perceptions in Australasia.” Australian Tax Forum 25 (2010): 507–34. [Google Scholar]

- International Bureau of Fiscal Documentation (IBFD). International Tax Glossary, 4th ed. Amsterdam: IBFD Publications, 2001. [Google Scholar]

- Charles Adams. Fight, Flight and Fraud: The Story of Taxation. Curacao: Euro-Dutch Publishers, 1982. [Google Scholar]

- Charles Adams. For Good or Evil: The Impact of Taxes on the Course of Civilization. London, New York and Lanham: Madison Books, 1993. [Google Scholar]

- Gordon Cohn. “The Jewish View on Paying Taxes.” Journal of Accounting, Ethics & Public Policy 1 (1998): 109–20. [Google Scholar]

- Meir Tamari. “Ethical Issues in Tax Evasion: A Jewish Perspective.” Journal of Accounting, Ethics & Public Policy 1 (1998): 121–32. [Google Scholar]

- Gregory M. A. Gronbacher. “Taxation: Catholic Social Thought and Classical Liberalism.” Journal of Accounting, Ethics & Public Policy 1 (1998): 91–100. [Google Scholar]

- D. Eric Schansberg. “The Ethics of Tax Evasion within Biblical Christianity: Are There Limits to ‘Rendering Unto Caesar’? ” Journal of Accounting, Ethics & Public Policy 1 (1988): 77–90. [Google Scholar]

- Mushtaq Ahmad. Business Ethics in Islam. Islamabad: The International Institute of Islamic Thought & the International Institute of Islamic Economics, 1995. [Google Scholar]

- Ali Reza Jalili. “The Ethics of Tax Evasion: An Islamic Perspective.” In The Ethics of Tax Evasion: Perspectives in Theory and Practice. Edited by Robert W. McGee. New York: Springer, 2012, pp. 167–99. [Google Scholar]

- Sayyid Muhammad Yusuf. Economic Justice in Islam. Lahore: Sh. Muhammad Ashraf, 1971. [Google Scholar]

- Wig DeMoville. “The Ethics of Tax Evasion: A Baha’i Perspective.” Journal of Accounting, Ethics & Public Policy 1 (1998): 356–68. [Google Scholar]

- Gueorgui Smatrakalev. “Walking on the Edge: Bulgaria and the Transition to a Market Economy.” In The Ethics of Tax Evasion. Edited by Robert W. McGee. Dumont: The Dumont Institute for Public Policy Research, 1988, pp. 316–29. [Google Scholar]

- Benno Torgler. Tax Compliance and Tax Morale: A Theoretical and Empirical Analysis. Cheltenham and Northampton: Edward Elgar, 2007. [Google Scholar]

- Vladimir V. Vaguine. “The ‘Shadow Economy’ and Tax Evasion in Russia.” In The Ethics of Tax Evasion. Edited by Robert W. McGee. Dumont: The Dumont Institute for Public Policy Research, 1998, pp. 306–14. [Google Scholar]

- Martin Timothy Crowe. The Moral Obligation of Paying Just Taxes. Washington: The Catholic University of America Press, 1944. [Google Scholar]

- Robert W. McGee. “Is Tax Evasion Unethical? ” University of Kansas Law Review 42 (1994): 411–35. [Google Scholar] [CrossRef]

- Robert W. McGee. “Three Views on the Ethics of Tax Evasion.” Journal of Business Ethics 67 (2006): 15–35. [Google Scholar] [CrossRef]

- Robert W. McGee. The Ethics of Tax Evasion: Perspectives in Theory and Practice. New York: Springer, 2012. [Google Scholar]

- Robert W. McGee, ed. “An Analysis of Some Arguments.” In The Ethics of Tax Evasion: Perspectives in Theory and Practice. New York: Springer, 2012, pp. 47–71.

- Robert W. McGee. Justifiable Homicide. Fayetteville: Create Space, 2014. [Google Scholar]

- Robert W. McGee, and Gordon Cohn. “Jewish Perspectives on the Ethics of Tax Evasion.” Journal of Legal, Ethical and Regulatory Issues 11 (2008): 1–32. [Google Scholar] [CrossRef]

- Lysander Spooner. No Treason: The Constitution of No Authority. Boston: printed by author, 1870. [Google Scholar]

- Robert Nozick. Anarchy, State & Utopia. New York: Basic Books, 1974. [Google Scholar]

- James Alm, and Benno Torgler. “Culture differences and tax morale in the United States and in Europe.” Journal of Economic Psychology 27 (2006): 224–46. [Google Scholar] [CrossRef]

- Robert W. McGee, and Galina G. Preobragenskaya. “The Ethics of Tax Evasion: A Survey of Business Students in Poland.” In Global Economy—How It Works. Edited by Mina Baliamoune-Lutz, Alojzy Z. Nowak and Jeff Steagall. Jacksonville: University of North Florida, 2006, pp. 155–74. [Google Scholar]

- Robert W. McGee, and Zhiwen Guo. “A Survey of Law, Business and Philosophy Students in China on the Ethics of Tax Evasion.” Society and Business Review 2 (2007): 299–315. [Google Scholar] [CrossRef]

- Benno Torgler, Ihsan C. Demir, Alison Macintyre, and Markus Schaffner. “Causes and Consequences of Tax Morale: An Empirical Investigation.” Economic Analysis & Policy 38 (2008): 313–39. [Google Scholar] [CrossRef]

- Sheldon R. Smith, and Kevin C. Kimball. “Tax Evasion and Ethics: A Perspective from Members of the Church of Jesus Christ of Latter-Day Saints.” Journal of Accounting, Ethics & Public Policy 1 (1998): 337–48. [Google Scholar]

- Robert W. McGee, and Marcelo J. Rossi. “A Survey of Argentina on the Ethics of Tax Evasion.” In Taxation and Public Finance in Transition and Developing Economies. Edited by Robert W. McGee. New York: Springer, 2008, pp. 239–61. [Google Scholar]

- Robert W. McGee, and Sanjoy Bose. “The Ethics of Tax Evasion: A Survey of Australian Opinion.” In Readings in Business Ethics. Edited by Robert W. McGee. Hyderabad: ICFAI University Press, 2009, pp. 143–66. [Google Scholar]

- Robert W. McGee, and Carlos Noronha. “The Ethics of Tax Evasion: A Comparative Study of Guangzhou (Southern China) and Macau Opinions.” Euro Asia Journal of Management 18 (2008): 133–52. [Google Scholar] [CrossRef]

- Robert W. McGee, Jaan Alver, and Lehte Alver. “The Ethics of Tax Evasion: A Survey of Estonian Opinion.” In Taxation and Public Finance in Transition and Developing Economies. Edited by Robert W. McGee. New York: Springer, 2008, pp. 461–80. [Google Scholar]

- Robert W. McGee, and Ravi Kumar Jain. “The Ethics of Tax Evasion: A Study of Indian Opinion.” In The Ethics of Tax Evasion: Perspectives in Theory and Practice. Edited by Robert W. McGee. New York: Springer, 2012, pp. 321–36. [Google Scholar]

- Robert W. McGee, Arsen M. Djatej, and Robert H. Sarikas. “The Ethics of Tax Evasion: A Survey of Hispanic Opinion.” Accounting & Taxation 4 (2012): 53–74. [Google Scholar] [CrossRef] [Green Version]

- Robert W. McGee, and Silvia López Paláu. “The Ethics of Tax Evasion: Two Empirical Studies of Puerto Rican Opinion.” Journal of Applied Business and Economics 7 (2007): 27–47. [Google Scholar] [CrossRef]

- Serkan Benk, Robert W. McGee, and Bahadir Yüzbasi. “How Religions Effect Attitudes toward Ethics of Tax Evasion? A Comparative and Demographic Analysis.” Journal for the Study of Religions and Ideologies 14 (2015): 202–23. [Google Scholar]

- Edward G. Carmines, and Zeller A. Richard. Reliability and Validity Assessment. Newbury Park: Sage Publications, 1979. [Google Scholar]

- “Australian Tax Office (ATO). ” Available online: https://www.ato.gov.au/individuals/income-and-deductions/in-detail/how-tax-works/your-notice-of-assessment/ (accessed on 18 September 2015).

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).