Abstract

After independence, subsidies have been a cornerstone of the social contracts in the Middle East and North Africa. Governments spent heavily to reduce poverty and strengthen their legitimacy. Yet, subsidies became financially unsustainable and donors pressed for reforms. This article assesses reform processes in Morocco, Egypt and Iran between 2010 and 2017, thus before sanctions against Iran were further tightened and before the COVID-19 pandemic. We show that even though the three countries had similar approaches to subsidisation, they have used distinct strategies to reduce subsidies and minimise social unrest—with the effect that their respective social contracts developed differently. Morocco tried to preserve its social contract as much as possible; it removed most subsidies, explained the need for reform, engaged in societal dialogue and implemented some compensatory measures, preserving most of its prevailing social contract. Egypt, in contrast, dismantled subsidy schemes more radically, without systematic information and consultation campaigns and offered limited compensation. By using repression and a narrative of collective security, the government transformed the social contract from a provision to a protection pact. Iran replaced subsidies with a more cost-efficient and egalitarian quasi-universal cash transfer scheme, paving the way to a more inclusive social contract. We conclude that the approach that governments used to reform subsidies transformed social contracts in fundamentally different ways and we hypothesize on the degree of intentionality of these differences.

1. Introduction

For decades, countries in the Middle East and North Africa (MENA) have been spending almost 7% of gross domestic product (GDP) on direct and indirect social transfers (IMF 2013, p. 50)1. Yet, the effects on poverty and inequality have been dissatisfying2 especially because most of the spending was in the form of subsidies (6% of GDP on average) rather than direct social transfers (only 0.7% of GDP on average). Subsidies reduce the prices of core commodities such as energy, food, water or public transportation. Direct transfers, in contrast, are paid to households in the form of, for example, social assistance. This pattern is not limited to the resource-rich MENA countries with large rents from the export of fossil fuels (for example, Iran or the Gulf states), but prevails equally in MENA countries where such rents are much smaller (for instance, Egypt) or even non-existent (such as Morocco and Tunisia).3

Subsidies used to be a core element of the populist-authoritarian social contracts that almost all MENA countries developed after independence (Loewe et al. 2021; Hinnebusch 2020). Social contracts are agreements between societal groups and their sovereign on rights and obligations toward each other. Typically, they stipulate the government to maintain protection (security of citizens), provision (social and economic services), political participation, or a combination of these, in exchange for citizens accepting the rule of the government. The early, post-independence social contracts of MENA countries were meant to provide for autonomy from Europe, socio-economic transformation and nation-building but also stability of an authoritarian government. Food and energy subsidies were the main elements of these social contracts (Loewe et al. 2021). They lowered the cost of living of low-income households and thereby reduced poverty and inequality. Subsidies also supported local firms in their competition on world markets by providing cheap energy and primary products (Rougier 2016). In both cases, subsidy spending helped governments defend the legitimacy of their rule in the absence of meaningful political participation.

Over time, however, subsidies have become a heavy burden for all MENA governments because their rent income has decreased while the number of inhabitants in their countries has continued to rise. In addition, it became evident that subsidies benefit the rich rather than the poor, and incentivise users to consume more food and energy—with negative effects on health, the environment, and employment. International finance institutions (such as the World Bank and the International Monetary Fund) therefore started to push early on for subsidy reform, especially in the poorer countries of the region. These efforts were met with resistance because reductions in subsidy spending not only affect low-income households but also middle-class consumers, micro and small businesses, and in some countries also larger companies in energy-intensive sectors. National rulers were therefore concerned that subsidy reform would delegitimise them, provoke revolt, and ultimately undermine their social contract with citizens. Only fairly recently, and under severe fiscal pressure, several MENA governments have engaged in extensive subsidy-reducing reforms. However, since the reform strategies differed, it is likely that social contracts were changed in different ways—depending, for example, on the inclusiveness of reform implementation. While the role, size, and (socio-economic and environmental) impact of subsidy reform have been widely discussed in the literature, a systematic assessment of the various different reform strategies and their different impacts on the prevailing social contract is missing.

In this article, we explore the dynamics of subsidy reforms conducted between 2010 and 2017 in three MENA countries: Morocco, Egypt and Iran. We show that the social contracts of these countries, which were quite similar before, have developed in different directions as a result of variations in subsidy reforms. We focus primarily on the pre-2017 period since reforms were initiated during that time frame. Although we reflect on policy implications during the post-2017 period, reform outcomes remain volatile due to changes in US politics towards the Middle East and the effects of the global COVID-19 pandemic. All three governments substantially reduced their subsidy spending, but they used different strategies in their efforts to reduce the likelihood of major social unrest (namely, unrest that could threaten their rule). Opposition to reform was present in all three countries, but governments aimed to contain it through different measures. While it is not surprising that social contracts change as a result of such policy interventions, we show that the specific strategies used to reform subsidies can be decisive for the direction in which social contracts develop.

We explore two questions: First, what have the governments of Morocco, Egypt and Iran done to make reforms pass with as little social unrest as possible? Second, what do their respective strategies mean for the transformation of social contracts? Our assessment draws on academic literature, data from policy reports, published statistics, mass media articles, available online, from national and international sources reporting on subsidy reform interventions, and interviews conducted with experts that have observed national-level developments during the respective years of reform.

The comparison of Morocco, Egypt and Iran shows that five strategic options—or combinations of those—can help governments overcome possible challenges to subsidy reform: creating awareness and acceptance of the need for reform; initiating a national dialogue on implementation alternatives; setting up mechanisms to compensate potential losers; proving the credibility of governments in their ability to bring reforms to an end; and repressing opposition to reforms, with the risk that it can entirely undermine the social contract.

The three cases show different emphases on these five elements by each focusing differently on one of the three types of government deliverables: protection, provision and participation. The government of Iran focused on provision, which had always been at the core of social contracts of MENA countries. It compensated households with a quasi-universal direct cash transfer scheme, broadening the social basis of the country’s social contract (at least for a couple of years). The government of Egypt, however, shifted its focus more towards protection as the main source of its legitimacy in Egypt’s new social contract. It replaced subsidies by far less generous conditional cash transfer programmes, used repression, and legitimised its policy by calling for compliance for the sake of security and national stability. Morocco emphasised participation without sacrificing too much of the delivery of provision in order to preserve (at least) the fundaments of the country’s old social contract. Its government established a new conditional cash transfer scheme. Relative to the other two cases, more emphasis was, however, put on raising awareness of the necessity and acceptance of reform, thus strengthening public information, an important element of participation (Loewe et al. 2021).

This article proceeds as follows: Section 2 presents the definition and framework of analysis of social contracts. Section 3 summarises the literature on subsidies, their strengths and weaknesses, challenges with reform and ways to manage them. Section 4 examines the reform strategies in the three MENA countries. Section 5 concludes by providing implications for the emerging social contracts.

2. Social Contracts

For our research purposes, we define a social contract as the ‘entirety of explicit or implicit agreements between all relevant societal groups and the sovereign (i.e., the government or any other actor in power) defining their rights and obligations towards each other’ (Loewe et al. 2021, p. 3). Social contracts add to the legitimacy of governments and allow them to stay in power without excessive use of repression. Thereby, they create dynamic equilibria in state-society relations and make politics more predictable (McCandless et al. 2018).

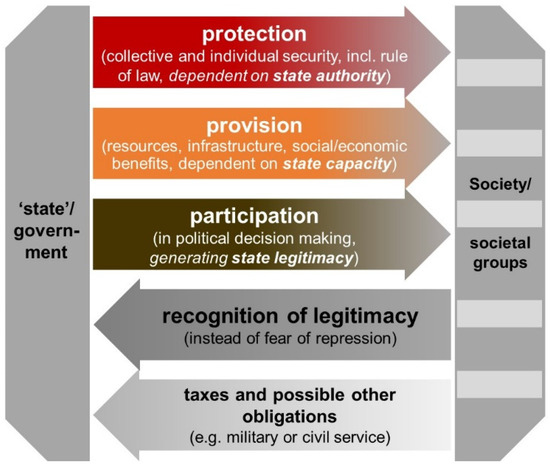

All countries with effective governments have social contracts but these differ substantially in the rights and obligations that they ascribe to the government and the various societal groups. The government has to deliver one or more of the following three “Ps” (see Figure 1):

Figure 1.

Deliverables in a social contract. Source: (Loewe et al. 2019).

- Protection (which includes collective security against external threats, individual security against physical threats such as criminal acts, as well as legal security such as the enforcement of human and civil rights);

- Provision of basic services such as access to resources, infrastructure, social services (for example, health and education), social protection and economic opportunities;

- Participation of society in political decision-making processes at different levels.

This creates an incentive for social groups to recognise the incumbent government as legitimate, to pay taxes or other obligations, not just out of fear of oppression. Failing to provide any or several of these deliverables leads to societal discontent and political instability known as “state fragility” (Grävingholt et al. 2015, p. 1282).

However, social contracts are all but static. While their main function is to render the relationship between state and society more predictable, they are renegotiated again and again in more formal and more informal processes. The result of these renegotiations can be that social contracts remain more or less as they are, are adapted, or are replaced by new ones. Of course, the result always depends on the relative negotiation power of the various contracting powers (McCandless et al. 2018).

After independence, almost all MENA countries had quite similar populist-authoritarian social contracts (Hinnebusch 2020). Above all, the republics in the region—but successively also the monarchies—legitimised the rule of authoritarian government on the basis of provision and protection. In particular, they provided social benefits for large parts of the population (energy and food subsidies, free health care and education, social housing, jobs in the public sector, public procurement) in order to compensate citizens for their lack of political participation.

To a large extent, these benefits were financed by rent income from abroad (from hydrocarbon exports, other natural resources, politically motivated transfers from abroad, remittances and other sources such as the Suez Canal rents in the case of Egypt). As a result, when external rent incomes declined while the population in MENA countries continued to grow, MENA governments faced budgetary problems. As a result, more or less all of them started to cut down the provisions stipulated by the existing social contracts, namely social benefits for the poor, while transfer programmes (such as energy subsidies) that benefitted more powerful societal groups such as the rich and the urban middle classes were kept in place.

The uprisings—which rocked most of the MENA countries from 2010 onwards—can therefore be seen as a protest against the erosion of the previous social contracts: falling social benefits and higher taxes along with continued low political participation. After the uprisings, however, the social contracts of MENA countries evolved in different directions. The rest of this article is meant to illustrate how these differences result from governments’ choice of reform strategies with respect to key policy fields such as social policies/ subsidy reforms.

It should be stressed, however, that the article looks mainly at the period until 2017. As a result, it does not consider the second subsidy reform in Iran (2018) and its effect, which unfolded only in the subsequent years. Furthermore, even more important, we do not look at the effects of the COVID-19, which has brought about additional challenges to the MENA countries (just like for the whole world) and which also has brought about further changes in the social contracts in the region.

3. Rationale, Effects and Challenges to Subsidy Reform

Governments have different options to overcome the challenges associated with subsidy reform, which, we argue, distinctly affect the existing social contracts. Before we reflect on this issue, we would like to briefly review the literature on why subsidies are widely used and what economic and social effects they trigger.

3.1. Goals of Subsidies and Distortionary Effects on the Economy

Subsidy estimates vary widely depending on the choice of benchmarks, measurement assumptions, and scope. A subsidy is any intervention lowering the actual selling price of a product. This can be an explicit transfer to the producer or seller, a tax reduction at any stage in the value chain or the sale of a product owned by the government (e.g., oil or gas) below world market price. The latter case would not even show up in the government budget because it causes only opportunity costs (foregone revenues).

Governments have diverse motives for the provision of subsidies (Rougier 2016; Victor 2009), such as to (i) improve households’ access to basic commodities, (ii) lower the cost of living and thereby reduce poverty and income inequality, (iii) enable local industries to compete on world markets (e.g., through access to subsidised energy), (iv) create rents for cronies owning industries that are particularly energy-intensive (e.g., steel), or (v) buy legitimacy (e.g., social benefits in exchange for low political participation).

However, subsidies also tend to have unintended negative side effects on the economy. They constitute a significant burden on state budgets (Verme and Araar 2017; Sdralevich et al. 2014), making it difficult to fund other social programmes or productive investments. However, their effects on poverty and inequality are normally much more limited than those of direct cash and in-kind transfers (INS et al. 2013; Verme and Araar 2017), due to the fact that subsidies tend to benefit mostly middle- and higher-income groups rather than the poor (Coady et al. 2010). Furthermore, many subsidy schemes suffer from leakages and losses in the apparatus, i.e., shortcomings in transfer efficiency (Blomquist 2006). Finally, many subsidy regimes constitute adverse incentives for consumption, production, and investment, by encouraging, for instance, investments in energy-intensive modes of production rather than in energy efficiency and renewable energy or in labour (IMF 2013, p.16).

3.2. Challenges to Reform and How to Address Them

Acknowledging the manifold negative effects of subsidies on the economy and society raises the question of why governments—particularly in the MENA region—have continued paying them for decades. The literature argues that removal is an extremely challenging task from a political economy perspective for three main reasons.

First, the existence of subsidy regimes creates lock-in for governments, which have built up these schemes not only to support vulnerable households or firms but also to buy legitimacy. The removal of subsidies can therefore be a risk for social and political stability and for regime survival (Inchauste and Victor 2017).

Second, many countries lack the administrative capacity needed to set up compensation mechanisms for the losers of reform. Very few low- and middle-income countries have social transfer schemes with efficient targeting mechanisms (Inchauste and Victor 2017), one of the reasons why subsidy schemes have been so popular in MENA countries in the past.

Third, many citizens are not even aware of the various problems associated with subsidies. As a result, they are often against reform, even if it harms them only marginally (IMF 2013, p. 23).

Reform would require policymakers to overcome these challenges. Drawing on existing literature, we argue, that the following elements contribute to addressing the challenges of subsidy reform. Each of them addresses one or more of these three challenges.

Information: Information is at utmost a precondition for real political participation but it can make citizens feel that they participate at least in their government’s reasoning about existing problems and possible ways to solve them. The government can run public information campaigns in the media to create awareness and acceptance of the need for reform by: (i) sensitising the population to problems associated with subsidies; (ii) explaining that in the long-run reform is better for all societal groups; and (iii) informing at an early stage about the rationale, goals, design, and possible effects of the implementation strategy, to make subsidy reform acceptable to all relevant segments of the state and the society (Worley et al. 2018). Information campaigns were key for containing opposition against subsidy reforms in Tunisia, Ghana, Niger, Uganda, Ukraine and the Philippines (Alleyne and Hussain 2013; Clements et al. 2013; Sdralevich et al. 2014).

Dialogue: Dialogue is a strategy of enabling citizens to participate in political decisions at least in informal ways. The government can initiate a ‘social dialogue between and among different interest groups’ (Karshenas et al. 2014, p. 726) (i) on the weaknesses of the existing subsidy schemes; (ii) on possible ways to reconcile the interests of the various social groups and identify an acceptable compromise; and (iii) on different options of reform implementation (in terms of speed, sequencing and other questions) (IISD 2013). Stakeholder dialogue was an important factor of success for energy subsidy reforms in Kenya, Namibia and Niger while lack of it was the main reason for widespread protests against energy reforms in Indonesia, Sudan and Yemen (Alleyne and Hussain 2013; Clements et al. 2013; Sdralevich et al. 2014).

Compensation: Compensation is a strategy that allows governments to not reduce provision but rather replace one form of provision with another form. The government can set up compensatory mechanisms to mitigate at least part of the losses that some social groups may suffer from subsidy cuts (IISD 2013). These mechanisms can, for example, be in the form of targeted or universal direct cash transfer programmes, extension of public health or education services, or increase in the minimum or average wage levels, each having advantages and disadvantages. At best, the compensation measures are set up even before the government starts reducing subsidies (Sdralevich et al. 2014). Compensation measures secured the political feasibility of subsidy cuts in Armenia and Indonesia (where both countries built up new targeted cash transfer schemes), Niger (where the government established a lump sum subsidy for the transportation sector), Yemen, Mozambique and Nigeria (where the government raised the budget of cash-for-work programmes), Mauritania (where the government transformed temporary safety nets into targeted social transfer programmes) and Sudan (where the government increased public sector wages) (Alleyne and Hussain 2013; Clements et al. 2013; Sdralevich et al. 2014).

Government commitment: Government commitment can be seen as a strategy of ‘repression light’; it is meant to tell citizens clearly that the government will not participate citizens in decision-making. It will not negotiate, and protests and uprisings will not make a change. Governments can use various measures to strengthen their own credibility of being willing and able to implement reforms. Commitment becomes obvious if willingness to implement reforms comes with risks for regime survival, for example, if the government proceeds with reform despite country-wide protests or if it promises subsidy reforms to foreign donors or if it connects its own destiny with the reform. Government commitment was essential in the Dominican Republic and in Ghana (Inchauste and Victor 2017).

Repression: Governments can, of course, also repress opposition to reform overtly through verbal expressions, legal restrictions or police/military action. In many cases, the threat of force suffices to hold back reform opponents (Moerenhout 2018). This strategy tends to further reduce opportunities for political participation. Therefore, it can be detrimental for the existence of a social contract as such and hence turn out to be unsustainable for the regime itself. All too often, regimes resort to repression without need, while underinvesting in strategies that might build public support for reforms.

As we will see in the next sections, how these strategies are used and emphasised to manage the reform process affect the social contract of a country in different ways.

4. Subsidy Reform in Morocco, Egypt and Iran

After several attempts to reduce subsidies in the 1970s, since the mid-2020s, policymakers in the MENA countries have been discussing more intensively the need to reform subsidy schemes, mainly due to growing budgetary problems but also pressure exerted by foreign donors to rationalise spending.

After 2010, several countries—especially Iran, Egypt, Jordan, Morocco and the United Arab Emirates—took major steps towards reforming subsidies. The vulnerable political landscape after the Arab Spring uprisings and the fact that these reforms are still ongoing, lead us to explore some of these cases in more detail. We focus here on Morocco, Egypt, and Iran, because these three countries followed quite different reform pathways (which are likely to result in different manifestations of new social contracts). The three countries have also been able to promote reforms fairly quickly without provoking larger-scale protests against the reforms.

Even if reforms started at different points in time, the political and economic framework conditions of reform were similar, a reason why we can still compare and contrast their strategies and outcomes. Our lines of inquiry are therefore orientated on two questions: First, what have the governments of Morocco, Egypt and Iran done to make reforms pass with little social unrest? Furthermore, second, what do their respective strategies mean for the transformation of social contracts?

4.1. Morocco

Energy prices have always been higher in Morocco than in other MENA countries. Nevertheless, its fuel subsidy budget increased tenfold during the 2000s. As Morocco imported 90–95% of its energy resources in the past, subsidies have continued to put pressure on the government’s budget. In 2012, Morocco’s subsidy bill peaked at 6.6% of GDP, higher than its spending on investment or its combined spending on education and health (Verme et al. 2014).

Therefore, in 2012, the Moroccan government began a systematic process of reforming subsidies, the goal being to dismantle the subsidy regime fully by 2017 (Verme et al. 2014). By 2021, all subsidies had been removed except those on liquefied petroleum gas (LPG, typically butane gas used for cooking and heating), flour, sugar and water, which are primarily consumed by low-income groups.

In 2013, a new pricing system was put in place for gasoline, diesel, and fuel oil, allowing local prices to rise with price changes on world markets (Verme and Araar 2017). As a result, gasoline prices increased by 20%, diesel by 14% and fuel oil by 27% (Sdralevich et al. 2014, p. 45). By 2015, subsidies for these products were removed entirely (see Table 1). Electricity prices were also increased by 3 to 5% except for those consuming less than 100 kW per month (Merrill et al. 2015). This decision reduced subsidies by almost 2% of GDP and lowered the fiscal deficit to 6% of GDP (from 7.3% in 2012) (Merrill et al. 2015). By 2019, the share of subsidies in GDP had dropped to 1.6% (IMF 2019) and the government of Morocco continued—even during the COVID-19 pandemic—to bring this figure further down (Maroc Diplomatique 2020).

Table 1.

The reform of energy subsidies in Morocco.

The increase in prices was, however, not followed by major opposition from consumer groups. The fact that world energy and food prices were comparatively low during the reform phase was beneficial in reducing the impact on consumers. More importantly, price increases were introduced only gradually following an extensive communication strategy and stakeholder dialogue (see below). Moreover, to minimise the impact on vulnerable groups, the reform left out prices for LPG consumed mostly by (poor) households and by the agriculture sector (a strategic source of income and employment for Morocco), and for sugar and flour (Royaume du Maroc 2014).

As such, while Morocco remains among the countries with the lowest LPG prices worldwide, the government was successful in achieving acceptance for reform, protecting the poor, avoiding social backlash, and buying itself time to identify optimal compensation mechanisms. Estimates show that if LPG prices increase by 30%, poverty rates are likely to increase by 9% (Verme and El-Massnaoui 2015) and the impact on small industrial producers and farmers is also likely to be significant. Further, reform was implemented at a time when Morocco also invested heavily in renewable energy as a way to reduce its dependence on imported fossil fuels and its vulnerability to changes in world energy prices. Expanding the use of energy efficiency instruments (a key component of Morocco’s new energy strategy) also contributed to reducing energy consumption and the financial burden on consumers.

Aside from the gradual implementation of reform and the systematic alignment with other reforms in the energy sector, the following aspects may also have contributed to the population’s acceptance of higher prices: extensive information; dialogue with selected representatives of society; compensation for those affected by higher prices; and government commitment. Repression played a limited role in Morocco. The government of Morocco has thus tried not to reduce the delivery of provision and participation. It replaced one form of provision with another and provided for a minimum level of informal political participation of citizens through information and dialogue.

4.1.1. Information

In addition, Morocco implemented a comprehensive and well-orchestrated communication strategy (El-Katiri and Fattouh 2017) channelled through public TV and radio discussions, newspaper articles targeted to different audiences including educated youth, advertisements, and debates. This campaign explained the scale and distribution of subsidies4, the economic reasons for reform, the different reform steps and ways to shelter the poor from negative effects, and the multiple benefits that could be captured as a result (El-Katiri and Fattouh 2017). In addition, the government promised the population that they would increase energy prices only gradually and continue the subsidisation of LPG, sugar, and flour, which is particularly important for the poor. Efforts to engage in dialogue and to provide information contributed not only to improving awareness, but also to building support for reform.

4.1.2. Dialogue

To avoid political backlash, the government also engaged in dialogue with representatives of important social groups (Verme and Araar 2017). In 2012, it established three commissions (including government, trade unions, and civil society representatives) to assess options for reforms, their possible macroeconomic effects, and how to mitigate negative effects (Verme and El-Massnaoui 2015). The leadership of the Justice and Development Party (PJD), which currently commands the executive branch of the government, and the popularity of prime minister Benkirane of the same party have been critical for keeping reform going, making it acceptable for many citizens and ensuring that no additional political opposition gained momentum (Merrill et al. 2015). The PJD also played a role in appeasing stakeholders such as trade unions, which protested against reforms several times.

4.1.3. Compensation

Before the reforms, the budget of Morocco’s direct cash transfer schemes had been smaller than the MENA average and reached just 15% of the households in the poorest quintile of the population (Silva et al. 2013). For this reason, the government developed specific measures to compensate professional categories most significantly hit by subsidy reforms, such as passenger/merchandise transporters and the industrial sector (Verme and El-Massnaoui 2015).

In addition, two existing nationwide social protection programmes were expanded. Tayssir (Arabic for “facilitation”) provides cash transfers to poor families (identified by geographical and categorical targeting) with children between ages 6 and 15 on the condition that they attend school on at least 80% of school days. The programme is active in rural areas with poverty head-count rates above 30% and school absenteeism above 5%. The programme extended its outreach from 80,000 families in 2009 to 466,000 families in 2014 (Nazih 2018).

The other programme is the Regime d’Assistance Médicale pour les Économiquement Démunis (RAMED—Medical Assistance Scheme for the Economically Deprived, Rabat)—a social health insurance programme granting free medical treatment to its members. Membership is free for households below the national poverty line and highly subsidised for households barely above it (who pay about 12 EUR per person and year but not more than 60 EUR per family). The number of members increased from 5.1 million individuals in mid-2013 to 11.46 million in 2017 (Machado et al. 2018). As a result, the overall coverage of social health insurance (including also the programme for formal sector employees, which had already existed in 2012) increased from 23% of the population (2012) to 63% (2018) (MMoH 2018).

However, both programmes face severe difficulties in targeting and budgeting. They fail to disburse transfers on time, to cover at least a large majority of households below the poverty line and to exclude at least households with very high income from benefits. In addition, the supply of health services falls short of keeping up with demand for them, which has risen sharply as a result of millions of people being covered by RAMED with the right to free access to health services. Patients complain about very long waiting times, the absence of doctors, bad hygiene, unrespectful treatment by health personnel and the lack of even the most basic equipment and medication (Verme and El-Massnaoui 2015; Nazih 2018).

To address these issues, the government is working on a unified National Population Registry (Maroc Diplomatique 2020). Further, the debate on whether to use universal or targeted cash transfers to compensate the poor is still ongoing. In response to the COVID-19 crisis, households working in the informal sector and workers with a social security number who lost their jobs, or who work less than before, received compensation. This new circumstance created momentum for improving the social targeting system, with the adoption of Law 72.18 in June 2020 approving a new mechanism, the Unified Social Register, aimed at identifying households wishing to benefit from social support programmes. Therefore, it remains to be seen whether the targeting problems will be solved and thus if acceptance of the reform will persist in the medium-term.

4.1.4. Government Commitment

While it is difficult to distinguish to what extent government commitment (as defined earlier) played a role in the Moroccan case, several factors may have been important in increasing the government’s credibility in implementing reforms, such as extensive information campaigns that contributed to transparency in implementation, and wider reforms in the energy sector to improve energy security.

4.1.5. Repression

In Morocco, protests against subsidy reform have been dispersed and did not escalate for several years, a reason why repression was only moderate between 2012 and 2017. This context facilitated the government’s focus on solutions associated with the subsidy reform rather than on using heavy-hand repression to de-escalate social tensions. While uprisings have increased since 2017—especially in the northern part of Morocco—they were not triggered by subsidy reforms. Instead, other concerns, such as unemployment, health services, civil rights, treatment by the authorities, political participation, education and corruption, featured more prominently among protest movements. These recent uprisings were however met with increased repression, raising questions about the government’s ability to protect “the rights and dignity of its citizens” (Chahir 2021).

4.2. Egypt

Few other MENA countries have spent so much on food and energy subsidies as Egypt (26% of total government spending, 8.7% of GDP in the fiscal year 2012/2013 according to Sdralevich et al. (2014), and even more than 35% of the government’s spending or 12.5% of GDP according to Griffin et al. (2016). Given that, in 2014, the government budget deficit peaked at 13.7% and total public debt surpassed 100% of GDP, decision-makers acknowledged that subsidy cuts could not be further avoided. This decision was reinforced by evidence that the poorest 40% of the population benefitted least from subsidies (only 43% of the food subsidies, 3% of gasoline subsidies, 7% of natural gas subsidies) (Abdalla and Al-Shawarby 2017).

Attempts to reform subsidies were made, however, even earlier than 2014. First steps were taken under President Mubarak who in 2008 increased the price of diesel by 25%, and in 2010 the price of sugar by 200% and that of edible oil by 120%. Further reforms were implemented after the uprisings in 2011 by the Muslim Brotherhood government of President Mursi and even more so after the army coup in July 2013 brought President Al-Sisi to power. As a result, the price of electricity for households rose by 16% while gasoline prices rose by 112% (Sdralevich et al. 2014).

However, the most substantial reforms were started after the presidential elections in 2014. By that time, the government had already eliminated large parts of the opposition and reinforced repression. Step by step, the government reduced all energy subsidies. As a result, by 2017 the price of petrol had gone up by 387% relative to its 2010 level, and the price of LPG (mainly used by low-income households for cooking) rose by 650% (see Table 2). Total government spending on energy subsidies decreased between 2013 and 2016 from USD 269 to USD 96 per capita in constant 2019 prices (IEA 2020).

Table 2.

The reform of subsidies in Egypt 2010–2017.

While end-consumer prices are still below international levels, the price increase strongly affected large parts of the Egyptian population, in particular because the government also had to float the Egyptian pound (EGP) and introduce a value-added tax. All three measures were taken in order to fulfil the requirements for getting a USD 12 billion loan in 2016 from the IMF plus the same amount from bilateral donors. After 2016, government spending on energy subsidies increased again to USD158 per capita in 2019 (IEA 2020).

These reforms had painful effects not only on the poor but also on the middle-class. Yet, they did not provoke major social unrest. Exceptions were smaller local protests that ended when the government promised to take back part of the reform (Abdellatif and Fakhry 2017). This acquiescence can be explained by three factors: fear of renewed political turmoil and instability; strong state-led repression and threatening of opposition movement; and strong government commitment to implement reform whatever it takes. Public information and awareness campaigns were also used, at least at the beginning, but in a less consistent manner than in Morocco and without any substantial societal dialogue. Specifically, although initially in 2014 the Egyptian government engaged in communication campaigns to explain the rationale for reform, its interest in integrating societal actors in the reform process faded later on. Furthermore, information on the next reform steps was often unsystematic, incomprehensive and sometimes even misleading (see below). Moreover, the compensation schemes were limited in scope and scale and therefore unable to absorb much of the negative effects of subsidy reforms. We can thus say that the government of Egypt reduced the delivery of both, provision and participation.

4.2.1. Information

The government informed the population regularly, especially early on, using various media channels on the reasons, goals and next steps of the subsidy reform (Ketchley and El-Rayyes 2017). Yet, information often came at short notice, was at times incomplete or contradictory, and sometimes the government even did the opposite of what it had previously stated it would do. For example, in 2013, it announced cuts on energy but not on food subsidies (El-Katiri and Fattouh 2017). Food subsidies were, in fact, not reduced in 2014, but a limit was set on the number of subsidised food items that households could buy at reduced prices.5 However, starting just two years later, subsidies on food other than bread were gradually reduced, and a substantial number of households lost the right to buy subsidised food (Abdalla and Al-Shawarby 2017; Abdellatif and Fakhry 2017). For a while, bread continued to be exempted from both the rationing and the price increases, but then the government also limited the purchase of subsidised bread to five loaves per person and day (James 2015, p. 10; Ketchley and El-Rayyes 2017). Likewise, the government initially promised to exempt LPG from subsidy cuts because many low-income households use it for cooking, but in 2014 the price of LPG also went up by 87% (Moerenhout 2018).

4.2.2. Dialogue

The decision to eliminate all energy and almost all food subsidies within just five years was taken unanimously by President Al-Sisi who has gained almost absolute authority in Egyptian politics. The only tangible opposition movement, the Muslim Brotherhood, was brutally repressed and other political groups (liberals, socialists, democrats) were largely discouraged from organising public demonstrations. The small opposition parties in parliament stayed silent on the issue (Abdellatif and Fakhry 2017). Open debate only took place within the army itself. The army leadership was in favour of subsidy reforms while some segments were against them, mainly because a number of army-owned enterprises used to benefit considerably from the old subsidy system (James 2015, p. 5). However, the army leadership held the sway and no public consultation with society representatives took place. Interestingly, this strategy contrasts not only with the strategy of the Moroccan government but also with the strategy that earlier governments of Egypt had used. In the late Mubarak years, the government opted for communication and negotiation to promote a social insurance reform that ultimately failed (Loewe and Westemeier 2018).

4.2.3. Compensation

In the beginning, the government promised to set aside 15% of the savings from reform for “social investments” such as cash transfer programmes, targeted food subsidies, free health insurance for the poor, and other social protection programmes to compensate the poor (James 2015, p. 17).

Until the beginning of the COVID-19 crisis in 2020, however, little happened in that regard. The government’s spending on social transfers did not increase by much, food subsidies were cut rather than extended, and the free health insurance for the poor will not be implemented in all governorates until the year 2032 (Loewe and Westemeier 2018). At the beginning of the reforms, the government extended food subsidies to 20 more items in order to compensate the poor for energy subsidy cuts (Abdellatif and Fakhry 2017); however, starting in 2016, it gradually reduced almost all food subsidies except for bread. Some authors also argue that the increase of public sector wages in 2014 was meant as compensation for subsidy cuts but benefitted only the middle-class (El-Cassabgui 2017).

The only immediate measure taken to compensate households for the reduction of subsidies was the establishment of two cash transfer schemes in 2015 with World Bank financial support: Karāma (Arabic for “dignity”) provides proxy means-tested cash transfers of 350 EGP per person per month to elderly and severely handicapped people, and takāful (Arabic for “mutual support”) grants proxy means-tested transfers of 325 EGP per family per month (plus 60–140 EGP for every child up to three) to poor families on the condition that children go to school regularly. The programmes are meant to replace some of the existing social assistance and social pension schemes, which suffer from significant deficits in terms of coverage, efficiency and effectiveness (Loewe 2014).

However, the new schemes do not perform significantly better. In early 2020, they covered about 2.5 million households or 10% of the population (Egypt Today Staff 2020). Yet, this number corresponds to just a third of the number of people living below the national Egyptian poverty line, and in 2018, only 45% of beneficiaries were from the poorest income quintile (17% were even from the richest income quintile) (Breisinger et al. 2018). The old transfer schemes had covered 4% of the population and, at most, 20% of the poor (Loewe 2010). Moreover, the transfers provided by the karāma system are equivalent to about 73% of the current national poverty line, while those provided by the takāful system correspond to just 25%. This is just slightly higher than transfers provided by the old cash transfer schemes (20% of the national poverty line for one programme, 10% for another; see (CAPMAS 2018)). As a result, the new schemes increased the consumption of beneficiaries by only 8.4% and lifted only 11% of them out of poverty (Breisinger et al. 2018). Lastly, the budget for these new schemes is just about USD 1.4 billion per year or 0.5% of GDP (UNICEF 2019), while the government saved several percentage points of GDP by reducing subsidies.

4.2.4. Government Commitment

The government repeatedly insisted that it did not want to alter any element of the subsidy reform even under pressure from protests. In other words, people would have to accept the reforms or challenge the Sisi government as such. Thus, the government-linked the reforms to its own destiny in order to strengthen its own credibility (Moerenhout 2018).

Even if the economic situation in the country was much better than many Egyptians perceived it to be, the Sisi regime was able to paint it in a dark light. Thereby, Sisi was able to portray himself not only as the saviour of the country, but also as a guarantor of stability. The president often highlighted that his policies were essential for the stability of Egypt and that Egyptians knew well what instability meant: they only had to look at the destiny of Syria, Yemen or Libya (El-Katiri and Fattouh 2017). Furthermore, he warned that reforms were inseparable from his own rule. Finally, he could point to international organisations not only supporting his subsidy reforms but also making further support dependent upon them (Adly 2020). As a result, most Egyptians accepted the Sisi regime and its political stand as a price for stability.

4.2.5. Repression

Of course, large parts of the population were still not in favour of reforms because they had benefitted markedly from subsidies. However, violent state repression discouraged opposition (Abdellatif and Fakhry 2017). In addition, the whole country found itself in an atmosphere of nationalism and glorification of political leadership.

The hopes of large parts of the population were on restoring stability and growth (El-Katiri and Fattouh 2017) and the political leadership capitalised on this atmosphere. When local protests broke out on 6–7 March 2017, they were not brutally suppressed; instead, the security police distributed bread and the government urged everyone to consider the country’s delicate situation and be ready for shared sacrifice (Ketchley and El-Rayyes 2017).

The apparent generosity was counterbalanced by threats of repression and low tolerance to criticism targeted towards the government. Specifically, the president, assured the population that, if need be, the army could “deploy all personnel across the entirety of Egypt in just six hours” (Sakr 2016). As a result, planned protests often do not even materialise because of fears of police aggression. More than 2000 Egyptians were detained after the crackdown on protests on 20 September 2019 alone. Observers believe that these protests had mainly been provoked by subsidy cuts and commodity price hikes, which was all the more credible against the background that the government afterwards considered reinstating subsidies for rice and pasta for almost 2 million Egyptians. Furthermore, individuals claiming that President Al-Sisi should step down were jailed and a journalist was detained just because of publishing an animation related to the revolution in 2011, resulting in prisons being currently overcrowded (Ioanes 2019).

The use of repression and threat has thus been successful for the regime so far. In the long term, however, it may turn out to be a challenge for citizens’ trust in the government and, hence, for the existence of a social contract in Egypt as such: the mistrust can unload in yet another revolution and a civil war or the transformation of the country into a totalitarian dictatorship.

4.3. Iran

Iran, a major exporter of fossil fuels, had one of the largest subsidy programmes worldwide. By early 2010, the value of subsidies equalled 20–25% of GDP (Mostafavi-Dehzooei et al. 2020). Most subsidies in Iran relate to the sale of government-controlled energy and food products below world market prices. They are thus foregone revenues rather than real expenditures (Harris 2017). Even if Iran’s government budget deficit never exceeded 2% of GDP, increasing budgetary pressures due to economic sanctions and decreasing revenues from oil exports contributed to the government’s decision to engage in subsidy reform (Salehi-Isfahani 2017).

The reform, focused especially on energy products and bread, started in 2010 and continued at a gradual pace in 2012 and 2014, just a few years before the reforms in Morocco and Egypt. The government decided to increase fuel and natural gas prices to at least 90% and 75% of export-parity prices, respectively, and power tariffs to full cost-recovery levels (Kojima 2016). As a result, the price of gasoline rose by 400% and diesel by 900%. Bread prices doubled (Salehi-Isfahani et al. 2015).

Due to external shocks (that is, intensifying sanctions, sharp depreciation, and high inflation) economic downturn followed and the early benefits from reform were eroded after only a few years. Already in 2012, the reform was halted due to criticism in the parliament.

A second phase of price increases started in 2014 (see Table 3), decreasing fuel subsidy spending from 10.5% in the fiscal year 2012/2013 to about 4% of GDP in the fiscal year 2015/2016 (IMF 2015). Energy subsidies decreased from USD 1384 per capita (in constant 2019 prices) in 2012 to USD 453 in 2016 (IEA 2020). In 2016, subsidies for gasoline had been fully eliminated, while subsidies for diesel still existed. Later, however, energy subsidies increased to previous levels (USD 1039 per capita in 2019, as per IEA (2020)) so that energy prices are again well below world-market levels. This is mainly due to international sanctions that accelerated local inflation and currency devaluation, which reduced the real value of nominal energy prices fixed by the Iranian government.

Table 3.

The reform of energy subsidies in Iran.

The first reform phases were met with only limited opposition. Two factors played a larger role in this outcome: comprehensive information of citizens on the rationale and goals of reforms; and clear compensation process to shift subsidies to direct cash transfers as part of the goal to make government spending more efficient and more egalitarian, compensating both poor households as well as the middle-class. The government has thus tried not to reduce political participation while extending the benefits of provision to larger parts of the population.

Since 2018, however, unmet social and economic expectations have led to larger protests. Unrest peaked in November 2019, when the government announced that the price of gasoline would increase once more, by 50%, in response to budgetary pressures created by renewed international sanctions. It soon became obvious, however, that the real source of the social unrest was not the subsidy reform—not least because energy subsidies had started to increase again in real terms after 2016. Instead, the protests were due to more general socio-economic and political concerns among Iranians, triggered by renewed international sanctions and Iran’s costly military intervention in Syria.

4.3.1. Information and Dialogue

The early acceptance of price increases by the Iranian population was partly due to an effective information strategy that contributed to trust-building. Authorities engaged in a months-long public dialogue to explain the rationale for reform and describe how reform was to be implemented. The fact that the rich benefitted most from energy subsidies was the central message in the “massive government advertising campaign” (Salehi-Isfahani et al. 2015, p. 5). Once reform was announced, the size of the compensation and the way in which it was to be channelled was explained in detail.

4.3.2. Compensation

The government specified that 50% of the savings from subsidy reform were meant to finance a new scheme paying out direct cash transfers to low- and middle-income households. In total, 30% were promised to enterprises that were particularly hard hit by the subsidy cuts. The remaining 20% were meant to reduce the budget deficit (IMF 2014). However, the government realised that it was challenging to identify low- and middle-income households properly. In addition, 30% of all households did not fulfil the formal requirements of transfer receipt (present birth certificate, have a bank account, and so on). Therefore, the government decided to turn instead to a quasi-universal cash transfer scheme, for which 97% of the population registered by 2014 (Kojima 2016). Even though it was not the initial intention of the government to set up a quasi-citizen grant to replace energy subsidies, it soon understood its benefits and promoted the new cash transfer scheme as a superior instrument to include the entire population, thereby improving social cohesion.

Soon after the announcement of subsidy reform in 2010, the president also stated that 445,000 Iranian rials per person (USD 40 in 2011, but USD 90 in purchasing power parities (PPPs)) would be deposited per month in the existing or newly created bank accounts of all registered individuals even before the reform started, but that this amount could be withdrawn only after prices had been raised. For a family of four, this was about 28% of the median per capita expenditures and greater than the monthly expenditures of 2.8 million Iranians (Salehi-Isfahani et al. 2015). The amount was immediately available on the day of the subsidy reform so that households did not face a gap between the reduction of subsidies and the payment of compensations. Thereby, the government built trust in its intention to protect those negatively affected and avoided potential social protests against the reform (Kojima 2016). This effort paid off, as individuals did not rush to withdraw the funds on the day prices were increased. Per capita income growth was clearly pro-poor for a number of years, a reason why reforms were very popular among large parts of the population (Mostafavi-Dehzooei et al. 2020). Even the IMF applauded it for being able to win support not only from the poor but also the more sceptical middle class (Harris 2017).

The transfers were also effective in reducing poverty and inequality. Despite the sanctions that were levied on Iran and their negative effects on economic growth and inflation, Iran’s national poverty line head-count rate went down from 14% in 2009 to 8% in 2013 (respectively from 23% to 11% by the international USD 4 in PPP poverty line) (Salehi-Isfahani et al. 2015). Meanwhile, food consumption increased by 8% per year despite significant food price increases (IMF 2014).

After 2013, however, the positive effects of the subsidy reforms on poverty rates were reduced by inflation (Enami et al. 2016). The real value of the cash transfers decreased by two-thirds by 2020 (Mostafavi-Dehzooei et al. 2020). Although often linked to the cash transfers themselves, the inflationary pressures have been shown to be mostly related to the renewed international sanctions that provoked a steep depreciation of the Iranian currency. The same pressures, however, also reduced the value of nominal energy prices again, with the effect that in 2019 Iran was back close to where it had started with social transfer reforms in 2010. After another sharp increase in energy prices, social unrest erupted once more in November 2019, which made the government establish a second cash transfer scheme, this time targeting only the lower 70% of the population and being less than proportional to family size (Mostafavi-Dehzooei et al. 2020).

4.3.3. Government Commitment

When first announcing the reform, president Ahmadinejad named the process “the most sweeping economic ‘surgery’ in Iran’s modern history” (Guillaume et al. 2011, p. 3). The IMF (2014, p. 4) has also qualified it as “the most courageous move to reform subsidies in an energy exporting country”. While the other factors discussed above (communication and compensation) contributed to improving credibility to implement reforms, it remains difficult to assess to what extent government commitment (as defined earlier) played a role.

4.3.4. Repression

The initial lack of revolt against reforms cannot only be explained by the compensation strategy; rather, it was also due to the use of repression and control. During the first phase of the reform, 800 checkpoints and sites were secured. Gas filling stations, shopping malls, and the entire Tehran bazaar were guarded by security forces and riot police. The government also threatened transportation workers with fines and union membership withdrawal if they took to the streets while the media was ordered to not criticise the programme. At the end of 2019, national protests (triggered by increases in gasoline prices) were brutally repressed. (Kojima 2016).

5. Conclusions on the Transformation of Social Contracts

Our three case studies show that in spite of the common challenges posed by subsidies we can observe considerable differences in how policymakers engaged with the problem of reform (see Table 4). These differences impacted social contracts in quite different ways.

Table 4.

Comparison of the three country cases.

The government of Morocco prioritised policies to avoid major social unrest. On the one hand, it established some new elements of rudimentary participation (namely public dialogue between state and society) in order to ensure peaceful acceptance of higher prices. The government explained why reform was essential for long-term development and started a discourse with key stakeholders. On the other hand, it continued to deliver on provision, though in a different form than before. It implemented reforms gradually, left some subsidies in place for products that were most crucial for the poor and established some new social programmes to compensate losers of reform with limited income. Even though these programmes were rather small in scope and scale, the reform strategy has created hope that a new social contract that is more egalitarian, more efficient, and perhaps more participatory than the old one, could emerge.

Egypt implemented more drastic reforms. Its subsidy scheme had been more generous than the Moroccan one but its reform was also implemented in a more radical and less participatory way. The government relied heavily on repression and instilled the fear of instability. Compensation remained small. This means that Egypt’s government under President Al-Sisi does not build any longer on the provision of social benefits as a means to buy legitimacy. Instead, it mainly offers the promise to provide for security and stability in exchange for (once again) citizens’ acceptance of its authoritarian political order. These reform choices led to a new social contract, which is even less egalitarian than the old one but more repressive and, hence, probably also less sustainable. As Rutherford (2018) argues, Egypt’s state-society relations have transformed from a provision pact to a protection pact. We will see in the future how sustainable this kind of strategy can really be.

Iran’s strategy for reform was again different. The government embarked on ambitious subsidy reforms but invested most of what it saved from reform into a quasi-universal direct cash transfer scheme, which was much more efficient and egalitarian than subsidies, at least for a couple of years. Although implemented in a top-down manner with elements of repression, reform was extensively communicated and the implementation process carefully designed. Thereby, the government preserved its strong commitment for provision and, hence, for the core of the country’s old social contract.

An end to the reforms has not yet been reached in any of the three countries. Thus, it remains to be seen whether reform can be sustained in the near future and whether the population will continue to accept the reforms and the changes that they have brought to the social contracts. The COVID-19 pandemic has placed additional pressure on government budgets, due to the urgent need to spend on health, social protection, and economic support. In addition, the renewal and intensification of international sanctions on Iran have triggered a new wave of inflation that has undermined the progress achieved and is heavily threatening the sustainability of the expensive, new quasi-universal cash transfer scheme. What is certain is that if the subsidy reforms are not sufficiently integrated with the countries’ long-term development strategies—that is, if jobs, economic opportunities, and social assistance fail to materialise—their sustainability will remain fragile.

These cases, and others in the literature, suggest that while governments choose different strategies for reform depending on domestic framework conditions and resources, three elements remain essential for minimising negative effects on households and the economy: (i) dialogue with society on the design of reforms; (ii) information of citizens on the rationale and goals of reforms; and (iii) generous and carefully designed compensation schemes for the social groups affected most negatively by reforms.

Proof of the government’s commitment to reforms (for trust-building) and the use of repression also result in preventing major revolts against reforms in the short run. Yet, it remains to be seen how sustainable the effects of these two elements can be in the long run, especially if emphasis is placed on repression.

Ultimately, subsidy reforms present a unique opportunity to establish more functional social protection systems. The choice of compensation programmes is decisive for the way in which reforms alter the existing social contract. Many governments opt for targeted transfers because they believe they cannot afford to pay benefits to others than the poor. Furthermore, in many countries, targeted transfers are also generally welcomed by large parts of the population. The appreciation is, however, conditional on the transparency, fairness and effectiveness of the targeting criteria and process. In reality, targeting the poor is quite difficult in low- and middle-income countries because of limited statistical data and, hence, it is either very expensive, defective or both. In addition, there is a large potential that households are favoured or disfavoured on political grounds or personal connections (Harris 2017). Finally, targeted transfer schemes are often designed, implemented and administered in a manner that beneficiaries perceive as paternalistic, benevolent and condescending. As a result, existing targeted transfer systems are rarely very popular.

The main alternative is to provide flat transfers to all households, as Iran did. Of course, such universal transfers are not cheap because they are also channelled to rich households. However, with targeting costs and possibilities of manipulation and corruption close to zero, universal transfers are more reliable, more effective in terms of poverty reduction (because they have hardly any error of exclusion) and in terms of social inclusion and cohesion (Hertog 2017). Moreover, universal transfers compensate all parts of society (not only the poor) for losses caused by cuts in subsidy spending, which can be crucial for the well-being of the middle-class and for the political backing of reforms.

Of course, it is important to adequately determine the level of universal transfers. Iran, for example, set a very high level at the beginning with the effect that the bulk of savings by cutting subsidies was soon eliminated. Today, due to high inflation rates, the real level of transfers has fallen considerably. It is possible, however, to find a compromise: If, for example, 10% of the direct and indirect benefits of subsidies have been flowing to the poorest 40% of the population, the government could set the level of universal lump-sum transfers such that all transfers cost a quarter of what subsidies used to cost. In this case, the net benefit/loss of the poorest 40% would be zero on average, and only the three richest income quintiles would incur net losses. Alternatively, the government could spend on universal direct transfers even half of what it used to spend on subsidies. In this case, the poorest households would even gain from the reform, the poorer parts of the middle-class would gain as much as they lose, and only the richest 40% of the population would suffer a net loss. Further, half of the spending on subsidies could be used for other social programmes or for infrastructure.

The most important argument for universal transfers is, however, that their rationale is an entirely different one than that of targeted transfers. Targeted transfers tend to be seen as an expression of paternalism and charity, both by policymakers and recipients. Universal transfers, in contrast, are not granted on the basis of need but of citizenship. They are perceived as an expression of a social contract that gives equal rights to all citizens. Universal transfers therefore strengthen the trust of citizens, the reliability and legitimacy of the government and the link between citizens and the government.

Ultimately, this means that Morocco and Egypt could also make their social contracts more inclusive if they set up universal cash transfer schemes or at least more generous targeted cash transfer schemes. A more generous social policy (though still more efficient than the subsidy scheme) could thus be a way to make the social contract more acceptable for the majority of citizens and hence more sustainable. The ongoing COVID-19 pandemic challenges the sustainability of subsidy reforms as the negative social and economic effects to become more visible. Therefore, it remains to be seen how robust the new social contracts will be in the face of a looming economic crisis. In this context, we would expect that the delivery of governments on provision and participation will be all the more important.

Author Contributions

Conceptualization, M.L. and G.V.A.; methodology, M.L. and G.V.A.; validation, M.L. and G.V.A.; formal analysis, M.L. and G.V.A.; investigation, M.L. and G.V.A.; resources, M.L. and G.V.A.; data curation, M.L. and G.V.A.; writing—original draft preparation, M.L. and G.V.A.; writing—review and editing, M.L. and G.V.A.; visualization, M.L. and G.V.A.; supervision, M.L. and G.V.A.; project administration, M.L. and G.V.A.; funding acquisition, M.L. and G.V.A. Both authors wrote all parts of the article jointly. All authors have read and agreed to the published version of the manuscript.

Funding

Both authors used to work in the research project “Stability and Development in the Middle East and North Africa” when they conducted the research for this article. Georgeta Vidican Auktor is still associate research fellow of the project, which is fully funded by the German Federal Ministry for Economic Co-operation and Development (BMZ). The contents of this document are the sole responsibility of the authors and do not reflect the position of the BMZ.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | MENA countries spent even more than 9% of GDP on food and energy subsidies between 2009 and 2013 (Sdralevich et al. 2014). |

| 2 | Food subsidies in Egypt, for example, reduced income poverty rates by just a third in 2009, while energy subsidies reduced income poverty rates by less than a fifth in 2004, even though both programmes together consumed 8% of GDP at that time (Silva et al. 2013). Direct social transfer programmes, in contrast, reduced income poverty rates by little more than 3% and the Gini coefficient by less than 1% but they also accounted for much less than 1% of GDP. Egypt is by far the best-performer in that regard: Yemen’s energy subsidies, for example, reduced income poverty rates by just 5% in 2009 even though they consumed almost 14% of GDP (Silva et al. 2013). In Tunisia, subsidies reduced poverty rates by 3.6% and the Gini index by 1.1% (INS et al. 2013). |

| 3 | The average spending of oil-exporting MENA countries on gasoline and diesel pre-tax subsidies fluctuated between 3% and 5% of GDP between 2009 and 2013, while the average spending of oil-importing MENA countries on gasoline and diesel pre-tax subsidies fluctuated just slightly lower between 2% and 4.5% of GDP (Sdralevich et al. 2014). The spending of oil-exporting countries on food subsidies ranged from 0.1% of GDP in the United Arab Emirates to 2% of GDP in Algeria and about 3.5% of GDP in Iraq, while the respective share was equally dispersed in the oil-importing countries (0.2% of GDP in Lebanon but 2.5% of GDP in Egypt) (Sdralevich et al. 2014). |

| 4 | The Moroccan government conducted a survey in 2010 finding that more than 70% of the population were unaware of the existence of fossil-fuel subsidies (Chen et al. 2014). For instance, most buyers of 12 kilogramme cooking LPG bottles were unaware that the real market price was over 100 Moroccan dirhams instead of the standard retail price of 40 Moroccan dirhams (Chen et al. 2014). |

| 5 | The government issued smart cards for all eligible citizens allowing the purchase of subsidised goods with a value of up to 15 EGP per person per month (Abdellatif and Fakhry 2017; James 2015). |

References

- Abdalla, Moustafa, and Sherine Al-Shawarby. 2017. The Tamween Food Subsidy System in Egypt. In The 1.5 Billion People Question: Food, Vouchers, or Cash Transfers? Edited by Harold Alderman, Ugo Gentilini and Ruslan Yemtsov. Washington: World Bank, pp. 107–50. [Google Scholar]

- Abdellatif, Amany, and Eman Fakhry. 2017. Social Policies of Al-Sisi and Its Implications on the Political Instability in Egypt. IMESC Working Papers Series 1. London: Institute for Middle East Studies (IMESC), Available online: http://imesc.org/wp-content/uploads/2020/08/Social-Policies-of-Al-Sisi-And-Its-Implications-on-the-Political-Instability-in-Egypt.pdf (accessed on 1 March 2021).

- Adel, Abdelrahman, and Ismail Amina. 2017. Egypt raises fuel prices by up to 50 percent under IMF deal. Reuters. June 29. Available online: https://www.reuters.com/article/egypt-economy/update-3-egypt-raises-fuel-prices-by-up-to-50-percent-under-imf-deal-idUSL8N1JQ1G5 (accessed on 1 March 2021).

- Adly, Amr. 2020. Unwarranted Suffering: The IMF and Egypt’s Illusory Economic Recovery. In The Impact and Influence of International Institutions on the Middle East and North Africa. Edited by Tarek Radwan. Tunis: Friedrich Ebert Foundation, pp. 12–25. [Google Scholar]

- Alleyne, Trevor, and Mumtaz Hussain. 2013. Energy Subsidy Reform in Sub-Saharan Africa: Experiences and Lessons. IMF Departmental Policy Papers 2013/002. Washington: International Monetary Fund. [Google Scholar]

- Blomquist, John. 2006. Social Safety Nets. In SPectrum: Opportunity, Security, and Equity in the Middle East and North Africa. Edited by Margo Hoftijzer and Tim Whitehead. Washington: World Bank, pp. 34–40. [Google Scholar]

- Breisinger, Clemens, Hagar ElDidi, Hoda El-Enbaby, Daniel Gilligan, Naureen Karachiwalla, Yumna Kassim, Sikandra Kurdi, Amir Hamya Jilani, and Giang Thai. 2018. Egypt’s Takaful and Karama Cash Transfer Program: Evaluation of Program Impacts and Recommendations. Washington: International Food Policy Research Institute. [Google Scholar] [CrossRef]

- CAPMAS. 2018. Annual Bulletin of Social Services Statistics. Cairo: Central Agency for Public Mobilization and Statistics. [Google Scholar]

- Chahir, Aziz. 2021. Morocco: Repression is no answer to fear of a new popular uprising. Middle East Eye. February 22. Available online: https://www.middleeasteye.net/opinion/morocco-uprising-popular-government-crackdown (accessed on 1 March 2021).

- Chen, Dorothée, Andrea Liverani, and Judith Krauss. 2014. Assessing Public Opinion in the Political Economy of Reform: The Case of Energy Subsidy Reform in Morocco. In Problem-Driven Political Economy Analysis: The World Bank’s Experience. Edited by Verena Fritz, Brian Levy and Rachel Ort. Washington: World Bank, pp. 67–87. [Google Scholar]

- Clements, Benedict, David Coady, Stefania Fabrizio, Sanjeev Gupta, Trevor Alleyne, Carlo Sdralevich, Baoping Shang, Mauricio Villafuerte, Mumtaz Hussain, Özgür Demirkol, and et al. 2013. Energy Subsidy REFORM: Lessons and Implications. Washington: International Monetary Fund, Available online: https://www.imf.org/external/np/pp/eng/2013/012813a.pdf (accessed on 1 March 2021).

- Coady, David, Robert Gillingham, Rolando Ossowski, John Piotrowski, Shamsuddin Tareq, and Justin Tyson. 2010. Petroleum Product Subsidies: Costly, Inequitable, and Rising. Washington: International Monetary Fund. [Google Scholar]

- Ecker, Olivier, Jean Francois Trinh Tan, and Perrihan Al-Riffai. 2014. Facing the Challenge: The Recent Reform of the Egyptian Food Subsidy System. Cairo: International Food Policy Research Institute Egypt, Available online: https://egyptssp.ifpri.info/2014/12/19/facing-the-challenge-the-recent-reform-of-the-egyptian-food-subsidy-system (accessed on 1 March 2021).

- Egypt Today Staff. 2020. 2.5 million families benefit from Takaful and Karama program. Egypt Today. February 23. Available online: https://www.egypttoday.com/Article/1/81927/2-5-million-families-benefit-from-Takaful-and-Karama-program (accessed on 1 March 2021).

- El-Cassabgui, Joseph. 2017. IMF to Review Egypt’s Economic Reform Program. Huffington Post. March 17. Available online: https://www.huffpost.com/entry/imf-to-review-egypts-reform-program_b_58cc1d66e4b07112b6472d18 (accessed on 1 March 2021).

- El-Katiri, Laura, and Bassam Fattouh. 2017. A Brief Political Economy of Energy Subsidies in the Middle East and North Africa. In Combining Economic and Political Development: The Experience of MENA. Edited by Giacomo Luciani. Geneva: Graduate Institute Publications, pp. 58–87. [Google Scholar]

- Enami, Ali, Nora Lustig, and Alireza Taqdiri. 2016. Fiscal Policy, Inequality and Poverty in Iran: Assessing the Impact and Effectiveness of Taxes and Transfers the Poor in the Developing World. Center for Global Development Working Paper 442. Washington: Center for Global Development, Available online: https://www.cgdev.org/sites/default/files/fiscal-policy-inequality-poverty-iran.pdf (accessed on 1 March 2021).

- Farouk, Menna. 2017. Egypt reforms food subsidy system by first kicking out the rich. Al-Monitor. April 20. Available online: https://www.al-monitor.com/pulse/originals/2017/04/subsidy-system-revamp-wealthy.html (accessed on 1 March 2021).

- Grävingholt, Jörn, Sebastian Ziaja, and Merle Kreibaum. 2015. Disaggregating state fragility: A method to establish a multidimensional empirical typology. Third World Quarterly 36: 1281–98. [Google Scholar] [CrossRef] [Green Version]

- Griffin, Peter, Thomas Laursen, and James Robertson. 2016. Egypt: Guiding Reform of Energy Subsidies Long-Term; World Bank Policy Research Working Paper 7571. Washington: World Bank. Available online: http://hdl.handle.net/10986/23890 (accessed on 1 March 2021).

- Guillaume, Dominique, Roman Zytek, and Mohammed Reza Farzin. 2011. Iran: The Chronicles of the Subsidy Reform. IMF Working Papers 11/167. Washington: International Monetary Fund. [Google Scholar] [CrossRef]

- Harris, Kevan. 2017. A Social Revolution: Politics and the Welfare State in Iran. Oakland: University of California Press. [Google Scholar]

- Hertog, Steffen. 2017. The Political Economy of Distribution in the Middle East: Is There Scope for a New Social Contract? In Combining Economic and Political Development: The Experience of MENA. Edited by Giacomo Luciani. Geneva: Graduate Institute Publications, pp. 88–113. [Google Scholar]

- Hinnebusch, Raymond. 2020. The rise and decline of the populist social contract in the Arab world. World Development 129: 104661. [Google Scholar] [CrossRef]

- IEA. 2020. IEA Fossil Fuel Subsidies Database. Paris: International Energy Agency, Available online: https://iea.blob.core.windows.net/assets/6ad1127d-821a-4c98-b58d-d53108fe70c8/IEA-Fossil-Fuel-Subsidies-2010-2019.xlsx (accessed on 1 March 2021).

- IISD. 2013. A Guidebook to Fossil-Fuel Subsidy Reform for Policy-Makers in South-East Asia. Geneva: International Institute for Sustainable Development. [Google Scholar]

- IMF. 2013. Energy Subsidy Reform: Lessons and Implications; Washington: International Monetary Fund. Available online: https://www.imf.org/~/media/Websites/IMF/imported-full-text-pdf/external/np/pp/eng/2013/_012813.ashx (accessed on 1 March 2021).

- IMF. 2014. Islamic Republic of Iran: Selected Issues Paper 2014:94. Washington: International Monetary Fund. [Google Scholar] [CrossRef]

- IMF. 2015. Islamic Republic of Iran: Selected Issues Paper 2015:350. Washington: International Monetary Fund. [Google Scholar] [CrossRef]

- IMF. 2019. Morocco: 2019 Article IV Consultation-Press Release; Staff Report 2019:30; Washington: International Monetary Fund. Available online: https://www.imf.org/en/Publications/CR/Issues/2019/07/12/Morocco-2019-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-47114 (accessed on 1 March 2021).

- Inchauste, Gabriela, and David G. Victor. 2017. The Political Economy of Energy Subsidy Reform. Washington: World Bank. [Google Scholar]

- INS, CRES, and AfDB. 2013. Distribution et Incidence des Subventions Indirectes sur les Ménages Pauvres. Tunis: Institut National de la Statistique, and Centre de Recherches et d’Etudes Sociales, and Banque Africaine de Développement, Available online: https://idaraty.tn/fr/publications/distribution-et-incidence-des-subventions-indirectes-sur-les-menages-pauvres (accessed on 1 March 2021).

- Ioanes, Ellen. 2019. Trump’s favorite dictator just rounded up 2000 people peacefully calling for an end to military rule. Business Insider India. September 28. Available online: https://www.businessinsider.in/trumps-favorite-dictator-just-rounded-up-2000-people-peacefully-calling-for-an-end-to-military-rule/articleshow/71343786.cms (accessed on 1 March 2021).

- James, Laura. 2015. Recent Developments in Egypt’s Fuel Subsidy Reform Process; Geneva: International Institute for Sustainable Development. Available online: https://www.iisd.org/gsi/sites/default/files/ffs_egypt_lessonslearned.pdf (accessed on 1 March 2021).

- Karshenas, Massoud, Valentine Moghadam, and Randa Alami. 2014. Social Policy after the Arab Spring: States and Social Rights in the MENA Region. World Development 64: 726–39. [Google Scholar] [CrossRef]

- Ketchley, Neil, and Thoraya El-Rayyes. 2017. On the Breadline in Sisi’s Egypt. Middle East Report Online. March 29. Available online: https://merip.org/2017/03/on-the-breadline-in-sisis-egypt/ (accessed on 1 March 2021).

- Kojima, Masami. 2016. Fossil Fuel Subsidy and Pricing Policies: Recent Developing Country Experience. World Bank Policy Research Working Paper 7531. Washington: World Bank, Available online: http://hdl.handle.net/10986/23631 (accessed on 1 March 2021).

- Loewe, Markus. 2010. Soziale Sicherung in den Arabischen Ländern: Determinanten, Defizite und Strategien für den Informellen Sektor. Baden-Baden: Nomos. [Google Scholar]