Transfer Function Analysis: Modelling Residential Building Costs in New Zealand by Including the Influences of House Price and Work Volume

Abstract

1. Introduction

2. Literature Review

2.1. The Factors Impact Building Costs

2.2. Estimating Methods

2.3. Gaps in the Existing Literature

3. Research Methodology

3.1. The Data

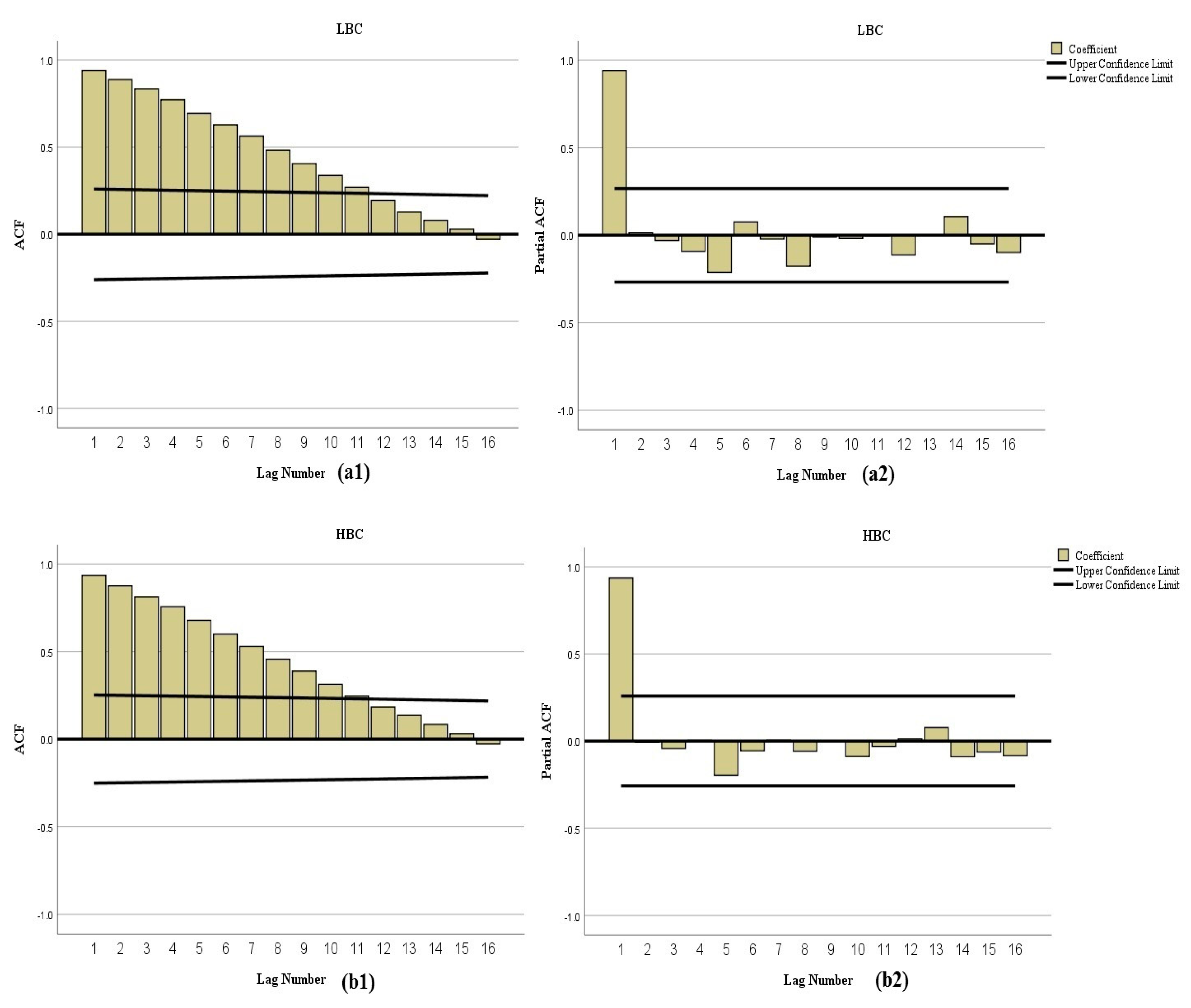

3.2. ARIMA Model

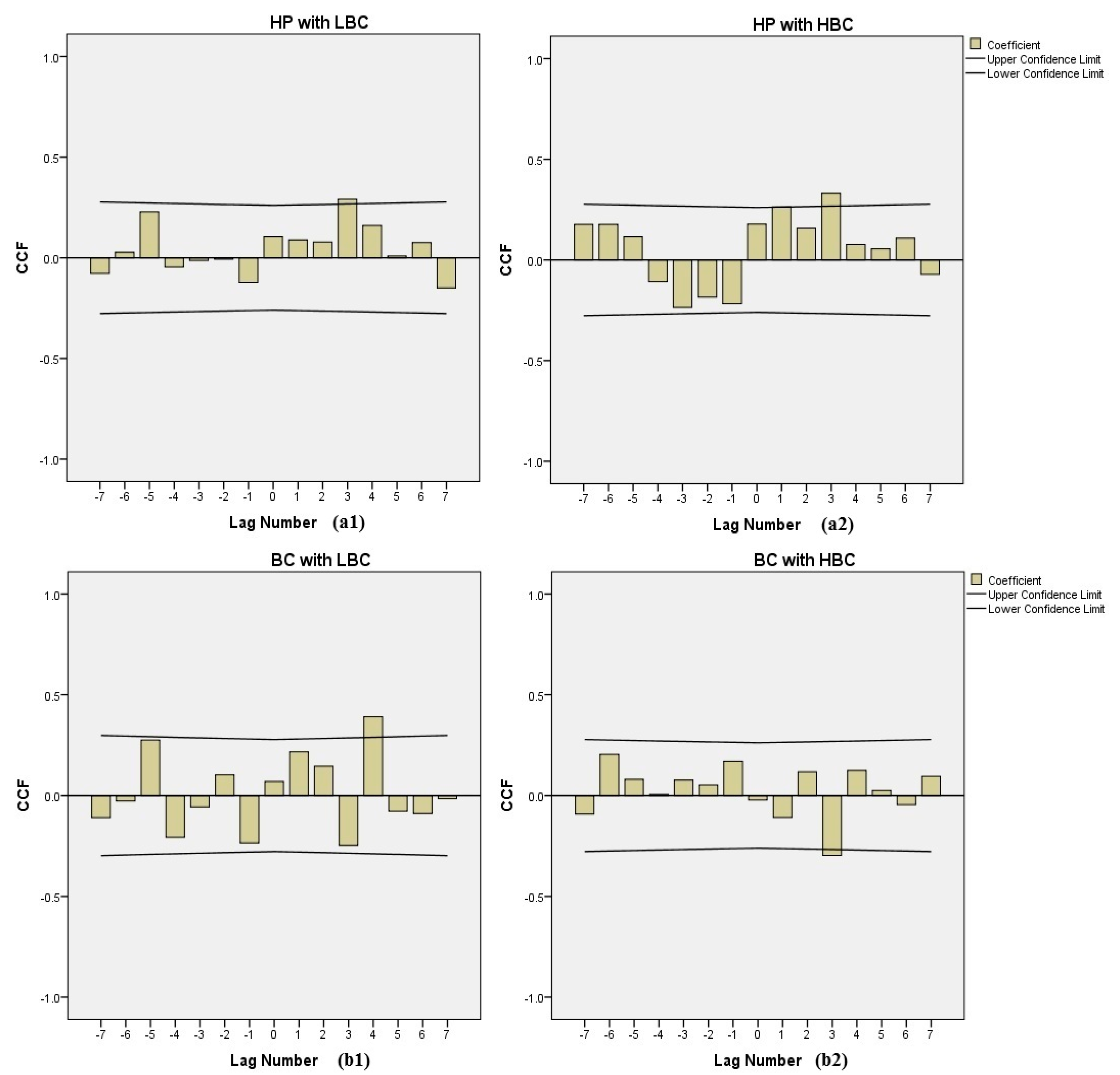

3.3. Bivariate Transfer Function Model

3.4. Multivariate Transfer Function Model

4. The Forecasting Models

4.1. ARIMA Model for Building Costs

4.2. Transfer Function Model for Building Costs

5. Forecasting Results

6. Results Discussion

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| ACF | Auto-Correlation Function |

| ANNs | Artificial Neutral Networks |

| AR | Autoregressive |

| ARIMA | Autoregressive Integrated Moving Average |

| BC | Building Consents |

| BTF-LBC1 | Bivariate Transfer Function Model for Low-rise Residential Building Cost involved House Prices as explanatory variable |

| BTF-LBC2 | Bivariate Transfer Function Model for Low-rise Residential Building Cost involved Building Consents as explanatory variable |

| BTF-HBC1 | Bivariate Transfer Function Model for High-rise Residential Building Cost involved House Prices as explanatory variable |

| BTF-HBC2 | Bivariate Transfer Function Model for High-rise Residential Building Cost involved Building Consents as explanatory variable |

| CBR | Case-Based Reasoning |

| CCF | Cross-Correlation Function |

| CPI | Consumer Price Index |

| GDP | Gross Domestic Product |

| HBC | High-rise Residential Building Cost |

| HP | House Prices |

| LBC | Low-rise Residential Building Cost |

| MAPE | Mean Absolute Percentage Error |

| MRA | Multiple Regression Analysis |

| MTF-LBC | Multivariate Transfer Function Model for Low-rise Residential Building Cost involved House Prices and Building Consents as explanatory variables |

| MTF-HBC | Multivariate Transfer Function Model for High-rise Residential Building Cost involved House Prices and Building Consents as explanatory variables |

| PACF | Partial Auto-Correlation Function |

| PCA | Principal Component Analysis |

| PPI | Producer Price Index |

| RBNZ | Reserve Bank of New Zealand |

| RMSE | Root Mean Square Error |

| SVM | Support Vector Machine |

| VEC | Vector Error Correction |

References

- Torp, O.; Klakegg, O.J. Challenges in cost estimation under uncertainty: A case study of the decommissioning of barsebäck nuclear power plant. Adm. Sci. 2016, 6, 14. [Google Scholar] [CrossRef]

- Williams, T.; Lakshminarayanan, S.; Sackrowitz, H. Analysing bidding statistics to predict completed project cost. In Proceedings of the International Conference on Computing in Civil Engineering, Cancun, Mexico, 1 January 2005. [Google Scholar]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Megaprojects and Risks: An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Li, H.; Shen, Q.; Love, P.E. Cost modelling of office buildings in Hong Kong: An exploratory study. Facilities 2005, 23, 438–452. [Google Scholar] [CrossRef]

- Goh, B.; Teo, H.P. Forecasting construction industry demand, price and productivity in Singapore: The Box-Jenkins approach. Constr. Manag. Econ. 2000, 18, 607–618. [Google Scholar]

- Dang, T.H.G.; Low, S.P. Role of construction in economic development: Review of key concepts in the past 40 years. Habitat Int. 2011, 35, 118–125. [Google Scholar]

- Lewis, T.M. The construction industry in the economy of Trinidad and Tobago. Constr. Manag. Econ. 2004, 22, 541–549. [Google Scholar] [CrossRef]

- Su, C.K.; Lin, C.Y.; Wang, M.T. Taiwanese construction sector in a growing ‘maturity’ economy, 1964–1999. Constr. Manag. Econ. 2003, 21, 719–728. [Google Scholar] [CrossRef]

- MBIE. NZ Sector Report 2013-Construction; Ministry of Building Innovation and Employment: Wellington, New Zealand, 2013.

- Rafiei, M.H.; Adeli, H. Novel Machine-Learning Model for Estimating Construction Costs Considering Economic Variables and Indexes. J. Constr. Eng. Manag. 2018, 144. [Google Scholar] [CrossRef]

- Ashuri, B.; Shahandashti, S.M.; Lu, J. Empirical tests for identifying leading indicators of ENR Construction Cost Index. J. Constr. Manag. Econ. 2012, 30, 917–927. [Google Scholar] [CrossRef]

- Yorucu, V.; Keles, R. The construction boom and environmental protection in Northern Cyprus as a consequence of the Annan Plan. Constr. Manag. Econ. 2006, 25, 77–86. [Google Scholar] [CrossRef]

- Ball, M.; Farshchi, M.; Grilli, M. Competition and the persistence of profits in the UK construction industry. Constr. Manag. Econ. 2000, 18, 733–745. [Google Scholar] [CrossRef]

- Martin, S. Advanced Industrial Economics; Blackwell: Oxford, UK, 1993. [Google Scholar]

- Onur, I.; Ozcan, R.; Tas, B.K.O. Public procurement auctions and competition in Turkey. Rev. Ind. Organ. 2012, 40, 207–223. [Google Scholar] [CrossRef]

- Assaf, S.A.; Al-Hejji, S. Causes of delay in large construction projects. Int. J. Proj. Manag. 2006, 24, 349–357. [Google Scholar] [CrossRef]

- Boermans, T.; Bettgenhauser, K.; Hermelink, A.; Schimschar, S. Cost Optimal Building Performance Requirements-Calculation Methodology for Reporting on National Energy Performance Requirements on the Basis of Cost Ptimality within the Framework of the EPBD; European Council for Energy Efficient Economy: Stockholm, Sweden, 2011. [Google Scholar]

- Figueiredo, E.; Figueiras, J.; Park, G.; Farrar, C.R.; Worden, K. Influence of the autoregressive model order on damage detection. Comput. Aided Civ. Infrastruct. Eng. 2011, 26, 225–238. [Google Scholar] [CrossRef]

- Moon, T.; Shin, D.H. Forecasting Construction Cost Index Using Interrupted Time-Series. KSCE J. Civ. Eng. 2018, 22, 1626–1633. [Google Scholar] [CrossRef]

- Zhang, H.B. Research on Structural Cost Analysis at Schematic Design Stage using Multi-variant Regression Analysis. Eng. Cost Manag. 2015, 2, 49–52. [Google Scholar]

- ElMousalami, H.H.; Elyamany, A.H.; Ibrahim, A.H. Predicting Conceptual Cost for Field Canal Improvement Projects. J. Constr. Eng. Manag. 2018, 144, 1–8. [Google Scholar] [CrossRef]

- Kim, G.H.; Shin, J.M.; Kim, S.; Shin, Y. Comparison of school building construction costs estimation methods using regression analysis, neural network, and support vector machine. J. Build. Constr. Plan. Res. 2013, 1, 1–7. [Google Scholar] [CrossRef]

- Cheng, M.Y.; Hoang, N.D.; Wu, Y.W. Hybrid intelligence approach based on LS-SVM and differential evolution for construction cost index estimation: A Taiwan case study. Autom. Constr. 2013, 35, 306–313. [Google Scholar] [CrossRef]

- Le´sniak, A.; Juszczyk, M. Prediction of site overhead costs with the use of artificial neural network based model. Arch. Civ. Mech. Eng 2018, 18, 973–982. [Google Scholar] [CrossRef]

- Juszczyk, M. Application of PCA-based data compression in the ANN-supported conceptual cost estimation of residential buildings. AIP Conf. Proc. 2016, 1738. [Google Scholar] [CrossRef]

- Juszczyk, M.; Le’sniak, A.; Zima, K. ANN Based Approach for Estimation of Construction Costs of Sports Fields. Complexity 2018, 2018, 11. [Google Scholar] [CrossRef]

- Ashuri, B.; Lu, J. Time series analysis of ENR construction cost index. J. Constr. Eng. Manag. 2010, 136, 1227–1237. [Google Scholar] [CrossRef]

- Wong, J.M.W.; Ng, S.T. Forecasting construction tender price index in Hong Kong using vector error correction model. Constr. Manag. Econ. 2010, 28, 1255–1268. [Google Scholar] [CrossRef]

- Marwala, T. Economic Modeling Using Artificial Intelligence Methods; Springer: London, UK, 2013. [Google Scholar]

- Chou, J.S.; Tseng, H.C. Establishing expert system for prediction based on the project-oriented data warehouse. Expert Syst. Appl. 2011, 38, 640–651. [Google Scholar] [CrossRef]

- Kim, S.Y.; Kim, G.H.; Kang, K.I. Comparing cost prediction methods for apartment housing projects: CBR versus ANN. J. Asian Archit. Build. Eng. 2005, 4, 113–120. [Google Scholar] [CrossRef]

- Alex, D.P.; Ai-Hussein, M.; Bouferguene, A.; Fernando, S. Artificial neural network model for cost estimation: City of Edmonton’s water and sewer installation services. J. Constr. Eng. Manag. 2010, 136, 745–756. [Google Scholar] [CrossRef]

- Cheng, M.-Y.; Tsai, H.C.; Sudjono, E. Conceptual cost estimates using evolutionary fuzzy hybrid neural network for projects in construction industry. Expert Syst. Appl. 2010, 37, 4224–4231. [Google Scholar] [CrossRef]

- Duran, O.; Rodriguez, N.; Consalter, L.A. Neural networks for cost estimation of shell and tube heat exchangers. Expert Syst. Appl. 2009, 36, 7435–7440. [Google Scholar] [CrossRef]

- Juszczyk, M.; Leśniak, A. Modelling construction site cost index based on neural network ensembles. Symmetry 2019, 11, 411. [Google Scholar] [CrossRef]

- Yazdani-Chamzini, A.; Zavadskas, E.K.; Antucheviciene, J.; Bausys, R. A model for shovel capital cost estimation, using a hybrid model of multivariate regression and neural networks. Symmetry 2017, 9, 298. [Google Scholar] [CrossRef]

- An, S.H.; Kim, G.; Kang, K. A Case-based reasoning cost estimating model using experience by analytic hierarchy process. Build. Env. 2007, 42, 2573–2579. [Google Scholar] [CrossRef]

- Le’sniak, A.; Zima, K. Cost calculation of construction projects including sustainability factors using the case based reasoning (cbr) method. Sustainability 2018, 10, 14. [Google Scholar]

- Ji, S.H.; Park, M.; Lee, H.S. Case adaptation method of case-based reasoning for construction cost estimation in Korea. J. Constr. Eng. Manag. 2012, 138, 43–52. [Google Scholar] [CrossRef]

- Koo, C.W.; Hong, T.H.; Hyun, C.T.; Koo, K.J. A CBR-based hybrid model for predicting a construction duration and cost based on project characteristics in multi-family housing projects. Can. J. Civ. Eng. 2010, 37, 739–752. [Google Scholar] [CrossRef]

- Ji, C.Y.; Hong, T.H.; Hyun, C.T. CBR revision model for improving cost prediction accuracy in multifamily housing projects. J. Manag. Eng. 2010, 26, 229–236. [Google Scholar] [CrossRef]

- Dysert, L. Is estimate accuracy an oxymoron? Cost Eng. 2007, 49, 32–36. [Google Scholar]

- Box, G.E.P.; Jenkins, G.M. Time Series Analysis Forecasting and Control, 5th ed.; Wiley: Hoboken, NJ, USA, 1976. [Google Scholar]

- Vandaele, W. Applied Time Series and Box-Jenkins Models; Academic Press: New York, NY, USA, 1993. [Google Scholar]

- Sunde, T.; Muzindutsi, P.F. Determinants of house prices and new consturciton activity: An empirical investigation of the Namibian housing market. J. Dev. Area 2017, 51, 390–407. [Google Scholar]

- Jacobsen, D.H.; Johansen, K.S.; Haugland, K. Hous ing inves tment and house prices. Econ. Bull. 2007, 78, 33–46. [Google Scholar]

| Cost Series | Model | Parameter | Estimate | SD | t-Statistics | p-Value |

|---|---|---|---|---|---|---|

| LBC | ARIMA (0,1,1) (0,1,1)4 | 0.317 | 0.147 | 2.160 | 0.036 ** | |

| 0.294 | 0.152 | 1.933 | 0.059 ** | |||

| HBC | ARIMA (0,1,0) (1,0,0)4 | ϕ1 | 0.594 | 0.108 | 5.483 | 0.0 *** |

| Model | Independent Variable | Parameter | Estimate | SD | t-Statistics | p-Value |

|---|---|---|---|---|---|---|

| BTF-LBC1 | HP | 0.488 | 0.152 | 3.211 | 0.002 *** | |

| B | 3 | |||||

| BTF-LBC2 | BC | 0.691 | 0.251 | 2.756 | 0.008 *** | |

| B | 4 | |||||

| MTF-LBC | HP & BC | 0.312 | 0.141 | 2.210 | 0.032 ** | |

| bHP | 3 | |||||

| 0.575 | 0.249 | 2.312 | 0.025 ** | |||

| bBC | 4 |

| Model | Independent Variable | Parameter | Estimate | SD | t-Statistics | p-Value |

|---|---|---|---|---|---|---|

| BTF-HBC1 | HP | 0.302 | 0.125 | 2.410 | 0.020 ** | |

| 0.741 | 0.147 | 5.034 | 0.0 *** | |||

| B | 1 | |||||

| BTF-HBC2 | BC | 0.232 | 0.110 | 2.101 | 0.038 ** | |

| B | 3 | |||||

| MTF-HBC | HP & BC | 0.452 | 0.102 | 4.431 | 0.001 *** | |

| 0.706 | 0.302 | 2.338 | 0.027 ** | |||

| bHP | 1 | |||||

| 0.313 | 0.151 | 2.078 | 0.040 ** | |||

| bBC | 3 |

| Cost Series | Model Statistics | ARIMA | Bivariate TF | Multivariate TF | |

|---|---|---|---|---|---|

| HP | BC | HP & BC | |||

| LBC | R2 | 0.955 | 0.935 | 0.934 | 0.942 |

| RMSE | 41.96 | 36.58 | 34.77 | 33.58 | |

| MAPE | 1.846 | 1.814 | 1.776 | 1.755 | |

| MAE | 28.79 | 28.67 | 28.10 | 26.87 | |

| HBC | R2 | 0.969 | 0.942 | 0.919 | 0.927 |

| RMSE | 52.87 | 37.88 | 45.75 | 36.33 | |

| MAPE | 1.944 | 1.796 | 1.836 | 1.676 | |

| MAE | 37.03 | 34.32 | 35.48 | 32.92 | |

| Cost Series | Model Statistics | ARIMA | Bivariate TF | Multivariate TF | |

|---|---|---|---|---|---|

| HP | BC | HP & BC | |||

| LBC | R2 | 0.955 | 0.935 | 0.934 | 0.942 |

| RMSE | 48.00 | 40.43 | 38.34 | 33.13 | |

| MAPE | 2.190 | 2.012 | 1.956 | 1.847 | |

| MAE | 40.00 | 36.49 | 29.88 | 28.01 | |

| HBC | R2 | 0.969 | 0.942 | 0.919 | 0.927 |

| RMSE | 56.23 | 42.55 | 47.36 | 41.88 | |

| MAPE | 2.159 | 1.861 | 1.942 | 1.795 | |

| MAE | 44.32 | 36.93 | 38.84 | 35.76 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, L.; Mbachu, J.; Liu, Z.; Zhang, H. Transfer Function Analysis: Modelling Residential Building Costs in New Zealand by Including the Influences of House Price and Work Volume. Buildings 2019, 9, 152. https://doi.org/10.3390/buildings9060152

Zhao L, Mbachu J, Liu Z, Zhang H. Transfer Function Analysis: Modelling Residential Building Costs in New Zealand by Including the Influences of House Price and Work Volume. Buildings. 2019; 9(6):152. https://doi.org/10.3390/buildings9060152

Chicago/Turabian StyleZhao, Linlin, Jasper Mbachu, Zhansheng Liu, and Huirong Zhang. 2019. "Transfer Function Analysis: Modelling Residential Building Costs in New Zealand by Including the Influences of House Price and Work Volume" Buildings 9, no. 6: 152. https://doi.org/10.3390/buildings9060152

APA StyleZhao, L., Mbachu, J., Liu, Z., & Zhang, H. (2019). Transfer Function Analysis: Modelling Residential Building Costs in New Zealand by Including the Influences of House Price and Work Volume. Buildings, 9(6), 152. https://doi.org/10.3390/buildings9060152