Is the Energy Transition of Housing Financially Viable? Unlocking the Potential of Deep Retrofits with New Business Models

Abstract

1. Introduction

2. Literature on Value Proposition and Business Models for Residential Retrofit

3. Methodology

4. Data Selection and Source

- Pi is the natural logarithm of the price of a dwelling expressed in EUR/sqm;

- β0 is the constant of the model;

- βi represents the marginal price of the characteristic;

- Xi is the numerical value of the observed variables, including EPC;

- ei represents a random error.

- Ce is the cost of energy consumption;

- EPgl,nren is the overall non-renewable energy performance index (kWh/sqm year);

- Pg is the price of non-renewable energy (EUR/kWh);

- EPgl,ren is the overall renewable energy performance index (kWh/sqm year);

- PUN is the price of renewable energy (EUR/kWh);

- S is the surface area of the building unit (sqm).

5. Analysis and Results

| Model | Functional Form | Typical Application |

|---|---|---|

| Power Law Model | Strong economies of scale, manufacturing, and industrial production [23,101] | |

| Learning Curve Model | Learning effect in production costs, renewable energy, and aerospace [127,129,130] | |

| Logarithmic Cost Function | Gradual cost reduction, industrial processes with limited scalability [128,131] |

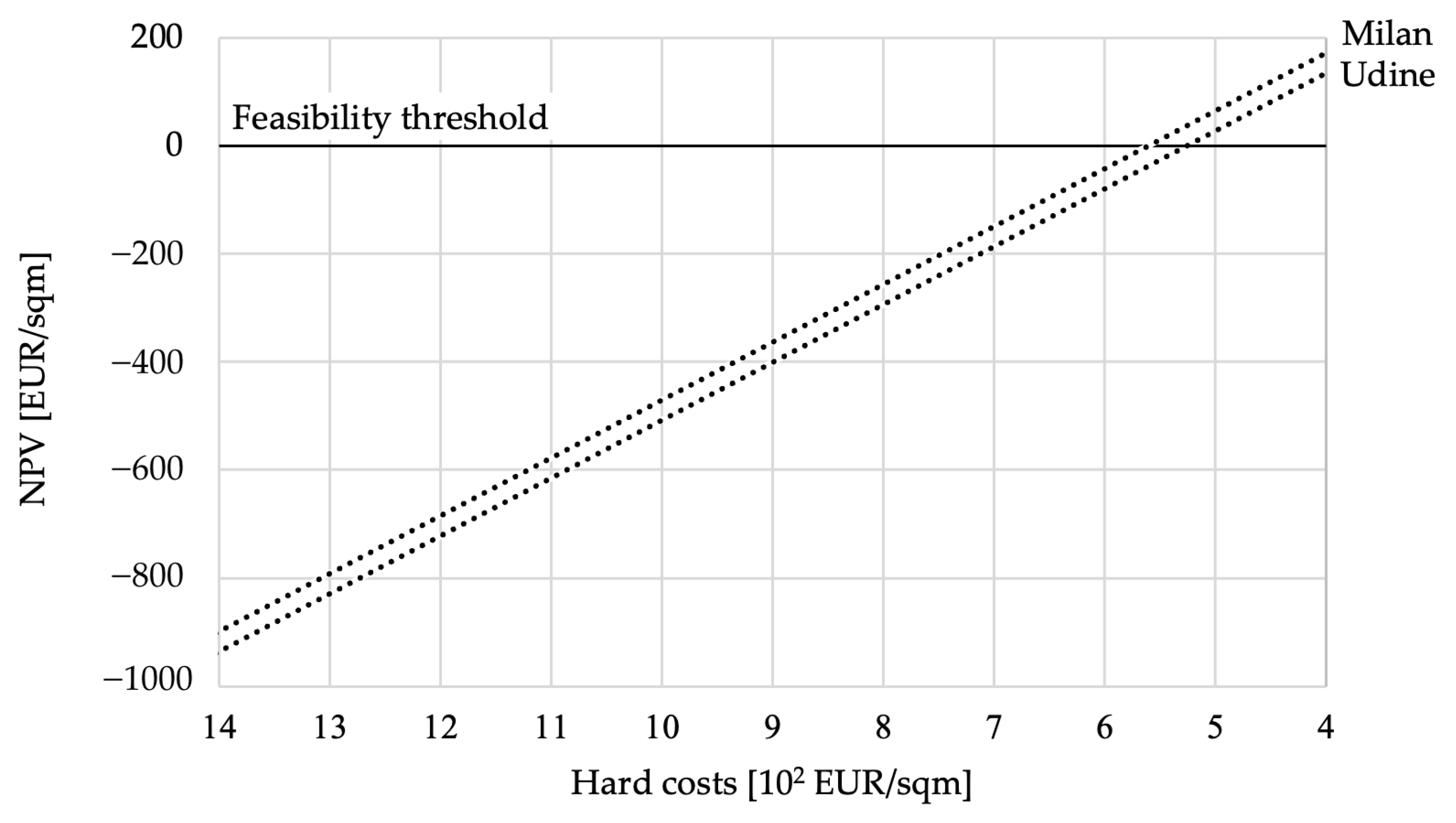

6. Discussion of the Results

7. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Categories | Milan | Udine | ||

|---|---|---|---|---|---|

| n | % | n | % | ||

| Zone | Central zone Semicentral zone Suburban zone | 209 224 440 | 23.9 25.7 50.4 | 151 160 93 | 37.4 39.6 23.0 |

| Proximity to infrastructure | Up to 200 m From 201 to 500 m Over 500 m | 265 518 90 | 30.4 59.3 10.3 | ||

| Typology | Villa Apartment | 0 873 | 0.0 100.0 | 24 380 | 5.9 94.1 |

| Property class | Luxury Prestigious Ordinary Economic | 53 469 283 19 | 6.1 53.7 32.42.2 | 15 152 222 15 | 3.7 37.6 55.0 3.7 |

| Number of bathrooms | One bathroom Two bathrooms Three bathrooms Four bathrooms | 489 295 86 2 | 56.0 33.8 9.9 0.2 | 179 193 32 - | 44.3 47.8 7.9 - |

| Energy class | A4 A3 A2 A1 A+ A B C D E F G | 7 8 12 11 6 24 22 20 87 130 182 362 | 0.8 0.9 1.4 1.3 0.7 2.7 2.5 2.3 10.0 14.9 20.8 41.5 | 21 2 5 4 8 4 26 31 52 91 91 69 | 5.2 0.5 1.2 1.0 2.0 1.0 6.4 7.7 12.9 22.5 22.5 17.1 |

| Maintenance status | New—under construction Excellent—renovatedGood—habitable Poor—to be renovated | 48 346 357 110 | 5.5 39.6 40.9 12.6 | 31 116 234 23 | 7.7 28.7 57.9 5.7 |

| Variables | Milan | Udine | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| n | Mean | S.D. | Min | Max | n | Mean | S.D. | Min | Max | |

| Unit value | 873 | 6324.9 | 2999 | 1307 | 21,883 | 404 | 1655.4 | 649.8 | 523.0 | 4063 |

| Zone | 873 | 2.26 | 0.821 | 1 | 3 | 404 | 1.8564 | 0.765 | 1 | 2 |

| Proximity to infrastructure | 873 | 1.80 | 0.606 | 1 | 3 | 0 | - | - | - | - |

| Typology | 873 | 1.00 | 0.000 | 1 | 1 | 404 | 0.9406 | 0.237 | 0 | 1 |

| Property class | 824 | 2.33 | 0.628 | 1 | 4 | 404 | 2.5866 | 0.626 | 1 | 4 |

| Number of bathrooms | 873 | 1.54 | 0.680 | 0 | 4 | 404 | 1.6361 | 0.625 | 1 | 3 |

| Energy class | 871 | 10.36 | 2.270 | 1 | 12 | 404 | 9.2995 | 2.756 | 1 | 12 |

| Maintenance status | 861 | 2.61 | 0.778 | 1 | 4 | 404 | 2.6163 | 0.711 | 1 | 4 |

| Surface | 873 | 108.09 | 57.371 | 19 | 482 | 404 | 128.73 | 66.716 | 23 | 490 |

| Energy Consumption Ec = (EPgl,nren × Pg + EPgl,ren × PUN) × S | |

| EPgl,nren | 313.6 kWh/sqm·y 1 |

| EPgl,ren | 5.8 kWh/sqm·y 1 |

| Pg | 0.078 EUR/kWh 2 |

| PUN | 0.081 EUR/kWh 3 |

| Surface (S) | 70 sqm |

| Ec | 1745 EUR·y |

| Owner–Tenant | Entrepreneur–Developer | |||||||

|---|---|---|---|---|---|---|---|---|

| Milan | Udine | Milan | Udine | |||||

| [EURsqm] | [€] | [EUR/sqm] | [€] | [EUR/sqm] | [€] | [EUR/sqm] | [EUR] | |

| Hard costs | 1400 | 98,000 | 1400 | 98,000 | 1400 | 98,000 | 1400 | 98,000 |

| Soft costs | 168 | 11,760 | 168 | 11,760 | 224 | 15,600 | 224 | 15,600 |

| Total costs | 1568 | 109,760 | 1568 | 109,760 | 1624 | 113,600 | 1624 | 113,600 |

| Δ price premium from G to A | 1078 | 75,481 | 502 | 35,135 | 1078 | 75,481 | 502 | 35,135 |

| Avoided cost of rent for the accommodation | 59 | 4147 | 21 | 1496 | - | - | - | - |

| Avoided cost of moving | 43 | 3000 | 43 | 3000 | - | - | - | - |

| Avoided cost of energy consumption | 499 | 34,907 | 499 | 34,907 | - | - | - | - |

| Avoided cost of extraordinary maintenance | 70 | 4870 | 70 | 4879 | - | - | - | - |

| Financial benefits | 1749 | 122,405 | 1134 | 79,409 | 1078 | 75,481 | 502 | 35,135 |

| Bank | 20-Year Green Mortage Fixed Rate [%] |

|---|---|

| Casa Banca delle Terre Venete Credito Cooperativo | 2.70 |

| Banca delle Terre Venete Credito Cooperativo—Gruppo Bancario Cooperativo Iccrea | 2.70 |

| Banca Monte dei Paschi di Siena | 3.50 |

| Banca Sella—Gruppo Banca Sella | 2.99 |

| Banco BPM—Gruppo Banco BPM | 3.40 |

| Banco di Desio e della Brianza—Gruppo Banco Desio | 3.40 |

| Banco di Sardegna—Gruppo BPER | 2.80 |

| Bcc Milano—Gruppo Bancario Cooperativo Iccrea | 3.50 |

| BNL—Gruppo BNP Paribas | 2.80 |

| BPER Banca—Gruppo BPER | 3.06 |

| CrediFriuli—Gruppo Bancario Cooperativo Iccrea | 2.70 |

| Crédit Agricole Italia—Gruppo bancario Crédit Agricole Italia | 2.60 |

| ING | 3.20 |

| Intesa Sanpaolo—Gruppo Intesa Sanpaolo | 3.20 |

| UniCredit | 3.40 |

| Average rate | 3.06 |

| Owner–Tenant | Entrepreneur–Developer | |||

|---|---|---|---|---|

| Equity [%] | Debt [%] | Equity [%] | Debt [%] | |

| Financial structure | 20 | 80 | 30 | 70 |

| Capital weight | 3.81 a | 3.06 | 8.00 | 3.06 |

| WACC | 3.21 | 4.54 | ||

References

- Calvin, K.; Dasgupta, D.; Krinner, G.; Mukherji, A.; Thorne, P.W.; Trisos, C.; Romero, J.; Aldunce, P.; Barrett, K.; Blanco, G.; et al. IPCC, 2023: Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Core Writing Team, Lee, H., Romero, J., Eds.; IPCC: Geneva, Switzerland, 2023. [Google Scholar] [CrossRef]

- United Nations. Annual Report 2022. United Nations Climate Change, Bonn. 2022. Available online: https://unfccc.int/sites/default/files/resource/UNClimateChange_AnnualReport_2022.pdf (accessed on 1 January 2025).

- GlobalABC. 2021 Globalabc Annual Narrative Report. 2022. Available online: https://globalabc.org/index.php/resources/publications/2021-globalabc-annual-narrative-report (accessed on 1 January 2025).

- UNEP—United Nations Environment Programme. Global Status Report for Buildings and Construction: Towards a Zero-Emission, Efficient and Resilient Buildings and Construction Sector. Nairobi. 2021. Available online: https://globalabc.org/ (accessed on 18 July 2024).

- European Commission. REfurbishment Decision Making Platform Through Advanced Technologies for Near Zero Energy BUILDing Renovation. 2024. Available online: https://cordis.europa.eu/project/id/768623/reporting (accessed on 19 June 2024).

- European Parliament and Council. Directive (EU) 2024/1275 of the European Parliament and of the Council of 24 April 2024 on the Energy Performance of Buildings; European Parliament and Council: Strasbourg, France, 2024. [Google Scholar]

- Ngwakwe, C.C. Environmental and economic benefits of compliance to green building. Int. J. Green Econ. 2019, 13, 288–299. [Google Scholar] [CrossRef]

- Ries, R.; Bilec, M.M.; Gokhan, N.M.; Needy, K.L. The Economic Benefits of Green Buildings: A Comprehensive Case Study. Eng. Econ. 2006, 51, 259–295. [Google Scholar] [CrossRef]

- Araújo, C.; Almeida, M.; Bragança, L.; Barbosa, J.A. Cost–benefit analysis method for building solutions. Appl. Energy 2016, 173, 124–133. [Google Scholar] [CrossRef]

- D’Alpaos, C.; Bragolusi, P. Buildings energy retrofit valuation approaches: State of the art and future perspectives. Valori Valutazioni 2018, 2018, 79–94. [Google Scholar]

- Dell’anna, F.; Bottero, M. Green premium in buildings: Evidence from the real estate market of Singapore. J. Clean. Prod. 2021, 286, 125327. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Energy performance ratings and house prices in Wales: An empirical study. Energy Policy 2016, 92, 20–33. [Google Scholar] [CrossRef]

- Leskinen, N.; Vimpari, J.; Junnila, S. A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties. Sustainability 2020, 12, 2729. [Google Scholar] [CrossRef]

- Bragolusi, P.; D’Alpaos, C. The valuation of buildings energy retrofitting: A multiple-criteria approach to reconcile cost-benefit trade-offs and energy savings. Appl. Energy 2022, 310, 118431. [Google Scholar] [CrossRef]

- Kerr, N.; Gouldson, A.; Barrett, J. The rationale for energy efficiency policy: Assessing the recognition of the multiple benefits of energy efficiency retrofit policy. Energy Policy 2017, 106, 212–221. [Google Scholar] [CrossRef]

- Rosenow, J.; Kern, F.; Rogge, K. The need for comprehensive and well targeted instrument mixes to stimulate energy transitions: The case of energy efficiency policy. Energy Res. Soc. Sci. 2017, 33, 95–104. [Google Scholar] [CrossRef]

- Baden-Fuller, C.; Haefliger, S. Business Models and Technological Innovation. Long Range Plan. 2013, 46, 419–426. [Google Scholar] [CrossRef]

- Cluett, R.; Amann, J. Multiple Benefits of Multifamily Energy Efficiency for Cost-Effectiveness Screening; American Council for an Energy-Efficient Economy: Washington, DC, USA, 2015. [Google Scholar]

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Bidmon, C.M.; Knab, S.F. The three roles of business models in societal transitions: New linkages between business model and transition research. J. Clean. Prod. 2018, 178, 903–916. [Google Scholar] [CrossRef]

- Bolton, R.; Hannon, M. Governing sustainability transitions through business model innovation: Towards a systems understanding. Res. Policy 2016, 45, 1731–1742. [Google Scholar] [CrossRef]

- Belova, N.; Sbitneva, D. Business model of construction organization management under conditions of new industrial basis. SHS Web Conf. 2018, 44, 00015. [Google Scholar] [CrossRef]

- Nagy, B.; Farmer, J.D.; Bui, Q.M.; Trancik, J.E. Statistical Basis for Predicting Technological Progress. PLoS ONE 2013, 8, e52669. [Google Scholar] [CrossRef]

- Brown, D. Business models for residential retrofit in the UK: A critical assessment of five key archetypes. Energy Effic. 2018, 11, 1497–1517. [Google Scholar] [CrossRef]

- EnergieSprong. Transition Zero. 2015. Available online: https://cdn.prod.website-files.com/59944999990f53000134107e/5bc8766a33d973180b34d58c_ESUK-Transition_Zero_document.pdf (accessed on 1 January 2025).

- Energiesprong. Available online: https://energiesprong.org/ (accessed on 1 January 2025).

- Sovacool, B.K. Fuel poverty, affordability, and energy justice in England: Policy insights from the Warm Front Program. Energy 2015, 93, 361–371. [Google Scholar] [CrossRef]

- Willand, N.; Ridley, I.; Maller, C. Towards explaining the health impacts of residential energy efficiency interventions—A realist review. Part 1: Pathways. Soc. Sci. Med. 2015, 133, 191–201. [Google Scholar] [CrossRef]

- Banca d’Italia, Eurosistema, e Istat. La Ricchezza dei Settori Istituzionali in Italia 2005–2021. Available online: https://www.bancaditalia.it (accessed on 1 January 2025).

- Dalla Zuanna, G.D.; Weber, G. Cose da Non Credere: Il Senso Comune Alla Prova dei Numeri; Laterza: Bari, Italy, 2012. [Google Scholar]

- Commissione Europea, Comunicazione della Commissione al Parlamento Europeo, al Consiglio, al Comitato Economico e Sociale Europeo e al Comitato delle Regioni. 2019. Available online: https://eur-lex.europa.eu/legal-content/IT/TXT/?uri=COM%3A2019%3A640%3AFIN (accessed on 1 January 2025).

- Haines, A.; Scheelbeek, P. European Green Deal: A major opportunity for health improvement. Lancet 2020, 395, 1327–1329. [Google Scholar] [CrossRef]

- Pierrehumbert, R. There is no Plan B for dealing with the climate crisis. Bull. At. Sci. 2019, 75, 215–221. [Google Scholar] [CrossRef]

- Owen, A.; Middlemiss, L.; Brown, D.; Davis, M.; Hall, S.; Bookbinder, R.; Brisbois, M.C.; Cairns, I.; Hannon, M.; Mininni, G. Who applies for energy grants? Energy Res. Soc. Sci. 2023, 101, 103123. [Google Scholar] [CrossRef]

- Cajias, M.; Piazolo, D. Green performs better: Energy efficiency and financial return on buildings. J. Corp. Real Estate 2013, 15, 53–72. [Google Scholar] [CrossRef]

- Cerin, P.; Hassel, L.G.; Semenova, N. Energy Performance and Housing Prices. Sustain. Dev. 2014, 22, 404–419. [Google Scholar] [CrossRef]

- Copiello, S.; Donati, E. Is investing in energy efficiency worth it? Evidence for substantial price premiums but limited profitability in the housing sector. Energy Build. 2021, 251, 111371. [Google Scholar] [CrossRef]

- Marmolejo-Duarte, C.; Chen, A. The Uneven Price Impact of Energy Efficiency Ratings on Housing Segments. Implications for Public Policy and Private Markets. Sustainability 2019, 11, 372. [Google Scholar] [CrossRef]

- Micelli, E.; Gilberto, G.; Righetto, E.; Tafuri, G. The economic value of sustainability. Real estate market and energy performance of homes: Il Valore Economico della Sostenibilità. Mercato Immobiliare e Prestazioni Energetiche delle Abitazioni. Valori Valutazioni 2023, 34, 3–16. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Stephenson, R.; Ashuri, B. Valuation of energy efficient certificates in buildings. Energy Build. 2018, 158, 1226–1240. [Google Scholar] [CrossRef]

- Aydin, E.; Brounen, D.; Kok, N. The capitalization of energy efficiency: Evidence from the housing market. J. Urban Econ. 2020, 117, 103243. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Stat. 2013, 95, 50–63. [Google Scholar] [CrossRef]

- Brounen, D.; Kok, N. On the economics of energy labels in the housing market. J. Environ. Econ. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef]

- Hyland, M.; Lyons, R.C.; Lyons, S. The value of domestic building energy efficiency—Evidence from Ireland. Energy Econ. 2013, 40, 943–952. [Google Scholar] [CrossRef]

- Jensen, O.M.; Hansen, A.R.; Kragh, J. Market response to the public display of energy performance rating at property sales. Energy Policy 2016, 93, 229–235. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Econ. 2015, 48, 145–156. [Google Scholar] [CrossRef]

- de Ayala, A.; Galarraga, I.; Spadaro, J.V. The price of energy efficiency in the Spanish housing market. Energy Policy 2016, 94, 16–24. [Google Scholar] [CrossRef]

- Bisello, A.; Antoniucci, V.; Marella, G. Measuring the price premium of energy efficiency: A two-step analysis in the Italian housing market. Energy Build. 2020, 208, 109670. [Google Scholar] [CrossRef]

- Del Giudice, V.; Massimo, D.E.; Salvo, F.; De Paola, P.; De Ruggiero, M.; Musolino, M. Market Price Premium for Green Buildings: A Review of Empirical Evidence. Case Study. In New Metropolitan Perspectives; Bevilacqua, C., Calabrò, F., Della Spina, L., Eds.; Smart Innovation, Systems and Technologies; Springer International Publishing: Cham, Switzerland, 2021; pp. 1237–1247. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E.; Saccani, F. Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability 2019, 11, 12. [Google Scholar] [CrossRef]

- Morano, P.; Rosato, P.; Tajani, F.; Di Liddo, F. An Analysis of the Energy Efficiency Impacts on the Residential Property Prices in the City of Bari (Italy). In Green Energy and Technology; Springer: Cham, Switzerland, 2020; pp. 73–88. [Google Scholar] [CrossRef]

- Dell’anna, F. Machine learning framework for evaluating energy performance certificate (EPC) effectiveness in real estate: A case study of Turin’s private residential market. Energy Policy 2025, 198, 114407. [Google Scholar] [CrossRef]

- Ruggeri, A.G.; Gabrielli, L.; Scarpa, M.; Marella, G. What Is the Impact of the Energy Class on Market Value Assessments of Residential Buildings? An Analysis throughout Northern Italy Based on Extensive Data Mining and Artificial Intelligence. Buildings 2023, 13, 2994. [Google Scholar] [CrossRef]

- Micelli, E.; Giliberto, G.; Righetto, E.; Tafuri, G. Urban Disparities in Energy Performance Premium Prices: Towards an Unjust Transition? Land 2024, 13, 224. [Google Scholar] [CrossRef]

- Loberto, M.; Mistretta, A.; Spuri, M. The Capitalization of Energy Labels into House Prices. Evidence from Italy. SSRN J. 2024. [Google Scholar] [CrossRef]

- Richter, M. Utilities’ business models for renewable energy: A review. Renew. Sustain. Energy Rev. 2012, 16, 2483–2493. [Google Scholar] [CrossRef]

- Steinberger, J.K.; van Niel, J.; Bourg, D. Profiting from negawatts: Reducing absolute consumption and emissions through a performance-based energy economy. Energy Policy 2009, 37, 361–370. [Google Scholar] [CrossRef]

- Boons, F.; Montalvo, C.; Quist, J.; Wagner, M. Sustainable innovation, business models and economic performance: An overview. J. Clean. Prod. 2013, 45, 1–8. [Google Scholar] [CrossRef]

- Brege, S.; Stehn, L.; Nord, T. Business models in industrialized building of multi-storey houses. Constr. Manag. Econ. 2014, 32, 208–226. [Google Scholar] [CrossRef]

- Johnson, M.W.; Christensen, C.M.; Kagermann, H. Reinventing your business model. Harv. Bus. Rev. 2008, 86, 50–59. [Google Scholar]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying Business Models: Origins, Present, and Future of the Concept. Commun. Assoc. Inf. Syst. 2005, 16, 1. [Google Scholar] [CrossRef]

- Suikki, R.M.; Goman, A.M.J.; Haapasalo, H.J.O. A framework for creating business models a challenge in convergence of high clock speed industry. Int. J. Bus. Environ. 2006, 1, 211–233. [Google Scholar] [CrossRef]

- Foxon, T.J.; Bale, C.S.E.; Busch, J.; Bush, R.; Hall, S.; Roelich, K. Low carbon infrastructure investment: Extending business models for sustainability. Infrastruct. Complex. 2015, 2, 4. [Google Scholar] [CrossRef]

- Gauthier, C.; Gilomen, B. Business Models for Sustainability: Energy Efficiency in Urban Districts. Organ. Environ. 2016, 29, 124–144. [Google Scholar] [CrossRef]

- Hall, S.; Roelich, K. Business model innovation in electricity supply markets: The role of complex value in the United Kingdom. Energy Policy 2016, 92, 286–298. [Google Scholar] [CrossRef]

- Hannon, M.J.; Bolton, R. UK Local Authority engagement with the Energy Service Company (ESCo) model: Key characteristics, benefits, limitations and considerations. Energy Policy 2015, 78, 198–212. [Google Scholar] [CrossRef]

- Mahapatra, K.; Gustavsson, L.; Haavik, T.; Aabrekk, S.; Svendsen, S.; Vanhoutteghem, L.; Paiho, S.; Ala-Juusela, M. Business models for full service energy renovation of single-family houses in Nordic countries. Appl. Energy 2013, 112, 1558–1565. [Google Scholar] [CrossRef]

- Winther, T.; Gurigard, K. Energy performance contracting (EPC): A suitable mechanism for achieving energy savings in housing cooperatives? Results from a Norwegian pilot project. Energy Effic. 2017, 10, 577–596. [Google Scholar] [CrossRef]

- Moschetti, R.; Brattebø, H. Sustainable Business Models for Deep Energy Retrofitting of Buildings: State-of-the-art and Methodological Approach. Energy Procedia 2016, 96, 435–445. [Google Scholar] [CrossRef]

- Brown, D.; Kivimaa, P.; Sorrell, S. How Can Intermediaries Promote Business Model Innovation: The Case of ‘Energiesprong’ Whole-House Retrofits in the United Kingdom (UK) and the Netherlands; SPRU Working Paper Series, Art. f2018–19; University of Sussex Business School: Falmer, UK, 2018; Available online: https://ideas.repec.org//p/sru/ssewps/2018-19.html (accessed on 11 January 2025).

- Brown, D.; Hall, S.; Martiskainen, M.; Davis, M.E. Conceptualising domestic energy service business models: A typology and policy recommendations. Energy Policy 2022, 161, 112704. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Turnheim, B.; Martiskainen, M.; Brown, D.; Kivimaa, P. Guides or gatekeepers? Incumbent-oriented transition intermediaries in a low-carbon era. Energy Res. Soc. Sci. 2020, 66, 101490. [Google Scholar] [CrossRef]

- Delpont, S. Industrialisation de la rénovation énergétique. Ann. Des Mines Réalités Ind. 2022, 2022, 35–38. [Google Scholar] [CrossRef]

- Massa, L.; Tucci, C.L. Business model innovation. In The Oxford Handbook of Innovation Management; Oxford Academic: Oxford, UK, 2013; Volume 20, pp. 420–441. [Google Scholar]

- Micelli, E.; Mangialardo, A. Recycling the City New Perspective on the Real-Estate Market and Construction Industry. In Smart and Sustainable Planning for Cities and Regions: Results of SSPCR 2015; Bisello, A., Vettorato, D., Stephens, R., Elisei, P., Eds.; Green Energy and Technology; Springer International Publishing: Cham, Switzerland, 2017; pp. 115–125. [Google Scholar] [CrossRef]

- Friedler, C.; Kumar, C.; Reinventing retrofit: How to scale up home energy efficiency in the UK. Green Alliance. 2019. Available online: https://green-alliance.org.uk/publication/reinventing-retrofit-how-to-scale-up-home-energy-efficiency-in-the-uk/ (accessed on 20 August 2024).

- Pellegrino, M.; Wernert, C.; Chartier, A. Social Housing Net-Zero Energy Renovations with Energy Performance Contract: Incorporating Occupants’ Behaviour. Urban Plan. 2022, 7, 5–19. [Google Scholar] [CrossRef]

- Pellegrino, M.; Building Sector Stakeholders Facing the Challenge of Scalingup high-Performance Energy Renovation: The case of the Energiesprong Approach in the Netherlands and France. Revue Internationale d’Urbanisme. 2019. Available online: https://hal.science/hal-02937949v1/document (accessed on 8 March 2025).

- Nesticò, A.; De Mare, G.; Aurigemma, I. Off-Site Construction. The Economic Analyses for the Energy Requalification of the Existing Buildings. In Values and Functions for Future Cities; Mondini, G., Oppio, A., Stanghellini, S., Bottero, M., Abastante, F., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 447–462. [Google Scholar] [CrossRef]

- Ellram, L.M. Total cost of ownership: An analysis approach for purchasing. Int. J. Phys. Distrib. Logist. Manag. 1995, 25, 4–23. [Google Scholar] [CrossRef]

- Ferreira, M.; Almeida, M. Benefits from Energy Related Building Renovation Beyond Costs, Energy and Emissions. Energy Procedia 2015, 78, 2397–2402. [Google Scholar] [CrossRef]

- Berto, R.; Tintinaglia, F.; Rosato, P. How much is the indoor comfort of a residential building worth? A discrete choice experiment. Build. Environ. 2023, 245, 110911. [Google Scholar] [CrossRef]

- Aydin, Y.C.; Mirzaei, P.A.; Akhavannasab, S. On the relationship between building energy efficiency, aesthetic features and marketability: Toward a novel policy for energy demand reduction. Energy Policy 2019, 128, 593–606. [Google Scholar] [CrossRef]

- Morano, P.; Tajani, F.; Di Liddo, F.; Amoruso, P. A Feasibility Analysis of Energy Retrofit Initiatives Aimed at the Existing Property Assets Decarbonisation. Sustainability 2024, 16, 3204. [Google Scholar] [CrossRef]

- Streicher, K.N.; Mennel, S.; Chambers, J.; Parra, D.; Patel, M.K. Cost-effectiveness of large-scale deep energy retrofit packages for residential buildings under different economic assessment approaches. Energy Build. 2020, 215, 109870. [Google Scholar] [CrossRef]

- Nesticò, A.; Moffa, R. Economic analysis and operational research tools for estimating productivity levels in off-site construction. Valori Valutazioni 2018, 20, 107–128. [Google Scholar]

- Cachon, G.P.; Harker, P.T. Competition and Outsourcing with Scale Economies. Manag. Sci. 2002, 48, 1314–1333. [Google Scholar] [CrossRef]

- Pellegrino, R.; Costantino, N. An empirical investigation of the learning effect in concrete operations. Eng. Constr. Arch. Manag. 2018, 25, 342–357. [Google Scholar] [CrossRef]

- Tagliaro, C.; Pomè, A.P.; Bellintani, S.; Ciaramella, A. La Digitalizzazione del Settore Immobiliare e Delle Costruzioni: Nuove Tecnologie e Soluzioni per la Gestione Dell’ambiente Costruito; FrancoAngeli: Milan, Italy, 2024. [Google Scholar]

- Guerrieri, G. Il Mercato Della Casa. Domanda, Offerta, Tassazione e Spesa Pubblica; Carocci: Rome, Italy, 2022. [Google Scholar]

- ENEA. Certificazione Energetica Degli Edifci Italiani. Available online: https://pnpe2.enea.it/statistiche (accessed on 25 July 2024).

- Fylan, F.; Glew, D.; Smith, M.; Johnston, D.; Brooke-Peat, M.; Miles-Shenton, D.; Fletcher, M.; Aloise-Young, P.; Gorse, C. Reflections on retrofits: Overcoming barriers to energy efficiency among the fuel poor in the United Kingdom. Energy Res. Soc. Sci. 2016, 21, 190–198. [Google Scholar] [CrossRef]

- Michelsen, C.; Rosenschon, S.; Schulz, C. Small might be beautiful, but bigger performs better: Scale economies in “green” refurbishments of apartment housing. Energy Econ. 2015, 50, 240–250. [Google Scholar] [CrossRef]

- Christersson, M.; Vimpari, J.; Junnila, S. Assessment of financial potential of real estate energy efficiency investments–A discounted cash flow approach. Sustain. Cities Soc. 2015, 18, 66–73. [Google Scholar] [CrossRef]

- IPD; KTI. Property Valuation in the Nordic Countries. 2012. Available online: https://kti.fi/wp-content/uploads/Property-valuation-in-the-Nordic-countries.pdf (accessed on 1 January 2025).

- Shapiro, E.; Mackmin, D.; Sams, G. Modern Methods of Valuation, 12th ed.; Estates Gazette: London, UK, 2019. [Google Scholar] [CrossRef]

- EnergieSprong France. Observatoire Coûts, Qualité et Impact des Rénovations EnergieSprong; Energiesprong: Paris, France, 2021. [Google Scholar]

- Eurostat Database. 2018. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 30 March 2025).

- Burroni, L.; Gherardini, A.; Scalise, G. Policy Failure in the Triangle of Growth: Labour Market, Human Capital, and Innovation in Spain and Italy. South Eur. Soc. Politics 2019, 24, 29–52. [Google Scholar] [CrossRef]

- Insee. Indice du Coût de la Construction des Immeubles à Usage D’habitation (ICC). Available online: https://www.insee.fr/fr/statistiques/serie/000008630 (accessed on 25 July 2024).

- Wright, T.P. Factors affecting the cost of airplanes. J. Aeronaut. Sci. 1936, 3, 122–128. [Google Scholar] [CrossRef]

- Thompson, P. The Relationship between Unit Cost and Cumulative Quantity and the Evidence for Organizational Learning-by-Doing. J. Econ. Perspect. 2012, 26, 203–224. [Google Scholar] [CrossRef]

- de La Tour, A.; Glachant, M.; Ménière, Y. Predicting the costs of photovoltaic solar modules in 2020 using experience curve models. Energy 2013, 62, 341–348. [Google Scholar] [CrossRef]

- Lafond, F.; Bailey, A.G.; Bakker, J.D.; Rebois, D.; Zadourian, R.; McSharry, P.; Farmer, J.D. How well do experience curves predict technological progress? A method for making distributional forecasts. Technol. Forecast. Soc. Chang. 2018, 128, 104–117. [Google Scholar] [CrossRef]

- Lancaster, K.J. A New Approach to Consumer Theory. J. Political Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Politic. Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Michelangeli, A. Il metodo dei prezzi edonici per la costruzione di indici dei prezzi per il mercato immobiliare. In Principi Metodologici per la Costruzione di Indici dei Prezzi del Mercato Immobiliare; Del Giudice, V., D’Amato, M., Eds.; Maggioli: Rimini, Italy, 2008. [Google Scholar]

- Energiesprong Italia. Introduzione a EnergieSprong. Edera, Milano. 2024. Available online: https://drive.google.com/drive/u/1/folders/1jVocyxki8l5fIkHLI3S8UtH7rXTYamEQ (accessed on 25 July 2024).

- Morri, G.; Benedetto, P.; Mazzocco, A.; Caselli, S. Valutazione Immobiliare. Metodologie e Casi; EGEA: Milan, Italy, 2017. [Google Scholar]

- Orefice, M.; Orefice, L. Estimo Civile; De Agostini: Rome, Italy, 2014. [Google Scholar]

- Micelli, E.; Righetto, E. How do metropolitan cities evolve after the 2008/2012 crisis and the Covid-19 pandemic? An analysis from real estate market values: Come evolvono le città metropolitane dopo crisi e pandemia Covid-19? Un’analisi a partire dai valori del mercato immobiliare. Valori Valutazioni 2023, 31, 49–67. [Google Scholar] [CrossRef]

- Eurostat. Our Lives in the City. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/EDN-20180207-1 (accessed on 25 July 2024).

- Presidente della Repubblica Italiana, d.P.R. n. 412—Regolamento Recante Norme per la Progettazione, L’installazione, L’esercizio e la Manutenzione Degli Impianti Termici Degli Edifici ai Fini del Contenimento dei Consumi di Ener 1993. Available online: https://www.bosettiegatti.eu/info/norme/statali/1993_0412.htm (accessed on 12 January 2025).

- Tsikaloudaki, K.; Laskos, K.; Bikas, D. On the Establishment of Climatic Zones in Europe with Regard to the Energy Performance of Buildings. Energies 2012, 5, 32–44. [Google Scholar] [CrossRef]

- Curto, R.; Fregonara, E.; Semeraro, P. Asking prices vs market prices: An empirical analysis. Territ. Ital. 2012, 12, 53–72. [Google Scholar]

- Immobiliare.it. Dati dei Prezzi Degli Immobili in Italia. Available online: https://www.immobiliare.it (accessed on 1 January 2025).

- Guglielminetti, E.; Loberto, M.; Zevi, G.; Zizza, R. Living on My Own: The Impact of the COVID-19 Pandemic on Housing Preferences; Bank of Italy Occasional Paper, Fasc. 627; Bank of Italy: Rome, Italy, 2021. [Google Scholar]

- Kain, J.F.; Quigley, J.M. Measuring the value of house quality. J. Am. Stat. Assoc. 1970, 65, 532–548. [Google Scholar] [CrossRef]

- Yayar, R.; Demir, D. Hedonic estimation of housing market prices in Turkey. Erciyes Üniversitesi İktisadi İdari Bilim. Fakültesi Derg. 2014, 43, 67–82. [Google Scholar] [CrossRef]

- Ottensmann, J.; Payton, S.; Man, J. Urban Location and Housing Prices within a Hedonic Model. J. Reg. Anal. Policy 2008, 38, 19–35. [Google Scholar]

- Simonotti, M. I prezzi marginali impliciti delle risorse immobiliari. In Estimo ed Economia Ambientale; Angeli: Milan, Italy, 1993. [Google Scholar]

- Gestore Mercati Energetici. Prezzi Medi Energie. Available online: https://www.mercatoelettrico.org/it-it/ (accessed on 1 January 2025).

- ARERA. Andamento del Prezzo del Gas Naturale per un Consumatore Domestico Tipo in Regime di tutela. Available online: https://www.arera.it (accessed on 1 March 2024).

- Agenzia delle Entrate. Osservatorio del Mercato Immobiliare, Banca Dati delle Quotazioni Immobiliari. Available online: http://www.agenziaentrate.gov.it (accessed on 1 March 2023).

- Assofin. Osservatorio sul Credito Immobiliare. Available online: https://www.assofin.it/ (accessed on 1 March 2024).

- Baum, A. Real Estate Investment: A Strategic Approach, 4th ed.; Routledge: London, UK, 2015. [Google Scholar] [CrossRef]

- Argote, L.; Epple, D. Learning Curves in Manufacturing. Science 1990, 247, 920–924. [Google Scholar] [CrossRef]

- Hirschmann, W.B. Profit from the Learning Curve. Harv. Bus. Rev. 1964, 42, 125–139. [Google Scholar]

- Nemet, G.F. Beyond the learning curve: Factors influencing cost reductions in photovoltaics. Energy Policy 2006, 34, 3218–3232. [Google Scholar] [CrossRef]

- Yeh, S.; Rubin, E.S. A review of uncertainties in technology experience curves. Energy Econ. 2012, 34, 762–771. [Google Scholar] [CrossRef]

- Thompson, P. Chapter 10—Learning by Doing. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; Elsevier: Amsterdam, The Netherlands, 2010; Volume 1, pp. 429–476. [Google Scholar] [CrossRef]

- de Blasio, G.; Fiori, R.; Lavecchia, L.; Loberto, M.; Michelangeli, V.; Padovani, E.; Pisano, E.; Rodano, M.L.; Roma, G.; Rosolin, T.; et al. Improving the Energy Efficiency of Homes in Italy: The State of the Art and Some Considerations for Public Intervention; Fasc. 845; Banca d’Italia: Rome, Italy, 2024. [Google Scholar]

- Dijkstra, L.; Poelman, H.; Rodríguez-Pose, A. The geography of EU discontent. Reg. Stud. 2020, 54, 737–753. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A. The revenge of the places that don’t matter (and what to do about it). Camb. J. Reg. Econ. Soc. 2018, 11, 189–209. [Google Scholar] [CrossRef]

- Amstalden, R.W.; Kost, M.; Nathani, C.; Imboden, D.M. Economic potential of energy-efficient retrofitting in the Swiss residential building sector: The effects of policy instruments and energy price expectations. Energy Policy 2007, 35, 1819–1829. [Google Scholar] [CrossRef]

- Fabbri, K.; Gaspari, J. Mapping the energy poverty: A case study based on the energy performance certificates in the city of Bologna. Energy Build. 2021, 234, 110718. [Google Scholar] [CrossRef]

- Sistema Informativo Sugli Attestati di Prestazione Energetica (SIAPE). Indice di Prestazione ed Emissioni. SIAPE. Available online: https://siape.enea.it/ (accessed on 2 August 2024).

| Owner–Tenant | Entrepreneur–Developer | |

|---|---|---|

| Economic benefits | Δ price premium from G and habitable to Class A and renovated | - |

| Financial benefits | - | Δ price premium from G and habitable to Class A and renovated |

| Avoided cost of energy consumption | - | |

| Avoided the cost of moving | - | |

| Avoided the cost of rent for the alternative accommodation | - | |

| Avoided cost of extraordinary maintenance | - |

| Model | R2 | Rq Adjusted | F | df1 a | df2 b | p-Value |

|---|---|---|---|---|---|---|

| Milan | 0.626 | 0.623 | 192.859 | 7 | 807 | <0.001 |

| Udine | 0.429 | 0.420 | 49.7 | 6 | 397 | <0.001 |

| Predictors xi | xi | Milan | Udine | ||

|---|---|---|---|---|---|

| βi | VIF | βi | VIF | ||

| K | 10.306 | - | 8.421 | - | |

| Zone | 2 | −0.314 | 1242 | −0.041 | 1.11 |

| Proximity to infrastructure | 3 | −0.076 | 1061 | - | - |

| Typology | 1 | - | - | - | - |

| Property class | 3 | −0.17 | 1408 | −0.132 | 1.34 |

| Number of bathrooms | 1 | 0.064 | 2413 | 0.150 | 2.01 |

| Surface | 70 | −0.001 | 2496 | −0.002 | 1.96 |

| Energy class | 12 | −0.027 | 1409 | −0.037 | 2.13 |

| Maintenance status | 3 | −0.036 | 1381 | −0.103 | 2.29 |

| Milan | Udine | |

|---|---|---|

| Vm ante unit: Class G and habitable | 4925 EUR | 1312 EUR |

| Vm post unit: Class A and renovated | 6003 EUR | 1814 EUR |

| Vm ante: Class G and habitable | 344,723 EUR | 91,844 EUR |

| Vm post: Class A and renovated | 420,204 EUR | 126,979 EUR |

| From G and habitable to Class A and renovated | 75,481 EUR | 35,135 EUR |

| 21.90% | 38.26% |

| Owner–Tenant | Entrepreneur–Developer | |||

|---|---|---|---|---|

| Unit Value [EUR/sqm] | Total Value [EUR] | Unit Value [EUR/sqm] | Total Value [EUR] | |

| Hard costs | 1400 | 98,000 | 1400 | 98,000 |

| Soft costs | 168 | 11,760 | 224 | 15,600 |

| Total costs | 1568 | 109,760 | 1624 | 113,600 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Micelli, E.; Giliberto, G.; Righetto, E. Is the Energy Transition of Housing Financially Viable? Unlocking the Potential of Deep Retrofits with New Business Models. Buildings 2025, 15, 1175. https://doi.org/10.3390/buildings15071175

Micelli E, Giliberto G, Righetto E. Is the Energy Transition of Housing Financially Viable? Unlocking the Potential of Deep Retrofits with New Business Models. Buildings. 2025; 15(7):1175. https://doi.org/10.3390/buildings15071175

Chicago/Turabian StyleMicelli, Ezio, Giulia Giliberto, and Eleonora Righetto. 2025. "Is the Energy Transition of Housing Financially Viable? Unlocking the Potential of Deep Retrofits with New Business Models" Buildings 15, no. 7: 1175. https://doi.org/10.3390/buildings15071175

APA StyleMicelli, E., Giliberto, G., & Righetto, E. (2025). Is the Energy Transition of Housing Financially Viable? Unlocking the Potential of Deep Retrofits with New Business Models. Buildings, 15(7), 1175. https://doi.org/10.3390/buildings15071175