Urban Megaprojects from Isolation to Integration: A Property Market Perspective on Flagship Buildings

Abstract

1. Introduction

2. Materials and Methods

2.1. Literature Review

2.2. Hedonic Pricing Model

2.3. Study Area and Context

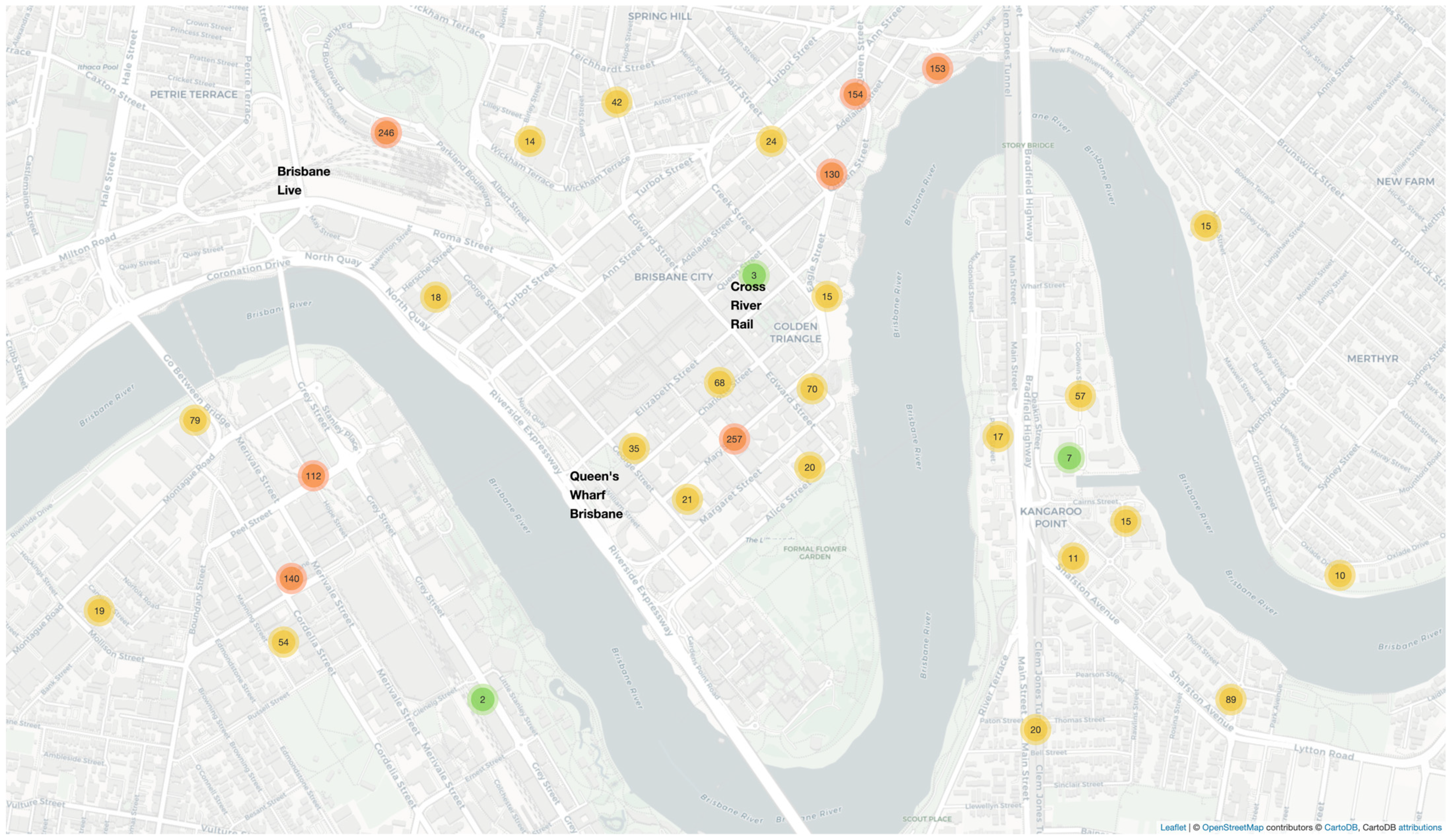

- Queen’s Wharf Brisbane: Located along Brisbane’s CBD riverfront, spanning from William Street to Alice Street, this USD 3.6 billion integrated resort project features luxury residential apartments, multiple hotels, high-end retail and dining precincts, extensive public spaces, and revitalized heritage structures [58].

- Cross River Rail (CRR): This USD 5.4 billion infrastructure development includes a 10.2 km rail corridor from Dutton Park to Bowen Hills, with new underground stations in Brisbane’s inner city. This project unlocks a bottleneck in Brisbane’s CBD through enhanced accessibility, reduced travel times, and increased connectivity to core areas [59,60,61].

- Brisbane Live: This USD 2.1 billion project is situated above the existing Roma Street railyard. The plan comprises a 17,000-seat entertainment arena, alongside new residential units, and commercial amenities. Its strategic location next to major transport nodes promises to attract increased activity in the area [62,63].

2.4. Data Sources and Variables

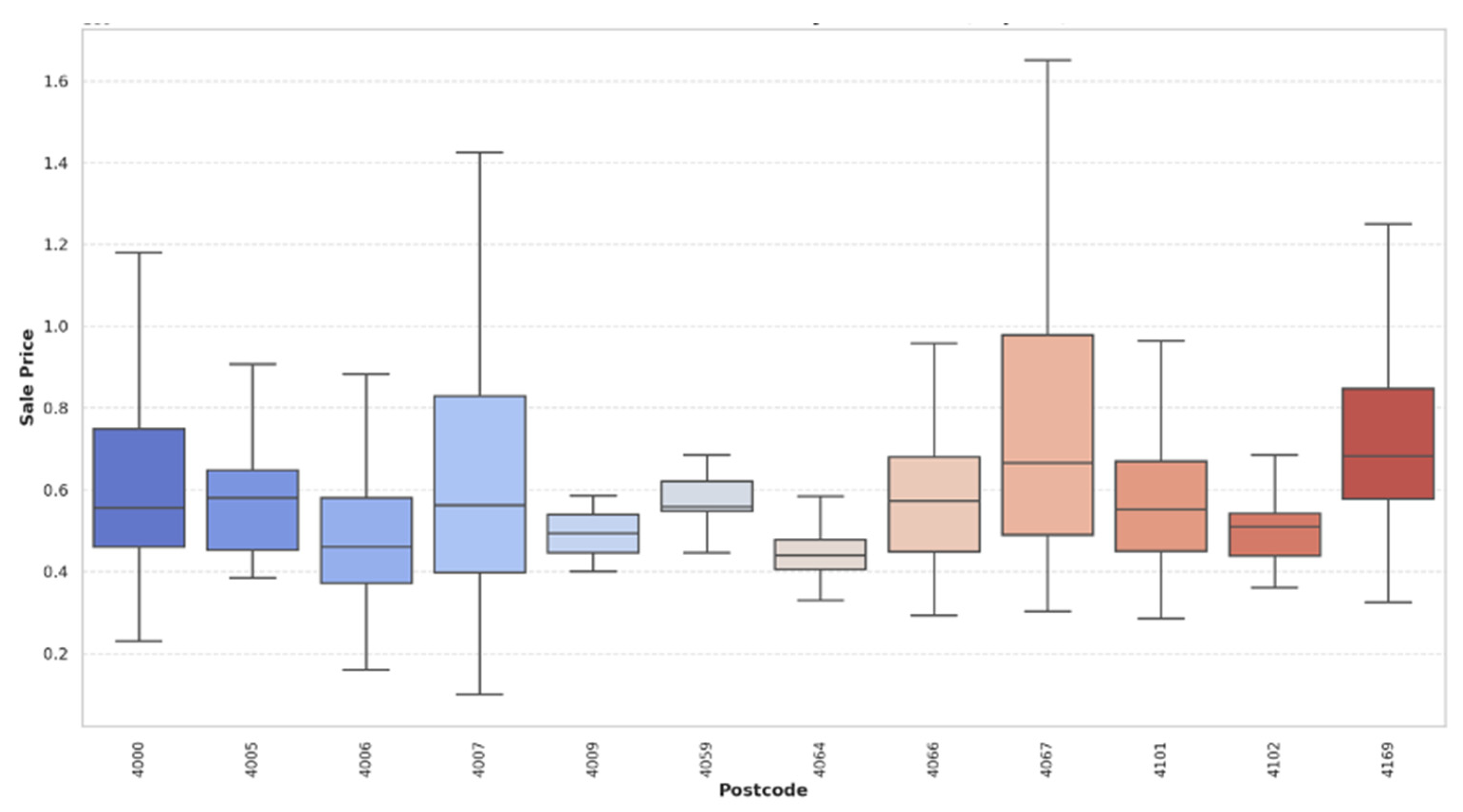

2.5. Descriptive Statistics

2.6. Model Specification and Estimation

- -

- ln(P) represents the natural logarithm of property sale price;

- -

- α is the intercept;

- -

- S denotes structural characteristics (bedrooms, bathrooms, car parks);

- -

- L captures temporal effects through yearly time dummies;

- -

- D is a vector of distance variables for each megaproject;

- -

- I incorporates interaction terms between projects;

- -

- β, γ, δ, and θ are vectors of coefficients to be estimated; and

- -

- ε is the error term.

3. Results and Discussion

3.1. Interpretation of Results

3.2. Hedonic Price Model Estimates

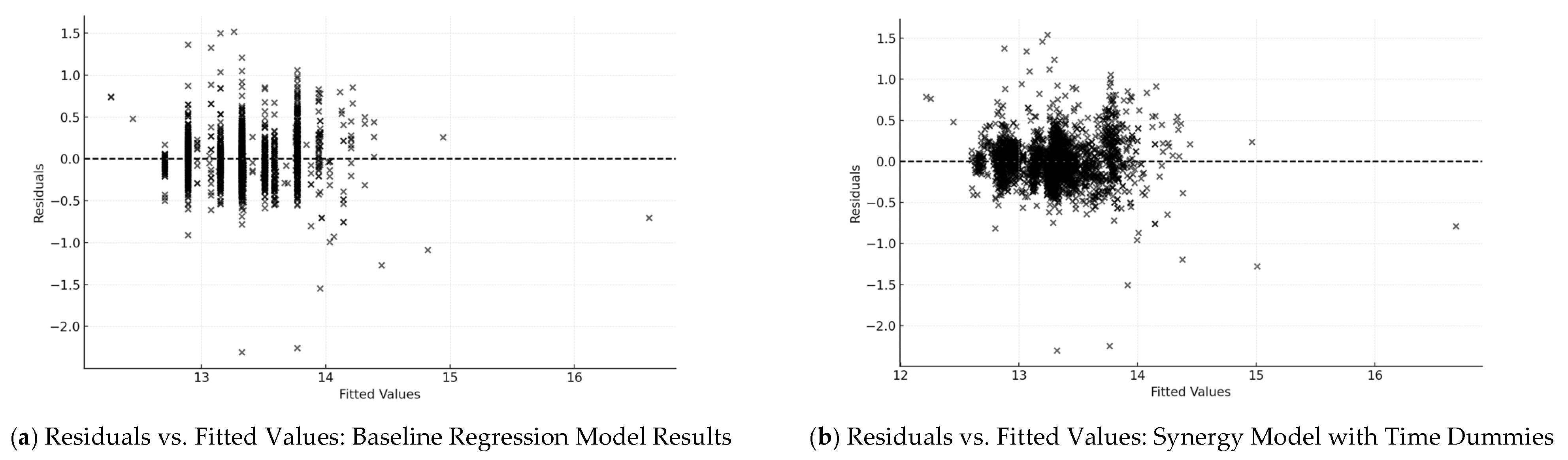

3.2.1. Baseline Model

3.2.2. Extended Model

3.3. Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| QWB | Queen Wharf Brisbane |

| CRR | Cross River Rail |

| CBD | Central Business District |

| VIF | Variance Inflated Factors |

Appendix A

References

- Almeida, R.; Brandão, M.; Torres, R.; Patrício, P.; Amaral, P. An assessment of the impacts of large-scale urban projects on land values: The case of Belo Horizonte, Brazil. Pap. Reg. Sci. 2021, 100, 517–559. [Google Scholar] [CrossRef]

- Sankaran, S.; Freeder, D.; Pitsis, A.; Clegg, S.; Drouin, N.; Caron, M.-A. Megaprojects. In Oxford Bibliographies in Urban Studies; Oxford Bibliographies: Oxford, UK, 2021. [Google Scholar] [CrossRef]

- Flyvbjerg, B. What you should know about megaprojects and why: An overview. Proj. Manag. J. 2014, 45, 6–19. [Google Scholar] [CrossRef]

- Swyngedouw, E.; Moulaert, F.; Rodriguez, A. Neoliberal Urbanization in Europe: Large–Scale Urban Development Projects and the New Urban Policy. Antipode 2002, 34, 542–577. [Google Scholar] [CrossRef]

- Hamnett, C.; Shoval, N. Museums as Flagships of Urban Development. In Cities and Visitors; Hoffman, L.M., Fainstein, S.S., Judd, D.R., Eds.; John Wiley & Sons: Oxford, UK, 2003; pp. 219–236. [Google Scholar] [CrossRef]

- Shaw, K.; Montana, G. Place-Making in Megaprojects in Melbourne. Urban Policy Res. 2014, 34, 166–189. [Google Scholar] [CrossRef]

- Alonso, W. Location and Land Use: Toward a General Theory of Land Rent; Harvard University Press: Cambridge, MA, USA, 1964. [Google Scholar]

- Mills, E.S. An aggregative model of resource allocation in a metropolitan area. Am. Econ. Rev. 1967, 57, 197–210. Available online: https://www.jstor.org/stable/1821621 (accessed on 1 March 2024).

- Muth, R.F. Cities and Housing: The Spatial Pattern of Urban Residential Land Use; University of Chicago Press: Chicago, IL, USA, 1969. [Google Scholar]

- Zegras, C. Metropolitan Governance for Sustainable Mobility. Available online: https://www.researchgate.net/publication/322328623 (accessed on 1 March 2024).

- Yuan, H.; Du, W.; Wang, Z.; Song, X. Megaproject Management Research: The Status Quo and Future Directions. Buildings 2021, 11, 567. [Google Scholar] [CrossRef]

- Metaxas, T.; Gallego, J.S.; Juarez, L. Sustainable urban development and the role of mega-projects: Experts’ view about Madrid Nuevo Norte Project. J. Infrastruct. Policy Dev. 2003, 7, 2161. [Google Scholar] [CrossRef]

- Altshuler, A.; Luberoff, D. Mega-Projects: The Changing Politics of Urban Public Investment; Brookings Institution Press: Washington, DC, USA, 2003; Available online: http://www.jstor.org/stable/10.7864/j.ctvb9384v (accessed on 1 March 2024).

- Siemiatycki, M. Riding the wave: Explaining cycles in urban mega-project development. J. Econ. Policy Reform 2013, 16, 160–178. [Google Scholar] [CrossRef]

- del Cerro Santamaría, G. Megaprojects, Development and Competitiveness: Building the Infrastructure for Globalization and Neoliberalism. Athens J. Soc. Sci. 2019, 6, 263–290. [Google Scholar] [CrossRef]

- Flyvbjerg, B. Introduction—The Iron Law of Megaprojects’. In The Oxford Handbook of Megaproject Management, 1st ed.; Flyvbjerg, B., Ed.; Oxford University Press Inc.: London, UK, 2017; pp. 1–19. [Google Scholar]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Megaprojects and Risk: An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2014; pp. 1–207. [Google Scholar] [CrossRef]

- Flyvbjerg, B.; Bester, D.W. The Cost-Benefit Fallacy: Why Cost-Benefit Analysis Is Broken and How to Fix It. J. Benefit-Cost Anal. 2021, 12, 395–419. [Google Scholar] [CrossRef]

- Cottafava, D.; Corazza, L.; Shams Esfandabadi, Z.; Torchia, D. Megaprojects from the lens of business and management studies: A systematic literature review. J. Public Aff. 2024, 24, e2937. [Google Scholar] [CrossRef]

- Machiels, T.; Compernolle, T.; Coppens, T. Real option applications in megaproject planning: Trends, relevance and research gaps. A literature review. Eur. Plan. Stud. 2020, 29, 446–467. [Google Scholar] [CrossRef]

- Platoni, S.; Timpano, F. The Economics of Mega-projects. In Megaproject Management. Springer Briefs in Applied Sciences and Technology; Favari, E., Cantoni, F., Eds.; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Raco, M.; Henderson, S. Flagship Regeneration in a Global City: The Re-making of Paddington Basin. Urban Policy Res. 2009, 27, 301–314. [Google Scholar] [CrossRef]

- Senaratne, S.; KC, A.; Rai, S. Stakeholder management challenges and strategies for sustainability issues in megaprojects: Case studies from Australia. Built Environ. Proj. Asset Manag. 2024, 14, 414–431. [Google Scholar] [CrossRef]

- Ang, K.C.S.; Sankaran, S.; Drouin, N. Social value from megaprojects and their governance. In Research Handbook on the Governance of Projects; Edward Elgar Publishing: Cheltenham, UK, 2023; Chapter 9; pp. 103–115. [Google Scholar]

- Jajamovich, G.; Silvestre, G.; Duque Franco, I. The symbolic dimensions of waterfront regeneration projects: Inter-referencing, legitimating strategies and circulating practices in three Latin American megaprojects. Camb. J. Reg. Econ. Soc. 2025, rsaf001. [Google Scholar] [CrossRef]

- Silvestre, G.; Jajamovich, G. The afterlives of urban megaprojects: Grounding policy models and recirculating knowledge through domestic networks. Environ. Plan. C 2022, 40, 1455–1472. [Google Scholar] [CrossRef]

- Robinson, J.; Wu, F.; Harrison, P.; Wang, Z.; Todes, A.; Dittgen, R.; Attuyer, K. Beyond variegation: The territorialisation of states, communities and developers in large-scale developments in Johannesburg, Shanghai and London. Urban Stud. 2022, 59, 1715–1740. [Google Scholar] [CrossRef]

- Song, Z.; Cao, M.; Han, T.; Hickman, R. Public transport accessibility and housing value uplift: Evidence from the Docklands light railway in London. Case Stud. Transp. Policy 2019, 7, 607–616. [Google Scholar] [CrossRef]

- Bozhya-Volya, A.; Tretiakova, E.; Bartov, O. Cities’ sustainable development: Revealing interproject synergies and trade-offs and making them manageable. Public Adm. Issue 2023, 5, 130–146. [Google Scholar]

- Klingmann, A. Rescripting Riyadh: How the capital of Saudi Arabia employs urban megaprojects as catalysts to enhance the quality of life within the city’s neighborhoods. J. Place Manag. Dev. 2023, 16, 45–72. [Google Scholar] [CrossRef]

- Hübscher, M. Two Megaprojects—One City. Learning between Large-Scale Urban Development Projects on Tenerife, Spain. In Urban Dynamics in the Post-Pandemic Period; Navarro-Jurado, E., Larrubia Vargas, R., Almeida-García, F., Natera Rivas, J.J., Eds.; The Urban Book Series; Springer: Cham, Switzerland, 2023. [Google Scholar] [CrossRef]

- Vankova, K.; Nakamura, H.; Witthöft, G. Synergistic Urban Improvement: Case Study of Hikifune Neighbourhood in Tokyo. Environ. Sci. Sustain. Dev. 2018, 3, 75–88. [Google Scholar] [CrossRef]

- Chen, Z.; Su, L.; Zhang, C. Research on the Synergy Degree of Aboveground and Underground Space along Urban Rail Transit from the Perspective of Urban Sustainable Development. Sustainability 2016, 8, 934. [Google Scholar] [CrossRef]

- Cantarelli, C.C.; Genovese, A. Innovation potential of megaprojects: A systematic literature review. Prod. Plan. Control 2021, 34, 1350–1370. [Google Scholar] [CrossRef]

- Ashkanani, S.; Franzoi, R. Gaps in megaproject management system literature: A systematic overview. Eng. Constr. Archit. Manag. 2023, 30, 1300–1318. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar]

- Malpezzi, S. Hedonic Pricing Models: A Selective and Applied Review. In Housing Economics and Public Policy; O’Sullivan, A., Gibb, K., Eds.; Wiley-Blackwell: Hoboken, NJ, USA, 2002; pp. 67–89. [Google Scholar] [CrossRef]

- Sirmans, G.S.; MacDonald, L.; Macpherson, D.A.; Zietz, E.N. The value of housing characteristics: A meta analysis. J. Real Estate Financ. Econ. 2006, 33, 215–240. [Google Scholar] [CrossRef]

- Cohen, J.P.; Coughlin, C.C. Spatial Hedonic Models of Airport Noise, Proximity, and Housing Prices. J. Reg. Sci. 2008, 48, 859–878. [Google Scholar] [CrossRef]

- Fernández-Avilés, G.; Minguez, R.; Montero, J.-M. Geostatistical air pollution indexes in spatial hedonic models: The case of Madrid, Spain. J. Real Estate Res. 2012, 34, 243–274. [Google Scholar] [CrossRef]

- Ridker, R.G.; Henning, J.A. The Determinants of Residential Property Values with Special Reference to Air Pollution. Rev. Econ. Stat. 1967, 49, 246–257. [Google Scholar]

- Smith, V.K.; Huang, J.-C. Can Markets Value Air Quality? A Meta-Analysis of Hedonic Property Value Models. J. Polit. Econ. 1995, 103, 209–227. [Google Scholar] [CrossRef]

- Haninger, K.; Ma, L.; Timmins, C. The Value of Brownfield Remediation. J. Assoc. Environ. Resour. Econ. 2017, 4, 197–241. [Google Scholar] [CrossRef]

- Shehata, W.; Abu Arqoub, M.; Langston, C.; Elkheshien, R.; Sarvimäki, M. From hard bed to luxury home: Impacts of reusing HM Prison Pentridge on property values. J. Hous. Built Environ. 2021, 36, 627–643. [Google Scholar] [CrossRef]

- Geniaux, G.; Napoléone, C. Semi-Parametric Tools for Spatial Hedonic Models: An Introduction to Mixed Geographically Weighted Regression and Geoadditive Models. In Hedonic Methods in Housing Markets: Pricing Environmental Amenities and Segregation; Baranzini, A., Ramirez, J., Schaerer, C., Thalmann, P., Eds.; Springer: New York, NY, USA, 2008; pp. 101–127. [Google Scholar] [CrossRef]

- Seo, K.; Salon, D.; Kuby, M.; Golub, A. Hedonic modeling of commercial property values: Distance decay from the links and nodes of rail and highway infrastructure. Transportation 2019, 46, 859–882. [Google Scholar] [CrossRef]

- Cervero, R.; Duncan, M. Transit’s value-added effects: Light and commuter rail services and commercial land values. Transp. Res. Rec. 2002, 1805, 8–15. [Google Scholar] [CrossRef]

- Dubé, J.; Thériault, M.; Des Rosiers, F. Commuter rail accessibility and house values: The case of the Montreal South Shore, Canada, 1992–2009. Transp. Res. Part A Policy Pract. 2013, 54, 49–66. [Google Scholar] [CrossRef]

- Chernobai, E.; Reibel, M.; Carney, M. Nonlinear Spatial and Temporal Effects of Highway Construction on House Prices. J. Real Estate Financ. Econ. 2011, 42, 348–370. [Google Scholar] [CrossRef]

- Mikelbank, B.A. Spatial analysis of the relationship between housing values and investments in transportation infrastructure. Ann. Reg. Sci. 2004, 38, 705–726. [Google Scholar] [CrossRef]

- Cajias, M. Is there room for another hedonic model?: The advantages of the CAMLSS approach in real estate research. J. Eur. Real Estate Res. 2018, 11, 204–245. [Google Scholar] [CrossRef]

- Cajias, M.; Ertl, S. Spatial effects and non-linearity in hedonic modeling: Will large data sets change our assumptions? J. Prop. Invest. Financ. 2018, 36, 32–49. [Google Scholar] [CrossRef]

- Sirmans, S.; Macpherson, D.; Zietz, E. The Composition of Hedonic Pricing Models. J. Real Estate Lit. 2005, 13, 1–44. [Google Scholar] [CrossRef]

- Bourassa, S.; Cantoni, E.; Hoesli, M. Predicting House Prices with Spatial Dependence: A Comparison of Alternative Methods. J. Real Estate Res. 2010, 32, 139–160. [Google Scholar] [CrossRef]

- Brunauer, W.A.; Lang, S.; Wechselberger, P.; Bienert, S. Additive hedonic regression models with spatial scaling factors: An application for rents in Vienna. J. Real Estate Financ. Econ. 2010, 41, 390–411. [Google Scholar] [CrossRef]

- Mason, C.; Quigley, J.M. Non-parametric hedonic house prices. Hous. Stud. 1996, 11, 373–386. [Google Scholar] [CrossRef]

- Pace, K. Appraisal Using Generalized Additive Models. J. Real Estate Res. 1998, 15, 77–99. [Google Scholar] [CrossRef]

- DBC. Queens Wharf Brisbane. 2024. Available online: https://queenswharfbrisbane.com.au/ (accessed on 25 February 2024).

- Building Queensland. Cross River Rail Business Case. 2017. Available online: https://cabinet.qld.gov.au/documents/2017/Aug/CRRBusCase/Attachments/BusinessCase.pdf (accessed on 25 February 2024).

- Cross River Rail Delivery Authority. 2024. Available online: https://crossriverrail.qld.gov.au/ (accessed on 25 February 2024).

- GlobalData Plc. Do TMR—Brisbane Cross River Rail—Queensland—Project Profile; GlobalData Plc: London, UK, 2018. [Google Scholar]

- GlobalData Plc. AEG—Brisbane Live Entertainment Precint—Queensland—Project Profile; GlobalData Plc: London, UK, 2018. [Google Scholar]

- Brisbane Development. 2024. Available online: https://brisbanedevelopment.com/brisbane-live/ (accessed on 25 February 2024).

- GlobalData Plc. QG—Queen’s Wharf Redevelopment—Queensland—Construction Project Profile; GlobalData Plc: London, UK, 2016. [Google Scholar]

- Infrastructure Partnerships Australia. Brisbane Live. 2020. Available online: https://infrastructurepipeline.org/project/brisbane-live (accessed on 25 February 2024).

- Infrastructure Partnerships Australia. Cross River Rail—Tunnel, Stations and Development (TSD) PPP. 2020. Available online: https://infrastructurepipeline.org/project/cross-river-rail-tunnel-stations-and-development-tsd-ppp (accessed on 25 February 2024).

- Australian Property Institute (API). Defintions. 2024. Available online: https://www.api.org.au/standards/definitions/ (accessed on 25 February 2024).

- Oertel, C.; Willwersch, J.; Cajias, M. Do cross-border investors benchmark commercial real estate markets? J. Eur. Real Estate Res. 2020, 13, 83–103. [Google Scholar] [CrossRef]

- Zurada, J.; Levitan, A.; Guan, J. Non-Conventional Approaches to Property Value Assessment. J. Appl. Bus. Res. 2006, 22, 1–14. [Google Scholar] [CrossRef]

- Can, A. Specification and estimation of hedonic housing price models. Reg. Sci. Urban Econ. 1992, 22, 453–474. [Google Scholar] [CrossRef]

- Anselin, L. Spatial Econometrics: Methods and Models; Springer Science & Business Media: Berlin, Germany, 1998. [Google Scholar] [CrossRef]

- Basu, S.; Thibodeau, T.G. Analysis of Spatial Autocorrelation in House Prices. J. Real Estate Financ. Econ. 1998, 17, 61–85. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Cantoni, E.; Hoesli, M. Spatial Dependence, Housing Submarkets, and House Price Prediction. J. Real Estate Financ. Econ. 2007, 35, 143–160. [Google Scholar] [CrossRef]

- Pace, R.K.; Gilley, O.W. Using the Spatial Configuration of the Data to Improve Estimation. J. Real Estate Financ. Econ. 1997, 14, 333–340. [Google Scholar] [CrossRef]

- Brunsdon, C.; Fotheringham, A.S.; Charlton, M. Geographically weighted summary statistics—A framework for localised exploratory data analysis. Comput. Environ. Urban Syst. 2002, 26, 501–524. [Google Scholar] [CrossRef]

- Brunsdon, C.; Fotheringham, A.S.; Charlton, M.E. Geographically Weighted Regression: A Method for Exploring Spatial Nonstationarity. Geogr. Anal. 1996, 28, 281–298. [Google Scholar] [CrossRef]

- Wilhelmsson, M. Evaluating the price effects of multifamily and single-family housing construction on surrounding single-family homes in Stockholm: A difference-in-difference analysis. Int. J. Hous. Mark. Anal. 2023, 16, 103–126. [Google Scholar] [CrossRef]

- Agostini, C.A.; Palmucci, G.A. The anticipated capitalisation effect of a new metro line on housing prices. Fisc. Stud. 2008, 29, 233–256. [Google Scholar] [CrossRef]

| Project Stage | Brisbane Live | Cross River Rail | Queen’s Wharf Brisbane |

|---|---|---|---|

| Prospective | May 2018: Business case | Apr 2016: Authority announced | 2012–2014: Initial |

| Detailed Planning | June 2018: USD 5M business case | June 2016: USD 850M funding, Aug 2017: Business case | 2015–2016: Design |

| Announced | Feb 2023: USD 2.5B funding, Mar 2024: Site change | Sept 2017: EOIs opened | 2017: Plan approved |

| Under Procurement | Dec 2019: Market sounding | Apr 2019: Contract, July 2019: Financial close | 2018–2020: Construction |

| Under Delivery | 2027: Construction start | Jan 2020–2025: Construction | 2021–2024: Main works |

| Operational | 2030: Completion | 2026: Operations start | 2024–2030 staged |

| Variable | Description | Data Source |

|---|---|---|

| Sales Price | The transaction price of the residential property in Australian dollars (AUD) | PriceFinder |

| Sales Date | Date of when the transaction has occurred | PriceFinder |

| Bedrooms | The number of bedrooms in the property | PriceFinder |

| Bathrooms | The number of bathrooms in the property | PriceFinder |

| Car Parks | The number of car spaces associated with the property | PriceFinder |

| Longitudinal and Latitudinal Coordinates | The geographic coordinates of the property | Google Maps API |

| Scope | Key milestones | Website |

| Distance | Euclidian distance to megaproject | Feature Engineered |

| Variable | N | Mean | Median | SD | Min | MAX | |

|---|---|---|---|---|---|---|---|

| Continuous | Sales Price [AUD] | 2859 | 645,527 | 555,000 | 361,989 | 60,800 | 8,000,000 |

| Latitude | 2859 | ||||||

| Longitude | 2859 | ||||||

| Discrete | Rooms | 2859 | 1.93 | 2 | 0.66 | 0 | 7 |

| Bathrooms | 2859 | 1.66 | 2 | 0.53 | 0 | 7 | |

| Carparks | 2859 | 1.2 | 1 | 0.57 | 0 | 10 | |

| Dummies [1 = Yes, 0 = No] | 2016 [AUD] | 529 | 634,111 | 573,740 | 407,031 | 100,000 | 8,000,000 |

| 2017 [AUD] | 403 | 655,768 | 555,000 | 348,839 | 293,000 | 2,750,000 | |

| 2018 [AUD] | 443 | 652,726 | 560,000 | 354,976 | 260,000 | 4,000,000 | |

| 2019 [AUD] | 421 | 663,527 | 560,000 | 360,477 | 160,000 | 3,500,000 | |

| 2020 [AUD] | 395 | 614,021 | 540,000 | 318,676 | 200,000 | 3,000,000 | |

| 2021 [AUD] | 668 | 650,898 | 545,000 | 361,445 | 60,800 | 2,900,000 | |

| Distances | QWB centroid [km] | 2859 | 1.73 | 1.44 | 1.23 | 0.24 | 6.27 |

| Cross River Rail centroid [km] | 2859 | 1.56 | 1.13 | 1.22 | 0.06 | 5.58 | |

| Brisbane Live [km] | 2859 | 1.69 | 1.16 | 1.19 | 0.20 | 5.86 | |

| Synergies | QWB centroid [km] × Cross River Rail centroid [km] | 2859 | |||||

| QWB centroid [km] × Brisbane Live centroid [km] | 2859 | ||||||

| Brisbane Live centroid [km] × Cross River Rail centroid [km] | 2859 | ||||||

| Correlation Matrix 1 | Ln_Sales Price | Bedrooms | Bathrooms | Car Parks | Std Distance to QWB km | Std Distance to Brisbane Live km | Std Distance to Cross River Rail |

|---|---|---|---|---|---|---|---|

| Ln_Sales Price | 1 | 0.0000 *** | 0.0000 *** | 0.0000 *** | 0.1134 | 0.1778 | 0.0962 * |

| Bedrooms | 0.7217 | 1 | 0.0000 *** | 0.0000 *** | 0.0157 ** | 0.0021 *** | 0.8288 |

| Bathrooms | 0.6162 | 0.7148 | 1 | 0.0000 *** | 0.0717 * | 0.0252 ** | 0.0137 ** |

| Car Parks | 0.5551 | 0.513 | 0.3282 | 1 | 0.0000 *** | 0.0000 *** | 0.0000 *** |

| Std Distance to QWB km | 0.0296 | 0.0452 | 0.0337 | 0.1538 | 1 | 0.0000 *** | 0.0000 *** |

| Std Distance to Brisbane Live km | −0.0252 | −0.0575 | −0.0418 | 0.1115 | 0.914 | 1 | 0.0000 *** |

| Std Distance to Cross River Rail | 0.0311 | −0.004 | −0.0461 | 0.1944 | 0.7565 | 0.7992 | 1 |

| Dependent Variable | Ln(Sales Price (AUD)) |

|---|---|

| Independent Variables | |

| Constant | 12.2724 (0.021) |

| Bedroom | 0.2606 *** |

| Bathrooms | 0.1723 *** |

| Carparks | 0.1853 *** |

| Observations | 2859 |

| R2 | 0.592 |

| Adjusted R2 | 0.592 |

| F Statistic | 841.7 *** (df = 3; 2855) |

| Dependent Variable | Ln(Sales Price (AUD)) |

|---|---|

| Independent Variables | |

| Constant | 12.3002(0.019) *** |

| Bedroom | 0.2717 (0.012) *** |

| Bathrooms | 0.1628 (0.013) *** |

| Carparks | 0.1947 (0.010) *** |

| Distance to QWB | −0.0606 (0.018) *** |

| Distance to Northshore Hamilton | 0.1463 (0.022) *** |

| Distance to Brisbane Live | −0.0728 (0.016) *** |

| QWB × Brisbane Live | 0.1766 (0.021) *** |

| QWB × Cross River Rail | −0.1106 (0.035) ** |

| Brisbane Live × Cross River Rail | −0.0924 (0.023) *** |

| Year 2016 | -- |

| Year 2017 | −0.0269 (0.017) |

| Year 2018 | −0.0410 (0.016) ** |

| Year 2019 | −0.0725(0.017) *** |

| Year 2020 | −0.0471 (0.017) ** |

| Year 2021 | −0.0201 (0.015) |

| Observations | 2859 |

| R2 | 0.616 |

| Adjusted R2 | 0.614 |

| F Statistic | 326.3 *** (df = 14; 2844) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Neuger, M.; Susilawati, C. Urban Megaprojects from Isolation to Integration: A Property Market Perspective on Flagship Buildings. Buildings 2025, 15, 1156. https://doi.org/10.3390/buildings15071156

Neuger M, Susilawati C. Urban Megaprojects from Isolation to Integration: A Property Market Perspective on Flagship Buildings. Buildings. 2025; 15(7):1156. https://doi.org/10.3390/buildings15071156

Chicago/Turabian StyleNeuger, Maximilian, and Connie Susilawati. 2025. "Urban Megaprojects from Isolation to Integration: A Property Market Perspective on Flagship Buildings" Buildings 15, no. 7: 1156. https://doi.org/10.3390/buildings15071156

APA StyleNeuger, M., & Susilawati, C. (2025). Urban Megaprojects from Isolation to Integration: A Property Market Perspective on Flagship Buildings. Buildings, 15(7), 1156. https://doi.org/10.3390/buildings15071156