The Internationalization of the Turkish HVAC Industry in Germany: Drivers, Challenges, and Success Factors

Abstract

1. Introduction

2. Literature Review

2.1. Internationalization

2.2. HVAC Industry

2.3. Theoretical Approach

“Alliances belonging to groups of companies that function together to achieve an economic objective and cooperate based on joint development projects, while complementing on another and specializing to solve common challenges and reaching a collective efficient goal, while conquering markets that would have been too difficult to reach on their own.”.(Foghani, Mahadi, and Omar, [24] p. 2)

3. Methodology

- ⬤

- An extensive literature review was carried out all through the research period.

- ⬤

- The interviews were recorded through audio recording with the permission of the participants in order to prevent data loss.

- ⬤

- The interview questions were revised by an expert academician and an experienced manager from the HVAC industry. This process was performed to ensure methodological rigor in the design of the research.

- ⬤

- A pre-interview with a manager was conducted to test the clarity of the interview questions. The outcomes of the pilot interview were reviewed with an expert academician, and the validity of the questions was confirmed.

- ⬤

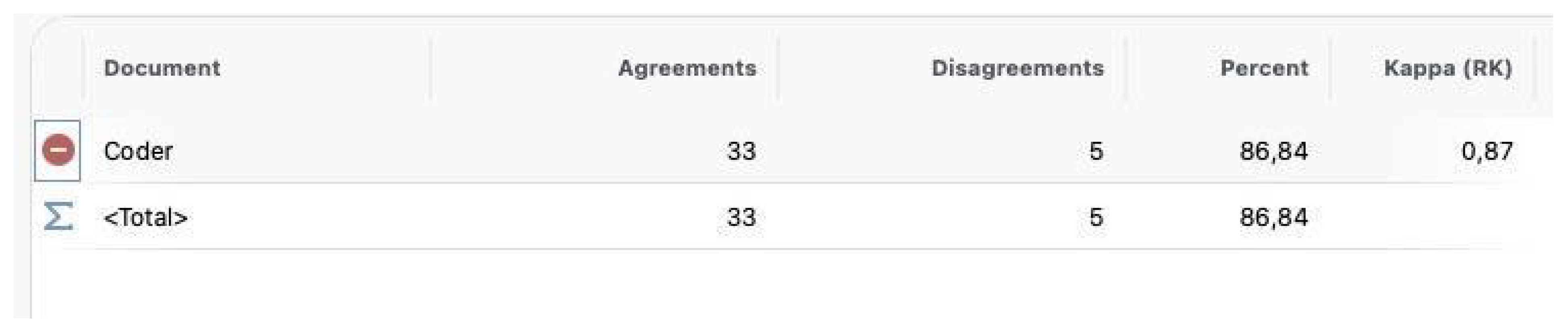

- To guarantee the reliability of the qualitative analysis, intercoder reliability was assessed. The check demonstrated an agreement rate of 86.84% with a Cohen’s Kappa of 0.87, exceeding the minimum threshold of 80% and confirming the internal consistency of the coding process. The below Figure 1 shows the Cohen’s Kappa coefficient of the research.

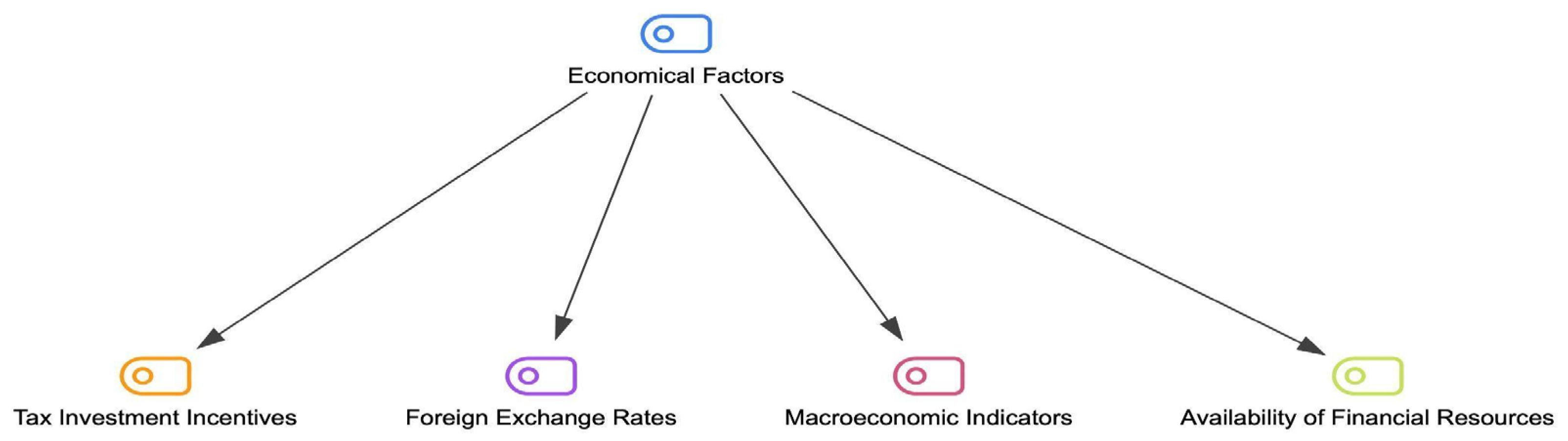

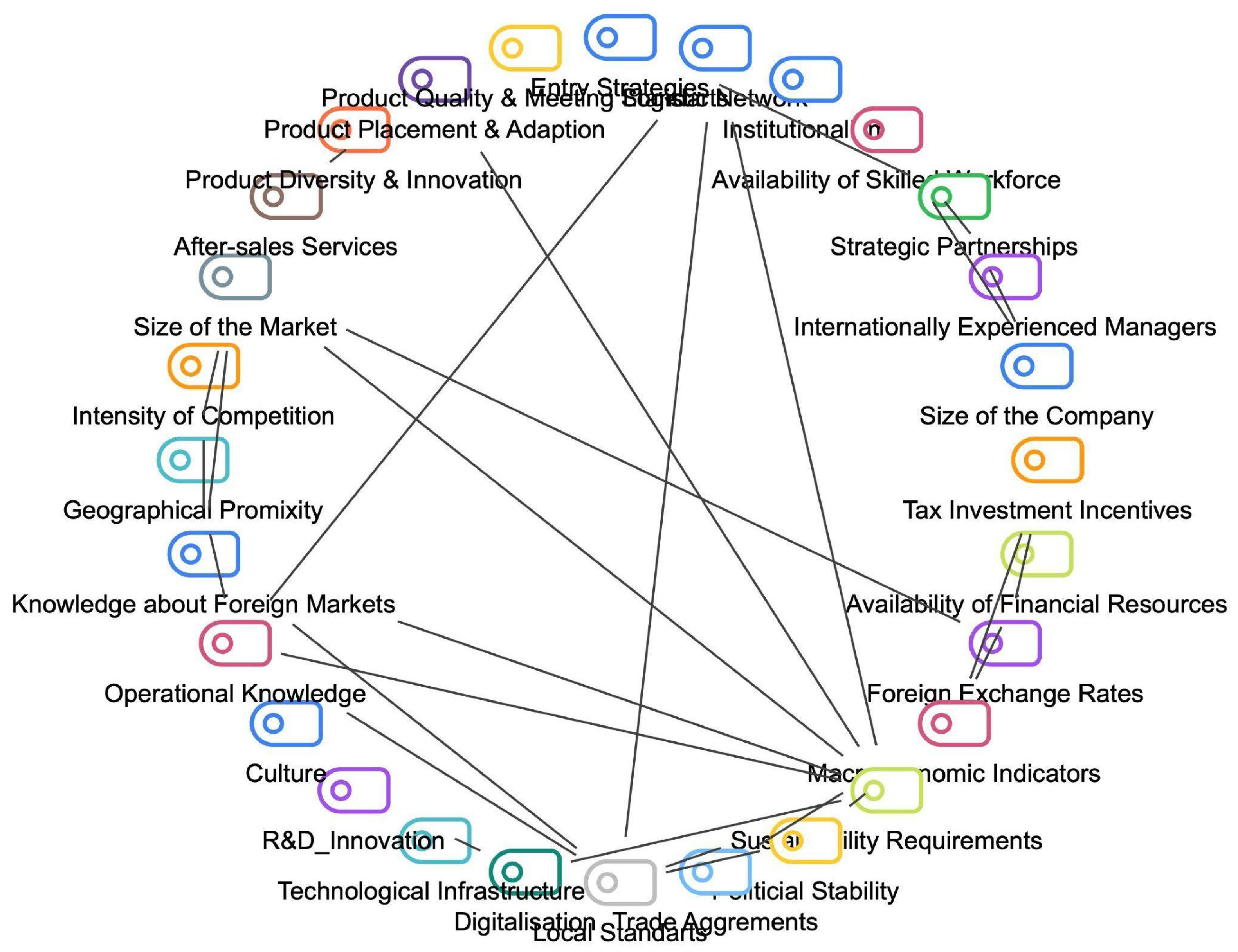

3.1. Economic Factors

“… Access to finance is important, in order to make the investments with affordable financial resources. However, there are challenges here as well, there have always been issues…”

“... Macroeconomic indicators only influence the timing of your investment. Trade continues regardless; it persists when indicators are down and when they are up. So, while these indicators do affect your investment decisions, they do so in terms of when to invest, not whether to invest…”

“Germany’s low inflation rate and stable interest rate policy ensure price stability in long-term contracts”.

“... Tax incentives play a crucial role. For example, the European Union encourages renewable energy use by offering a 50% tax reduction to customers who replace their old boiler or heating system with a renewable energy-based solution, like a heat pump. Such incentives significantly lower costs for individuals transitioning to renewable energy and help promote sustainable energy solutions…”

“... The parity of USD/EUR makes the export to Germany more favorable as we supply in USD from China”.

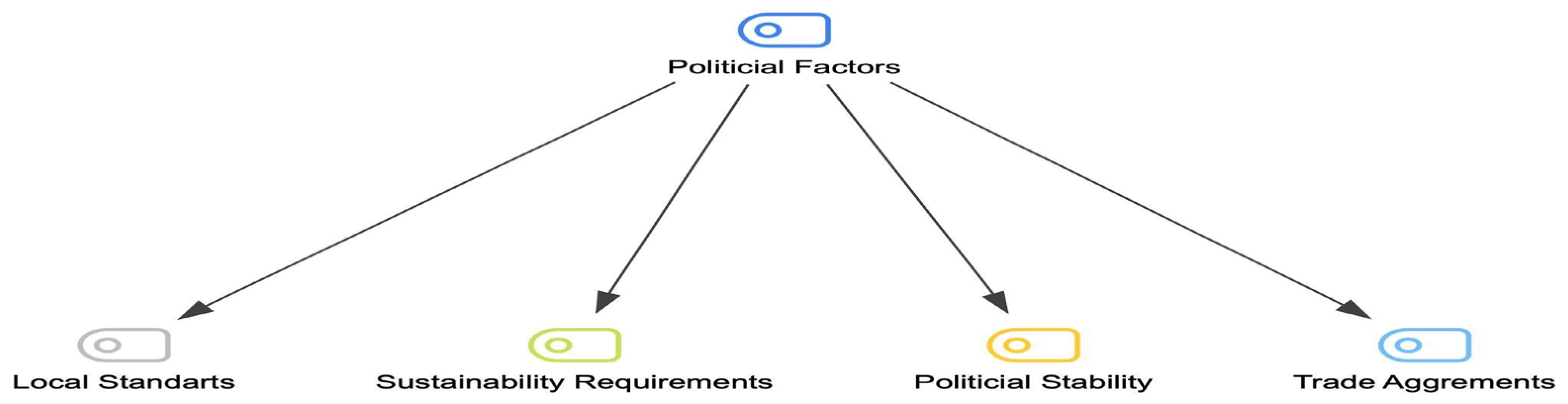

3.2. Political Factors

“... Political stability is one of the factors that already impacts the decision-making process of entry. If political stability means that the plans you make today can be entirely altered tomorrow due to factors beyond your control, then you likely wouldn’t want to enter that market…”

“... Trade agreements and regulations are important. In this regard, the HVAC sector’s relationship with the Turkish Ministry of Trade is going quite well. We are trying to push these forward, but it’s not always easy…”

“Standards and the Turkish Standards Institute (TSE) need to become more internationally recognized. Local laws, standards, and compliance requirements are important, and there are areas for improvement here as well…”

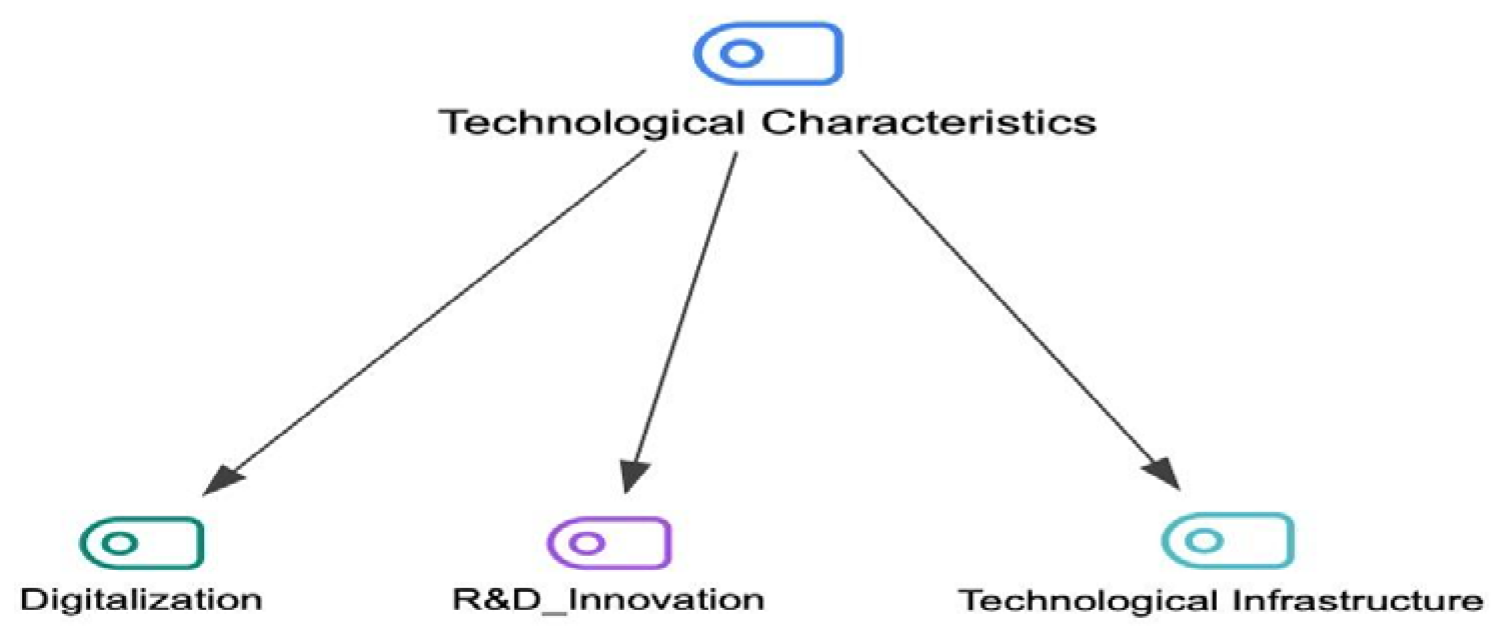

3.3. Technological Factors

“... Turkish companies often perceive R&D investments as unnecessary costs, which makes them fall behind Germany in the competitiveness”.

“... The more advanced the technological infrastructure, the more innovative the company becomes, reduces its costs and becomes a pioneer…”

“... Turkish HVAC is a sector that requires high technology. In this sector, digitalization, internet, remote access. In the future, artificial intelligence will come…”

“... All the processes of the German HVAC industry are followed by ERP systems which means they are totally digital…”

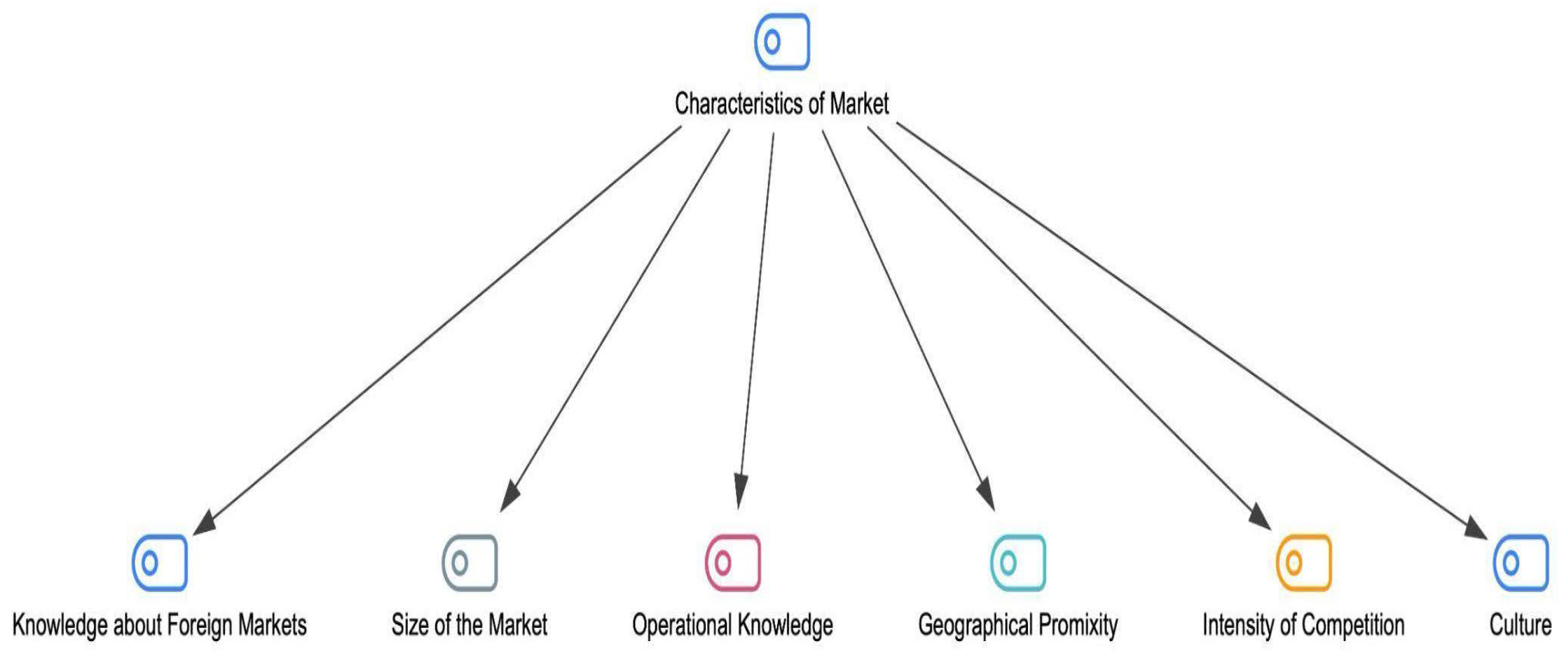

3.4. Factors of Market

“... Specifications in the Turkish HVAC industry are weaker compared to Germany. Therefore, we are improving our products in line with market demands, particularly as there is increasing demand for sustainable packaging”.

“... As a strategy we preferred to enter to the market by wholesalers or projects instead of distributors”.

“... Of course, it is very important to get information about the foreign markets, however it is very difficult for us to access this information. In fact, the Turkish Exporters’ Association (TIM) should be more active and gather detailed information rather than just graphics”.

“... Geographical proximity is important in terms of logistics and it is an advantage, especially for the HVAC industry as the products are bulky”.

“... We entered the Spanish market because the competition was not intense. There was a demand for flexible air ducts and no manufacturer…”

“... The companies are not interested in entering small markets anymore. If the market size is less than 1 million for them, they prefer to have a distributor in that market…”

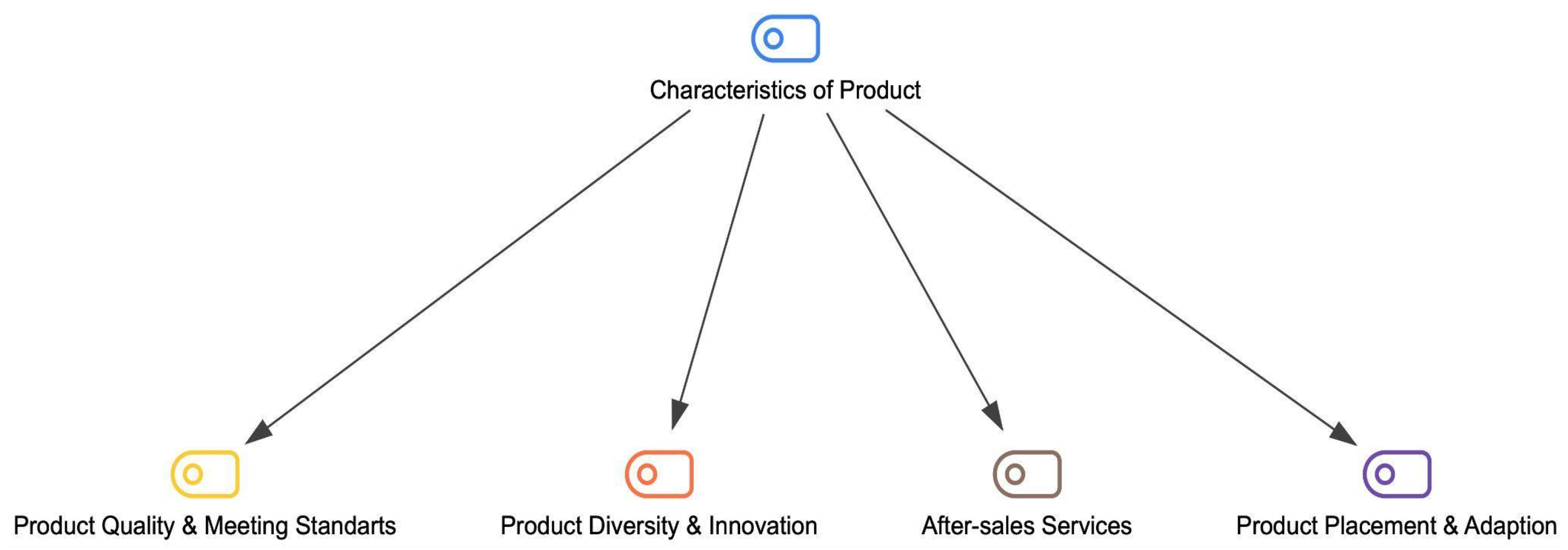

3.5. Factors of Product

“... It is impossible to be successful in internationalization without innovation, but it is also possible to be successful without diversity if a company’s products are very good…”

“... Although after-sales service is important for every industry, if you have products that need periodic maintenance, such as air conditioners, combi boilers, Heat-Pump or VRF systems, this becomes a necessity”.

“... In the past, ventilators were made from very thick sheets of metal. Then, Nikotra started using the thinnest metal sheets possible to find the optimal thickness. This approach enabled them to sell to the entire world.”

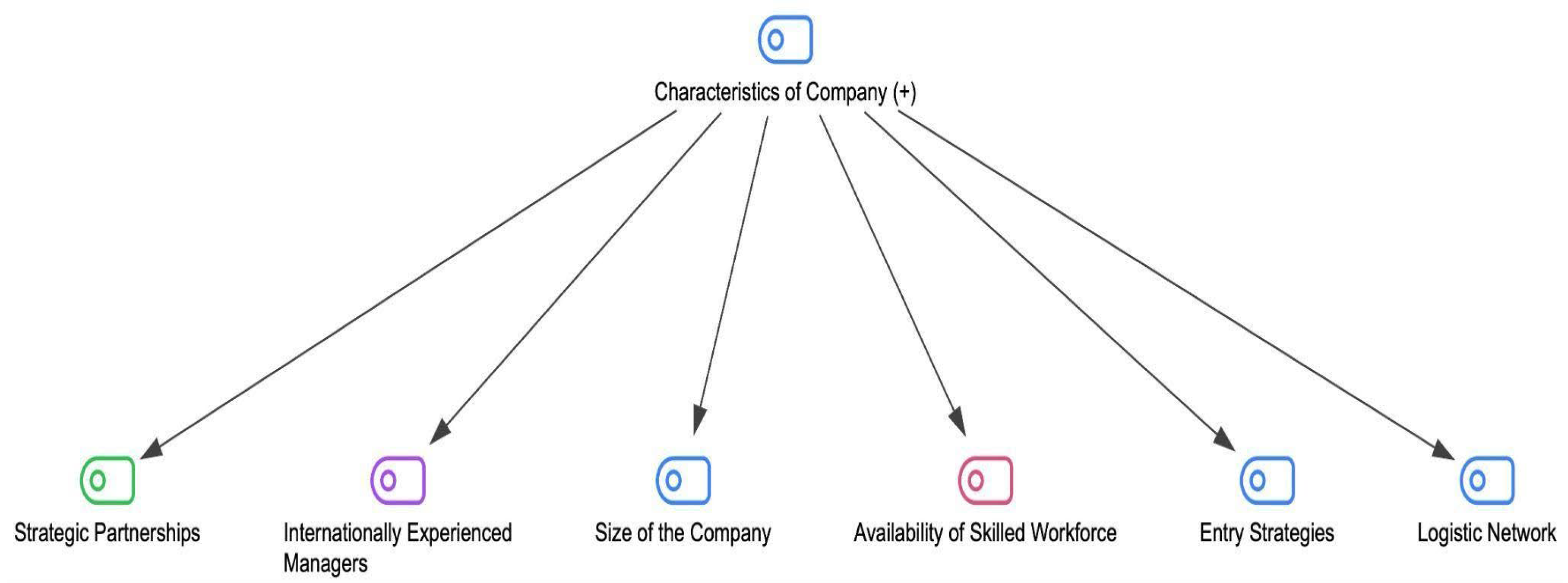

3.6. Factors of Organization

“The staff we have is fluent in German and this is very important for our success”

“... Strategic partnerships and collaborations are, of course, crucial. No matter how high the quality of your products is, it’s very difficult to promote them abroad and reach consumers if you don’t have local supporters, dealers, or distributors…”.

4. Discussion

5. Conclusions

6. Managerial Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Divrik, B.; Baykal, E. Turkish textile and clothing SMEs: Importance of organizational learning, digitalization, and internationalization. Autex Res. J. 2024, 24, 20230043. [Google Scholar] [CrossRef]

- Divrik, B.; Baykal, E. Relation of digitalization and internationalization for SMEs; Evidence from Turkish textile and clothing industry. J. Glob. Strateg. Manag. 2022, 16, 57–68. [Google Scholar] [CrossRef]

- Floriani, D.E.; Vasconcellos, S.L.D.; Morandi, C.L.; Andersson, S. Speed and longevity: Elements of the internationalization of technology-based firms. BBR. Braz. Bus. Rev. 2023, 20, 540–560. [Google Scholar] [CrossRef]

- Katebi, P.; Hoque, A.; Butt, O. Internationalization of Service Firms and Its Challenges: A Systematic Literature Review. Glob. Bus. Econ. J. 2023, 4, 22–56. [Google Scholar]

- Handoyo, S.; Yudianto, I.; Fitriyah, F.K. Critical success factors for the internationalisation of small–medium enterprises in indonesia. Cogent Bus. Manag. 2021, 8, 1923358. [Google Scholar] [CrossRef]

- Yılmaz, İ.C.; Yılmaz, D.; Kandemir, O.; Tekin, H.; Atabay, Ş.; Bulut Karaca, Ü. Barriers to BIM implementation in the HVAC industry: An exploratory study. Buildings 2024, 14, 788. [Google Scholar] [CrossRef]

- Domínguez Romero, E.; Durst, S.; Navarro Garcia, A. Rethinking internationalization processes: Toward a circular framework. Rev. Manag. Sci. 2024, 18, 3363–3394. [Google Scholar] [CrossRef]

- Tanrıverdi, Y. Bulanık Çok Kriterli Karar Verme Yöntemleri Ile Uluslararası Pazarlara Giriş Stratejilerinin Analizi. Doktora Tezi, Pamukkale Üniversitesi Sosyal Bilimler Enstitüsü, Denizli, Türkiye, 2023. [Google Scholar]

- Knight, G.A.; Cavusgil, S.T. Reprint: Innovation, Organizational Capabilities, and the Born-global Firm. In Key Developments in International Marketing: Influential Contributions and Future Avenues for Research; Springer International Publishing: Cham, Switzerland, 2024; pp. 17–54. [Google Scholar]

- Cavusgil, S.T.; Knight, G.; Riesenberger, J.R.; Rammal, H.G.; Rose, E.L. International Business; Pearson Australia: Melbourne, Australia, 2014. [Google Scholar]

- Chetty, S.; Campbell, H.C. Paths to internationalization among small and medium-sized firms: A global versus regional approach. Eur. J. Mark. 2003, 37, 796–820. [Google Scholar] [CrossRef]

- Nambisan, S.; Zahra, S.A.; Luo, Y. Global platforms and ecosystems: Implications for international business theories. J. Int. Bus. Stud. 2019, 50, 1464–1486. [Google Scholar] [CrossRef]

- Witt, M.A. De-globalization: Theories, predictions, and opportunities for international business research. J. Int. Bus. Stud. 2019, 50, 1053–1077. [Google Scholar] [CrossRef]

- Verbeke, A.; van Tulder, R.; Piscitello, L. International business and sustainable development goals. J. Int. Bus. Policy 2021, 4, 1–7. [Google Scholar] [CrossRef]

- Witt, M.A. De-globalization and decoupling: Conceptualization and implications for international business. J. Int. Bus. Policy 2023, 6, 1–10. [Google Scholar] [CrossRef]

- Liao, Y. Sustainable leadership: A literature review and prospects. Front. Psychol. 2022, 13, 1045570. [Google Scholar] [CrossRef]

- ASHRAE. ASHRAE Handbook: HVAC Systems and Equipment; American Society of Heating, Refrigerating and Air-Conditioning Engineers: Peachtree Corners, GA, USA, 2020. [Google Scholar]

- TOBB. HVAC Industry Report. 2018. Available online: https://www.tobb.org.tr/Documents/yayinlar/2018/Tobb_iklimlendirme%20%C3%A7al%C4%B1%C5%9Fmalar%C4%B1_bask%C4%B1.pdf (accessed on 27 June 2025).

- Wang, S.; Wang, X. Handbook of Air Conditioning and Refrigeration; McGraw-Hill: New York, NY, USA, 2013. [Google Scholar]

- Ashley, C.M. Recollections of Willis, H. Carrier. ASHRAE J.-Am. Soc. Heat. Refrig. Airconditioning Eng. 1994, 36, 50–54. [Google Scholar]

- TOBB. HVAC Industry Report. 2024. Available online: https://www.tobb.org.tr/Documents/yayinlar/2024/iklimlendirme%20raporu%20e-isbn.pdf (accessed on 27 June 2025).

- Kanter, R.M. Collaborative advantage: The Art of Alliances. Harv. Bus. Rev. 1994, 74, 96–108. [Google Scholar]

- Haapanen, L.; Juntunen, M.; Juntunen, J. Firms’ capability portfolios throughout international expansion: A latent class approach. J. Bus. Res. 2016, 69, 5578–5586. [Google Scholar] [CrossRef]

- Foghani, S.; Mahadi, B.; Omar, R. Promoting clusters and networks for small and medium enterprises to economic development in the globalization era. SAGE Open 2017, 7, 2158244017697152. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.S. A resource-based theory of strategic alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H.; Hesterly, W.S. The relational view revisited: A dynamic perspective on value creation and value capture. Strateg. Manag. J. 2018, 39, 3140–3162. [Google Scholar] [CrossRef]

- Gulati, R.; Nohria, N.; Zaheer, A. Strategic networks. Strateg. Manag. J. 2000, 21, 203–215. [Google Scholar] [CrossRef]

- Lavie, N. Attention, distraction, and cognitive control under load. Curr. Dir. Psychol. Sci. 2010, 19, 143–148. [Google Scholar] [CrossRef]

- Mitgwe, B. Theoretical milestones in international business: The journey to international entrepreneurship theory. J. Int. Entrep. 2006, 4, 5–25. [Google Scholar] [CrossRef]

- Burt, R. The contingent value of social capital. Adm. Sci. Q. 1997, 42, 339–365. [Google Scholar] [CrossRef]

- Granovetter, M.S. The strength of weak ties. Am. J. Sociol. 1973, 78, 1360–1380. [Google Scholar] [CrossRef]

- Boafo, C.; Owusu, R.A.; Guiderdoni-Jourdain, K. Understanding internationalisation of informal African firms through a network perspective. Int. Small Bus. J. 2022, 40, 618–649. [Google Scholar] [CrossRef]

- Alptekin, M.Y. Almanya’daki Türk Dernekleri ve Diyaspora Oluşturma Potansiyalleri: Duisburg-Essen Örneği. İnsan Hareketliliği Uluslararası Derg. 2024, 4, 14–43. [Google Scholar]

- Bagci, U.E.; Franz, M.; Yavan, N. Ethnic networks in the internationalization of Turkish food producers. ZFW–Adv. Econ. Geogr. 2022, 66, 201–210. [Google Scholar] [CrossRef]

- German-Turkish Chamber of Commerce and Industry. German Companies in Turkey Report; German-Turkish Chamber of Commerce and Industry: Istanbul, Türkiye, 2023. [Google Scholar]

- Yıldırım, A.; Şimşek, H. Sosyal Bilimlerde Nitel Araştırma Yöntemleri; Seçkin Yayıncılık: Ankara, Türkiye, 2016. [Google Scholar]

- Creswell, J.W. Nitel Araştırmacılar İçin 30 Temel Beceri; Anı Yayıncılık: Ankara, Türkiye, 2017. [Google Scholar]

- Merriam, S.B. Qualitative Research: A Guide to Design and İmplementation; Jossey-Bass: Hoboken, NJ, USA, 2009. [Google Scholar]

- Sandelowski, M. The Problem of Rigor in Qualitative Research. Adv. Nurs. Sci. 1986, 8, 27–37. [Google Scholar] [CrossRef]

- Hye, N.; Kenny, A.; Dickson-Swift, V. Methodology or method? A critical review of qualitative case study reports. Int. J. Qual. Stud. Health Well-Being 2014, 9, 23606. [Google Scholar]

- Patton, M.Q. Two decades of developments in qualitative inquiry: A personal, experiential perspective. Qual. Soc. Work 2002, 1, 261–283. [Google Scholar] [CrossRef]

- Welch, C.; Marschan-Piekkari, R.; Penttinen, H.; Tahvanainen, M. Corporate elites as informants in qualitative international business research. Int. Bus. Rev. 2002, 11, 611–628. [Google Scholar] [CrossRef]

- Lincoln, Y.S.; Guba, E.G. Naturalistic Inquiry; Sage: Thousand Oaks, CA, USA, 1985. [Google Scholar]

- Nowell, L.S.; Norris, J.M.; White, D.E.; Moules, N.J. Thematic analysis: Striving to meet the trustworthiness criteria. Int. J. Qual. Methods 2017, 16, 1–13. [Google Scholar] [CrossRef]

- Turkish Exporters Report TIM. 2024. Available online: https://tim.org.tr/files/downloads/Strateji_Raporlari/ihracat_2024_raporu-2.pdf (accessed on 27 June 2025).

- Steinhäuser, V.P.S.; Paula, F.D.O.; de Macedo-Soares, T.D.L.V.A. Internationalization of SMEs: A systematic review of 20 years of research. J. Int. Entrep. 2021, 19, 164–195. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Barłożewski, K.; Trąpczyński, P. Internationalisation motives and the multinationality-performance relationship: The case of Polish firms. Entrep. Bus. Econ. Rev. 2021, 9, 85–104. [Google Scholar] [CrossRef]

- Wen, H.; Liu, Y.; Zhou, F. Promoting the International Competitiveness of Small and Medium-Sized Enterprises Through Cross-Border E-Commerce Development. Sage Open 2023, 13, 1–16. [Google Scholar] [CrossRef]

- Chandra, A.; Paul, J.; Chavan, M. Internationalization barriers of SMEs from developing countries: A review and research agenda. Int. J. Entrep. Behav. Res. 2020, 26, 1281–1310. [Google Scholar] [CrossRef]

- Breuillot, A.; Bocquet, R.; Favre-Bonté, V. Navigating the internationalization process: Strategic resources for early internationalizing firms. J. Int. Entrep. 2022, 20, 282–315. [Google Scholar] [CrossRef]

- Jiang, G.; Kotabe, M.; Zhang, F.; Hao, A.W.; Paul, J.; Wang, C.L. The determinants and performance of early internationalizing firms: A literature review and research agenda. Int. Bus. Rev. 2020, 29, 101662. [Google Scholar] [CrossRef]

- Arredondo-Hidalgo, M.G.; Caldera-González, D.D.C.; Álvarez-Valadez, G. Strategic Analysis to Develop an Internationalization Plan for a Small Construction Company in Guanajuato, Mexico. Chin. Bus. Rev. 2018, 17, 209–222. [Google Scholar] [CrossRef]

- Buckley, P.J.; Casson, M. The internalization theory of the multinational enterprise: Past, present and future. Br. J. Manag. 2020, 31, 239–252. [Google Scholar] [CrossRef]

- Zaytseva, V.M.; Tsviliy, S.M.; Demko, V.S.; Klopov, I.O. Internalization of the investment environment in the international tourism industry. Apunt. Del CENES 2024, 43, 35–67. [Google Scholar] [CrossRef]

- Nambisan, S.; Luo, Y. Toward a loose coupling view of digital globalization. J. Int. Bus. Stud. 2021, 52, 1646–1663. [Google Scholar] [CrossRef]

- Luo, Y.; Tung, R.L. International expansion of emerging market enterprises: A springboard perspective. J. Int. Bus. Stud. 2007, 38, 481–498. [Google Scholar] [CrossRef]

- Eden, L.; Miller, S.R.; Khan, S.; Weiner, R.J.; Li, D. The event study in international business research: Opportunities, challenges, and practical solutions. J. Int. Bus. Stud. 2022, 53, 803. [Google Scholar] [CrossRef] [PubMed]

- Knight, G.A.; Cavusgil, S.T. Innovation, organizational capabilities, and the born-global firm. J. Int. Bus. Stud. 2004, 35, 124–141. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Feliciano-Cestero, M.M.; Ameen, N.; Kotabe, M.; Paul, J.; Signoret, M. Is digital transformation threatened? A systematic literature review of the factors influencing firms’ digital transformation and internationalization. J. Bus. Res. 2023, 157, 113546. [Google Scholar] [CrossRef]

- Kyove, J.; Streltsova, K.; Odibo, U.; Cirella, G.T. Globalization impact on multinational enterprises. World 2021, 2, 216–230. [Google Scholar] [CrossRef]

| Participant ID | Age | Participant ID | Age |

|---|---|---|---|

| P1 | 43 | P13 | 64 |

| P2 | 55 | P14 | 53 |

| P3 | 65 | P15 | 65 |

| P4 | 46 | P16 | 59 |

| P5 | 52 | P17 | 54 |

| P6 | 44 | P18 | 57 |

| P7 | 49 | P19 | 58 |

| P8 | 47 | P20 | 57 |

| P9 | 43 | P21 | 58 |

| P10 | 51 | P22 | 59 |

| P11 | 58 | P23 | 45 |

| P12 | 60 | P24 | 43 |

| (1) Corpus and Team Setup |

| 24 interviews, MAXQDA, two coders, six themes (Economic, Political, Technological, Market, Product, Organisation). |

| (2) Pre-analysis Setup |

| Verbatim transcription, IDs (P01–P24), metadata, reflexive memos. |

| (3) Codebook Generation |

| Deductive skeleton from literature, refined abductively with examples and include/exclude rules. |

| (4) Pilot Coding and Reliability |

| 3 transcripts coded independently ≥80% intercoder consensus achieved. |

| (5) Full Coding Workflow |

| 21 transcripts coded, alternating leads, weekly spot checks, consistency scans. |

| (6) Theme Development |

| Summaries per theme, code relations analysis, search for disconfirming evidence. |

| (7) Decision Log and Refinement |

| All changes logged (e.g., digitalisation split into operational vs market-facing). |

| (8) Example Code Refinement |

| Documentation in local language moved from Organisation to Market → |

| Adaptation |

| (9) Reliability Records |

| Consensus ≥80%, random 10% adjudicated, stability check with re-coding. |

| (10) Reproducibility Checklist |

| Final codebook, decision log, memos, anonymized quotes archived. |

| Dimension | Turkish HVAC Firms | German HVAC Firms |

| Policy Response | Benefit from EU Customs Union, but struggle with meeting stringent EU/German standards; rely on tax incentives (e.g., renewable energy support) and exchange rate advantages. Limited state support in standard-setting (TSE less recognized). | Strong policy alignment with EU/German regulations; stable macroeconomic environment; government-backed incentives for R&D, renewable energy, and sustainability adoption. |

| Technological Advantage | R&D often seen as a cost, leading to underinvestment; technological infrastructure improving but digitalization still fragmented; innovation pursued selectively in niche products. | Strong, continuous investment in R&D and innovation; advanced digitalization (ERP systems standard across firms); technological infrastructure supports global leadership. |

| Network Type | Heavy reliance on diaspora networks in Germany; project-based entry and wholesalers preferred over distributors; need stronger institutional/export association support. Strategic partnerships considered vital but inconsistently developed. | Embedded in global industry clusters and associations; strong professional and industrial networks; partnerships leveraged systematically to build long-term competitive advantage. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Divrik, B.; Karakaya, T.; Yaşar, O. The Internationalization of the Turkish HVAC Industry in Germany: Drivers, Challenges, and Success Factors. Buildings 2025, 15, 3392. https://doi.org/10.3390/buildings15183392

Divrik B, Karakaya T, Yaşar O. The Internationalization of the Turkish HVAC Industry in Germany: Drivers, Challenges, and Success Factors. Buildings. 2025; 15(18):3392. https://doi.org/10.3390/buildings15183392

Chicago/Turabian StyleDivrik, Bahar, Turhan Karakaya, and Okan Yaşar. 2025. "The Internationalization of the Turkish HVAC Industry in Germany: Drivers, Challenges, and Success Factors" Buildings 15, no. 18: 3392. https://doi.org/10.3390/buildings15183392

APA StyleDivrik, B., Karakaya, T., & Yaşar, O. (2025). The Internationalization of the Turkish HVAC Industry in Germany: Drivers, Challenges, and Success Factors. Buildings, 15(18), 3392. https://doi.org/10.3390/buildings15183392