Current Market Landscape and Industry Voices in Key Timber Construction Markets

Abstract

1. Introduction

1.1. Objectives of This Study

1.2. Research Approach and Methodology

2. Market Perspective and Industry Voices Towards Timber Construction

2.1. Global Market Overview

2.1.1. Timber Buildings with 1–8 Stories Segment to Keep Leadership from 2022 to 2031

2.1.2. Residential Building Segment to Maintain Leadership from 2022 to 2031

2.1.3. Europe to Maintain Market Dominance Through 2031

2.2. National and Regional Perspectives

2.2.1. Australia

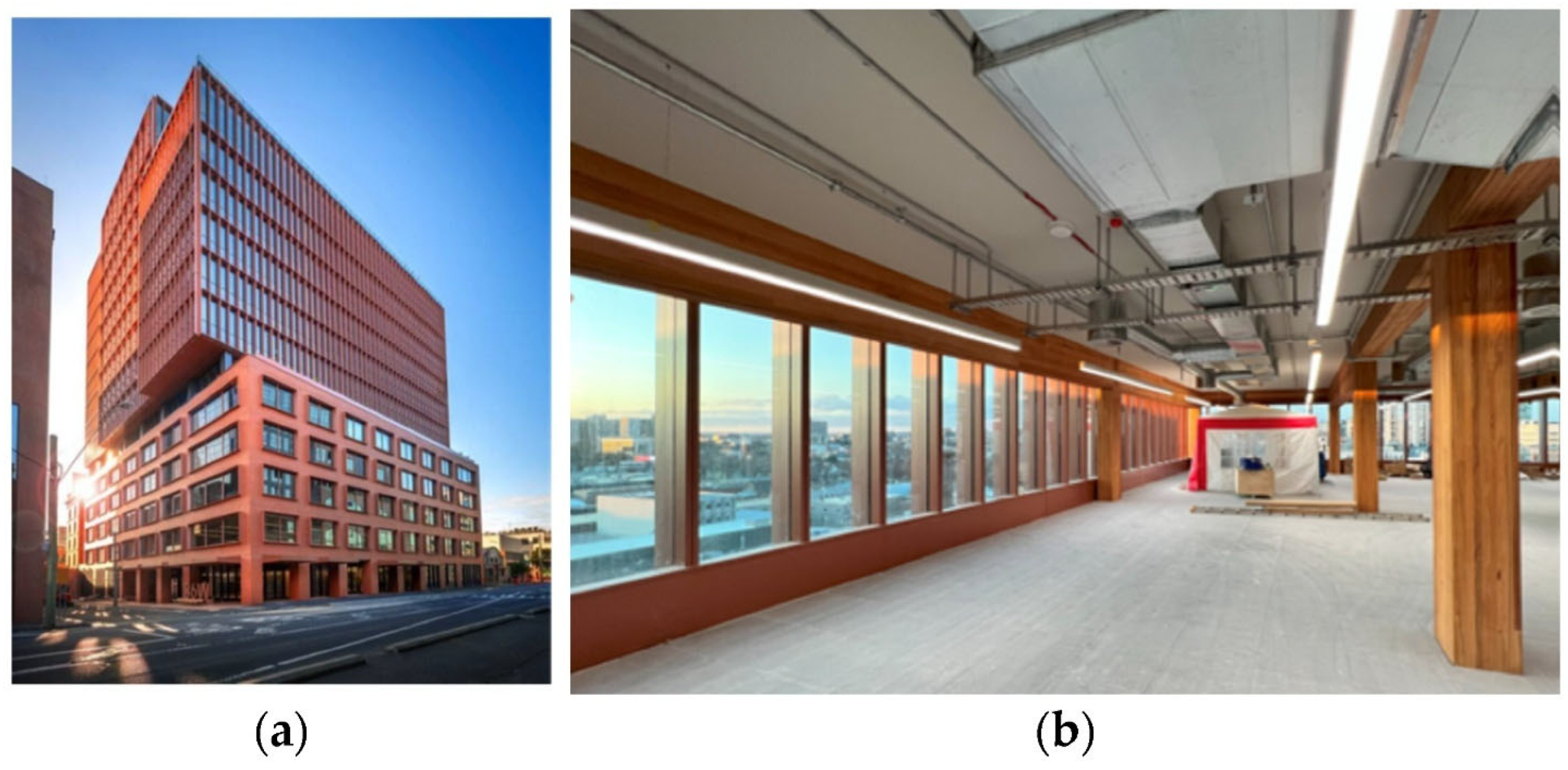

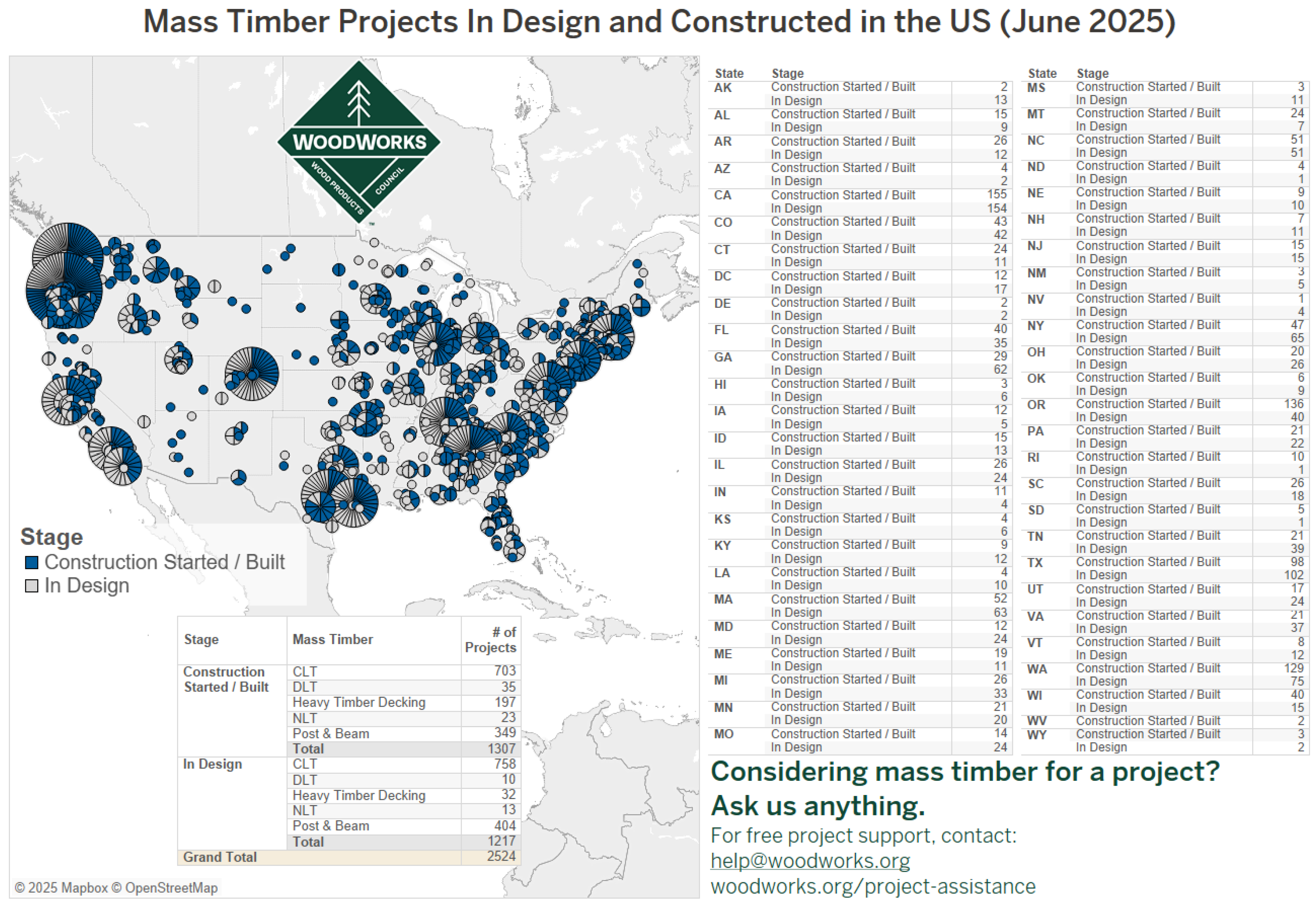

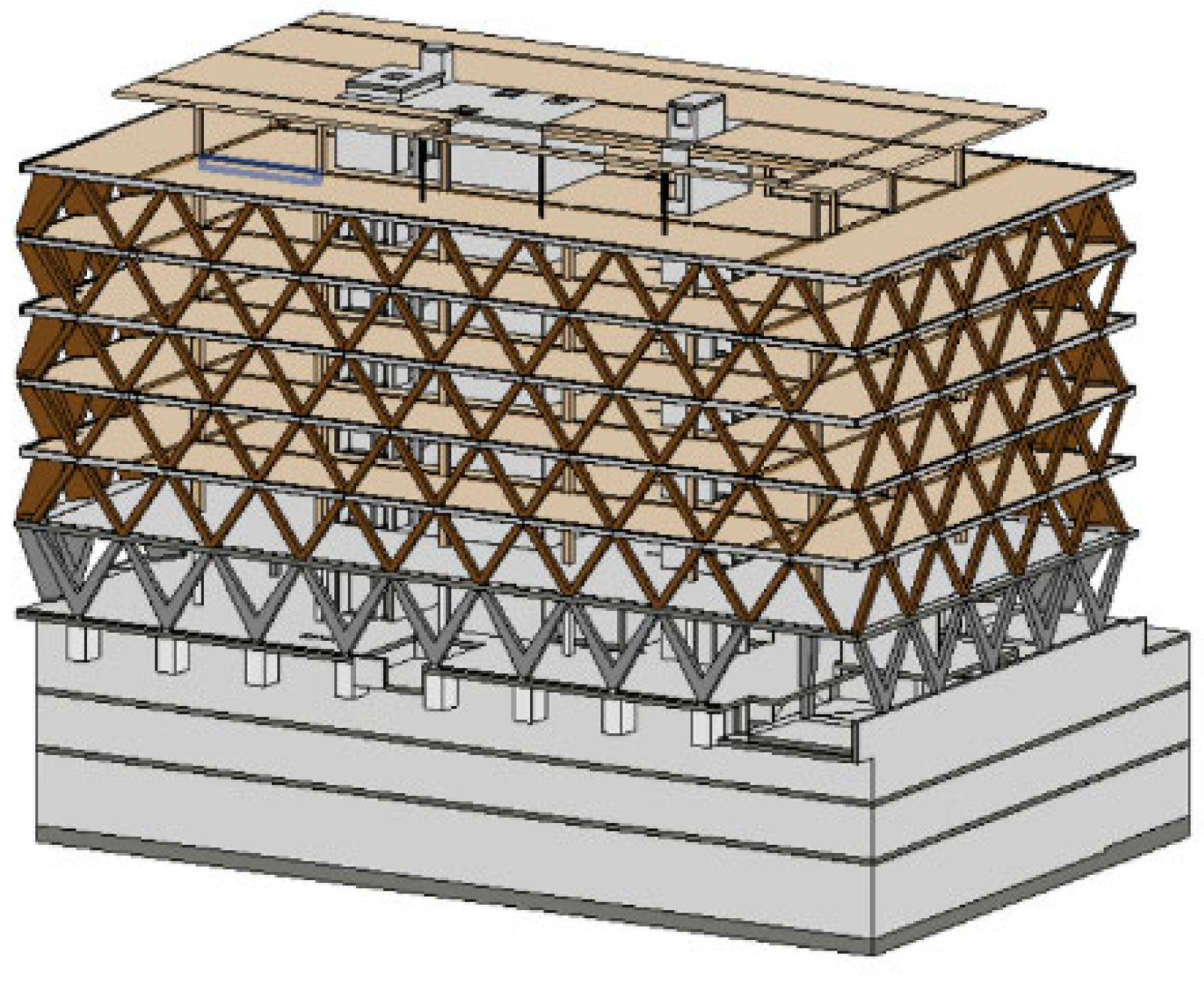

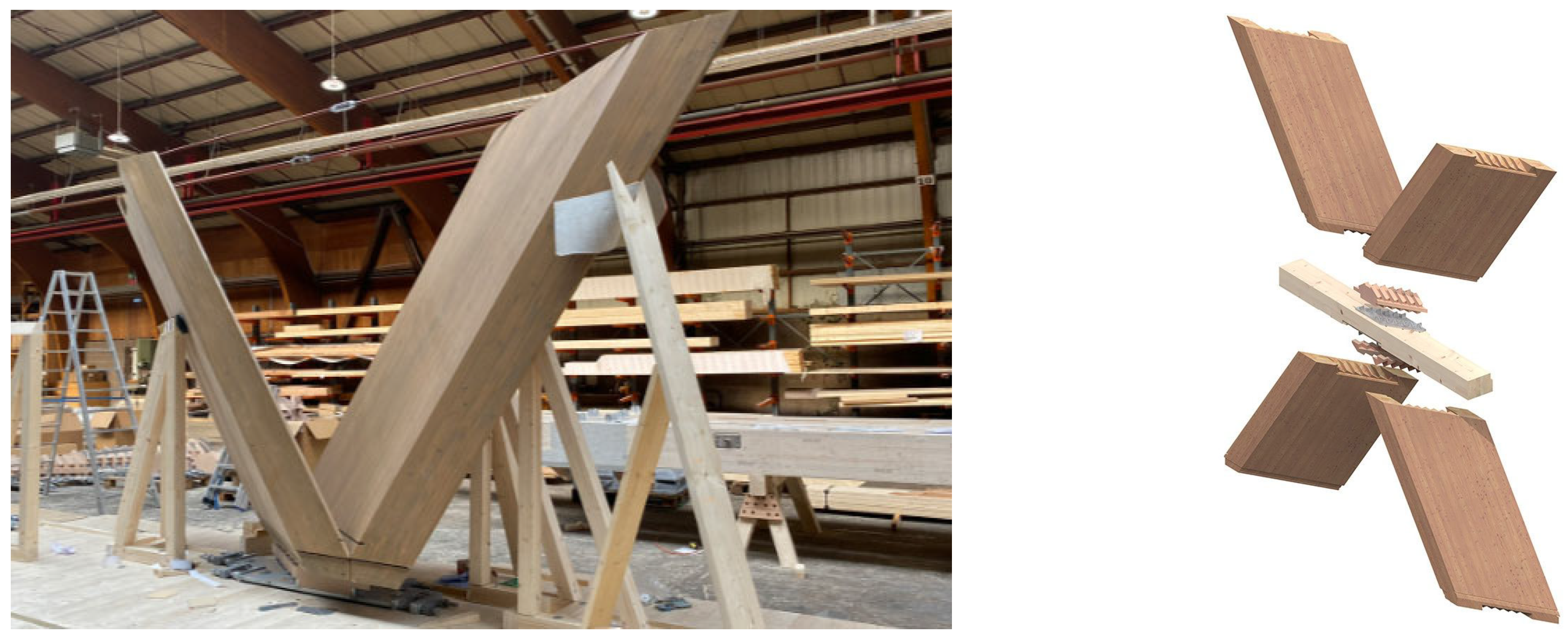

2.2.2. The United States of America

2.2.3. Austria

2.2.4. Switzerland

2.2.5. Sweden

2.2.6. Finland

2.2.7. SUDOE Region (Southwest France, Portugal and Spain)

2.2.8. Germany

- Knippershelbig GmbH, an internationally respected engineering design firm and structural designer of the proposed Burj Zanzibar (96 m), anticipated to become the world’s tallest timber building.

- Kaden + Lager GmbH, regarded as Germany’s trailblazer in multi-story timber architecture, with landmark projects such as Skaio (34 m, Heilbronn), Famju (20 m, Heilbronn), and WA 16 West in Munich’s Prinz-Eugen-Park.

- C4 Engineers GmbH, the structural engineering office behind The Cradle (22 m, Düsseldorf), Germany’s first circular-economy timber-hybrid office building.

2.2.9. China

2.2.10. Japan

2.2.11. New Zealand

2.2.12. Norway

2.2.13. Canada

2.3. Cross-Regional Insights and Discussion on Different Industrial Voices

3. Results, Discussions and Conclusions

3.1. Results and Discussions

- Europe maintains global leadership, underpinned by strong climate policy, advanced CLT/GLT production, and growing mid- and high-rise timber adoption. Europe accounts for more than half of global revenue and remains the most advanced market. Austria and Switzerland have strong export-oriented timber industries; Germany integrates timber into national climate strategies; and the Nordic countries continue to rely heavily on wood-frame traditions while moving toward high-rise timber. Policies such as France’s RE2020 and the German Holzbauinitiative provide regulatory pull, while digitalization and prefabrication improve competitiveness. Challenges persist in fire protection and labor shortages. Some countries in Europe, such as Switzerland, Norway, Finland, Austria and Germany, emphasize sustainability, digitalization, and regulatory innovation but echo recurring constraints of cost, permitting, and skills gaps.

- North America shows rapid project growth (particularly the U.S.) but still faces cost, code, and insurance barriers; Canada benefits from a more integrated strategy and significant production capacity.

- Australia and New Zealand advance through targeted financial programs (e.g., CEFC Timber Building Program, Mid-Rise Wood Programme), though domestic uptake remains uneven.

- Japan and China represent large-scale opportunities, supported by strong forest resources and government policies. Both countries, however, face technical and market challenges such as fire design, insurer acceptance, and supply chain maturity.

- Harmonized building codes (especially performance-based fire safety);

- Expanded financial incentives and procurement frameworks that internalize carbon benefits;

- Supply chain integration and scaling of prefabrication;

- Workforce upskilling to address gaps in timber engineering, digital construction, and sustainability competences.

3.2. Conclusions

- Market growth trajectory: The global market is expected to nearly double from 2021 to 2031, with Europe leading and the Asia-Pacific region showing the fastest growth potential.

- Opportunities: Carbon reduction, speed of construction, prefabrication, and biophilic benefits make timber an attractive alternative to steel and concrete.

- Barriers: Common hurdles include high upfront costs, regulatory and fire safety challenges, insurance constraints, and limited technical skills.

- Regional contrasts: Europe and Canada illustrate the benefits of integrated policy and industrial ecosystems; the U.S. demonstrates rapid project expansion but fragmented frameworks; Australia and New Zealand rely on targeted financing to overcome supply chain gaps; and China and Japan highlight how large markets can be mobilized by strong policy but still face cultural and technical barriers.

- Cross-cutting needs: Harmonized codes, financial and procurement incentives, integrated supply chains, and workforce training are the most frequently cited levers for scaling up adoption.

Funding

Conflicts of Interest

References

- United Nations Environment Programme. 2020 Global Status Report for Buildings and Construction. 2020. Available online: https://globalabc.org/sites/default/files/inline-files/2020%20Buildings%20GSR_FULL%20REPORT.pdf (accessed on 29 November 2024).

- Ramage, M.H.; Burridge, H.; Busse-Wicher, M.; Fereday, G.; Reynolds, T.; Shah, D.U.; Wu, G.; Yu, L.; Fleming, P.; Densley-Tingley, D.; et al. The wood from the trees: The use of timber in construction. Renew. Sustain. Energy Rev. 2017, 68, 333–359. [Google Scholar] [CrossRef]

- Gustavsson, L.; Pingoud, K.; Sathre, R. Carbon dioxide balance of wood substitution: Comparing concrete- and wood-framed buildings. Mitig. Adapt. Strateg. Glob. Change 2006, 11, 667–691. [Google Scholar] [CrossRef]

- Jones, D.; Brischke, C.; Humar, M. The Role of Timber in a Circular Bioeconomy. Eur. J. Wood Sci. 2016, 74, 15–26. [Google Scholar]

- Green, M.; Karsh, E. The Case for Tall Wood Buildings. 2012. Available online: https://cwc.ca/wp-content/uploads/2020/06/Second-Edition-The-Case-for-Tall-Wood-Buildings.pdf (accessed on 27 August 2025).

- Mishra, A.; Humpenöder, F.; Churkina, G.; Reyer, C.P.O.; Beier, F.; Bodirsky, B.L.; Schellnhuber, H.J.; Lotze-Campen, H.; Popp, A. Land use change and carbon emissions of a transformation to timber cities. Nat. Commun. 2022, 13, 4889. [Google Scholar] [CrossRef] [PubMed]

- Pramreiter, M.; Nenning, T.; Malzl, L.; Konnerth, J. A plea for the efficient use of wood in construction. Nat. Rev. Mater. 2023, 8, 217–218. [Google Scholar] [CrossRef]

- Stora, E. Mjøstårnet: The Tallest Timber Building. 2020. Available online: https://www.storaenso.com/-/media/documents/download-center/documents/annual-reports/2020/storaenso_annual_report_2020.pdf (accessed on 27 August 2025).

- Hines. T3 Collingwood. 2023. Available online: https://www.hines.com/properties/t3-collingwood-melbourne (accessed on 27 August 2025).

- Tensorflight. Mjøstårnet. A Wooden Skyscraper. 2025. Available online: https://tensorflight.com/mjostarnet-a-wooden-skyscrapper/ (accessed on 10 July 2025).

- Wikipedia. 2025. Available online: https://de.m.wikipedia.org/wiki/Datei:Mj%C3%B8st%C3%A5rnet.jpg (accessed on 18 August 2025).

- Wiehag. Ascent Tower. 2025. Available online: https://www.wiehag.com/en/references/ascent-tower/ (accessed on 10 July 2025).

- ICC. International Building Code (IBC). 2021. Available online: https://codes.iccsafe.org/content/IBC2021P2 (accessed on 15 March 2025).

- Espinoza, O.; Laguarda-Mallo, M.F.; Buehlmann, U. Mass Timber: US Market Outlook and Policy Landscape. For. Prod. J. 2019, 69, 232–243. [Google Scholar]

- Prnewswire. Mass Timber Construction Market to Reach $1.5 Billion, Globally, by 2031 at 6.0% CAGR: Allied Market Research. 2023. Available online: https://www.prnewswire.com/news-releases/mass-timber-construction-market-to-reach-1-5-billion-globally-by-2031-at-6-0-cagr-allied-market-research-301814502.html (accessed on 16 November 2024).

- Allan, B.; Eaton, D.; Leung, P. The Mass Timber Roadmap—An Integrated Forest-to-Buildings Value Chain. 2024. Available online: https://transitionaccelerator.ca/wp-content/uploads/2024/06/MT_Roadmap_Digital_vf.pdf (accessed on 18 December 2024).

- Churkina, G.; Organschi, A.; Reyer, C.P.O.; Ruff, A.; Vinke, K.; Liu, Z.; Reck, B.K.; Graedel, T.E.; Schellnhuber, H.J. Buildings as a global carbon sink. Nat. Sustain. 2020, 3, 269–276. [Google Scholar] [CrossRef]

- Riddle Anne, A. Mass Timber: Overview and Issues for Congress. Congressional Research Service (CRS) Reports and Issue Briefs. 2023. Available online: https://www.congress.gov/crs-product/R47752 (accessed on 28 August 2025).

- Abed, J.; Rayburg, S.; Rodwell, J.; Neave, M. A Review of the Performance and Benefits of Mass Timber as an Alternative to Concrete and Steel for Improving the Sustainability of Structures. Sustainability 2022, 14, 5570. [Google Scholar] [CrossRef]

- Ayanleye, S.; Udele, K.; Nasir, V.; Zhang, X.F.; Militz, H. Durability and protection of mass timber structures: A review. J. Build. Eng. 2022, 46, 103731. [Google Scholar] [CrossRef]

- Nath, S.K. Use Wood—Combat Climate Change. In Wood Is Good: Current Trends and Future Prospects in Wood Utilization; Springer: Singapore, 2017; pp. 469–478. [Google Scholar]

- Safarik, D.; Jacob, E.; Miranda, W. State of tall timber 2022. CTBUH J. 2022, 2022, 22–31. [Google Scholar]

- VSJF. Fairbanks Museum Home to Vermont’s First Demonstration Mass Timber Building. 2023. Available online: https://www.vsjf.org/2023/05/15/fairbanks-museum-home-to-vermonts-first-demonstration-mass-timber-building/ (accessed on 29 August 2025).

- European Commission. New EU Forest Strategy for 2030—Communication COM (2021) 572 Final; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- Advance-Timber-Hub. Australian Government Signs Up to Increase the Use of Timber in Buildings by 2030. 2024. Available online: https://www.advance-timber-hub.org/media-releases/australian-government-signs-up-to-increase-the-use-of-timber-in-buildings-by-2030/ (accessed on 16 November 2024).

- Forest2market. Australia’s Growthig Market for Cross-Laminated Timber. 2024. Available online: https://www.forest2market.com/blog/australias-growing-market-for-cross-laminated-timber (accessed on 16 November 2024).

- AS1684.4; Residential Timber Framed Construction. Standards Australia Technical Committee: Sydney, Australia, 2024.

- AS1720.1; Australian Standard for Timber Structures. Standards Australia Technical Committee: Sydney, Australia, 2022.

- EN 1995-1-1; Eurocode 5: Design of Timber Structures—Part 1-1: General—Common Rules and Rules for Buildings. European Standard: Brussels, Belgium, 2004.

- Ross, J. New QLD Premier’s $7B Pledge for ‘Greener’ Olympic Venues: What’s Next? 2023. Available online: https://woodcentral.com.au/brisbane-olympics-7b-pledge-for-greener-venues-whats-next/ (accessed on 16 November 2024).

- Wijeratne, C.; Lavisci, P. Investing in mass timber construction in Australia: The clan energy finance corporation timber building program. In Proceedings of the Wolrd Conference on Timber Enginering, Oslo, Norway, 19–22 June 2023. [Google Scholar]

- England, P.; Bennetts, I. Fire Safety Design of Midrise Timber Buildings; WoodSolutions: Melbourne, Australia, 2016. [Google Scholar]

- Chapa, J.; Cornell, T.; Barbov, N.; Bezzina, E.; Wouters, T. Driving Responsible Products in the Built Environment—Changes to Green Star Buildings and Our Strategy for the Future; Green Building Council of Australia: Barangaroo, Australia, 2021. [Google Scholar]

- Vickers, J.; Sullivan, N.; Davies, A.; Kogileru, T.; Wouters, T. Embodied Emissions Technical Report; NABERS: Parramatta, Australia, 2022. [Google Scholar]

- Materials and Embodied Carbon Leaders Alliance: MECLA Partners. 2023. Available online: https://mecla.org.au/partners (accessed on 30 November 2024).

- Whyte, S.; Kaburagi, R.; Gan, V.; Candido, C.; Avazpour, B.; Fatourehchi, D.; Chan, H.F.; Dong, Y.; Dulleck, U.; Finlay, S.; et al. Exploring the Benefits of Mass Timber Construction in the Workplace: A Novel Primer for Research. Buildings 2024, 14, 2072. [Google Scholar] [CrossRef]

- Ross, J. Mass Timber Coluld Surge 25-Fold: Is US Ready Fort All-Timber Boom? 2024. Available online: https://woodcentral.com.au/mass-timber-could-surge-25-fold-fueled-by-us-south-high-rise/ (accessed on 29 August 2024).

- Woodworks. Mass Timber Project Designed and Constructed in the US (June 2025). 2025. Available online: https://www.woodworks.org/wp-content/uploads/WoodWorks-Mass-Timber-Projects-June-2025.png (accessed on 19 August 2025).

- Woodworks. Mapping Mass Timber. 2024. Available online: https://www.woodworks.org/resources/mapping-mass-timber/ (accessed on 11 November 2024).

- Wingo, L. The Obstacles Opportunities of Mass Timber Construction in the, U.S. 2024. Available online: https://www.arup.com/insights/the-obstacles-and-opportunities-of-mass-timber-construction-in-the-us/ (accessed on 22 December 2024).

- UNECE. 2023 Country Market Statements. Austrian Market Report 2023. 2023. Available online: https://unece.org/forests/2023-country-market-statements (accessed on 22 December 2024).

- Forest Europe 2020. Implementation of the Forest Europe Commitments. National and Pan-European Actions 2016–2020. 2020. Available online: https://foresteurope.org/wp-content/uploads/2016/08/Implementation-of-the-FOREST-EUROPE-Commitments.pdf (accessed on 22 December 2024).

- Waldinventur. 2024. Available online: https://www.waldinventur.at/#/ (accessed on 22 December 2024).

- Econmove, Economica. The ECONOMIC impact of the Forestry and Wood Industry in Europe in Terms of Bioeconomy, Vienna. 2023. Available online: https://www.forstholzpapier.at/images/fhp_0623_studie_EN_web.pdf (accessed on 22 December 2024).

- Swedish Forest Agency. Market Statement 2022—Sweden: UNECE Committee on Forest and the Forest Industry and European Foresty Commission (Foresta 2022). 2022. Available online: https://unece.org/sites/default/files/2022-10/sweden-country-market-statement-2022.pdf (accessed on 24 November 2024).

- Schafer, A. 2022 Market Statement for Switzerland Developments in Forest Product Markets. Seoul, Republic of Korea. 2022. Available online: https://unece.org/sites/default/files/2022-11/switzerland-country-market-statement-2022.pdf (accessed on 24 November 2024).

- Färnström, I. Market Development for Multi-Story Wood Construction—Views of Architects and Structural Engineers. Master‘s Thesis, Faculty of Forest Sciences, Swedish University of Agricultural Sciences, Uppsala, Sweden, 2022. [Google Scholar]

- Natural Resources Institute Finland. Forest Sector Market Statement for Finland 2023. 2023. Available online: https://unece.org/sites/default/files/2023-11/Market%20statement%20Finland%202023.pdf (accessed on 22 December 2024).

- Ilgın, H.E.; Karjalainen, M.; Pelsmakers, S. Finnish architects’ attitudes towards multi-storey timber-residential buildings. Int. J. Build. Pathol. Adapt. 2024, 42, 352–368. [Google Scholar] [CrossRef]

- Basterra, L.A.; Baño, V.; López, G.; Cabrera, G.; Vallelado-Cordobés, P. Identification and Trend Analysis of Multistorey Timber Buildings in the SUDOE Region. Buildings 2023, 13, 1501. [Google Scholar] [CrossRef]

- Timberfinance. Frence Residential Market. 2024. Available online: https://timberfinance.ch/en/france-construction-activity/ (accessed on 22 December 2024).

- Statistics Portugal. Estatísticas da Construção e Habitação—2021; Lisboa Instituto Nacional de Estatística: Lisbon, Portugal, 2023. [Google Scholar]

- European Construction Sector Observatory 2022-Country Profile France. 2022. Available online: https://single-market-economy.ec.europa.eu/document/download/ac4e49de-9746-43b6-a6ca-084c98a072d1_en (accessed on 22 December 2024).

- BMEL. Forestry Strategy 2050. 2024. Available online: https://www.bmel.de/DE/themen/wald/waldstrategie2050.html (accessed on 22 December 2024).

- UNECE. 2023 Country Market Statements German Market Report 2023. 2023 Country Market Statements. 2023. Available online: https://unece.org/sites/default/files/2023-10/Market%20Statement_81th%20COFFI_Germany.pdf (accessed on 22 December 2024).

- BMUB. 2024. Available online: http://www.bmub.bund.de/themen/klima-energie/klimaschutz/klima-klimaschutz-download/artikel/klimaschutzplan-2050/?tx_ttnews%5BbackPid%5D=3915 (accessed on 20 December 2024).

- DW. German Housing Crisis: Government Plans Construction Boost. 2025. Available online: https://www.dw.com/en/german-government-plans-construction-boost-amid-major-housing-shortage/a-73351540 (accessed on 8 August 2025).

- BMWSB. Auch in 2026: Kabinett Beschließt Rekordetat des Bundesbauministeriums. 2025. Available online: https://www.bmwsb.bund.de/SharedDocs/pressemitteilungen/DE/2025/07/haushalt.html?nn=42820 (accessed on 8 August 2025).

- Holzbau Deutschland. Lagebericht 2023. 2023. Available online: https://www.holzbau-deutschland.de/fileadmin/user_upload/eingebundene_Downloads/Lagebericht_2023_mit_Statistiken.pdf (accessed on 15 March 2025).

- Knippershelbig. The Cradle. 2025. Available online: https://www.knippershelbig.com/en/projects/the-cradle/ (accessed on 10 July 2025).

- Holzbauoffensivebw. Skaio—Germany’s First Wood-Hybrid High-Rise Building. 2025. Available online: https://www.holzbauoffensivebw.de/de/frontend/product/detail?productId=4 (accessed on 8 July 2025).

- Lagerschwertfeger. Skaio Project. 2025. Available online: https://www.lagerschwertfeger.de/projekte/skaio (accessed on 8 July 2025).

- Von-Fragstein. 2025. Available online: https://www.von-fragstein.com/referenzen/mehrgeschossiger-holzbau/skaio-heilbronn/ (accessed on 19 August 2025).

- Kadenplus. WA 16 West Project. 2025. Available online: https://www.kadenplus.de/projekt/pe16w (accessed on 8 July 2025).

- Bauart-Ingenieure. WA 16 West Project. 2025. Available online: https://www.bauart-ingenieure.de/projekt/pep-wa-16-west-muenchen/ (accessed on 8 July 2025).

- Baunetzwissen. 2024. Available online: https://www.baunetzwissen.de/brandschutz/fachwissen/sonderbauten/hochhaeuser-3154225 (accessed on 22 December 2024).

- Margulesgroome. Market Potential of Structural Timber for Chinese Wood-Frame Construction Industry. 2018. Available online: https://margulesgroome.com/publications/market-potential-of-structural-timber-for-chinese-wood-frame-construction-industry/#:~:text=Currently%2C%20wood%20frame%20construction%20represents%20a%20minor,brick%20and%20mortar%20construction%20dominates%20the%20market (accessed on 28 August 2025).

- Edgebuildings. China—Green Building Market Snapshot 2020. 2023. Available online: https://edgebuildings.com/wp-content/uploads/2023/11/IFC0077-2023-China-Green-Building-Market-Maturity-Sheet.pdf (accessed on 28 August 2025).

- Chineseclimatepolicy. Guide to Chinese Climate Policy: 23. Forestry. 2025. Available online: https://chineseclimatepolicy.oxfordenergy.org/book-content/domestic-policies/forestry/ (accessed on 26 August 2025).

- Climatepolicydatabase. The 14th Five-Year Plan for the Development of Forestry and Grassland Conservation (2021–2025) China (2021). 2025. Available online: https://climatepolicydatabase.org/policies/14th-five-year-plan-development-forestry-and-grassland-conservation-2021-2025 (accessed on 25 August 2025).

- Zhai, Y.K.; Li, Y.N.; Tang, S.; Liu, Y.X.; Liu, Y.Z. Lightweight strategies for wooden-structure buildings based on embodied carbon emission calculations for carbon reduction. Buildings 2024, 14, 3460. [Google Scholar] [CrossRef]

- GB 50005-2017; Standard for Design of Timber Structures. National Standard of China: Beijing, China, 2017.

- GB/T 51226-2017; Technical Standard for Multi-Story and High-Rise Timber Buildings. Chinse National Standard: Beijing, China, 2017.

- LY/T3039-2018; Cross Laminated Timber. Forestry Industry Standard of China: Beijing, China, 2018.

- GB 50016; Code for Fire Protection Design of Buildings. National Standard of China: Beijing, China, 2018.

- GB/T 50378-2019; Assessment Standard for Green Building. Chinese Standards: Beijing, China, 2019.

- Wang, Z.Q.; Yin, T.X. Cross-Laminated Timber: A Review on Its Characteristics and an Introduction to Chinese Practices; IntechOpen: London, UK, 2021. [Google Scholar] [CrossRef]

- Luo, T.; Xue, X.L.; Wang, Y.N.; Xue, W.R.; Tan, Y.T. A systematic overview of prefabricated construction policies in China. J. Clean. Prod. 2021, 280, 124371. [Google Scholar] [CrossRef]

- USDA. Solid Wood Annual 2024 for The People’s Republic of China. 2024. Available online: https://www.fas.usda.gov/data/china-solid-wood-annual-2024 (accessed on 27 August 2025).

- Lu, H.Y.; You, K.R.; Feng, W.; Zhou, N.; Fridley, D.; Price, L.; de la Rue du Can, S. Reducing China’s building material embodied emissions: Opportunities and challenges to achieve carbon neutrality in building materials. iScience 2024, 27, 109028. [Google Scholar] [CrossRef]

- Li, H.M.; Li, J.J. Prospects for the application of modern wood construction in China based on SWOT analysis: Towards socially sustainable cities. J. Arts Cult. Stud. 2023, 2, 1–14. [Google Scholar] [CrossRef]

- Du, Q.; Zhang, R.; Cai, C.; Jin, L. Factors Influencing Modern Timber Structure Building Development in China. Sustainability 2021, 13, 7936. [Google Scholar] [CrossRef]

- Maff. Annual Report on Forest and Forestry in Japan; Ministry of Agriculture, Forestry, and Fisheries: Tokyo, Japan, 2022; Available online: https://www.maff.go.jp/e/data/publish/attach/pdf/index-193.pdf (accessed on 28 August 2025).

- Yamashita, N.; Fishman, T.; Kayo, C.; Tanikawa, H. An interlinked dynamic model of timber and carbon stocks in Japan’s wooden houses and plantation forests. Sustain. Prod. Consum. 2024, 52, 314–323. [Google Scholar] [CrossRef]

- Mlit. Overview of the Art on the Improvement of Energy Consumption Performance of Buildings. 2016. Available online: https://www.mlit.go.jp/common/001134876.pdf (accessed on 28 August 2025).

- Fujisaki, T. Policies and Initiatives for Sustainable Wood Use Promotion by Public and Private Sectors in Japan. 2023. Available online: https://www.rinya.maff.go.jp/j/boutai/attach/pdf/japan_policy.pdf (accessed on 28 August 2025).

- Forestpolicy. Japan Revised Clean Wood Act (Act to Partially Amend the Act on Promotion of Use and Distribution of Legally-Harvested Wood and Wood Products). 2025. Available online: https://forestpolicy.org/policy-law/japan-revised-clean-wood-act (accessed on 22 August 2025).

- Markwideresearch. Japan Prefab Wood Building Market Analysis—Industry Size, Share, Research Report, Insights, COVID-19 Impact, Statistics, Trends, Growth and Forecast 2025–2034. 2025. Available online: https://markwideresearch.com/japan-prefab-wood-building-market/ (accessed on 28 August 2025).

- Grandviewresearch. Japan Timber Construction Market Size & Outlook, 2024–2033. 2025. Available online: https://www.grandviewresearch.com/horizon/outlook/timber-construction-market/japan (accessed on 22 August 2025).

- Imarcgroup. Japan Cross Laminated Timber (CLT) Market Report by Application (Residential, Government/Public Buildings, Commercial Buildings, Educational Institutes) 2025–2033. 2025. Available online: https://www.imarcgroup.com/japan-cross-laminated-timber-market (accessed on 22 August 2025).

- USDA. JAS Program Supports Domestic Lumber in Japan. 2020. Available online: https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=JAS+Program+Supports+Domestic+Lumber_Tokyo_Japan_04-20-2020 (accessed on 27 August 2025).

- Tachibana, K.; Nagashima, T.; Pei, S.L.; Isoda, H.; Miyazaki, T.; Abe, S.; van de Lindt, J.W.; Pryor, S.E. Shake table test of a full-scale ten-story mass timber building designed with Japanese building standard law. Eng. Struct. 2025, 343, 120851. [Google Scholar] [CrossRef]

- MPI. Forestry and Wood Processing Data. 2025. Available online: https://www.mpi.govt.nz/forestry/forest-industry-and-workforce/forestry-wood-processing-data/ (accessed on 22 August 2025).

- MBIE. Building and Construction Sector Trends. 2023. Available online: https://www.mbie.govt.nz/assets/building-and-construction-sector-trends-annual-report-2023.pdf (accessed on 28 August 2025).

- A Plea for the Efficient Use of Ministry for Primary Industries. Mid-Rise Wood Construction. 2022. Available online: https://www.mpi.govt.nz/funding-rural-support/primary-growth-partnerships-pgps/currentpgp-programmes/mid-rise-wood-construction/ (accessed on 28 August 2025).

- Midrisewood. 2025. Available online: https://midrisewood.co.nz/ (accessed on 22 August 2025).

- Imarc. Australia and New Zealand Cross Laminated Timber (CLT) Market Size, Share, Trends and Forecast by Application, 2025–2033. 2025. Available online: https://www.imarcgroup.com/australia-newzealand-clt-market (accessed on 28 August 2025).

- WoodWorks. Clearwater: Showcase for Sequestration. 2023. Available online: https://woodworks.events/clearwater-showcase-for-sequestration/ (accessed on 11 November 2024).

- Tauranga City Council. New Zealand’s Largest Mass Timber Office Building Coming to Town. 2023. Available online: https://www.tauranga.govt.nz/council/council-news-andupdates/latest-news/artmid/456/articleid/8672 (accessed on 28 August 2025).

- Wong, F.P.W.; Oldfield, P.; Osmond, P. Industry perceptions of mass engineered timber (MET) construction: A comparison of South-East Asia with other regions. Archit. Eng. Des. Manag. 2024, 20, 1543–1565. [Google Scholar] [CrossRef]

- Building. Climate Change Work Programme. 2025. Available online: https://www.building.govt.nz/getting-started/climate-change-work-programme (accessed on 22 August 2025).

- Statistics Norway. The National Forest Inventory. 2025. Available online: https://www.ssb.no/en/jord-skog-jakt-og-fiskeri/skogbruk/statistikk/landsskogtakseringen (accessed on 22 August 2025).

- RVO. Market Study: Sustainable Building in Norway. 2021. Available online: https://www.rvo.nl/sites/default/files/2021/06/Norway-Sustainable-Building-Market-Study-2021.pdf (accessed on 28 August 2025).

- DIBK. Building Technology Regulations (TEK17) with Guidance. 2025. Available online: https://www.dibk.no/regelverk/byggteknisk-forskrift-tek17/17/17-1 (accessed on 23 August 2025).

- Byggalliansen. BREEAM-NOR v6.1.1 New Construction. 2025. Available online: https://byggalliansen.no/wp-content/uploads/2025/01/BREEAM-NOR-6.1.1-English.pdf (accessed on 22 August 2025).

- Zahiri, N. Timber high-rises in Nordic countries: Current trends. CTBUH J. 2023, 2023, 44–50. [Google Scholar]

- Ledinek. Complete CLT Manufacturing Facility for Splitkon AS in Norway. 2025. Available online: https://www.ledinek.com/clt-production-line-norway (accessed on 23 August 2025).

- FutureBuilt. What is FutureBuilt? 2025. Available online: https://www.futurebuilt.no/English (accessed on 23 August 2025).

- Nordic Innovation. Harmonised Carbon Limit Values for Buildings in Nordic Countries. 2024. Available online: https://pub.norden.org/us2024-415/us2024-415.pdf (accessed on 28 August 2025).

- Skatvedt, K.A.; Ullah, S.; Normann, H.E.; Ingeborgrud, L. Competence needs in the wood-based construction industry in Norway. For. Policy Econ. 2025, 178, 103589. [Google Scholar] [CrossRef]

- Natural Resources Canada. How Much Forest Does Canada Have? 2025. Available online: https://natural-resources.canada.ca/forest-forestry/state-canada-forests/much-forest-does-canada-have? (accessed on 23 August 2025).

- Canadian Wood Council. Encapsulated Mass Timber Construction. 2025. Available online: https://cwc.ca/articles/encapsulated-mass-timber-construction/ (accessed on 23 August 2025).

- Canada Green Building Council. Zero Carbon Building—Design Standard Version 3. 2024. Available online: https://www.cagbc.org/wp-content/uploads/2022/06/CAGBC_Zero_Carbon_Building-Design_Standard_v3.pdf (accessed on 18 December 2024).

- British Columbia. Mass Timber Action Plan. 2024. Available online: https://www2.gov.bc.ca/gov/content/industry/construction-industry/mass-timber/mass-timber-action-plan (accessed on 23 August 2025).

- Ontario. Building Code updates. 2025. Available online: https://www.ontario.ca/page/building-code-updates (accessed on 26 August 2025).

| Country/Region | Current Status and Perspectives |

|---|---|

| Global market | USD 850M in 2021; USD 1.54 billion by 2031 (CAGR 6%). Growth driven by demand for low-carbon materials; barriers include high costs and durability concerns. CLT leads; NLT has the fastest growth. Residential dominates; commercial is the fastest-growing. Europe leads; LAMEA has the fastest growth. |

| Australia | The CEFC AUD 300M program supports timber uptake. Domestic production is limited; imports are high. Barriers: outdated codes, cost perception, insurer/financier hesitance. Initiatives: new codes, carbon reporting, training, and financing schemes. |

| The United States | More than 2000 projects completed/planned. Growth potential huge (0.4% of softwood industry). Barriers: cost, code limits, few suppliers. The 2021 IBC permits taller timber; incentives and collaboration needed to scale. |

| Switzerland | New EU-aligned timber regulation (2022). Growing multi-story timber sector. Drivers: prefabrication, hardwood use, and robotics/digitization. Still reliant on imports; potential in public and residential sectors. |

| Finland | The National Forest Strategy 2035 promotes sustainable forestry. Construction slowdown since 2022; recovery expected in 2025. Architects value wood’s ecology but note cost/fire safety issues. Barriers: cost, sound/fire concerns, and knowledge gaps. |

| SUDOE region (Southwest France, Portugal and Spain) | Since 2013, 39 multi-story timber buildings. CLT production boosted growth. Spruce dominant, local pine/Douglas rising. Portugal: strong exports; France: RE2020 regulation and NRRP investments drive timber use. Challenges: market dynamics. |

| Austria | Forests cover 48% of the land. Harvest 19.4M m3 in 2022. Strong exports (laminated timber, parquet). Incentives: “CO2 Bonus” subsidy. Iconic projects (HoHo Wien) illustrate advanced timber adoption. |

| Germany | Climate Action Plan 2050 and Forest Strategy 2050 drive wood use. Wood is ~20% of multi-story residential permits. Industry: ~75k employees, EUR 9 billion turnover. Barriers: fire safety, permits, cost. Government initiatives: “Holzbauinitiative” and “building-turbo”. |

| China | Timber construction is <0.05% of the residential market but is growing in low-rise and public buildings. Strong policy push (NFPP, “30·60” climate targets, prefab 30% by 2025). Domestic CLT standards (LY/T 3039-2018) and mid-rise allowances up to 18 stories. Emerging supply (≥4 CLT plants), but barriers remain: cost, fire/code complexity, and limited stakeholder familiarity. |

| Japan | Timber construction revenue is USD ~729M in 2024; projected CAGR is ~10%. Forest-rich, rising wood self-sufficiency (~41%). Strong policy alignment (ZEH/ZEB, wood promotion acts, Clean Wood Act). Prefab wood housing dominates (80% of low-rise homes); policy focuses on scaling mid-/high-rise. Barriers: cost, insurer/code acceptance; enablers: R&D in seismic/fire safety and CLT growth. |

| New Zealand | The 1.79M ha plantation forest is radiata pine dominant. Forestry exports USD ~5.9 billion (2024). Mass timber is still limited, mainly residential CLT. The government BfCC program targets “near-zero” buildings by 2050. The Mid-Rise Wood Programme drives uptake; notable projects include Clearwater Quays and Tauranga Council HQ. Constraints: cost, fire consenting, uneven supply chain. Growing momentum in non-residential. |

| Canada | The world’s second largest mass timber market after Europe. Approximately 700 completed projects; 140+ underway. Market USD ~379M in 2024, forecast USD ~1.2 billion by 2030, USD ~2.4 billion by 2035. Strong provincial policies (e.g., BC, Ontario) allow 12–18 story EMTC. ~20 production facilities, ~0.5M m3 CLT/GLT capacity. Barriers: insurance, logistics, and supply chain integration. Opportunities: scaling prefab, code modernization, and procurement incentives. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, L.; Klingner, R.; Al-Qudsi, A.; Chen, H.; Dand, J.A. Current Market Landscape and Industry Voices in Key Timber Construction Markets. Buildings 2025, 15, 3381. https://doi.org/10.3390/buildings15183381

Yan L, Klingner R, Al-Qudsi A, Chen H, Dand JA. Current Market Landscape and Industry Voices in Key Timber Construction Markets. Buildings. 2025; 15(18):3381. https://doi.org/10.3390/buildings15183381

Chicago/Turabian StyleYan, Libo, Raoul Klingner, Ahmad Al-Qudsi, Haoze Chen, and Junaid Ajaz Dand. 2025. "Current Market Landscape and Industry Voices in Key Timber Construction Markets" Buildings 15, no. 18: 3381. https://doi.org/10.3390/buildings15183381

APA StyleYan, L., Klingner, R., Al-Qudsi, A., Chen, H., & Dand, J. A. (2025). Current Market Landscape and Industry Voices in Key Timber Construction Markets. Buildings, 15(18), 3381. https://doi.org/10.3390/buildings15183381