Artificial Intelligence for Predicting Insolvency in the Construction Industry—A Systematic Review and Empirical Feature Derivation

Abstract

1. Introduction

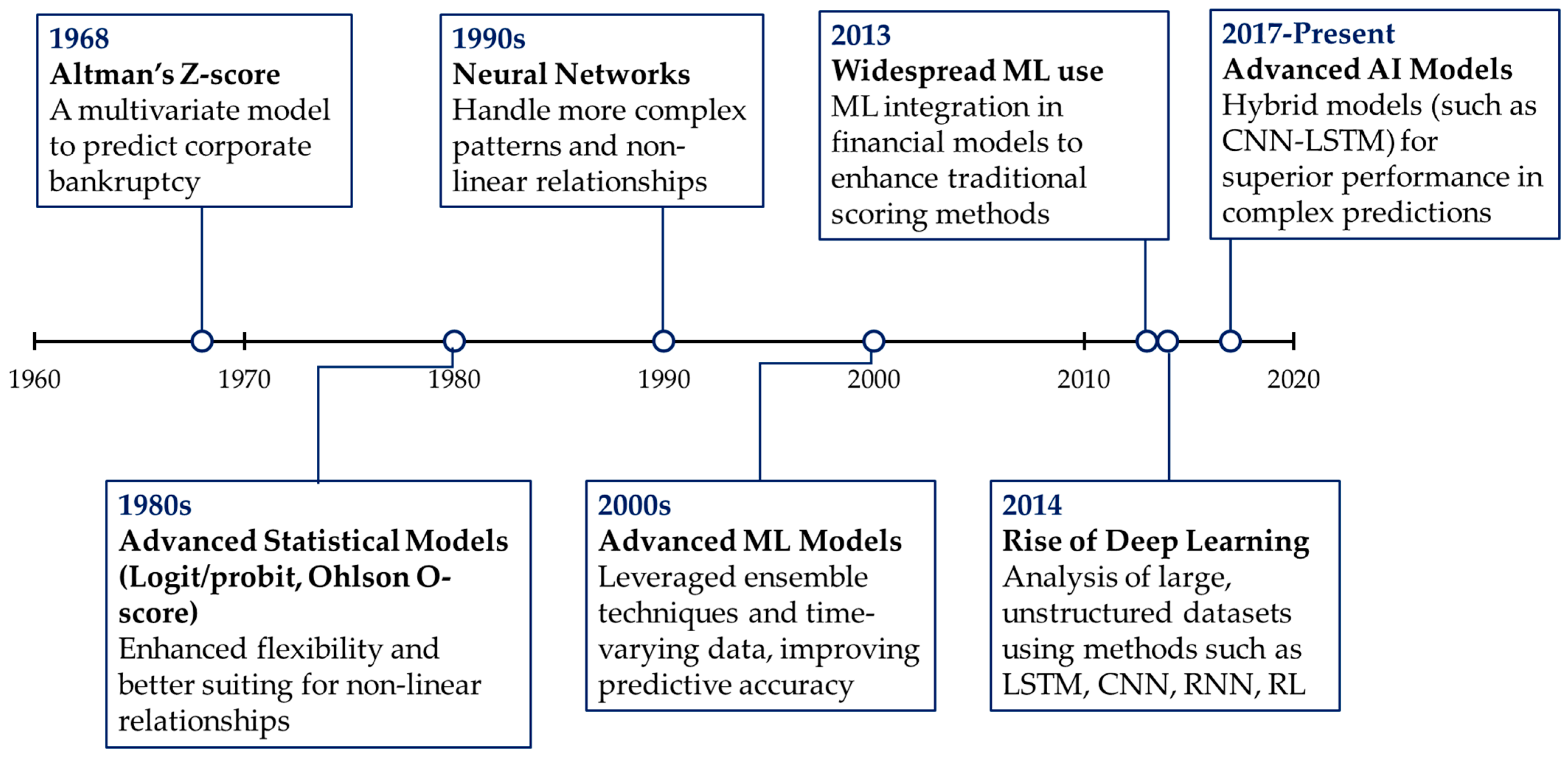

2. Background: Predictive Models in Financial Bankruptcy and Insolvency

2.1. Altman’s Z Score

2.2. Advanced Statistical Models

2.3. Neural Networks

2.4. Advanced ML Models

2.5. Rise of Deep Learning and Advanced AI Models

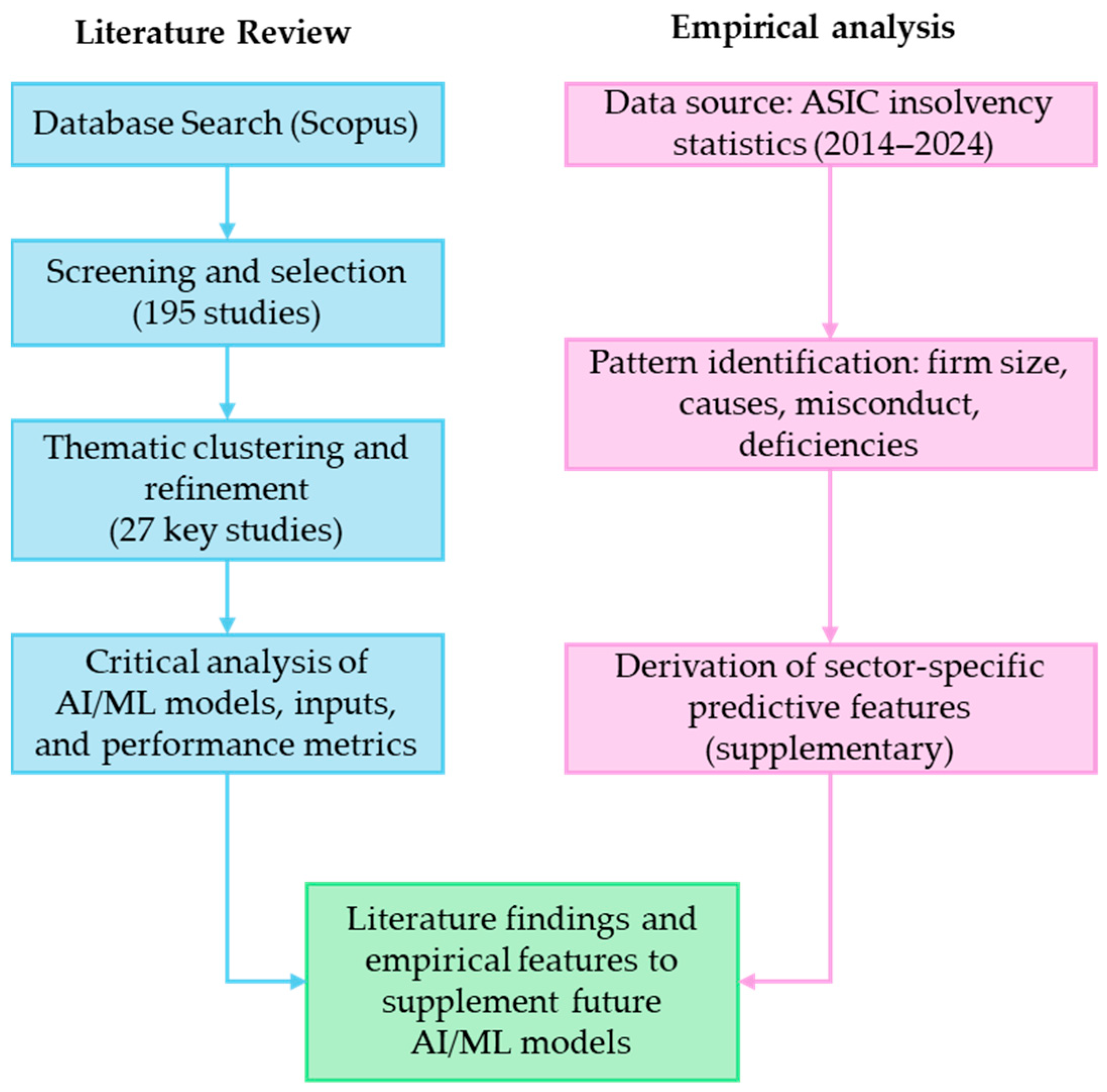

3. Research Methodology

3.1. The Literature Review Process

3.2. Empirical Feature Derivation from Sector-Level Construction Insolvency Data

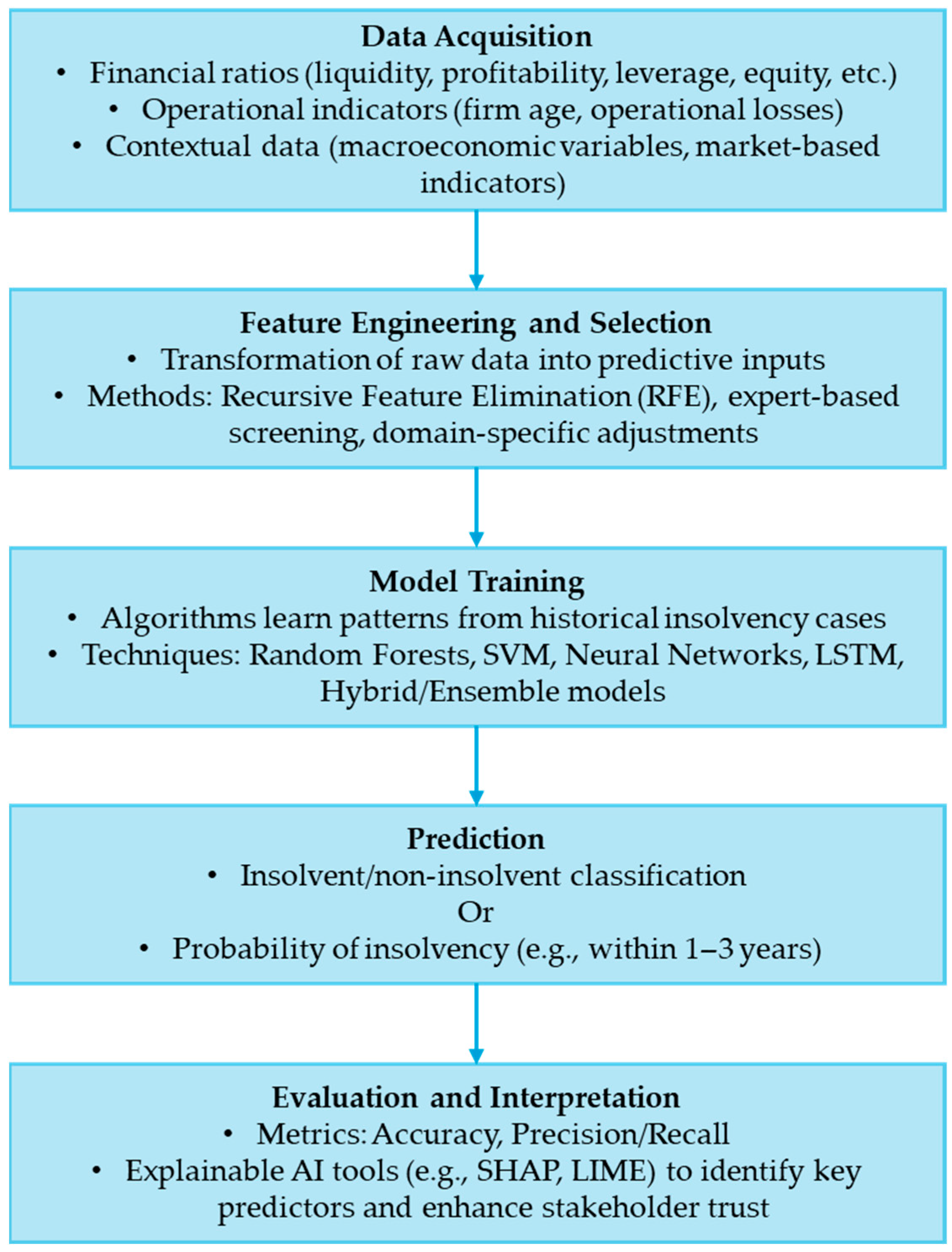

4. Analysis of Predictive Models for Bankruptcy in Construction

4.1. Overview of Predictive Model Studies

4.2. AI/ML-Based Predictive Model Studies

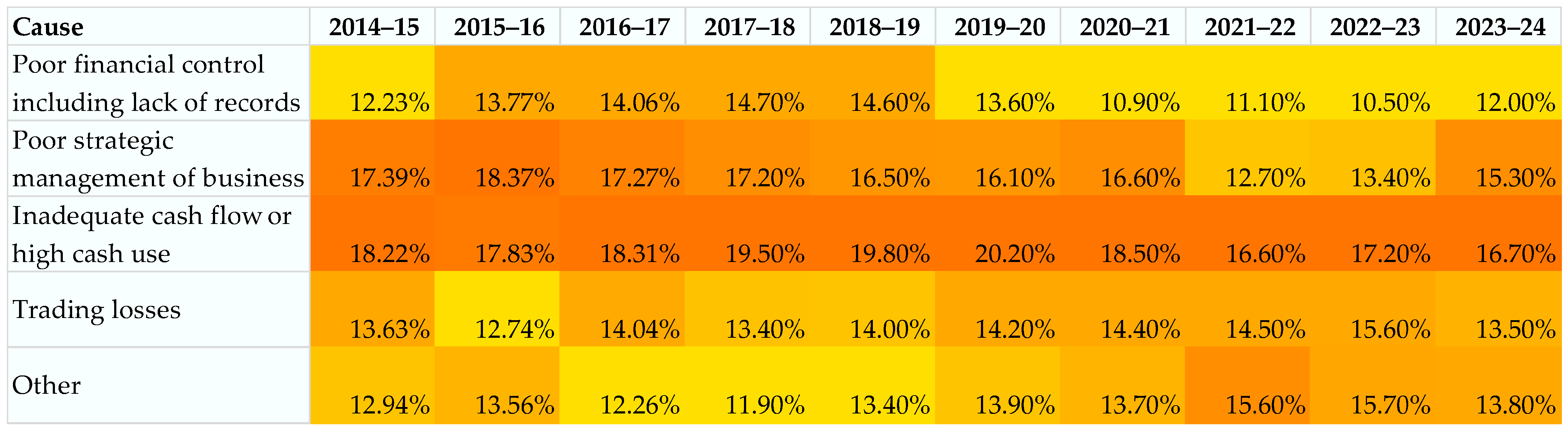

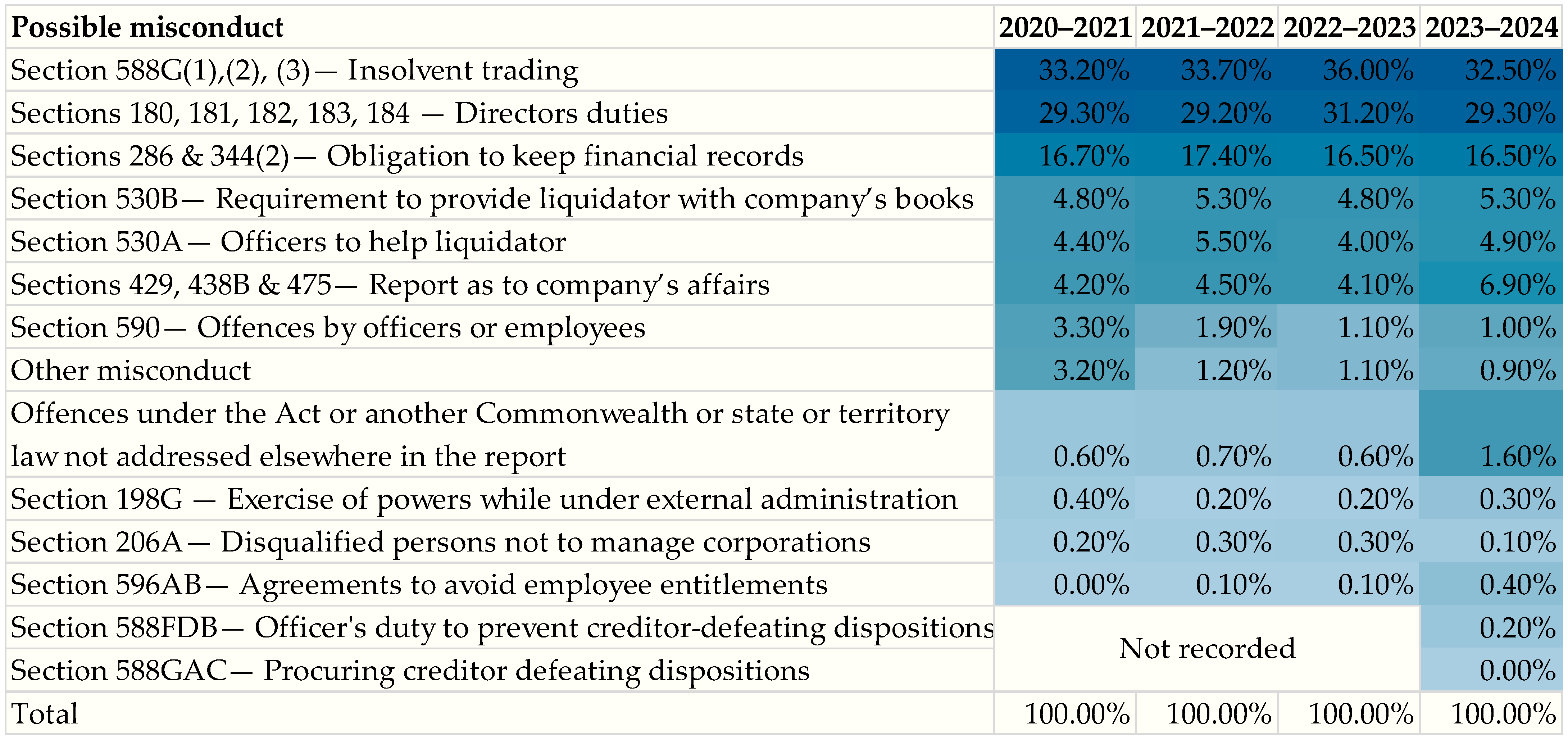

5. Empirical Analysis and Feature Derivation from Australian Construction Insolvency Data

5.1. Patterns and Trends in Australian Construction Insolvency (2014–2024)

5.2. Variable Derivation and Model Feature Framework

6. Conclusions, Limitations, and Future Agenda

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AI | Artificial intelligence |

| ML | Machine learning |

| ASIC | Australian Securities and Investments Commission |

| MDA | Multiple discriminant analysis |

| ESG | Environmental, social, and governance |

| NN | Neural network |

| RF | Random forest |

| RL | Reinforcement learning |

| SVM | Support vector machine |

| DNN | Deep neural network |

| CNN | Convolutional neural network |

| NLP | Natural language processing |

| LSTM | Long short-term memory |

| AM | Attention mechanism |

| GNN | Graph neural network |

| BERT | Bidirectional encoder representations from transformers |

| XAI | Explainable AI |

| SHAP | Shapley additive explanations |

| LIME | Local interpretable model-agnostic explanations |

| SMOTE | Synthetic minority over-sampling technique |

| RFECV | Recursive feature elimination with cross-validation |

| DEA | Data envelopment analysis |

| BiLSTM | Bidirectional long short-term memory |

| RS | Random subspace |

| RNN | Recurrent neural network |

| BP | Backpropagation |

| CART | Classification and regression trees |

| AUC | Area under the curve |

| ROC | Receiver operating characteristic |

| FTE | Full-time equivalent |

| SME | Small to medium-sized enterprise |

References

- Abdelalim, A.M.; Salem, M.; Salem, M.; Al-Adwani, M.; Tantawy, M. An Analysis of Factors Contributing to Cost Overruns in the Global Construction Industry. Buildings 2025, 15, 18. [Google Scholar] [CrossRef]

- Raheel Shah, S.A.; Nawaz, A.; Abid, M.; Salman Malik, A.; Fakhar, S.; Elahi, M. Identification of risk factors involved in SCP of developing countries-establishing guidelines: An analysis of mixed method sequential approach. Rev. Mex. Constr. 2021, 20, 407–426. [Google Scholar]

- Amoah, C.; Pretorius, L. Evaluation of the impact of risk management on project performance in small construction firms in South Africa: The case study of construction systems. J. Eng. Des. Technol. 2020, 18, 611–634. [Google Scholar] [CrossRef]

- Yap, J.B.H.; Goay, P.L.; Woon, Y.B.; Skitmore, M. Revisiting critical delay factors for construction: Analysing projects in Malaysia. Alex. Eng. J. 2021, 60, 1717–1729. [Google Scholar] [CrossRef]

- Sanni-Anibire, M.O.; Mohamad Zin, R.; Olatunji, S.O. Causes of delay in the global construction industry: A meta analytical review. Int. J. Constr. Manag. 2022, 22, 1395–1407. [Google Scholar] [CrossRef]

- Omopariola, E.D.; Windapo, A.; Edwards, D.J.; Thwala, W.D. Contractors’ perceptions of the effects of cash flow on construction projects. J. Eng. Des. Technol. 2020, 18, 308–325. [Google Scholar] [CrossRef]

- Oladimeji, O.; Aina, O.O. Cash flow management techniques practices of local firms in Nigeria. Int. J. Constr. Manag. 2021, 21, 395–403. [Google Scholar] [CrossRef]

- Manu, E.; Knight, A. Understanding supply chain management from a main contractor’s perspective. In Successful Construction Supply Chain Management: Concepts and Case Studies; Wiley-Blackwell: Chichester, UK, 2020; pp. 251–269. [Google Scholar]

- Sholeh, M.N.; Wibowo, M.A. Supply chain in the construction industry: Micro, meso, macro. J. Adv. Civ. Environ. Eng. 2020, 3, 50–57. [Google Scholar] [CrossRef]

- Rojas, P.; Kan, V. Business Insolvency: Australia’s Top 5 Hardest-Hit Industries. 2025. Available online: https://rcrlaw.com.au/business-insolvency-australia/ (accessed on 18 July 2025).

- Kenneally, D. Construction Sector Remains Hardest Hit for Insolvencies. 2025. Available online: https://constructionwave.co.uk/2025/05/21/construction-sector-remains-hardest-hit-for-insolvencies/ (accessed on 18 July 2025).

- Kassem, M.A.; Radzi, A.R.; Pradeep, A.; Algahtany, M.; Rahman, R.A. Impacts and response strategies of the COVID-19 pandemic on the construction industry using structural equation modeling. Sustainability 2023, 15, 2672. [Google Scholar] [CrossRef]

- Zamani, S.H.; Rahman, R.; Fauzi, M.; Yusof, L. Effect of COVID-19 on building construction projects: Impact and response mechanisms. IOP Conf. Ser. Earth Environ. Sci. 2021, 682, 012049. [Google Scholar] [CrossRef]

- Ogunnusi, M.; Omotayo, T.; Hamma-Adama, M.; Awuzie, B.O.; Egbelakin, T. Lessons learned from the impact of COVID-19 on the global construction industry. J. Eng. Des. Technol. 2021, 20, 299–320. [Google Scholar] [CrossRef]

- Wang, J.; Li, M.; Skitmore, M.; Chen, J. Predicting construction company insolvent failure: A scientometric analysis and qualitative review of research trends. Sustainability 2024, 16, 2290. [Google Scholar] [CrossRef]

- Sathyanarayana, N.; Narayanan, R. A systematic review of models for the prediction of corporate insolvency. Salud Cienc. Tecnol. Ser. Conf. 2024, 3, 952. [Google Scholar] [CrossRef]

- Voda, A.D.; Dobrotă, G.; Țîrcă, D.M.; Dumitrașcu, D.D.; Dobrotă, D. Corporate bankruptcy and insolvency prediction model. Technol. Econ. Dev. Econ. 2021, 27, 1039–1056. [Google Scholar] [CrossRef]

- Arora, I.; Singh, N. Prediction of corporate bankruptcy using financial ratios and news. Int. J. Eng. Manag. Res. 2020, 10, 82–87. [Google Scholar] [CrossRef]

- Mwachikoka, C.F.; Adil, M.; Phiri, J. Enhancing Bankruptcy Prediction: The Integration of Financial Ratios and Artificial Intelligence for more Accurate Risk Assessment. Int. J. Adv. Multidisc. Res. Stud. 2025, 5, 37–46. [Google Scholar] [CrossRef]

- Meena, M.; Pandey, A.; Garg, A. Machine Learning Models Comparison for Bankruptcy Predication for Indian Companies: A study based on India’s Insolvency and Bankruptcy Code (IBC ‘2016). J. Predict. Mark. 2024, 18, 3–18. [Google Scholar] [CrossRef]

- Buckby, S.; Gallery, G.; Ma, J. An analysis of risk management disclosures: Australian evidence. Manag. Audit. J. 2015, 30, 812–869. [Google Scholar] [CrossRef]

- Sordo-Sierpe, J.I.; Del-Rio-Merino, M.; Pérez-Raposo, A.; Vitiello, V. Algoritmos de Random Forest como alerta temprana para la predicción de insolvencias en empresas constructoras = Random Forest algorithms as early warning tools for the prediction of insolvencies in construction companies. An. Edif. 2021, 7, 9–18. [Google Scholar] [CrossRef]

- Platt, H.D.; Platt, M.B. Understanding differences between financial distress and bankruptcy. Rev. Appl. Econ. 2006, 2, 141–157. [Google Scholar]

- Eidenmuller, H. What is an insolvency proceeding. Am. Bankr. Law J. 2018, 92, 53. [Google Scholar]

- Tanaka, K.; Higashide, T.; Kinkyo, T.; Hamori, S. A Multi-Stage Financial Distress Early Warning System: Analyzing Corporate Insolvency with Random Forest. J. Risk Financ. Manag. 2025, 18, 195. [Google Scholar] [CrossRef]

- Altman, E.I.; Hotchkiss, E. Corporate Financial Distress and Bankruptcy; John Wiley & Sons: New York, NY, USA, 1993; Volume 1998. [Google Scholar]

- Platt, H.D.; Platt, M. Comparing financial distress and bankruptcy. Rev. Appl. Econ. 2006, 2, 2. [Google Scholar]

- Altman, E.I.; Iwanicz-Drozdowska, M.; Laitinen, E.K.; Suvas, A. Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-score model. J. Int. Financ. Manag. Account. 2017, 28, 131–171. [Google Scholar] [CrossRef]

- Anjum, S. Business bankruptcy prediction models: A significant study of the Altman’s Z-score model. SSRN 2012. [Google Scholar] [CrossRef]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Rashid, F.; Khan, R.A.; Qureshi, I.H. A Comprehensive Review of the Altman Z-Score Model Across Industries. SSRN 2023. [Google Scholar] [CrossRef]

- Boďa, M.; Úradníček, V. The portability of Altman’s Z-score model to predicting corporate financial distress of Slovak companies. Technol. Econ. Dev. Econ. 2016, 22, 532–553. [Google Scholar] [CrossRef]

- Holpus, H.; Alqatan, A.; Arslan, M. Investigating the Viability of Applying a Lower Bound Risk. In Accounting and Finance Innovations; IntechOpen: London, UK, 2021; p. 159. [Google Scholar]

- Lawrence, J.R.; Pongsatat, S.; Lawrence, H. The use of Ohlson’s O-score for bankruptcy prediction in Thailand. J. Appl. Bus. Res. 2015, 31, 2069. [Google Scholar] [CrossRef]

- Lisin, A.; Kushnir, A.; Koryakov, A.G.; Fomenko, N.; Shchukina, T. Financial stability in companies with high ESG scores: Evidence from North America using the Ohlson O-Score. Sustainability 2022, 14, 479. [Google Scholar] [CrossRef]

- Pramudita, A. The Application of Altman Revised Z-Score Four Variables and Ohlson O-Score as A Bankruptcy Prediction Tool in Small and Medium Enterprise Segments in Indonesia. In Proceedings of the 5th Global Conference on Business, Management and Entrepreneurship (GCBME 2020), Bandung, West Java, Indonesia, 8 August 2020; Atlantis Press: Dordrecht, The Netherlands, 2021. [Google Scholar]

- Şenel, C.; Kalfa, B.B. Prediction of Financial Failure in Borsa Istanbul Insurance Companies with the Altman Z” Score and Ohlson’s O-Model. Ank. Hacı Bayram Veli Üniversitesi İktisadi Ve İdari Bilim. Fakültesi Derg. 2025, 27, 27–52. [Google Scholar] [CrossRef]

- Xu, M.; Zhang, C. Bankruptcy prediction: The case of Japanese listed companies. Rev. Account. Stud. 2009, 14, 534–558. [Google Scholar] [CrossRef]

- Altman, E.I. A fifty-year retrospective on credit risk models, the Altman Z-score family of models and their applications to financial markets and managerial strategies. J. Credit Risk 2018, 14, 1–34. [Google Scholar] [CrossRef]

- Jose, A.; Philip, M.; Prasanna, L.; Manjula, M. Comparison of probit and logistic regression models in the analysis of dichotomous outcomes. Curr. Res. Biostat. 2020, 10, 1–19. [Google Scholar] [CrossRef]

- Ma, J.; Li, C. A comparison of Logit and Probit models using Monte Carlo simulation. In Proceedings of the 2021 40th Chinese Control Conference (CCC), Shanghai, China, 26–28 July 2021; IEEE: New York, NY, USA, 2021. [Google Scholar]

- Horowitz, J.L.; Savin, N. Binary response models: Logits, probits and semiparametrics. J. Econ. Perspect. 2001, 15, 43–56. [Google Scholar] [CrossRef]

- Opić, S. Specifics of logit and probit regression in education sciences—Why wouldn’t we use it? Kıbrıslı Eğitim Bilim. Derg. 2020, 15, 1557–1568. [Google Scholar]

- Zhong, J.; Wang, Z. Artificial intelligence techniques for financial distress prediction. AIMS Math. 2022, 7, 20891–20908. [Google Scholar] [CrossRef]

- Islam, M.; Chen, G.; Jin, S. An overview of neural network. Am. J. Neural Netw. Appl. 2019, 5, 7–11. [Google Scholar] [CrossRef]

- Zhang, G.; Hu, M.Y.; Patuwo, B.E.; Indro, D.C. Artificial neural networks in bankruptcy prediction: General framework and cross-validation analysis. Eur. J. Oper. Res. 1999, 116, 16–32. [Google Scholar] [CrossRef]

- Odom, M.D.; Sharda, R. A neural network model for bankruptcy prediction. In Proceedings of the 1990 IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, 17–21 June 1990; IEEE: New York, NY, USA, 1990. [Google Scholar]

- Wilson, R.L.; Sharda, R. Bankruptcy prediction using neural networks. Decis. Support Syst. 1994, 11, 545–557. [Google Scholar] [CrossRef]

- Barboza, F.; Kimura, H.; Altman, E. Machine learning models and bankruptcy prediction. Expert Syst. Appl. 2017, 83, 405–417. [Google Scholar] [CrossRef]

- Hamdi, M.; Mestiri, S.; Arbi, A. Artificial intelligence techniques for bankruptcy prediction of tunisian companies: An application of machine learning and deep learning-based models. J. Risk Financ. Manag. 2024, 17, 132. [Google Scholar] [CrossRef]

- Alam, T.M.; Shaukat, K.; Mushtaq, M.; Ali, Y.; Khushi, M.; Luo, S.; Wahab, A. Corporate bankruptcy prediction: An approach towards better corporate world. Comput. J. 2021, 64, 1731–1746. [Google Scholar] [CrossRef]

- Gurnani, I.; Tandian, F.S.; Anggreainy, M.S. Predicting company bankruptcy using random forest method. In Proceedings of the 2021 2nd International Conference on Artificial Intelligence and Data Sciences (AiDAS), Ipoh, Malaysia, 8–9 September 2021; IEEE: New York, NY, USA, 2021. [Google Scholar]

- Teles, G.; Rodrigues, J.J.; Rabelo, R.A.; Kozlov, S.A. Comparative study of support vector machines and random forests machine learning algorithms on credit operation. Softw. Pract. Exp. 2021, 51, 2492–2500. [Google Scholar] [CrossRef]

- Shin, K.-S.; Lee, T.S.; Kim, H.-j. An application of support vector machines in bankruptcy prediction model. Expert Syst. Appl. 2005, 28, 127–135. [Google Scholar] [CrossRef]

- Min, J.H.; Lee, Y.-C. Bankruptcy prediction using support vector machine with optimal choice of kernel function parameters. Expert Syst. Appl. 2005, 28, 603–614. [Google Scholar] [CrossRef]

- Sohangir, S.; Wang, D.; Pomeranets, A.; Khoshgoftaar, T.M. Big Data: Deep Learning for financial sentiment analysis. J. Big Data 2018, 5, 1–25. [Google Scholar] [CrossRef]

- Mehtab, S.; Sen, J. A time series analysis-based stock price prediction using machine learning and deep learning models. Int. J. Bus. Forecast. Mark. Intell. 2020, 6, 272–335. [Google Scholar] [CrossRef]

- Qu, Y.; Quan, P.; Lei, M.; Shi, Y. Review of bankruptcy prediction using machine learning and deep learning techniques. Procedia Comput. Sci. 2019, 162, 895–899. [Google Scholar] [CrossRef]

- Wyrobek, J. Predicting bankruptcy at polish companies: A comparison of selected machine learning and deep learning algorithms. Zesz. Nauk. Uniw. Ekon. Krakowie 2018, 978, 41–60. [Google Scholar] [CrossRef]

- Boonpan, S.; Sarakorn, W. Deep neural network model enhanced with data preparation for the directional predictability of multi-stock returns. J. Open Innov. Technol. Mark. Complex. 2025, 11, 100438. [Google Scholar] [CrossRef]

- Sun, F.; Belatreche, A.; Coleman, S.; McGinnity, T.M.; Li, Y. Pre-processing online financial text for sentiment classification: A natural language processing approach. In Proceedings of the 2014 IEEE Conference on Computational Intelligence for Financial Engineering & Economics (CIFEr), London, UK, 27–28 March 2014; IEEE: New York, NY, USA, 2014. [Google Scholar]

- Oyewole, A.T.; Adeoye, O.B.; Addy, W.A.; Okoye, C.C.; Ofodile, O.C.; Ugochukwu, C.E. Automating financial reporting with natural language processing: A review and case analysis. World J. Adv. Res. Rev. 2024, 21, 575–589. [Google Scholar] [CrossRef]

- Li, J.; Xu, C.; Feng, B.; Zhao, H. Credit Risk Prediction Model for Listed Companies Based on CNN-LSTM and Attention Mechanism. Electronics 2023, 12, 1643. [Google Scholar] [CrossRef]

- Sun, L.; Xu, W.; Liu, J. Two-channel Attention Mechanism Fusion Model of Stock Price Prediction Based on CNN-LSTM. ACM Trans. Asian Low-Resour. Lang. Inf. Process. 2021, 20, 83. [Google Scholar] [CrossRef]

- Gonon, L.; Meyer-Brandis, T.; Weber, N. Computing systemic risk measures with graph neural networks. arXiv 2024, arXiv:2410.07222. [Google Scholar]

- Zhang, X.; Xu, Z.; Liu, Y.; Sun, M.; Zhou, T.; Sun, W. Robust Graph Neural Networks for Stability Analysis in Dynamic Networks. In Proceedings of the 2024 3rd International Conference on Cloud Computing, Big Data Application and Software Engineering (CBASE), Hangzhou, China, 11–13 October 2024; IEEE: New York, NY, USA, 2024. [Google Scholar]

- Balmaseda, V.; Coronado, M.; de Cadenas-Santiago, G. Predicting systemic risk in financial systems using Deep Graph Learning. Intell. Syst. Appl. 2023, 19, 200240. [Google Scholar] [CrossRef]

- Lee, W.; Lee, S. Development of a Knowledge Base for Construction Risk Assessments Using BERT and Graph Models. Buildings 2024, 14, 3359. [Google Scholar] [CrossRef]

- Černevičienė, J.; Kabašinskas, A. Explainable artificial intelligence (XAI) in finance: A systematic literature review. Artif. Intell. Rev. 2024, 57, 216. [Google Scholar] [CrossRef]

- Dwivedi, R.; Dave, D.; Naik, H.; Singhal, S.; Omer, R.; Patel, P.; Qian, B.; Wen, Z.; Shah, T.; Morgan, G. Explainable AI (XAI): Core ideas, techniques, and solutions. ACM Comput. Surv. 2023, 55, 1–33. [Google Scholar] [CrossRef]

- Ali, S.; Abuhmed, T.; El-Sappagh, S.; Muhammad, K.; Alonso-Moral, J.M.; Confalonieri, R.; Guidotti, R.; Del Ser, J.; Díaz-Rodríguez, N.; Herrera, F. Explainable Artificial Intelligence (XAI): What we know and what is left to attain Trustworthy Artificial Intelligence. Inf. Fusion 2023, 99, 101805. [Google Scholar] [CrossRef]

- Vellamcheti, S.; Singh, P. Class Imbalance Deep Learning for Bankruptcy Prediction. In Proceedings of the 2020 First International Conference on Power, Control and Computing Technologies (ICPC2T), Raipur, India, 3–5 January 2020. [Google Scholar]

- Zhen, H.; Niu, D.; Yu, M.; Wang, K.; Liang, Y.; Xu, X. A Hybrid Deep Learning Model and Comparison for Wind Power Forecasting Considering Temporal-Spatial Feature Extraction. Sustainability 2020, 12, 9490. [Google Scholar] [CrossRef]

- ASIC. Insolvency Statistics. 2025. Available online: https://www.asic.gov.au/about-asic/corporate-publications/statistics/insolvency-statistics/ (accessed on 11 July 2025).

- Ishak, S.; Ilias, M.; Nayan, A.; Rahim, A.; Morat, B. Logistic regression model for evaluating performance of construction, technology and property-based companies in Malaysia. J. Adv. Res. Appl. Sci. Eng. Technol. 2024, 39, 72–85. [Google Scholar] [CrossRef]

- Wang, J.; Li, M.; Moorhead, M.; Skitmore, M. Forecasting financial distress in listed Chinese construction firms: Leveraging ensemble learning and non-financial variables. Constr. Manag. Econ. 2025, 43, 175–195. [Google Scholar] [CrossRef]

- Balina, R.; Idasz-Balina, M.; Achsani, N.A. Predicting Insolvency of the Construction Companies in the Creditworthiness Assessment Process—Empirical Evidence from Poland. J. Risk Financ. Manag. 2021, 14, 453. [Google Scholar] [CrossRef]

- Voiko, A. Bankruptcy prediction models for construction companies in the Russian Federation. Finans. Teor. Prakt. Financ. Theory Pract. 2019, 23, 62–74. [Google Scholar] [CrossRef]

- Karminsky, A.M.; Burekhin, R.N. Comparative analysis of methods for forecasting bankruptcies of Russian construction companies. Bus. Inform. 2019, 13, 52–66. [Google Scholar] [CrossRef]

- Huang, H.-T.; Tserng, H.-P. A Study of Integrating Support-Vector-Machine (SVM) Model and Market-based Model in Predicting Taiwan Construction Contractor Default. KSCE J. Civ. Eng. 2018, 22, 4750–4759. [Google Scholar] [CrossRef]

- Karas, M. The Stability of Bankruptcy Predictors in the Construction and Manufacturing Industries at Various Times Before Bankruptcy; Technická Univerzita v Liberci: Liberec, Czech Republic, 2017; ISBN 1212-3609. Available online: https://www.fch.vut.cz/en/rad/results/detail/137572 (accessed on 4 July 2025).

- Karas, M.; Režňáková, M. The potential of dynamic indicator in development of the bankruptcy prediction models: The case of construction companies. Acta Univ. Agric. Silvic. Mendel. Brun. 2017, 65, 641–652. [Google Scholar] [CrossRef]

- Ryu, H.; Son, K.; Kim, J.-M. Loss prediction model for building construction projects using insurance claim payout. J. Asian Archit. Build. Eng. 2016, 15, 441–446. [Google Scholar] [CrossRef]

- Assaad, R.H.; Assaf, G.; El-Adaway, I.H. A Fuzzy Model and Decision-Support Tool for Assessing and Predicting the Probability of Bankruptcy of Construction Companies. In Computing in Civil Engineering 2023; Mendel University in Brno, Faculty of Business and Economics: Brno, Czech Republic, 2024; pp. 213–220. [Google Scholar]

- Shuang, Q.; Yuan, Y.; Zhang, M.; Yu, D. Bankruptcy prediction in construction companies via Fisher’s Linear Discriminant Analysis. In Proceedings of the 2011 International Conference on E-Business and E-Government (ICEE), Shanghai, China, 6–8 May 2011; IEEE: New York, NY, USA, 2011. [Google Scholar]

- Sun, J.; Liao, B.; Li, H. AdaBoost and bagging ensemble approaches with neural network as base learner for financial distress prediction of Chinese construction and real estate companies. Recent Pat. Comput. Sci. 2013, 6, 47–59. [Google Scholar] [CrossRef]

- Tserng, H.P.; Chen, P.-C.; Huang, W.-H.; Lei, M.C.; Tran, Q.H. Prediction of default probability for construction firms using the logit model. J. Civ. Eng. Manag. 2014, 20, 247–255. [Google Scholar] [CrossRef]

- Alaka, H.A.; Oyedele, L.O.; Owolabi, H.A.; Oyedele, A.A.; Akinade, O.O.; Bilal, M.; Ajayi, S.O. Critical factors for insolvency prediction: Towards a theoretical model for the construction industry. Int. J. Constr. Manag. 2017, 17, 25–49. [Google Scholar] [CrossRef]

- Bal, J.; Cheung, Y.; Wu, H.-C. Entropy for business failure prediction: An improved prediction model for the construction industry. Adv. Decis. Sci. 2013, 2013, 2. [Google Scholar] [CrossRef]

- Bu, L.; Wang, S.; Lin, G.; Xu, H. Insolvency prediction of Australian construction companies using deep learning with bidirectional LSTM autoencoder. J. Ind. Manag. Optim. 2024, 20, 1967–1978. [Google Scholar] [CrossRef]

- Karas, M.; Reznakova, M. Predicting the bankruptcy of construction companies: A CART-based model. Eng. Econ. 2017, 28, 145–154. [Google Scholar] [CrossRef]

- Toudas, K.; Archontakis, S.; Boufounou, P. Corporate Bankruptcy Prediction Models: A Comparative Study for the Construction Sector in Greece. Computation 2024, 12, 9. [Google Scholar] [CrossRef]

- Wibowo, F.A.; Satria, A.; Gaol, S.L.; Indrawan, D. Financial Risk, Debt, and Efficiency in Indonesia’s Construction Industry: A Comparative Study of SOEs and Private Companies. J. Risk Financ. Manag. 2024, 17, 303. [Google Scholar] [CrossRef]

- Jeong, J.; Kim, C. Comparison of Machine Learning Approaches for Medium-to-Long-Term Financial Distress Predictions in the Construction Industry. Buildings 2022, 12, 1759. [Google Scholar] [CrossRef]

- Jang, Y.; Jeong, I.; Cho, Y.K. Business Failure Prediction of Construction Contractors Using a LSTM RNN with Accounting, Construction Market, and Macroeconomic Variables. J. Manag. Eng. 2020, 36, 04019039. [Google Scholar] [CrossRef]

- Kapelko, M.; Oude Lansink, A. Technical efficiency and its determinants in the Spanish construction sector pre-and post-financial crisis. Int. J. Strateg. Prop. Manag. 2015, 19, 96–109. [Google Scholar] [CrossRef]

- Alaka, H.A.; Oyedele, L.O.; Owolabi, H.A.; Ajayi, S.O.; Bilal, M.; Akinade, O.O. Methodological approach of construction business failure prediction studies: A review. Constr. Manag. Econ. 2016, 34, 808–842. [Google Scholar] [CrossRef]

- Elexa, L.; Klement, L.; Hvolkova, L. Reasons for potential bankruptcy: Evidence from the construction industry in Slovakia. In Proceedings of the Forum Scientiae Oeconomia, Dąbrowa Górnicza, Poland, 9 October 2023. [Google Scholar]

- Van, H.T.K.; Toan, N.Q. Using the Altman’s Z-score formula to assess the bankruptcy risk of state-owned construction enterprises in Vietnam. Edelweiss Appl. Sci. Technol. 2024, 8, 935–944. [Google Scholar]

- Adeleye, T.; Huang, M.; Huang, Z.; Sun, L. Predicting Loss for Large Construction Companies. J. Constr. Eng. Manag. 2013, 139, 1224–1236. [Google Scholar] [CrossRef]

- Im, H.; Minchin, E.; Hakim, H.; Zhang, Y. Monitoring the Financial Trends of Construction Firms in Korea, Japan, and the United States by Using Bankruptcy Prediction Model. In Proceedings of the Construction Research Congress 2018, New Orleans, LO, USA, 2–4 April 2018; Wydawnictwo Naukowe Akademii WSB: Dąbrowa Górnicza, Poland, 2018; pp. 294–304. [Google Scholar]

- Press, S.J.; Wilson, S. Choosing between logistic regression and discriminant analysis. J. Am. Stat. Assoc. 1978, 73, 699–705. [Google Scholar] [CrossRef]

- Ebrahimzadeh, F.; Hajizadeh, E.; Vahabi, N.; Almasian, M.; Bakhteyar, K. Prediction of unwanted pregnancies using logistic regression, probit regression and discriminant analysis. Med. J. Islam. Repub. Iran 2015, 29, 264. [Google Scholar]

- Nikita, E.; Nikitas, P. Sex estimation: A comparison of techniques based on binary logistic, probit and cumulative probit regression, linear and quadratic discriminant analysis, neural networks, and naïve Bayes classification using ordinal variables. Int. J. Leg. Med. 2020, 134, 1213–1225. [Google Scholar] [CrossRef]

- Jaffari, A.A.; Ghafoor, Z. Predicting corporate bankruptcy in Pakistan: A comparative study of multiple discriminant analysis (MDA) and logistic regression. Res. J. Financ. Account. 2017, 8, 81–100. [Google Scholar]

- Iparraguirre-Villanueva, O.; Cabanillas-Carbonell, M. Predicting business bankruptcy: A comparative analysis with machine learning models. J. Open Innov. Technol. Mark. Complex. 2024, 10, 100375. [Google Scholar] [CrossRef]

- Nugroho, D.S.; Dewayanto, T. Application of statistics and artificial intelligence for corporate financial distress prediction models: A systematic literature review. J. Model. Manag. 2025, 2025, 294–304. [Google Scholar] [CrossRef]

- Guyon, I.; Elisseeff, A. An introduction to variable and feature selection. J. Mach. Learn. Res. 2003, 3, 1157–1182. [Google Scholar]

- Jeon, H.; Oh, S. Hybrid-recursive feature elimination for efficient feature selection. Appl. Sci. 2020, 10, 3211. [Google Scholar] [CrossRef]

- Priyatno, A.M.; Widiyaningtyas, T. A systematic literature review: Recursive feature elimination algorithms. J. Ilmu Pengetah. Dan Teknol. Komput. 2024, 9, 196–207. [Google Scholar] [CrossRef]

- Yang, T.; Ying, Y. AUC maximization in the era of big data and AI: A survey. ACM Comput. Surv. 2022, 55, 1–37. [Google Scholar] [CrossRef]

- Li, J. Area under the ROC Curve has the most consistent evaluation for binary classification. PLoS ONE 2024, 19, e0316019. [Google Scholar] [CrossRef] [PubMed]

- Lee, J.-S. AUC4. 5: AUC-based C4. 5 decision tree algorithm for imbalanced data classification. IEEE Access 2019, 7, 106034–106042. [Google Scholar] [CrossRef]

- Halimu, C.; Kasem, A.; Newaz, S.S. Empirical comparison of area under ROC curve (AUC) and Mathew correlation coefficient (MCC) for evaluating machine learning algorithms on imbalanced datasets for binary classification. In Proceedings of the 3rd International Conference on Machine Learning and Soft Computing, Da Lat, Vietnam, 25 January 2019. [Google Scholar]

- Obi, J.C. A comparative study of several classification metrics and their performances on data. World J. Adv. Eng. Technol. Sci. 2023, 8, 308–314. [Google Scholar] [CrossRef]

- Tomasic, R.; Bottomley, S.; McQueen, R. Corporations Law in Australia; Federation Press: Alexandria, Australia, 2002. [Google Scholar]

- Reith, A.; Tran, H. Homebuilder—The Bigger Picture for Residential Construction and the Economy. 2021. Available online: https://www.bdo.com.au/en-au/insights/real-estate-construction/homebuilder-the-bigger-picture-for-residential-construction-and-the-economy (accessed on 19 July 2025).

| Study | Purpose | Model/Technique | Type | Country |

|---|---|---|---|---|

| [75] | Evaluate financial distress using logistic regression and financial ratios | Altman, Springate, Grover, Zmijewski with Logistic Regression | Statistical | Malaysia |

| [92] | Compare the Altman, Ohlson, and Zmijewski models in construction bankruptcy | Altman, Ohlson, Zmijewski | Statistical | Greece |

| [99] | Assess the bankruptcy risk of state-owned construction firms | Altman Z-score | Statistical | Vietnam |

| [93] | Compare the financial risk/efficiency of state-owned enterprises vs. private firms | Financial ratio analysis, DEA | Statistical | Indonesia |

| [76] | Predict distress using ensemble learning and non-financial variables | Ensemble Learning (Soft Voting), SMOTETomek, Recursive Feature Elimination with Cross-Validation (RFECV) | AI/ML | China |

| [98] | Analyse bankruptcy reasons in Slovak construction small and medium-sized enterprises (SMEs) | Descriptive statistics, Regional stratification | Statistical | Slovakia |

| [94] | Compare ML models for long-term distress in construction | Random Subspace (RS), ML, Ensemble Models | AI/ML | South Korea |

| [77] | Develop an insolvency model for creditworthiness in construction | Discriminant Analysis, Logistic Regression, Classification Trees | Statistical | Poland |

| [95] | Predict the business failure of construction contractors using financial, market, and macroeconomic data | LSTM RNN | AI/ML | US |

| [78] | Estimate bankruptcy probability in construction companies | Logit regression | Statistical | Russia |

| [79] | Compare methods for predicting construction company bankruptcy using financial and non-financial data | Logistic/probit regression, Classification trees, RF, NNs | AI/ML | Russia |

| [80] | Integrate SVM and market-based models to forecast contractor default in Taiwan | SVM, Artificial Neural Network, Hybrid models | AI/ML | Taiwan |

| [81] | Assess the stability of bankruptcy predictors over time for the Czech construction and manufacturing sectors | Univariate (T-test, F-test) and multivariate methods (Boosted trees) | AI/ML | Czech Republic |

| [82] | Evaluate dynamic indicators for bankruptcy prediction in Czech construction firms | Dynamic financial indicators, statistical testing | Statistical | Czech Republic |

| [83] | Predict financial loss in building projects using insurance claim data | Multiple regression analysis | Statistical | South Korea |

| [96] | Measure and analyse construction firm efficiency pre-/post-financial crisis | DEA, Bootstrap regression | Statistical | Spain |

| [87] | Predict construction firm default using financial ratios and market factors | Logit regression | Statistical | Taiwan |

| [100] | Predict financial loss for large construction companies | Logistic regression | Statistical | US |

| [86] | Predict the financial distress of Chinese construction and real estate companies | Back propagation NN (BPNN), AdaBoost, Bagging ensembles | AI/ML | China |

| [85] | Predict the bankruptcy of construction companies using financial ratios | Fisher’s Linear Discriminant Analysis | Statistical | China |

| [84] | Predict the bankruptcy probability of construction companies with business risk indicators | Fuzzy logic model, Decision-support tool | Fuzzy logic | US |

| [101] | Compare financial trends of construction firms using bankruptcy prediction models | Altman Z-score (multivariate discriminant analysis) | Statistical | Korea, Japan, US |

| [88] | Identify and rank critical factors for predicting insolvency in construction firms | Systematic review, Statistical analysis | Statistical/Review | UK |

| [91] | Develop a bankruptcy prediction model for construction companies using sector-specific data | Classification and Regression Trees (CART) | AI/ML | Czech Republic |

| [97] | Review and critique methodological approaches in construction business failure prediction studies | Systematic review, meta-analysis | Review | Global |

| [89] | Improve construction business failure prediction using entropy-based discriminant analysis | Entropy measure, Discriminant analysis | Statistical | Taiwan |

| [90] | Predict insolvency using Bidirectional LSTM (BiLSTM) autoencoder and financial/macro indicators | BiLSTM Autoencoder | AI/ML | Australia |

| Study | AI/ML Function | Data Type/Scope | Variable Selection | Model Evaluation | Key Results |

|---|---|---|---|---|---|

| [76] | Predict financial distress 1 to 2 years in advance | Chinese listed construction firms, Financial and non-financial variables | RFECV | Compared against single classifiers | Soft voting ensemble model outperformed all single models |

| [94] | Predict medium-to-long-term (3, 5, 7 years) financial distress | Korean construction firms, multiple-year forecasts | Used financial ratios relevant for long-term predictions | AUC, Friedman test for model comparison | The RS model achieved the best performance over a medium-to-long-term horizon |

| [95] | Predict business failure 1–3 years in advance | US construction contractors | Compared models using only accounting, only market, only macro, and all combined | Compared the LSTM RNN performance for variable sets and prediction windows | Adding market and macro variables increased prediction accuracy by 2–4% over using accounting alone |

| [79] | Predict bankruptcy within 1 year | Russian construction firms, Public financial and non-financial data (2011–2017) | Included financial ratios (profitability, liquidity, stability, activity) and non-financial factors (firm size, age) | Compared logistic/probit regression, classification trees, RF, and NN, Used AUC/Gini as quality metrics | Neural networks had the highest predictive power, and Logistic regression with discretisation also performed well |

| [80] | Forecast contractor defaults using hybrid AI | Taiwanese construction firms, Financial and stock data | Integrated from the literature and expert screening | Accuracy and model comparison | Hybrid models outperformed individual algorithms |

| [81] | Explore predictor stability over time and sectors | Czech data (2003 to 2013), 34,533 firms comprise | Statistical significance testing | Cross-sectoral and temporal model robustness | Predictor importance varies by sector and time frame |

| [86] | Predict financial distress 1 to 3 years in advance | Chinese listed construction and real estate companies | Three financial ratio datasets were constructed from public stock exchange data | Compared BPNN-AdaBoost and BPNN-Bagging ensembles to a single BP neural network and Z3-score model | Both ensemble models outperformed single BPNN and Z3-score, AdaBoost best for 1–2 years, Bagging best for 3-year prediction |

| [91] | Predict the bankruptcy of construction companies | Czech construction firms (period: 2011 to 2014), 29 financial indicators | Selection based on relevance from accounting/financial data | Evaluated using correct classification rate, Type I/II errors, Receiver Operating Characteristic (ROC) curve (AUC) | The CART model for construction firms had the highest discrimination ability and outperformed generic models |

| [90] | Predict insolvency using reconstruction error | Australian construction firms (2000 to 2020), 180 records post-balancing | 17 financial, operational, growth, and macroeconomic indicators | Accuracy, Precision, Recall, F1-score | Achieved 97.3% accuracy, outperforming CNN-BiLSTM and LSTM models |

| Empirical Pattern | Potential Supplementary Feature | Definition/Rationale |

|---|---|---|

| High risk among micro/small firms | Company size | Number of employees, higher risk for micro/small firms |

| Poor financial control and record-keeping | Financial control flag | An indicator of management quality, supplementing ratio-based analysis |

| Under-capitalisation | Capital adequacy flag | Adds qualitative depth to capital structure metrics |

| Chronic cash flow issues | Liquidity/cash flow issues | Enhances standard liquidity ratios with behavioural evidence |

| Trading losses | Trading losses flag | Flag recent performance trends that are not always visible in annual ratios |

| Company or officer misconduct | Misconduct indicator | Provides behavioural context to quantitative analysis |

| Persistent negative equity | Net deficiency bracket | Categorical supplement to net worth calculation |

| Large debts to creditors | Outstanding debt | Context for leverage or creditor concentration |

| Employee/tax arrears | Compliance arrears flag | Captures regulatory and late-stage distress signals |

| Number of unsecured creditors | Number of unsecured creditors | Enhances the detail of the creditor risk assessment |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jayawardana, J.; Wijeratne, P.; Vrcelj, Z.; Sandanayake, M. Artificial Intelligence for Predicting Insolvency in the Construction Industry—A Systematic Review and Empirical Feature Derivation. Buildings 2025, 15, 2988. https://doi.org/10.3390/buildings15172988

Jayawardana J, Wijeratne P, Vrcelj Z, Sandanayake M. Artificial Intelligence for Predicting Insolvency in the Construction Industry—A Systematic Review and Empirical Feature Derivation. Buildings. 2025; 15(17):2988. https://doi.org/10.3390/buildings15172988

Chicago/Turabian StyleJayawardana, Janappriya, Pabasara Wijeratne, Zora Vrcelj, and Malindu Sandanayake. 2025. "Artificial Intelligence for Predicting Insolvency in the Construction Industry—A Systematic Review and Empirical Feature Derivation" Buildings 15, no. 17: 2988. https://doi.org/10.3390/buildings15172988

APA StyleJayawardana, J., Wijeratne, P., Vrcelj, Z., & Sandanayake, M. (2025). Artificial Intelligence for Predicting Insolvency in the Construction Industry—A Systematic Review and Empirical Feature Derivation. Buildings, 15(17), 2988. https://doi.org/10.3390/buildings15172988