1. Introduction

After construction, engineering structures are expected to serve for several decades or even over a century, during which they are subjected to numerous unpredictable challenges, such as environmental corrosion, insufficient maintenance, improper human usage, and sudden geological damage [

1]. These issues are often overlooked in conventional design approaches, resulting in long-term deterioration of structural performance. When decisions focus solely on minimizing initial construction costs, low-standard structural solutions may be selected, leading to substantially increased maintenance expenses during the operational phase. The life cycle of engineering structures typically encompasses design and construction, operation, inspection and maintenance, repair and reinforcement, as well as demolition and recycling. The life cycle cost (LCC) management approach is, therefore, advocated to comprehensively account for the degradation patterns, maintenance strategies, and associated costs across different stages, enabling scientifically informed decisions to ensure long-term performance with reasonable economic input [

2]. Such a systematic management method is recommended to be adopted by stakeholders to control upfront investment while effectively reducing subsequent maintenance costs, ultimately enhancing the overall project economy.

Life cycle cost is one of the most intuitive indicators for evaluating the life cycle performance of structures, and the minimization of LCC is commonly adopted as a key criterion in life cycle design schemes. Considerable progress has been made in the development of life cycle cost calculation models, providing systematic approaches for life cycle assessment (LCA) [

3,

4,

5,

6]. Mithraratne [

7] proposed a life cycle analysis method for individual buildings in New Zealand based on operational energy demands and life cycle costs over a building’s service life. Verbeeck [

8] conducted a comparative life cycle inventory study of four typical Belgian residential buildings, demonstrating that the energy consumption during the usage phase far exceeds the embodied energy in construction, thus validating the overall energy-saving benefits of low-energy buildings. Dong [

9,

10] developed a bridge deterioration assessment framework incorporating multiple hazard factors, establishing a multidimensional sustainability evaluation system by quantifying environmental indicators, such as energy consumption and carbon emissions alongside social impact parameters including downtime and casualties. García-Segura [

11] proposed an optimization method for bridge design that simultaneously considers structural reliability and sustainability, with particular attention to vehicle operating costs, traffic delay costs, and additional carbon emissions caused by detours in the sustainability assessment. Jebelli [

12] introduced a bi-objective heuristic optimization framework based on life cycle design aimed at balancing initial construction costs and long-term maintenance costs of steel structures. Ping [

13] focused on environmental costs by developing a life cycle cost assessment framework integrating seismic losses and environmental impacts, quantifying economic and carbon emission effects across different steel frame structures through case studies. However, existing studies generally evaluate economic, environmental, and social impacts as separate indicators, resulting in limitations in the comprehensiveness of these models.

To overcome these limitations, some researchers have attempted to integrate multiple factors for a multidimensional evaluation. For instance, Kendall [

14] developed a combined LCA-LCC model that systematically quantifies three types of costs, namely institutional costs (including materials, equipment, and labor), social costs (covering traffic delays, vehicle wear, and accident risks), and environmental costs (accounting for six air pollutants and three greenhouse gases causing environmental damage). Al-Kabaha [

15] employed a multi-objective optimization approach, integrating EnergyPlus, jEPlus + EA, and NSGA-II software, to optimize the LCC of residential buildings, achieving significant reductions in energy consumption and costs. Dervishaj [

16] compared the functionalities and limitations of CAD, BIM, and computational design plugins, highlighting the potential and future development directions of BIM-LCA integration for sustainable design. Boje [

17,

18] proposed a novel framework incorporating digital twins and building information modeling (BIM), targeting environmental, social, and economic sustainability, and conducted real-world case studies. Alsaffar [

19] systematically reviewed applications of digital twin technology in construction and asset management, exploring its potential to advance building intelligence and the Fourth Industrial Revolution. However, current research still exhibits several deficiencies. First, the scope of evaluation systems is limited. For example, environmental cost analyses mainly focus on air pollution, neglecting water pollution and solid waste impacts; social cost accounting often omits negative regional economic effects, such as disruption of commercial activities and fiscal revenue losses. Second, quantification methods lack consistency. Environmental costs use markedly different valuation standards for prevention and damage, while a systematic monetization model for social costs is yet to be established. These limitations compromise the comprehensiveness and comparability of assessment results.

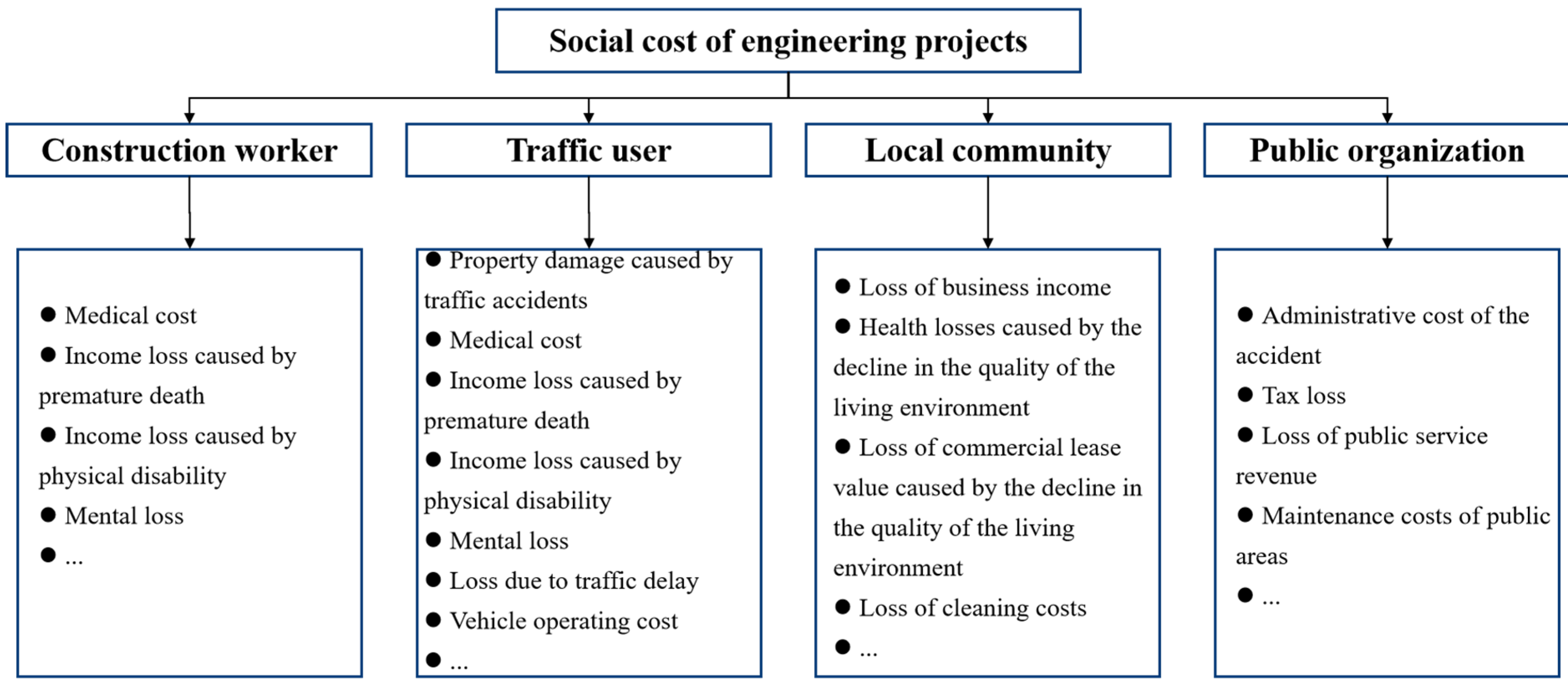

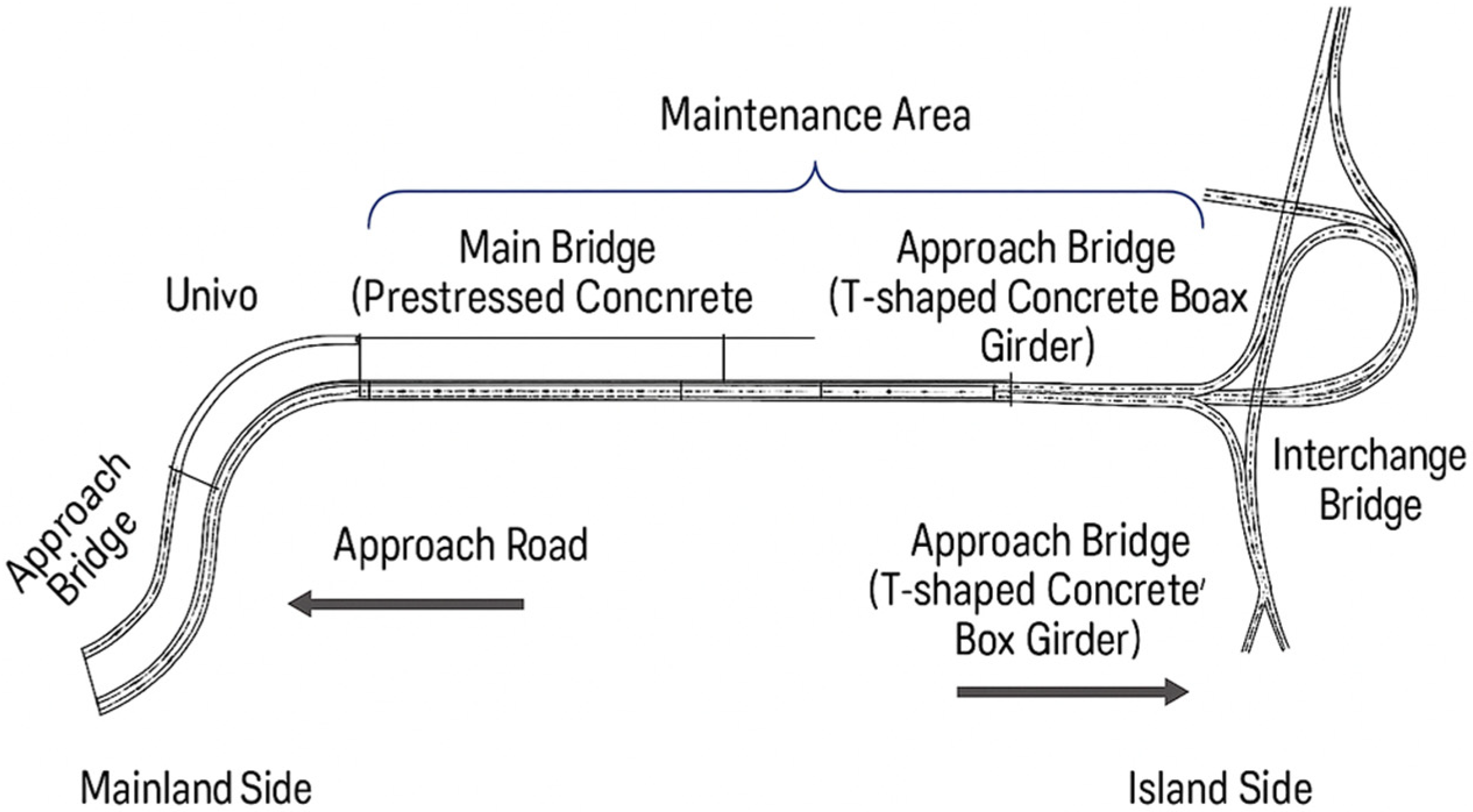

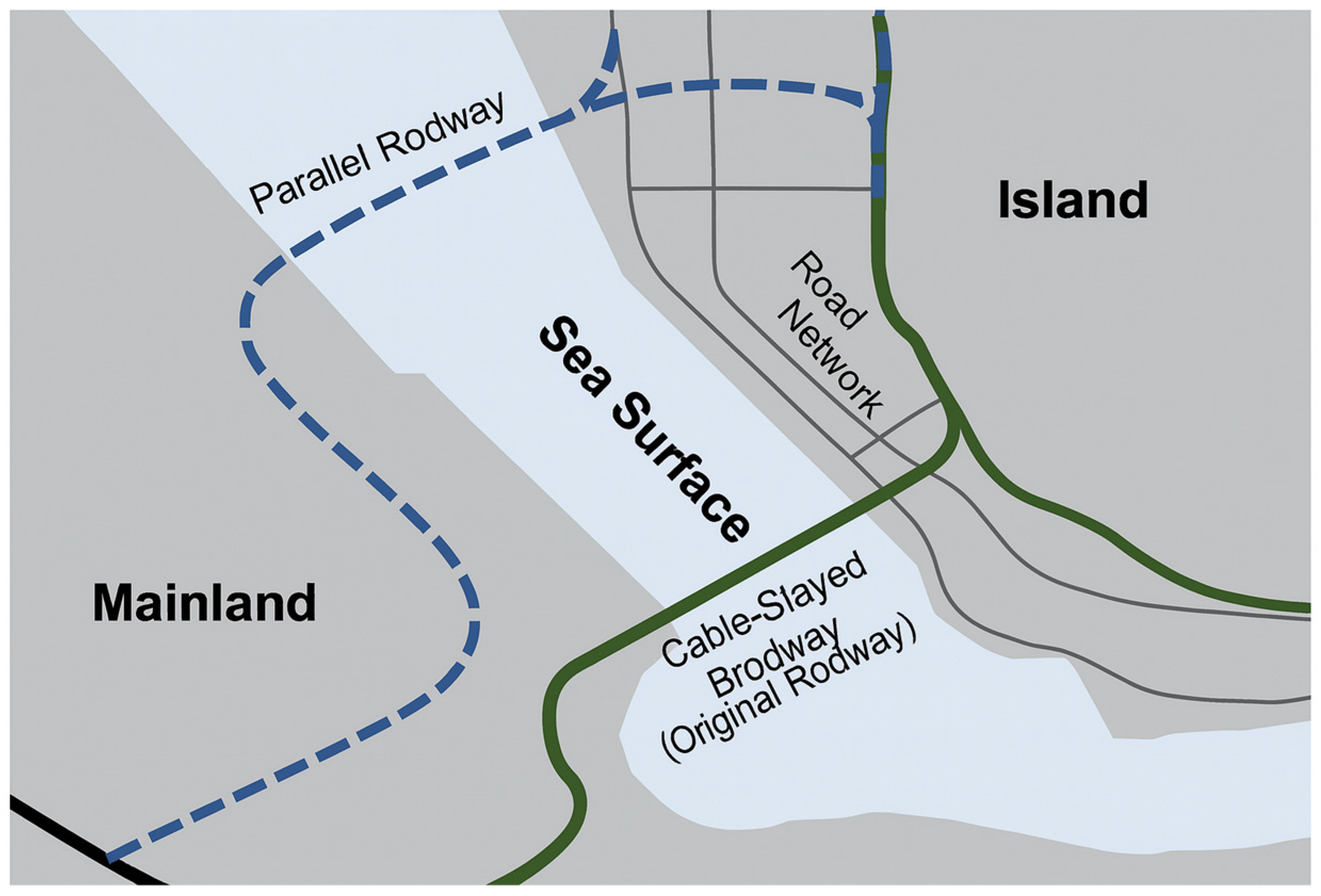

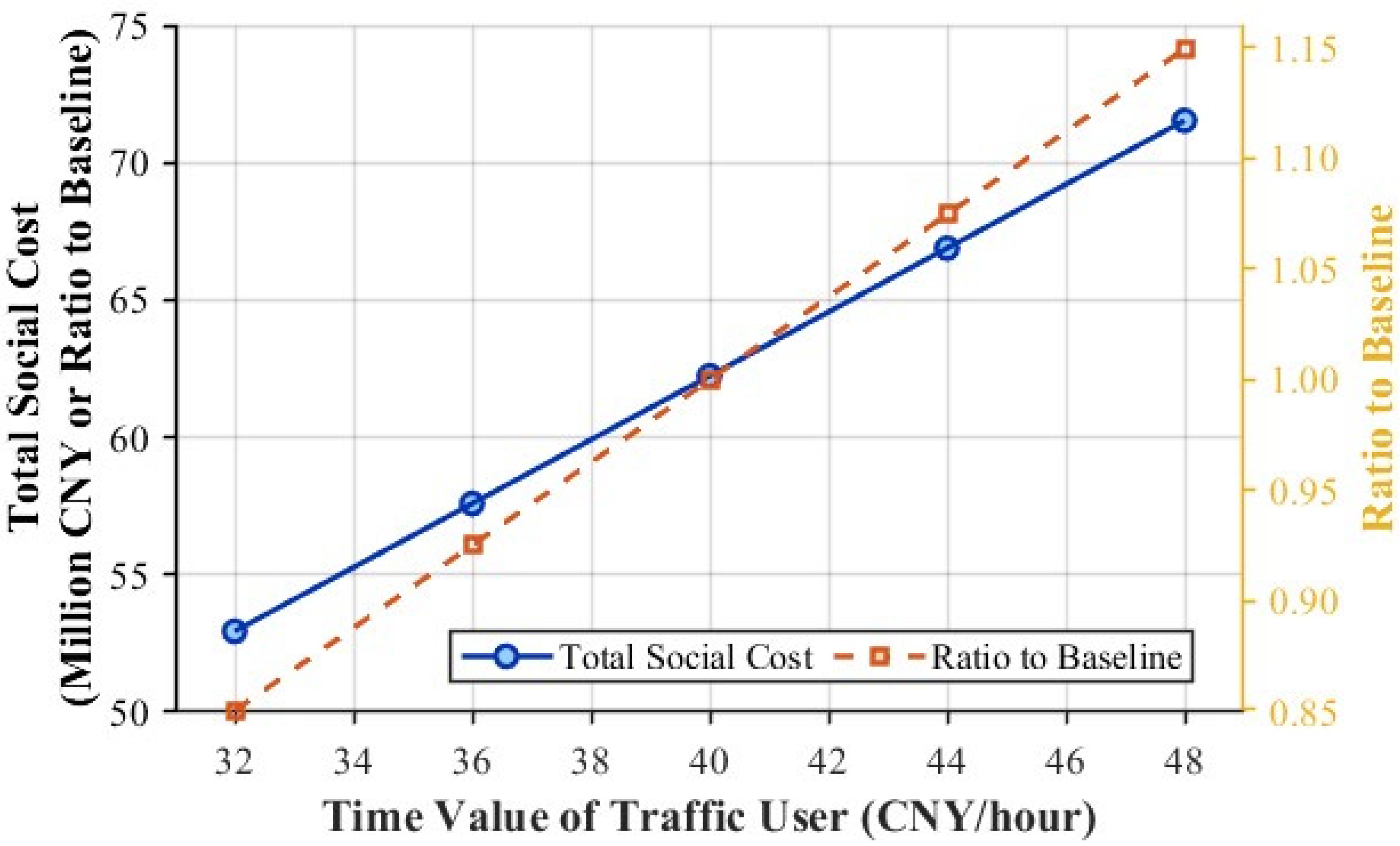

Therefore, to address these issues, this study integrates key elements of economic input, environmental impact, and social benefits over the entire life cycle of structures to construct a comprehensive LCC assessment framework and explores its engineering applications. Regarding environmental costs, a quantitative model based on pollutant emissions is developed, focusing on the pollution impacts of concrete structures on air, water, and soil media, while incorporating additional emissions caused by traffic congestion during construction. Environmental damage and mitigation cost rates for different pollutants are established, and a comparative analysis of environmental costs between two design schemes is conducted based on a real bridge project. In social cost assessment, a stakeholder analysis approach is employed to systematically quantify multiple factors across direct economic losses and indirect social impacts, including personal safety risks, psychological effects, time costs, and property value losses. A systematic measurement model is developed to provide methodological support for social benefit assessments in similar projects.

2. Life Cycle Economic Costs of Engineering Structures

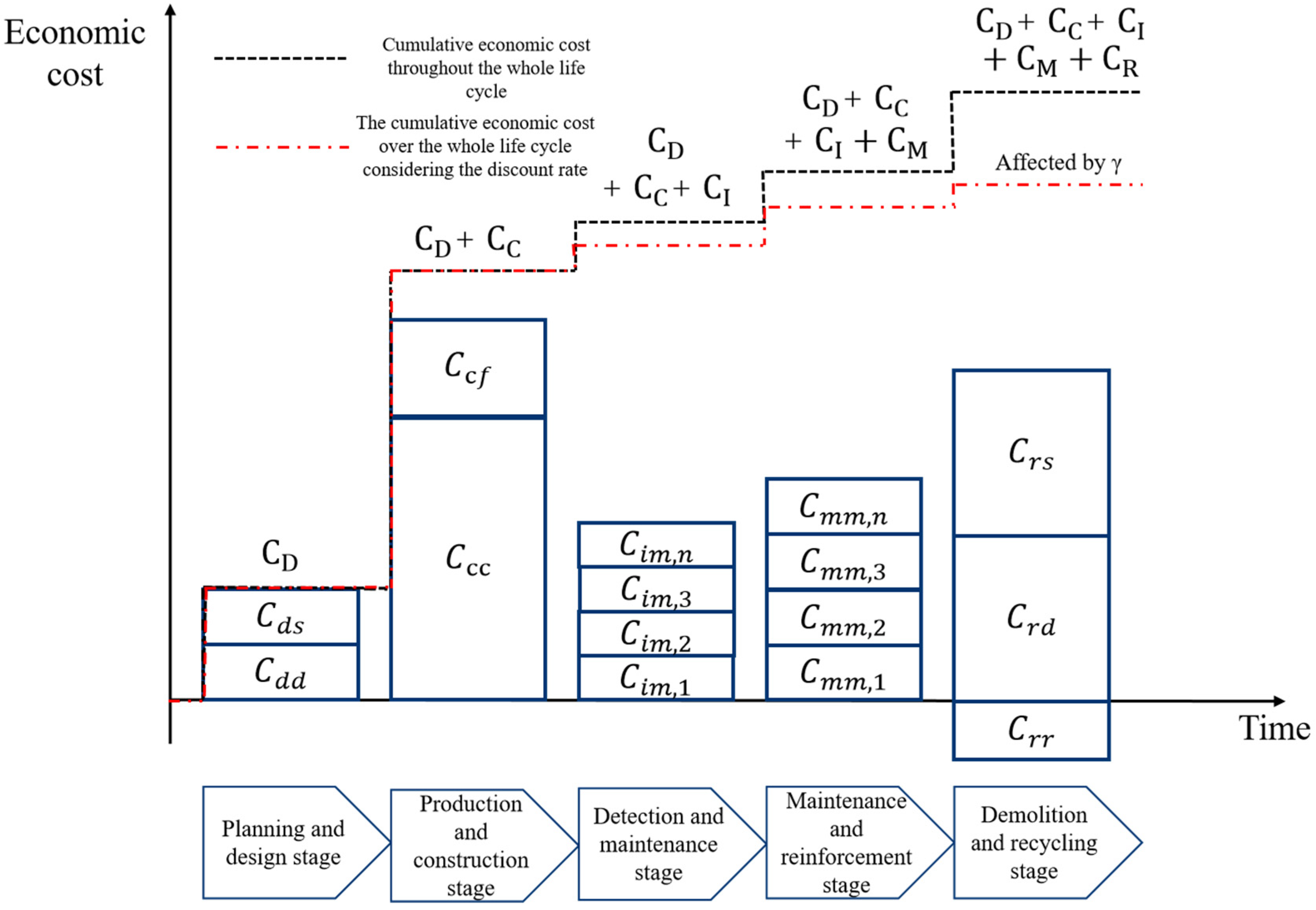

The economic costs of engineering structures are comprised of all monetizable capital expenditures incurred throughout the entire life cycle, including initial construction investments, maintenance expenses during the operational phase, and decommissioning or renovation costs at the end-of-life stage, as illustrated in

Figure 1. These direct financial outlays form the foundation of a comprehensive life cycle financial evaluation.

To ensure accurate accounting, economic costs are categorized based on the distinct characteristics of each life cycle phase. Given that engineering structures typically remain in service for several decades from construction to demolition, the time value of money is considered a critical factor. Consequently, appropriate discount rates are applied during the operational and decommissioning stages to accurately reflect long-term cost-effectiveness. Through this dynamic evaluation approach, capital value fluctuations over time are more realistically represented.

2.1. Discount Rate

The discount rate is regarded as a pivotal economic parameter that reflects the time value of money. Influences, such as economic growth, inflation, and various uncertainties, including natural disasters, armed conflicts, and public health emergencies, cause variations in the real value of a fixed monetary amount across different time periods. Therefore, the discount rate is incorporated as a fundamental variable when assessing the life cycle economic cost of concrete construction projects. This incorporation enables the conversion of all cash flows—from construction and operation to decommissioning and recycling—into a common temporal reference point, thereby ensuring comparability and accuracy in long-term economic evaluations.

Both the expected return on capital and the underlying supply–demand dynamics in financial markets are captured by the discount rate. Its magnitude is strongly influenced by a country’s stage of economic development, prevailing interest-rate environment, and macroeconomic policies. Fiscal, monetary, and industrial policies are utilized by governments to regulate liquidity and maintain the discount rate within a reasonable and stable range. As a result, the discount rate serves as a core metric in national economic appraisals and project-level investment decisions.

In practice, reference discount rates are proposed by public authorities based on opportunity-cost capital, social time preference, and anticipated investment returns. For example, the Institute of Standards and Quotas of the Ministry of Housing and Urban–Rural Development in China issues the Economic Evaluation Methods and Parameters for Construction Projects, which prescribes calculation frameworks, such as the capital-output and social time-preference approaches. Based on theoretical models and Delphi expert surveys, a social discount rate () of 7–8% is recommended for the construction sector, reflecting domestic capital scarcity and the pursuit of high-quality growth.

Internationally, social discount rates are aligned with each nation’s economic maturity, long-term development strategy, and demographic profile. Advanced economies, such as the United States and Germany, typically adopt rates around 3%, while Japan, affected by prolonged deflationary pressure, sets a rate near 4%. The European Union applies a median rate of approximately 5% to accommodate differences among member states. In China, the selection of an appropriate discount rate requires balancing evolving capital return characteristics under the “dual-circulation” development paradigm with the need for international comparability. The establishment of a dynamic adjustment mechanism is recommended to ensure that evaluation results remain consistent with domestic realities while aligning with global investment appraisal standards.

As the economy evolves, fluctuations in the time value of money are observed, and increases in the costs of labor, materials, and equipment associated with construction projects are typically experienced. Following project completion, prices of various resources utilized throughout the life cycle are not considered fixed but are generally subject to incremental rises over time. To more accurately capture the effects of inflation and risk factors on pricing, it is necessary to incorporate the growth rate of the Producer Price Index (

) as an economic parameter alongside the social discount rate when determining the appropriate discount rate for construction projects. As a key indicator for tracking price fluctuations, formulating economic policy, and conducting national economic accounting, the PPI complements the social discount rate in evaluating long-term project costs. According to economic theory, the final discount rate applicable to construction projects can be derived by integrating these two parameters, as follows:

where

is the adjusted discount rate, accounting for project-specific factors;

is the base social discount rate;

is the growth rate of the Producer Price Index (PPI), reflecting inflation and price changes over time.

For engineering structures, performance degradation and increased failure probability are observed over time. Therefore, the discount rate applied in life cycle cost assessments should be adjusted to reflect this upward trend in risk. Following comprehensive evaluation, it is recommended that the discount rate for engineering structures be set within the range of 2% to 3% to appropriately account for long-term risk variations.

2.2. Life Cycle Economic Cost Calculation Model

2.2.1. Calculation Model in Planning and Design Stage

During the planning and design phase, economic costs primarily comprise surveying fees, design expenses, and related costs, such as drawing reviews and bidding agency fees. These costs are closely tied to the construction entity and can be expressed as follows:

where

is the planning and designing economic cost;

is the engineering investigation cost during year

;

is the engineering design cost during year

;

is the continuous year of planning and design stage.

is the discount rate for construction projects.

2.2.2. Production and Construction Stage Calculation Model

In the production and construction phase, economic costs consist mainly of construction and installation expenditures, along with supporting fees, such as supervision, consultation, and auditing. Construction and installation costs are further subdivided into labor, material, and machinery usage expenses. These costs can be calculated as:

where

is the economic cost of production and construction;

is the engineering construction and installation cost during year

;

is the ancillary cost of engineering construction and installation during year

.

is the continuous year of production and construction stage.

is the discount rate for construction projects.

2.2.3. Inspection, Maintenance, and Reinforcement Phase Cost Models

The economic costs incurred during the inspection and maintenance phase, as well as those arising from the maintenance and reinforcement phase, are determined by the adopted strategies, the timing of interventions, and the frequency of the associated activities. Given that inspection and maintenance tasks differ in nature and timing from reinforcement works, their costs are modeled separately to accurately capture their individual contributions.

The total discounted cost of inspection and maintenance is calculated as follows:

where

represents the inspection and maintenance economic costs;

is the one-time cost of the inspection and maintenance work in the Jth year after the structure is completed;

is the discount rate for construction projects;

is the total number of years from the completion of the structure to its demolition.

Similarly, the economic cost of maintenance and reinforcement is expressed as follows:

where

is the economic cost of maintenance and reinforcement;

is the cost of the first maintenance and reinforcement work in the Jth year after the structure is completed;

is the discount rate for construction projects;

is the total number of years from the completion of the structure to its demolition.

2.2.4. Disposal and Recycling Phase Cost Model

At the end of the service life, dismantling and environmentally responsible disposal of the structure are required. Recoverable materials and components are recycled, and when recycling revenues exceed dismantling and treatment costs, the residual value offsets total life cycle economic costs. The net discounted cost of disposal and recycling is calculated as follows:

where

is the dismantling and recycling costs;

is the construction cost of the project demolition;

is the cost of harmless treatment of demolition materials;

is the revenue from the recycling of engineering materials.

is the discount rate for construction projects;

is the total number of years from the completion of the structure to its demolition.

Based on the above analysis, the calculation model of economic cost throughout the entire life cycle of the engineering structure can be obtained:

where

is the total life cycle economic cost of the engineering structure.

To sum up, the composition of the economic cost of the engineering structure over its entire life cycle can be summarized as shown in

Figure 2.

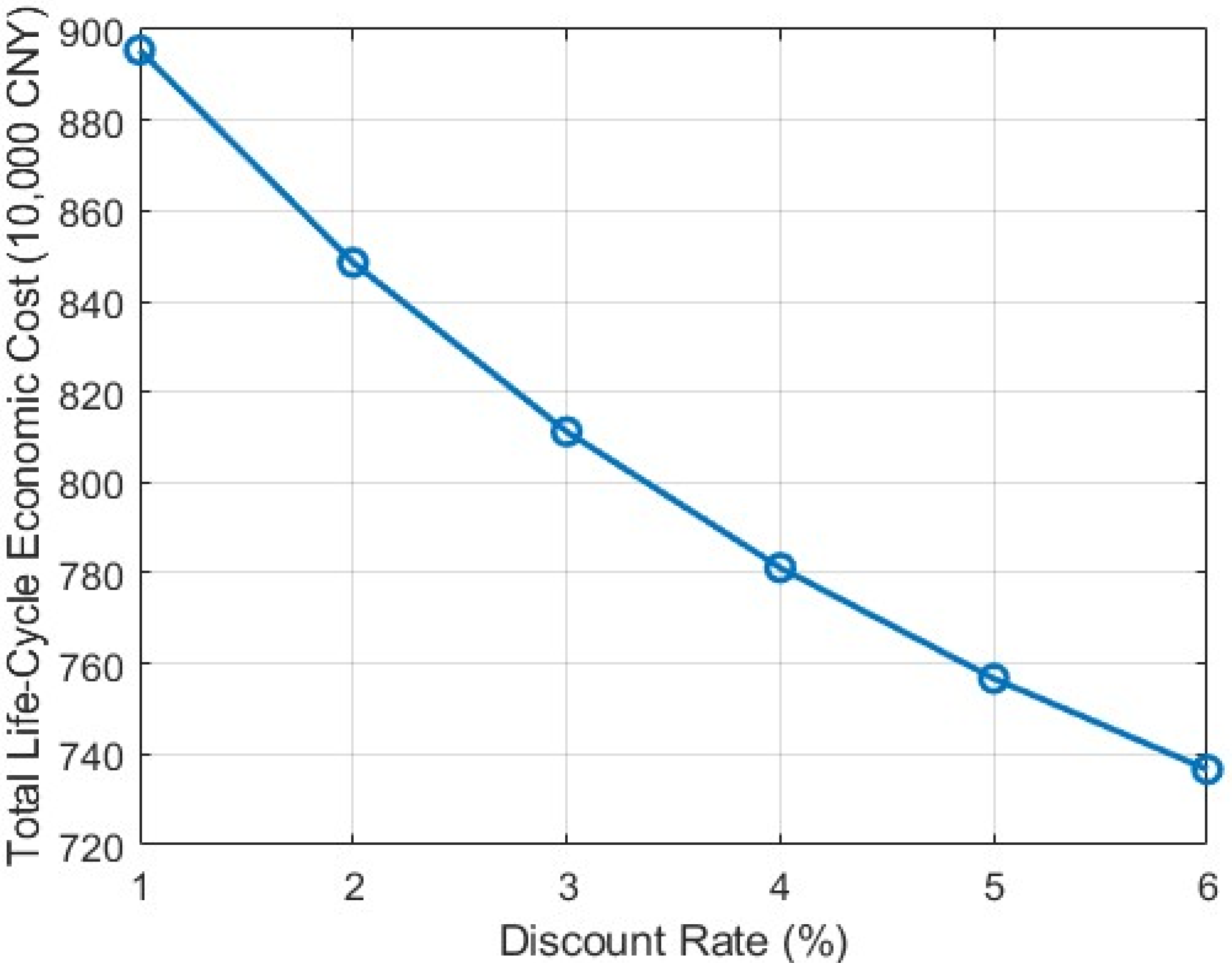

2.3. Sensitivity Analysis of Discount Rate

To examine the sensitivity of the model to assumptions regarding the discount rate, a stepwise sensitivity analysis was conducted by varying the discount rate γ from 1% to 6%. Cost parameters for each stage (in 10,000 yuan) were assigned as follows: design and survey costs of 20/10 and 15/10 in years 1 and 2, respectively; construction costs of 300/200 and 50/40 in years 1 and 2, respectively; inspection costs of 20 at years 10, 20, and 30; maintenance costs of 30 at years 5, 10, 15, 20, 25, and 30; and demolition-related costs of 80, 10, and 20 at year 30.

The resulting life cycle cost (LCC) variation with respect to the discount rate is presented in

Table 1 and

Figure 3. The results indicate that as the discount rate increases, the present values of future-stage expenses, such as inspection, maintenance, and demolition, rapidly decrease, leading to a significant reduction in total LCC. This demonstrates that the discount rate parameter is highly sensitive in economic evaluations. Therefore, it is recommended that a reasonable discount rate be selected in engineering practice and decision making, with sensitivity analyses conducted to verify the robustness and scientific validity of the evaluation outcomes.