Pricing Decisions in a Dual-Channel Construction and Demolition Waste Recycling Supply Chain with Bilateral Free-Riding Behavior

Abstract

1. Introduction

2. Literature Review and Theory

2.1. Market Promotion Challenges in CDW Recycling

2.2. Dual-Channel Supply Chains and Sales Effort Dynamics

2.3. Developments in Free-Riding Theory Under Digital Transformation

3. Problem Description and Associated Assumptions

3.1. Model Assumptions

- (1)

- Product homogeneity: recycled building materials products supplied through online sales channels operated directly by manufacturers and offline physical sales channels operated by retailers are completely consistent in terms of core functions, performance quality, and physical characteristics. This setting is the basic premise for the model to depict the essence of competition in a dual-channel structure. This effectively eliminates the interference of product differences on consumer channel preferences and ensures that the model can focus purely on the combined impact of price competition and free-riding behavior on demand.

- (2)

- Zero production costs and zero basic operating costs: Referring to [25,37], to focus the research on the complex decision-making conflicts caused by the interaction between the dual-channel structure, free-riding behavior, and subject strategies, the model sets the unit production cost of recycled building materials manufacturing to zero. Moreover, the model ignores the basic unit sales or fulfillment costs involved in the operation of online direct sales channels and offline channels (such as basic packaging and standardized short-distance logistics).

- (3)

- Parametric constraints on bidirectional free-riding behavior: The core parameters depicting cross-channel sales service externalities in the model, namely, the free-riding coefficient () of offline channel members on online channel efforts and the free-riding coefficient () of online channels on offline channel efforts, are strictly defined to have theoretical values ranging from 0 to 0.5 (, ). This is because although the sales efforts provided by one channel increase the demand of the other channel, the increase in demand of the other channel will not exceed the increase in the channel’s own market demand [23].

- (4)

- Specific simplification of sales effort costs: To further control the model parameter dimensions and computational complexity and facilitate a more intuitive analysis of the core mechanisms (free riding and competition), the model sets the sales effort cost coefficient of the retailer’s offline channel to a fixed unit value () and sets the sales effort cost coefficient of the online channel to . This simplification is an important variable normalization technique. By setting as the benchmark, we can more clearly explore the impact of the relative relationship between the manufacturer’s online sales effort cost coefficient and other parameters (, ) on decision-making [25].

- (5)

- Intrinsic conditions for model solubility and feasibility: To ensure that subsequent analysis based on the Stackelberg game framework can smoothly obtain meaningful and realistic equilibrium solutions (e.g., nonnegative sales effort values and the existence of a unique internal equilibrium), the model parameters must satisfy a set of specific technical constraints with clear mathematical guarantees: and . The mathematical basis for this constraint lies in ensuring the strict concavity of the profit functions of manufacturers and retailers within their respective decision spaces (negative Hessian matrix), which is a fundamental requirement for solving interior-point equilibria via first- and second-order optimization conditions. The ultimate goal is to eliminate unreasonable solutions caused by the model form (such as negative effort levels) and ensure the practical significance and economic interpretability of the final solution set. The proof of its mathematical necessity is provided in Appendix A, along with the subsequent derivation process for solving the model.

3.2. Demand Function

4. Model Building and Solving

4.1. Decentralized Decision Model (D Model)

4.1.1. Optimal Price Response for Retailer

4.1.2. Pricing Decisions of Construction Waste Remanufacturers

4.1.3. Best Effort Level of Model D

- (1)

- When , that is, , , and .

- (2)

- When , that is, , .

- (1)

- , , .

- (2)

- When , that is, , .

4.2. Centralized Decision Model (C Model)

4.2.1. Optimal Price Response for Construction Waste Remanufacturers and Retailers

4.2.2. Best Effort Level of Model C

- (1)

- When , that is, .

- (2)

- When , that is, .

- (1)

- When , that is, .

- (2)

- When and , that is, .

- (3)

- When , that is, .

5. Model Analysis

- (1)

- .

- (2)

- When , that is, .

6. Numerical Simulation

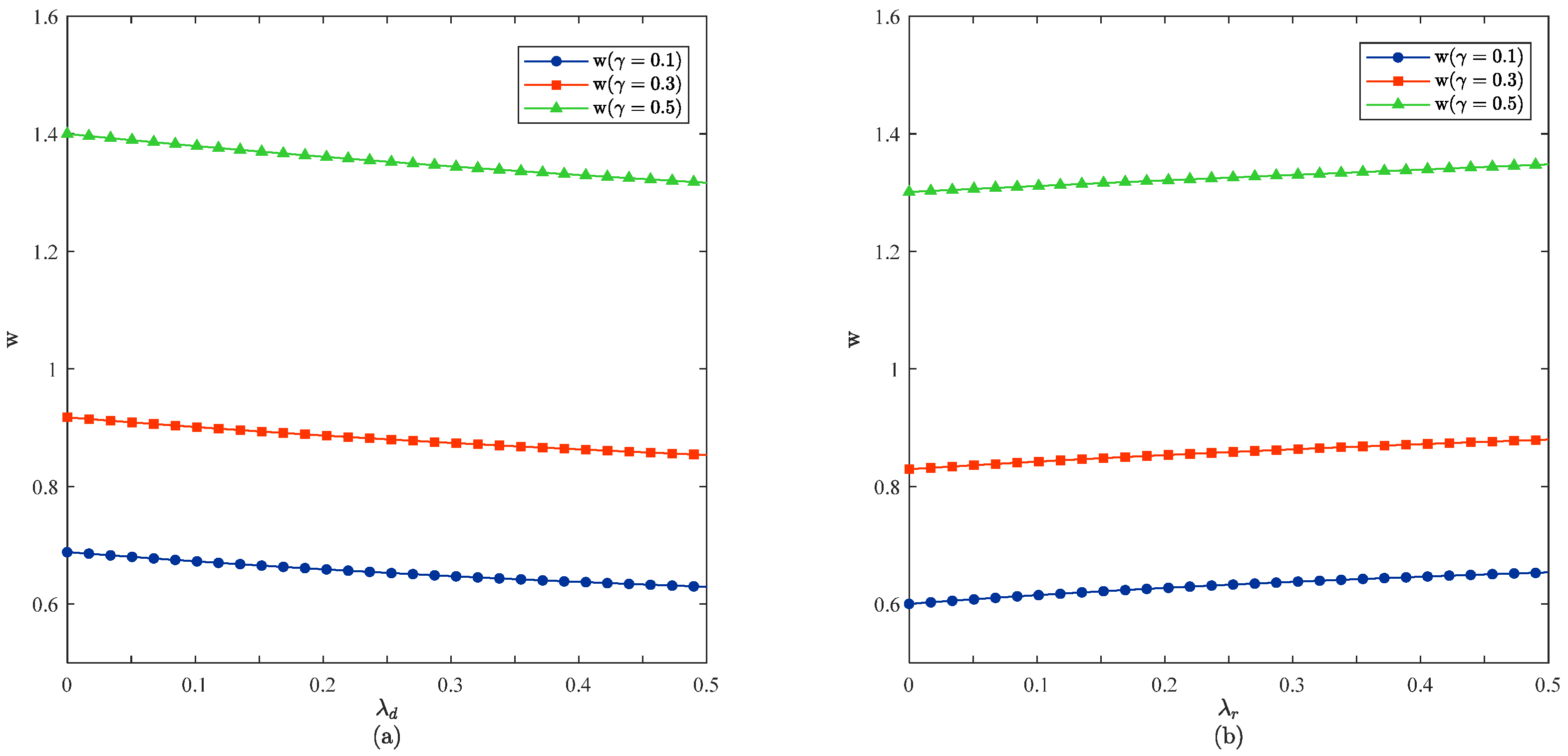

6.1. Impact of the Free-Riding Coefficient on the Wholesale Price

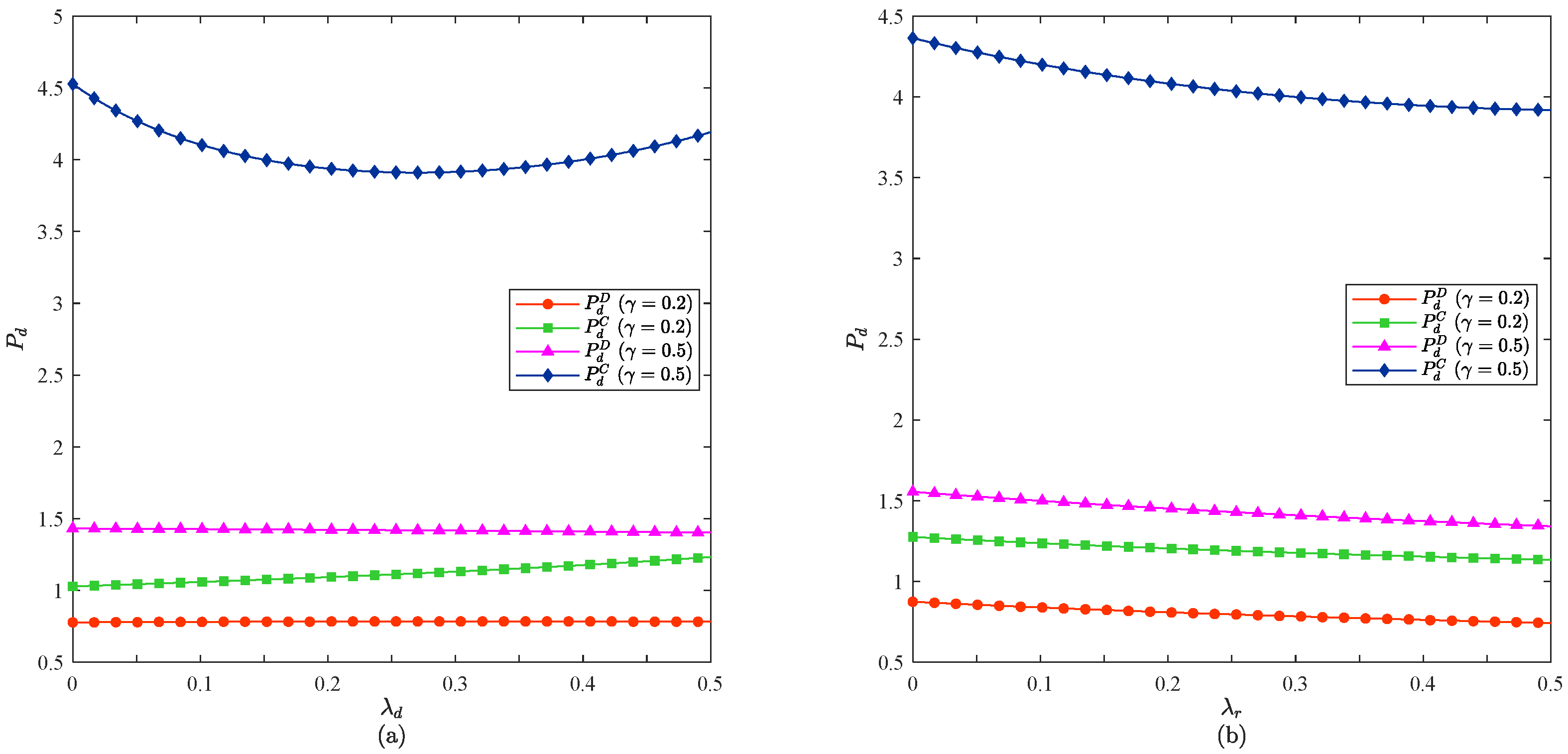

6.2. Impact of the Free-Riding Coefficient on the Online Direct Selling Price

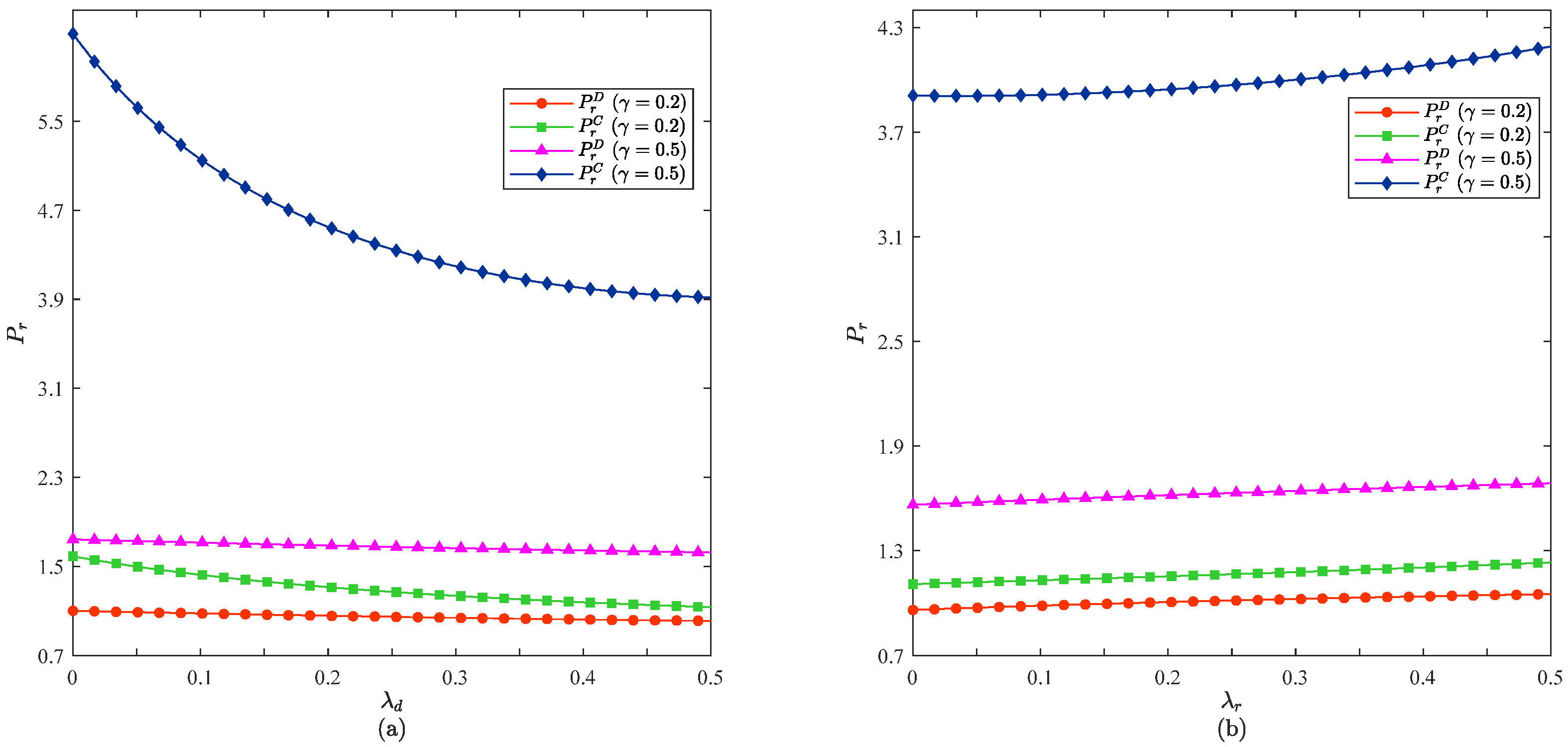

6.3. Impact of the Free-Riding Coefficient on the Offline Retail Price

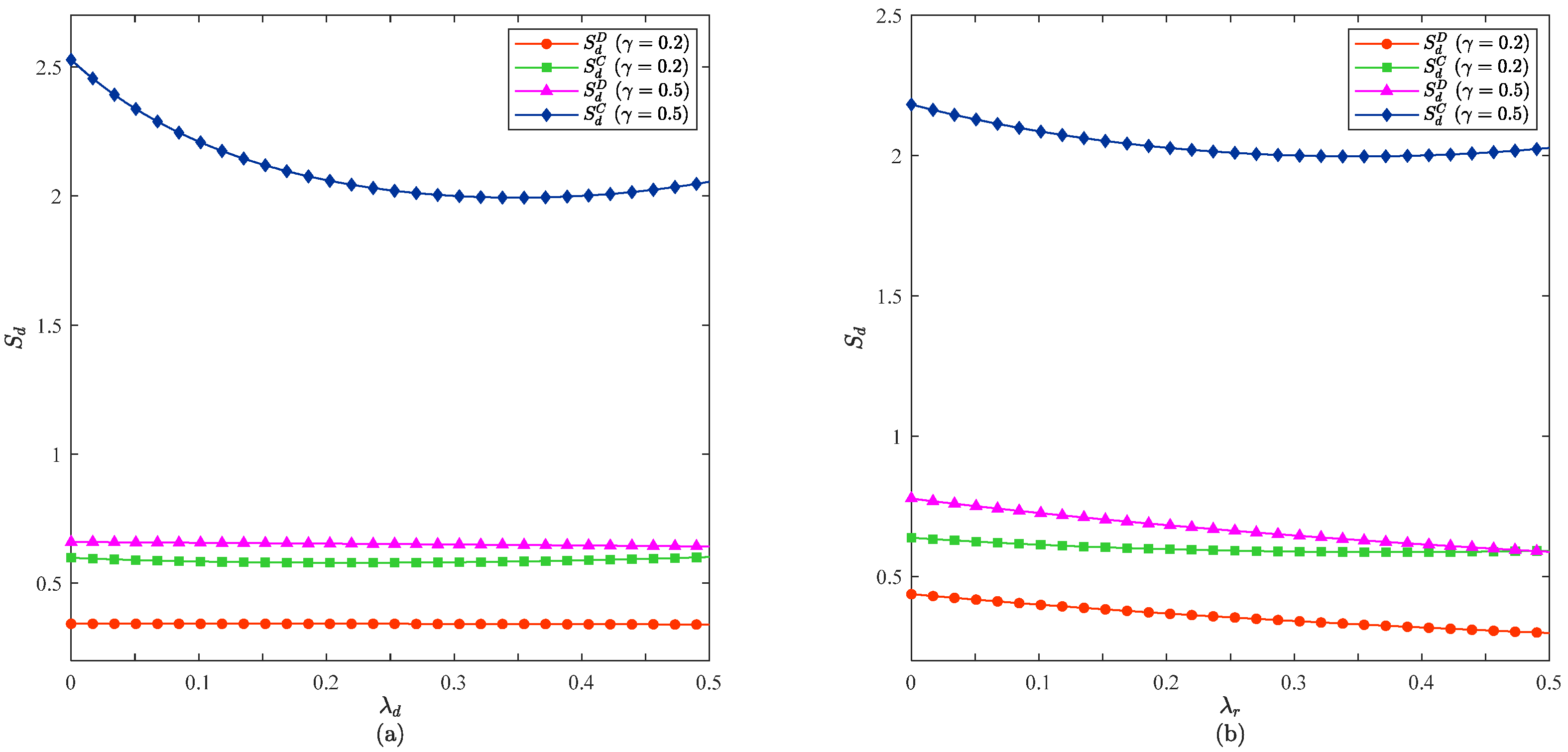

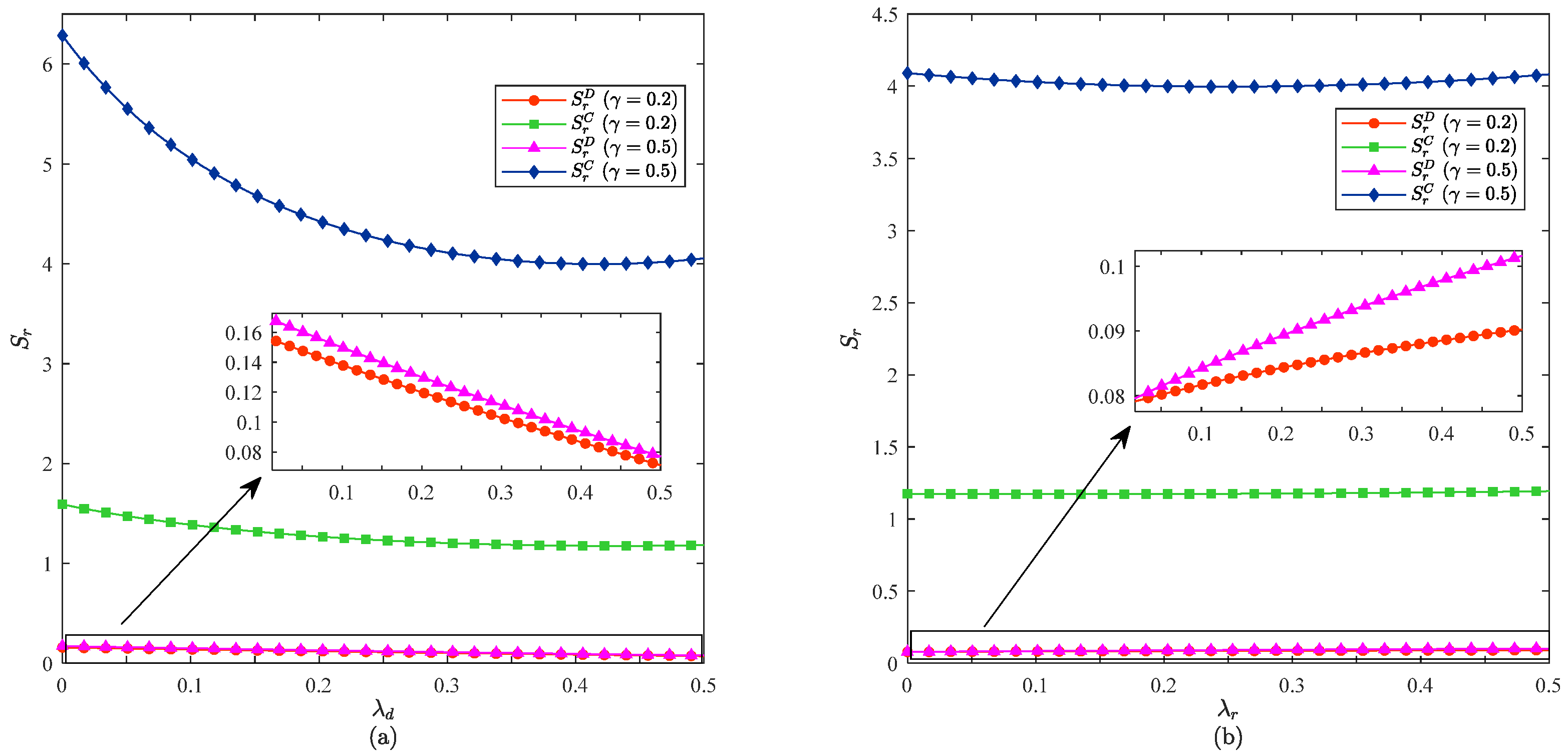

6.4. Impact of the Free-Riding Coefficient on Sales Effort in the Online Channel

6.5. Impact of the Free-Riding Coefficient on Sales Effort in the Offline Channel

7. Conclusions and Implications

7.1. Conclusions

7.2. Implications

- (1)

- For construction waste remanufacturers, when cross-price sensitivity is high, both online and offline free-riding weaken the competitiveness of online channels, so it is necessary to establish a systematic strategy to prevent bidirectional free-riding. In response to the risk of offline consumer migration due to offline free-riding, the online experience should be optimized through technological innovation, such as establishing an omni-channel membership points system or learning from Conch Cement’s use of 3D+VR technology tools to transform traditional education costs into customer loyalty advantages [61]. At the same time, it is necessary to work with retailers to build a cross-channel investment measurement mechanism, such as a revenue sharing scheme based on the proportion of sales efforts, to resolve the contradiction of unilateral investment and multiparty benefits through contract design.

- (2)

- Retailers should take a dialectical view of the free-riding effect. Faced with the shift in demand caused by offline free-riding, they should seize the opportunities brought about by offline free-riding and invest more sales efforts, such as equipping themselves with professional technical teams in the engineering field and providing customized solutions and other nonprice means to lock in core customer groups. Regarding the phenomenon where the service value of offline channels is absorbed by online channels due to online free-riding, retailers can proactively collaborate with manufacturers to enhance supply chain synergy—jointly organizing technical seminars in offline settings to integrate brand resources, breaking down data barriers between supply and demand on the digital front, and establishing a joint decision-making mechanism to mitigate channel conflicts.

- (3)

- Government departments should adopt a combination of policies. The first priority is to set mandatory procurement quotas for recycled building materials in municipal engineering tenders, using large-scale demand to break through market bottlenecks. The second priority is to accelerate the establishment of a product certification standard system to increase public trust in recycled building materials. Policy resources should be prioritized for companies implementing end-to-end traceability technology, particularly supply chain consortia adopting a manufacturer–retailer decision-making collaboration model. This approach can reduce the intensity of market competition while amplifying collaborative advantages through incentive mechanisms, effectively transforming free-riding behavior from a threat into a catalyst for channel integration.

7.3. Limitations

- (1)

- The model structure of this study focuses on the dual-subject game between construction waste remanufacturers’ self-built platforms and offline retailers. Although this approach is consistent with the practices of leading companies in the industry, it does not include multichannel competition scenarios involving third-party digital retailers (such as EPC). In reality, it is difficult for manufacturers to completely monopolize online channels, and the intervention of digital retailers may reshape the role of bidirectional free-riding behavior. Future research can construct a dynamic game model involving three parties, self-built platform manufacturers, digital retailers, and physical retailers, to explore the enabling mechanism of platform data advantages for free-riding governance.

- (2)

- At the theoretical level, the study is based solely on the free-riding theory framework and has not yet incorporated new perspectives from behavioral economics. The risk preferences and trust-building of consumers of recycled building materials exhibit significant characteristics of prospect theory, such as loss aversion toward the uncertainty of recycled aggregate strength. Future research should combine social exchange theory with consumer experiments to investigate the moderating role of quality trust gaps and service commitments in cross-channel free-riding, thereby optimizing the demand function assumption.

- (3)

- The conclusions rely on pure mathematical reasoning and lack empirical calibration in industry. Although case studies from companies such as Huaxin Cement Co., Ltd. are cited to support the explanation, there is a risk of a disconnect between the model parameters and actual market feedback. It is recommended that subsequent scholars collaborate with resource recycling companies to conduct experiments to identify the price sensitivity thresholds and free-riding factors of contractors in different regions, thereby improving the practicality of management recommendations.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

- (1)

- In the decentralized decision model, the wholesale price of recycled building materials is:Finding the partial derivative of with respect to gives:Since the proof presupposes , it is easy to obtain:When , solve the following equation:, and then obtain:In summary, is positively correlated with the free-riding coefficient of online channel when .

- (2)

- The proof of the effect of the free-riding coefficient of the online channel on , , and in Proposition 1 follows the same steps as the proof of the effect of the free-riding coefficient of the online channel on . The equations used in the calculation are too long, so we do not present them here. □

- (1)

- In the decentralized decision model, finding the partial derivative of with respect to yields:Note: , , , , , , .Since the proof presupposes and , it is easy to determine that the numerator of the fraction of has a partial derivative with respect to greater than zero.When , the requirements are as follows:Note: ., and then obtain:Since the slope k > 0 was previously obtained, when .

- (2)

- The proof of the effect of the free-riding coefficient of the offline channel on , , and in Proposition 2 follows the same steps as the proof of the effect of the free-riding coefficient of the offline channel on . The equations used in the calculation are too long, so we do not present them here. □

- (1)

- In the centralized decision model, the offline retail price of recycled building materials is as follows:Finding the partial derivative of with respect to gives:The numerator of is a quadratic function with an open face down on . It is easy to see that m has two zeros. Since and one of the zeros of m is less than , the other zero is solved for:Note: , , , .In summary, is negatively correlated with the free-riding coefficient of the online channel when .

- (2)

- The proof of the effect of the free-riding coefficient of the online channel on in Proposition 3 follows the same steps as the proof of the effect of the free-riding coefficient of the online channel on . The equations used in the calculation are too long, so we do not present them here. □

- (1)

- In the centralized decision model, finding the partial derivative of with respect to yields:The numerator of is a unitary function with respect to . Additionally, owing to the modeling constraints, its slope is greater than zero.When , the requirements are as follows:Since the slope k > 0 was previously obtained, when .

- (2)

- The proof of the effect of the free-riding coefficient of the offline channel on and in Proposition 4 follows the same steps as the proof of the effect of the free-riding coefficient of the offline channel on . The equations used in the calculation are too long, so we do not present them here. In addition, their critical points are shown below:□

- (1)

- The difference between the optimal online direct selling price in the centralized and decentralized decision models is as follows:Note: , , , , , , , , , .The numerator of is a univariate quadratic function on with the open side facing up. It is easy to see that m has two zeros. The presence of the modeling constraints , and leads to both zeros being less than , so .

- (2)

- The steps in the proof of the comparison of the optimal offline retail price of recycled building materials in the centralized and decentralized decision models in Proposition 5 are the same as the steps in the proof of the comparison of the optimal online direct price in both models. The equations used in the calculation are too long to be listed here. □

References

- Du, L.; Feng, Y.; Lu, W.; Kong, L.; Yang, Z. Evolutionary Game Analysis of Stakeholders’ Decision-Making Behaviours in Construction and Demolition Waste Management. Environ. Impact Assess. Rev. 2020, 84, 106408. [Google Scholar] [CrossRef]

- De Alwis, A.M.L.; Bazli, M.; Arashpour, M. Automated Recognition of Contaminated Construction and Demolition Wood Waste Using Deep Learning. Resour. Conserv. Recycl. 2025, 219, 108278. [Google Scholar] [CrossRef]

- Sirimewan, D.; Kunananthaseelan, N.; Raman, S.; Garcia, R.; Arashpour, M. Optimizing Waste Handling with Interactive AI: Prompt-Guided Segmentation of Construction and Demolition Waste Using Computer Vision. Waste Manag. 2024, 190, 149–160. [Google Scholar] [CrossRef] [PubMed]

- Construction and Demolition Debris: Material-Specific Data. Available online: https://www.epa.gov/facts-and-figures-about-materials-waste-and-recycling/construction-and-demolition-debris-material (accessed on 7 June 2025).

- Waste Statistics. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Waste_statistics#Waste_generation_excluding_major_mineral_wastehttps://ec.europa.eu/eurostat/statistics-explained/index.php?title=Waste_statistics (accessed on 7 June 2025).

- Guo, F.; Wang, J.; Song, Y. How to Promote Sustainable Development of Construction and Demolition Waste Recycling Systems: Production Subsidies or Consumption Subsidies? Sustain. Prod. Consum. 2022, 32, 407–423. [Google Scholar] [CrossRef]

- Construction and Demolition Waste Remediation Progress Refreshed, Accelerating the Improvement of Disposal Capacity Around the World. Available online: http://dzb.jzsbs.com/epaper/jzsb/pc/content/202411/28/content_27756.html (accessed on 7 June 2025).

- He, L.; Yuan, H. Impacts of Tax Refund on Enterprise’s Decisions on Recycled Materials Production: A Cross-Regional Perspective. Comput. Ind. Eng. 2022, 167, 108035. [Google Scholar] [CrossRef]

- Zheng, J.; Tan, R.; Yu, M.; Tang, Z.; Zhang, J. Optimal Decisions of Construction and Demolition Waste Recycling Based on Reference Green Effect under Different Subsidy Models. Comput. Ind. Eng. 2024, 196, 110479. [Google Scholar] [CrossRef]

- Li, Y.; Li, M.; Sang, P. A Bibliometric Review of Studies on Construction and Demolition Waste Management by Using CiteSpace. Energy Build. 2022, 258, 111822. [Google Scholar] [CrossRef]

- Annual Production of 3.5 Billion Tons! Construction Waste Production End Is Not Enough to Eat, the Market End Is Difficult to Sell How to Break the Situation? Available online: https://www.zgss.org.cn/zixun/zhuti/15615.html (accessed on 8 June 2025).

- Ding, Z.; Wang, X.; Zou, P.X.W. Barriers and Countermeasures of Construction and Demolition Waste Recycling Enterprises under Circular Economy. J. Clean. Prod. 2023, 420, 138235. [Google Scholar] [CrossRef]

- He, L.; Yuan, H. Investigation of Construction Waste Recycling Decisions by Considering Consumers’ Quality Perceptions. J. Clean. Prod. 2020, 259, 120928. [Google Scholar] [CrossRef]

- Cai, J.; Dong, R.; Zeng, Z.; Hu, X. Supply Chain Competition Models with Strategic Customers Considering Sales Effort. Comput. Ind. Eng. 2022, 172, 108566. [Google Scholar] [CrossRef]

- Gao, N.; Qu, L.; Jiang, Y.; Hou, J. Game Models for Ordering and Channel Decisions of New and Differentiated Remanufactured Products in a Closed-Loop Supply Chain with Sales Efforts. Systems 2024, 12, 67. [Google Scholar] [CrossRef]

- Huashan Marketing Company: Sales of Sharp Troops to Break the Game in a Way. Available online: https://www.smstsn.com/view.php?id=17648&use_xbridge3=true&loader_name=forest&need_sec_link=1&sec_link_scene=im (accessed on 9 June 2025).

- Huaxin Cement Co., Ltd.: Selling Cement Online Tastes Sweet. Available online: https://www.ccement.com/news/content/644499143135211013.html (accessed on 9 June 2025).

- A Great Exploration of Huangsha Cement Retail Tips. Available online: https://6597300.shop.liebiao.com/article102320174?use_xbridge3=true&loader_name=forest&need_sec_link=1&sec_link_scene=im (accessed on 9 June 2025).

- Yan, N.; Zhang, Y.; Xu, X.; Gao, Y. Online Finance with Dual Channels and Bidirectional Free-Riding Effect. Int. J. Prod. Econ. 2021, 231, 107834. [Google Scholar] [CrossRef]

- Dong, L.; Dai, Y. Research on Alliance Decision of Dual-Channel Remanufacturing Supply Chain Considering Bidirectional Free-Riding and Cost-Sharing. Comput. Model. Eng. Sci. 2024, 140, 2913–2956. [Google Scholar] [CrossRef]

- Yan, L.; Hong, P.; Wu, Z. Dynamic Pricing and Emission Reduction Efforts in a Dual-Channel Green Supply Chain under Bidirectional Free Riding. J. Clean. Prod. 2024, 438, 140713. [Google Scholar] [CrossRef]

- Li, J.; Zhu, M.; Dai, B. Optimal pricing and sales effort decisions in a dual-channel supply chain in case of bidirectional free riding. Syst. Eng.-Theory Pract. 2016, 36, 3046–3058. [Google Scholar]

- Gong, Y.; Hao, Y.; Zhang, M. Decision-making Strategy for Service Effort of Dual-channel Retailers under Condition of Bidirectional Free Riding. Stat. Decis. 2020, 36, 162–166. [Google Scholar] [CrossRef]

- Ganguly, S.; Das, P.; Maiti, M. A Game Theoretic Model for Dual Supply Chains with Green and Non-Green Products and Bi-Directional Free-Riding and Carbon Policy. Supply Chain Anal. 2025, 9, 100103. [Google Scholar] [CrossRef]

- Luo, M.; Li, G.; Zhang, W. The Bidirectional Free-Riding in a Dual-Channel Supply Chain. J. Syst. Manag. 2014, 23, 314–323, 338. [Google Scholar]

- Mahpour, A. Prioritizing Barriers to Adopt Circular Economy in Construction and Demolition Waste Management. Resour. Conserv. Recycl. 2018, 134, 216–227. [Google Scholar] [CrossRef]

- Krour, H.; Trauchessec, R.; Lecomte, A.; Diliberto, C.; Barnes-Davin, L.; Bolze, B.; Delhay, A. Incorporation Rate of Recycled Aggregates in Cement Raw Meals. Constr. Build. Mater. 2020, 248, 118217. [Google Scholar] [CrossRef]

- Tefa, L.; Bianco, I.; Bassani, M. Stabilising CDW Recycled Aggregates with Alternatives to Portland Cement. Constr. Build. Mater. 2025, 471, 140705. [Google Scholar] [CrossRef]

- Schneider, M.; Hoenig, V.; Ruppert, J.; Rickert, J. The Cement Plant of Tomorrow. Cem. Concr. Res. 2023, 173, 107290. [Google Scholar] [CrossRef]

- Li, X.; Huang, R.; Dai, J.; Li, J.; Shen, Q. Research on the Evolutionary Game of Construction and Demolition Waste (CDW) Recycling Units’ Green Behavior, Considering Remanufacturing Capability. Int. J. Environ. Res. Public Health 2021, 18, 9268. [Google Scholar] [CrossRef]

- Hu, Q.; Su, P.; Xiong, F. Dynamic Game Strategies for Construction and Demolition Waste Recycling with Learning and Reference Effects. Environ. Impact Assess. Rev. 2021, 89, 106592. [Google Scholar] [CrossRef]

- Han, Y.; Zheng, H.; Huang, Y.; Li, X. Considering Consumers’ Green Preferences and Government Subsidies in the Decision Making of the Construction and Demolition Waste Recycling Supply Chain: A Stackelberg Game Approach. Buildings 2022, 12, 832. [Google Scholar] [CrossRef]

- Jin, R.; Li, B.; Zhou, T.; Wanatowski, D.; Piroozfar, P. An Empirical Study of Perceptions towards Construction and Demolition Waste Recycling and Reuse in China. Resour. Conserv. Recycl. 2017, 126, 86–98. [Google Scholar] [CrossRef]

- Su, Y. Multi-Agent Evolutionary Game in the Recycling Utilization of Construction Waste. Sci. Total Environ. 2020, 738, 139826. [Google Scholar] [CrossRef]

- Zeng, L.; Ding, Z.; Wang, Y.; Peng, J.; Zhang, H.; Li, X. Pricing Decisions for Recycled Building Materials with Misrepresentation of Information from Social Exchange Theory. Buildings 2025, 15, 967. [Google Scholar] [CrossRef]

- Yang, W.; Zhang, J.; Yan, H. Impacts of Online Consumer Reviews on a Dual-Channel Supply Chain. Omega 2021, 101, 102266. [Google Scholar] [CrossRef]

- Zhou, Y.-W.; Guo, J.; Zhou, W. Pricing/Service Strategies for a Dual-Channel Supply Chain with Free Riding and Service-Cost Sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- Pu, X.; Gong, L.; Han, X. Consumer Free Riding: Coordinating Sales Effort in a Dual-Channel Supply Chain. Electron. Commer. Res. Appl. 2017, 22, 1–12. [Google Scholar] [CrossRef]

- Rapp, A.; Baker, T.L.; Bachrach, D.G.; Ogilvie, J.; Beitelspacher, L.S. Perceived Customer Showrooming Behavior and the Effect on Retail Salesperson Self-Efficacy and Performance. J. Retail. 2015, 91, 358–369. [Google Scholar] [CrossRef]

- Chiou, J.-S.; Wu, L.-Y.; Chou, S.-Y. You Do the Service but They Take the Order. J. Bus. Res. 2012, 65, 883–889. [Google Scholar] [CrossRef]

- Zhao, D. Collective Action, Free-rider Problem, and the Application of Formal Modelsin Social Sciences. Sociol. Stud. 2006, 21, 1–21. [Google Scholar] [CrossRef]

- Gong, D.; Gao, H.; Ren, L.; Yan, X. Consumers’ Free Riding: Pricing and Retailer Service Decisions in a Closed-Loop Supply Chain. Comput. Ind. Eng. 2023, 181, 109285. [Google Scholar] [CrossRef]

- Ostrom, E. Collective Action and the Evolution of Social Norms. J. Econ. Perspect. 2000, 14, 137–158. [Google Scholar] [CrossRef]

- Gurnani, H.; Erkoc, M.; Luo, Y. Impact of Product Pricing and Timing of Investment Decisions on Supply Chain Co-Opetition. Eur. J. Oper. Res. 2007, 180, 228–248. [Google Scholar] [CrossRef]

- Xu, S.; Tang, H.; Lin, Z.; Lu, J. Pricing and Sales-Effort Analysis of Dual-Channel Supply Chain with Channel Preference, Cross-Channel Return and Free Riding Behavior Based on Revenue-Sharing Contract. Int. J. Prod. Econ. 2022, 249, 108506. [Google Scholar] [CrossRef]

- Pi, Z.; Fang, W.; Perera, S.C.; Zhang, B. Enhancing the Online Buyer Perception of Consumer Experience Products in a Dual-Channel Supply Chain: A New Role of Free-Riding. Int. J. Prod. Econ. 2022, 253, 108600. [Google Scholar] [CrossRef]

- Gu, S.-Q.; Liu, Y.; Zhao, G. Pricing Coordination of a Dual-Channel Supply Chain Considering Offline in-Sale Service. J. Retail. Consum. Serv. 2023, 75, 103483. [Google Scholar] [CrossRef]

- Yi, C.; Cao, Y.; Zhou, Z.; Wan, G. Effects of Online-to-Offline Spillovers on Manufacturers’ Online Sales Mode Selection. Comput. Ind. Eng. 2024, 197, 110584. [Google Scholar] [CrossRef]

- Xiao, W.; Cao, Y. The Manufacturer’s Strategic Involvement in Product Sharing. Comput. Ind. Eng. 2023, 180, 109253. [Google Scholar] [CrossRef]

- Wang, J.; He, S. Optimal Decisions of Modularity, Prices and Return Policy in a Dual-Channel Supply Chain under Mass Customization. Transp. Res. Part E Logist. Transp. Rev. 2022, 160, 102675. [Google Scholar] [CrossRef]

- Batarfi, R.; Jaber, M.Y.; Glock, C.H. Pricing and Inventory Decisions in a Dual-Channel Supply Chain with Learning and Forgetting. Comput. Ind. Eng. 2019, 136, 397–420. [Google Scholar] [CrossRef]

- Wu, X.; Zha, Y.; Yu, Y. Asymmetric Retailers’ Sales Effort Competition in the Presence of a Manufacturer’s Help. Transp. Res. Part E Logist. Transp. Rev. 2022, 159, 102625. [Google Scholar] [CrossRef]

- Xiao, D.; Kuang, X.; Chen, K. E-Commerce Supply Chain Decisions under Platform Digital Empowerment-Induced Demand. Comput. Ind. Eng. 2020, 150, 106876. [Google Scholar] [CrossRef]

- Sun, S.; Liu, T. Pricing and Sales-Effort Coordination Facing Free Riding Behaviors between a Brick-and-Mortar Retailer and a Platform Store Owned by the Manufacturer. Transp. Res. Part E Logist. Transp. Rev. 2023, 179, 103285. [Google Scholar] [CrossRef]

- Zheng, J.; Xu, Q. Dynamic Cooperation of the O2O Supply Chain Based on Time Delays and Bidirectional Free-Riding. Processes 2022, 10, 2424. [Google Scholar] [CrossRef]

- Qiu, R.; Hou, L.; Sun, Y.; Sun, M.; Sun, Y. Joint Pricing, Ordering and Order Fulfillment Decisions for a Dual-Channel Supply Chain with Demand Uncertainties: A Distribution-Free Approach. Comput. Ind. Eng. 2021, 160, 107546. [Google Scholar] [CrossRef]

- The Price of Cement in More Than 100 Areas Has Fallen Below 300 Yuan Per Ton! Available online: https://m.sohu.com/a/687467079_121123881/m.sohu.com/a/687467079_121123881 (accessed on 10 June 2025).

- Yatai Group Harbin Cement Co., Ltd. Officially Opens Live Webcast. Available online: http://mjlysn.yatai.com/xwzx_5838/zxxx_7818/202105/t20210531_137697.html?use_xbridge3=true&loader_name=forest&need_sec_link=1&sec_link_scene=im (accessed on 10 June 2025).

- Yatai Yitong Layout “Dual-Line Marketing” Mode to Establish “Green Channel” in Townships and Villages. Available online: http://ytsn.yatai.com/yxkx2019/202307/t20230712_155125.htm (accessed on 10 June 2025).

- [Spring Sword 2024] Strike Hard against “Ghosts”—Suixi County Market Supervision Administration to Carry out Action Against Counterfeit and Shoddy Cement. Available online: http://www.suixi.gov.cn/zjsxscjg/gkmlpt/content/1/1892/mpost_1892470.html#5880 (accessed on 10 June 2025).

- Experience Conch VR Cloud Tour Wuhu Conch Cement, a Perfect Combination of Smart Factories and Green Technology! Available online: https://www.ccement.com/news/content/48186922352935001.html (accessed on 7 July 2025).

| References | Free-Riding in CDW | Remanufactured Products | Game Subject | Stackelberg Game | Sales Effort | |

|---|---|---|---|---|---|---|

| Remanufacturer of Self-Built Platforms | Offline Retailer | |||||

| [19] | × | × | × | √ | √ | √ |

| [20] | × | √ | × | √ | √ | √ |

| [21] | × | × | × | √ | × | × |

| [24] | × | × | √ | √ | √ | × |

| [22] | × | × | × | √ | √ | √ |

| [23] | × | × | × | √ | √ | × |

| [25] | × | × | √ | √ | √ | × |

| This study | √ | √ | √ | √ | √ | √ |

| Parameter | Description | Source Papers |

|---|---|---|

| The sales effort of the construction waste remanufacturer/retailer in the channel, such as sales and marketing efforts, including advertising and other promotional efforts (decision variable), | [19,45] | |

| Wholesale price (decision variable) | [46] | |

| Online direct selling price (decision variable) | [47] | |

| Offline retail price (decision variable) | [48] | |

| The cost of building the construction waste remanufacturer’s self-built platform, | [49] | |

| Free-riding coefficient of the online channel, | [20,45] | |

| Free-riding coefficient of the offline channel, | [19,20] | |

| The cross-price sensitivity coefficient, | [50,51] | |

| Sales effort cost coefficient for the construction waste remanufacturer in the online channel, | [20,52] | |

| Sales effort cost coefficient for the retailer in the offline channel, | [19,53] | |

| Expected demand in channel , | [46] | |

| The construction waste remanufacturer’s profit | [54] | |

| The retailer’s profit | [50] |

| and | ||||

|---|---|---|---|---|

| Decentralized Decision Model | Centralized Decision Model | Comparison Results |

|---|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, Z.; Zhang, H.; Li, X. Pricing Decisions in a Dual-Channel Construction and Demolition Waste Recycling Supply Chain with Bilateral Free-Riding Behavior. Buildings 2025, 15, 2851. https://doi.org/10.3390/buildings15162851

Hu Z, Zhang H, Li X. Pricing Decisions in a Dual-Channel Construction and Demolition Waste Recycling Supply Chain with Bilateral Free-Riding Behavior. Buildings. 2025; 15(16):2851. https://doi.org/10.3390/buildings15162851

Chicago/Turabian StyleHu, Zihan, Hao Zhang, and Xingwei Li. 2025. "Pricing Decisions in a Dual-Channel Construction and Demolition Waste Recycling Supply Chain with Bilateral Free-Riding Behavior" Buildings 15, no. 16: 2851. https://doi.org/10.3390/buildings15162851

APA StyleHu, Z., Zhang, H., & Li, X. (2025). Pricing Decisions in a Dual-Channel Construction and Demolition Waste Recycling Supply Chain with Bilateral Free-Riding Behavior. Buildings, 15(16), 2851. https://doi.org/10.3390/buildings15162851