Proactive and Data-Driven Decision-Making Using Earned Value Analysis in Infrastructure Projects

Abstract

1. Introduction

- A tool to monitor and control the cost, time, and work conducted of a construction project.

- Provides an “Early Warning” signal for immediate corrective action.

- Forecasting the total project cost.

- It compares the planned amount of work with what has actually been completed to determine if cost, schedule, and work accomplished are progressing as planned.

- The present study aims to show the theoretical dimension of performance measurement on construction projects and thereby contribute to its wider practical application.

- The coding and implementation of these analyses were performed using MATLAB and Excel.

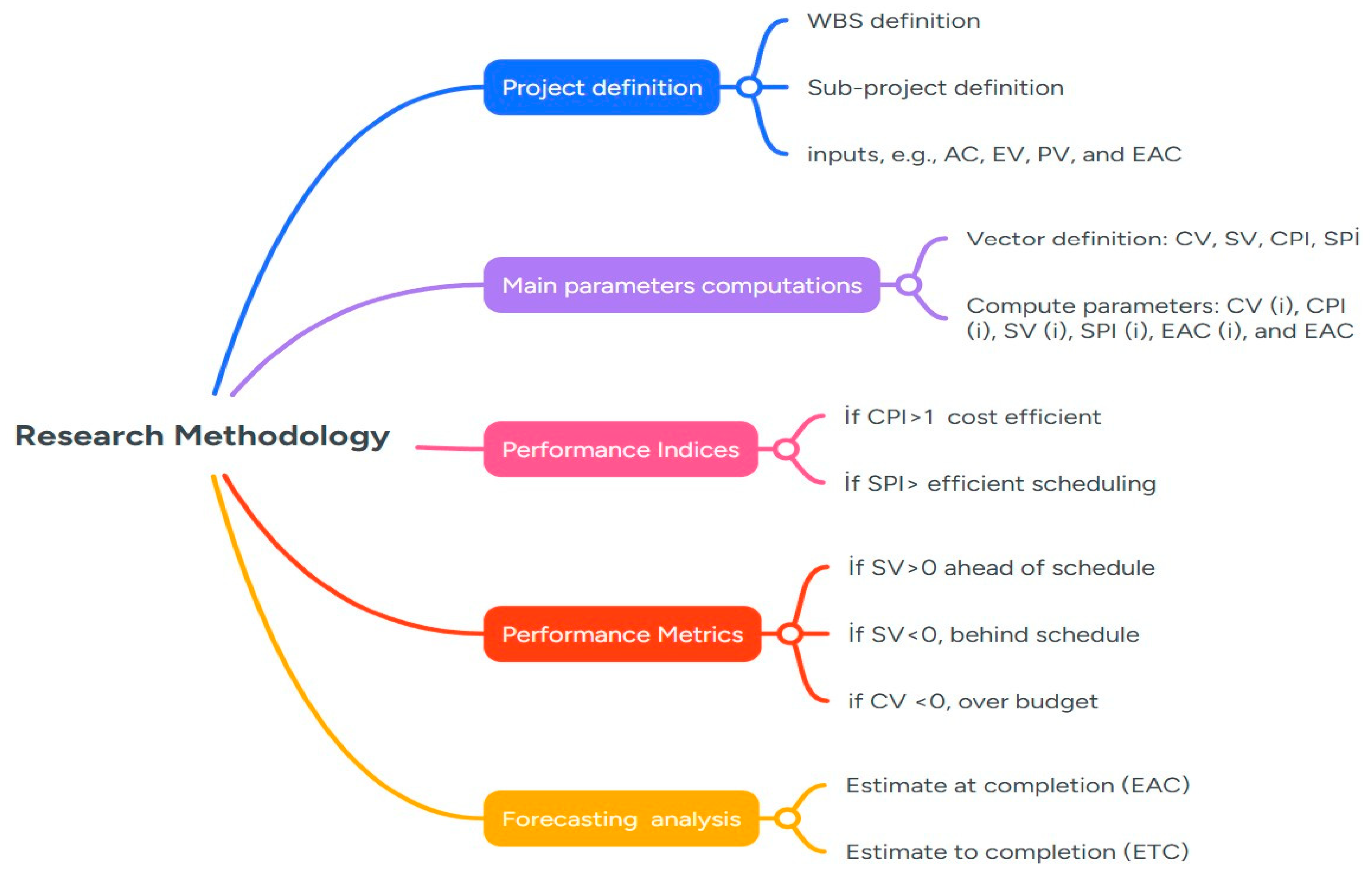

2. Visual Methodology Map

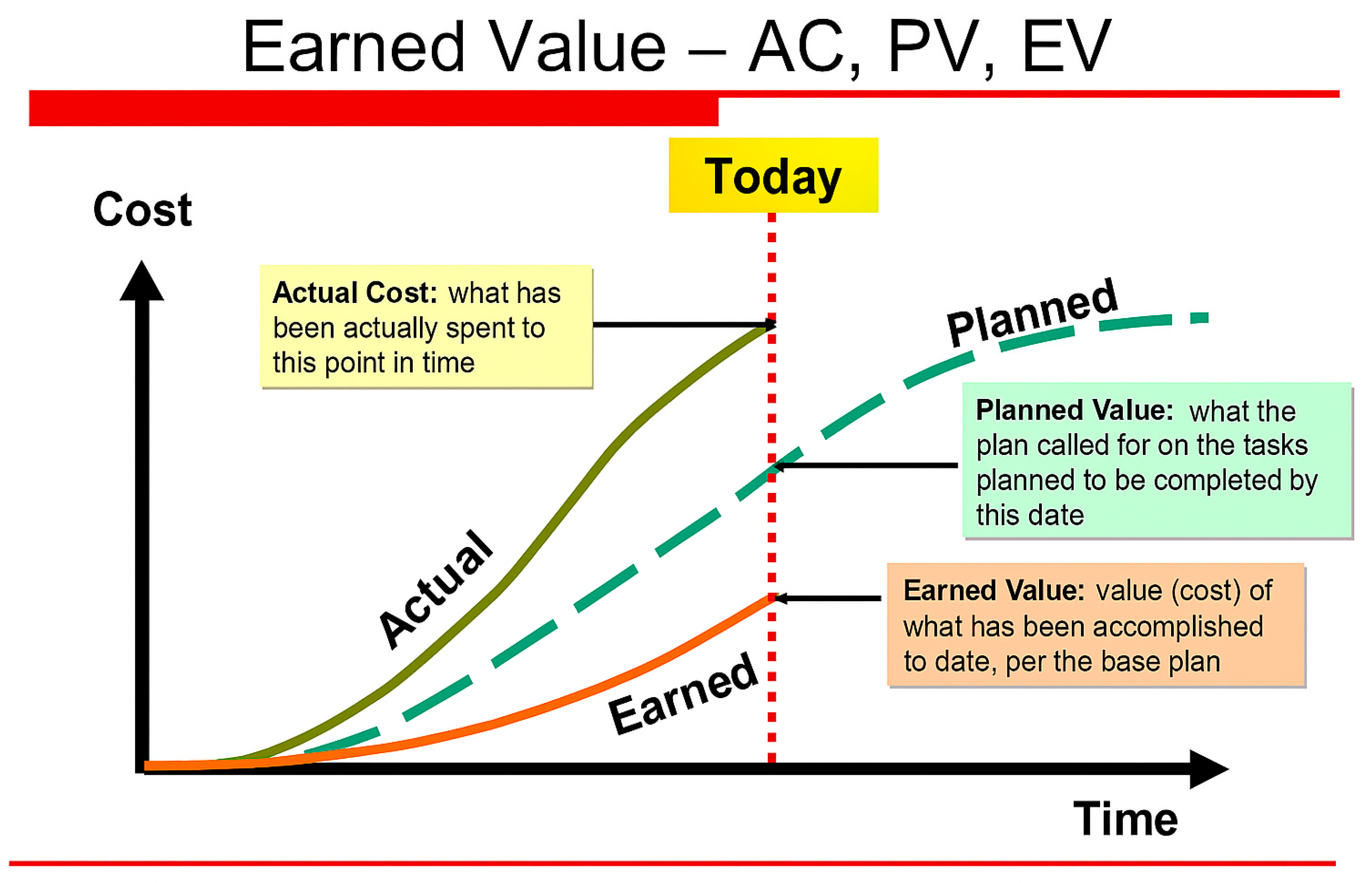

2.1. The Earned Value Management

Basic Concepts of Earned Value Method

3. Numerical Simulations Application

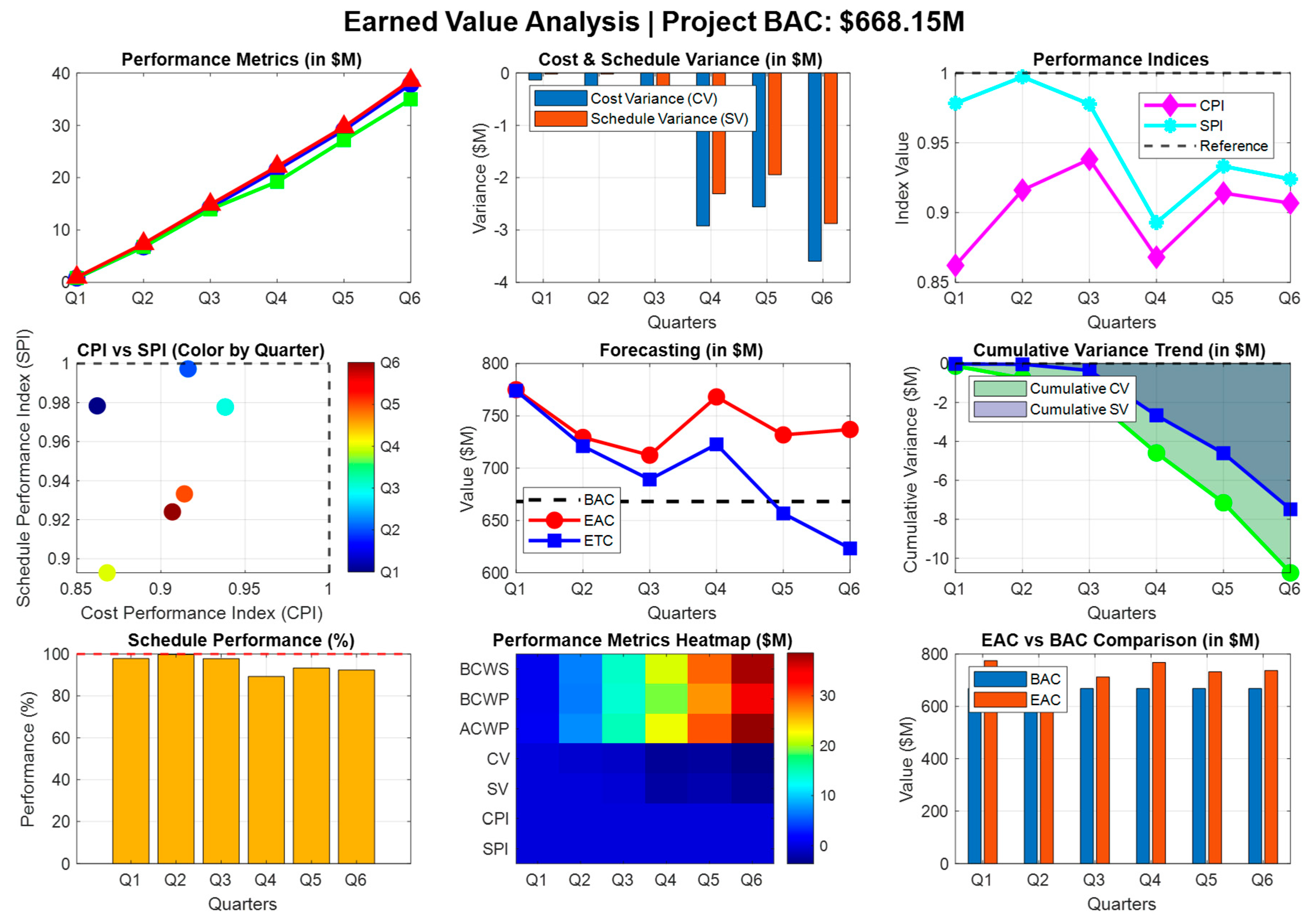

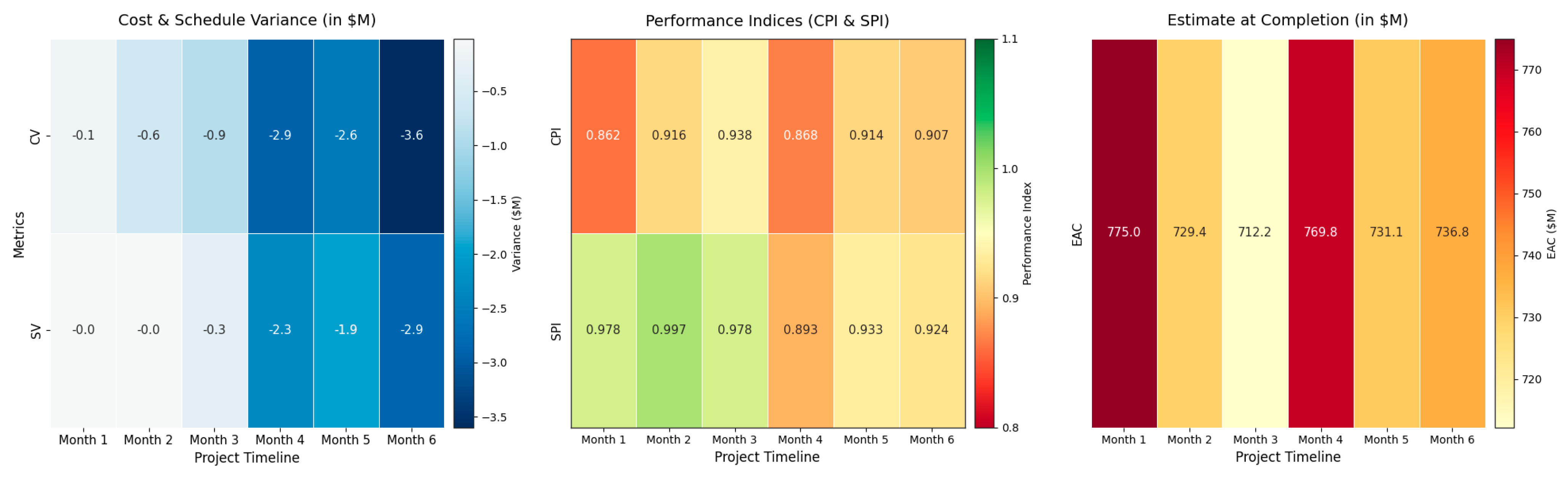

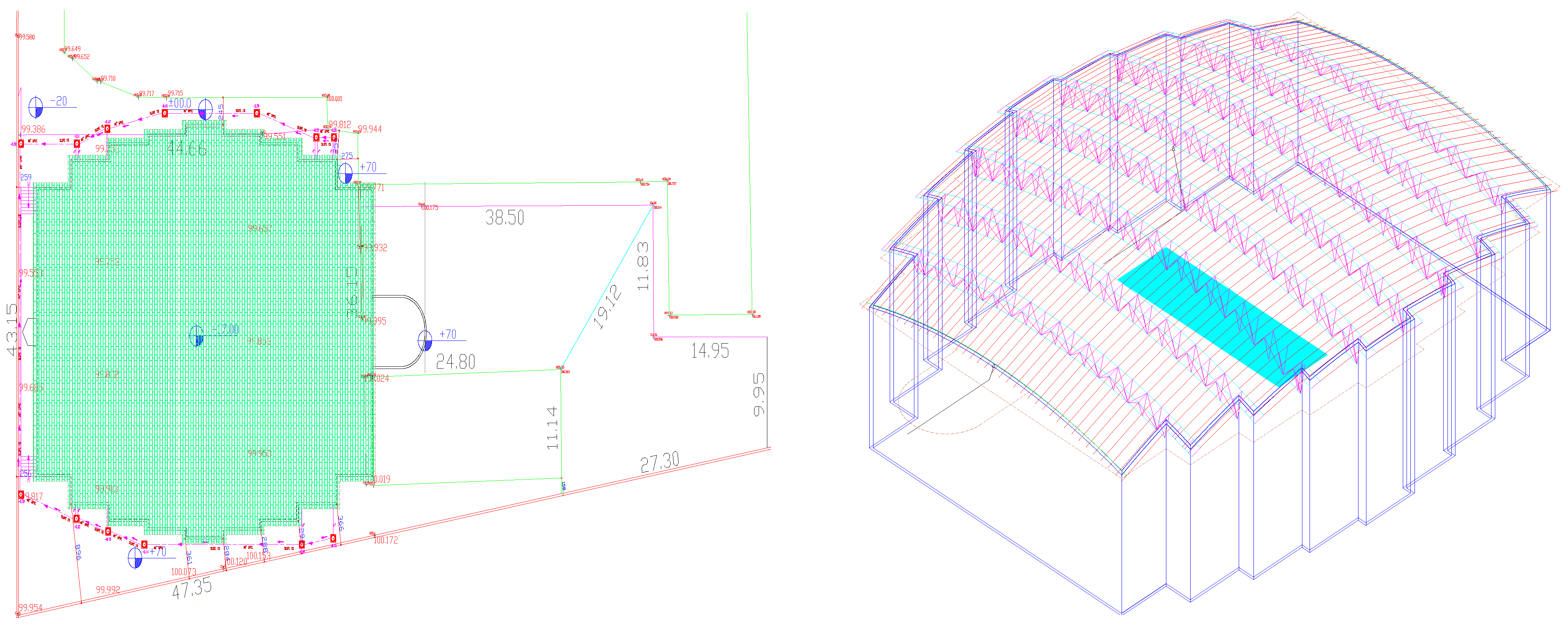

3.1. Real-Life Project (Case 1)

- Cost losss:

- ○

- Final EAC = MYR 774,992,828;

- ○

- Estimated BAC (based on trends) ≈ MYR 700,000,000;

- ○

- Cost overrun = 774,992,828 − 700,000,000 = MYR 74,992,828;

- ○

- Percentage cost overrun = (74,992,828/700,000,000) × 100 ≈ 10.71%.

- Schedule loss:

- ○

- Best SPI = 0.997, final SPI = 0.924;

- ○

- Percentage schedule inefficiency = (1 − 0.924) × 100 = 7.6%.

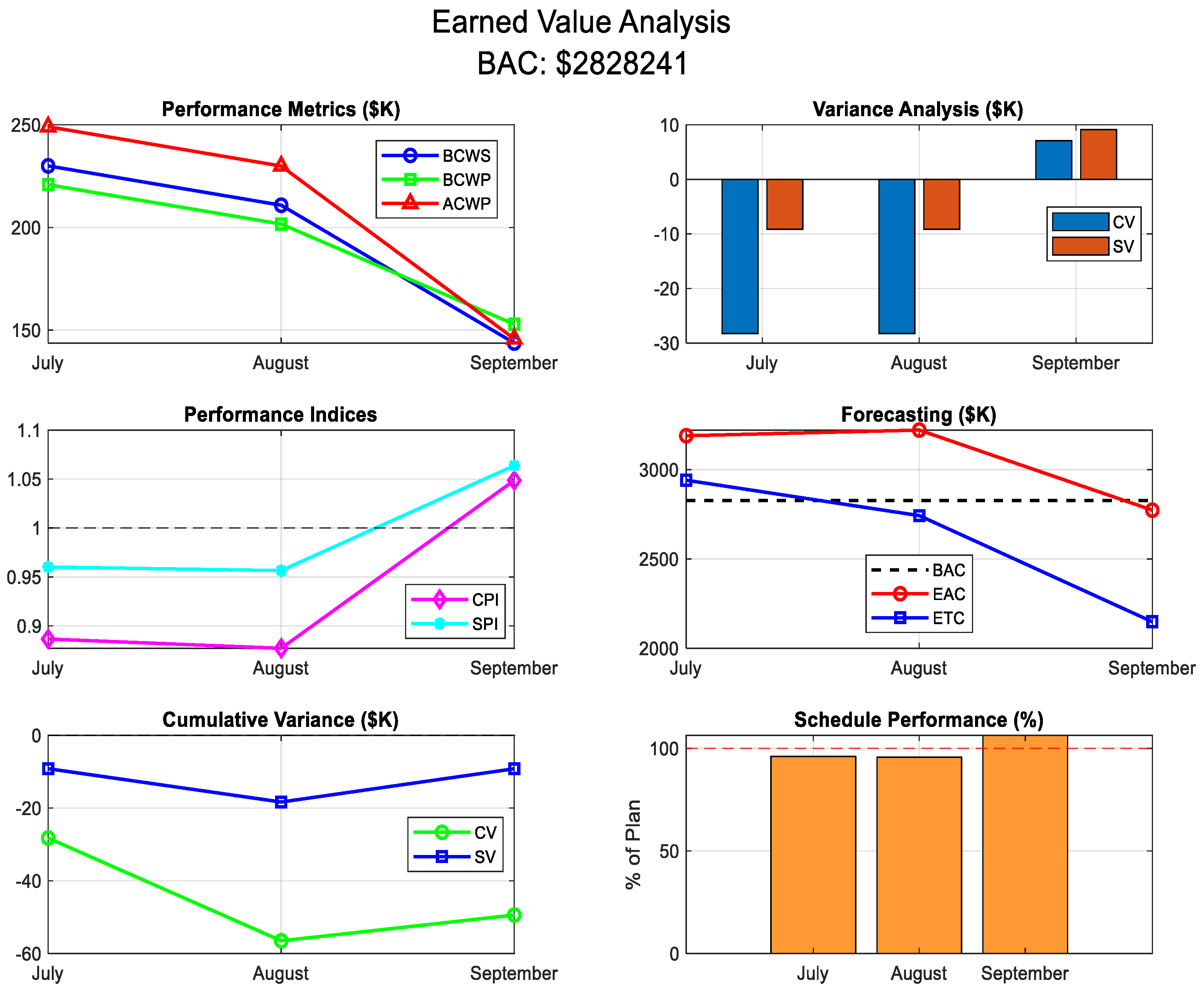

3.2. Real-Life Project (Case 2)

- Cost Savings:

- ○

- Initial EAC (July) = MYR 3.19 million;

- ○

- Final EAC (September) ≈ MYR 2.70 million;

- ○

- Savings = 3.19M − 2.70M = MYR 490,000;

- ○

- Percentage cost savings = (490,000/3.19M) × 100 ≈ 15.36%.

- Schedule Savings:

- ○

- SPI improved from 0.96 to 1.06;

- ○

- Percentage schedule improvement = (1.06 − 0.96) × 100 = 10.42%.

4. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Eirgash, M.A.; Toğan, V.; Kazaz, A. Application Earned Value Based Metrics to Enhance the Performance Measurement of Engineering Project Management. Nevşehir J. Sci. Technol. 2017, 6, 431–439. [Google Scholar]

- Anbari, F.T. Earned Value Project Management Method and Extensions. Proj. Manag. J. 2003, 34, 12–23. [Google Scholar] [CrossRef]

- Ippakayal, P.D.; Kumthekar, M.B. A Review on Earned Value Management Analysis in Construction Industry. Int. Res. J. Eng. Technol. 2021, 8, 855–857. [Google Scholar]

- Lipke, W.; Zwikael, O.; Henderson, K.; Anbari, F. Prediction of Project Outcome: The Application of Statistical Methods to Earned Value Management and Earned Schedule Performance Indexes. Int. J. Proj. Manag. 2009, 27, 400–407. [Google Scholar] [CrossRef]

- Bahar, M. Hizmet Alımlı Tipi Sözleşmelerde KDA Modeli ve Bir Uygulama. Master’s Thesis, Fen Bilimleri Enstitüsü, İstanbul Üniversitesi, İstanbul, Turkey, 2008. [Google Scholar]

- Borrmann, A.; König, M.; Koch, C.; Beetz, J. Building Information Modeling: Technology Foundations and Industry Practice; Springer: Berlin, Germany, 2015. [Google Scholar]

- Gürbüzer, A. KDA Metodunun Bir Tersane Projesine Uygulanması. Master’s Thesis, Sosyal Bilimler Enstitüsü, Gebze İleri Teknoloji Enstitüsü, Gebze, Turkey, 2010. [Google Scholar]

- Oesterreich, T.D.; Teuteberg, F. Understanding the Implications of Digitization and Automation in the Context of Industry 4.0: A Triangulation Approach and Elements of a Research Agenda for the Construction Industry. Comput. Ind. 2016, 83, 121–139. [Google Scholar] [CrossRef]

- Zhang, D.; Zhang, H.; Cheng, T. Causes of Delay in the Construction Projects of Subway Tunnel. Adv. Math. Risk Anal. Civ. Eng. 2020, 1, 45–60. [Google Scholar] [CrossRef]

- Kaplan, O. Proje Yönetiminde Maliyetlerin Optimizasyonu ve İnşaat Sektöründe Uygulanması. Master’s Thesis, Sosyal Bilimler Enstitüsü, Yıldız Teknik Üniversitesi, İstanbul, Turkey, 2012. [Google Scholar]

- Love, P.E.; Edwards, D.J.; Irani, Z.; Walker, D.H. Project Risks and AI: Identification, Assessment and Mitigation Strategies. Int. J. Proj. Manag. 2020, 38, 403–416. [Google Scholar] [CrossRef]

- Shaik, M.M.; Devanand, R.; Harsha, H.N. An Analysis on Resource Planning, Cost Estimation & Tracking of Project by Earned Value Management. Int. J. Eng. Innov. Technol. 2014, 4, 42–48. [Google Scholar]

- Eirgash, M.A.; Baltaci, Y. Project Monitoring and Early Warning of Time-Cost Overruns in Earned Value Management. Curr. Trends Civ. Struct. Eng. 2021, 7, CTCSE.MS.ID.000673. [Google Scholar] [CrossRef]

- Eirgash, M.A. Earned Value Analysis for Construction Projects Using Project Management Scheduling Engine. Am. J. Civ. Eng. 2019, 7, 121–125. [Google Scholar] [CrossRef]

- Chen, H.L.; Chen, W.T.; Lin, Y.L. Earned Value Project Management: Improving the Predictive Power of Planned Value. Int. J. Proj. Manag. 2016, 34, 22–29. [Google Scholar] [CrossRef]

- Subramani, T.; Jabasingh, D.S.S.; Jayalakshmi, J. Analysis of Cost Controlling in Construction Industries by Earned Value Method Using Primavera. Int. J. Eng. Res. Appl. 2014, 4, 145–153. [Google Scholar]

- Koçak, S. İnşaat Projelerinde KDA İle Primavera P6 Destekli Maliyet Kontrolü ve Bir Uygulama. Master’s Thesis, Fen Bilimleri Enstitüsü, Akdeniz Üniversitesi, Antalya, Turkey, 2018. [Google Scholar]

- Liu, J.; Zhang, G.; Lee, W.B. Fuzzy Neural Network-Based Project Performance Prediction Approach. Expert Syst. Appl. 2017, 72, 256–268. [Google Scholar] [CrossRef]

- Din, Z.U.; Raza, A.; Khan, M.B. Comparative Analysis of Factors Causing Delay in Residential Construction Projects in Pakistan. In Proceedings of the Construction Research Congress, Tempe, AZ, USA, 8–10 March 2020. [Google Scholar]

- Ottaviani, F.M.; De Marco, A.; Narbaev, T.; Rebuglio, M. Improving Project Estimates at Completion Through Progress-Based Performance Factors. Buildings 2024, 14, 643. [Google Scholar] [CrossRef]

- Yalçın, G.; Bayram, S.; Çıtakoğlu, H. Evaluation of Earned Value Management-Based Cost Estimation via Machine Learning. Buildings 2024, 14, 3772. [Google Scholar] [CrossRef]

- Nejatyan, E.; Sarvari, H.; Hosseini, S.A.; Javanshir, H. Determining the Factors Influencing Construction Project Management Performance Improvement Through Earned Value-Based Value Engineering Strategy: A Delphi-Based Survey. Buildings 2023, 13, 1964. [Google Scholar] [CrossRef]

- Barrientos-Orellana, A.; Ballesteros-Pérez, P.; Mora-Melià, D.; Cerezo-Narváez, A.; Gutiérrez-Bahamondes, J.H. Comparison of the Stability and Accuracy of Deterministic Project Cost Prediction Methods in Earned Value Management. Buildings 2023, 13, 1206. [Google Scholar] [CrossRef]

- Tukundane, H.; Yang, Y. Effect of Project Control Practices on the Performance of Building Construction Companies in Uganda: A Case Study of the City of Kampala. Buildings 2024, 14, 1818. [Google Scholar] [CrossRef]

- López Pascual, J.; Meléndez Rodríguez, J.C.; Cruz Rambaud, S. The Enhanced-Earned Value Management (E-EVM) Model: A Proposal for the Aerospace Industry. Symmetry 2021, 13, 232. [Google Scholar] [CrossRef]

- Mahdi, I.; Abd-Elrashed, I.; Ahmed, S.; Lamisse, R. Difficulties of Implementing Earned Value Management in Construction Sector in Egypt. Int. J. Eng. Res. Stud. 2018, 5, 15–25. [Google Scholar]

- Khesal, T.; Abbas, S.; Mohammad, K.; Masoud, G.; Soltani, R. Integrated Cost, Quality, Risk and Schedule Control Through Earned Value Management. J. Eng. Des. Technol. 2019, 17, 183–203. [Google Scholar] [CrossRef]

- Sackey, S.; Lee, D.; Kim, B. Duration Estimate at Completion: Improving Earned Value Management Forecasting Accuracy. KSCE J. Civ. Eng. 2020, 24, 693–702. [Google Scholar] [CrossRef]

- Guerras, L.A.; Navas, J.E. La Dirección Estratégica de la Empresa. Teoría y Aplicaciones, 4th ed.; Thomson-Civitas Editorial: Roma, Italy, 2007. [Google Scholar]

- Colin, J.; Vanhoucke, M. A Comparison of the Performance of Various Project Control Methods Using Earned Value Management Systems. Expert Syst. Appl. 2015, 42, 3159–3175. [Google Scholar] [CrossRef]

- Dibert, J.C.; Velez, J.C. An Analysis of Earned Value Management Implementation Within the F-22 System Program Office’s Software Development; Naval Postgraduate School: Monterey, CA, USA, 2006. [Google Scholar]

- Acebes, F.; Pajares, J.; Galán, J.M.; López-Paredes, A. A New Approach for Project Control Under Uncertainty. Going Back Basics. Int. J. Proj. Manag. 2014, 32, 423–434. [Google Scholar] [CrossRef]

- Khodakarami, V.; Abdi, A. Project Cost Risk Analysis: A Bayesian Networks Approach for Modeling Dependencies Between Cost Items. Int. J. Proj. Manag. 2014, 32, 1233–1245. [Google Scholar] [CrossRef]

- Hendiani, S.; Bagherpour, M.; Mahmoudi, A.; Liao, H. Z-Number Based Earned Value Management (ZEVM): A Novel Pragmatic Contribution Towards a Possibilistic Cost-Duration Assessment. Comput. Ind. Eng. 2020, 143, 106430. [Google Scholar] [CrossRef]

- Khamooshi, H.; Golafshani, H. Earned Duration Management, a New Approach to Schedule Performance Management and Measurement. Int. J. Proj. Manag. 2014, 32, 1019–1041. [Google Scholar] [CrossRef]

- Araszkiewicz, K.; Bochenek, M. Control of Construction Projects Using the Earned Value Method—Case Study. Gruyter Open Civ. Eng. 2019, 9, 186–195. [Google Scholar] [CrossRef]

- Atkins, K.L.; Martin, B.D.; Vellinga, J.M.; Rick, A.P. STARDUST: Implementing a New Manage-to-Budget Paradigm. Acta Astronaut. 2003, 52, 87–97. [Google Scholar] [CrossRef]

- Koke, B.; Moehler, R.C. Earned Green Value Management for Project Management: A Systematic Review. J. Clean. Prod. 2019, 230, 189–197. [Google Scholar] [CrossRef]

- TEDAE. Spanish Association of Technological Defence, Aeronautical and Space Companies; Activities Report; TEDAE: Madrid, Spain, 2018. [Google Scholar]

- Antvik, S. Earned Value Management in Sweden—Experiences and Examples: The Gripen Project. In Proceedings of the Project Management Institute Annual Seminars & Symposium, San Antonio, TX, USA, 3–10 October 2002. [Google Scholar]

- Chin Keng, T.; Shahdan, N. The Application of Earned Value Management (EVM) in Construction Project Management. J. Technol. Manag. Bus. 2015, 2, 1–12. [Google Scholar]

- Sruthi, M.D.; Aravindan, A. Performance Measurement of Schedule and Cost Analysis by Using Earned Value Management for a Residential Building. Mater. Today Proc. 2020, 33, 524–532. [Google Scholar] [CrossRef]

- Meléndez-Rodríguez, J.C.; López-Pascual, J.; Cañamero, P.; García, F.P. An Overview of Earned Value Management in Aerospace Industry. In Proceedings of the Tenth International Conference on Management Science and Engineering Management; Springer: Berlin/Heidelberg, Germany, 2017; pp. 1465–1477. [Google Scholar]

- Kabir, H.; Wu, J.; Dahal, S.; Joo, T.; Garg, N. Automated Estimation of Cementitious Sorptivity via Computer Vision. Nat. Commun. 2024, 15, 9935. [Google Scholar] [CrossRef] [PubMed]

- Song, Z.; Zou, S.; Zhou, W.; Huang, Y.; Shao, L.; Yuan, J.; Gou, X.; Jin, W.; Wang, Z.; Chen, X.; et al. Clinically Applicable Histopathological Diagnosis System for Gastric Cancer Detection Using Deep Learning. Nat. Commun. 2020, 11, 4294. [Google Scholar] [CrossRef]

| Sector | References | Main Topics | Publication |

|---|---|---|---|

| Aerospace | [15,26,27,28] | Supplier and Contractor Oversight, Aircraft Production and Integration, Space Vehicle Fabrication, Aviation Performance Testing | 2016, 2018, 2019, 2020 |

| Software development and computational research | [29,30,31,32,33] | Computational Modeling, Quantitative Analysis Techniques, Schedule Optimization Implementation, Performance Motivation Indicators | 2006, 2007, 2014, 2015 |

| Products | [34] | Advanced Technology Systems, Industrial Manufacturing Apparatus, Production Machinery and Tooling | 2020 |

| Army forces | [35] | Modernized Scheduling Methodology, integrated into USCG Command Structures | 2014 |

| Miscellaneous | [36,37] | EVM methodology revision | 2003, 2019 |

| Chemical | [38] | Improving forecasting models | 2016 |

| Building construction | [39,40,41,42] | Financial risk evaluation in project budgeting, holistic project management methodology combining financial, quality and risk parameters | 2002, 2015, 2018, 2020 |

| Cement factory | [27] | Time-cost–quality trade-off method | 1999 |

| Construction | [1,13,14] | Project scheduling model | 2017, 2021 |

| Environment | [43] | Quantitative assessment of project sustainability indicators and operational performance metrics | 2017 |

| Terms | Abbreviation | Description |

|---|---|---|

| Planned Value | PV(BCWS) | The budgeted cost of work scheduled to be completed by a specific date. |

| Earned Value | EV (BCWP) | The budgeted cost of work actually completed by a specific date. |

| Actual Cost | AC (ACWP) | The actual cost incurred for the work performed by a specific date. |

| Cost Variance | CV | EV − AC, shows if you are over or under budget. |

| Schedule Variance | SV | EV − PV, shows if you are ahead or behind schedule. |

| Cost Performance Index | CPI | EV ÷ AC, indicates cost efficiency. |

| SchedulePerformance Index | SPI | EV ÷ PV, indicates schedule efficiency. |

| Estimate at Completion | EAC | Forecast of total cost at project completion, based on current performance. |

| Estimate to Complete | ETC | The expected cost to finish all remaining work. |

| Budget at Completion | BAC | The total budgeted cost for the entire project. |

| BAC | MYR 668,153,392 | ||

|---|---|---|---|

| Duration | BCWS (Planned) PV | BCWP (Earned) EV | ACWP (Actual) AC |

| Quarter 1 | 839,184 | 821,000 | 952,280 |

| Quarter 2 | 6,789,683 | 6,771,000 | 7,391,301 |

| Quarter 3 | 14,268,639 | 13,951,000 | 14,870,257 |

| Quarter 4 | 21,528,478 | 19,220,074 | 22,142,755 |

| Quarter 5 | 29,102,452 | 27,159,074 | 29,716,702 |

| Quarter 6 | 37,867,842 | 34,990,074 | 38,587,439 |

| Variance | Indices | Forecasting | Status | ||

|---|---|---|---|---|---|

| CV | SV | CPI | SPI | EAC | |

| −131,280 | −18,184 | 0.862 | 0.978 | 774,992,828,421 | Slightly delayed and over budget |

| −620,301 | −18,683 | 0.916 | 0.997 | 729,363,880,438 | Still over budget but improving |

| −919,257 | −317,639 | 0.938 | 0.978 | 712,179,245,535 | Delayed but better cost control |

| −292,2681 | −2,308,404 | 0.868 | 0.893 | 769,755,457,834 | Severely over budget |

| −2,557,628 | −1,943,378 | 0.914 | 0.933 | 731,074,823,845 | Still over budget but improving |

| −3,597,365 | −2,877,768 | 0.907 | 0.924 | 736,846,919,971 | High risk of budget overrun |

| BAC | MYR 2,828,241 | ||

|---|---|---|---|

| Months | BCWS (Planned) | BCWP (Earned) | ACWP (Actual) |

| July | 229.999 | 220.831 | 249.077 |

| August | 210.840 | 201.672 | 229.918 |

| September | 143.731 | 152.878 | 145.791 |

| Variance | Indices | Forecasting | Status | ||

|---|---|---|---|---|---|

| CV | SV | CPI | SPI | EAC | |

| −28.2 | −9.2 | 0.886 | 0.960 | 3,189,994 | Cost overrun, behind schedule |

| −28.2 | −9.2 | 0.877 | 0.956 | 3,224,362 | Cost overrun, behind schedule |

| 7.1 | 9.1 | 1.048 | 1.064 | 2,697,132 | Under budget, ahead of schedule |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ateş, B.; Eirgash, M.A. Proactive and Data-Driven Decision-Making Using Earned Value Analysis in Infrastructure Projects. Buildings 2025, 15, 2388. https://doi.org/10.3390/buildings15142388

Ateş B, Eirgash MA. Proactive and Data-Driven Decision-Making Using Earned Value Analysis in Infrastructure Projects. Buildings. 2025; 15(14):2388. https://doi.org/10.3390/buildings15142388

Chicago/Turabian StyleAteş, Bayram, and Mohammad Azim Eirgash. 2025. "Proactive and Data-Driven Decision-Making Using Earned Value Analysis in Infrastructure Projects" Buildings 15, no. 14: 2388. https://doi.org/10.3390/buildings15142388

APA StyleAteş, B., & Eirgash, M. A. (2025). Proactive and Data-Driven Decision-Making Using Earned Value Analysis in Infrastructure Projects. Buildings, 15(14), 2388. https://doi.org/10.3390/buildings15142388