Circular Economy Innovation in Built Environments: Mapping Policy Thresholds and Resonant Resilience via DEMATEL–TAISM

Abstract

1. Introduction

2. Literature Review

2.1. Research Progress and Systemic Challenges of Circular Economy in the Built Environment

2.2. Resilience Mechanisms of Construction Enterprises in Responding to the Circular Economy

2.3. From Enterprise Resilience to Vitality: Current Research on Systemic Drivers

2.4. Methodological Developments: Applications of DEMATEL and TAISM in Sustainable Systems

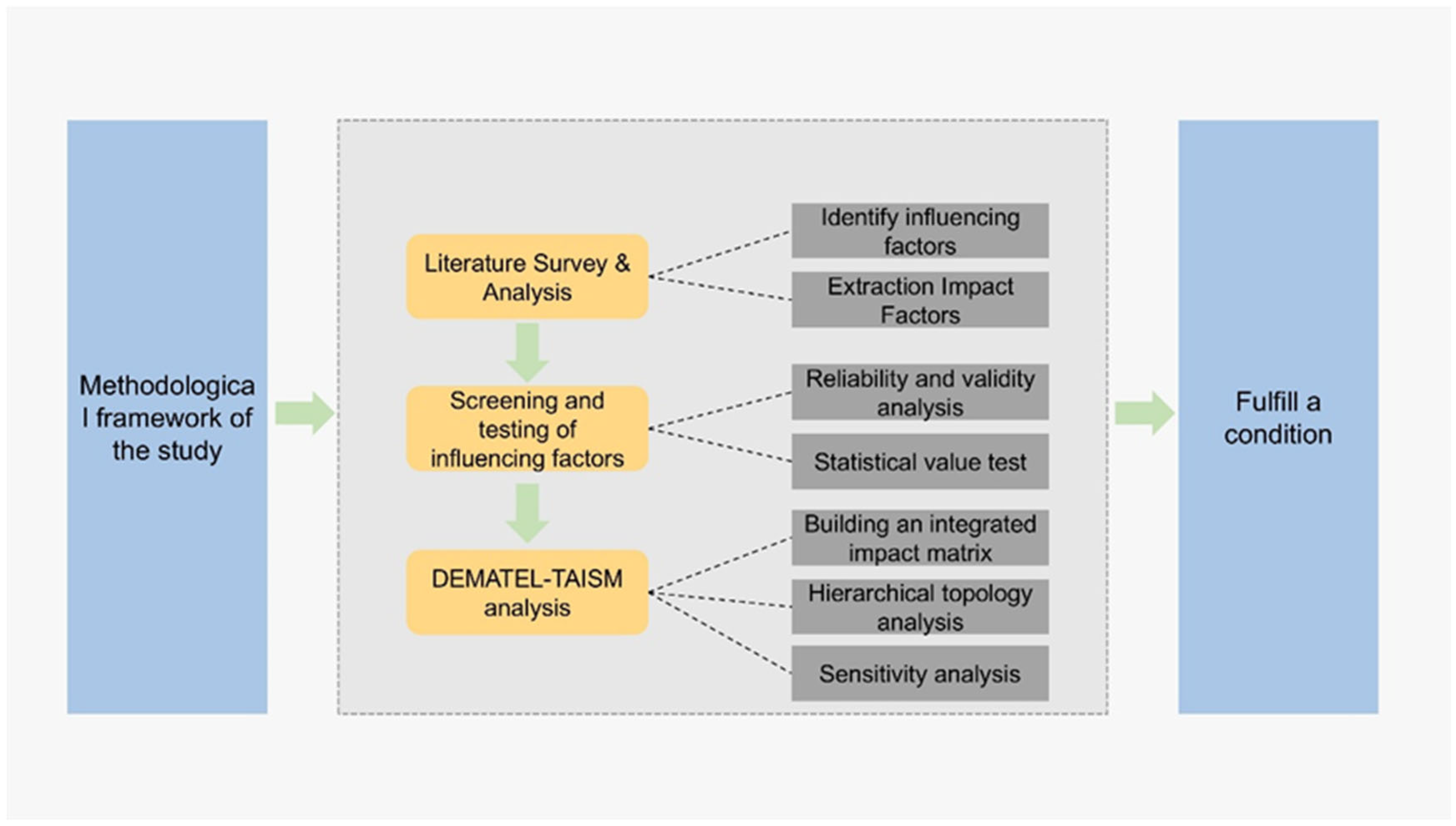

3. Research Methodology

3.1. Identification of Influencing Factors Based on Literature Review

3.2. Questionnaire Development, Reliability–Validity Testing, and Structural Dimension Classification

3.3. Causal Analysis and Hierarchical Modeling

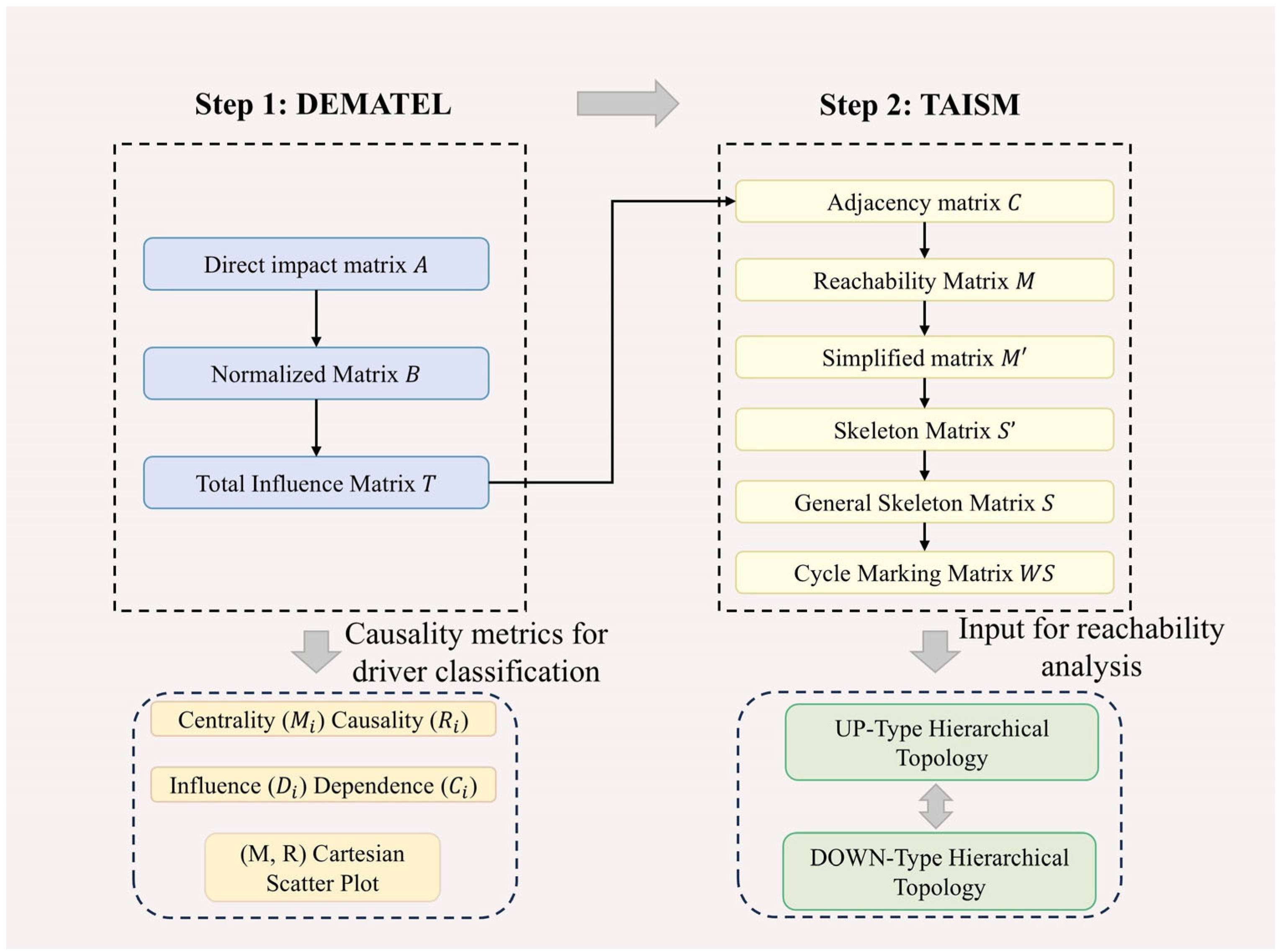

3.3.1. Overview of the Integrated Method

3.3.2. DEMATEL Analysis

3.3.3. TAISM Analysis

3.3.4. Expert Weight Sensitivity Analysis

3.4. Ethical Considerations

4. Results

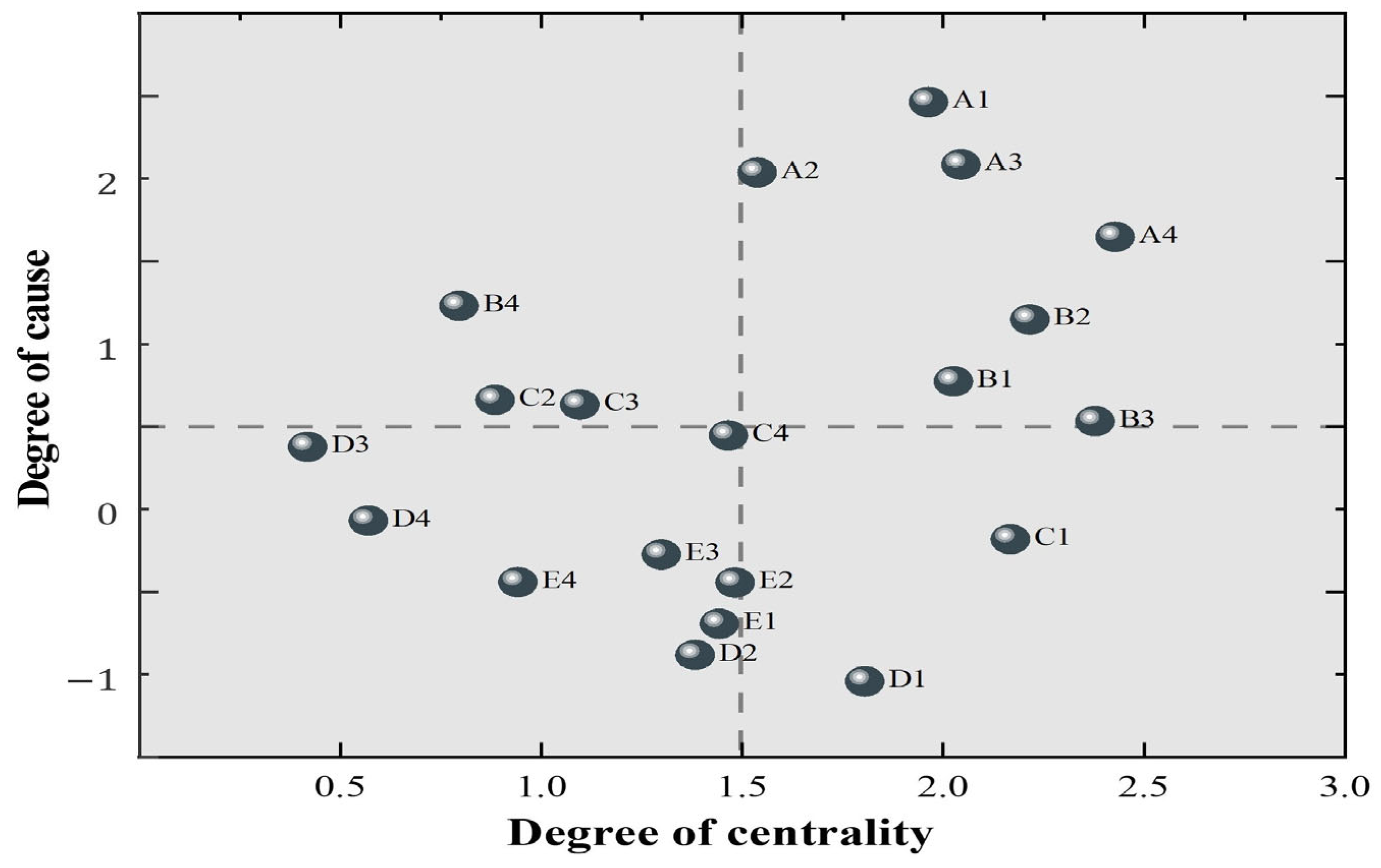

4.1. High-Impact Factors Identified by DEMATEL

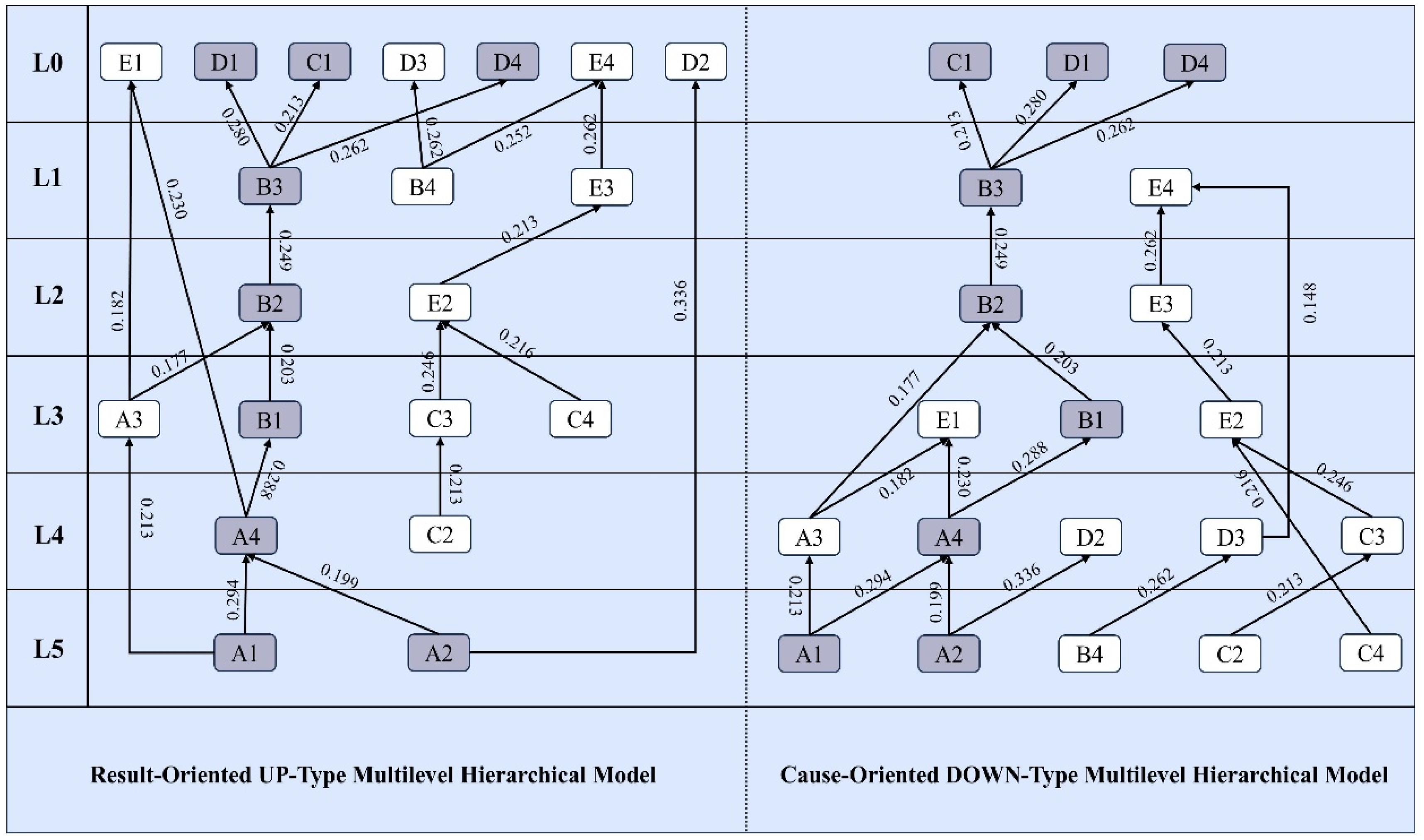

4.2. Hierarchical Influence Structure Based on TAISM

4.3. Evaluation of Model Stability Across Expert Scenarios

4.4. Summary of Key Findings

5. Discussion

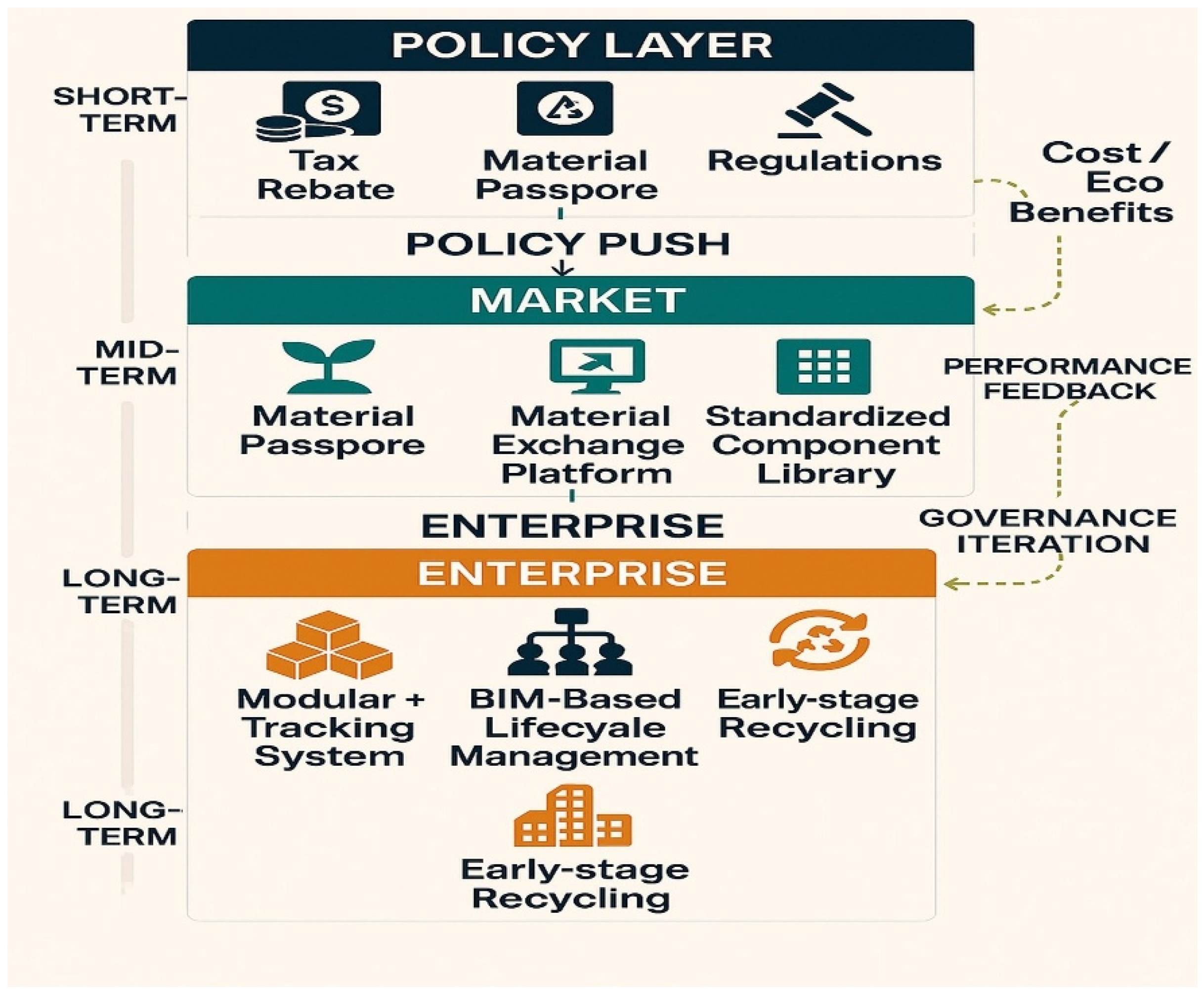

5.1. Key Findings and Mechanism Interpretation

5.2. Comparison with Existing Studies and Theoretical Contributions

- Policy Threshold–Market Amplification: This paper identifies a critical threshold (~30% policy weight) below which market mechanisms fail to sustain circular investments, enriching institutional economic theory.

- Resonant Resilience: This section highlights the mutual reinforcement between supply chain resilience and organizational governance, refining dynamic capabilities theory.

- Governance–Digital Compatibility: This paper demonstrates that digital technology effectiveness depends significantly on simultaneous governance realignment, challenging assumptions of technological determinism.

5.3. Practical Implications

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. DEMATEL-TAISM Methodology Steps

Appendix A.1. Expert Evaluation and Direct Impact Matrix Construction

Appendix A.2. Normalization of Direct Impact Matrix

Appendix A.3. Comprehensive Impact Matrix Calculation

Appendix A.4. Influence Metrics Calculation

Appendix A.5. Causal Diagram

Appendix A.6. Thresholding to Form Adjacency Matrix

Appendix A.7. Reachability and General Skeleton Matrix

Appendix A.8. Cyclic Marking Matrix (WS) Construction

- “1” indicates cyclic relationships.

- “0” indicates no mutual influence.

- Numeric values represent comprehensive impacts.

Appendix A.9. Hierarchical Extraction

- UP-type (top-down): Assign factors whose reach sets are equal to their intersection sets to top levels; remove them iteratively.

- DOWN-type (bottom-up): Assign factors whose precedent sets equal their intersection sets to bottom levels; remove them iteratively.

Appendix A.10. Multi-Level Hierarchical Structure Model

References

- Karaca, F.; Tleuken, A.; Pineda-Martos, R.; Ros Cardoso, S.; Orel, D.; Askar, R.; Agibayeva, A.; Güemez, E.G.; Salles, A.; Varol, H.A. Cultivating sustainable construction: Stakeholder insights driving circular economy innovation for inclusive resource equity. Buildings 2024, 14, 935. [Google Scholar] [CrossRef]

- Mikulėnas, M.; Šeduikytė, L. Circularity and Decarbonization Synergies in the Construction Sector: Implications for Zero-Carbon Energy Policy. Energies 2025, 18, 1164. [Google Scholar] [CrossRef]

- Zhou, H.; Zhao, Y.; Zhang, Z.; Geng, Y.; Yu, J.; Lin, B. Post occupancy investigation of 40 certified green buildings in Beijing: Results, lessons and policy suggestions. J. Build. Eng. 2022, 60, 105153. [Google Scholar] [CrossRef]

- Chen, Q.; Feng, H.; de Soto, B.G. Revamping construction supply chain processes with circular economy strategies: A systematic literature review. J. Clean. Prod. 2022, 335, 130240. [Google Scholar] [CrossRef]

- Li, F.; Na, P.; Mahmood, S.; Wang, X.; Ahmed, T. State Ownership and the Sustainable Development of Private Enterprises: Exploring the Role of State Ownership Participation. SAGE Open 2025, 15, 21582440251321848. [Google Scholar] [CrossRef]

- Zhang, R.; Yan, H. Complex system risk assessment model based on improved cloud DEMATEL-TAISM. Civ. Eng. Environ. Syst. 2024, 42, 1–24. [Google Scholar] [CrossRef]

- Luthin, A.; Traverso, M.; Crawford, R.H. Circular life cycle sustainability assessment: An integrated framework. J. Ind. Ecol. 2024, 28, 41–58. [Google Scholar] [CrossRef]

- Liu, Y.; Pedrycz, W.; Deveci, M.; Chen, Z.-S. BIM-based building performance assessment of green buildings-A case study from China. Appl. Energy 2024, 373, 123977. [Google Scholar] [CrossRef]

- Tam, V.W.; Zhou, Y.; Illankoon, C.; Le, K.N. A critical review on BIM and LCA integration using the ISO 14040 framework. Build. Environ. 2022, 213, 108865. [Google Scholar] [CrossRef]

- Graessler, S.; Guenter, H.; de Jong, S.B.; Henning, K.J. Organizational change towards the circular economy: A systematic review of the literature. Int. J. Manag. Rev. 2024, 26, 556–579. [Google Scholar] [CrossRef]

- Singh, R.K. Exploring the impact of green supply chain strategies and sustainable practices on circular supply chains. Benchmarking Int. J. 2025, 32, 1387–1409. [Google Scholar] [CrossRef]

- Namaki, P.; Vegesna, B.S.; Bigdellou, S.; Chen, R.; Chen, Q. An Integrated Building Information Modeling and Life-Cycle Assessment Approach to Facilitate Design Decisions on Sustainable Building Projects in Canada. Sustainability 2024, 16, 4718. [Google Scholar] [CrossRef]

- Kabir, M.R.; Halder, D.; Ray, S. Digital Twins for IoT-Driven Energy Systems: A Survey. IEEE Access 2024, 12, 177123–177143. [Google Scholar] [CrossRef]

- Jraisat, L.; Upadhyay, A.; Ghalia, T.; Jresseit, M.; Kumar, V.; Sarpong, D. Triads in sustainable supply-chain perspective: Why is a collaboration mechanism needed? Int. J. Prod. Res. 2023, 61, 4725–4741. [Google Scholar] [CrossRef]

- Dantas, S.M.C.; Mendes, A.A. Exploring the Interplay of Agile Methodologies, Resilience, and ESG in Supply Chains: A Bibliometric Review and Qualitative Analysis. Exacta 2024, 23, e25048. [Google Scholar] [CrossRef]

- Wasserbaur, R.; Sakao, T.; Milios, L. Interactions of governmental policies and business models for a circular economy: A systematic literature review. J. Clean. Prod. 2022, 337, 130329. [Google Scholar] [CrossRef]

- Yang, G.; Deng, F. The impact of digital transformation on enterprise vitality–evidence from listed companies in China. Technol. Anal. Strat. Manag. 2024, 36, 3955–3972. [Google Scholar] [CrossRef]

- Upadhyay, A.; Shukla, A. Development of circular supply chain implementation model for MSMEs using extended theory of planned behaviour and DEMATEL approach. Manag. Sci. Lett. 2025, 15, 113–122. [Google Scholar] [CrossRef]

- Peng, J.; Su, Z.; Liu, X.; Ma, C. Promoting Low-Carbonization in the Construction Supply Chain: Key Influencing Factors and Sustainable Practices. Sustainability 2025, 17, 3375. [Google Scholar] [CrossRef]

- Liu, H.; Yu, H.; Zhou, H.; Zhang, X. Research on the Influencing Factors of Construction Enterprises’ Digital Transformation Based on DEMATEL-TAISM. Sustainability 2023, 15, 9251. [Google Scholar] [CrossRef]

- Bian, Y.-j.; Xie, L.; Li, J.-Q. Research on influencing factors of artificial intelligence multi-cloud scheduling applied talent training based on DEMATEL-TAISM. J. Cloud Comput. 2022, 11, 35. [Google Scholar] [CrossRef]

- Platon, V.; Frone, S.; Constantinescu, A.; Jurist, S.; Banghiore, G.; Moise, O. Circular economy and economic instruments in the EU and Romania. Rom. J. Econ. 2024, 59, 5–24. [Google Scholar]

- Xiao, Z.; Niu, Y.; Xiang, L.; Cui, Y. Central bank digital currency and corporate debt financing costs: Empirical evidence from China. Financ. Res. Lett. 2024, 69, 106195. [Google Scholar] [CrossRef]

- Jamoussi, B.; Abu-Rizaiza, A.; AL-Haij, A. Sustainable building standards, codes and certification systems: The status quo and future directions in Saudi Arabia. Sustainability 2022, 14, 10314. [Google Scholar] [CrossRef]

- Vagtholm, R.; Matteo, A.; Vand, B.; Tupenaite, L. Evolution and current state of building materials, construction methods, and building regulations in the UK: Implications for sustainable building practices. Buildings 2023, 13, 1480. [Google Scholar] [CrossRef]

- Wang, F.; Yao, M.; Huang, X.; Guo, H.; Zheng, P.; Yu, H. The effects of investment in major construction projects on regional economic growth quality: A difference-in-differences analysis based on ppp policy. Sustainability 2022, 14, 6796. [Google Scholar] [CrossRef]

- Rifai, A.; Irawan, T.; Indrawan, D. The Effect of Government Policy on Infrastructure Priorities on the Profitability of Construction Companies in Indonesia 2011-2019. J. Indones. Econ. Bus. 2024, 39, 308–327. [Google Scholar] [CrossRef]

- Ajeeb, S.; Lai, W.S. The impact of the mortgage on the real estate market: A study case in Saudi Arabia. Int. J. Hous. Mark. Anal. 2024, 17, 329–344. [Google Scholar] [CrossRef]

- Kim, K.-B.; Cho, J.-H.; Kim, S.-B. Model-based dynamic forecasting for residential construction market demand: A systemic approach. Appl. Sci. 2021, 11, 3681. [Google Scholar] [CrossRef]

- Kumar, P.; Yerramilli, V. Firm size, capital investment, and debt financing over industry business cycles. J. Financ. Quant. Anal. Forthcom. 2025, 60, 524–550. [Google Scholar] [CrossRef]

- Chodorow-Reich, G.; Wieland, J. Secular labor reallocation and business cycles. J. Political Econ. 2020, 128, 2245–2287. [Google Scholar] [CrossRef]

- Ghansah, F.A.; Lu, W.; Ababio, B.K. Modelling the critical challenges of quality assurance of cross-border construction logistics and supply chain during the COVID-19 pandemic. Eng. Constr. Arch. Manag. 2024, 31, 2128–2150. [Google Scholar] [CrossRef]

- Le, P.L.; Jarroudi, I.; Dao, T.-M.; Chaabane, A. Integrated construction supply chain: An optimal decision-making model with third-party logistics partnership. Constr. Manag. Econ. 2021, 39, 133–155. [Google Scholar] [CrossRef]

- Wen, S.; Tang, H.; Ying, F.; Wu, G. Exploring the global research trends of supply chain management of construction projects based on a bibliometric analysis: Current status and future prospects. Buildings 2023, 13, 373. [Google Scholar] [CrossRef]

- Zhang, K.; Chen, L.; Zhou, X. Transmission of risk to China’s construction industry due to international interest rate fluctuations. Eng. Constr. Arch. Manag. 2025, 32, 1781–1797. [Google Scholar] [CrossRef]

- Zhou, W.; Xia, S.; Ye, J.; Zhang, N. How Do International Contractors Choose Target Market Based on Environmental, Social and Governance Principles? A Fuzzy Ordinal Priority Approach Model. Sustainability 2024, 16, 1203. [Google Scholar] [CrossRef]

- Rompotis, G. Cash flow management, performance and risk: Evidence from Greece. EuroMed J. Bus. 2024, 23, 245. [Google Scholar] [CrossRef]

- Youssef, M.A.; Ibrahim, A.H.; El-Badawy Hafez, M.J. Impact factors on subcontractor’s cash flow management. Civ. Eng. J. 2023, 9, 94–104. [Google Scholar] [CrossRef]

- Jemal, K.M.; Kabzhassarova, M.; Shaimkhanov, R.; Dikhanbayeva, D.; Turkyilmaz, A.; Durdyev, S.; Karaca, F. Facilitating circular economy strategies using digital construction tools: Framework development. Sustainability 2023, 15, 877. [Google Scholar] [CrossRef]

- Ogunmakinde, O.E.; Egbelakin, T.; Sher, W. Contributions of the circular economy to the UN sustainable development goals through sustainable construction. Resour. Conserv. Recycl. 2022, 178, 106023. [Google Scholar] [CrossRef]

- Atuahene, B.T.; Kanjanabootra, S.; Gajendran, T. Transformative role of big data through enabling capability recognition in construction. Constr. Manag. Econ. 2023, 41, 208–231. [Google Scholar] [CrossRef]

- Jin, R.; Hancock, C.; Tang, L.; Chen, C.; Wanatowski, D.; Yang, L. Empirical study of BIM implementation–based perceptions among Chinese practitioners. J. Manag. Eng. 2017, 33, 04017025. [Google Scholar] [CrossRef]

- Ershadi, M.; Jefferies, M.; Davis, P.; Mojtahedi, M. Modeling the capabilities of high-performing project management offices in general contracting companies. Proj. Manag. J. 2023, 54, 268–284. [Google Scholar] [CrossRef]

- Neiroukh, S.; Emeagwali, O.L.; Aljuhmani, H.Y. Artificial intelligence capability and organizational performance: Unraveling the mediating mechanisms of decision-making processes. Manag. Decis. 2024, 10, 1946. [Google Scholar] [CrossRef]

- Jahan, S.; Khan, K.I.A.; Thaheem, M.J.; Ullah, F.; Alqurashi, M.; Alsulami, B.T. Modeling profitability-influencing risk factors for construction projects: A system dynamics approach. Buildings 2022, 12, 701. [Google Scholar] [CrossRef]

- Yuan, Q.; Sun, Y.; Ren, J. How interest rate influences a business cycle model. Contin. Dyn. Syst. 2020, 13, 3231–3251. [Google Scholar] [CrossRef]

- Yu, M.; Wang, N. The influence of geopolitical risk on international direct investment and its countermeasures. Sustainability 2023, 15, 2522. [Google Scholar] [CrossRef]

- Le, A.-T.; Tran, T.P. Does geopolitical risk matter for corporate investment? Evidence from emerging countries in Asia. J. Multinatl. Financ. Manag. 2021, 62, 100703. [Google Scholar] [CrossRef]

- Ling, F.Y.; Zhang, Z.; Yew, A.Y.J. Impact of COVID-19 pandemic on demand, output, and outcomes of construction projects in Singapore. J. Manag. Eng. 2022, 38, 04021097. [Google Scholar] [CrossRef]

- Brucker Juricic, B.; Galic, M.; Marenjak, S. Review of the Construction Labour Demand and Shortages in the EU. Buildings 2021, 11, 17. [Google Scholar] [CrossRef]

- Liu, G.; Aroean, L.; Ko, W.W.; Management, P. Power, shared goals and supplier flexibility: A study of the HUB-and-spoke supply chain. Int. J. Oper. Prod. Manag. 2022, 42, 182–205. [Google Scholar] [CrossRef]

- Kamalahmadi, M.; Shekarian, M.; Mellat Parast, M. The impact of flexibility and redundancy on improving supply chain resilience to disruptions. Int. J. Prod. Res. 2022, 60, 1992–2020. [Google Scholar] [CrossRef]

- Bertassini, A.C.; Ometto, A.R.; Severengiz, S.; Gerolamo, M.C. Circular economy and sustainability: The role of organizational behaviour in the transition journey. Bus. Strat. Environ. 2021, 30, 3160–3193. [Google Scholar] [CrossRef]

- Castro-Lopez, A.; Iglesias, V.; Santos-Vijande, M.L. Organizational capabilities and institutional pressures in the adoption of circular economy. J. Bus. Res. 2023, 161, 113823. [Google Scholar] [CrossRef]

- Rahla, K.M.; Mateus, R.; Bragança, L. Implementing circular economy strategies in buildings—From theory to practice. Appl. Syst. Innov. 2021, 4, 26. [Google Scholar] [CrossRef]

- Takacs, F.; Brunner, D.; Frankenberger, K. Barriers to a circular economy in small-and medium-sized enterprises and their integration in a sustainable strategic management framework. J. Clean. Prod. 2022, 362, 132227. [Google Scholar] [CrossRef]

- Chabowski, B.R.; Gabrielsson, P.; Hult, G.T.M.; Morgeson III, F.V. Sustainable international business model innovations for a globalizing circular economy: A review and synthesis, integrative framework, and opportunities for future research. J. Int. Bus. Stud. 2025, 56, 383–402. [Google Scholar] [CrossRef]

- Si, S.-L.; You, X.-Y.; Liu, H.-C.; Zhang, P. DEMATEL technique: A systematic review of the state-of-the-art literature on methodologies and applications. Math. Probl. Eng. 2018, 2018, 3696457. [Google Scholar] [CrossRef]

- Zhang, X.; Wu, Y.; Shen, L. Embedding “green” in project-based organizations: The way ahead in the construction industry? J. Clean. Prod. 2015, 107, 420–427. [Google Scholar] [CrossRef]

- Chen, A.; Li, L.; Shahid, W. Digital transformation as the driving force for sustainable business performance: A moderated mediation model of market-driven business model innovation and digital leadership capabilities. Heliyon 2024, 10, e29509. [Google Scholar] [CrossRef] [PubMed]

- Shishodia, A.; Sharma, R.; Rajesh, R.; Munim, Z.H. Supply chain resilience: A review, conceptual framework and future research. Int. J. Logist. Manag. 2023, 34, 879–908. [Google Scholar] [CrossRef]

| Influencing Factors | Reference | Definition |

|---|---|---|

| Fiscal Incentives and Subsidies F1 | Platon, V. [22] | Government-imposed tax reductions and financial subsidies to encourage construction enterprises to adopt green building technologies and circular economy models. |

| Credit and Interest Rate Policies F2 | Z. Xiao [23] | Central bank policies adjust interest rates and credit availability, influencing construction enterprises’ financing costs and investment decisions. |

| Sectoral Regulatory Standards F3 | Jamoussi, B. [24] R. Vagtholm [25] | Standards related to environmental protection and construction codes regulate the operations of construction enterprises to promote resource recycling and sustainable building. |

| Public Infrastructure Funding F4 | Wang, F. [26] Rifai, A. [27] | Government investment in infrastructure development provides construction enterprises with opportunities to engage in green building and circular economy practices. |

| Adjustment of the Real Estate Market Dynamics F5 | Ajeeb, S. [28] Kim, K. B. [29] | Market fluctuations, influenced by economic cycles, policy adjustments, and supply–demand changes, affect construction enterprises’ project planning and resource allocation. |

| Sectoral Economic Cycles F6 | Kumar, P. [30] Chodorow-Reich, G. [31] | Due to economic and market factors, periodic growth and decline phases within the construction industry impact enterprises’ strategic planning and sustainability capabilities. |

| Supply Chain Resilience F7 | Ghansah, F. A. [32] Le, P. L. [33] S. Wen [34] | The ability of supply chains to maintain stable operations amidst external shocks, ensuring continuity of construction projects and efficient resource utilization. |

| Global Market Variability F8 | Zhang, K. [35] Zhou, W. [36] | Changes in international markets are driven by economic, political, and trade factors that affect cross-border projects and resource acquisition of construction enterprises. |

| Liquidity Control F9 | Rompotis, G. [37] Youssef, M. A. [38] | Managing cash inflows and outflows to ensure financial stability and flexibility during the green transition process. |

| Technology Advancement F10 | Jemal, K. M. [39] Ogunmakinde, O. E. [40] | Developing and applying new technologies to enhance efficiency and sustainability in construction processes, supporting circular economy practices. |

| Digital Integration F11 | Atuahene, B. T. [41] Jin, R. [42] | Integrating advanced digital technologies into construction processes to improve resource efficiency and project management capabilities. |

| Organizational Management Skills F12 | Ershadi, M. [43] Neiroukh, S. [44] | Enhancing management skills and strategic execution capabilities of enterprises to support the implementation of green building and circular economy models. |

| Cost Escalation F13 | Jahan, S. [45] | Rising prices of materials and labor, increasing construction project costs, and affecting profitability and sustainability of enterprises. |

| Increased Borrowing Costs F14 | Zhang, K. [35] Yuan, Q. [46] | Higher interest rates lead to increased financing costs, limiting the investment capacity of construction enterprises in green projects. |

| Global Political Conditions F15 | Yu, M. [47] Le, A. T. [48] | International political and economic factors impact the stability and security of international projects undertaken by construction enterprises. |

| Workforce Scarcity F16 | Ling, F. Y. [49] Brucker Juricic [50] | A shortage of skilled labor leads to increased costs and project delays, hindering the advancement of green building and circular economy practices. |

| Adaptive Supply Chain Practices F17 | Liu, G. [51] Kamalahmadi, M. [52] | Enhancing resource allocation and risk response capabilities of construction enterprises in uncertain environments through flexible supply chain management. |

| Change Management Capability F18 | Bertassini, A. C. [53] Castro-Lopez, A. [54] | The ability of enterprises to adjust organizational structures and processes to meet the requirements of green transformation and circular economy. |

| Strategic Adaptation F19 | Rahla, K. M. [55] Takacs, F. [56] | Adjusting the strategic direction of enterprises to enhance competitiveness and responsiveness in green building and circular economy sectors. |

| Global Expansion Capacity F20 | Chabowski, B. R. [57] | The ability of enterprises to successfully expand into international markets while maintaining domestic competitiveness, promoting globalization of green building and circular economy models. |

| Variable | Form | Frequency | Percentages |

|---|---|---|---|

| Enterprise ownership | A. State-owned enterprise | 58 | 38.67% |

| B. Private enterprise | 72 | 48.00% | |

| C. Foreign/Joint venture | 12 | 8.00% | |

| D. Other | 8 | 5.33% | |

| Position | A. Top-level management (CEO/CFO) | 25 | 16.67% |

| B. Middle-level management | 65 | 43.33% | |

| C. Front-line management | 60 | 40.00% | |

| Enterprise size | A. <100 employees | 28 | 18.67% |

| B. 100–300 employees | 42 | 28.00% | |

| C. 300–1000 employees | 55 | 36.67% | |

| D. >1000 employees | 25 | 16.67% | |

| Primary business | A. Residential construction | 62 | 41.33% |

| B. Infrastructure construction | 68 | 45.33% | |

| C. Commercial real estate | 20 | 13.33% | |

| Years established | A. <5 years | 18 | 12.00% |

| B. 5–10 years | 35 | 23.33% | |

| C. 10–20 years | 52 | 34.67% | |

| D. >20 years | 45 | 30.00% | |

| Market coverage | A. Domestic-focused | 105 | 70.00% |

| B. Overseas-focused | 15 | 10.00% | |

| C. Both domestic and international | 30 | 20.00% |

| Items | Corrected Item-Total Correlation (CITC) | Cronbach’s Alpha if Item Deleted | Cronbach α |

|---|---|---|---|

| Financial policy | 0.518 | 0.922 | 0.924 |

| Monetary policy | 0.550 | 0.921 | |

| Industry regulatory policies | 0.624 | 0.919 | |

| Government infrastructure investment | 0.615 | 0.920 | |

| Adjustment of the real estate market | 0.696 | 0.918 | |

| Industry cycle fluctuations | 0.711 | 0.917 | |

| Supply chain stability | 0.602 | 0.920 | |

| International market fluctuations | 0.606 | 0.920 | |

| Cash flow management | 0.473 | 0.922 | |

| technological innovation | 0.658 | 0.919 | |

| Digital transformation | 0.615 | 0.920 | |

| Business management capabilities | 0.532 | 0.921 | |

| Inflation | 0.627 | 0.919 | |

| Rising interest rates | 0.600 | 0.920 | |

| Geopolitics | 0.530 | 0.921 | |

| Labor shortages | 0.579 | 0.920 | |

| Flexible supply chain management | 0.541 | 0.921 | |

| Organizational change capacity | 0.615 | 0.920 | |

| Strategic realignment | 0.516 | 0.922 | |

| Internationalization capability | 0.597 | 0.920 |

| Test Item | Value | |

|---|---|---|

| KMO | 0.857 | |

| Chi-Square | 1926.296 | |

| Bartlett’s Test of Sphericity | df | 190 |

| p | 0.000 | |

| Items | Factor Loading Factor | Commonality (Common Factor Variance) | ||||

|---|---|---|---|---|---|---|

| Factor 1 | Factor 2 | Factor 3 | Factor 4 | Factor 5 | ||

| Financial Policy | 0.070 | 0.189 | 0.792 | 0.028 | 0.199 | 0.709 |

| Monetary policy | 0.172 | 0.100 | 0.799 | 0.132 | 0.134 | 0.714 |

| Industry regulatory policies | 0.138 | 0.106 | 0.783 | 0.275 | 0.195 | 0.758 |

| Government infrastructure investment | 0.202 | 0.084 | 0.742 | 0.221 | 0.219 | 0.695 |

| Adjustment of the real estate market | 0.811 | 0.206 | 0.230 | 0.201 | 0.175 | 0.824 |

| Industry cycle fluctuations | 0.771 | 0.225 | 0.195 | 0.222 | 0.242 | 0.790 |

| Supply Chain Stability | 0.817 | 0.083 | 0.130 | 0.244 | 0.143 | 0.771 |

| International market fluctuations | 0.821 | 0.180 | 0.092 | 0.188 | 0.152 | 0.774 |

| Cash flow management | 0.084 | 0.897 | 0.064 | 0.109 | 0.058 | 0.831 |

| technological innovation | 0.266 | 0.755 | 0.180 | 0.244 | 0.146 | 0.753 |

| Digital transformation | 0.304 | 0.783 | 0.129 | 0.105 | 0.179 | 0.766 |

| Business management capabilities | 0.058 | 0.822 | 0.146 | 0.161 | 0.155 | 0.750 |

| Inflation | 0.264 | 0.136 | 0.222 | 0.763 | 0.115 | 0.733 |

| Rising interest rates | 0.200 | 0.221 | 0.115 | 0.714 | 0.201 | 0.653 |

| Geopolitics | 0.263 | 0.107 | 0.176 | 0.727 | 0.003 | 0.640 |

| Labor shortages | 0.101 | 0.146 | 0.112 | 0.835 | 0.213 | 0.787 |

| Flexible supply chain management | 0.185 | 0.060 | 0.183 | 0.090 | 0.826 | 0.762 |

| Organizational change capacity | 0.134 | 0.122 | 0.259 | 0.303 | 0.686 | 0.662 |

| Strategic realignment | 0.167 | 0.193 | 0.084 | 0.078 | 0.770 | 0.671 |

| Internationalization capability | 0.161 | 0.163 | 0.359 | 0.120 | 0.662 | 0.635 |

| Dimension | Name of Influencing Factor | Encodings |

|---|---|---|

| Policy adaptability | Fiscal incentives and subsidies | A1 |

| Credit and interest rate policies | A2 | |

| Sectoral regulatory standards | A3 | |

| Public infrastructure funding | A4 | |

| Market environment | Real estate market dynamics | B1 |

| Sectoral economic cycles | B2 | |

| Supply chain resilience | B3 | |

| Global market variability | B4 | |

| Enterprise competitiveness | Liquidity control | C1 |

| Technology advancement | C2 | |

| Digital integration | C3 | |

| Organizational management skills | C4 | |

| External risk | Cost escalation | D1 |

| Increased borrowing costs | D2 | |

| Global political conditions | D3 | |

| Workforce scarcity | D4 | |

| Enterprise adaptive capacity | Adaptive supply chain practices | E1 |

| Change management capability | E2 | |

| Strategic adaptation | E3 | |

| Global expansion capacity | E4 |

| Factor | Influence | Rank | Influenced | Rank | Causality | Rank | Center | Rank |

|---|---|---|---|---|---|---|---|---|

| A1 | 1.96387 | 1 | 0 | 19 | 1.96387 | 4 | 1.96387 | 1 |

| A2 | 1.53783 | 4 | 0 | 18 | 1.53783 | 7 | 1.53783 | 2 |

| A3 | 1.81505 | 2 | 0.22951 | 15 | 2.04456 | 3 | 1.58554 | 3 |

| A4 | 1.78786 | 3 | 0.64042 | 7 | 2.42828 | 1 | 1.14744 | 4 |

| B1 | 1.14946 | 5 | 0.87626 | 9 | 2.02572 | 5 | 0.2732 | 7 |

| B2 | 1.43174 | 6 | 0.78417 | 10 | 2.21591 | 2 | 0.64757 | 5 |

| B3 | 1.20512 | 7 | 1.17321 | 3 | 2.37833 | 6 | 0.03191 | 8 |

| B4 | 0.76297 | 8 | 0.03279 | 17 | 0.79576 | 16 | 0.73018 | 6 |

| C1 | 0.74272 | 9 | 1.42463 | 2 | 2.16735 | 8 | −0.68191 | 15 |

| C2 | 0.52303 | 12 | 0.36204 | 14 | 0.88507 | 15 | 0.16099 | 9 |

| C3 | 0.61421 | 10 | 0.48169 | 12 | 1.0959 | 12 | 0.13252 | 10 |

| C4 | 0.70534 | 11 | 0.76016 | 8 | 1.4655 | 10 | −0.05482 | 14 |

| D1 | 0.13115 | 16 | 1.67388 | 1 | 1.80503 | 9 | −1.54273 | 18 |

| D2 | 0 | 18 | 1.38288 | 5 | 1.38288 | 13 | −1.38288 | 17 |

| D3 | 0.14754 | 15 | 0.27089 | 16 | 0.41843 | 17 | −0.12335 | 12 |

| D4 | 0 | 19 | 0.57002 | 13 | 0.57002 | 18 | −0.57002 | 13 |

| E1 | 0.12427 | 17 | 1.31881 | 4 | 1.44308 | 11 | −1.19454 | 19 |

| E2 | 0.26901 | 13 | 1.21333 | 6 | 1.48234 | 14 | −0.94432 | 16 |

| E3 | 0.2623 | 14 | 1.03688 | 11 | −0.77458 | 15 | 1.29918 | 15 |

| E4 | 0 | 20 | 0.94187 | 10 | −0.94187 | 20 | 0.94187 | 16 |

| Scenario 1 (Increased Weighting of Industry Experts) | Scenario 1 (Increased Weighting of Academic Experts) | ||||||

|---|---|---|---|---|---|---|---|

| Factor | Influence Fluctuation | Cause Fluctuation | Hierarchical Stability | Factor | Influence Fluctuation | Cause Fluctuation | Hierarchical Stability |

| A1 | +0.5% (2.15) | +0.4% (+1.99) | Root cause layer (unchanged) | A1 | −0.3% (2.12) | −0.5% (+1.98) | Root cause layer (unchanged) |

| A4 | +0.3% (1.30) | +1.1% (−0.32) | Intermediary layer (unchanged) | A4 | +0.4% (1.33) | −2.5% (−0.34) | Intermediary layer (unchanged) |

| C1 | +0.6% (1.71) | +5.3% (+0.20) | Intermediary layer (unchanged) | C1 | −0.5% (1.68) | −4.8% (+0.18) | Intermediary layer (unchanged) |

| D1 | +0.3% (0.1318) | +2.0% (+1.7059) | Outcome layer (unchanged) | D1 | −0.2% (0.1313) | −1.0% (+1.6575) | Outcome layer (unchanged) |

| Global Statistics | Average fluctuation: ±0.43% | Average fluctuation: ±2.95% | 87% factor tier stability | Average fluctuation: ±0.15% | Average fluctuation: ±2.45% | 87% factor tier stability | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, Z.; Peng, J.; Wang, M.; Gui, G.; Meng, Q.; Su, Y.; Xiao, Z.; Zhang, S. Circular Economy Innovation in Built Environments: Mapping Policy Thresholds and Resonant Resilience via DEMATEL–TAISM. Buildings 2025, 15, 2110. https://doi.org/10.3390/buildings15122110

Su Z, Peng J, Wang M, Gui G, Meng Q, Su Y, Xiao Z, Zhang S. Circular Economy Innovation in Built Environments: Mapping Policy Thresholds and Resonant Resilience via DEMATEL–TAISM. Buildings. 2025; 15(12):2110. https://doi.org/10.3390/buildings15122110

Chicago/Turabian StyleSu, Zhuo, Junlong Peng, Mengyu Wang, Guyue Gui, Qian Meng, Yuntao Su, Zhenlin Xiao, and Sisi Zhang. 2025. "Circular Economy Innovation in Built Environments: Mapping Policy Thresholds and Resonant Resilience via DEMATEL–TAISM" Buildings 15, no. 12: 2110. https://doi.org/10.3390/buildings15122110

APA StyleSu, Z., Peng, J., Wang, M., Gui, G., Meng, Q., Su, Y., Xiao, Z., & Zhang, S. (2025). Circular Economy Innovation in Built Environments: Mapping Policy Thresholds and Resonant Resilience via DEMATEL–TAISM. Buildings, 15(12), 2110. https://doi.org/10.3390/buildings15122110