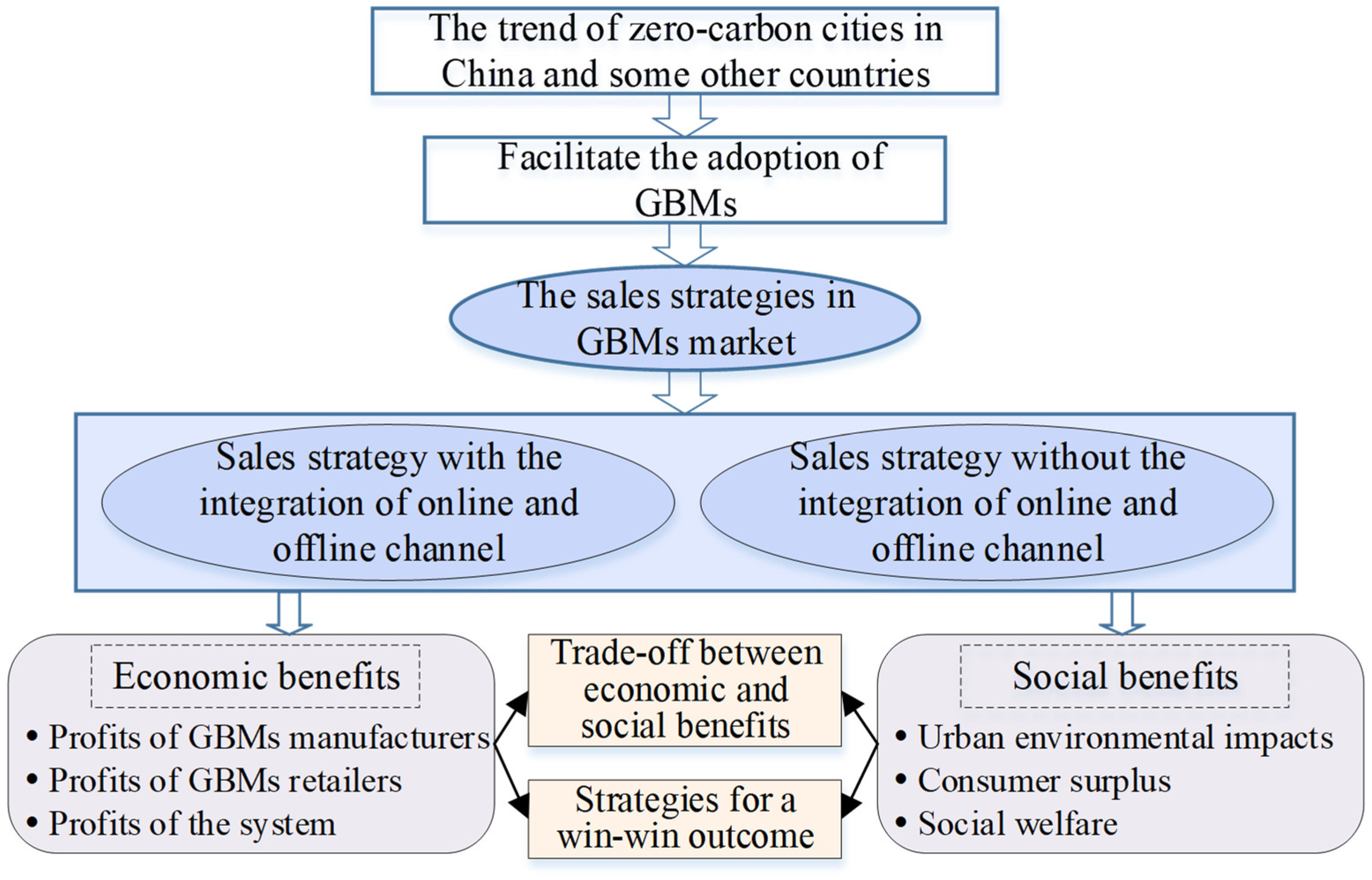

Towards Zero-Carbon Cities: Optimal Sales Strategies of Green Building Materials Considering Consumer Purchasing Behaviors

Abstract

1. Introduction

- (1)

- To explore optimal sales strategies of alliance-based GBMs manufacturers and retailers considering consumer purchasing behavior, a dynamic game model containing an online channel, an offline channel, and a store-to-online channel is proposed. We believe that this modeling approach can better measure the evolution of optimal GBMs sales strategies with heterogeneous consumer preferences.

- (2)

- Based on the goal of maximizing their interests among the group in terms of decision-making, the effects of different sales strategies on the urban environment and social welfare have been theoretically verified. In this framework, the contribution of this paper is to increase the understanding of the effect of different selected GBMs sales strategies on the urban environment and social welfare, which is of significant value in filling a gap in the synergistic effect of urban environment and social welfare by optimizing sales strategies in GBMs markets.

- (3)

- With regard to the goal of achieving zero-carbon cities in the future, the results of this paper can help governments better understand the positive role of GBMs manufacturers and GBMs retailers in formulating optimal sales strategies. Therefore, the results of this paper not only help GBMs enterprises in the market find optimal sales strategies considering different channels but also provide practical guidance in realizing the Greenest City Action Plan of China and some other countries.

2. Literature Review

3. Research Method

3.1. Problem Description

3.2. Utility Function and Cost Function

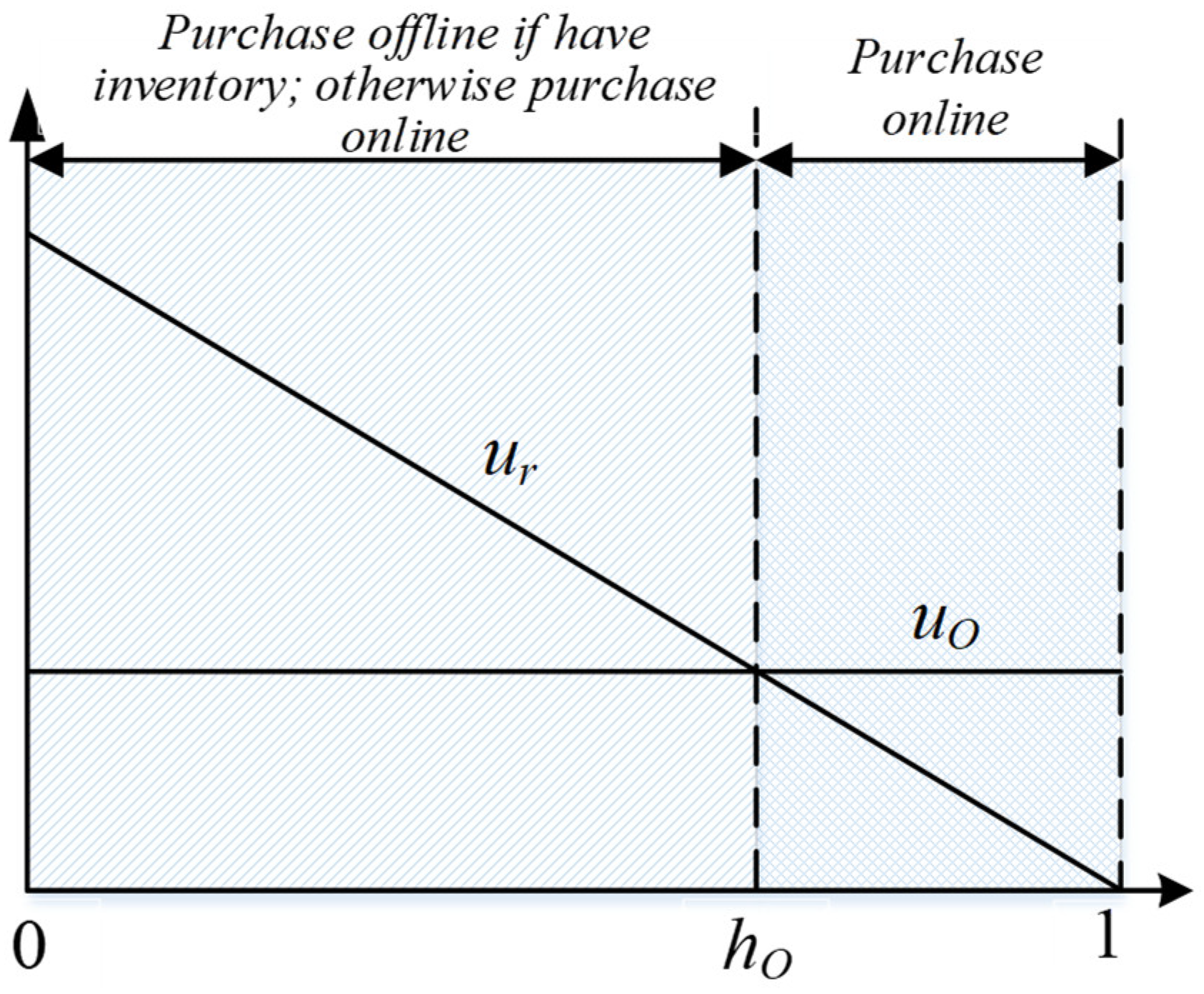

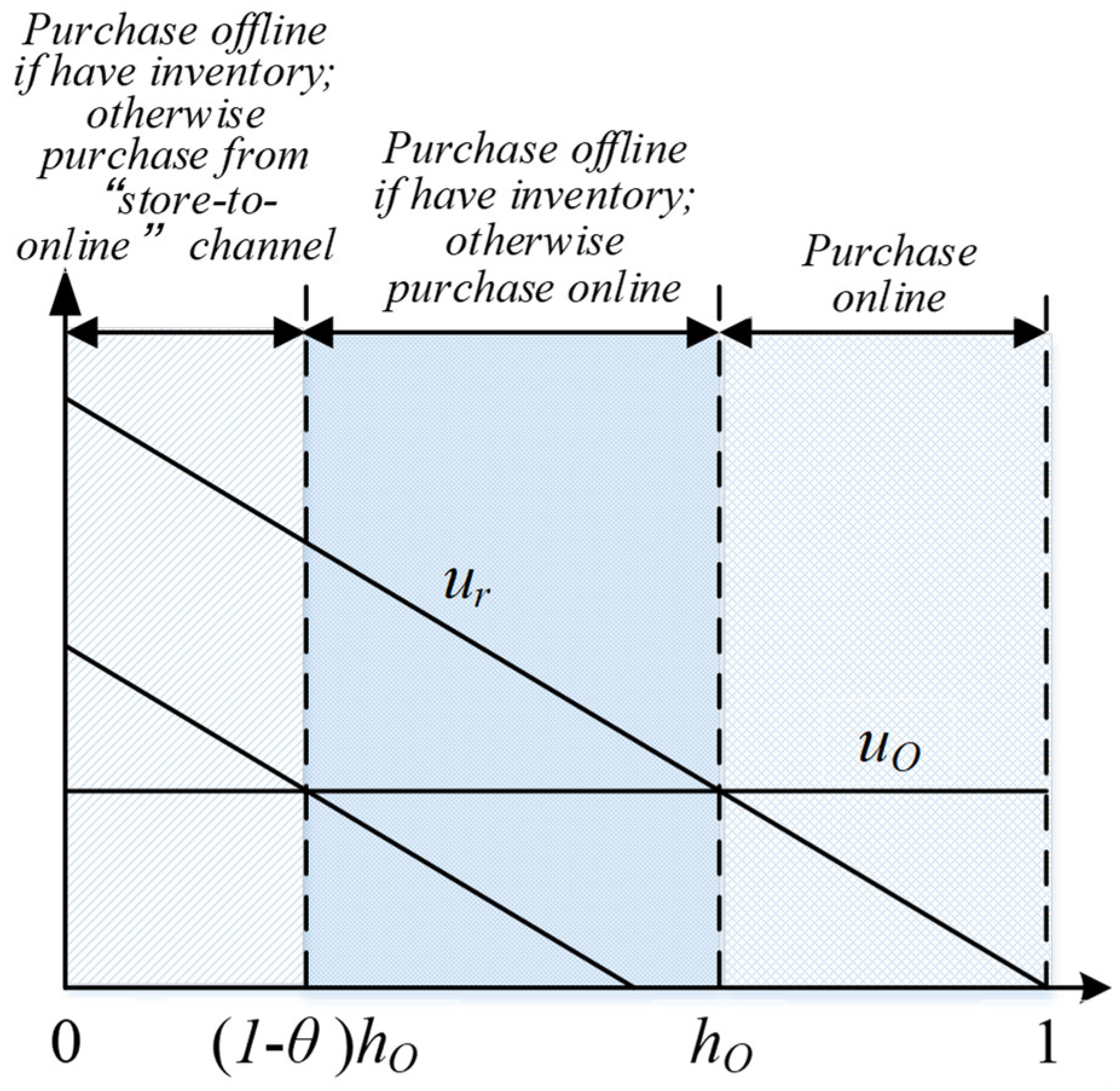

- (1) Utility function

- (2) Cost function

3.3. Model Construction and Analysis

- (1) Dual-channel sales strategy (D)

- (2) Introducing a store-to-online channel (S)

- where , and .

- (3) Equilibrium decisions comparison between D and S sales strategies

4. Results and Discussions

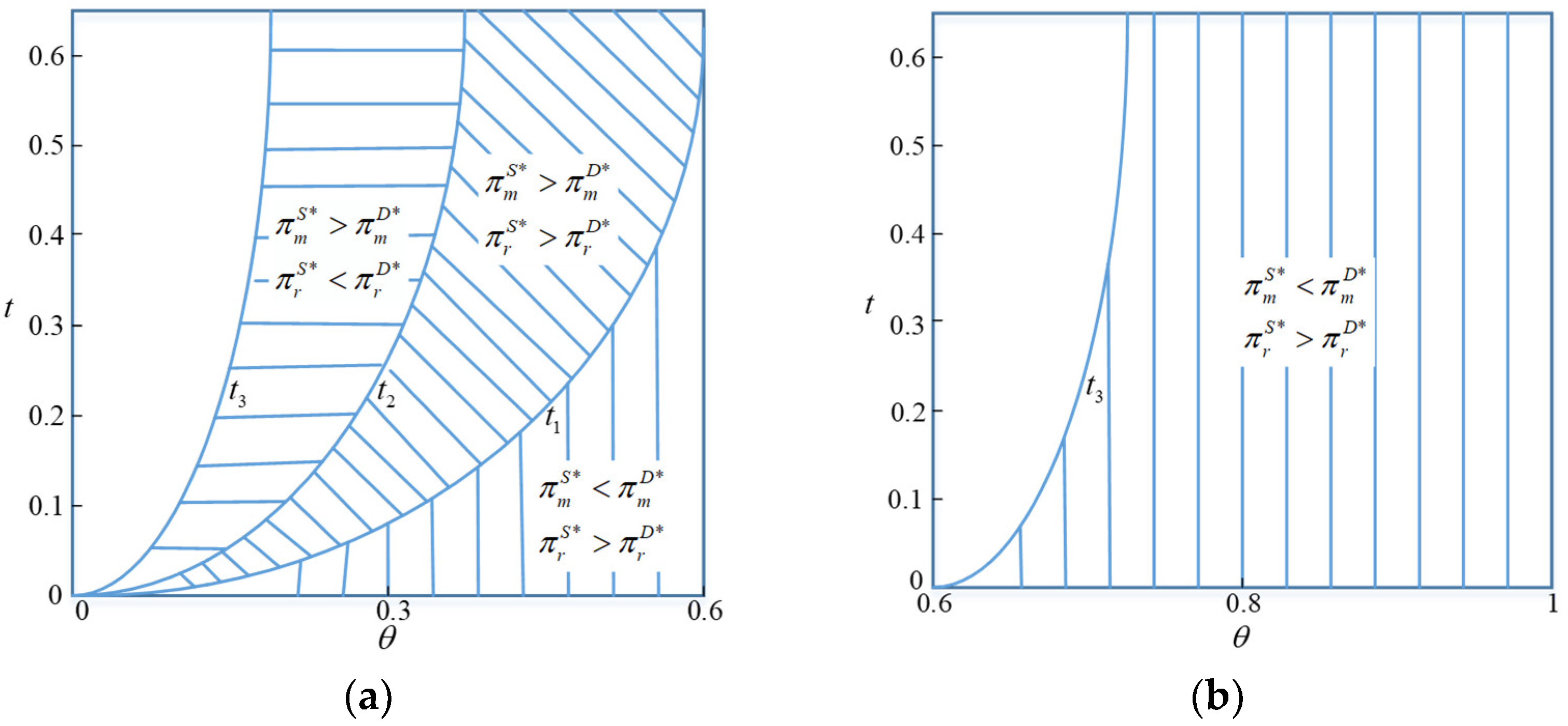

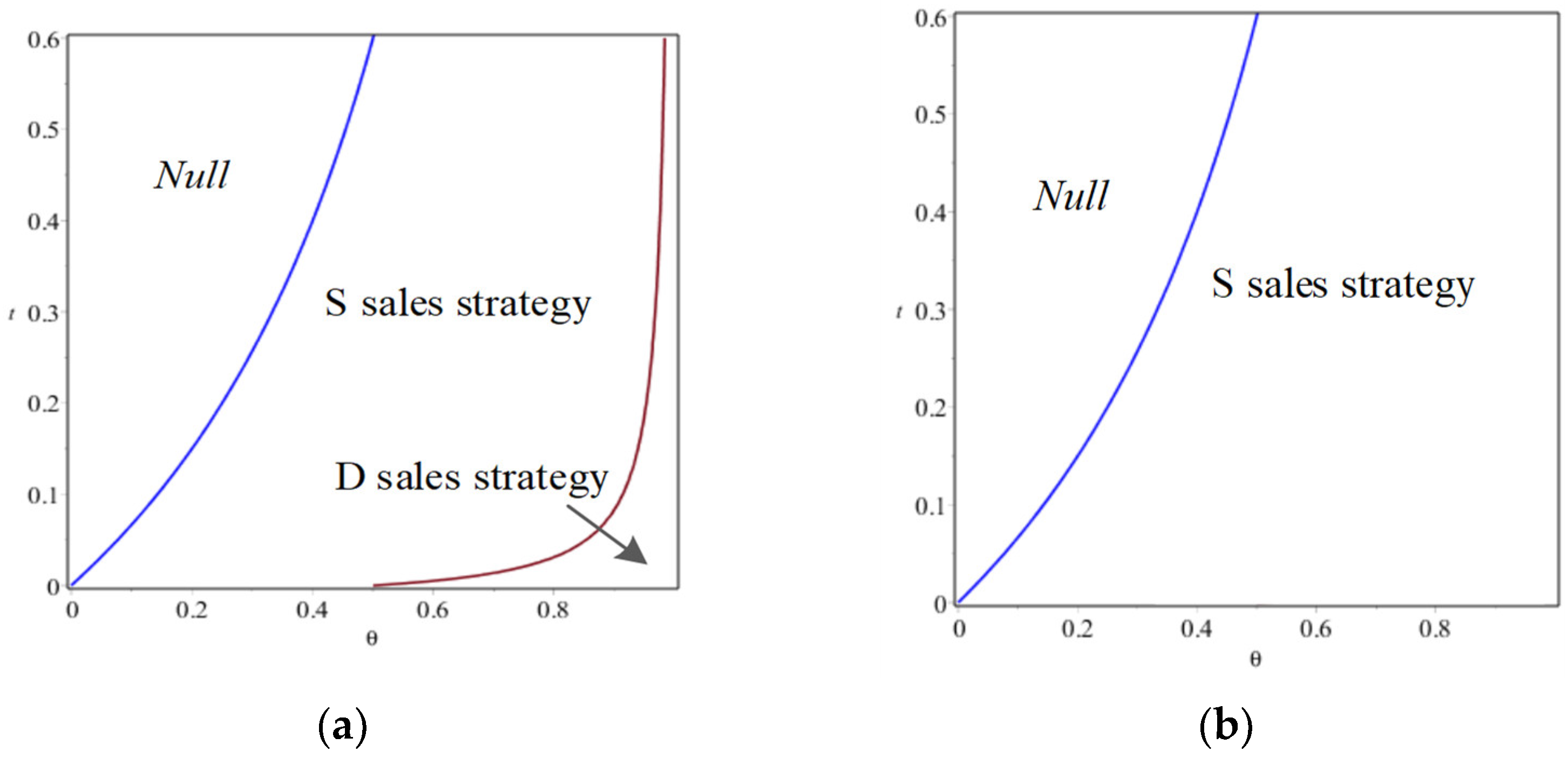

4.1. Optimal Sales Strategy of GBMs Considering Inventory Risk

- (1) Equilibrium GBMs sales strategy

- (2) Pareto improvement of GBMs sales strategy

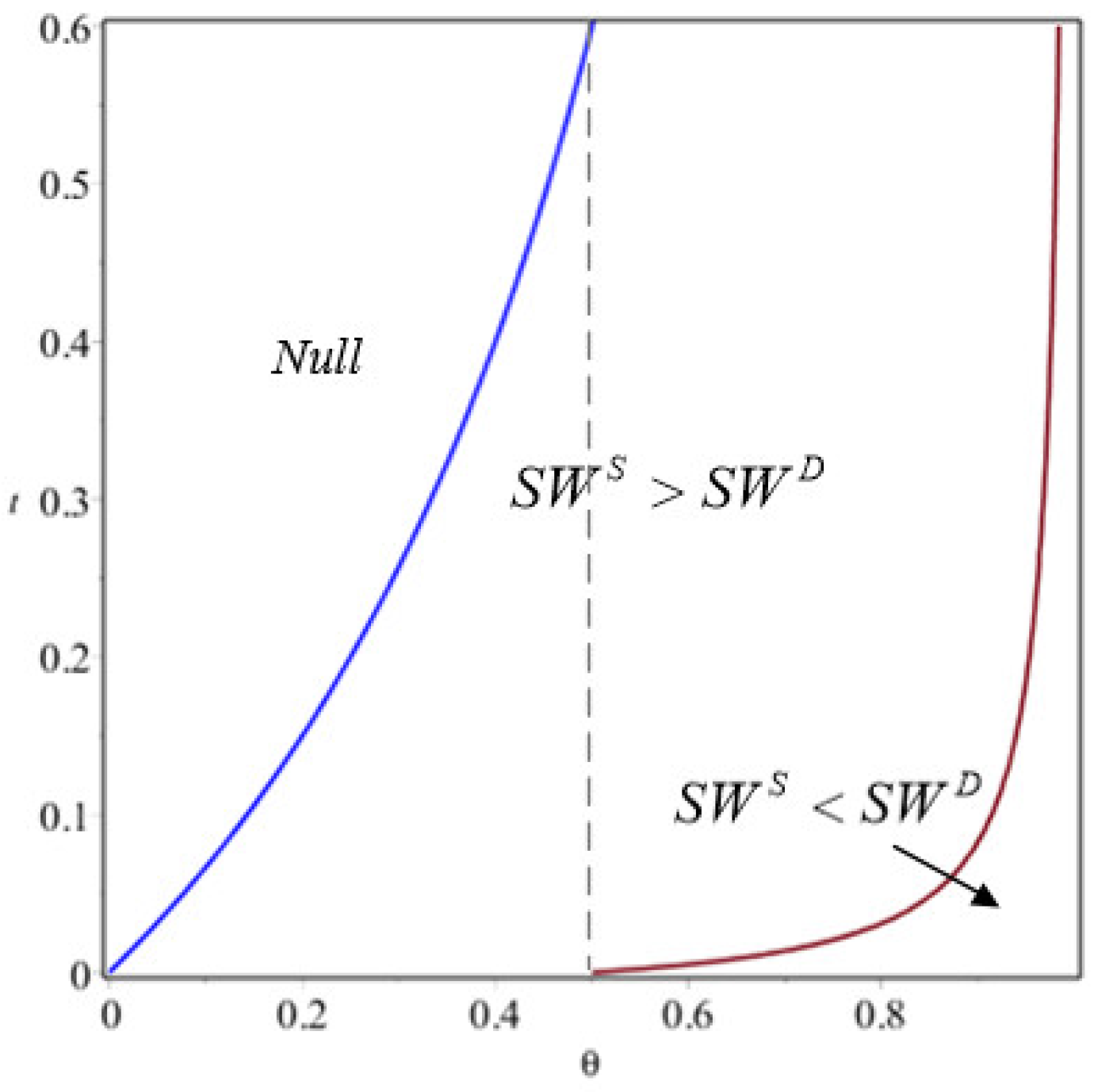

4.2. Effects of GBMs Sales Strategy on Urban Environment and Social Welfare

- (1) The effect of GBMs sales strategies on urban environment

- (2) The effect of GBMs sales strategies on social welfare

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Yoshino, H. Zero-carbon city and community in japan—policies, proposals, and examples. In Resilient Urban Environments: Planning for Livable Cities; Springer Nature: Cham, Switzerland, 2024; pp. 289–308. [Google Scholar] [CrossRef]

- Lin, Y.; Xu, S.; Zhou, Y.; Xiong, L. Should local governments adopt dynamic subsidy mechanism to promote the development of green intelligent buildings? An evolutionary game analysis. J. Environ. Manag. 2024, 367, 122060. [Google Scholar] [CrossRef] [PubMed]

- Yang, Z.; Chen, H.; Mi, L.; Li, P.; Qi, K. Green building technologies adoption process in China: How environmental policies are reshaping the decision-making among alliance-based construction enterprises? Sustain. Cities Soc. 2021, 73, 103122. [Google Scholar] [CrossRef]

- Yin, S.; Zhao, Y. An agent-based evolutionary system model of the transformation from building material industry (BMI) to green intelligent BMI under supply chain management. Humanit. Soc. Sci. Commun. 2024, 11, 468. [Google Scholar] [CrossRef]

- Zeyad, A.M. Sustainable concrete Production: Incorporating recycled wastewater as a green building material. Constr. Build. Mater. 2023, 407, 133522. [Google Scholar] [CrossRef]

- Chen, L.; Huang, L.; Hua, J.; Chen, Z.; Wei, L.; Osman, A.I.; Fawzy, S.; Rooney, D.W.; Dong, L.; Yap, P.S. Green construction for low-carbon cities: A review. Environ. Chem. Lett. 2023, 21, 1627–1657. [Google Scholar] [CrossRef]

- Khoshnava, S.M.; Rostami, R.; Valipour, A.; Ismail, M.; Rahmat, A.R. Rank of green building material criteria based on the three pillars of sustainability using the hybrid multi criteria decision making method. J. Clean. Prod. 2018, 173, 82–99. [Google Scholar] [CrossRef]

- Liu, T.T.; Cao, M.Q.; Fang, Y.S.; Zhu, Y.H.; Cao, M.S. Green building materials lit up by electromagnetic absorption function: A review. J. Mater. Sci. Technol. 2022, 112, 329–344. [Google Scholar] [CrossRef]

- Shehata, N.; Mohamed, O.A.; Sayed, E.T.; Abdelkareem, M.A.; Olabi, A.G. Geopolymer concrete as green building materials: Recent applications, sustainable development and circular economy potentials. Sci. Total Environ. 2022, 836, 155577. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Darko, A.; Olanipekun, A.O.; Ameyaw, E.E. Critical barriers to green building technologies adoption in developing countries: The case of Ghana. J. Clean. Prod. 2018, 172, 1067–1079. [Google Scholar] [CrossRef]

- Liu, Y.; Zuo, J.; Pan, M.; Ge, Q.; Chang, R.; Feng, X.; Fu, Y.; Dong, N. The incentive mechanism and decision-making behavior in the green building supply market: A tripartite evolutionary game analysis. Build. Environ. 2022, 214, 108903. [Google Scholar] [CrossRef]

- Yin, S.; Li, B. Transferring green building technologies from academic research institutes to building enterprises in the development of urban green building: A stochastic differential game approach. Sustain. Cities Soc. 2018, 39, 631–638. [Google Scholar] [CrossRef]

- Qian, Y.; Yu, X.A.; Shen, Z.; Song, M. Complexity analysis and control of game behavior of subjects in green building materials supply chain considering technology subsidies. Expert Syst. Appl. 2023, 214, 119052. [Google Scholar] [CrossRef]

- Liang, X.; Peng, Y.; Shen, G.Q. A game theory based analysis of decision making for green retrofit under different occupancy types. J. Clean. Prod. 2016, 137, 1300–1312. [Google Scholar] [CrossRef]

- Zhao, Y.; Liu, L.; Yu, M. Comparison and analysis of carbon emissions of traditional, prefabricated, and green material buildings in materialization stage. J. Clean. Prod. 2023, 406, 137152. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy & society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar]

- Von Neumann, J.; Morgenstern, O. Theory of Games and Economic Behavior; Princeton University Press: Princeton, NJ, USA, 1944. [Google Scholar]

- Yang, Z.; Chen, H.; Peng, C.; Liu, X. Exploring the role of environmental regulations in the production and diffusion of electric vehicles. Comput. Ind. Eng. 2022, 173, 108675. [Google Scholar] [CrossRef]

- Gao, Z.; Zhou, P.; Wen, W. What drives urban low-carbon transition? Findings from China. Environ. Impact Assess. Rev. 2025, 110, 107679. [Google Scholar] [CrossRef]

- Zhang, J.; Yang, K.; Wu, J.; Duan, Y.; Ma, Y.; Ren, J.; Yang, Z. Scenario simulation of carbon balance in carbon peak pilot cities under the background of the “dual carbon” goals. Sustain. Cities Soc. 2024, 116, 105910. [Google Scholar] [CrossRef]

- Zhu, B.; Nakaishi, T.; Kagawa, S. Neighbor’s profit or Neighbor’s beggar? Evidence from China’s low carbon cities pilot scheme on green development. Energy Policy 2024, 195, 114318. [Google Scholar] [CrossRef]

- Liu, X.; Wang, H.; You, C.; Yang, Z.; Yao, J. The impact of sustainable development policy for resource-based cities on green technology innovation: Firm-level evidence from China. J. Clean. Prod. 2024, 469, 143246. [Google Scholar] [CrossRef]

- Tian, C.; Sui, H.; Chen, Y.; Wang, W.; Deng, H. Estimating carbon emission reductions from China’s “Zero-waste City” construction pilot program. Resour. Conserv. Recycl. 2025, 212, 107975. [Google Scholar] [CrossRef]

- Rayegan, S.; Katal, A.; Wang, L.L.; Zmeureanu, R.; Eicker, U.; Mortezazadeh, M.; Tahmasebi, S. Modeling building energy self-sufficiency of using rooftop photovoltaics on an urban scale. Energy Build. 2024, 324, 114863. [Google Scholar] [CrossRef]

- Wang, X.; Wang, G.; Chen, T.; Zeng, Z.; Heng, C.K. Low-carbon city and its future research trends: A bibliometric analysis and systematic review. Sustain. Cities Soc. 2023, 90, 104381. [Google Scholar] [CrossRef]

- Fan, W.; Huang, S.; Yu, Y.; Xu, Y.; Cheng, S. Decomposition and decoupling analysis of carbon footprint pressure in China’s cities. J. Clean. Prod. 2022, 372, 133792. [Google Scholar] [CrossRef]

- Liao, Y.; Koelewijn, S.F.; van den Bossche, G.; van Aelst, J.; van den Bosch, S.; Renders, T.; Navare, K.; Nicolaï, T.; van Aelst, K.; Maesen, M.; et al. A sustainable wood biorefinery for low-carbon footprint chemicals production. Science 2020, 367, 1385–1390. [Google Scholar] [CrossRef]

- Liang, H.; Bian, X.; Dong, L. Towards net zero carbon buildings: Accounting the building embodied carbon and life cycle-based policy design for Greater Bay Area, China. Geosci. Front. 2024, 15, 101760. [Google Scholar] [CrossRef]

- Franzoni, E. Materials selection for green buildings: Which tools for engineers and architects? Procedia Eng. 2011, 21, 883–890. [Google Scholar] [CrossRef]

- Iwuanyanwu, O.; Gil-Ozoudeh, I.; Okwandu, A.C.; Ike, C.S. The role of green building materials in sustainable architecture: Innovations, challenges, and future trends. Int. J. Appl. Res. Soc. Sci. 2024, 6, 1935–1950. [Google Scholar] [CrossRef]

- James, J.P.; Yang, X. Emissions of volatile organic compounds from several green and non-green building materials: A comparison. Indoor Built Environ. 2005, 14, 69–74. [Google Scholar] [CrossRef]

- Mayhoub, M.M.G.; El Sayad, Z.M.T.; Ali, A.A.M.; Ibrahim, M.G. Assessment of green building materials’ attributes to achieve sustainable building façades using ahp. Buildings 2021, 11, 474. [Google Scholar] [CrossRef]

- Wang, H.; Chiang, P.C.; Cai, Y.; Li, C.; Wang, X.; Chen, T.L.; Wei, S.; Huang, Q. Application of wall and insulation materials on Green building: A review. Sustainability 2018, 10, 3331. [Google Scholar] [CrossRef]

- He, W.; Yang, Y.; Wang, W.; Liu, Y.; Khan, W. Empirical study on long-term dynamic coordination of green building supply chain decision-making under different subsidies. Build. Environ. 2022, 208, 108630. [Google Scholar] [CrossRef]

- Feng, H.; Ren, H.; Yang, S.; Xue, Y. Research on stability strategy based on the dynamic evolution game of promoting low-carbon building green building materials market. Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Song, Y. Research on high quality development strategy of green building: A full life cycle perspective on recycled building materials. Energy Build. 2022, 273, 112406. [Google Scholar] [CrossRef]

- Eze, C.E.; Ugulu, R.A.; Egwunatum, S.I.; Awodele, I.A. Green Building Materials Products and Service Market in the Construction Industry. J. Eng. Proj. Prod. Manag. 2021, 11, 89–101. [Google Scholar]

- Ak, Ş.; Aytekin, O.; Kuşan, H.; Zorluer, İ. Environmental Sustainability of Building Materials in Turkey: Reference Information Recommendations for European Green Deal Declarations. Buildings 2024, 14, 889. [Google Scholar] [CrossRef]

- He, W.; Zhang, Y.; Li, S.; Li, W.; Wang, Z.; Liu, P.; Zhang, L.; Kong, D. Reducing betrayal behavior in green building construction: A quantum game approach. J. Clean. Prod. 2024, 463, 142760. [Google Scholar] [CrossRef]

- Rajendra, P.; Mohanasundaram, T. Factors driving consumer adoption of smart and green building materials: The role of civil engineers and architects. J. Asian Archit. Build. Eng. 2024, 24, 332–349. [Google Scholar] [CrossRef]

- Yongbo, S.; Zhang, Z. Evolutionary Game Analysis on the Promotion of Green Buildings in China Under the “Dual Carbon” Goals: A Multi-Stakeholder Perspective. Buildings 2025, 15, 1392. [Google Scholar] [CrossRef]

- Tsai, I.C. Willingness to pay for green buildings post COVID-19 pandemic outbreak: Differences between high-and low-income areas and high-and low-price settlements. Ann. Reg. Sci. 2025, 74, 23. [Google Scholar] [CrossRef]

- Lan, Y.; Li, Y.; Papier, F. Competition and coordination in a three-tier supply chain with differentiated channels. Eur. J. Oper. Res. 2018, 269, 870–882. [Google Scholar] [CrossRef]

- Yi, Z.; Wang, Y.; Liu, Y.; Chen, Y.J. The Impact of Consumer Fairness Seeking on Distribution Channel Selection: Direct Selling vs. Agent Selling. Prod. Oper. Manag. 2018, 27, 1148–1167. [Google Scholar] [CrossRef]

- Cao, J.; So, K.C.; Yin, S. Impact of an “online-to-store” channel on demand allocation, pricing and profitability. Eur. J. Oper. Res. 2016, 248, 234–245. [Google Scholar] [CrossRef]

- Chen, K.Y.; Kaya, M.; Özer, Ö. Dual sales channel management with service competition. Manuf. Serv. Oper. Manag. 2008, 10, 654–675. [Google Scholar] [CrossRef]

- Gallino, S.; Moreno, A. Integration of online and offline channels in retail: The impact of sharing reliable inventory availability information. Manag. Sci. 2014, 60, 1434–1451. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Zhou, M. Firms’ green R&D cooperation behaviour in a supply chain: Technological spillover, power and coordination. Int. J. Prod. Econ. 2019, 218, 118–134. [Google Scholar]

- Ebekozien, A.; Aigbavboa, C.; Thwala, W.D.; Amadi, G.C.; Aigbedion, M.; Ogbaini, I.F. A systematic review of green building practices implementation in Africa. J. Facil. Manag. 2024, 22, 91–107. [Google Scholar] [CrossRef]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental taxes and the choice of green technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Niu, B.; Mu, Z.; Li, B. O2O results in traffic congestion reduction and sustainability improvement: Analysis of “Online-to-Store” channel and uniform pricing strategy. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 481–505. [Google Scholar] [CrossRef]

| Related Studies | Methodology | Key Results |

|---|---|---|

| Liu et al. [22]; Tian et al. [23] | Questionnaire survey and empirical research | Discussing drivers and barriers of green building development. |

| Eze et al. [37] | Questionnaire survey approach and snowball sampling techniques | Assessing the benefits of GBMs incorporation in the green construction market. |

| Feng et al. [35] | Evolutionary game model | Effective subsidy and penalty policies can motivate the adoption of GBMs. |

| Qian et al. [13] | Stackelberg model | Investigating the promotion of green building materials production through technology subsidies. |

| Guo et al. [36] | Multi-agent modeling | Examining strategy changes from the production of GBMs to the purchase and use of homes. |

| Liu et al. [8] | Text mining | Investigating consumers’ preferences and attention to different attributes of green build products. |

| Ak et al. [38] | Semi-structured interviews and case study | Providing weight and normalization reference information for declaring the environmental information of building materials produced and exported. |

| Yongbo & Zhang [41] | Evolutionary game | The development of the green building market correlates with increased consumer willingness to purchase green buildings. |

| Tsai [42] | Empirical research | Examining whether city residents’ willingness to pay for green buildings changed after the outbreak of the COVID-19 pandemic. |

| Iwuanyanwu et al. [30] | Literature research | Reviewing the latest innovations in green building materials and highlighting advances. |

| Variables | Explanation |

|---|---|

| Decision variables | |

| The wholesale price | |

| The product quality level | |

| Other variables | |

| The retail price | |

| Unit diversion revenue | |

| The GBMs market size | |

| The probability of product matching consumers’ purchasing preferences in the GBMs market | |

| The initial utility of consumers obtained from the GBMs | |

| , | The hassle cost of the online channel and offline channel |

| , , | The expected utility of consumers purchasing from the online channel, offline channel, and store-to-online channel |

| The unit return cost | |

| , , | The expected number of consumers who choose the online channel, offline channel, and store-to-online channel |

| , | The expected profit of the GBMs manufacturer and retailer |

| , | The sales strategy with and without the store-to-online channel |

| Conditions | Preference of the GBMs Manufacturer | Preference of the GBMs Retailer | Consistent? | Equilibrium GBMs Sales Strategy | |

|---|---|---|---|---|---|

| No | / | ||||

| Yes | S | ||||

| No | / | ||||

| No | / |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zha, X.; Yang, Z.; Hou, B.; Zhang, F. Towards Zero-Carbon Cities: Optimal Sales Strategies of Green Building Materials Considering Consumer Purchasing Behaviors. Buildings 2025, 15, 1813. https://doi.org/10.3390/buildings15111813

Zha X, Yang Z, Hou B, Zhang F. Towards Zero-Carbon Cities: Optimal Sales Strategies of Green Building Materials Considering Consumer Purchasing Behaviors. Buildings. 2025; 15(11):1813. https://doi.org/10.3390/buildings15111813

Chicago/Turabian StyleZha, Xiaoyu, Zhi Yang, Bo Hou, and Feng Zhang. 2025. "Towards Zero-Carbon Cities: Optimal Sales Strategies of Green Building Materials Considering Consumer Purchasing Behaviors" Buildings 15, no. 11: 1813. https://doi.org/10.3390/buildings15111813

APA StyleZha, X., Yang, Z., Hou, B., & Zhang, F. (2025). Towards Zero-Carbon Cities: Optimal Sales Strategies of Green Building Materials Considering Consumer Purchasing Behaviors. Buildings, 15(11), 1813. https://doi.org/10.3390/buildings15111813