1. Introduction

Housing affordability remains a critical socio-economic challenge in Central Europe, influenced by a complex interplay of macroeconomic, demographic, and policy-related factors. The surge in property prices, wage stagnation, and global economic disruptions—such as the COVID-19 pandemic and the ongoing geopolitical instability—have exacerbated housing accessibility issues across the region [

1,

2]. Numerous studies have explored housing affordability within individual countries, focusing on specific drivers such as interest rates, wage growth, and government housing initiatives [

3,

4]. However, cross-border comparative analyses evaluating the effectiveness of housing policies in addressing affordability disparities remain limited. Furthermore, while many studies acknowledge affordability constraints, few provide a systematic evaluation of policy responses or their varying impacts across different national contexts.

1.1. Research Gap and Justification

The existing literature has largely examined housing affordability through the lens of national economic conditions; yet, there is a lack of cross-border comparative research assessing policy effectiveness in mitigating regional disparities. Countries such as Austria, the Czech Republic, Slovakia, and Poland have implemented diverse housing policies, ranging from state-supported housing initiatives in Austria to market-driven approaches in the Czech Republic and Poland. However, there is insufficient empirical analysis evaluating the relative success of these models in addressing affordability pressures.

Additionally, the role of innovative housing finance solutions—such as state-supported mortgage programs, public–private partnerships, and rent-to-own schemes—remains underexplored in the Central European context. While some countries have introduced measures to enhance affordability, their impact has not been systematically assessed. The convergence of recent economic disruptions, including the post-pandemic economic recovery, rising energy costs, and migration-driven housing demand, further necessitates a re-evaluation of affordability trends and policy responses.

This study seeks to bridge this gap by offering a multi-country comparative perspective, analyzing how different regulatory and financial interventions influence housing affordability outcomes. By integrating data from real estate platforms, national statistical offices, and European housing reports, the research provides a granular and up-to-date assessment of affordability trends and policy effectiveness across the four case study countries.

1.2. Research Questions and Hypotheses

Building upon the identified research gap, this study formulates several research questions aimed at deepening the understanding of the relationship between wage dynamics and housing affordability in Central Europe. Specifically, it seeks to answer:

RQ1: How does regional wage growth influence urban housing prices in selected Central European cities?

RQ2: Do housing price responses to wage growth differ between capital cities and secondary urban centers?

RQ3: To what extent does labor migration contribute to increased housing demand and property price escalation in these cities?

Guided by these questions, the study posits the following hypotheses:

H1: In cities characterized by constrained housing supply, the responsiveness of housing prices to wage growth is significantly higher.

H2: Wage growth impacts housing prices with a time lag of one to two years, particularly in economically dynamic urban centers.

H3: An increase in labor migration significantly contributes to upward pressure on housing prices in major cities.

These hypotheses are grounded in established economic theories, including the monocentric city model, filtering theory, and labor market mobility frameworks. Their testing, even in preliminary form, will enable a more nuanced exploration of the mechanisms underlying observed affordability trends, moving beyond purely descriptive regional comparisons.

1.3. Structure of the Paper

The paper is structured as follows:

Section 2 details the theoretical background and the methodological approach, including data sources, analytical techniques, and criteria for city selection.

Section 3 presents the findings, focusing on affordability trends, spatial disparities, and comparative policy analysis.

Section 4 discusses the implications of these results, emphasizing policy effectiveness, financial accessibility, and regulatory challenges. Finally,

Section 5 concludes the study, summarizing key insights, addressing limitations, and suggesting future research directions.

1.4. Novel Contribution of the Study

This study makes several key contributions to the existing literature on housing affordability in Central Europe.

The study covers comparative cross-country analysis: Unlike previous studies that focus on single-country case studies, this research provides a multinational perspective encompassing the Czech Republic, Slovakia, Austria, and Poland. This cross-country comparison enables the identification of common affordability challenges and unique national policy responses.

Multiple crisis impacts are incorporated: While prior studies analyze individual crises (e.g., the pandemic or the energy crisis) in isolation, this study assesses their cumulative effects, providing a more comprehensive understanding of how simultaneous global disruptions have shaped affordability trends. This is particularly relevant given the intersection of the COVID-19 pandemic, the 2021–2022 energy crisis, and geopolitical instability in Central Europe.

The article integrates real-time market data: Unlike Eurostat’s aggregated affordability indicators, which have significant reporting lags, this study incorporates real-time data from real estate platforms, allowing for more granular, city-level insights.

As far as the policy-oriented approach, this research extends beyond documentation of housing affordability metrics by systematically evaluating policy responses in a comparative framework. It asks not only what policies exist, but how they interact with affordability outcomes in different national contexts. By emphasizing cross-border policy coordination, this study identifies opportunities for regional governments to learn from one another’s successes and failures, fostering more effective housing affordability interventions.

By addressing these gaps, this study enhances the current understanding of housing affordability challenges and provides data-driven insights that can guide future policy interventions in Central Europe. The findings emphasize that a comparative, data-driven approach is essential for identifying the most effective housing policies and exploring avenues for cross-border cooperation to enhance affordability outcomes across the region.

2. Theoretical Background and Methodology

2.1. Housing Affordability and Market Trends in Central Europe

The issue of housing affordability in Central Europe has garnered significant scholarly attention, with researchers identifying both macroeconomic drivers and regional disparities as key determinants of affordability trends. Early foundational research by Banerji et al. [

5] and Égert and Mihaljek [

6] established that foreign investment influxes, constrained housing supply, and economic cycles play pivotal roles in shaping Central and Eastern European real estate markets. These studies highlighted how low interest rates and high demand, particularly in urban centers, drove property price appreciation across the region.

More recent studies focus on housing market responses to economic disruptions, particularly in the wake of the COVID-19 pandemic. Duca et al. [

7] demonstrate that the pandemic accelerated demand shifts towards suburban and secondary housing markets due to remote work policies, while Trojanek [

8] shows how pandemic-induced supply chain disruptions intensified construction cost inflation, exacerbating affordability challenges in Poland. Similarly, Hromada and Čermáková [

9] analyze the link between rising energy prices and cost-of-living increases, concluding that these factors have significantly eroded real purchasing power and widened affordability gaps across Central European cities.

Beyond the pandemic, geopolitical instability has emerged as a critical determinant of affordability trends. Trojanek and Gluszak [

10] explore the impact of the Ukrainian refugee crisis, noting that sudden increases in housing demand in cities such as Warsaw and Kraków have fueled rental price inflation, further exacerbating affordability pressures. Valderrama et al. [

10] contextualize these developments within the broader framework of European monetary policies, emphasizing how persistently low interest rates and expansionary fiscal policies have encouraged speculative housing investments, worsening affordability in Central Europe.

2.2. Affordability Challenges and Cross-Country Disparities

Housing affordability has emerged as one of the most pressing economic and social issues in Central Europe. Numerous studies have documented price-to-income ratio deteriorations, revealing significant disparities between and within countries. Hromada and Čermáková [

3] analyze affordability trends in the Czech Republic, highlighting how a combination of stagnant wages and surging real estate prices has made homeownership increasingly unattainable for middle-income households. Similarly, Mironiuc et al. [

11] argue that a lack of market transparency contributes to affordability challenges by hindering informed decision-making and enabling speculative pricing.

Comparative research also suggests that post-pandemic migration trends have exacerbated affordability issues. Colomb and Gallent [

12] observe that urban-to-suburban migration has led to increased demand for housing in traditionally affordable areas, causing price escalations in suburban and satellite cities surrounding major metropolitan hubs. Výbošťok and Štefkovičová [

13] further demonstrate that quality-of-life preferences, including access to green spaces and lower population density, are reshaping demand patterns and further influencing housing affordability in Central Europe’s peripheries.

Supply-side constraints are also a major contributor to affordability issues. Ionascu et al. [

14] assess housing supply elasticity in Central Europe and find that regulatory bottlenecks and restrictive zoning policies have significantly curtailed the ability of markets to respond to demand surges. Cavischia et al. [

15] reinforce this perspective, stressing that addressing structural mismatches between housing supply and demand is crucial for improving affordability, particularly in urban hubs such as Prague, Vienna, and Bratislava.

2.3. Policy Responses and Housing Market Regulation

Governments across Central Europe have implemented a range of policy interventions aimed at alleviating affordability pressures. However, their effectiveness varies significantly across different contexts. Trojanek and Gluszak [

10] evaluate Poland’s rental market regulations and state-supported affordable housing initiatives, concluding that while these measures provide short-term relief, they fail to address long-term affordability constraints. Similarly, Eurostat [

1] reports that Poland has experienced one of the steepest declines in affordability due to increased refugee-driven housing demand in urban centers.

Austria’s housing model has often been cited as a best-practice example for mitigating affordability crises. Lindqvist [

16] and Bitterer and Heeg [

17] highlight how Vienna’s combination of social housing programs and progressive wage policies has successfully cushioned affordability pressures, providing long-term stability for residents. Comparative research suggests that similar models could be adapted in other Central European nations to counteract affordability declines.

In contrast, the Czech Republic faces competing policy priorities, balancing affordability with environmental and regulatory objectives. Hromada and Čermáková [

9] note that rising energy costs and stricter environmental regulations have reshaped the housing market, increasing costs for new developments and exacerbating affordability gaps. Krainer and Wei [

18] further explore the impact of speculative investment, arguing that stronger anti-speculation measures and enhanced financial oversight are necessary to prevent artificial price inflation in major cities.

2.4. Theoretical Foundations

Understanding the relationship between wage dynamics and housing market outcomes requires grounding the analysis in established economic theories. This study draws on three key theoretical models that provide mechanisms for interpreting observed patterns: the monocentric city model, filtering theory, and labor mobility frameworks.

First, the monocentric city model—developed by Alonso [

19], Muth [

20], and Mills [

21] —proposes that urban land and housing prices reflect a trade-off between location and transportation costs. In this model, wage gradients and housing demand are closely linked: higher wages in central areas can increase demand for proximate housing, exerting upward pressure on property prices, particularly when commuting costs are high or public transport is underdeveloped. This framework helps explain why economically dynamic cities like Prague or Warsaw, which are experiencing wage growth, simultaneously face significant housing price inflation.

Second, the filtering theory suggests that housing markets operate through a dynamic process in which newer, high-end housing gradually “filters down” to lower-income groups over time as properties age and depreciate. However, when housing supply, particularly at the high end, is constrained—due to regulatory barriers, rising construction costs, or limited land availability—this filtering process slows, creating bottlenecks across all market segments. Consequently, affordability challenges intensify not only for first-time buyers but also for middle- and lower-income households. Applying this theory helps contextualize the observed worsening affordability trends in Central European urban centers despite varying levels of new housing supply.

Finally, labor mobility theories emphasize that wage differentials across regions and cities incentivize internal migration, particularly toward economically thriving metropolitan areas. Such migration flows amplify housing demand pressures in receiving cities, especially when housing supply fails to keep pace with population inflows. In the Central European context, cities like Vienna and Warsaw have experienced increased migration not only domestically but also from neighboring countries, exacerbating demand-side pressures on already strained housing markets.

Together, these theoretical models underscore that rising housing prices in Central European cities are not solely the result of wage growth but are mediated by supply constraints, spatial structure, and labor mobility patterns. By integrating these perspectives, the study moves beyond descriptive analysis and seeks to uncover the structural mechanisms underlying regional disparities in housing affordability.

2.5. Conceptual Framework

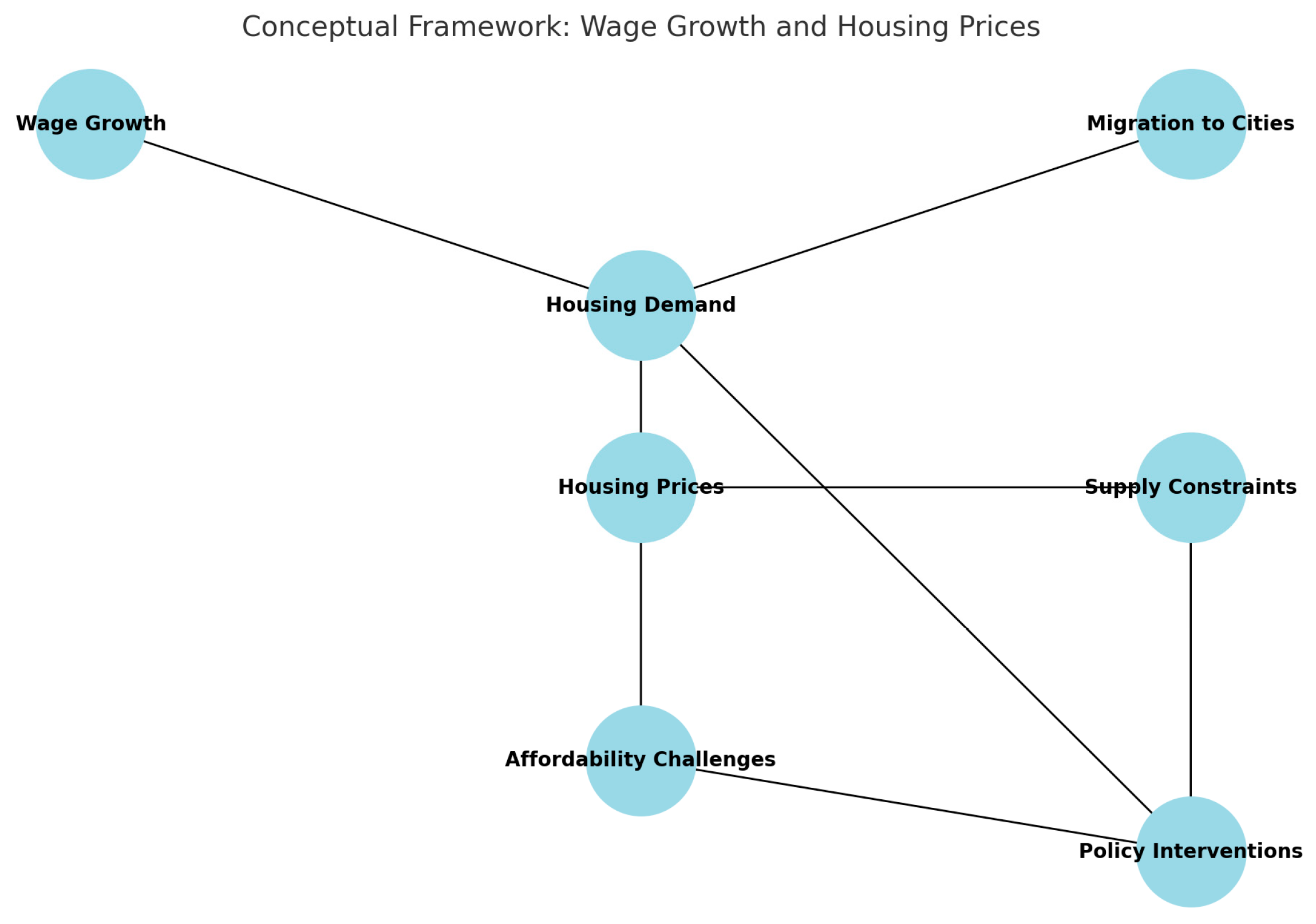

To provide a structured foundation for the subsequent analysis, this study proposes a conceptual framework illustrating the relationships between wage growth, migration dynamics, housing demand, supply constraints, and housing affordability outcomes (see below

Figure 1). The framework integrates insights from urban economic theories and highlights the key factors hypothesized to influence housing market dynamics in Central European cities.

The conceptual framework presented in this study (

Figure 1) highlights the core mechanisms linking economic and demographic trends to housing affordability outcomes in Central Europe. Specifically, wage growth and increased urban migration act as primary drivers of housing demand. In markets where housing supply is constrained by regulatory, financial, or physical factors, this surge in demand leads to accelerated housing price inflation. As housing costs rise faster than income growth, affordability challenges deepen, disproportionately affecting lower- and middle-income households. Policy interventions—whether by expanding housing supply, regulating speculative demand, or offering affordability support measures—can mitigate these pressures by addressing both structural and cyclical vulnerabilities in the housing market. This framework provides a structured basis for analyzing the empirical relationships explored in the subsequent sections.

To guide the empirical analysis, this study develops a conceptual analytical framework illustrating the causal pathways linking wage dynamics to housing market outcomes in Central European cities. The framework builds upon established economic theories and incorporates key mediating factors influencing housing affordability.

As depicted in

Figure 1, rising wage levels stimulate housing demand, particularly in urban centers characterized by dynamic labor markets and migration inflows. This heightened demand exerts upward pressure on property prices. However, the degree to which housing supply can respond to increased demand—referred to as supply elasticity—critically shapes market outcomes.

In markets where supply-side bottlenecks exist—such as restrictive zoning regulations, lengthy construction permitting processes, or high development costs—the responsiveness of new housing supplies is limited. Consequently, price movements become more volatile, and affordability challenges are exacerbated.

Migration trends further intensify demand pressures, particularly when cities experience sudden population growth due to economic opportunities or external shocks (e.g., the Ukrainian refugee crisis impacting Warsaw and Kraków). Increased migration inflates both rental and purchase markets, particularly when supply expansion lags population growth.

Moreover, energy and climate regulation impacts serve as additional mediators. Stricter building standards, requirements for energy-efficient retrofitting, and rising energy costs can increase the total cost of housing development and ownership. While these policies aim to promote environmental sustainability, they can inadvertently elevate housing prices, especially in markets where developers pass costs onto consumers.

In summary, the analytical framework posits a multi-layered relationship where wage growth initiates demand expansion, but affordability outcomes are jointly determined by supply responsiveness, migration pressures, and regulatory environments. Understanding these interactions is crucial for explaining the observed spatial disparities in housing affordability across Central Europe.

2.6. Research Design

This study adopts a mixed-methods approach, integrating quantitative data analysis with comparative policy evaluation. The quantitative component involves statistical examination of affordability indicators, while the qualitative aspect assesses housing policy frameworks in the selected Central European countries. The mixed-methods approach is justified, as it enables both data-driven affordability assessments and an evaluation of policy responses, ensuring a more comprehensive understanding of regional disparities in housing affordability.

2.6.1. Data Sources: Distinguishing Primary and Secondary Data

The study utilizes both primary and secondary data. As far as primary data, while the study does not collect firsthand survey data, it treats real estate platform data and market reports as primary sources of real-time market conditions. With regards to secondary data, official wage statistics and macroeconomic indicators from Eurostat, national statistical offices, and the OECD provide standardized affordability benchmarks.

This distinction clarifies that real estate listing prices and affordability trends are derived from secondary sources rather than being directly collected by the researchers.

To ensure the timeliness and relevance of the analysis, the dataset primarily covers the year 2022, supplemented by additional data from major real estate platforms collected up to March 2023. This extension allows the study to better capture emerging housing affordability trends influenced by recent economic and geopolitical developments.

2.6.2. Data Clarifications

To enhance the transparency and reliability of the study’s findings, this section clarifies key methodological choices regarding data treatment.

As regards Inflation Adjustment, all monetary figures—wages, rental prices, and property purchase costs—are presented in nominal terms and reflect market conditions at the time of data collection (December 2022–March 2023). Inflation adjustment was not applied because the primary aim was to capture real-time affordability dynamics rather than conduct a longitudinal comparison over an extended period. Nonetheless, the relatively short data collection window minimizes distortions caused by inflation fluctuations. Future longitudinal studies could apply inflation indexing to facilitate comparisons across broader time horizons.

As far as Income Measure, the affordability calculations in this study are based on individual average monthly wages, rather than household incomes. This decision was driven by the greater availability and comparability of individual wage data across the selected cities and countries. It is acknowledged that household income typically provides a more comprehensive measure of affordability, particularly in dual-income households. As such, the affordability challenges presented here may be slightly overstated compared to a household-based analysis. However, using individual wages offers a conservative estimate of affordability pressures faced by single earners, a group often more vulnerable to housing market constraints.

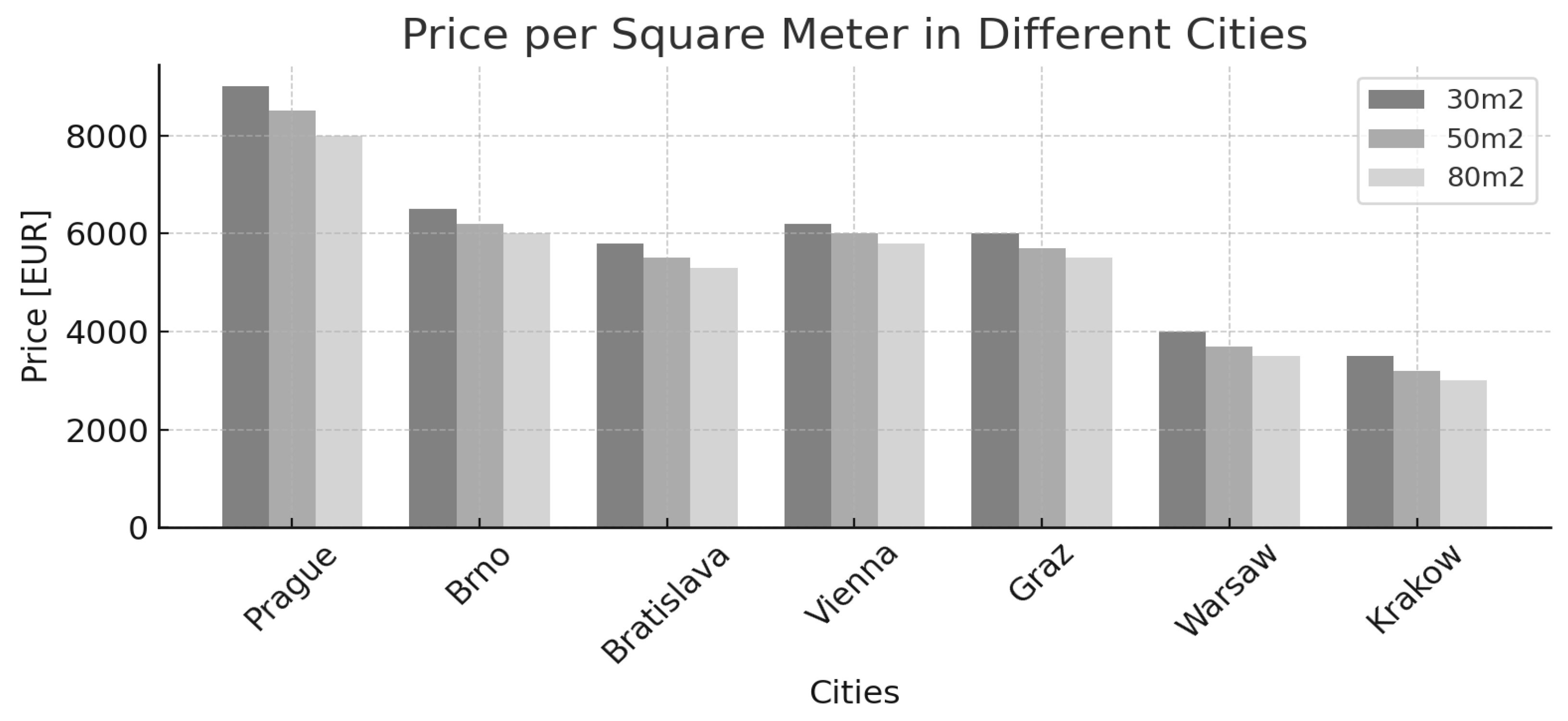

However, the unit of analysis in this study is the city level, focusing on major urban centers rather than national aggregates. Specifically, the analysis covers seven cities: Prague, Brno, Bratislava, Vienna, Graz, Warsaw, and Kraków. This approach allows for a more granular understanding of housing affordability trends, recognizing that urban housing markets often diverge significantly from national averages due to localized economic conditions, migration patterns, and supply constraints.

These clarifications aim to ensure that the affordability measures presented are interpreted within their appropriate methodological context, strengthening the validity of the study’s conclusions.

To further enhance transparency and facilitate the interpretation of results,

Table 1 summarizes the key data assumptions and methodological clarifications underlying the study’s affordability analysis.

2.6.3. Selection of Case Study Cities

The selection of seven major cities—Prague, Brno, Bratislava, Vienna, Graz, Warsaw, and Kraków—was based on their economic importance, real estate market activity, and availability of data. The rationale for including two cities per country, except for Slovakia, is as follows: the Czech Republic, Austria, and Poland are larger economies with more pronounced housing market variations, necessitating multiple cities for an adequate representation of national disparities. Slovakia, being smaller in population and economic scale, has a more centralized housing market, making Bratislava the most representative choice. The selection ensures regional comparability while maintaining feasibility in data collection.

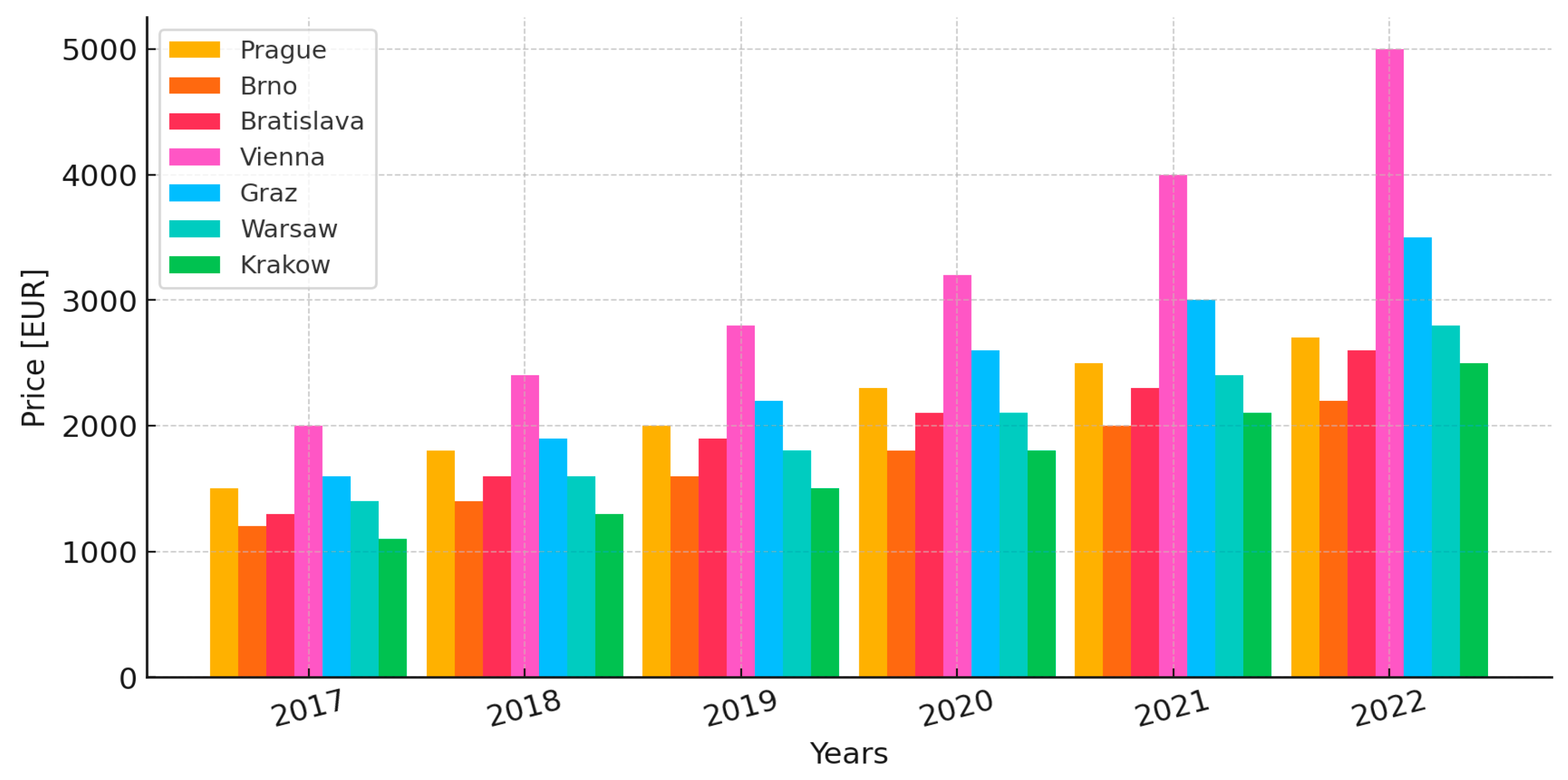

To operationalize these indicators, standard flat sizes were selected based on common market categorizations, as explained below. To ensure comparability and relevance, the selection of flat sizes for affordability analysis was based on common apartment categories across Central European housing markets. Specifically, 30 m2 was chosen to represent a typical studio flat, 50 m2 for a one-bedroom apartment, 70 m2 for a standard two-bedroom unit, and 80 m2 for a medium-sized family flat. These categories reflect widely recognized European real estate market norms and align with typical urban housing preferences. A minor inconsistency previously observed between the use of 70 m2 (for affordability calculations) and 80 m2 (in price trend visualizations) has been corrected to ensure internal consistency throughout the study.

Each country defines affordability differently. In Austria, policies emphasize rental affordability, with affordability thresholds set around 30–35% of household income. As far as Czech Republic and Poland, the affordability is largely defined by market-driven indicators, with a higher reliance on mortgage-based purchasing. In Slovakia, housing affordability includes government-backed loans as a mechanism to support homeownership. By incorporating country-specific affordability frameworks, this study provides a more contextualized analysis of housing access disparities.

2.7. Definitions and Measurement of Housing Affordability

Housing affordability is measured using two key indicators. The first is the price-to-income ratio (years of income required to purchase a home). This metric calculates the number of years a household would need to allocate its entire income toward purchasing a property. It is widely used by OECD, the World Bank, and UN-Habitat as a standard measure of affordability. The other is the rent-to-income ratio (proportion of income required for rent). This indicator measures the percentage of monthly wages required to afford rental housing in each city.

2.7.1. Housing Affordability Measure: Years of Income to Purchase a Property

A key metric in this study is the number of years of median income required to purchase a home—essentially a price-to-income ratio. This measure is widely recognized as a valid indicator of housing affordability. It is sometimes called the “median multiple”, defined as the median house price [

22] divided by the median household income. Housing economists and industry analysts favor this metric because it directly relates housing costs to what households earn, reflecting the fact that housing is typically the largest expense in a family’s budget. Numerous organizations and studies use this ratio: for example, the World Bank/UN Housing Indicators program [

23] and the UN Commission for Sustainable Development adopted it as a primary affordability index, and real estate associations like the National Association of Realtors have long employed it in their affordability assessments. Industry benchmarks further underscore its validity—analysts often consider a home “affordable” if it costs around 3 to 5 years’ worth of median household income, with higher multiples indicating greater unaffordability. In the UK [

24] for instance, a house priced at five times the average income or below is deemed broadly affordable; yet, recent data show the average home costing 8.4 years of income, highlighting severe affordability strains. Because of such clear interpretability and widespread use in both academia and industry, the “years of income to purchase a property” ratio is a well-justified choice for measuring housing affordability in this methodology.

2.7.2. Use of GIS Mapping and Spatial Analysis Techniques

We employ Geographic Information System (GIS) mapping and spatial analysis to visualize and analyze housing affordability patterns across space. This approach is well-supported in the literature [

25] as an effective means to assess and communicate affordability issues. Researchers have long used GIS-based analyses to identify spatial trends and “hotspots” in housing markets. By mapping affordability data, analysts can spot clustering of high- or low-affordability areas and investigate spatial relationships (for example, proximity to city centers or transit) that influence housing costs. In our methodology, mapping the “years of income” metric across different neighborhoods or cities helps reveal geographic disparities that raw numbers alone might obscure. This is consistent with practices in urban planning research. GIS and spatial analysis can illuminate housing market dynamics, and numerous recent studies continue to endorse spatial techniques for housing assessments. For instance, Argiolas et al. [

26] used a spatial decision support system to map housing affordability in urban areas, allowing them to pinpoint where home prices vastly exceed local incomes.

Beyond academic research, industry practitioners also leverage GIS mapping to evaluate affordability. Mapping affordability ratios has proven insightful in practice; for example, a recent analysis merged home value and income data to produce a county-level affordability map of the United States [

27] This map vividly showed an affordability divide: coastal regions and certain pockets of the West and Southwest were “severely unaffordable” (high price-to-income ratios), whereas much of the Midwest and Deep South remained “affordable”, with lower ratios. Such spatial visualizations are powerful for highlighting regional inequities and trends in housing costs. By using GIS and spatial analysis in our study, we align with established methods that add a crucial geographic dimension to affordability assessment. This ensures that our findings consider not just how affordable housing is on average, but where affordability problems are most acute—a nuance that purely tabular analysis could miss. The reliance on GIS is thus methodologically justified by its prominence in prior affordability studies and its ability to enhance analysis with spatial rigor [

28].

2.7.3. Justification for Reassessing Affordability Metrics

While affordability has been studied in previous research, this study reassesses affordability metrics due to the recent economic disruptions that have altered housing market dynamics:

COVID-19 Pandemic: shifted demand patterns toward suburban and secondary markets.

Energy Crisis: increased utility costs, adding to total housing expenses.

Geopolitical Instability (Russia–Ukraine War): led to population shifts and rental price surges, particularly in Poland.

Given these transformations, pre-existing affordability assessments may no longer reflect current conditions, justifying the need for an updated cross-country analysis.

2.8. Data Analysis Methods

This study employs a multifaceted analytical approach combining descriptive statistical analysis, affordability index calculations, spatial mapping techniques, and exploratory econometric testing to investigate the relationship between wage growth and housing affordability across selected Central European cities. The methodology is structured to progressively move from basic trend analysis to preliminary causal investigation, thus offering both descriptive and explanatory insights into urban housing market dynamics.

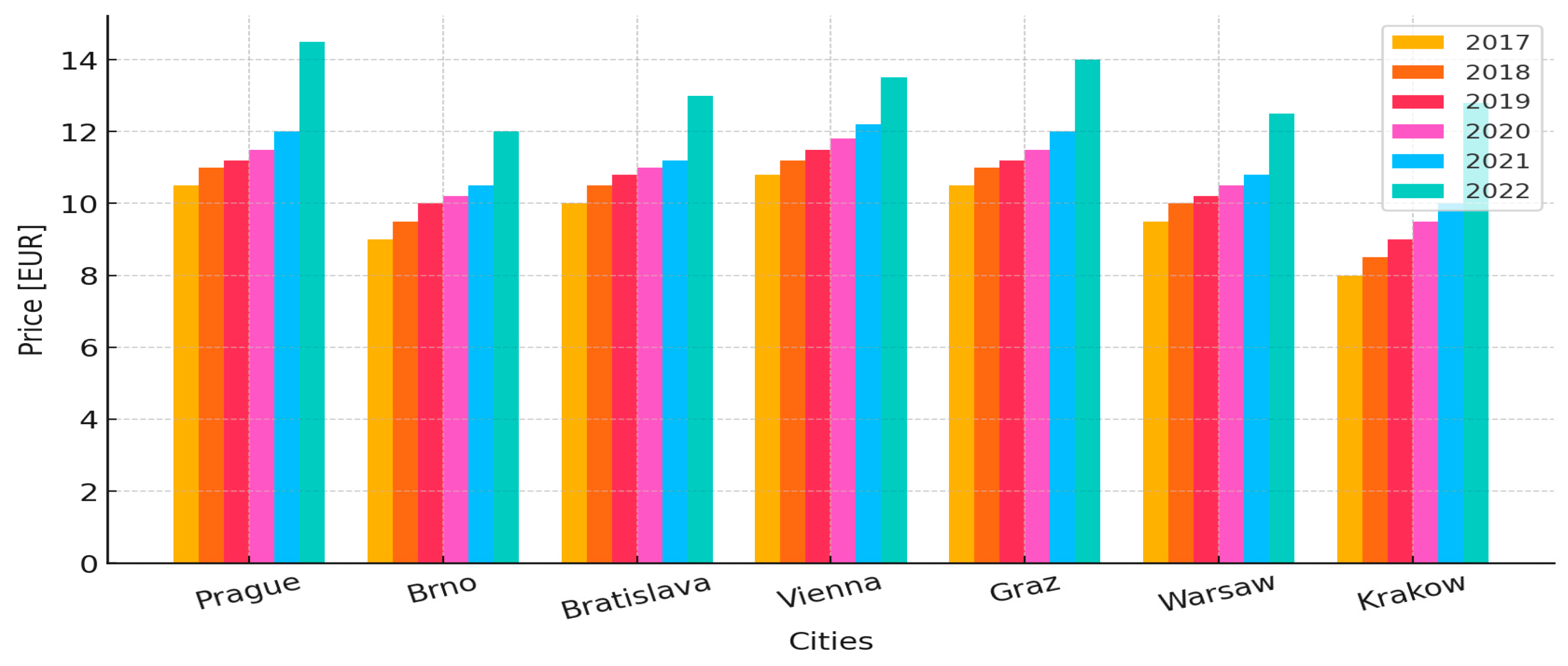

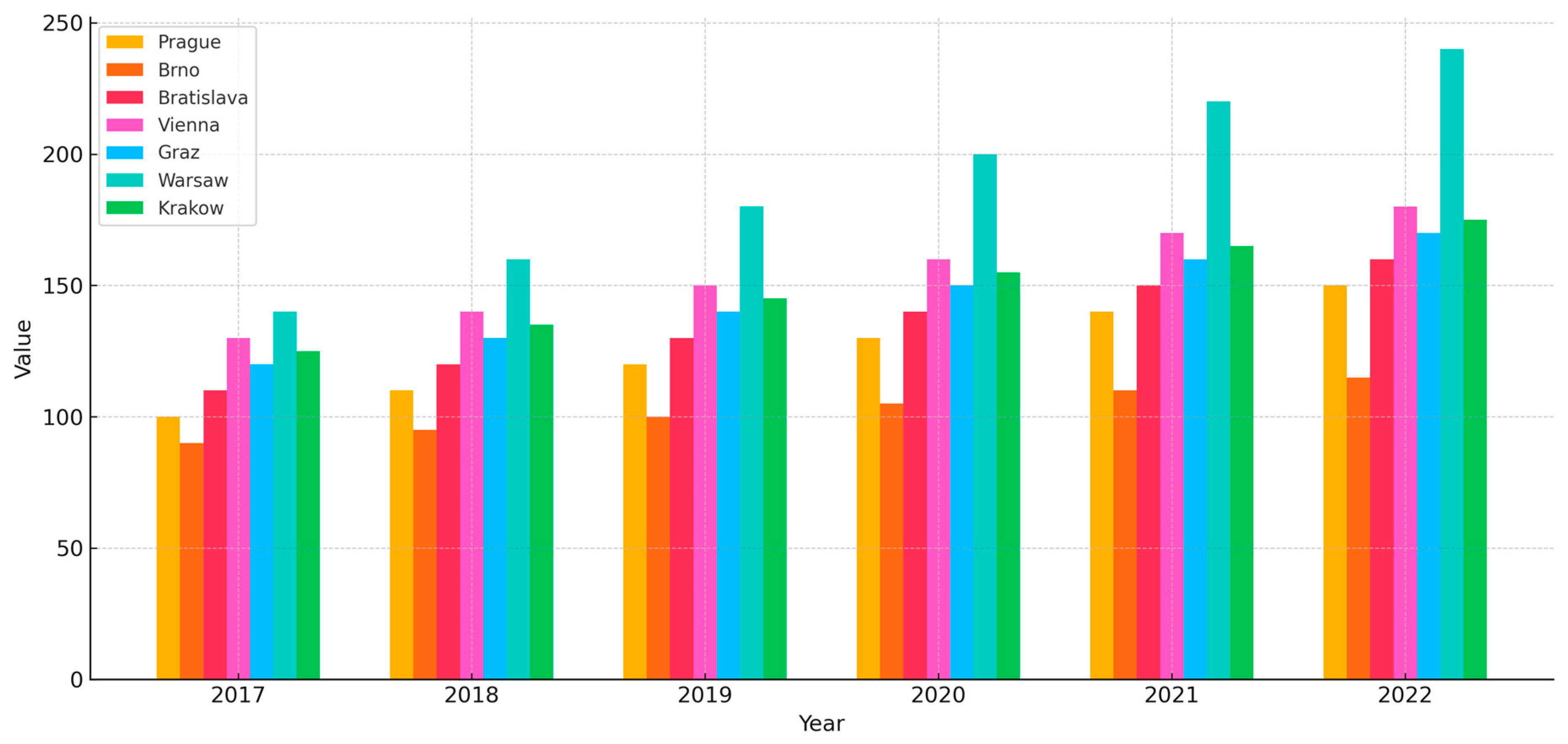

The analysis begins with descriptive statistical techniques to capture trends in wages, housing prices, and affordability ratios over the period 2017–2022. Key affordability indicators include the price-to-income ratio, defined as the number of gross annual salaries required to purchase a standard 70 m2 apartment, and the rent-to-income ratio, measuring the proportion of a monthly wage needed to rent a 50 m2 flat. In addition to these metrics, mean values, median affordability thresholds, and affordability gaps across the selected cities are calculated to assess regional disparities in housing accessibility.

To enhance the understanding of spatial patterns, Geographic Information System (GIS) tools are employed to map affordability levels across urban areas. The spatial analysis highlights regional differences and enables the identification of cities and neighborhoods facing the most severe affordability pressures.

Complementing the statistical and spatial analyses, a comparative evaluation of national housing policy frameworks is undertaken. The study systematically assesses the effectiveness of regulatory measures, supply-side interventions, and affordability support programs in the Czech Republic, Slovakia, Austria, and Poland. This policy evaluation contextualizes the observed empirical patterns within different institutional and governance environments, providing a richer interpretation of affordability outcomes.

Recognizing the importance of moving beyond descriptive findings, the study incorporates exploratory econometric testing to investigate potential causal relationships. A Pearson correlation matrix is constructed to explore the strength and direction of the association between wage growth and housing price growth at the city level. The results reveal a moderate negative correlation, suggesting that stronger wage growth does not uniformly translate into faster housing price inflation across the analyzed urban centers.

Later in the analysis, a lagged regression model is introduced to assess potential time-delayed relationships (see

Section 2.12, Equation (1)).

While this study introduces exploratory econometric testing, it acknowledges certain limitations. The ability to perform more sophisticated causal modeling was constrained by the relatively short timeframe of available data and the cross-country variations in data structure and quality. Future research could significantly enhance causal inference by utilizing panel data over longer periods and incorporating household-level income information, such as data from the European Union Statistics on Income and Living Conditions (EU-SILC). Such improvements would allow for a more rigorous exploration of the dynamic interactions between wage trends, housing policies, and affordability outcomes across diverse urban contexts.

2.9. Structures of Housing Provision

To provide a robust theoretical foundation, this study adopts the ‘Structures of Housing Provision’ (SHP) theory by Michael Ball and Michael Harloe. This framework categorizes housing markets based on their dominant provision structures—state-led, market-driven, or hybrid. By applying SHP theory, we contextualize the housing affordability disparities observed across Central Europe. Austria, with its strong social housing programs, aligns with a state-led model, mitigating affordability challenges. Conversely, the Czech Republic and Poland exhibit a market-driven approach, where affordability constraints are exacerbated by speculative investment and limited state intervention. Slovakia falls within a hybrid model, where both government regulation and private-market forces interact to shape affordability. This theoretical grounding enhances the comparative analysis, linking observed affordability trends to broader structural factors influencing housing markets in Central Europe.

2.10. Rationale for Cross-City Affordability Comparisons

Our methodology compares affordability metrics across different cities to illuminate spatial disparities. Cross-city (and cross-region) comparisons are a common approach in housing research to understand how affordability varies by location. Focusing only on national or aggregate figures can be misleading, since housing affordability often differs markedly between metropolitan areas within the same country. By examining multiple cities side by side, we can identify which local markets are affordable, providing insight into underlying factors like local income levels, housing supply, and policy environments. Indeed, widely cited surveys, such as the Demographia International Housing Affordability report [

29,

30], explicitly compare dozens of urban markets worldwide for this reason. These comparisons have revealed enormous variation—for example, some U.S. cities (like Pittsburgh) have median multiples near 3.1 (relatively affordable), while others (like San Francisco or Hong Kong) reach well above 10 (extremely unaffordable). Academic research also supports the cross-city approach: a global study of 200 cities by Kallergis et al. [

31] found that housing is significantly less affordable in certain cities than others and linked these differences to city-specific factors (e.g., population size, land use constraints, and economic productivity). Within individual countries, more economically dynamic or populous cities tend to exhibit higher price-to-income ratios, indicating that local market pressures strongly influence affordability. Therefore, comparing multiple cities is methodologically important for capturing these affordability disparities and for understanding how context—such as geography, economy, and local policies—affects the ability to afford housing. This cross-sectional perspective, backed by prior studies and reports, adds depth to our assessment of housing affordability.

2.11. Integrating Real Estate Platform Data with Official Statistics

Our data sources combine private-market real estate data with official statistical data, a strategy that strengthens the robustness of the analysis. This integration is supported by research highlighting that each data source offers complementary benefits. Private real estate platform data (such as online listing prices or market indices) provide up-to-date insights into current housing market conditions that may not yet be captured in slower, official datasets. Official statistics [

24] offer authoritative and comprehensive coverage, ensuring that analyses are grounded in reliable benchmarks. By merging these sources, we capitalize on the timeliness and detail of market data alongside the credibility and demographic context of institutional data.

Housing researchers and industry analysts increasingly advocate for such data integration. According to housing data experts, incorporating local or private-sector data adds “nuance, specificity, and timeliness” to traditional public data, yielding a more detailed understanding of housing needs and conditions. In practice, our methodology follows this best practice. For example, we use real estate platform data on home prices (e.g., from online listings or a property marketplace) combined with official income statistics (e.g., median household incomes from a national statistics office). This mirrors approaches in the literature: Argiolas et al. [

26] demonstrated the value of comparing free-market listing prices with official average incomes to evaluate affordability in Italy. Likewise, recent U.S. studies [

32] have merged Zillow’s Home Value Index (a private-sector dataset) with Census Bureau income data to map affordability ratios across regions. By integrating these datasets, one can directly calculate how many years of local income are needed for local housing prices, yielding a nuanced affordability map grounded in both market reality and socio-economic data. This blended data approach enhances methodological rigor by cross-verifying insights—any affordability patterns observed are supported by two independent data sources, reducing the risk of bias or blind spots inherent in using a single source. Overall, citing both academic analysis and industry practice, the use of combined private and official data is a justified methodological choice that improves the accuracy and credibility of our housing affordability assessment.

2.12. Exploratory Empirical Testing

To complement the descriptive statistical analysis, this study incorporates preliminary empirical testing to provide initial insights into the relationship between wage growth and housing price dynamics in Central European cities. While the primary objective remains comparative and descriptive, exploratory econometric techniques are employed to reveal underlying patterns consistent with the formulated hypotheses.

Correlation Analysis: A Pearson correlation matrix was constructed to assess the strength and direction of associations between average annual wage growth and housing price growth across the seven selected cities during the 2017–2022 period. This approach enables an initial evaluation of whether stronger wage growth correlates systematically with greater property price inflation at the city level.

Lagged Regression Model: To account for the possibility that housing prices may react to wage developments with a temporal delay, a basic lagged regression model was estimated, as specified in Equation (1):

In this specification, housing price growth in period t is modeled as a function of wage growth in the preceding period (t − 1). The model provides preliminary empirical insight into the hypothesized time-lagged relationship between labor market developments and housing market dynamics, in line with Hypothesis H2 outlined in the conceptual framework.

Due to the limited sample size and short time series, these results are interpreted cautiously and are not intended to establish definitive causal relationships. However, they serve to enrich the descriptive findings by providing early empirical validation of the proposed mechanisms linking labor market trends and housing affordability outcomes.

Future research, utilizing extended time series and broader city samples, could build upon this foundation to develop more robust econometric models and test the causal pathways in greater depth.

4. Discussion

This study highlights the intricate relationship between wages and housing costs in Central Europe, revealing pronounced affordability challenges in Czech and Polish cities. The findings of this study provide partial support for the proposed research hypotheses. Consistent with H1, cities exhibiting more constrained housing supply, such as Prague and Brno, demonstrate a stronger sensitivity of housing prices to wage growth, reflected in longer property saving periods relative to wage levels. In line with H2, preliminary evidence suggests a temporal lag between wage increases and housing price escalation, particularly in larger urban centers; however, more longitudinal data would be required to confirm this relationship robustly. Regarding H3, while labor migration following geopolitical disruptions (e.g., the Ukrainian refugee crisis) has notably increased housing demand in Polish cities like Warsaw and Kraków, its precise contribution relative to endogenous wage dynamics warrants further investigation. Overall, the results emphasize that housing affordability trends in Central Europe are shaped by a complex interaction of wage growth, supply constraints, and migration pressures, reinforcing the need for multidimensional policy responses.

4.1. Key Affordability Challenges

Czech Republic: The widening gap between income growth and property price inflation is most acute in Prague and Brno, where affordability metrics are among the most challenging in the region. This reflects the urgent necessity for strategic housing policies, such as increasing the housing supply, incentivizing affordable housing projects, and regulating speculative investments in the property market.

Poland: While property prices in Warsaw and Kraków are comparatively lower, stagnant wage growth has limited improvements in affordability. This highlights the need for broader economic policies aimed at wage increases and enhanced support for middle- and low-income households.

4.2. Influence of Geopolitical and Economic Factors

The rental market has proven particularly sensitive to geopolitical events, as evidenced by the price hikes following the Russian invasion of Ukraine in 2022. The influx of Ukrainian refugees into Central European cities significantly increased urban housing demand, driving up rental prices, particularly in Warsaw and Kraków. These cities experienced double-digit percentage increases in rental costs, compounding existing affordability pressures.

4.3. Policy Effectiveness Across Countries

The contrasting policy responses observed across cities reveal important lessons for designing resilient housing systems. Building on the broader affordability analysis, this study explicitly examines the role of specific housing policies and geopolitical events in shaping recent market dynamics. In Austria, Vienna’s long-standing social housing model has played a stabilizing role, helping to moderate rental price inflation even during periods of economic and political turbulence. In contrast, Poland’s response to affordability challenges—particularly through targeted rent support programs implemented following the influx of Ukrainian refugees—demonstrates a more reactive approach. These programs aimed to alleviate sudden rental market pressures in cities like Warsaw and Kraków, where demand surged rapidly. Furthermore, the analysis considers the broader impact of the Ukrainian refugee crisis, highlighting how large-scale migration flows intensified affordability pressures, especially in markets with already constrained housing supply. This targeted policy and geopolitical analysis underscores the importance of institutional capacity and proactive housing strategies in mitigating affordability risks during periods of external shock.

4.4. Specific Policies and Housing Market Interventions

4.4.1. Climate Policies

European Union climate policies, while essential for sustainability, have inadvertently contributed to higher living costs, including housing expenses. Measures aimed at reducing energy consumption have driven inflationary pressures, particularly in energy markets, which directly impact lower-income households. Policymakers face the challenge of balancing ambitious climate objectives with affordability considerations, ensuring that energy-efficient housing initiatives do not disproportionately burden vulnerable populations.

4.4.2. Austria as a Comparative Model

Vienna’s relative stability in property price dynamics provides valuable insights into effective housing policy. The city benefits from a robust combination of high wages, social housing initiatives, and regulated rental markets, which have mitigated the affordability crisis seen elsewhere in the region. Austrian cities demonstrate how well-designed government interventions can buffer the impact of market fluctuations, making housing more accessible without compromising long-term economic objectives.

4.4.3. Trends in Rental and Purchase Markets

The analysis reveals a steady increase in rental prices across Central Europe, with a particularly sharp rise observed in 2022. While Vienna’s high average wages cushion its housing market against affordability crises, cities like Prague and Brno face the dual challenge of escalating prices and slower wage growth. For property purchases, the Czech Republic continues to present the most significant affordability hurdles, with prospective buyers in Prague requiring over 10 years of income to purchase a 30 m2 flat.

4.4.4. Increase Housing Supply Through Regulatory and Financial Incentives

The shortage of affordable housing in urban centers is a primary driver of escalating prices. Governments and municipalities should implement policies that facilitate new housing developments by reducing bureaucratic barriers and offering financial incentives to developers who prioritize affordable housing projects.

Streamline Zoning and Building Permit Processes: Simplify and expedite zoning and permitting procedures to accelerate new residential construction, particularly in high-demand urban areas. The implementation of fast-track permitting programs in cities such as Vienna and Berlin have successfully increased housing supply.

Tax Incentives for Affordable Housing Developers: Introduce targeted tax benefits (e.g., reduced corporate tax rates, VAT exemptions) for developers who allocate a portion of their projects to affordable housing.

Public–Private Partnerships (PPPs): Encourage collaboration between the public sector and private developers to create affordable housing initiatives, similar to Vienna’s subsidized rental housing model, which ensures long-term affordability while leveraging private capital.

4.4.5. Regulate Speculative Investments to Stabilize Prices

Speculative real estate investments contribute to housing price inflation by reducing the availability of properties for primary residents. Effective policy tools can curb speculative buying and ensure that housing remains accessible to local populations.

Higher Taxes on Short-Term Speculative Purchases: Implement increased property transaction taxes on homes resold within a short timeframe (e.g., within two years), as seen in Germany and Canada.

Restrictions on Foreign Ownership in High-Demand Cities: Limit non-resident property purchases in cities experiencing affordability crises, as done in New Zealand and certain Canadian provinces.

Vacancy Taxes: Introduce taxes on long-term vacant residential units to discourage hoarding of housing assets for speculative purposes. The successful implementation of vacancy taxes in cities like Vancouver and Paris has led to a higher rate of available housing stock.

4.4.6. Strengthen Wage Growth and Economic Support for Housing Affordability

Stagnant wage growth relative to housing price increases exacerbates affordability challenges. Economic policies that promote income growth and financial assistance for housing can help bridge this gap.

Increase Minimum Wages in High-Cost Urban Areas: Implement region-specific wage policies that reflect local living costs, ensuring that incomes keep pace with housing expenses.

Expand Housing Allowance Programs: Governments should introduce or enhance housing subsidies for low- and middle-income households, like Austria’s rent assistance programs.

Employer-Assisted Housing Programs: Encourage large employers to provide housing assistance to workers in expensive metropolitan areas, a strategy used in cities like San Francisco to retain essential workforce populations.

4.5. Improve Market Transparency and Consumer Protections

A lack of transparency in the real estate market can contribute to price manipulation and unfair practices. Strengthening oversight mechanisms and increasing data availability can enhance affordability and market fairness.

Mandatory Price Disclosure on Real Estate Transactions: Require public disclosure of historical property sale prices to improve market transparency and prevent speculative price inflation.

Stronger Tenant Protections and Rent Stabilization Measures: Introduce policies that limit excessive rent increases and improve tenant rights, following successful models in Sweden and Germany.

Standardized Affordability Metrics for Policymakers: Develop national affordability benchmarks that guide urban planning and housing policy decisions, like those used by the OECD.

4.6. Integrated Sustainability and Housing Affordability

The rising costs of energy and environmental regulations must be balanced with housing affordability objectives. Sustainable housing policies should ensure that eco-friendly measures do not disproportionately burden lower-income households.

Subsidies for Energy-Efficient Retrofitting: Provide financial incentives for landlords and homeowners to upgrade insulation and heating systems, reducing long-term energy costs without increasing rental prices.

Incentives for Green Affordable Housing: Offer tax credits or lower-interest loans for developers building energy-efficient, affordable housing, similar to programs in the Netherlands.

Regulated Pass-Through Costs for Energy Upgrades: Ensure that landlords cannot excessively transfer sustainability upgrade costs to tenants, protecting low-income renters from sudden rental price spikes.

4.7. Synthesis of Comparative Lessons

This study yields several novel insights that extend beyond merely compiling statistical data. One of the key findings is the variation in affordability trends among Central European cities, which highlights significant disparities in how different markets respond to economic shocks. For example, while Prague exhibits one of the highest property price-to-income ratios in the region, Vienna remains comparatively more affordable due to higher wages and the prevalence of social housing policies. This contrast underscores the crucial role of government intervention in mitigating affordability challenges.

Another major insight is how recent crises have unevenly affected housing affordability across countries. The post-pandemic economic rebound has led to increased property demand in some cities, particularly Warsaw and Kraków, where housing costs surged due to an influx of Ukrainian refugees. This geopolitical factor is rarely captured in standard affordability indices but plays a critical role in local market dynamics. In contrast, Austria’s housing market has remained relatively stable, demonstrating the buffering effect of strong social housing policies and government intervention.

Furthermore, our analysis reveals the growing disconnect between wage growth and property prices, particularly in cities like Prague and Brno. While wages have risen modestly over the past five years, property prices have escalated at a much faster rate, exacerbating affordability issues. This finding aligns with global trends but is particularly pronounced in Central Europe, where rapid economic growth has fueled speculative real estate investments.

The study also sheds light on the impact of energy price fluctuations on housing affordability. Rising energy costs have placed additional financial strain on households, increasing the overall cost of homeownership and rentals. While this factor is typically considered in macroeconomic analyses, its direct impact on affordability at the city level has been underexplored in prior studies. Our findings indicate that higher energy costs have disproportionately affected lower-income households, leading to increased demand for rental properties in more affordable suburban areas.

By integrating multiple crisis impacts and analyzing affordability from a city-level perspective, this research provides a more comprehensive understanding of housing market dynamics in Central Europe. These insights not only contribute to the academic discourse but also offer practical implications for policymakers seeking to address housing affordability challenges in an era of economic volatility.

In summary, the discussion highlights that housing affordability challenges in Central European cities are driven by a complex interplay of wage trends, supply constraints, migration pressures, and policy responses. Comparative analysis underscores that integrated, proactive housing policies are more effective in mitigating affordability risks than reactive, market-based approaches alone. Addressing these challenges requires balancing economic growth, social equity, and environmental sustainability. The following section draws together the key findings of this study and outlines policy recommendations and future research directions.

5. Conclusions, Policy Implications, and Future Research

The Central European real estate market faces complex affordability challenges, exacerbated by economic stagnation, policy gaps, and market imbalances. The findings of this study emphasize the necessity of evidence-based housing policies that integrate economic, social, and environmental considerations to foster long-term market stability.

Ensuring housing affordability amid economic uncertainty remains a critical policy challenge. However, with targeted and well-structured interventions, governments can establish a more equitable and sustainable housing market, safeguarding access to housing as a fundamental socio-economic right. This study serves as a foundation for ongoing discussions on the intersection of wages, housing policies, and market stability, contributing to a more nuanced understanding of affordability dynamics in Central Europe.

Recognizing the limitations of this study is essential for accurately interpreting the findings and ensuring the robustness of policy recommendations. Several key constraints should be considered: This analysis was based on data collected over a four-month period (December 2022–March 2023). While this provides valuable insights into recent affordability trends, it does not capture long-term market cycles, seasonal fluctuations, or potential post-pandemic corrections. The study examines selected urban centers, omitting insights from rural and secondary cities, where affordability dynamics may differ significantly. Expanding the geographic scope would offer a more comprehensive understanding of regional disparities. The reliance on listed property prices rather than final sale transaction prices may introduce discrepancies in affordability estimates. Actual affordability could vary based on negotiation trends, transaction costs, and financing terms. Finally, the study does not account for key macroeconomic factors such as interest rate fluctuations, currency exchange rates, and labor market shifts, all of which significantly impact affordability over time.

Despite these limitations, the comparative analysis remains valuable in identifying regional disparities and highlighting key policy intervention points. Future research should address these constraints and expand the study’s scope to enhance the depth and applicability of the findings.

5.1. Key Findings and Policy Implications

This study examined the relationship between wage growth, migration trends, and housing market dynamics across selected Central European cities. The findings provide partial support for the proposed hypotheses. Consistent with Hypothesis H1, evidence suggests that cities characterized by constrained housing supply—such as Prague and Brno—exhibit a greater sensitivity of housing prices to wage growth. However, preliminary correlation and lagged regression analyses indicate that wage growth alone does not fully account for housing price inflation, highlighting the critical moderating roles of supply-side bottlenecks, migration-induced demand pressures, and regulatory constraints, as outlined in Hypotheses H2 and H3.

These insights carry important policy implications. Housing affordability challenges in Central Europe are driven by a combination of rapid property price increases, insufficient wage adjustments, and geopolitical uncertainties. Addressing these challenges requires a comprehensive, multi-pronged policy framework that simultaneously tackles supply constraints, manages demand-side pressures, and strengthens affordability support mechanisms.

The findings highlight several targeted policy recommendations:

Enhancing Income Growth Strategies: Policymakers should promote wage growth initiatives aligned with rising property costs. Potential measures include labor market incentives, regional wage adjustments, and targeted tax relief programs to support income mobility, particularly in economically dynamic urban centers.

Expanding Housing Supply: Increasing the availability of affordable and mid-range housing is essential. This goal can be supported through streamlined zoning regulations, accelerated permitting processes, financial incentives for private developers, and strengthened investments in public and social housing programs.

Balancing Energy and Climate Policies with Affordability: Housing sector decarbonization initiatives must be carefully aligned with affordability objectives. Policymakers should ensure that energy-efficiency standards, retrofitting programs, and climate-related construction regulations are paired with financial incentives, subsidies, or exemptions to prevent disproportionate burdens on lower- and middle-income households.

Finally, the study underscores that housing affordability in Central Europe is shaped by complex, multi-causal dynamics, not merely by wage growth patterns. Policymakers must adopt an integrated approach that coordinates supply-side interventions, demand regulation, and affordability support to foster more stable, inclusive, and resilient urban housing markets across the region.

5.2. The Broader Policy Context

The impact of recent geopolitical and economic disruptions—such as the COVID-19 pandemic and the Russian invasion of Ukraine—has further intensified urban housing demand pressures. Rising living costs and supply chain disruptions have strained affordability, underscoring the need for resilient and adaptable housing policies that can withstand external shocks.

Furthermore, the study highlights the importance of cross-border cooperation within the European Union to harmonize housing strategies and stabilize regional disparities. Successful models, such as Austria’s social housing framework, illustrate that government intervention can be instrumental in ensuring equitable access to housing.

5.3. Future Research Directions

This study contributes to the broader discourse on housing affordability by integrating economic, demographic, and policy dimensions. However, the complexity of the housing affordability crisis in Central Europe suggests several promising avenues for future research that could deepen scholarly understanding and better inform evidence-based policymaking.

First, future research should focus on assessing the impact of specific policy measures. Detailed evaluations of interventions such as rent control mechanisms, tax incentives for affordable housing development, and regional wage support programs could yield concrete recommendations for mitigating affordability pressures in diverse urban contexts.

Second, investigating sustainable urban planning strategies remains crucial. Research should explore how urban development approaches that balance housing demand, transportation accessibility, and environmental sustainability can foster more equitable and resilient urban spaces.

Third, exploring cross-border housing cooperation could offer valuable insights. Evaluating how EU-level initiatives and funding mechanisms—such as the European Regional Development Fund—might address housing affordability disparities across member states would contribute to understanding the potential for supranational solutions to local challenges.

In addition to policy-focused research, there is a need to expand theoretical applications in housing market analyses. The “Structures of Housing Provision” (SHP) framework offers a valuable lens for examining how different institutional arrangements shape affordability trends over time. Longitudinal studies could assess how shifts in housing provision models—such as increased state intervention, privatization, or deregulation—impact affordability outcomes in Central Europe.

Moreover, advancing methodological approaches is essential. Future analyses should utilize panel data covering longer timeframes to better capture dynamic interactions between wage growth, migration flows, regulatory changes, and housing price evolution. Year-over-year data across multiple cities would enable more robust causal inference and time-lagged modeling.

To further enhance affordability measurements, researchers should integrate household-level data sources, such as the European Union Statistics on Income and Living Conditions (EU-SILC) dataset. Incorporating household income metrics would provide a more accurate and nuanced understanding of housing accessibility, particularly in regions with high rates of multi-earner households.

Geographically, future studies should also expand the scope beyond major capitals to include smaller urban centers and rural areas. A broader comparative analysis across Western and Eastern Europe could reveal structural differences stemming from diverse historical development paths, regulatory environments, and labor market dynamics.

Finally, emerging areas such as the role of digitalization in real estate transparency, the impact of demographic shifts on housing demand, and the effectiveness of sustainability-driven housing policies deserve further exploration, particularly regarding their capacity to mitigate or exacerbate affordability challenges.

Advancing research along these lines would not only enrich the academic discourse on housing markets but also provide critical guidance for policymakers seeking to ensure housing accessibility, economic resilience, and social inclusion across a rapidly changing European landscape.

5.4. Limitations and Considerations

Despite the robustness of this study, certain limitations should be acknowledged. First, the analysis is constrained by the timeframe of data collection (December 2022–March 2023), which may not fully capture long-term affordability trends or future market corrections. Additionally, the study focuses on selected urban centers (Prague, Brno, Bratislava, Vienna, Graz, Warsaw, and Kraków), meaning that affordability challenges in smaller cities or rural areas remain unexplored.

Another limitation is the data sources used for affordability calculations. While the study integrates real estate platform data with official statistics, disparities between listing prices and actual transaction prices could introduce some bias in affordability metrics. Furthermore, external factors such as government policy changes, macroeconomic shifts, or demographic trends may influence affordability over time, necessitating further longitudinal research.

These policy recommendations provide concrete and actionable steps to address the housing affordability crisis in Central Europe. By increasing supply, regulating speculation, supporting wage growth, integrating sustainability with affordability, and improving market transparency, policymakers can create a more stable and accessible housing market. The successful implementation of these measures will require coordinated efforts among national governments, local municipalities, and private stakeholders to ensure equitable and sustainable housing solutions for the region.

Future research should expand the geographic scope beyond major urban centers to provide a more comprehensive understanding of regional affordability disparities. Additionally, longitudinal studies examining housing market trends over an extended period could offer deeper insights into the long-term impacts of affordability policies. Lastly, further exploration of alternative housing models, such as cooperative housing or rent-to-own schemes, could present viable solutions for mitigating affordability pressures.

5.5. Final Reflections

The Central European real estate market faces complex affordability challenges, exacerbated by economic stagnation, policy gaps, and market imbalances. The findings of this study reinforce the need for evidence-based housing policies that integrate economic, social, and environmental considerations to foster long-term stability.

Ensuring housing affordability in the face of economic uncertainty remains a critical policy challenge. However, with targeted, evidence-based interventions, governments can establish a more equitable and sustainable housing market, safeguarding access to housing as a fundamental socio-economic right.

This study provides a foundation for continued discussions on the intersection of wages, housing policies, and market stability. Through coordinated policy efforts and innovative housing strategies, a more inclusive, resilient, and sustainable housing market can be achieved in Central Europe. Only through coordinated research and policy action can housing affordability be sustainably addressed in the face of ongoing global challenges.