1. Introduction

Cost segregation is a tax savings tool utilized by companies and individuals involved in real estate construction, purchase, expansion, or remodeling [

1,

2]. Its objective is to identify and assess the value of tangible personal property, other tangible property, and land improvements, while assigning the remaining costs to real property classifications [

3]. It enables the acceleration of depreciation deductions by classifying various building components and property as becoming depreciated over shorter periods, such as 5, 7, or 15 years, as opposed to the standard 27.5 or 39 years [

4,

5]. This approach offers several advantages over straight-line depreciation, including (i) an immediate increase in cash flow through accelerated depreciation deductions; (ii) an opportunity to claim ’catch up’ depreciation on previously misclassified assets; (iii) provision of an independent third-party analysis that withstands IRS review [

5,

6,

7].

For instance, a

$10 million office building subject to straight-line depreciation would result in approximately

$256,400 in annual depreciation. However, using accelerated depreciation through cost segregation, the deduction in the first year of ownership would be around

$382,900, representing a nearly 50% increase in cash flow for the building owner [

5,

6,

7]. The timing for conducting a cost segregation study can vary based on individual client circumstances [

8]. For investors engaged in planning construction or remodeling, the ideal time for considering a cost segregation study is before the building’s infrastructure is established [

5,

6]. Pre-construction consulting allows accurate tracking of items eligible for accelerated depreciation, resulting in time and cost savings [

3].

New owners benefit from conducting a study during the year of construction, purchase, or remodeling, enabling immediate tax optimization and accurate asset classification from the building’s inception [

8]. The advent of modern tools and processes in the field of construction and management of buildings and real estate properties is revolutionizing the industry. Performing a cost segregation study requires a comprehensive understanding of IRS guidelines and case law and expertise in engineering, construction, and tax matters [

6]. Compliance with the IRS Audit Techniques Guide and familiarity with prior court cases and rulings pertaining to individual assets are also crucial [

4]. Therefore, it is recommended that cost segregation studies be conducted by cost engineering professionals who possess knowledge of construction methods.

Cost segregation reports are offered at a fee, which varies depending on the type and size of the building [

6]. The researchers conducted a case study and determined that the value of cost segregation services is generally estimated to be

$10,000 or higher, offering a prompt return on investment [

5]. Additionally, offering the cost segregation report as the added value during bid proposals could be a modest investment in business development, especially for securing multimillion-dollar projects. While it is feasible for General Contractors (GCs) to provide cost segregation reports, the challenge lies in educating project owners about this service [

6]. The potential benefits for owners significantly outweigh the costs for GCs, making the provision of cost segregation services an appealing proposition for both parties involved in the construction project.

However, few GCs are currently capitalizing on the opportunity to provide cost segregation studies. Engineers collaborate with the project owner’s accountant to develop the cost segregation report, which involves breaking down project components and their costs into depreciable lives (5, 7, 10, 15, 31.5 or 39 years). The accountant then makes decisions regarding tax filing based on the information provided [

6]. Typically, the engineering report of a cost segregation study is put together after the building has been handed over to the owner. This report is based on an analysis of available building plans, contract documents, and a physical inspection of the property. One significant advancement in this regard is the integration of BIM technology, due to its numerous benefits and resource savings during the design, planning, and construction phases of new buildings [

9,

10]. The integration of BIM technology allows for data sharing on a common platform among various stakeholders, making construction project management more convenient and effective [

11,

12]. These advancements in the use of technology will improve and optimize the way in which cost segregation is carried out.

The feasibility of GCs offering cost segregation studies depends on the specific project, as each project has unique characteristics. GCs who are averse to risk can partner with cost segregation professionals, whereby the GC provides project data and clientele, while the cost segregation professional prepares the report. This approach may reduce the potential profit for the GC but also shifts the associated risk away from them. It can be particularly advantageous for contractors focusing on smaller projects [

6]. Additionally, cost segregation studies offer GCs an avenue for additional revenue generation and competitive differentiation. By partnering with cost segregation professionals or training internal employees, GCs can provide this valuable service to project owners. The feasibility and implementation approach may vary depending on the specific project and the risk appetite of the GC. Nonetheless, seizing the opportunity to offer cost segregation studies can be a strategic move for GCs in the construction industry [

6,

13].

The utilization of cost segregation services in the construction industry is currently limited, resulting in missed opportunities for property owners to maximize their tax benefits. This limitation stems from a lack of comprehensive understanding of IRS guidelines, insufficient expertise in cost segregation practices, and the absence of automated workflows that leverage technologies [

13]. Manual cost segregation processes are characterized by extensive time requirements and high costs [

13]. Additionally, there is a lack of widespread collaboration between engineers and accountants in the development of cost segregation reports, and GCs encounter challenges when attempting to offer these services and to educate their clients [

14].

To address these limitations, this research aims to propose an automated BIM-enabled workflow for conducting cost segregation studies within the construction industry. This automated approach will be particularly advantageous for property owners and GCs who already employ BIM methodologies in their projects. This automated approach will be particularly beneficial for property owners and GCs who utilize BIM in their projects or aim to use BIM in the future. The study will also highlight the benefits of performing cost segregation studies, which include the potential for additional tax deductions and increased cash flow for owners. By providing insights into the optimization of tax benefits and financial planning through the application of cost segregation analysis, this research seeks to foster the effective implementation of cost segregation studies across the construction and real estate industry.

3. Methodology

The research methodology employed in this study adopts a systematic case study approach to perform cost segregation by harnessing the capabilities of BIM. The selection of the case study method in this research was based on its capacity to offer comprehensive and in-depth insights into the specific context and intricacies of cost segregation practices. Alternative methods, such as qualitative or quantitative surveys, were deemed unsuitable as they would have limited the ability to thoroughly explore and analyze real-world scenarios related to cost segregation. By employing the case study approach, this research was able to provide a thorough examination of the complexities and dynamics associated with cost segregation.

Initially, a detailed BIM model is developed, with a focus on enhancing the level of detail to facilitate accurate cost estimation and subsequent cost segregation analysis. The cost segregation process is conducted based on the MACRS Property Class and Unit of Property as defined by the IRS. Building elements are categorized according to the MARCS system, and the cost segregation procedure is automated within Autodesk Revit, taking advantage of the information-rich model.

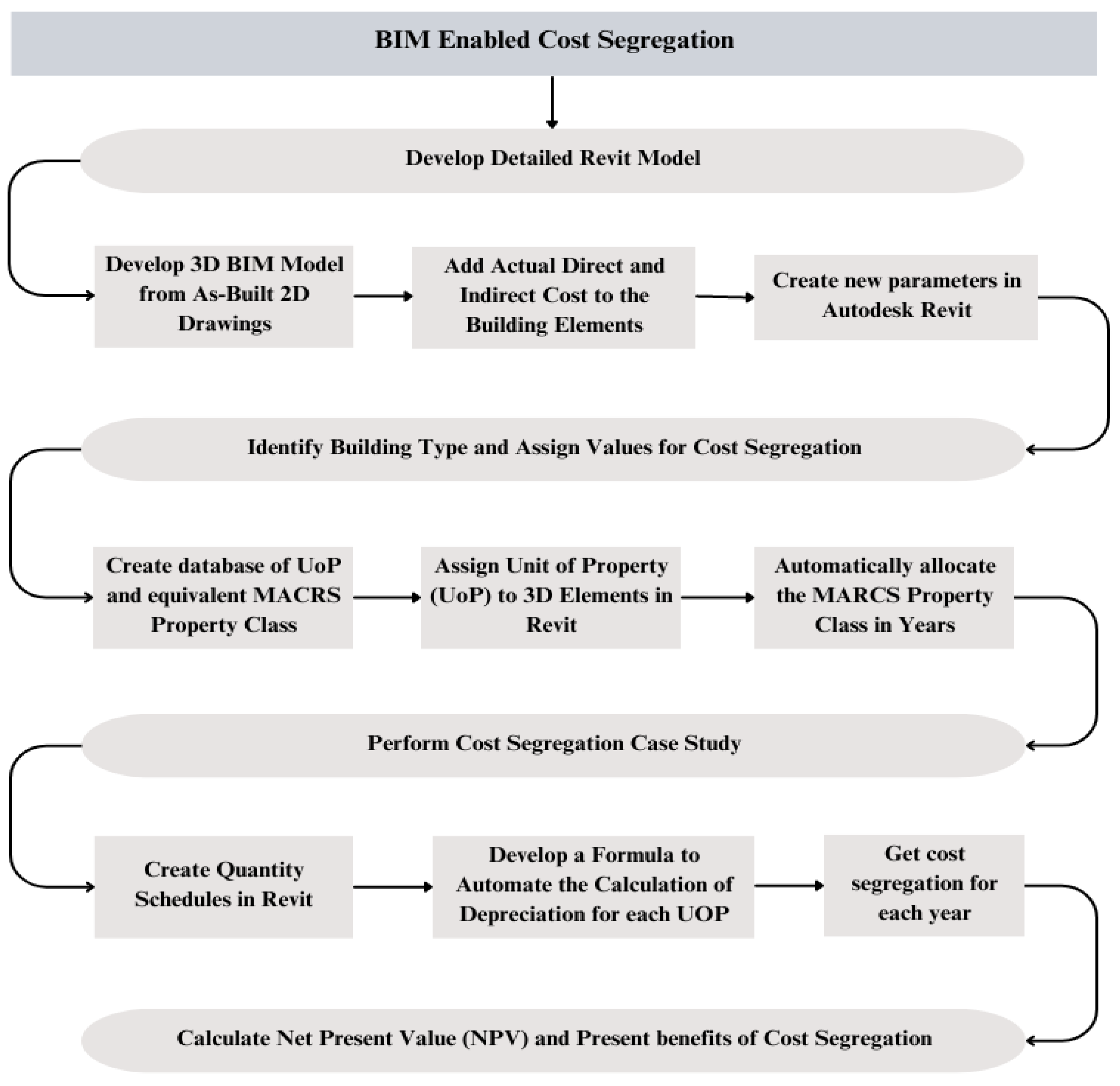

Figure 1 provides a summary of the research methodology employed in this study. Subsequent sections will provide a comprehensive explanation of each phase and its corresponding steps, offering an in-depth understanding of the research process.

3.1. BIM Model Development Workflow

The initial phase of the research methodology involves the utilization of Autodesk Revit software, 2023 version, a widely recognized industry tool [

35], to develop a detailed BIM model. This model serves as a comprehensive representation of the building, capturing all relevant elements and components. To ensure precise visualization and depiction of the building’s physical attributes, the model is developed based on the as-built 2D drawings, facilitating the creation of an accurate 3D BIM model. Furthermore, actual direct and indirect costs are assigned to the elements within the BIM model, thereby enhancing the level of detail and enabling accurate cost estimation.

The assignment of actual costs to the building elements within the BIM model holds paramount importance in the research methodology, driven by the necessity to conduct a comprehensive cost segregation study and ensure the validity of tax deductions based on the actual expenses incurred. This practice aligns with the requirement that tax deductions can only be claimed based on real expenses. By associating actual costs with the model’s elements, the research methodology establishes a robust and reliable foundation for performing the cost segregation study. This integration of actual cost data allows for a more precise assessment of depreciation and facilitates the identification of eligible tax deductions. The development of the BIM model plays a critical role in capturing the necessary information for conducting the cost segregation analysis. By leveraging the capabilities of the BIM model and incorporating actual cost data, this research methodology aims to establish a solid framework for conducting the cost segregation analysis on commercial buildings. Building upon the established BIM model, the next step is to identify the specific building type and assign appropriate values of Unit of Property (UoP) and MACRS Property Class for cost segregation.

3.2. Workflow for Cost Segregation Study

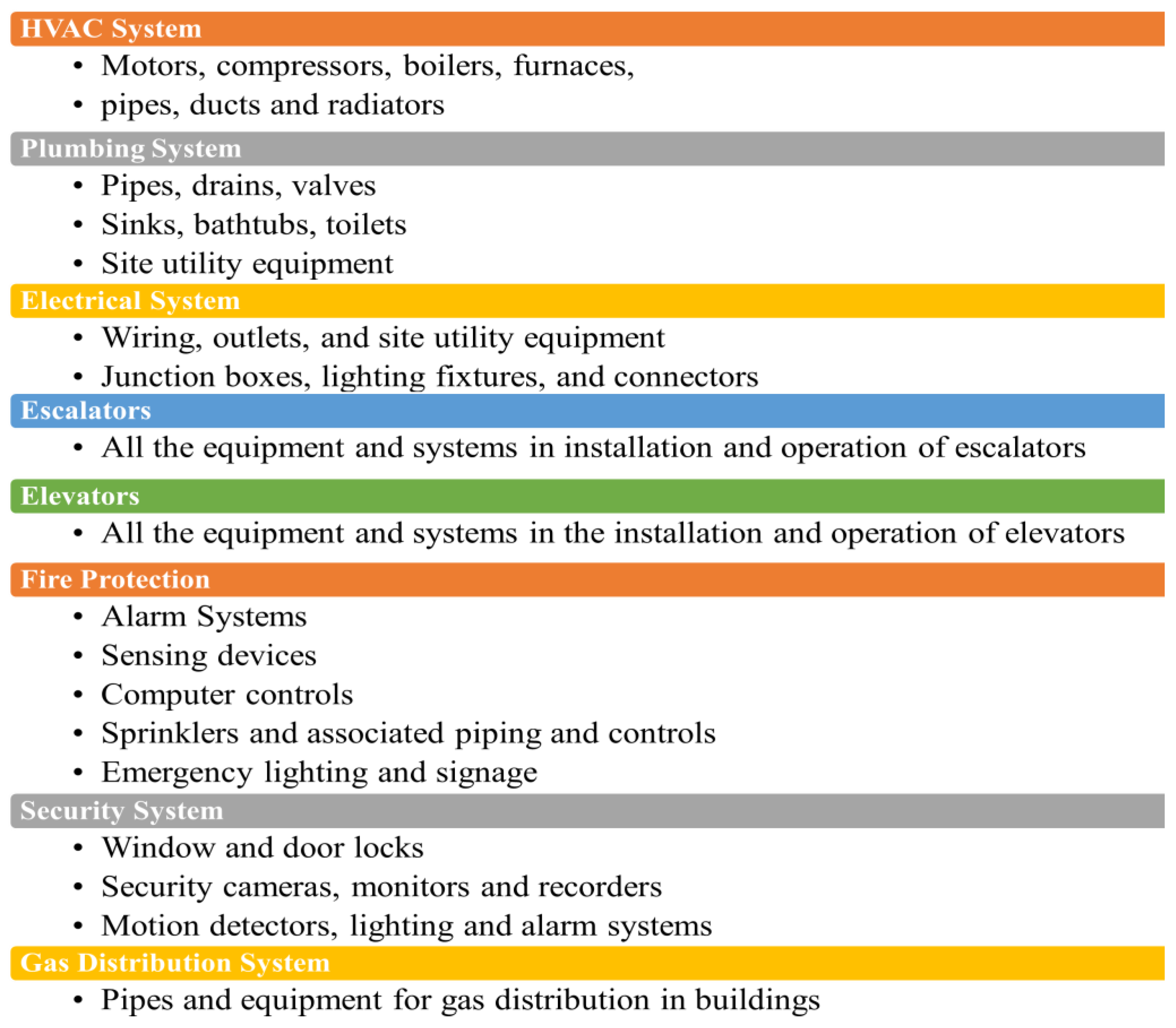

To conduct an effective cost segregation analysis, accurate identification of the property’s type and function is crucial. The case study in this paper focuses on commercial construction, encompassing various categories such as restaurants, banks, hospitals, schools, office buildings, department stores, and others. Each property type possesses distinct characteristics that influence the classification and allocation of depreciable components. Thus, determining the precise type and function of the property is essential in assigning the appropriate UoP and property class to facilitate the analysis process. The Internal Revenue Service (IRS) provides definitions for building costs, distinguishing between the cost of the overall building structure and each individually defined building system. The entire building, along with its structural components, constitutes a single property class. Additionally, eight specific building systems are considered separate UoPs having varying property classes. Any improvements made to these systems must be depreciated accordingly. The specific building systems are shown in

Figure 2.

Notably, the naming of depreciable property is primarily determined by the provisions of Sections 1245 and 1250. Section 1245 property refers to depreciable property that is either (1) personal property (tangible and intangible) or (2) other tangible property (excluding buildings and their structural components) used as an integral part of manufacturing, production, extraction, or the provision of transportation, communications, electrical energy, gas, water, or sewage disposal services. MACRS is used for the most tangible depreciable property placed in service after 31 December 1986. Under MACRS, the eligible property’s cost is recovered over a specified period of 3, 5, 7, 10, 15, 20, 27.5, 31.5, or 39.0 years. The classes of depreciable property are defined in accordance with Internal Revenue Code Sections 1245 and 1250, as well as the Asset Depreciation Range (ADR) class life as of 1 January 1986.

3.3. Cost Segregation Workflow in Autodesk Revit

The building type used to perform cost segregation comes under the category of office buildings. To facilitate this process, a comprehensive database is developed, comprising the UoP and its corresponding MACRS Property Class under the standardized data tool for Revit. Through this tool, UoP and its equivalent property are assigned to building components in Revit. The database used is presented in

Table 1. These classifications play a pivotal role in accurately allocating the MARCS Property Class to the relevant building elements while considering the associated depreciation timeline.

To perform cost segregation on the BIM model in Revit, the research methodology involves the generation of quantity schedules by incorporating parameters from the database shown in

Table 1. The parameters of property class and unit of property as per MARCS classification are assigned to building elements. This process provides a comprehensive overview of the quantities associated with each building element. Additionally, a formula is devised to automate the calculation of depreciation for each UoP, enabling the determination of cost segregation for each year. Furthermore, the research methodology encompasses the calculation of the Net Present Value (NPV), which facilitates an assessment of the present benefits derived from cost segregation. These systematic steps aim to rigorously evaluate the feasibility and advantages of implementing BIM-enabled cost segregation within the context of construction projects. To validate the research methodology, a case study of a commercial bank building project is conducted in the subsequent section.

4. Case Study

Case studies serve as a valuable research methodology for validating the idea of BIM-enabled cost segregation, primarily due to their capacity to offer comprehensive and detailed insights within a specific context [

36]. It has been recognized that case studies are the predominant method of data collection in various research domains [

37]. By selecting a particular construction project as the case study, researchers are able to thoroughly examine and explore the feasibility and benefits associated with implementing BIM-enabled cost segregation in practical applications. This approach facilitates a deep understanding of the intricacies and complexities involved in utilizing BIM for cost segregation, considering factors such as the unique characteristics of the building, the specific types of properties involved, and the corresponding depreciation classes. Through a meticulous analysis of these factors within the chosen case study, researchers can generate empirical evidence that supports and refines the underlying theory of BIM-enabled cost segregation. Ultimately, this contextualized examination enhances comprehension of the advantages, challenges, and practical implications of employing BIM in cost segregation processes within the construction industry. This research study demonstrates the applicability of the proposed cost segregation process by employing a new construction project as a case study. The site plan of the building is shown in

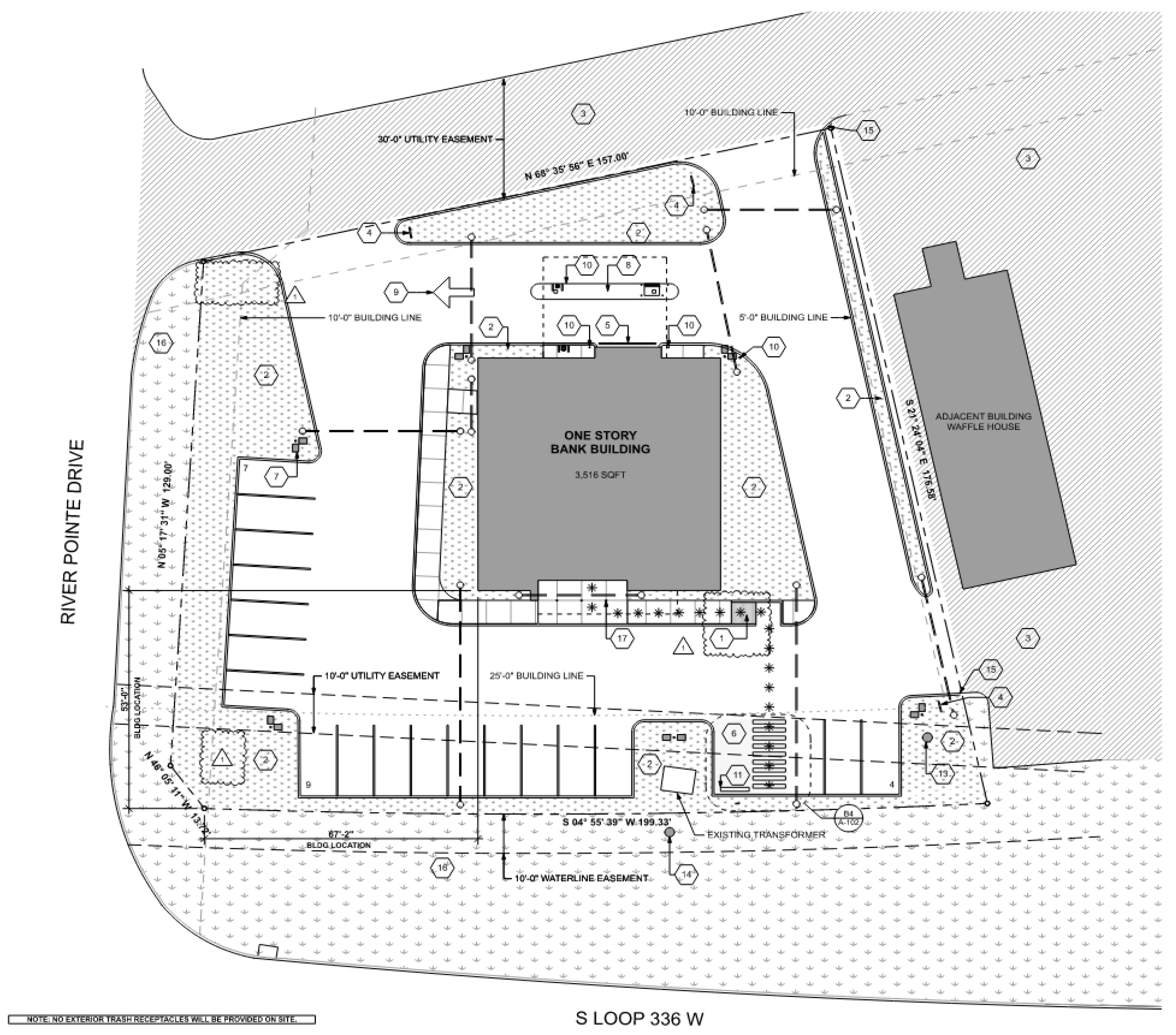

Figure 3.

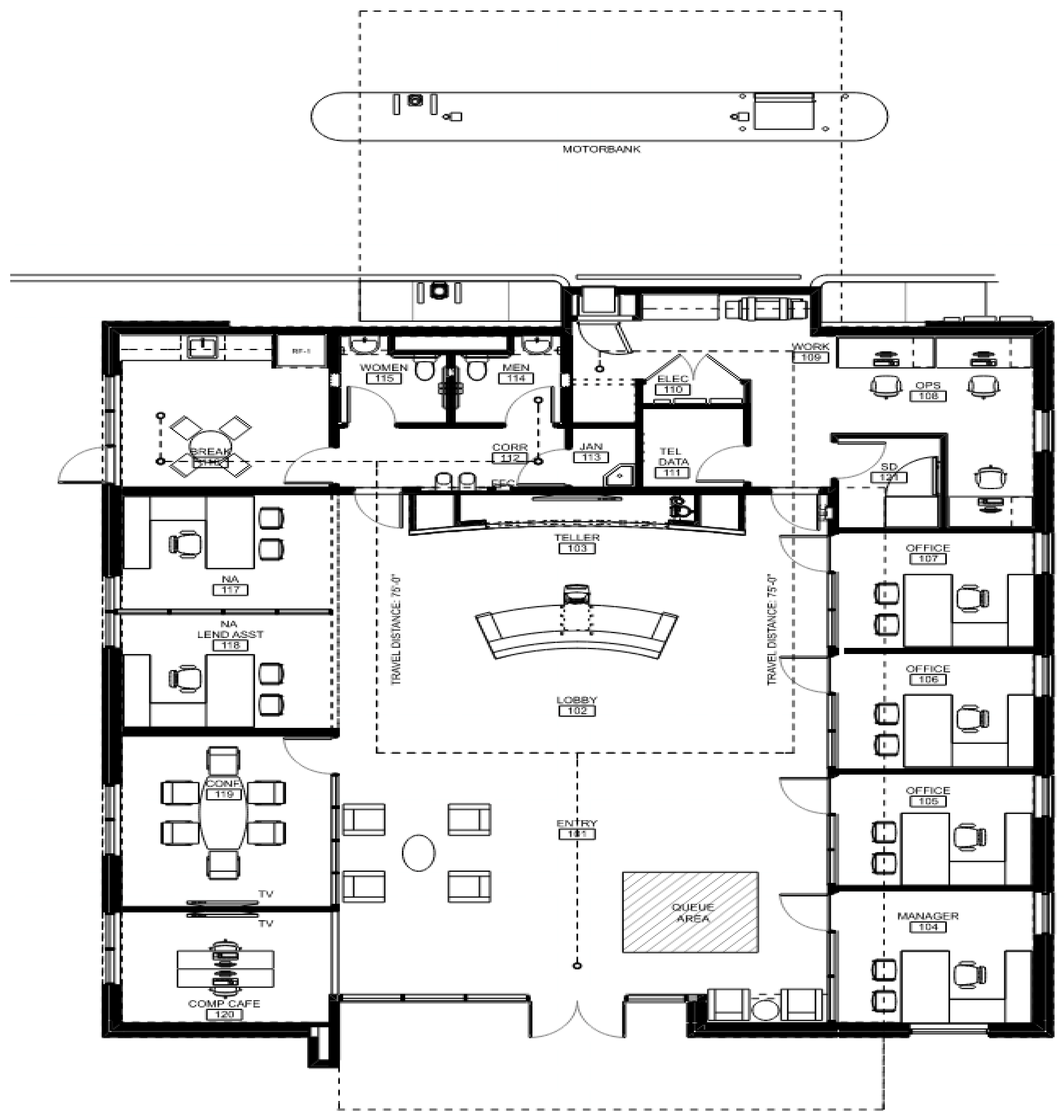

This project entails the construction of a single-story bank branch, encompassing a substantial floor area spanning 3516 square feet. The architectural design of the bank building incorporates various functional spaces, including offices, conference rooms, a welcoming area lobby, and a dedicated break room. The spatial layout of the building, illustrating the distribution and arrangement of these internal spaces, is shown in

Figure 4.

The bank property falls under a 39-year depreciation schedule, although certain specific items qualify for accelerated depreciation periods of 5, 7, and 15 years. The BIM model of the bank was developed using the as-built drawings in Revit as shown in

Figure 5. Subsequently, the property units within the model are identified and defined based on their functional use, physical characteristics, and other relevant criteria. During the model development phase, information from contract documents such as drawings, specifications, and cost-related data was utilized to increase the level of detail of the BIM model. The capitalized cost summary of direct and indirect expenses is shown in

Table 2 and

Table 3.

During the development of the BIM model, a comprehensive analysis of the building components is carried out to generate detailed quantity take-offs. This process involves utilizing the information within the BIM model to accurately assess the quantities associated with each element. As a result of this analysis, a total of 34 UoPs have been critically identified. Furthermore, a schedule has been formulated for each UoP, facilitating a systematic approach to cost segregation.

The classification of the building components has led to the identification of property classes spanning 5 years, 7 years, 15 years, and 39 years. This classification enables the identification of components that qualify for different depreciation periods. Upon conducting the analysis, the assets of the bank building were carefully assessed, leading to the identification of specific assets categorized under Section 1245 as personal property, land improvements, and real property.

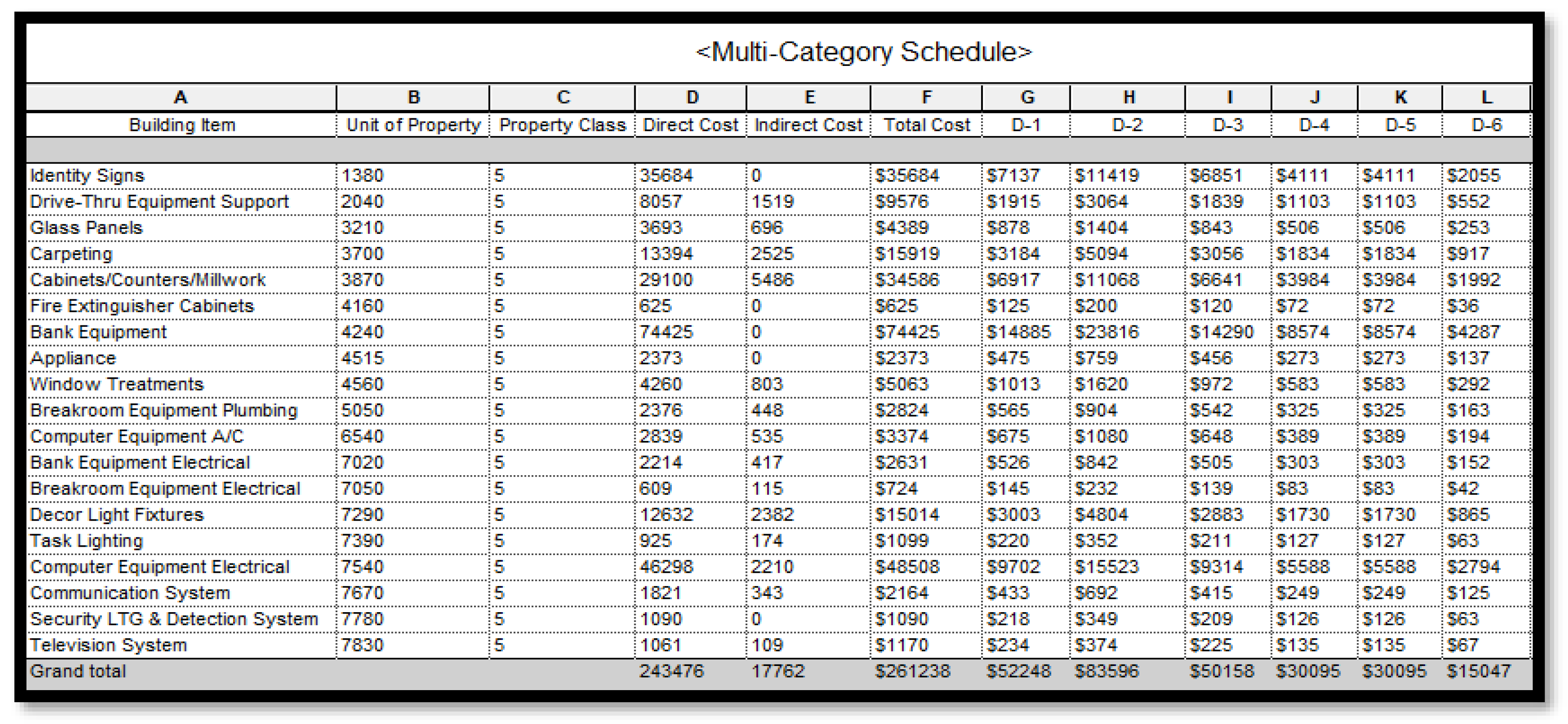

Figure 6 illustrates the depreciation of building items belonging to the 5-year property class. According to the MACRS, these components are depreciated over a period of 6 years. Notably, the building consists of 19 distinct elements falling within the 5-year property class. To streamline the cost segregation process for these elements, a multi-category schedule has been created in Revit, consolidating the various building items. In Revit, Equation (1) is utilized to calculate the depreciation of each building component based on its assigned property class.

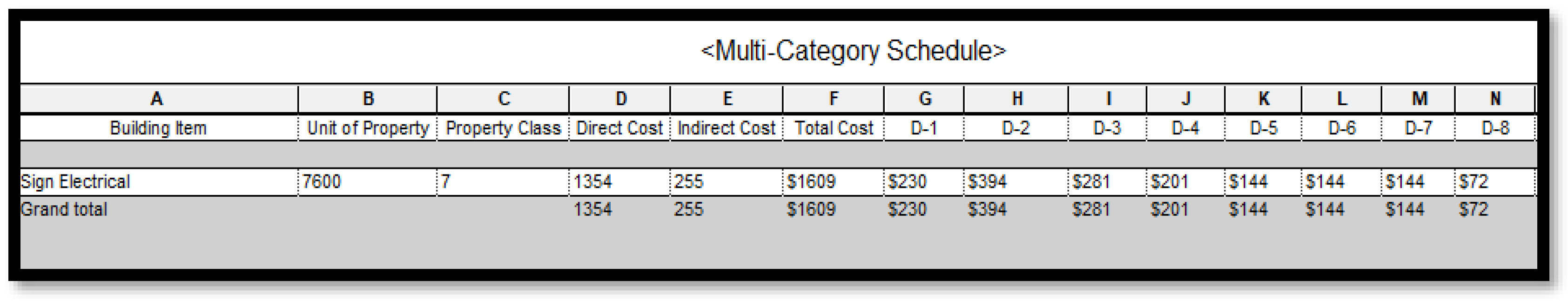

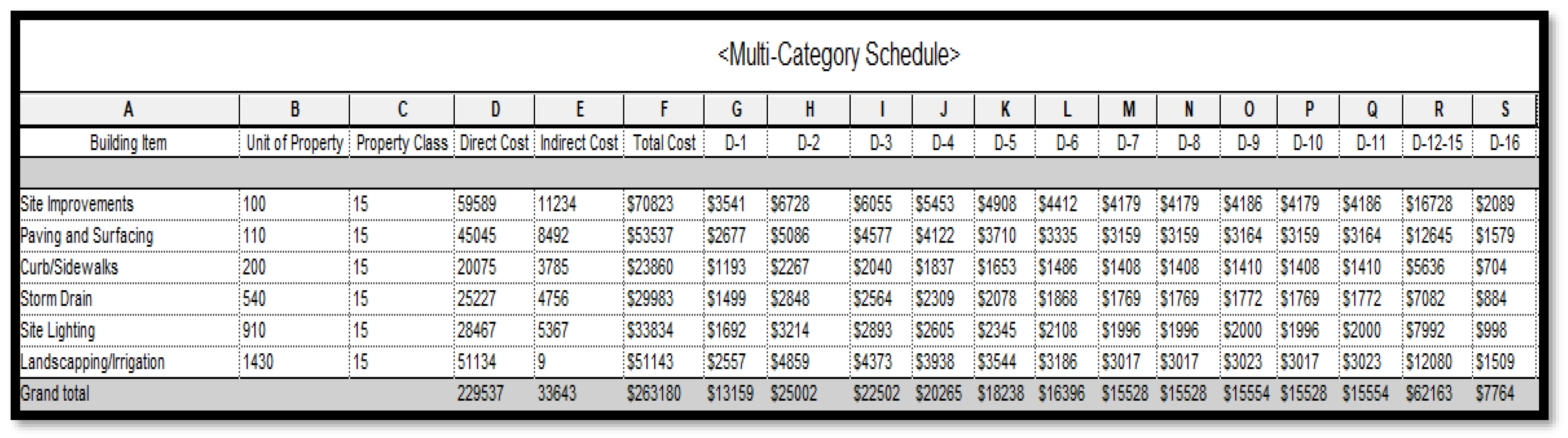

Figure 7 illustrates the cost segregation analysis conducted on building elements with a property class of 7 years and only one item falls under this specific property class. According to the MARCS classification, building items with property classes of 5 and 7 years are categorized as personal property. On the other hand, building items with a property class of 15 years as shown in

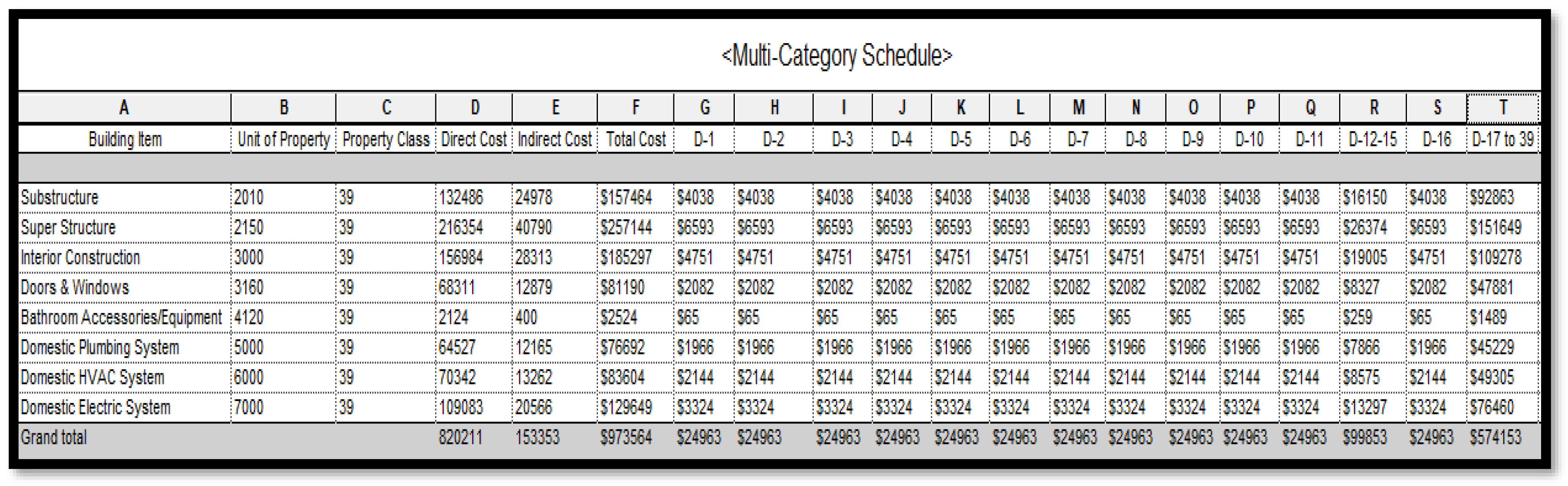

Figure 8 are identified as land improvement. The building elements with a property class of 39 years are shown in

Figure 9, which includes all the structural components of the building.

This research methodology adopts a meticulous approach by utilizing the BIM model and relevant equations to assess depreciation for each building component systematically and accurately. By integrating property classes and leveraging the capabilities of Revit, this methodology establishes a robust framework for conducting cost segregation analysis on commercial buildings. The cost segregation outcomes for each property class are summarized in

Table 4.

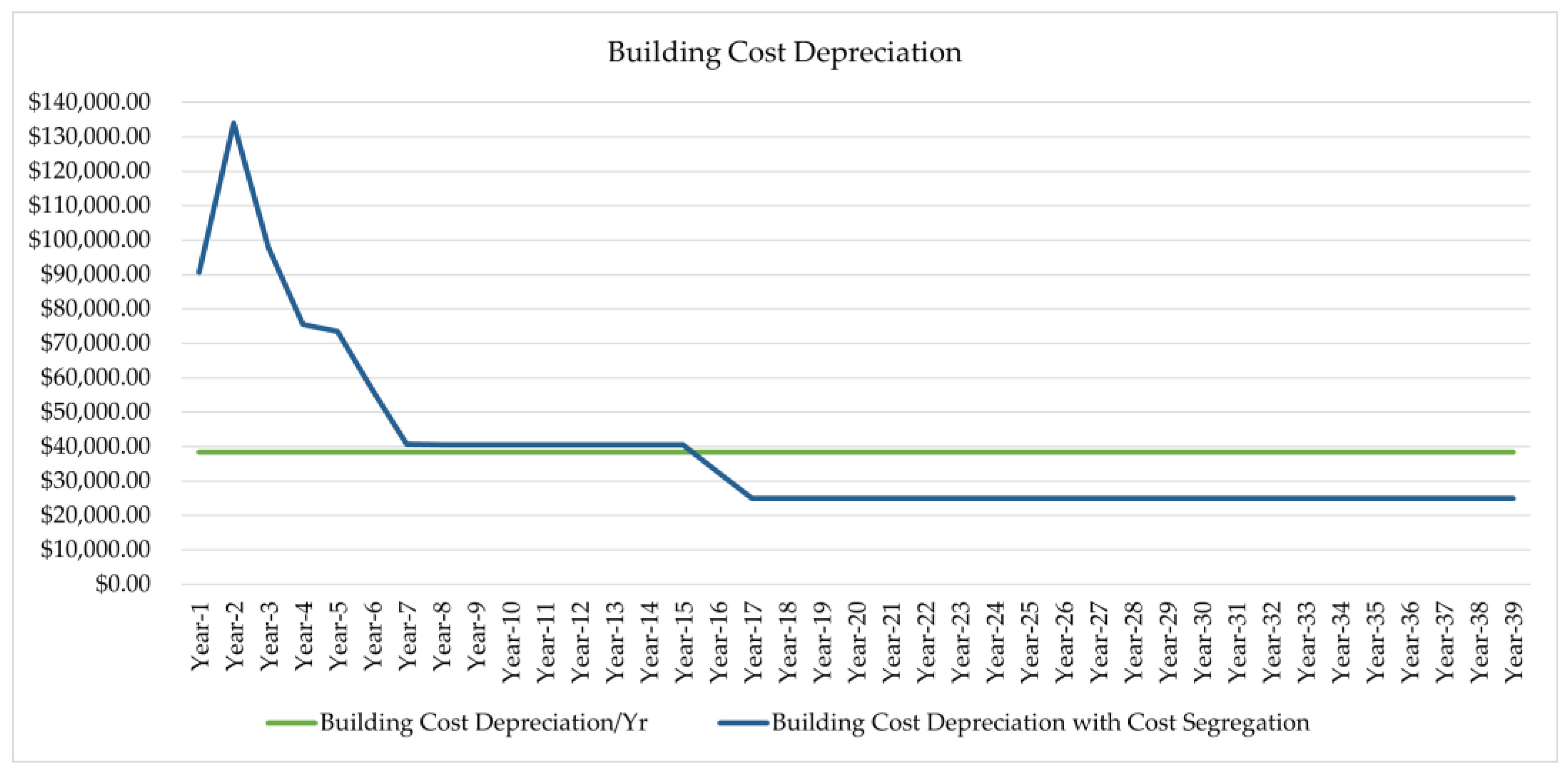

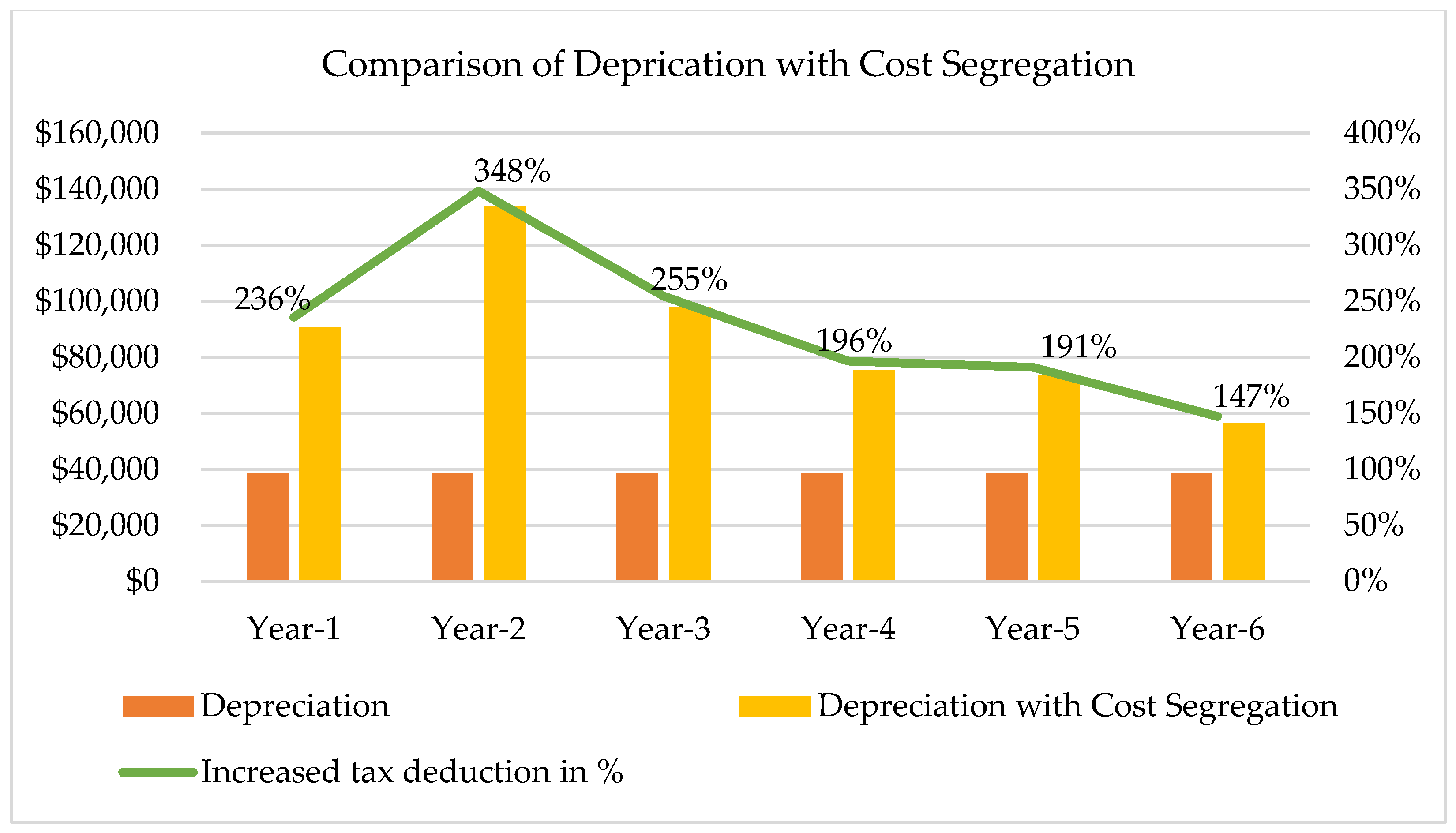

A visual representation of the distribution of cost depreciation over each year is shown in

Figure 10, highlighting the substantial tax deduction opportunities that arise from the depreciation of personal property, especially in the initial six years, as shown in

Figure 11. In the absence of cost segregation, the annual depreciation remains constant at

$38,451. However, the implementation of cost segregation significantly increases the depreciation amounts, particularly during the first six years, resulting in higher tax deductions. The authors in [

5,

6,

7] have also reported similar results while performing cost segregation analysis on a commercial property.

The analysis focuses on these initial six years as they demonstrate substantial financial gains that can be realized through tax deductions. Additionally, there is a noteworthy percentage increase in tax deductions compared to regular depreciation, with figures of 236%, 348%, 255%, 196%, 191%, and 147% for years 1 to 6, respectively. This data underscores the significant impact of cost segregation in maximizing tax benefits and optimizing financial planning for property owners. The benefits derived from cost segregation are made possible through a comprehensive assessment that enables the identification and separate depreciation of specific building components, which would not be attainable without this analysis.

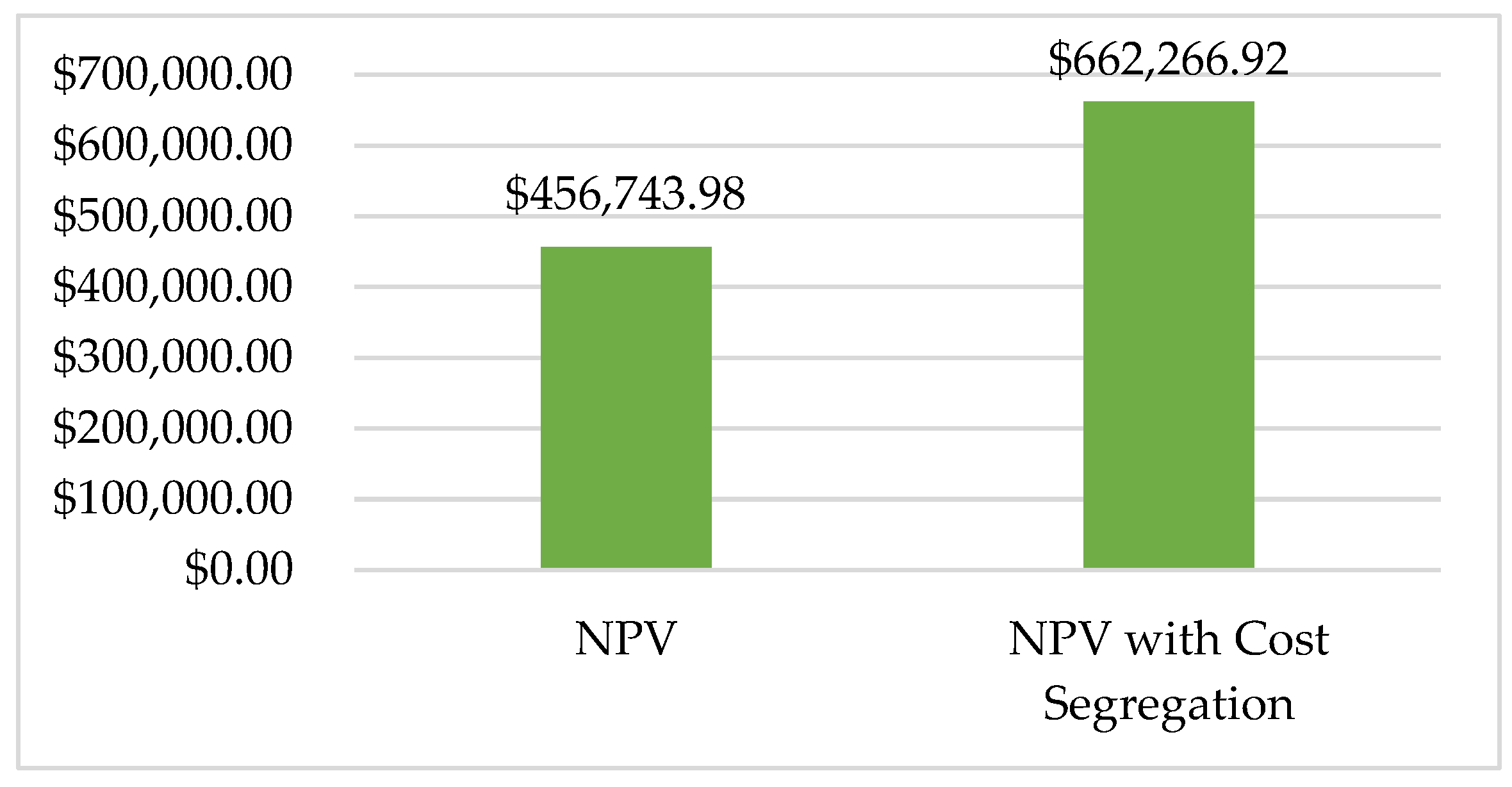

The benefits of cost segregation analysis through BIM are exemplified in

Figure 12, which calculates the Net Present Value (NPV) based on annual depreciation, considering an interest rate of 8%. The analysis reveals a notable difference in NPV amounting to

$205,523. This surplus in financial resources presents real estate developers and investors with valuable opportunities for additional investments, ultimately yielding greater benefits. Consequently, these findings emphasize the significance and effectiveness of cost segregation in maximizing tax advantages for commercial buildings.

The utilization of BIM for cost segregation offers significant advantages by streamlining the process and conserving time and resources. By leveraging the comprehensive data and accurate visualization capabilities of BIM, the identification and allocation of depreciable components can be efficiently performed. This not only ensures a detailed assessment of assets for cost segregation analysis but also eliminates the need for labor-intensive manual evaluation and calculations. The integration of BIM-enabled cost segregation thus presents a valuable opportunity for property owners, construction professionals, tax advisors, and financial planners to enhance financial outcomes and maximize returns on their real estate investments.

5. Conclusions

The cost segregation system is a strategic approach employed to reduce tax liabilities by reclassifying real property as personal property and land improvement, thereby accelerating the tax depreciation of assets. Traditional cost segregation methods have their limitations of time and cost, prompting the introduction of an automated cost segregation process in this study, which harnesses the capabilities of BIM. The primary objective of this novel approach is to optimize and automate the cost segregation of commercial building projects. This automated BIM-enabled cost segregation process empowers owners of diverse commercial properties and assets by facilitating additional cash flow. By effectively integrating and leveraging cost segregation data from various construction assets, owners can optimize their financial resources and enhance their overall profitability. This approach offers a strategic advantage in terms of maximizing tax benefits and increasing the available funds for investment and operational purposes. This integration offers the potential to generate increased cash flow for owners with diverse portfolios of commercial properties and assets. Through the utilization of BIM, owners can enhance cost optimization and contractors can leverage it as an additional value proposition during the bidding process. Consequently, this innovative BIM-enabled cost segregation process shows promising potential in maximizing financial benefits and streamlining operations within the construction and real estate industry.

Future research endeavors may center on the integration of cost segregation modules within BIM systems, complemented by asset management tools, to enhance facility and fiscal management of building components. This integration holds immense potential for delivering substantial benefits to the construction and real estate industry. By seamlessly combining cost segregation analysis with robust asset management functionalities, stakeholders can gain comprehensive insights into the financial aspects of building components throughout their lifecycle. Moreover, the integration of cost segregation modules with asset management tools foster efficient tracking, monitoring, and maintenance of assets, resulting in enhanced facility management practices.