A Real Estate Early Warning System Based on an Improved PSO-LSSVR Model—A Beijing Case Study

Abstract

:1. Introduction

1.1. Background

1.2. Literature Review

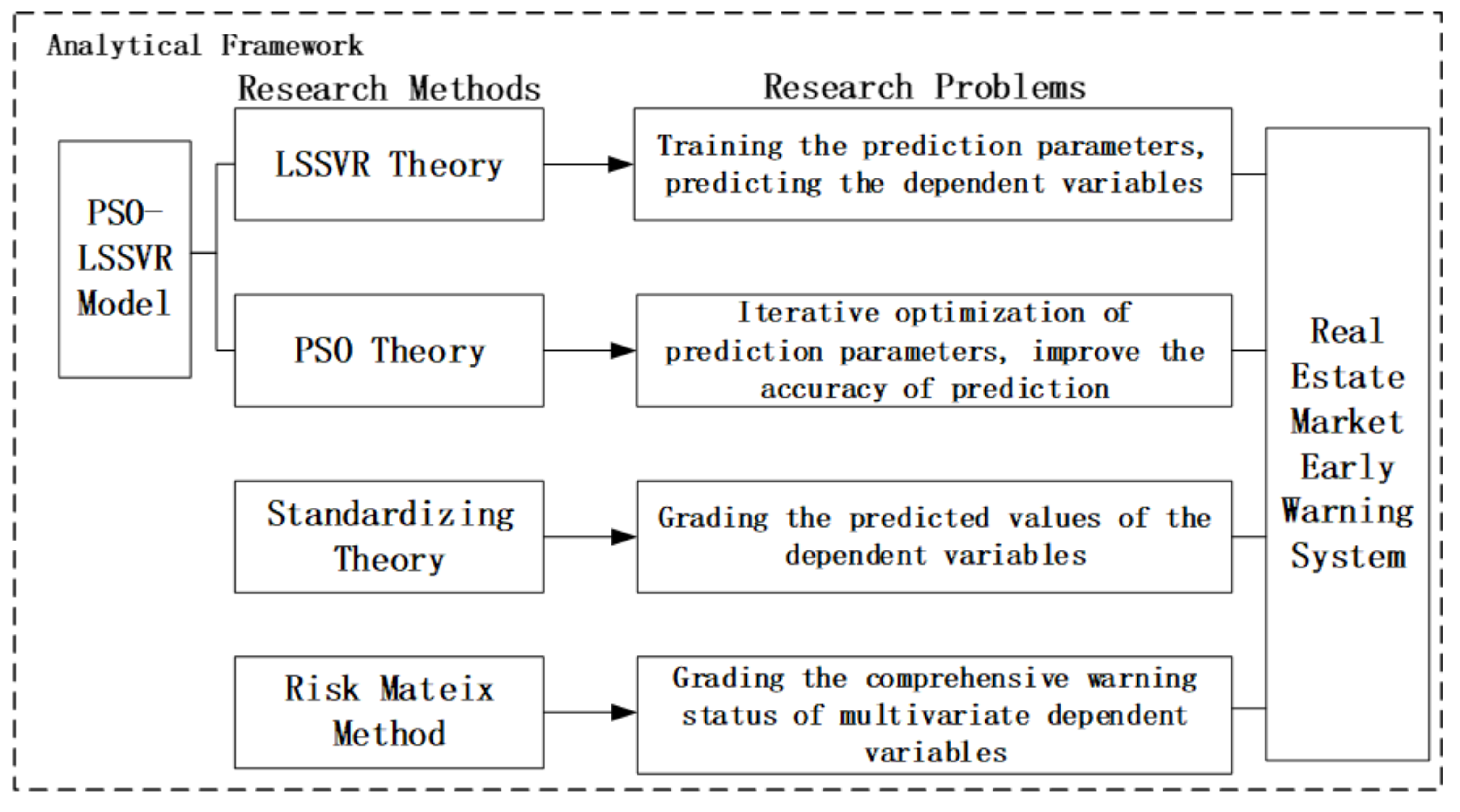

2. Materials and Methods

2.1. Least-Squares Support Vector Regression (LSSVR) Theory

2.2. Particle Swarm Optimization (PSO) Theory

- (1)

- The inertia term is affected by the constant inertia weight and the previous step velocity term.

- (2)

- The cognitive learning term is the distance between the particle’s best position so far found (called ) and the particle current position (called ).

- (3)

- The social learning term is the distance between the global best position found thus far in the entire swarm (called ) and the particle’s current position.

2.3. Standardization Risk Matrix Method

3. Results

3.1. Choice of Urban Early Warning Indicators

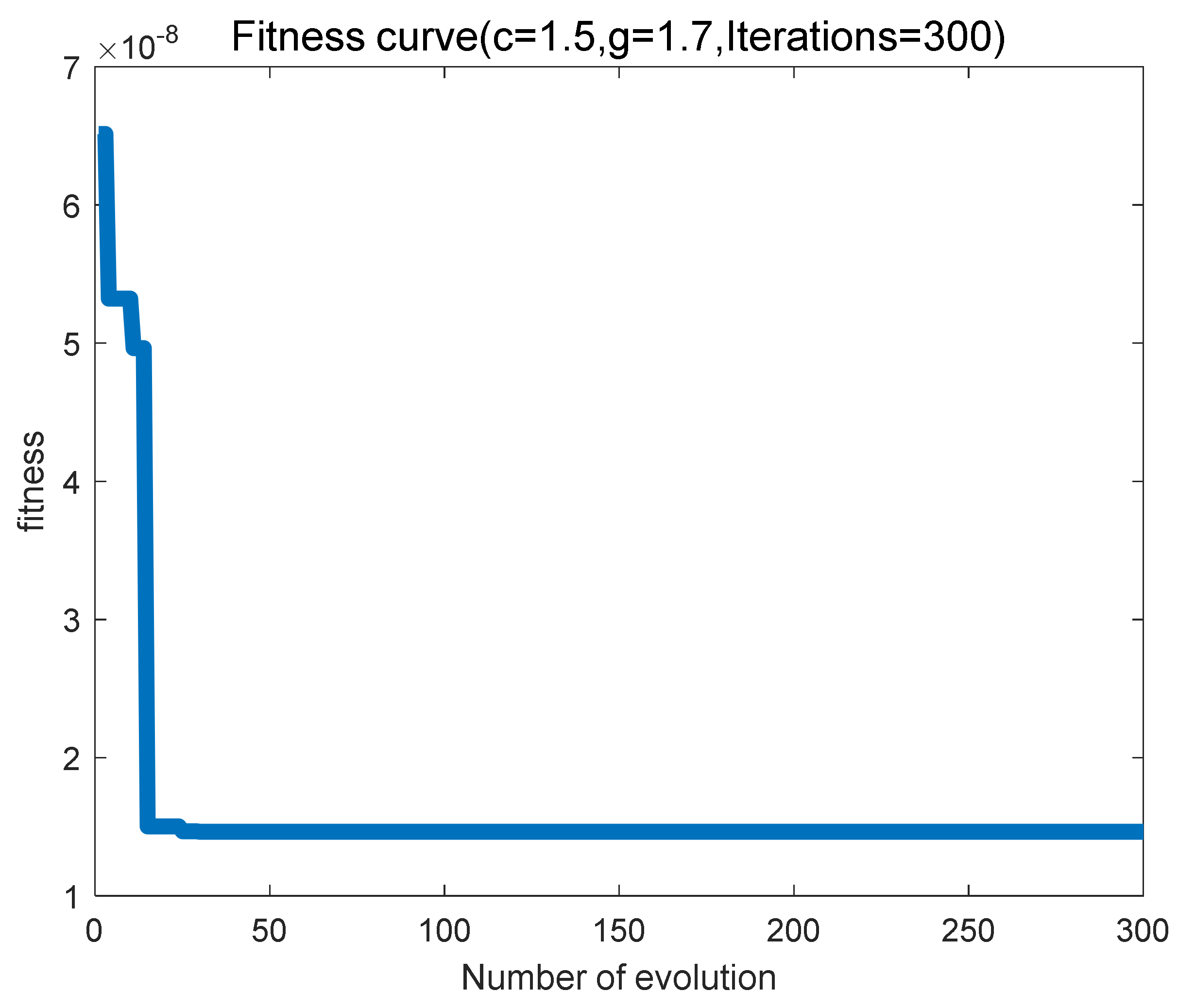

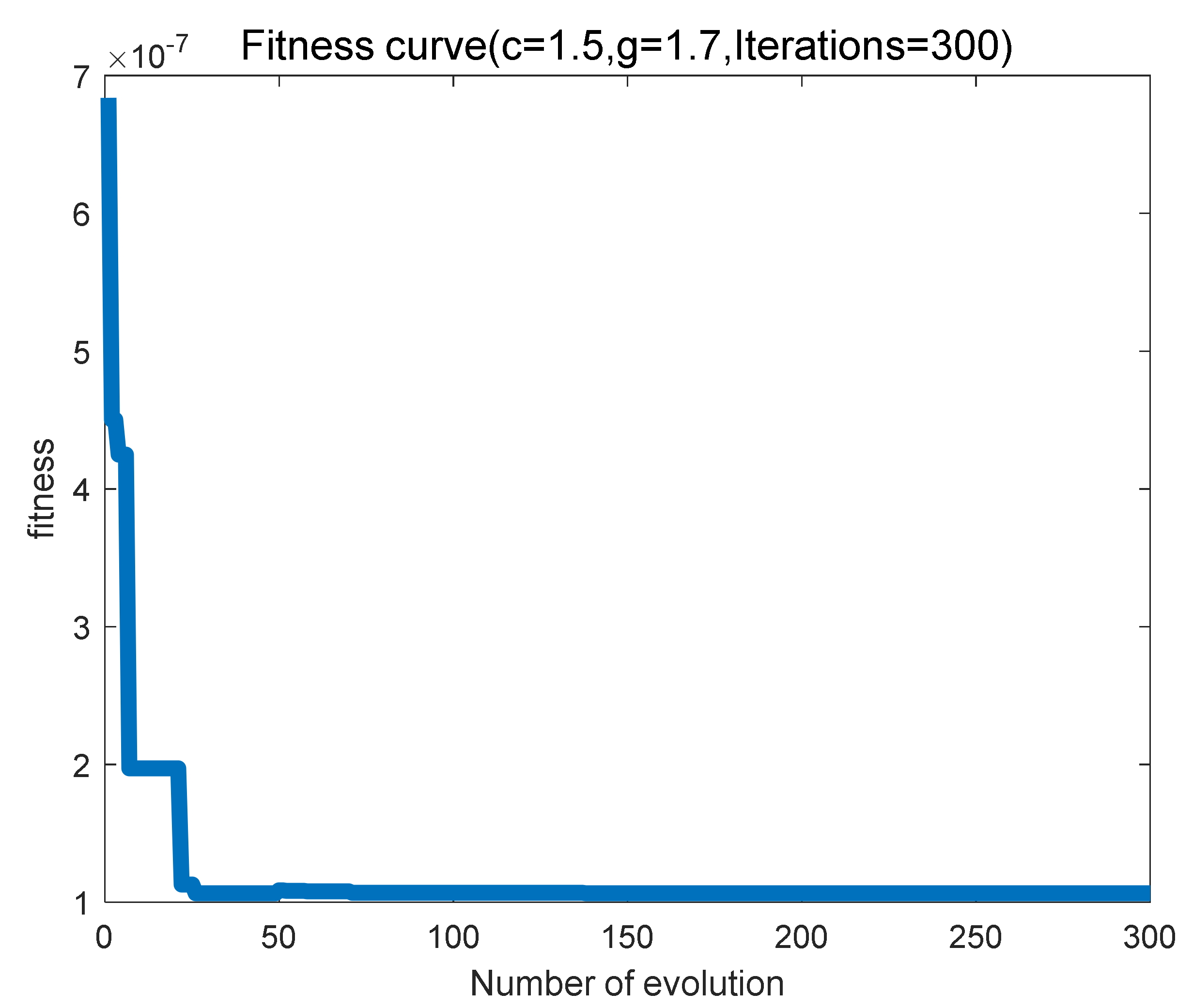

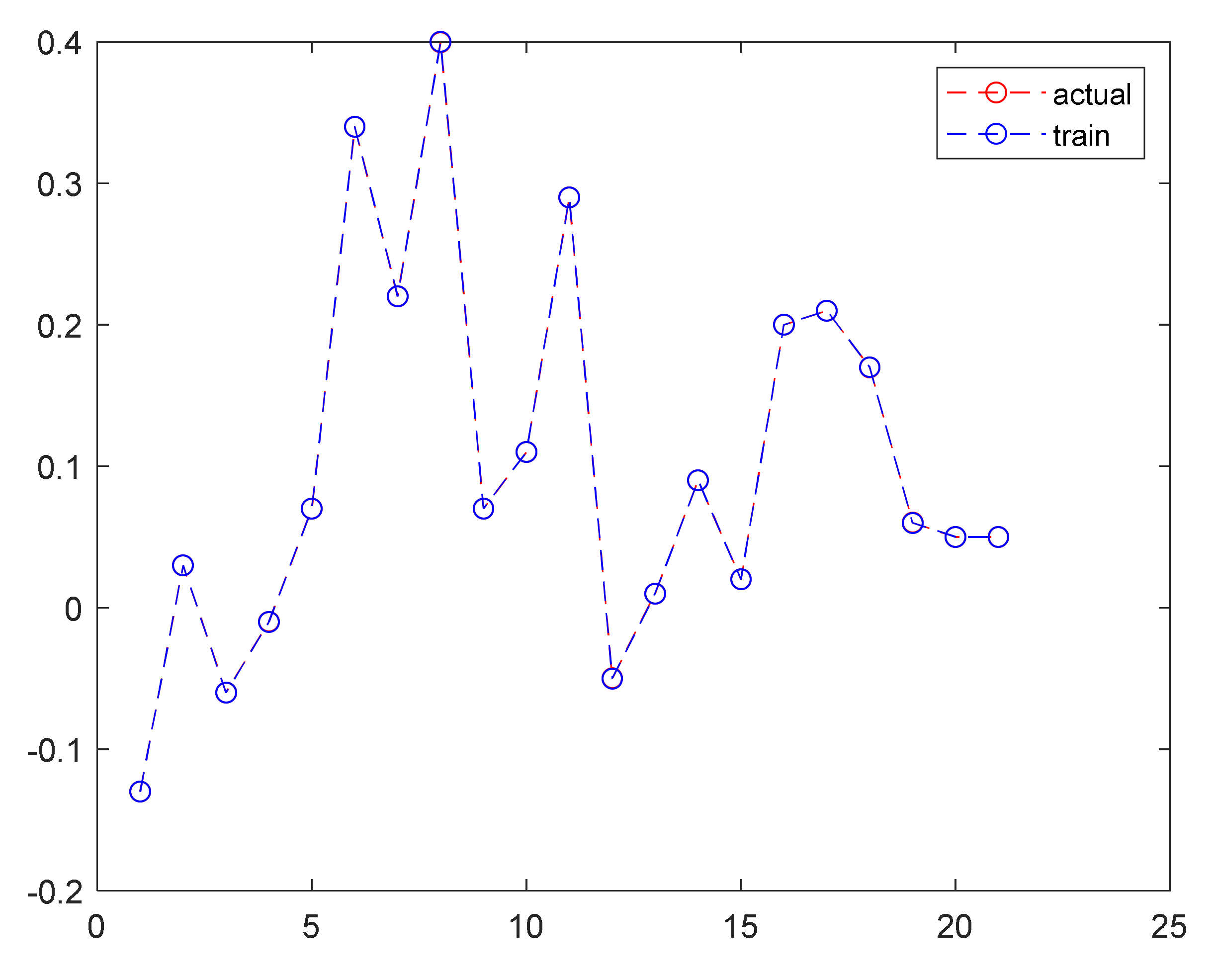

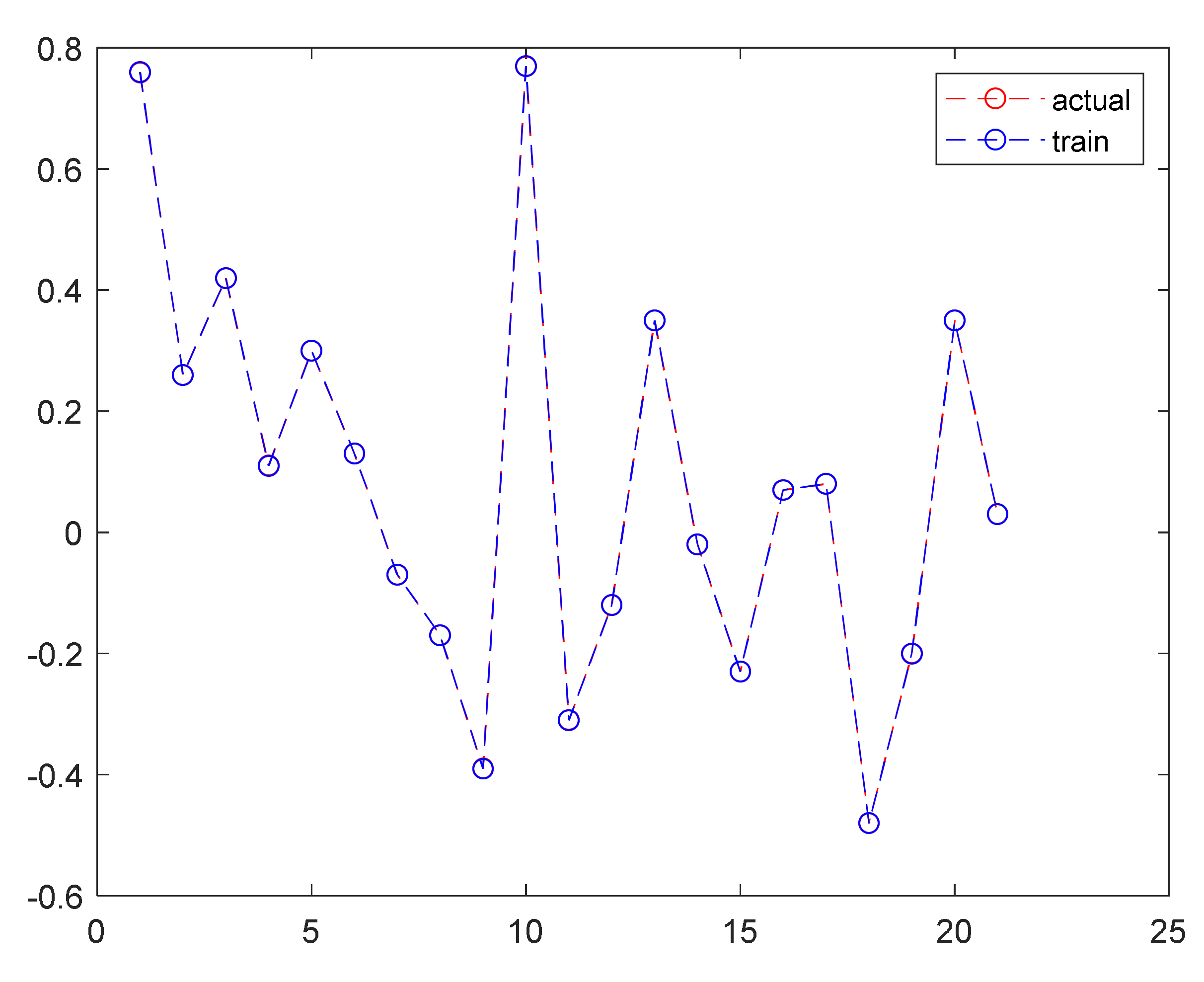

3.2. Training and Testing of PSO-LSSVR

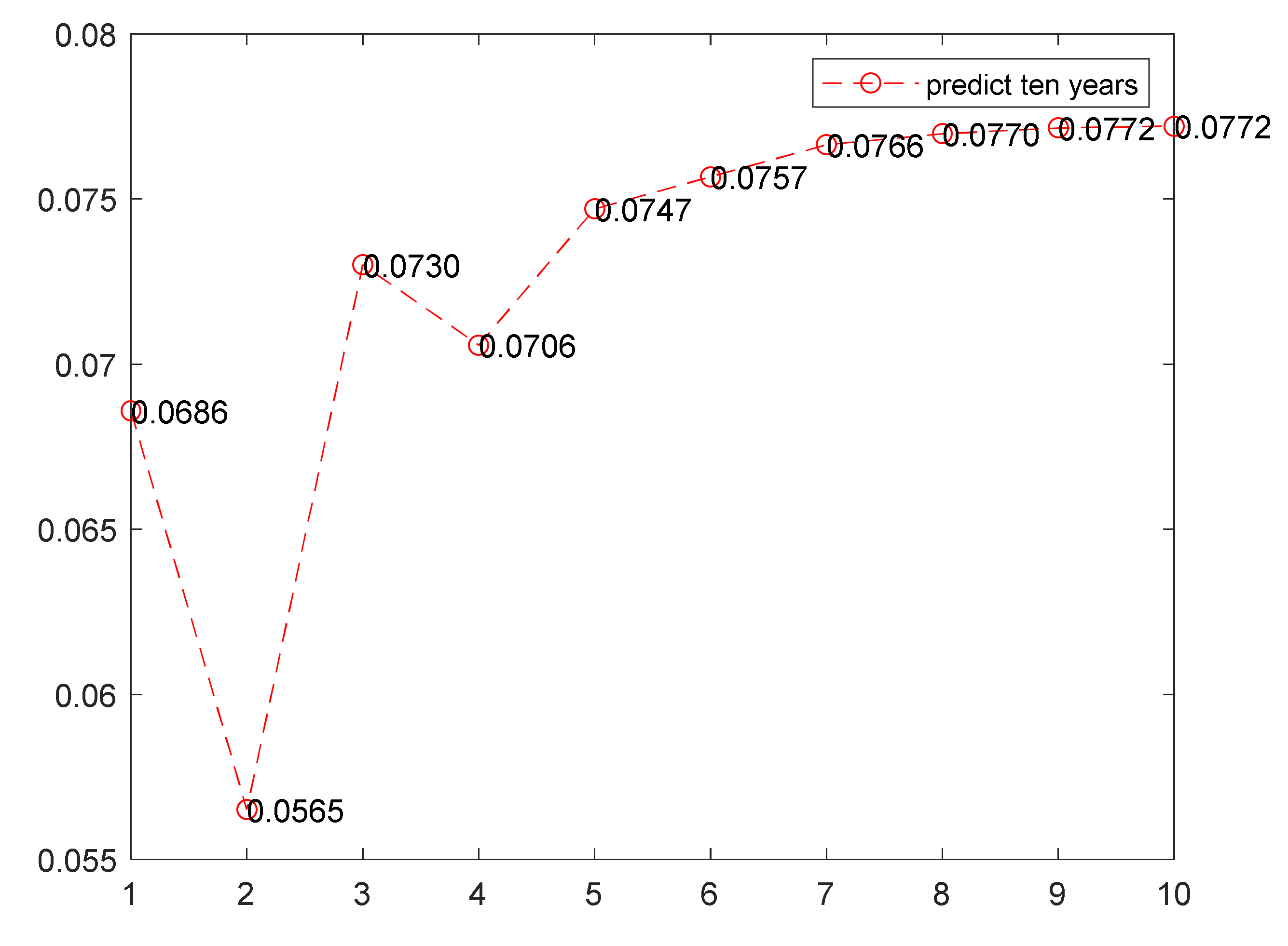

3.3. Prediction for Indicators N15 and N16 Based on PSO-LSSVR

3.4. Early Warning Degree of Beijing Real Estate Market

4. Discussion

4.1. The Validation of PSO-LSSVR Model

4.2. Analysis of the Early Warning Status from 2000 to 2020

4.3. Analysis of the Early Warning Status from 2021 to 2030

5. Conclusions

- 1.

- Balance regional housing supply and demand while promoting real estate marketization

- 2.

- Construct the long-term mechanism to promote the healthy development of the real estate market

- 3.

- Expand financing channels in the real estate market and regulate financing behaviors in the real estate market

- 4.

- Strengthen supervision policies in the real estate market

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Statistics Bureau of the People’s Republic of China, China Statistical Yearbook. 2021. Available online: http://www.stats.gov.cn/ (accessed on 18 March 2022). (In Chinese)

- Yan, J.Z.L. Empirical Researches on Macroeconomic Influence Factors in Real Estate Based on Data Mining (DM). Agro Food Ind. Hi-Tech 2017, 28, 2729–2732. [Google Scholar]

- Kuil, P.; Wellner, K. The Imperatives of the Real Estate Industry and its Effects on Architecture and the Built Environment; Case Studies Presentation. In Proceedings of the 24th Annual European Real Estate Society Conference, Delft, The Netherlands, 30 June 2017. [Google Scholar]

- Carrasco-Gallego, J.A. Real Estate, Economic Stability and the New Macro-Financial Policies. Sustainability 2020, 13, 236. [Google Scholar] [CrossRef]

- Jian, C.; Cao, P.; Zhou, X.; Lai, K.K.; Chen, X.; Su, S. The Conductive and Predictive Effect of Oil Price Fluctuations on China's Industry Development Based on Mixed-Frequency Data. Energies 2018, 11, 1372. [Google Scholar]

- Brzezicka, J. Towards a typology of housing price bubbles: A literature review. Hous. Theory Soc. 2021, 38, 320–342. [Google Scholar] [CrossRef]

- Machaj, M. Can the Taylor Rule be a Good Guidance for Policy? The Case of 2001–2008 Real Estate Bubble. Prague Econ. Pap. 2016, 25, 381–395. [Google Scholar] [CrossRef]

- Liow, K.H.; Zhou, X.; Ye, Q. Correlation Dynamics and Determinants in International Securitized Real Estate Markets. Real Estate Econ. 2015, 43, 537–585. [Google Scholar] [CrossRef]

- Yan, X.; Lin, X. Business Expanding and Strategic Decision-Making Innovation for Real Estate Valuation Companies Based on Big-Data. In Proceedings of the 20th International Symposium on Advancement of Construction Management and Real Estate; Springer: Singapore, 2017; pp. 1057–1068. [Google Scholar]

- Gu, H. Macroeconomic early warning research: Theory, method, history. Econ. Theor. Econ. Manag. 1997, 4, 1–7. [Google Scholar]

- Xiao, L. Research on Urban Residential Area Early Warning System Based on Artificial Neural Network. Agro Food Ind. HI-Tech 2017, 28, 2250–2254. [Google Scholar]

- Vergara-Perucich, J.; Aguirre-Nunez, C. Housing Prices in Unregulated Markets: Study on Verticalised Dwellings in Santiago de Chile. Buildings 2020, 10, 6. [Google Scholar] [CrossRef] [Green Version]

- Echeverri, N.; Jylha, T.; Koppels, P. Searching for Flexibility in Corporate Real Estate Portfolio: Six Co-Working Strategies for User Corporations. Buildings 2021, 11, 115. [Google Scholar] [CrossRef]

- Zhao, X.; Gao, Y. Impact of Transaction Characteristics on the Performance of Mergers and Acquisitions (M and A) in Chinese Real Estate Industry. J. Tianjin Univ. (Soc. Sci.) 2017, 19, 119–124. [Google Scholar]

- Kang, J.; Lee, H.; Jeong, S.; Lee, H.; Oh, K. Developing a forecasting model for real estate auction prices using artificial intelligence. Sustainability 2020, 12, 2899. [Google Scholar] [CrossRef] [Green Version]

- Yu, Y.; Lu, J.; Shen, D.; Chen, B. Research on real estate pricing methods based on data mining and machine learning. Neural Comput. Appl. 2021, 33, 3925–3937. [Google Scholar] [CrossRef]

- Pyhrr, S.A.; Born, W.L.; Robinson, R.; Lucas, S.R. Real property valuation in a changing economic and market cycle. Apprais. J. 1996, 64, 14. [Google Scholar]

- Pyhrr, S.A. A Computer Simulation Model to Measure the Risk in Real Estate Investment. Real Estate Economics. 2010, 1, 48–78. [Google Scholar] [CrossRef]

- Nieboer, N.; Voogd, H. Housing vacancy and early warning systems. Neth. J. Hous. Environ. Res. 1990, 5, 237–249. [Google Scholar] [CrossRef]

- Hoffman, A.V.; Belsky, E.S.; Lee, K. The Impact of Housing on Community: A Review of Scholarly Theories and Empirical Research, Joint Center for Housing Studies, Graduate School of Design and John F. Kennedy School of Government; Harvard University: Cambridge, MA, USA, 2006. [Google Scholar]

- Chan, K.F.; Treepongkaruna, S.; Brooks, R.; Gray, S. Asset market linkages: Evidence from financial, commodity and real estate assets. J. Bank. Financ. 2011, 35, 1415–1426. [Google Scholar] [CrossRef]

- Gonzalez, M.R.; Basse, T.; Kunze, F.; Vornholz, G. Early warning indicator systems for real estate investments: Empirical evidence and some thoughts from the perspective of financial risk management. Z. Für Gesamte Versicher. 2018, 107, 387–403. [Google Scholar] [CrossRef]

- Huang, A.; Qiu, L.; Li, Z. Applying Deep Learning Method in TVP-VAR Model under Systematic Financial Risk Monitoring and Early Warning. J. Comput. Appl. Math. 2021, 382, 113065. [Google Scholar] [CrossRef]

- Loris, A.B. A Financial Early Warning System for Over-the-Counter Broker-Dealers. J. Financ. 1976, 31, 1201–1217. [Google Scholar]

- Caruzzo, A.; Belderrain, M.C.N.; Fisch, G.; Young, G.S.; Hanlon, C.J.; Verlinde, J. Modelling weather risk preferences with multi-criteria decision analysis for an aerospace vehicle launch. Meteorol. Appl. 2018, 25, 456–465. [Google Scholar] [CrossRef] [Green Version]

- Burnaev, E.V. On Construction of Early Warning Systems for Predictive Maintenance in Aerospace Industry. J. Commun. Technol. Electron. 2019, 64, 1473–1484. [Google Scholar] [CrossRef]

- Clements, C.F.; Mccarthy, M.A.; Blanchard, J.L. Early warning signals of recovery in complex systems. Nat. Commun. 2019, 10, 1681. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kong, Q.; Allen, R.M.; Schreier, L.; Kwon, Y.-W. MyShake: A smartphone seismic network for earthquake early warning and beyond. Sci. Adv. 2016, 2, e1501055. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Li, Z.; Meier, M.-A.; Hauksson, E.; Zhan, Z.; Andrews, J. Machine Learning Seismic Wave Discrimination: Application to Earthquake Early Warning. Geophys. Res. Lett. 2018, 45, 4773–4779. [Google Scholar] [CrossRef] [Green Version]

- Wang, J.; Wang, J. A New Early Warning Method of Train Tracking Interval Based on CTC. IEEE Trans. Intell. Transp. Syst. 2017, 99, 1–7. [Google Scholar] [CrossRef] [Green Version]

- Wang, H.; Li, L.; Pan, P.; Wang, Y.; Jin, Y. Early warning of burst passenger flow in public transportation system. Transp. Res. Part C Emerg. Technol. 2019, 105, 580–598. [Google Scholar] [CrossRef]

- Kalliomäki, J.; Kontula, T.; Kalliomäki, M.L.; Kivipuro, M.; Tirkkonen, J.; Solin, J.; Pauniaho, S.-L.; Huhtala, H.; Yli-Hankala, A.; Hoppu, S. The national early warning score (NEWS) could not predict secondary transportation to the tertiary hospital in Finnish prehospital care. Resuscitation 2016, 106, e69. [Google Scholar] [CrossRef]

- Kovacs, C. Outreach and early warning systems for the prevention of intensive care admission and death of critically ill adult patients on general hospital wards. Int. J. Nurs. Pract. 2016, 22, 523–525. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.-J.; Zeng, G.-T.; Zhang, K.-X.; Chu, H.-B.; Chen, Z.-S. Urban real estate market early warning based on support vector machine: A case study of Beijing. Int. J. Comput. Intell. Syst. 2020, 13, 153–166. [Google Scholar] [CrossRef] [Green Version]

- Begusic, S.; Kostanjcar, Z.; Kovac, D.; Stanley, H.; Podobnik, B. Information feedback in temporal networks as a predictor of market crashes. Complexity 2018, 2018, 2834680. [Google Scholar] [CrossRef]

- Huang, F.; Feng, W. A system for early-warning and forecasting of real estate development. Autom. Constr. 2005, 14, 333–342. [Google Scholar] [CrossRef]

- Yang, J. Design of early warning multimedia computer system for real estate market under PROBIT model. Multimed. Tools Appl. 2019, 1–15. [Google Scholar] [CrossRef]

- Kholodilin, K.A.; Michelsen, C. High Risk of a Housing Bubble in Germany and Most OECD Countries. DIW Wkly. Rep. 2019, 9, 265–273. [Google Scholar]

- Kim, T.Y.; Oh, K.J.; Sohn, I.; Hwang, C. Usefulness of Artificial Networks for Early Warning System of Economic Crisis. Expert Syst. Appl. 2004, 6, 583–590. [Google Scholar] [CrossRef]

- Zheng, Y.J.; Chen, S.Y.; Xue, Y. A Pythagorean-Type Fuzzy Deep Denoising Autoencoder for Industrial Accident Early Warning. IEEE Trans. Fuzzy Syst. 2017, 25, 1561–1575. [Google Scholar] [CrossRef]

- Park, D.; Ryu, D. A Machine Learning-Based Early Warning System for the Housing and Stock Markets. IEEE Access. 2021, 9, 3077962. [Google Scholar] [CrossRef]

- Cortes, C.; Vapnik, V. Support-vector network. Mach. Learn. 1995, 20, 273–295. [Google Scholar] [CrossRef]

- Izadyar, N.; Ghadamian, H.; Chong, W.T.; Moghadam, Z.; Tong, C.W.; Shamshirband, S. Appraisal of the support vector machine to forecast residential heating demand for the District Heating System based on the monthly overall natural gas consumption. Energy 2015, 93, 1558–1567. [Google Scholar] [CrossRef]

- Suykens, J.; Vandewalle, J. Least Squares Support Vector Machine Classifiers. Neural Process. Lett. 1999, 9, 293–300. [Google Scholar] [CrossRef]

- Chou, J.; Ngo, N. Time series analytics using sliding window metaheuristic optimization-based machine learning system for identifying building energy consumption patterns. Appl. Energy 2016, 177, 751–770. [Google Scholar] [CrossRef]

- Xue, X.; Xiao, M. Deformation evaluation on surrounding rocks of underground caverns based on PSO-LSSVM. Tunn. Undergr. Space Technol. 2017, 69, 171–181. [Google Scholar] [CrossRef]

- Chen, Y.; Zhou, Z.; Chen, Q. The research and application of LS-SVM based on particle swarm optimization. In Proceedings of the IEEE International Conference on Automation and Logistics, Jinan, China, 18–21 August 2007; pp. 1115–1120. [Google Scholar]

- Wang, B.; Tang, W.; Song, L.; Bai, G. PSO-LSSVR: A surrogate modeling approach for probabilitic flutter evaluation of compressor blade. Structures 2020, 28, 1634–1645. [Google Scholar] [CrossRef]

- Sun, W.; Zheng, S.; Geltner, D.M.; Wang, R. The Housing Market Effects of Local Home Purchase Restrictions: Evidence from Beijing. J. Real Estate Financ. Econ. 2017, 55, 288–312. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, D.; Zhao, J.; Zheng, X.; Zhang, L. Effect of the Housing Purchase Restriction Policy on the Real Estate Market: Evidence from a Typical Suburb of Beijing, China. Land Use Policy 2020, 94, 104528. [Google Scholar] [CrossRef]

- Degn Eskesen, S.; Tengborg, P.; Kampmann, J.; Veicherts, T.H. Guidelines for tunnelling risk management: International Tunnelling Association, Work Group No.2. Tunn. Undergr. Space Technol. 2004, 19, 217–237. [Google Scholar] [CrossRef]

- Yin, S. Research on Early Warning of Real Estate Market in Harbin. Master’s Thesis, Northeast Forestry University, Harbin, China, 2014. [Google Scholar]

- Yi, X. China’s Real Estate Market Overheating and Risk Early Warning. Financ. Trade Economics 2005, 5, 14–21. [Google Scholar]

- Qian, S. Study on Real Estate Monitoring and Early Warning Model in Beijing Based on Neural Network. Master’s Thesis, University of International Business and Economics, Beijing, China, 2009. [Google Scholar]

- Han, L. Research on Urban Real Estate Early Warning System in China. Ph.D. Thesis, Sichuan University, Chengdu, China, 2004. [Google Scholar]

- Shi, Y.; Wang, P. Research on Early-warning Index System and Integrated Warning of Real Estate. Stat. Res. 2011, 28, 16–21. [Google Scholar]

- Wang, J. Research on Real Estate Market Early Warning System Based on Artificial Neural Network. Master’s Thesis, Zhejiang University, Hangzhou, China, 2006. [Google Scholar]

- Tajani, F.; Liddo, F.; Guarini, M.; Ranieri, R.; Anelli, D. An Assessment Methodology for the Evaluation of the Impacts of the COVID-19 Pandemic on the Italian Housing Market Demand. Buildings 2022, 11, 592. [Google Scholar] [CrossRef]

- Yang, L. Research on Early Warning System of Real Estate Market. Master’s Thesis, Wuhan, Wuhan University, 2005. [Google Scholar]

- Ding, L.; Li, B. Technical Points and Process Design of Early Warning Control System in Real Estate Market. Syst. Eng. Theory Pract. 2002, 4, 58–62. [Google Scholar]

- Ullah, F.; Sepasgozar, S. Key Factors Influencing Purchase or Rent Decisions in Smart Real Estate Investments: A System Dynamics Approach Using Online Forum Thread Data. Sustainability 2020, 12, 4382. [Google Scholar] [CrossRef]

- He, F. Design and Application of Real Estate Early Warning System Based on BP Neural Network. Master’s Thesis, Huazhong Agricultural University, Wuhan, China, 2011. [Google Scholar]

- Su, X.; Qian, Z. State Intervention in Land Supply and Its Impact on Real Estate Investment in China: Evidence from Prefecture-Level Cities. Sustainability 2020, 12, 1019. [Google Scholar] [CrossRef] [Green Version]

- Statistics Bureau of the People’s Republic of China, China City Statistical Yearbook. 2021. Available online: https://www.stats.gov.cn/ (accessed on 18 March 2022).

- China Entrepreneur Investment Club, China Entrepreneur Investment Club (CEIC) Database. 2021. Available online: https://www.ceicdata.com/zh-hans (accessed on 18 March 2022).

- China Real Estate Information Corporation, China Real Estate Information Corporation (CRIC). 2021. Available online: https://cric.dichan.com/system.html (accessed on 18 March 2022).

- Chang, L. Historical Review and Prospect of China’s Real Estate Regulation Policy. China Econ. Rev. 2019, 6, 49–53. [Google Scholar]

| Types | Indicator | Sub-Indicators | Serial Number | References |

|---|---|---|---|---|

| Control variables | Relationship between the real estate market and the national economy | Real estate development investment level and urban economic development level | N1 | [52] |

| Real estate investment level | N2 | [53] | ||

| Real estate development self-raised financing level | N3 | [54] | ||

| Ratio of commercial housing price growth and urban residents’ income growth | N4 | [55] | ||

| Real estate land area purchased level | N5 | [56] | ||

| Relationship between supply and demand | Commercial housing sales level | N6 | [57] | |

| Land sales area level | N7 | [54] | ||

| Per capita residential area level | N8 | [55,58] | ||

| Commercial housing prices and urban residents’ disposable income level | N9 | [58,59] | ||

| Inner relationship of the real estate industry | Residential investment level in commercial housing construction | N10 | [52] | |

| Residential sales level | N11 | [54] | ||

| Residential area completion level | N12 | [53] | ||

| Proportion of new construction area of commercial housing | N13 | [60,61] | ||

| Construction and completed area ratio | N14 | [62] | ||

| Dependent variables | Early warning indicators | Commercial housing price growth rate | N15 | [55,61] |

| Growth rate of the land area of commercial housing sales | N16 | [56,63] |

| Years | N1 | N2 | N3 | N4 | N5 | N6 | N7 | N8 | N9 | N10 | N11 | N12 | N13 | N14 | N15 | N16 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2000 | 0.16 | 0.4 | 0.25 | −0.95 | 4.037 | 1.83 | 0.70 | 0.47 | 0.53 | 0.55 | 0.87 | 0.74 | 0.64 | 2.99 | −0.13 | 0.76 |

| 2001 | 0.20 | 0.51 | 0.28 | 0.23 | 1.456 | 1.54 | 0.71 | 0.5 | 0.49 | 0.59 | 0.87 | 0.82 | 0.73 | 3.06 | 0.03 | 0.26 |

| 2002 | 0.22 | 0.55 | 0.29 | −0.68 | 2.428 | 1.73 | 0.72 | 0.6 | 0.42 | 0.59 | 0.88 | 0.81 | 0.77 | 2.6 | −0.06 | 0.42 |

| 2003 | 0.23 | 0.56 | 0.31 | −0.05 | 0.67 | 1.58 | 0.73 | 0.66 | 0.38 | 0.53 | 0.88 | 0.8 | 0.81 | 2.7 | −0.01 | 0.11 |

| 2004 | 0.24 | 0.58 | 0.29 | 0.49 | 1.625 | 1.68 | 0.81 | 0.72 | 0.35 | 0.53 | 0.87 | 0.78 | 0.76 | 2.45 | 0.07 | 0.30 |

| 2005 | 0.21 | 0.54 | 0.4 | 1.96 | 0.934 | 1.84 | 0.74 | 0.75 | 0.4 | 0.51 | 0.82 | 0.75 | 0.76 | 2.13 | 0.34 | 0.13 |

| 2006 | 0.21 | 0.51 | 0.32 | 1.52 | −0.403 | 1.52 | 0.82 | 0.84 | 0.43 | 0.50 | 0.75 | 0.69 | 0.75 | 2.23 | 0.22 | −0.07 |

| 2007 | 0.19 | 0.50 | 0.43 | 3.53 | −0.68 | 1.09 | 0.75 | 0.86 | 0.54 | 0.50 | 0.73 | 0.64 | 0.74 | 2.35 | 0.40 | −0.17 |

| 2008 | 0.16 | 0.50 | 0.49 | 0.55 | −2.904 | 0.7 | 0.52 | 0.91 | 0.51 | 0.49 | 0.72 | 0.55 | 0.71 | 2.6 | 0.07 | −0.39 |

| 2009 | 0.18 | 0.48 | 0.44 | 1.23 | 8.351 | 1.01 | 0.88 | 0.96 | 0.52 | 0.39 | 0.76 | 0.60 | 0.68 | 2.64 | 0.11 | 0.77 |

| 2010 | 0.19 | 0.53 | 0.61 | 2.89 | −1.913 | 0.57 | 0.69 | 1.08 | 0.61 | 0.52 | 0.71 | 0.63 | 0.66 | 3.32 | 0.29 | −0.31 |

| 2011 | 0.18 | 0.51 | 0.58 | −0.39 | −0.82 | 0.47 | 0.64 | 1.18 | 0.51 | 0.59 | 0.66 | 0.59 | 0.67 | 3.93 | −0.05 | −0.12 |

| 2012 | 0.17 | 0.49 | 0.51 | 0.09 | 3.275 | 0.62 | 0.81 | 1.18 | 0.46 | 0.52 | 0.74 | 0.64 | 0.65 | 3.86 | 0.01 | 0.35 |

| 2013 | 0.16 | 0.50 | 0.61 | 0.83 | −0.188 | 0.55 | 0.71 | 1.3 | 0.45 | 0.50 | 0.69 | 0.63 | 0.65 | 3.55 | 0.09 | −0.02 |

| 2014 | 0.17 | 0.49 | 0.46 | 0.17 | −2.753 | 0.37 | 0.48 | 1.31 | 0.42 | 0.50 | 0.77 | 0.59 | 0.63 | 2.94 | 0.02 | −0.23 |

| 2015 | 0.17 | 0.52 | 0.54 | 2.26 | 0.811 | 0.37 | 0.59 | 1.41 | 0.47 | 0.45 | 0.71 | 0.52 | 0.65 | 3.03 | 0.20 | 0.07 |

| 2016 | 0.15 | 0.47 | 0.49 | 2.56 | 0.848 | 0.41 | 0.70 | 1.51 | 0.52 | 0.48 | 0.61 | 0.53 | 0.58 | 3.25 | 0.21 | 0.08 |

| 2017 | 0.13 | 0.41 | 0.46 | 1.89 | −4.545 | 0.23 | 0.60 | 1.61 | 0.56 | 0.46 | 0.74 | 0.41 | 0.59 | 4.98 | 0.17 | −0.48 |

| 2018 | 0.12 | 0.46 | 0.4 | 0.70 | −1.895 | 0.18 | 0.45 | 1.64 | 0.55 | 0.48 | 0.66 | 0.53 | 0.72 | 4.46 | 0.06 | −0.20 |

| 2019 | 0.11 | 0.47 | 0.31 | 0.60 | 5.094 | 0.24 | 0.70 | 1.65 | 0.53 | 0.49 | 0.81 | 0.43 | 0.74 | 4.82 | 0.05 | 0.35 |

| 2020 | 0.11 | 0.47 | 0.36 | 1.98 | 1.65 | 0.25 | 0.63 | 1.55 | 0.54 | 0.57 | 0.83 | 0.63 | 0.79 | 5.93 | 0.05 | 0.03 |

| Mean | 0.17 | 0.50 | 0.42 | 1.02 | 0.72 | 0.89 | 0.68 | 1.08 | 0.49 | 0.51 | 0.77 | 0.63 | 0.70 | 3.32 | 0.10 | 0.08 |

| SD | 0.04 | 0.04 | 0.11 | 1.21 | 2.94 | 0.61 | 0.11 | 0.39 | 0.07 | 0.05 | 0.08 | 0.12 | 0.07 | 1.01 | 0.14 | 0.34 |

| CV | 0.21 | 0.09 | 0.27 | 1.19 | 4.10 | 0.69 | 0.16 | 0.36 | 0.14 | 0.10 | 0.11 | 0.19 | 0.09 | 0.30 | 1.33 | 4.33 |

| Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|

| N15 | 0.0802 | 0.0675 | 0.0781 | 0.0838 | 0.0906 | 0.0940 | 0.0970 | 0.0985 | 0.0994 | 0.0998 |

| N16 | 0.0686 | 0.0565 | 0.0730 | 0.0706 | 0.0747 | 0.0757 | 0.0766 | 0.0770 | 0.0772 | 0.0772 |

| Header | Cold | Normal | Hot |

|---|---|---|---|

| Cold | Cold | Cold | Abnormal |

| Normal | Cold | Normal | Hot |

| Hot | Abnormal | Hot | Hot |

| Year | N15 | N16 | Warning Degree | ||||

|---|---|---|---|---|---|---|---|

| Indicator Data | Standardized Value | Warning Degree | Indicator Data | Standardized Value | Warning Degree | ||

| 2000 | −0.13 | −1.71 | Cold | 0.76 | 2.02 | Hot | Abnormal |

| 2001 | 0.03 | −0.54 | Normal | 0.26 | 0.54 | Normal | Normal |

| 2002 | −0.06 | −1.19 | Cold | 0.42 | 1.01 | Normal | Cold |

| 2003 | −0.01 | −0.80 | Normal | 0.11 | 0.09 | Normal | Normal |

| 2004 | 0.07 | −0.26 | Normal | 0.30 | 0.67 | Normal | Normal |

| 2005 | 0.34 | 1.78 | Hot | 0.13 | 0.17 | Normal | Hot |

| 2006 | 0.22 | 0.87 | Normal | −0.07 | −0.44 | Normal | Normal |

| 2007 | 0.40 | 2.17 | Hot | −0.17 | −0.72 | Normal | Hot |

| 2008 | 0.07 | −0.20 | Normal | −0.39 | −1.38 | Cold | Cold |

| 2009 | 0.11 | 0.07 | Normal | 0.77 | 2.05 | Hot | Hot |

| 2010 | 0.29 | 1.38 | Hot | −0.31 | −1.14 | Cold | Abnormal |

| 2011 | −0.05 | −1.14 | Cold | −0.12 | −0.59 | Normal | Cold |

| 2012 | 0.01 | −0.68 | Normal | 0.35 | 0.81 | Normal | Normal |

| 2013 | 0.09 | −0.09 | Normal | −0.02 | −0.29 | Normal | Normal |

| 2014 | 0.02 | −0.64 | Normal | −0.23 | −0.92 | Normal | Normal |

| 2015 | 0.20 | 0.74 | Normal | 0.07 | −0.04 | Normal | Normal |

| 2016 | 0.21 | 0.83 | Normal | 0.08 | 0.00 | Normal | Normal |

| 2017 | 0.17 | 0.49 | Normal | −0.48 | −1.65 | Cold | Cold |

| 2018 | 0.06 | −0.30 | Normal | −0.20 | −0.84 | Normal | Normal |

| 2019 | 0.05 | −0.37 | Normal | 0.35 | 0.80 | Normal | Normal |

| 2020 | 0.05 | −0.39 | Normal | 0.03 | −0.13 | Normal | Normal |

| Mean | 0.10 | - | - | 0.08 | - | - | - |

| SD | 0.14 | - | - | 0.34 | - | - | - |

| Year | N15 | N16 | Warning Degree | ||||

|---|---|---|---|---|---|---|---|

| Indicator Data | Standardized Value | Warning Degree | Indicator Data | Standardized Value | Warning Degree | ||

| 2021 | 0.08 | −0.16 | Normal | 0.07 | −0.03 | Normal | Normal |

| 2022 | 0.07 | −0.26 | Normal | 0.06 | −0.06 | Normal | Normal |

| 2023 | 0.08 | −0.18 | Normal | 0.07 | −0.02 | Normal | Normal |

| 2024 | 0.08 | −0.14 | Normal | 0.07 | −0.02 | Normal | Normal |

| 2025 | 0.09 | −0.09 | Normal | 0.07 | −0.01 | Normal | Normal |

| 2026 | 0.09 | −0.06 | Normal | 0.08 | −0.01 | Normal | Normal |

| 2027 | 0.10 | −0.04 | Normal | 0.08 | 0.00 | Normal | Normal |

| 2028 | 0.10 | −0.03 | Normal | 0.08 | 0.00 | Normal | Normal |

| 2029 | 0.10 | −0.02 | Normal | 0.08 | 0.00 | Normal | Normal |

| 2030 | 0.10 | −0.02 | Normal | 0.08 | 0.00 | Normal | Normal |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, L.; Rong, X.; Chen, Z.; Mu, L.; Jiang, S. A Real Estate Early Warning System Based on an Improved PSO-LSSVR Model—A Beijing Case Study. Buildings 2022, 12, 706. https://doi.org/10.3390/buildings12060706

Wang L, Rong X, Chen Z, Mu L, Jiang S. A Real Estate Early Warning System Based on an Improved PSO-LSSVR Model—A Beijing Case Study. Buildings. 2022; 12(6):706. https://doi.org/10.3390/buildings12060706

Chicago/Turabian StyleWang, Lida, Xian Rong, Zeyu Chen, Lingling Mu, and Shan Jiang. 2022. "A Real Estate Early Warning System Based on an Improved PSO-LSSVR Model—A Beijing Case Study" Buildings 12, no. 6: 706. https://doi.org/10.3390/buildings12060706

APA StyleWang, L., Rong, X., Chen, Z., Mu, L., & Jiang, S. (2022). A Real Estate Early Warning System Based on an Improved PSO-LSSVR Model—A Beijing Case Study. Buildings, 12(6), 706. https://doi.org/10.3390/buildings12060706