This section presents the results of applying SNA to the survey datasets across the selected countries. It is divided into two main sections: (I) the country-specific networks, and (II) a cross-country comparison of the results to evaluate how these vary across each region.

4.1. Stakeholder Network per Country

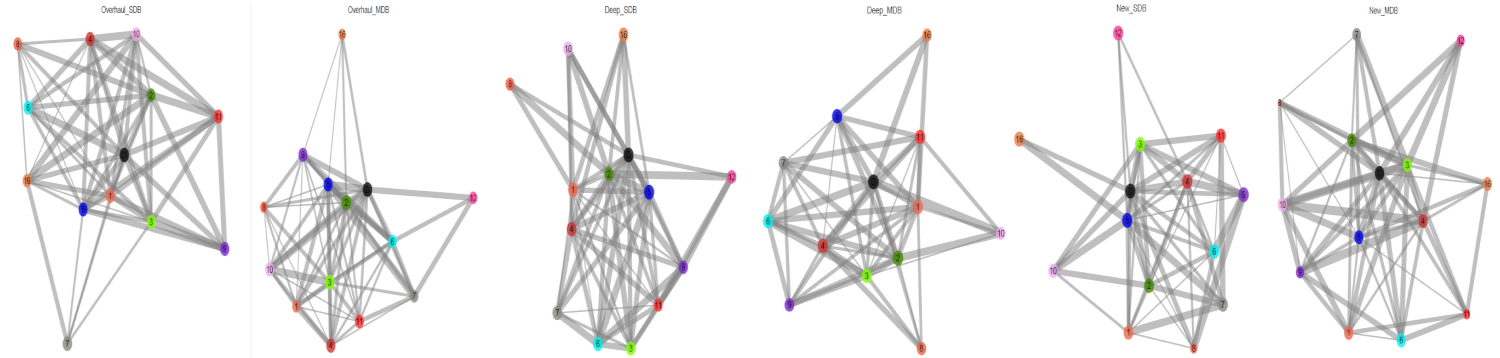

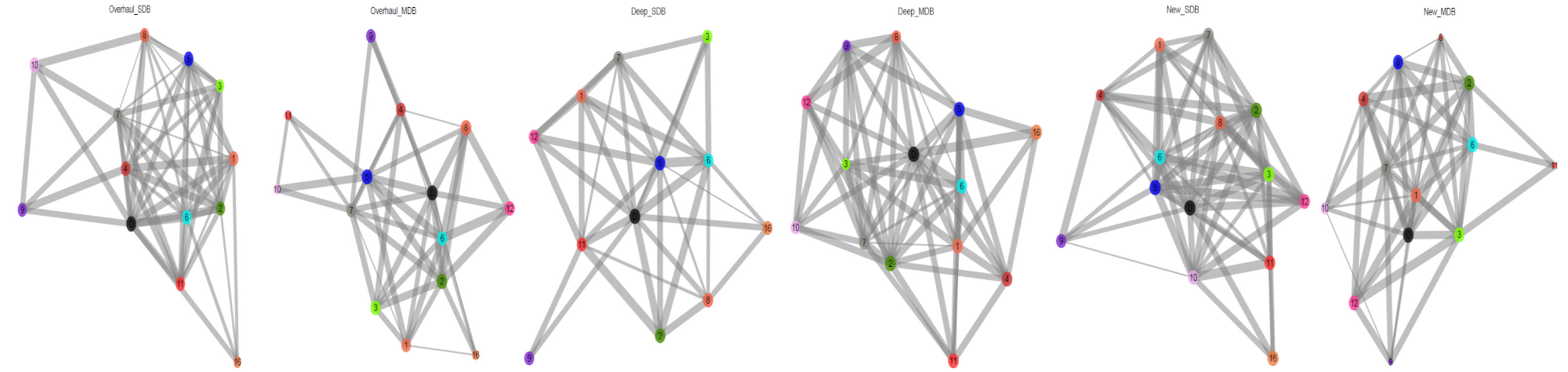

The resulting networks from the application of the SNA are displayed below. The numerical output of the SNA can be found in

Appendix B.

The figures should be read in the following way: the circles or nodes represent the different stakeholder groups; and the size of the circle represents the level of power in the decision (i.e., the bigger the circle, the greater the level of power). As previously mentioned, power in this context is defined by the conjunction of interest and influence. The level of communication among the stakeholders is defined by the different lines or edges. The thickness of the line represents the level of communication, from communicating on a regular basis (“Daily”) to a seldom exchange (“1” on the Likert scale). In the event of no communication at all (“Never”), no line is traced. In addition, the more links or lines within a circle, the stronger its standing point is in the communication. The location in the graphs is defined by the Fruchterman–Reingold algorithm, as described in the method section.

The final responses are listed in the tables below, indicating the median value of the level of importance of each stakeholder group in the decision leading to the selection of the technology. For both the level of power (size of the circles) and the level of communication, the median value in the total responses was categorised into six main groups:

No power or communication (0 in the Likert scale)

Very low level of power or communication (1 in the Likert scale)

Low level of power or communication (2 in the Likert scale)

Medium level of power or communication (3 in the Likert scale)

High level of power or communication (4 in the Likert scale)

Very high level of power or communication (5 in the Likert scale)

The legend for the stakeholder group reference in the network is provided in

Table 3 below.

4.1.1. Italy

For retrofit projects in single-dwelling buildings (SDBs), the most powerful actors in the technology selection are the demand-side actors and the engineers (

Table 4). The stakeholders with the highest level of communication (in terms of number and intensity) are also demand-side actors, this time with architects, engineers and the construction company. Material or technology traders, banks/other financial service companies and consultants have the lowest level of communication with other stakeholders, along with facility managers (administrative), who only communicate with the demand-side actors. For multi-dwelling buildings (MDBs), the results show a rare case in which the level of power is the same for all stakeholders, all of whom having a strong influence in the decision. In terms of communication, demand-side actors, engineers and construction companies have the highest level.

For comprehensive retrofit projects in SDBs, demand-side actors and banks and other financial service companies are perceived to have the highest level of power. In terms of information exchange, demand-side actors, installers, architects and construction companies have the strongest and highest number of exchanges. The energy suppliers, on the other hand, only communicate with the demand-side actors. For MDBs, demand-side actors and construction companies have the strongest power in the decision-making process (with 5). The remaining stakeholders all share the same level of power (with 4). In terms of the communication, demand-side actors and installers have the highest level. The remaining stakeholders also have a high level of power (all with 5). The stakeholder with the lowest level of communication is the public authority, which only communicates with the construction company.

For new construction projects in SDBs, the demand-side actors and the architects have the highest level of control in the technology selection process (both with 6). These are followed by the engineers, the installers, the facility managers (both technical and administrative) and the consultants. In terms of communications and exchange, the demand-side actors again have the highest number and frequency, exchanging with 11 stakeholders. Construction companies are the other most communicative actor in this process, with 10 linkages to other agents. On the other hand, for MDBs, demand-side actors and facility managers (administrative) have the highest level of power (with 5), followed by the remaining stakeholders (with 4). Construction companies have the highest level of communication (10 links), followed by the demand-side actors (9 links).

In Italy, the demand-side actors are considered to be particularly important stakeholders, as they have a leading position in terms of both power and communication in nearly all building and project types. In addition, more stakeholders and streams of communication are involved in new constructions than in retrofit projects.

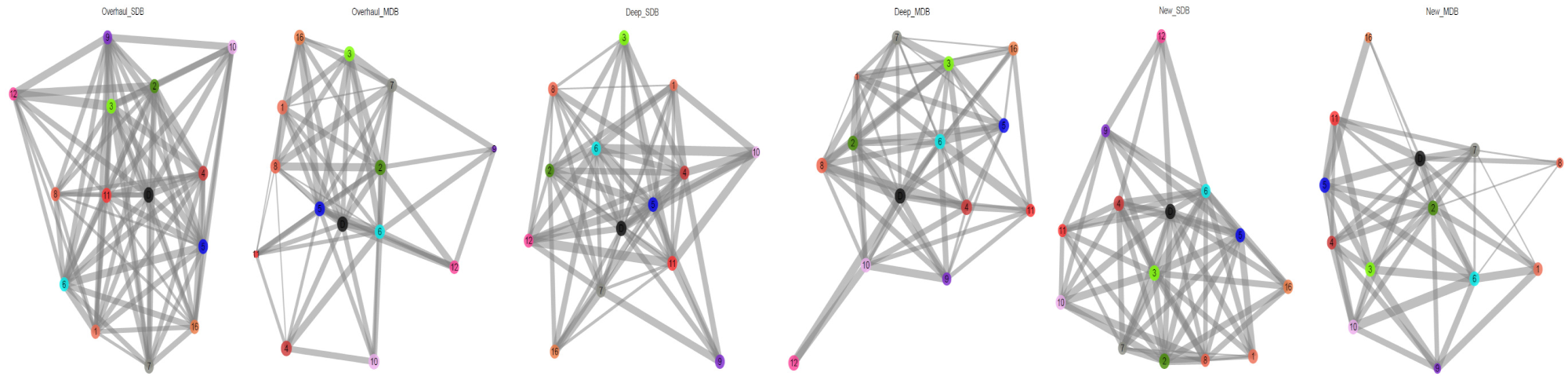

4.1.2. Spain

In the case of retrofit projects in SDBs, the most powerful actors in the technology selection are the demand-side actors, the engineers and the technology or material suppliers (all with 6) (

Table 5). In terms of level of communication, it is again the demand-side actors who have the highest number and frequency of connections (10), followed by the architects, installers and engineers (with 9 links). For MDBs, demand-side actors have the highest level of power in the process, along with public authorities (both with 6). In terms of communication, demand-side actors again have the highest level, followed by the architects (with 8).

For comprehensive retrofit projects in SDBs, the highest level of power goes to the demand-side actors, the architects, engineers and the consultants (all with 6). In terms of communication, demand-side actors have the highest number of communications, followed by architects and construction companies (8 links). For MDBs, as with SDBs, the engineers, architects and the demand-side actors have the highest level of power. Energy suppliers and consultants also have quite high importance (with 5). The demand-side actors and the construction companies also have the highest level of communication.

For new constructions in SDBs, the highest level of power is perceived to be held by the demand-side actors, engineers and consultants (all with 6). The stakeholders with highest level of communication in this process are again the demand-side actors (11 links), and the architects (10). In terms of MDBs, the highest level of power is assigned to demand-side actors, architects and engineers (all with 6). In terms of communication, demand-side actors have the largest and most frequent number of exchanges with other stakeholders (10 links), followed by the architects and the construction companies (both with 8 links).

Therefore, the general picture in Spain is that demand-side actors, architects and engineers are the most powerful stakeholders in the technology selection. There are also more streams of communication in new constructions than in retrofit projects.

4.1.3. Germany

For retrofit projects in SDBs in Germany, many stakeholders have a high level of power in the technology selection (

Table 6). The most powerful actors in the technology selection are the demand-side actors and public authorities (both with 5.5), followed by the engineers, energy suppliers or utilities, consultants, construction companies and banks (with 5). The stakeholders with the highest level of communication (in terms of number and intensity) are also the demand-side actors, together with the installers (both 13). Public authorities and architects also have a high number of interactions with other stakeholders (12 and 11 links, respectively). For MDBs, the highest level of power is shared between demand-side actors and (technical) facility managers (both with 6). Consultants and administrative facility managers are also quite relevant (both 5). In terms of information exchange, it is the demand-side actors that have the highest number of interactions with other stakeholders (12 links). Consultants and installers also have interactions with many other stakeholders (11 links).

For comprehensive retrofit projects in SDBs, demand-side actors and energy suppliers have the highest level of power (both with 6). They are closely followed by the engineers (5.5). In terms of communications, the strongest agent in terms of number and level of communication are the demand-side actors (13 links). Architects, engineers, installers and technology or material providers also have a high number of communications (12 links). On the other hand, for MDBs, the highest level of power is assigned to demand-side actors and consultants (6). These are followed by the engineers and the construction companies (both with 5.5). In terms of level of communication, the highest level goes to demand-side actors and architects (11 links), followed by the engineers and the installers (both with 9).

For new construction projects in SDBs, demand-side actors and installers (both with 6) have the highest level of control in the technology selection process. Then come the engineers, the consultants and the energy suppliers (all with 5). In terms of communications and exchange, the demand-side actors again have the highest number and frequency, exchanging with 13 stakeholders. Architects are the other most communicative actors in this process (with 11 linkages to other agents). For MDBs, demand-side actors and material and technology traders have the highest level of power (with 6), followed by the architects and energy suppliers (with 5). With the highest level of communication for MDBs, it is the architects (with 12) and the engineers and the demand-side actors (both 11 links).

Overall in Germany, the level of power is concentrated in a few groups—particularly demand-side actors, architects, engineers, installers and construction companies. In all cases (i.e., retrofit projects and new constructions), the stakeholder network is particularly strong in terms of communication and number of stakeholders involved.

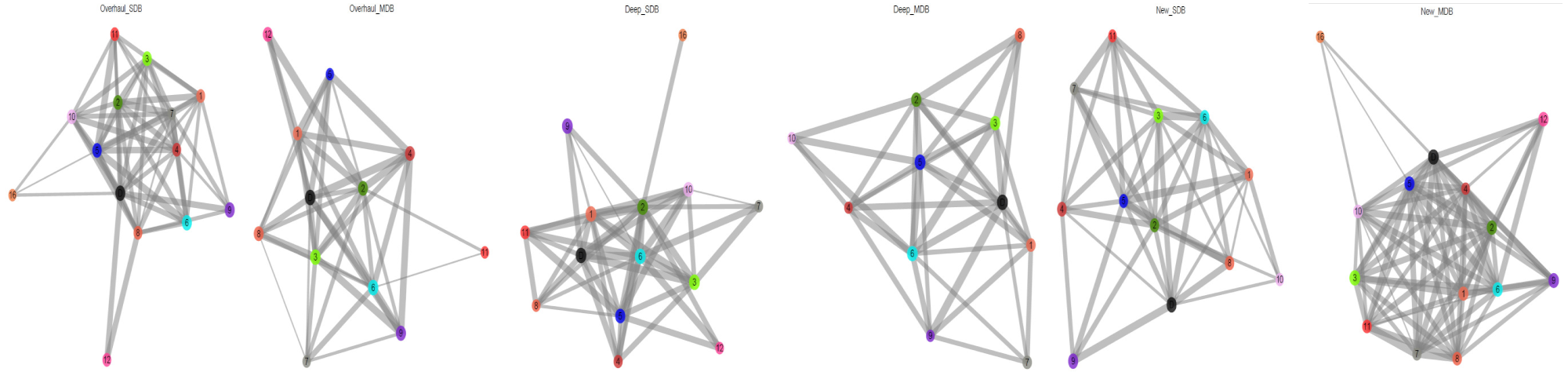

4.1.4. Poland

For retrofit projects and SDBs in Poland (

Table 7), most of the stakeholders have a high level of power in the technology selection. As with Germany, the most powerful actors in this case are the demand-side actors and the public authorities (both with 6). In terms of level of communication, it is again the demand-side actors, material or technology providers and installers who are the stakeholders with the highest number and frequency of connections (12 links), followed by the architects and the engineers (11 links). For MDBs, demand-side actors have the highest level of power in the process, along with architects and engineers (all with 6). In terms of communication, demand-side actors again have the highest level, followed by the architects and installers (11 links).

For comprehensive retrofit projects and SDBs, the highest level of power goes to the demand-side actors and the installers (with 6). In terms of communication, demand-side actors and architects have the highest number of communications (13), followed by the technology providers (12 links). For MDBs, on the other hand, the consultants and the demand-side actors have the highest level of power in the selection (6), closely followed by the construction companies and the engineers (with 5.5). With the highest level of communication are the demand-side actors and architects (11).

For new constructions and SDBs, many stakeholders share the highest level of power in the decision: the demand-side actors, the consultants, the installers, the facility managers and business associations (all with 5). The stakeholders with the highest level of communication in this process are again the demand-side actors and the installers (13 links). In terms of MDBs, the highest level of power is assigned to demand-side actors (6), followed by the consultants, the facility managers (technical) and construction companies (all with 5.5). In terms of communication, demand-side actors and the engineers have the largest and most frequent number of exchanges with other stakeholders (13 links), followed by the architects, installers and consultants (12 links).

In Poland, the stakeholder with most importance in the technology selection, both in power and communication, is again the demand-side actors. In addition, worth mentioning in relation to the level of power are the consultants and installers, as are the architects and installers in relation to the communications. As with Germany—both in retrofit projects and new constructions—the stakeholder network is particularly strong in terms of communication and number of stakeholders involved.

4.1.5. France

For retrofit projects in SDBs in France, there are many relevant stakeholders in the technology selection (

Table 8). The actors perceived to be most powerful are the demand-side actors (with 6), followed by the engineers, the consultants, the installers and the energy suppliers (all with 5). In terms of level of communication, there are many strong interactions (more than in other countries), and it is again the demand-side actors, the engineers, energy suppliers and the architects who are perceived as having the highest number and frequency of connections (13), along with the construction companies, installers, etc. (12). For MDBs, demand-side actors have the highest level of power in the process, along with architects and consultants (all with 6). In terms of communication, it is again demand-side actors, along with the architects, installers and construction companies, that have the highest level. It is noteworthy that the number of streams of communications between stakeholders is much higher in SDBs than in MDBs.

For comprehensive retrofit projects and SDBs, the highest level of power goes to the demand-side actors (6), followed by the engineers (5.5). In terms of communication, demand-side actors and installers have the highest number of communications (13 links), followed by the consultants and construction companies (12 links). For MDBs, on the other hand, the consultants, the banks and the business associations, along with the demand-side actors, have the highest level of power (6), closely followed by the construction companies (5.5). The demand-side actors also have the highest level of communication (13), closely followed by the construction companies (12). Business associations are only connected to the demand-side actors and facility managers (technical). As in the case of retrofit projects, the number of links between stakeholders in the decision is higher than in MDBs.

For new construction projects in SDBs, the highest level of power is perceived to be held by the demand-side actors, engineers, architects and consultants (all with 6). The stakeholders with the highest level of communication in this process are again the demand-side actors (13 links), the engineers and construction companies (12) and the architects (11). In terms of MDBs, the highest level of power is assigned to demand-side actors (5.5) and the installers (5). In terms of communication, the architects have the largest and most frequent number of exchanges with other stakeholders (12 links), followed by the demand-side actors (11 links).

Therefore, the general picture in France is that there are many stronger interactions than in other countries. The demand-side actors, architects and engineers are crucial in this process. The case with the highest number of stakeholders involved, as well as strong streams of communication, is retrofit projects in SDBs.

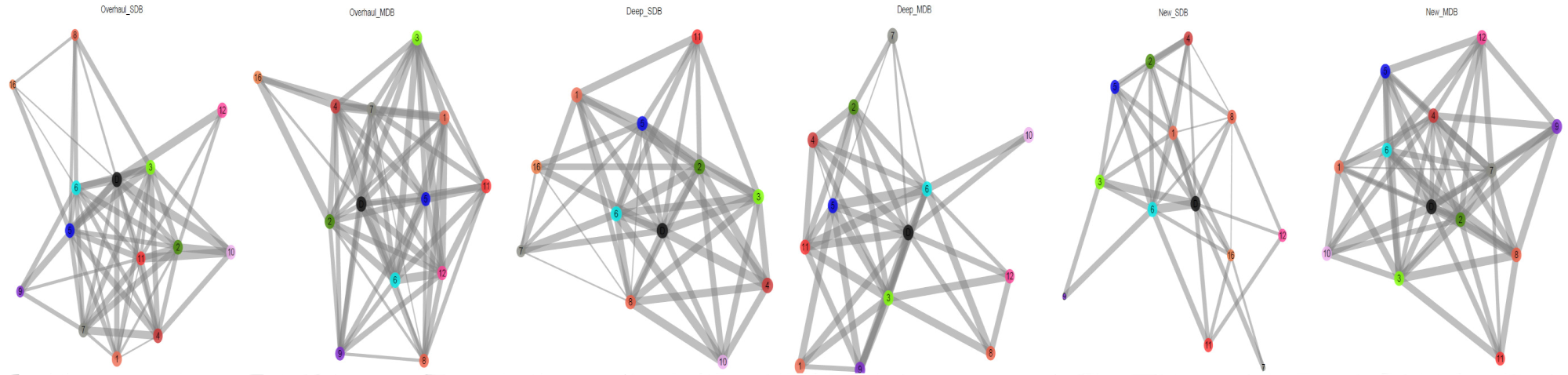

4.1.6. Belgium

When looking at retrofit or partial retrofit projects in Belgium, the stakeholder setup varies between SDBs and MDBs (

Table 9). For SDBs, the most powerful influencers in the technology selection are the demand-side actors, the facility managers (administrative) and the construction companies. For MDBs, on the other hand, the most influential actors are the demand-side actors, the engineers and the construction companies. When it comes to the level of communication, more streams of communication are taking place in SDBs—namely the demand-side actors (with 13), consultants, installers and public authorities (all 11) with a high level of communication among them. In MDBs, it is the engineers who have the highest number of links, with a high level of communication in each case.

For comprehensive retrofit projects, the stakeholder setup in the technology selection also varies between SDBs and MDBs. For SDBs, the key persuaders are the demand-side actors, the material or technology traders, the architects, the construction companies, the facility managers (administrative) and the engineers, whereas for MDBs it is mostly the installers and the demand-side actors. In terms of communication, it is the architects and construction companies that have the highest number of communication streams in SDBs, with a high level of communication. In MDBs, it is again the installers and the demand-side actors that have a key role in the exchange with other stakeholders.

For new constructions in SDBs, the stakeholders with the highest level of power are the demand-side actors and facility managers (both with 6), as well as the engineers (with 5). In terms of communication, it is a rare case in which the demand-side actors are not the ones with the highest number of interactions. In new constructions and SDBs in Belgium, it is the architects (11 links) and the installers that are the stakeholders with the highest level of communication. They are followed by demand-side actors, engineers and construction companies (all with 6 links). For MDBs, on the other hand, it is demand-side actors and engineers that have the strongest power, closely followed by facility managers (administrative). In terms of the information exchange, it is the demand-side actors and installers who have the highest and strongest exchanges. It is noteworthy how more and stronger interactions take place in this case than in the other cases in Belgium.

Similar to other countries, the demand side is again well represented in terms of power and communication. In addition, of importance in Belgium are the facility managers (administrative), construction companies and engineers (level of power), as well as the architects (level of communication). In retrofit projects and MDBs (both retrofits and comprehensive retrofits), the network of stakeholders is much less dense than in the other cases (i.e., less stakeholders involved and less level of communication among them).

4.1.7. The United Kingdom

For retrofit or partial retrofit projects in the United Kingdom (

Table 10), the stakeholder network varies between SDBs and MDBs. For SDBs, the most powerful influencers in the technology selection are the demand-side actors, the business associations or agencies and the technology or material traders. For MDBs, on the other hand, the most influential actors are the demand-side actors, the construction companies and the engineers. When it comes to communication, for SDBs as well as for MDBs the main course of communication seems to go through the demand-side actors (13 for SDBs, and 12 for MDBs).

For comprehensive retrofit projects, the stakeholder setup in the technology selection also varies between SDBs and MDBs. For SDBs, the key persuaders are the demand-side actors and the consultants. This contrasts with MDBs, where many groups are deemed to be powerful: the demand-side actors, technology suppliers, facility managers (technical and administrative), consultants and the public authorities (all with 6). In terms of communication for SDBs, the demand-side actors (with 11) have the highest number of streams with high level of communication, followed by the architects, installers and banks (all with 10). For MDBs, it is the demand-side actors, the construction companies and the engineers that have a key role in the exchange with other stakeholders.

For new constructions and SDBs, the stakeholders with the highest level of power are the demand-side actors, followed by the construction companies and the architects. In terms of communication, it is again the demand-side actors and the construction companies that show a key connection to other stakeholders involved in the decision-making process. On the other hand, for new constructions and MDBs, demand-side actors have the strongest power, closely followed by facility managers (administrative). When it comes to the information exchange, demand-side actors and architects are the strongest.

In the UK, the demand side actors are key in the information exchange, whereas in terms of power there are other key stakeholders involved, e.g., the material and technology traders or the consultants. When comparing results across the various cases, retrofit projects in MDBs and comprehensive retrofits in SDBs have the highest number of stakeholders involved and the least level of communication.

4.1.8. The Netherlands

For retrofit projects and SDBs in the Netherlands (

Table 11), the actors perceived to be most powerful are the demand-side actors and the facility managers (technical) (with 6). In terms of the level of communication, it is the demand-side actors (12), the architects, the consultants and the construction companies that have the highest number and frequency of connections (10), along with the business associations (11). For MDBs, many stakeholders are perceived to have a high level of power, with demand-side actors being identified as having the strongest influence in the technology choice, along with the architects, the installers and the bank authorities (all with 6). In terms of communication, it is again the demand-side actors that have the highest level (11 links), followed by the construction companies and the public authorities (both with 10 links).

For comprehensive retrofits and SDBs, the highest level of power goes to the demand-side actors (6), followed by the installers and the architects (5). In terms of communication, demand-side actors have the highest number of communications (11 links), along with construction companies (10 links). As is the case for retrofit projects, for comprehensive retrofit projects in MDBs, many stakeholders are present with a high level of power in the decision, with the architects dominating, along with the demand-side actors. As for the level of communication, demand-side actors have the strongest presence (13), along with architects (12) and public authorities (11).

For new constructions and SDBs, there are many stakeholders with a high level of power and high level of communication. The most powerful actors are perceived to be the demand-side actors, installers and architects (all with 6). The stakeholders with the highest level of communication in this process are again the demand-side actors (13 links), followed by the construction companies and the installers (12 links). In terms of MDBs, the highest level of power is assigned to demand-side actors, the construction companies and the architects (all with 5.5). In terms of communication, the demand-side actors again have the largest and most frequent number of exchanges with other stakeholders, along with the public authorities and technology and material traders (11 links).

Therefore, the general picture in the Netherlands is that there are many strong interactions, with demand-side actors, architects and engineers being crucial in this process. In contrast to the UK, when comparing results across the various cases, retrofit projects in MDBs and comprehensive retrofits in SDBs have the lowest number of stakeholders involved, with the least intense channels of communication.