Review of the Energy Consumption and Production Structure of China’s Steel Industry: Current Situation and Future Development

Abstract

1. Introduction

2. Development and Present Situation of China’s Steel Industry

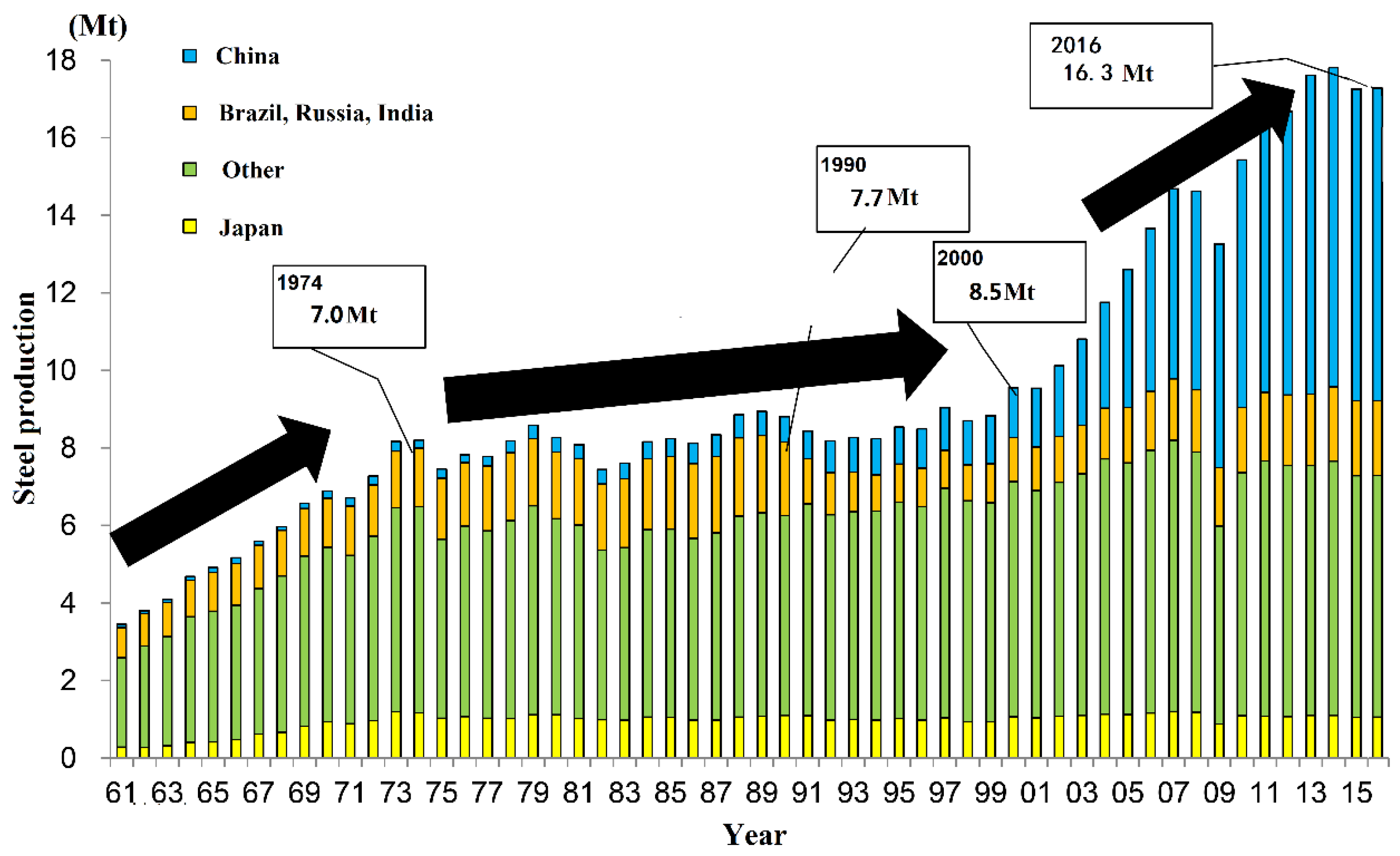

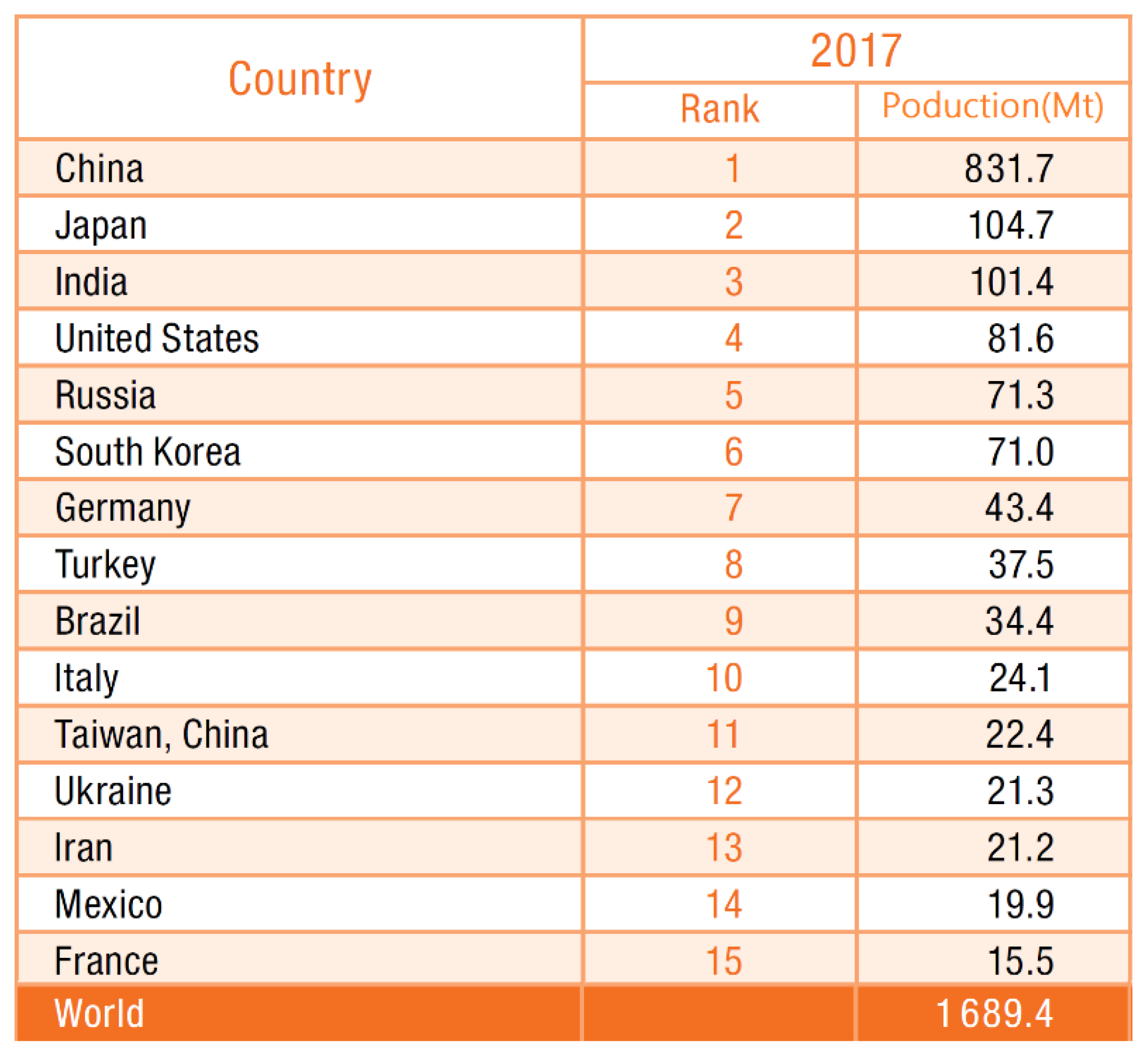

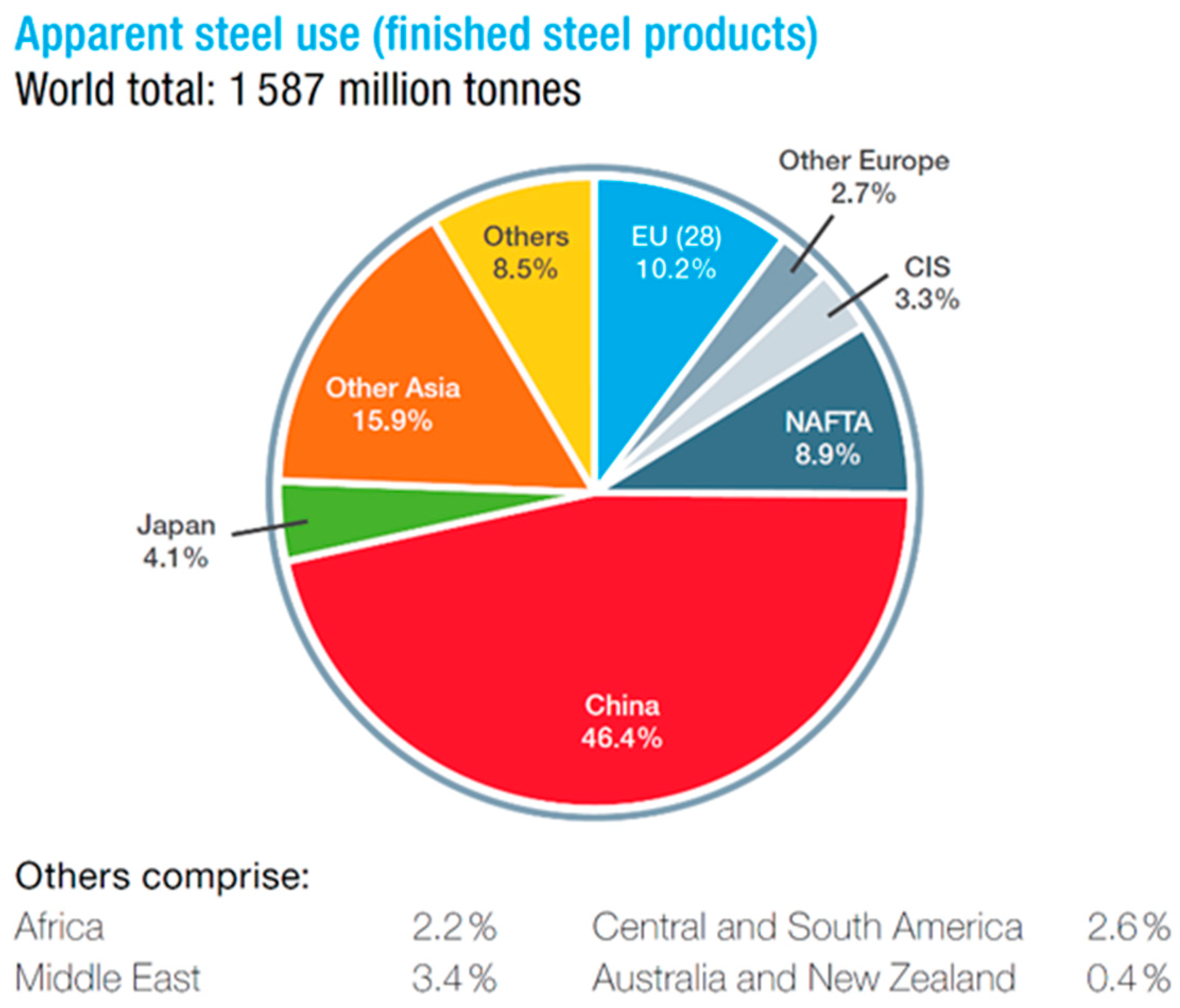

2.1. Steel Production and Consumption

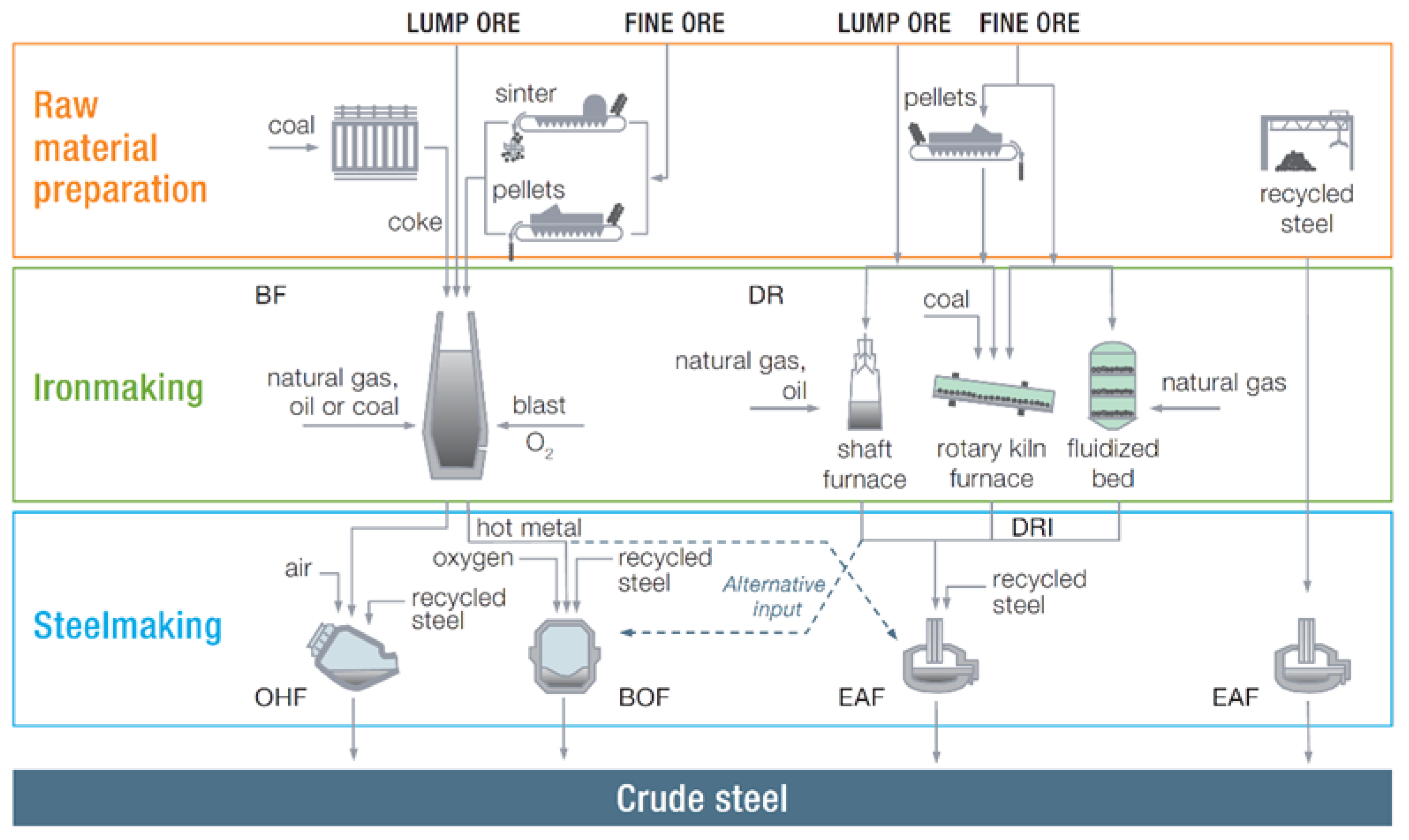

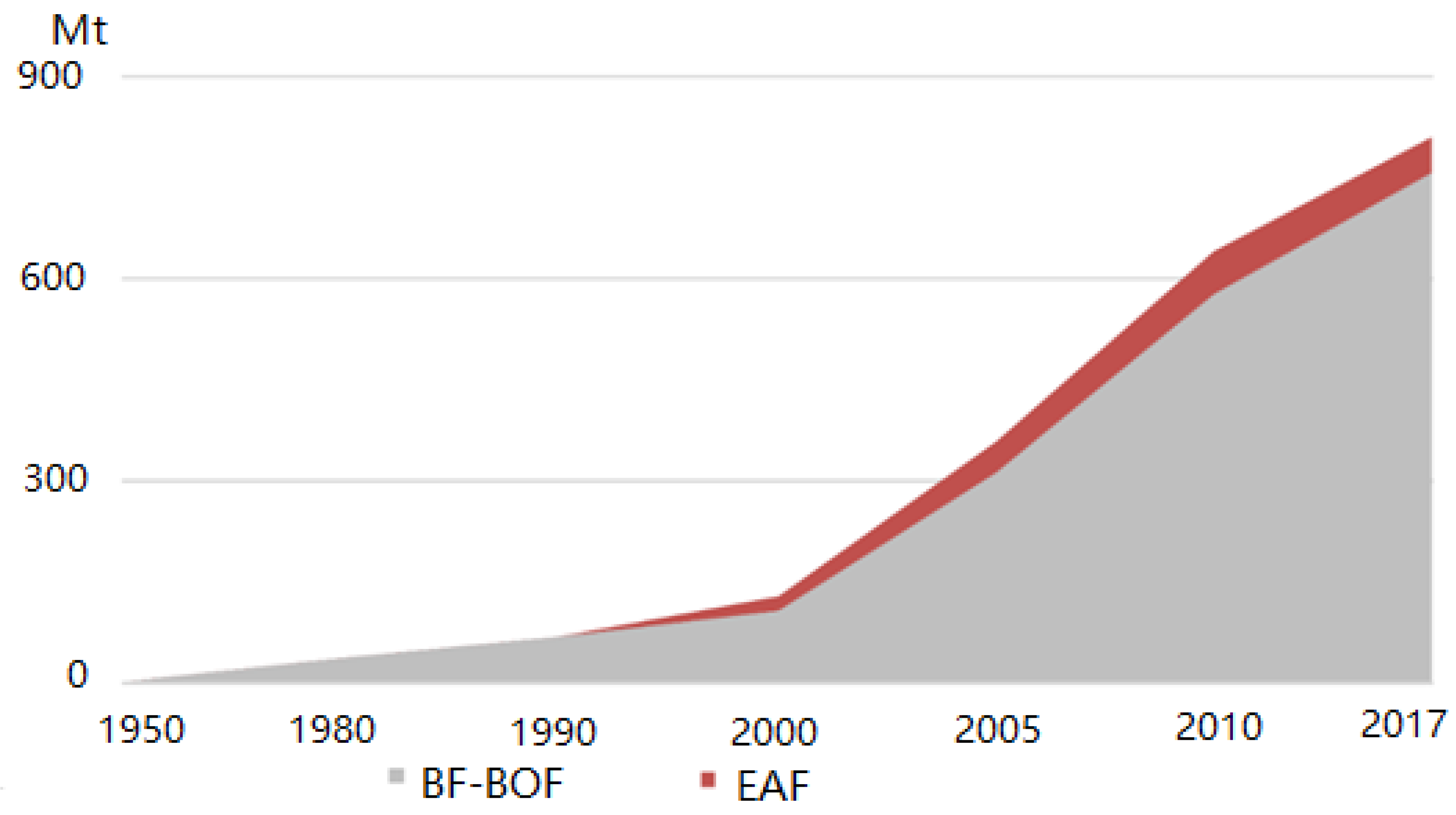

2.2. Production Route

2.3. Production Technology Development

2.3.1. Implementation Rates of Coke Dry Quenching and Top Pressure Recovery Turbine Technologies

2.3.2. By-Product Gas Recovery and Utilization

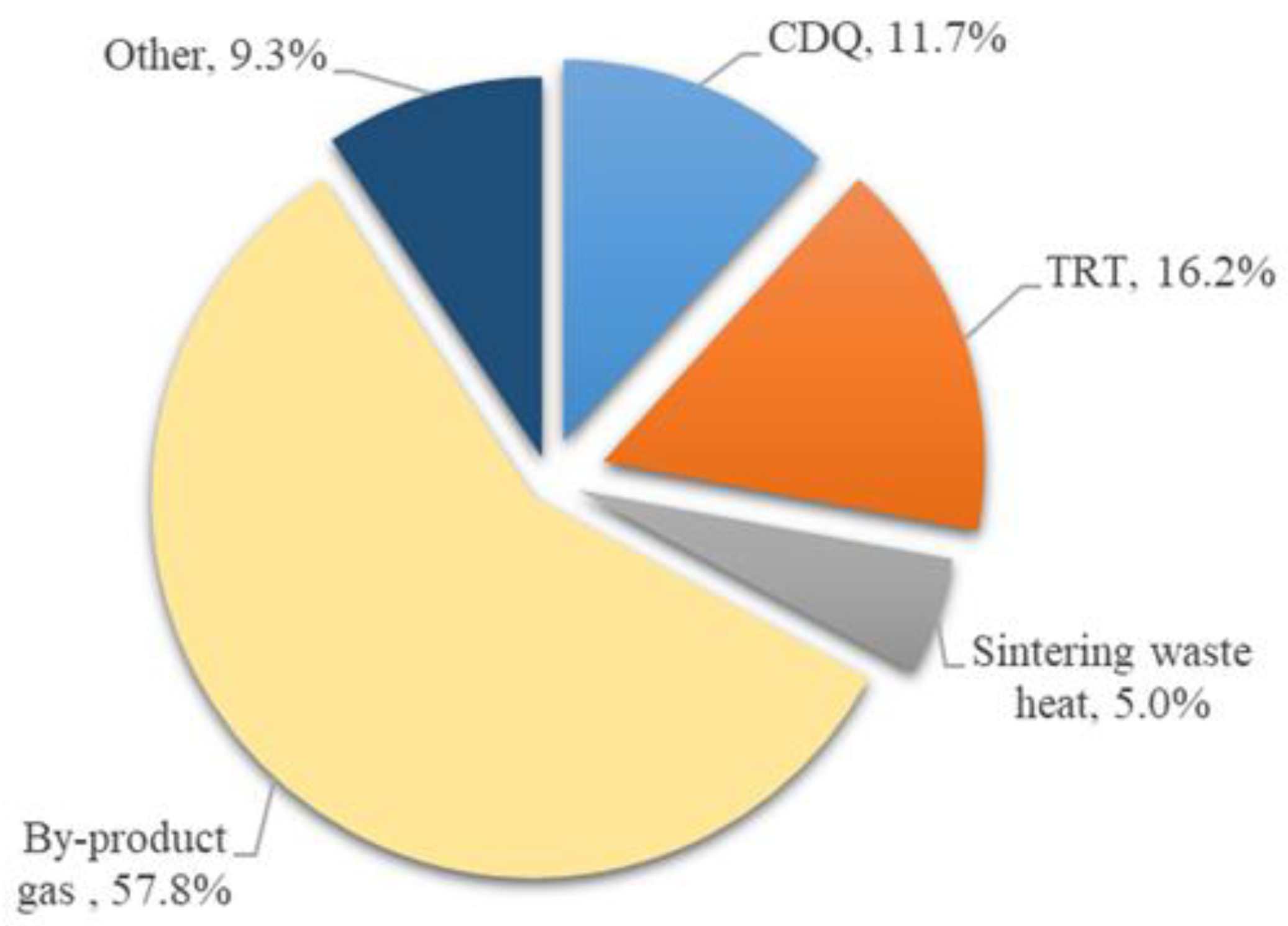

2.3.3. Power Generation from Secondary Energy

2.4. Energy Consumption

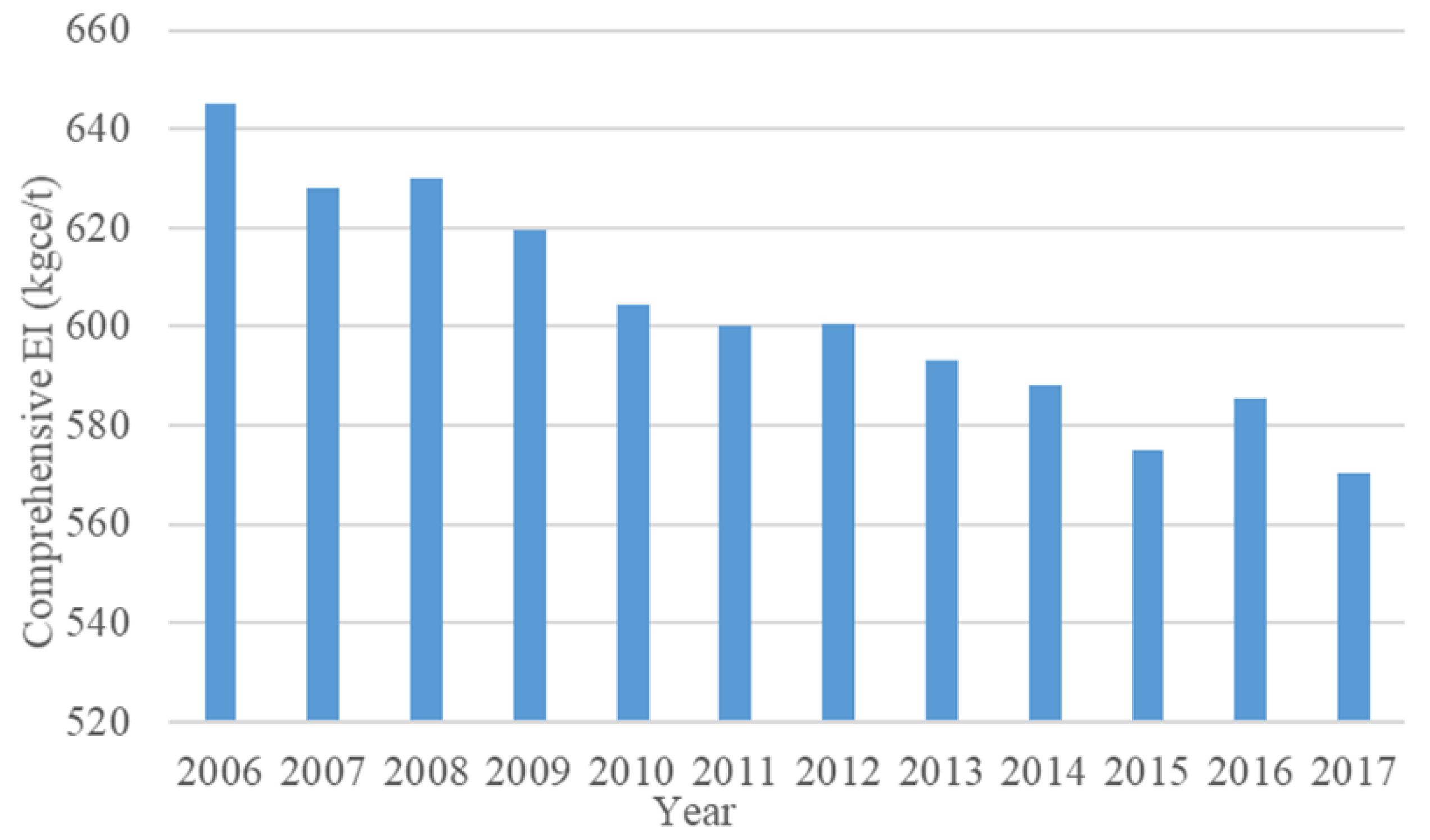

2.4.1. Overall Energy Consumption

2.4.2. EI of the Production Process

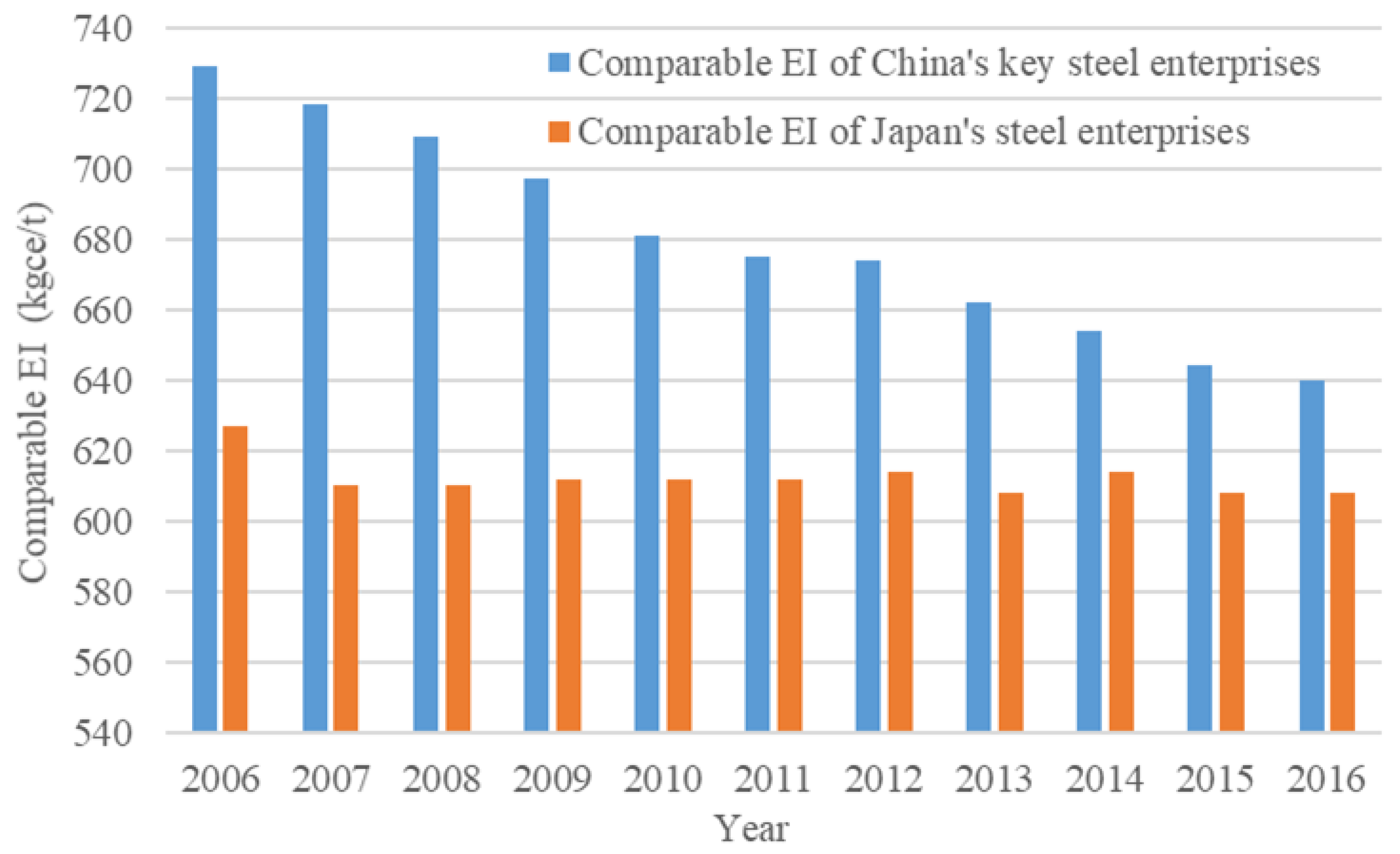

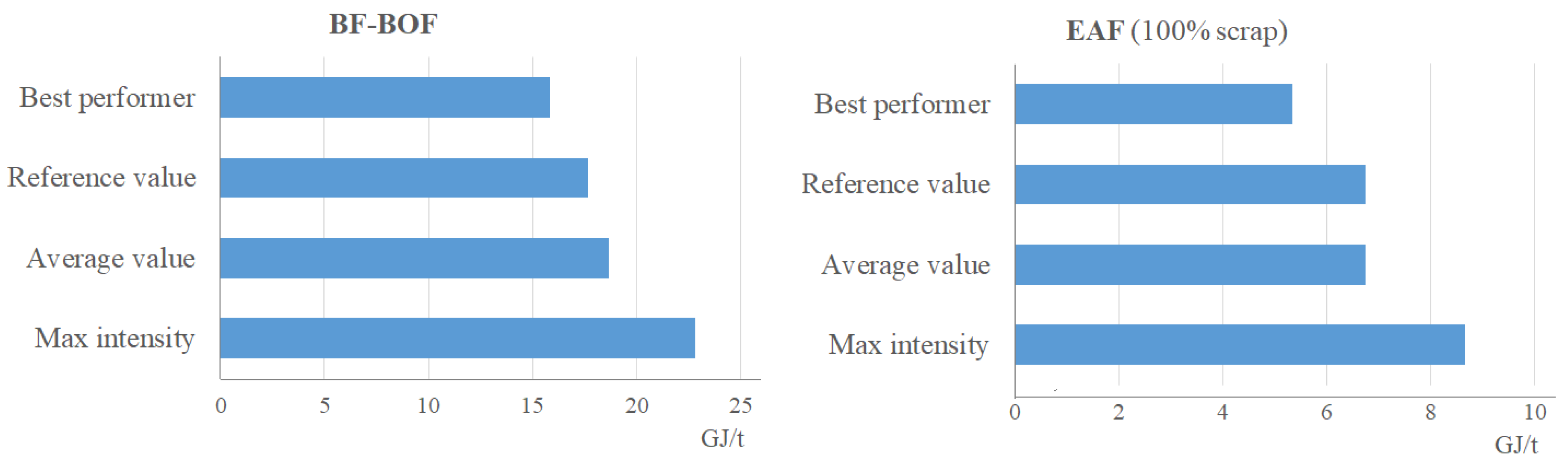

2.4.3. Comparison of EIs between Steel Industries in China and the World

2.5. CO2 Emissions

3. Comparison of Steel Industries between China and the World

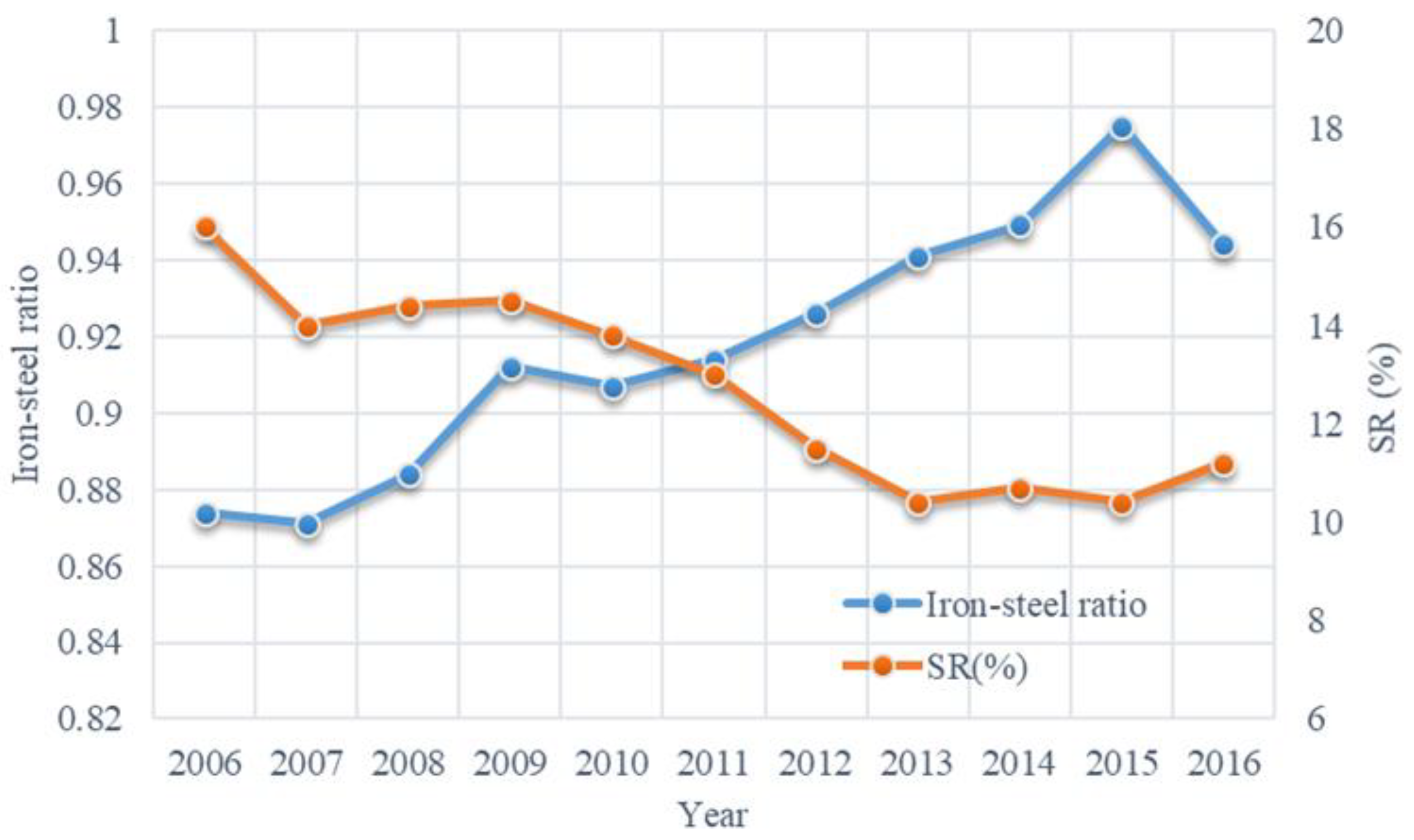

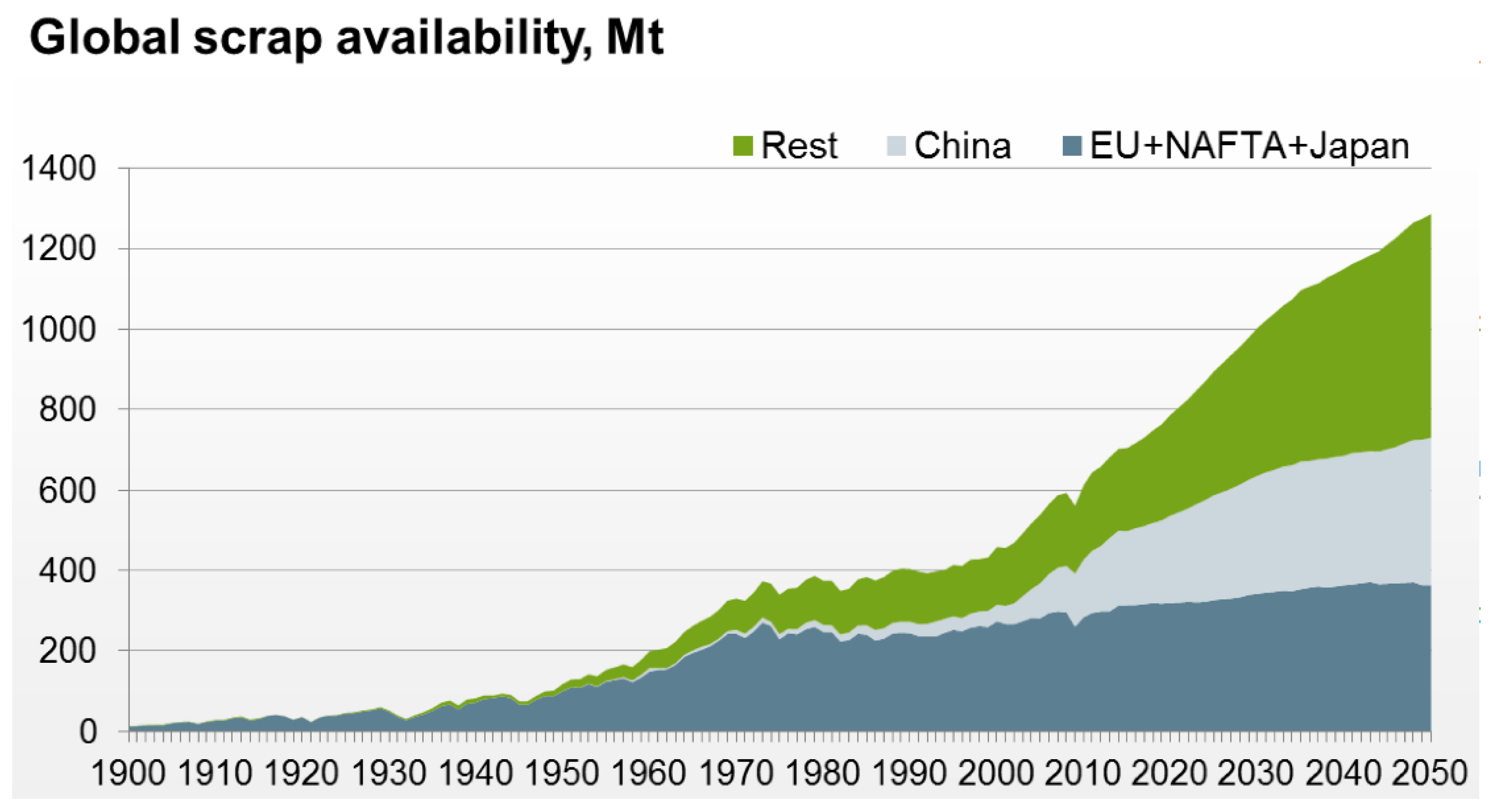

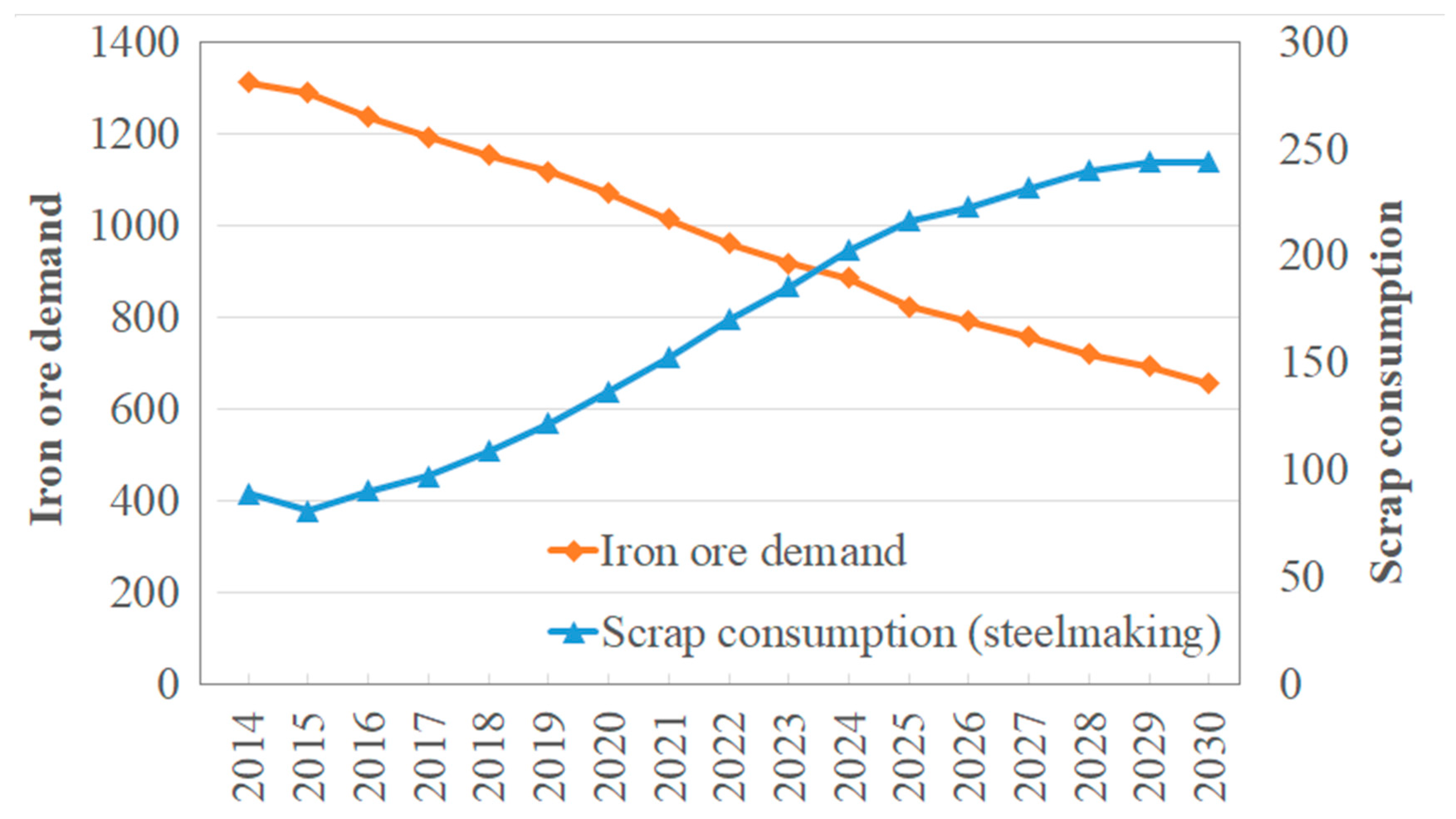

3.1. Difference in Scrap Ratio

3.2. Differences in Production Structure

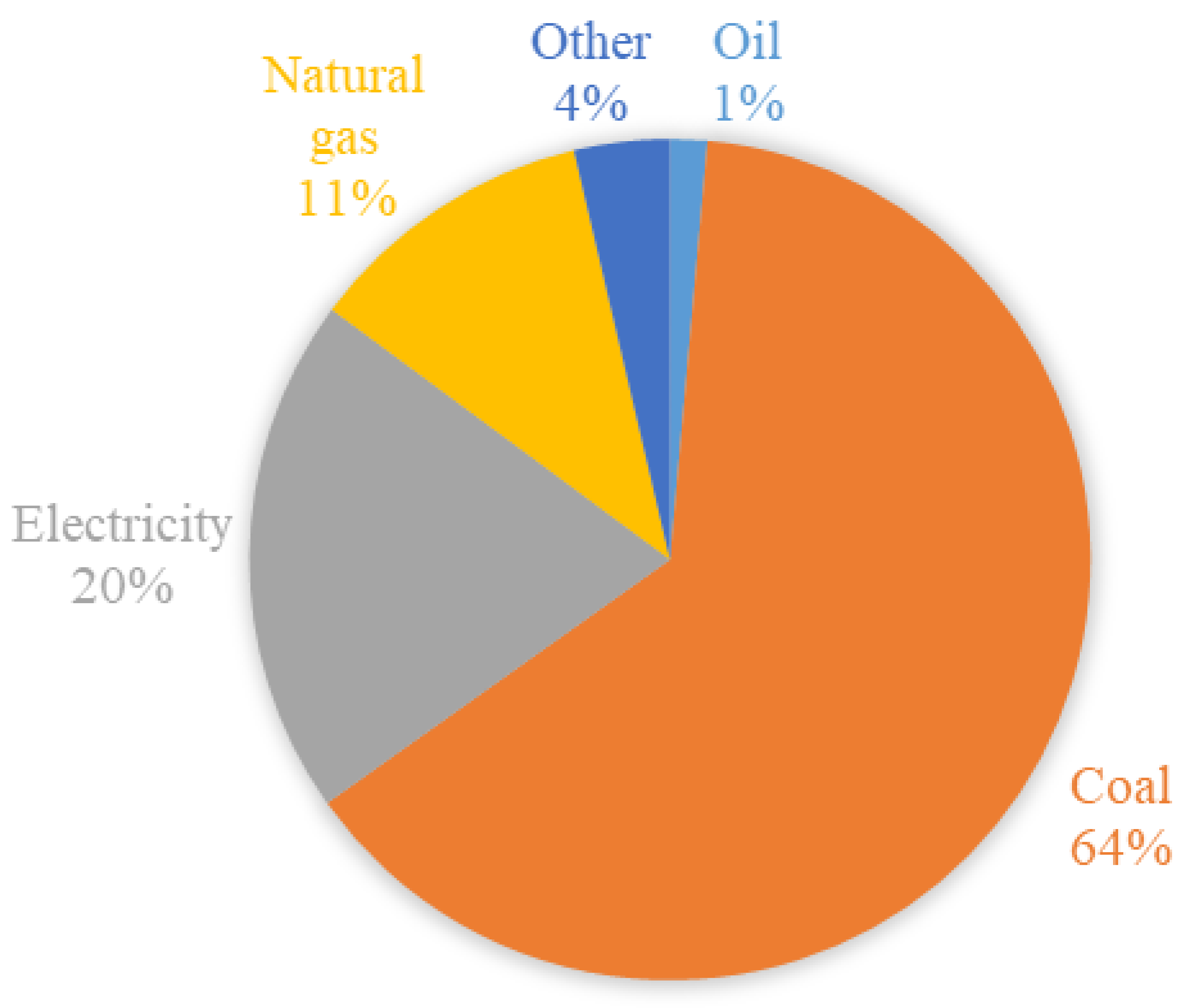

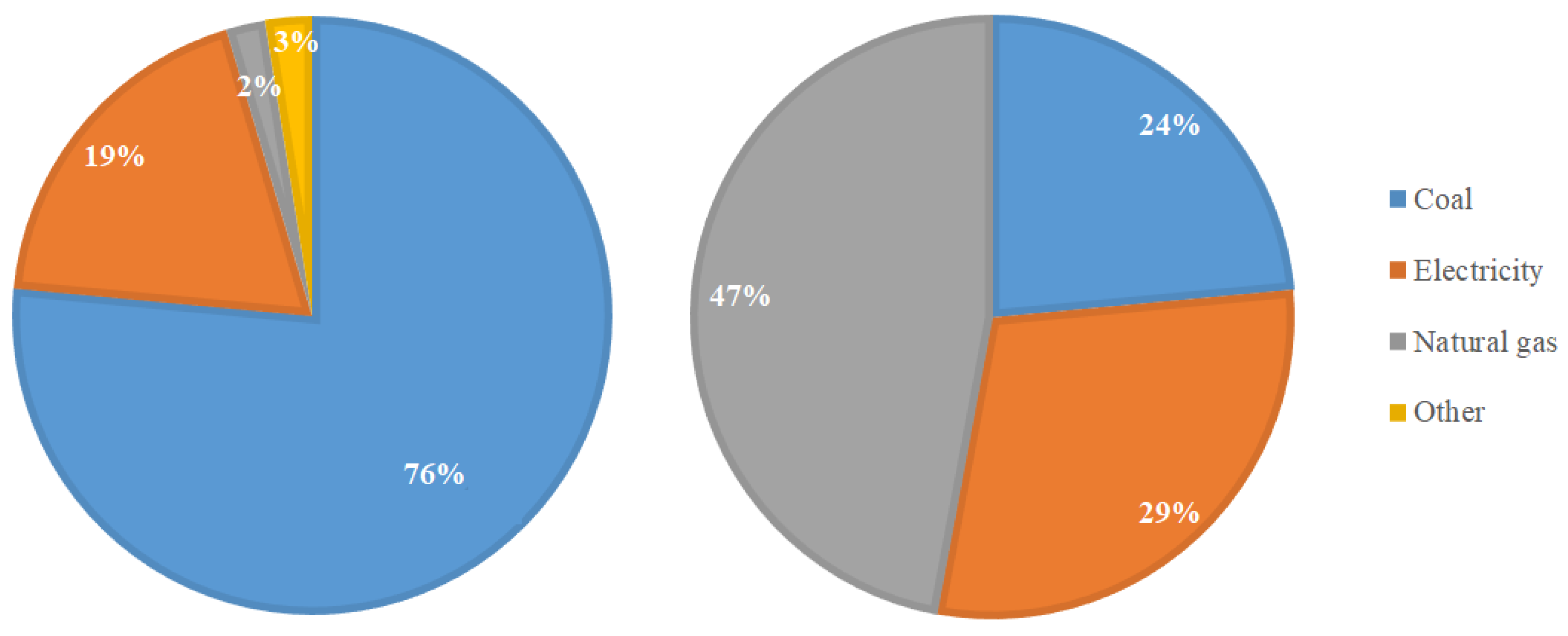

3.3. Differences in Energy Structure

3.4. Differences in Industrial Concentration

4. Development Directions for Energy Savings and Emission Reduction in China’s Steel Industry

4.1. Eliminating Dackward Production Capacity

4.2. Research and Promotion of Energy-Saving and Emission-Reduction Technologies

4.3. Production Structure Transformation

5. Results and Discussion

5.1. Conclusions

5.2. Policy Implications

5.2.1. Scientifically and Rationally Elimination of Backward Production Capacity

5.2.2. Improvement of the Production Technology Level

5.2.3. Normalization of the Scrap Steel Market

Author Contributions

Funding

Conflicts of Interest

References

- Quadera, M.; Ahmed, S.; Ghazillaa, R.; Ahmed, S.; Dahari, M. A comprehensive review on energy efficient CO2 breakthrough technologies for sustainable green iron and steel manufacturing. Renew. Sustain. Energy Rev. 2015, 50, 594–614. [Google Scholar] [CrossRef]

- Mousa, E.; Wang, C.; Riesbeck, J.; Larsson, M. Biomass applications in iron and steel industry: An overview of challenges and opportunities. Renew. Sustain. Energy Rev. 2016, 65, 1247–1266. [Google Scholar] [CrossRef]

- World Steel Association. Steel Statistics Yearbook 2018; World Steel Association: Belgium, Brussels, 2019. [Google Scholar]

- International Energy Agency (IEA). Energy Balance Flows 2015. Available online: http://www.iea.org/Sankey/index.html (accessed on 11 January 2020).

- Zhang, Q.; Xu, J.; Wang, Y.; Hasanbeigi, A.; Zhang, W.; Lu, H.; Arens, M. Comprehensive assessment of energy conservation and CO2 emissions mitigation in China’s iron and steel industry based on dynamic material flows. Appl. Energy 2018, 209, 251–265. [Google Scholar] [CrossRef]

- Liu, H.; Fu, J.; Liu, S.; Xie, X.; Yang, X. Calculation methods and application of carbon dioxide emission during steel-making process. Iron Steel 2016, 51, 74–82. [Google Scholar]

- World Steel Association. Statistics. 2018. Available online: https://www.worldsteel.org/steel-by-topic/statistics.html (accessed on 11 January 2020).

- National Bureau of Statistics of China. China Energy Statistics Yearbook 2016–2017; China Statistics Press: Beijing, China, 2018. [Google Scholar]

- Tan, X.; Li, H.; Guo, J.; Gu, B.; Zeng, Y. Energy-saving and emission-reduction technology selection and CO2 emission reduction potential of China’s iron and steel industry under energy substitution policy. J. Clean. Prod. 2019, 222, 823–834. [Google Scholar] [CrossRef]

- Wang, X.; Wen, X.; Xie, C. An evaluation of technical progress and energy rebound effects in China’s iron & steel industry. Energy Policy 2018, 123, 259–265. [Google Scholar]

- Hasanbeigi, A.; Price, L.; Zhang, C.; Nathaniel, A.; Li, X.; Shangguan, F. Comparison of iron and steel production energy use and energy intensity in China and the U.S. J. Clean. Prod. 2014, 65, 108–119. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, L. Cost of energy saving and CO2 emissions reduction in China’s iron and steel sector. Appl. Energy 2014, 130, 603–616. [Google Scholar] [CrossRef]

- Zhang, S.; Worrell, E.; Crijns, G.; Wagner, F.; Cofala, J. Co-benefits of energy efficiency improvement and air pollution abatement in the Chinese iron and steel industry. Energy 2014, 78, 333–345. [Google Scholar] [CrossRef]

- Wen, Z.; Meng, F.; Chen, M. Estimates of the potential for energy conservation and CO2 emissions mitigation based on Asian-Pacific Integrated Model (AIM): The case of the iron and steel industry in China. J. Clean. Prod. 2014, 65, 120–130. [Google Scholar] [CrossRef]

- He, F.; Zhang, Q.; Lei, J.; Fu, W.; Xu, X. Energy efficiency and productivity change of China’s iron and steel industry: Accounting for undesirable outputs. Energy Policy 2013, 54, 204–213. [Google Scholar] [CrossRef]

- World Steel Association. World Steel in Figures 2018; World Steel Association: Belgium, Brussels, 2019. [Google Scholar]

- World Steel Association. Sustainable Steel at the Core of a Green Economy; World Steel Association: Belgium, Brussels, 2012. [Google Scholar]

- International Energy Agency. Energy Technology Perspectives 2012; International Energy Agency: Paris, France, 2012. [Google Scholar]

- The Editorial Board of China Steel Yearbook. China Steel Yearbook 2018; Metallurgical Industry Press: Beijing, China, 2019. [Google Scholar]

- Wang, W. Energy consumption and energy saving potential analysis of China’s iron and steel industry. Metall. Manag. 2017, 8, 50–58. [Google Scholar]

- Ding, Y.; Deming, S. High-efficiency utilization of waste heat at fully integrated steel plant. Iron Steel 2011, 46, 88–98. [Google Scholar]

- Zhang, G. Research and Application of Index System for Evaluating Energy Consumption in Iron and Steel Enterprises; Northeastern University: Shenyang, China, 2013. [Google Scholar]

- China Iron and Steel Industry Association. Energy-Saving and Emission-Reduction. 2018. Available online: http://www.chinaisa.org.cn/gxportal/login.jsp (accessed on 11 January 2020).

- He, K.; Wang, L.; Zhu, H.; Ding, Y. Energy-Saving Potential of China’s Steel Industry According to Its Development Plan. Energies 2018, 11, 948. [Google Scholar] [CrossRef]

- Hao, Y. Study on Machanism and Model of Circular Economy in China’s Iron and Steel Industry. Ph.D. Thesis, University of Science and Technology, Beijing, China, 2014. [Google Scholar]

- National Bureau of Statistics. Handbook of Energy Statistics; China Statistics Press: Beijing, China, 2010. [Google Scholar]

- The Research Institute of Innovative Technology for the Earth. Estimated Energy Unit Consumption in 2010. Available online: https://www.rite.or.jp/system/en/global-warming-ouyou/download-data/E-Comparison_EnergyEfficiency2010steel.pdf (accessed on 11 January 2020).

- The Japanese Iron and Steel Federation. Activities of Japanese steel industry to Combat Global Warming. 2017. Available online: http://www.jisf.or.jp/en/activity/climate/documents/ActivitiesofJapanesesteelindustrytoCombatGlobalWarming.pdf (accessed on 11 January 2020).

- Cai, J. Air consumption and waste gas emission of steel industry. Iron Steel 2019, 54, 7–14. [Google Scholar]

- Wang, H.; Zhang, J.; Wang, G.; Jiang, X. Analysis of carbon emission reduction before ironmaking. China Metall. 2018, 28, 1–6. [Google Scholar]

- Wang, P.; Jiang, Z.; Zhang, X.; Geng, X.; Hao, S. Long-term scenario forecast of production routes, energy consumption and emissions for Chinese steel industry. J. Univ. Sci. Technol. Beijing 2014, 36, 1683–1693. [Google Scholar]

- Bureau of International Recycling. World steel recycling in Figure 2017; Bureau of International Recycling: Belgium, Brussels, 2018. [Google Scholar]

- The Editorial Board of China Steel Yearbook. China Steel Yearbook 2010–2017; Metallurgical Industry Press: Beijing, China, 2018. [Google Scholar]

- International Energy Agency (IEA). Energy Use in the Steel Industry. Available online: https://www.iea.org/media/workshops/2014/industryreviewworkshopoct/8_Session2_B_WorldSteel_231014.pdf? (accessed on 11 January 2020).

- United States Environment Protection Agency (EPA). Available and Emerging Technologies for Reducing Greenhouse Gas Emissions from the Iron and Steel Industry; EPA: Research Triangle Park, NC, USA, 2012.

- Zang, Y.; Liu, W.; Zhang, J. Accelerating the utilization of scrap to promote energy-saving and emission-reduction of China’s iron and steel industry. Res. Iron Steel 2010, 38, 43–46. [Google Scholar]

- World Steel Association. Global Steel Industry Outlook, Challenges and Opportunities. 2017. Available online: https://www.worldsteel.org/en/dam/jcr:d9e6a3df-ff19-47ff-9e8f-f8c136429fc4/International+Steel+Industry+and+Sector+Relations+Conference+Istanbul_170420.pdf.? (accessed on 11 January 2020).

- Sun, H.; Li, W. Natural Gas Play an Important Role in the Energy Conservation and Emissions Reduction. Pet. Plan. Eng. 2009, 20, 7–9. [Google Scholar]

- Zhang, C. Potential Analysis and Synergy Approaches of Energy Saving and Pollution Reduction: Case in Iron Industry; Tsinghua University: Beijing, China, 2015. [Google Scholar]

- Editorial Department of Metallurgical Management. Ranking of crude steel production of global steel enterprises in 2017. Metall. Manag. 2018, 6, 4–15. [Google Scholar]

- Lin, B.; Wu, Y.; Zhang, L. Estimates of the potential for energy conservation in the Chinese steel industry. Energy Policy 2011, 39, 3680–3689. [Google Scholar] [CrossRef]

- Lukas, B. Overcapacity in Steel-China’s Role in a Global Problem 2016; Alliance for American Manufacturing: Washington, DC, USA, 2016. [Google Scholar]

- Ministry of Industry and Information Technology of the People’s Republic of China. Steel Industry Standard Conditions 2015. Available online: http://www.miit.gov.cn/n1146285/n1146352/n3054355/n3057569/n3057577/c3571380/content.html (accessed on 11 January 2020).

- Research group of China Iron and Steel Industry Association. Supply Side Structural Reform of Iron and Steel Industry; China Iron and Steel Industry Association: Beijing, China, 2018. [Google Scholar]

| Country | BF–BOF | EAF | Open-Hearth |

|---|---|---|---|

| (%) | (%) | (%) | |

| China | 90.7 | 9.3 | - |

| Japan | 75.8 | 24.2 | - |

| U.S. | 31.6 | 68.4 | - |

| India | 44.2 | 55.8 | - |

| Russia | 66.9 | 30.7 | 2.4 |

| South Korea | 67.1 | 32.9 | - |

| Germany | 70.0 | 30.0 | - |

| Turkey | 30.8 | 69.2 | - |

| Brazil | 77.6 | 21.0 | - |

| Ukraine | 71.8 | 6.8 | 21.5 |

| World | 71.6 | 28.0 | 0.4 |

| Year | CDQ | TRT |

|---|---|---|

| 2000 | 12% | 14% |

| 2005 | 26% | 74% |

| 2010 | 85% | 95% |

| 2015 | 90% | 99% |

| Year | Utilization Rate of BF Gas (%) | Utilization Rate of Coke Oven Gas (%) | Converter Gas Recovery (m3/t) |

|---|---|---|---|

| 2016 | 98.26 | 98.16 | 115 |

| 2017 | 98.34 | 98.77 | 114 |

| Year | Sintering | Pelletizing | Coking | BF | Converter | EAF | Processing |

|---|---|---|---|---|---|---|---|

| 2006 | 55.61 | 33.08 | 123.11 | 433.08 | 9.09 | 81.26 | 64.98 |

| 2007 | 55.21 | 30.12 | 121.72 | 426.84 | 6.03 | 81.34 | 63.08 |

| 2008 | 55.49 | 30.49 | 119.97 | 427.72 | 5.74 | 81.52 | 59.58 |

| 2009 | 54.52 | 29.96 | 113.97 | 410.55 | 2.78 | 73.44 | 57.66 |

| 2010 | 52.65 | 29.39 | 105.89 | 407.76 | −0.16 | 73.98 | 61.69 |

| 2011 | 54.34 | 29.60 | 106.65 | 404.07 | −3.21 | 69.00 | 60.93 |

| 2012 | 50.60 | 28.75 | 102.72 | 401.82 | −6.08 | 67.53 | 57.31 |

| 2013 | 49.76 | 28.58 | 99.87 | 399.88 | −7.81 | 62.38 | 60.32 |

| 2014 | 49.48 | 27.12 | 98.15 | 388.70 | −8.73 | 66.06 | 63.30 |

| 2015 | 48.53 | 26.72 | 99.66 | 384.43 | −11.89 | 60.38 | 63.44 |

| 2016 | 47.78 | 26.16 | 97.46 | 387.75 | −12.24 | 65.90 | 61.78 |

| 2017 | 48.49 | 26.17 | 99.67 | 391.37 | −14.26 | 60.22 | 61.73 |

| Types of Enterprises | Coking | Sintering | Blast Furnace | Converter | Common Steel EAF | Special Steel EAF |

|---|---|---|---|---|---|---|

| New construction and transformation enterprises | ≤122 (Top loading) | ≤50 | ≤370 | ≤−25 | ≤90 | ≤159 |

| ≤127 (Tamping) | ||||||

| Existing enterprises | ≤150 (Top loading) | ≤55 | ≤435 | ≤−10 | ≤92 | ≤171 |

| ≤155 (Tamping) | ≤485 (Vanadic titanomagnetite) |

| Parameter | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| Capacity (Mt) | 1151 | 1134 | 1069 | 1019 |

| Capacity reduction (Mt) | 31.1 | 17.1 | 65 | 50 |

| Capacity utilization rate (%) | 71.5 | 70.9 | 75.6 | 86.65 |

| No. | Technology | Energy Saving Effect | Development Plan | Coal Saving (Mtce) |

|---|---|---|---|---|

| 1 | High temperature and pressure CDQ | 40kgce/t coke | add more than 30 new equipments, involving 57 Mt of coke production capacity | 2.28 |

| 2 | Waste heat recovery of coke oven riser | 90 kg steam (0.6 MPa)/t coke (equivalent to 9 kgce/t) | add more than 30 new waste heat recovery equipments, involving 57 Mt of coke production capacity | 0.51 |

| 3 | Coal moisture control | 6 kgce/t coke | add more than 10 new equipments, involving 20 Mt of coke production capacity | 0.12 |

| 4 | Recycling of waste heat from sintering | 4 kgce/t sinter | about 40 new units, involving 80 Mt of sintering production capacity | 0.32 |

| 5 | Waste heat recovery of slag washing water | 40 ktce/heating cycle (1 million m2 of heating area) | add more than 7000 m2 heating area, of which 2300 m2 have been added in 2016 | 2.80 |

| 6 | Comprehensive utilization of waste heat from converter flue gas- pure dry dedusting | 8 kgce/t steel | applied to 200 converters, involving 300 Mt of steel production | 2.40 |

| 7 | High parameter gas power generator unit | thermal efficiency increased by over 5%, 40 ktce compared with medium temperature and medium pressure unit (enterprises with steel production of 10 Mt/year) | applied to 135/65/54 MW high parameter gas generator units in 30 enterprises (steel production over 5 Mt/year), involving 250 Mt of steel production | 1.00 |

| Total | 9.43 | |||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, K.; Wang, L.; Li, X. Review of the Energy Consumption and Production Structure of China’s Steel Industry: Current Situation and Future Development. Metals 2020, 10, 302. https://doi.org/10.3390/met10030302

He K, Wang L, Li X. Review of the Energy Consumption and Production Structure of China’s Steel Industry: Current Situation and Future Development. Metals. 2020; 10(3):302. https://doi.org/10.3390/met10030302

Chicago/Turabian StyleHe, Kun, Li Wang, and Xiaoyan Li. 2020. "Review of the Energy Consumption and Production Structure of China’s Steel Industry: Current Situation and Future Development" Metals 10, no. 3: 302. https://doi.org/10.3390/met10030302

APA StyleHe, K., Wang, L., & Li, X. (2020). Review of the Energy Consumption and Production Structure of China’s Steel Industry: Current Situation and Future Development. Metals, 10(3), 302. https://doi.org/10.3390/met10030302