A Probabilistic Block Economic Value Calculation Method for Use in Stope Designs under Uncertainty

Abstract

:1. Introduction

2. Sources of Uncertainty in Mining and Associated Risk

- (1)

- Economic loss due to either foregone extra profits which could be gained during periods of favourable market conditions or losses because of unexpected weak markets [19].

- (2)

- (3)

- Changes being made to mine designs later in the life of mine (LOM) which may require substantial capital, negatively affecting the NPV of the project [22].

- (4)

- Cost overruns and failure to complete projects in time because the initial estimates would not have incorporated uncertainty which is intrinsic to mining projects.

- (5)

- Achievement of below-target, behind-schedule or beyond-budget outcomes [23].

2.1. Geological Uncertainty

2.2. Economic Uncertainty

3. Research Methodology or Steps

3.1. Conversion of the Geological Block Model into an Economic Block Model

- (1)

- Density of rock was based on a mean value of 3 t/m3.

- (2)

- Mining and processing costs were assumed to be $50/t and $30/t, respectively.

- (3)

- Average gold price was US$1520/oz.

- (4)

- Average mineral processing recovery rate was 84%.

- is the economic value of block bij at time t,

- is the gold grade of block bij,

- is the recovery rate of processing block bij,

- is the gold price at time, t,

- = is the cost per tonne of mining block bij,

- = is the cost per tonne of processing block bij,

- is the tonnage of block bij,

- is the dimension of block bij in the x direction,

- is the dimension of block bij in the y direction,

- is the dimension of block bij in the z direction,

- is the density of block bij.

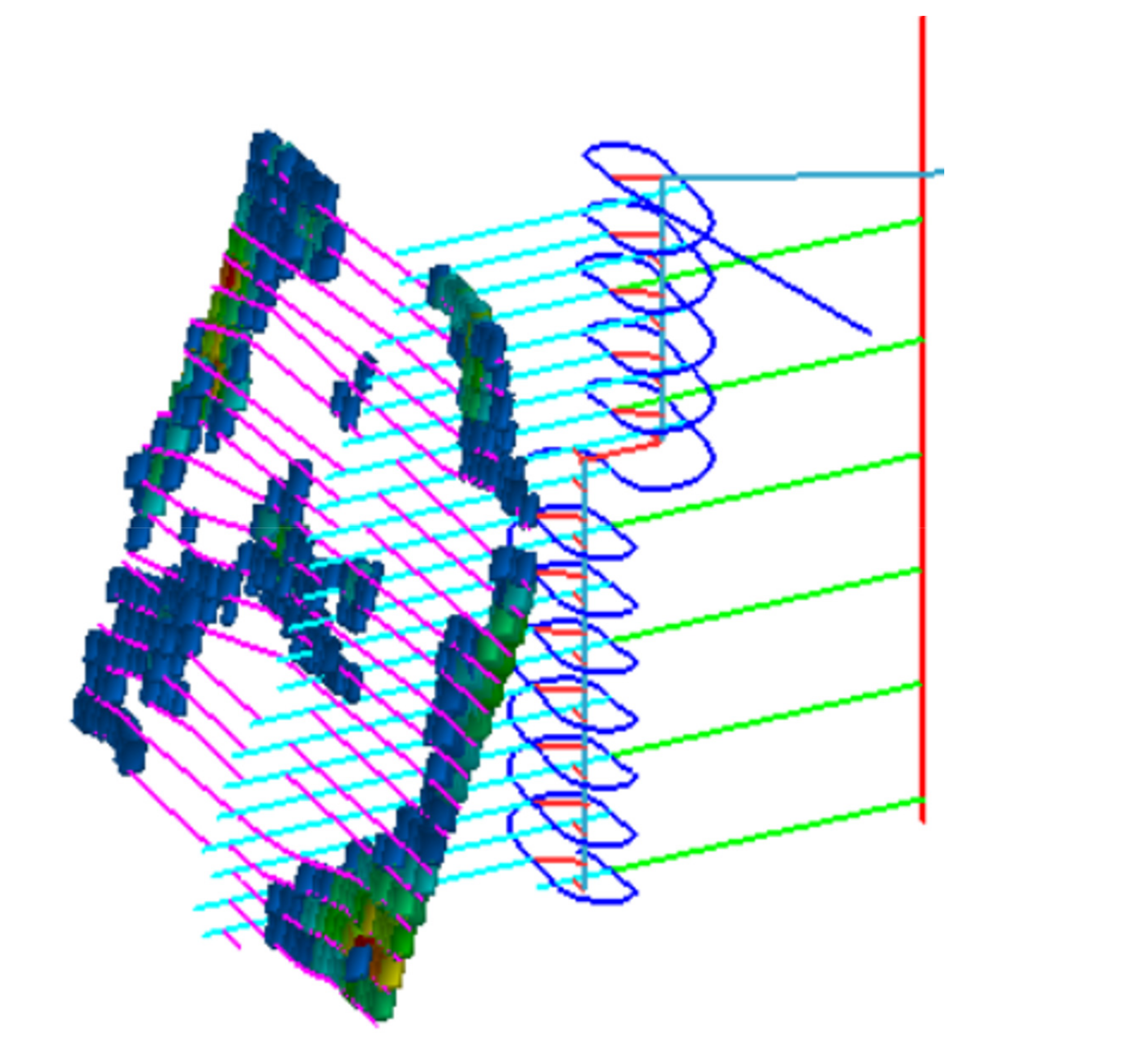

3.2. Simulation of Block Economic Values

4. Results and Discussion

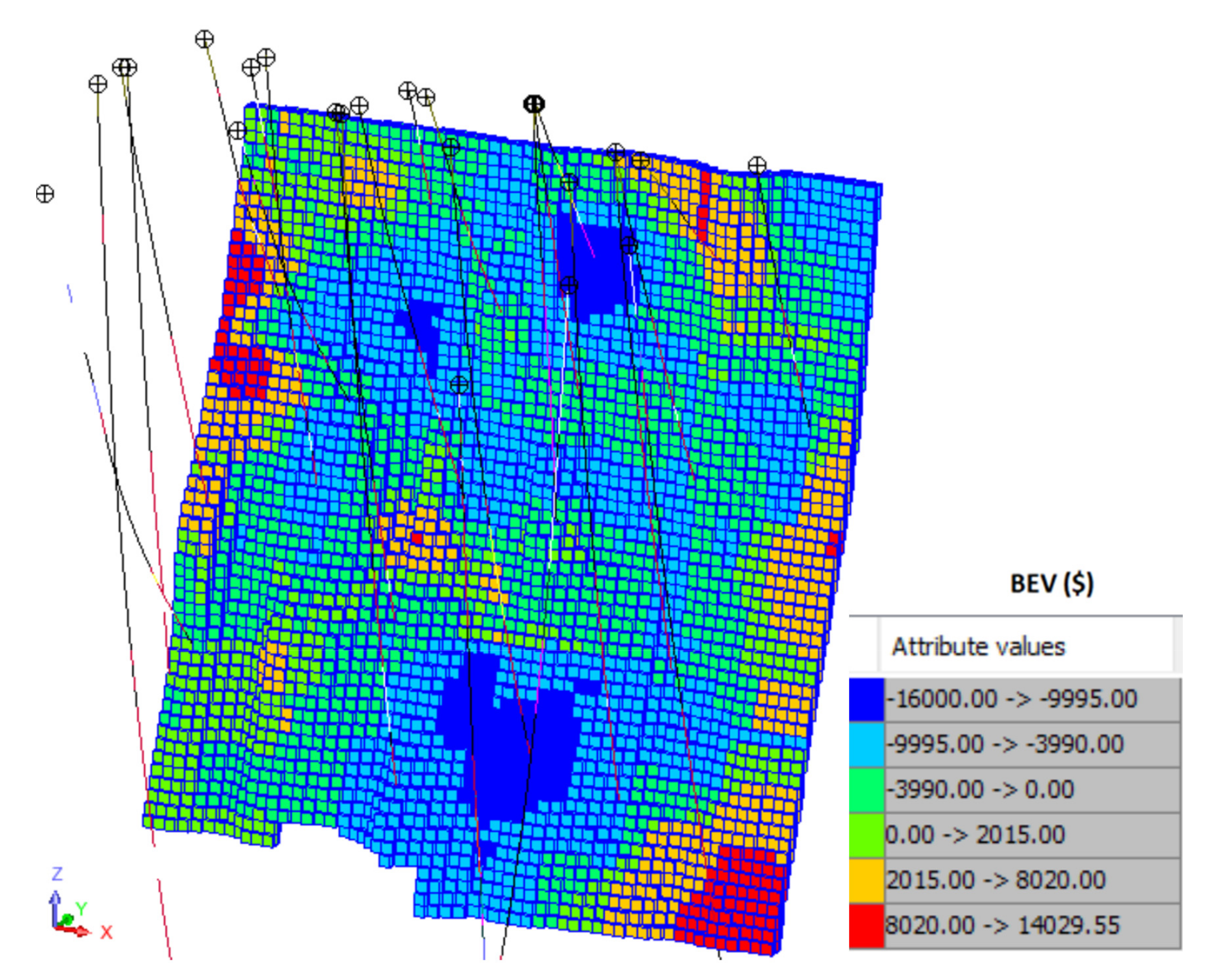

4.1. Deterministic and Probabilistic Economic Block Models

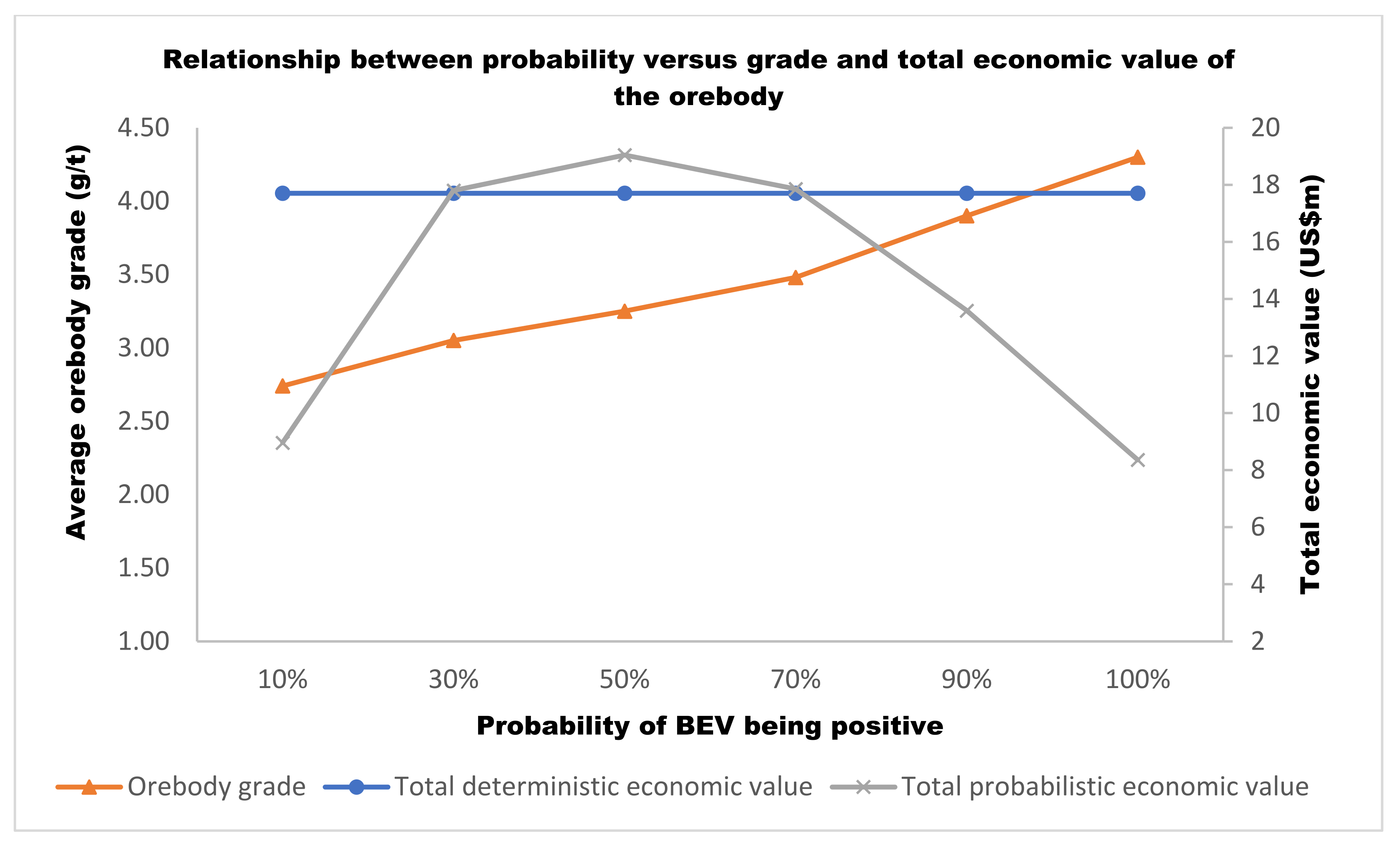

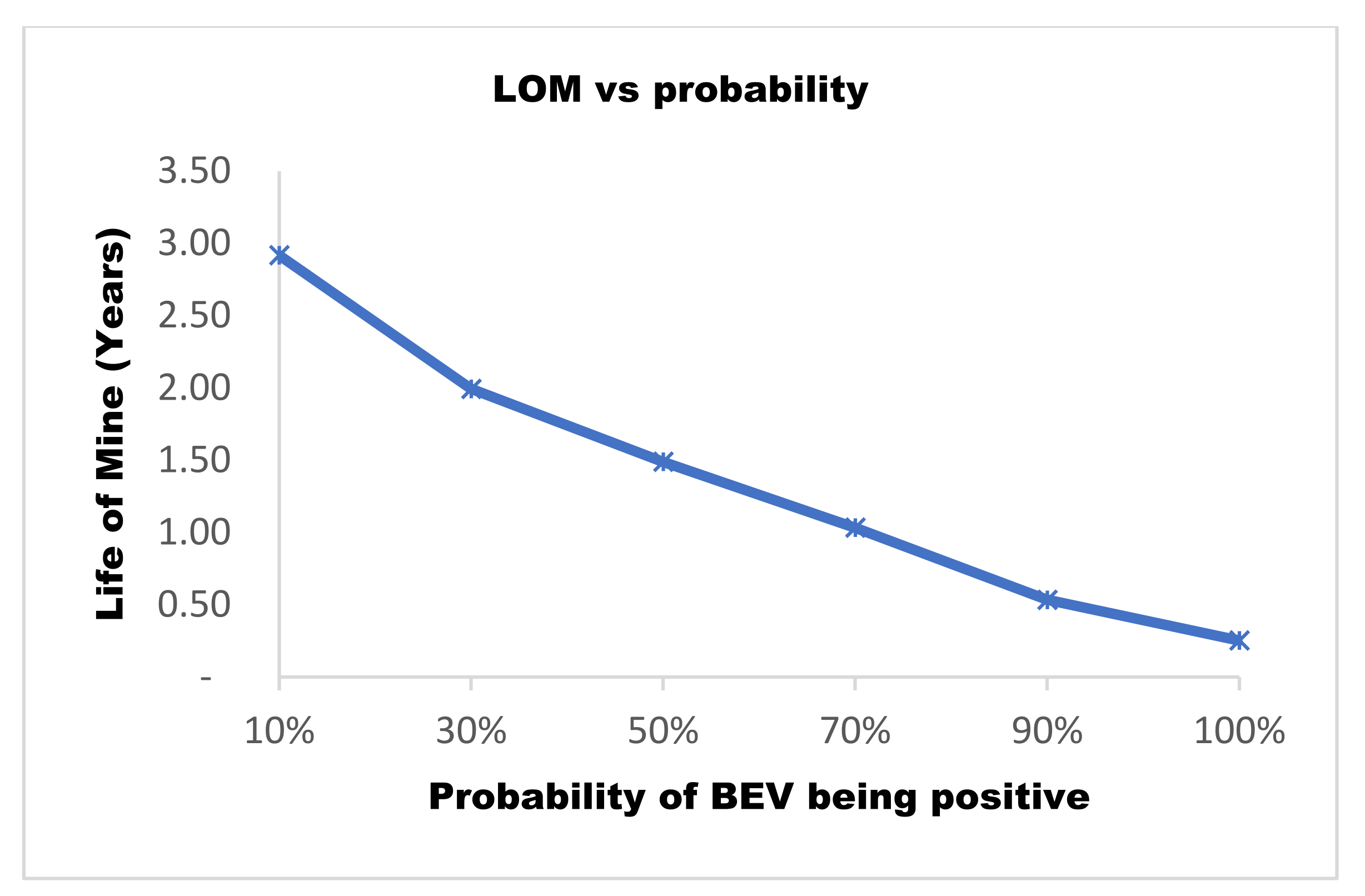

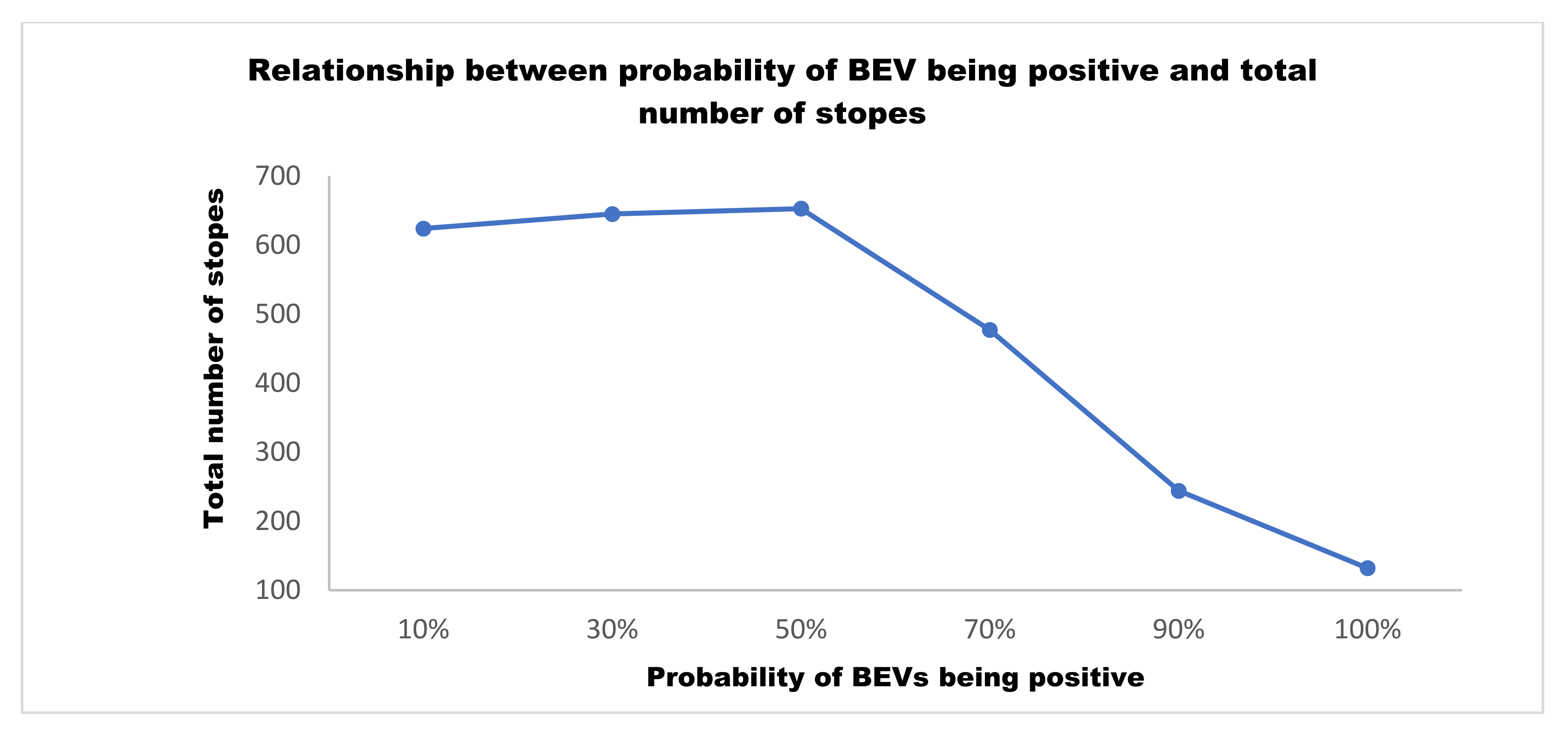

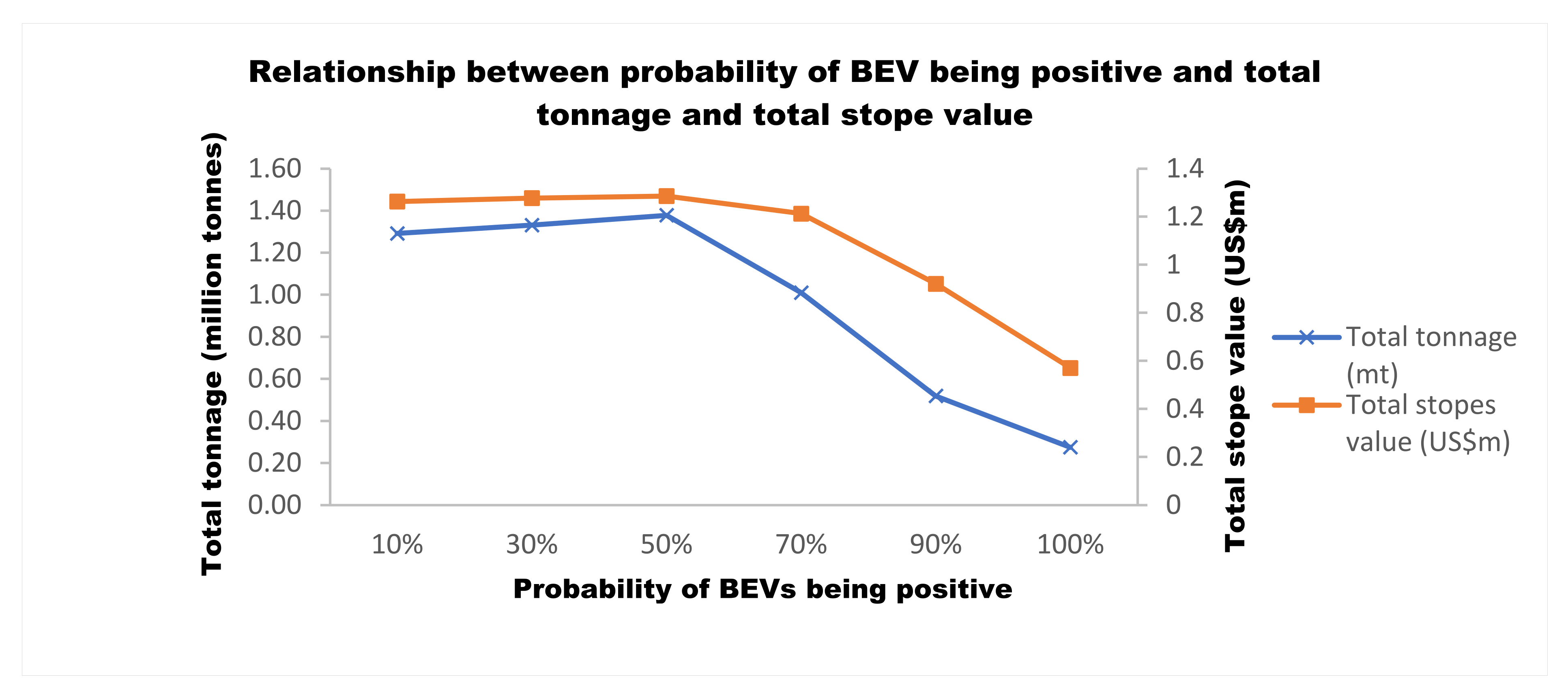

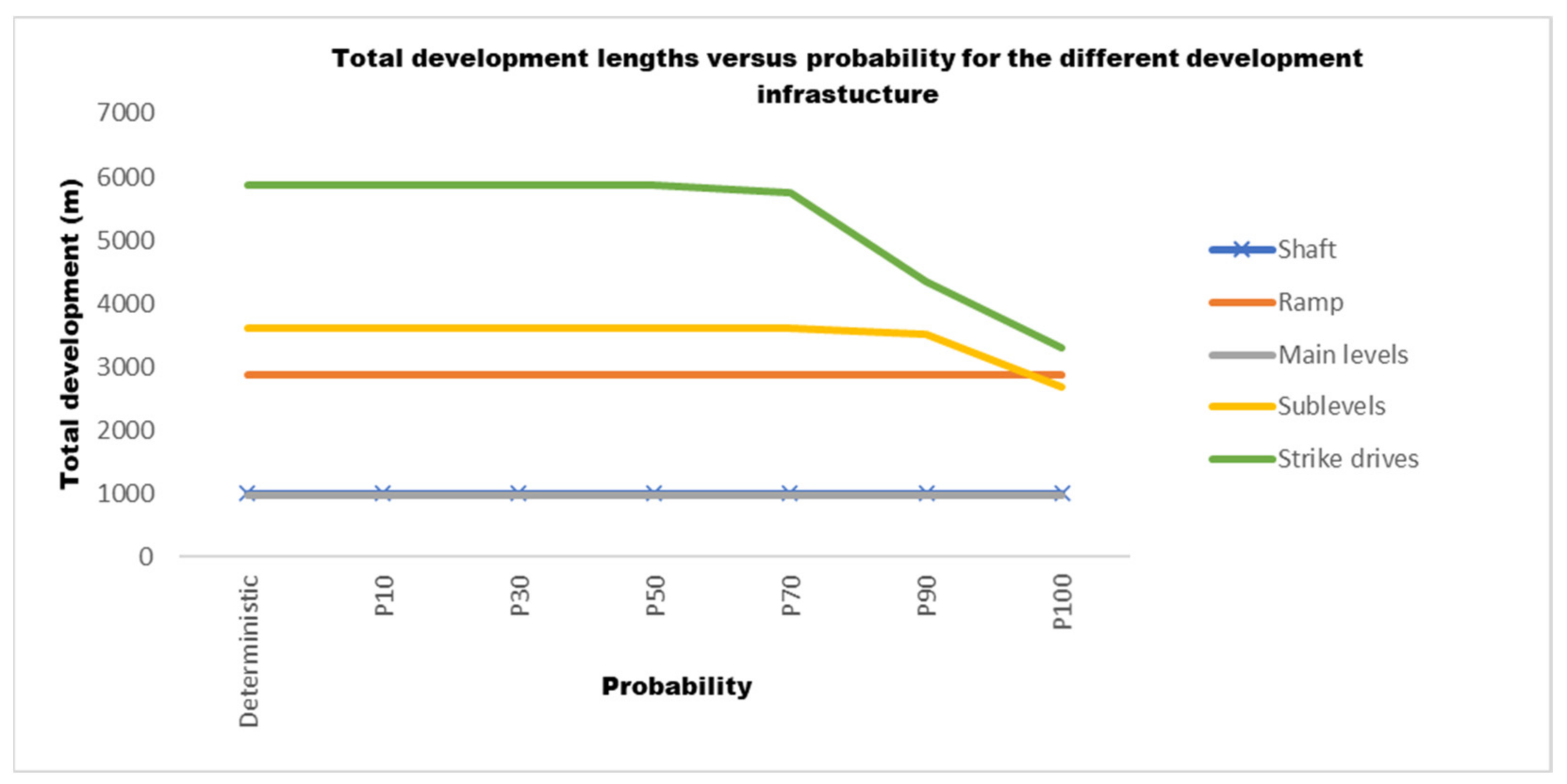

4.2. Comparison of Deterministic and Probabilistic Stope Designs

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Coombes, J. The Art and Science of Resource Estimation: A Practical Guide for Geologists and Engineers; Coombes Capability: Perth, Australia, 2008; 232p. [Google Scholar]

- Ataee-pour, M. A linear model for determination of block economic values. In Proceedings of the 19th International Mining Congress and Fair of Turkey, İzmir, Turkey, 9–12 June 2005; pp. 289–294. [Google Scholar]

- Chung, J.; Topal, E.; Ghosh, A.K. Where to make the transition from open-pit to underground? Using integer programming. J. S. Afr. Inst. Min. Metall. 2016, 116, 801–808. [Google Scholar] [CrossRef] [Green Version]

- Jamshidi, M.; Osanloo, M. Determination of block economic value in multi-element deposits. In Proceedings of the 6th International Conference on Computer Applications in the Minerals Industries, CAMI2016-06, Istanbul, Turkey, 5–7 October 2016. [Google Scholar]

- Nhleko, A.; Tholana, T.; Neingo, P. A review of underground stope boundary optimization algorithms. Resour. Policy 2018, 56, 59–69. [Google Scholar] [CrossRef]

- Tholana, T.; Musingwini, C.; Ali, M.M. A stochastic block economic value model. In Proceedings of the Mine Planners Colloquium 2019: Skills for the Future—Yours and Your Mine’s, Johannesburg, South Africa, 22–23 May 2019; The Southern African Institute of Mining and Metallurgy: Johannesburg, Southern Africa, 2019; pp. 35–50. [Google Scholar]

- Nikbin, V.; Ataee-Pour, M.; Shahriar, K.; Pourrahimian, Y. A 3D approximate hybrid algorithm for stope boundary optimization. Comput. Oper. Res. 2020, 115, 104475. [Google Scholar] [CrossRef]

- Alford, C. Optimisation in underground mine design. Proc. Int. J. Rock Mech. Min. Sci. Geomech. Abstr. 1996, 33, 213–218. [Google Scholar]

- Sandanayake, D.S.; Topal, E.; Asad, M.W. Designing an optimal stope layout for underground mining based on a heuristic algorithm. Int. J. Min. Sci. Technol. 2015, 25, 767–772. [Google Scholar] [CrossRef]

- Sari, Y.A.; Kumral, M. A planning approach for polymetallic mines using a sublevel stoping technique with pillars and ultimate stope limits. Eng. Optim. 2020, 52, 932–944. [Google Scholar] [CrossRef]

- Martha, E.; Matamoros, V.; Kumral, M. Calibration of genetic algorithm parameters for mining-related optimization problems. Nat. Resour. Res. 2019, 28, 443–456. [Google Scholar]

- Wilson, B.; Boisvert, J. Updates and Implementation Recommendations for Stochastic Stope Layout Optimization. Cent. Comput. Geostat. 2020, 22, 1–10. [Google Scholar]

- Faria, M.F.; Dimitrakopoulos, R.; Pinto, C. Stochastic stope design optimisation under grade uncertainty and dynamic development costs. Int. J. Min. Reclam. Environ. 2022, 36, 81–103. [Google Scholar] [CrossRef]

- Janiszewski, M.; Pontow, S.; Rinne, M. Industry Survey on the Current State of Stope Design Methods in the Underground Mining Sector. Energies 2021, 15, 240. [Google Scholar] [CrossRef]

- Corrigall, S. Stochastic Programs and Their Value over Deterministic Programs. MSc Dissertation, University of the Witwatersrand, Johannesburg, South Africa, 1998. [Google Scholar]

- Tholana, T. Generation of Probabilistic Stopes Using Monte-Carlo Simulation of Block Economic Values for Use in Mine Planning under Uncertainty. Ph.D. Thesis, University of the Witwatersrand, Johannesburg, South Africa, 2021. [Google Scholar]

- Savage, S.L.; Markowitz, H.M. The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2009. [Google Scholar]

- Palisade. Introduction to @Risk. 2016. Available online: http://www.palisade.com (accessed on 20 April 2017).

- Abdel Sabour, S.A.; Dimitrakopoulos, R.; Kumral, M. Mine design selection under uncertainty. Min. Technol. 2008, 117, 53–63. [Google Scholar] [CrossRef]

- Vallee, M. Mineral Resource + engineering, economic and legal feasibility = ore reserve. Can. Inst. Min. Metall. Pet. 2000, 93, 53–61. Available online: https://www.researchgate.net/publication/285842182_Mineral_resource_engineering_economic_and_legal_feasibility_ore_reserve (accessed on 5 July 2016).

- Martinez, L.A. Why accounting for uncertainty and risk can improve final decision-making in strategic open pit mine evaluation. In Proceedings of the Project Evaluation Conference, Melbourne, Australia, 21–22 April 2009; pp. 113–124. [Google Scholar]

- Musingwini, C. Optimisation in underground mine planning-developments and opportunities. J. S. Afr. Inst. Min. Metall. 2016, 116, 809–820. [Google Scholar] [CrossRef] [Green Version]

- Magagula, N.S.; Musingwini, C.; Ali, M. Multinomial logistic regression analysis of a stochastic mine production system. In Proceedings of the 23rd International Symposium on Mine Planning and Equipment Selection (MPES2015): Smart Innovation in Mining, Johannesburg, South Africa, 9–11 November 2015; pp. 331–339. [Google Scholar]

- Godoy, M. A risk analysis based framework for strategic mine planning and design—Method and application. In Advances in Applied Strategic Mine Planning; Springer: Cham, Switzerland, 2018; pp. 75–90. [Google Scholar]

- Dimitrakopoulos, R.; Farrelly, C.; Godoy, M. Moving forward from traditional optimisation: Grade uncertainty and risk effects in open-pit design. Min. Technol. 2002, 111, 82–88. [Google Scholar] [CrossRef]

- Rossi, M.E.; Van Brunt, B.H. Optimizing conditionally simulated orebodies with Whittle 4D. Optim. Whittle 1997, 97, 119–128. [Google Scholar]

- Grieco, N.; Dimitrakopoulos, R. Managing grade risk in stope design optimisation: Probabilistic mathematical programming model and application in sub-level stoping. Min. Technol. 2007, 116, 49–57. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R.; Grieco, N. Stope design and geological uncertainty: Quantification of risk in conventional designs and a probabilistic alternative. J. Min. Sci. 2009, 45, 152–163. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R. Stochastic mine planning–methods, examples and value in an uncertain world. In Advances in Orebody Modelling and Strategic Mine Planning; Series No. 17; The Australasian Institute of Mining and Metallurgy Spectrum: Carlton, Australia, 2010; pp. 13–19. [Google Scholar]

- Ersoy, A.; Yünsel, T.Y. Geostatistical conditional simulation for the assessment of the quality characteristics of Cayırhan lignite deposits. Energy Explor. Exploit. 2006, 24, 391–416. [Google Scholar] [CrossRef]

- Godoy, M.; Dimitrakopoulos, R. Managing risk and waste mining in long-term production scheduling of open-pit mines. SME Trans. 2004, 316, 43–50. [Google Scholar]

- Croll, R.C. Technical and financial risk in project evaluation. In Proceedings of the Colloquium: Bankable Feasibility Studies and Project Financing for Mining Projects, Johannesburg, South Africa, 18 March 1999; pp. 1–4. [Google Scholar]

- Abdel Sabour, S.A.; Dimitrakopoulos, R. Accounting for joint ore supply, metal price and exchange rate uncertainties in mine design. In Advances in Orebody Modelling and Strategic Mine Planning: Old and New Dimensions in a Changing World; The Australasian Institute of Mining and Metallurgy (AusIMM): Carlton, Australia, 2009; pp. 29–34. [Google Scholar]

- Tapia Cortez, C.A.; Saydam, S.; Coulton, J.; Sammut, C. Alternative techniques for forecasting mineral commodity prices. Int. J. Min. Sci. Technol. 2018, 28, 309–322. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.C. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994; 468p. [Google Scholar]

- Haque, M.A.; Topal, E.; Lilford, E. A numerical study for a mining project using real options valuation under commodity price uncertainty. Resour. Policy 2014, 39, 115–123. [Google Scholar] [CrossRef]

- Abdel Sabour, S.A.; Poulin, R. Mine expansion decisions under uncertainty. Int. J. Min. Reclam. Environ. 2010, 24, 340–349. [Google Scholar] [CrossRef]

- Lemelin, B.; Abdel Sabour, S.A.; Poulin, R. Valuing mine 2 at Raglan using real options. Int. J. Surf. Min. Reclam. Environ. 2006, 20, 46–56. [Google Scholar] [CrossRef]

- Glasserman, P. Monte Carlo Methods in Financial Engineering; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2003; 596p. [Google Scholar]

- Schwartz, E.S. The stochastic behaviour of commodity prices: Implications for valuation and hedging. J. Financ. 1997, 52, 923–973. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R.; Martinez, L.; Ramazan, S. A maximum upside/minimum downside approach to the traditional optimisation of open-pit mine design. J. Min. Sci. 2007, 43, 73–82. [Google Scholar] [CrossRef]

- Whittle, G.; Stange, W.; Hanson, N. Optimising project value and robustness. In Proceedings of the Project Evaluation Conference, Melbourne, Australia, 19–20 June 2007; The Australasian Institute of Mining and Metallurgy: Melbourne, Australia, 2007; pp. 147–155. [Google Scholar]

- Abdel Sabour, S.A.; Dimitrakopoulos, R. Incorporating geological and market uncertainties and operational flexibility into open-pit mine design. J. Min. Sci. 2011, 47, 191–201. [Google Scholar] [CrossRef]

- Del Castillo, F.; Dimitrakopoulos, R. Joint effect of commodity price and geological uncertainty over the life of mine and ultimate pit limit. Min. Technol. 2014, 123, 207–219. [Google Scholar] [CrossRef]

| Excavation Type | Value |

|---|---|

| Shaft dimensions (m) | 3 × 2 |

| Ramp gradient (degrees) | −10 |

| Ramp dimensions (m) | 5 × 3 |

| Main level spacing (m) | 60 |

| Main level dimensions (m) | 5 × 3 |

| Sub-level dimension (m) | 4 × 3 |

| Sub-level spacing (m) | 15 |

| Strike drive dimensions (m) | 4 × 3 |

| Item | Cost |

|---|---|

| Shaft development cost ($/m) | 2000 |

| Ramp development cost ($/m) | 1800 |

| Main level development cost ($/m) | 730 |

| Sublevels development cost ($/m) | 500 |

| Strike drives cost ($/m) | 500 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tholana, T.; Musingwini, C. A Probabilistic Block Economic Value Calculation Method for Use in Stope Designs under Uncertainty. Minerals 2022, 12, 437. https://doi.org/10.3390/min12040437

Tholana T, Musingwini C. A Probabilistic Block Economic Value Calculation Method for Use in Stope Designs under Uncertainty. Minerals. 2022; 12(4):437. https://doi.org/10.3390/min12040437

Chicago/Turabian StyleTholana, Tinashe, and Cuthbert Musingwini. 2022. "A Probabilistic Block Economic Value Calculation Method for Use in Stope Designs under Uncertainty" Minerals 12, no. 4: 437. https://doi.org/10.3390/min12040437

APA StyleTholana, T., & Musingwini, C. (2022). A Probabilistic Block Economic Value Calculation Method for Use in Stope Designs under Uncertainty. Minerals, 12(4), 437. https://doi.org/10.3390/min12040437