Abstract

Smart contracts, as a critical application of blockchain technology, significantly enhance its programmability and scalability, offering broad application prospects. However, frequent security incidents have resulted in substantial economic losses and diminished user trust, making security issues a key challenge for further development. Since smart contracts cannot be modified after deployment, flaws in their design or implementation may lead to severe consequences. Therefore, rigorous pre-deployment verification of their correctness is particularly crucial. This paper explores the symmetry in control flows and state transitions of Solidity smart contracts and leverages this inherent structural symmetry to develop a normalized state transition model based on a finite state machine. The FSM model is subsequently formalized into a Promela model with the Spin model checker. By integrating manually defined Linear Temporal Logic formulas with those generated by Smart Pulse, the Promela model is formally verified in Spin to ensure the correctness and security of smart contracts. This approach establishes a systematic verification framework, providing effective support to enhance the reliability and security of smart contracts.

1. Introduction

In [1], Satoshi Nakamoto formally introduced the concept of blockchain, emphasizing the prevailing reliance of online transactions on trusted third parties. This dependency not only increased transaction costs but also introduced unnecessary complexities into transaction processes. To address these challenges, Nakamoto proposed a peer-to-peer digital currency system, known as Bitcoin, which marked the beginning of the blockchain era. At its core, blockchain functions as a distributed ledger that employs cryptographic algorithms and consensus mechanisms to ensure user privacy while eliminating the need for intermediary trust in transactional activities.

In recent years, smart contract platforms, represented by Ethereum [2], have undergone significant development. By the end of 2024, the number of Ethereum addresses exceeded 220 million, with a total market capitalization surpassing USD 400 billion [3]. The concept of smart contracts, first introduced by Szabo [4], was designed to enforce transactions between two or more parties through the automated execution of program code. The primary objective of this design is to utilize digital methods to disseminate, verify, or execute contract terms, thereby minimizing reliance on trusted intermediaries and ensuring the automatic fulfillment of contractual obligations. The decentralized, transparent, trustworthy, collectively maintained, and immutable nature of Ethereum makes it an ideal platform for smart contract execution. With technological advancements, smart contracts have become a fundamental component of blockchain applications. They not only foster novel digital economic models but are also extensively applied in domains such as digital identity, the Internet of Things, and supply chain management. Furthermore, they underpin the development of decentralized applications (dApps) such as wallets, prediction markets, instant messaging platforms, blogs, and crowdfunding systems [5]. These developments highlight the vast potential of smart contracts in shaping the future.

However, despite the inherent characteristics of smart contracts, such as automatic execution and immutability, their code remains susceptible to vulnerabilities. Given that smart contracts often manage substantial digital assets and cannot be modified once deployed, any potential flaw may be exploited by attackers, resulting in significant financial losses or even catastrophic consequences. Numerous cases have demonstrated that smart contracts deployed on public blockchains frequently contain security vulnerabilities, leading to the theft of cryptocurrency worth hundreds of millions of dollars [6,7,8]. Therefore, ensuring the correct and secure execution of smart contracts on blockchains has become a critical and urgent task.

While various verification frameworks such as KEVM [9], Zeus [10], and Verx [11] have been proposed, they often rely on manual annotations, support limited Solidity subsets, or focus solely on safety properties. Crucially, most lack the capability to verify liveness and fairness, leaving a gap in ensuring the full correctness of smart contracts.

In this paper, we propose a novel approach to convert Solidity-based smart contracts into the formal language Promela, and then use the model-checking tool Spin [12] to verify whether the Promela model aligns with the intended functionality of the smart contract, thereby ensuring its correctness. Unlike existing methods, our approach is not limited to security analysis but also extends to the verification of critical properties such as fairness and liveness, which are essential to ensure that the contract reaches its desired state during execution. Notably, liveness properties are particularly important in this context, as smart contracts often involve expected final outcomes, such as “funds will eventually be transferred once specific conditions are met.” For example, in the case of a remote purchase smart contract, a core correctness requirement is that the buyer should be able to recover their funds unless the purchase transaction is successfully completed. This property is essentially a liveness property, ensuring that the fund transfer will ultimately occur. To summarize, this paper makes the following contributions:

- Formal Modeling and Transformation of Smart Contracts: We propose an innovative method to convert Solidity-based smart contracts into the formal language Promela, using a finite state machine (FSM) model that captures the symmetry in contract control flow and state transitions. This provides a structured framework for systematic verification of smart contracts.

- Comprehensive Verification Method Expansion: Our approach extends beyond security analysis to include the verification of key properties such as fairness and liveness, ensuring the correctness, ideal behavior, and expected outcomes of contracts in decentralized environments. This expansion broadens the scope of smart contract verification, addressing not only protection against attacks but also the fairness and final goals of contract execution.

- Blockchain Smart Contract Security Assurance: We introduce a rigorous formal verification mechanism to ensure the security and correctness of smart contracts in decentralized blockchain environments. By formally modeling and verifying the contract execution process, potential logical errors and security vulnerabilities can be effectively identified, preventing deviations from expected behaviors during contract execution and ensuring the transparency and controllability of the contract.

- Model Checking and Verification: We utilize the Spin tool to verify the Promela-modeled smart contracts, employing both manually and automatically generated Linear Temporal Logic (LTL) formulas for comprehensive validation. This ensures the correctness of the contract logic, identifies potential errors and design flaws, and enhances the robustness and trustworthiness of the smart contract.

2. Related Works

In recent years, formal verification of smart contracts has received extensive attention, focusing on three key areas: formal modeling, correctness and security verification, and temporal characterization. Various studies have pushed the development of blockchain technology through a variety of methods and tools, helping to ensure the reliability and security of smart contracts in real-world applications.

2.1. Formal Modeling of Smart Contracts

Hamdaqa et al. proposed a domain-specific language (DSL) [13] designed to help developers create smart contracts and deploy them on blockchain networks, including platforms like Ethereum, Hyperledger Composer, Azure, and DAML. In [14], this approach combines UML class diagrams and state machine diagrams to support modeling smart contracts and their behavioral logic at multiple levels of abstraction. By evaluating examples from the Solidity documentation, the study found a high degree of similarity between the generated contract code and metrics.

Furthermore, according to the definition from Ethereum [15], smart contracts possess FSM characteristics, where the self-executing code running on the blockchain operates through a set of functions that modify the contract state. The smart contract code describes future transactional operations using conditional statements (such as if/when...then), and these operations trigger the subsequent actions [16]. In other words, smart contracts are modeled through the logic of states, operations, and conditions, with their lifecycle involving multiple transitions from an initial state to a final state [17]. Additionally, Mavridou [18] et al. modeled Solidity contracts as state machines using FSolidM, supporting model checking of safety properties and further advancing the formal analysis of smart contracts. Therefore, FSM patterns are considered an ideal choice for modeling smart contracts, as they provide an appropriate level of abstraction to accurately reflect contract behavior [19]. SmartState [20] is a fine-grained state dependency analysis framework based on FSM that automatically detects SRVs in Solidity smart contracts. FSM-SCG leverages FSM and large language models to enhance smart contract generation’s correctness and security via requirement modeling and iterative refinement [21]. Notably, the Solidity documentation explicitly recommends using the FSM pattern for smart contract development, which helps improve modeling accuracy and practicality. Moreover, in [22], a unified model is proposed, defining fully standardized core components for legal smart contracts and providing structured support for legal and behavioral norms.

2.2. Verification of Smart Contracts

In recent years, formal verification of smart contracts has gained increasing attention, leading to the emergence of various verification tools and methods. Early research on the formalization of smart contracts primarily focused on the Ethereum Virtual Machine (EVM) layer. For instance, Hirai [23] provided a formalization of the EVM in Lem, while Hildebrandt et al. used the K-framework [24] to propose KEVM. In contrast to these studies, F* [25] and Zeus also employed formal verification to check the correctness of smart contracts. F* converts Solidity into the F* language and verifies it, but its scope is limited to a subset of Solidity and requires user intervention to prove assertions specified by the user. Zeus, on the other hand, converts Solidity into an intermediate language and uses an SMT solver for verification. To ensure specification compliance, Nehai, Z [26] introduced a generic modeling approach for Ethereum-based smart contract applications and utilized model-checking methods to verify implementation correctness. Bai et al. [27] formalized smart contracts using finite state machines and used the SPIN model-checking tool to verify their correctness, demonstrating the indispensable role of FSM in verifying smart contracts.

VERISOL, SOLC-VERIFY, and KEVMVER [28,29,30] offer correctness property verification based on contract preconditions and postconditions. VERISOL and SOLC-VERIFY rely on user-provided invariants, while KEVMVER automatically generates invariants or converts EVM bytecode into KEVM for verification using the K framework.

ChainSecurity AG introduced the Verx tool, which can perform a combination of symbolic execution and predicate abstraction and automatically extract predicates from contract source code, enabling semi-automated verification of the time safety properties expressed in PastLTL. Jon Stephens et al. proposed the SMARTPULSE tool [31], which builds upon Verx and offers a more efficient verification process. Their work achieves fully automated falsification and verification, eliminating the need for manual intervention while improving the feasibility and accuracy of the verification process. Additionally, research such as TinySol, Featherweight Solidity, and SolidiKeY [32,33,34] has formalized key Solidity features. Although these studies provide important foundations for Solidity formalization, their lack of executability makes them less useful for practical evaluation. A selection of verification tools and their corresponding abstraction levels are provided in Appendix A.

2.3. Checking Correctness and Safety Properties

Many studies focus on analyzing the temporal properties of smart contracts. For instance, in [35], the authors proposed a method for testing whether a smart contract violates past LTL (Linear Temporal Logic) formulas. Similarly, ref. [36] explored how to verify LTL formulas in UML models. The T2 [37] system verifies temporal properties using LLVM, supporting analysis of linear integer arithmetic programs. Moreover, E-HSF [38] introduced a method for converting existentially quantified Horn clauses into existential CTL (Computation Tree Logic) formulas and solving these formulas through counterexample-guided reasoning for verification.

Additionally, typestates [39] provide a method for expressing the correct usage rules for class operations or protocols, and some of the properties we evaluate can also be represented as typestates. These temporal property verifications often rely on formal logical descriptions. The proposed model is implemented in the NuSMV input language to support formal ver-ification, where system properties are specified using CTL [40].

In active verification of infinite-state systems, several methods verify program paths violating LTL properties, such as those in [41,42,43,44]. These methods simplify the verification of liveness properties into a fairness termination problem and use a combination of SMT solvers and ranking function synthesizers to search for unfair termination paths. In the active verification of smart contracts, Sergey et al. proposed the SCILLA [45] intermediate language, and the Coq [46] proof assistant’s manual proof method, which, despite relying on significant manual intervention, has had a profound impact on research in this field.

The commonality of these methods lies in their aim to formalize and verify the temporal properties and liveness characteristics of smart contracts. By utilizing various forms of logic and tools, they provide robust verification mechanisms for the correctness and reliability of smart contracts.

3. Materials and Methods

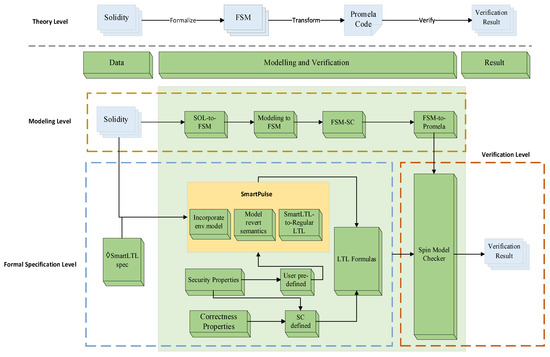

The methodology proposed in this work for the formal verification of Solidity-based smart contracts is schematically presented in Figure 1. At the theoretical level, the behavioral semantics of the smart contract are abstracted into a finite state machine model, which serves as a formal representation of its execution logic. Based on the FSM abstraction, the original Solidity code is systematically transformed into a Promela specification through a set of well-defined translation algorithms. This Promela model is then subjected to exhaustive verification using the Spin model checker, where specified correctness properties are formally evaluated.

Figure 1.

Schematic workflow of our approach.

The overall process comprises three key phases—formal modeling, property specification, and automated verification—thereby enabling rigorous analysis of contract behavior with respect to safety, liveness, and fairness guarantees. Specifically, the method consists of three main stages.

Modeling level: We provide a formal description of Ethereum smart contracts written in Solidity, and by converting them into finite state machines, we successfully create a structured and formal representation of the contract’s execution process and its state transition relations. This formalization provides a solid foundation for subsequent verification. Based on the FSM model, we design a series of algorithms to convert Solidity-based smart contracts into Promela models that can be executed in the Spin tool. This conversion allows the smart contract to be further analyzed and verified using formal model-checking tools, thereby enhancing the understanding and scrutiny of the contract’s behavior.

Formal specification level: we define the functionality of the smart contract using LTL formulas and combine them with LTL formulas automatically generated by the Smart Pulse tool. These combined formulas are then applied in the Spin tool for verification.

Verification level: we use the Promela model obtained in the first stage and the LTL formulas derived in the second stage and input them into the modelchecker tool Spin. This allows us to verify whether the functionality of the formal Promela model aligns with the intended functionality of the Solidity contract, ensuring the correctness and security of the smart contract during execution.

3.1. Formal Description of Smart Contracts

There exist multiple methodologies for the verification of smart contracts. In this context, we adopt an automata-theoretic approach wherein both smart contracts and their properties are formally represented as automata. The primary objective is to rigorously verify that the contract model constitutes a refinement of the specified property.

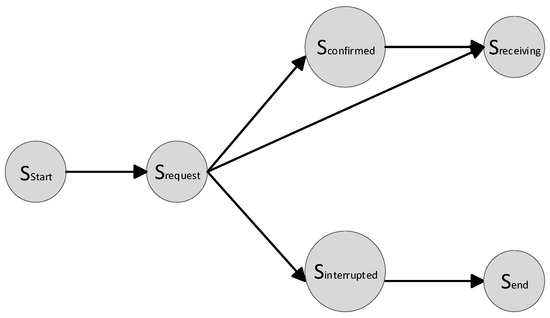

In the remainder of this section, we provide a formal description of these automata. For illustrative purposes, we employ the example of a smart contract modeling the business process of a remote shopping system. Figure 2 illustrates a simple state machine example of this contract.

Figure 2.

A simple state machine.

The execution of smart contracts is from one state to another state, so we can use a contract state machine to represent smart contracts. The smart contract is represented by a six tuple:

Among them,

- is a finite set of states that represents the different stages of the contract.

- is a finite set of events.

- is a finite set of variables.

- is the deterministic transition relation (where , and ).

- is the initial state set, which assigns initial values to the contract’s variables and states, .

- is the final state set.

Transitions in the semantics are tagged by pairs of events and variable states, denoting the triggered monitored events and the variable state at that point in time. In the semantics we give to FSM, we only consider the traces that reach end configurations. Then we ignore infinite loops that would never be recorded to the blockchain.

For , a path in starting from is an infinite sequence of transitions such that if is not empty, the source of is , and the destination of is the source of for all for which these are defined. If is not empty, define as ; if is finite, define as the destination of the last transition of . We say that spells the word , where is the label of .

For the smart contract , an infinite path is accepted if it visits a state in infinitely often. An (accepting) trace starting from is a word spelled by a path starting from . A trace of is a trace starting from an initial state. The language of , denoted , is the set of all accepting traces of . We use an example of a smart contract called Safe Remote Purchase, which is described in the official Solidity documentation (https://docs.soliditylang.org/en/v0.8.26/, accessed on 12 June 2025) to illustrate the method proposed in this paper.

The state machine is a six tuple , where the contract between the buyer and the escrow named BCC, is the executing state of the contract between the buyer and the escrow. is the set of input events, is the set of variables, and is the transition function, where . is the set of the initial state, ; is the set of termination states, , . The state of can be represented in Table 1.

Table 1.

The set of .

The state machine is also a six tuple , where the contract between the seller and the escrow named SBC, is the executing state of the contract between seller and escrow, is the set of input events, is the set of variables, and is the transition function, where . is the set of the initial state, ; and is the set of termination states, , . The state of can be represented in Table 2.

Table 2.

The set of .

The set of events for the two smart contracts above can be briefly summarized as shown in Table 3.

Table 3.

The set of contract events .

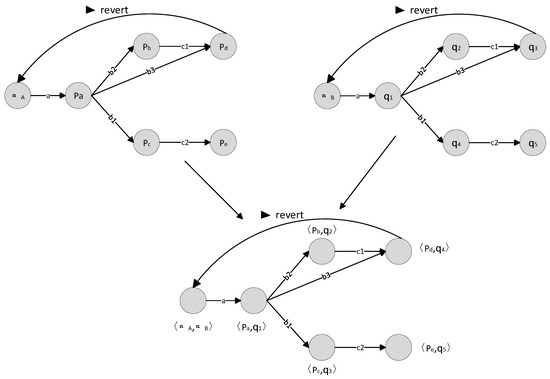

In [47], there is an algorithm that consumes any finite subset of smart contract SPR and an Form with , and produces an SPR with alphabet such that = , and there are well-known algorithms that can be used to produce an FSM with alphabet which accepts exactly the words satisfying under the state semantics. Let be the same as , except the alphabet is and there is a transition in if there is a transition in . We have

This indicates that the states within the state machines of different smart contracts demonstrate a form of behavioral symmetry, revealing consistent structural patterns and analogous execution logic across various contract implementations. So let = denote two FSMs over the smart contract. The parallel composition of and is the SPR :

where denotes

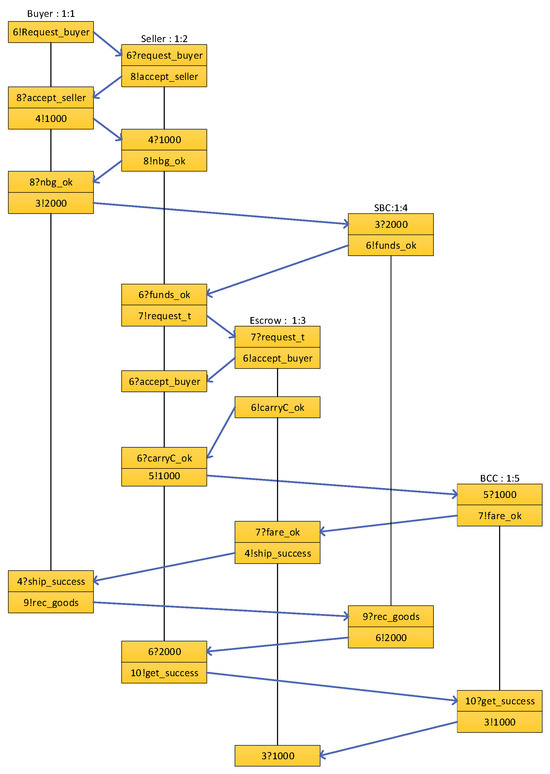

Using the above axioms, we can combine multiple smart contracts of the same type. The contract state machine and the contract state machine of can be combined to form the entire contract state machine. The following diagram represents the state machine transitions of each smart contract and the combined state machine.

In Figure 3, the initial states of BCC and SBC are denoted as and , respectively. Following a series of event-driven transitions, the system reaches the final states and . By combining the transition relations of these two distinct smart contracts, we can construct the complete contract state machine. This approach allows us to apply a transformation rule to convert a smart contract written in Solidity into an FSM.

Figure 3.

The composition of the smart contract state machine.

After formally defining the smart contract’s FSM, this section details the algorithmic methodology for converting Solidity code into the SPR model. In particular, it systematically maps Solidity variables, statements, functions, and visibility modifiers to their respective FSM components, enabling precise formal representation and analysis.

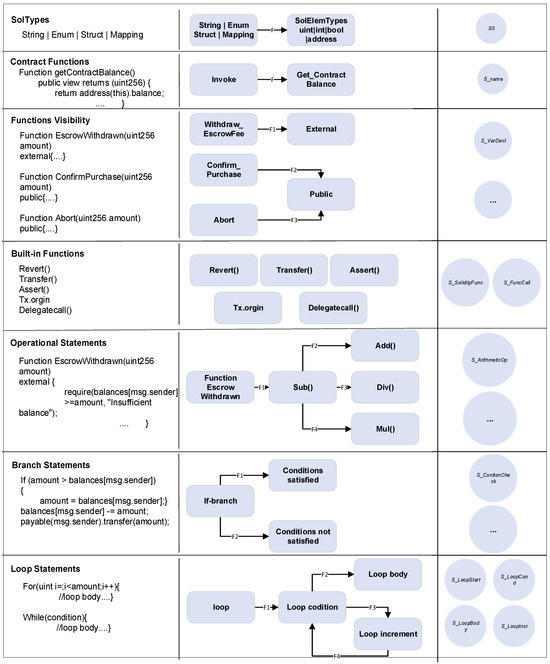

Figure 4 illustrates the transformation of Solidity smart contract statements into an FSM, mapping code components into states and transitions for structured analysis. On the left is the Solidity code, while the right represents corresponding FSM states. Key components include type declarations, functions, visibility, built-in functions, arithmetic operations, conditionals, and loops.

Figure 4.

Algorithm explanation.

In type declarations, data types like uint256, bool, and address are converted into individual states to facilitate identification and handling. For contract functions, each function begins in an Invoke state and transitions to its specific state, enabling clear tracking of function calls. Function visibility, such as that of public, internal, and external functions, maps to distinct states to validate access control logic.

Built-in functions like revert(), transfer(), and assert() are represented as separate states to simulate their execution. Arithmetic operations, such as subtraction and division, are modeled as independent states with transitions representing their sequence. Conditional statements are split into states like If-Branch, Condition Satisfied, and Condition Not Satisfied to simulate logical branching accurately. Loops are broken into states like Loop Start, Condition, Body, and Increment, capturing their iterative behavior.

This FSM model provides a structured representation of Solidity smart contract statements, enabling intuitive modeling and analysis of contract functionality and behavior within the FSM framework. This conversion method supports automated verification, behavioral analysis, and lays the foundation for security checks.

3.2. Converting Smart Contracts to FSM

In this section, we introduce a series of transformation algorithms designed to model a smart contract SC as an FSM. Specifically, Algorithm 1 integrates Algorithms 2 and 3 to construct the SPR model. Algorithm 2 maps the contract’s functions and variables to their respective initial states, where each function is represented by a state named after the function, followed by states that characterize its visibility. Algorithm 3 handles the transformation of function bodies into states and transitions, incorporating relevant parameters into the model. This process generates a state transition system that accurately represents the SC as an FSM. Furthermore, predefined names for certain Solidity statements are employed to enhance the generalizability of the verification model.

| Algorithm 1: CREATEStateMachine (,,,,,) |

| Call Algorithm 2 and 3 to construct state machine Input: Solidity Source Code Output: SRP Model (,,,,,) Initialization 1: Initialize state set with initial states Σ* 2: Initialize event set 3: Initialize variable set 4: Initialize transition function 5: Initialize end state set Algorithm 2 Expressions Transformation Algorithm 6: Solidity Statements ← Expressions Algorithm 3 Statements Transformation Algorithm 7: SRP Model ← Function statements 8: return SRP Model |

Algorithm 1 establishes the foundational elements of the FSM, including the state set , event set , variable set , transition function , initial state set , and end state set . This initialization provides a robust structural baseline for the FSM representation. Subsequently, the FSM is refined through the mapping of Solidity constructs to their corresponding states and transitions, ultimately resulting in an SRP model that comprehensively encapsulates the operational semantics of the contract.

First, as we see in Algorithm 2, the modeling process begins by introducing an initial state S0, which represents the entry point of the smart contract. If the contract includes variable declarations or a constructor, the algorithm adds S0 to the state set and establishes a self-transition from S0 to itself to capture contract-level initialization behaviors.

Then, for each function declaration in the contract, a state named after the function is added, along with a transition from S0 to the corresponding function state. An event associated with the function declaration is also recorded in the event set.

Within each function, the algorithm systematically models individual statements by translating them into corresponding FSM states and transitions, accompanied by well-defined events to preserve execution semantics. Variable declarations are assigned to states, and built-in Solidity functions such as revert(), transfer(), assert(), tx.origin, and delegatecall() are abstracted into states labeled by the function name, with transitions from the calling state to the built-in function’s state to represent invocation semantics abstracted into states. Arithmetic operations transition into states, conditional statements are represented by states, and loop constructs are decomposed into states representing the loop initiation, condition, body, and increment stages.

| Algorithm 2: Transform Statements to SRP |

| Input: Solidity Statements Output: SRP Model (,,,,,) 1: if Contract variable declarations or constructor exists then 2: Add initial state S0 to ; 3: Add state S0 to ; 4: Add transition (S0, S0) to ; 5: Add event related to contract declarations to ; 6: for Each function declaration do 7: Add state S_name to ; 8: Add transition (S0, S_name) to ; 9: Add event related to function declaration to ; 10: for Each function statement do 11: if Variable declaration then 12: Add state S_VarDecl to ; 13: Add transition from previous state to S_VarDecl; 14: Add variable to ; 15: Add event related to variable declaration to ; 16: if Built-in functions Revert(), Transfer(), Assert(), Tx.origin, Delegatecall() then 17: Add state S_SolidityFunc to ; 18: Add transition from previous state to S_SolidityFunc; 19: Add event related to Solidity function call to ; 20: if Function calls then 21: Add state S_FuncCall to ; 22: Add transition from previous state to S_FuncCall; 23: Add event related to function calls to ; 24: if Arithmetic operations Add(a + b), Sub(a - b) then 25: Add state S_ArithmeticOp to ; 26: Add transition from previous state to S_ArithmeticOp; 27: Add event related to arithmetic operations to ; 28: if Conditional statements switch(condition), if(condition) then 29: Add state S_ConditionCheck to ; 30: Add transition from previous state to S_ConditionCheck; 31: Add event related to condition checks to ; 32: if Loop statements for(int i, condition, i++) then 33: Add states S_LoopStart, S_LoopCond, S_LoopBody, S_LoopIncr to ; 34: Add transition from previous state to S_LoopStart; 35: Add transition from S_LoopStart to S_LoopCond; 36: Add transition from S_LoopCond to S_LoopBody; 37: Add transition from S_LoopBody to S_LoopIncr; 38: Add transition from S_LoopIncr back to S_LoopCond; 39: Add event related to loops to ; 40: Add final states to ; 41: return SRP Model |

Finally, the algorithm appends final states to indicate termination of execution paths, completing the construction of the SRP model that systematically maps the contract’s control flow and semantics into a formal state-transition representation. This meticulous translation enables the FSM to accurately reflect the control flow and logical architecture inherent in the contract’s source code.

Algorithm 3 provides a systematic approach to transform various types of expressions within a smart contract into an FSM representation, ensuring each expression accurately reflects the contract’s logical flow and behavior. The algorithm begins by iterating over each expression in the set of expressions (lines 1–2). Based on the type of expression, it proceeds to handle specific cases.

- Expressions with Variables (): These are expressions that contain at least one local variable. For such expressions (lines 3–13), the FSM introduces a state for each expression , with transitions to handle conditional checks and loops, replicating complex execution paths.

- Expressions with Function Calls (): These are expressions containing at least one function call, in this case (lines 14–23). The algorithm sets up states and transitions to manage function call sequences and any Ether-sending operations, accurately reflecting interactions within the smart contract.

- Explicit Expressions (): These are straightforward expressions without any variables or function calls. The algorithm (lines 24–36) handles arithmetic operations, conditional checks, and loops with constant bounds by creating corresponding states and transitions to maintain logical accuracy in the FSM.

Algorithm 3: Convert Expressions to Statements Input: Expressions where i =1…N

Output: State machine representation of expressions

1: for Every expression and i = 1..N do

2: if Expression is of type (with variables) then

3: Add state Si for expression ;

4: Add transition Ti from S_visibility to Si;

5: if Expression involves conditional checks then

6: Add state S_Condition;

7: Add transition Ti from Si to S_Condition;

8: if Expression involves loops then

9: Add state S_Loop, S_Loop_condition, S_Loop_increment;

10: Add transition Ti from Si to S_Loop;

11: Add transition Ti+1 from S_Loop to S_Loop_condition with guard(condition);

12: Add transition Ti+2 from S_Loop_condition to S_Loop_increment;

13: Add transition Ti+3 from S_Loop_increment back to

S_Loop_condition with guard(!condition);

14: if Expression is of type (with function calls) then

15: Add state Si for function calls in ;

16: Add transition Ti from S_visibility to Si;

17: if Expression involves sending ether then

18: Add state S_Sending_ether;

19: Add transition Ti from Si to S_Sending_ether;

20: if Expression involves internal/external function calls then

21: Add state S_Call_function, S_External_call_function;

22: Add transition Ti from Si to S_Call_function;

23: Add transition Ti+1 from Si to S_External_call_function;

24: if Expression is of type (explicit expression) then

25: if Expression involves simple arithmetic then

26: Add state S_Arithmetic;

27: Add transition Ti from S_visibility to S_Arithmetic;

28: if Expression involves conditional checks without variables then

29: Add state S_Condition;

30: Add transition Ti from S_Arithmetic to S_Condition;

31: if Expression involves loops with constant bounds then

32: Add state S_Loop, S_Loop_condition, S_Loop_increment;

33: Add transition Ti from S_Arithmetic to S_Loop;

34: Add transition Ti+1 from S_Loop to S_Loop_condition with guard(condition);

35: Add transition Ti+2 from S_Loop_condition to S_Loop_increment;

36: Add transition Ti+3 from S_Loop_increment to S_Loop_condition with guard(!condition);

37: return SRP model

The algorithm is completed by returning the final SRP model (line 37), representing a faithful simulation of the contract’s structure. Each expression type’s handling ensures that complex behaviors like conditionals, loops, and function calls are captured accurately in the FSM, allowing for a detailed analysis and execution simulation of the contract’s internal logic.

By integrating the outputs from Algorithms 2 and 3, Algorithm 1 constructs a comprehensive SRP model. This model provides an exhaustive FSM representation of all contract functions and state transitions, utilizing predefined state identifiers for various Solidity constructs to enhance generalization within the verification model. This layered methodology establishes a robust FSM-based framework that supports rigorous analysis and formal verification of the contract’s structural and behavioral integrity.

3.3. Modeling Promela Through FSM

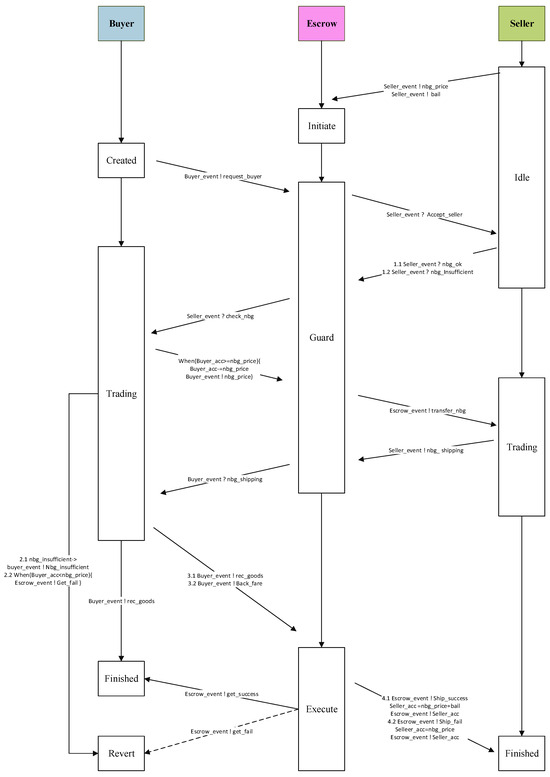

To demonstrate our approach to verifying the security of composite smart contracts in blockchain-based collaborative environments—particularly those deployed on the Ethereum platform—we implement a remote purchase security model using Solidity to briefly describe the flow of this smart contract and the flow of the Promela model shown in Figure 5.

Figure 5.

Transaction flowchart after formal modeling.

The transaction process of the whole smart contract consists of three main bodies in total, in which the main body Buyer has four phases {Created,Trading,Finished,Revert}, which mainly include inventory inquiries, checking the account balance, acceptance of goods, and initiating the return request. The main Seller model has three phases {Idle,Trading,Finished} which include providing a margin for transactions and registering product information, responding to inventory inquiries, confirming purchase requests and shipping the goods, completing transaction confirmations, and processing return requests. The main Escrow model also has three stages {Initiate,Guard,Execute}, during which it is responsible for registering transactions, securely holding the Buyer’s funds, monitoring the fulfillment of obligations by both parties, handling disputes, and releasing funds to the Seller or processing refunds as needed.

The transaction begins with the Seller in the Idle state. Upon submitting a security deposit and uploading product information to the Escrow, the Seller transitions to the Initiate state. Subsequently, the Buyer enters the Created state by sending a query request to confirm product availability. The Escrow (Guard state) verifies the query with the Seller, who responds with the availability status. If goods are unavailable or the Buyer lacks sufficient balance, the process ends in the Revert state. Otherwise, the Buyer sends a purchase request with payment to the Escrow, which forwards it to the Seller. Upon confirmation, the Seller ships the goods and enters the Trading state. If the Buyer successfully receives the goods, they send a receipt signal, moving to the Finished state. The Escrow then releases the payment and deposit to the Seller, who also enters the Finished state. If the goods are rejected, the Buyer requests a return, and the Escrow refunds the payment while the Seller retrieves the goods and deposit, finalizing the process. This formal process is modeled using Promela for smart contracts.

4. Experiments

After transforming the Solidity-based smart contract into its corresponding Promela model and modeling relevant entities, we proceed to verify the behavioral consistency between the Promela model and the original contract functionality using LTL within a formal verification framework. A two-phase verification strategy is adopted. In the first phase, the functional specifications of the smart contract are formally expressed in LTL. These specifications serve as correctness criteria and are defined with the assistance of Smart Pulse. In the second phase, the Spin model checker is employed to simulate and verify whether the Promela model satisfies the specified LTL properties, thereby ensuring the correctness and reliability of the contract’s execution logic.

We conduct our evaluation using a set of benchmarks that reference and build upon the VerX and Smart Pulse benchmark suites, both of which feature known vulnerability patterns identified in prior research. A selection of these common vulnerability patterns is included in Appendix B for reference. All benchmark data used in our study is publicly available at https://github.com/olstussy/Verification, accessed on 12 June 2025.

4.1. Sculpting Promela Models Using LTL

The correct execution of smart contracts should ensure the orderly execution of the transaction, and the funds should flow safely among accounts during the specific properties to be verified, as follows:

Property 1.

After closing the transaction, the money remaining in all accounts is equal to the money at the beginning of the transaction.

Property 2.

When a buyer makes a return request and the seller receives the goods, the buyer must eventually receive a refund.

Property 3.

Either the seller will never return the goods themselves until the buyer returns the goods, or the buyer will never perform a return refund action at all, and will only perform a pickup action after paying for the smart contract BCC; otherwise, the pickup will never happen. This means that the system strictly controls the order of the whole process.

&&([]((!pick_goods Upay_bcc) || !pay_bcc)))

Property 4.

If the transaction is successful, the seller’s account balance is the initial balance plus the margin and the price of the item, the buyer’s account balance is the initial balance minus the price of the item, and the escrow’s account balance is the initial balance.

&&<>(buyer_Acc==buyer_AccInit-pay_goods)&&<>(escrow_Acc==escrow_AccInit))

Property 5.

This property guarantees that the buyer will not be able to request a refund after receiving the goods.

4.2. Generating LTL with Smart Pulse

We put the smart contract Solidity source code into Smart pulse to obtain the LTL generated by this tool according to the function of this smart contract, as shown in Table 4, and then convert the LTL generated by this tool into the LTL that can be recognized in the Promela model according to the variables of Promela and enter it into Spin for verification.

Table 4.

Liveness properties in smart pulse.

Property 6.

Once the EscrowVault.enableRefunds operation is completed, the contract must ensure that, at some future time, the buyer will receive the corresponding refund amount. This refund amount is equal to the total deposit the user made in the EscrowVault.deposit operation.

Property 7.

This property guarantees that the seller’s fund withdrawal and the buyer’s refund request will not occur simultaneously.

Property 8.

At some future point, the EscrowVault.close function will be completed, and when this operation finishes, the seller of the current contract will be specified. It emphasizes that before closing the escrow contract, the seller must be correctly identified and complete the necessary operations.

Property 9.

Ensures that, for each user, the contract’s deposit and refund operations will both be completed at some point in the future. This means that the contract will not indefinitely block the buyer’s deposit or refund operations, ensuring that the user has an opportunity to complete their deposit and receive the corresponding refund under any circumstances.

Our work rigorously verifies the correctness and security of the remote shopping smart contract by formalizing key properties using LTL. These properties cover fund integrity, operation sequencing, state consistency, and contract liveness, effectively detecting major vulnerabilities such as integer overflow, DoS, TOD, fund leakage, reentrancy, race conditions, and improper finalization. Table 5 summarizes each property’s description, verification purpose, and the primary vulnerabilities addressed.

Table 5.

LTL properties and vulnerabilities.

These LTL specifications are translated into Promela-compatible formulas and verified using the Spin model checker to rigorously validate the contract’s behavior under all possible executions.

4.3. Model Checking of Smart Contracts

Once we apply the transformation algorithm to generate the Promela model of the smart contract, the verification of the contract’s properties can be reduced to verifying the corresponding properties of the Promela model. For model checking, we use Spin, a formal verification tool based on the Promela language, which is designed to verify the properties of concurrent systems. By exhaustively exploring the system’s state space, Spin automatically checks properties such as safety and liveness and generates counterexamples to reveal potential design flaws.

4.4. Simulation

In the previous section, we formalized the smart contract and transformed it into Pro mela using FSM. Next, we use Spin to perform model checking on the Promela model. We run Spin using bit-state storage and breadth-first search mode. Each time Spin fails, we double the estimated state space until an attack is detected or we reach the memory limit. The final simulation results are shown in Figure 6.

Figure 6.

Spin simulation results.

The transaction process include the buyer, seller, escrow, and the smart contract accounts, ensuring secure and regulated execution through multi-party message interactions. First, the buyer sends a request_buyer message to the seller to initiate the transaction. Upon confirmation, the buyer transfers the transaction amount into the smart contract account SBC via the nbg_ok message, ensuring the funds are securely escrowed. SBC then sends a funds_ok message to the seller, signaling that they can prepare for shipment. The seller subsequently sends a request_t message to the escrow to request transportation services. Upon receiving this, the escrow provides confirmation and responds with the carryC_ok message, indicating that transportation preparations are ready. SBC sends a fare_ok message confirming that the transportation fee is in place, allowing the escrow to safely proceed with the delivery. The seller ships the goods and informs the buyer with the ship_success message. Upon receiving the goods, the buyer sends a rec_goods message to SBC to confirm receipt. Based on this confirmation, the SBC smart contract account transfers the payment to the seller, and the seller confirms receipt with the get_success message. Finally, BCC transfers the transportation fee to the escrow.

This transaction process, reliant on the message-passing mechanism, ensures that each participant fulfills their responsibilities and that the funds are transferred transparently and securely in accordance with the transaction rules. From this simulation diagram, it can be concluded that our method of converting Solidity code into Promela models effectively captures all the functionality of the smart contract without errors.

4.5. Verification

Leveraging a prototype conversion algorithm, we systematically generated the Promela model and formally specified a range of smart contract properties using LTL. Building upon the earlier simulation of the Promela model’s execution, we conducted comprehensive verification of both manually defined properties and contract-specific attributes pertinent to our case study. The verification tools employed, along with detailed experimental results and the prototype implementation, are publicly accessible via our GitHub repository (https://github.com/olstussy/Verification, accessed on 12 June 2025).

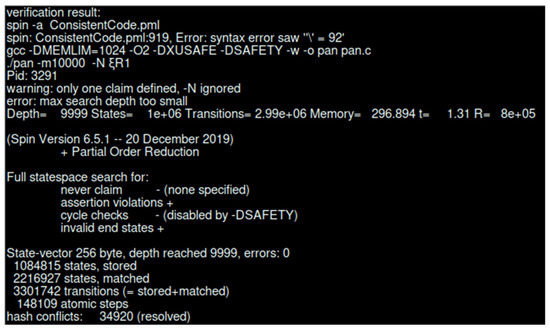

In this section, we validate both the manually defined LTL formulas and those generated by Smart Pulse through a representative verification experiment. The results of this validation are presented in the figure below.

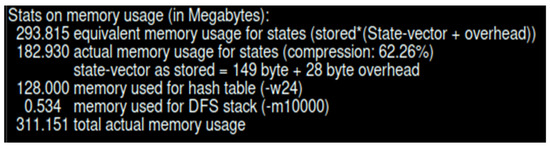

The results from the model checker Spin in Figure 7 indicate that the search depth reached 9999, exploring 1,084,815 states and nearly 3 million state transitions, with no errors or assertion violations detected. Figure 8 shows the state storage was compressed, occupying 182.93 MB of memory, with a compression ratio of 62.26%. The hash table utilized 128 MB of memory and resolved 34,920 conflicts, with the total memory usage amounting to 311.15 MB. These results demonstrate that the current model satisfies the verification properties, with no deadlock or cycle violations.

Figure 7.

Verification result of specific properties.

Figure 8.

Memory usage for state-space verification.

We used the method proposed in this paper to verify functional consistency in Spin, and all verifications were successful. A summary of all verification results is shown in Table 6.

Table 6.

Properties’ verification results.

The table illustrates that these properties primarily focus on the security, fairness, and fund protection aspects of the smart contract during the transaction process. Specifically, ensures that the balance of all accounts is consistent with their initial state at the end of the transaction; guarantees that the buyer will receive a refund after a return; controls the transaction flow, ensuring that the actions of the seller and buyer do not conflict; states that, after a successful transaction, the account balances of all parties must meet predetermined conditions; ensures that the buyer cannot request a refund after confirming the receipt of goods; ensures that users will receive a full refund on time after the refund function is activated; prevents simultaneous withdrawal by the seller and refund by the buyer; emphasizes that when the contract is closed, the seller must be correctly designated and complete the relevant actions; and finally, ensures that each user’s deposit and refund operations will be completed at a future point, avoiding indefinite blockage of actions. The verification exhibited a very high accuracy rate. Furthermore, the method proposed in this paper is applicable to a wide range of other smart contracts. Corresponding tests have been conducted, producing the following results.

The data presented in Table 7 demonstrates that our approach exhibits strong applicability and achieves high verification coverage across a diverse range of smart contract categories, particularly in Crowdsale, ICO, and ERC20 token projects. Nevertheless, verification coverage is comparatively lower for certain wallet and gaming contracts, indicating potential limitations in addressing more complex or specialized contract logic. These observations underscore the necessity for further refinement of the verification framework to enhance its capability in handling sophisticated contract scenarios.

Table 7.

Smart contract project verification summary.

We applied our proposed method to a range of additional smart contract projects, most of which exhibited strong verification performance. To further assess its effectiveness and generalizability, we conducted a comparative evaluation against several state-of-the-art verification tools—Verx, KEVM, Smart Pulse, and Zeus—using a benchmark suite of 67 tests available at https://github.com/olstussy/Verification, accessed on 12 June 2025. This benchmark set, curated by domain experts, focuses on widely recognized vulnerability classes, including Reentrancy, Transaction-Ordering Dependency, DoS, and race conditions.

Table 8 presents a comparative analysis of each verification tool using standard metrics: true positives (TPs), true negatives (TNs), false negatives (FNs), and false positives (FPs), evaluated across four major vulnerability categories. The results show that our method achieves competitive performance, with relatively high true positive rates and fewer misclassifications in most cases. These findings suggest that our approach can effectively identify a wide range of smart contract vulnerabilities, offering a practical and reliable option for formal verification tasks.

Table 8.

Comparative evaluation of smart contract verification tools.

We further evaluated our approach using an additional set of 41 tests (Verx’s Benchmark) targeting assertion violations and arithmetic overflows/underflows—common sources of critical smart contract failures. The results reinforce the accuracy and robustness of our method, demonstrating its effectiveness in detecting subtle yet severe vulnerabilities that are often missed by conventional tools.

Through the design of these properties, the smart contract ensures transaction transparency, fairness, and fund security, preventing improper actions and fund losses. Thus, the method we propose demonstrates high functional consistency when converting Solidity smart contracts into Promela models.

5. Conclusions and Future Work

This paper addresses the critical challenges of correctness and security in smart contracts. We introduce a novel approach for transforming Solidity-based smart contracts into formal Promela models through FSMs. Compared to previous methods, our approach not only converts smart contracts into a formal language but also verifies whether they conform to the specifications defined by stakeholders. Our method provides a formal description of Solidity smart contracts, constructs a standardized state transition model through FSM, and transforms it into a formal Promela model. Additionally, we define the smart contract’s security properties using LTL and incorporate formulas generated by the Smart Pulse tool to conduct formal verification in Spin. This process ensures the correctness and security of the smart contracts. The proposed approach offers a systematic verification framework that significantly enhances the reliability and security of smart contracts. It not only reduces the risks associated with design and implementation flaws but also provides strong support for the widespread adoption of secure and reliable blockchain applications.

The method we propose remains largely theoretical, and we plan to focus on automating the conversion of smart contracts into formal languages and verifying their security properties in future work.

In future work, two main research directions will be explored. First, we will expand the scope of smart contracts being verified, including other types of smart contracts written in Solidity and contracts developed using other programming languages. Second, we plan to develop an automated conversion tool using semantic transformation techniques to convert Solidity smart contracts into formal Promela models, which will improve the efficiency of the verification process.

Author Contributions

Conceptualization, M.X. and Y.X.; methodology, Y.X.; validation, Y.X., S.Y. and L.C.; formal analysis, Y.Z.; investigation, Y.X.; writing—original draft preparation, Y.X.; writing—review and editing, M.X. and K.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 62362033, 61962020), Double Thousand Talent Plan of Jiangxi Province (No. jxsq2023201009), Natural Science Foundation of Jiangxi Province (No. 20224ACB202006), Jiangxi Province Early Career Youth Science and Technology Talent Training Special Project (No.20244BCE52146).

Data Availability Statement

The authors confirm that the data supporting the findings of this study are available within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

This Appendix provides an overview of common smart contract analysis methods and representative tools, categorized by their underlying techniques such as symbolic execution, model checking, and theorem proving. The table summarizes each tool’s targeted input and analysis focus, offering insight into the current landscape of smart contract verification.

Table A1.

Overview of smart contract analysis methods and tools.

Table A1.

Overview of smart contract analysis methods and tools.

| Analysis Method | Tool | Target |

|---|---|---|

| Symbolic Execution/Static Analysis | Oyente | EVM bytecode + Ethereum global state |

| Zeus | Solidity source → LLVM | |

| Mythril | Solidity source + EVM bytecode | |

| VERX | Solidity + properties → symbolic automata | |

| SOLC-VERIFY | Solidity source with annotations | |

| Slither | Solidity source → SlithIR | |

| Model Checking | SPIN | Solidity → Promela (FSM model + LTL) |

| UPPAAL | Solidity with timing constraints | |

| NuSMV | Solidity modeled via transition systems | |

| Smart Pulse | Solidity → FSM → Smart LTL properties | |

| VERISOL | Solidity (Boogie-based) | |

| Theorem Proving | Coq | Solidity modeled manually in Coq |

| Isabelle/HOL | EVM bytecode → Lem language | |

| KEVM | EVM bytecode → K framework | |

| KEVMVER | KEVM-based property verifier with specification language |

Appendix B

This Appendix presents a focused overview of eight widely recognized vulnerabili-ties in smart contracts, each of which poses significant security and reliability challenges. The table below summarizes the root causes and potential impacts of these vulnerabilities, offering actionable insights for secure contract development and verification.

Table A2.

Overview of Typical Smart Contract Vulnerabilities.

Table A2.

Overview of Typical Smart Contract Vulnerabilities.

| Vulnerability | Cause | Potential Impact |

|---|---|---|

| Reentrancy | External calls are made before completing internal state updates, allowing repeated entry | Repeated unauthorized fund withdrawals; exemplified by the DAO attack where the contract was drained |

| Disorder | Contract functions depend on a specific execution order but can be called out of sequence | Unauthorized access, unintended state transitions, or disruption of contract logic |

| Timestamp Dependency | Reliance on block timestamps for critical logic which can be influenced by miners | Time-based conditions may be manipulated to gain unfair advantages |

| Block Number Dependency | Use of block numbers in key logic, which miners can slightly influence | Fairness or correctness of time- or randomness-related operations may be compromised |

| Stack Overflow | Excessive recursion or deeply nested calls exceed the EVM’s stack limit | Contract failure or erratic behavior, possibly leading to service disruption |

| Denial of Service (DoS) | Resource exhaustion, such as excessive gas consumption or blocked execution paths | Contract becomes unresponsive, leading to loss of functionality or availability |

| Integer Overflow | Arithmetic operations exceed variable limits, causing numeric wraparound | Inaccurate computations, balance manipulation, or faulty contract logic |

| Race Condition | Contract behavior is influenced by transaction timing, which can be manipulated concurrently | Double-spending, inconsistent states, or unexpected execution outcomes |

References

- Yaga, D.; Mell, P.; Roby, N.; Scarfone, K. Blockchain technology overview. arXiv 2019, arXiv:1906.11078. [Google Scholar] [CrossRef]

- Gavin, W. Ethereum: A Secure Decentralised Generalised Transaction Ledger. 2019. Available online: https://mholende.win.tue.nl/seminar/references/ethereum_yellowpaper.pdf (accessed on 12 June 2025).

- Etherscan. The Ethereum Blockchain Explorer. 2025. Available online: https://etherscan.io (accessed on 12 June 2025).

- Szabo, N. The idea of smart contracts. Nick Szabo’s Pap. Concise Tutor. 1997, 6, 199. [Google Scholar]

- Andreas, M.; Gavin, W. Mastering Ethereum: Building Smart Contracts and Dapps; O’Reilly Media: Sebastopol, CA, USA, 2018. [Google Scholar]

- BlockCAT. On the Parity Multi-Sig Wallet Attack. 2017. Available online: https://medium.com/blockcat/on-the-parity-multi-sig-wallet-attack-83fb5e7f4b8c (accessed on 12 June 2025).

- Pretrov, S. Another Parity Wallet Hack Explained. 2017. Available online: https://medium.com/@Pr0Ger/another-parity-wallet-hack-explained-847ca46a2e1c (accessed on 12 June 2025).

- Wikipedia. Poly Network Exploit. 2025. Available online: https://en.wikipedia.org/wiki/Poly_Network_exploit (accessed on 12 June 2025).

- Hildenbrandt, E.; Saxena, M.; Rodrigues, N.; Zhu, X.; Daian, P.; Guth, D.; Moore, B.; Park, D.; Zhang, Y.; Stefanescu, A.; et al. KEVM: A complete formal semantics of the Ethereum virtual machine. In Proceedings of the 2018 IEEE 31st Computer Security Foundations Symposium (CSF), Oxford, UK, 9–12 July 2018; pp. 204–217. [Google Scholar] [CrossRef]

- Kalra, S.; Goel, M.; Dhawan, M.; Sharma, S. Zeus: Analyzing safety of smart contracts. In Proceedings of the Network and Distributed System Security Symposium (NDSS), San Diego, CA, USA, 18–21 February 2018; pp. 1–12. [Google Scholar]

- Permenev, A.; Dimitrov, D.; Tsankov, P.; Drachsler-Cohen, D.; Vechev, M. Verx: Safety verification of smart contracts. In Proceedings of the 2020 IEEE Symposium on Security and Privacy, San Francisco, CA, USA, 18–21 May 2020; pp. 18–20. [Google Scholar]

- Holzmann, G.J. The model checker SPIN. IEEE Trans. Softw. Eng. 1997, 23, 279–295. [Google Scholar] [CrossRef]

- Hamdaqa, M.; Met, L.A.P.; Qasse, I. iContractML 2.0: A domain-specific language for modeling and deploying smart contracts onto multiple blockchain platforms. Inf. Softw. Technol. 2022, 144, 106762. [Google Scholar] [CrossRef]

- Jurgelaitis, M.; Butkien e, R. Solidity Code Generation from UML State Machines in Model-Driven Smart Contract Development. IEEE Access 2022, 10, 33465–33481. [Google Scholar] [CrossRef]

- Ethereum. Solidity Documentation. 2022. Available online: https://docs.soliditylang.org/en/v0.8.11 (accessed on 12 June 2025).

- Dolev, S.; Wang, Z. Sodsmpc: Fsm based anonymous and private quantumsafe smart contracts. In Proceedings of the 2020 IEEE 19th International Symposium on Network Computing and Applications (NCA), Cambridge, MA, USA, 24–27 November 2020; pp. 1–10. [Google Scholar]

- Volland, F. State Machine: A Compilation of Patterns and Best Practices for the Smart Contract Programming Language.2024. Available online: https://fravoll.github.io/solidity-patterns/state_machine.html (accessed on 12 June 2025).

- Mavridou, A.; Laszka, A. Designing secure ethereum smart contracts: A finite state machine based approach. In Proceedings of the International Conference on Financial Cryptography and Data Security, Nieuwpoort, Curacao, 26 February–2 March 2018; Springer: Berlin/Heidelberg, Germany, 2018; pp. 523–540. [Google Scholar]

- Mavridou, A.; Laszka, A.; Stachtiari, E.; Dubey, A. Verisolid: Correct-by-design smart contracts for Ethereum. In Proceedings of the Financial Cryptography and Data Security-23rd International Conference (FC 2019), Frigate Bay, Saint Kitts and Nevis, 18–22 February 2019; Revised Selected Papers. pp. 446–465. [Google Scholar] [CrossRef]

- Liao, Z.; Hao, S.; Nan, Y.; Zheng, Z. Smartstate: Detecting state-reverting vulnerabilities in smart contracts via fine-grained state-dependency analysis. In Proceedings of the 32nd ACM SIGSOFT International Symposium on Software Testing and Analysis, Seattle, WA, USA, 17–21 July 2023; pp. 980–991. [Google Scholar]

- Luo, H.; Lin, Y.; Yan, X.; Hu, X.; Wang, Y.; Zeng, Q.; Wang, H.; Jiang, J. Guiding LLM-based Smart Contract Generation with Finite State Machine. arXiv 2025, arXiv::2505.08542. [Google Scholar] [CrossRef]

- Ladleif, J.; Weske, M. A unifying model of legal smart contracts. In Proceedings of the International Conference on Conceptual Modeling, Vienna, Austria, 3–6 November 2019; Springer: Berlin/Heidelberg, Germany, 2019; pp. 323–337. [Google Scholar]

- Hirai, Y. Defining the ethereum virtual machine for interactive theorem provers. In Financial Cryptography and Data Security; Brenner, M., Ed.; Springer International Publishing: Cham, Switzerland, 2017. [Google Scholar]

- Roșu, G.; Șerbănută, T.F. An overview of the K semantic framework. J. Log. Algebr. Program. 2010, 79, 397–434. [Google Scholar] [CrossRef]

- Bhargavan, K.; Delignat-Lavaud, A.; Fournet, C.; Gollamudi, A.; Gonthier, G.; Kobeissi, N.; Kulatova, N.; Rastogi, A.; Sibut-Pinote, T.; Swamy, N.; et al. Formal verification of smart contracts: Short paper. In Proceedings of the 2016 ACM Workshop on Programming Languages and Analysis for Security, Vienna, Austria, 24 October 2016; pp. 91–96. [Google Scholar]

- Nehai, Z.; Piriou, P.Y.; Daumas, F. Model-checking of smart contracts. In Proceedings of the 2018 IEEE International Conference on Internet of Things (iThings) and IEEE Green Computing and Communications (GreenCom) and IEEE Cyber, Physical and Social Computing (CPSCom) and IEEE Smart Data (SmartData), Halifax, NS, Canada, 30 July–3 August 2018; pp. 980–987. [Google Scholar]

- Bai, X.; Cheng, Z.; Duan, Z.; Hu, K. Formal Modeling and Verification of Smart Contracts. In Proceedings of the 2018 7th International Conference on Software and Computer Applications, Kuantan, Malaysia, 8–10 February 2018. [Google Scholar]

- Wang, Y.; Lahiri, S.; Chen, S.; Pan, R.; Dillig, I.; Born, C.; Naseer, I.; Ferles, K. Formal verification of workflow policies for smart contracts in azure blockchain. In Verified Software. Theories, Tools, and Experiments, Proceedings of the 11th International Conference, VSTTE 2019, New York, NY, USA, 13–14 July 2019; Revised Selected Papers; Springer Nature: Heidelberg, Germany, 2019; p. 87. [Google Scholar]

- Hajdu, A.; Jovanovic, D. solc-verify: A modular verifier for solidity smart contracts. In Verified Software. Theories, Tools, and Experiments, Proceedings of the 11th International Conference, VSTTE 2019, New York, NY, USA, 13–14 July 2019; Chakraborty, S., Navas, J.A., Eds.; Revised Selected Papers, Volume 12031 of Lecture Notes in Computer Science; Springer: Cham, Switzerland, 2020; pp. 161–179. [Google Scholar]

- Park, D.; Zhang, Y.; Saxena, M.; Daian, P.; Roşu, G. A formal verification tool for ethereum vm bytecode. In Proceedings of the 2018 26th ACM Joint Meeting on European Software Engineering Conference and Symposium on the Foundations of Software Engineering, Lake Buena Vista, FL, USA, 4–9 November 2018; p. 912915. [Google Scholar]

- Stephens, J.; Ferles, K.; Mariano, B.; Lahiri, S.; Dillig, I. SmartPulse: Automated Checking of Temporal Properties in Smart Contracts. In Proceedings of the 2021 IEEE Symposium on Security and Privacy (SP), San Francisco, CA, USA, 24–27 May 2021; pp. 555–571. [Google Scholar] [CrossRef]

- Bartoletti, M.; Galletta, L.; Murgia, M. A minimal core calculus for Solidity contracts. In Data Privacy Management, Cryptocurrencies and Blockchain Technology; Pérez-Solà, C., Navarro-Arribas, G., Biryukov, A., Garcia-Alfaro, J., Eds.; Springer: Berlin/Heidelberg, Germany, 2019; pp. 233–243. [Google Scholar]

- Crafa, S.; Di Pirro, M.; Zucca, E. Is Solidity solid enough? In Financial Cryptography and Data Security; Bracciali, A., Clark, J., Pintore, F., Rønne, P.B., Sala, M., Eds.; Springer: Berlin/Heidelberg, Germany, 2020; pp. 138–153. [Google Scholar]

- Ahrendt, W.; Bubel, R. Functional verification of smart contracts via strong data integrity. In Leveraging Applications of Formal Methods, Verification and Validation: Applications; Margaria, T., Steffen, B., Eds.; Springer: Berlin/Heidelberg, Germany, 2020; pp. 9–24. [Google Scholar]

- Rosu, G.; Chen, F.; Ball, T. Synthesizing monitors for safety properties: This time with calls and returns. In International Workshop on Runtime Verification, RV; Leucker, M., Ed.; Springer: Berlin/Heidelberg, Germany, 2008; pp. 51–68. [Google Scholar]

- Baresi, L.; Mehdi, M.; Kallehbasti, P.; Rossi, M. Efficient scalable verification of LTL specifications. In Proceedings of the ACM/IEEE International Conference on Software Engineering (ICSE), Florence, Italy, 16–24 May 2015; pp. 711–721. [Google Scholar]

- Brockschmidt, M.; Cook, B.; Ishtiaq, S.; Khlaaf, H.; Piterman, N. T2: Temporal property verification. In Tools and Algorithms for the Construction and Analysis of Systems, Proceedings of the TACAS, Eindhoven, The Netherlands, 2–8 April 2016; Springer: Berlin/Heidelberg, Germany, 2016; pp. 387–393. [Google Scholar]

- Beyene, T.A.; Popeea, C.; Rybalchenko, A. Solving existentially quantified horn clauses. In Computer Aided Verification (CAV); Springer: Berlin/Heidelberg, Germany, 2013; pp. 869–882. [Google Scholar]

- Strom, R.E.; Typestate, S. A programming language concept for enhancing software reliability. IEEE Trans. Softw. Eng. 1986, SE-12, 157–171. [Google Scholar] [CrossRef]

- Browne, M.C.; Clarke, E.M.; Grümberg, O. Characterizing finite Kripke structures in propositional temporal logic. Theor. Comput. Sci. 1988, 59, 115–131. [Google Scholar] [CrossRef]

- Wang, M.; Tian, C.; Zhang, N.; Duan, Z. Verifying full regular temporal properties of programs via dynamic program execution. IEEE Trans. Reliab. 2018, 68, 1101–1116. [Google Scholar] [CrossRef]

- Cook, B.; Gotsman, A.; Podelski, A.; Rybalchenko, A.; Vardi, M.Y. Proving that programs eventually do something good. In Proceedings of the 34th ACM SIGPLANSIGACT Symposium on Principles of Programming Languages, Proceedings of the POPL 2007, Nice, France, 17–19 January 2007; Hofmann, M., Felleisen, M., Eds.; ACM: New York, NY, USA, 2007; pp. 265–276. [Google Scholar]

- Dietsch, D.; Heizmann, M.; Langenfeld, V.; Podelski, A. Fairness modulo theory: A new approach to ltl software model checking. In International Conference on Computer Aided Verification; Springer: Cham, Switzerland, 2015; pp. 49–66. [Google Scholar]

- Garfatta, I.; Klai, K.; Graïet, M.; Gaaloul, W. Model checking of vulnerabilities in smart contracts: A solidity-to-CPN approach. In Proceedings of the 37th ACM/SIGAPP Symposium on Applied Computing, Brno, Czech Republic, 25–29 April 2022; pp. 316–325. [Google Scholar]

- Sergey, I.; Nagaraj, V.; Johannsen, J.; Kumar, A.; Trunov, A.; Hao, K.C.G. Safer smart contract programming with scilla. Proc. ACM Program. Lang. 2019, 3, 185:1–185:30. [Google Scholar] [CrossRef]

- Coquand, T.; Huet, G.P. The calculus of constructions. Inf. Comput. 1988, 76, 95–120. [Google Scholar] [CrossRef]

- Vardi, M.Y. Automata-theoretic model checking revisited. In VMCAI 2007. LNCS; Cook, B., Podelski, A., Eds.; Springer: Berlin/Heidelberg, Germany, 2007; Volume 4349, pp. 137–150. [Google Scholar] [CrossRef][Green Version]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).