In recent times, several papers related to supply chain modeling and optimization have investigated the problem of inventory-distribution synchronization. For example, Ben-Daya et al. [

19] proposed integrated supplier-retailer inventory models and Khouja and Goyal [

20] presented a review on the joint optimization models proposed for the economic lot-sizing problem. Abdul-Jalbar et al. [

21] studied the one-warehouse multi-retailer inventory-distribution systems considering situations under both joint and independent replenishment schemes. They proposed a near-optimal solution for the decentralization case. Moreover, they developed a branch and bound algorithm that gives a near-optimal policy for the centralized case. In the same year, Gnoni et al. [

22] hybridized mixed-integer linear programming and simulation to solve the lot sizing and scheduling problem in a multi-site manufacturing supply chain. This system is constrained to capacity and the demand of the multi-product in the multi-period is stochastic. They applied the hybrid model to an industrial case study related to a supply chain of braking components for the automotive industry taking into account centralized and decentralized decision policies. Later, Chen and Chen [

23] addressed the multi-item two-echelon supply chain inventory system with deterministic demand. They considered centralized and decentralized decision policies and derived mathematical models to minimize the total supply chain costs. The numerical results have shown that implementing a policy of jointly coordinated replenishment decisions is better in terms of cost reduction and achieving savings than allowing independent replenishment decisions made by each member.

Regularly, in operations research, the differential calculus is used to model and optimize the integrated production inventory systems. On the other hand, some researchers and academicians have been proposing easy to apply and understand solution methods to optimize the production inventory integrated models. In this direction there exist the works of [

24,

25,

26,

27,

28]. Grubbström [

24] applied an algebraic o approach to the EOQ without backlogging. Later, Cárdenas-Barrón [

25] also employed the algebraic method to derive and solve the EPQ model with back-ordering assuming the situation of only one type of backorder: the cost per unit and time unit. In a subsequent paper, Cárdenas-Barrón [

26] developed an optimization model to solve the inventory decision making problem for a supply chain system involving a firm which supplies its produced goods to multiple buyers. The model was developed based on deterministic rates of production and demand. It is significant to see that this model formulation followed the simplest scheme for inventory coordination. This scheme assumes that all the firms at all tiers in the supply chain will share the same production-replenishment cycle time. He concluded that it is feasible to apply the algebraic optimization approach to derive the solution for the supply chain model without the need of using the traditional derivatives method. Wee and Chung [

28] applied the algebraic method to solve the economic lot size of the integrated buyer inventory problem. They concluded that the algebraic method is very helpful for those who lack the required calculus knowledge and skills to understand the solution procedure easily. Afterward, Chung and Wee [

27] proposed replenishment policies for an integrated three-stage inventory system with backorders. They were able to algebraically derive the optimal solution for this inventory problem in the supply chain of three echelons. Later, this model was extended by Seliaman [

29] to model a four-stage inventory system. Chi [

30] developed a simplified algebraic procedure to show that it is possible to find the optimal solution for the economic manufacturing quantity (EMQ) model with imperfect products, without using traditional calculus methods. In the same year, Cárdenas-Barrón [

31] dealt with the problem of finding the optimal manufacturing quantity in a single manufacturing facility assuming a rework process. The optimal solutions under two different inventory policies were obtained. Besides, the author derived the conditions for the existence of an optimal policy, the exact solution for the joint total inventory cost under the two inventory schemes, and the formulated structures that can identify the other additional costs resulting from using a suboptimal solution. Afterward, Ben-Daya et al. [

32] solved the joint economic quantity sizing problem for a supply chain with three layers to find the optimal order quantities for all the members in the chain to minimize the total costs comprising of production setup costs, costs of holding raw material, and costs of holding finished product inventory. In their model, the replenishment period in each echelon is established to be a whole multiple of the replenishment period for the contiguous direct following stage. To improve the performance in the shipment delivery, lots from a specific batch are permitted to occur during the time of producing batch and not after completing the production of the whole lot. They applied an optimization method without using the concepts of derivatives to obtain the optimal solution in its closed form for their proposed inventory model. Cárdenas-Barrón et al. [

33] revised the Ben-Daya et al. [

32] model improving their algorithm and obtaining less supply chain total cost and less CPU time. According to Cárdenas-Barrón [

34], the algebraic optimization approach for the modeling and optimization of production inventory systems has had remarkable interest from researchers in the domains of operational research and operational management. Also, Cárdenas-Barrón [

34] states that the increasing interest in using the algebraic optimization methods for solving these types of operational management problems and models of inventory is because these methods do not require any knowledge of differential calculus or the derivatives methods. A complete and comprehensive survey of literature on the use of these emerging algebraic techniques for the optimization of supply inventory models is done in Cárdenas-Barrón [

34]. Those who are interested in this line of research may refer to the relevant inventory models given in [

35,

36,

37,

38,

39,

40].

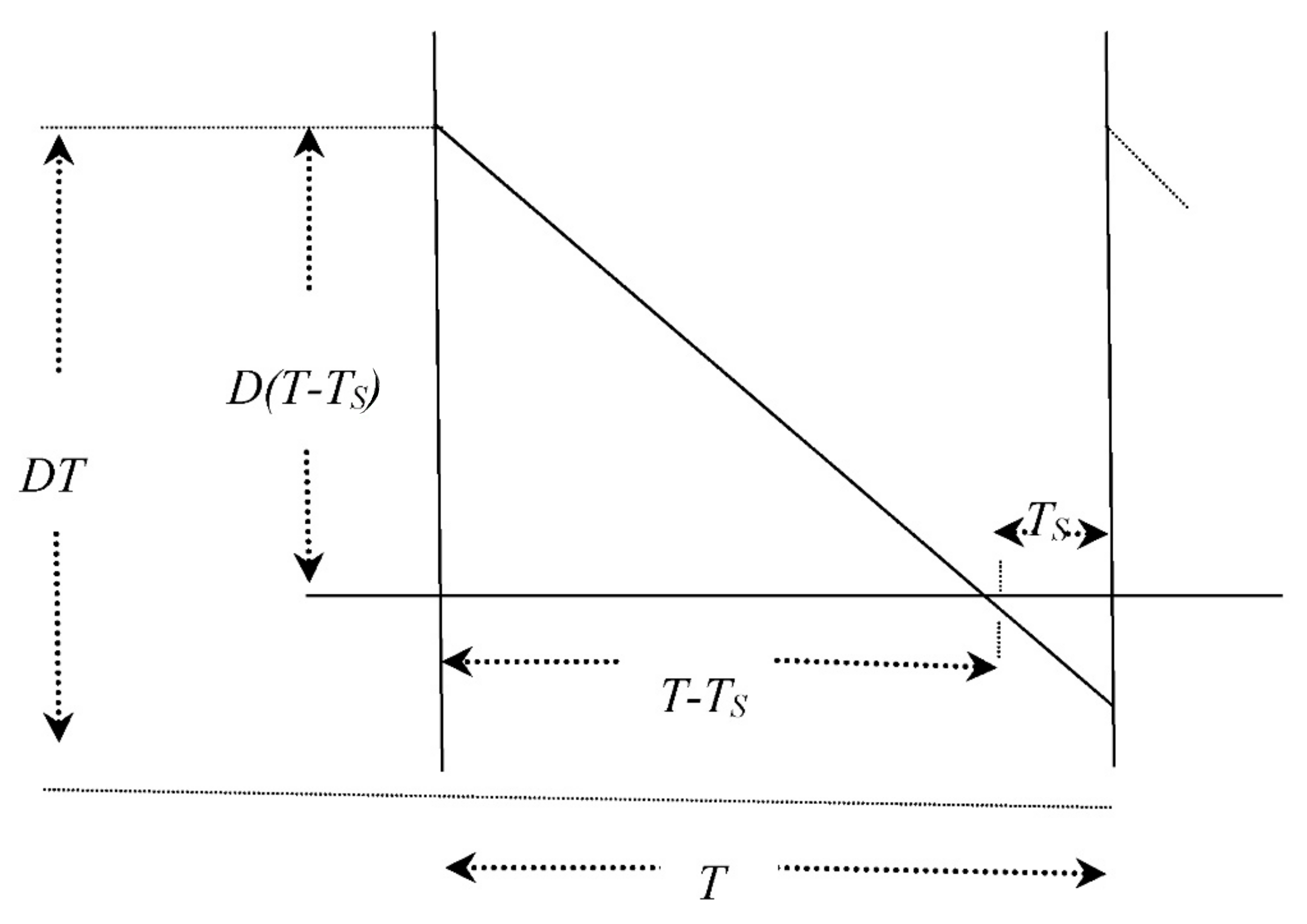

In this research paper, a generalized model is developed for the multi-tier multi-level supply chain using the mechanism of integer multipliers to coordinate the production and inventory operations among the different partners in the supply chain integrated system. The model assumes two well-known backorder costs. Furthermore, this model extends the generalized model of Seliaman and Ahmad [

41]. To the best of the authors’ knowledge, the research work presented in this paper is the first to develop an algebraic algorithm to derive the optimal solution for the generalized

n-stage serial or non-serial supply chain inventory problem considering linear and fixed backorder costs. The algebraic algorithm presented in this paper obtains the solution for a supply chain having the general

n number of stages (

n = 2, 3, 4, 5, 6, …). The remainder of this paper is structured in the following manner.

Section 3 describes the model notation, assumptions the model development details.

Section 4 shows the development of the algebraic optimization process and the proposed solution algorithm for the developed model and illustrates the use of the solution algorithm through two numerical examples.

Section 5 presents a brief discussion of the research results. Finally,

Section 6 provides some general conclusions.