Conversion of Dual-Use Technology: A Differential Game Analysis under the Civil-Military Integration

Abstract

1. Introduction

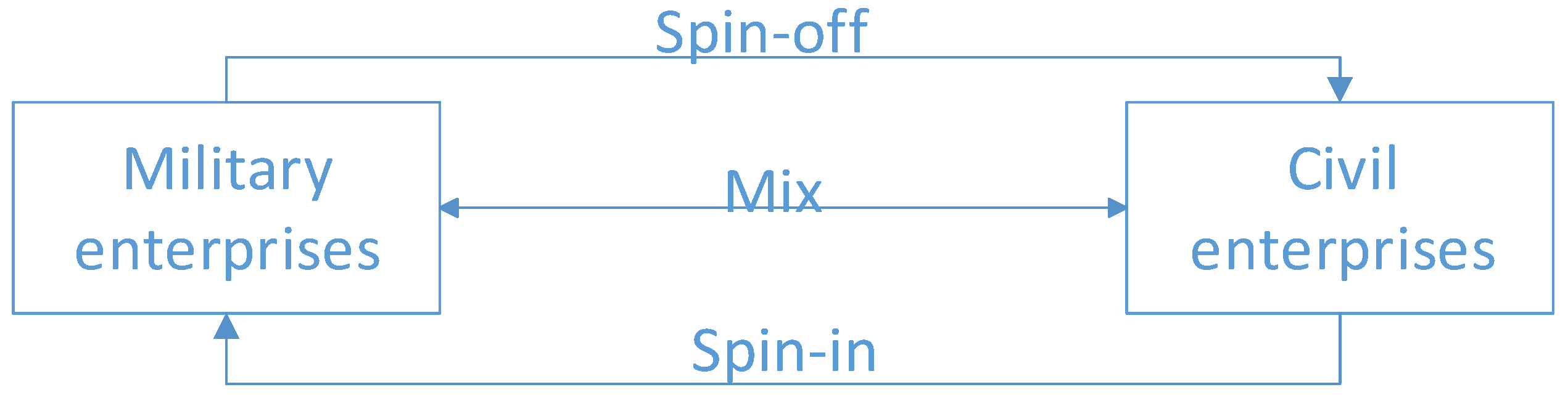

2. Model Design

Stochastic Differential Game Models

3. Equilibrium Analysis

3.1. Resolving Models of Spin-Off

3.2. Resolving Models of Spin-In

3.3. Resolving Models of Mix

4. Comparative Analysis of Equilibrium Results

4.1. Comparative Analysis of Equilibrium Results of Optimal Effort Level

4.2. Comparative Analysis of Equilibrium Results of Optimal Revenue

4.3. Dual-Use Technology Development

5. Simulation and Discussion

5.1. Generic Simulation

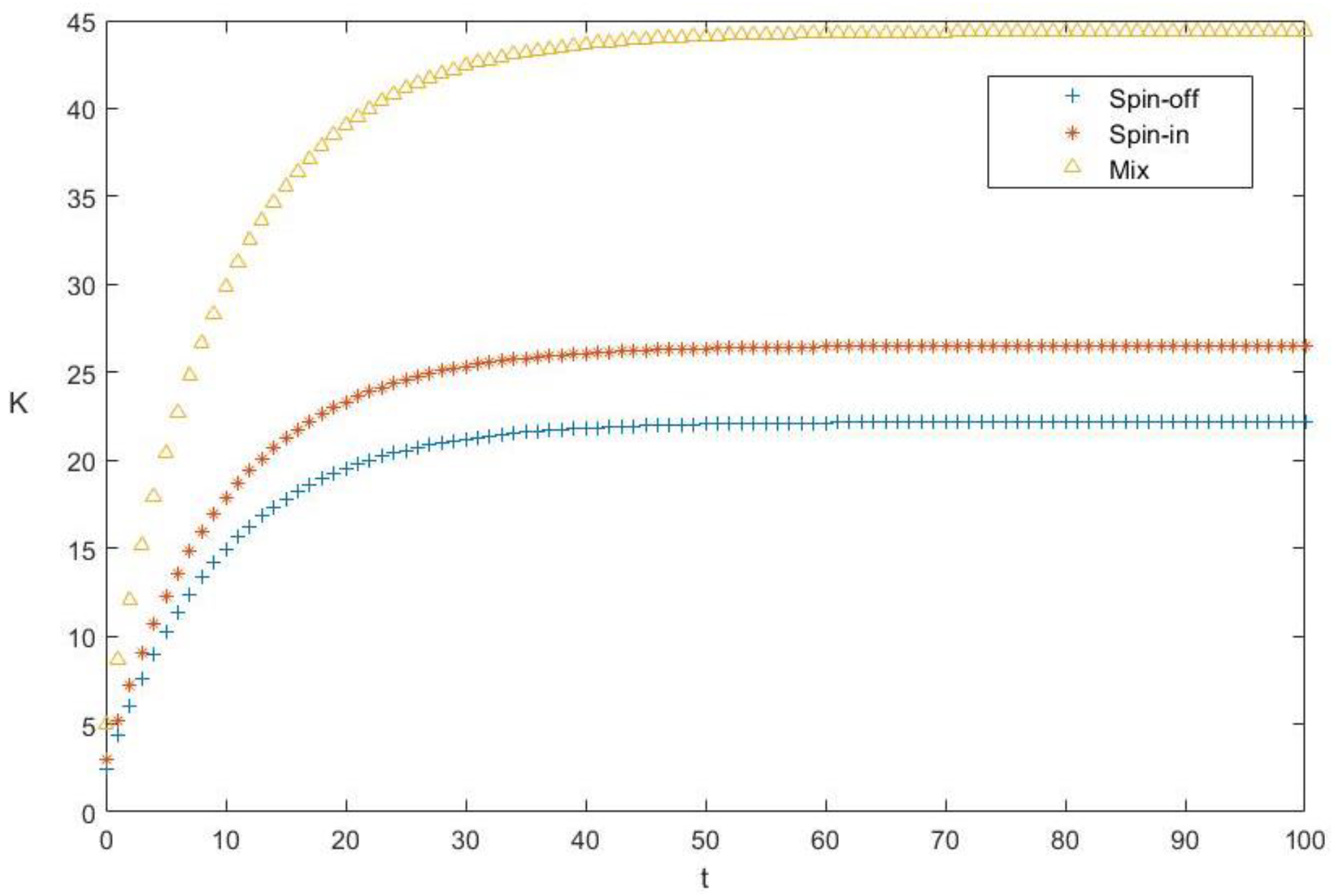

5.2. Dual-Use Technology Development in Three Modes

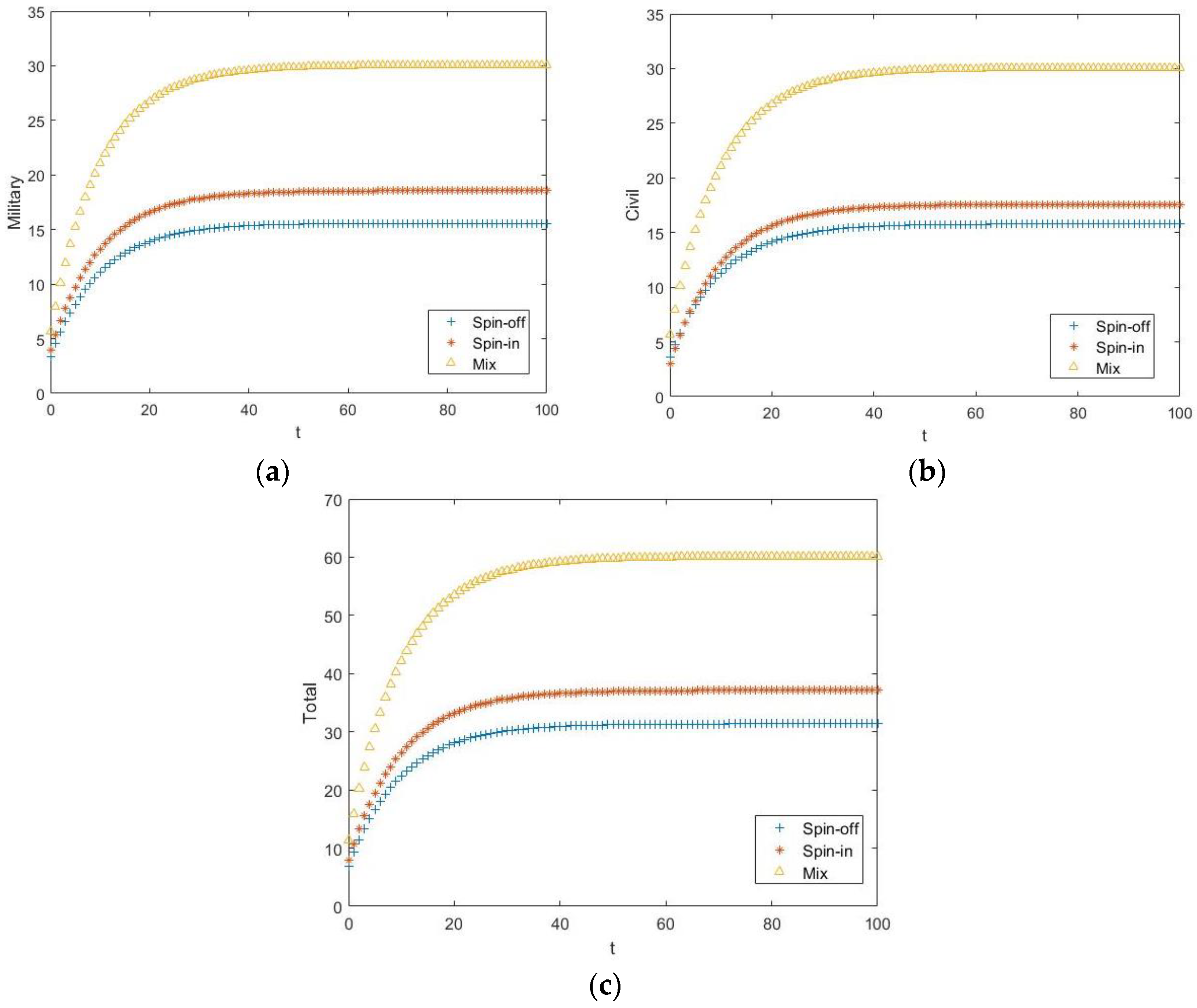

5.3. Individual and Total Revenue in Three Modes

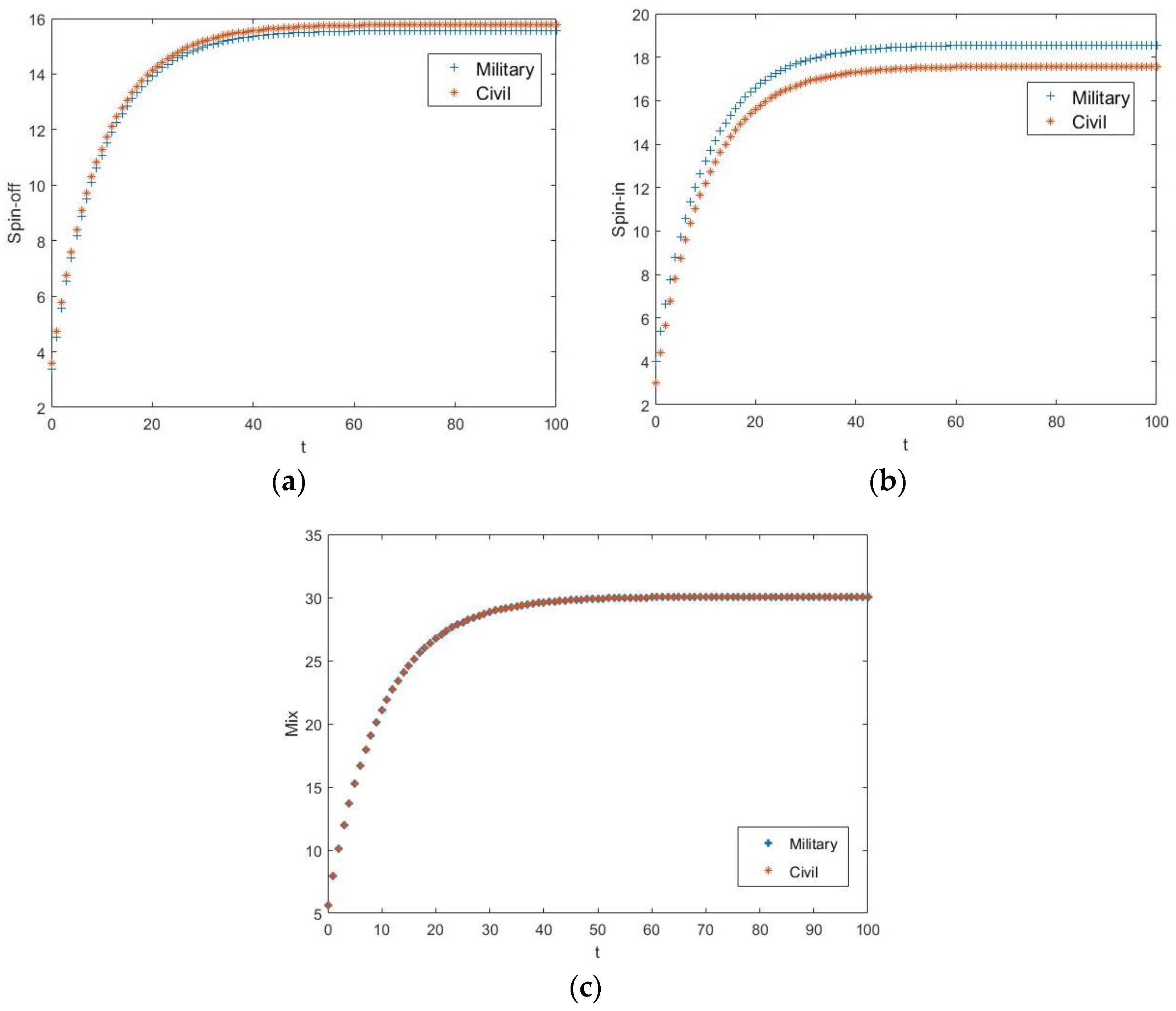

5.4. Revenue Comparison between Military and Civil Firms

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Data Availability

References

- Cowan, R.; Foray, D. Quandaries in the economics of dual technologies and spillovers from military to civilian research and development. Res. Policy 1995, 24, 851–868. [Google Scholar] [CrossRef]

- Hausken, K.; Moxnes, J.F. Innovation, Development and National Indices. Soc. Indic. Res. 2018, 141, 1165–1188. [Google Scholar] [CrossRef]

- Furuoka, F.; Oishi, M.; Karim, M.A. Military expenditure and economic development in China: An empirical inquiry. Def. Peace Econ. 2014, 27, 137–160. [Google Scholar] [CrossRef]

- Kulve, H.T.; Smit, W.A. Civilian–military co-operation strategies in developing new technologies. Res. Policy 2003, 32, 955–970. [Google Scholar] [CrossRef]

- Jing, R.; Benner, M. Institutional Regime, Opportunity Space and Organizational Path Constitution: Case Studies of the Conversion of Military Firms in China. J. Manag. Stud. 2015, 53, 552–579. [Google Scholar] [CrossRef]

- Song, C.H.; Elvers, D.; Leker, J. Anticipation of converging technology areas—A refined approach for the identification of attractive fields of innovation. Technol. Forecast. Soc. Chang. 2016, 116, 98–115. [Google Scholar] [CrossRef]

- Tu, Z.; Gu, X. Study on process of industry-university-research institute collaborative innovation based on knowledge flow. Stud. Sci. 2013, 31, 1381–1390. [Google Scholar]

- You, G.; Yan, H.; Zhao, X. The Policy System Construction on the Development of Civil-military Integration: Quo Status, Problems and Countermeasures. Forum Sci. Technol. China 2017, 1, 150–156. [Google Scholar]

- Acosta, M.; Coronado, D.; Ferrandiz, E.; Marin, M.R.; Moreno, P.J. Patents and dual-use technology: An empirical study of the world’s largest defence companies. Def. Peace Econ. 2018, 29, 821–839. [Google Scholar] [CrossRef]

- Tran, T.A.; Kocaoglu, D.F. Literature review on technology transfer from government laboratories to industry. In Proceedings of the PICMET ‘09–2009 Portland International Conference on Management of Engineering & Technology, Portland, OR, USA, 2–6 August 2009; pp. 2771–2782. [Google Scholar]

- Mowery, D.C. Handbook of The Economics of Innovation; Military R&D and Innovation: Amsterdam, The Netherlands, 2010; Volume 2, pp. 1219–1256. [Google Scholar] [CrossRef]

- Fitzgerald, B.; Parziale, J. As technology goes democratic, nations lose military control. Bull. At. Sci. 2017, 73, 1–6. [Google Scholar] [CrossRef]

- Zullo, R.; Liu, Y. Contending with Defense Industry Reallocations: A Literature Review of Relevant Factors. Econ. Dev. Q. 2017, 31, 360–372. [Google Scholar] [CrossRef]

- Avadikyan, A.; Cohendet, P.; Dupouët, O.; Avadikyan, A.; Cohendet, P.; Dupouët, O. A Study of Military Innovation Diffusion Based on Two Case Studies. In Innovation Policy in a Knowledge-Based Economy; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2005; pp. 161–189. [Google Scholar]

- Curran, C.-S. The Anticipation of Converging Industries. Anticipat. Converg. Ind. 2013, 45, 34–43. [Google Scholar]

- Gansler, J.S. Integrating civilian and military industry. Issues Sci. Technol. 1988, 5, 68–73. [Google Scholar]

- Diebold, W.; Alic, J.A. Beyond Spinoff: Military and Commercial Technologies in a Changing World. Foreign Aff. 1992, 71, 204. [Google Scholar] [CrossRef]

- Matelly, S.; Lima, M. The influence of the state on the strategic choices of defence companies: The cases of Germany, France and the UK after the Cold War. J. Innov. Econ. 2016, 20, 61. [Google Scholar] [CrossRef]

- Seró, M.A.; Coronado, D.; Marín, R. Potential Dual-Use of Military Technology: Does Citing Patents Shed LihgtI on This Process? Def. Peace Econ. 2011, 22, 335–349. [Google Scholar] [CrossRef]

- Brandt, L. Defense conversion and dual-use technology: The push toward civil-military integration. Policy Stud. J. 2010, 22, 359–370. [Google Scholar] [CrossRef]

- Uttley, M.R.H. Democracy’s arsenal: Creating a twenty-first-century defense industry. Def. Secur. Anal. 2011, 28, 194–195. [Google Scholar] [CrossRef]

- Sillers, T.S.; Kleiner, B.H. Defence conversion: Surviving (and prospering) in the 1990’s. Work Study 1997, 46, 45–48. [Google Scholar] [CrossRef]

- Pamen, O.M. Optimal Control for Stochastic Delay Systems Under Model Uncertainty: A Stochastic Differential Game Approach. J. Optim. Theory Appl. 2015, 167, 998–1031. [Google Scholar] [CrossRef]

- Yin, S.; Li, B. Transferring green building technologies from academic research institutes to building enterprises in the development of urban green building: A stochastic differential game approach. Sustain. Cities Soc. 2018, 39, 631–638. [Google Scholar] [CrossRef]

- Wang, J.-Y.; Blomström, M. Foreign investment and technology transfer. Eur. Econ. Rev. 1992, 36, 137–155. [Google Scholar] [CrossRef]

- Koessler, F. Strategic knowledge sharing in Bayesian games. Games Econ. Behav. 2004, 48, 292–320. [Google Scholar] [CrossRef]

- Podvezko, V. Others Game theory in building technology and management. J. Bus. Econ. Manag. 2008, 3, 237–239. [Google Scholar] [CrossRef]

- Wei, M.; Chen, G.; Cruz, J.B.; Hayes, L.; Krüger, M.; Blasch, E. Game-theoretic modeling and control of military operations with partially emotional civilian players. Decis. Support Syst. 2008, 44, 565–579. [Google Scholar] [CrossRef]

- Li, J.; Yi, J.; Zhao, Y. Effective Boundary of Innovation Subsidy: Searching by Stochastic Evolutionary Game Model. Symmetry 2020, 12, 1531. [Google Scholar] [CrossRef]

- Stowsky, J. Secrets to shield or share? New dilemmas for military R&D policy in the digital age. Res. Policy 2004, 33, 257–269. [Google Scholar] [CrossRef]

- Sydow, J.O.R.; Schrey, G.; Koch, J. Organizational path dependence: Opening the black box. Acad. Manag. Rev. 2009, 34, 689–709. [Google Scholar]

- Anzola-Rom, A.N.P.; Bayona, C.; Garc-Marco, T. Organizational innovation, internal R&D and externally sourced innovation practices: Effects on technological innovation outcomes. J. Bus. Res. 2018, 91, 233–247. [Google Scholar]

- Liu, G.; Zhang, J.; Tang, W. Strategic transfer pricing in a marketing–operations interface with quality level and advertising dependent goodwill. Omega 2015, 56, 1–15. [Google Scholar] [CrossRef]

- Zhao, L.M.; Sun, J.H.; Zhang, H.B. Technology sharing behavior in civil-military integration collaborative innovation system based on differential game. J. Ind. Eng. Eng. Manag. 2017, 31, 183–191. [Google Scholar]

- Basar, T.; Olsder, G.J. Dynamic Noncooperative Games; Academic Press: New York, NY, USA, 1995. [Google Scholar]

- Hausken, K. Governments Playing Games and Combating the Dynamics of a Terrorist Organization. Int. Game Theory Rev. 2020, 36. [Google Scholar] [CrossRef]

- Dockner, E.J.; Jorgensen, S.; van Long, N.; Sorger, G. Differential Games in Economics and Management Science; Cambridge University Press (CUP): Cambridge, UK, 2000. [Google Scholar]

- Hausken, K. Production and Conflict Models Versus Rent-Seeking Models. Public Choice 2005, 123, 59–93. [Google Scholar] [CrossRef]

| Notation | Description |

|---|---|

| M | A single military firm |

| C | A single civil firm |

| E(t) | The effort level of dual-use technology conversion |

| c(t) | Conversion cost |

| K(t) | Dual-use technologies level |

| Cost coefficients | |

| Coefficient of technological innovation capability of military and civilian firms | |

| The attenuation coefficient of dual-use technology | |

| Q(t) | Total revenue of dual-use technology conversion |

| Coefficient of military and civilian firms on the national defense demand | |

| Coefficient of economic demand | |

| t | At time t |

| The discount rate of dual-use technology | |

| The revenue distribution coefficient of civil firm | |

| Subsidy of dual-use technology conversion | |

| J | Objective function |

| V | Optimal revenue function |

| E(K(t)) | Expectation |

| D(K(t)) | Variance |

| A quadratic continuous differential function | |

| B(t) | Brownian motion |

| z(t) | Standard Wiener process |

| Random interference factors |

| Notation | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Initialization Settings | 0.8 | 0.6 | 0.95 | 0.1 | 0.7 | 0.6 | 0.5 | 0.5 | 0.5 | 0.333 |

| Spin-Off | Spin-In | Mix | |

|---|---|---|---|

| 1.690 | 1.690 | 3.381 | |

| 1.443 | 2.536 | 2.886 | |

| 0.619K + 1.848 | 0.619K + 2.075 | 0.619K + 2.136 | |

| 0.619K + 2.052 | 0.619K + 2.324 | 0.619K + 2.136 | |

| V | 1.238K + 3.90 | 1.238K + 4.31 | 1.238K + 4.271 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, X.; Yang, X.; Zhang, L. Conversion of Dual-Use Technology: A Differential Game Analysis under the Civil-Military Integration. Symmetry 2020, 12, 1861. https://doi.org/10.3390/sym12111861

Cao X, Yang X, Zhang L. Conversion of Dual-Use Technology: A Differential Game Analysis under the Civil-Military Integration. Symmetry. 2020; 12(11):1861. https://doi.org/10.3390/sym12111861

Chicago/Turabian StyleCao, Xia, Xiaojun Yang, and Lupeng Zhang. 2020. "Conversion of Dual-Use Technology: A Differential Game Analysis under the Civil-Military Integration" Symmetry 12, no. 11: 1861. https://doi.org/10.3390/sym12111861

APA StyleCao, X., Yang, X., & Zhang, L. (2020). Conversion of Dual-Use Technology: A Differential Game Analysis under the Civil-Military Integration. Symmetry, 12(11), 1861. https://doi.org/10.3390/sym12111861