Optimal Incentive Contract for Sales Team with Loss Aversion Preference

Abstract

1. Introduction

2. The Model

2.1. Sales Revenue Process

2.2. The Objective Function of Salesman

2.3. The Objective Function of Manager

3. Risk Sharing under Symmetric Information

3.1. First-Best Contract

3.2. A Special Case

4. Contracting Under Hidden Action

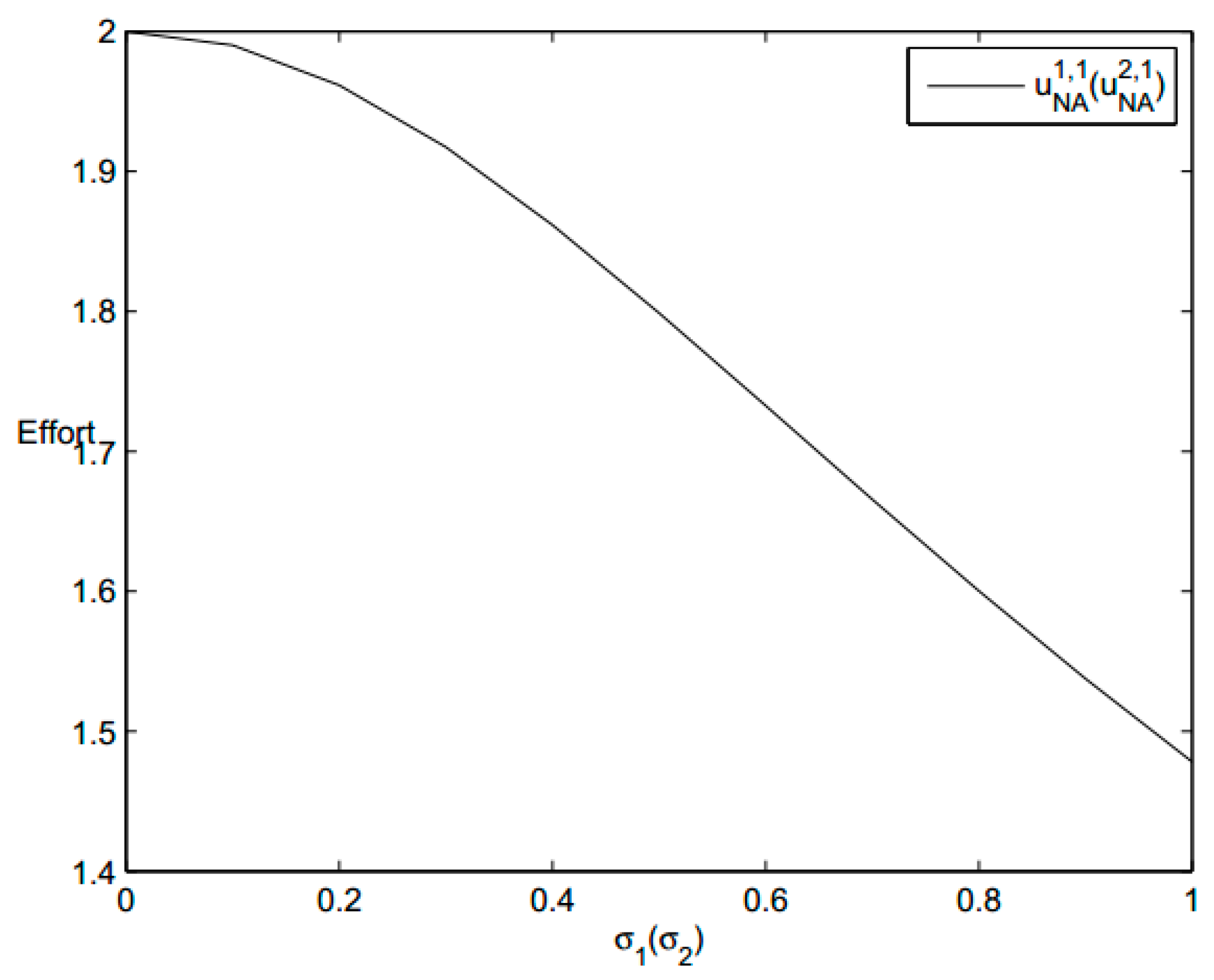

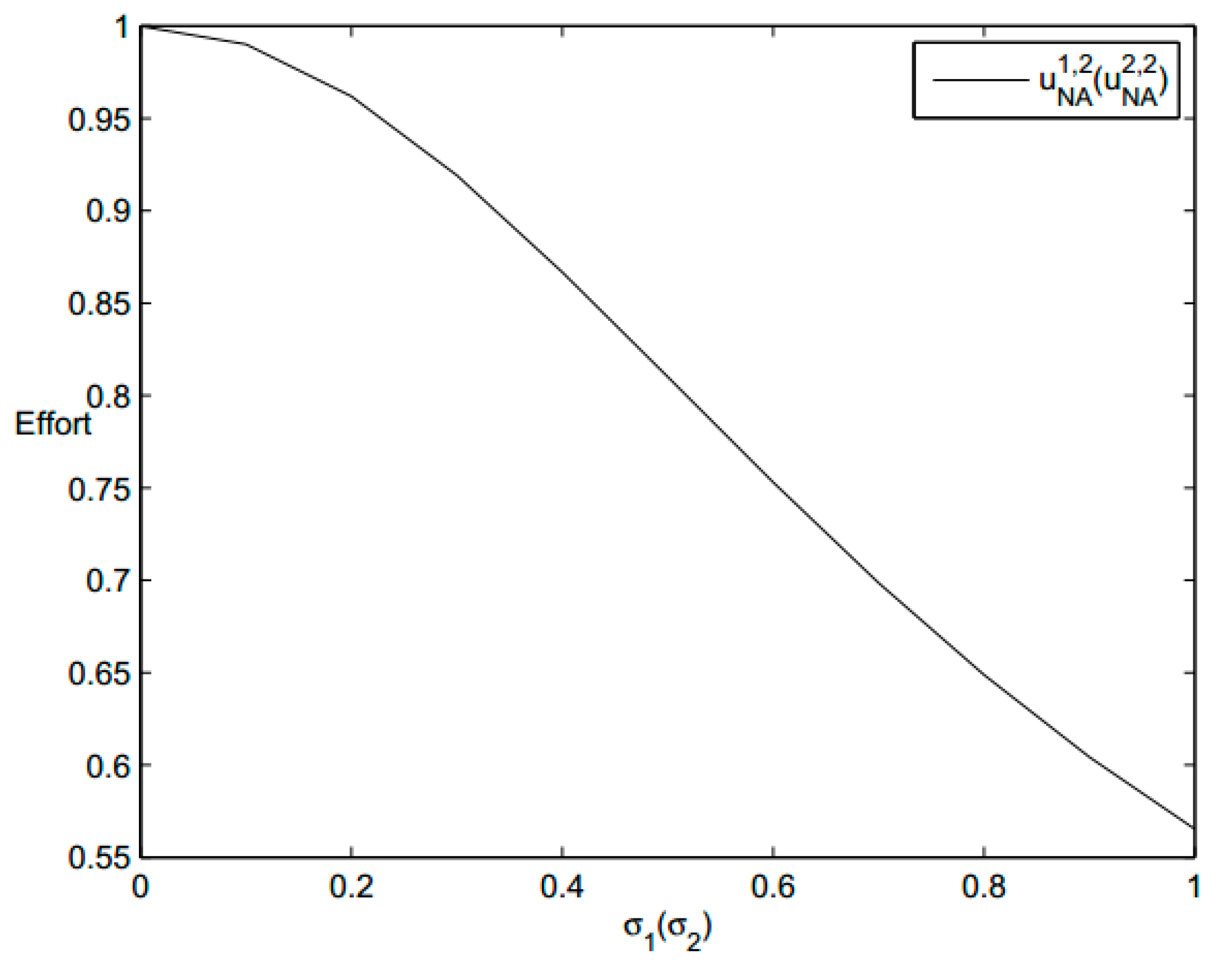

4.1. Nash Equilibrium Effort for the Salesmen

4.2. Admissible Contract

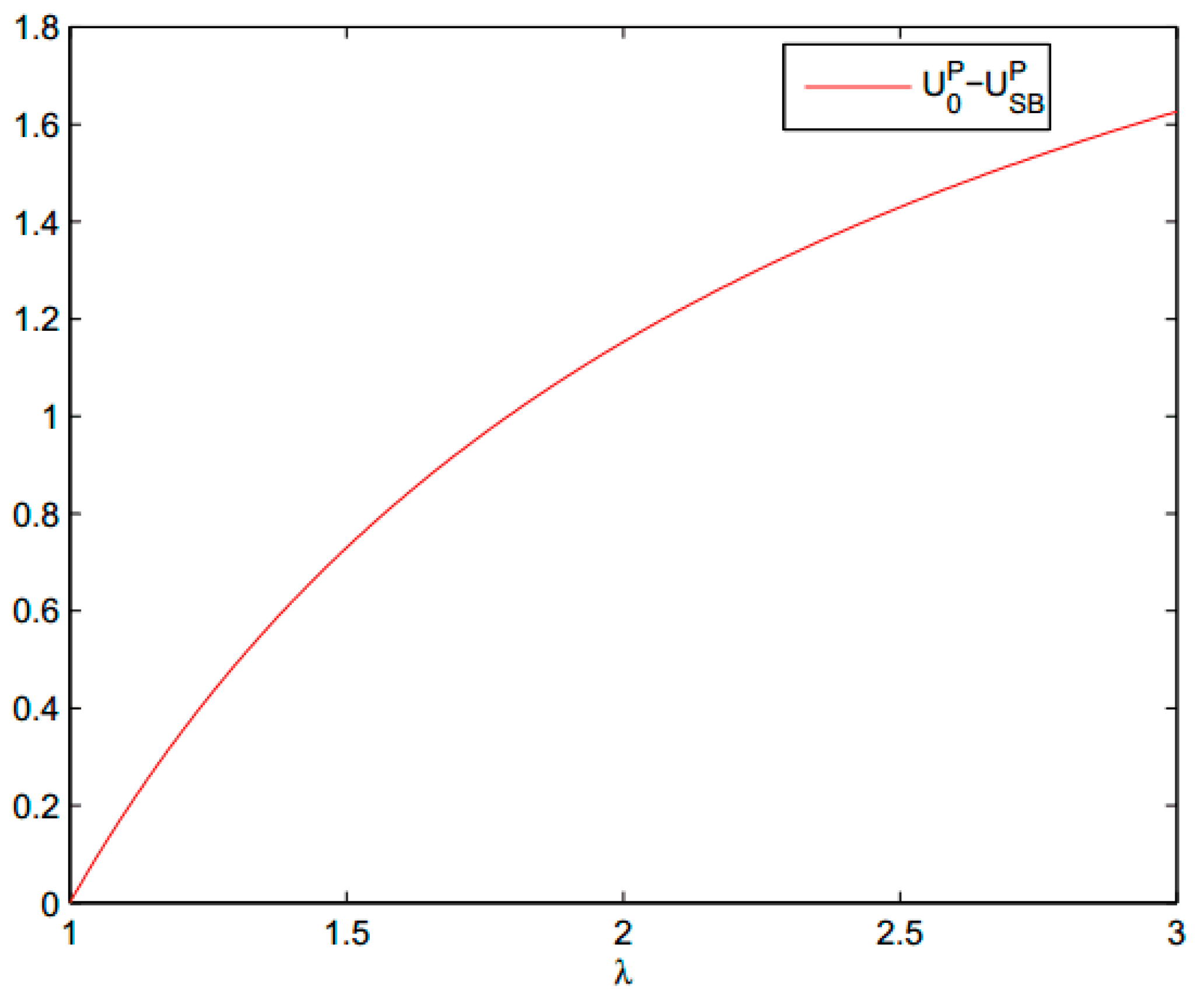

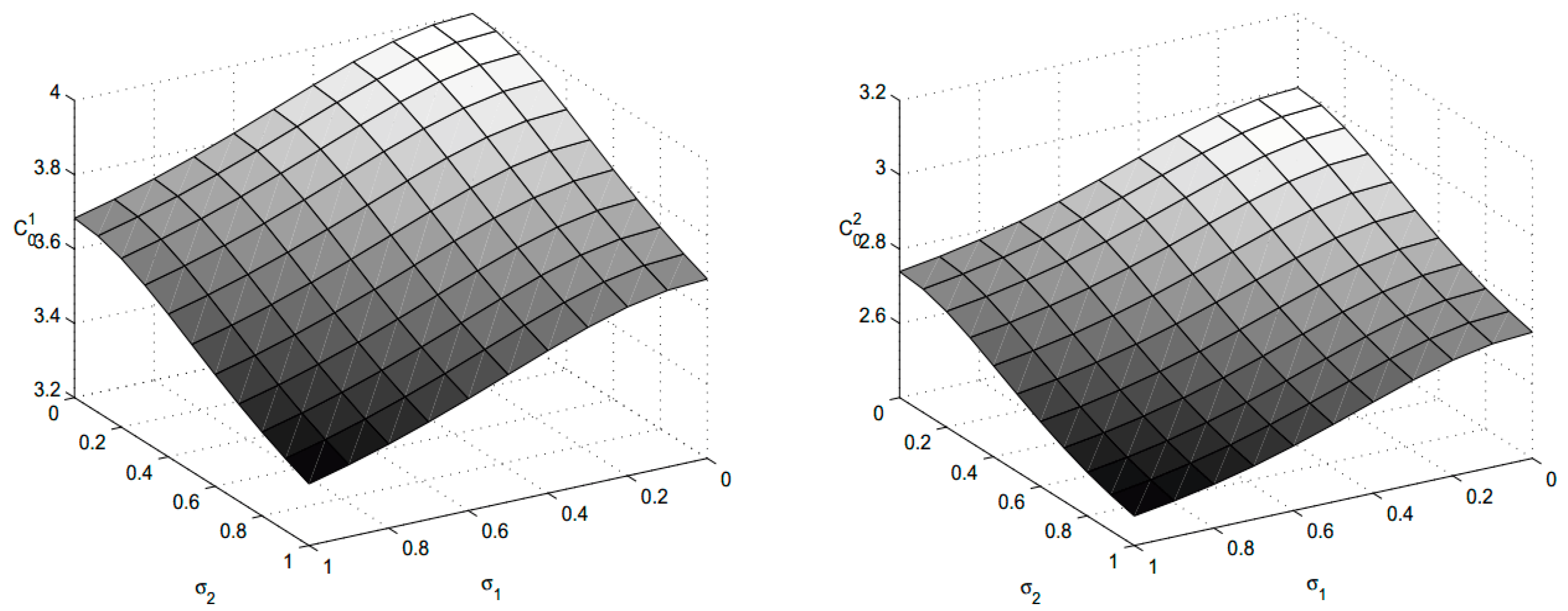

4.3. The Manager Problem

4.4. Special Cases

4.4.1. The Case with no Difference between Salesmen

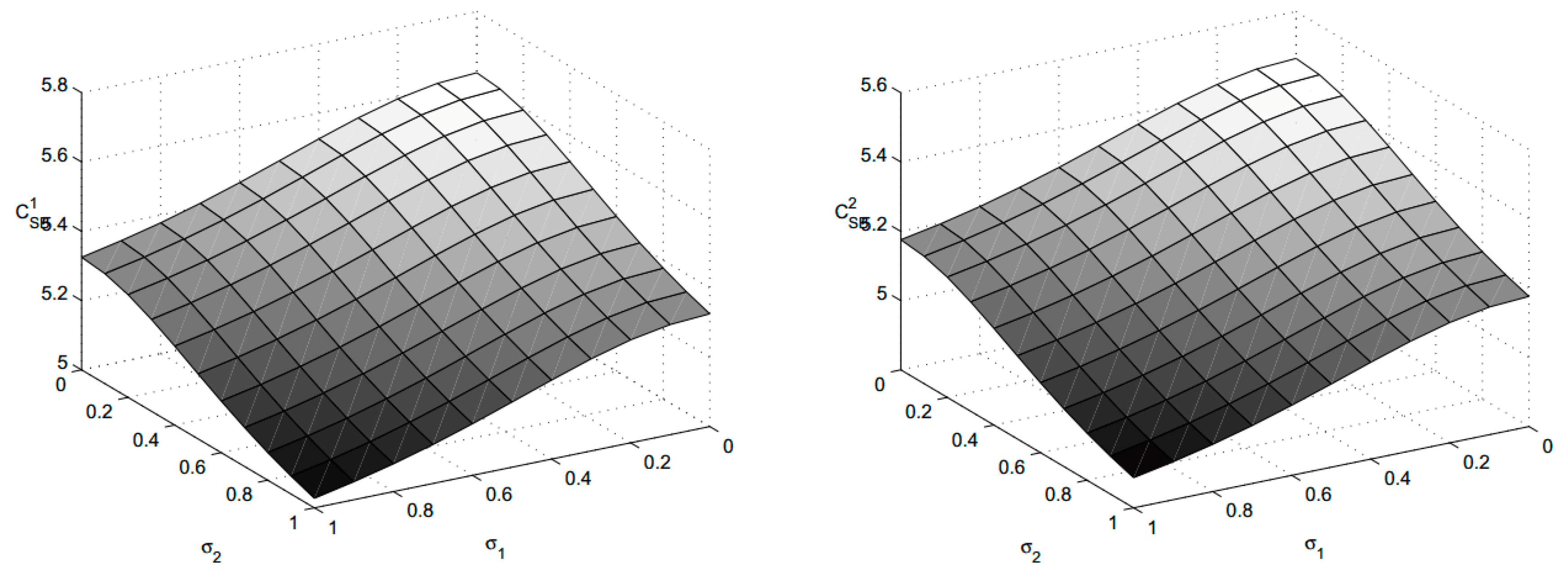

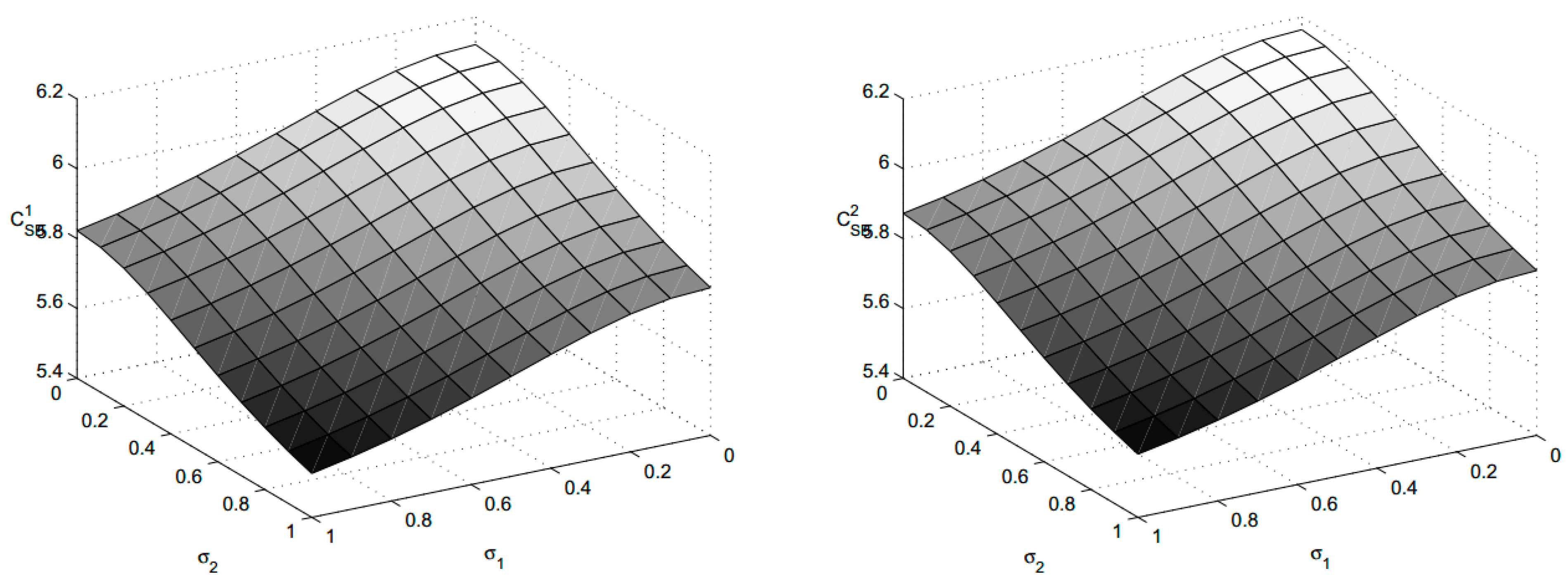

4.4.2. Empirical Analysis

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1

- (I)

- , continuous for , is second order differentiable when , and .

- (II)

- is strictly monotonous.

- (III)

- if , then .

- (IV)

- If , ; otherwise , .

- (V)

- , here , .

Appendix B

Appendix B.1

- Find all local maximum points;

- Find all non-differentiable points;

- Find all max points on boundary;

- Choose the biggest one, which is the global max point.

Appendix B.2

Appendix C

Appendix C.1

Appendix C.2

Appendix C.3

Appendix C.4

Appendix C.5

References

- Lal, R.; Srinivasan, V. Compensation plans for single-and multi-product salesforces: An application of the Holmstrom-Milgrom model. Manag. Sci. 1993, 39, 777–793. [Google Scholar] [CrossRef]

- Chan, T.-Y.; Li, J.; Pierce, L. Compensation and peer effects in competing sales teams. Manag. Sci. 2014, 60, 1965–1984. [Google Scholar] [CrossRef]

- Chung, J.; Narayandas, D. Incentives versus reciprocity: Insights from a field experiment. J. Mark. Res. 2017, 54, 511–524. [Google Scholar] [CrossRef]

- Basu, A.; Lal, R.; Srinivasan, V.; Staelin, R. Salesforce compensation plans: An agency theoretic perspective. Mark. Sci. 1985, 4, 267–291. [Google Scholar] [CrossRef]

- Coughlan, A.; Narasimhan, C. An empirical analysis of sales-force compensation plans. J. Bus. 1992, 65, 93–121. [Google Scholar] [CrossRef]

- Chen, F. Salesforce incentives, market information, and production/inventory planning. Manag. Sci. 2005, 51, 60–75. [Google Scholar] [CrossRef]

- Rubel, O.; Prasad, A. Dynamic incentives in sales force compensation. Mark. Sci. 2015, 35, 676–689. [Google Scholar] [CrossRef]

- Kräkel, M.; Schöttner, A. Optimal sales force compensation. J. Econ. Behav. Organ. 2016, 126, 179–195. [Google Scholar] [CrossRef]

- Albers, S. Optimization models for salesforce compensation. Eur. J. Oper. Res. 1996, 89, 1–17. [Google Scholar] [CrossRef]

- Rouziès, D.; Coughlan, A.; Anderson, E.; Iacobucci, D. Determinants of pay levels and structures in sales organizations. J. Mark. 2009, 73, 92–104. [Google Scholar]

- Bommaraju, R.; Hohenberg, S. Self-Selected Sales Incentives: Evidence of their Effectiveness, Persistence, Durability, and Underlying Mechanisms. J. Mark. 2018, 82, 106–124. [Google Scholar] [CrossRef]

- Holmstrom, B. Moral hazard in teams. Bell J. Econ. 1982, 13, 324–340. [Google Scholar] [CrossRef]

- McAfee, R.; McMillan, J. Competition for agency contracts. RAND J. Econ. 1987, 18, 296–307. [Google Scholar] [CrossRef]

- Itoh, H. Incentives to help in multi-agent situations. Econometrica 1991, 59, 611–636. [Google Scholar] [CrossRef]

- Tian, H.-P.; Liu, C.-X.; Guo, Y.-J. Pay scheme designing method with multiple agents’ competition. J. Ind. Eng. Eng. Manag. 2007, 21, 153–156. [Google Scholar]

- Caldieraro, F.; Coughlan, A. Optimal sales force diversification and group incentive payments. Mark. Sci. 2009, 28, 1009–1026. [Google Scholar] [CrossRef]

- K˝oszegi, B.; Rabin, M. A model of reference-dependent preferences. Q. J. Econ. 2006, 121, 1133–1165. [Google Scholar]

- K˝oszegi, B.; Rabin, M. Reference-dependent risk attitudes. Am. Econ. Rev. 2007, 97, 1047–1073. [Google Scholar] [CrossRef]

- K˝oszegi, B.; Rabin, M. Reference-dependent consumption plans. Am. Econ. Rev. 2009, 99, 909–936. [Google Scholar] [CrossRef]

- Herweg, F.; Müller, D.; Weinschenk, P. Binary Payment Schemes: Moral Hazard and Loss Aversion. Am. Econ. Rev. 2010, 100, 2451–2477. [Google Scholar] [CrossRef]

- Dittmann, I.; Maug, E.; Spalt, O. Sticks or Carrots? Optimal CEO Compensation when Managers Are Loss Averse. J. Financ. 2010, 65, 2015–2050. [Google Scholar] [CrossRef]

- Daido, K.; Murooka, T. Team Incentives and Reference-Dependent Preferences. J. Econ. Manag. Strat. 2016, 25, 958–989. [Google Scholar] [CrossRef]

- Goukasian, L.; Wan, X.-H. Optimal incentive contracts under relative income concerns. Math. Financ. Econ. 2010, 4, 57–86. [Google Scholar] [CrossRef]

- Elie, R.; Mastrolia, T.; Possamaï, D. A Tale of a Principal and Many, Many Agents. Math. Oper. Res. 2018. [Google Scholar] [CrossRef]

- Elie, R.; Possamaï, D. Contracting theory with competitive interacting agents. SIAM J. Control Optim. 2019, 57, 1157–1188. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Cvitani’c, J.; Possamaï, D.; Touzi, N. Dynamic programming approach to principal-agent problems. Financ. Stoch. 2018, 22, 1–37. [Google Scholar] [CrossRef]

- Keun Koo, H.; Shim, G.; Sung, J. Optimal Multi-Agent Performance Measures for Team Contracts. Math. Financ. 2008, 18, 649–667. [Google Scholar] [CrossRef]

- Yan, J.-A.; Peng, S.-G.; Fang, S.-Z.; Wu, L.-M. Stochastic Analysis; Science Press: Beijing, China, 1997. [Google Scholar]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.; Cheng, S.-J.; Cheng, P.-F. Optimal Incentive Contract for Sales Team with Loss Aversion Preference. Symmetry 2019, 11, 864. https://doi.org/10.3390/sym11070864

Li C, Cheng S-J, Cheng P-F. Optimal Incentive Contract for Sales Team with Loss Aversion Preference. Symmetry. 2019; 11(7):864. https://doi.org/10.3390/sym11070864

Chicago/Turabian StyleLi, Chao, Si-Jie Cheng, and Peng-Fei Cheng. 2019. "Optimal Incentive Contract for Sales Team with Loss Aversion Preference" Symmetry 11, no. 7: 864. https://doi.org/10.3390/sym11070864

APA StyleLi, C., Cheng, S.-J., & Cheng, P.-F. (2019). Optimal Incentive Contract for Sales Team with Loss Aversion Preference. Symmetry, 11(7), 864. https://doi.org/10.3390/sym11070864